Form DEF 14A Installed Building Produ For: May 31

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

INSTALLED BUILDING PRODUCTS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

Table of Contents

INSTALLED BUILDING PRODUCTS, INC.

495 SOUTH HIGH STREET, SUITE 50

COLUMBUS, OHIO 43215

Notice of Annual Meeting of Stockholders to be held on May 31, 2018

The 2018 Annual Meeting of Stockholders (the “Annual Meeting”) of Installed Building Products, Inc. (the “Company”) will be held on Thursday, May 31, 2018 at 10:00 a.m. Eastern Time. The Annual Meeting will be conducted as a virtual meeting of stockholders by means of a live webcast.

The Annual Meeting is being held for the following purposes:

| 1. | To elect Margot L. Carter, Robert H. Schottenstein and Michael H. Thomas as directors to serve for three-year terms; |

| 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; |

| 3. | To conduct a non-binding advisory vote to approve the compensation of our named executive officers; |

| 4. | To approve the material terms and performance criteria of our 2014 Omnibus Incentive Plan; and |

| 5. | To transact any other business that may properly come before the Annual Meeting or any adjournment thereof. |

The Board of Directors has fixed April 5, 2018 as the record date for determining stockholders entitled to receive notice of and to vote at the Annual Meeting and any adjournment of the Annual Meeting. Only stockholders of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting.

On or about April 20, 2018, we will mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record at the close of business on the record date. The Notice contains instructions on how you can obtain internet access to our Proxy Statement and our Annual Report, which includes our Annual Report on Form 10-K for the 2017 fiscal year. The Notice also contains instructions on how you can request a paper copy of the proxy materials, including a form of proxy.

| By Order of the Board of Directors |

|

| Shelley A. McBride |

| General Counsel and Secretary |

Columbus, Ohio

April 20, 2018

Table of Contents

|

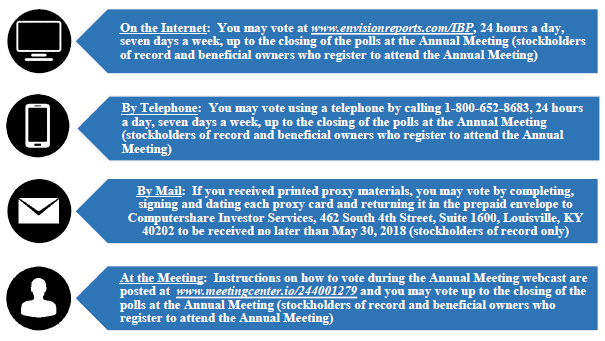

Your vote is important. Whether or not you plan to attend the Annual Meeting webcast, please vote as promptly as possible to ensure your representation at the Annual Meeting. In order to vote, you must have the Control Number included on your Notice, your proxy card (if you received a printed copy of the proxy materials) or your Annual Meeting registration confirmation (if you are a beneficial owner who registered to attend the Annual Meeting). You may vote in any of the following ways:

|

Table of Contents

INSTALLED BUILDING PRODUCTS, INC.

| 1 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| Information Regarding the Director Nominees and Directors Continuing in Office |

8 | |||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| Meetings of the Board and Director Attendance at Annual Meeting of Stockholders |

18 | |||

| 18 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| PROPOSAL 2 – RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 26 | |||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| PROPOSAL 3 – NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION |

29 | |||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 42 | ||||

| 46 | ||||

|

IBP 2018 Proxy Statement | i

|

Table of Contents

|

ii | IBP 2018 Proxy Statement

|

Table of Contents

Installed Building Products, Inc.

495 South High Street, Suite 50

Columbus, Ohio 43215

(614) 221-3399

|

PROXY STATEMENT FOR THE 2018 ANNUAL MEETING OF STOCKHOLDERS

|

The 2018 Annual Meeting of Stockholders of Installed Building Products, Inc. (“Annual Meeting”) will be held on Thursday, May 31, 2018 at 10:00 a.m. Eastern Time. The Annual Meeting will be a virtual meeting hosted by means of a live webcast. This Proxy Statement is furnished in connection with the solicitation of proxies by our Board of Directors (sometimes referred to as the “Board”) for use at the Annual Meeting and any adjournment thereof.

We intend to begin mailing our Notice of Internet Availability of Proxy Materials (“Notice”) on or about April 20, 2018. Our Notice of Annual Meeting of Stockholders, Proxy Statement and Annual Report are available free of charge at www.envisionreports.com/IBP.

All references in this Proxy Statement to “we,” “us,” “our” or the “Company” refer to Installed Building Products, Inc.

All references in this Proxy Statement to our “Annual Report” refer to our 2017 Annual Report, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2017.

|

FREQUENTLY ASKED QUESTIONS ABOUT THE ANNUAL MEETING

|

A number of the questions and answers below refer to “stockholders of record” and “beneficial owners.” If your shares were registered directly in your name on the books of our transfer agent on the record date, then you are a stockholder of record. If your shares were held in an account at a brokerage firm, bank or other nominee on the record date (sometimes referred to as holding shares in street name), then you are a beneficial owner.

| Q: | Can I attend the Annual Meeting in person? |

| A: | We will be hosting the Annual Meeting only by means of a live webcast. You will not be able to attend the meeting in person. Please be assured that you will be afforded the same rights and opportunities to participate in the virtual meeting as you would at an in-person meeting. You may participate in the Annual Meeting in the following ways: |

Stockholders of Record. You will be able to listen to the Annual Meeting, submit questions and vote by going to www.meetingcenter.io/244001279 prior to the meeting and clicking on “I have a Control Number.”

Beneficial Owners. You may participate in the Annual Meeting in one of two ways:

|

IBP 2018 Proxy Statement | 1

|

Table of Contents

| ● | If you wish to submit questions or vote your shares during the Annual Meeting (rather than directing your brokerage firm, bank or other nominee how to vote your shares), you must register in advance to attend the Annual Meeting. See “How do I register to attend the Annual Meeting?” below. When you have received your confirmation of registration and Control Number, you will be able to listen to the Annual Meeting, submit questions and vote by going to www.meetingcenter.io/244001279 prior to the meeting and clicking on “I have a Control Number.” |

| ● | If you wish to listen to the Annual Meeting, but do not wish to submit questions or vote during the Annual Meeting, you may go to www.meetingcenter.io/244001279 prior to the meeting and click on “I am a guest.” |

The Annual Meeting webcast will start at 10:00 a.m. Eastern Time on Thursday, May 31, 2018. We encourage you to access the meeting website prior to the start time to allow ample time for check in. The password for the meeting is IBP2018.

| Q: | How do I register to attend the Annual Meeting? |

| A: | Stockholders of Record. You do not need to register to attend the Annual Meeting webcast. Follow the instructions on your Notice or proxy card (if you received a printed copy of the proxy materials) to access the Annual Meeting. See “Can I attend the Annual Meeting in person?” above. |

Beneficial Owners. If you wish to submit questions or vote your shares during the Annual Meeting (rather than directing your brokerage firm, bank or other nominee how to vote your shares), you must register in advance to attend the Annual Meeting. If you only want to listen to the Annual Meeting, then you do not need to register in advance. See “Can I attend the Annual Meeting in person?” above.

A beneficial owner wishing to attend the Annual Meeting webcast must provide our transfer agent, Computershare Trust Company, N.A. (“Computershare”) with your name, email address and a copy of a legal proxy from your brokerage firm, bank or other nominee reflecting your beneficial stock ownership in the Company. Registration requests must be in writing and be mailed to:

Computershare Investor Services

Installed Building Products, Inc. – Legal Proxy

462 South 4th Street, Suite 1600

Louisville, KY 40202

Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on May 21, 2018. You will receive a confirmation email from Computershare acknowledging your registration along with a Control Number for the Annual Meeting.

| Q: | What is the purpose of the Annual Meeting? |

| A: | The items of business to be brought before the Annual Meeting are: |

| 1. | To elect Margot L. Carter, Robert H. Schottenstein and Michael H. Thomas as directors to serve for three-year terms; |

| 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; |

| 3. | To conduct a non-binding advisory vote to approve the compensation of our named executive officers; |

| 4. | To approve the material terms and performance criteria of our 2014 Omnibus Incentive Plan; and |

|

2 | IBP 2018 Proxy Statement

|

Table of Contents

| 5. | To transact any other business that may properly come before the Annual Meeting or any adjournment thereof. |

Following the meeting, we will respond to questions from our stockholders.

| Q: | Could other matters be decided at the Annual Meeting? |

| A: | Our Amended and Restated Bylaws (“Bylaws”) require that we receive advance notice of any proposal from a stockholder to be brought before the Annual Meeting. We have not received notice of any stockholder proposals for the Annual Meeting. If any other matters were to properly come before the Annual Meeting, the persons named as proxies will have the discretion to vote on those matters in accordance with their best judgment. |

| Q: | Who is entitled to vote at the Annual Meeting? |

| A: | Only holders of record of our common stock at the close of business on April 5, 2018, the record date for the Annual Meeting, are entitled to notice of and to vote at the Annual Meeting. At the close of business on April 5, 2018, we had 31,518,607 shares of common stock outstanding and entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each other matter to be voted on at the Annual Meeting. |

Stockholders of Record. You may vote your shares in any of the ways specified below in “How do I vote?”

Beneficial Owners. If you are a beneficial owner, the Notice was forwarded to you by your brokerage firm, bank or other nominee. The organization holding your account is the stockholder of record for purposes of attending and voting at the Annual Meeting; however, you have the right to direct the organization how to vote the shares in your account. Alternatively, you may vote your shares directly at the Annual Meeting by obtaining a legal proxy from your brokerage firm, bank or other nominee and registering in advance to attend the Annual Meeting webcast. See “How do I register to attend the Annual Meeting?” above.

A list of our stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder during ordinary business hours at our principal executive offices at 495 S. High Street, Suite 50, Columbus, Ohio 43215 for a period of ten days prior to the Annual Meeting. During the Annual Meeting, the list will be available for examination at www.meetingcenter.io/244001279.

| Q: | How do I vote? |

| A. | Stockholders of Record. You may vote in any of the following ways: |

|

On the Internet. You may vote at www.envisionreports.com/IBP, 24 hours a day, seven days a week. You will need the Control Number included on your Notice or proxy card (if you received a printed copy of the proxy materials). Votes submitted through the internet must be received no later than the closing of the polls at the Annual Meeting. | |

|

By Telephone. You may vote using a telephone by calling 1-800-652-8683, 24 hours a day, seven days a week. You will need the Control Number included on your Notice or proxy card (if you received a printed copy of the proxy materials). Votes submitted by telephone must be received no later than the closing of the polls at the Annual Meeting. | |

|

By Mail. If you received printed proxy materials, you may vote by completing, signing and dating each proxy card you received and returning it in the prepaid envelope to Computershare Investor Services, 462 South 4th Street, Suite 1600, Louisville, KY 40202. Sign your name exactly as it appears on the proxy card. Proxy cards submitted by mail must be received no later than May 30, 2018. | |

|

IBP 2018 Proxy Statement | 3

|

Table of Contents

|

At the Annual Meeting. Instructions on how to vote during the Annual Meeting webcast are posted at www.meetingcenter.io/244001279. Votes submitted during the Annual Meeting must be received no later than the closing of the polls at the Annual Meeting. |

Voting on the internet, by telephone or at the Annual Meeting authorizes the persons named as proxies to vote as you direct in the same manner as if you had completed, signed, dated and returned a proxy card. If you vote on the internet or by telephone, or plan to vote during the Annual Meeting webcast, do not return your proxy card(s).

Beneficial Owners. You have the right to direct your broker, bank or other nominee how to vote your shares. If you are a beneficial owner, the Notice was forwarded to you by the organization holding your account and you should follow the voting instructions provided by that organization. The availability of internet and telephone voting will depend on the voting options of your broker, bank or other nominee. If you do not provide the organization holding your account with instructions on how to vote your shares, the organization may be able to vote your shares with respect to some of the proposals to be voted on at the Annual Meeting, but not all of the proposals. See “What happens if I do not vote my shares?” below.

Instead of directing your broker, bank or other nominee how to vote your shares, you may elect to attend the Annual Meeting and vote your shares during the meeting. If you wish to vote your shares during the Annual Meeting, you must register in advance. See “How do I register to attend the Annual Meeting?” above. When you have received your confirmation of registration and Control Number, you may vote in any of the ways in which a stockholder of record may vote described above except by mail.

| Q: | What does it mean if I received more than one proxy card or Notice? |

| A: | If you received more than one proxy card or Notice, your shares are registered in more than one name or are registered in multiple accounts. To make certain all of your shares are voted, please complete, sign, date and return each proxy card that you received, or if you vote via the internet, by telephone or at the Annual Meeting, vote once for each Notice that you received. |

| Q: | Can I revoke my proxy or change my vote? |

| A: | Stockholders of Record. You may revoke your proxy or change your vote at any time before the closing of the polls at the Annual Meeting by: |

| ● | signing and returning a new proxy card with a later date; |

| ● | submitting a later-dated vote on the internet or by telephone — only your latest internet or telephone vote will be counted; |

| ● | participating in the Annual Meeting webcast and voting during the meeting; or |

| ● | delivering a written revocation to our Corporate Secretary at Installed Building Products, Inc., 495 South High Street, Suite 50, Columbus, Ohio 43215, which must be received no later than May 30, 2018. |

If you attend the Annual Meeting without voting during the meeting, it will not cause a previously submitted vote to be revoked unless you specifically request that your prior proxy be revoked.

Beneficial Owners. You should contact the broker, bank or other nominee holding your shares to obtain instructions for revoking or changing your vote. If you registered in advance to attend the Annual Meeting, you may change your vote by submitting a later-dated vote on the internet or by telephone or by participating in the Annual Meeting webcast and by submitting a later vote during the meeting.

| Q: | What happens if I do not vote my shares? |

|

4 | IBP 2018 Proxy Statement

|

Table of Contents

| A. | Stockholders of Record. If you do not vote by proxy card, by telephone, on the internet, or during the Annual Meeting live webcast, your shares will not be voted at the Annual Meeting. If you submit a proxy but fail to provide instructions on how you want your shares to be voted, your proxy will be voted in the manner recommended by the Board of Directors as follows: |

| ● | FOR the election of Margot L. Carter, Robert H. Schottenstein and Michael H. Thomas as directors to serve for three-year terms; |

| ● | FOR the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; |

| ● | FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers; and |

| ● | FOR the approval of the material terms and performance criteria of our 2014 Omnibus Incentive Plan. |

We do not expect any other business to properly come before the Annual Meeting; however, if any other business should properly come before the Annual Meeting, the persons named as proxies will vote your shares on such matters in accordance with their best judgment.

Beneficial Owners. If you do not provide your broker, bank or other nominee with voting instructions for your shares, your broker, bank or other nominee may nevertheless vote your shares on certain routine, or “discretionary,” matters. The ratification of the appointment of our independent registered public accounting firm is currently considered a discretionary matter. On this proposal, the organization holding your account may vote your shares in the absence of voting instructions or may choose not to vote your shares. The other matters to be voted on at the meeting are not considered discretionary and cannot be voted by your broker, bank or other nominee without your instructions. When a broker, bank or other nominee is not able to vote shares for this reason, it is called a “broker non-vote.” In the case of a broker non-vote, your shares will not have any effect on the outcome of any proposal other than the ratification of the appointment of our independent registered public accounting firm.

If you are a beneficial owner and registered in advance to attend the Annual Meeting webcast but do not vote your shares on the internet, by telephone or during the Annual Meeting live webcast, your shares will not be voted at the Annual Meeting.

| Q: | How many shares must be present in order to conduct business at the Annual Meeting? |

| A: | In order to carry out the business of the Annual Meeting, a minimum number of shares, constituting a quorum, must be present. A quorum is present if holders of at least a majority of the outstanding shares of our common stock entitled to vote are present or represented by proxy at the Annual Meeting. At the close of business on April 5, 2018, we had 31,518,607 shares of common stock outstanding and entitled to vote at the Annual Meeting, meaning that at least 15,759,304 shares of common stock must be present or represented by proxy to have a quorum. If a quorum is not present at the Annual Meeting, the meeting may be adjourned from time to time until a quorum is present. |

If you are a stockholder of record and you submit a proxy, your shares will be counted to determine the presence of a quorum, even if you abstain from voting or fail to provide voting instructions on one or more of the proposals. If you are a beneficial owner and you do not direct your broker, bank or other nominee how to vote your shares, your shares will be counted for purposes of determining the presence of a quorum if the institution submits a proxy, even if your shares are not voted with respect to one or more proposals. If you obtain a legal proxy from your broker, bank or other nominee and you fail to vote your shares, your shares will not be counted for purposes of determining a quorum.

| Q: | How many votes are required to approve each proposal? |

|

IBP 2018 Proxy Statement | 5

|

Table of Contents

| A.

|

Proposal

|

Required Vote

| ||

| Proposal 1 – To elect Margot L. Carter, Robert H. Schottenstein and Michael H. Thomas as directors to serve for three-year terms

|

Majority of the votes cast at the Annual Meeting | |||

| Proposal 2 – To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018

|

Majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote | |||

| Proposal 3 – To approve, on a non-binding advisory basis, the compensation of our named executive officers

|

Majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote | |||

| Proposal 4 – To approve the material terms and performance criteria of our 2014 Omnibus Incentive Plan

|

Majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote | |||

| Q: | How can I find the voting results of the Annual Meeting? |

| A: | Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a current report on Form 8-K to be filed with the Securities and Exchange Commission (“SEC”) within four business days after the Annual Meeting. If final voting results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final voting results in an amendment to the Form 8-K as soon as they become available. |

| Q: | Why did I receive a Notice in the mail regarding the internet availability of proxy materials instead of a full set of printed proxy materials? |

| A: | We are making our proxy materials available to our stockholders electronically on the internet by mailing the Notice to our stockholders instead of mailing a full set of proxy materials. The Notice contains instructions on how to access an electronic copy of our proxy materials, including this Proxy Statement and our Annual Report. The Notice also contains instructions on how to request a paper copy of this Proxy Statement, including a form of proxy. We believe this process allows us to provide you with the information you need in a timely manner, while conserving natural resources and lowering the costs of printing and distributing our proxy materials. |

| Q: | Who is conducting this proxy solicitation? |

| A: | Our Board of Directors is soliciting your vote for the proposals being submitted to the stockholders at the Annual Meeting. Solicitation is being made by mail or internet but could also be made by our directors, officers and select other employees telephonically, electronically or by other means of communication. The Company will bear the cost of soliciting proxies. Directors, officers and employees who help us in the solicitation will not be specially compensated for those services, but we may reimburse them for their out-of-pocket expenses incurred in connection with the solicitation. We are requesting brokers, banks and other nominees to forward our soliciting materials to beneficial owners of our common stock and we will reimburse them for their reasonable out-of-pocket expenses. |

|

6 | IBP 2018 Proxy Statement

|

Table of Contents

|

PROPOSAL 1 – ELECTION OF DIRECTORS

|

At the Annual Meeting, three directors are to be elected to serve for three-year terms. Each nominee elected as a director will continue in office until the 2021 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified or until his or her earlier death, resignation, retirement, disqualification or removal. Our directors are divided into three classes, with one class of directors elected annually for three-year terms. Our directors are classified into the following three classes:

| Director

|

Class I

|

Class II

|

Class III

| |||

|

Margot L. Carter |

● | |||||

|

Jeffrey W. Edwards |

● | |||||

|

Lawrence A. Hilsheimer |

● | |||||

|

Janet E. Jackson |

● | |||||

|

Michael T. Miller |

● | |||||

|

J. Michael Nixon |

● | |||||

|

Robert H. Schottenstein |

● | |||||

|

Michael H. Thomas |

● | |||||

|

Vikas Verma |

● | |||||

Upon the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has nominated and is submitting to a vote of our stockholders a proposal to elect Margot L. Carter, Robert H. Schottenstein and Michael H. Thomas as directors. All of the nominees are incumbent directors and are independent Board members. In making its recommendation, the Nominating and Corporate Governance Committee considered the experience, qualifications, attributes and skills of each nominee, as well as the nominee’s individual contributions to our Board. See “Corporate Governance – Director Qualification and Board Diversity.”

In response to a stockholder proposal approved at the 2017 Annual Meeting of Stockholders, effective February 22, 2018, the Board approved the amendment and restatement of our Bylaws, which included implementation of majority voting in uncontested director elections. The amended and restated Bylaws provide that a director nominee may be elected only upon the affirmative vote of a majority of the total votes cast, which means that the number of shares voted “for” a director’s election must exceed the number of shares voted “against” that director’s election. Votes cast do not include abstentions or broker non-votes. Prior to the amendment and restatement of the Bylaws, directors were elected by a plurality of votes cast, whether or not the election was contested. The Bylaws retain plurality voting for contested director elections.

Any incumbent director who fails to receive a majority of votes is required to promptly tender his or her resignation to the Board. Such resignation will become effective only upon its acceptance by the Board. The Nominating and Corporate Governance Committee will recommend to the Board whether to accept or reject the resignation, and the Board will act upon such resignation and publicly disclose its decision within 90 days from the date of the certification of the election results.

|

IBP 2018 Proxy Statement | 7

|

Table of Contents

Nominees for Board membership are expected to demonstrate leadership and to possess outstanding integrity, values and judgment. Our nominees have a blend of historical and new perspectives about our Company. Our Nominating and Corporate Governance Committee and our Board of Directors have determined that each of the nominees possesses the right skills, experience and perspectives, collectively with other directors, to comprise a well-rounded, highly effective Board of Directors, and have determined that the nominees add to the overall diversity of the Board by bringing a wide range of experiences spanning various industries and organizations.

Based on the Nominating and Corporate Governance Committee’s recommendation and the nominees’ credentials, experience, attributes and skills outlined below under the caption “Information Regarding the Director Nominees and Directors Continuing in Office,” the Board of Directors has determined that the nominees can make a significant contribution to the Board and should serve as directors of the Company. Each nominee has accepted the nomination and has agreed to serve if elected. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the persons named as proxies will use their discretion to vote for the election of the remaining nominees and for the election of any substitute nominee nominated and recommended by the Board.

Information Regarding the Director Nominees and Directors Continuing in Office

The following biographical information regarding each director nominee and director continuing in office is as of April 20, 2018. In addition to age and tenure as a director of the Company, it includes information about each individual’s principal occupation, professional experience, including public company and other directorships during the past five years, educational background, and certain other attributes, qualifications and skills that led the Nominating and Corporate Governance Committee and the Board to conclude that each individual should be nominated for election.

The average age of our directors is 61, with an average tenure of seven years. Our independent directors have an average tenure of four years. Our Board is comprised of 22% women and 22% minorities.

|

8 | IBP 2018 Proxy Statement

|

Table of Contents

|

Director Nominees

Class II – Terms to Expire at the 2021 Annual Meeting of Stockholders

| ||||

|

Margot L. Carter Independent Age 50 Director since 2014 and Presiding Independent Director since 2015 |

Occupation

President and Founder, Living Mountain Capital L.L.C., a business advisory consulting firm, which advises clients on corporate governance, business strategy, business development, strategic alliances and acquisitions (1998–present)

Education

B.A. in Economics and History, Binghamton University and J.D., Fordham University School of Law

Experience

● Executive Vice President, Chief Legal Officer and Secretary, RealPage, Inc., a publicly traded leading global software solutions and big data company in the commercial, multifamily, single-family and vacation rental industries (2010–2015) ● Executive Vice President and General Counsel, The Princeton Review, Inc. ● Executive Vice President, General Counsel and Managing Director, Soundview Technology Group, Inc. ● Assistant General Counsel, Cantor Fitzgerald and eSpeed, Inc. |

Other Board Service

● Eagle Materials, Inc., a publicly traded leading provider of building materials, member of Corporate Governance and Nominating and Audit committees ● Freeman Company, one of the world’s largest brand experience companies, member of Audit and Compensation committees

● NACD North Texas | ||

|

Ms. Carter’s experience as a business builder in the technology, real estate and construction industries and experience in global business strategy, development, acquisitions and corporate governance, both as a C-Suite executive, general counsel and board member of global public and private companies, make her a valued member of the Board.

| ||||

|

Robert H. Schottenstein Independent Age 65 Director since 2014 |

Occupation

Chairman (since 2004), Chief Executive Officer (since 2004) and President (since 1996) of M/I Homes, Inc., one of the largest publicly traded home builders in the U.S.

Education

B.A., Indiana University and J.D., Capital University Law School

Experience

● Private practice of law specializing in commercial real estate, corporate and banking transactions ● Central Ohio Building Industry Association “Builder of the Year” Award 2002 ● “Executive of the Year” for the homebuilding industry by Builder Magazine 2008 |

Other Board Service

● L Brands, a publicly traded leading specialty retailer focused on women’s intimate and other apparel, personal care, beauty and home fragrance categories, member of Audit Committee ● The Ohio State University Wexner Medical Center ● The Ohio State University Foundation

● Executive Committee of The Policy Advisory Board of Harvard University’s Joint Center for Housing Studies

| ||

|

Mr. Schottenstein’s experience in the homebuilding industry and as an executive and board member of public companies make him a valued member of the Board.

| ||||

|

IBP 2018 Proxy Statement | 9

|

Table of Contents

|

Michael H. Thomas Independent Age 68 Director since 2014 |

Occupation

Former partner, Stonehenge Partners, Inc., a private mezzanine and equity investment firm, where he provided counsel in investment origination, portfolio asset management and disposition of investments (1999–2014)

Education

B.A. in Business Administration, University of Notre Dame

Experience

● Executive Vice President and Treasurer, JMAC, Inc., the holding and investment company of the McConnell family of Worthington, Ohio, where he directed investments in the financial services, publishing, health care, real estate and manufacturing sectors and was responsible for the McConnell family’s financial, estate and income tax planning ● Manager of Ernst & Young LLP Columbus, Ohio tax practice

|

Other Board Service

● Served as a director for the Company’s predecessor from 2004 to 2011

| ||

|

Mr. Thomas’ significant business and investment experience, knowledge of our business and accounting background make him a valued member of the Board.

| ||||

|

Directors Continuing in Office

Class III – Terms to Expire at the 2019 Annual Meeting of Stockholders

| ||||

|

Jeffrey W. Edwards Age 54 Chairman of the Board since 1999 |

Occupation

Our President (since 2011), Chief Executive Officer (since 2004) and Chairman (since 1999)

Education

B.S. in Marketing, Miami University

Experience

● Officer and strategist for several family-owned companies across a variety of industries, including multi-family and student housing development and management, industrial tool distribution, wholesale building supply, homebuilding, land and real estate development and real estate brokerage ● Commercial real estate development throughout the U.S. |

Other Board Service

Board of Trustees, Columbus Museum of Art

| ||

|

Mr. Edwards’ leadership, executive, managerial and business experience, along with his more than 29 years of experience in the industry make him a valued member of the Board.

| ||||

|

10 | IBP 2018 Proxy Statement

|

Table of Contents

|

Lawrence A. Hilsheimer Independent Age 60 Director since 2014 |

Occupation

Executive Vice President and Chief Financial Officer, Greif, Inc., a publicly traded global leader in industrial packing products and services (2014–present)

Education

B.A. in Business Administration, Fisher College of Business, The Ohio State University and J.D., Capital University Law School

Experience

● Executive Vice President and Chief Financial Officer, The Scotts Miracle-Gro Company, a publicly traded manufacturer of branded consumer lawn and garden products (2013–2014) ● Executive Vice President and Chief Financial Officer, Nationwide Mutual Insurance Company, a provider of property and casualty insurance and financial services, President and Chief Operating Officer of multiple business units, including Nationwide Direct and Customer Solutions and Nationwide Retirement Plans ● Vice Chairman and Regional Managing Partner, Deloitte & Touche USA, LLP

|

Other Board Service

● Root Insurance Company, member of Audit and Investment committees ● Dean’s Advisory Council, Fisher College of Business ● The Ohio State University Board of Trustees, member of Audit and Compliance Committee

| ||

|

Mr. Hilsheimer’s broad business background and corporate finance and public accounting experience, including as a chief financial officer with responsibility and accountability for all corporate and operating finance functions, make him a valued member of the Board

| ||||

|

Janet E. Jackson Independent Age 65 Director since 2014 |

Occupation

Former President and Chief Executive Officer, United Way of Central Ohio, a nonprofit organization and one of the largest United Way affiliates in the U.S. (2003–2017)

Education

B.A. in History, Wittenberg University and J.D., National Law Center at The George Washington University

Experience

● Columbus City Attorney, Columbus, Ohio ● Franklin County Municipal Court Judge ● First woman and first African American to hold her position at United Way and to be elected as Columbus City Attorney, and the first African American female judge in Franklin County history

|

Other Board Service

● Wittenberg University ● Columbus Jazz Arts Group ● United Way Retirees Association

| ||

|

Ms. Jackson’s significant leadership experience, as well as extensive strategy and legal background, make her a valued member of the Board.

| ||||

|

IBP 2018 Proxy Statement | 11

|

Table of Contents

|

Class I – Terms Expire at the 2020 Annual Meeting of Stockholders

| ||||

|

Michael T. Miller Age 53 Director since 2004 |

Occupation

Our Executive Vice President – Finance (since 2004) and Chief Financial Officer (since July 2013)

Education

● B.A. in Economics and German, Wake Forest University

Experience

● Senior Vice President/Managing Director, Corporate Investment Banking, Huntington Capital Corp., a subsidiary of Huntington Bancshares, Inc., a regional bank holding company ● Various positions with Deutsche Bank and Canadian Imperial Bank of Commerce ● First Union National Bank, Charlotte, North Carolina |

Other Board Service

● BMC Stock Holdings, Inc., a publicly traded leader in diversified building products and services to builders, contractors and professional remodelers in the U.S., member of Audit Committee

| ||

|

Mr. Miller’s extensive experience with us in the building products industry, background in finance and knowledge of financial reporting make him a valued member of the Board.

| ||||

|

J. Michael Nixon Age 73 Director since 2012 |

Occupation

Founder and Chief Executive Officer, TCI Contracting, LLC, installer of building products and one of our subsidiaries (2006–present)

Education

Attended Memphis State University

Experience

Quality Insulation Inc., a Connecticut-based insulation installer |

Other Boards

● Cherokee County Airport Authority Georgia Properties Commission

| ||

|

Mr. Nixon’s extensive experience and leadership in the building products installation industry make him a valued member of the Board.

| ||||

|

12 | IBP 2018 Proxy Statement

|

Table of Contents

|

Vikas Verma Age 65 Director since 2017 |

Occupation

Chief Executive Officer of our subsidiaries Trilok Industries, Inc., Alpha Insulation & Water Proofing Company and Alpha Insulation & Water Proofing, Inc. (the “Alpha companies), installers of commercial waterproofing, insulation, fireproofing and fire stopping (2012– present)

Education

B.A. in Engineering and Associate’s Degree in International Marketing and Marketing Management, University of Bombay

Experience

● Founder of the Alpha Companies ● President of Alamo Insulation Co., a residential insulation company

|

Other Board Service

● National Association of Minority Contractors

| ||

|

Mr. Verma’s more than 36 years of experience in commercial and specialty construction make him a valued member of the Board.

| ||||

Required Vote and Recommendation of the Board

The affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve the election of each nominee as a director. A majority of votes cast means that the number of shares voted “FOR” a director must exceed the number of votes cast “AGAINST” the director. “ABSTAIN” votes and broker non-votes will not be counted as votes cast either “FOR” or “AGAINST” the director’s election.

Unless otherwise instructed, the persons named as proxies will vote “FOR” each nominee.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF MARGOT L. CARTER, ROBERT H. SCHOTTENSTEIN AND MICHAEL H. THOMAS AS DIRECTORS, EACH TO SERVE A THREE-YEAR TERM.

|

|

IBP 2018 Proxy Statement | 13

|

Table of Contents

|

| ||

Composition and Responsibilities of the Board

Our business and affairs are managed under the direction of our Board of Directors. Although the Board does not have responsibility for the day-to-day management of the Company, our directors stay informed about the Company’s business through regular meetings and interactions with management. The Board’s responsibilities include oversight of:

| ● | the Company’s performance, strategies and major decisions, including acquisitions; |

| ● | the Company’s compliance with legal and regulatory requirements; |

| ● | the integrity of the Company’s financial statements; |

| ● | management’s practices for identifying, managing and mitigating key enterprise risks; |

| ● | management’s performance and succession planning; and |

| ● | executive and director compensation. |

Our Bylaws provide that the number of directors constituting the Board is fixed from time to time by a majority vote of the directors then in office. No decrease in the authorized number of directors will result in the removal of an incumbent director until that director’s term of office expires. Vacancies may be filled by the Board.

Our Board of Directors currently consists of nine members. Our Second Amended and Restated Certificate of Incorporation provides that our directors are divided into three classes, as nearly equal in number as possible and designated Class I, Class II and Class III, with one class of directors elected annually for three-year terms. Each director holds office until his or her successor is duly elected and qualified or until his or her earlier death, resignation, retirement, disqualification or removal. As a result, only one class of directors is elected at each annual meeting of stockholders, with the other classes of directors continuing to serve for the remainder of their respective terms.

Director Qualification and Board Diversity

Our Nominating and Corporate Governance Committee is responsible for annually reviewing and evaluating the appropriate characteristics, skills and experience required for the Board as a whole and its individual members. In evaluating the suitability of both new candidates and current directors for director positions, the Nominating and Corporate Governance Committee, in recommending candidates, and the Board, in approving (and, in the case of vacancies, appointing) such candidates, consider whether there are evolving needs of the Board that may require expertise in a particular field. The entirety of each candidate’s credentials is evaluated, with no specific eligibility requirements or minimum qualifications.

The Nominating and Corporate Governance Committee and the Board take into account numerous factors, including those set forth in the “skills matrix” below. The skills matrix helps the Nominating and Corporate Governance Committee and the Board determine whether a candidate or a Board member possesses one or more of the skill sets and attributes set forth in the matrix that may qualify him or her for service on the Board or a particular committee.

|

14 | IBP 2018 Proxy Statement

|

Table of Contents

|

Industry Knowledge

|

Financial Skills |

Experience |

Diversity |

Miscellaneous | ||||

|

● Housing ● Construction |

● Public Company ● Financial Reporting ● Capital Structure Experience ● M&A Transactions ● IT / Risk Management |

● Public Board ● Audit Committee ● Compensation Committee ● Corporate Governance / Nominating Committee ● Executive Leadership Strategic / Operational |

● Age ● Gender ● Race / Ethnicity ● Geographic |

● Time Commitment |

The Nominating and Corporate Governance Committee and the Board also take into account whether the nominee meets applicable criteria for independence and whether the individual will enhance the diversity of views and experiences available to the Board in its deliberations. If the nominee is a current director, the Nominating and Corporate Governance Committee also considers the director’s individual contributions to the Board, the director’s ability to work collaboratively with other directors and the effectiveness of the Board as a whole. The Nominating and Corporate Governance Committee and the Board do not assign specific weight to any particular factor, and depending on the current needs of the Board, may weigh a factor or factors more or less heavily.

Although the Nominating and Corporate Governance Committee and the Board of Directors do not have a written diversity policy, the Board, as a group, is expected to represent a broad diversity of backgrounds and experience in business matters, and our current Board is comprised of 22% women and 22% minorities. The Nominating and Corporate Governance Committee believes that the collective experience of our directors, covering a wide range of backgrounds, skills, geographies, industries, ages, gender and race, serves to make the Board balanced and well diversified.

In identifying potential candidates for Board membership, the Nominating and Corporate Governance Committee may rely on recommendations from directors, stockholders, management and others. The Nominating and Corporate Governance Committee does not distinguish between nominees recommended by stockholders and nominees recommended by other sources, and evaluates candidates recommended by stockholders on a substantially similar basis as it considers other nominees.

Stockholders desiring to recommend or nominate a director candidate must comply with certain procedures. If you are a stockholder and desire to nominate a director candidate at the 2019 Annual Meeting of Stockholders, you must comply with the procedures for nomination set forth in the section entitled “Proposals of Stockholders for the 2019 Annual Meeting.” Stockholders who do not wish to nominate a director at an annual meeting may recommend a director candidate to the Nominating and Corporate Governance Committee for consideration at any time by giving written notice of the recommendation to our Corporate Secretary at Installed Building Products, Inc., 495 South High Street, Suite 50, Columbus, Ohio 43215. The recommendation must include the candidate’s name, age, business address, residence address and principal occupation or employment, as well as a description of the candidate’s qualifications, attributes and other skills. The Nominating and Corporate Governance Committee may require the submission of additional information before considering the candidate. A written consent from the candidate consenting to serve as a director, if elected, must accompany the recommendation. These procedural requirements are intended to ensure that the Nominating and Corporate Governance Committee has sufficient time and a basis on which to assess potential director candidates and are not intended to discourage or interfere with appropriate stockholder nominations.

Based upon information provided by each director concerning his or her background, education, employment, experience and affiliations, our Nominating and Corporate Governance Committee and Board of Directors have

|

IBP 2018 Proxy Statement | 15

|

Table of Contents

determined that each of Ms. Carter, Ms. Jackson and Messrs. Hilsheimer, Schottenstein and Thomas has no material relationship with the Company or its subsidiaries, either directly or indirectly, that would interfere with the exercise of his or her independent judgment, and that each qualifies as an “independent director” as defined in the rules of the New York Stock Exchange (“NYSE”) and the rules promulgated by the SEC.

When determining whether a director qualifies as independent, the Board broadly considers all relevant facts and circumstances to determine whether the director has any material relationship with the Company, either directly or indirectly, that would interfere with the exercise of independent judgment. In the course of determining the independence of Mr. Schottenstein, the Board considered that Mr. Schottenstein is the Chief Executive Officer of M/I Homes, Inc., a company with which we conduct transactions in the ordinary course of our business. Based on the aggregate annual value of these transactions (less than 1% of the annual revenues of each of the Company and M/I Homes, Inc. in 2017) and the nature of the transactions (which is the sale and installation of building products in the ordinary course of business of both companies), the Board does not believe that this relationship impairs the independence of Mr. Schottenstein or that Mr. Schottenstein has any material interest in any transaction between the Company and M/I Homes, Inc. Upon careful consideration, the Board of Directors has determined that our Board is comprised of a majority of independent directors, and that each Board committee is comprised solely of independent directors. There are no family relationships among any of our executive officers or any of our directors.

Mr. Edwards serves as our President, Chief Executive Officer and Chairman. The Board regularly evaluates its governance structure and has concluded that the Company and its stockholders are best served by not having a formal policy regarding whether the same individual should serve as both chairman and chief executive officer. This approach allows the Board to exercise its business judgment in determining the most appropriate leadership structure in light of the prevailing facts and circumstances facing the Company, including the composition and tenure of the Board, the tenure of the Chief Executive Officer, the strength of the Company’s management team, the Company’s recent financial performance, the Company’s strategic plan and the economic environment, among other factors. The positions of Chairman and Chief Executive Officer have historically been combined at our Company.

We believe that a combined Chairman and Chief Executive Officer role helps provide strong and consistent leadership for our management team and Board of Directors. In reviewing our leadership structure, the Board has considered that:

| ● | Mr. Edwards has extensive experience in our industry; |

| ● | Mr. Edwards demonstrates the leadership and vision necessary to lead the Board and our Company in challenging industry environments; |

| ● | Mr. Edwards exercises leadership that has generated strong operational performance; |

| ● | Mr. Edwards is viewed by our customers, stockholders, suppliers and other business partners as a leader in our industry; and |

| ● | Mr. Edwards has a strong working relationship with the Board. |

Based on the demonstrated success of our structure to date, both in terms of the functioning of the Board and the growth and performance of the Company, and the continued benefits of retaining Mr. Edwards’ strategic perspective in the position of Chairman, the Board believes that having a combined position is the appropriate leadership structure for the Company at this time.

To support our leadership structure, we have established a Presiding Independent Director position. Our Presiding Independent Director is elected annually by the independent directors on our Board. Ms. Carter, a director since 2014, currently serves as our Presiding Independent Director. Ms. Carter works with management to determine information to be provided to the Board, chairs regular executive sessions of the independent directors and serves as liaison between management and the Board as well as among independent directors. She regularly attends the meetings of the various Board committees.

|

16 | IBP 2018 Proxy Statement

|

Table of Contents

We believe that having a combined Chief Executive Officer and Chairman position, together with a Presiding Independent Director and a Board of Directors comprised of a majority of independent directors, provides the best leadership structure for our Company at the present time. The Board periodically reviews our leadership structure and retains the authority to modify the structure when appropriate.

Executive Sessions of the Board

Our Board of Directors holds regularly scheduled executive sessions in which the independent directors meet without the presence or participation of management. These meetings allow the independent directors to discuss the business and affairs of the Company, as well as matters concerning management, without any member of management present. At these meetings, Ms. Carter serves as the Presiding Independent Director who chairs the meetings and acts as liaison among the independent directors and the other Board members and management. As part of the executive sessions, the independent directors may meet with our Chief Executive Officer, our management team members and representatives of our independent registered public accounting firm as they deem necessary or appropriate.

Annual Board and Committee Self-Assessments

Pursuant to NYSE requirements, our Corporate Governance Guidelines and the charters of each of the Board committees, the Board and each of its committees conduct an annual self-assessment. This self-assessment is intended to determine whether the Board and the committees are functioning effectively and to provide them with an opportunity to improve their effectiveness. The self-assessment enables directors to provide confidential feedback on topics ranging from Board and committee composition and structure to responsibility and accountability of directors. A summary of the results is presented to the Nominating and Corporate Governance Committee, which is responsible for oversight of the process. The Nominating and Corporate Governance Committee reports the results of these self-assessments to the Board, which considers ways in which Board and committee effectiveness may be enhanced. This process helps identify opportunities to consider implementing new practices and procedures as appropriate. While the formal Board and committee self-evaluation is conducted on an annual basis, the directors share perspectives, feedback and suggestions year-round.

Role of the Board in Risk Oversight

Risk assessment and oversight are an integral part of our corporate governance and management processes. Our Board of Directors encourages management to promote a culture that incorporates risk management into both our overall corporate strategy and our day-to-day business operations.

It is management’s responsibility to identify, evaluate, manage and mitigate risk within the context of our strategic plans and to bring to the Board’s attention the most material risks facing the Company. It is the Board’s responsibility to oversee our risk management processes and to ensure that management is taking appropriate action to manage material risks. The Board also has responsibility for oversight of leadership succession for our most senior officers, including the Chief Executive Officer, and reviews succession plans on an annual basis.

Management regularly discusses strategic and operational risks, including a focused analysis of specific risks facing the Company. In addition, our risk assessment practices, including auditing procedures, internal controls over financial reporting, and compliance policies and programs, are designed to inform management about our material risks. Throughout the year, management reviews these risks with the Board and its committees as part of presentations that focus on particular business functions, operations or strategies. At the meetings, management advises the Board concerning major risk exposure and the steps taken to monitor, mitigate or eliminate material risks.

Our Board of Directors does not have a standing risk management committee, choosing instead to administer this oversight function through the entire Board.

|

IBP 2018 Proxy Statement | 17

|

Table of Contents

|

Board of Directors

| ||||

| Oversees overall risk management function and strategic risks to the Company. The Board has delegated certain risk management oversight to its committees in their areas of responsibility. The Board is kept informed of each committee’s risk oversight and other activities through reports to the Board presented at every regular Board meeting.

| ||||

| Audit Committee | Compensation Committee |

Nominating and Corporate Governance Committee

| ||

| Monitors financial statement integrity and compliance, including internal controls over financial reporting. Monitors operational and strategic risks related to the Company’s financial affairs, including strategies for managing financial exposure and contingent liabilities. Monitors compliance with ethics, investment and related-party transaction policies. | Monitors potential risks related to the design and administration of our compensation plans, policies, and programs, including our performance-based compensation programs, to promote appropriate incentives that do not encourage executive officers or employees to take unnecessary and/or excessive risks. | Monitors potential risks related to our governance practices, including reviewing succession plans and performance and composition of the Board, monitoring legal developments and trends regarding corporate governance practices and reviewing the effectiveness of our Corporate Governance Guidelines. | ||

Meetings of the Board and Director Attendance at Annual Meeting of Stockholders

The Board of Directors held five meetings during 2017. Each director attended, in person or by telephone, at least 75% of the total number of meetings of both the Board and the committees on which he or she served during the year. Board agendas are set in advance by management with the assistance of the Presiding Independent Director to ensure that appropriate subjects are covered. Any member of the Board may request that an item be included on the agenda. Directors are provided with materials in advance of meetings and are expected to review these materials before each meeting to ensure that time in Board and committee meetings is focused on active discussions versus lengthy presentations. The independent directors held four meetings in executive session during 2017 (without the presence of Mr. Edwards or other employees of the Company) to discuss various matters related to the oversight of the Company and the management of Board affairs.

Although we do not have a formal policy requiring Board members to attend annual meetings of our stockholders, our directors are expected to make every effort to attend our stockholders’ meetings. All of our directors attended the Annual Meeting of Stockholders in 2017.

The Board has established three standing committees to assist it in the discharge of its duties. The table below shows the current membership for each of these committees:

| Member | Audit | Compensation | Nominating and Corporate Governance | |||

|

Margot L. Carter |

● | Chair | ||||

|

Lawrence A. Hilsheimer |

Chair | ● | ||||

|

Janet E. Jackson |

Chair | ● | ||||

|

Robert H. Schottenstein |

● | |||||

|

Michael H. Thomas |

● | ● | ||||

|

18 | IBP 2018 Proxy Statement

|

Table of Contents

Audit Committee

| Chair:

Lawrence A. Hilsheimer

Additional Members:

Margot L. Carter Michael H. Thomas

Meetings in 2017: 4

— All members are independent under applicable rules of the SEC and NYSE and are “financially literate” under applicable rules of the NYSE

— Mr. Hilsheimer is an “audit committee financial expert” under applicable rules of the SEC

— Governed by a Board-approved charter |

The Audit Committee oversees our corporate accounting and financial reporting processes and is primarily responsible for:

● selecting our independent registered public accounting firm and determining its scope of engagement; ● evaluating the firm’s qualifications, independence and performance; ● approving the scope of the annual audit and fees; ● approving audit and non-audit services to be performed by the firm, taking into consideration whether the firm’s provision of non-audit services is compatible with maintaining its independence; ● ensuring the rotation of partners of the firm on our engagement team; ● reviewing the adequacy and effectiveness of our accounting and financial reporting processes, internal controls and our financial statement audits; ● reviewing major financial risk exposures and the steps management has taken to monitor and control such exposures; ● overseeing complaints received regarding accounting, internal accounting controls or auditing matters; ● reviewing related-party transactions for potential conflicts of interest; ● reviewing reports to management prepared by our internal audit department and management’s responses; ● reviewing and discussing with management and our independent registered public accounting firm our financial statements and management’s discussion and analysis of financial condition and results of operations; ● evaluating, at least annually, the performance of the Audit Committee and its members, including compliance by the Audit Committee with its charter; and ● handling such other matters that are specifically delegated to the Audit Committee by the Board. | |

|

IBP 2018 Proxy Statement | 19

|

Table of Contents

Compensation Committee

| Chair:

Janet E. Jackson

Additional Members:

Robert H. Schottenstein Michael H. Thomas

Meetings in 2017: 6

— All members are independent under applicable rules of the NYSE and are “non-employee directors” under applicable rules of the SEC and are “outside directors” under the Internal Revenue Code

— Governed by a Board-approved charter |

The Compensation Committee oversees the compensation of our executive officers, including our Chief Executive Officer, and is responsible for, among other things:

● reviewing and determining the compensation, employment agreements, severance arrangements and other benefits of our executive officers; ● approving, on an annual basis, the corporate goals and objectives relevant to the compensation of our executive officers and evaluating their performance in light of such goals and objectives; ● administering our 2014 Omnibus Incentive Plan; ● making recommendations to the Board with respect to non-employee director compensation; ● reviewing and discussing with management our Compensation Discussion and Analysis; ● reviewing any risks arising from our compensation policies and practices for our executives and employees that would be reasonably likely to have a material adverse effect on the Company; ● retaining the advice of a compensation consultant, independent legal counsel or other adviser after taking into consideration the factors required by any applicable requirements of law and NYSE rules; ● overseeing the appointment, work and compensation of compensation consultants, independent legal counsel and other advisers engaged by the Compensation Committee; ● evaluating, at least annually, the performance of the Compensation Committee and its members, including compliance by the Compensation Committee with its charter; and ● handling such other matters that are specifically delegated to the Compensation Committee by the Board. | |

During 2017 (i) no officer, former officer or employee of the Company served as a member of our Compensation Committee, and (ii) none of our executive officers served as a member of the board of directors or the compensation committee of any entity whose executive officers served on our Board or Compensation Committee.

|

20 | IBP 2018 Proxy Statement

|

Table of Contents

Nominating and Corporate Governance Committee

| Chair:

Margot L. Carter

Additional Members:

Lawrence A. Hilsheimer Janet E. Jackson

Meetings in 2017: 4

— All members are independent under applicable rules of the NYSE

— Governed by a Board-approved charter |

The Nominating and Corporate Governance Committee is responsible for, among other things: | |

|

● reviewing and establishing criteria for candidates to serve on the Board to ensure that the Board has the requisite expertise and is sufficiently diverse; ● conducting inquiries into the backgrounds and qualifications of potential director candidates; ● recommending to the Board nominees for election as directors, taking into account factors such as experience, skills, industry knowledge, financial expertise, existing commitments, potential conflicts of interest, independence and the extent to which the candidate fills a present need on the Board; ● recommending to the Board the composition and size of the Board; ● overseeing the evaluation of the Board, its committees and management in accordance with applicable rules of the NYSE; ● recommending members of the Board to serve on the committees of the Board as well as committee chairs; ● monitoring the structure and operations of Board committees, the qualifications and criteria for membership on each committee and, as appropriate, recommending periodic rotation of committee members and term limitations on committee service; ● reviewing the charter of each committee and recommending to the Board any changes; ● reviewing our Certificate of Incorporation and Bylaws and recommending to the Board any necessary or desirable amendments; ● assessing the adequacy of our Corporate Governance Guidelines and Code of Business Conduct and Ethics and recommending any proposed changes to the Board; ● periodically reviewing the Board’s leadership structure to assess whether it is appropriate given the specific characteristics and circumstances of the Company; ● overseeing an annual review of succession planning for senior executives; ● evaluating, at least annually, the performance of the Nominating and Corporate Governance Committee and its members, including compliance by the Nominating and Corporate Governance Committee with its charter; and ● handling such other matters that are specifically delegated to the Nominating and Corporate Governance Committee by the Board. |

The Board of Directors annually reviews and determines the compensation of our non-employee directors, taking into account the recommendations of the Compensation Committee. In connection with this review and determination, the Board and the Compensation Committee consider the compensation paid to the non-employee directors of our peer group, which is the same peer group used in reviewing the compensation of our executive officers, current facts and circumstances relating to our business and our past practices. The Board believes that non-employee director compensation should be competitive to ensure that we attract and retain qualified non-employee directors and that the compensation of our non-employee directors should include a combination of cash and equity-based compensation to align the long-term interests of our non-employee directors and our stockholders. The Board does not have a pre-established policy or target for allocation between cash and equity-based compensation and determines the mix of compensation based on what it believes is most appropriate under the circumstances. The Compensation Committee approves all equity-based compensation granted to the non-employee directors. In 2016, the Compensation Committee engaged Mercer, LLC, a subsidiary of Marsh & McLennan Companies and a global

|

IBP 2018 Proxy Statement | 21

|

Table of Contents

professional services firm (“Mercer”), to review our non-employee director compensation program and to conduct market comparisons for our non-employee directors similar to that performed for our executive officer compensation program. See “Our Executive Compensation Process – Role of Compensation Consultant” and “Benchmarking.” The Compensation Committee evaluates director compensation primarily on the basis of peer group data provided by Mercer. The Compensation Committee intends to engage Mercer to update its review of our director compensation program biannually.

2017 Elements of our Non-Employee Director Compensation

| Annual Board retainer | $ | 50,000 | ||

| Annual committee chair retainer (Compensation Committee and Nominating and Corporate Governance Committee) | $ | 10,000 | ||

| Annual committee chair retainer (Audit Committee) | $ | 20,000 | ||

| Annual Presiding Independent Director retainer | $ | 10,000 | ||

| Annual grant of stock under our 2014 Omnibus Incentive Plan (fair market value on grant date) | $ | 60,000 |

Director compensation, including aggregate cash compensation and the grant date fair value of shares of the Company’s common stock, may not exceed $400,000 in any fiscal year.

All directors are entitled to be reimbursed for their reasonable expenses to attend Board meetings and meetings of committees on which they serve. Directors who are employees of the Company receive no additional compensation for their service as directors.

Director Stock Ownership Policy

Pursuant to our Stock Ownership Policy for Directors established by the Board of Directors and the Compensation Committee, to align each director’s interests with the long-term interests of our stockholders, each director is required to beneficially own our common stock having a fair market value equal to at least the greater of $150,000 or three times the director’s annual cash retainer (excluding committee chair and Presiding Independent Director retainers). If a director chooses to meet this guideline using annual grants of restricted stock pursuant to our director compensation program, the fair market value of the stock for purposes of meeting the requirement is measured as of the grant date. Directors have five years from the date of (a) our initial public offering in February 2014, or (b) if later, from the date of his or her first appointment or election, or (c) if later, the date of an increase in the amount of common stock required to be held to meet this requirement. All of our directors meet, or are on track to meet, the guidelines within the timeframe established by the policy.

The following table presents the total compensation paid during 2017 (i) to each non-employee director and (ii) to Messrs. Nixon and Verma, who are employees of the Company and who also serve as directors, but who receive no compensation for their Board service, as noted below. Directors’ retainer fees are paid quarterly.

|

22 | IBP 2018 Proxy Statement

|

Table of Contents

| Name | Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1)(2) |

All Other Compensation ($) |

Total ($) |

||||||||||||||

| Margot L. Carter |

70,000 | 60,000 | - | 130,000 | ||||||||||||||

| Lawrence A. Hilsheimer |

(3) | 64,093 | 60,000 | - | 124,093 | |||||||||||||

| Janet E. Jackson |

60,000 | 60,000 | - | 120,000 | ||||||||||||||

| J. Michael Nixon |

(4) | - | - | 275,195 | 275,195 | |||||||||||||

| Steven G. Raich |

(5) | 33,516 | - | - | 33,516 | |||||||||||||

| Robert H. Schottenstein |

50,000 | 60,000 | - | 110,000 | ||||||||||||||

| Michael H. Thomas |

50,000 | 60,000 | - | 110,000 | ||||||||||||||

| Vikas Verma |

(4) | - | - | 785,802 | 785,802 | |||||||||||||

|

|

| (1) | Represents an annual grant of restricted stock made pursuant to our 2014 Omnibus Incentive Plan having a value of $60,000 on the grant date (June 1, 2017), with the number of shares determined based on the closing price of our common stock ($50.50) on the grant date. All of the restricted stock awards vested upon grant. | |

| (2) | None of our non-employee directors nor Messrs. Nixon or Verma held any stock options as of December 31, 2017. | |

| (3) | Effective May 3, 2017, the Compensation Committee increased the annual retainer for the Chair of the Audit Committee from $10,000 to $20,000. The amount specified under “Fees Earned or Paid in Cash” column represents Mr. Hilsheimer’s prorated increased Audit Committee chair annual retainer. | |

| (4) | As employees of the Company, Messrs. Nixon and Verma earn no compensation for their Board service. The amount specified under the “All Other Compensation” column reflects the following compensation paid to them as employees in 2017: (i) a salary of $250,000 and $300,000, respectively, (ii) a bonus of $478,993 paid to Mr. Verma; and (iii) other compensation, including a vehicle or vehicle allowance, Company-paid car insurance and Company-paid cell phone, totaling $25,195 and $6,809, respectively. | |

| (5) | Represents fees paid to Mr. Raich through his term as a director, which expired on June 1, 2017. | |

Code of Business Conduct and Ethics

Our Board of Directors has established a Code of Business Conduct and Ethics applicable to all of our employees, officers and directors, including our principal executive, financial and accounting officers and all persons performing similar functions, to help ensure that our business is conducted in a consistently legal and ethical manner. Adherence to this code assures that our directors, officers and employees are held to the highest standards of integrity. The Code of Business Conduct and Ethics covers such areas as:

| ● | conflicts of interest; |

| ● | compliance with laws; |

| ● | protection and proper use of Company assets; |

| ● | use of Company assets for personal gain; |

| ● | confidentiality of Company, customer, supplier and business partner information; |

| ● | fair dealing; and |

| ● | gifts, entertainment and other benefits. |

|

IBP 2018 Proxy Statement | 23

|

Table of Contents

The Code of Business Conduct and Ethics is overseen by the Audit Committee.

Insider Trading Policy and Hedging and Pledging Prohibition

Our insider trading policy prohibits all directors, officers, employees and their family members from directly or indirectly purchasing or selling any type of security, whether the issuer of that security is our Company or another company, while aware of material, non-public information relating to the issuer. The policy also prohibits such persons from providing any such material, non-public information to any other person who may trade in the securities while aware of such information.

Effective February 22, 2018, the Board amended our insider trading policy to prohibit certain other transactions in Company stock:

| Speculating | Speculating in securities of the Company, including buying with the intention of quickly reselling such securities, or selling Company securities with the intention of quickly buying such securities.

| |

| Short Sales | Directly or indirectly selling any equity security of the Company if the person does not own the security sold, including a “sale against the box” (a sale with delayed delivery).

| |