Form DEF 14A ISABELLA BANK Corp For: May 03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||||||||||||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||||||||

| ý | Definitive Proxy Statement | |||||||||||||

| ¨ | Definitive Additional Materials | |||||||||||||

| ¨ | Soliciting Material Under §240.14a-12 | |||||||||||||

ISABELLA BANK CORPORATION | ||||||||||||||

| (Name of Registrant as Specified In Its Charter) | ||||||||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||||||||

| Payment of Filing Fee (Check the appropriate box): | ||||||||||||||

| ý | No fee required. | |||||||||||||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

| 1) | Title of each class of securities to which transaction applies: | |||||||||||||

| 2) | Aggregate number of securities to which transaction applies: | |||||||||||||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||||||||

| 4) | Proposed maximum aggregate value of transaction: | |||||||||||||

| 5) | Total fee paid: | |||||||||||||

| ¨ | Fee paid previously with preliminary materials. | |||||||||||||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||||||||

| 1) | Amount Previously Paid: | |||||||||||||

| 2) | Form, Schedule or Registration Statement No.: | |||||||||||||

| 3) | Filing Party: | |||||||||||||

| 4) | Date Filed: | |||||||||||||

ISABELLA BANK CORPORATION

401 N. Main St.

Mt. Pleasant, Michigan 48858

NOTICE OF THE ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 3, 2022

Notice is hereby given that the Annual Meeting of Shareholders of Isabella Bank Corporation will be held virtually, in lieu of an in-person meeting, on Tuesday, May 3, 2022 at 5:00 p.m. Eastern Daylight Time. The meeting is for the purpose of considering and acting upon the following items of business:

1.The election of four directors.

2.To transact such other business as may properly come before the meeting, or any adjournment or adjournments thereof.

The Board of Directors has fixed March 11, 2022 as the record date for determination of shareholders entitled to notice of, and to vote at, the meeting or any adjournments thereof.

Shareholders can attend, vote, and submit questions at the virtual Annual Meeting via the internet at www.virtualshareholdermeeting.com/ISBA2022 and entering their 16-digit control number included on their proxy card.

By order of the Board of Directors

Debra Campbell, Secretary

Dated: March 25, 2022

ISABELLA BANK CORPORATION

401 N. Main St.

Mt. Pleasant, Michigan 48858

PROXY STATEMENT

General Information

This Proxy Statement is furnished in connection with the solicitation of proxies, to be voted at our Annual Meeting of Shareholders (the “Annual Meeting”) which is to be held virtually, in lieu of an in-person meeting, on Tuesday, May 3, 2022 at 5:00 p.m., or at any adjournment or adjournments thereof, for the purposes set forth in the accompanying Notice of the Annual Meeting of Shareholders and in this Proxy Statement.

Shareholders can attend, vote, and submit questions at the virtual Annual Meeting via the internet at www.virtualshareholdermeeting.com/ISBA2022 and entering their 16-digit control number included on their proxy card.

This Proxy Statement has been mailed on March 25, 2022 to all holders of record of common stock as of the record date. If a shareholder’s shares are held in the name of a broker, bank, or other nominee, then that party should give the shareholder instructions for voting the shareholder’s shares.

Voting at the Meeting

We have fixed the close of business on March 11, 2022 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment or adjournments thereof. We have only one class of common stock and no preferred stock. As of March 11, 2022, there were 7,534,136 shares of stock outstanding. Each outstanding share entitles the holder thereof to one vote on each separate matter presented for vote at the meeting. You may vote on matters that are properly presented at the Annual Meeting by attending the meeting and casting a vote, signing and returning the enclosed proxy, voting on the internet, or voting by phone. You may change your vote or revoke your proxy at any time before it is voted at the Annual Meeting by filing with the Corporation an instrument revoking it, filing a duly executed proxy bearing a later date (including a proxy given over the internet or by phone) or by attending the virtual meeting and electing to vote in person. You are encouraged to vote by mail, internet, or phone.

A quorum must be present in order to hold the Annual Meeting. A quorum is present if a majority of the shares of common stock entitled to vote are represented in person or by proxy. If you execute and return a proxy, those shares will be counted to determine if there is a quorum, even if you abstain or fail to vote on any of the proposals.

Your broker may not vote on Proposal 1 if you do not furnish instructions for such proposal. You should use the voting instruction card provided by us to instruct the broker to vote the shares, or else your shares will be considered “broker non-votes.” Broker non-votes are shares held by brokers or nominees as to which voting instructions have not been received from the shares’ beneficial owner or the individual entitled to vote those shares and the broker or nominee does not have discretionary voting power under rules applicable to broker-dealers. Under these rules, Proposal 1 is not an item on which brokerage firms may vote in their discretion on your behalf unless you have furnished voting instructions.

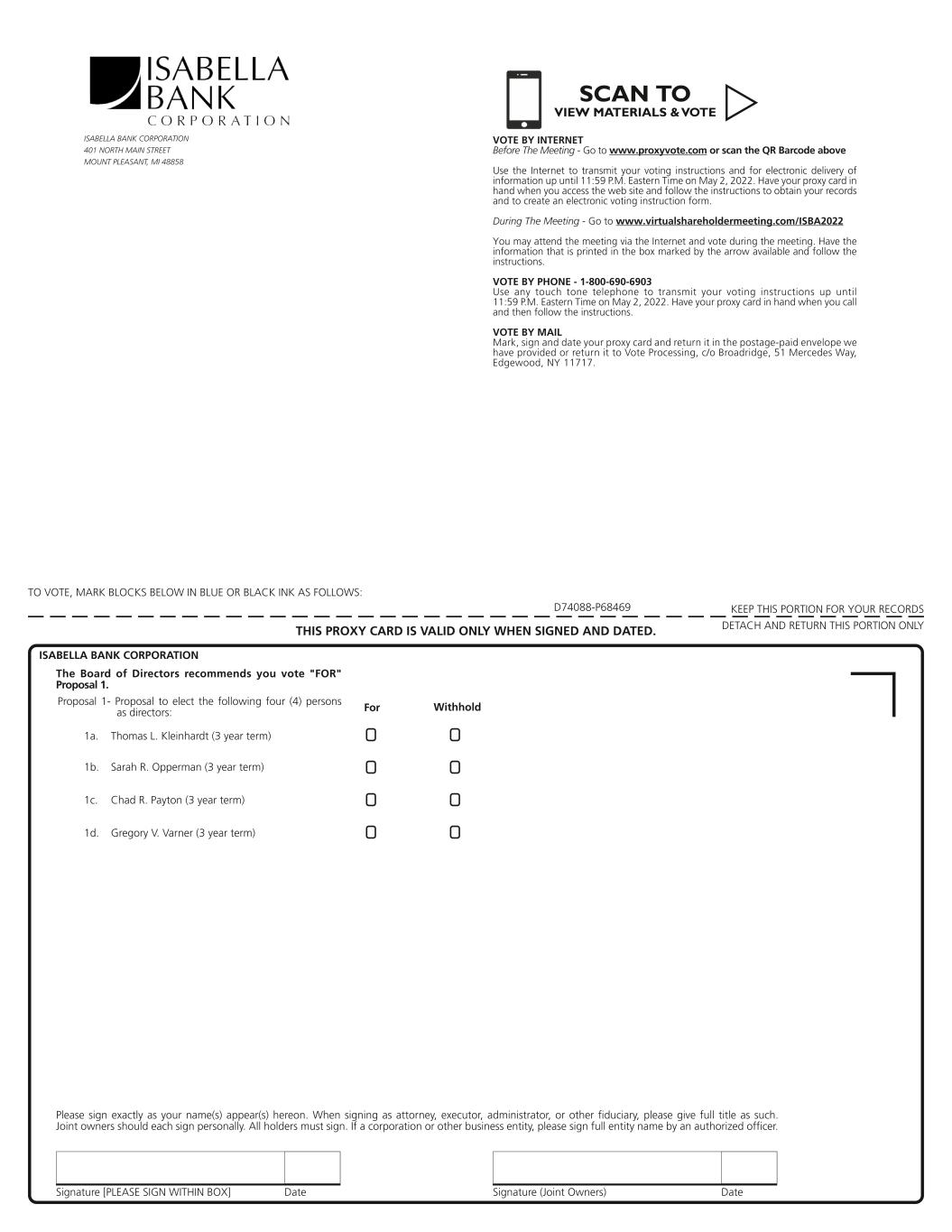

At this year’s Annual Meeting, you will elect four directors to serve for a term of three years. You may vote in favor or withhold your vote with respect to any or all nominees. Directors are elected by a plurality of the votes cast at the Annual Meeting. Abstentions and shares not voted, including broker non-votes, have no effect on the elections.

1

Proposal 1 - Election of Directors

The Board of Directors (the “Board”) currently consists of twelve (12) members divided into three classes, with the directors in each class being elected for a term of three years. At the Annual Meeting, Thomas L. Kleinhardt, Sarah R. Opperman, Chad R. Payton, and Gregory V. Varner, whose terms expire at the Annual Meeting, have been nominated for election to serve through the 2025 Annual Meeting.

Except as otherwise specified, proxies will be voted for the election of the four nominees. If a nominee becomes unable or unwilling to serve, proxies will be voted for such other person, if any, as shall be designated. However, we know of no reason to anticipate that this will occur. Each of the nominees has agreed to serve as a director if elected.

Nominees and current directors, including their principal occupation for the last five or more years, age, and length of service as a director, are listed below.

We recommend that you vote FOR the election of each of the nominees.

Director Qualifications

Board members are highly qualified and represent your best interests. We select nominees who:

•Have extensive business leadership.

•Bring a diverse perspective and experience.

•Are objective and collegial.

•Have high ethical standards and have demonstrated sound business judgment.

•Are willing and able to commit the significant time and effort to effectively fulfill their responsibilities.

•Are active in and knowledgeable of their respective communities.

Each nominee and current director possesses these qualities and provides a diverse complement of specific business skills and experience. In addition to the general qualifications described above, qualifications are included in the biographical summaries provided below.

The following table identifies individual Board members serving on each of our standing committees:

| Director | Audit | Nominating and Corporate Governance | Compensation and Human Resource | ||||||||||||||

| Sarah R. Opperman | Xo | Xo | Xo | ||||||||||||||

| Dr. Jeffrey J. Barnes | X | ||||||||||||||||

| Jill Bourland | Xc | Xc | |||||||||||||||

| Jae A. Evans | |||||||||||||||||

| G. Charles Hubscher | Xc | ||||||||||||||||

| Thomas L. Kleinhardt | X | X | |||||||||||||||

| David J. Maness | X | X | |||||||||||||||

| Richard L. McGuirk | |||||||||||||||||

| Chad R. Payton | X | ||||||||||||||||

| Vicki L. Rupp | |||||||||||||||||

| Jerome E. Schwind | |||||||||||||||||

| Gregory V. Varner | X | X | |||||||||||||||

| C — Chairperson | |||||||||||||||||

| O — Ex-Officio | |||||||||||||||||

2

Director Nominees for Terms Ending in 2025

Thomas L. Kleinhardt (age 67) has been a director of the Bank since 1998 and of Isabella Bank Corporation since 2010. Mr. Kleinhardt is President of McGuire Chevrolet, active in the Clare Kiwanis Club, and the former coach of the girls Varsity Basketball team for both Farwell High School and Clare High School. Mr. Kleinhardt's years of experience in managing a successful automobile dealership and understanding the financing needs of customers are valuable to the Board.

Sarah R. Opperman (age 62) has been a director of Isabella Bank Corporation and of the Bank since 2012 and has served as chair of both boards since May 2021. Ms. Opperman previously was employed for 28 years by The Dow Chemical Company, where she held leadership roles in public and government affairs. She served as interim President and Chief Executive Officer of the Midland Business Alliance from March 1 to December 2018. Ms. Opperman is a member of the Central Michigan University Advancement Board and MyMichigan Health Foundation. Ms. Opperman's business and leadership expertise, as well as her depth of community relationships, benefit Board discussions and decisions.

Chad R. Payton (age 53) has been a director of Isabella Bank Corporation and of the Bank since March 2021. Mr. Payton is a Certified Public Accountant and Partner of Roslund, Prestage & Company, PC, with over 30 years of tax and accounting experience. Mr. Payton is a member of the American Institute of Certified Public Accountants and Michigan Association of Certified Public Accountants. Mr. Payton has served as a member of an Isabella Bank regional advisory board since 2019. Mr. Payton's expertise in accounting and business experience are valuable to the Board.

Gregory V. Varner (age 67) has been a director of Isabella Bank Corporation and of the Bank since 2015. Mr. Varner was the Research Director for the Michigan Bean Commission for 40 years and retired in 2019. He received a Bachelor of Science in Agricultural Education and a Master of Science in Crop Science from Michigan State University. Mr. Varner's knowledge and years of experience in the agricultural field is an asset to the Board.

Current Directors with Terms Ending in 2023

Dr. Jeffrey J. Barnes (age 59) has been a director of the Bank since 2007 and of Isabella Bank Corporation since 2010. Dr. Barnes is a physician and shareholder in L.O. Eye Care, P.C. He is a former member of the Central Michigan Community Hospital Board of Directors. Dr. Barnes has experience in business operations and management, as well as knowledge of the communities we serve, which adds value to the Board.

G. Charles Hubscher (age 68) has been a director of the Bank since 2004 and of Isabella Bank Corporation since 2010. Mr. Hubscher is President of Hubscher and Son, Inc., a sand and gravel producer. He is a former director of the National Stone, Sand and Gravel Association, the Michigan Aggregates Association, and served on the Mt. Pleasant Area Community Foundation Board of Trustees for 20 years. Mr. Hubscher is a former member of the Zoning Board of Appeals for Deerfield Township. Mr. Hubscher brings his experience in business operations and management to the Board as well as his knowledge of the communities we serve.

David J. Maness (age 68) has been a director of the Bank since 2003 and of Isabella Bank Corporation since 2004. Mr. Maness served as Chairman of the Board for the Corporation and the Bank from 2010 to May 2021. He is President of Maness Petroleum, a geological and geophysical consulting services company. Mr. Maness is currently serving as a director for the Michigan Oil & Gas Association, and he previously served on the Mt. Pleasant Public Schools Board of Education. The business experience and community involvement that Mr. Maness brings to the Board is invaluable.

Vicki L. Rupp (age 62) has been a director of Isabella Bank Corporation and of the Bank since 2019. Ms. Rupp retired from The Dow Chemical Company after a successful thirty-five year career in various positions, including her final position of Corporate Director of Business Services. Her experience included specialty research & development, environmental, health and safety, global corporate service management, mergers & acquisition implementation, and organizational management. Ms. Rupp owns her own consulting company, Vicki Rupp Consulting, for companies seeking operational improvements. She also serves on the Saginaw Valley State University Foundation Board and Saginaw Valley State University Board of Control as chair. Ms. Rupp serves her community as a member of the executive committee of United Way and as a DOW/Saginaw Valley State University Affinity Network leader. Ms. Rupp brings experience in operations and strategic development and a commitment to community involvement.

3

Current Directors with Terms Ending in 2024

Jill Bourland (age 51) has been a director of Isabella Bank Corporation and of the Bank since 2017. Ms. Bourland is CEO and Partner of Blystone & Bailey, CPAs, P.C. Ms. Bourland is a graduate of Central Michigan University, a Certified Public Accountant, and a Housing Credit Certified Professional. She has over 25 years of audit, tax and accounting experience with a concentration in small business and affordable housing sectors. She currently serves as Treasurer of the William and Janet Strickler Nonprofit Center. She formerly served as President of the Mt. Pleasant Area Community Foundation and also as Treasurer and Chair of its Finance Committee. She is involved with the Gratiot-Isabella Technical Education Center Accounting/Business Advisory Committee. She is also a member of the American Institute of Certified Public Accountants, Michigan Association of Certified Public Accountants and Home Builders Association. Ms. Bourland has expertise in accounting, business experience and a strong commitment to community involvement.

Jae A. Evans (age 65) has been a director of Isabella Bank Corporation and of the Bank since 2014. He has been President and Chief Executive Officer of the Corporation since 2014 and Chief Executive Officer of the Bank since 2018. Mr. Evans has been employed by the Corporation since 2008 and served as Chief Operations Officer of the Bank from 2011 to 2013 and President of the Greenville Division of the Bank from 2008 to 2011. He is a graduate of Central Michigan University and has over 45 years of banking experience. Mr. Evans currently serves as a board member for The Community Bankers of Michigan, United Bankers Bank, and the Central Michigan University Advancement Board. Mr. Evans is also past Chair of the EightCap, Inc. Governing Board, past Vice Chair of the Carson City Hospital, past board member of the McLaren Central Michigan Hospital, was president of the Greenville Rotary Club, and past Chair of The Community Bankers of Michigan. Mr. Evans provides the Board with executive leadership, knowledge of commercial banking, and strong community involvement.

Richard L. McGuirk (age 50) was appointed a director of Isabella Bank Corporation and of the Bank at the February 24, 2021 Board meeting, effective March 31, 2021. Mr. McGuirk is the President and Operations Manager of Central Management, Inc. and a management consultant for McGuirk Sand-Gravel, Inc. Mr. McGuirk is a graduate of Central Michigan University and is a licensed real estate broker and builder. He currently serves as a board member for the Mt. Pleasant Area Community Foundation and the Central Michigan University Advancement Board. Mr. McGuirk has expertise in business, and a strong commitment to community involvement.

Jerome E. Schwind (age 55) has been a director of Isabella Bank Corporation and of the Bank since 2017. Mr. Schwind is President of the Bank and Vice President of the Corporation. He has been employed by the Bank since 1999 and has served in various roles at the Bank including Executive Vice President and Chief Operations Officer. Mr. Schwind received his undergraduate degree from Ferris State University and his MBA from Lake Superior State University. He is also a graduate of the Dale Carnegie Executive Development program, the Graduate School of Banking at the University of Wisconsin-Madison, and the Rollie Denison Leadership Institute. He currently serves as the Chair for the Middle Michigan Development Corporation, is a member of the Finance Advisory Board for the Ferris State University College of Business, the Michigan Bankers Association Grassroots Advocacy Committee, the Perry School of Banking Board, the Michigan Bankers Association Board, and also the Great Lakes Bay Alliance Board. Mr. Schwind brings his experience in banking and his many years at Isabella Bank to the Board in addition to his knowledge of the markets we serve.

Each of the directors has been engaged in their stated professions for more than five years unless otherwise stated.

Other Executive Officers

Neil M. McDonnell (age 58), Chief Financial Officer of Isabella Bank Corporation and of the Bank, joined Isabella Bank Corporation on January 30, 2018. Mr. McDonnell has over 30 years of banking experience and has served as chief financial officer, controller, treasurer, compliance & risk officer, and director of finance at large international banks, local community banks, as well as de novo banks. Prior to joining the Corporation, Mr. McDonnell was the Executive Vice President and Chief Financial Officer at Patriot Bank, N.A. located in Stamford, CT from January 2016 to May 2017.

David J. Reetz (age 61), Chief Lending Officer of the Bank, has over 35 years of lending experience and has been employed by the Bank since 1987, serving in his current role since 2003. He is a past President of the Exchange Club of Isabella County, served as Treasurer of the Isabella County Co-Expo Board and serves as a member of the Summit Clubhouse Advisory Board.

Peggy L. Wheeler (age 62), Chief Operations Officer of the Bank, has been employed by the Bank since 1977. She has over 40 years of banking experience with Isabella Bank, holding various positions including customer service, accounting, Controller, and Senior Vice President of Operations. She is a member of the grant review committee for the Mt. Pleasant Area Community Foundation and a member of the Optimist Club in Mt. Pleasant.

4

Corporate Governance

Director Independence

We have adopted the director independence standards as defined under the NASDAQ listing requirements. We have determined that Dr. Jeffrey J. Barnes, Jill Bourland, G. Charles Hubscher, Thomas L. Kleinhardt, David J. Maness, Richard L. McGuirk, Sarah R. Opperman, Chad R. Payton, Vicki L. Rupp, and Gregory V. Varner are independent directors. Jae A. Evans is not independent as he is employed as President and CEO of Isabella Bank Corporation and CEO of Isabella Bank. Jerome E. Schwind is not independent as he is employed as President of Isabella Bank and Vice President of Isabella Bank Corporation.

Board Leadership Structure and Risk Oversight

Our Governance Policy provides that only directors who are deemed to be independent as set forth by the NASDAQ listing requirements and SEC rules are eligible to hold the office of chairperson. Additionally, the chairpersons of Board established committees must also be independent directors. It is our belief that having a separate chairperson and CEO best serves the interest of the shareholders. The Board elects its chairperson at the first Board meeting following the Annual Meeting. Independent members of the Board meet without inside directors at least twice per year.

Management is responsible for our day-to-day risk management and the Board’s role is to engage in informed oversight. The Board utilizes committees to oversee risks associated with compensation, and governance. The Isabella Bank Board of Directors is responsible for overseeing credit, investment, information technology, interest rate, and trust risks. The chairpersons of the respective boards or committees report on their activities on a regular basis.

Our Audit Committee is responsible for overseeing the integrity of our consolidated financial statements, the independent auditors’ qualifications and independence, the performance of our internal audit function and those of independent auditors, our system of internal controls, our financial reporting and system of disclosure controls, and our compliance with legal and regulatory requirements and with our Code of Conduct and Business Ethics.

Committees of the Board of Directors and Meeting Attendance

The Board met 14 times during 2021. No current member of the Board attended less than 75% of the aggregate meetings of the Board and all committees on which such director served during 2021. The Board has an Audit Committee, a Nominating and Corporate Governance Committee, and a Compensation and Human Resource Committee.

Audit Committee

The Audit Committee is composed of independent directors. Information regarding the functions performed by the Audit Committee, its membership, and the number of meetings held during the year, is set forth in the “Audit Committee Report” included in this Proxy Statement. The Audit Committee is governed by a written charter approved by the Board, which is available on the Bank’s website: www.isabellabank.com.

In accordance with the provisions of the Sarbanes-Oxley Act of 2002, director Bourland and director Payton met the requirements of Audit Committee Financial Expert and have been so designated. The Audit Committee also consists of directors Kleinhardt, Maness, and Opperman (ex-officio).

Nominating and Corporate Governance Committee

We have a standing Nominating and Corporate Governance Committee consisting of independent directors Barnes, Hubscher, Maness, Opperman (ex-officio), and Varner. The Nominating and Corporate Governance Committee held two meetings in 2021, with all committee members attending each meeting for which they were a member. The Board has approved a Nominating and Corporate Governance Committee Charter which is available on the Bank’s website: www.isabellabank.com.

The Nominating and Corporate Governance Committee is responsible for evaluating and recommending individuals for nomination to the Board for approval. This Committee, in evaluating nominees, including incumbent directors and any nominees put forth by shareholders, considers business experience, skills, character, judgment, leadership experience, and their knowledge of the geographical markets, business segments or other criteria the Committee deems relevant and appropriate based on the current composition of the Board. This Committee considers diversity in identifying members with respect to our geographical markets served, the industry knowledge and experience of the nominee, and community relations of the nominee.

The Nominating and Corporate Governance Committee will consider, as potential nominees, persons recommended by shareholders. Recommendations should be submitted in writing to the Secretary of the Corporation, 401 N. Main St., Mt. Pleasant, Michigan 48858 and include the shareholder’s name, address and number of shares of the Corporation owned by the shareholder. The recommendation should also include the name, age, address and qualifications of the candidate.

5

Recommendations for the 2023 Annual Meeting of Shareholders should be delivered no later than November 25, 2022. The Nominating and Corporate Governance Committee evaluates all potential director nominees in the same manner, whether the nominations are received from a shareholder, or otherwise.

Compensation and Human Resource Committee

The Compensation and Human Resource Committee is responsible for reviewing and recommending to the Board the compensation of directors and the compensation of the President and CEO, Bank President, and CFO, including benefit plans. This Committee consists of independent directors Bourland, Kleinhardt, Opperman (ex-officio), and Varner. The Compensation and Human Resource Committee held five meetings during 2021. This Committee is governed by a written charter approved by the Board that is available on the Bank’s website: www.isabellabank.com.

Communications with the Board

Shareholders may communicate with the Board by sending written communications to the attention of the Corporation’s Secretary, Isabella Bank Corporation, 401 N. Main St., Mt. Pleasant, Michigan 48858. Communications will be forwarded to the Board or the appropriate committee, as soon as practicable.

Code of Ethics

Our Code of Conduct and Business Ethics, which is applicable to the CEO, CFO, and Controller, is available on the Bank’s website: www.isabellabank.com.

6

Audit Committee Report

The Audit Committee oversees the financial reporting process on behalf of the Board. The 2021 Audit Committee consisted of directors Bourland, Kleinhardt, Maness, Opperman (ex-officio), and Payton.

The Audit Committee is responsible for pre-approving all auditing services and permitted non-audit services by our independent auditors, or any other auditing or accounting firm, if those fees are reasonably expected to exceed 5.0% of the current year agreed upon fee for independent audit services. The Audit Committee has established general guidelines for the permissible scope and nature of any permitted non-audit services in connection with its annual review of the audit plan and reviews the guidelines with the Board.

Management has the primary responsibility for the consolidated financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited consolidated financial statements in the Annual Report with management including a discussion of the acceptability of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the consolidated financial statements. The Audit Committee also reviewed with management and the independent auditors, management’s assertion on the design and effectiveness of our internal control over financial reporting as of December 31, 2021.

The Audit Committee reviewed with our independent auditors, who are responsible for expressing an opinion on the conformity of those audited consolidated financial statements with accounting principles generally accepted in the United States of America, their judgments as to the acceptability of our accounting principles and such other matters as are required to be discussed with the Audit Committee by the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”), including those described in Auditing Standard No. 1301, “Communications with Audit Committees”, as may be modified or supplemented. In addition, the Audit Committee has received the written disclosures and the letter from the independent auditors required by PCAOB Rule 3526, “Communication with Audit Committees Concerning Independence”, as may be modified or supplemented, and has discussed this issue with the independent auditors.

The Audit Committee discussed with our internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee meets with the internal and external independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of our internal controls, and the overall quality of our financial reporting process. The Audit Committee held five meetings during 2021.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited consolidated financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2021 for filing with the Securities and Exchange Commission. The Audit Committee has appointed Rehmann Robson LLC as the independent auditors for the 2022 audit.

Respectfully submitted,

Jill Bourland, Audit Committee Chairperson

Thomas L. Kleinhardt

David J. Maness

Sarah R. Opperman (ex-officio)

Chad R. Payton

7

Executive Officers

Executive officers are compensated in accordance with their employment with the applicable entity. The following table shows information on compensation earned in each of the last two fiscal years ended December 31, 2021, for the CEO, CFO, and our next most highly compensated executive officer.

Summary Compensation Table

| Name and principal position | Year | Salary ($)(1) | Bonus ($)(2) | Stock Awards ($)(3) | Change in pension value and nonqualified deferred compensation earnings ($)(4) | All other compensation ($)(5) | Total ($) | ||||||||||||||||||||||||||||||||||

| Jae A. Evans | 2021 | 463,000 | 89,250 | — | — | 50,387 | 602,637 | ||||||||||||||||||||||||||||||||||

| President and CEO of Isabella Bank Corporation and CEO of Isabella Bank | 2020 | 449,250 | 74,366 | 74,366 | — | 49,918 | 647,900 | ||||||||||||||||||||||||||||||||||

| Neil M. McDonnell | 2021 | 275,687 | 30,946 | — | — | 149,832 | 456,465 | ||||||||||||||||||||||||||||||||||

CFO of Isabella Bank Corporation and Isabella Bank(6) | 2020 | 266,773 | 46,253 | 46,253 | — | 22,379 | 381,658 | ||||||||||||||||||||||||||||||||||

| Jerome E. Schwind | 2021 | 349,209 | 44,616 | — | (4,000) | 51,263 | 441,088 | ||||||||||||||||||||||||||||||||||

| President of Isabella Bank and Vice President of Isabella Bank Corporation | 2020 | 332,661 | 50,731 | 50,731 | 14,000 | 49,557 | 497,680 | ||||||||||||||||||||||||||||||||||

(1)Executive officer salary includes compensation voluntarily deferred under our 401(k) plan. Director fees are also included and are displayed in the following table for each of the last two years ended December 31, 2021:

| Director fees ($) | |||||||||||

| Name | 2021 | 2020 | |||||||||

| Jae A. Evans | 28,000 | 24,250 | |||||||||

| Jerome E. Schwind | 28,000 | 24,250 | |||||||||

(2)Includes payouts granted pursuant to the Isabella Bank Corporation Employee Cash Incentive Plans .

(3)Includes shares granted pursuant to the Isabella Bank Corporation Stock Award Incentive Plan.

(4)Includes the aggregate non-cash change in the actuarial present value of the noted executive's accumulated benefit under the Isabella Bank Corporation Pension Plan.

(5)For all named executives, all other compensation includes 401(k) matching contributions and auto allowance. For Neil M. McDonnell all other compensation includes relocation payment.

(6)Neil M. McDonnell served as Interim Controller from November 5, 2020 to March 1, 2021.

Outstanding Equity Awards at Fiscal Year-End Table

The following table provides information on the unvested shares of restricted stock pursuant to the Isabella Bank Corporation Restricted Stock Plan as of December 31, 2021:

| Stock awards | |||||||||||||||||

| Name | Grant Date | Number of shares or units of stock that have not vested (#)(1) | Market value of shares or units of stock that have not vested ($)(2) | ||||||||||||||

| Jae A. Evans | 4/1/2021 | 8,000 | 174,000 | ||||||||||||||

| Jae A. Evans | 6/24/2020 | 2,427 | 42,500 | ||||||||||||||

| Neil M. McDonnell | 4/1/2021 | 3,184 | 69,250 | ||||||||||||||

| Neil M. McDonnell | 6/24/2020 | 952 | 16,673 | ||||||||||||||

| Jerome E. Schwind | 4/1/2021 | 4,281 | 93,120 | ||||||||||||||

| Jerome E. Schwind | 6/24/2020 | 1,279 | 22,383 | ||||||||||||||

(1)Shares of restricted stock are subject to a three year vesting period from the date of issuance.

(2)Based on the closing price of the Corporation's common stock as of the grant date.

8

Pension Benefits

Defined Benefit Pension Plan. We sponsor the Isabella Bank Corporation Pension Plan (“Defined Benefit Pension Plan”), a frozen defined benefit pension plan. The curtailment, which was effective March 1, 2007, froze the current participant’s accrued benefits as of that date and limited participation in the plan to eligible employees as of December 31, 2006. Due to the curtailment of the plan, the number of years of credited service was frozen. As such, the years of credited service for the plan may differ from the participant’s actual years of service.

Annual contributions are made to the plan as required by accepted actuarial principles, applicable federal tax laws, and to pay expenses related to operating and maintaining the plan. The amount of contributions on behalf of any one participant cannot be separately or individually computed.

Pension plan benefits are based on years of service and the employees’ five highest consecutive years of compensation out of the last ten years of service, through December 31, 2006.

A participant may earn a benefit for up to 35 years of accredited service. Earned benefits are 100% vested after five years of service. Benefit payments normally start when a participant reaches age 65. A participant with more than five years of service may elect to take early retirement benefits anytime after reaching age 55. Benefits payable under early retirement are reduced actuarially for each month prior to age 65 in which benefits begin.

Under the provisions of the plan, participants are eligible for early retirement after reaching the age of 55 with at least five years of service. The early retirement benefit amount is the accrued benefit payable at normal retirement date reduced by 5/9% for each of the first 60 months and 5/18% for each of the next 60 months that the benefit commencement date precedes the normal retirement date.

Retirement Bonus Plan. We sponsor the Isabella Bank Corporation Retirement Bonus Plan (“Retirement Bonus Plan”). This nonqualified plan is intended to provide eligible employees with additional retirement benefits. To be eligible, the employee needed to be an employee on January 1, 2007, and be a participant in our frozen Executive Supplemental Income Agreement. Participants were also required to be an officer with at least 10 years of service as of December 31, 2006. We have sole and exclusive discretion to add new participants to the Retirement Bonus Plan by authorizing such participation pursuant to action of the Board.

An initial amount was credited for each eligible employee as of January 1, 2007. Subsequent amounts have been credited on each allocation date thereafter as defined in the Retirement Bonus Plan. The amount of the initial allocation and the annual allocation shall be determined pursuant to the payment schedule adopted at our sole and exclusive discretion, as set forth in the Retirement Bonus Plan.

Under the provisions of the Retirement Bonus Plan, participants are eligible for early retirement upon attaining 55 years of age. There is no difference between the calculation of benefits payable upon early retirement and normal retirement; however, the participant would not receive their full benefit under early retirement.

Nonqualified Deferred Compensation

Directors Plan. Under the Isabella Bank Corporation and Related Companies Deferred Compensation Plan for Directors (“Directors Plan”), directors, including named executive officers who serve as directors, are required to invest at least 25% of their board fees in our common stock and may invest up to 100% of their earned fees based on their annual election. These amounts are reflected in footnote 1 to the Summary Compensation Table on the previous page. These stock investments can be made either through deferred fees or through the purchase of shares through the Isabella Bank Corporation Stockholder Dividend Reinvestment and Employee Stock Purchase Plan (“DRIP Plan”). Deferred fees, under the Directors Plan, are converted on a quarterly basis into stock units of our common stock based on the fair value of a share of our common stock as of the relevant valuation date. Stock units credited to a participant’s account are eligible for stock and cash dividends as paid. DRIP Plan shares are purchased pursuant to the DRIP Plan.

Distribution of deferred fees from the Directors Plan occurs when the participant retires from the Board or upon the occurrence of certain other events. The participant is eligible to receive distributions in the form of shares of our common stock of all of the stock units that are then in his or her account, and any unconverted cash will be converted to and rounded up to a whole share of stock and distributed, as well. Any common stock issued from deferred fees under the Directors Plan will be considered restricted stock under the Securities Act of 1933, as amended. Common stock purchased through the DRIP Plan are not considered restricted stock under the Securities Act of 1933, as amended.

9

SERP. Under the supplemental executive retirement plan (“SERP”), we may promise deferred compensation benefits to employees who are members of a select group of management or highly compensated employees, which may include the named executive officers. The SERP authorizes us to make annual and discretionary credits to a participant’s SERP account pursuant to a participation agreement with the participant that sets forth the amount and timing of any annual credits and the vesting, payment, “clawback” and other terms to which the credits are subject.

The SERP provides default terms that may be modified by a participant’s participation agreement, including default vesting, interest and payment terms. Under the SERP’s default vesting terms, a participant is initially unvested in the participant’s SERP account and becomes 100% vested upon attaining normal retirement age, retirement, involuntary separation from service without cause, death, disability or a change in control. Special vesting rules apply to amounts that are credited after a change in control. Under the SERP’s interest rule, a participant’s account balance is credited with interest annually, the rate of which may be changed and is based on Federated Investor's Institutional Money Market Management Fund yield (MMPXX) for the current plan year, updated annually. Under the SERP’s default payment terms, a participant’s vested and nonforfeited account balance will be paid in a single cash lump sum within 90 days after the first to occur of the participant’s separation from service (subject to a six-month delay for a “specified employee”), death, disability, or any date specified in the participant’s participation agreement. The SERP also includes restrictive covenants that restrict a participant’s ability to compete with us and certain other activities.

Executive Cash Incentive Plan. On June 24, 2020, we amended and restated the Isabella Bank Corporation Employee Cash Incentive Plans to create two separate plans: one for non-executive employees and the other, the Isabella Bank Corporation Executive Cash Incentive Plan for executive employees. The executive plan provides separate potential payouts for the President and CEO, Bank President and CFO based on achievement of personal and corporate goals. The maximum potential payouts under the plan range from 20% to 30% of the employee's annual salary. The Compensation and Human Resource Committee is responsible for establishing personal goals and measuring the achievement of personal goals for the President and CEO. This Committee also reviews the performance of the President and CEO. The President and CEO recommends to the Compensation and Human Resource Committee the measurement and achievement of personal and corporate goals for the Bank President and CFO.

Restricted Stock Plan. On June 24, 2020 the Board of Directors adopted the Isabella Bank Corporation Restricted Stock Plan ("RSP"), an equity-based bonus plan. The primary purpose of the plan is to promote our growth and profitability by attracting and retaining executive officers and key employees of outstanding competence through ownership of equity that provides them with incentives to achieve corporate objectives. In connection with the adoption of the RSP, the Isabella Bank Corporation Stock Award Incentive Plan was terminated.

The RSP authorizes the issuance of unvested restricted stock to an eligible employee with a maximum award ranging from 25% to 40% of the employee’s annual salary, on a calendar year basis. Under the RSP, the Board of Directors may grant restricted stock awards to eligible employees on an annual basis based on satisfactory achievement of performance targets and measures established by the Board of Directors. If these grant conditions are not satisfied, then the award of restricted shares will lapse or be adjusted appropriately, at the discretion of the Board of Directors. Restricted stock awards granted are not fully transferable or vested until certain conditions are met, as stated in the plan.

10

Potential Payments Upon Termination or Change in Control

The estimated amounts payable to each named executive officer upon severance from employment, retirement, termination upon death or disability or termination following a change in control are described below. For all termination scenarios, the amounts assume such termination took place as of December 31, 2021.

Any Severance of Employment

Regardless of the manner in which a named executive officer’s employment terminates, he or she is entitled to receive amounts earned during his or her term of employment. Such amounts include:

•Amounts accrued and vested through the Defined Benefit Pension Plan.

•Amounts accrued and vested through the Retirement Bonus Plan.

•Amounts credited and vested through the SERP.

•Amounts deferred in the Directors Plan.

•Amounts vested through the Stock Award Incentive Plan.

•Amounts granted and vested through the Restricted Stock Plan.

•Eligible unused vacation and short-term disability pay.

Retirement

In the event of the retirement of an executive officer, the officer would receive the benefits identified above.

Death or Disability

In the event of death or disability of an executive officer, in addition to the benefits listed above, the executive officer will also receive payments under our life insurance plan or under our disability plan as appropriate.

Change in Control

We currently do not have a change in control agreement with any of the executive officers. Under the SERP, each participant would become 100% vested in their SERP account upon a change in control. Under certain conditions, following a change in control, if a participant is involuntarily terminated without cause or voluntarily terminates for good reason all uncredited annual credits would be credited to his or her SERP account. If termination took place on December 31, 2021, that would have resulted in an additional credit to Jae A. Evans’ SERP account of $0, Neil M. McDonnell's SERP account of $195,000, and Jerome E. Schwind's SERP account of $490,500 and a total credit for each individual of $837,633, $250,683, and $602,903, respectively.

Under the RSP, each participant would become 100% vested in their RSP account upon a change in control. Under certain conditions, following a change in control, if a participant is involuntarily terminated without cause or voluntarily terminates for good reason all nonvested shares would be fully vested. If termination took place on December 31, 2021, that would have resulted in vested shares to Jae A. Evans’ RSP account of 10,427 ($216,500), Neil M. McDonnell's RSP account of 4,136 ($85,923), and Jerome E. Schwind's RSP account of 5,560 ($115,503).

11

Director Compensation

The following table summarizes the compensation of each non-employee director who served on the Board during 2021.

| Name | Fees paid in cash ($)(1) | Fees deferred under Directors Plan ($)(1) | Total fees earned ($) | ||||||||||||||

| Dr. Jeffrey J. Barnes | 1,475 | 30,375 | 31,850 | ||||||||||||||

| Jill Bourland | 40,900 | — | 40,900 | ||||||||||||||

| G. Charles Hubscher | — | 31,850 | 31,850 | ||||||||||||||

| Thomas L. Kleinhardt | — | 40,700 | 40,700 | ||||||||||||||

| David J. Maness | — | 44,000 | 44,000 | ||||||||||||||

| Richard L. McGuirk | 8,550 | 2,850 | 11,400 | ||||||||||||||

| Sarah R. Opperman | 51,434 | — | 51,434 | ||||||||||||||

| Chad R. Payton | 12,950 | 9,000 | 21,950 | ||||||||||||||

| Vicki L. Rupp | 36,600 | — | 36,600 | ||||||||||||||

| Gregory V. Varner | 34,162 | 11,388 | 45,550 | ||||||||||||||

(1) Directors electing to receive all fees in cash, resulting in no contributions to the Directors Plan, invest at least 25% of their board fees in our common stock under the DRIP Plan as described in our Directors Plan within the “Executive Officers” section.

We paid $1,500 per board meeting plus a retainer of $10,000 to each member during 2021. Members of the Audit Committee were paid $750 per Audit Committee meeting attended. Members of the Nominating and Corporate Governance Committee were paid $350 per meeting attended. Members of the Compensation and Human Resource Committee were paid $350 per meeting attended. The chairperson of the Board is paid a retainer of $35,000, and the chairperson for the Audit Committee is paid a retainer of $6,000.

Under the Directors Plan, upon a participant’s retirement from the Board, or the occurrence of certain other events, the participant is eligible to receive a distribution in the form of shares of our common stock of all of the stock units that are then credited to the participant's account. The plan does not allow for cash settlement. Stock issued under the Directors Plan is restricted stock under the Securities Act of 1933, as amended.

We established a Rabbi Trust to supplement the Directors Plan. The Rabbi Trust is an irrevocable grantor trust to which we may contribute assets for the limited purpose of funding a nonqualified deferred compensation plan. Although we may not reach the assets of the Rabbi Trust for any purpose other than meeting its obligations under the Directors Plan, the assets of the Rabbi Trust remain subject to the claims of our creditors. We may contribute cash or common stock to the Rabbi Trust from time to time for the sole purpose of funding the Directors Plan. The Rabbi Trust will use any cash that we may contribute to purchase shares of our common stock on the open market.

We transferred $1,095,300 to the Rabbi Trust in 2021, which held 105,654 shares of our common stock for settlement as of December 31, 2021. As of December 31, 2021, there were 83,710 stock units credited to participants’ accounts; such credits are unfunded as of such date to the extent that they are in excess of the stock and cash that has been credited to the Rabbi Trust. All amounts are unsecured claims against our general assets. The net cost of this benefit was $198,824 in 2021.

12

The following table displays the cumulative number of stock units of our common stock credited to the accounts of current directors pursuant to the terms of the Directors Plan as of March 11, 2022:

| Name | # of stock units credited | ||||

| Dr. Jeffrey J. Barnes | 21,049 | ||||

| Jill Bourland | 1,111 | ||||

| Jae A. Evans | 2,546 | ||||

| G. Charles Hubscher | 29,048 | ||||

| Thomas L. Kleinhardt | 40,179 | ||||

| David J. Maness | 44,475 | ||||

| Richard L. McGuirk | 166 | ||||

| Sarah R. Opperman | 5,265 | ||||

| Chad R. Payton | 1,346 | ||||

Vicki L. Rupp (1) | — | ||||

| Jerome E. Schwind | 9,058 | ||||

| Gregory V. Varner | 15,625 | ||||

(1) Vicki L. Rupp has elected to receive all fees in cash, resulting in no contributions to the Directors Plan. Ms. Rupp invests at least 25% of her board fees in our common stock under the DRIP Plan as described in our Directors Plan within the “Executive Officers” section.

Indebtedness of and Transactions with Management

Certain directors and officers and members of their families were loan customers of the Bank, or have been directors or officers of corporations, members or managers of limited liability companies, or partners of partnerships which have had transactions with the Bank. In our opinion, all such transactions were made in the ordinary course of business and were substantially on the same terms, including collateral and interest rates, as those prevailing at the same time for comparable transactions with customers not related to the Bank. These transactions do not involve more than normal risk of collectability or present other unfavorable features. Total loans to these customers were approximately $22,558,000 and $2,977,000 as of December 31, 2021, and 2020.

13

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information as of March 11, 2022 as to our common stock owned beneficially by the only persons known by us to be beneficial owners of more than 5% of our common stock.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class | |||||||||

| Richard L. McGuirk | 386,071 | 5.12 | % | ||||||||

| P.O. Box 222 | |||||||||||

| Mt. Pleasant, MI 48804 | |||||||||||

(1) Based on information contained in Schedule 13D filed with the SEC on November 5, 2021.

The following table sets forth certain information as of March 11, 2022 as to our common stock owned beneficially by: 1) each director and director nominee, 2) by each named executive officer, and 3) by all directors, director nominees and executive officers as a group.

| Name of Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class | |||||||||

| Dr. Jeffrey J. Barnes | 8,844 | 0.12 | % | ||||||||

| Jill Bourland | 1,927 | 0.03 | % | ||||||||

| Jae A. Evans | 18,863 | 0.25 | % | ||||||||

| G. Charles Hubscher | 201,237 | 2.67 | % | ||||||||

| Thomas L. Kleinhardt | 56,596 | 0.75 | % | ||||||||

| David J. Maness | 7,633 | 0.10 | % | ||||||||

| Neil M. McDonnell | 1,652 | 0.02 | % | ||||||||

| Richard L. McGuirk | 386,071 | 5.12 | % | ||||||||

| Sarah R. Opperman | 14,012 | 0.19 | % | ||||||||

| Chad R. Payton | 1,460 | 0.02 | % | ||||||||

| Vicki L. Rupp | 3,905 | 0.05 | % | ||||||||

| Jerome E. Schwind | 5,767 | 0.08 | % | ||||||||

| Gregory V. Varner | 8,193 | 0.11 | % | ||||||||

| All Directors, nominees and Executive Officers as a Group (13) persons | 716,160 | 9.51 | % | ||||||||

(1) Beneficial ownership is defined by rules of the SEC and includes shares that the person has or shares voting or investment power over and shares that the person has a right to acquire within 60 days from March 11, 2022. Consequently, with respect to shares acquired under the Directors Plan, participants may not be eligible to convert their stock units to shares within 60 days from March 11, 2022 as a result of distribution elections and plan conditions. For stock units credited to each participant's account as of March 11, 2022, refer to the “Director Compensation” section of this report.

14

Independent Registered Public Accounting Firm

The Audit Committee has appointed Rehmann Robson LLC as our independent auditors for the year ending December 31, 2022.

A representative of Rehmann Robson LLC is expected to be present at the Annual Meeting to respond to appropriate questions from shareholders and to make any comments Rehmann Robson LLC believes are appropriate.

Fees for Professional Services Provided by Rehmann Robson LLC

The following table shows the aggregate fees billed by Rehmann Robson LLC for the audit and other services provided for:

| 2021 | 2020 | ||||||||||

| Audit fees | $ | 335,579 | $ | 321,310 | |||||||

| Audit related fees | 18,250 | 25,025 | |||||||||

| Tax fees | 36,425 | 25,010 | |||||||||

| All other fees | 2,250 | — | |||||||||

| Total | $ | 392,504 | $ | 371,345 | |||||||

The audit fees were for performing the integrated audit of our consolidated annual financial statements and the internal control report related to the Federal Deposit Insurance Corporation Improvement Act, reviews of interim quarterly financial statements included in our Quarterly Reports on Form 10-Q, and services that are normally provided by Rehmann Robson LLC in connection with statutory and regulatory filings or engagements.

The audit related fees are typically for various discussions related to the adoption and interpretation of new accounting pronouncements. During 2021, this included fees for procedures related to nonrecurring regulatory filings. Also included are fees for auditing of our employee benefit plans.

The tax fees were for the preparation of our state and federal income tax returns and for consultation on various tax matters. All other fees were training and consultant related services.

The Audit Committee has considered whether the services provided by Rehmann Robson LLC, other than the audit fees, are compatible with maintaining Rehmann Robson LLC’s independence and believes that the other services provided are compatible.

Pre-Approval Policies and Procedures

All non-audit services to be performed by Rehmann Robson LLC must be approved in advance by the Audit Committee if those fees are reasonably expected to exceed 5.0% of the current year agreed upon fee for independent audit services, so long as such services were recognized by the Corporation at the time of engagement to be non-audit services, and such services are promptly brought to the attention of the Audit Committee subsequent to completion of the audit. As permitted by SEC rules, the Audit Committee has authorized its chairperson to pre-approve audit, audit-related, tax and non-audit services, provided that such approved service is reported to the full Audit Committee at its next meeting.

As early as practicable in each calendar year, the independent auditor provides to the Audit Committee a schedule of the audit and other services that the independent auditor expects to provide or may provide during the next twelve months. The schedule will be specific as to the nature of the proposed services, the proposed fees, timing, and other details that the Audit Committee may request. The Audit Committee will by resolution authorize or decline the proposed services. Upon approval, this schedule will serve as the budget for fees by specific activity or service for the next twelve months.

A schedule of additional services proposed to be provided by the independent auditor, or proposed revisions to services already approved, along with associated proposed fees, may be presented to the Audit Committee for their consideration and approval at any time. The schedule will be specific as to the nature of the proposed service, the proposed fee, and other details that the Audit Committee may request. The Audit Committee will by resolution authorize or decline authorization for each proposed new service.

Applicable SEC rules and regulations permit waiver of the pre-approval requirements for services other than audit, review or attest services if certain conditions are met. Out of the services characterized above as audit-related, tax and other professional services, none were billed pursuant to these provisions in 2021 and 2020 without pre-approval.

15

Shareholder Proposals

Any proposals which you intend to present at the next Annual Meeting must be received before November 25, 2022 to be considered for inclusion in our Proxy Statement and proxy for that meeting. Proposals should be made in accordance with Securities and Exchange Commission Rule 14a-8.

Directors’ Attendance at the Annual Meeting of Shareholders

Our directors are encouraged to attend the Annual Meeting. At the 2021 Annual Meeting, all directors, with the exception of Mr. Kleinhardt, were in attendance.

Other Matters

We will bear the cost of soliciting proxies. In addition to solicitation by mail, officers and other employees may solicit proxies by telephone or in person, without compensation other than their regular compensation.

As to Other Business Which May Come Before the Meeting

We do not intend to bring any other business before the meeting for action. However, if any other business should be presented for action, it is the intention of the persons named in the enclosed form of proxy to vote in accordance with their judgment on such business.

By order of the Board of Directors

Debra Campbell, Secretary

SHAREHOLDERS’ INFORMATION

Financial Information and Annual Report on Form 10-K

Copies of the 2021 Annual Report, Isabella Bank Corporation Annual Report on Form 10-K, and other financial information not contained herein are available on the Bank’s website (www.isabellabank.com) under the Invest in Us tab, or may be obtained, without charge, by writing to:

Debra Campbell

Secretary

Isabella Bank Corporation

401 N. Main St.

Mt. Pleasant, Michigan 48858

16

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Isabella Bank Corporation Reports First Quarter 2024 Results

- Supremex Announces Date of Its 2024 First Quarter Results Conference Call and Annual Meeting of Shareholders

- Tower Adopts Structural Model Connecting the Widespread Orogenic Gold Mineralization Intersected at Rabbit North and Prepares to Drill Systematically through 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share