Form DEF 14A INNODATA INC For: Jun 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Innodata Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party |

| (4) | Date Filed: |

55 Challenger Road

Ridgefield Park, New Jersey 07660

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 8, 2021

To the Stockholders of Innodata Inc.:

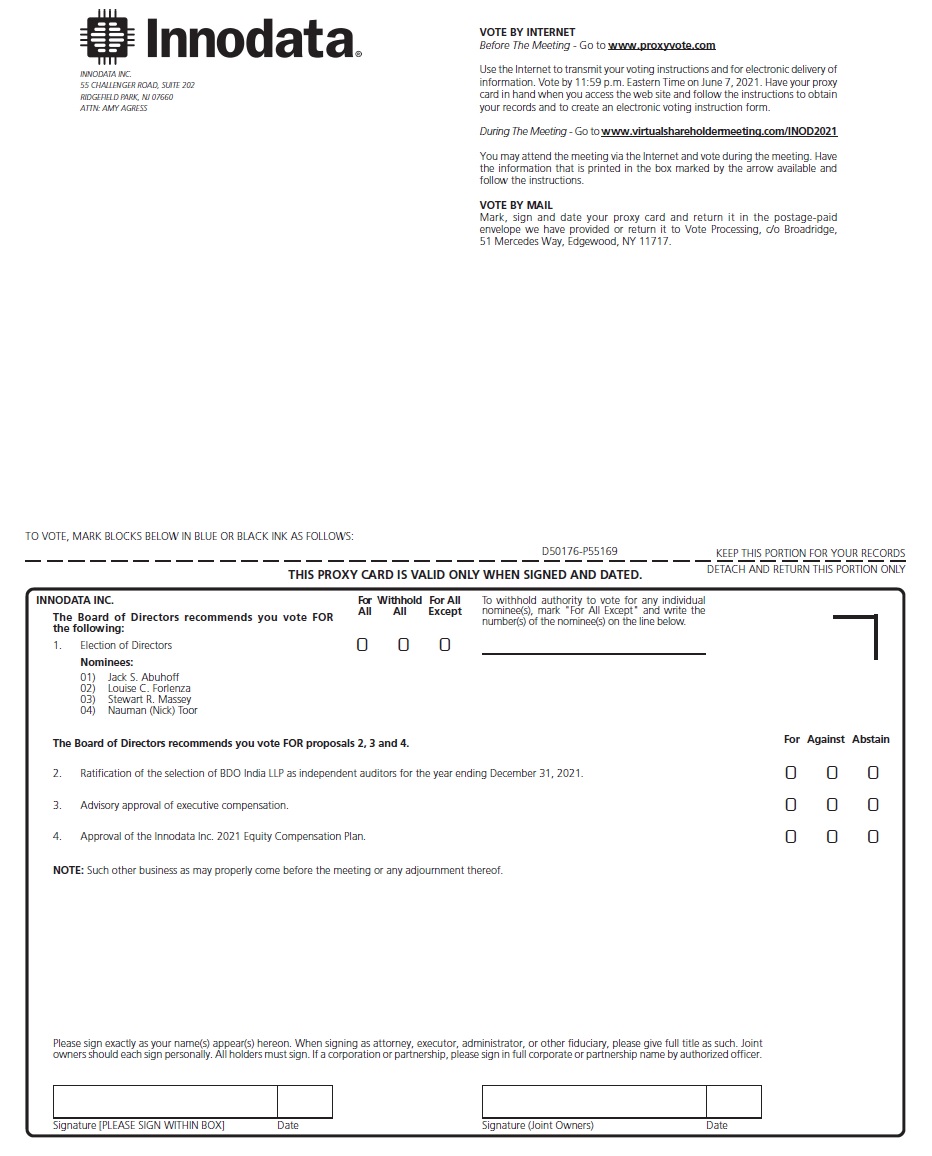

The Annual Meeting of Stockholders (the “Meeting”) of Innodata Inc. (the "Company") will be held at 11:00 a.m. Eastern Time on Tuesday, June 8, 2021 in a virtual-only format, through a virtual meeting platform available at www.virtualshareholdermeeting.com/INOD2021, for the following purposes:

| (1) | To elect four directors of the Company to hold office until the next Annual Meeting of Stockholders and until their successors have been duly elected and qualified; |

| (2) | To ratify the selection and appointment by the Company's Board of Directors of BDO India LLP, independent registered public accounting firm, as auditors for the Company for the year ending December 31, 2021; |

| (3) | To approve, on an advisory basis, the Company’s executive compensation; |

| (4) | To approve the Innodata Inc. 2021 Equity Compensation Plan; and |

(5) To consider and transact such other business as may properly come before the Meeting or any adjournments thereof.

The Board of Directors knows of no other business currently contemplated to be transacted at the Meeting.

Due to the continuing public health impact of the coronavirus (COVID-19) pandemic, and to support the health and safety of our stockholders, employees, directors and other meeting participants, the Meeting will be held in virtual-only format again this year. Stockholders will not be able to attend the Meeting physically in person. Stockholders will have the same opportunities to participate in the Meeting as they would at an in-person meeting, including having the ability to vote and the opportunity to submit questions during the Meeting using the directions on the Meeting website.

Instead of mailing a printed copy of our proxy materials, including our Annual Report, to each stockholder of record as of April 12, 2021 (the “Record Date”), we have decided to provide access to these materials in a fast and efficient manner via the Internet. This reduces the amount of paper necessary to produce these materials, as well as the costs associated with mailing these materials to all such stockholders. Accordingly, on or about April 22, 2021, we began mailing to our stockholders of record as of the Record Date (other than those stockholders who previously requested electronic or paper delivery of communications from us) a Notice Regarding Internet Availability of Proxy Materials (the “Notice”), and posted our proxy materials on the website referenced in the Notice (http://materials.proxyvote.com/457642). As more fully described in the Notice, all stockholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

A complete list of the stockholders entitled to vote will be available for inspection by any stockholder for ten days prior to the Meeting upon request and shall be open to the examination of any stockholder during the whole time of the Meeting at www.virtualshareholdermeeting.com/INOD2021.

All stockholders are cordially invited to attend the Meeting. Whether or not you plan to attend the Meeting, you are encouraged to promptly submit your Proxy with voting instructions or use Internet voting prior to the Meeting. To vote your shares, please follow the instructions in the Notice or the Proxy card you received in the mail. If you vote via the Internet, you need not return a Proxy card. No postage is required if a Proxy card is mailed in the United States. Any person giving a Proxy has the power to revoke it any time prior to its exercise by submitting a later-dated Proxy card, casting a new vote over the Internet, sending a written notice of revocation to the Company’s Corporate Secretary at 55 Challenger Road, Ridgefield Park, New Jersey 07660, or by voting in person at the Meeting.

Registered stockholders as of the Record Date can vote during the Meeting. Beneficial owners must obtain a legal proxy from their brokerage firm, bank, or other holder of record and present it to the inspector of elections with their ballot in order to be able to vote shares at the Meeting. Voting at the Meeting will replace any previous votes submitted by Proxy.

Attendance at the Meeting is limited to stockholders, their proxies and invited guests of the Company.

Important Notice Regarding the Availability of Proxy Materials for the

2021 Annual Meeting of Stockholders to be held on June 8, 2021

This Notice of Annual Meeting, the Proxy Statement, form of Proxy and our 2020 Annual Report are available on the Internet at: http://materials.proxyvote.com/457642.

| By Order of the Board of Directors | |

| /s/ Amy R. Agress | |

| Amy R. Agress | |

| Senior Vice President, General Counsel and Secretary | |

| Ridgefield Park, New Jersey | |

| April 22, 2021 |

INNODATA INC.

55 Challenger Road

Ridgefield Park, New Jersey 07660

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Innodata Inc. (the "Company") of Proxies in the form enclosed. Such Proxies will be voted at the Annual Meeting of Stockholders of the Company (the “Meeting”) to be held at 11:00 a.m. Eastern Time on Tuesday, June 8, 2021 in a virtual-only format, through a virtual meeting platform available at www.virtualshareholdermeeting.com/INOD2021 and at any adjournments thereof for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders.

Due to the continuing public health impact of the coronavirus (COVID-19) pandemic, and to support the health and safety of our stockholders, employees, directors and other meeting participants, the Meeting will be held in virtual-only format again this year. Stockholders will not be able to attend the Meeting physically in person. Stockholders will have the same opportunities to participate in the Meeting as they would at an in-person meeting, including having the ability to vote and the opportunity to submit questions during the Meeting using the directions on the Meeting website.

We are following the SEC rule that permits us to furnish proxy materials to certain of our stockholders via the Internet. We believe electronic delivery of our Proxy materials will help us reduce the environmental impact and costs of printing and distributing paper copies and improve the speed and efficiency by which our stockholders can access these materials. As a result, we are mailing a short Notice of Internet Availability of Proxy Materials (the “Notice”) to most of our stockholders instead of a paper copy of our full proxy materials. The Notice contains instructions on how to cast your vote online and how to electronically access our proxy materials, including the Notice of Annual Meeting, Proxy Statement, our 2020 Annual Report and a Proxy card. The Notice also contains instructions on how to request a paper copy of our proxy materials. All stockholders who do not receive the Notice will receive a paper copy of the proxy materials. If you receive a paper copy of our proxy materials, you may cast your vote by completing the enclosed Proxy card and returning it in the enclosed self-addressed, postage-paid envelope, or by utilizing the Internet voting mechanisms noted on the Proxy card. The Notice or paper copy of our proxy materials will first be mailed on or about April 22, 2021. If you hold your shares in “street name” (i.e., your shares are held of record by a broker, bank, trustee or other nominee), your broker, bank, trustee or other nominee will provide you with materials and instructions for voting your shares, including a voting instruction form. Beneficial owners of shares held in street name will need to follow the instructions provided by their broker, bank, trustee or other nominee that holds their shares.

Any stockholder giving a Proxy has the power to revoke the same at any time before it is voted by submitting a later-dated Proxy card, casting a new vote over the Internet, sending a written notice of revocation to the Company’s Corporate Secretary at 55 Challenger Road, Ridgefield Park, New Jersey 07660, or by voting in person at the Meeting. The cost of soliciting Proxies will be borne by the Company. Following the mailing of the Notice, solicitation of Proxies may be made by officers and employees of the Company by mail, telephone, facsimile, electronic communication or personal interview. Properly executed Proxies will be voted in accordance with instructions given by stockholders at the places provided for such purpose in the accompanying Proxy and, as to any other matter properly coming before the Meeting (none of which is presently known to the Board of Directors), in accordance with the judgment of the persons designated as proxies on the Proxy card. Unless contrary instructions are given by stockholders, persons named in the Proxy intend to vote the shares represented by such Proxies for the election of the four nominees for director named herein, for the ratification of BDO India LLP as independent auditors, for the approval, on an advisory basis, of the Company’s executive compensation as disclosed in these materials, and for the approval of the Innodata Inc. 2021 Equity Compensation Plan. The current members of the Board of Directors presently hold voting authority for common stock, par value $0.01 per share (the “Common Stock”), representing an aggregate of 2,584,683 votes, or approximately 9.83% of the total number of votes eligible to be cast at the Meeting. The members of the Board of Directors have indicated their intention to vote affirmatively on all of the proposals.

3

VOTING SECURITIES

Stockholders of record as of the close of business on the record date will be entitled to notice of, and to vote at, the Meeting or any adjournments thereof. On the record date there were 26,296,813 outstanding shares of Common Stock. Each holder of Common Stock is entitled to one vote for each share held by such holder. The presence, in person or by Proxy, of the holders of a majority of the outstanding shares of Common Stock is necessary to constitute a quorum at the Meeting. Proxies submitted that contain abstentions or broker non-votes will be deemed present at the Meeting in determining the presence of a quorum. A broker non-vote occurs when a broker, bank, trustee or other nominee has not received voting instructions from the beneficial owner and the broker, bank, trustee or other nominee does not have discretionary authority to vote on a particular matter. We urge you to vote by proxy even if you plan to virtually attend the Meeting so that we will know as soon as possible that enough votes will be present for us to conduct business at the Meeting.

PROPOSAL 1. ELECTION OF DIRECTORS

It is the intention of the persons named in the enclosed form of Proxy, unless such form of Proxy specifies otherwise, to nominate and to vote the shares represented by such Proxy for the election as directors of Jack S. Abuhoff, Louise C. Forlenza, Stewart R. Massey and Nauman (Nick) Toor, to hold office until the next Annual Meeting of Stockholders and until their respective successors shall have been duly elected and qualified or until such director’s earlier death, resignation or removal. Each of the nominees named below currently serves as a director of the Company and was elected at the Annual Meeting of Stockholders held on June 5, 2020. The Company has no reason to believe that any of the nominees will become unavailable to serve as director for any reason before the Meeting. However, in the event that any of them shall become unavailable, each of the persons designated as proxy on the Proxy card reserves the right to substitute another person of his or her choice when voting at the Meeting. Below is the biographical and other information about the nominees. Following each nominee’s biographical information, we have provided information concerning the particular experience, qualifications, attributes and/or skills that led the Nominating Committee and the Board of Directors to determine that each nominee should serve as a director.

|

Jack S. Abuhoff

|

Age: 60

|

Principal Occupation and Business Experience

President and Chief Executive Officer of the Company since September 1997, and a director of the Company since its founding in 1988. Mr. Abuhoff was Chairman of the Company’s Board of Directors from May 2001 to June 2020, and served as the Company’s interim Principal Financial Officer from May 2018 to April 2019. From 1995 to 1997 he was Chief Operating Officer of Charles River Corporation, an international systems integration and outsourcing firm. From 1992 to 1994, Mr. Abuhoff was employed by Chadbourne & Parke, LLP in connection with its joint venture with Goldman Sachs to develop capital projects in China. He practiced international corporate law at White & Case LLP from 1986 to 1992. Mr. Abuhoff holds an A.B. degree in English from Columbia College (1983) and a J.D. degree from Harvard Law School (1986).

Key Experience, Qualifications, Attributes and Skills

Mr. Abuhoff has knowledge of the Company, its clients, and the industries the Company serves, both from an historical and a current perspective, as well as leadership and management skills, international experience, and experience in providing technology services.

|

4

|

Louise C. Forlenza

|

Age: 71 |

Principal Occupation and Business Experience

Director of the Company since October 2002, Chair of the Company’s Audit Committee since September 2006, a member of the Company’s Compensation Committee since December 2002 and a member of the Company’s Nominating Committee since October 2008. Ms. Forlenza founded LC Forlenza CPA PC Advisory Services in 1987, providing strategic insight and expertise in global accounting and reporting, forensic accounting, auditing, foreign tax issues, turnarounds and litigation support to over 250 global clients in industries such as technology, real estate, entertainment, transportation and health and wellness. Ms. Forlenza has also previously served as Chief Financial Officer of Bierbaum-Martin, a foreign exchange firm. Ms. Forlenza is a Certified Public Accountant. She received a B.B.A. degree in Accounting from Iona College (1971), and a Certificate in Forensic Accounting from New York University in 2012. Ms. Forlenza attended the Harvard Executive Program for Board Governance and Audit in 2015 and the Harvard Executive Compensation Program in 2016.

Key Experience, Qualifications, Attributes and Skills

Ms. Forlenza satisfies the financial literacy requirements of Nasdaq, and the Company has determined that she is an “audit committee financial expert,” as defined by Item 407(d)(5) of Regulation S-K. A Certified Public Accountant and a former Chief Financial Officer, she has a background in accounting, audit, tax planning and foreign exchange planning, and she provides diversity of background and viewpoint.

|

|

Stewart R. Massey

|

Age: 64 |

Principal Occupation and Business Experience

Director of the Company since March 2009, Chair of the Company’s Compensation Committee since June 2009, Chair of the Company’s Nominating Committee since June 2020 and a member of the Company’s Audit Committee since December 2013. From September 2018 through July 2019, Mr. Massey was Vice Chairman of Bow River Capital Partners, a private investment firm. Mr. Massey served as Founding Partner of Massey, Quick, Simon and Co. LLC, a provider of investment advisory and financial planning services for endowments, foundations and wealthy families, from 2004 to September 2018, and served as Founding Partner Emeritus through December 2018. Mr. Massey co-founded Massey, Quick in 2004 after a 24-year career on Wall Street. Mr. Massey joined Morgan Stanley in 1983 after four years with Dean Witter Reynolds. Mr. Massey retired as a managing director in Morgan Stanley’s Institutional Securities Group in 2004 after postings in New York, Hong Kong and Tokyo. Mr. Massey served as President and CEO of Robert Fleming, Inc. in 1997 and 1998. At Fleming, he had regional responsibility for equity sales and trading, research, capital markets, investment banking, and asset management in the Americas, serving on the Board of Directors and Executive Committee of the parent company in London. Mr. Massey holds a B.A. degree in History from The College of Wooster (1979), where he has served as a Trustee since 1987. As an Emeritus Trustee he serves on the Trustee and Governance, Finance and Investment committees. Mr. Massey also serves on the investment committee of Hobart and William Smith Colleges. Mr. Massey was honored as one of the top 100 independent investment advisors in America by Barron’s Magazine in 2010, 2011, 2012, 2013 and 2014.

Key Experience, Qualifications, Attributes and Skills

Mr. Massey has leadership experience as a Chief Executive Officer and a senior executive officer. He has financial management expertise, as well as compensation, mergers and acquisitions, investment advisory, board, corporate governance and international experience, and he provides diversity of background and viewpoint.

|

5

| Nauman (Nick) Toor | Age: 52 |

Principal Occupation and Business Experience

Director of the Company since August 2019, Chairman of the Company’s Board of Directors since June 2020 and a member of the Company’s Audit, Compensation and Nominating Committees since June 2020. Mr. Toor currently serves as chief investment officer of Blackroot Capital, an investment fund focused on small-cap public equities, that he founded in January 2007. From December 2012 to February 2019, Mr. Toor was a partner and chief investment officer of Luzich Partners, a multi-strategy hedge fund and investment firm. Prior to Luzich Partners, Mr. Toor was managing director of Jefferies & Company, Inc. He joined Jefferies in 1994 when its investment banking group had fewer than a dozen bankers. During his tenure, Jefferies became the largest middle market-focused investment bank in the country, with an increase in market value from $50 million to over $3 billion. With his promotion to managing director, Mr. Toor became the youngest managing director in the firm’s history. He then served as the group head of the Media Investment Banking Group and helped guide Jefferies’ growth and strategic direction as a member of its Investment Banking Management Group. Prior to Jefferies, Mr. Toor was founder and CEO of Netsperanto.com, an online media company. Mr. Toor holds an MBA from the Harvard Business School (1994), where he was the youngest member of his class, and a BA degree in Economics and Mathematics from Ohio Wesleyan University (1990).

Key Experience, Qualifications, Attributes and Skills

Mr. Toor has financial management, financial oversight and investment experience, has experience guiding a company’s growth and strategic direction, and provides diversity of background and viewpoint.

|

There are no family relationships between or among any nominees for director of the Company. Directors are elected to serve until the next annual meeting of stockholders and until their successors are elected and qualified.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE

DIRECTOR NOMINEES

CORPORATE GOVERNANCE MATTERS

Director Independence

The Board of Directors currently consists of four directors. The Board of Directors has determined that Louise C. Forlenza, Stewart R. Massey and Nauman (Nick) Toor are independent directors. The independent directors comprise a majority of the Board. The only director who is not independent is Jack S. Abuhoff, the Company’s President and Chief Executive Officer. The Company defines independence as meeting the requirements to be considered as an independent director as set forth in the Nasdaq Listing Rule 5605(a)(2). To assist in determining director independence, the Board of Directors also considers any business relationship with any independent director, including any business entity with which any independent director is affiliated, to determine if there is any material relationship that would impair a director’s independence. In making its determination, the Board of Directors reviewed information provided by each of the directors and information otherwise gathered by the Company.

6

Board Leadership Structure

Chairman of the Board and Chief Executive Officer Positions

Under the Board of Directors’ current leadership structure Mr. Toor, who is an independent director, serves as the Chairman of the Board of Directors and Mr. Abuhoff serves as the Company’s Chief Executive Officer. The Board of Directors believes that bifurcating these positions enables the Chief Executive Officer to focus on strategy, operations, and organizational issues while an independent board chairman focuses on board leadership, strategic oversight and governance-related matters that support stockholders’ interests. Mr. Abuhoff, as the Company’s Chief Executive Officer and President, provides day-to-day leadership of the Company, executes the Company’s strategic initiatives, and manages the Company’s business. Mr. Toor, as Chairman of the Board of Directors, collaborates with the Chief Executive Officer on setting the Company’s strategic direction in a way that best aligns with creating value for stockholders, oversees the Board of Directors’ engagement with stockholders and facilitates the Board of Directors’ independent oversight of the Company.

The Board’s Role in Risk Oversight

The Board of Directors believes that the goal of risk oversight is to identify and assess risks that may affect the Company’s ability to fulfill its business objectives and to formulate plans to mitigate potential effects. The Board of Directors administers its oversight function directly, through both its Audit Committee and Compensation Committee, and through executive management of the Company, as follows:

| · | Through Board of Directors discussions on general business strategy and risks that could drive tactical and strategic decisions in the near and long term; |

| · | Through the Audit Committee with respect to financial risks and risks that may affect the financial situation of the Company; |

| · | Through the Compensation Committee with respect to risks associated with executive compensation plans and arrangements; |

| · | Through executive management of the Company with respect to risks that may arise in the ordinary course of business, such as operational, managerial, business, legal, regulatory and reputational risks; |

| · | Through the Compliance Committee of the Company with respect to risks that may arise with respect to global compliance and ethical conduct; |

| · | Through the chief information security officer and head of global technology with respect to risks related to cyber security; and |

| · | Through the Chief Executive Officer via updates to the Board of Directors during Board of Directors meetings with respect to potential material risks identified by executive management, as is deemed appropriate based on the circumstances. |

The Board of Directors believes the various roles of the board committees, compliance committee and executive management in risk oversight described above complement the Board of Directors’ leadership structure described above.

Meetings of the Board of Directors

The Board of Directors meets throughout the year on a set schedule. The Board of Directors also holds special meetings and acts by unanimous written consent from time to time as appropriate. The Board of Directors held seven meetings during the year ended December 31, 2020. Each director attended at least 75% of all of the meetings of the Board of Directors and of the committees on which he or she served. The Company does not have a policy requiring incumbent directors and director nominees to attend the Company’s annual meeting of stockholders. Four directors attended last year’s annual meeting.

7

The Board of Directors meets in executive sessions without management, as needed, immediately prior or during its regularly scheduled meetings. The Board of Directors also schedules executive sessions during the year for the independent directors only.

Committees of the Board of Directors

Audit Committee

The Board of Directors has a standing Audit Committee within the meaning of Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that is comprised of independent directors only. The Audit Committee operates under a written charter adopted by the Board of Directors. A copy of the charter is available on our website at www.innodata.com. Serving on the Committee are Ms. Forlenza and Messrs. Massey and Toor, with Ms. Forlenza serving as Chair. The Board of Directors has determined that Ms. Forlenza is an “audit committee financial expert” as defined under the applicable rules of the SEC and has the requisite financial sophistication as defined under the applicable rules and regulations of Nasdaq. For a discussion of Ms. Forlenza’s relevant experience that qualifies her as an audit committee financial expert, refer to Proposal 1. Election of Directors above. The functions of the Audit Committee are, among other things, to make recommendations concerning the selection each year of, and to oversee the Company’s relationship with, the independent auditors of the Company, to assist the Board of Directors in fulfilling its oversight responsibilities relating to the quality and integrity of the Company's financial reports and financial reporting processes and systems of internal controls, to consider whether the Company's principal accountant’s provision of non-audit services is compatible with maintaining the principal accountant’s independence, to determine through discussions with the independent auditors whether any instructions or limitations have been placed upon them in connection with the scope of their audit, and to review and approve or reject any proposed related party transactions. To carry out its responsibilities, the Audit Committee met six times during the year ended December 31, 2020. The Company defines independence as meeting the standards to be considered as an independent director as set forth in Nasdaq Listing Rule 5605(a)(2), Nasdaq Listing Rule 5605(c)(2) and applicable SEC rules, and the Board of Directors has determined that all the members of the Audit Committee are "independent" in accordance therewith.

Compensation Committee

The Company has a standing Compensation Committee comprised of Messrs. Massey and Toor and Ms. Forlenza, with Mr. Massey serving as Chair. The Compensation Committee operates under a written charter adopted by the Board of Directors. A copy of the charter is available on our website at www.innodata.com. The function of the Compensation Committee is to discharge the responsibilities of the Board of Directors regarding executive and director compensation, including determining and approving the compensation packages of the Company’s executive officers, including its Chief Executive Officer. The Compensation Committee also reviews and approves stock option grants to non-executive officer employees. The Chief Executive Officer recommends to the Compensation Committee proposed compensation for the executive officers other than the Chief Executive Officer. The Compensation Committee may from time to time, as it deems appropriate and to the extent permitted under applicable law and regulations, form and delegate authority to subcommittees and to the officers of the Company. The Compensation Committee engages the services of an independent compensation consultant on an as-needed basis to provide market data and advice regarding executive and director compensation and proposed compensation programs and amounts. To carry out its responsibilities, the Compensation Committee met three times during the year ended December 31, 2020. The Company defines independence as meeting the standards to be considered as an independent director as set forth in the Nasdaq Listing Rule 5605(a)(2), and the Board of Directors has determined that all the members of the Compensation Committee are "independent" as defined in the Nasdaq Listing Rule 5605(a)(2).

8

Nominating Committee

The Company has a standing Nominating Committee comprised of Messrs. Massey and Toor and Ms. Forlenza, with Mr. Massey serving as Chair. The Company does not have a Nominating Committee charter. The primary responsibilities of the Nominating Committee include assisting the Board of Directors in identifying and evaluating qualified candidates to serve as directors; recommending to the Board of Directors candidates for election or re-election to the Board of Directors or to fill vacancies on the Board of Directors; and assisting in attracting qualified candidates to serve on the Board of Directors. Director nominees are selected by approval of a resolution of the Board of Directors. All of the nominees recommended for election to the Board of Directors at the Meeting are directors standing for re-election. The Nominating Committee has a formal policy regarding the identification of director nominees. The process of the Nominating Committee for identifying nominees reflects the Company’s practice of re-nominating incumbent directors who continue to satisfy the Nominating Committee’s criteria for membership on the Board of Directors, whom the Nominating Committee believes continue to make important contributions to the Board of Directors and who consent to continue their service on the Board of Directors. In identifying candidates for membership on the Board of Directors, the Nominating Committee takes into account all factors it considers appropriate, which may include (a) ensuring that the Board of Directors, as a whole, consists of individuals with diverse and relevant career experience, technical skills, education, industry knowledge and experience, financial expertise (including expertise that could qualify a director as a “audit committee financial expert,” as that term is defined by the rules of the SEC) and (b) minimum individual qualifications, including strength of character, mature judgment, familiarity with the Company's business and industry, independence of thought and an ability to work collegially. The Nominating Committee also may consider the extent to which the candidate would fill a present need on the Board of Directors, as well as diversity of origin and gender. To carry out its responsibilities, the Nominating Committee met two times during the year ended December 31, 2020. The Company defines independence as meeting the standards to be considered as an independent director as set forth in the Nasdaq Listing Rule 5605(a)(2), and the Board of Directors has determined that all the members of the Nominating Committee are "independent" as defined in the Nasdaq Listing Rule 5605(a)(2). In 2020, the Company did not pay any fees to any third party to assist in identifying or evaluating potential nominees.

The Company's Amended and Restated By-laws (the “By-Laws”) include a procedure whereby its stockholders can nominate director candidates, as more fully described below under “Stockholder Proposals for the 2022 Annual Meeting.” The Board of Directors will consider director candidates recommended by the Company's stockholders in a similar manner as those recommended by members of management or other directors, provided the stockholder submitting such nomination has complied with the procedures set forth in the By-laws. To date, the Company has not received any recommended nominees from any non-management stockholder or group of stockholders who beneficially owns five percent or more of its voting stock.

Hedging

The Company has not adopted any policies or practice guidelines expressly prohibiting hedging of the Company’s stock.

Stockholder Communications with the Board of Directors

Generally, stockholders who have questions or concerns regarding the Company should contact our Investor Relations department at 201-371-8000. However, stockholders may communicate with the Board of Directors by sending a letter to: Board of Directors of Innodata Inc., c/o Corporate Secretary, 55 Challenger Road, Ridgefield Park, New Jersey 07660. Any communications must contain a clear notation indicating that it is a "Stockholder—Board Communication" or a "Stockholder—Director Communication" and must identify the author as a stockholder. The office of the Corporate Secretary will receive the correspondence and forward appropriate correspondence to the Chairman of the Board of Directors or to any individual director or directors to whom the communication is directed. The Company reserves the right not to forward to the Board of Directors any communication that is hostile, threatening, illegal, does not reasonably relate to the Company or its business, or is otherwise inappropriate. The office of the Corporate Secretary has authority to discard or disregard any inappropriate communication or to take any other action that it deems to be appropriate with respect to any inappropriate communications.

9

REPORT OF THE AUDIT COMMITTEE

The following report of the Audit Committee does not constitute soliciting material and should not be deemed filed with the SEC or subject to Regulation 14A promulgated under the Exchange Act or incorporated by reference into any other Company filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent the Company specifically incorporates this report by reference therein.

The responsibilities of the Audit Committee, which are set forth in the Audit Committee Charter, include providing oversight to the Company’s financial reporting process through periodic meetings with the Company’s independent auditors and management to review accounting, auditing, internal control and financial reporting matters. The Audit Committee is also responsible for the appointment, compensation and oversight of the Company’s independent auditors. The management of the Company is responsible for the preparation and integrity of the financial reporting information and related systems of internal control. The Audit Committee, in carrying out its role, relies on the Company’s senior management, including senior financial management, and its independent auditors.

The Audit Committee has implemented procedures to ensure that during the course of each fiscal year it devotes the attention that it deems necessary or appropriate to each of the matters assigned to it under the Audit Committee's charter.

The primary purpose of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities relating to the quality and integrity of the Company's financial reports and financial reporting processes and systems of internal control. Management of the Company has primary responsibility for the Company's financial statements and the overall reporting process, including maintenance of the Company's system of internal controls. The Company retains independent auditors who are responsible for conducting independent audits of the Company's financial statements and internal control over financial reporting, if applicable, in accordance with standards of the Public Company Accounting Oversight Board (United States) (the “PCAOB”), and issuing report(s) thereon.

The Audit Committee has reviewed and discussed the Company’s consolidated audited financial statements as of and for the year ended December 31, 2020 and the revision adjustments made to the 2019 financial statements and audited by the Company’s current independent auditors with management and the independent auditors. The Audit Committee has discussed with the independent auditors the matters required to be discussed by the applicable requirements of the PCAOB. The independent auditors have provided to the Audit Committee the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent auditor’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed with the auditors their independence from the Company. The Audit Committee has concluded that the independent auditors are independent from the Company and its management.

On the basis of the foregoing reviews and discussions, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2020 for filing with the SEC.

Members of the Audit Committee

Louise C. Forlenza, Chair

Stewart R. Massey

Nauman (Nick) Toor

10

Fiscal 2020 and 2019 Accounting Firm Fee Summary

Set forth below is certain information concerning (1) fees billed to the Company by BDO India LLP in respect of professional services rendered to the Company for the audit of the annual financial statements for the year ended December 31, 2020; the reviews of the financial statements included in reports on Form 10-Q for the quarterly period ended September 30, 2020; related regulatory filings for periods commencing on August 24, 2020; and other services; and (2) fees billed to the Company by CohnReznick LLP in respect of professional services rendered to the Company for the annual audit and quarterly reviews of the financial statements for the year ended December 31, 2019; the reviews of the financial statements included in reports on Form 10-Q for the quarterly periods ended March 31, 2020 and June 30, 2020; related regulatory filings for periods within January 1, 2020 through August 24, 2020, and 2019; and other services. The Audit Committee has determined that the provision of all services is compatible with maintaining the independence of both BDO India LLP and CohnReznick LLP.

| 2020 ($) | 2019($) | |||||||||||

| BDO India LLP | CohnReznick LLP | CohnReznick LLP | ||||||||||

| Audit Fees | 155,000 | 146,325 | 407,753 | |||||||||

| Audit-Related Fees | 7,254 | - | - | |||||||||

| Tax Fees | - | - | - | |||||||||

| All Other Fees | - | - | - | |||||||||

Audit fees consist of fees for the audit of the Company’s financial statements, the review of the interim financial statements included in the Company’s quarterly reports on Form 10-Q, and other professional services provided in connection with statutory and regulatory filings or engagements.

Audit-Related fees consist of attestation services related to SSAE 18.

Audit Committee Pre-Approval Policy

All audit, audit-related services, tax services and other services provided by BDO India LLP and CohnReznick LLP must be pre-approved by the Audit Committee in one of two methods. Under the first method, the engagement to render the services would be entered into pursuant to pre-approval policies and procedures established by the Audit Committee, provided (i) the policies and procedures are detailed as to the services to be performed, (ii) the Audit Committee is informed of each service, and (iii) such policies and procedures do not include delegation of the Audit Committee's responsibilities under the Exchange Act to the Company's management. Under the second method, the engagement to render the services would be presented to and pre-approved by the Audit Committee (subject to the de minimis exceptions for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act that are approved by the Audit Committee prior to the completion of the audit). The Audit Committee may delegate to its Chair the authority to pre-approve otherwise permissible non-audit services, provided that any decision made pursuant to such delegation must be presented to the full Audit Committee for informational purposes at its next scheduled meeting. The Audit Committee considers, among other things, whether the provision of such audit or non-audit services is consistent with applicable regulations regarding maintaining auditor independence, whether the provision of such services would impair the independent registered public accounting firm's independence and whether the independent registered public accounting firm is best positioned to provide the most effective and efficient service.

PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Subject to ratification by the stockholders, the Board of Directors has appointed BDO India LLP as the independent auditors to audit the financial statements of the Company for the fiscal year ending December 31, 2021. BDO India LLP has served as the Company's auditors since August 24, 2020. A representative of BDO India LLP is expected to be present at the Meeting and will have the opportunity to make a statement if he or she desires to do so. A representative of BDO India LLP is also expected to be available to respond to appropriate questions at the Meeting.

While stockholder ratification is not required by the Company’s Restated Certificate of Incorporation, as amended, By-Laws or otherwise, the Board of Directors is submitting the appointment of BDO India LLP to the stockholders for ratification as part of good corporate governance practice. In the event that the stockholders fail to ratify this appointment, the Board of Directors may appoint other independent auditors, upon the recommendation of the Audit Committee. Even if this appointment is ratified, our Board of Directors, in its discretion, may direct the appointment of a new independent accounting firm at any time during the year, if the Board of Directors believes that such a change would be in the best interest of the Company and its stockholders.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” RATIFICATION OF THE

APPOINTMENT OF BDO INDIA LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM,

AS AUDITORS FOR THE COMPANY FOR THE YEAR ENDING DECEMBER 31, 2021

11

EXECUTIVE COMPENSATION

Overview of Executive Compensation Program

We are currently a smaller reporting company and we have elected to comply with the scaled disclosure requirements afforded to smaller reporting companies under the Jumpstart Our Business Startups Act of 2012 for our executive compensation disclosure included in this Proxy Statement. In the following discussion of our executive compensation programs, we summarize the compensation awarded to our executive officers listed in the Summary Compensation Table for the most recently completed fiscal year.

Executive Compensation Objectives

The Compensation Committee (the “Committee”) of the Board of Directors is responsible for overseeing and administering our executive compensation program and for establishing our executive compensation philosophy. The Committee applies key objectives in selecting the specific elements of compensation to pay to executive officers. The objectives of our compensation program are to:

| · | Attract, motivate and retain qualified, talented and dedicated executives |

| · | Motivate executives to achieve business and financial objectives that will enhance stockholder value |

| · | Align the interests of our executives with the long-term interests of stockholders through stock-based incentives |

| · | Maintain a strong link between pay and performance by placing a significant portion of the executive’s total pay at risk |

The Committee also reviews and considers:

| · | Company performance, both separately and in relation to similar companies |

| · | The individual executive’s performance, experience and scope of responsibilities |

| · | Historical compensation levels and stock option awards at the Company |

| · | Internal parity among executive officers |

| · | The recommendations of management |

| · | The recommendations of an independent compensation consultant, to the extent compensation consultants are utilized |

| · | Competitive market and peer company data |

The Committee uses the following processes, procedures and resources to help it perform its responsibilities:

| · | Executive sessions without management present to discuss various compensation matters, including the compensation of our Chief Executive Officer (“CEO”) |

| · | A periodic review of executive compensation and benefit programs for reasonableness and cost effectiveness |

| · | The recommendations of the CEO on compensation for the other executive officers |

| · | On an as-needed basis, the services of an independent compensation consultant |

12

Components of the Executive Compensation Program

The primary elements of the Company’s Executive Compensation Program are described below. The Committee does not use a pre-set formula to allocate a percentage of total compensation to each compensation component, and the percentage of total compensation allocated to each compensation component varies among the executive officers.

Base Salary

The base salaries of our executive officers are designed to attract and retain a high performing and dedicated leadership team. The Committee reviews the performance evaluations and salary recommendations provided to the Committee by the CEO for each executive officer other than himself. Increases to the CEO’s base salary are determined by the Committee without a recommendation by Company management. Adjustments to base salary are determined based on the individual’s responsibility level, performance, contribution and length of service, after considering the Company’s financial performance, as well as any requirements set forth in the executive officer’s employment agreement. No adjustments were made to the named executive officers’ base salary in calendar year 2020.

Performance-Based Cash Incentives

Performance-based cash incentives provide the Company with a means of rewarding performance based upon the attainment of corporate financial goals, individual goals, and individual accomplishments and contributions to the Company. The Committee reviews the Company’s financial performance and individual performance, accomplishments and contributions, as well as recommendations provided to the Committee by the CEO for each executive officer other than the CEO. Cash incentives may be paid pursuant to an incentive compensation plan or as cash bonuses. Based on the Company’s performance in 2020, and on each executive officer’s individual accomplishments and contributions towards the Company’s performance in 2020, in March 2021 the Committee awarded the following cash bonuses to named executive officers for the year ended 2020: $300,000 to Mr. Abuhoff and $170,000 to Mr. Mishra.

Stock-Based Incentives

The Company uses stock option grants as the primary vehicle for employee stock-based incentives. The Company also uses restricted share grants as a form of stock-based incentives. The Committee believes stock-based incentives align the executive officers’ interests with those of stockholders in building stockholder value over the long term, offer executive officers an incentive for the achievement of superior performance over time, and foster the retention of key management personnel. The number of stock options or restricted shares the Committee awards each executive officer is based on his or her relative position, responsibilities and performance, including anticipated future performance, potential and responsibilities, and performance over the previous fiscal year, to the extent applicable. The exercise price of stock options that are granted are equal to the closing market price of the Company’s Common Stock on the date of grant. The Committee also reviews and considers prior stock-based grants to each executive officer, including the extent to which any prior stock option grants remained unexercised upon expiration due to an underwater stock price at the time of expiration. The size of stock-based grants is not directly related to the Company’s performance. In 2020, the Committee awarded the following stock option grants to named executive officers: 400,000 shares to Mr. Abuhoff and 160,000 shares to Mr. Mishra. The stock options have an exercise price of $1.42, a term of ten years from the date of grant, and vest in three equal installments on June 5, 2021, June 5, 2022 and June 5, 2023.

Benefits and Perquisites

The Company offers retirement, health, life, and disability benefits, as well as medical and dependent care reimbursement plans to all full-time employees. These plans do not discriminate in scope, terms or operation in favor of executive officers. In addition, in calendar year 2020, the Company reimbursed Mr. Abuhoff $8,891 for the cost of life and disability insurance premiums and related taxes pursuant to his employment agreement.

13

Severance and Change-of-Control

The Company uses severance and change-of-control agreements to attract and retain qualified, talented and dedicated executives and to help the Company remain competitive in the marketplace.

Results of 2020 Advisory Vote on Executive Compensation

At the 2020 Annual Meeting of Stockholders held in June 2020, the Company’s stockholders approved the 2019 compensation of the Company’s named executive officers by 95% of the votes cast. The Company took into account these results when making decisions about its compensation practices for the fiscal year ended December 31, 2020. The Compensation Committee values the stockholder feedback provided through the vote, as well as the feedback regarding Company performance received through conversations with stockholders subsequent to the vote. The Compensation Committee will continue to review the Company’s executive compensation programs to assure that the compensation of the named executive officers remains consistent with the objectives stated above under “Overview of Executive Compensation Program” and reflective of the Company’s financial performance.

officers

Set forth below is information concerning the Company’s current named executive officers who are not directors.

| Name | Age | Position |

| Ashok Mishra | 66 | Executive Vice President and Chief Operating Officer |

| Mark A. Spelker | 61 | Executive Vice President, Chief Financial Officer, Principal Financial Officer and Principal Accounting Officer |

Ashok Mishra has been the Company’s Executive Vice President and Chief Operating Officer since January 2007. Prior to 2007, Mr. Mishra held senior level positions with the Company and its subsidiaries for more than nine years. Mr. Mishra has served as Senior Vice President since May 2004, after serving as Vice President, Project Delivery from October 2001 through April 2004. Prior thereto, Mr. Mishra served as Assistant Vice President, Project Delivery from November 2000 to September 2001, and as General Manager and Head of the Facility of the Company’s India operations from 1997 to October 2000. Mr. Mishra holds a Bachelor of Technology degree in Mechanical Engineering from Pantnagar University (1976). He also has Component Manufacturing Technical Training from Alcatel France (1985) and completed a condensed MBA course from Indian Institute of Management Bangalore (1995).

Mark A. Spelker has been the Company’s Executive Vice President, Chief Financial Officer, Principal Financial Officer and Principal Accounting Officer since October 2020. Prior to joining the Company Mr. Spelker was an audit and technical consulting partner at CohnReznick LLP (“CohnReznick”), a position he held since 2000, and he also served as the National Director of SEC Services for CohnReznick, a position he held since 2012. CohnRenzick is a leading accounting, tax and business advisory firm. Since 2017, Mr. Spelker has also been a part-time lecturer in Accounting at Rutgers University. Mr. Spelker holds a B.S degree in Accounting from Villanova University (1982), and is a Certified Public Accountant.

The Company’s executive officers are appointed by, and serve at the discretion of, our Board of Directors. There are no family relationships between or among any of the Company’s executive officers and there are no arrangements or understandings between our executive officers and any other persons pursuant to which our named executive officers were appointed as officers.

14

SUMMARY COMPENSATION TABLE

The following table sets forth, for the periods indicated, all of the compensation awarded to, earned by or paid to the Company’s “named executive officers” for the fiscal year ended December 31, 2020.

| Name and Principal Position |

Year | Salary ($) | Bonus ($) | Option Awards ($) |

All Other Compensation ($) |

Total ($) |

||||||||||||||||||

|

Jack S. Abuhoff

President and Chief Executive Officer |

2020 | 500,000 | 300,000 | (1) | 254,705 | (2) | 8,891 | (3) | 1,063,596 | |||||||||||||||

| 2019 | 500,000 | - | 225,998 | (4) | 8,921 | (5) | 734,919 | |||||||||||||||||

|

Ashok Mishra

Executive Vice President and Chief Operating Officer |

2020 | 300,000 | 170,000 | (1) | 101,882 | (2) | - | 571,882 | ||||||||||||||||

| 2019 | 300,000 | - | 90,399 | (4) | - | 390,399 | ||||||||||||||||||

|

Mark A. Spelker (6)

Executive Vice President, Chief Financial Officer, Principal Financial Officer and Principal Accounting Officer |

2020 | 36,932 | - | - | - | 36,932 | ||||||||||||||||||

| (1) | Represents a cash bonus awarded in March 2021 for an executive officer’s individual accomplishments and contributions towards the Company’s performance in 2020. |

| (2) | Represents the dollar amount of the aggregate grant date fair value of stock options granted in 2020. The aggregate grant date fair value is the amount the Company expects to expense in its financial statements over the award’s vesting schedule. This amount reflects the Company’s accounting expense and does not correspond to the actual value that will be realized by the named executive officer. For stock options, grant date fair value is calculated using the Black-Scholes option pricing model and is based on the value of the option on the grant date, which was $0.64 on June 5, 2020. For information on the valuation assumptions, see Note 10 in the Notes to Consolidated Financial Statements filed with the Annual Report on Form 10-K for year-end 2020. On June 5, 2020, each of Messrs. Abuhoff and Mishra were granted options to purchase 400,000 and 160,000 shares of Common Stock, respectively. Each option has an exercise price equal to $1.42, and the options vest in three equal installments on June 5, 2021, June 5, 2022 and June 5, 2023. |

| (3) | Represents the cost of employer-provided executive life and disability insurance in the amount of $6,150, and reimbursement for related federal and state income taxes in the amount of $2,741. |

| (4) | Represents the dollar amount of the aggregate grant date fair value of stock options granted in 2019. The aggregate grant date fair value is the amount the Company expects to expense in its financial statements over the award’s vesting schedule. This amount reflects the Company’s accounting expense and does not correspond to the actual value that will be realized by the named executive officer. For stock options, grant date fair value is calculated using the Black-Scholes option pricing model and is based on the value of the option on the grant date, which was $0.56 on August 1, 2019. For information on the valuation assumptions, see Note 9 in the Notes to Consolidated Financial Statements filed with the Annual Report on Form 10-K for year-end 2019. On August 1, 2019, each of Messrs. Abuhoff and Mishra were granted options to purchase 400,000 and 160,000 shares of Common Stock, respectively. Each option has an exercise price equal to $1.24, and the options vest in three equal installments on August 1, 2020, August 1, 2021 and August 1, 2022. |

| (5) | Represents the cost of employer-provided executive life and disability insurance in the amount of $6,150, and reimbursement for related federal and state income taxes in the amount of $2,771. |

| (6) | Mr. Spelker’s employment with the Company commenced in October 2020. |

15

Narrative Disclosure to Summary Compensation Table

Employment Agreements

Jack S. Abuhoff

On March 25, 2009, the Company and Mr. Abuhoff, the President and Chief Executive Officer of the Company, executed an employment agreement with an effective date of February 1, 2009 (as amended on July 11, 2011, the “Agreement”). The Agreement will continue until terminated by the Company or Mr. Abuhoff.

The Agreement provides for: annual base salary compensation of $424,350 subject to cost of living adjustments and annual discretionary increases as determined by the Company’s Board of Directors; additional cash incentive or bonus compensation for each calendar year determined by the Compensation Committee of the Board of Directors in its discretion and conditioned on the attainment of certain quantitative objectives to be established by the Compensation Committee with a target bonus of not less than 60% of Mr. Abuhoff’s base salary for the year; and stock options and/or other equity-based and/or non-equity-based awards and incentives as determined by the Compensation Committee in its sole and absolute discretion. The Agreement also provides for indemnification, insurance and other fringe benefits, and contains confidentiality, non-compete and non-interference provisions. Mr. Abuhoff’s annual base salary has been $500,000 since April 2012.

In the event Mr. Abuhoff is terminated by the Company other than for cause (as defined in the Agreement), death or disability, or Mr. Abuhoff resigns his employment with the Company for good reason (as defined in the Agreement), Mr. Abuhoff is entitled to receive (i) an amount equal to 200% of his (A) base salary and (B) the greater of his most recently declared bonus (as defined in the Agreement) or the average of his three most recently declared bonuses to be paid in substantially equal payments over a period of 24 months; (ii) the continuation of his (and as applicable, his dependents’) medical and dental insurance until the earlier of the end of the maximum applicable COBRA coverage period or for the 24 month period immediately following Mr. Abuhoff’s termination (and if the COBRA period is shorter than the applicable 24 month period, pay to Mr. Abuhoff an amount equal to the monthly cost charged by the Company for COBRA coverage during the period beginning upon the expiration of the maximum COBRA coverage period and the end of the 24 month continuation period); (iii) the continuation of his life and long-term disability insurance for the 24 month period immediately following Mr. Abuhoff’s termination; (iv) payment of up to six weeks’ accrued but unused vacation; and (v) the removal of any vesting, transfer, lock-up, performance or other restrictions or requirements on his stock options and other equity-based and non-equity-based awards and incentives. If Mr. Abuhoff’s employment is terminated upon his death, his estate will receive payment of his base salary through the date of termination, a pro-rated bonus based on his performance of his objectives through the date of termination, and payment of up to six weeks of any accrued but unused vacation. If Mr. Abuhoff’s employment is terminated for disability he will receive payment of his base salary for a 90-day period following the date of termination, a pro-rated bonus based on active duty with the Company and conditioned on attainment of certain quantitative objectives, and payment of up to six weeks of any accrued but unused vacation. If Mr. Abuhoff’s employment is terminated for cause, Mr. Abuhoff will receive his base salary through the date of termination, and payment of up to six weeks of any accrued but unused vacation. Under the terms of the Agreement, Mr. Abuhoff’s receipt of the benefits described above is conditioned upon his entry into a separation agreement and general release, and an agreement, for a 12-month period following termination of his employment, not to compete or interfere with the Company, and not to employ or retain the services of an employee of the Company. In the event Mr. Abuhoff is terminated by the Company coincident with or following a change-of-control (as defined in the Agreement), Mr. Abuhoff is entitled to receive (i) an amount equal to 300% of his (A) base salary and (B) the greater of his most recently declared bonus (as defined in the Agreement) or the average of his three most recently declared bonuses, in either case to be paid in a lump sum payout within 30 days of the date of his termination; (ii) the continuation of his (and as applicable, his dependents’) medical and dental insurance until the earlier of the end of the maximum applicable COBRA coverage period or for the 36-month period immediately following Mr. Abuhoff’s termination (and if the COBRA period is shorter than the applicable 36-month period, pay to Mr. Abuhoff an amount equal to the monthly cost charged by the Company for COBRA coverage during the period beginning upon the expiration of the maximum COBRA coverage period and the end of the 36-month continuation period); and (iii) the continuation of his life and long-term disability insurance for the 36-month period immediately following Mr. Abuhoff’s termination; and (iv) the removal of any vesting, transfer, lock-up, performance or other restrictions or requirements on his stock options and other equity and non-equity-based awards and incentives.

16

In the event Mr. Abuhoff is a “specified employee” as defined in Section 409A of the Code at the time of his termination of employment, the payments referenced above (for both change-of-control and other than upon change-of-control) shall be delayed until the date that is six months and one day following his termination of employment (or, if earlier, the earliest other date as is permitted under Section 409A of the Code). The amount payable on such date shall include all amounts that would have been payable to Mr. Abuhoff prior to that date but for the application of Section 409A and the remaining payments shall be made in substantially equal installments until fully paid. Notwithstanding the foregoing, the six month delay shall not apply to any such payments made (A) during the short term deferral period set forth in Treasury Regulation Section 1.409A-1(b)(4), or (B) after said short term deferral period, payable solely on account of an involuntary separation from service (as defined in Section 409A of the Code) and in an amount less than the Section 409A Severance Exemption Amount. The Agreement also provides for potential tax gross-up payments in respect of taxes, penalties and/or interest that may be incurred by Mr. Abuhoff under Section 409A of the Code.

Ashok Mishra

On January 1, 2007, the Company and Mr. Mishra, the Executive Vice President and Chief Operating Officer of the Company, entered into a three year agreement with an effective date of January 1, 2007 whereby the Company agreed to cause one or more of its wholly-owned subsidiaries to offer employment to Mr. Mishra. Mr. Mishra’s agreement automatically renews for one-year periods unless the Company either provides a notice of non-renewal by June 30 of the then-current term or the Company and Mr. Mishra execute a new agreement prior to the end of the then-current term. The agreement provides for annual base compensation of $175,000 per annum, subject to annual reviews for discretionary annual increases; and incentive compensation pursuant to an incentive compensation plan. The agreement also provides for insurance and other fringe benefits, and contains confidentiality, non-compete and non-interference provisions. In August 2018, the Company and Mr. Mishra amended the agreement to provide that Mr. Mishra would be jointly employed by the Company and one of its wholly-owned subsidiaries. Mr. Mishra’s annual base compensation has been $300,000 since April 2016.

Pursuant to Mr. Mishra’s agreement, if the agreement is terminated without cause (as defined in Mr. Mishra’s employment agreement) or by Mr. Mishra with good reason (as defined in Mr. Mishra’s employment agreement), he will be entitled to his base salary for 12 months following the date of his termination or resignation with good reason, any earned but unpaid incentive compensation, and payment for up to six weeks of any accrued but unused vacation. If the agreement is terminated due to Mr. Mishra’s death, his estate will receive payment of his base salary through the date of termination, any earned but unpaid incentive compensation, and payment for up to six weeks’ of any accrued but unused vacation. If the agreement is terminated due to Mr. Mishra’s disability he will receive payment of his base salary for a 90-day period following the date of termination, any earned but unpaid incentive compensation, and payment for up to six weeks’ accrued but unused vacation. If the agreement is terminated for cause (as defined in Mr. Mishra’s employment agreement), Mr. Mishra will receive his base salary through the date of termination, and payment for up to six weeks of any accrued but unused vacation. Under the terms of Mr. Mishra’s employment agreement, Mr. Mishra’s receipt of the benefits described above is conditioned upon his entry into a separation agreement and general release, and an agreement not to compete with the Company for a 12-month period following termination of his employment, and not to solicit the customers of the Company or to solicit or employ the services of an employee of the Company for a 24-month period following termination of employment.

Mark A, Spelker

On October 2, 2020, the Company and Mr. Spelker entered into an Offer of Employment (the “Employment Agreement”) which provides for Mr. Spelker’s part-time, at-will employment with the Company. The Employment Agreement provides for an annual base salary of $100,000 for approximately four weeks of services per quarter, plus an additional eight weeks of services per annum, which may be increased if mutually agreed upon by the Company and Mr. Spelker, at a rate of $6,250 per week (or pro-rata portion thereof). As a part-time employee, Mr. Spelker will not be eligible for health insurance benefits, vacation or other benefits to which the Company’s full-time employees are entitled. Furthermore, the Employment Agreement contains a customary non-competition and non-solicitation provision during Mr. Spelker’s part-time employment with the Company and for 12 months thereafter. Additionally, contemporaneous with the Employment Agreement, the Company and Mr. Spelker entered into an agreement containing customary confidentiality, non-solicitation and invention assignment provisions, which apply during and after Mr. Spelker’s employment with the Company.

17

Outstanding Equity Awards at fiscal year-end 2020

The following table summarizes the outstanding equity awards held by each named executive officer at December 31, 2020.

| Option Awards | ||||||||||||||

| Name (1) | Number of Securities Underlying Unexercised Options Exercisable (#) | Number of Securities Underlying Unexercised Options Unexercisable (#) | Option Exercise Price ($) | Option Expiration Date | ||||||||||

| Jack S. Abuhoff | 255,000 | - | 2.75 | 04/06/2021 | ||||||||||

| 290,000 | - | 2.85 | 12/30/2025 | |||||||||||

| 290,000 | - | 2.45 | 12/29/2026 | |||||||||||

| 266,667 | (2) | 133,333 | (2) | 1.07 | 07/12/2028 | |||||||||

| 133,333 | (3) | 266,667 | (3) | 1.24 | 07/31/2029 | |||||||||

| - | 400,000 | (4) | 1.42 | 06/04/2030 | ||||||||||

| Total | 1,235,000 | 800,000 | ||||||||||||

| Ashok Mishra | 180,000 | - | 2.85 | 12/30/2025 | ||||||||||

| 150,000 | - | 2.45 | 12/29/2026 | |||||||||||

| 106,667 | (2) | 53,333 | (2) | 1.07 | 07/12/2028 | |||||||||

| 53,333 | (3) | 106,667 | (3) | 1.24 | 07/31/2029 | |||||||||

| - | 160,000 | (4) | 1.42 | 06/04/2030 | ||||||||||

| Total | 490,000 | 320,000 | ||||||||||||

| (1) | No information is included for Mr. Spelker as he held no outstanding equity awards at year end. |

| (2) | Granted on July 13, 2018. Two-thirds of the stock options are vested. The balance of the stock options vest in one installment July 13, 2021. |

| (3) | Granted on August 1, 2019. One third of the stock options are vested. The balance of the stock options vest in two equal installments on August 1, 2021 and August 1, 2022. |

| (4) | Granted on June 5, 2020. The stock options vest in three equal installments on June 5, 2021, June 5, 2022 and June 5, 2023. |

18

Potential Payments Upon Termination or Change-OF-Control

Estimated Termination or Change-of-Control Benefits at Year-End 2020

The following table summarizes the estimated value

of payments to each of the named executive officers assuming

different termination events occurred at December 31, 2020.

| Name (1) | Cash | Stock-based | Welfare Benefits ($) | Aggregate | ||||||||||||

| Jack S. Abuhoff | ||||||||||||||||

| Termination for cause | - | - | 57,692 | 57,692 | ||||||||||||

| Termination without cause (2) | 1,600,000 | 3,198,667 | 172,206 | 4,970,873 | ||||||||||||

| Change-of-Control (3) | 2,400,000 | 3,198,667 | 229,463 | 5,828,130 | ||||||||||||

| Death | 300,000 | - | 57,692 | 357,692 | ||||||||||||

| Disability | 425,000 | - | 57,692 | 482,692 | ||||||||||||

| Ashok Mishra | ||||||||||||||||

| Termination for cause | - | - | 11,538 | 11,538 | ||||||||||||

| Termination without cause (2) | 470,000 | - | 11,538 | 481,538 | ||||||||||||

| Death | 170,000 | - | 11,538 | 181,538 | ||||||||||||

| Disability | 245,000 | - | 11,538 | 256,538 | ||||||||||||

| (1) | No information for Mr. Spelker is included in the table as Mr. Spelker’s Employment Agreement with the Company does not provide for any payments upon the termination of his employment with the Company. |

| (2) | Includes resignation by the executive with good reason. |

| (3) | Assumes the Company’s termination of the executive’s employment coincident with or following a change-of-control (as described below). |

Payments on Change-of-Control

Pursuant to Mr. Abuhoff’s employment agreement, a change-of-control shall be deemed to have occurred as of the earliest of any of the following events:

| · | The closing of a transaction by the Company or any person (other than the Company, any subsidiary of the Company or any employee benefit plan of the Company or of any subsidiary of the Company) (a “Person”), together with all “affiliates” and “associates” (within the meanings of such terms under Rule 12b-2 of the Exchange Act) of such Person, shall be the beneficial owner of thirty percent (30%) or more of the Company’s then-outstanding voting stock (“Beneficial Ownership”); |

| · | A change in the constituency of the Board such that, during any period of thirty-six (36) consecutive months, at least a majority of the entire Board shall not consist of Incumbent Directors. For purposes of this Paragraph 5(c)(ii), “Incumbent Directors” shall mean individuals who at the beginning of such thirty-six (36) month period constitute the Board, unless the election or nomination for election by the shareholders of the Company of each such new director was approved by a vote of a majority of the Incumbent Directors; |

| · | The closing of a transaction involving the merger, consolidation, share exchange or similar transaction between the Company and any other corporation other than a transaction which results in the Company’s voting stock immediately prior to the consummation of such transaction continuing to represent (either by remaining outstanding or by being converted into voting stock of the surviving entity) at least two-thirds (2/3rds) of the combined voting power of the Company’s or such surviving entity’s outstanding voting stock immediately after such transaction; |

| · | The closing of a transaction involving the sale or disposition by the Company (in one transaction or a series of transactions) of all or substantially all of the Company’s assets; or |

19

| · | A plan of liquidation or dissolution of the Company goes into effect. |

Upon the Company’s termination of Mr. Abuhoff’s employment coincident or following a change-of-control, Mr. Abuhoff will receive:

| · | 300% of his base salary to be paid in a lump sum payout within 30 days of the date of his termination; |

| · | 300% of the greater of his most recently declared bonus (as defined) or the average of his three most recently declared bonuses to be paid in a lump sum payout within 30 days of the date of his termination; |

| · | Continuation of his (and as applicable, his dependents’) medical and dental insurance until the earlier of the end of the maximum applicable COBRA coverage period or for the 36-month period immediately following Mr. Abuhoff’s termination (and if the COBRA period is shorter than the applicable 36-month period, pay Mr. Abuhoff an amount equal to the monthly cost charged by the Company for COBRA coverage during the period beginning upon the expiration of the maximum COBRA coverage period and the end of the 36-month continuation period); |

| · | Continuation of his life and long-term disability insurance for the 36-month period immediately following Mr. Abuhoff’s termination; |

| · | The removal of any vesting, transfer, lock-up, performance or other restrictions or requirements on his stock options and other equity-based and non-equity-based awards and incentives; and |

| · | Payment of up to six weeks’ accrued but unused vacation. |

Upon the occurrence of a change-of-control without a termination of Mr. Abuhoff’s employment, Mr. Abuhoff will receive:

| · | The removal of any vesting, transfer, lock-up, performance or other restrictions or requirements on his stock options and other equity-based and non-equity-based awards and incentives. |

QUALIFICATION BY REFERENCE

The matters described in the sections titled "Narrative Disclosure to Summary Compensation Table" and "Potential Payments Upon Termination or Change-of-Control" are qualified in their entirety by reference to agreements previously filed by the Company in reports with the SEC.

DIRECTOR COMPENSATION FOR 2020

Summary Director Compensation Table Update

The following table sets forth information regarding compensation paid to non-executive directors during the fiscal year ended December 31, 2020 for service as a director.

| Name | Fees Earned or Paid in Cash ($) | Option Awards ($) | Total ($) | |||||||||

| Louise C. Forlenza | 44,500 | 30,625 | (1) | 75,125 | ||||||||

| Stewart R. Massey | 41,583 | 30,625 | (1) | 72,208 | ||||||||

| Nauman (Nick) Toor | 55,000 | 61,249 | (2) | 116,249 | ||||||||

| Total | 141,083 | 122,499 | 263,582 | |||||||||

20

| (1) | Represents the dollar amount of the aggregate grant date fair value of an option to purchase 50,000 shares of Common Stock granted in 2020. 100% of the shares of Common Stock underlying the stock options vested and became exercisable on June 5, 2020. The aggregate grant date fair value is the amount the Company expects to expense in its financial statements over the award’s vesting schedule. This amount reflects the Company’s accounting expense and does not correspond to the actual value that will be realized by the director. For stock options, grant date fair value is calculated using the Black-Scholes option pricing model and is based on the value of the option on the grant date, which was $0.61 on June 5, 2020. For information on the valuation assumptions, see Note 10 in the Notes to Consolidated Financial Statements filed with the Annual Report on Form 10-K for year-end 2020. |