Form DEF 14A II-VI INC For: Nov 09

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| ☒ | Filed by the Registrant |

| ☐ | Filed by a Party other than the Registrant |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

II-VI INCORPORATED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

2) Form, Schedule or Registration Statement No.:

| 3) | Filing Party: |

| 4) | Date Filed: |

Table of Contents

375 Saxonburg Boulevard

Saxonburg, Pennsylvania 16056

Notice of Annual Meeting of Shareholders

TO BE HELD ON NOVEMBER 9, 2018

September 21, 2018

Dear Shareholder:

This year, II-VI’s annual shareholder event will again consist solely of the formal business portion of the Annual Meeting of Shareholders. This year’s Annual Meeting will be webcast from, and physically held in, a conference room at 5000 Ericsson Drive, in Warrendale, Pennsylvania 15086, on November 9, 2018, at 3:00 p.m. local time.

It is important for you to mark the appropriate box on the accompanying proxy card if you plan to attend the Annual Meeting in person. We would like to know by October 29, 2018, if you plan to attend in person. We encourage you to take advantage of the convenience of attending via webcast.

We expect the formal business of the Annual Meeting to consist of the election of directors, a non-binding advisory vote on executive compensation, approval of the 2018 Employee Stock Purchase Plan, approval of the 2018 Omnibus Incentive Plan, ratification of the Audit Committee’s selection of our independent registered public accounting firm, and any other business that validly arises at the Annual Meeting.

To ensure that your shares are represented and voted, please vote your shares as soon as possible, even if you plan to attend the Annual Meeting in person or via webcast.

On behalf of the Board of Directors and management, we would like to express our appreciation for your investment and interest in II-VI Incorporated.

Sincerely,

VINCENT D. MATTERA, JR., PHD

President and Chief Executive Officer

Table of Contents

375 Saxonburg Boulevard

Saxonburg, Pennsylvania 16056

Notice of Annual Meeting of Shareholders

| DATE: |

Friday, November 9, 2018 | |

| TIME: |

3:00 p.m. local time | |

| PLACE: |

Via webcast at www.virtualshareholdermeeting.com/IIVI2018 In person at 5000 Ericsson Drive, Warrendale, PA 15086 |

VOTING

Shareholders are asked to vote on the following items at the Annual Meeting:

| 1. | Election of three Class One directors, each for a three-year term to expire in 2021. |

| 2. | A non-binding advisory vote to approve compensation paid to our named executive officers in fiscal year 2018, as disclosed in this proxy statement. |

| 3. | Approval of the 2018 Employee Stock Purchase Plan. |

| 4. | Approval of the 2018 Omnibus Incentive Plan. |

| 5. | Ratification of the Audit Committee’s selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2019. |

| 6. | Any other matters that properly come before the Annual Meeting. |

RECORD DATE

Shareholders of record at the close of business on September 7, 2018, are entitled to notice of, and to vote at, the Annual Meeting, and any adjournment or postponement of the meeting.

AVAILABILITY OF MATERIALS

Shareholders of record will automatically receive a printed set of proxy materials, including a proxy card. For shareholders who hold shares through a broker, bank or other nominee (commonly referred to as held in “street name”), we furnish proxy materials via the internet. If you received a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail from your broker, bank or other nominee, you will not receive a printed copy of the proxy materials unless you request one. The Notice instructs you how to access and review all of the important information contained in the proxy materials over the Internet. The Notice also provides instructions for submitting your proxy over the Internet. If you received a Notice and would like to receive a printed copy of our proxy materials, please follow the instructions for requesting materials included in the Notice.

This Proxy Statement and Proxy Card will first be made available to shareholders on or about September 21, 2018.

By Order of the Board

JO ANNE SCHWENDINGER, Secretary

September 21, 2018

|

YOUR VOTE IS IMPORTANT. WE URGE YOU TO CAST YOUR VOTE AS INSTRUCTED IN THE NOTICE OR PROXY CARD AS PROMPTLY AS POSSIBLE. IF YOU DID NOT RECEIVE A PAPER PROXY CARD, YOU MAY REQUEST ONE BY CONTACTING THE COMPANY’S SECRETARY AT II-VI INCORPORATED, 375 SAXONBURG BOULEVARD, SAXONBURG, PA 16056

|

Table of Contents

Table of Contents

375 Saxonburg Boulevard

Saxonburg, Pennsylvania 16056

Annual Meeting of Shareholders

TO BE HELD ON NOVEMBER 9, 2018

GENERAL

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”) of II-VI Incorporated, a Pennsylvania corporation (the “Company” or “II-VI”), for use at the Annual Meeting of Shareholders (“the Annual Meeting”) to be held on November 9, 2018, at 3:00 p.m. local time, or any rescheduled date. These proxy materials were first made available on or about September 21, 2018, to shareholders of record on September 7, 2018 (the “Record Date”).

A webcast of the Annual Meeting will be available to shareholders only at www.virtualshareholder meeting.com/IIVI2018. You will need your control number, included on your proxy card or Notice, to access the webcast. The physical location of the Annual Meeting will be a conference room at 5000 Ericsson Drive, Warrendale, PA 15086. Please see the Company’s website at www.ii-vi.com/investor/investors.html for further information about the Annual Meeting.

WHAT IS THE PURPOSE OF THE ANNUAL MEETING?

Shareholders will act on the matters outlined on the cover page of this proxy statement. We are not aware of any matters to be presented at the meeting other than those described in this proxy statement. If any other matter is properly presented at the Annual Meeting, your proxy holder will vote your shares in his or her discretion.

WHO MAY VOTE AT THE ANNUAL MEETING?

You are entitled to vote at the Annual Meeting if our records show that you held your shares as of the close of business on the Record Date. As of the Record Date, 63,739,579 shares of Company common stock, no par value (“Common Stock”), were issued and outstanding.

WHAT ARE THE VOTING RIGHTS OF HOLDERS OF II-VI COMMON STOCK?

Each share of Common Stock is entitled to one vote on all matters submitted to a vote of the shareholders, including the election of directors. Shareholders do not have cumulative voting rights.

WHO CAN ATTEND THE ANNUAL MEETING?

All shareholders may attend the Annual Meeting online via the Internet, or in person. To attend online, log on to www.virtualshareholdermeeting.com/IIVI2018. While all shareholders will be permitted to listen online to the Annual Meeting, only shareholders of record and beneficial owners as of the close of business on the Record Date may vote and ask questions. To vote or submit a question if you are participating online, you will need the control number included on your proxy card or Notice, and to follow the instructions posted at www.virtualshareholdermeeting.com/IIVI2018. Broadridge Financial Solutions, Inc., is hosting the webcast

| 1 |

Table of Contents

and, as of 2:30 PM on the Annual Meeting date, will be available via telephone at 1-855-449-0991 toll free, or at 1-720-378-5962 for international calls, to answer your questions regarding how to attend and participate in the Annual Meeting via the Internet.

If you are a shareholder of record and plan to attend the Annual Meeting in person, please mark the appropriate box on the proxy card, or enter that information when voting by telephone or Internet prior to the Annual Meeting. We would like to know by October 29, 2018, if you plan to attend in person. If your shares are held through an intermediary, such as a broker or a bank, you will need to present proof of your ownership as of the Record Date for admission to the Annual Meeting location. Proof of ownership could include a proxy card from your bank or broker, or a copy of your account statement. All in-person attendees will need to present valid photo identification for admission. Recording devices and other electronic devices will not be permitted during the Annual Meeting.

WHAT CONSTITUTES A QUORUM?

Our bylaws provide that shareholders holding a majority of the shares of common stock issued, outstanding and entitled to vote on the Record Date constitute a quorum at the Annual Meeting. The presence in person or by proxy of holders representing at least 31,869,790 shares of Common Stock will be required to establish a quorum. Proxies received but marked as abstentions or broker non-votes (explained below) will be included as shares present when determining whether there is a quorum. If there is no quorum, the holders of a majority of shares present at the meeting may adjourn the Annual Meeting to another date.

| 2 |

Table of Contents

How Do I Vote?

Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. If entitled to vote, you may vote:

| ✓ | Through your broker: If your shares are held through a broker, bank or other nominee (commonly referred to as held in “street name”), you will receive instructions from them that you must follow to have your shares voted. If you do not provide voting instructions to your broker, bank or other nominee, your shares will not be voted on any matter that your broker, bank or other nominee does not have discretionary authority to vote on. |

| ✓ | Returning a Proxy Card: If you receive a proxy card, sign and date it, then return it promptly in the envelope provided. If your signed proxy card is received before the Annual Meeting, the designated proxies will vote your shares as you direct. If you return a signed proxy card that does not direct how to vote on any proposal, the designated proxies will vote in their discretion on that proposal. |

| ✓ | Using the Telephone: Dial toll-free at 1-800-690-6903, or 1-720-378-5962 for international calls, and follow the recorded instructions. You will be asked to provide the control number from your proxy card or Notice. |

| ✓ | Through the Internet: Go to www.proxyvote.com and follow the instructions provided. You will be asked for the control number located on the proxy card or Notice. |

| ✓ | Virtually During the Annual Meeting: Please follow the instructions for attending and voting virtually posted at www.virtualshareholdermeeting.com/IIVI2018. All votes must be received before the polls close during the Annual Meeting. |

| ✓ | In Person: If you attend the Annual Meeting in person and so request, we will give you a ballot. If you have previously submitted a proxy card and intend to vote in person, you must notify us upon arrival at the Annual Meeting that you intend to cancel your prior proxy and vote by ballot at the Annual Meeting. Please report to the voting table for assistance. |

HOW DO I REQUEST PAPER COPIES OF THE PROXY MATERIALS?

Please refer to the Notice for the ways you may request a paper copy of the proxy statement and proxy card.

CAN I CHANGE OR REVOKE MY VOTE AFTER I VOTE ONLINE OR RETURN MY PROXY CARD?

Yes. Even after you have submitted your proxy, you may change or revoke your vote at any time before the proxy is exercised. You may (i) deliver a notice of revocation or deliver a later-dated proxy to the Company’s Secretary at II-VI Incorporated, 375 Saxonburg Boulevard, Saxonburg, Pennsylvania 16056; (ii) submit another vote over the Internet or by telephone; or (iii) vote in person at the Annual Meeting or via the Internet during the Annual Meeting. Neither your attendance in person nor your participation in the webcast will automatically revoke a previously submitted proxy. A shareholder’s last vote is the vote that will be counted.

WHAT ARE THE RECOMMENDATIONS OF THE BOARD?

Unless you give other instructions when you vote, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board. These recommendations are set forth in the description of each proposal in this proxy statement. In summary, the Board recommends a vote:

| - | FOR election of the nominated slate of Class One Directors for terms expiring in 2021 (see Proposal 1); |

| - | FOR approval, on a non-binding advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement (see Proposal 2); |

| - |

|

| - |

|

| - | FOR ratification of the Audit Committee’s selection of Ernst & Young (“EY”) as our Independent Accountants for the fiscal year ending June 30, 2019 (see Proposal 5). |

| 3 |

Table of Contents

With respect to any other matter that properly comes before the Annual Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

WHAT IS THE EFFECT OF ABSTENTIONS AND BROKER NON-VOTES?

For each of the matters to be voted on at the Annual Meeting, abstentions and broker non-votes will be counted for purposes of establishing a quorum, but will not be counted in determining the number of votes necessary for approval. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular matter because it did not receive instructions from the beneficial owner. A nominee may have discretionary authority to vote on Proposal 5 but will not be permitted to vote a beneficial owner’s shares on Proposals 1, 2, 3 or 4 absent having instructions from the beneficial owner. Abstentions and broker non-votes will not be taken into account in determining the outcome of the election of directors, since they are not considered to be “votes cast”. Abstentions have the effect of a vote “AGAINST” with respect to Proposals 2, 3, 4 and 5, while broker non-votes have no effect.

| 4 |

Table of Contents

MATTERS OF BUSINESS, VOTES NEEDED AND

RECOMMENDATIONS OF THE BOARD OF DIRECTORS

| For More

|

Board

| |||

|

Proposal 1 – Election of Directors |

Page 6 |

✓ For Each Nominee | ||

| Each outstanding share of our Common Stock is entitled to one vote for as many separate nominees as there are directors to be elected. There are three directors nominated for election to Class One of our Board at the Annual Meeting: Vincent D. Mattera, Jr., Marc Y.E. Pelaez, and Howard H. Xia. A nominee will be elected to the Board if the number of votes cast for the nominee exceeds the number of votes cast against the nominee’s election, subject to the Company’s policy described under “Proposal 1 – Election of Directors – Director Conditional Resignation Policy.” Abstentions and broker non-votes have no effect on this matter. The Board recommends that you vote FOR the election of each of the Board’s nominees for director. |

||||

| Proposal 2 – Non-binding advisory vote to approve compensation paid to named executive officers in fiscal year 2018, as disclosed in this proxy statement |

Page 43 |

✓ For | ||

| The affirmative vote of at least a majority of the votes that all shareholders present at the Annual Meeting, in person or by proxy, are entitled to cast is required to approve on a non-binding advisory basis the compensation of our named executive officers for fiscal year 2018, as disclosed in this proxy statement. Abstentions have the effect of an “AGAINST” vote, and broker non-votes have no effect. Because this is an advisory vote, it will not be binding on the Company or the Board. However, the Compensation Committee will consider the voting results, among other factors, when making future decisions on executive compensation. The Board recommends that you vote FOR the resolution approving the Company’s fiscal year 2018 named executive officer compensation. |

||||

| Proposal 3 – Approval of the 2018 Employee Stock Purchase Plan |

Page 44 |

✓ For | ||

| The affirmative vote of at least a majority of the votes that all shareholders present at the Annual Meeting, in person or by proxy, are entitled to cast is required to approve the 2018 Employee Stock Purchase Plan. Abstentions have the effect of an “AGAINST” vote, and broker non-votes have no effect. The Board recommends that you vote FOR the approval of the 2018 Qualified Employee Stock Purchase Plan. |

||||

| Proposal 4 – Approval of the 2018 Omnibus Incentive Plan |

Page 51 |

✓ For | ||

| The affirmative vote of at least a majority of the votes that all shareholders present at the Annual Meeting, in person or by proxy, are entitled to cast is required to approve the 2018 Omnibus Incentive Plan. Abstentions have the effect of an “AGAINST” vote, and broker non-votes have no effect. The Board recommends that you vote FOR the 2018 Omnibus Incentive Plan. |

||||

| Proposal 5 – Ratification of the Audit Committee’s selection of EY as the Company’s independent registered public accounting firm (“Independent Accountants”) for the fiscal year ending June 30, 2019 |

Page 59 |

✓ For | ||

| The affirmative vote of at least a majority of the votes that all shareholders present at the Annual Meeting, in person or by proxy, are entitled to cast is required to ratify the appointment of EY as the Company’s Independent Accountants for the fiscal year ending June 30, 2019. Abstentions have the effect of an “AGAINST” vote, and broker non-votes have no effect. The Audit Committee is responsible for appointing the Company’s Independent Accountants. The Audit Committee is not bound by the outcome of this vote but, if the appointment of EY is not ratified by shareholders, the Audit Committee will reconsider the appointment. The Board recommends that you vote FOR the ratification of the Audit Committee’s selection of EY as the Company’s Independent Accountants for the fiscal year ending June 30, 2019. |

||||

| 5 |

Table of Contents

PROPOSAL 1—ELECTION OF DIRECTORS

| The Board is divided into three classes, each consisting of as nearly an equal number of directors as practicable. At present, the Board consists of eight members, with three directors in Classes One and Two and two directors in Class Three. |

|

|

|

The current term of our Class One Directors expires at the Annual Meeting. Accordingly, three directors have been nominated for election to Class One positions, for a term of three years or until such time as their respective successors are elected and qualified, or until death, resignation or removal. Any Board vacancy may be filled by the remaining directors then in office, and any director so elected will serve for the predecessor’s remaining term, or until his or her death, resignation or removal.

The persons named as proxies for this Annual Meeting were selected by the Board and have advised the Board that, unless authority is withheld, they intend to vote the shares represented by validly submitted proxies as follows:

| - | FOR the election of Vincent D. Mattera, Jr., who has served as a director since 2012; |

| - | FOR the election of Marc Y.E. Pelaez, who has served as a director since 2002; and |

| - | FOR the election of Howard H. Xia, who has served as a director since 2011. |

Each of the nominees has consented to serve if elected. However, if any of them is unable or unwilling to serve as a director, the Board may designate a substitute nominee, in which case the persons named as proxies will vote for any substitute nominee proposed by the Board.

DIRECTOR CONDITIONAL RESIGNATION POLICY

Each incumbent director nominee has submitted an irrevocable conditional resignation, which is effective if the nominee receives a greater number of votes “AGAINST” than votes “FOR” that person’s election. If this occurs, the Corporate Governance and Nominating Committee will recommend to the Board whether to accept or reject the resignation, or if other action should be taken. The Board will act on the resignation, taking into account the Committee’s recommendation, and publicly disclose its decision and the underlying rationale, within 90 days after the date the election results are certified. The incumbent director will remain as a member of the Board during this process.

| 6 |

Table of Contents

INFORMATION REGARDING THE COMPANY’S BOARD

The professional and personal experience, qualifications, attributes and skills of each director nominee are described below, and reflect the qualities that the Company seeks in its Board members. In addition to the specific examples, the Board and the Company believe that the broad-based business knowledge, commitment to ethical and moral values, personal and professional integrity, sound business judgment, and commitment to corporate citizenship demonstrated by the nominees make them exceptional candidates for these positions.

| Name

|

Class

|

Expiration

|

Age

|

Director

|

Position(s)

|

Audit

|

Compensation

|

Corporate

|

Subsidiary

| |||||||||

|

NON-EMPLOYEE DIRECTORS: |

||||||||||||||||||

| Marc Y.E. Pelaez

|

One

|

2018

|

72

|

2002

|

Lead Independent Director

|

Member

|

Chair

|

Member

| ||||||||||

|

Howard H. Xia

|

One

|

2018

|

57

|

2011

|

Director

|

Member

|

Member

|

Chair

| ||||||||||

|

Shaker Sadasivam

|

Two

|

2019

|

58

|

2016

|

Director

|

Member

|

Chair

|

|||||||||||

|

Francis J. Kramer

|

Two

|

2019

|

69

|

1989

|

Chairman of the Board

|

Member

| ||||||||||||

|

Enrico Digirolamo

|

Two

|

2019

|

63

|

2018

|

Director

|

|||||||||||||

|

Joseph J. Corasanti

|

Three

|

2017

|

54

|

2002

|

Director

|

Chair

|

Member

|

Member

| ||||||||||

|

William A. Schromm

|

Three

|

2017

|

60

|

2015

|

Director

|

Member

|

Member

|

|||||||||||

|

EMPLOYEE DIRECTOR:

|

||||||||||||||||||

| Vincent D. Mattera, Jr.

|

One

|

2018

|

62

|

2012

|

President and Chief Executive Officer, Director

|

CLASS ONE DIRECTORS STANDING FOR ELECTION

Vincent D. Mattera, Jr. Dr. Mattera initially served as a member of the II-VI Board from 2000 until 2002. Dr. Mattera joined the Company as Vice President in 2004, and served as Executive Vice President from January 2010 to November 2013, when he became Chief Operating Officer. He was re-appointed to the Board in 2012. In November 2014, Dr. Mattera became the President and Chief Operating Officer. In September 2016, Dr. Mattera became the Company’s third President and Chief Executive Officer in 45 years. During his career at II-VI he has assumed successively broader management roles, including as a lead architect of the Company’s diversification strategy. He has provided vision, energy and dispatch to the Company’s growth initiatives, including overseeing the acquisition-related integration activities in the United States, Europe, and Asia - especially in China - thereby establishing additional platforms. These have contributed to a new positioning of the Company into large and transformative global growth markets while increasing considerably the global reach of the Company, deepening the technology and IP portfolio, broadening the product roadmap and customer base, and increasing the potential of II-VI.

Prior to joining II-VI as an executive, Dr. Mattera had a continuous 20-year career in the Optoelectronic Device Division of AT&T Bell Laboratories, Lucent Technologies and Agere Systems, during which he led the development and manufacturing of semiconductor laser based materials and devices for optical and data communications networks. Dr. Mattera has 34 years of leadership experience in the compound semiconductor materials and device technology, operations and markets that are core to II-VI’s business and strategy. Dr. Mattera holds a B.S. in chemistry from the University of Rhode Island (1979), and a Ph.D. in chemistry from Brown University (1984). He completed the Stanford University Executive Program (1996). His 14-year tenure at II-VI underpins a valuable historical knowledge about the Company’s operational and strategic issues. We believe that Dr. Mattera’s expertise and experience qualify him to provide the Board with continuity and a unique perspective about the Company.

| 7 |

Table of Contents

Marc Y.E. Pelaez. Mr. Pelaez is a Rear Admiral, United States Navy (retired). Rear Admiral Pelaez is currently a private consultant to defense and commercial companies. He was Vice President of Engineering, and later Vice President of Business and Technology Development, for Newport News Shipbuilding, from 1996 until 2001, when it was acquired by Northrop Grumman Corporation. From 1993 to 1996, Rear Admiral Pelaez served as Chief of Naval Research. He served as the Executive Assistant to the Assistant Secretary of the Navy (Research, Development, and Acquisition) from 1990 to 1993. From 1968 to 1990, he held numerous positions, including command assignments, in the United States Navy. He is a graduate of the United States Naval Academy. Rear Admiral Pelaez has a broad background and understanding of technology and technology development, a seasoned knowledge of military procurement practices, and management leadership and consulting skills developed throughout his military and civilian careers.

Howard H. Xia. Dr. Xia currently serves as a consultant to the telecommunications industry. Dr. Xia served as General Manager of Vodafone China Limited, a wholly-owned subsidiary of Vodafone Group Plc, a telecommunications company, from 2001 to 2014. From 1994 to 2001, he served as a Director-Technology Strategy for Vodafone AirTouch Plc and AirTouch Communications, Inc. He served as a Senior Staff Engineer at Telesis Technology Laboratory from 1992 to 1994, and was a Senior Engineer at PacTel Cellular from 1990 to 1992. Dr. Xia holds a B.S. degree in Physics from South China Normal University, and an M.S. in Physics and Electrical Engineering, and a Ph.D. in Electrophysics from Polytechnic School of Engineering of New York University. Dr. Xia’s extensive knowledge of and experience in the telecommunications industry, his knowledge of international business, including with China, and strong leadership skills make him a valuable member of our Board. In particular, his experience and knowledge of telecommunications in Asia contribute to the Board’s breadth of knowledge in this area.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE NOMINEES NAMED ABOVE FOR ELECTION AS A CLASS ONE DIRECTOR.

|

EXISTING CLASS TWO DIRECTORS WHOSE TERMS EXPIRE IN 2019

Francis J. Kramer. Mr. Kramer joined the Company in 1983, served as its President from 1985 to 2007, its President and Chief Executive Officer from 2007 to November 2014, and its Chairman and CEO from November 2014 to September 2016. He now serves as the Company’s Chairman of the Board. Mr. Kramer holds a B.S. degree in Industrial Engineering from the University of Pittsburgh, and an M.S. degree in Industrial Administration from Purdue University. Mr. Kramer served as a director of Barnes Group Inc., an aerospace and industrial manufacturing company from 2012 to September 2016. Mr. Kramer provides our Board and the Company with guidance on growth strategy, in particular on the profitable execution of the strategy to achieve sustainable competitive advantage. He contributes considerable business development experience. He also has significant operations experience that is relevant to the Company’s strategy.

Shaker Sadasivam. Dr. Sadasivam is the Co-Founder, President and CEO of Auragent Bioscience, LLC. He also serves on the Board of four private companies, FTC Solar, Sfara, DClimate, and Sea Pharma LLC, and is a member of the Board of Trustees of Chesterfield Montessori School in Chesterfield, MO. In 2016, Dr. Sadasivam retired as President and Chief Executive Officer of SunEdison Semiconductor LLC, a leading manufacturer of advanced semiconductors for electronics, a position he held from December 2013. From 2009 to December 2013, he served as Executive Vice President and President, Semiconductor Materials Business Unit of SunEdison, Inc. (a predecessor to SunEdison Semiconductor LLC, formerly known as MEMC Electronic Materials, Inc.). From 2002 to 2009, Dr. Sadasivam served as Senior Vice President, Research and Development of SunEdison, Inc. Dr. Sadasivam holds B.S. and M.S. degrees in Chemical Engineering from the University of Madras and Indian Institute of Technology, an M.B.A. from Olin School of Business, and a Ph.D. in Chemical Engineering from Clarkson University. Dr. Sadasivam brings to the Board his extensive experience related to the semiconductor industry, and insight into areas including operations, product development and engineering management.

| 8 |

Table of Contents

Enrico Digirolamo. Mr. Digirolamo was appointed to the Board in May 2018. He is currently a senior advisor to technology companies and manufacturing firms. From 2013 to 2017, Mr. Digirolamo served as Chief Financial Officer and Senior Vice President of Covisint Corporation, a leading cloud computing company for the Internet of Things and Identity platforms. Mr. Digirolamo was with Allstate Insurance from 2010-2013, where he served as Senior Vice President, Sales and Marketing and Finance. From 2008 to 2010 Mr. Digirolamo served as Vice President and CFO for General Motors in Europe. During a 31-year career with General Motors, Mr. Digirolamo held a variety of senior executive positions throughout the corporation, including 12 years outside the United States. Mr. Digirolamo served on the Board of Directors of Metromedia International Group from 2010-2017; Premier Trailer Leasing, Inc., from 2011-201; and Identifix from 2013-2014. Mr. Digirolamo holds a B.S. from Central Michigan University, and an M.B.A. from Eastern Michigan University, and completed the Senior Executive Program at the International Institute for Management Development in Lausanne, Switzerland. He is a member of the Dean’s Leadership Roundtable at Central Michigan University, and a member of the Detroit Opera House Board of Directors and Board of Trustees. Mr. Digirolamo has extensive experience leading complex global businesses, and a broad CFO, general management, and board background.

EXISTING CLASS THREE DIRECTORS WHOSE TERMS EXPIRE IN 2020

Joseph J. Corasanti. Mr. Corasanti presently serves as a member of the Board of Directors and Chair of the Audit Committee for SRC, Inc., a non-profit research and development company. Previously, Mr. Corasanti held a number of management roles at CONMED Corporation, a medical technology company, serving as President and Chief Executive Officer from 2006 to July 2014; President and Chief Operating Officer from 1999 to 2006; Executive Vice President/General Manager from 1998 to 1999; and General Counsel and Vice President-Legal Affairs from 1993 to 1998. He also served as a director of CONMED from 1994 to 2014. From 1990 to 1993, he was an Associate Attorney with the Los Angeles office of the law firm of Morgan, Wenzel & McNicholas. Mr. Corasanti holds a B.A. degree in Political Science from Hobart College, and a J.D. degree from Whittier College School of Law. Mr. Corasanti’s past executive positions and his prior public company board experience have provided him with leadership skills and experience in a variety of matters that he contributes to our Board. His experience and skill set, including his legal background and acquisition experience, are valuable to our Board.

William A. Schromm. Mr. Schromm has served in various roles at ON Semiconductor Corporation, a leading manufacturer of energy-efficient, low-cost, high-volume analog, logic and discrete semiconductors, which was separated from Motorola in 1999. At ON Semiconductor, Mr. Schromm has served as Executive Vice President and Chief Operating Officer since 2014. Prior to that, he served as Senior Vice President, Operating Systems and Technology from 2012 to 2014, and as Senior Vice President, General Manager, Computing and Consumer Products from 2006 to 2012. Prior to joining ON Semiconductor, he worked for 19 years at Motorola in various roles, including Process Engineer, Product Manager, Operations Manager and Marketing Director. He brings extensive engineering, management and marketing experience to our Board.

| 9 |

Table of Contents

MEETINGS AND STANDING COMMITTEES OF THE BOARD OF DIRECTORS

The Company’s Board held four regularly scheduled meetings, and 14 special meetings during fiscal year 2018. Each scheduled quarterly meeting took place over a two-day period. In fiscal year 2018, each director attended at least 75% of the aggregate of (a) the total number of meetings of the Board and (b) the total number of meetings for the committees of which he or she was a member. The Board and committees of the Board have the authority to hire independent advisors to help fulfill their respective duties.

The Board has four standing committees: Audit; Compensation; Corporate Governance and Nominating; and Subsidiary. All Committees have written charters that may be found on the Company’s website at www.ii-vi.com/investor/investors.html.

|

Committee and Members

|

Primary Committee Functions

|

Number of

|

||||

| Audit |

||||||

| Joseph J. Corasanti (Chair)* Shaker Sadasivam* William A. Schromm Howard H. Xia *Qualifies as an audit committee “financial expert,” as defined by the Securities and Exchange Commission (“SEC”) |

– Oversees the Company’s discharge of its financial reporting obligations – Monitors the Company’s relationship with its Independent Accountants – Monitors performance of the Company’s business plan – Reviews the internal accounting methods and procedures – Reviews certain financial strategies – Establishes procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of concerns regarding accounting or auditing matters – Periodically reviews the Company’s risk assessment approach and activities undertaken by management

|

4 |

||||

| Compensation |

||||||

| Shaker Sadasivam (Chair) Joseph J. Corasanti Marc Y.E. Pelaez |

– Recommends and oversees compensation of the Company’s directors and executive officers – Administers and interprets the Company’s equity and incentive plans – Establishes terms and conditions of equity awards – Further information regarding the functions of the Compensation Committee is provided in the Compensation Discussion and Analysis section on page 19

|

12 |

||||

| Corporate Governance and Nominating: |

||||||

| Marc Y.E. Pelaez (Chair) William A. Schromm Howard H. Xia |

– Develops and implements corporate governance policies and processes – Assesses Board membership needs and makes recommendations regarding potential director candidates to the Board – Reviews succession plans for CEO and other senior executives of the Company

|

3 |

||||

| Subsidiary: |

||||||

| Howard H. Xia (Chair) Joseph J. Corasanti Francis J. Kramer Marc Y.E. Pelaez |

– Oversees the activities of the Company’s operating subsidiaries, as directed from time to time by the Board – Attends selected meetings of the Company’s operating subsidiaries and reports to the Board on material developments and risks – Focuses on risks related to operations, markets, customers and technology

|

4 |

||||

| 10 |

Table of Contents

DIRECTOR INDEPENDENCE AND CORPORATE GOVERNANCE POLICIES

The Rules of the Nasdaq Stock Market require that a majority of the Company’s Board be Independent Directors (as defined in the Nasdaq Rules). Our Corporate Governance Guidelines further provide that a substantial majority of the members of the Company’s Board must qualify as independent. The Board has determined that all of the continuing directors or nominees for election as director are independent within the meaning of the Nasdaq Rules, other than Mr. Kramer and Dr. Mattera. In its annual review of director independence, the Board considers all commercial, banking, consulting, legal, accounting or other business relationships any director may have with the Company to determine whether any director has a material relationship with the Company. The Board considers a “material relationship” to be one that impairs or inhibits, or has the potential to impair or inhibit, a director’s exercise of critical and disinterested judgment on behalf of the Company. When assessing the “materiality” of a director’s relationship with the Company, the Board considers all relevant facts and circumstances, from both the standpoint of the director in his or her individual capacity, and from the standpoint of the director’s family and other affiliations.

NOMINATION OF CANDIDATES FOR DIRECTOR

The Company will consider director candidates from several sources, including existing directors, members of the Company’s management team, shareholders, and third-party search firms. Enrico Digirolamo was appointed to the Board in May 2018, and was recommended to the Board by a third party search firm. The Company’s current bylaws describe the procedures by which shareholders may recommend candidates for election to the Board. In general, such nominations must be made by a shareholder in good standing, be in writing and be received by our Chairman of the Board no later than the close of business on the 120th day, and no earlier than the close of business on the 150th day, before the anniversary date of the mailing date of the Company’s proxy statement in connection with the previous year’s annual meeting. In addition, nominations must include information regarding both the nominating shareholder and the director nominee, including, their relationship to each other; any understanding between them regarding the nomination; the shares owned by the nominating shareholder; and other information concerning the proposing shareholder and/or nominee that is required for inclusion in a proxy statement filed with the SEC. Further, to be eligible for election as a director of the Company, the nominee must deliver within the timeframe noted above a written questionnaire detailing his or her background and qualifications, and a written representation and agreement as set forth in the Company’s bylaws. The form for this representation and agreement will be provided by the Secretary of the Company upon written request.

The Corporate Governance and Nominating Committee considers a variety of factors when determining whether to recommend a nominee for election to the Board, including those factors set forth in the Company’s Corporate Governance and Nominating Committee Charter. In general, candidates nominated for election to the Board should possess the following qualifications:

| - | High personal and professional integrity, practical wisdom and mature judgment; |

| - | Broad training and experience in policy-making decisions in business; |

| - | Expertise that is useful to the Company in relevant disciplines, particularly financial, commercial, governmental, international, technical or scientific, and that is complementary to the experience of our other directors; |

| - | Willingness to devote the time necessary to carry out the duties and responsibilities of a director; |

| - | Commitment to serve on the Board over several terms to develop critical Company knowledge; and |

| - | Willingness to represent the best interests of all shareholders and objectively appraise Company performance. |

Potential candidates are initially screened and interviewed by the Corporate Governance and Nominating Committee and/or a third party search firm.

Although the Board does not have a formal diversity policy, the Corporate Governance and Nominating Committee’s practice is to review the skills and attributes of individual Board members and candidates for the Board within the context of the current make-up of the full Board, to ensure that the Board as a whole is composed of individuals who, when combined, provide a diverse portfolio of experience, knowledge, talents

| 11 |

Table of Contents

and perspectives that will serve the Company’s governance and strategic needs. Candidates are also evaluated as to their broad-based business knowledge and contacts, prominence, commitment to ethical and moral values, personal and professional integrity, sound reputation in their respective fields, as well as a global business perspective and commitment to corporate citizenship. All members of the Board may interview the final candidates. The same evaluation procedures apply to all candidates for nomination, including candidates submitted by shareholders.

SIZE OF THE BOARD

As provided in the Company’s bylaws, the Board is composed of no less than five and no more than eleven members, with the exact number determined by the Board based on its current composition and requirements. At present, the Board consists of eight members.

BOARD STRUCTURE AND LEAD INDEPENDENT DIRECTOR

As part of the Board’s ongoing succession planning and leadership transition processes, the Board separated the roles of Chairman and CEO in September 2016, so as to enhance the stability of leadership and provide continued decisive leadership and seamless operation of the Company. Accordingly, Francis J. Kramer currently serves as Chairman, and Dr. Vincent D. Mattera, Jr. serves as President and CEO.

Regardless of whether, in the future, the roles of Chairman and CEO are combined or remain separated, the Company intends to retain the position of Lead Independent Director, which is currently held by Rear Admiral Pelaez. The primary responsibilities of the Lead Independent Director include:

| - | Chairing executive sessions of the independent directors; |

| - | Supporting the Chairman in the setting of Board agendas, based on director input; |

| - | Chairing meetings of the Board in the Chairman’s absence; and |

| - | Carrying out other duties as requested by the Corporate Governance and Nominating Committee and the Board. |

BOARD’S ROLE IN THE OVERSIGHT OF RISK MANAGEMENT

The Audit Committee has been designated to take the lead in overseeing the Company’s risk management at the Board level. The Audit Committee schedules time for periodic review of risk assessment and activities being undertaken by management throughout the year as part of its duties. The Audit Committee receives reports from Company management, internal audit, and other advisors, and strives to provide serious and thoughtful attention to the Company’s risk management processes and system, the nature of the material risks the Company faces, and the adequacy of the Company’s policies and procedures that respond to and mitigate these risks. Although the Audit Committee leads these efforts, risk management is periodically reviewed with the full Board, and feedback is sought from each director as to the most significant risks that the Company faces. Risk management is also reviewed and assessed by the Subsidiary Committee of the Board. Risks identified by the Subsidiary Committee are brought to the attention of the full Board.

In addition to the compliance program, the Board encourages management to promote a corporate culture that understands the importance of risk management and to incorporate it into the corporate strategy and day-to-day operations of the Company. The Company’s risk management approach also includes an ongoing effort to assess and analyze the most likely areas of future risk for the Company and to address them in its long-term planning process.

COMMUNICATION WITH DIRECTORS

Shareholders wishing to communicate with the Board may send written communications addressed to the Lead Independent Director, or to any member of the Board individually, in care of II-VI Incorporated, Attn: Secretary, 375 Saxonburg Boulevard, Saxonburg, Pennsylvania 16056. Any communication addressed to a director that is received by the Company at this address will be delivered or forwarded to the individual

| 12 |

Table of Contents

director as soon as practicable, except for advertisements, solicitations or other matters unrelated to the Company. The Company will forward communications received from shareholders that are addressed to the Board, to the chair of the Board committee whose function is most closely related to the subject matter of the communication.

DIRECTOR MANDATORY SERVICE CONCLUSION AND SUCCESSION PLANNING

The Board has instituted a policy for directors, as set forth in the Company’s Corporate Governance Guidelines. Under this policy, directors must voluntarily separate from the Board after the last regularly scheduled Board meeting prior to reaching the age of 75. The Board has undertaken a succession planning process to proactively address future openings on the Board. As part of this process, the Corporate Governance and Nominating Committee expects to evaluate new director candidates in the 2019 fiscal year using the criteria described in the “Nomination of Candidates for Director” section of this Proxy Statement under the heading “Director Independence and Corporate Governance Policies.”

DIRECTOR OWNERSHIP REQUIREMENTS

The minimum beneficial share ownership amount for members of the Board is a number of shares having a value of $150,000, which represents approximately three times the current annual Board cash retainer. A new Board member will have three years from the date of joining the Board to comply with this ownership requirement. In the event of non-compliance, the Board will consider measures appropriate to the circumstances.

STANDING BOARD LIMITS

Board members are limited to serving on a maximum of four public company boards, including the Company. No director currently serves on any other public company boards.

CHANGE IN DIRECTOR OCCUPATION

Under the Company’s Corporate Governance Guidelines, when a director’s principal occupation or business association changes substantially during his/her tenure, the director must tender a resignation for consideration by the Corporate Governance and Nominating Committee. The Committee then will recommend to the Board any action needed regarding the proposed resignation. Each director is limited to one employee director role.

EXECUTIVE SESSIONS OF NON-EMPLOYEE DIRECTORS

Executive sessions of non-employee directors are held regularly, with the Lead Independent Director presiding.

DIRECTOR ATTENDANCE AT ANNUAL MEETING OF SHAREHOLDERS

Directors are expected to attend the Annual Meeting. All directors attended last year’s Annual Meeting.

CODE OF BUSINESS CONDUCT AND ETHICS

The Board has approved and adopted a Code of Business Conduct and Ethics (the “Code of Conduct”) applicable to all directors, officers and employees of the Company and its subsidiaries. In addition, the Company has adopted an additional Code of Ethics for Senior Leaders. Designated senior leaders are required to sign the Code of Business Conduct and Ethics every year. These documents are available on the Company’s website at www.ii-vi.com/investor/Investors.html. The Company will promptly disclose on its website any substantive amendments or waivers with respect to any provision of the Code of Conduct and any provision of the Code of Ethics for Senior Leaders.

| 13 |

Table of Contents

Employees are required and encouraged to report suspected violations of our Code of Conduct on an anonymous basis. Anonymous reports are forwarded for review by the Audit Committee.

REVIEW AND APPROVAL OF RELATED PERSON TRANSACTIONS

The Company’s policies and procedures regarding related party transactions are included in the Code of Conduct. The Code of Conduct specifically requires that all Company directors, officers and employees refrain from activities that might involve a conflict of interest. Additionally, the Code of Conduct requires each Company director, officer and employee to openly and honestly handle any actual, apparent or potential conflict between that individual’s personal and business relationships and the Company’s interests. Before making any investment, accepting any position or benefit, participating in any transaction or business arrangement, or otherwise acting in a manner that creates or appears to create a conflict of interest, such person must make a full disclosure of all relevant facts and circumstances to, and obtain the prior written approval of, the Company. Waivers under the Code of Conduct for any of the Company’s executive officers or directors are granted only by the Board or a properly designated committee of the Board. It is expected that only those matters that are in the best interest of the Company would be approved or waived under our Code of Conduct.

DIRECTOR COMPENSATION IN FISCAL YEAR 2018

The Company uses a combination of cash and equity compensation to attract and retain qualified candidates to serve on the Company’s Board. In setting director compensation, the Company consults with its independent compensation advisor, Radford, an Aon Hewitt company (“Radford”) and considers the significant amount of time and skill required for directors to fulfill their overall responsibilities. Director compensation is only paid to non-employee directors. For purposes of this section, all references to “directors” means non-employee directors.

Our director compensation program is periodically reviewed by our Compensation Committee, with the help of the Company’s independent compensation advisor, to ensure the program remains competitive. As part of this review, the types and levels of compensation offered to our directors are compared to those offered by a select group of comparable companies. The comparable companies used are the same as those used for the Company’s named executive officers (the “Comparator Group”) and are listed in the “Compensation Discussion and Analysis” section of this Proxy Statement.

The components of our director compensation program for fiscal year 2018 are disclosed below. The Board is compensated based on a role-based compensation program, not based on the number of meetings attended, with the exception of activities of the Subsidiary Committee. Attendance at Subsidiary Committee meetings is compensated on a per-meeting basis due to the fact that there is not a set number of meetings for which attendance is required. The Compensation Committee strives to set director compensation at levels that are competitive with our Comparator Group. Typically, the overall compensation level of the Company’s directors ranges between the upper end of the second quartile and the lower end of the third quartile of compensation provided by the Comparator Group.

| 14 |

Table of Contents

DIRECTOR COMPENSATION STRUCTURE FOR FISCAL YEAR 2018

DIRECTOR CASH COMPENSATION

| Annual Retainer | ||||||||||||

| Compensation Item

|

Member

|

Chair(1)

|

Meeting Fee

|

|||||||||

|

Full Board Membership

|

$

|

50,000

|

|

$

|

90,000

|

|

$

|

—

|

| |||

|

Lead Independent Director

|

|

10,000

|

|

|

—

|

|

|

—

|

| |||

|

Audit Committee

|

|

10,000

|

|

|

20,000

|

|

|

—

|

| |||

|

Compensation Committee

|

|

7,500

|

|

|

15,000

|

|

|

—

|

| |||

|

Corporate Governance & Nominating Committee

|

|

5,000

|

|

|

10,000

|

|

|

—

|

| |||

|

Subsidiary Committee

|

|

—

|

|

|

5,000

|

|

|

1,500

|

(2)

| |||

| (1) | Retainers paid to Chairs are in lieu of, and not in addition to, retainers otherwise paid to members. |

| (2) | Per-day meeting fee. |

DIRECTOR EQUITY PROGRAM

In addition to the cash compensation outlined above, directors receive annual equity awards, typically in August of each fiscal year. In August 2018, each director (other than Mr. Digirolamo, who joined the Board in May 2018) received a grant of 5,700 stock options at an exercise price of $35.25 per share, and a restricted stock award grant of 2,280 shares of Common Stock. Stock options granted to directors generally have the same terms as those granted to our employees, including vesting occurring in four equal annual installments, and a term of ten years, but do not automatically vest upon a director’s departure from the Board. The Compensation Committee may recommend and the Board may approve, in its sole discretion, that a stock option award will vest upon departure from the Board, with an exercise period not to exceed five years. Restricted stock awards also generally have the same terms as those granted to our employees, including annual vesting of one-third of the award over three years, but do not automatically vest upon a director’s departure from the Board. The Compensation Committee may recommend and the Board may approve, in its sole discretion, that a restricted stock award will vest upon a director’s departure from the Board.

DIRECTOR COMPENSATION TABLE FOR FISCAL YEAR 2018

| Non-Employee Director (alphabetical order)

|

Fees Earned ($)(1)

|

Stock

|

Option

|

Total ($)

|

||||||||||||

|

Joseph J. Corasanti

|

$

|

88,000

|

|

$

|

80,370

|

|

$

|

85,960

|

|

$

|

254,330

|

| ||||

|

Enrico Digirolamo(4)

|

|

25,000

|

|

|

—

|

|

|

—

|

|

|

25,000

|

| ||||

|

Francis J. Kramer

|

|

129,000

|

|

|

80,370

|

|

|

85,960

|

|

|

295,330

|

| ||||

|

Marc Y.E. Pelaez

|

|

107,500

|

|

|

80,370

|

|

|

85,960

|

|

|

273,830

|

| ||||

|

Shaker Sadasivam

|

|

75,000

|

|

|

80,370

|

|

|

85,960

|

|

|

241,330

|

| ||||

|

William A. Schromm

|

|

65,000

|

|

|

80,370

|

|

|

85,960

|

|

|

231,330

|

| ||||

|

Howard H. Xia

|

|

85,750

|

|

|

80,370

|

|

|

85,960

|

|

|

252,080

|

| ||||

| (1) | Amounts reflect fees actually paid during fiscal year 2018. Director fees are usually paid in January of the applicable fiscal year. |

| (2) | Represents the aggregate grant date fair value of restricted stock issued to the non-employee directors under the 2012 Omnibus Incentive Plan, computed in accordance with Financial Accounting Standards Board (“FASB”) ASC Topic 718 (excluding the effect of forfeitures). The grant date fair value of restricted stock was computed based upon the closing price of the Company’s Common Stock on the date of grant, which was $35.25. |

| (3) | Represents the aggregate grant date fair value of option awards issued by the Company to the non-employee directors under the 2012 Omnibus Incentive Plan, computed in accordance with FASB ASC Topic 718. The grant date fair value of stock option awards is based on the Black-Scholes option pricing model. The actual value, if any, that a director may realize upon exercise of stock options will depend on the excess of the stock option price over the strike value on the date of exercise. As such, there is no assurance that the value realized by a director will be at or near the value estimated by the Black-Scholes model. Refer to Note 11 to the Consolidated Financial Statements in the Company’s Annual Report on Form 10-K for fiscal year 2018 filed with the SEC on August 28, 2018, for relevant assumptions used to determine the valuation of option awards, except that any estimate of forfeitures for service-based conditions have been disregarded. |

| (4) | Mr. Digirolamo was appointed to the Board in May 2018. The fees paid to Mr. Digirolamo represented his board retainer on a pro-rata basis for 2018. |

| 15 |

Table of Contents

DIRECTOR EQUITY AWARDS OUTSTANDING

The following table sets forth the aggregate number of shares of restricted stock and shares of underlying stock options held by the named directors as of June 30, 2018.

| Non-Employee Director (alphabetical order)

|

Restricted (#)

|

Total Option

|

Exercisable Option Awards (#)(1)

| ||||||||||||

|

Joseph J. Corasanti

|

|

9,229

|

|

|

109,560

|

|

|

85,318

|

| ||||||

|

Enrico Digirolamo(2)

|

|

—

|

|

|

—

|

|

|

—

|

| ||||||

|

Francis J. Kramer

|

|

39,124

|

|

|

609,300

|

|

|

483,178

|

| ||||||

|

Marc Y.E. Pelaez

|

|

9,229

|

|

|

69,440

|

|

|

45,198

|

| ||||||

|

Shaker Sadasivam

|

|

4,744

|

|

|

14,940

|

|

|

2,310

|

| ||||||

|

William A. Schromm

|

|

9,229

|

|

|

23,910

|

|

|

5,898

|

| ||||||

|

Howard H. Xia

|

|

9,229

|

|

|

61,540

|

|

|

37,298

|

| ||||||

| (1) | Includes options exercisable within 60 days of June 30, 2018. |

| (2) | Mr. Digirolamo was appointed to the Board in May 2018, and did not receive any restricted shares or stock options as of June 30, 2018. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

STOCK BENEFICIALLY OWNED BY PRINCIPAL SHAREHOLDERS

The following table sets forth certain information regarding the ownership by any person, including any “group” as defined in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), known to us to be the beneficial owner of more than 5% of the issued and outstanding shares of Common Stock as of August 31, 2018. Unless otherwise indicated, each of the shareholders named in the table has sole voting and investment power with respect to the shares beneficially owned. Ownership information is as reported by the shareholder in their respective filings with the SEC.

| Name and Address

|

Number of

|

Percent of Common Stock(1)

| ||||||||

|

BlackRock, Inc.(2) |

|

7,562,217 |

|

|

11.87 |

% | ||||

| 55 East 52nd Street |

||||||||||

| New York, NY 10055

|

||||||||||

|

Wellington Management Group LLP(3) |

|

6,389,481 |

|

|

10.03 |

% | ||||

| 280 Congress Street |

||||||||||

| Boston, MA 02210

|

||||||||||

|

The Vanguard Group(4) |

|

5,217,643 |

|

|

8.19 |

% | ||||

| P.O. Box 2600 |

||||||||||

| Valley Forge, PA 19482-2600

|

||||||||||

|

Carl J. Johnson(5) |

|

3,343,965 |

|

|

5.25 |

% | ||||

| 90 Elisabeth Way |

||||||||||

| McKinney, TX 75069

|

||||||||||

| (1) | As of August 31, 2018. There were 63,694,258 shares of our common stock outstanding as of August 31, 2018. |

| (2) | Based solely on a Schedule 13G/A filed with the SEC on February 8, 2018. BlackRock, Inc., reported sole voting power over 7,429,243 shares of Common Stock and sole dispositive power over 7,562,217 shares of Common Stock. As reported in the Schedule 13G/A, certain shares reported by BlackRock, Inc., are owned by various investment companies affiliated with BlackRock, Inc. |

| (3) | Based solely on a Schedule 13G/A filed with the SEC on February 12, 2018. Wellington Management Group LLP reported shared voting power over 5,711,181 shares of Common Stock and sole dispositive power over 6,389,481 shares of Common Stock. As reported in the Schedule 13G, the shares of Common Stock are owned of record by clients of one or more investment advisers directly or indirectly owned by Wellington Management Group LLP. |

| (4) | Based solely on a Schedule 13G/A filed with the SEC on February 9, 2018. The Vanguard Group, Inc., reported sole voting power over 79,883 shares, shared voting power over 9,294 shares of common stock, sole dispositive power over 5,133,172 shares, and shared dispositive power over 84,471 shares of Common Stock. |

| 16 |

Table of Contents

| (5) | Based solely on a Schedule 13D/A filed with the SEC on June 1, 2018. Mr. Johnson reported sole voting power over 1,034,440 shares of Common Stock, shared voting power over 2,309,525 shares of Common Stock, sole dispositive power over 1,329,351 shares of Common Stock, and shared dispositive power over 2,309,525 shares of Common Stock. |

STOCK BENEFICIALLY OWNED BY DIRECTORS AND OFFICERS

The following table shows the number of shares of II-VI Common Stock beneficially owned by all directors, our named executive officers (as reflected in the “Summary Compensation Table”), and all of our directors and executive officers as a group, as of August 31, 2018. This includes shares that could have been acquired within 60 days of that date through the exercise of stock options. The number of shares “beneficially owned” is defined by Rule 13d-3 under the Exchange Act. Unless otherwise indicated, each individual and member of the group has sole voting power and sole investment power with respect to shares owned. None of the shares reflected in the table below have been pledged as security.

| Beneficial Ownership of Common Stock(9) | ||||||||||

| Shares

|

Percent

| |||||||||

|

Joseph J. Corasanti(1)(2)

|

|

106,303

|

|

|

*

|

| ||||

|

Enrico Digirolamo(2)(3)

|

|

1,608

|

|

|

*

|

| ||||

|

Francis J. Kramer(1)(2)(4)(5)(6)

|

|

1,134,705

|

|

|

1.8

|

%

| ||||

|

Vincent D. Mattera, Jr.(1)(2)(5)

|

|

607,905

|

|

|

*

|

| ||||

|

Marc Y.E. Pelaez(1)(2)

|

|

117,426

|

|

|

*

|

| ||||

|

Shaker Sadasivam(1)(2)

|

|

13,629

|

|

|

*

|

| ||||

|

William A. Schromm(1)(2)

|

|

23,496

|

|

|

*

|

| ||||

|

Howard H. Xia(1)(2)

|

|

73,208

|

|

|

*

|

| ||||

|

Giovanni Barbarossa(1)(2)

|

|

145,907

|

|

|

*

|

| ||||

|

Gary A. Kapusta(1)(2)

|

|

88,791

|

|

|

*

|

| ||||

|

Mary Jane Raymond(1)(2)

|

|

115,271

|

|

|

*

|

| ||||

|

Jo Anne Schwendinger(1)(2)(7)

|

|

21,362

|

|

|

*

|

| ||||

|

All Executive Officers and Directors as a Group (13 persons)(8)

|

|

2,570,740

|

|

|

4.0

|

%

| ||||

| * | Less than 1% |

| (1) | Includes the following amounts subject to stock options that are exercisable within 60 days of June 30, 2018: 54,669 options exercisable by Mr. Corasanti, 533,149 options exercisable by Mr. Kramer, 340,770 options exercisable by Dr. Mattera, 54,669 options exercisable by Rear Admiral Pelaez, 6,045 options exercisable by Mr. Sadasivam, 11,427 options exercisable by Mr. Schromm, 46,769 options exercisable by Dr. Xia, 79,270 options exercisable by Dr. Barbarossa, 59,076 options exercisable by Ms. Raymond, 28,380 options exercisable by Mr. Kapusta, 6,045 options exercisable by Mr. Sadasivam, and 4,320 options exercisable by Ms. Schwendinger. |

| (2) | Includes 2,752 shares of restricted stock and 1,608 restricted stock units held by each of Mr. Corasanti, Rear Admiral Pelaez, Dr. Xia, Mr. Sadasivam and Mr. Schromm, 37,132 shares of restricted stock and 1,608 restricted stock units held by Mr. Kramer, 1,608 shares of restricted stock units held by Mr. Digirolamo, 46,134 shares of restricted stock and 21,672 restricted stock units held by Dr. Mattera, 18,440 shares of restricted stock and 7,104 restricted stock units held by Dr. Barbarossa, 18,952 shares of restricted stock and 6,864 restricted stock units held by Ms. Raymond, 47,561 shares of restricted stock and 7,512 restricted stock units held by Mr. Kapusta and 7,808 shares of restricted stock and 4,608 restricted stock units held by Ms. Schwendinger. |

| (3) | Mr. Digirolamo was appointed to the Board in May 2018. |

| (4) | Includes 285,401 shares held in a Spousal Limited Access Trust as to which Mr. Kramer disclaims beneficial ownership. |

| (5) | Includes 21,135 shares held on behalf of Dr. Mattera and 16,133 shares held on behalf of Mr. Kramer in the II-VI Incorporated Nonqualified Deferred Compensation Plan. |

| (6) | Includes 89,657 shares held in a grantor retained annuity trust as to which Mr. Kramer disclaims beneficial ownership. |

| (7) | Includes 2,000 shares held by Ms. Schwendinger’s spouse, as to which Ms. Schwendinger disclaims beneficial ownership. |

| (8) | Includes a total of 1,278,795 shares subject to stock options exercisable within 60 days of June 30, 2018, and a total of 198,022 shares of restricted stock and 71, 742 restricted stock units held by all executive officers and directors as a group. |

| (9) | There were 63,694,258 shares of our common stock outstanding as of August 31, 2018. In accordance with the rules and regulations of the SEC, in computing the percentage ownership for each person listed, any shares which the listed person had the right to acquire within 60 days are deemed outstanding; however, shares which any other person had the right to acquire within 60 days are disregarded in the calculation. Therefore, the denominator used in calculating beneficial ownership among the persons listed may differ for each person. |

| 17 |

Table of Contents

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act, requires the Company’s directors, executive officers and persons who beneficially own more than 10% of a class of the Company’s registered equity securities to file with the SEC and deliver to the Company initial reports of ownership and reports of changes in ownership of such registered equity securities.

The Company’s directors and executive officers timely filed all reports due under Section 16(a) during the period from July 1, 2017, through June 30, 2018, except that one late Form 4 on behalf of Jo Anne Schwendinger was filed to report the withholding by the Company of 790 shares to discharge withholding tax obligations in connection with the vesting of restricted shares on March 6, 2018, and one late Form 4 on behalf of Francis J. Kramer was filed to report the withholding by the Company of 25,000 and 2,208 shares to discharge withholding tax obligations in connection with the vesting of restricted shares on March 2, 2017, and March 2, 2018, respectively.

Set forth below is information concerning our Named Executive Officers (“NEOs”) discussed herein as of June 30, 2018.

|

Name

|

Age

|

Position

| ||||

|

Vincent D. Mattera, Jr.

|

|

62

|

|

President and Chief Executive Officer; Director

| ||

|

Mary Jane Raymond

|

|

57

|

|

Chief Financial Officer, Treasurer and Assistant Secretary

| ||

|

Gary A. Kapusta

|

|

58

|

|

Chief Operating Officer

| ||

|

Giovanni Barbarossa

|

|

56

|

|

Chief Technology Officer and President II-IV Laser Solutions

| ||

|

Jo Anne Schwendinger

|

|

62

|

|

Chief Legal and Compliance Officer and Secretary

| ||

Biographical information for VINCENT D. MATTERA, JR. may be found in the “DIRECTORS” section of this Proxy Statement.

MARY JANE RAYMOND has been Chief Financial Officer and Treasurer of the Company since March 2014. Previously, Ms. Raymond was Executive Vice President and Chief Financial Officer of Hudson Global, Inc., from 2005 to 2013. Ms. Raymond was the Chief Risk Officer and Vice President and Corporate Controller at Dun and Bradstreet, Inc., from 2002 to 2005. In addition, she was the Vice President, Merger Integration, at Lucent Technologies, Inc., from 1997 to 2002, and held several management positions at Cummins Engine Company from 1988 to 1997. Ms. Raymond holds a B.A. degree in Public Management from St. Joseph’s University, and an M.B.A. from Stanford University.

GARY A. KAPUSTA joined II-VI in February 2016, serving as Chief Operating Officer. Prior to his employment with the Company, Mr. Kapusta served in various roles at Coca-Cola, including as President & Chief Executive Officer, Coca-Cola Bottlers’ Sales & Services L.L.C.; and President, Customer Business Solutions, and Vice President, Procurement Transformation, of Coca-Cola Refreshments. He joined Coca-Cola following a 19-year career at Agere Systems, Lucent Technologies, and AT&T. Mr. Kapusta graduated from the University of Pittsburgh with B.S. and M.S. degrees in Industrial Engineering, and holds an M.B.A. from Lehigh University.

GIOVANNI BARBAROSSA joined II-VI in October 2012, and has been the President, Laser Solutions Segment since 2014, and the Chief Technology Officer since 2012. Dr. Barbarossa was employed at Avanex Corporation from 2000 through 2009, serving in various executive positions in product development and general management, ultimately serving as President and Chief Executive Officer. When Avanex merged with Bookham Technology, forming Oclaro, Dr. Barbarossa became a member of the Board of Directors of Oclaro, and served as such from 2009 to 2011. Previously, he held senior management roles in the Optical Networking Division of Agilent Technologies and in the Network Products Group of Lucent Technologies. He was previously a Member of Technical Staff, then Technical Manager at AT&T Bell Labs, and a Research Associate at British Telecom Labs. Dr. Barbarossa graduated from the University of Bari, Italy, with a B.S. degree in Electrical Engineering, and holds a Ph.D. in Photonics from the University of Glasgow, U.K.

| 18 |

Table of Contents

JO ANNE SCHWENDINGER was appointed to the position of General Counsel and Secretary of II-VI Incorporated in March 2017, and assumed the role of Chief Legal and Compliance Office and Secretary in November 2017. Prior to joining II-VI, from August 2016 to March 2017, Ms. Schwendinger was in the private practice of law at Blank Rome LLP, where she was a member of the firm’s Corporate Mergers & Acquisitions and Securities group. Before joining Blank Rome, Ms. Schwendinger held various positions, from February 2000 to August 2016, at Deere & Company, including Regional General Counsel for Asia-Pacific and Sub-Saharan Africa. Ms. Schwendinger currently serves on the global Board of Directors of the Association of Corporate Counsel. Ms. Schwendinger holds a Bachelor’s degree from the Université d’Avignon et des Pays de Vaucluse, and a Master’s degree from the Université de Strasbourg. Her Juris Doctor degree is from the University of Pittsburgh School of Law.

FISCAL YEAR 2018 COMPENSATION DISCUSSION AND ANALYSIS

INTRODUCTION

Our Compensation Discussion and Analysis explains the key features of our executive compensation program for fiscal year 2018 and the Compensation Committee’s approach in deciding fiscal year 2018 compensation for our NEOs. We have divided this discussion into six parts:

| 1. | Compensation Philosophy and Objectives |

| 2. | Elements of Total Direct Compensation |

| 3. | Fiscal Year 2018 Total Direct Compensation Decisions and Results |

| 4. | Process for Setting Compensation for Fiscal Year 2018 |

| 5. | Compensation and Risk |

| 6. | Additional Information |

COMPENSATION PHILOSOPHY AND OBJECTIVES

Overview

The Company believes in setting challenging objectives and requires talented and committed people to achieve them. The Company’s executive compensation program is designed to align our executives’ compensation with the market and the interests of our shareholders, and to attract, motivate and retain high-quality executive talent.

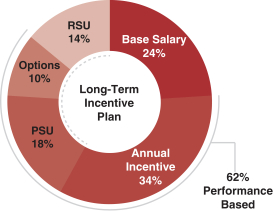

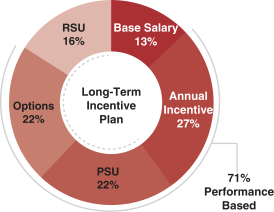

The Company’s executive compensation philosophy is based on the principle of pay-for-performance, with a substantial portion of total direct compensation (“TDC”) being at risk, and tied to performance. TDC refers to the sum of base salary, annual cash incentives and annual equity-based awards, which collectively form the core of our executive compensation program. We target TDC in the range of median level of pay of our Comparator Group for performance at target. Actual compensation received by the NEOs may be higher or lower than the competitive median depending on our performance results.

The primary objectives of our fiscal year 2018 executive compensation program were:

| - | Continuous Improvements in Performance: Ensure that a significant portion of TDC is at risk, based on Company and individual performance, measured by revenue and net income (the measures for determining cash incentives), and cash flow from operations (a metric used for performance shares). |

| - | Shareholder Returns Above Median: Maximize Company performance to enhance relative total shareholder return (“rTSR”), another metric used for performance shares. |

| - | Stable Leadership: Attract and retain a high caliber of executive talent by taking into account competitive market practices at our Comparator Group and providing equity awards with multi-year vesting conditions to encourage retention and performance. |

| 19 |

Table of Contents

| - | Sustainable Achievement of Results: Encourage a long-term focus by our NEOs, while recognizing the importance of short-term performance, with goals that are challenging yet attainable, and discourage excessive risk taking, all through a balanced mix of annual and longer-term incentives tied to our business goals and various best-practice policies, such as our compensation clawback policy. |

| - | Commitment: Align executive and shareholder interests by requiring our NEOs to meet share ownership and holdings guidelines and prohibit them from hedging or pledging Company stock. |

Shareholder Outreach