Form DEF 14A IHS Markit Ltd. For: Apr 11

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

IHS MARKIT LTD.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

4th Floor, Ropemaker Place

25 Ropemaker Street

London EC2Y 9LY

United Kingdom

February 27, 2019

Dear IHS Markit Shareholder:

We are pleased to invite you to attend the 2019 Annual General Meeting of Shareholders of IHS Markit Ltd.

The meeting will be held on Thursday, April 11, 2019, at 9:00 a.m., local time, at the IHS Markit corporate headquarters, 4th Floor, Ropemaker Place, 25 Ropemaker Street, London EC2Y 9LY, United Kingdom.

The enclosed Notice of Annual General Meeting of Shareholders and related materials describe the business that we will conduct at the meeting and the proposals that the shareholders of IHS Markit will consider and vote upon. IHS Markit’s audited consolidated financial statements for the year ended November 30, 2018 and the auditor’s report thereon will be available to shareholders at the meeting.

Each shareholder of record has the opportunity to vote in person at the meeting. If you plan to attend the meeting in person, you will need to request an admission ticket in advance. You can request a ticket in advance by following the instructions under “Admission and Ticket Request Procedure” in the proxy statement.

Whether or not you plan to attend the meeting in person, it is important that your shares be represented and voted at the meeting. Accordingly, if you have elected to receive your proxy materials by mail, please date, sign and return the proxy card. If you received your proxy materials over the internet, please submit your voting instructions by internet or by telephone in accordance with the instructions provided in the notice of internet availability of proxy materials that you received in the mail. If your shares are held in the name of a bank or broker, submitting your voting instructions by mail, telephone or internet will depend on the processes of the bank or broker, and you should follow the instructions you receive from your bank or broker. Returning the proxy card or otherwise submitting your proxy does not deprive you of your right to attend the meeting and vote in person. If you decide to attend the meeting in person, you will be able to revoke your proxy and vote in person. Any signed proxy returned and not completed will be voted by management in favor of all proposals presented in the proxy statement.

Contact us if we can explain any of these matters or otherwise help you with your voting instructions or attending the meeting.

Remember that your shares cannot be voted unless you submit your proxy or attend the meeting in person. Your participation is important to all of us at IHS Markit, so please review these materials carefully and submit your voting instructions.

We look forward to hearing from you or seeing you at the Annual Meeting.

| Sincerely, |

|

|

| Lance Uggla |

| Chairman and Chief Executive Officer |

Table of Contents

Table of Contents

IHS MARKIT LTD.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY given that the Annual General Meeting of Shareholders (the “Annual Meeting”) of IHS Markit Ltd. (“IHS Markit” or the “Company”) will be held on April 11, 2019 beginning at 9:00 a.m., local time, at the IHS Markit corporate headquarters, 4th Floor, Ropemaker Place, 25 Ropemaker Street, London EC2Y 9LY, United Kingdom.

The Company is holding this Annual Meeting for the following purposes:

1. To elect a total of four Class II directors to serve until the next Annual General Meeting of Shareholders or until their respective offices shall otherwise be vacated pursuant to the Company’s bye-laws;

2. To approve the appointment of Ernst & Young LLP as the Company’s independent registered public accountants until the close of the next Annual General Meeting of Shareholders and to authorize the Company’s Board of Directors, acting by the Audit Committee, to determine the remuneration of the independent registered public accountants;

3. To approve, on an advisory, non-binding basis, the compensation of the Company’s named executive officers;

4. To approve amendments to the Company’s bye-laws to implement “proxy access” and related changes; and

5. To transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

The Company’s audited consolidated financial statements for the year ended November 30, 2018, together with the auditor’s report thereon, will be presented at the Annual Meeting.

IHS Markit’s Board of Directors has fixed the close of business on February 14, 2019 as the record date (the “Record Date”) for the determination of the shareholders entitled to receive notice and to vote at the Annual Meeting or any adjournment or postponement thereof. For 10 days prior to the Annual Meeting, a complete list of shareholders entitled to vote at the Annual Meeting will be available for shareholders to review for purposes relevant to the meeting. To arrange to review that list, contact: Company Secretary, c/o Legal Department, IHS Markit Ltd., 4th Floor, Ropemaker Place, 25 Ropemaker Street, London EC2Y 9LY, United Kingdom or by email to [email protected].

The Annual Meeting is open to all shareholders of record or their authorized representatives. Each shareholder of record has the opportunity to vote in person at the meeting. If you plan to attend the meeting in person, you will need to request an admission ticket in advance. You can request a ticket in

Table of Contents

advance by following the instructions under “Admission and Ticket Request Procedure” in the attached proxy statement. The Company Secretary must receive your written request for an admission ticket on or before April 5, 2019. If you hold your IHS Markit common shares through a brokerage account (in “street name”), your request for an admission ticket must include a copy of a brokerage statement reflecting share ownership as of the Record Date. Your ticket will be sent to you prior to the meeting if you follow these instructions. Don’t forget your ticket and government-issued photo identification. You will not be admitted to the meeting if you do not have your ticket and photo identification. Contact us if we can explain any of these matters or otherwise help you with your voting instructions or attending the Annual Meeting.

Even if you plan to attend the Annual Meeting in person, we hope that you will promptly provide your voting instructions by submitting your proxy by completing, dating, signing, and returning the enclosed Proxy Card by mail, or by submitting your voting instructions by telephone or internet, or, if you hold your shares in the name of a bank or broker, by following the instructions you receive from your bank or broker. Returning the proxy card or otherwise submitting your proxy does not deprive you of your right to attend the meeting and vote in person. If you decide to attend the meeting in person, you will be able to revoke your proxy and vote in person. Any signed proxy returned and not completed will be voted by management in favor of all proposals presented in the proxy statement.

No weapons, cameras, audio or video recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Annual Meeting. Please note that, for security reasons, all bags may be searched. We will be unable to admit anyone to the Annual Meeting who does not comply with these security procedures. No one will be admitted to the Annual Meeting once the meeting has commenced.

Submitting voting instructions by proxy will not limit your rights to attend or vote at the Annual Meeting.

| Sincerely, |

|

|

| Christopher McLoughlin |

| Secretary |

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on April 11, 2019: The Proxy Statement and our 2018 Annual Report for the year ended November 30, 2018 are available at http://investor.ihsmarkit.com.

Table of Contents

Table of Contents

IHS MARKIT LTD.

PROXY STATEMENT FOR

ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 11, 2019

INFORMATION CONCERNING PROXY SOLICITATION

AND VOTING

This Proxy Statement is being furnished to you in connection with the solicitation by the Board of Directors of IHS Markit Ltd., a Bermuda company, of proxies for the 2019 Annual General Meeting of Shareholders (the “Annual Meeting”) and any adjournments or postponements thereof. The Annual Meeting will be held on Thursday, April 11, 2019, 9:00 a.m. local time, at the IHS Markit corporate headquarters, 4th Floor, Ropemaker Place, 25 Ropemaker Street, London EC2Y 9LY, United Kingdom.

This Proxy Statement, the IHS Markit Annual Report on Form 10-K for the year ended November 30, 2018 (the “Annual Report”), and the accompanying Proxy Card are being first sent to shareholders on or about February 27, 2019. We are providing notice and electronic access to our proxy materials to our shareholders. The notice will be mailed on or about February 27, 2019. The notice contains instructions regarding how to access and review our proxy materials over the internet or receive a hard copy. The notice also provides instructions regarding how to submit a proxy over the internet. We believe that this process allows us to provide shareholders with important information in a timely manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials.

On July 12, 2016, we completed a merger between IHS Inc. (“IHS”), Markit Ltd. (“Markit”), and Marvel Merger Sub, Inc., an indirect and wholly owned subsidiary of Markit Ltd. (the “Merger”). Upon completion of the Merger, Markit Ltd. became the public combined group holding company and was renamed IHS Markit Ltd. IHS Inc. was treated as the acquiring entity for accounting purposes, which is reflected in the results of operations, financial position, financial statements, and Management’s Discussion and Analysis of Financial Condition and Results of Operations in the Annual Report.

References in this Proxy Statement to “we,” “us,” “our,” the “Company,” and “IHS Markit” refer to IHS Markit Ltd. and our consolidated subsidiaries.

We operate on a November 30 fiscal year-end. Unless otherwise indicated, references in this Proxy Statement to an individual year means the fiscal year ended November 30. For example, “2018” refers to the fiscal year ended November 30, 2018 and “2017” refers to the fiscal year ended November 30, 2017.

Appointment of Proxy Holders

The Board of Directors of IHS Markit (the “Board of Directors” or “Board”) asks you to appoint the following individuals as your proxy holders to vote your shares at the Annual Meeting:

Lance Uggla, Chairman and Chief Executive Officer;

Todd Hyatt, Executive Vice President and Chief Financial Officer; and

Sari Granat, Executive Vice President, Chief Administrative Officer and General Counsel.

1

Table of Contents

You may make this appointment by using one of the methods described below. If appointed by you, the proxy holders will vote your shares as you direct on the matters described in this Proxy Statement. In the absence of your direction, they will vote your shares if you sign the proxy card as recommended by the Board.

Unless you otherwise indicate on the Proxy Card, you also authorize your proxy holders to vote your shares on any matters not known by the Board at the time this Proxy Statement was printed and that, under our amended and restated bye-laws (“bye-laws”), may be properly presented for action at the Annual Meeting.

Who Can Vote

Only shareholders who owned our common shares at the close of business on February 14, 2019—the Record Date for the Annual Meeting—can vote at the Annual Meeting.

Each holder of our common shares is entitled to one vote for each share held as of the Record Date. As of the close of business on the Record Date, we had 424,625,307 common shares issued and outstanding and entitled to vote, including 25,219,470 issued and outstanding common shares held by the Markit Group Holdings Limited Employee Benefit Trust (the “EBT”). The trustee of the EBT may not vote any common shares held by the EBT unless we direct otherwise. We intend to direct the EBT to vote the common shares held by the EBT on each proposal at the Annual Meeting in accordance with the percentages voted by other holders of common shares on such proposal.

Our common shares are listed on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “INFO.”

How You Can Vote

The common shares represented by any proxy in the enclosed form will be voted in accordance with the instructions given on the proxy if the proxy is properly executed and is received by us prior to the close of voting at the Annual Meeting or any adjournment or postponement thereof. Any proxies returned without instructions will be voted FOR the proposals set forth in the Notice of Annual General Meeting of Shareholders.

Revocation of Proxies

A shareholder giving a proxy may revoke it at any time before it is exercised. A proxy may be revoked by:

(i) filing with the Secretary of the Company prior to the Annual Meeting a written notice of revocation by mail to IHS Markit Ltd., Attention: Company Secretary, c/o Legal Department, IHS Markit Ltd., 4th Floor, Ropemaker Place, 25 Ropemaker Street, London EC2Y 9LY, United Kingdom;

(ii) submitting a duly executed proxy bearing a later date that we receive prior to the conclusion of voting at the Annual Meeting;

(iii) attending the Annual Meeting and voting in person; or

(iv) logging onto www.proxyvote.com in the same manner you would to submit your proxy electronically or calling 1-800-690-6903, and in either case following the instructions to revoke or change your voting instructions.

2

Table of Contents

Quorum

Two or more persons present at the start of the Annual Meeting and representing, in person or by proxy, in excess of 50 percent of the total issued common shares in the Company entitled to vote at the Annual Meeting (including the common shares held by the EBT) shall form a quorum for the transaction of business at the Annual Meeting.

If you indicate an abstention as your voting preference, your shares will be counted toward a quorum but they will not be voted on any given proposal (see “—Required Vote” below). “Broker non-votes” (see “—Required Vote” below) will be counted as common shares that are present for the purpose of determining the presence of a quorum but will have no effect with respect to any matter for which a broker does not have authority to vote.

Required Vote

For Proposal 1, the election of our Class II directors, each person receiving a majority of the votes cast (the number of shares voted “for” a director must exceed the number of shares voted “against” that director) will be elected as a Director. You may instruct to vote “for” or “against,” or “abstain” from voting for each of the nominees to become a director. If you “abstain” from voting with respect to the proposal, your vote is not considered a vote cast and will have no effect for such proposal.

For Proposal 2, approval of the appointment of our independent registered public accountants, the affirmative vote of a majority of the votes cast on the issue, either in person or by proxy, will be required to approve. You may instruct to vote “for” or “against,” or “abstain” from voting on the proposal. If you “abstain” from voting with respect to the proposal, your vote is not considered a vote cast and will have no effect for such proposal.

For Proposal 3, advisory vote on the compensation of the Company’s named executive officers, the affirmative vote of a majority of the votes cast on the issue, either in person or by proxy, will be required to approve. You may instruct to vote “for” or “against,” or “abstain” from voting on the proposal. If you “abstain” from voting with respect to the proposal, your vote is not considered a vote cast and will have no effect for such proposal.

For Proposal 4, approval of amendments to the Company’s bye-laws to implement “proxy access” and certain related changes, the affirmative vote of not less than 66-2/3 percent of the votes attaching to all shares in issue, either in person or by proxy, will be required to approve. You may instruct to vote “for” or “against,” or “abstain” from voting the proposal. If you “abstain” from voting with respect to the proposal, your vote will have the same effect as a vote “against” such proposal.

Brokers cannot vote your shares on “non-routine” matters without your voting instructions. In those cases, if you do not provide your broker or other nominee with instructions on how to vote your shares, it will be considered a “broker non-vote” and your broker or nominee will not be permitted to vote those shares. Your broker or nominee will be entitled to cast uninstructed votes only on Proposal 2, the approval of the appointment of our independent registered public accountants.

We encourage you to provide instructions to your broker regarding the voting of your shares.

Solicitation of Proxies

We will pay the expenses of soliciting proxies. Proxies may be solicited in person or by mail, telephone and electronic transmission on our behalf by directors, officers or employees of IHS Markit or its

3

Table of Contents

subsidiaries, without additional compensation. We will reimburse brokerage houses and other custodians, nominees and fiduciaries that are requested to forward soliciting materials to the beneficial owners of the common shares held of record by such persons.

Multiple Shareholders Sharing the Same Mailing Address

Multiple IHS Markit shareholders who share an address may receive only one copy of this Proxy Statement and the Annual Report, unless the shareholder gives instructions to the contrary. This delivery method, called “householding”, will not be used if we receive contrary instructions from one or more of the shareholders sharing a mailing address. We will deliver promptly a separate copy of this Proxy Statement and the Annual Report to any IHS Markit shareholder who resides at a shared address and to which a single copy of the documents was delivered if the shareholder makes a request by contacting the Company Secretary, c/o Legal Department, IHS Markit Ltd., 4th Floor, Ropemaker Place, 25 Ropemaker Street, London EC2Y 9LY, United Kingdom or by telephone at +44 207 260 200 or by email at [email protected].

If your household has received multiple copies of the Annual Report and Proxy Statement, you can request the delivery of single copies in the future by marking the designated box on the attached proxy card.

If you own common shares through a bank, broker or other nominee and receive more than one Annual Report and Proxy Statement, contact the holder of record to eliminate duplicate mailings.

Available Information

IHS Markit makes available free of charge through its website at http://investor.ihsmarkit.com, its Annual Reports to Shareholders, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements and form of proxy and all amendments to these reports no later than the day on which such materials are first sent to shareholders or made public. Further, IHS Markit will provide, without charge to each shareholder upon written request, a copy of IHS Markit’s Annual Reports to Shareholders, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements and form of proxy and all amendments to those reports. Written requests for copies should be addressed to the Company Secretary, c/o Legal Department, IHS Markit Ltd., 4th Floor, Ropemaker Place, 25 Ropemaker Street, London EC2Y 9LY, United Kingdom. Requests may also be directed via e-mail to [email protected]. Copies may also be accessed electronically by means of the U.S. Securities and Exchange Commission’s (“SEC”) homepage on the Internet at www.sec.gov.

Important Reminder

Please promptly provide your voting instructions by submitting your proxy in writing or by telephone or internet, or if you hold your common shares through a bank or broker, as instructed by your bank or broker.

To submit written voting instructions, you may sign, date, and return the enclosed Proxy Card. To submit voting instructions telephonically or by internet, follow the instructions provided on the Proxy Card.

Submitting voting instructions by proxy will not limit your rights to attend or vote at the Annual Meeting.

4

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

Directors and Nominees

Pursuant to the authority granted to the Board by the Company’s bye-laws, the Board determined that it be composed of 12 directors, divided into three classes. However, our bye-laws were amended and restated in 2018 to eliminate the classified structure of our Board over a three-year period and provide that all director nominees standing for election upon completion of their term after the 2018 annual general meeting would be elected to a one-year term. Each director elected at our 2018 annual general meeting will hold office for a three-year term until our 2021 annual general meeting. Each director serving as a Class II director immediately prior to the 2018 annual general meeting will hold office until the Annual Meeting. Each director serving as a Class III director immediately prior to the 2018 annual general meeting will hold office until the 2020 annual general meeting. Any director elected or appointed to fill a vacancy pursuant to our bye-laws shall hold office until the next annual general meeting of shareholders held after the date of such appointment.

Four directors who serve as Class II directors are to be elected at the Annual Meeting. These directors will hold office until the annual general meeting of shareholders in 2020, or until their respective offices shall otherwise be vacated pursuant to the Company’s bye-laws. Each director nominee set forth below has consented to being named in this Proxy Statement as a nominee for election as director and has agreed to serve as a director if elected. In the event that any of the nominees should become unavailable prior to the Annual Meeting, proxies in the enclosed form will be voted for a substitute nominee or nominees designated by the Board, or the Board may reduce the number of directors to constitute the entire Board, in its discretion.

Majority Vote Standard for Election of Directors

Our amended and restated bye-laws require directors to be elected by a majority of the votes cast with respect to each director in uncontested elections, and a director nominee will be elected as a director only if the votes cast “for” the director nominee exceed the votes cast “against” the director nominee. Abstentions will not be counted as votes cast for or against a director nominee. If the Board determines that an election of directors is contested (i.e., the number of director nominees in any one year exceeds the number of directors to be elected in that year), our bye-laws provide that a plurality voting standard will apply and the director nominees receiving the greatest number of votes (up to the number of directors to be elected) will be elected. Under Bermuda law and our bye-laws, any incumbent director who fails to be re-elected may not continue to sit on the Board after their term in office has expired and their position on the Board is left vacant. If any director positions are left vacant following a general meeting, the Board may reduce its size or, if authorized by shareholders, may fill such vacant positions.

5

Table of Contents

2019 Nominees For Director

For more information about each director nominee, our continuing directors, and the operation of our Board, see “Corporate Governance and Board of Directors—Business Experience and Qualifications of Board Members.”

|

| ||||||||||

| Name | Age | Director Since |

Position with Company | |||||||

|

| ||||||||||

| Jean-Paul L. Montupet |

71 | 2012 | Director | |||||||

| Richard W. Roedel |

69 | 2004 | Director | |||||||

| James A. Rosenthal |

64 | 2013 | Director | |||||||

| Lance Uggla |

57 | 2003 | Chairman and CEO | |||||||

Vote Required and Recommendation

For Proposal 1, directors are elected by a majority vote, which means that each person receiving the affirmative vote of a majority of the votes cast (the number of shares voted “for” a director must exceed the number of shares voted “against” that director) will be elected as a Director. You may instruct to vote “for” or “against,” or “abstain” from voting for each of the nominees to become a Class II director. If you “abstain” from voting with respect to the proposal, your vote is not considered a vote cast and will have no effect for such proposal. If you do not provide your broker or other nominee with instructions on how to vote your shares with respect to Proposal 1, your broker or nominee will not be entitled to cast votes and a “broker non-vote” on Proposal 1 will result. “Broker non-votes” are not considered votes cast and will have no effect on the vote for this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

THE ELECTION OF THESE NOMINEES

6

Table of Contents

PROPOSAL 2: APPROVAL OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Board is submitting for approval at the Annual Meeting the appointment of Ernst & Young LLP as the Company’s independent registered public accountants until the close of the next annual general meeting of shareholders to audit our books, records, and accounts and those of our subsidiaries for 2019, and to authorize the Board, acting by the Audit Committee, which is composed entirely of independent directors, to determine the remuneration of the independent registered public accountants.

Ernst & Young LLP has advised the Company that the firm does not have any direct or indirect financial interest in the Company, nor has such firm had any such interest in connection with the Company during the past three fiscal years other than in its capacity as the Company’s (and prior to July 12, 2016, IHS Inc.’s) independent registered public accountants.

Representatives of Ernst & Young LLP will be present at the Annual Meeting. They will have an opportunity to make a statement, if they desire to do so, and will be available to respond to appropriate shareholder questions.

Audit, Audit-Related, and Tax Fees

In connection with the audit of the Company’s financial statements for the fiscal year ended November 30, 2018, IHS Markit entered into an engagement agreement with Ernst & Young LLP that set forth the terms by which Ernst & Young LLP performed audit services for IHS Markit. Aggregate fees for professional services rendered for us by Ernst & Young LLP for the fiscal years ended November 30, 2018 and November 30, 2017 were as follows:

|

|

||||||||

| 2018 | 2017 | |||||||

|

|

||||||||

| (in thousands) | ||||||||

| Audit Fees |

$ | 6,433 | $ | 5,543 | ||||

| Audit-Related Fees |

2,843 | 1,373 | ||||||

| Tax Fees |

25 | 13 | ||||||

| All Other Fees |

— | — | ||||||

|

|

||||||||

| Total |

$ | 9,301 | $ | 6,929 | ||||

Audit Fees. Audit fees consist of fees billed for professional services rendered for the audit of our consolidated financial statements, the statutory audit of our subsidiaries, the review of our interim consolidated financial statements, and other services provided in connection with statutory and regulatory filings.

Audit-Related Fees. Audit-related fees consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements and are not reported under “—Audit Fees.” These services may include employee benefit plan audits, due diligence services related to acquisitions and divestitures, auditing work on proposed transactions, attestation services that are not required by regulation or statute, and consultations regarding financial accounting or reporting standards. For 2018, audit-related fees included approximately $1,637,000 for attestation reports for service organizations and $1,093,000 for due

7

Table of Contents

diligence services rendered related to acquisitions and divestitures. For 2017, audit-related fees included approximately $826,000 for attestation reports for service organizations and $434,000 for due diligence services rendered related to acquisitions and divestitures.

Tax Fees. Tax fees consist of tax compliance consultations, preparation of tax reports, and other tax services.

Audit Committee Pre-approval Policies and Procedures

The Audit Committee has implemented pre-approval policies and procedures related to the provision of audit and non-audit services by Ernst & Young LLP, our independent registered public accountants. Under these procedures, the Audit Committee pre-approves both the type of services to be provided by Ernst & Young LLP and the estimated fees related to these services.

During the approval process, the Audit Committee considers the impact of the types of services and the related fees on the independence of the registered public accountants. The services and fees must be deemed compatible with the maintenance of such accountants’ independence, including compliance with rules and regulations of the SEC and NASDAQ.

The Audit Committee has delegated authority to pre-approve services performed by Ernst & Young LLP to the chair of the Audit Committee for services of up to $500,000, with any approvals pursuant to such delegated authority regularly reported to the Audit Committee. The Audit Committee has not delegated any of its responsibilities to pre-approve services performed by Ernst & Young LLP to management. Throughout the year, the Audit Committee will review any revisions to the estimates of audit and non-audit fees initially approved. No such services were approved pursuant to the procedures described in Rule 2-01(c)(7)(i)(C) of Regulation S-X, which waives the general requirement for pre-approval in certain circumstances.

Vote Required and Recommendation

Approval of Proposal 2 will require the affirmative vote of a majority of the votes cast at the Annual Meeting, either in person or by proxy. Unless marked to the contrary, proxies received will be voted “FOR” this Proposal 2 regarding the approval of the appointment of Ernst & Young LLP as our independent registered public accountants until the close of the next annual general meeting of shareholders and the authorization of the Board, acting by the Audit Committee, to determine the remuneration of the independent registered public accountants.

With respect to Proposal 2, you may instruct to vote “for” or “against,” or “abstain” from voting on, such proposal. If you “abstain” from voting, your vote is not considered a vote cast and will have no effect for such proposal. If you do not provide your broker or other nominee with instructions on how to vote your shares with respect to Proposal 2, your broker or nominee will be entitled to cast discretionary votes on Proposal 2 as such proposal is a “routine” matter.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF

ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

UNTIL THE CLOSE OF THE NEXT ANNUAL GENERAL MEETING AND THE AUTHORIZATION

OF THE BOARD, ACTING BY THE AUDIT COMMITTEE, TO DETERMINE THE

REMUNERATION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

8

Table of Contents

PROPOSAL 3: ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

At the 2017 annual general meeting of shareholders, we conducted an advisory, non-binding vote regarding the frequency with which we would seek approval of the compensation of our named executive officers. At such meeting, shareholders expressed their preference for an annual vote on executive compensation on an advisory, non-binding basis and, consistent with this preference, the Board determined that we will conduct such a vote on an annual basis.

Accordingly, and pursuant to Section 14A of the Securities Exchange Act of 1934, as amended, we are providing our shareholders with the opportunity to vote, on an advisory, nonbinding basis, on the compensation of our named executive officers (sometimes referred to herein as “NEOs”) for 2018, as disclosed in this Proxy Statement, including the “Compensation Discussion and Analysis,” compensation tables and related material.

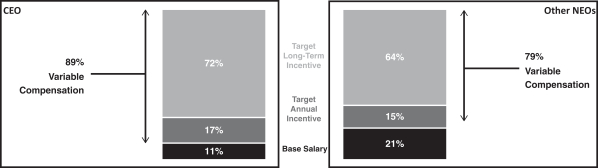

Our executive compensation program for 2018 is geared towards driving long-term, sustainable business performance. It is governed by the following guiding principles:

| ● | It is fully consistent with our business objectives and strategy. |

| ● | It drives accountability and transparency, and aligns executive compensation with shareholders’ interests. |

| ● | It supports our mission, vision and values. |

| ● | The philosophy is designed to attract, retain and motivate top talent. |

| ● | Our programs are globally consistent and locally competitive. |

| ● | Our short-term incentives are aligned to key business objectives appropriate to colleague role and business segment. |

| ● | We provide long-term incentives that align colleague and shareholder interests and promote shareholder return. |

| ● | We have a pay-for-performance culture that is incentivized to achieve business performance that will sustain growth across the Company. |

| ● | The program takes into account both affordability and IHS Markit’s risk appetite, ensuring that our incentive plans do not encourage any undue risk taking, and strives to avoid any undue complexity. |

| ● | The program strengthens alignment with shareholders, through significant share ownership guidelines that apply to both executive officers and directors. |

The Human Resources Committee continually reviews the compensation programs for our NEOs to ensure they achieve the desired goals of aligning our executive compensation structure with our shareholders’ interests and current market practices.

We are asking our shareholders to indicate their support for our NEO compensation program and practices as described in this Proxy Statement. This proposal, commonly known as a “say-on-pay” proposal, gives our shareholders the opportunity to express their views on our NEOs’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs and the philosophy, policies, and practices described in this Proxy Statement.

9

Table of Contents

We are asking our shareholders to approve the compensation program and practices of our NEOs as described in this Proxy Statement (which includes the “Compensation Discussion and Analysis,” the compensation tables, and related material).

Vote Required and Recommendation

The say-on-pay vote is advisory and therefore not binding on the Company, the Human Resources Committee, or the Board. The Board and the Human Resources Committee value the opinions of our shareholders and, to the extent there is a significant vote against the named executive officer compensation policies and practices as disclosed in this Proxy Statement, we will consider our shareholders’ concerns and the Human Resources Committee will evaluate whether any actions are necessary to address those concerns.

Unless you instruct us to the contrary, proxies will be voted “FOR” this Proposal 3 regarding named executive officer compensation policies and practices, as described in the “Compensation Discussion and Analysis,” and the other related tables and disclosures in this Proxy Statement.

With respect to Proposal 3, you may instruct your vote “for” or “against,” or “abstain” from voting on, such proposal. If you “abstain” from voting, your vote is not considered a vote cast and will have no effect for such proposal. If you do not provide your broker or other nominee with instructions on how to vote your shares with respect to Proposal 3, your broker or nominee will not be entitled to cast votes and a “broker non-vote” on Proposal 3 will result. Broker non-votes are not considered votes cast and will have no effect on the vote for this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

APPROVAL OF THE COMPENSATION OF THE COMPANY’S

NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT

PURSUANT TO ITEM 402 OF REGULATION S-K

10

Table of Contents

PROPOSAL 4: AMENDMENTS TO BYE-LAWS TO IMPLEMENT PROXY ACCESS AND RELATED CHANGES

The Board is submitting for approval at the Annual Meeting amendments to our bye-laws to implement “proxy access” to our shareholders. Proxy access would allow eligible shareholders to nominate candidates for election to our Board and have those nominees included in our proxy materials, along with the candidates nominated by the Board.

As part of the Company’s commitment to effective governance practices, management and the Board considered evolving trends and the views of institutional shareholders and, after careful consideration, the Board, upon the recommendation of the Nominating and Governance Committee, has determined that it is appropriate to propose for shareholder consideration amendments to our bye-laws that, if adopted, would implement proxy access.

If this proposal is adopted, our bye-laws would be amended and restated to provide that the Company would, subject to certain requirements and limitations, include in its proxy statement for an annual general meeting, names of any person or persons nominated for election as a director by any qualifying shareholder, required disclosure about each person nominated, a statement supporting the nomination by the shareholder and any other information the Board determined to include in the proxy statement related to the nomination.

The amendments also include a change to Bye-law 38 adopted in 2018 to phase out our classified board as part of our plan to adopt majority voting and implement a “proxy access” bye-law, and certain other immaterial changes, including revising certain defined terms. In particular, the amendments correct a transcription error in the transition terms of Class II and III directors set forth in the bye-law to conform to the correct terms set forth in the proxy disclosure for the proposal in the 2018 proxy statement that was approved by shareholders.

The following description is only a summary and is qualified in its entirety by reference to the complete text of the proposed amendments. You are urged to read the proposed amendments in their entirety. The specific language of the proposed amendments to our bye-laws is set forth in Appendix A to this Proxy Statement and is marked to show the proposed changes.

Amendments to Implement Proxy Access

Shareholder Eligibility to Nominate Directors

Any shareholder or group of up to 20 shareholders that has continuously maintained ownership of at least 3 percent of the shares of the Company’s outstanding common shares for at least three years would be permitted to nominate the greater of two candidates or up to 20 percent of the Board. Any two or more funds under common management and investment control would generally count as one shareholder.

Calculation of Qualifying Ownership

A nominating shareholder would be deemed to own only those outstanding common shares of the Company as to which the shareholder possesses both the full voting and investment rights pertaining to the shares and the full economic interest in (including the opportunity for profit from and risk of loss on) such shares.

11

Table of Contents

The following shares would not count as “owned” shares for purposes of determining whether the ownership threshold has been met: shares sold in any transaction that has not been settled or closed; shares borrowed or purchased pursuant to an agreement to resell; or shares subject to any derivative instrument or similar agreement which has the purpose or effect of reducing the shareholder’s full right to vote or direct the voting of any such shares and/or hedging, offsetting or altering the gain or loss arising from the full economic ownership of such shares.

A shareholder will be deemed to “own” outstanding common shares that have been loaned by or on behalf of the shareholder to another person if the shareholder has the right to recall such loaned shares on not more than five business days’ notice.

Number of Shareholder Nominees

The maximum number of candidates nominated by all eligible shareholders that the Company would be required to include in its proxy materials cannot exceed the greater of two candidates or 20 percent (rounded down) of the number of directors in office as of the last day on which a notice of proxy access nomination may be delivered to the Company. The maximum number of shareholder nominees would be reduced by candidates nominated under proxy access procedures who (i) have subsequently withdrawn or who become unwilling to serve, (ii) cease to satisfy certain eligibility requirements, (iii) are included in the Company’s proxy statement as a nominee of the Board, (iv) are nominated by the Board pursuant to an agreement or other arrangement with one or more shareholders, or (v) were previously elected to the Board as shareholder nominees at any of the last two preceding annual general meetings and renominated as a director by the Board.

Nominating Procedure

In order to provide adequate time to assess shareholder nominees, requests to include shareholder nominees in the Company’s proxy materials must be delivered not less than 120 days nor more than 150 days prior to the anniversary of the date the Company mailed its proxy statement for the prior year’s annual general meeting to shareholders.

Information and Undertakings Required of All Nominating Shareholders and Nominees

Each shareholder seeking to include a shareholder nominee in the Company’s proxy materials would be required to provide certain information, representations and undertakings to the Company regarding the nominating shareholder (including all members of the group) and each shareholder nominee, including, but not limited to:

| ● | verification of the shareholder’s continuous qualifying ownership of the Company’s common shares as of the date of the submission of the nomination, and agreement to provide written statements verifying continuous qualifying ownership through the record date for the applicable annual general meeting; |

| ● | information regarding each candidate, including biographical and share ownership information; and |

| ● | information as to whether a nominee is or has been a director or officer of a competitor and on any other relationship with or financial interest in any competitor within the preceding three years. |

In addition, each shareholder nominee requested to be included in the Company’s proxy materials would be required to provide certain written representations and undertakings to the Company,

12

Table of Contents

including agreeing that, if elected as a director, the shareholder nominee will comply with all of the Company’s corporate governance, conflict of interest, confidentiality, share ownership and trading policies and guidelines, and other Company policies and guidelines applicable to directors.

No Proxy Access Nominees in the Event of Proxy Contest or Legal Violations

The Company would not be required to include a shareholder nominee in its proxy materials if, among other things, any shareholder nominates a person for election pursuant to the advance notice provisions of the Company’s bye-laws, or the nomination or election of the nominee would cause the Company to violate its bye-laws, applicable laws or the rules or the rules and listing standards of the principal exchange upon which the Company’s shares are listed.

Future Disqualification of Shareholder Nominees

Any nominee who is included in the Company’s proxy materials but subsequently either withdraws from or becomes ineligible for election at the meeting, or does not receive at least 25 percent of the votes cast in favor of his or her election, would be ineligible for nomination for the next two annual general meetings.

Supporting Statement

Shareholders would be permitted to include in the Company’s proxy statement for the applicable annual general meeting a written statement of up to 500 words in support of the election of their nominees. The Company would be permitted to omit any information or statement that the Company determines is materially false or misleading or whose disclosure would violate any applicable law or regulation.

Conforming Amendments

The bye-laws also make clear that the Board may remove any director for a material breach of any of the Company’s corporate governance, conflict of interest, confidentiality, share ownership or trading policies and guidelines, or any other Company policies or guidelines applicable to directors.

Amendment to Bye-Law 38

Bye-law 38 was amended in 2018 to phase out our classified board as part of our plan to adopt majority voting and implement a “proxy access” bye-law. The proposed amendments correct a transcription error in the transition terms of Class II and III directors set forth in Bye-law 38 to conform to the correct terms set forth in the proxy disclosure for the proposal in the 2018 proxy statement that was approved by shareholders. The Class II director term is meant to expire in 2019 (as stated in the 2018 proxy disclosure, whereas the bye-law incorrectly had a transcription error of 2020). The Class III director term is meant to expire in 2020 (as stated in the 2018 proxy disclosure, whereas the bye-law incorrectly had a transcription error of 2019). The proposed amendments would conform the bye-law to the 2018 proxy disclosure so that Class II Directors shall hold office until the annual general meeting held in 2019 and Class III Directors shall hold office until the annual general meeting held in 2020. In addition, the proposed amendments make certain other immaterial changes, including revising certain defined terms.

If this proposal is approved, the amendments to our bye-laws will become effective immediately following the Annual Meeting.

13

Table of Contents

Vote Required and Recommendation

Approval of Proposal 4 will require the affirmative vote of not less than 66-2/3 percent of the votes attaching to all shares in issue.

With respect to Proposal 4, you may instruct your vote “for,” or “against,” or “abstain” from voting. If you “abstain” from voting, your vote will have the same effect as a vote “against” such proposal. If you do not provide your broker or other nominee with instructions on how to vote your shares with respect to Proposal 4, your broker or nominee will not be entitled to cast votes and a “broker non-vote” on Proposal 4 will result. Broker non-votes are not considered votes cast and will have the same effect as a vote “against” such proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE

AMENDMENTS TO THE COMPANY’S BYE-LAWS TO IMPLEMENT PROXY ACCESS AND THE RELATED CHANGES DESCRIBED ABOVE

14

Table of Contents

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS

Our Board of Directors is currently composed of 12 members, divided into three classes. Our bye-laws were amended and restated in 2018 to eliminate the classified structure of our Board over a three-year period and provide that all director nominees standing for election upon completion of their term after the 2018 annual general meeting would be elected to a one-year term. Each of our directors will continue to serve as director until the end of his or her term, or until the earlier of his or her death, resignation, or removal. Under Bermuda law and our bye-laws, any incumbent director who fails to be re-elected to the Board may not continue to sit on the Board after his or her term in office has expired. If any director positions are left vacant following a general meeting of shareholders, the Board may reduce its size or, if authorized by shareholders, may fill such vacant positions. Our shareholders have not authorized the Board to fill positions on the Board left vacant following a general meeting of shareholders.

Board Leadership Structure

The Board of Directors of IHS Markit believes strongly in the value of an independent board of directors to provide effective oversight of management. This includes all independent members of the key board committees: the Audit Committee, the Human Resources Committee, the Nominating and Governance Committee, and the Risk Committee. Each of the Company’s directors, other than Mr. Uggla, is independent (see “—Independent Directors”). The independent members of the Board of Directors meet regularly without management, which meetings are chaired by the lead independent director, which our bye-laws refer to as the Lead Director, whose role is described further below.

The Board believes that it is important to retain its flexibility to allocate the responsibilities of the offices of the Chairman and Chief Executive Officer (“CEO”) in any way that it deems to be in the best interests of the Company. Upon the retirement of Jerre Stead as Chairman and CEO on December 31, 2017, Lance Uggla became our Chairman and CEO as was set out in our bye-laws. Prior to the Merger, Mr. Uggla was Chairman and CEO of Markit. Mr. Uggla possesses detailed and in-depth knowledge of the business and the opportunities we have in the global marketplace and is thus well positioned to develop agendas and lead the Board to ensure that the Board’s time and attention are focused on the most critical matters.

IHS Markit has established a Lead Director role with broad authority and responsibility. Robert P. Kelly has served as our Lead Director since the closing of the Merger and was previously the lead director of Markit beginning in June 2014. The Lead Director’s responsibilities include:

| ● | scheduling and chairing meetings of the independent directors; |

| ● | serving as principal liaison between the independent directors and the Chairman and CEO on sensitive issues; |

| ● | communicating from time to time with the Chairman and CEO, and disseminating information among the Board as appropriate; |

| ● | providing leadership to the Board if circumstances arise in which the role of the Chairman may be, or may be perceived to be, in conflict; |

| ● | reviewing and approving the agenda and schedule for Board meetings and executive sessions and adding topics to the agenda as appropriate; |

| ● | reviewing the quality, quantity, and timeliness of information to be provided to the Board; |

15

Table of Contents

| ● | serving as a nonmanagement point of contact for the Company’s shareholders and other external stakeholders; and |

| ● | with the Chair of the Nominating and Governance Committee, preside over the annual self-evaluation of the Board. |

The Board believes that these responsibilities appropriately and effectively complement the Board leadership structure of IHS Markit.

The Role of the Board of Directors in Risk Oversight

We believe that risk is inherent in innovation and the pursuit of long-term growth opportunities for our business. The Board of Directors, acting directly and through its committees, is responsible for the oversight of the Company’s risk management. With the oversight of the Board, IHS Markit has implemented practices and programs designed to help manage the risks to which we are exposed in our business and to align risk-taking appropriately with our efforts to increase shareholder value. Each of the Audit, Human Resources, and Risk Committees of the Board has a role in assisting the Board in its oversight of the Company’s risk management, as set forth in the relevant committee charters.

The Board’s Risk Committee brings additional Board-level focus to the oversight of the Company’s management of key risks, as well as the Company’s policies and processes for identifying, evaluating, and mitigating such risks. The Risk Committee meets at least quarterly. The Chair of the Risk Committee gives regular reports of the Risk Committee’s meetings and activities to the Board in order to keep the Board informed of the Company’s guidelines, policies, and practices with respect to risk assessment and risk management, and each other committee also reports regularly to the full Board on its activities.

In addition, the Board of Directors participates in regular discussions among the Board and with IHS Markit senior management on many core subjects, including strategy, operations, finance, information technology, information and cybersecurity, human resources, legal, compliance, and public policy matters, and any other subjects regarding which the Board or its committees consider risk oversight an inherent element. Management at IHS Markit is responsible for day-to-day risk management activities. The Company has formed a management risk committee led by a Chief Risk Officer to supervise these day-to-day risk management efforts, including identifying potential material risks and appropriate and reasonable risk mitigation efforts. The Chief Risk Officer regularly reports such efforts to the Risk Committee and, as required, the Audit Committee and Human Resources Committee. The Board of Directors believes that the leadership structure described under “—Board Leadership Structure” facilitates the Board’s oversight of risk management because it allows the Board, with leadership from the Lead Director and working through its independent committees, to participate actively in the oversight of management’s actions.

Shareholder Engagement

Engagement with our shareholders has always been a significant priority for us, and we invest focused time and resources speaking with shareholders and proxy advisors about our corporate governance and executive compensation practices.

As we have done in the past, in 2018 we reached out to the governance leaders and stewardship teams of shareholders representing at that time approximately 50 percent of our common shares outstanding. We asked for feedback on our performance and practices, particularly related to corporate

16

Table of Contents

governance and pay practices. We offered to visit in person or meet by teleconference. In response to our outreach efforts, we conducted meetings with several of our top shareholders via teleconference or in person. Those meetings were attended at various times by our Chief Administrative Officer and General Counsel and Head of Investor Relations.

We discussed a range of topics at those meetings, including the board structure and composition, corporate governance practices, executive compensation policies and design, and environmental-, social-, and governance-related matters. Shareholders were generally supportive of our current practices. We took the feedback that we received to our Nominating and Governance Committee and Human Resources Committee. Both committees, as well as the entire Board, find shareholder input valuable in their oversight of the Company.

As a result of our shareholder engagement, we have made a number of changes to our governance practices and disclosure:

| ● | In Proposal 4, we are asking shareholders to vote on amendments to our bye-laws that would implement “proxy access” and allow eligible shareholders to include their nominees for election to the Board in the Company’s proxy materials, along with the candidates nominated by the Board. |

| ● | In January 2019, we amended and restated our 2014 Equity Incentive Award Plan to prohibit the repricing of outstanding options and share appreciation rights such that we cannot reduce their exercise price without shareholder approval. |

| ● | In October 2018, we announced the launch of a board mentorship program designed to build the ranks of female candidates for board directorships. We have committed to increase the percentage of female independent directors on our Board to at least 30 percent by 2021. |

| ● | In January 2018, we added two new directors, increasing gender and sexual orientation diversity, and refreshed the composition of our Board committees to continue to provide our Board with fresh insights. |

| ● | For the last few years, we have had discussions with certain shareholders about annual equity award dilution and we are actively managing our annual run rate share usage. For 2019, we are again committed to limiting our annual equity award dilution to a maximum annual run rate of 1.00 percent of total common shares outstanding. |

For more information on changes we made to our compensation governance practices and disclosure, please see “Compensation Discussion and Analysis—Shareholder Engagement”

Shareholder engagement is and will continue to be a top priority for our management team and Board. We will continue to engage our shareholders and consider the feedback that we receive from our discussions.

Business Experience and Qualifications of Board Members

The following discussion presents information about the persons who compose the Board of Directors of IHS Markit, including the four nominees for election at the Annual Meeting. On February 13, 2019, Mr. Iyer informed the Board that, after 16 years of service on the Board, he had decided to retire from the Board, and he tendered his resignation as a Class III director of the Board and its committees effective as of the end of the day on April 11, 2019, the date of the Annual Meeting. Mr. Iyer confirmed that his decision to retire was not due to any disagreement with the Company on any matter related to the Company’s operations, policies or practices. The Board expects to reduce its size to 11 directors upon Mr. Iyer’s retirement and will make a final determination at its April meeting after the Annual Meeting.

17

Table of Contents

All director biographical information is as of February 1, 2019, except for the age of the directors, which is as of the date of the Annual Meeting. We measure director tenure from when a director joined the Board or the board of either IHS or Markit (or their relevant predecessor companies) prior to the Merger.

2019 Nominees For Director

The following are the four director nominees for election at the Annual Meeting.

| Jean-Paul L. Montupet | Director since 2012 | |

| Class II Director with term expiring in 2019 | Age: 71 | |

|

IHS Markit Board Committees Human Resources Nominating and Governance (Chair) |

Experience and Qualifications

Until his retirement in December 2012, Mr. Montupet served as the Chair of Emerson Electric Co.’s Industrial Automation business and President of Emerson Europe SA. Mr. Montupet joined Emerson in 1981, serving in a number of senior leadership roles at the global technology provider, including Executive Vice President of Emerson Electric Co. and Chief Executive Officer of Emerson Electric Asia Pacific. Mr. Montupet serves on the boards of WABCO Holdings Inc. and Assurant, Inc.

Mr. Montupet is also an advisor to Eurazeo Société Anonyme and to Cornell Capital, and serves on the board of certain private portfolio companies of the private investment firm. Mr. Montupet was the non-executive chair of the board of PartnerRE Ltd. from 2010 until March 2016 and served on the board of Lexmark International, Inc. from 2006 until November 2016. He is also a trustee of the International Churchill Society.

Mr. Montupet brings to the Board extensive international business and executive management experience, particularly from Europe and Asia Pacific, and additional experience gained as a director of multiple publicly traded companies, including as the non-executive chairman of the board of PartnerRe Ltd.

Other Public Company Directorships (within past 5 years)

| ● | WABCO Holdings Inc. (2012-Present) |

| ● | Assurant, Inc. (2012- Present) |

| ● | PartnerRE Ltd. (2010-2016) |

| ● | Lexmark International, Inc. (2006-2016) |

|

Richard W. Roedel |

Director since 2004 | |

| Class II Director with term expiring in 2019 | Age: 69 | |

|

IHS Markit Board Committees Audit Risk (Chair) |

Experience and Qualifications

Mr. Roedel serves as a director of BrightView Holdings, Inc., Six Flags Entertainment Corporation, LSB Industries, Inc., and Luna Innovations Incorporated. Mr. Roedel also serves as the non-executive

18

Table of Contents

chairman of LSB Industries and Luna Innovations. Mr. Roedel served as a director of Broadview Network Holdings, Inc., a private company with publicly traded debt until 2012 and of Beaulieu Group LLC, a private company, until 2018. Mr. Roedel served on the board of Dade Behring, Inc. from 2002 until it was acquired in 2007; on the board of BrightPoint, Inc. from 2002 until it was acquired in 2012; on the board of Sealy Corporation from 2006 until it was acquired in 2013; and on the board of Lorillard, Inc. from 2008 until it was acquired in June 2015. As a director of public companies, Mr. Roedel has served as lead independent director, executive and non-executive chairman, and as the chairman of audit, risk, governance, compensation, and special committees. Mr. Roedel served in various capacities at Take-Two Interactive Software, Inc. from 2002 until 2005, including chairman and chief executive officer. Mr. Roedel is a member of the National Association of Corporate Directors (NACD) Risk Oversight Advisory Council. Until 2016, Mr. Roedel was a director of the Association of Audit Committee Members, Inc., a nonprofit association of audit committee members dedicated to strengthening audit committees by developing best practices. In 2014, Mr. Roedel was appointed to the Standing Advisory Group of the Public Accounting Oversight Board for a three-year term ending in 2017. From 1971 through 2000, Mr. Roedel was employed by BDO Seidman LLP, becoming an audit partner in 1980, later being promoted in 1990 to managing partner in Chicago and then managing partner in New York in 1994, and finally, in 1999, to Chairman and CEO. Mr. Roedel holds a Bachelor of Science degree in accounting from The Ohio State University and is a Certified Public Accountant.

Mr. Roedel provides to the Board of Directors expertise in corporate finance, accounting, and strategy. He brings experience gained as a chief executive officer and as a director for several companies.

Other Public Company Directorships (within past 5 years)

| ● | BrightView Holdings, Inc. (2015-Present) |

| ● | Six Flags Entertainment Corporation (2010-Present) |

| ● | LSB Industries, Inc. (2015-Present) |

| ● | Luna Innovations Incorporated (2005-Present) |

| ● | Lorillard, Inc. (2008-2015) |

| James A. Rosenthal | Director since 2013 | |

| Class II Director with term expiring in 2019 | Age: 65 | |

|

IHS Markit Board Committees Human Resources Risk |

Experience and Qualifications

Mr. Rosenthal is the Chief Executive Officer of BlueVoyant, a global cybersecurity services firm. Until December 2016, Mr. Rosenthal was Executive Vice President and Chief Operating Officer of Morgan Stanley, a member of Morgan Stanley’s management and operating committees, Chairman and CEO of Morgan Stanley Bank, N.A., and Chairman of Morgan Stanley Private Bank, N.A. Mr. Rosenthal was previously head of corporate strategy of Morgan Stanley, Chief Operating Officer of Morgan Stanley Wealth Management and head of firmwide technology and operations for Morgan Stanley. Prior to joining Morgan Stanley, Mr. Rosenthal served as Chief Financial Officer of Tishman Speyer from 2006 to 2008. From 1999 to 2005, he served as the head of Corporate Strategy and Corporate Development at Lehman Brothers and as a member of the Management Committee. Mr. Rosenthal was with McKinsey & Company from 1986 to 1999, where he was a senior partner specializing in financial institutions. Mr. Rosenthal has been on the board of Intarcia Therapeutics, Inc, a private company, since June 2017. From April until October 2017, Mr. Rosenthal was a director of On Deck Capital, Inc.

19

Table of Contents

Mr. Rosenthal was a trustee of the Lincoln Center for the Performing Arts until 2018. Mr. Rosenthal also formerly served as chairman of the board of the Securities Industry and Financial Markets Association (SIFMA). Mr. Rosenthal holds a BA from Yale University and a JD from Harvard Law School.

Mr. Rosenthal brings to the Board cybersecurity experience, as well as extensive experience gained as chief operating officer of one of the world’s largest financial institutions.

Other Public Company Directorships (within past 5 years)

| ● | On Deck Capital, Inc. (April 2017-December 2017) |

| Lance Uggla | Director since 2003 | |

| Chairman and CEO | Age: 57 | |

| Class II Director with term expiring in 2019 | ||

|

IHS Markit Board Committees None |

Experience and Qualifications

Mr. Uggla is Chairman and CEO of IHS Markit. He served as President from July 2016 to December 2017 and was appointed Chief Operating Officer in October 2017. Prior to the Merger, Mr. Uggla was Chairman and CEO of Markit since January 2003, responsible for leading the Company’s strategic development and managing day-to-day operations. He founded Markit in 2003 after spotting an opportunity to bring transparency to the credit default swap market. The Company launched the first daily credit default swap pricing service that year. He oversaw Markit’s growth from a startup to a global public company with more than 4,200 employees in 28 offices worldwide, serving more than 3,000 customers. Mr. Uggla graduated from the Simon Fraser University in Canada with a BBA and holds a Master of Science from the London School of Economics, UK.

Mr. Uggla was a founder and Chairman and CEO of Markit since its creation, and was previously an executive in the financial industry. As Chairman and CEO of IHS Markit, Mr. Uggla brings to the Board of Directors his knowledge of our business, strategy, people, operations, competition, and financial position. In addition, he brings with him extensive relationships in the financial services industry.

Other Public Company Directorships (within past 5 years)

None

20

Table of Contents

Continuing Directors

The following directors will continue in office until the expiration of their respective terms.

| John Browne (The Lord Browne of Madingley) | Director since 2018 | |

| Class III Director with term expiring in 2020 | Age: 71 | |

|

IHS Markit Board Committees Human Resources Nominating and Governance |

Experience and Qualifications

Lord Browne is the chairman of L-1 Energy (UK), the chairman of Huawei Technologies (UK) and the executive chairman of the supervisory board of DEA Deutsche Erdoel AG. He is also on the board of Pattern Energy Group Inc. Prior to joining L-1 Energy in March 2015, Lord Browne was a partner at Riverstone Holdings LLC, an energy and power-focused private equity firm, for eight years. From May 2013 to May 2015, he was also a director of Riverstone Energy Limited, a closed-ended investment company listed on the London Stock Exchange. Lord Browne spent 41 years at BP plc, holding various senior management positions during that time. In 1991, he joined the board of The British Petroleum Company and was appointed Group Chief Executive in 1995 and remained in this position until May 2007. Lord Browne was the chairman of the advisory board of Apax Partners LLC from 2006 to 2007, a non-executive director of Goldman Sachs from 1999 to 2007, a non-executive director of Intel Corporation from 1997 to 2006, a trustee of The British Museum from 1995 to 2005, a member of the supervisory board of DaimlerChrysler AG from 1998 to 2001, and a non-executive director of SmithKline Beecham from 1996 to 1999. Lord Browne holds a degree in Physics from Cambridge University and an MS in Business from Stanford University.

Lord Browne was the president of the Royal Academy of Engineering from 2006 to 2011 and is the chairman of the trustees of the Queen Elizabeth prize for engineering. He is a fellow of the Royal Society and a foreign member of the U.S. Academy of Arts and Sciences. He was appointed as the chair of the board of trustees of the Francis Crick Institute from August 2017 and the chairman of governing board of The Courtauld Institute of Art from September 2017. He is also a member of the board of governors of the Folger Shakespeare Library in Washington, D.C and a member of the board of UK Research and Innovation. Lord Browne was a trustee of the Tate Gallery from August 2007, and was the chairman of the trustees from January 2009 until July 2017 when he retired as a trustee. He was the chairman of the Independent Review of Higher Education Funding and Student Finance, which published its report in October 2010. He was the UK Government’s lead non-executive board member from June 2010 to January 2015. He was knighted in 1998 and made a life peer in 2001.

We believe that Lord Browne’s extensive experience as the chairman and chief executive officer of one of the world’s largest energy companies, his leadership experience and his financial and energy industry expertise enable him to contribute significant managerial, organizational, strategic and financial oversight skills to our Board.

Other Public Company Directorships (within past 5 years)

| ● | Pattern Energy Group Inc. (2013-Present) |

| ● | Riverstone Energy Limited (2013-May 2015) |

21

Table of Contents

| Dinyar S. Devitre | Director since 2012 | |

| Class I Director with term expiring in 2021 | Age: 71 | |

|

IHS Markit Board Committees Audit (Chair) Nominating and Governance Risk |

Experience and Qualifications

In March 2008, Mr. Devitre retired from his position as Senior Vice President and Chief Financial Officer of Altria Group, Inc. Prior to Mr. Devitre’s appointment to that position in April 2002, he held a number of senior management positions with Altria, including President, Philip Morris Asia, and Chairman and CEO of Philip Morris Japan. Mr. Devitre is a member of the board of directors of Altria Group, Inc. Mr. Devitre also serves as a trustee of the Brooklyn Academy of Music and of Pratham USA. Mr. Devitre served as a special advisor to General Atlantic LLC, a private equity firm, from June 2008 to January 2017. Mr. Devitre previously served on the boards of SABMiller plc, Western Union Company, and Kraft Foods Inc. (now known as Mondelez International, Inc.). Mr. Devitre also previously served on the boards the Asia Society and The Lincoln Center for the Performing Arts, Inc. Mr. Devitre holds a BA (Hons) degree from St. Joseph’s College, Darjeeling, and an MBA from the Indian Institute of Management in Ahmedabad.

Mr. Devitre brings to the Board experience as the chief financial officer of a large multinational company, as an executive and director of large corporations, as well as diversity in viewpoint and international business experience.

Other Public Company Directorships (within past 5 years)

| ● | Altria Group, Inc. (2008-Present) |

| ● | SABMiller plc (2007 to October 2016) |

| ● | Western Union Company (2006 to May 2015) |

| Ruann F. Ernst | Director since 2006 | |

| Class III Director with term expiring in 2020 | Age: 72 | |

|

IHS Markit Board Committees Risk |

Experience and Qualifications

Dr. Ernst served as Chief Executive Officer of Digital Island, Inc., an e-business delivery network company, from 1998 until her retirement in 2002. Dr. Ernst was Chairperson of the Board of Digital Island from December 1999 through July 2001, when the company was acquired by Cable & Wireless, Plc., and afterwards headed the business for Cable & Wireless until her retirement. Prior to Digital Island, Dr. Ernst worked for Hewlett Packard Company in various management positions, including General Manager, Financial Services Business Unit. Prior to that, she was Vice President for General Electric Information Services Company. Prior to her work in the technology industry, Dr. Ernst served on the faculty of The Ohio State University, was Director of Medical Research and Computing where she managed a biomedical computing and research facility. Dr. Ernst served on the board of Digital

22

Table of Contents

Realty Trust from 2004 until May 2015. Dr. Ernst serves on the University Foundation Board and the Fisher College of Business Advisory Board at The Ohio State University. She was a founder and is Board Chair of the nonprofit Healthy LifeStars. Dr. Ernst received Bachelor of Science, Master of Science and Ph.D. degrees from The Ohio State University.

Dr. Ernst brings to the Board a strong technical and computing background as well as skill in the development of information technology businesses. She also has extensive experience as a member of boards where strategic planning and long-term planning are critical to the success of the enterprise.

Other Public Company Directorships (within past 5 years)

| ● | Digital Realty Trust (2004-May 2015) |

| William E. Ford | Director since 2010 | |

| Class III Director with term expiring in 2020 | Age: 57 | |

|

IHS Markit Board Committees Human Resources (Chair) |

Experience and Qualifications

Mr. Ford is the Chief Executive Officer of General Atlantic, a global growth equity firm, a position he has held since 2007 and where he has worked since 1991. He also serves as Chairman of General Atlantic’s management committee and is a member of the firm’s investment and portfolio committees. Mr. Ford also serves on the board of BlackRock Inc. Mr. Ford is on the board of Tory Burch, a current General Atlantic portfolio company, and was formerly a director of a number of prior General Atlantic investments, including First Republic Bank, NYSE Euronext, e*Trade, Priceline and NYMEX. Mr. Ford is actively involved in a number of educational and nonprofit organizations. He is a member of the board of Rockefeller University, where he is Chairman, and is a member of the Amherst College Endowment Investment Committee. Mr. Ford is an advisory board member of Tsinghua University’s School of Economics and Management and sits on the board of overseers and managers for Memorial Sloan Kettering Cancer. Mr. Ford serves on the board of directors of the National Committee on United States-China Relations, and is a member of The Council on Foreign Relations. He is also a member of the steering committee for the CEO Action for Diversity and Inclusion initiative and is the co-chair of the Partnership for New York City. Mr. Ford sits on the New York State Life Sciences Advisory Board and is on the advisory board of the United Nations Economic Commission for Africa’s Initiative on Digital Identification for Africa. Mr. Ford holds a BA in Economics from Amherst College and an MBA from the Stanford Graduate School of Business.

Mr. Ford brings to the Board a wealth of global private equity and investment management experience and extensive knowledge of business, finance, and strategic acquisitions, which provide valuable insight for our long-term corporate and business strategy.

Other Public Company Directorships (within past 5 years)

| ● | BlackRock Inc. (2018-Present) |

| ● | Axel Springer (2016-April 2018) |

| ● | First Republic Bank (2010-May 2015) |

23

Table of Contents

| Nicoletta Giadrossi | Director since 2018 | |

| Class I Director with term expiring in 2021 | Age: 52 | |

|

IHS Markit Board Committees Audit |

Experience and Qualifications