Form DEF 14A IF Bancorp, Inc. For: Nov 22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

IF Bancorp, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No:

| |||

| (3) | Filing party:

| |||

| (4) | Date Filed:

| |||

October 18, 2021

Dear Stockholder:

The annual meeting of stockholders of IF Bancorp, Inc. (the “Company”) will be held at the administrative office of Iroquois Federal Savings and Loan Association located at 204 East Cherry Street, Watseka, Illinois on Monday, November 22, 2021 at 2:00 p.m., local time.

The notice of annual meeting and proxy statement appearing on the following pages describe the formal business to be transacted at the meeting. Also enclosed for your review is our Annual Report, which contains detailed information concerning the operating activities and financial statements of the Company.

COVID-19 PANDEMIC CONSIDERATIONS

We currently intend to hold the 2021 annual meeting in person. However, due to the ongoing health concerns relating to the Coronavirus Disease 2019 (COVID-19) pandemic, and to best protect the health of our employees, shareholders and community, space at the annual meeting will be limited and seating will be available on a first-come, first-served basis. We urge you to carefully evaluate the relative benefits of in-person attendance at the 2021 annual meeting and to consider not attending the annual meeting in person. Instead, please take advantage of the ability to vote by proxy, as instructed on the proxy card or voting instructions that have been provided to you. Even if you plan to attend the annual meeting, however, we encourage you to complete and mail the enclosed proxy card promptly. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card.

We are actively monitoring the recommendations of public health officials in response to the continuing COVID-19 pandemic. Please be advised that if we decide to change the location of the 2021 annual meeting or hold it partly or solely by means of virtual communications, as permitted by applicable law, we will announce such decision in advance, as promptly as practicable. If we take this step, details of how to participate will be issued by a press release which will also be posted on our website and filed with the Securities and Exchange Commission as definitive additional soliciting material.

Thank you for your understanding as we strive to best serve our stockholders while protecting the health of our employees, shareholders and community.

| Sincerely, |

|

| Walter H. Hasselbring III |

| President and Chief Executive Officer |

201 East Cherry Street

Watseka, Illinois 60970

(815) 432-2476

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

| TIME AND DATE | 2:00 p.m. on Monday, November 22, 2021 | |

| PLACE | The administrative office of Iroquois Federal Savings and Loan Association, 204 East Cherry Street, Watseka, Illinois 60970 | |

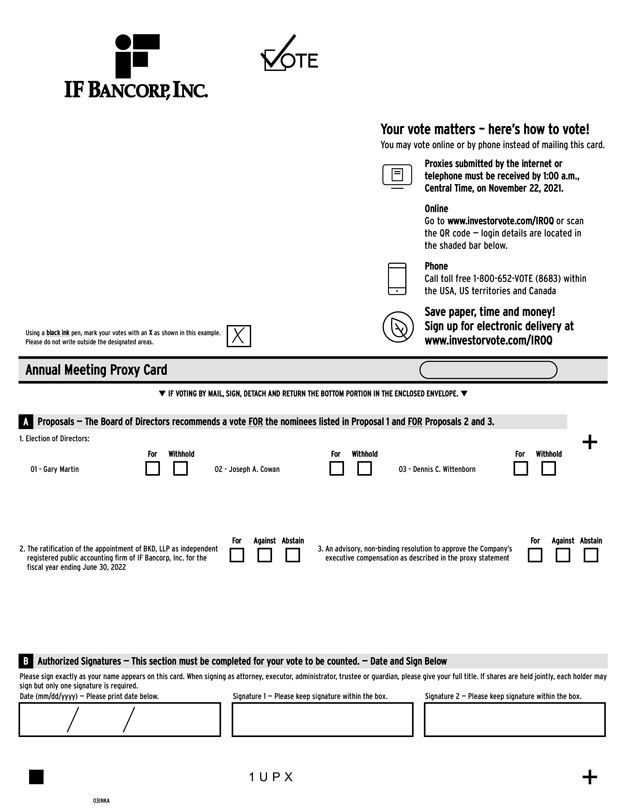

| ITEMS OF BUSINESS | (1) To elect three directors to serve for a term of three years.

(2) To ratify the selection of BKD, LLP as our independent registered public accounting firm for fiscal year 2022.

(3) To hold an advisory, non-binding vote to approve the executive compensation described in the proxy statement.

(4) To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. | |

| RECORD DATE | To vote, you must have been a stockholder at the close of business on September 24, 2021. | |

| PROXY VOTING | It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning the proxy card or voting instruction card sent to you. Voting instructions are printed on your proxy or voting instruction card and included in the accompanying proxy statement. You can revoke a proxy at any time before its exercise at the meeting by following the instructions in the proxy statement. | |

| By Order of the Board of Directors | ||

| ||

| Beth A. Warren | ||

| Corporate Secretary | ||

October 18, 2021

COVID-19 PANDEMIC CONSIDERATIONS

We currently intend to hold the 2021 annual meeting in person. However, due to the ongoing health concerns relating to the Coronavirus Disease 2019 (COVID-19) pandemic, and to best protect the health of our employees, shareholders and community, space at the annual meeting will be limited and seating will be available on a first-come, first-served basis. We urge you to carefully evaluate the relative benefits of in-person attendance at the 2021 annual meeting and to consider not attending the annual meeting in person. Instead, please take advantage of the ability to vote by proxy, as instructed on the proxy card or voting instructions that have been provided to you.

We are actively monitoring the recommendations of public health officials in response to the continuing COVID-19 pandemic. If we decide to change the location of the 2021 annual meeting or hold it partly or solely by means of virtual communications, as permitted by applicable law, we will announce such decision in advance, as promptly as practicable. If we take this step, details of how to participate will be issued by a press release which will also be posted on our website and filed with the Securities and Exchange Commission as definitive additional soliciting material.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be Held on November 22, 2021: Our Proxy Statement, Proxy Card, Annual Report for the fiscal year ended June 30, 2021, and all other Proxy Materials are Available at http://www.edocumentview.com/IROQ.

IF Bancorp, Inc.

Proxy Statement

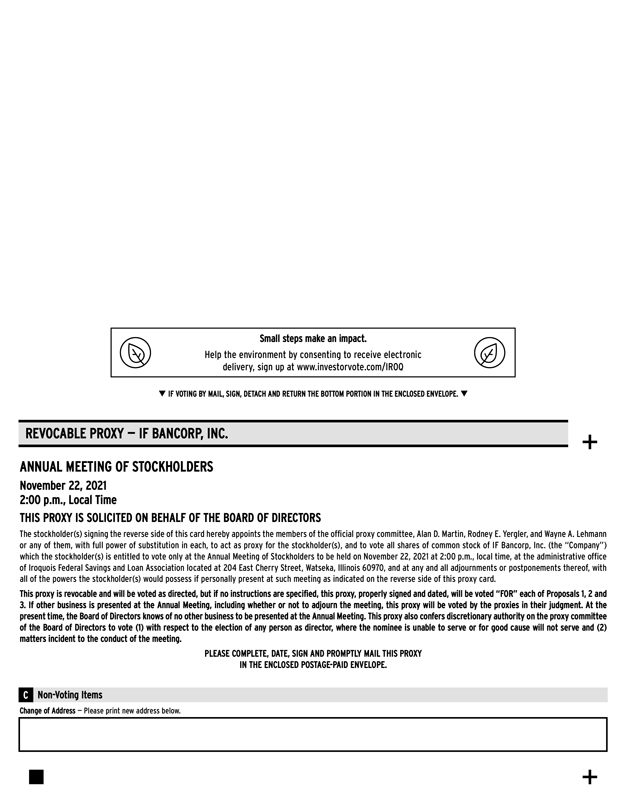

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of IF Bancorp, Inc. (the “Company” or “IF Bancorp”) to be used at the annual meeting of stockholders of the Company. The Company is the holding company for Iroquois Federal Savings and Loan Association (the “Association” or “Iroquois Federal”). The annual meeting will be held at the Association’s administrative office located at 204 East Cherry Street, Watseka, Illinois 60970 on Monday, November 22, 2021 at 2:00 p.m. local time. The notice of annual meeting of stockholders and this proxy statement are first being made available to stockholders on or about October 18, 2021.

Voting and Proxy Procedure

Who Can Vote

You are entitled to vote your Company common stock if the records of the Company show that you held your shares as of the close of business on September 24, 2021. If your shares are held through a broker, bank or other holder of record, you are considered the beneficial owner of shares held in “street name” and you will receive instructions directly from your broker, bank or other holder of record in order to vote your shares. Your holder of record may allow you to provide voting instructions by telephone or by the Internet.

As of the close of business on September 24, 2021, there were 3,247,376 shares of Company common stock outstanding. Each share of common stock has one vote. The Company’s Articles of Incorporation provide that record owners of Company common stock beneficially owned by a person who beneficially owns in excess of 10% of the Company’s outstanding common stock (a “10% beneficial owner”), shall not be entitled to vote, in the aggregate, shares beneficially owned by the 10% beneficial owner in excess of 10% of the Company’s outstanding common stock, unless a majority of unaffiliated directors (as defined in the articles of incorporation) grant such entitlement by resolution in advance of the acquisition of the excess shares.

Attending the Meeting

If you were a stockholder as of the close of business on September 24, 2021, you may attend the meeting. However, before deciding to attend the meeting in person, please see the discussion below under “COVID-19 Pandemic Considerations.”

If your shares of Company common stock are held in street name and you wish to attend the meeting, you will need proof of ownership to be admitted. A recent brokerage statement or a letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of Company common stock held in street name in person at the meeting, you will have to get a written proxy in your name from the broker, bank or other holder of record who holds your shares.

COVID-19 Pandemic Considerations

Due to the ongoing health concerns relating to the Coronavirus Disease 2019 (COVID-19) pandemic, and to best protect the health of our employees, shareholders and community, space at the

annual meeting will be limited and seating will be available on a first-come, first-served basis. We urge you to carefully evaluate the relative benefits of in-person attendance at the 2021 annual meeting and to consider not attending the annual meeting in person. Instead, please take advantage of the ability to vote by proxy, as instructed on the proxy card or voting instructions that have been provided to you.

We are actively monitoring the recommendations of public health officials in response to the continuing COVID-19 pandemic. If we decide to change the location of the 2021 annual meeting or hold it partly or solely by means of virtual communications, as permitted by applicable law, we will announce such decision in advance, as promptly as practicable. If we take this step, details of how to participate will be issued by a press release which will also be posted on our website and filed with the Securities and Exchange Commission as definitive additional soliciting material.

Quorum and Vote Required for Proposals

Quorum. A majority of the outstanding shares of common stock entitled to vote is required to be represented at the meeting to constitute a quorum for the transaction of business.

Votes Required for Proposals. At this year’s annual meeting, stockholders will elect three directors to serve for a term of three years and until their successors are elected and qualified. In voting on the election of directors, you may vote in favor of the nominees, withhold votes as to all nominees, or withhold votes as to specific nominees. There is no cumulative voting for the election of directors. Directors must be elected by a plurality of the votes cast at the annual meeting. This means that the nominees receiving the greatest number of votes will be elected.

In voting on the ratification of the appointment of BKD, LLP as the Company’s independent registered public accounting firm, you may vote in favor of the proposal, vote against the proposal or abstain from voting. To ratify the selection of BKD, LLP as our independent registered public accounting firm for fiscal 2022, the affirmative vote of a majority of the votes cast on the proposal is required.

In voting on the advisory, non-binding proposal to approve the executive compensation described in this proxy statement, you may vote in favor of the advisory proposal, vote against the advisory proposal or abstain from voting. Approval of this proposal requires the affirmative vote of a majority of the votes cast on the proposal. While this vote is required by law, it will neither be binding on the Board of Directors, nor will it create or imply any change in the fiduciary duties of or impose any additional fiduciary duty on the Board of Directors.

Broker Non-Votes. If you do not provide your broker or other record holder with voting instructions on certain non-routine matters, your broker will not have discretion to vote your shares on such matters. The election of directors and the advisory non-binding proposal to approve the executive compensation described in this proxy statement are non-routine matters. In the case of routine matters (e.g., the ratification of the independent auditors), your broker or other holder of record is permitted to vote your shares in the record holder’s discretion if you have not provided voting instructions. A “broker non-vote” occurs when your broker submits a proxy for the meeting with respect to routine matters, but does not vote on non-routine matters because you did not provide voting instructions on such matters.

How Votes Are Counted. If you return valid proxy instructions or attend the meeting in person, we will count your shares for purposes of determining whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted for purposes of determining the existence of a quorum.

2

In counting votes for the election of directors, votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In counting votes on the proposal to ratify the selection of the independent registered public accountants, abstentions will have no effect on the outcome of the vote.

In counting votes on the approval of the advisory, non-binding proposal to approve the executive compensation described in this proxy statement, abstentions and broker non-votes will have no effect on the outcome of the vote.

Voting by Proxy

The Company’s Board of Directors is providing you this proxy statement to request that you allow your shares of Company common stock to be represented at the annual meeting by the persons named in the enclosed proxy card. All shares of Company common stock represented at the meeting by properly executed and dated proxies will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors.

The Board of Directors recommends that you vote:

| • | for each of the nominees for director; |

| • | for ratification of the appointment of BKD, LLP as the Company’s independent registered public accounting firm; and |

| • | for the approval of the compensation of the Company’s named executive officers (“Named Executive Officers”) as disclosed in this proxy statement. |

If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will use their judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the meeting to solicit additional proxies. If the annual meeting is postponed or adjourned for less than 30 days, your Company common stock may be voted by the persons named in the proxy card on the new meeting date, provided you have not revoked your proxy. The Company does not currently know of any other matters to be presented at the meeting.

You may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy, you must advise the Corporate Secretary of the Company in writing before your common stock has been voted at the annual meeting, deliver a later dated proxy or attend the meeting and vote your shares in person by ballot. Attendance at the annual meeting will not in itself constitute revocation of your proxy.

Participants in the Iroquois Federal Savings and Loan Association ESOP or 401(k) Plan

If you participate in the Iroquois Federal Savings and Loan Association Employee Stock Ownership Plan (the “ESOP”), you will receive a vote authorization form for the ESOP that reflects all shares you may direct the trustees to vote on your behalf under the ESOP. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but each ESOP participant may direct the trustee how to vote the shares of common stock allocated to his or her account. The ESOP trustee, subject to the exercise of its fiduciary responsibilities, will vote all unallocated shares of IF Bancorp common stock held by the ESOP and allocated shares for which no voting instructions are received in the same proportion as shares for which it has received timely voting instructions. Under the terms of the 401(k) Plan, a

3

participant is entitled to vote the shares credited to his or her 401(k) Plan account. Shares for which no voting instructions are given or for which instructions were not timely received may be voted by the 401(k) Plan trustee in the same proportion as shares for which voting instructions were received. The deadline for returning your ESOP voting instructions is Monday, November 15, 2021.

Corporate Governance

General

The Company periodically reviews its corporate governance policies and procedures to ensure that the Company meets the highest standards of ethical conduct, reports results with accuracy and transparency and maintains full compliance with the laws, rules and regulations that govern the Company’s operations. As part of this periodic corporate governance review, the Board of Directors reviews and adopts best corporate governance policies and practices for the Company.

Code of Ethics and Business Conduct

The Company has adopted a Code of Ethics and Business Conduct that is designed to promote the highest standards of ethical conduct by the Company’s directors, executive officers and employees. The Code of Ethics and Business Conduct requires that the Company’s directors, executive officers and employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity, and in the Company’s best interest. Under the terms of the Code of Ethics and Business Conduct, directors, executive officers and employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the Code of Ethics and Business Conduct. A copy of the Code of Ethics and Business Conduct can be found in the “Investor Relations—Corporate Information—Governance Documents” section of the Company’s website, www.iroquoisfed.com.

As a mechanism to encourage compliance with the Code of Ethics and Business Conduct, the Company has established procedures for receiving, retaining and addressing complaints regarding accounting, internal accounting controls and auditing matters. These procedures ensure that individuals may submit concerns regarding questionable accounting or auditing matters in a confidential and anonymous manner. The Code of Ethics and Business Conduct also prohibits the Company from retaliating against any director, executive officer or employee who reports actual or apparent violations of the Code of Ethics and Business Conduct.

Director Independence

The Board has determined that, except for Mr. Walter H. Hasselbring, III, each member of the Board is an “independent director” within the meaning of the Rules of the NASDAQ Stock Market, Inc. (the “Nasdaq rules”). Mr. Hasselbring is not considered independent because he is our President and Chief Executive Officer. In determining the independence of the directors, the Board of Directors reviewed certain accounts that directors and their affiliates had with IF Bancorp, some of which are not required to be reported in this proxy statement under the heading “Transactions With Related Persons.”

Meetings of the Board of Directors

The Company conducts business through meetings of its Board of Directors and through activities of its committees. During fiscal 2021, the Board of Directors held 15 meetings. No director attended fewer than 75% of the total meetings of the Company’s Board of Directors and the board committees on which such director served.

4

Board Leadership Structure

At IF Bancorp, the positions of Chairman of the Board and Chief Executive Officer are held by different individuals. The Chairman of the Board provides guidance to the Chief Executive Officer, is active in setting the agenda for Board meetings and presides over meetings of the full Board and the Executive Committee. The Chief Executive Officer is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company. As required by the Nasdaq rules, the Audit, Nominating and Compensation Committees are comprised solely of directors who are independent as defined by Nasdaq rules.

Board’s Role in Risk Oversight

The Board’s role in the Company’s risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal and regulatory, strategic and reputational risks. The full Board (or the appropriate committee in the case of risks that are reviewed and discussed at committee meetings) receives these reports from the appropriate “risk owner” within the organization to enable the Board or appropriate committee to understand our risk identification, risk management and risk mitigation strategies. After a committee has received and discussed a report, the chairperson of such committee reports on the discussion to the full Board at the next Board meeting. This enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

Committees of the Board of Directors

The following table identifies our standing committees and their members as of September 24, 2021. All members of each committee are independent as defined by Nasdaq rules. Each committee operates under a written charter available in the “Investor Relations—Corporate Information—Governance Documents” section of the Company’s website, www.iroquoisfed.com.

| Director |

Audit Committee |

Compensation Committee |

Nominating Committee |

Corporate Governance Committee |

||||||||||||

| Gary Martin |

X | X | * | X | * | |||||||||||

| Joseph A. Cowan |

X | X | ||||||||||||||

| Wayne A. Lehmann |

X | X | X | * | ||||||||||||

| Dennis C. Wittenborn |

X | * | X | X | ||||||||||||

| Rodney E. Yergler |

X | X | X | |||||||||||||

| Alan D. Martin |

X | X | X | X | ||||||||||||

| Number of Meetings in Fiscal 2021 |

12 | 7 | 2 | 1 | ||||||||||||

| * | Denotes Chairperson. |

Audit Committee. The Audit Committee assists the Board of Directors in its oversight of the Company’s accounting and reporting practices, the quality and integrity of the Company’s financial reports and the Company’s compliance with applicable laws and regulations. The Audit Committee is also responsible for engaging the Company’s independent registered public accounting firm and monitoring its conduct and independence. The Board of Directors has designated Dennis C. Wittenborn as an audit committee financial expert under the rules of the Securities and Exchange Commission. The report of the Audit Committee required by the rules of the Securities and Exchange Commission is included in this proxy statement under the heading “Audit Committee Report.”

5

Compensation Committee. The Compensation Committee approves the compensation objectives for the Company and the Association and establishes the compensation for the Chief Executive Officer and other executives. Our Chief Executive Officer and Chief Financial Officer attend committee meetings at the invitation of the committee and make recommendations to the Compensation Committee from time to time regarding the appropriate mix and level of compensation for their subordinates. Those recommendations consider the objectives of our compensation philosophy and the range of compensation programs authorized by the Compensation Committee. Our Chief Executive Officer and Chief Financial Officer do not participate in committee discussions or the review of committee documents relating to the determination of their own compensation. The Compensation Committee reviews all compensation components for the Company’s Chief Executive Officer and other highly compensated executive officers’ compensation including base salary, annual incentive, long-term incentives and perquisites. In addition to reviewing competitive market values, the committee also examines the total compensation mix, pay-for-performance relationship, and how all elements, in the aggregate, comprise the executives’ total compensation package. Decisions by the Compensation Committee with respect to the compensation of executive officers are approved by the full Board of Directors.

Nominating Committee. The Company’s Nominating Committee assists the Board of Directors in identifying qualified individuals to serve as Board members, and in determining the composition of the Board of Directors and its committees. The Nominating Committee also considers and recommends the nominees for director to stand for election at the Company’s annual meeting of stockholders. The procedures of the Nominating Committee required to be disclosed by the rules of the Securities and Exchange Commission are included in this proxy statement under the heading “Nominating Committee Procedures.”

Corporate Governance Committee. The Corporate Governance Committee assists the Board in developing and implementing the Company’s corporate governance guidelines, developing a director orientation program for new directors, and any additional matters related to corporate governance as may be assigned to the Committee by the Board.

Director Attendance at the Annual Meeting

The Board of Directors encourages each director to attend annual meetings of stockholders. Each current member of the Board of Directors attended the annual meeting last year.

Proposal 1 — Election of Directors

The Board of Directors of IF Bancorp is presently composed of seven members. The Board is divided into three classes with staggered three-year terms, with approximately one-third of the directors elected each year. The nominees for election as directors at the 2021 Annual Meeting are Joseph A. Cowan, Gary Martin and Dennis C. Wittenborn, each of whom is a current director of the Company and the Association.

It is intended that the proxies solicited by the Board of Directors will be voted for the election of the nominees named below unless other instructions are provided. If any nominee is unable to serve, the proxy committee will vote your shares to approve the election of any substitute proposed by the Board of Directors. Alternatively, the Board of Directors may adopt a resolution to reduce the size of the Board. At this time, the Board of Directors knows of no reason why any nominee might be unable to serve.

6

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES.

Information regarding the nominees and the directors continuing in office is provided below. Unless otherwise stated, each individual has held his or her current occupation for the last five years. The age indicated in each nominee’s biography is as of June 30, 2021.

Nominees for Election as Director

The nominees standing for election are:

Joseph A. Cowan. Mr. Cowan has worked with Iroquois Paving Corporation since 1985, and was appointed President in 1996. Iroquois Paving Corporation is a heavy highway construction company employing approximately 150 people and with annual gross income of approximately $45 million. Mr. Cowan is very involved with industry associations, and served as President of The Associated General Contractors of Illinois in 2003 and currently serves on their Board of Directors. He holds a B.A. from Eureka College. Mr. Cowan’s business and management experience and knowledge of the local business community bring invaluable business insight to the Board. Director of Iroquois Federal since 2000 and director of IF Bancorp since its formation. Age 61.

Gary Martin. Mr. Martin has served as Chairman of the Board of Iroquois Federal since 2000. He graduated from the University of Illinois with a degree in Business Administration. He has 41 years of experience in the retail industry. Mr. Martin was named as one of the Top Illinois Retailers of the 20th Century in 2000. In 2003 he was named Illinois Retailer of the Year. He is a former Chairman of the Illinois Retail Merchants Association. His extensive business background and long-term experience managing the operations of a successful business enterprise provide the Board with general business acumen and insight in assessing strategic decisions involving Iroquois Federal. His Board tenure provides the Board with valuable institutional knowledge of the development of Iroquois Federal. Director of Iroquois Federal since 1985 and director of IF Bancorp since its formation. Age 72.

Dennis C. Wittenborn. Mr. Wittenborn served as President and Chairman of Pizza Resources Corporation from 1993 until his retirement as President in March, 2017 and continues to serve as its Chairman. He served as President of GRIF Corporation from 1997 through July, 2018, and now serves as its Chairman and as Managing Member of Wittenborn Enterprises L.L.C. since 2012. He also served as President of Monical Pizza Corporation from 1987 through 1992, and as past President of Witmat Development Corporation from 1998 through 2010. In addition, Mr. Wittenborn has served as a Director of the Iroquois Memorial Hospital and Resident Home Board from 1998 to 2013 and as its Chairman from 2009 to 2013. Mr. Wittenborn has successfully opened and operated numerous restaurants in Illinois and Indiana. He is a past Alderman of South Pekin, Illinois, and a past Charter President of the Jaycees, South Pekin, Illinois. Mr. Wittenborn has a strong background in marketing and finance, as well as extensive experience with computer networking systems and business software packages. His businesses and marketing experience assist the Board with matters relating to business generation and the business community that we serve. Director of Iroquois Federal since 2000 and director of IF Bancorp since its formation. Age 67.

7

Directors Continuing in Office

The following directors have terms ending in 2022:

Dr. Rodney E. Yergler. Dr. Yergler has operated his own dental practice in Crescent City, Illinois, since 1985. He is a member of the American Dental Association, the Illinois State Dental Association, the Kankakee District Dental Association and the American Academy of Implant Dentistry. Dr. Yergler has a B.S. in Biology from Wheaton College, and graduated cum laude from Loyola University School of Dentistry. He served for many years on the American Cancer Society Iroquois County Board and assisted with the Iroquois County Relay For Life for three years. He has also served as Superintendent for St. Peter’s Lutheran Church Sunday School and Church Council. He is currently on the Board for the Iroquois County Public Health Department. Dr. Yergler’s business experience and involvement in the local community provide the Board with invaluable perspective regarding the business community that we serve. Director of Iroquois Federal since 1998 and director of IF Bancorp since its formation. Age 63.

Alan D. Martin. Mr. Martin has served with Iroquois Federal since 1973 and until his retirement in September 2015, had been our President and Chief Executive Officer since 1999. Mr. Martin spent eight years of his banking experience in the Danville and Vermilion County market for Iroquois Federal, giving him a broad prospective on the market area in which Iroquois Federal operates. He has a degree in Business Administration from Illinois State University. Mr. Martin serves on the Iroquois Federal Foundation Board and was its President from its inception in 2011 through May, 2017. Additionally, he has been active in civic and charitable organizations in Illinois, and has significant ties to the communities that support business generation by Iroquois Federal. In June, 2021, he received Legion of Honor recognition from the Kiwanis Club of Watseka for 38 years of service. He formerly served on the Federal Reserve Bank of Chicago Depository Advisory Council and the Illinois League of Financial Institutions Trust Board. His experience in leading IF Bancorp and Iroquois Federal, his significant local banking experience and his participation in industry trade groups provide the Board with a perspective on the day to day operations of Iroquois Federal and assist the Board in assessing the trends and developments in the financial industry on a local and national basis. Director of Iroquois Federal since 2001 and director of IF Bancorp since its formation. Age 70.

The following directors have terms ending in 2023:

Walter H. Hasselbring, III. Mr. Hasselbring has served as President and Chief Executive Officer and Director of IF Bancorp and Iroquois Federal since 2015. He has been with Iroquois Federal since 1978 and has served as Senior Executive Vice President and Chief Operating Officer, Vice President of Loans, Danville Branch Manager, and Marketing Officer, among other responsibilities. Mr. Hasselbring holds a B.S. degree in Business Administration with emphasis in both Management and Marketing and a minor in Economics from Olivet University, supported by educational development courses, training seminars, and key industry associations. In addition, he is an alumnus of Kankakee Community College. Mr. Hasselbring is directly involved in the communities served by Iroquois Federal, with service in key leadership roles for many organizations. In Danville, he has served as Chairman of Cross Point Human Services, President of Schlarman H.S. Board, member of the Board of Commissioners of Danville Housing Authority, Vice President of Danville Economic Development Corporation, President of Danville Youth Baseball, YMCA Board member, and led local Boy Scout annual fund drives. In Watseka, he has served as a Director, President and Treasurer of The ARC of Iroquois County, a Director, President and Treasurer of Iroquois Economic Development Association, a member of the Iroquois Memorial Hospital Business and Development Committee, and as a Director and Past Chairman of the Illinois League of Financial Institutions. Mr. Hasselbring currently serves as a Director and Immediate Past Chairman of the Community Foundation of Kankakee and Iroquois Counties, a Board member of

8

Kankakee Community College Foundation, a Trustee on the Illinois Banker’s Insurance Trust, Director and President of The ARC of Iroquois County, a Director of the Iroquois Economic Development Association and as a Director and President of Iroquois Federal Foundation. Age 65.

Wayne A. Lehmann. Mr. Lehmann served as President of Iroquois Title Company, Watseka, Illinois, since 1991, retiring in 2020. He received Illinois Title Professional designation in 2013. He graduated from Eastern Illinois University with a B. S. in Finance. Mr. Lehmann has been active in our community as a member of the Kiwanis Club of Watseka and has served on the Board of Directors of the Watseka Area Chamber of Commerce. He has been a member of the Regional Board of School Trustees for more than 16 years as well as a member of Gideons International for more than 10 years and is now on the Illinois State Management Team. He was previously named Affiliate of the Year by the Kankakee Iroquois Ford Association of Realtors and was the 2019 recipient of the Watseka Times-Republic Newspaper’s Lifetime Achievement Award. Mr. Lehmann is also active in his church, having served in many capacities. He is co-founder of GriefShare Ministry in his church. Mr. Lehmann’s experience in the real estate industry and involvement in the local community provide the Board with valuable perspective regarding the local real estate market. Director of Iroquois Federal since 1996 and director of IF Bancorp since its formation. Age 67.

Proposal 2 — Ratification of Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has appointed BKD, LLP to be its independent registered public accounting firm for the 2022 fiscal year, subject to ratification by stockholders. A representative of BKD, LLP is expected to be present at the annual meeting to respond to appropriate questions from stockholders and will have the opportunity to make a statement should he or she desire to do so.

If the ratification of the appointment of BKD, LLP is not approved by a majority of the votes cast by stockholders at the annual meeting, other independent registered public accounting firms may be considered by the Audit Committee of the Board of Directors.

Unless otherwise instructed, validly executed proxies will be voted “FOR” the ratification of the appointment of BKD, LLP.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF BKD, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

Audit Fees

The following table sets forth the fees we paid to BKD, LLP for the fiscal years ended June 30, 2021 and 2020.

| 2021 | 2020 | |||||||

| Audit fees |

$ | 137,622 | $ | 135,703 | ||||

| Tax fees |

$ | 23,877 | $ | 28,733 | ||||

| All other fees |

$ | — | $ | 14,098 | ||||

9

Pre-Approval of Services by the Independent Registered Public Accounting Firm

The Audit Committee is responsible for appointing, setting compensation and overseeing the work of the independent registered public accounting firm. In accordance with its charter, the Audit Committee approves, in advance, all audit and permissible non-audit services to be performed by the independent registered public accounting firm. Such approval process ensures that the external auditor does not provide any non-audit services to the Company that are prohibited by law or regulation.

In addition, the Audit Committee has established a policy regarding pre-approval of all audit and permissible non-audit services provided by the independent registered public accounting firm. Requests for services by the independent registered public accounting firm for compliance with the auditor services policy must be specific as to the particular services to be provided. The request may be made with respect to either specific services or a type of service for predictable or recurring services. During the year ended June 30, 2021, all services were approved, in advance, by the Audit Committee in compliance with these procedures.

Audit Committee Report

The Company’s management is responsible for the Company’s internal controls and financial reporting process. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements and issuing an opinion on the conformity of those financial statements with generally accepted accounting principles. The Audit Committee oversees the Company’s internal controls and financial reporting process on behalf of the Board of Directors.

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm the matters related to the results of the audit in accordance with PCAOB Standard 1301, Communications with Audit Committees, including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of the disclosures in the financial statements.

In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by Rule 3520 of the PCAOB Auditing Standards and has discussed with the independent registered public accounting firm the firm’s independence from the Company and its management. In concluding that the registered public accounting firm is independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the firm were compatible with its independence.

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their audit, their evaluation of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management,

10

which has the primary responsibility for financial statements and reports, and of the independent registered public accounting firm who, in their report, express an opinion on the conformity of the Company’s financial statements to generally accepted accounting principles. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent registered public accounting firm do not ensure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s financial statements has been carried out in accordance with standards of the Public Company Accounting Oversight Board (United States) or that the Company’s independent registered public accounting firm is in fact “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the board has approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2021, for filing with the Securities and Exchange Commission. The Audit Committee also has approved, subject to stockholder ratification, the selection of the Company’s independent registered public accounting firm, for the fiscal year ending June 30, 2022.

Audit Committee of the Board of Directors of

IF Bancorp, Inc.

Dennis C. Wittenborn, Chair

Gary Martin

Wayne A. Lehmann

Rodney E. Yergler

Joseph A. Cowan

Alan D. Martin

Proposal 3 — Advisory Vote On Executive Compensation

The compensation of our Named Executive Officers listed in the Summary Compensation Table is described in the “Executive Officers—Executive Compensation” section. Shareholders are urged to read these sections of this proxy statement.

In accordance with Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”), stockholders will be asked at the annual meeting to provide their support with respect to the compensation of our Named Executive Officers by voting on the following advisory, non-binding resolution:

RESOLVED, that the stockholders of IF Bancorp, Inc. hereby approve, on an advisory basis, the compensation paid to the Company’s Named Executive Officers as disclosed in the Executive Compensation section of this proxy statement, including the compensation tables and other narrative disclosures set forth in that section.

This advisory vote, commonly referred to as a “say-on-pay” advisory vote, is non-binding on the Board of Directors. Although non-binding, the Board of Directors and the Compensation Committee value constructive dialogue on executive compensation and other important governance topics with our stockholders and encourage all stockholders to vote their shares on this matter. The Board of Directors and the Compensation Committee will review the results of the vote and take them into consideration when making future decisions regarding our executive compensation programs.

11

Unless otherwise instructed, validly executed proxies will be voted “FOR” the resolution set forth in this Proposal Three.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RESOLUTION SET FORTH IN THIS PROPOSAL THREE.

Executive Officers

The Board of Directors annually elects the executive officers of IF Bancorp and Iroquois Federal, who serve at the Board’s discretion. Our executive officers are:

| Name |

Position | |

| Walter H. Hasselbring, III | President and Chief Executive Officer of IF Bancorp and Iroquois Federal | |

| Pamela J. Verkler | Senior Executive Vice President, Chief Financial Officer and Treasurer of IF Bancorp and Iroquois Federal | |

| Linda L. Hamilton | Executive Vice President and Chief Operating Officer of IF Bancorp and Iroquois Federal | |

| Thomas J. Chamberlain | Executive Vice President of IF Bancorp and Executive Vice President and Chief Lending Officer of Iroquois Federal | |

Below is information regarding the Company’s executive officers who are not also directors. Ages presented are as of June 30, 2021.

Linda L. Hamilton. Ms. Hamilton joined Iroquois Federal as Community President for the Champaign/Savoy market in November, 2014. She was appointed as Executive Vice President and Chief Operating Officer effective October 1, 2015. Prior to joining Iroquois Federal, she most recently served as Executive Vice President and Chief Operating Officer for Freestar Bank. Ms. Hamilton has 43 years of banking experience in the areas of operations, IT, compliance, retail banking, risk management and marketing. She holds a B.S. in Liberal Arts and Sciences from the University of Illinois and attended the Executive Graduate School of Banking. She was formerly a board member of the Illinois Bankers Association, President of the Champaign County Bankers Federation and an instructor at the Illinois Bankers School. Ms. Hamilton is an active member of Champaign West Rotary, a past president of the Executive Club of Champaign County, and a former board member and treasurer of Lincolnshire Fields Country Club. She was the 2000 recipient of the Athena Award. Age 65.

Thomas J. Chamberlain. Mr. Chamberlain currently serves as Executive Vice President and has been the Chief Lending Officer of Iroquois Federal since July of 2010. He has served with Iroquois Federal since July of 2004, when he joined the association as Vice President and Manager – Danville Office, with responsibility for the management and commercial loan activities of that office. Prior to his service with Iroquois Federal, Mr. Chamberlain worked with First Mid Bank & Trust for over 18 years, managing branches, and working in their lending and trust/farm management departments. Mr. Chamberlain has an MBA from Eastern Illinois University and a Bachelor’s degree from the University of Illinois. He is a 2011 graduate of the ABA Stonier Graduate School of Banking at the University of Pennsylvania where he also earned the Wharton Leadership Certificate, and is a graduate of the Illinois Agricultural Leadership Program. He currently serves as Treasurer of the Illinois Bankers Association. He has served as a member or Chairman of different committees of the Illinois Bankers Association, Illinois Bankers Education Services, Inc., American Bankers Association, and both the

12

Illinois and American Societies of Farm Managers and Rural Appraisers. He has served in the top leadership position of several community organizations including: Board President of the Danville Area Community College Foundation; Board Chair of United Way of Danville; Board Chair of Vermilion Advantage economic development organization; President of Schlarman Foundation; President of the Rotary Club of Tuscola; President of the Tuscola Chamber of Commerce; President of Main Street Tuscola; Grand Knight Mattoon Knights of Columbus; and, President Mid-Illinois Big Brothers/Big Sisters. Age 56.

Pamela J. Verkler. Ms. Verkler currently serves as Senior Executive Vice President and Chief Financial Officer, and has been with Iroquois Federal since 1982, previously holding positions of staff accountant, Assistant Treasurer, and Treasurer. She holds a Bachelor’s degree in Business from the University of Illinois and has over 39 years of experience in the financial services industry. Her responsibilities include supervision and oversight of the Accounting, Financial Management, Human Resources, and Investment areas. She also chairs the Asset/Liability Management Committee and has served as trustee of the company’s 401(k) plan. She is a member of the Financial Managers Society and the ABA CFO Exchange advisory committee. Ms. Verkler has also served as Treasurer of the Iroquois County Community Unit School District 9 since 1999. She has also been active in the American Cancer Society, serving on the American Cancer Society Iroquois County Board for several years, as Relay For Life Accounting Chair for seven years and as Relay Team Captain for thirteen years. She has also served as vice president and treasurer of the Iroquois Federal Foundation since its formation in 2011. Age 61.

Executive Compensation

Overview

Our Board of Directors, through our Compensation Committee, is responsible for establishing and administering our executive compensation program. The Compensation Committee, consisting of Gary Martin (Chair), Joseph A. Cowan, Wayne A. Lehmann, Dennis C. Wittenborn, Alan D. Martin and Rodney E. Yergler, annually reviews the executive compensation program and recommends to the Board, for its approval, appropriate modifications to the compensation packages for each of our executive officers, including specific amounts and types of compensation provided. The Compensation Committee reviews recommendations from the Chief Executive Officer regarding compensation of the named executive officers and recommends final compensation packages to the full Board for final approval. The Compensation Committee reviews the charter at least annually to ensure that the scope of the charter is consistent with the Compensation Committee’s expected role. Under the charter, the Compensation Committee is charged with general responsibility for the oversight and administration of our compensation program.

For fiscal 2021, our Named Executive Officers were Walter H. Hasselbring, III, our President and Chief Executive Officer, Pamela J. Verkler, our Senior Executive Vice President, Chief Financial Officer and Treasurer and Thomas J. Chamberlain, our Executive Vice President.

Overall Compensation Philosophy and Guiding Principles

The Compensation Committee believes that the success of our Company depends on the ability to attract and retain talented executives motivated to drive the Company’s goals and provide long-term value to our stockholders.

Our compensation program is designed to link compensation with performance, taking into account competitive compensation levels in similar banks and in the markets where Iroquois Federal competes for talent. Principles guiding the compensation philosophy include the following:

| • | Employer of Choice: We view compensation as one key to being an employer of choice in our markets, able to attract and retain key employees critical to our long-term success. |

13

| • | Pay Aligned with Performance: We provide a competitive base salary combined with incentive opportunities that provide additional compensation for outstanding bank and individual performance. Accordingly, our compensation program is designed to align the executives’ efforts on the Company’s primary goals and objectives, which are intended to promote long-term business success and increased stockholder value. |

| • | Flexibility: We recognize that the market for talent requires flexibility in compensation in order to attract qualified individuals. Salary ranges and individual compensation decisions take into account local competitive pressures and changing conditions. Furthermore, the targeted competitive position may vary depending on the type and level of position, recognizing the different recruiting conditions and relative importance of various qualifications. |

The Compensation Committee, composed entirely of independent directors, sets and administers the policies that govern our executive compensation programs. The Compensation Committee reviews compensation levels of the named executive officers. The Compensation Committee evaluates the performance of our named executive officers, and considers management succession and related matters. All decisions relating to the compensation of the named executive officers are recommended by the Compensation Committee for approval of the full Board.

The policies and underlying philosophy governing our executive compensation program, as endorsed by the Compensation Committee and the Board of Directors, are designed to accomplish the following:

| • | Maintain a compensation program that is equitable in a competitive marketplace. |

| • | Provide opportunities that integrate pay with the Company’s performance goals. |

| • | Encourage achievement of strategic objectives and creation of shareholder value. |

| • | Recognize and reward individual initiative and achievements. |

| • | Maintain an appropriate balance in the total compensation mix. |

| • | Allow us to compete for, retain, and motivate talented executives critical to its success. |

The Compensation Committee seeks to target executive compensation at levels that the Compensation Committee believes to be consistent with others in the banking industry within our marketplace. The Compensation Committee believes that a portion of each executive’s total compensation should be at risk, based on the Company’s performance, in order to motivate and reward executives to achieve the Company’s strategic goals. The named executive officers’ compensation is weighted toward programs contingent upon our level of annual and long-term performance. In general, for our named executive officers, we target base salaries that, on average, are at the 50th percentile of other banks and financial service companies of the Company’s asset size, complexity and with similar products and markets. See “Compensation Program Design” below. Goals for specific components include:

| • | Base salaries that are designed to provide a reasonable level of predictable income commensurate with market standards. Base salaries for executives are generally targeted at the 50th percentile. |

14

| • | An annual incentive plan that provides performance-based cash incentives to reward our executives for the execution of specific financial and non-financial elements of our strategic business plan. |

| • | Equity awards that further align management with our shareholders. Restricted stock awards vesting over 10 years and stock options vesting over 7 years are used to encourage ongoing exceptional performance and to retain these executives for the long term. |

Compensation Consultant/Role of Management

The Compensation Committee has authority under its charter to engage the services of independent third party experts to assist it in reviewing and determining executive officer compensation. Pursuant to this authority, the Compensation Committee engaged Newcleus Compensation Advisors in fiscal 2021 to conduct comparative studies of our compensation for executive officers and members of our Board of Directors, and related to benchmarking chief executive officer compensation in connection with the Governance and Nominating Committee process.

The Chief Executive Officer annually presents to the Compensation Committee, for their review and approval, his self-evaluation and an assessment of other executive officers, including each individual’s accomplishments, and individual and corporate performance relative to the approved incentive plan. The Committee has discretion to adjust the Chief Executive Officer’s recommendations, but generally has approved his recommendations for executive officers.

Compensation Committee Activities in Fiscal 2021

The Compensation Committee met 7 times during the fiscal year ended June 30, 2021. The Company took several actions during fiscal 2021 to further adjust our executive officer compensation program to correspond to our status as a publicly traded stock institution and to create alignment with the interests of our stockholders, including engaging Newcleus Compensation Advisors as compensation consultant to assess the competitiveness of our executive total compensation program and to provide competitive guidelines for programs going forward. The compensation consultant also provided services related to chief executive officer salary benchmarking. The Compensation Committee reviewed executive salaries, performance and competitive market pay practices (see “Executive Compensation Program Design – Use of Compensation Survey”), and based on such assessment, recommended a 12.3% increase in base salary for Mr. Hasselbring, a 4.8% increase for Ms. Verkler and a 4.8% increase for Mr. Chamberlain.

Objectives of Our Compensation Programs

Our executive officer compensation program is designed to:

| • | Attract, retain, motivate and reward highly qualified and productive executives by providing overall compensation that is competitive with other institutions with which we compete for executive talent; |

| • | Motivate each individual to perform, to the best of his or her ability, in order to achieve targeted goals for the individual and the Company; |

| • | Improve Company performance, balancing risk-taking with fundamental concepts of safety and soundness; |

| • | Establish compensation levels that provide the greatest potential rewards for positions of greatest responsibility within a framework that is internally equitable; |

| • | Promote the long-term increase in the value of the Company by providing a portion of compensation in the form of Company common stock that vests over a period of years; and |

15

| • | Provide the appropriate mix of compensation that will drive superior performance and create alignment with the interests of our stockholders. |

Executive Compensation Program Design

Cash Compensation

Current cash compensation consists of base salary and bonuses, which covers executive officers and other Iroquois Federal employees. Our base salary levels for executive officers are intended to be competitive with our peer group, to motivate individuals to discharge the responsibilities of their position, and to reflect the officer’s role, responsibilities, experience, performance and contribution to the Company’s success. Our Compensation Committee considers base salaries of executive officers annually with input from our President and Chief Executive Officer, and makes such adjustments as are warranted. In making these adjustments, our Compensation Committee takes into account individual and Company performance; the total current and potential compensation of a given officer based on a review; the levels of compensation paid by institutions that compete with us for executive talent; and the relative level of compensation in comparison to other executive officers and to our employees.

Non-Equity Incentive Compensation

The Iroquois Federal Annual Incentive Plan (the “Incentive Plan”) provides the opportunity for eligible executives to earn non-equity incentive compensation upon the attainment of specified objectives. The Board sets a minimum acceptable return to shareholders each year which is required to be met before any incentive payments can be made. Incentive awards under this Incentive Plan are based on a 3-year rolling performance cycle to encourage ongoing exceptional performance.

Equity Compensation

The IF Bancorp, Inc. 2012 Equity Incentive Plan (the “Equity Incentive Plan”) was established to provide officers, employees, and directors of IF Bancorp and Iroquois Federal with additional incentives to promote the growth and performance of IF Bancorp. Awards granted in the year ended June 30, 2014, include restricted stock which vests over 10 years and stock options which vest over 7 years. Awards granted in the year ended June 30, 2016 include restricted stock which vests over 8 years.

Benefits and Perquisites

Executive officers also receive broad based benefits that are available to all qualifying employees of the Company. These include a defined contribution 401(k) plan and a discretionary profit sharing plan, an employee stock ownership plan, medical coverage, and group life and disability coverage. In addition, the Company provides a cell phone and, for certain executive officers, incurs the expense of country club dues for executive officers.

Use of Compensation Survey

The Compensation Committee relies on peer group surveys prepared by its consultant, Newcleus Compensation Advisors, to assess the competitiveness of the Company’s pay practices in the marketplace. The peer group data is used in combination with other supplemental published survey sources reflecting industry data for banks of similar size (national financial institutions with assets between $473.4 million and $1.4 billion) and for banks in our region, as well as with information relating to individual and Company performance, to help the Compensation Committee make compensation decisions. Newcleus Compensation Advisors selected a peer group and benchmarked the Company’s cash

16

compensation (base salary plus annual cash incentive compensation) against this group. The peer group consisted of 15 publicly traded financial institutions of similar asset size and regional location. The median assets for the peer group are $1.0 billion, as compared to $735.5 million for IF Bancorp, Inc.

The peer group consisted of the following companies:

| • | Consumers Bancorp, Inc. |

| • | Cortland Bancorp, Inc. |

| • | CSB Bancorp, Inc. |

| • | First Bancorp of Indiana, Inc. |

| • | First Capital, Inc. |

| • | Guaranty Federal Bancshares, Inc. |

| • | HMN Financial, Inc. |

| • | Kentucky Bancshares, Inc. |

| • | Limestone Bancorp, Inc. |

| • | Middlefield Banc Corp. |

| • | Ohio Valley Banc Corp |

| • | Richmond Mutual Bancorporation, Inc. |

| • | SB Financial Group, Inc. |

| • | United Bancorp, Inc. |

| • | United Bancshares, Inc. |

Tax and Accounting Considerations

In consultation with our advisors, we evaluate the tax and accounting treatment of each of our compensation programs at the time of adoption and on an annual basis to ensure that we understand the financial impact of the program. Our analysis includes a detailed review of recently adopted and pending changes in tax and accounting requirements. As part of our review, we consider modifications and/or alternatives to existing programs to take advantage of favorable changes in the tax or accounting environment or to avoid adverse consequences. We attempt to maximize the tax benefits related to compensation expense, however, tax considerations are not a compelling factor in determining compensation. The Compensation Committee intends for all compensation to be compliant under Rule 162(m) of the Internal Revenue Code, which limits deductible compensation paid to named executive officers and other “covered employees” to $1 million per calendar year, to permit us to realize tax benefits of all compensation paid to such officers; however, none of the officers currently receive compensation close to the $1 million threshold.

17

Summary Compensation Table

The following information is provided for our Chief Executive Officer and two other most highly compensated executive officers who received compensation totaling $100,000 or more for the years ended June 30, 2021 and June 30, 2020, referred to herein as the “Named Executive Officers.”

| Summary Compensation Table | ||||||||||||||||||||||||||||||||

| Name and principal position |

Year | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Nonequity incentive plan compensation ($) |

All other compensation ($) (1) |

Total ($) |

||||||||||||||||||||||||

| Walter H. Hasselbring, III |

||||||||||||||||||||||||||||||||

| President and Chief Executive Officer |

2021 | 377,254 | 1,000 | — | — | 328,664 | 118,889 | 825,807 | ||||||||||||||||||||||||

| 2020 | 355,900 | — | — | — | 150,126 | 112,143 | 618,169 | |||||||||||||||||||||||||

| Pamela J. Verkler |

||||||||||||||||||||||||||||||||

| Senior Executive Vice President and Chief Financial Officer |

2021 | 279,825 | 1,000 | — | — | 208,958 | 71,909 | 561,692 | ||||||||||||||||||||||||

| 2020 | 267,000 | — | — | — | 96,537 | 67,305 | 430,842 | |||||||||||||||||||||||||

| Thomas J. Chamberlain |

||||||||||||||||||||||||||||||||

| Executive Vice President |

2021 | 256,750 | 1,000 | — | — | 147,350 | 64,657 | 469,757 | ||||||||||||||||||||||||

| 2020 | 245,000 | — | — | — | 70,679 | 60,554 | 376,233 | |||||||||||||||||||||||||

| (1) | Details of the amounts reported in the “All Other Compensation” column for fiscal year 2021 are provided in the table below. Amounts do not include perquisites, which did not total in the aggregate more than $10,000 for any of the named executive officers. |

| Walter H. Hasselbring, III |

Pamela J. Verkler | Thomas J. Chamberlain | ||||||||||

| 401(k) Matching |

$ | 3,562 | $ | 3,562 | $ | 3,562 | ||||||

| 401(k) Profit Sharing |

35,625 | 35,625 | 28,500 | |||||||||

| ESOP |

16,697 | 16,697 | 16,697 | |||||||||

| Life Insurance/AD&D Premium |

430 | 495 | 495 | |||||||||

| LTD Insurance Premium |

228 | 228 | 228 | |||||||||

| Medical/Dental Insurance Premium |

14,962 | 14,962 | 9,975 | |||||||||

| Cell Phone |

336 | 340 | 330 | |||||||||

| Club Dues |

1,455 | — | 4,870 | |||||||||

| Director Fees |

45,594 | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 118,889 | $ | 71,909 | $ | 64,657 | ||||||

|

|

|

|

|

|

|

|||||||

Employment Agreement

Iroquois Federal Savings and Loan Association and IF Bancorp, Inc. each have entered into an employment agreement with Walter H. Hasselbring, III, our President and Chief Executive Officer, effective November 25, 2015, with amendments effective July 1, 2016 and July 1, 2017. The Iroquois Federal agreement and the IF Bancorp agreement each provide for a three-year term, subject to annual renewal by the disinterested members of the Board of Directors. Prior to each such renewal, the disinterested members of the Board of Directors conduct a comprehensive performance evaluation for purposes of determining whether to extend the agreements. Both agreements have been renewed effective July 7, 2021 for a term ending on July 7, 2024. Although the agreements are substantially similar and each requires payments to the executive under certain circumstances, there will be no duplication of benefits. Any payment made under the Iroquois Federal agreement will be subtracted from the same payment required under the IF Bancorp, Inc. agreement.

18

Mr. Hasselbring’s base salary under his employment agreement with Iroquois Federal is $377,254. In addition to base salary, the agreement provides for, among other things, Mr. Hasselbring’s right to participate in discretionary bonuses or other incentive compensation programs and employee benefit plans and to receive perquisites applicable to executive management. If we terminate Mr. Hasselbring without cause or if he terminates voluntarily under specified circumstances that constitute good reason (as defined in the agreements), Mr. Hasselbring will be entitled to three times the sum of (i) base salary and (ii) the highest annual bonus (whether paid or accrued) during the prior three years and the value of all employee benefits that would have been provided for the 36-month period following the his termination, had his employment not terminated. Such amounts will be paid in a lump sum payment. In addition, Mr. Hasselbring will be entitled to participate in any life insurance, non-taxable medical, health, or dental arrangement, subject to the same premium contribution as prior to his termination, until the earlier of his death, his employment by another employer other than one in which he is the majority owner, or for the 36-month period immediately following his termination. In the event that IF Bancorp or Iroquois Federal do not provide welfare benefits at any time after the executive’s termination or if providing such benefits would subject Iroquois Federal to excise taxes or penalties, then executive will receive a lump sum payment equal to the premiums for such benefits. If there is a change in control followed within 24 months by Mr. Hasselbring’s dismissal or resignation due to a demotion, loss of title, office or significant authority, reduction in compensation or benefits, or relocation by more than 35 miles, he will be entitled to the greater of the payments set forth above or three times his average annual compensation (as “annual compensation” is defined in the employment agreements) over the last five years ending before the year in which the change in control occurs, payable in a lump sum, plus, continued welfare benefits either provided under the Iroquois Federal plans for a period of up to the earlier of his death, employment by another employer other than one of which he is the majority owner, or the expiration of 36 months, or by payment of a cash lump sum payment equal to the cost of providing such benefits for up to 36 months. In addition, any memberships or automobile use shall be continued during the remaining unexpired term of the agreement (or if less, the maximum period permitted under Internal Revenue Code Section 409A without being considered deferred compensation). The payments required under the Iroquois Federal employment agreement in connection with a change in control will be reduced to the extent necessary to avoid an excess parachute payment. The IF Bancorp, Inc. agreement will not require a reduction in severance benefits on a termination of employment in connection with a change in control in the event of an excess parachute payment

In the event of Mr. Hasselbring’s death during the term of the agreements, Mr. Hasselbring’s dependents will continue to receive non-taxable medical insurance benefits for a period of six months following his death. In the event of his disability (as construed in accordance with Internal Revenue Code Section 409A), the agreements provide that Mr. Hasselbring will be entitled to 100% of his base salary for 180 days following his disability termination and 60% of his base salary from the 181st day following termination until the earlier of the date of his death or the date he attains age 65. Such payments will be reduced by any short or long-term disability benefits payable under any disability program to which he is entitled. To the greatest extent possible, Mr. Hasselbring and his dependents will be covered under life and non-taxable medical and dental plans of Iroquois Federal, on the same terms as Mr. Hasselbring participated prior to his disability termination.

Change in Control Agreements

Iroquois Federal has entered into change in control agreements with Ms. Verkler and Mr. Chamberlain. Each of the agreements provides for a 24-month term, subject to annual renewal by the disinterested members of the Board of Directors on July 7 of each year. Prior to each such renewal, the disinterested members of the Board of Directors conduct a comprehensive performance evaluation for purposes of determining whether to extend the agreements. Each agreement was renewed in fiscal 2021. In the event of a change in control (as defined in the agreement), each agreement will automatically renew

19

for a term of 12 months following the effective date of the change in control. The agreements will terminate if the executive or Iroquois Federal terminates executive’s employment prior to a change in control. If, within 12 months after a change in control, we terminate the executive without cause or if the executive terminates voluntarily under specified circumstances that constitute good reason, including a material diminution in authority, duties or responsibilities, a material diminution in base salary, a relocation that increases the executive’s commute by more than 35 miles, or any other action or inaction by the bank or IF Bancorp, Inc. that would constitute a breach of the agreement, the executive will be entitled to a lump sum cash payment equal to two times the executive’s base salary and highest rate of bonus paid to the executive during the three years prior to termination, payable in a single lump sum within ten days following the termination of employment. In addition, the executive will be entitled to continue participation in life insurance, non-taxable medical, vision, and dental coverage, subject to the same terms and conditions as prior to the executive’s termination of employment. Such coverage will cease 24 months after the executive’s termination. In the event the provision or payment of such benefit would subject Iroquois Federal to excise taxes or penalties, Iroquois Federal will pay to the executive a cash lump sum payment equal to the cost of providing such benefits. The payments required under the change in control agreements will be reduced to the extent necessary to avoid an excess parachute payment. Payments under the agreements will be paid from the general funds of Iroquois Federal; IF Bancorp, Inc., however, will guarantee the payments due under the agreements. We will agree to pay all reasonable costs and legal fees of the executive in relation to the enforcement of the change in control agreements, provided the executive succeeds on the merits in a legal judgment, arbitration proceeding or settlement.

Annual Incentive Plan

In the fiscal year ended June 30, 2012, Iroquois Federal entered into the Iroquois Federal Annual Incentive Plan (the “Incentive Plan”). The Incentive Plan provides the opportunity to earn an incentive award to employees who have been designated by the committee administering the Incentive Plan as eligible to participate and who have been approved by the Iroquois Federal Board of Directors, based upon attainment of specified objectives, determined periodically by the Iroquois Federal Board of Directors. The plan incorporates two key components. First, a minimum acceptable return to shareholders is established each year, which is required to be met before incentive payments can be made. Second, the plan provides for a 3-year rolling performance cycle, with incentive awards made at the end of each cycle. After achievement of the minimum acceptable return to shareholders, Iroquois Federal contributes a percentage of Iroquois Federal’s earnings above the minimum acceptable return to an eligible participant incentive pool, which is used to fund awards to participants under the Incentive Plan. During the first two years of the initial 3-year performance cycle, the Iroquois Federal Board of Directors made partial payments of the ultimate initial 3-year incentive award. The 2014 fiscal year marked the end of the initial 3-year performance cycle. Starting in 2015 fiscal year, incentive awards under the Incentive Plan are made based on the full 3-year rolling performance cycle. Payment of any award under the Incentive Plan is conditioned upon Iroquois Federal’s financial capacity to fund the payment. If Iroquois Federal is not financially capable of funding the payment of an award at the time it is due, the payment may be reduced or eliminated. The award for each participant is based on the participants’ compensation and the objectives determined by the Iroquois Federal Board of Directors. In the year ended June 30, 2018, the minimum acceptable return was not achieved, and therefore, no incentives were paid to participants.

Generally, a participant must be employed by Iroquois Federal or IF Bancorp on the date that the amounts credited to the participant’s account are distributed to the participant. In the year in which a participant retires, dies, becomes disabled, or has an involuntary separation from service without cause or resigns for good reason (as defined in the Incentive Plan), special vesting provisions apply and generally would permit a payment to the participant for the performance cycle that would end in that year, provided

20