Form DEF 14A HENRY JACK & ASSOCIATES For: Nov 16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[x] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

JACK HENRY & ASSOCIATES, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[x] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

JACK HENRY & ASSOCIATES, INC.

663 Highway 60, P.O. Box 807

Monett, Missouri 65708

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

TO THE STOCKHOLDERS OF JACK HENRY & ASSOCIATES, INC.:

PLEASE TAKE NOTICE that the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Jack Henry & Associates, Inc., a Delaware corporation (the “Company”), will be held in the Company’s Executive Conference Center, lower level (Building J-7) at the Company’s Headquarters, 663 Highway 60, Monett, Missouri, on Tuesday, November 16, 2021, 10:00 a.m. (Central). The purpose of the Annual Meeting will be the following:

(1)To elect nine (9) directors to serve until the 2022 Annual Meeting of Stockholders;

(2)To approve, on an advisory basis, the compensation of our named executive officers;

(3)To ratify the selection of the Company’s independent registered public accounting firm; and

(4)To transact such other business as may properly come before the Annual Meeting and any adjournments thereof.

The Company reserves the right to require that all persons attending the meeting comply with then-applicable social distancing guidelines, wear masks inside the building, and comply with any additional reasonable rules that the Company implements in order to protect the health and safety of all attendees. In the event the Company determines that a change in the date, time, or location of the meeting or implementation of a virtual-only meeting format is necessary due to public health concerns related to the COVID-19 pandemic, the Company will promptly announce such decision in advance through a press release, a copy of which would be filed with the Securities and Exchange Commission as additional proxy materials and posted on the Company’s website at www.jackhenry.com.

The close of business on September 20, 2021, has been fixed as the record date for the Annual Meeting. Only stockholders of record as of that date will be entitled to notice of and to vote at said meeting and any adjournment or postponement thereof.

The accompanying form of proxy is solicited by the Board of Directors of the Company. The attached Proxy Statement contains further information with respect to the business to be transacted at the Annual Meeting.

ALL STOCKHOLDERS ARE INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND, PLEASE DATE AND SIGN THE ENCLOSED PROXY. IF YOU DECIDE TO ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON.

| By Order of the Board of Directors | |||||

| |||||

| Craig K. Morgan | |||||

| Secretary | |||||

| Monett, Missouri | |||||

October 4, 2021 | |||||

TABLE OF CONTENTS | |||||

Proxy and Voting Information | |||||

Stock Ownership of Certain Stockholders | |||||

Election of Directors (Proposal 1) | |||||

Corporate Governance | |||||

Certain Relationships and Related Transactions | |||||

Delinquent Section 16(a) Reports | |||||

Audit Committee Report | |||||

Executive Officers | |||||

Compensation Committee Report | |||||

Compensation Discussion and Analysis | |||||

Compensation and Risk | |||||

Executive Compensation | |||||

Equity Compensation Plan Information | |||||

Advisory Vote on Executive Compensation (Proposal 2) | |||||

| Ratification of Selection of the Company’s Independent Registered Public Accounting Firm (Proposal 3) | |||||

Stockholder Proposals and Nominations | |||||

Cost of Solicitation and Proxies | |||||

Financial Statements | |||||

| Householding | |||||

Other Matters | |||||

JACK HENRY & ASSOCIATES, INC.

663 Highway 60, P.O. Box 807

Monett, Missouri 65708

PROXY STATEMENT

FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS

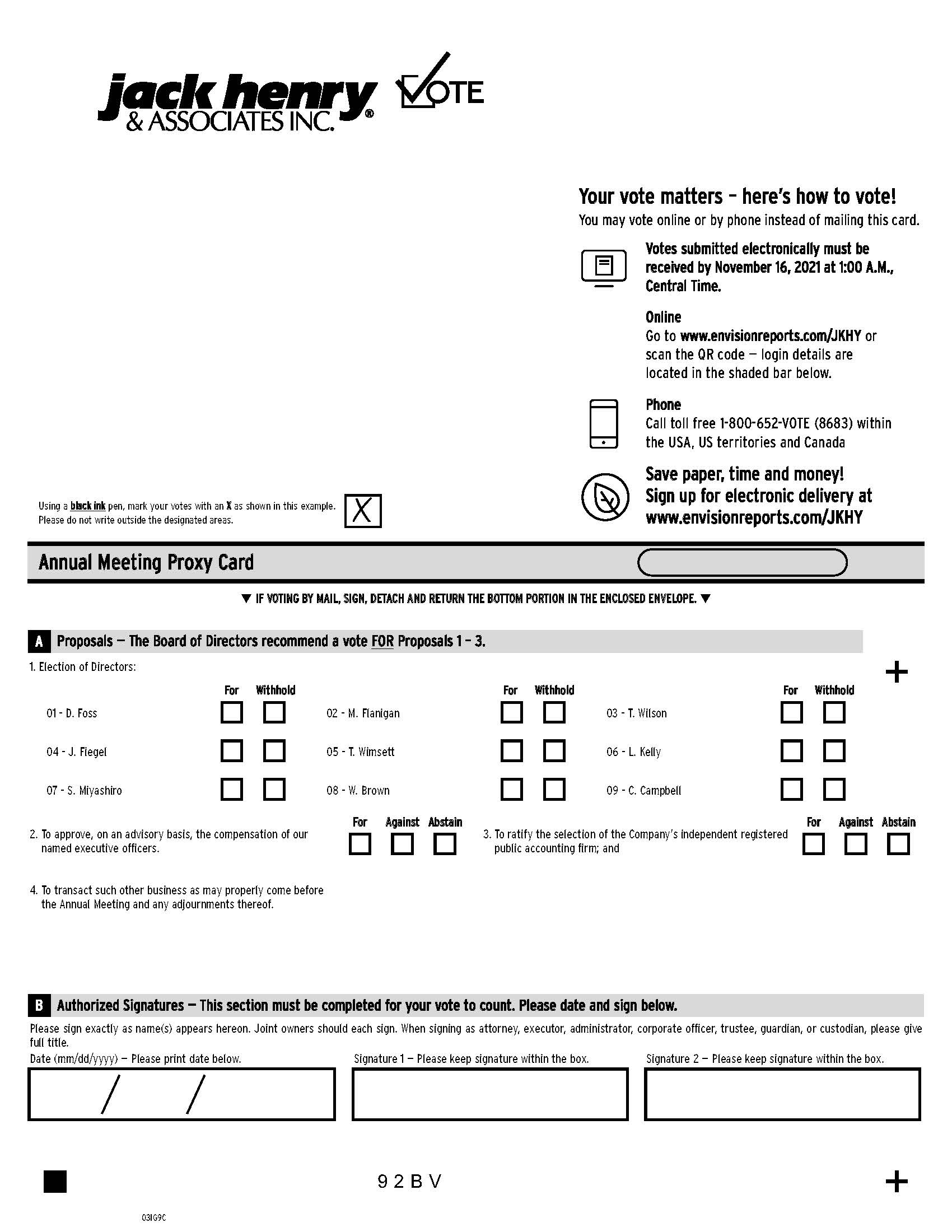

To Be Held Tuesday, November 16, 2021

This proxy statement (the “Proxy Statement”) and the enclosed proxy card (the “Proxy Card”) are furnished to the stockholders of Jack Henry & Associates, Inc., a Delaware corporation (the “Company”), in connection with the solicitation of proxies by the Company’s Board of Directors (the “Board”) for use at the 2021 Annual Meeting of Stockholders, and any adjournment or postponement thereof (the “Annual Meeting”), to be held in the Company’s Executive Conference Center, lower level (Building J-7) at the Company’s Headquarters, 663 Highway 60, Monett, Missouri, at 10:00 a.m. (Central), on Tuesday, November 16, 2021. The mailing of this Proxy Statement, the Proxy Card, the Notice of 2021 Annual Meeting of Stockholders (the “Notice”) and the accompanying 2021 Annual Report to Stockholders (the “2021 Annual Report”) is expected to commence on or about October 4, 2021.

The Board does not intend to bring any matters before the Annual Meeting except those indicated in the Notice and does not know of any matter which anyone else proposes to present for action at the Annual Meeting. If any other matters properly come before the Annual Meeting, however, the persons named in the accompanying form of Proxy Card, or their duly constituted substitutes, acting at the Annual Meeting, will be deemed authorized to vote or otherwise to act thereon in accordance with their judgment on such matters.

If the enclosed Proxy Card is properly executed and returned prior to voting at the Annual Meeting, the shares represented thereby will be voted in accordance with the instructions marked thereon.

Any stockholder executing a Proxy Card retains the power to revoke it at any time prior to the voting of the proxy. It may be revoked by a stockholder personally appearing at the Annual Meeting and casting a contrary vote, by filing an instrument of revocation with the Secretary of the Company, or by the presentation at the Annual Meeting of a duly executed later dated Proxy Card.

In the event the Company determines that a change in the date, time, or location of the meeting or implementation of a virtual-only meeting format is necessary due to public health concerns related to the COVID-19 pandemic, the Company will promptly announce such decision in advance through a press release, a copy of which would be filed with the Securities and Exchange Commission (the “SEC”) as additional proxy materials and posted on the Company's website at www.jackhenry.com.

In this Proxy Statement, all references to the “Company”, “Jack Henry”, “we”, “us”, and “our”, refer to Jack Henry & Associates, Inc.

PROXY AND VOTING INFORMATION

Proxies

If the enclosed Proxy Card is properly executed and returned prior to voting at the Annual Meeting, the shares represented thereby will be voted in accordance with the instructions marked thereon.

1

All shares represented by proxy and all proxies solicited hereunder will be voted in accordance with the specifications made by the stockholders executing such proxies. If a stockholder does not specify how a proxy is to be voted, the shares represented thereby will be voted: (1) FOR the election as directors of the nine (9) persons nominated by the Board; (2) FOR approval of the compensation of our named executive officers; (3) FOR ratification of the selection of the Company’s independent registered public accounting firm; and (4) upon other matters that may properly come before the Annual Meeting, in accordance with the discretion of the persons to whom the proxy is granted.

Any stockholder executing a proxy retains the power to revoke it at any time prior to the voting of the proxy. It may be revoked by a stockholder attending in the Annual Meeting and casting a contrary vote or by filing an instrument of revocation with the Secretary of the Company.

Stockholders Entitled to Vote

Only stockholders of record at the close of business on September 20, 2021, the record date set by the Board for the Annual Meeting, are entitled to notice of and to vote at such meeting.

The Company’s authorized capital stock currently consists of 250,000,000 shares of common stock, par value $.01 per share (the “Common Stock”), and 500,000 shares of preferred stock, par value $1.00 per share (the “Preferred Stock”). As of September 20, 2021, there were 73,999,135 shares of Common Stock outstanding and no shares of Preferred Stock outstanding. At such date, our executive officers and directors were entitled to vote, or to direct the voting of, shares of Common Stock representing less than 1% of the shares entitled to vote at the 2021 Annual Meeting.

Each share of our Common Stock outstanding on the record date will be entitled to one vote on each matter.

Matters to be Voted on at the Annual Meeting

At the 2021 Annual Meeting, stockholders will consider and vote upon the following matters:

| Proposal | Board Recommendation | Page | ||||||

(1)The election of nine (9) directors to serve until the 2022 Annual Meeting of Stockholders; | FOR each nominee | 7 | ||||||

(2)Approval, on an advisory basis, of the compensation of our named executive officers; and | FOR | 47 | ||||||

(3)To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2022. | FOR | 48 | ||||||

In addition, the stockholders will consider and vote upon such other business as may properly come before the Annual Meeting and any adjournments thereof.

Only stockholders of record at the close of business on September 20, 2021, the record date for the Annual Meeting, are entitled to notice of and to vote at such meeting. A list of these stockholders will be available at the time and place of the meeting and, during the ten days prior to the meeting, at the Company’s headquarters at 663 Highway 60, Monett, Missouri.

Required Vote

In an uncontested election, a director nominee must be elected by a majority of the votes cast, in person or by proxy, regarding the election of that director nominee. A “majority of the votes cast” for the purposes of director elections means that the number of votes cast “For” a director nominee’s election exceeds the number of votes cast as “Withhold” for that director nominee. If an incumbent director is not re-elected in an uncontested election and no successor is elected at the same meeting, the Company’s Corporate Governance Guidelines require that such director must offer to tender his or her resignation to the Board.

2

In a contested election, which occurs when the number of director nominees exceeds the number of open seats on the Board, director nominees will be elected by a plurality of the shares represented in person or by proxy at the meeting. A “plurality” means that the open seats on the Board will be filled by those director nominees who received the most affirmative votes, regardless of whether those director nominees received a majority of the votes cast with respect to their election.

At the Annual Meeting, the election of directors is considered to be uncontested because we have not been notified of any other nominees as required by our Restated and Amended Bylaws (the “Bylaws”). To be elected, each director nominee must receive a majority of votes cast regarding that nominee.

The approval of all other matters to be voted on at the Annual Meeting will require the affirmative vote of a majority of the shares of Common Stock present at the Annual Meeting in person or by proxy and entitled to vote.

Abstentions and broker non-votes will have no effect on the election of directors. For the purpose of determining whether the stockholders have approved other matters, abstentions are treated as shares present or represented and voting, so abstaining has the same effect as a negative vote. Shares held by brokers that do not have discretionary authority to vote on a particular matter and that have not received voting instructions from their clients are not counted or deemed to be present or represented for the purpose of determining whether stockholders have approved that matter, but they are counted as present for the purpose of determining the existence of a quorum at the Annual Meeting. Please note that banks and brokers that have not received voting instructions from their clients cannot vote on their clients’ behalf on “non-routine” proposals.

How to Vote

Stockholders may submit their votes in the following ways:

1.At the Annual Meeting. Stockholders of record may vote in person at the Annual Meeting; or

2. By Proxy. There are three ways to vote by proxy:

•by internet, following the instructions on the enclosed Proxy Card;

•by mail, using the enclosed Proxy Card and return envelope; or

•by telephone, using the telephone number and instructions on the enclosed Proxy Card.

Even if a stockholder expects to attend the Annual Meeting, it is advisable to vote by proxy to ensure such stockholder’s vote is represented. It is particularly important that stockholders be represented by proxy at the Annual Meeting given the possibility that public health developments surrounding the COVID-19 pandemic may require a change in the date, time, or location of the meeting or the implementation of a virtual-only meeting format.

If a stockholder’s shares are held in the name of a bank, broker, or other nominee, that nominee will provide separate instructions on how to vote.

If you are a participant in the Company’s 401(k) Retirement Savings Plan (the “Retirement Plan”) and you own shares of our Common Stock through the Retirement Plan, you may vote by proxy or you may receive separate instructions on how to direct the Retirement Plan trustee how to vote those shares on your behalf. If you do not vote by proxy or otherwise provide voting instructions for these shares, then, as permitted by the terms of the Retirement Plan, the Retirement Plan administrator will instruct the trustee to vote your Retirement Plan shares “FOR” all the director nominees named in this Proxy Statement and “FOR” all other proposals.

Participation in the Annual Meeting

Stockholders and guests may attend the Annual Meeting in person. The Company reserves the right to require that all persons attending the meeting comply with then-applicable social distancing guidelines, wear masks inside the building, and comply with any additional reasonable rules that the Company implements in order to protect the health and safety of all attendees.

3

The Company will hold a question and answer session with management immediately following the conclusion of the business to be conducted at the Annual Meeting. To help ensure that the Annual Meeting is productive and efficient, and in fairness to all stockholders in attendance, the Company requests that meeting participants limit participation to one question or comment and that remarks are respectful of fellow stockholders and meeting participants. Questions may be ruled as out of order if they are, among other things, irrelevant to our business, related to legal matters, ongoing negotiations or potential transactions, or other matters which the Company does not comment on, disorderly, repetitious of statements already made, or in furtherance of the speaker’s own personal, political, or business interests.

4

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth information concerning the beneficial ownership of shares of the Company’s Common Stock of (a) those individuals who are known to be the beneficial owners, as defined in Rule 13d-3 of the Securities Exchange Act of 1934 (the “Exchange Act”), of 5% or more of the Company’s Common Stock, (b) each director and director nominee, (c) the executive officers named in the Summary Compensation Table and (d) all of our current directors and executive officers as a group. The mailing address of each director, director nominee and executive officer shown in the table below is c/o Jack Henry & Associates, Inc., 663 Highway 60, Monett, Missouri 65708.

| Beneficial Owner | Number of Shares Beneficially Owned (1) | Percentage of Shares Outstanding (1) | |||||||||||||||

| The Vanguard Group | 9,114,548 | (2) | 12.3% | ||||||||||||||

| BlackRock Inc. | 8,458,328 | (3) | 11.4% | ||||||||||||||

| David B. Foss | 122,799 | (4)(13) | * | ||||||||||||||

| Wesley A. Brown | 91,473 | (5) | * | ||||||||||||||

| Kevin D. Williams | 46,684 | (6)(13) | * | ||||||||||||||

| Matthew C. Flanigan | 46,277 | (5) | * | ||||||||||||||

| Thomas A. Wimsett | 33,863 | (5) | * | ||||||||||||||

| Teddy I. Bilke | 26,917 | (7)(13) | * | ||||||||||||||

| Jacque R. Fiegel | 18,171 | (5) | * | ||||||||||||||

| Laura G. Kelly | 13,709 | (5)(8) | * | ||||||||||||||

| Thomas H. Wilson, Jr. | 13,272 | (5)(9) | * | ||||||||||||||

| Gregory R. Adelson | 11,008 | (10)(13) | * | ||||||||||||||

| Shruti S. Miyashiro | 8,935 | (5)(11) | * | ||||||||||||||

| Craig K. Morgan | 5,819 | (12)(13) | * | ||||||||||||||

| Curtis A. Campbell | 382 | (5) | * | ||||||||||||||

| All current directors and executive officers as a group (14 persons) | 443,327 | (13)(14) | * | ||||||||||||||

| * Less than 1% | |||||||||||||||||

(1)Except as otherwise noted in the footnotes, information is set forth as of September 20, 2021. The persons named in the table have sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by them, except as noted below. With respect to shares held in the Company’s Retirement Plan, a participant has the right to direct the disposition of shares allocated to their account and a participant is allowed to vote the shares held in their individual account.

(2)According to a Schedule 13G/A filed February 10, 2021, The Vanguard Group has shared dispositive power with respect to 365,088 shares, sole dispositive power with respect to 8,749,460 shares, shared voting power with respect to 156,844 shares, and sole voting power with respect to 0 shares. The address for The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355.

(3)According to a Schedule 13G/A filed January 27, 2021, BlackRock Inc. has sole voting power with respect to 7,667,890 shares and sole dispositive power with respect to 8,458,328 shares. The address for BlackRock Inc. is 55 East 52nd St., New York, NY 10055.

(4)Includes 21,685 shares that are currently acquirable by exercise of outstanding stock options and 4,680 shares held in the Retirement Plan for Mr. Foss’ account.

(5)Includes 1,022 restricted stock units that will vest on November 20, 2021 for each non-employee director, other than Mr. Campbell, and 382 restricted stock units that will vest on November 20, 2021 for Mr. Campbell.

(6)Includes 11,329 shares held in the Retirement Plan for Mr. Williams’s account.

(7)Mr. Bilke has elected to defer receipt of 3,047 performance shares, which have fully vested and will become payable, in cash or common stock, at the Company’s option, upon Mr. Bilke’s termination of service with the Company pursuant to Mr.

5

Bilke’s deferral elections. Each performance share is the economic equivalent of one share of common stock. These deferred performance shares have been excluded from the amounts set forth in this table.

(8)Ms. Kelly has elected to defer receipt of 1,593 restricted stock units, which have fully vested and will become payable, in cash or common stock at the Company’s option, either upon Ms. Kelly’s termination of service as a director of the Company or on specified future dates, pursuant to Ms. Kelly’s deferral elections. Each restricted stock unit is the economic equivalent of one share of common stock. These deferred restricted stock units have been excluded from the amounts set forth in this table.

(9)Mr. Wilson has elected to defer receipt of 8,960 restricted stock units, which have fully vested and will become payable, in cash or common stock at the Company’s option, upon Mr. Wilson’s termination of service as a director of the Company pursuant to Mr. Wilson’s deferral elections. Each restricted stock unit is the economic equivalent of one share of common stock. These deferred restricted stock units have been excluded from the amounts set forth in this table.

(10)Mr. Adelson has elected to defer receipt of 3,561 performance shares, which have fully vested and will become payable, in cash or common stock, at the Company’s option, upon Mr. Adelson’s termination of service with the Company pursuant to Mr. Adelson’s deferral elections. Each performance share is the economic equivalent of one share of common stock. These deferred performance shares have been excluded from the amounts set forth in this table.

(11)Ms. Miyashiro has elected to defer receipt of 257 restricted stock units, which have fully vested and will become payable, in cash or common stock, at the Company’s option, either upon Ms. Miyashiro’s termination of service as a director of the Company or on specified future dates, pursuant to Ms. Miyashiro’s deferral elections. Each restricted stock unit is the economic equivalent of one share of common stock. These deferred restricted stock units have been excluded from the amounts set forth in this table.

(12)Includes 980 shares held in the Retirement Plan for Mr. Morgan’s account.

(13)Includes restricted stock units that will vest and be delivered for settlement to executive officers on or about October 4, 2021 in the following amounts: 4,506 shares to Mr. Foss; 1,100 shares to Mr. Williams; 321 shares to Mr. Adelson; 298 shares to Mr. Morgan; 307 shares to Mr. Bilke; and 305 shares to other executive officers. Includes restricted stock units that will vest and be delivered for settlement to executive officers on or about November 15, 2021 in the following amounts: 515 shares to Mr. Adelson and 77 shares to Mr. Bilke.

(14)Includes 3,713 shares beneficially owned by other executive officers.

6

PROPOSAL 1

ELECTION OF DIRECTORS

Procedure

At the Annual Meeting, the stockholders will elect nine (9) directors to hold office for one-year terms ending at the 2022 Annual Meeting of Stockholders or until their successors are elected and qualified. The Board has nominated the Company’s nine (9) current directors for re-election at the Annual Meeting.

The stockholders are entitled to one vote per share on each matter submitted to vote at any meeting of the stockholders. Unless contrary instructions are given, the persons named in the enclosed Proxy Card or their substitutes will vote “FOR” the election of the nominees named below.

Each of the nominees has consented to serve as director. However, if any nominee at the time of election is unable to serve or is otherwise unavailable for election, and as a result other nominees are designated by the Board, the persons named in the enclosed Proxy Card or their substitutes intend to vote for the election of such designated nominees.

Director Qualifications and Selection

Under the Company’s Corporate Governance Guidelines, the Governance Committee is charged with the responsibility for determining the appropriate skills and characteristics required of Board members and are to consider such factors as experience, strength of character, maturity of judgment, technical skills, diversity, and age in assessing the needs of the Board. The Corporate Governance Guidelines specify that a majority of the members shall qualify as independent under applicable Nasdaq Global Select Market (“Nasdaq”) listing standards. While the term “diversity” is not specifically defined in the Corporate Governance Guidelines and there is no formal policy regarding application of the term, it has been the practice of the Governance Committee to apply the term broadly, resulting in Board composition over the years that has reflected diversity in race, gender, and age, as well as diversity in business experience and in representation of the markets served by the Company.

While the Company has a nomination policy by which stockholders may recommend to the Governance Committee certain prospective directors for consideration (See “Corporate Governance—Stockholder Recommended Director Candidates,” below), to date no such recommendation has ever been received. If such a recommendation is received in the future, it will be evaluated in the same manner as any other recommendation to the Governance Committee. The Governance Committee nomination process varies depending upon the particular expertise and skill set sought by the Governance Committee. The process can be informal, consisting of solicitation of suggestions of possible candidates from other Board members and management, contacting candidates to determine interest level, and in-person interviews to determine “fit.” The Governance Committee has also used a more formal process utilizing a recruiting firm to identify candidates, screening of recommendations, followed by telephone and in-person interviews, background checks, and Governance Committee evaluation and nomination. The Governance Committee will in the future continue to use a mix of formal and informal processes to identify appropriate candidates for the Board.

The Company’s Board has also adopted a “Proxy Access for Director Nominations” bylaw as part of the Company’s Bylaws. The proxy access bylaw permits a stockholder, or certain groups of stockholders, meeting the requirements contained in the proxy access bylaw to nominate and include in the Company’s proxy materials director nominees constituting up to two individuals or 20% of the Board (whichever is greater). See “Stockholder Nominated Director Candidates” on page 14 for more information.

7

Nominees for Election

The nominees for election as directors of the Company, as well as certain information about them, are as follows:

| Name | Position with Company | Director Since | ||||||

| David B. Foss | Board Chair, President, and Chief Executive Officer | 2017 | ||||||

| Matthew C. Flanigan | Vice Chair and Lead Director | 2007 | ||||||

| Thomas H. Wilson, Jr. | Director | 2012 | ||||||

| Jacque R. Fiegel | Director | 2012 | ||||||

| Thomas A. Wimsett | Director | 2012 | ||||||

| Laura G. Kelly | Director | 2013 | ||||||

| Shruti S. Miyashiro | Director | 2015 | ||||||

| Wesley A. Brown | Director | 2015 | ||||||

| Curtis A. Campbell | Director | 2021 | ||||||

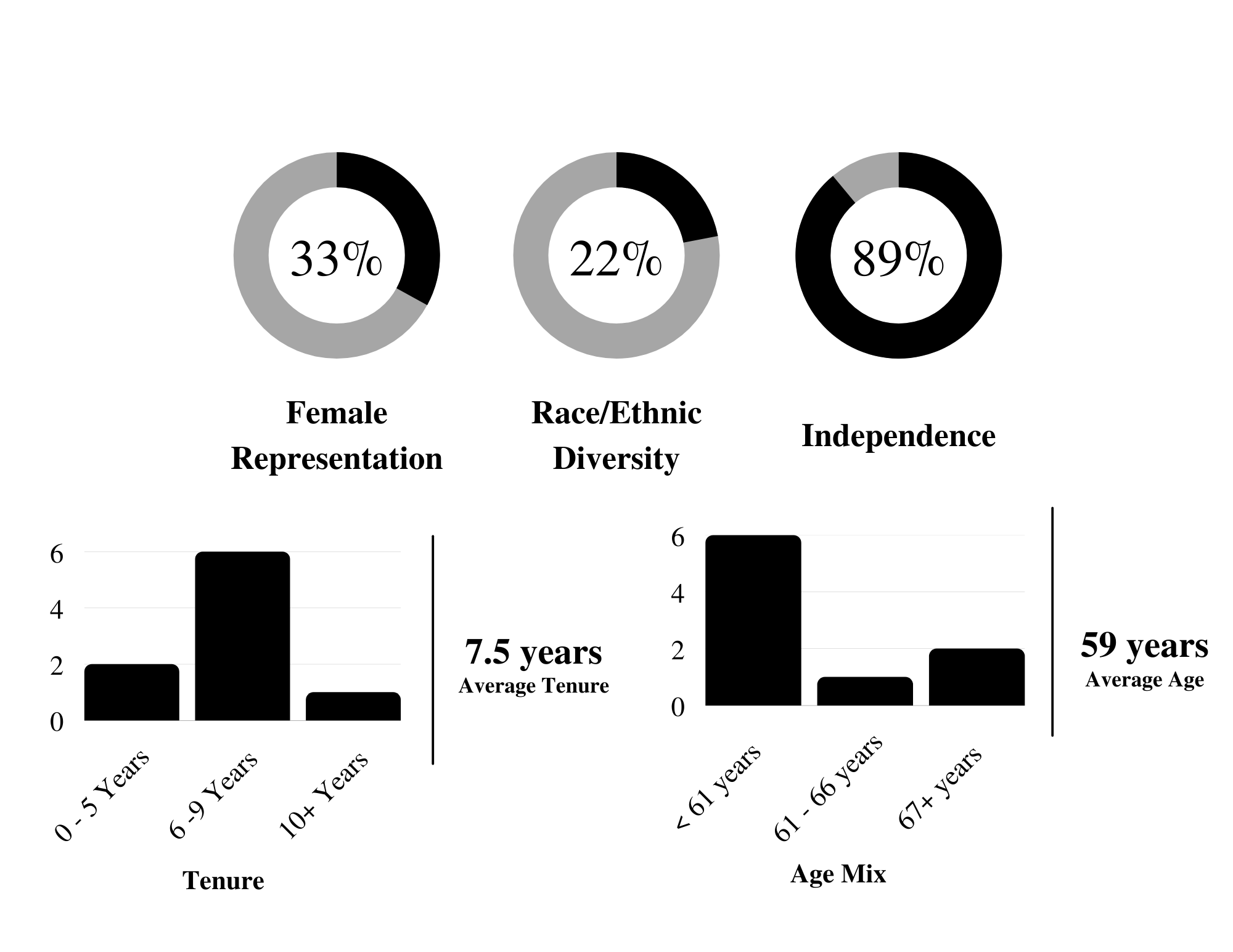

Board Snapshot

8

Board Skills Matrix

We believe that all the Company’s directors possess required common attributes such as good judgment, intelligence, strategic perspective, financial literacy and business experience. They each exhibit a strong commitment of time and attention to their roles as directors. We also have sought certain specific skills and backgrounds in our directors to provide an array of expertise in the Board. The chart below summarizes certain specific qualifications, attributes and skills for each director. A check mark indicates a specific area of focus or expertise of a director on which the Board relies, but a lack of a check mark does not mean that an individual does not possess that skill.

| Expertise | Board of Directors | ||||||||||||||||||||||||||||

| Foss | Flanigan | Wilson | Fiegel | Wimsett | Kelly | Miyashiro | Brown | Campbell | |||||||||||||||||||||

| Leadership | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

| Finance | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||

| Banking Business | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

| Credit Union Business | ✓ | ||||||||||||||||||||||||||||

| Payments | ✓ | ✓ | |||||||||||||||||||||||||||

| Compliance | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

| Governance | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

| Regulatory | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

| Technology | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

Board Diversity Matrix

The matrix below summarizes the self-identified gender and ethnic diverse attributes on our Board.

| Board Diversity Matrix (As of September 20, 2021) | ||||||||||||||

| Total Number of Directors | 9 | |||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||

| Directors | 3 | 6 | - | - | ||||||||||

| Number of Directors who identify in any of the categories below | ||||||||||||||

| African American or Black | - | 1 | - | - | ||||||||||

| Alaskan Native or Native American | - | - | - | - | ||||||||||

| Asian | 1 | - | - | - | ||||||||||

| Hispanic or Latinx | - | - | - | - | ||||||||||

| Native Hawaiian or Pacific Islander | - | - | - | - | ||||||||||

| White | 2 | 5 | - | - | ||||||||||

| Two or More Races or Ethnicities | - | - | - | - | ||||||||||

| LGBTQ+ | - | |||||||||||||

| Undisclosed | - | |||||||||||||

Nominee Information

The following information relating to the Company’s director nominees details their principal occupations, business experience,and positions during the past five years, as well as the specific experiences, qualifications, attributes, and skills that led to the conclusion that they should serve as directors of the Company:

9

David B. Foss, age 60, Board Chair, President, and Chief Executive Officer. Mr. Foss was named Board Chair on July 1, 2021. He had been named President and Chief Executive Officer of the Company on July 1, 2016, having previously been appointed President in 2014. Mr. Foss’s prior positions with the Company include President of the Company’s ProfitStars Division from 2009 to 2014 and General Manager of ProfitStars from 2006 to 2009. He led the Company’s Acquisition and Business Integration unit from 2004 to 2006, during which time the Company completed 10 acquisitions. Mr. Foss’s prior positions with the Company include General Manager of the Complementary Solutions Group from 2000 to 2004 and President of the Open Systems Group from 1999 to 2004. He is also currently serving as a director of CNO Financial Group, Inc. (NYSE: CNO). Before joining the Company in 1999, Mr. Foss held a variety of positions in the financial services industry including senior operations management, sales management, and supervisory roles at BancTec, Advanced Computer Systems, and NCR. His long tenure in the industry and variety of leadership roles provide significant experience to the Company and its products, employees, and customers.

Matthew C. Flanigan, age 59, Vice Chair and Lead Director. Mr. Flanigan is former Executive Vice President, Chief Financial Officer and nine-year Board Member of Leggett & Platt, Incorporated (NYSE: LEG), having retired from those positions in 2019. Headquartered in Carthage, Missouri, Leggett & Platt is an S&P 500 leading manufacturer of engineered components and products found in many homes, offices, automobiles, and airplanes. Mr. Flanigan became Chief Financial Officer in 2003, was appointed Executive Vice President in 2009, and elected to Leggett & Platt’s Board of Directors in 2010. From 1999 until 2003, he served as President of the Office Furniture and Plastics Components Groups of Leggett. Prior to joining Leggett in 1997, Mr. Flanigan was employed in the banking industry for 13 years, the last 10 of which as First Vice President and Manager for Societe Generale S.A. in Dallas, the largest non-U.S. lending institution in the Southwestern United States at that time. Mr. Flanigan currently serves as a director of Performance Food Group Company (NYSE: PFGC), one of the nation’s largest food distribution businesses and a Fortune 100 company. Mr. Flanigan brings to our Board expertise in banking and finance, risk and compliance functions as well as a unique perspective coming from his wide experience at a large, global S&P 500 manufacturer as both an executive and Board Member. Mr. Flanigan was appointed “Lead Director” by the independent directors in 2012.

Thomas H. Wilson, Jr., age 60, Director. Mr. Wilson is a Managing Partner at DecisionPoint Advisors, LLC in Charlotte, N.C., a specialized merger and acquisition advisory firm for mid-market technology companies and currently serves as a director of NN, Inc. (Nasdaq: NNBR), a diversified industrial company. Prior to joining DecisionPoint in 2008, he served as Chairman and CEO of NuTech Solutions from 2004 to 2008, a business intelligence software company that was acquired by Neteeza. From 1997 to 2004, Mr. Wilson was President of Osprey, a consulting and systems integration firm. Prior to his work at Osprey, Mr. Wilson was employed by IBM for 14 years in a variety of management and sales positions. Mr. Wilson earned a Master’s in Business Administration from Duke University and has served on the boards of various non-profit and community organizations, including North Carolina Innovative Development for Economic Advancement (NC IDEA), Junior Achievement and the Charlotte United Way. Mr. Wilson brings to the Board extensive management and sales experience in technology companies, as well as expertise in technology-oriented investment banking and mergers and acquisitions.

Jacque R. Fiegel, age 67, Director. Ms. Fiegel is Chairman, Central Oklahoma Area of Prosperity Bank in Oklahoma City, Oklahoma. Ms. Fiegel serves on the Management Committee and Strategic Technology Oversight Committee at Prosperity. Prior to its acquisition by Prosperity Bank, she served at Coppermark Bank as Senior Executive Vice President, Chief Operating Officer, and director, as well as director and treasurer of affiliates Coppermark Bancshares, Inc. and Coppermark Card Services, Inc. She began her career at the bank in 1976 as a teller. Ms. Fiegel is a former member of the Oklahoma City Branch Board of the Federal Reserve Bank of Kansas City, a former director of the Oklahoma Bankers Association, and was previously a director and past President of the Economic Club of Oklahoma, as well as a number of civic organizations in Oklahoma City. Ms. Fiegel was named in 2008 one of the US Banker “25 Most Powerful Women in Banking” and to the “25 Women to Watch” lists in both 2009 and 2010. Ms. Fiegel brings to the Board a broad experience with and understanding of bank technology, banking operations, financial management, and the overall banking business.

Thomas A. Wimsett, age 57, Director. Mr. Wimsett is the Founder and Chairman of Merchant’s PACT, a payments consulting firm he formed in 2012. He also served as Executive Chairman of ControlScan, Inc., a payment card compliance, network, and managed security services firm, from 2014 through 2020. He is a 35+ year veteran of the payments industry, the founder and former Chairman and Chief Executive Officer of Iron Triangle Payment Systems, a leading merchant payment processor, which was acquired by Vantiv (now Fidelity National Information Services, Inc.) in late 2010. Prior

10

managerial and executive positions in the payments industry include President and CEO of National Processing Company (NYSE: NAP) from 1999 to 2002. He formerly served as Chairman and director of Town & Country Bank and Trust Company in Bardstown, Kentucky. Mr. Wimsett brings deep knowledge and experience in the payments industry to the Board, including service for more than 10 years as a director or advisory board member of the Electronic Transaction Association, an international trade association, and prior roles as a director of MasterCard’s US Board and on advisory boards for both Discover Card and Visa.

Laura G. Kelly, age 64, Director. Ms. Kelly recently retired as a Managing Director of CoreLogic, Inc., where she served as President of Columbia Institute, an industry education affiliate. She also currently serves as a director for RE/MAX Holdings, Inc. (NYSE: RMAX) and director for USAA’s Savings Bank. Ms. Kelly also served Dun & Bradstreet Corporation as Chief Product and Content Officer from 2013 to 2015, and American Express Company, where she was Senior Vice President and General Manager in Global Payments from 2011 to 2013. From 2005 to 2011, Ms. Kelly was employed by MasterCard Worldwide, Inc. as Executive Vice President and Group Head with Global Product responsibilities in Prepaid and Debit. Prior to MasterCard, Ms. Kelly held various executive leadership positions within the insurance and financial services sector. Early in her career, Ms. Kelly served her country as an active duty and reserve officer in the United States Air Force. Ms. Kelly brings to the Board extensive management experience in innovation, payments, and financial services technology. Her background includes a focus on digital transformation, leading large scale organizations, and experience developing international payments products and services. Ms. Kelly is a certified public accountant, a certified property and casualty underwriter, an associate in risk management and earned a Master’s in Business Administration from Auburn University.

Shruti S. Miyashiro, age 50, Director. Ms. Miyashiro is President and Chief Executive Officer of Orange County’s Credit Union, which she has led since 2007. Orange County’s Credit Union is based in Santa Ana, California with over $2 billion in assets. Ms. Miyashiro has served in numerous leadership positions in the credit union industry, including state and national committees for the California Credit Union League and the Credit Union National Association, as well as the Board of Directors of CO-OP Financial Services, a large credit union services organization which serves institutions nationwide. Ms. Miyashiro serves on the Advisory Committee for the California Department of Oversight and as a director of Federal Home Loan Bank of San Francisco. Ms. Miyashiro brings to the Board the perspective and experience of a large credit union customer, as Orange County’s Credit Union uses the Company’s Episys core software system and many of our complementary products and services. Ms. Miyashiro earned a Master’s in Business Administration from the University of Redlands.

Wesley A. Brown, age 67, Director. Mr. Brown currently serves as President of Bent St. Vrain & Company, LLC, a Denver-based bank consulting firm that he formed in 2016, and as director of FirstBank Holding Company, a $25 billion asset bank holding company based in Lakewood, CO. Mr. Brown served KPMG, LLP as Managing Director in its Corporate Finance subsidiary from June 2014 to his retirement in October 2015. From 2004 to 2014, Mr. Brown was a co-founder and Managing Director of St. Charles Capital, LLC in Denver, Colorado, where he also served as its first President and Compliance Officer. Mr. Brown has specialized in merger transactions and financings for financial institutions, completing over 125 transactions totaling in excess of $3.5 billion over his career. His connections with and to the community banking industry in the Rocky Mountain Region are extensive, as he has personally worked on approximately half of all Colorado bank and thrift merger transactions from 1993 through 2015. Prior to founding St. Charles Capital, he served as Managing Director of McDonald Investments, Inc. (2001-2004) and Executive Vice President of The Wallach Company (1991-2000). Mr. Brown previously served as a Director from 2005 to 2014, when he resigned due to changes in the terms and requirements of his employment by the national accounting and consulting firm KPMG. In addition to experience with finance and compliance, Mr. Brown brings a deep knowledge of the banking industry to the Board as well as unique insight to the Company’s mergers and acquisitions. Mr. Brown earned a Master’s in Business Administration with Honors from the University of Chicago.

Curtis A. Campbell, age 49, Director. Mr. Campbell is President of Software at Blucora, Inc. (Nasdaq: BCOR), where he also previously served as President of TaxAct from 2018 to 2020. Prior to joining Blucora, Mr. Campbell served Capital One Financial Corporation as a Managing Vice President of Consumer Auto from 2017 to 2018 and Intuit Inc., where he was Vice President of Product Management, Strategy, Analytics and Innovation from 2014 to 2017. Mr. Campbell brings extensive experience with infrastructure and cloud computing as well as digital development and a keen focus on customer experience from his work with several technology companies. Mr. Campbell earned a Master’s in International Business from the

11

University of South Carolina. Mr. Campbell was appointed as a director of the Company on July 1, 2021, to fill the vacancy left by the retirement of John F. Prim. Mr. Campbell was brought to the Board’s attention by a third-party search firm engaged by the Board to identify possible director candidates.

Director Independence

Eight of the nine nominated directors are independent. Non-employee directors Flanigan, Wilson, Fiegel, Wimsett, Kelly, Miyashiro, Brown, and Campbell qualify as “independent” in accordance with the published listing requirements of Nasdaq. Mr. Foss does not qualify as independent because Mr. Foss is currently an employee of the Company. The Nasdaq rules have both objective and subjective tests for determining who is an “independent director.” The objective tests state, for example, that a director is not considered independent if he or she is an employee of the company, has been an employee within the prior three years, or is a partner in or executive officer of an entity to which the company made, or from which the company received, payments in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenue for that year. The subjective test states that an independent director must be a person who lacks a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The Board relies upon evaluation of director independence by the Board’s Governance Committee. In assessing independence under the subjective test, the Governance Committee took into account the standards in the objective tests and reviewed additional information provided by the directors with regard to each individual’s business and personal activities as they may relate to the Company and its management. Based on all the foregoing, as required by Nasdaq rules, the Governance Committee made a subjective determination as to each of Mses. Fiegel, Kelly, and Miyashiro and Messrs. Flanigan, Wilson, Wimsett, Brown, and Campbell that no relationship exists, which, in the opinion of the Committee, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The Governance Committee has not established categorical standards or guidelines to make these subjective determinations but considers all relevant facts and circumstances.

In making its independence determinations, the Governance Committee considered transactions occurring since the beginning of its 2018 fiscal year between the Company and entities associated with the independent directors or members of their immediate family. The Governance Committee considered the customer relationships between the Company and each of (1) the credit union associated with Ms. Miyashiro, (2) the bank associated with Ms. Fiegel and (3) the bank associated with Mr. Brown. For each of these customer relationships, the Governance Committee has determined that these transactions were on terms no less favorable to the Company than arrangements with other unaffiliated customers and that because of the amounts involved in relation to the total revenues of the Company and the applicable credit union or bank, the relationships did not impair the independence of Ms. Miyashiro, Ms. Fiegel, or Mr. Brown. In all cases and in all years reviewed, the amounts received by the Company from each of these institutions were less than 1% of the Company’s total revenue for the year. The Governance Committee also considered that Mr. Wimsett is Chairman, Managing Partner, and majority owner of Merchant’s PACT, which has a referral agreement with the Company pursuant to which the Company is paid a fee for referring customers to Merchant’s PACT. Because the amounts produced under this relationship have been well below amounts set in the Company’s Related Party Transactions Policy and constitute far less than 1% of the Company’s total revenue for the year, the Governance Committee has determined the relationship does not impair the independence of Mr. Wimsett. See “Certain Relationships and Related Transactions”, below for further information.

In addition to the Board-level standards for director independence, the directors who serve on the Audit Committee each satisfy standards established by the SEC providing that to qualify as “independent” for the purposes of membership, members of audit committees may not accept directly or indirectly any consulting, advisory, or other compensatory fee from the Company other than their director compensation.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES FOR ELECTION TO THE BOARD. PROXIES RECEIVED BY THE BOARD WILL BE VOTED FOR THE ELECTION OF EACH NOMINEE UNLESS STOCKHOLDERS SPECIFY IN THEIR PROXY CARD A VOTE OF “WITHHOLD” WITH RESPECT TO A NOMINEE.

12

CORPORATE GOVERNANCE

The Company and its businesses are managed under the direction of the Board. The Board generally meets a minimum of five times during the year but has complete access to management throughout the year.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines which include, among others, the following subjects (the following description is a summary as of September 20, 2021 and is qualified in its entirety by the Corporate Governance Guidelines, which may be updated or amended from time to time):

| Director Independence | •The majority of the Board should be independent under relevant Nasdaq standards. •Independent directors should not be compensated by the Company other than in the form of director’s fees (including any equity awards). •Membership on the Audit, Compensation, and Governance Committees should be limited to independent directors. | |||||||

| Stockholders Rights | •The Board will not adopt a shareholder rights plan or reprice stock options without a stockholder vote. •Stockholders may communicate with the Board by submitting written comments to the Secretary for the Company, who will screen out inappropriate communications and forward appropriate comments to the directors. | |||||||

| Meeting Requirements | •Non-management directors may meet in executive session from time to time with or without members of management. •The Board should have at least 4 regularly scheduled meetings a year and members are invited to attend an annual review of business strategy conducted with senior management. •Board members are expected to attend all Annual Meetings of the Stockholders. | |||||||

| Board Composition | •The Governance Committee is responsible for determining skills and characteristics of Board candidates, and should consider factors such as independence, experience, strength of character, mature judgment, technical skills, diversity, and age. •Board members should not sit on more than 3 other boards of public companies. •Directors may not stand for re-election after age 70 and any director first elected after May 14, 2021 may not stand for re-election after a total of 12 years of service. | |||||||

| Stock Requirements and Restrictions | •Directors, executive officers, and vice presidents of the Company should own minimum amounts of Company stock in relation to their base compensation and should retain and hold 75% of all shares granted, net of taxes, until the ownership requirements are met. •All directors, executives, and employees are prohibited from engaging in hedging transactions, short sales, pledges, and trading in any publicly traded options involving the Company’s stock. •Executives are subject to a Recoupment Policy providing for clawback of incentive compensation in the event of a restatement of financial statements due to material non-compliance with reporting requirements. | |||||||

| Board Operations | •The Board should conduct an annual self-evaluation to determine whether it and its committees are functioning properly and an annual performance evaluation for each individual director. •The Chief Executive Officer shall provide an annual report to the Governance Committee on succession planning. •The Board and its committees shall have the right at any time to retain independent counsel. •When the Chair is a member of management, the independent directors shall appoint a Lead Director to coordinate the activities of the independent directors, help to set the agenda and schedule for Board meetings, and chair Board and stockholder meetings in the absence of the Chair. | |||||||

13

Stockholder Recommended Director Candidates

The Board has also adopted a Nomination Policy with respect to the consideration of director candidates recommended by stockholders. A candidate submission from a stockholder will be considered at any time if the following information is submitted to the Secretary of the Company (the following description is qualified in its entirety by the Nomination Policy):

•The recommending stockholder’s name and address, together with the number of shares held, length of period held, and proof of ownership;

•Name, age, and address of candidate;

•Detailed resume of candidate, including education, occupation, employment, and commitments;

•Any information required to be disclosed in the solicitation of proxies for election of a director under the Exchange Act;

•Description of arrangements or understandings between the recommending stockholder and the candidate;

•Statement describing the candidate’s reasons for seeking election to the Board and documenting candidate’s satisfaction of qualifications described in the Corporate Governance Guidelines;

•A signed statement from the candidate, confirming willingness to serve; and

•If the recommending stockholder has been a beneficial holder of more than 5% of the Company’s stock for more than a year, then it must consent to additional public disclosures by the Company with regard to the nomination.

The Secretary of the Company will promptly forward complying nominee recommendation submissions to the Chair of the Governance Committee. The Governance Committee may consider nominees submitted from a variety of sources including but not limited to stockholder recommendations. If a vacancy arises or the Board decides to expand its membership, the Governance Committee will evaluate potential candidates from all sources and will rank them by order of preference if more than one is identified as properly qualified. A recommendation will be made to the Board by the Governance Committee based upon qualifications, interviews, background checks and the Company’s needs.

Stockholder Nominated Director Candidates

The Company’s Board has adopted a “Proxy Access for Director Nominations” bylaw as part of the Company’s Bylaws. The proxy access bylaw permits a stockholder, or a group of up to 20 stockholders, owning 3% or more of the Company’s outstanding common stock continuously for at least three years to nominate and include in the Company’s proxy materials director nominees constituting up to two individuals or 20% of the Board (whichever is greater), provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in Article II, Section 2.12 of our Bylaws. See “Stockholder Proposals and Nominations” on page 50 for more information.

Majority Election Policy

The Company’s Bylaws and Corporate Governance Guidelines require that a director nominee only be elected if he or she receives a majority vote of the votes cast with respect to his or her election in an uncontested election. Thus, for a nominee to be elected, the number of votes cast “For” must exceed the number of votes cast as “Withheld” for the nominee. If a nominee who is currently serving as a director is not re-elected with a majority of the votes cast, then under the Corporate Governance Guidelines, he or she is required to submit a resignation to the Board. In this event, the Governance Committee will consider the tendered resignation and will make a recommendation to the Board as to whether to accept or reject the resignation. The Board must act on the tendered resignation within 90 days from the date of certification of the election results and must also promptly disclose its decision and explain its rationale.

Board Leadership Structure

The Board does not have a fixed policy regarding the separation of the offices of Board Chair and Chief Executive Officer. These offices were held by different persons from 2004-2012 but were combined in one person (Mr. Prim) from 2012-2016. In 2016, these two offices were separated when Mr. Prim was appointed Executive Chair and Mr. Foss was appointed President and Chief Executive Officer. In 2021, these two offices were again combined when Mr. Foss was appointed as

14

Board Chair. The members of the Board believe that the Company has been well served in the past by both combined Chair/CEOs and by separate persons in these offices and believes that the Board should maintain the flexibility to combine or separate these offices in the future if deemed to be in the best interests of the Company.

The Board has adopted a governance guideline providing for an independent “Lead Director.” Under the guideline, when the Chair is a member of Company management, the independent directors will annually appoint from among themselves a Lead Director. The Lead Director will coordinate the activities of the independent directors, coordinate with the Chair to set the agenda and schedule for Board meetings, advise on materials distributed to directors, chair meetings of the Board and stockholders in the absence of the Chair, call and chair executive sessions of the independent directors, and perform other duties assigned from time to time by the Board. Mr. Flanigan currently serves as the Lead Director.

The Board is committed to strong, independent Board leadership and believes that objective oversight is critical to effective governance. Eight of our nine director nominees are independent, as are all members of each of the committees of the Board. The independent directors regularly meet in executive session without Mr. Foss, the sole non-independent director.

Communication with the Board

Stockholders and all other interested parties wishing to contact our Board may write to: Board of Directors of Jack Henry & Associates, Inc., Attn: Corporate Secretary, PO Box 807, 663 West Highway 60, Monett, MO 65708. The Corporate Secretary distributes this correspondence to the appropriate member(s) of the Board.

Risk Oversight

Pursuant to the Company’s Corporate Governance Guidelines, the Board performs its risk oversight function primarily through its Risk and Compliance, Audit, and Compensation Committees. The Risk and Compliance Committee has primary responsibility for overseeing, monitoring, and addressing the Company’s enterprise and operational risks. The Risk and Compliance Committee is charged with overseeing the Company’s risk management program that measures, prioritizes, monitors, and responds to risks. This oversight includes ensuring the adequacy of management’s design and implementation of information security measures. The Risk and Compliance Committee receives reports from the Company’s Chief Information Officer, as well as other members of management. The Audit Committee oversees risks relating to financial statements and reporting, credit, and liquidity risks. The Compensation Committee is charged with oversight of risks in compensation policies and practices. The Audit Committee and the Compensation Committee provide periodic reports regarding their risk assessments to the Risk and Compliance Committee. The Board receives regular reports from both the Risk and Compliance Committee of the consolidated risk assessments of these committees and from management. The Board assesses major risks and reviews with management options for risk mitigation. As such, the Board is informed and engaged when new risks arise. For example, in response to the COVID-19 global pandemic, the Board received and continues to receive regular reports from members of management to monitor and assess risks to our business and to manage the impact of the pandemic on our employees, customers, suppliers and other business partners, and the communities in which we operate.

Corporate Responsibility and Sustainability

The Company has long incorporated a commitment to corporate social responsibility into the way it does business and is committed to both doing the right thing and increasing stockholder value through increased focus and disclosure on these issues. The Board has overall oversight responsibility for matters related to environmental, social, and governance issues, with individual Board committees responsible for certain subcomponents. The executive leadership team is held accountable for execution through their lines of business. The Company published its inaugural sustainability report in December 2020. The sustainability report is posted on our web site at www.jackhenry.com under the “Investors” tab. In April 2021, Jack Henry launched its first environmental sustainability focused Business Innovation Group, Go Green.

Code of Conduct

The members of the Board, as well as the executive officers and all other employees, contractors, vendors, and business partners of the Company are subject to and responsible for compliance with the Jack Henry & Associates Code of Conduct.

15

The Code of Conduct contains policies and practices for the ethical and lawful conduct of our business, as well as procedures for confidential investigation of complaints and discipline of wrongdoers.

Governance Materials Available

The Company has posted its significant corporate governance documents on its website at https://ir.jackhenry.com/corporate-governance. There you will find copies of the current Corporate Governance Guidelines, the Code of Conduct, the Human Rights Commitment and Policy Statement, the Compensation Committee Charter, the Governance Committee Charter (with attached Nomination Policy), Audit Committee Charter, and the Risk and Compliance Committee Charter, as well as the Company’s Certificate of Incorporation and Bylaws. Other investor relations materials are also posted at http://ir.jackhenry.com, including SEC reports, financial statements, and news releases.

The Board of Directors and Its Committees

The Board held four regular meetings and three special meetings during the last fiscal year. Each director attended at least 75% of all meetings of the Board and all committees on which they served. The independent directors met in four executive sessions without management present during the last fiscal year. In accordance with our Corporate Governance Guidelines, all the directors attended the Annual Meeting of the Stockholders held on November 17, 2020.

The Governance Committee of the Board has determined that eight of the Board’s nine members, Flanigan, Wilson, Fiegel, Wimsett, Kelly, Miyashiro, Brown, and Campbell are independent directors under applicable Nasdaq standards.

The Board has adopted stock ownership guidelines within the Corporate Governance Guidelines establishing stock ownership goals applicable to directors as well as senior management of the Company. Each non-employee director of the Company is expected to own Company shares having a value of at least five times the annual director cash retainer. Under the terms of the guidelines, new directors should be in compliance with this standard within five years after joining the Board. For this purpose, in addition to shares held outright, directors may include shares held in trust for immediate family members as well as the “in-the-money” value of any vested stock options and all vested and unvested restricted stock units. As measured on June 30, 2021, all directors on such date were in compliance with these guidelines.

The Board has the following four standing committees, each of which operates under a written charter adopted by the Board:

| Audit Committee | ||||||||

Thomas H. Wilson, Jr. (Chair) | The Audit Committee selects and oversees the independent auditor, reviews the scope and results of the annual audit, including critical audit matters, reviews critical accounting policies, reviews internal controls over financial reporting, pre-approves retention of the independent registered public accounting firm for any services, oversees our internal audit function, reviews and approves all material related party transactions, reviews regulatory examination results and addresses financial reporting risks. All members of the Audit Committee are independent. The Board has determined that Mr. Flanigan, Mr. Wilson, and Mr. Wimsett are each an “audit committee financial expert” as defined by the SEC because of their extensive accounting and financial experience. Please see the Audit Committee Report in this Proxy Statement for information about our 2021 fiscal year audit. | |||||||

| Matthew C. Flanigan | ||||||||

| Thomas A. Wimsett | ||||||||

| Wesley A. Brown | ||||||||

Meetings in FY2021: 17 | ||||||||

16

| Compensation Committee | ||||||||

Matthew C. Flanigan (Chair) | The Compensation Committee establishes and reviews the compensation, perquisites, and benefits of the Company’s executive officers, evaluates the performance of senior executive officers, makes recommendations to the Board on director compensation, considers incentive compensation plans for our employees, and carries out duties assigned to the Compensation Committee under our equity compensation plans and employee stock purchase plan. Under its charter, the Compensation Committee has the authority to delegate certain responsibilities to subcommittees, but it may not delegate any matter relating to senior executive compensation. To date, the Compensation Committee has not delegated any of its responsibilities. All members of the Compensation Committee are independent. Please see the Compensation Committee Report and the Compensation Discussion and Analysis in this Proxy Statement for further information about the Compensation Committee’s process and decisions in fiscal 2021. | |||||||

| Thomas H. Wilson, Jr. | ||||||||

| Shruti S. Miyashiro | ||||||||

| Wesley A. Brown | ||||||||

Meetings in FY2021: 11 | ||||||||

| Governance Committee | ||||||||

Laura G. Kelly (Chair) | The Governance Committee identifies, evaluates and recruits qualified individuals to stand for election to the Board, recommends corporate governance policy changes, reviews executive succession planning, and evaluates Board performance. The Governance Committee will consider candidates recommended by stockholders, provided such recommendations are made in accordance with the procedures set forth in the “Governance Committee Nomination Policy” attached to its charter, discussed in greater detail in “Stockholder Recommended Director Candidates,” above. All members of the Governance Committee are independent. | |||||||

| Jacque R. Fiegel | ||||||||

| Matthew C. Flanigan | ||||||||

| Curtis A. Campbell | ||||||||

Meetings in FY2021: 12 | ||||||||

| Risk and Compliance Committee | ||||||||

Jacque R. Fiegel (Chair) | The Risk and Compliance Committee reviews the Company’s compliance practices, reviews enterprise risks, oversees the Company’s risk assessment and management programs, reviews risk preparedness and mitigation, monitors regulatory compliance and oversees response to regulatory requirements. All members of the Risk and Compliance Committee are independent. Please see “Risk Oversight” above for further information about the Committee’s risk management responsibilities. | |||||||

| Thomas A. Wimsett | ||||||||

| Laura G. Kelly | ||||||||

| Shruti S. Miyashiro | ||||||||

| Curtis A. Campbell | ||||||||

Meetings in FY2021: 9 | ||||||||

Compensation Committee Interlocks and Insider Participation

During our 2021 fiscal year, Messrs. Flanigan, Wilson, and Brown and Ms. Miyashiro served on the Compensation Committee. None of the members of the Compensation Committee is currently or was formerly an officer or employee of the Company. Ms. Miyashiro is President and CEO of Orange County’s Credit Union, which is a customer of the Company as described below in “Certain Relationships and Related Transactions.” There are no other Compensation Committee interlocks and no insider participation in compensation decisions that are required to be reported under the SEC’s rules and regulations.

Director Compensation

The following table sets forth compensation paid to our non-employee directors in fiscal year 2021. The compensation paid to Mr. Foss as an employee is detailed below at “Executive Compensation.”

17

| Name | Fees Earned or Paid in Cash | Stock Awards | Options Awards | Non-Equity Incentive Plan Compensation | All Other Compensation | Total | |||||||||||||||||||||||

| ($) | ($) (1) (2) | ($) | ($) | ($) | ($) | ||||||||||||||||||||||||

| John F. Prim | (3) | 221,000 | 163,254 | - | - | - | 384,254 | ||||||||||||||||||||||

| Matthew C. Flanigan | 154,500 | 163,254 | - | - | - | 317,754 | |||||||||||||||||||||||

| Thomas H. Wilson, Jr. | 124,500 | 163,254 | (4) | - | - | - | 287,754 | ||||||||||||||||||||||

| Jacque R. Fiegel | 112,500 | 163,254 | - | - | - | 275,754 | |||||||||||||||||||||||

| Laura G. Kelly | 109,000 | 163,254 | - | - | - | 272,254 | |||||||||||||||||||||||

| Wesley A. Brown | 104,500 | 163,254 | - | - | - | 267,754 | |||||||||||||||||||||||

| Thomas A. Wimsett | 101,500 | 163,254 | - | - | - | 264,754 | |||||||||||||||||||||||

| Shruti S. Miyashiro | 92,500 | 163,254 | - | - | - | 255,754 | |||||||||||||||||||||||

| Curtis. A. Campbell | (5) | - | - | - | - | - | - | ||||||||||||||||||||||

(1) These amounts reflect the aggregate grant date fair value of restricted stock units granted in the fiscal year ended June 30, 2021, in accordance with FASB ASC Topic 718. For assumptions used in determining the fair value of restricted stock units granted, see Note 10 to the Company’s 2021 Consolidated Financial Statements.

(2) As of June 30, 2021, each director listed here, other than Mr. Campbell, held an aggregate of 3,197 unvested restricted stock units.

(3) Mr. Prim retired from the Board in June 2021.

(4) Includes amounts deferred pursuant to the Company’s Non-Employee Director Deferred Compensation Plan.

(5) Mr. Campbell was appointed to the Board on July 1, 2021 and received no compensation in fiscal year 2021.

A director who is employed by the Company does not receive any separate compensation for service on the Board. In the fiscal year ended June 30, 2021, each non-employee director received annual retainer compensation of $40,000 per year plus $3,500 for attending each full-day in-person or remote Board meeting and $1,500 for each half-day or less in-person or remote Board meeting. The annual retainer is paid following the Annual Meeting of the Stockholders with respect to the period running from the Annual Meeting in November to the next Annual Meeting. Each non-employee director is also reimbursed for out-of- pocket expenses incurred in attending all Board and committee meetings.

If there is a Non-Executive Chair, such individual is compensated with an additional annual retainer amount of $100,000. Mr. Prim served as Non-Executive Chair during fiscal year 2021, but retired from the Board on June 30, 2021. The current Board Chair, Mr. Foss, is an employee of the Company and does not receive compensation for his service on the Board. The Lead Director (Mr. Flanigan) is compensated with an additional annual retainer amount of $20,000.

Equity compensation is paid annually to the non-employee directors in the form of restricted stock units. These restricted stock units are issued under the Company’s 2015 Equity Incentive Plan. For fiscal 2021, the annual grant amount paid to each non-employee director was targeted at $165,000. This consisted of 1,022 restricted stock units, granted on the third business day following the date of the 2020 Annual Meeting. The fiscal 2021 restricted stock units granted to the non-employee directors will vest on November 20, 2021.

In the year ended June 30, 2021, the chair of the Audit Committee and the Risk and Compliance Committee each received an annual retainer of $20,000 and the chair of the Compensation Committee and the Governance Committee each received an annual retainer of $15,000. Meeting fees (in-person or remote) of the committees, paid to all attending Board members, were $1,500 per meeting for all Board committees.

In fiscal 2021, the directors listed above were not eligible to participate in any non-equity incentive compensation plan from the Company or any pension plan of the Company. Non-employee directors are eligible for and may elect to participate in the Company’s Non-Employee Director Deferred Compensation Plan. In fiscal 2021, only the restricted stock unit awards to non-employee directors were eligible for deferral and one of the non-employee directors elected deferral of all or part of their award. Deferred amounts are maintained by the Company in bookkeeping accounts. Stock awards that are deferred are deemed invested in the Company’s common stock, and deemed dividends paid on deferred equity awards are invested in a Federal Rate fund. The deferred amounts are unsecured obligations of the Company. Restricted stock units that are deferred

18

under the Company’s Non-Employee Director Deferred Compensation Plan may be settled in stock or, at the option of the Compensation Committee, in cash.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Related Party Transactions

Director Shruti S. Miyashiro is President and Chief Executive Officer of Orange County’s Credit Union of Santa Ana, California. Orange County’s Credit Union is a customer of the Company and during the year ended June 30, 2021, it paid $1,208,166 to the Company, primarily for software maintenance, electronic payment solutions, and implementation services. The Audit Committee has reviewed the transactions with the credit union and has concluded that they were on terms no less favorable to the Company than arrangements with other unaffiliated customers.

Director Jacque R. Fiegel is Chairman, Central Oklahoma Area, Prosperity Bank, which is a customer of the Company. In November 2019, the parent entity of Prosperity Bank acquired LegacyTexas Bank through a merger, which is also a customer of the Company. Combined total fiscal 2021 cash receipts from Prosperity Bank and cash receipts from LegacyTexas Bank were $791,134, primarily for software maintenance, electronic payment solutions, and item processing. The Audit Committee has reviewed the transactions with these banks and has concluded that they were on terms no less favorable to the Company than arrangements with other unaffiliated customers.

Director Wesley A. Brown is a director of FirstBank Holding of Lakewood, Colorado which is a customer of the Company. Total fiscal 2021 cash receipts from this customer were $605,261, primarily for software maintenance and online financial management. The Audit Committee has reviewed the transactions with the bank and has concluded that they were on terms no less favorable to the Company than arrangements with other unaffiliated customers.

Director Thomas A. Wimsett is Chairman, Managing Partner, and majority owner of Merchant’s PACT, formerly known as Wimsett & Co. On July 1, 2016, a “Referral Partner Agreement” was entered into between Merchant’s PACT and the Company under which the Company may refer certain customers to Merchant’s PACT for credit and debit card consulting services with a portion of the consulting fees paid to the Company for the referrals. On July 15, 2019, Merchant’s PACT and the Company entered into an “Amended and Restated Referral Partner Agreement” which expanded the scope of the services and responsibilities of Merchant’s PACT stated in the 2016 Referral Partner Agreement. In addition to the credit and debit card consulting services, Merchant’s PACT may also engage and negotiate with certain merchant processing companies on revenue share, pricing, and terms on behalf of financial institution customers and their merchants. Under the terms of the amended agreement, all payments are made from Merchant’s PACT to the Company and Merchant’s PACT will not receive any payments from the Company. Merchant’s PACT paid the Company less than $10,000 in referral fees in fiscal 2021.

The Audit Committee reviewed the relationship with Ms. Fiegel and determined that because Ms. Fiegel is an employee and not an executive officer of Prosperity Bank, and the total amounts paid to the Company do not exceed the greater of $1,000,000 or two percent of that customer’s total annual revenue, this relationship falls under the standing pre-approval granted in the Related Party Transaction Policy. The Audit Committee also reviewed the relationships with each of Mr. Brown and Mr. Wimsett and determined that they each did not qualify as a “Related Party Transaction” under the policy because, for Mr. Brown, he is solely a director of FirstBank Holding and the aggregate amount involved did not exceed the greater of $1,000,000 or two percent of that customer’s total annual revenue and because, for Mr. Wimsett, total payments from Merchant’s PACT to the Company in fiscal 2021 did not exceed $100,000. The Governance Committee also considered each of the transactions described in this paragraph and concluded that Ms. Miyashiro, Ms. Fiegel, and Mr. Brown to be independent directors despite the customer relationships. The Governance Committee also determined Mr. Wimsett to be independent despite the relationship between the Company and Merchant’s PACT.

Related Party Transaction Policy

The Board has adopted a written policy that requires all related party transactions to be reviewed and approved by the Audit Committee of the Board. The Audit Committee is charged with determining whether a related party transaction is in the best

19

interests of, or not inconsistent with the interests of, the Company and its stockholders. In making this determination, the Audit Committee will consider such factors as whether the related party transaction is on terms no less favorable to the Company than terms generally available to unaffiliated third parties and the extent of the related party’s interest in the transaction. No director may participate in any discussion, approval, or ratification of any transaction in which he or she has an interest, except for the purpose of providing information concerning the transaction. For transactions in which the aggregate amount is expected to be less than $200,000, the Chair of the Audit Committee has been delegated the authority to pre-approve related party transactions, subject to later review by the full committee. At least annually, ongoing related party transactions will be reviewed to assess continued compliance with the policy. For purposes of the Related Party Transaction Policy, a related party transaction is a transaction or relationship in which the aggregate amount involved will be or may exceed $100,000 in any calendar year, involves the Company as a participant, and in which any related party has or will have a direct or indirect interest (other than solely as a result of being a director or less than 10% beneficial owner of the other entity). A related party is any executive officer, director, or more than 5% beneficial owner of the Company or any immediate family member of such persons.

The policy also contains standing pre-approvals of certain transactions that are not believed to pose any material risk to the Company even if the aggregate amount exceeds $100,000 in a calendar year, including: employment arrangements with executive officers, director compensation, transactions involving competitive bids, certain banking-related services, certain Company charitable contributions, transactions where all stockholders receive proportional benefits, certain regulated transactions, and satisfaction of indemnification obligations. Standing approval is also provided for transactions with another company where the related party’s only relationship is as an employee (other than an executive officer), director, or beneficial owner of less than 10% of that entity’s shares, if the aggregate amount does not exceed the greater of $1,000,000 or 2% of that entity’s annual revenues.

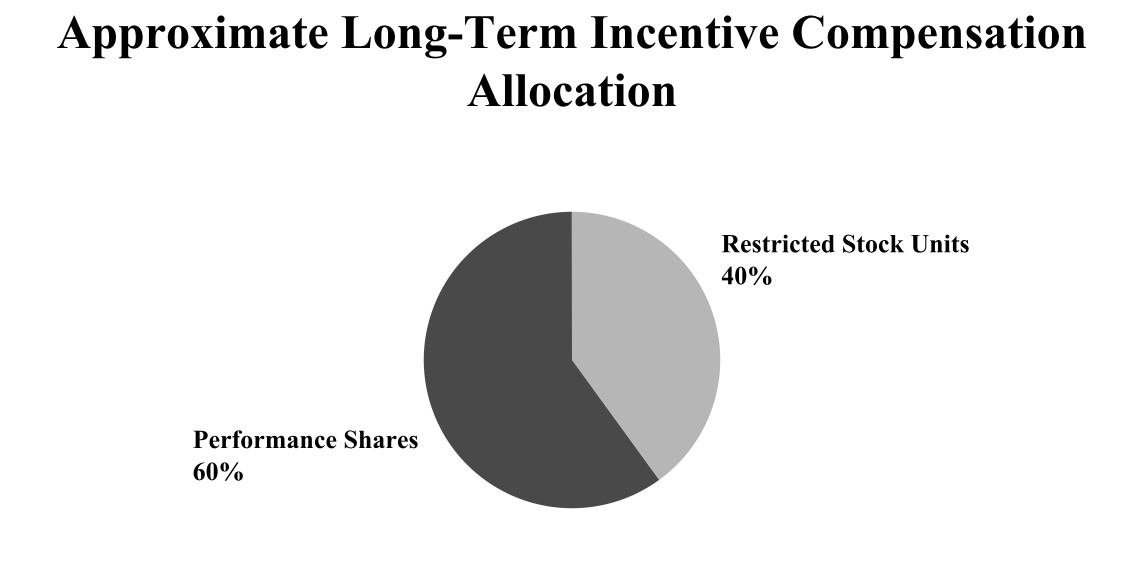

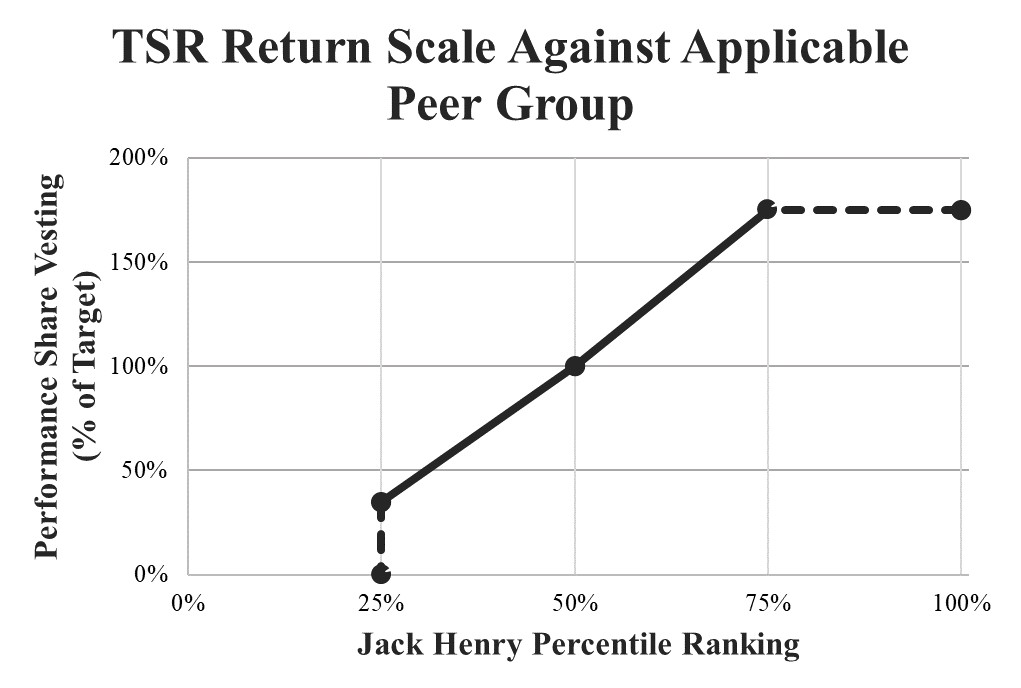

DELINQUENT SECTION 16(a) REPORTS