Form DEF 14A HAEMONETICS CORP For: Jun 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x | Filed by a Party other than the Registrant ☐ | ||||

| Check the appropriate box: | |||||

| ☐ | Preliminary Proxy Statement | ||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| x | Definitive Proxy Statement | ||||

| ☐ | Definitive Additional Materials | ||||

| ☐ | Soliciting Material under §240.14a-12 | ||||

HAEMONETICS CORPORATION

(Name of Registrant as Specified in Its Charter)

| Payment of Filing Fee (Check the appropriate box): | |||||

| x | No fee required. | ||||

| ☐ | Fee paid previously with preliminary materials. | ||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

| ||

| Notice of Annual Meeting of Shareholders and Proxy Statement | ||

| Friday, August 5, 2022 8:00 A.M. Eastern Time | ||

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Friday August 5, 2022

8:00 A.M. Eastern Time

8:00 A.M. Eastern Time

125 Summer Street, Boston, Massachusetts 02110

To Our Shareholders:

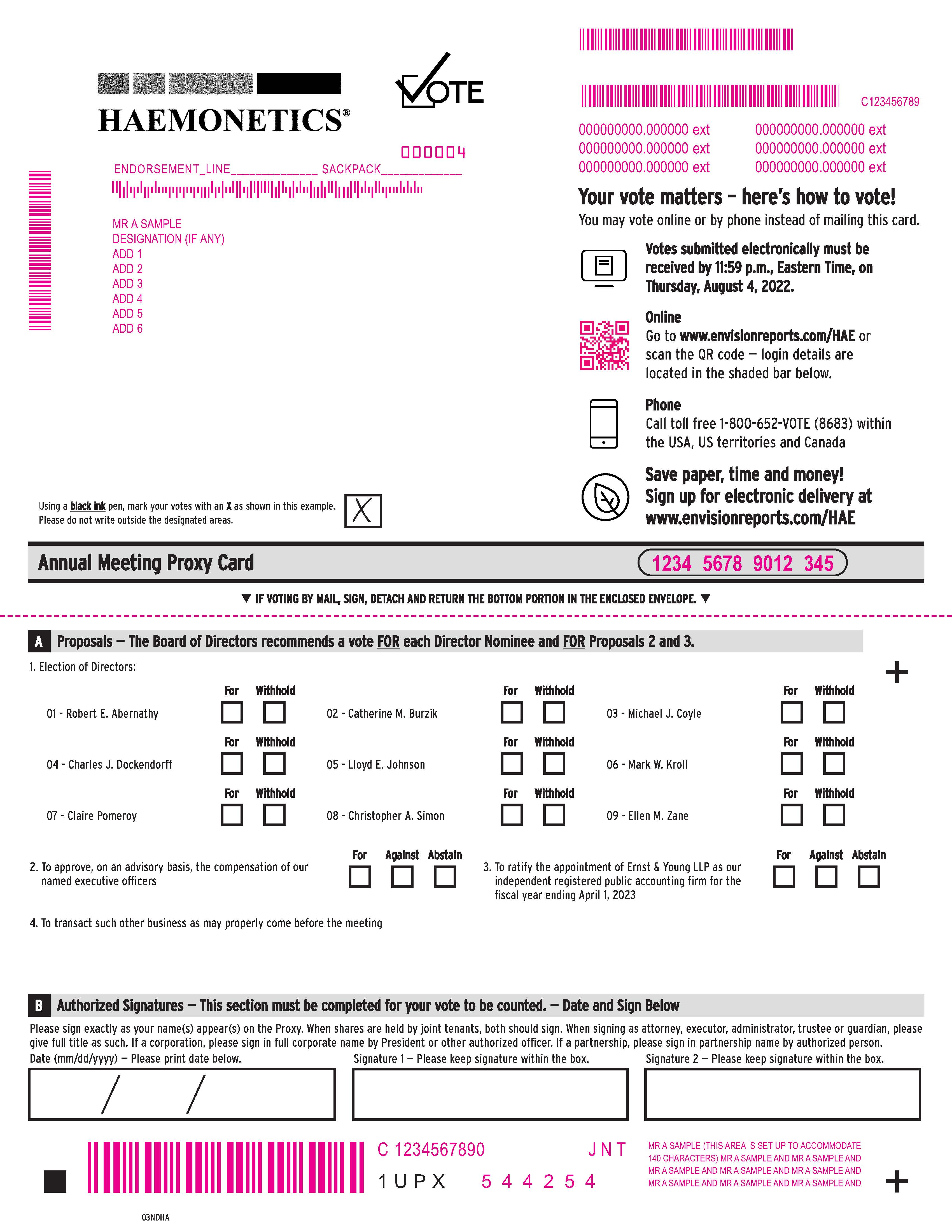

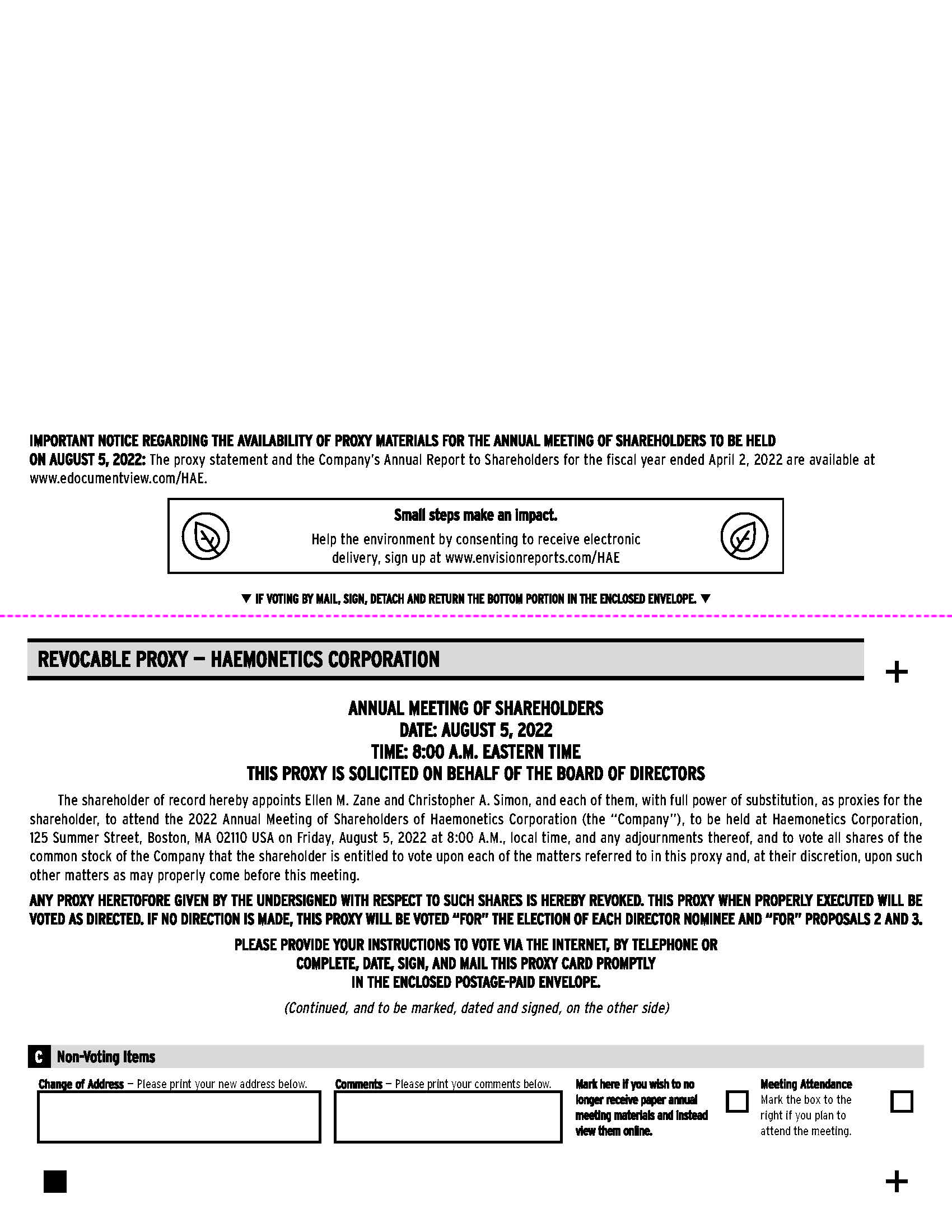

The 2022 Annual Meeting of Shareholders of Haemonetics Corporation, a Massachusetts corporation (the "Company"), will be held on Friday, August 5, 2022 at 8:00 A.M., Eastern Time, at the offices of the Company, 125 Summer Street, Boston, Massachusetts 02110 for the following purposes:

1 To elect the nine director nominees named in the proxy statement to one-year terms expiring in 2023; | ||

2 To approve, on an advisory basis, the compensation of our named executive officers; | ||

3 To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending April 1, 2023; and | ||

4 To transact such other business as may properly come before the meeting. | ||

The foregoing items of business are more fully described in the proxy statement accompanying this Notice of Annual Meeting of Shareholders. Additionally, we continue to carefully monitor COVID-19 developments and related guidance issued by Massachusetts regulatory agencies and relevant health organizations. Should we determine that alternative arrangements for the meeting may be advisable or required, such as changing the date, time, location or format of the meeting (including holding a virtual meeting, subject to local law requirements), we will announce our decision by press release and through our filings with the Securities and Exchange Commission and post additional information on our investor relations website at www.haemonetics.com.

We are pleased to continue utilizing the Securities and Exchange Commission rules that allow companies to furnish proxy materials to their shareholders on the Internet. We believe these rules allow us to provide you with the information you need while lowering the costs of delivery and reducing the environmental impact of the meeting. On or about June 20, 2022, we will mail to our shareholders of record as of June 2, 2022, the record date for the meeting, a Shareholder Meeting Notice and Important Notice Regarding the Availability of Proxy Materials containing instructions on how to access our proxy statement and our 2022 Annual Report to Shareholders (unless the shareholder previously requested electronic or paper delivery on an ongoing basis).

Your vote is important. Whether or not you plan to attend the meeting, we encourage you to vote your shares. Accordingly, we request that as soon as possible, you vote via the Internet or, if you have received printed proxy materials, you vote via the Internet, by telephone or by mailing your completed proxy card or voter instruction form.

By Order of the Board of Directors

Michelle L. Basil

Corporate Secretary

Boston, Massachusetts

June 17, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON AUGUST 5, 2022: This proxy statement and the Company’s 2022 Annual Report to Shareholders are available at www.envisionreports.com/HAE. | ||

HAEMONETICS CORPORATION | 2022 Proxy Statement 1

TABLE OF CONTENTS

Page Number | |||||

2 HAEMONETICS CORPORATION | 2022 Proxy Statement

PROXY STATEMENT SUMMARY

This summary highlights selected information in this proxy statement (this "Proxy Statement"), which is being furnished in connection with the solicitation of proxies by Haemonetics Corporation for use at the 2022 Annual Meeting of Shareholders. Please review this entire Proxy Statement before voting. References in this Proxy Statement to "Haemonetics," the "Company," "we," "us" or "our" refer to Haemonetics Corporation.

| Voting Roadmap | ||

2022 ANNUAL MEETING OF SHAREHOLDERS

| Date and Time: | Friday, August 5, 2022 at 8:00 A.M., Eastern Time | ||||

| Place: | Haemonetics Corporation 125 Summer Street Boston, MA 02110 | ||||

| Commence Mail Date: | On or about June 20, 2022 | ||||

| Record Date: | June 2, 2022 | ||||

MEETING AGENDA AND VOTING RECOMMENDATIONS

Voting Items | Board Recommendation | For Further Information | |||||||||||||||

| 1 | Election of nine director nominees named in this Proxy Statement for one-year terms expiring at the 2023 Annual Meeting of Shareholders | FOR each director nominee | Page 8 | ||||||||||||||

| 2 | Approval, on an advisory basis, of our named executive officers’ compensation | FOR | Page 18 | ||||||||||||||

| 3 | Ratification of our independent registered public accounting firm for fiscal 2023 | FOR | Page 47 | ||||||||||||||

HOW TO VOTE

ONLINE | BY PHONE | BY MAIL | IN PERSON | |||||||||||||||||

Go to www.envisionreports.com/HAE and enter the 15-digit control number provided on your proxy card or voting instruction form. | If you received a paper copy of your proxy materials by mail, call the number on your proxy card or voting instruction form. You will need the 15-digit control number provided on your proxy card or voting instruction form. | If you received a paper copy of your proxy materials by mail, complete, sign and date the proxy card or voting instruction form and mail it in the accompanying pre-addressed envelope. | See the instructions beginning on page 54 regarding how to attend and vote in person at the meeting. | |||||||||||||||||

HAEMONETICS CORPORATION | 2022 Proxy Statement 3

| Performance Highlights | ||

Haemonetics is a global healthcare company dedicated to providing a suite of innovative medical products and solutions for customers, to help them improve patient care and reduce the cost of healthcare. Our technology addresses important medical markets: blood and plasma component collection, the surgical suite and hospital transfusion services. We view our operations and manage our business in three principal reporting segments: Plasma, Blood Center and Hospital. The Company's common stock trades on the New York Stock Exchange ("NYSE") under the symbol "HAE."

Fiscal 2022 was a challenging year for Haemonetics but we are proud of how our people responded. We continued to strengthen and grow our business despite the continued challenges caused by COVID-19, and we acted with urgency to address the transition of CSL Plasma (“CSL”), one of our largest customers, following its April 2021 notice of intent not to renew its current U.S. supply agreement for the use of Haemonetics PCS2® Plasma Collection System devices and the purchase of plasma disposables that was set to expire in June 2022 (including negotiating an extended transition of the CSL agreement through December 2023, on a non-exclusive basis). Our agility and perseverance through these challenges helped us achieve growth in our Plasma and Hospital businesses and further stabilize our Blood Center business, and we continued to distinguish Haemonetics for the meaningful value we are creating across our markets. As the industry leader, we delivered integrated solutions to help our Plasma customers realize much needed increases in the volume of collections. In the face of unprecedented blood shortages, our Blood Center products helped maximize the impact of donations and attract and retain donors. Hospital, including our new Vascular Closure product line acquired through our March 2021 purchase of Cardiva Medical, Inc. ("Cardiva Medical") continued to exceed expectations and was our fastest growing business in fiscal 2022, helping customers improve patient care and outcomes at less cost. The acquisition of Cardiva Medical was an important step in our transformational growth journey, and we remain focused on further optimizing our portfolio and accelerating growth. Our Operational Excellence Program also proved fundamental to our resilience and ability to quickly address supply chain disruptions and serve all who depend on us. This program will continue to play a critical role in our ongoing transformation, enabling us to sustain our success, become a more agile, efficient and productive company, create lasting cost savings and free up resources to fund growth investments. We look forward to sharing more detail about our long-range plans to deliver value for customers and shareholders at our fiscal 2023 Investor Day.

For further discussion of our fiscal 2022 business highlights and how our fiscal 2022 performance affected our Named Executive Officers' compensation, please see our Compensation Discussion and Analysis beginning on page 21. For additional information on our fiscal 2022 financial results and Haemonetics' COVID-19 response efforts please see our Annual Report on Form 10-K for the fiscal year ended April 2, 2022.

| Governance Highlights | ||

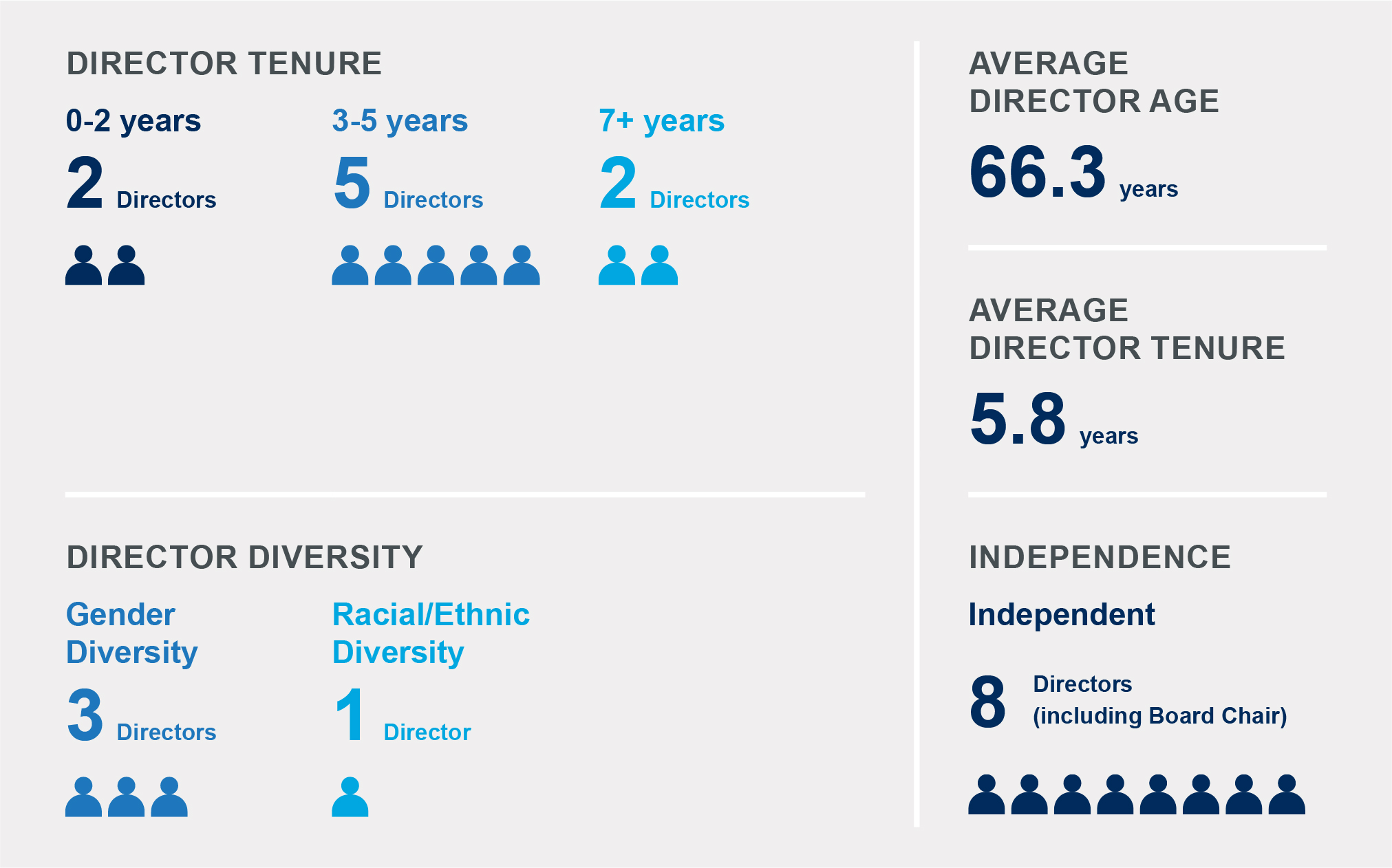

The following "Governance Highlights" are for the nine Board members nominated for re-election at our 2022 Annual Meeting of Shareholders, all of whom (with the exception of Christopher A. Simon, our President and Chief Executive Officer) are independent.

BOARD COMPOSITION SNAPSHOT

4 HAEMONETICS CORPORATION | 2022 Proxy Statement

BOARD MEMBERS

Name and Principal Professional Experience | Age | Director Since | Independent | Committee Membership | ||||||||||

DIRECTOR NOMINEES | ||||||||||||||

Christopher A. Simon President and Chief Executive Officer, Haemonetics | 58 | 2016 | N/A | |||||||||||

Robert E. Abernathy Retired Chairman and Chief Executive Officer, Halyard Health, Inc. | 67 | 2017 | ü | Compensation  Technology | ||||||||||

Catherine M. Burzik Former President and Chief Executive Officer, Kinetic Concepts, Inc. | 71 | 2016 | ü | Audit Technology  | ||||||||||

Michael J. Coyle Former President and Chief Executive Officer, iRhythm Technologies, Inc. | 60 | 2020 | ü | Audit Governance and Compliance | ||||||||||

Charles J. Dockendorff Retired Executive Vice President and Chief Financial Officer, Covidien plc | 67 | 2014 | ü | Audit  Governance and Compliance | ||||||||||

Lloyd E. Johnson Retired Global Managing Director, Finance and Internal Audit, Accenture Corporation | 68 | 2021 | ü | Audit Governance and Compliance | ||||||||||

Mark W. Kroll, Ph.D. Retired Senior Executive Officer, St. Jude Medical, Inc. | 69 | 2006 | ü | Compensation Technology | ||||||||||

Claire Pomeroy, M.D., M.B.A. President, Albert and Mary Lasker Foundation | 67 | 2019 | ü | Compensation Technology | ||||||||||

Ellen M. Zane (Board Chair) CEO Emeritus of Tufts Medical Center | 70 | 2018 | ü | Compensation Governance and Compliance  | ||||||||||

Committee Chair

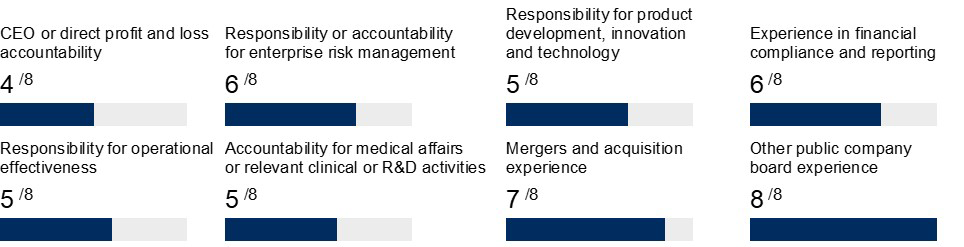

Committee ChairINDEPENDENT DIRECTOR QUALIFICATIONS

As discussed below under “Board Composition and the Director Nomination Process” (beginning on page 8), the Governance and Compliance Committee is responsible for reviewing and assessing the appropriate skills, experience and background that should be reflected in the composition of the Board. The experience, expertise and diversity represented by the Board as a collective body allows the Board to lead Haemonetics in a manner that serves its shareholders’ interests appropriately. The Governance and Compliance Committee believes that the independent directors on our Board have an effective mix of experience, qualifications, attributes and skills that are important to our business, which include:

BOARD REFRESHMENT

The Board does not endorse arbitrary term limits for director service, nor does it believe in automatic re-nomination until directors reach the mandatory retirement age. The Board and each Committee of the Board conduct an annual self-evaluation of their performance, which is an important determinant for Board refreshment. Beginning in fiscal 2023, the Board has determined to further enhance its annual self-evaluation process by incorporating an individual Board member peer review component.

HAEMONETICS CORPORATION | 2022 Proxy Statement 5

Under the Company’s Principles of Corporate Governance, directors are required to retire from the Board as of the annual shareholders meeting coincident with or next following his or her 72nd birthday. Upon the recommendation of the Governance and Compliance Committee, the Board may waive this requirement for a director if it deems such waiver to be in the best interests of the Company. During the Company's fiscal 2022 annual shareholder outreach, Board members engaged with shareholders on potential modifications to the age 72 mandatory retirement policy in conjunction with the addition of a peer review component to the annual Board evaluation process, with shareholders expressing either support or deference to the Board's determination. For more information on the Company's' annual shareholder outreach see "Shareholder Outreach" on page 6 below.

| How We Think About Board Refreshment | ||

| ||

BEST PRACTICES

We are committed to high standards in corporate governance and creating a corporate governance environment that supports the long-term success of our Company. Our governance practices include the following:

BOARD PRACTICES | SHAREHOLDER PRACTICES | |||||||

ü Independent Board Chair and directors (other than CEO) ü Committees consist solely of independent directors ü Annual election of directors (phase out of classified Board complete as of the 2022 Annual Meeting of Shareholders) ü Regular executive sessions of independent directors ü Board oversight of risk management and compliance ü Annual Board/Committee evaluations, including Board member peer review beginning in fiscal 2023 | ü Transparent and active shareholder engagement (outreach to over 52% of shares outstanding in each of last four years) ü Annual say on pay advisory vote, with over 95% approval in each of the last seven years ü Majority voting provisions in Charter and By-Laws ü Shareholder right to call special meetings ü Director resignation policy if a director does not obtain a majority of the votes cast in an uncontested election ü No shareholder rights plan (i.e., a "poison pill") | |||||||

OTHER BEST PRACTICES | ||||||||

ü Maintain strong executive compensation governance and pay practices (see "Strong Governance and Pay Practices" beginning on page 24) | ||||||||

SHAREHOLDER OUTREACH

The Company is committed to transparent and active engagement with its shareholders. On an ongoing basis, members of senior management meet with shareholders to discuss the Company's business fundamentals, performance and long-term outlook. Our Board also proactively engages with shareholders on governance and executive compensation matters and other topics of shareholder interest. During the fall and winter of fiscal 2022, our Board Chair (who also Chairs our Governance and Compliance Committee) and Compensation Committee Chair offered meetings to nine of our largest shareholders that collectively held over 52% of our outstanding shares. Together with our Executive Vice President, General Counsel and Director, Investor Relations, these Board members met in January 2022 with shareholders representing approximately 30% of shares outstanding to discuss, among other things, Haemonetics' corporate strategy and performance, board diversity and refreshment, executive compensation, corporate responsibility and other governance matters. Details of shareholder feedback are discussed throughout this Proxy Statement.

For information on how to contact our Board please see "Communications with the Board of Directors" on page 13.

6 HAEMONETICS CORPORATION | 2022 Proxy Statement

CORPORATE RESPONSIBILITY

"We make it possible. You make it matter." At Haemonetics, our Purpose inspires the important work we do every day to meaningfully advance patient care and drive greater possibilities in healthcare. How we do this work is equally important. Guided by our Purpose, and mindful of our shareholders, customers, employees and other key stakeholders whose trust we value, we are committed to being a good corporate citizen and take responsibility to proactively identify and manage the environmental, social and governance (“ESG”) risks and opportunities that are relevant to our business and those we serve. Please visit the “Corporate Responsibility” page on our website www.haemonetics.com for more information on our ESG-related policies and practices.

We look forward to publishing our first Corporate Responsibility report in fiscal 2023.

| Performance Highlights | ||

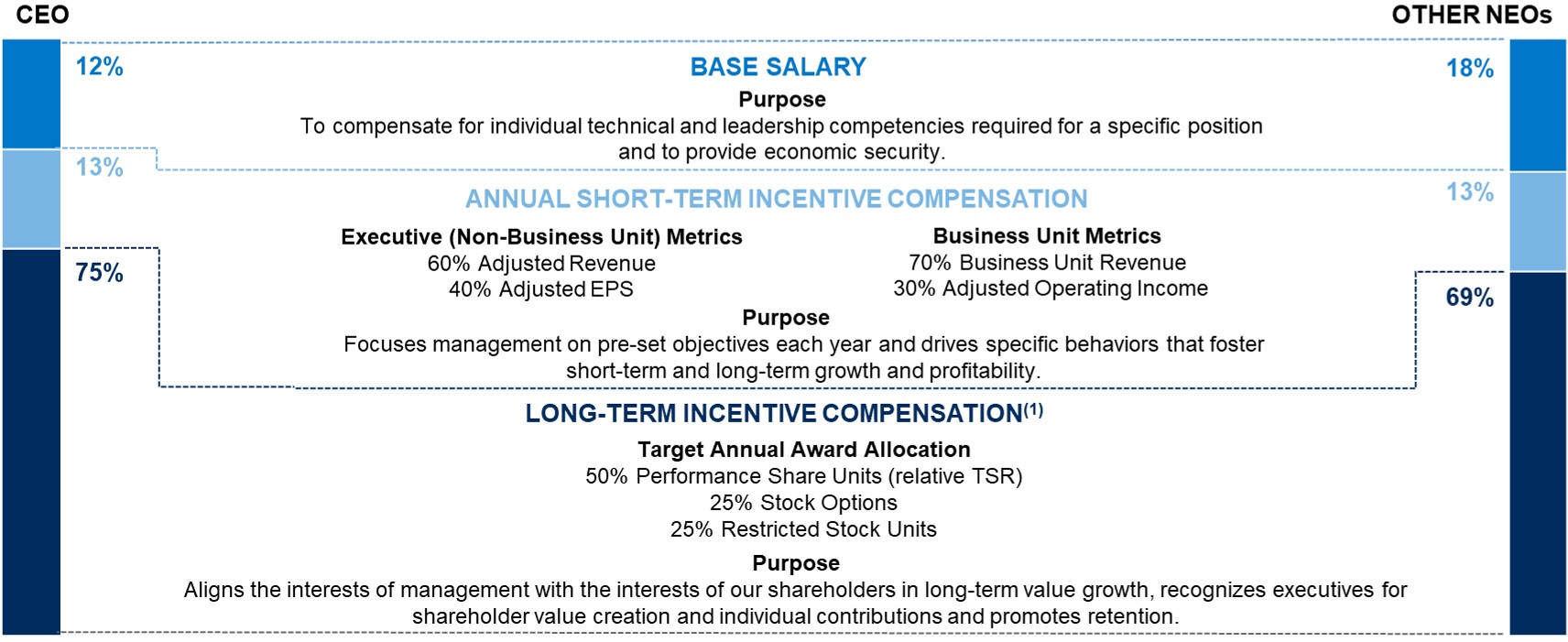

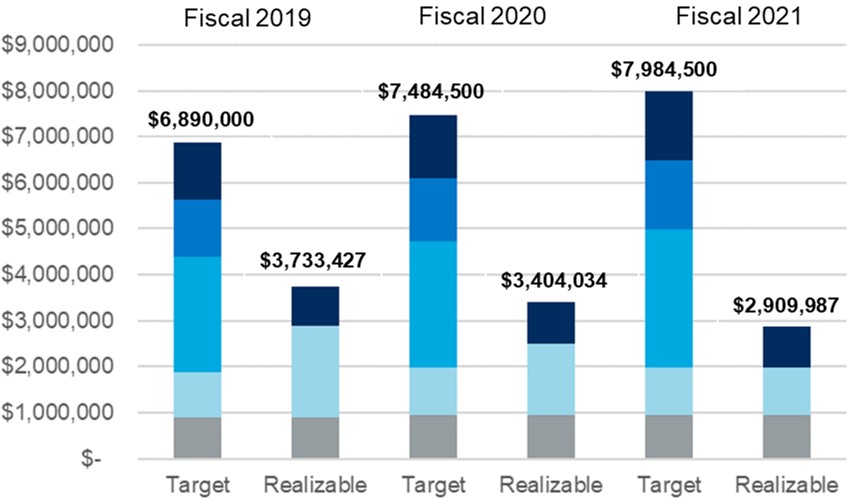

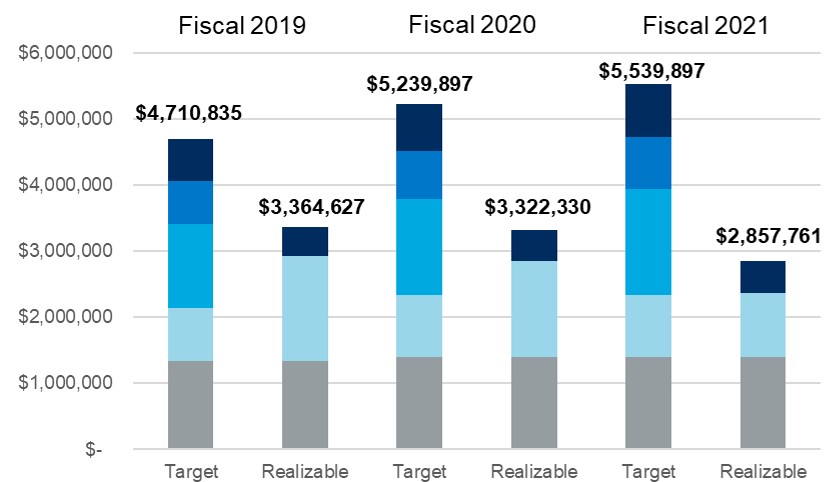

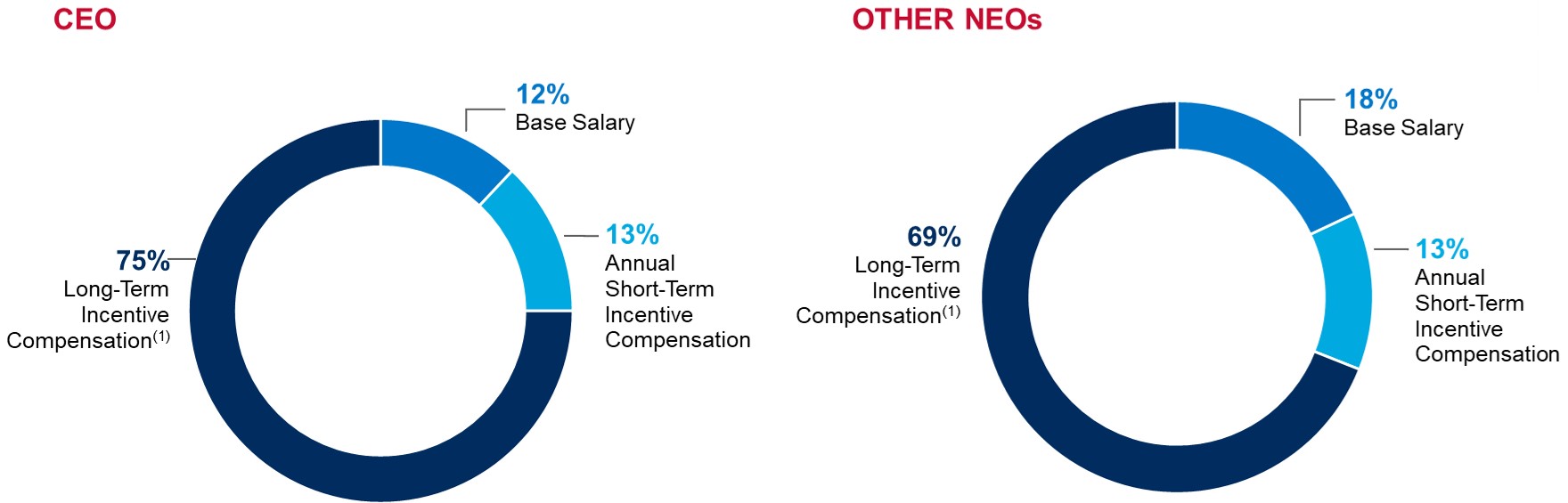

ELEMENTS OF TOTAL COMPENSATION

When setting compensation for our Named Executive Officers, or "NEOs," the Compensation Committee focuses on total direct compensation. Total direct compensation includes three major components - base salary, annual short-term incentive compensation and annual long-term incentive compensation - all of which are designed to work together to drive a complementary set of behaviors and outcomes. The following chart illustrates, for fiscal 2022, the target annual compensation mix among the three elements of direct compensation for our Chief Executive Officer and, on average, for our other NEOs.

(1)Long-term incentive compensation includes grant value of all fiscal 2022 equity awards to Named Executive Officers. For more information see "Individual Fiscal 2022 Long-Term Incentive Awards" beginning on page 32 of this Proxy Statement.

| Cautionary Note Regarding Forward-Looking Statements | ||

Any statements contained in this Proxy Statement that do not describe historical facts may constitute forward-looking statements. Forward-looking statements in this Proxy Statement may include, without limitation, statements regarding (i) plans and objectives of management for operations of the Company, including plans or objectives related to the development and commercialization of, and regulatory approvals related to, the Company’s products and plans or objectives related to the Operational Excellence Program; (ii) estimates or projections of financial results, financial condition, capital expenditures, capital structure or other financial items; (iii) the impact of the COVID-19 pandemic on the Company’s operations, availability and demand for its products and future financial performance; and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above. Such forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon the Company's current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences. Factors that may cause actual results to differ materially from those contemplated by the statements in this Proxy Statement can be found in the Company’s most recent Annual Report on Form 10-K for the fiscal year ended April 2, 2022 under the headings "Cautionary Statement Regarding Forward-Looking Information" and "Risk Factors" and in our other periodic reports filed with the Securities and Exchange Commission ("SEC"). The Company does not undertake to update these forward-looking statements.

This Proxy Statement contains statements regarding individual and Company performance objectives and targets. These objectives and targets are disclosed in the limited context of our compensation plans and programs and should not be understood to be statements of management's future expectations or estimates of future results or other guidance. We specifically caution investors not to apply these statements to other contexts.

HAEMONETICS CORPORATION | 2022 Proxy Statement 7

ITEM 1—ELECTION OF DIRECTORS

Our Board currently has nine members, each of whom is standing for election at our 2022 Annual Meeting of Shareholders (see "Director Nominees" beginning on page 9). If elected, each director will serve for a one-year term expiring at our 2023 Annual Meeting of Shareholders or until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. Each nominee has agreed to be named in this Proxy Statement and to serve if elected. We believe that each nominee will be able and willing to serve if elected. However, if any nominee should become unable for any reason or unwilling to serve, proxies may be voted for another person nominated as a substitute by our Board, or our Board may reduce the number of directors.

In 2019, we amended our Charter and By-Laws to phase out our classified Board structure over a three-year period beginning at the 2020 Annual Meeting of Shareholders. As of the 2022 Annual Meeting of Shareholders, our classified Board structure will have been fully phased out and all Haemonetics director nominees with be subject to annual election.

þ | Our Board unanimously recommends that you vote FOR each of the nominees for director named in this Proxy Statement. Directors are elected by a plurality of the votes cast by shareholders entitled to vote at the meeting. Abstentions and broker non-votes will not have any effect on this proposal. Accordingly, the nominees receiving the highest number of “for” votes at the meeting will be elected as directors. However, under a policy adopted by the Board, in an uncontested election, any nominee for director who does not receive the favorable vote of at least a majority of the votes cast with respect to such director is required to tender his or her resignation to the Board, which will consider whether to accept the resignation. This is an uncontested election of directors because the number of nominees for director does not exceed the number of directors to be elected. The persons named in the accompanying proxy will vote all duly submitted proxies FOR the nominees listed below (see "Director Nominees" beginning on page 9) unless instructed otherwise. | ||||

| Haemonetics Board of Directors | ||

BOARD COMPOSITION AND THE DIRECTOR NOMINATION PROCESS

The Governance and Compliance Committee is responsible for reviewing and assessing the appropriate skills, experience and background required for the Board. Because our business operates in regulated healthcare markets around the globe and encompasses research and development, manufacturing and marketing functions that are subject to technological and market changes, the skills, experience and backgrounds that are needed are diverse.

While the priority and emphasis of each factor changes from time to time to take into account the current needs of the Company, the aim is to have a diverse portfolio of talents and backgrounds, including diversity with respect to age, gender, race, ethnicity and experience in aspects of business or technology relevant to the Company’s business. The Governance and Compliance Committee and the Board review and assess the importance of these factors as part of the Board’s annual self-evaluation process, and the Governance and Compliance Committee at least annually reviews and reports to the Board on what skills and characteristics it believes are reflected in the then-current directors and what additional qualifications should be sought in new directors to augment the skills and expertise on the Board. These steps are intended to ensure that the Company continues to create and sustain a Board that can support and effectively oversee the Company’s business.

Although the Board has not adopted any absolute prerequisites for Board service, the Governance and Compliance Committee considers the following minimum criteria when identifying nominees:

Background | Qualifications | ||||

His or her skills, experience and acumen as they relate to the Company's needs and the current state of its markets | His or her independence from the Company and management, as defined under SEC and NYSE rules | ||||

His or her integrity, independence, diversity, experience, leadership and ability to exercise sound judgment | His or her contemporaneous service on other public company boards of directors and related committees | ||||

His or her knowledge of the healthcare sector and the markets in which the Company participates | His or her ability to participate fully in Board activities and represent the Company's stakeholders | ||||

In the case of current directors being considered for re-nomination, the Governance and Compliance Committee will also take into consideration the director’s history of attendance at Board and committee meetings, tenure as a member of the Board and preparation for and participation in such meetings.

8 HAEMONETICS CORPORATION | 2022 Proxy Statement

DIRECTOR NOMINEES

PRESENT TERMS EXPIRING IN 2022 AND PROPOSED TERMS TO EXPIRE IN 2023

Age: 58 | CHRISTOPHER A. SIMON President and Chief Executive Officer, Haemonetics Corporation | |||||||

Mr. Simon is President and Chief Executive Officer of the Company. He joined Haemonetics in May 2016 and our Board in September 2016. Mr. Simon previously served as a Senior Partner of McKinsey & Company where he led the Global Medical Products Practice. Mr. Simon served as a consultant with McKinsey & Company beginning in 1993 and was the lead partner for McKinsey & Company’s strategy review with Haemonetics that began in October 2015, where he gained invaluable insights into the Company’s business and markets. Prior to his career at McKinsey & Company, Mr. Simon served in commercial roles with Baxter Healthcare Corporation and as a U.S. Army Infantry Officer in Korea with the 1st Ranger Battalion. He also currently serves on the Board of Directors of AdvaMed, a global trade association of companies that develop, produce, manufacture, and market medical technologies. Mr. Simon earned a Bachelor of Science in Economics from the Wharton School at the University of Pennsylvania and an M.B.A. from Harvard Business School. Skills and Qualifications: As President and Chief Executive Officer of the Company, Mr. Simon provides the Board with an intensive understanding of the Company's business, operations and strategy. Mr. Simon also brings to the Board more than 20 years of experience in helping businesses transform and grow. | ||||||||

Independent Age: 67 Other Public Co. Board Service: •Avient Corp. | ROBERT E. ABERNATHY Retired Chairman and Chief Executive Officer, Halyard Health, Inc. | |||||||

Mr. Abernathy joined our Board in October 2017 and is Chair of the Compensation Committee and a member of the Technology Committee. Mr. Abernathy served as Chairman of the Board of Directors and Chief Executive Officer of Halyard Health Inc., a publicly-traded medical technology company and spin-off from Kimberly-Clark, from October 2014 until his retirement in June 2017 (he continued as Chairman until September 2017). Mr. Abernathy joined Kimberly-Clark, a global personal care products company, in 1982 and held numerous roles of increasing responsibility, including President of Kimberly-Clark’s Global Health Care business, Group President, Developing & Emerging Markets, Managing Director, Kimberly-Clark Australia and President, North Atlantic Consumer Products. Skills and Qualifications: Mr. Abernathy brings to the Board extensive leadership experience in the healthcare industry and in international operations, including in-depth knowledge and insight on the needs of healthcare providers and patients and enterprise risk management matters. | ||||||||

Independent Age: 71 Other Public Co. Board Service: •Becton, Dickinson and Co. •Orthofix Medical, Inc. (Board Chair) | CATHERINE M. BURZIK Former President and Chief Executive Officer, Kinetic Concepts, Inc. | |||||||

Ms. Burzik joined our Board in October 2016 and is the Chair of the Technology Committee and a member of the Audit Committee. Ms. Burzik is currently President and Chief Executive Officer of CFB Interests, LLC. From 2013 to 2017, Ms. Burzik was also a general partner at Targeted Technology, an early stage venture capital firm focused on medical device, life sciences and biotechnology investments. Ms. Burzik previously served as President and Chief Executive Officer of Kinetic Concepts, Inc., a leading medical device company specializing in the fields of wound care and regenerative medicine, from 2006 until the Company’s sale in 2012. Prior to joining Kinetic Concepts, Inc., Ms. Burzik’s leadership experience included serving as President of Applied Biosystems and holding senior executive positions at Eastman Kodak and Johnson & Johnson, including Chief Executive Officer and President of Kodak Health Imaging Systems and President of Ortho-Clinical Diagnostics, Inc., a Johnson & Johnson company. In 2019, Ms. Burzik received the AdvaMed Lifetime Achievement Award that honors accomplishments of pioneers in the medical technology industry. Skills and Qualifications: Ms. Burzik is a widely respected healthcare industry leader, having successfully led major medical device, diagnostic imaging and life science businesses. Ms. Burzik brings to the Board many years of leadership experience in strategic planning, international operations and financial and enterprise risk management. | ||||||||

HAEMONETICS CORPORATION | 2022 Proxy Statement 9

Independent Age: 60 | MICHAEL J. COYLE Former President and Chief Executive Officer, iRhythm Technologies, Inc. | |||||||

Mr. Coyle joined our Board in April 2020 and is a member of both the Audit Committee and the Governance and Compliance Committee. Mr. Coyle previously served as the President and Chief Executive Officer of iRhythm Technologies, Inc., a digital healthcare company, from January 2021 to June 2021. From December 2009 to January 2021, Mr. Coyle served as Executive Vice President and Group President, Cardiac and Vascular Group of Medtronic plc (and its predecessor, Medtronic, Inc.), a global medical device company, where he oversaw four of the company’s business divisions. Mr. Coyle previously served as President of the Cardiac Rhythm Management division at St. Jude Medical Inc. from 2001 to 2007 and earlier in his career held numerous leadership positions at St. Jude and Eli Lilly & Company. Mr. Coyle previously served on the boards of iRhythm Technologies, Inc. and of two NASDAQ-listed medical device companies responsible for making catheter-based products. He holds six U.S. patents related to cardiovascular medical device products and technologies. Skills and Qualifications: Mr. Coyle's many years of executive experience in the medical device industry, including building global businesses and bringing technologies to important medical markets, provides the Board with a valuable perspective as the Company pursues growth and advances its innovation agenda. His leadership positions with global medical device companies also brings additional expertise to the Board in strategic planning, enterprise risk management, market development and international operations. | ||||||||

Independent Age: 67 Other Public Co. Board Service: •Boston Scientific Corporation •Hologic, Inc. •Keysight Technologies, Inc. | CHARLES J. DOCKENDORFF Retired Executive Vice President and Chief Financial Officer, Covidien plc | |||||||

Mr. Dockendorff joined our Board in July 2014 and is Chair of the Audit Committee and a member of the Governance and Compliance Committee. Mr. Dockendorff served as Executive Vice President and Chief Financial Officer of Covidien plc, a global healthcare company, and its predecessor, Tyco Healthcare, from 1995 until his retirement in 2015. Mr. Dockendorff joined the Kendall Healthcare Products Company, the foundation of the Tyco Healthcare business, in 1989 as Controller and was named Vice President and Controller five years later. Prior to joining Kendall/Tyco Healthcare, Mr. Dockendorff was the Chief Financial Officer, Vice President of Finance and Treasurer of Epsco, Inc. and Infrared Industries, Inc. Earlier in his career, Mr. Dockendorff worked as an accountant for Arthur Young & Company (now Ernst & Young LLP) and the General Motors Corporation. Skills and Qualifications: Mr. Dockendorff is a highly-respected healthcare industry leader with extensive experience in finance and corporate management. As a retired Chief Financial Officer of a large global healthcare products company, Mr. Dockendorff brings to the Board many years of leadership experience in accounting and financial management and planning as well as enterprise risk management. | ||||||||

Independent Age: 68 Other Public Co. Board Service: •Apogee Enterprises, Inc. •Beazer Homes USA, Inc. | LLOYD E. JOHNSON Retired Global Managing Director, Finance and Internal Audit, Accenture Corporation | |||||||

Mr. Johnson joined our Board in August 2021 and is a member of both the Audit Committee and the Governance and Compliance Committee. Mr. Johnson served as Global Managing Director, Finance and Internal Audit at Accenture Corporation from 2004 until his retirement in 2015, where he led the global management consulting company’s audit organization and provided strategic leadership in finance, risk, compliance and governance. Prior to joining Accenture, Mr. Johnson served as Executive Director, M&A and General Auditor for Delphi Automotive PLC, a global automotive technology industry leader. He has also held senior financial leadership positions at Emerson Electric Corporation, Sara Lee Corporation and Shaw Food Services. In addition to his public company board service, Mr. Johnson also serves on the boards of AARP, where he is Second Vice Chair, and the National Association of Corporate Directors (NACD) Carolinas Chapter. He was named one of the "Most Influential Black Corporate Directors" by Savoy in 2017 and has been listed as a "Director to Watch" in 2018 and 2020 by Directors & Boards. Skills and Qualifications: Mr. Johnson has over 35 years of corporate finance leadership experience, mostly at multi-national public companies. He brings to the Board significant expertise and strategic insight in the areas of accounting and financial management, mergers and acquisitions, international operations, business development, corporate governance and enterprise risk management. | ||||||||

10 HAEMONETICS CORPORATION | 2022 Proxy Statement

Independent Age: 69 Other Public Co. Board Service: •Axon Enterprise, Inc. | MARK W. KROLL, Ph.D. Retired Senior Executive Officer at St. Jude Medical, Inc. | |||||||

Dr. Kroll joined our Board in 2006 and is a member of both the Compensation Committee and the Technology Committee. He currently serves as an Adjunct Full Professor of Biomedical Engineering at the University of Minnesota. From 1995 until his retirement in 2005, Dr. Kroll held a variety of executive leadership positions at St. Jude Medical, Inc., a global medical device company, including as Senior Vice President and Chief Technology Officer for the Cardiac Rhythm Management division and as Vice President of the Tachycardia Business division. Dr. Kroll has more than 25 years of experience with cardiovascular devices and instrumentation and is the named inventor of more than 380 U.S. patents as well as numerous international patents. He is a fellow of the American College of Cardiology, Heart Rhythm Society, Institute of Electronics and Electrical Engineering and the American Institute for Medicine and Biology in Engineering. In 2010, Dr. Kroll was awarded the Career Achievement Award in Biomedical Engineering, among the highest international awards in biomedical engineering. Skills and Qualifications: Dr. Kroll is a well-known pioneer in the field of electrical medical devices and a distinguished technology expert throughout the global medical device industry. He brings to the Board extensive expertise in the areas of medical innovation and technology. | ||||||||

Independent Age: 67 Other Public Co. Board Service: •Embecta Corp. | CLAIRE POMEROY, M.D., M.B.A. President, Albert and Mary Lasker Foundation | |||||||

Dr. Pomeroy joined our Board in April 2019 and is a member of both the Technology Committee and the Compensation Committee. Since 2013, Dr. Pomeroy has served as the President of the Albert and Mary Lasker Foundation, a private foundation that seeks to improve health by accelerating support for medical research through recognition of research excellence, education and advocacy. Previously, Dr. Pomeroy served as Dean of the UC Davis School of Medicine and Vice Chancellor of the UC Davis Health System. In addition to her public company board service, Dr. Pomeroy also is Chair of the Center for Women in Academic Medicine and Science and a director of the Lasker Foundation, the Sierra Health Foundation, the Science Philanthropy Alliance, the Science Communication Lab and the Morehouse School of Medicine. Dr. Pomeroy previously served on the board of directors of Becton, Dickinson and Company, from which she resigned in March 2022 in connection with joining the board of directors of Embecta Corp., a diabetes care spin-off of Becton, Dickinson and Company. Skills and Qualifications: Dr. Pomeroy is an expert in infectious diseases with broad leadership experience in health system administration, healthcare delivery, medical research and public health. She provides the Board with important perspectives in the areas of global health services, health policy and medical innovation. | ||||||||

Independent Chair Age: 70 Other Public Co. Board Service: •Azenta, Inc. •Boston Scientific Corporation •Synchrony Financial | ELLEN M. ZANE CEO Emeritus of Tufts Medical Center | |||||||

Ms. Zane joined our Board in January 2018 and serves as the Chair of the Board, Chair of the Governance and Compliance Committee and a member of the Compensation Committee. Ms. Zane is CEO Emeritus of Tufts Medical Center, where she served as President and Chief Executive Officer from 2004 to 2011. Prior to 2004, Ms. Zane served as Network President for Partners Healthcare System, a physician/hospital network sponsored by the Harvard-affiliated Massachusetts General Hospital and Brigham and Women's Hospital. Ms. Zane also previously served as Chief Executive Officer of Quincy Hospital in Quincy, Massachusetts. Ms. Zane has previously served as a director of Century Capital Management, Parexel International Corporation, Lincare Holdings Inc. and Press Ganey Holdings. Ms. Zane previously served on the Company's Board from 2012 to 2016. Ms. Zane was named to the NACD Directorship 100 for 2021, an annual award that recognizes the most influential boardroom leaders each year. Skills and Qualifications: Ms. Zane is a nationally renowned healthcare leader with substantial public company board experience. She brings to the Board extensive functional and leadership expertise in the healthcare industry, including with respect to strategy development, finance, operational effectiveness and enterprise risk management. | ||||||||

HAEMONETICS CORPORATION | 2022 Proxy Statement 11

IDENTIFYING NEW DIRECTORS

The Company’s nomination process for new Board members is as follows:

ASSESS BOARD NEEDS 6 | The Governance and Compliance Committee or other Board member identifies a need to add a new Board member who meets specific criteria or to fill a vacancy on the Board. | |||||||

IDENTIFY CANDIDATES 6 | The Governance and Compliance Committee initiates a search seeking input from Board members and senior management and, if necessary, hires a search firm. The Governance and Compliance Committee also considers recommendations for nominees for directorships submitted by shareholders. | |||||||

EVALUATE POTENTIAL CANDIDATES 6 | An initial list of candidates that will satisfy specific criteria and otherwise qualify for membership on the Board is identified and presented to the Governance and Compliance Committee, which evaluates the candidates. | |||||||

INTERVIEW CANDIDATES 6 | The Board Chair, the Chair of the Governance and Compliance Committee, the Chief Executive Officer and at least one other member of the Governance and Compliance Committee interview top candidates. | |||||||

RECOMMEND CANDIDATES FOR BOARD REVIEW 6 | The Governance and Compliance Committee seeks the entire Board’s endorsement of the final candidate and makes a recommendation to the Board regarding the election of the candidate. | |||||||

NOMINATION AND ELECTION | The final candidate is nominated by the Board for shareholder election or elected by the Board to fill a vacancy. | |||||||

The Governance and Compliance Committee reviews and evaluates all director nominations in the same manner and in accordance with the Company’s By-Laws. Shareholders who wish to submit candidates for consideration as nominees may submit a letter and resume to our Corporate Secretary at the Company’s headquarters located at 125 Summer Street, Boston, Massachusetts 02110.

| Board’s Role and Responsibilities | ||

OVERVIEW

The Board oversees, directs and counsels senior management in conducting the business in the long-term interests of the Company and its shareholders. The Board’s responsibilities include:

•Reviewing and approving the Company’s financial and strategic objectives, operating plans and significant actions, including mergers and acquisitions;

•Overseeing the conduct of the business and compliance with applicable laws and ethical standards;

•Overseeing the processes that maintain the integrity of our financial statements and public disclosures;

•Evaluating and determining the compensation of senior management, including the Chief Executive Officer;

•Overseeing and providing counsel on scientific, innovation and technology activities at the Company; and

•Selecting the Chief Executive Officer, developing succession plans for the position of Chief Executive Officer and supervising senior management succession plans.

THE BOARD’S ROLE IN RISK MANAGEMENT

The Board is responsible for oversight of the Company’s enterprise-wide approach to risk management, while the Company’s management is responsible for managing risk on a day-to-day basis and for bringing to the Board's attention material risks facing the Company. The Board focuses on the quality and scope of the Company’s risk management strategies and considers the most significant areas of risk inherent in the Company’s business strategies and operations and the steps that management is taking to mitigate those risks.

In addition to full Board oversight of the Company’s risk management, Board committees consider discrete categories of risk relating to their respective areas of responsibility. All committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise level risk.

Senior management has overall responsibility for the Company’s risk management approach. This responsibility includes identifying, evaluating and addressing potential risks that may exist at the enterprise, strategic, financial, operational, compliance

12 HAEMONETICS CORPORATION | 2022 Proxy Statement

and reporting levels. As discussed above under the heading "Corporate Responsibility" on page 7, the Company is also committed to being a good corporate citizen and take responsibility to proactively identify and manage the ESG risks and opportunities that are relevant to our business and those we serve. The Company’s internal audit function, which reports regularly to the Audit Committee of the Board, serves as the primary monitoring and testing function for compliance with company-wide policies and procedures.

The Company believes that the division of risk management responsibilities described above constitutes an effective program for addressing the risks inherent in the operation of the Company and the achievement of its business objectives.

THE BOARD’S ROLE IN MANAGEMENT SUCCESSION PLANNING

Pursuant to our Principles of Corporate Governance, the Board also plans for succession to the position of Chief Executive Officer as well as certain other senior management positions. To assist the Board, the Chief Executive Officer annually provides the Board with an assessment of senior managers and their potential to succeed him. The Chief Executive Officer also provides the Board with an assessment of persons considered potential successors to certain senior management positions.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

The Board considers shareholder perspectives, as well as the interests of all stakeholders, when overseeing Company strategy, formulating governance practices and designing compensation programs. Interested parties and shareholders may communicate with the Board, or the non-management directors as a group, or any individual director by sending communications to the attention of our Corporate Secretary, 125 Summer Street, Boston, Massachusetts 02110, who will forward such communications to the appropriate recipients. Communications may also be sent via the Investor Relations page on our website: www.haemonetics.com.

| Board Leadership Structure | ||

STRUCTURE OF THE BOARD OF DIRECTORS

The Board currently has nine members, eight of whom are independent, including the Board Chair. The independent directors are organized into four standing committees: Audit Committee, Compensation Committee, Governance and Compliance Committee and Technology Committee (for more information see "Committees of the Board" beginning on page 14). Ellen M. Zane succeeded Richard J. Meelia as our independent Board Chair on August 6, 2021 following his retirement at our 2021 Annual Meeting of Shareholders. Mr. Meelia had previously served as our independent Board Chair from June 2011 to August 2021. We believe that having separate individuals serving in the roles of Board Chair and Chief Executive Officer is appropriate for the Company at this time in recognition of the different responsibilities of each position and to foster independent leadership of our Board. This structure allows the Chief Executive Officer to focus on the day-to-day leadership of the Company and its operations and the Board Chair to focus on leadership of the Board, while both individuals provide direction and guidance on strategic initiatives.

BOARD INDEPENDENCE

The Board has determined that each director who served during fiscal 2022, with the exception of Mr. Simon, had no material relationship with the Company and is independent within the meaning of the SEC and NYSE director independence standards in effect. In making this determination, the Board considered information provided by the Company and by each director and director nominee with regard to a director’s business and personal activities as they relate to the Company and its management.

EXECUTIVE SESSIONS AND MEETINGS OF THE BOARD

Executive sessions of the independent directors were held during each of the Board’s regular quarterly meetings and at such special meetings of the Board as requested by the independent directors. During fiscal 2022, Mr. Meelia or Ms. Zane, in their capacities as Board Chair, presided over all such executive sessions.

In addition to its regular quarterly meetings, the Board held numerous special meetings during fiscal 2022 to address, among other things, the impacts of COVID-19 on the business. The Board and its committees met as follows during our last fiscal year:

Board of Directors | Audit Committee | Compensation Committee | Governance and Compliance Committee | Technology Committee | |||||||||||||||||||||||||

Regular Meetings | 4 | 4 | 4 | 4 | 4 | ||||||||||||||||||||||||

Special Meetings | 4 | 4 | 1 | 0 | 1 | ||||||||||||||||||||||||

Total Number of Meetings | 8 | 8 | 5 | 4 | 5 | ||||||||||||||||||||||||

In fiscal 2022, each of the directors attended at least 75% of the total number of meetings of the full Board held while he or she was a director and the meetings held by committees of the Board on which he or she served. All directors are strongly encouraged to attend each Annual Meeting of Shareholders. Eight of the directors serving on the Company’s Board at the time of the 2021 Annual Meeting of Shareholders attended the 2021 Annual Meeting of Shareholders held in person at the Company's headquarters.

HAEMONETICS CORPORATION | 2022 Proxy Statement 13

COMMITTEES OF THE BOARD

The Board maintains four standing committees to assist the Board in its various oversight functions: Audit, Compensation, Governance and Compliance and Technology. The Board has determined that all members of our standing committees have no material relationship with the Company and are independent within the meaning of the SEC’s and the NYSE’s director independence standards. The Board has also determined that the service by Charles J. Dockendorff on the audit committees of three other public companies will not impair his ability to effectively serve on our Audit Committee and that our shareholders will benefit from Mr. Dockendorff’s extensive experience as a Chief Financial Officer and audit committee member at multi-national healthcare companies.

AUDIT COMMITTEE | ||||||||

Members | Key Responsibilities | |||||||

Charles J. Dockendorff (Chair) Catherine M. Burzik Michael J. Coyle Lloyd E. Johnson | •Oversee financial reporting and disclosure practices on behalf of the Board, including: - Oversee internal controls and the internal audit function and processes for monitoring compliance by the Company with Company policies - Select, replace and determine the compensation (including pre-approval of all audit and non-audit fees) of the independent registered public accounting firm •Review the scope of the annual audit and its results - Review with the Company’s independent registered public accounting firm •Review various matters relating to financial risk assessments and remediation •Review transactions subject to the Company's Related Party Transactions Policy | |||||||

COMPENSATION COMMITTEE | ||||||||

Members | Key Responsibilities | |||||||

Robert E. Abernathy (Chair) Mark W. Kroll Claire Pomeroy Ellen M. Zane | •Determine total compensation philosophy for executives •Approve peer group and review competitive standing of compensation •Review human capital strategy and practices at least quarterly with management, including talent development, turnover and diversity, equity and inclusion matters •Set competitive short- and long-term compensation elements, benefits and perquisites •Set, and determine achievement of, short- and long-term performance goals •Review and approve Named Executive Officer compensation (Board ratification for CEO) •Oversee employee compensation plans and policies, including performance of an annual risk-assessment of such plans and policies •Recommend changes to Board compensation •Select, replace and determine compensation of independent compensation consultant | |||||||

GOVERNANCE AND COMPLIANCE COMMITTEE | ||||||||

Members | Key Responsibilities | |||||||

Ellen M. Zane (Chair) Michael J. Coyle Charles J. Dockendorff Lloyd E. Johnson | •Consider and make recommendations for CEO role and director nominees •Oversee compliance programs and recommend corporate governance principles •Consider and make recommendations to the Board concerning corporate governance matters, public issues having broad social significance and Company conduct as a responsible corporate citizen •Lead annual Board self-evaluation process •Ensure that directors receive orientation and continuing education as needed | |||||||

TECHNOLOGY COMMITTEE | ||||||||

Members | Key Responsibilities | |||||||

Catherine M. Burzik (Chair) Robert Abernathy Mark W. Kroll Claire Pomeroy | •Review alignment of Company's innovation agenda with strategy and growth objectives •Review overall direction, effectiveness, competitiveness and timing of the Company's research and development programs and pipelines •Review the Company's intellectual property portfolio and related strategies, as well as potentially disruptive technology that could impact the Company and its products •Oversee quality assurance, regulatory affairs and clinical and medical affairs in support of the Company’s new product development and lifecycle management •Review technology aspects of products as they relate to quality, safety and cybersecurity •Receive periodic reports regarding the Company's Scientific Advisory Committee | |||||||

14 HAEMONETICS CORPORATION | 2022 Proxy Statement

AUDIT COMMITTEE FINANCIAL EXPERT

The Board has determined that all Audit Committee members meet the independence and financial literacy requirements of the NYSE for audit committee members. The Board has also determined that each of Messrs. Dockendorff and Johnson and Ms. Burzik qualify as an “audit committee financial expert” as defined under the rules of the SEC.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During the fiscal year ended April 2, 2022, the members of the Compensation Committee were Robert E. Abernathy (Chair), Mark W. Kroll, Claire Pomeroy and Ellen M. Zane. During fiscal 2022, no member of the Compensation Committee was an executive officer or employee, or former executive officer or employee, of the Company or any of its subsidiaries. None of our executive officers served as a director or member of the compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

| Board Policies and Processes | ||

TRANSACTIONS WITH RELATED PERSONS

The Board has adopted a written policy and procedures for approval of transactions between the Company and its directors, director nominees, executive officers, greater than 5% beneficial owners of Haemonetics common stock, and each of their respective immediate family members, where the amount involved in the transaction exceeds or is expected to exceed $120,000 in a single calendar year and the related person has or will have a direct or indirect material interest in the transaction (other than solely as a result of being a director or less than 10% beneficial owner of another entity). The policy, as amended from time to time, provides that the Audit Committee reviews transactions subject to the policy and determines (subject to Board ratification) whether or not to approve those transactions. In addition, in reviewing transactions subject to the policy, the Audit Committee considers, among other factors it deems appropriate:

•The material terms of the transaction, including whether the transaction with the related person is proposed to be, or was, entered into on terms no less favorable to Haemonetics than terms that could have been reached with an unrelated third-party;

•The nature and extent of the related person’s interest in the transaction;

•The approximate dollar value of the amount involved in the transaction;

•The approximate dollar value of the amount of the related person’s interest in the transaction without regard to the amount of any profit or loss;

•Whether the transaction was undertaken in the ordinary course of Haemonetics' business;

•The business purpose of, and the potential benefits to Haemonetics of, the transaction;

•Whether the transaction would impair the independence of a non-employee director;

•Required public disclosure, if any; and

•Any other information regarding the transaction or the related person in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular transaction.

The Company is not aware of any transaction required to be reported under Item 404(a) of Regulation S-K promulgated by the SEC since the beginning of fiscal 2022, nor is the Company aware of any instances during the period in which the foregoing policies and procedures required review, approval or ratification of such transaction but for which such policies and procedures were not followed.

CODE OF CONDUCT, GOVERNANCE PRINCIPLES AND BOARD MATTERS

The Company’s Code of Conduct requires that all of our directors, officers and employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in the best interest of the Company. The Company’s Code of Conduct, Principles of Corporate Governance and the charters of the Audit Committee, Compensation Committee, Governance and Compliance Committee and Technology Committee may be viewed on the Investor Relations page on the Company’s website at www.haemonetics.com and printed copies can be obtained by contacting our Corporate Secretary at the Company's headquarters located at 125 Summer Street, Boston, Massachusetts 02110.

HAEMONETICS CORPORATION | 2022 Proxy Statement 15

| Directors’ Compensation | ||

PROCESS FOR DETERMINING DIRECTOR COMPENSATION

We seek to offer our directors compensation that is consistent with other companies of our revenue, industry and operational scope. The Compensation Committee, with input from its independent compensation consultant, is responsible for annually reviewing and recommending to the Board any changes to director compensation.

Directors receive a $55,000 annual retainer with an additional $10,000 meeting retainer which covers attendance at up to eight Board meetings. If the Board meets more than eight times per year, each director receives $2,000 for each additional live meeting and $750 for each additional telephonic meeting. The Board Chair receives an annual retainer of $250,000 in place of the standard Board retainer and meeting fees. Committee Chairs are paid an additional retainer as follows: Audit Committee Chair $20,000; Compensation Committee Chair $15,000; Governance and Compliance Committee and Technology Committee Chairs $10,000. For attendance at Committee meetings, members of the Audit Committee are paid $12,000 for attending up to 12 meetings per year, members of the Compensation Committee are paid $9,000 for up to eight meetings per year, and members of the Governance and Compliance and Technology Committees are paid $6,000 for up to eight meetings per year.

Each non-employee director is eligible to receive an annual equity grant with an approximate value of $180,000. The grant is in the form of restricted stock units which vest on the first anniversary of the date of grant. Directors elected outside of the Annual Meeting of Shareholders receive a prorated annual equity award based on the number of days to be served from their date of election through the first anniversary of the last Annual Meeting of Shareholders.

We reimburse directors for reasonable travel expenses incurred in connection with Board and committee meetings. We also extend coverage to them under our directors’ and officers’ indemnity insurance policies and have entered into our standard form of Indemnification Agreement with each director. We do not provide any other benefits, including retirement benefits or perquisites, to our non-employee directors.

DIRECTOR COMPENSATION TABLE FOR FISCAL YEAR ENDED APRIL 2, 2022

The following table sets forth the compensation paid to our non-employee directors for service on our Board during fiscal 2022. Compensation for Christopher A. Simon, our President and Chief Executive Officer, is set forth in the Summary Compensation Table beginning on page 39. Mr. Simon does not receive any additional compensation for his service as a director.

Name | Fees Earned or Paid in Cash ($) | Stock Awards(1) ($) | Total ($) | |||||||||||||||||

Robert E. Abernathy | $ | 95,000 | $ | 179,943 | $ | 274,943 | ||||||||||||||

Catherine M. Burzik | $ | 93,000 | $ | 179,943 | $ | 272,943 | ||||||||||||||

Michael J. Coyle | $ | 83,000 | $ | 179,943 | $ | 262,943 | ||||||||||||||

Charles J. Dockendorff | $ | 103,000 | $ | 179,943 | $ | 282,943 | ||||||||||||||

Lloyd E. Johnson | $ | 51,392 | $ | 179,943 | $ | 231,335 | ||||||||||||||

Mark W. Kroll | $ | 80,000 | $ | 179,943 | $ | 259,943 | ||||||||||||||

Richard J. Meelia(2) | $ | 86,957 | $ | — | $ | 86,957 | ||||||||||||||

Claire Pomeroy | $ | 80,000 | $ | 179,943 | $ | 259,943 | ||||||||||||||

Ellen M. Zane | $ | 194,346 | $ | 179,943 | $ | 374,289 | ||||||||||||||

(1)Represents the aggregate grant date fair value for annual equity awards of 3,077 restricted stock units, or RSUs, awarded to each such person on August 6, 2021, in each case calculated in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, Compensation - Stock Compensation. The assumptions that we used to calculate these amounts are discussed in Note 17 "Capital Stock" to our financial statements included in our Annual Report on Form 10-K for the fiscal year ended April 2, 2022. See “Director Outstanding Equity Award Table for Fiscal Year Ended April 2, 2022” on page 17 for a description of the number of unvested RSUs and unexercised options held by each director as of the end of fiscal 2022.

(2)Mr. Meelia retired from our Board as of the 2021 Annual Meeting of Shareholders and, therefore, did not receive the annual equity award granted to directors on August 6, 2021.

16 HAEMONETICS CORPORATION | 2022 Proxy Statement

DIRECTOR OUTSTANDING EQUITY AWARD TABLE FOR FISCAL YEAR ENDED APRIL 2, 2022

The following table sets forth the aggregate number of Stock Awards (representing unvested RSUs) held at April 2, 2022 by each non-employee director that served on our Board during fiscal 2022.

| Name | Unvested Stock Awards (RSUs) (#) | ||||

Robert E. Abernathy | 3,077 | ||||

Catherine M. Burzik | 3,077 | ||||

Michael J. Coyle | 3,077 | ||||

Charles J. Dockendorff | 3,077 | ||||

Lloyd E. Johnson | 3,077 | ||||

| Mark W. Kroll | 3,077 | ||||

| Richard J. Meelia | — | ||||

| Claire Pomeroy | 3,077 | ||||

| Ellen M. Zane | 3,077 | ||||

HAEMONETICS CORPORATION | 2022 Proxy Statement 17

ITEM 2—ADVISORY VOTE ON EXECUTIVE COMPENSATION

As described in the Compensation Discussion and Analysis beginning on page 21, our executive compensation programs aim to be competitive with our peers and aligned with our business strategy and corporate objectives. Our compensation philosophy emphasizes a pay for performance culture focused on the long-term interests of our shareholders. We believe that this alignment between executive compensation and shareholder interests will drive corporate performance over time. Additionally, the Company maintains strong governance and pay practices, including meaningful share ownership guidelines for directors and executive officers, clawback policies that apply to short-term cash awards and long-term equity awards, “double trigger” change in control benefits and performance of an annual compensation risk assessment by our Compensation Committee.

Our Compensation Committee continually evaluates the design and direction of our compensation structure. Each year, we take into account the result of the "say-on-pay" vote cast by our shareholders. At our 2021 Annual Meeting of Shareholders, approximately 96.8% of shares voting supported our 2021 executive compensation program. The Compensation Committee is also committed to maintaining an open dialogue with our shareholders throughout the year. In each of the last four years, members of our Board have offered meetings during the fall and winter to large Haemonetics shareholders to discuss governance topics of interest. In fiscal 2022, our Board Chair (who also chairs our Governance and Compliance Committee) and Compensation Committee Chair offered meetings to 9 of our largest shareholders, representing more than 52% of shares outstanding, and met with shareholders representing approximately 30% of shares outstanding in January 2022 to discuss, among other topics, Haemonetics' corporate strategy and performance, board diversity and refreshment, executive compensation, corporate responsibility and other governance matters. Shareholders we met with were complimentary of our executive compensation program overall, and of our senior management team, while asking insightful questions and providing perspective on how they evaluate the program. The feedback from the shareholder outreach efforts was provided to the Governance and Compliance and Compensation Committees and the full Board (for further discussion see "Advisory 'Say on Pay' Vote and Shareholder Outreach" beginning on page 22).

Shareholders are urged to read our Compensation Discussion and Analysis beginning on page 21 and the section entitled “Executive Compensation Tables” beginning on page 39 for additional details about our executive compensation programs, including information about the fiscal 2022 compensation of our Named Executive Officers.

We are asking our shareholders to indicate their support for our Named Executive Officers’ compensation as described in this Proxy Statement. This proposal, commonly known as a "say-on-pay" proposal, gives our shareholders the opportunity to express their views on our Named Executive Officers’ compensation. This vote, as required by Section 14A of the Exchange Act, is not intended to address any specific element of our compensation programs, but rather to address our overall approach to the compensation of our Named Executive Officers described in this Proxy Statement. To that end, we ask our shareholders to vote FOR the following resolution at the meeting:

RESOLVED, that the Company’s shareholders approve, on an advisory basis, the compensation of the Company's named executive officers, as disclosed in the Compensation Discussion and Analysis section, the related executive compensation tables and the related narrative executive compensation disclosures contained in this Proxy Statement.

As an advisory vote, the results of this vote will not be binding on the Board or the Company. However, the Board values the opinions of our shareholders and will consider the outcome of the vote when making future decisions on the compensation of our Named Executive Officers and the Company’s executive compensation principles, policies and procedures.

þ | The Board recommends that shareholders vote, in an advisory manner, FOR the resolution set forth above. Approval of this proposal requires the affirmative vote of a majority of shares present, in person or represented by proxy, and voting on this proposal at the meeting. Abstentions and broker “non-votes” will not have any effect on this proposal. Management proxy holders will vote all duly submitted proxies FOR approval unless instructed otherwise. | ||||

18 HAEMONETICS CORPORATION | 2022 Proxy Statement

| Executive Officers | ||

Executive officers are chosen by and serve at the discretion of the Board. Set forth below are the names and ages of our executive officers, along with certain biographical information, for all but Christopher A. Simon, our President and Chief Executive Officer. For Mr. Simon’s biographical information, please see page 9.

| Michelle L. Basil, age 50, joined the Company in March 2017 as Executive Vice President, General Counsel. Ms. Basil was previously a Partner and Chair of the Life Sciences Practice Group at Nutter, McClennen & Fish LLP, a Boston-based law firm, where she practiced from September 1997 to March 2017. Ms. Basil focused her practice on corporate and securities law, including mergers and acquisitions, strategic partnerships and corporate governance matters, and represented both public and private companies, principally in the life sciences and medical technology industries. Ms. Basil is a member of the Board of Directors of the Massachusetts Medical Device Industry Council (MassMEDIC). She is admitted to the bar in Massachusetts and holds both a Bachelor of Arts and a Juris Doctor from the University of California at Berkeley. | |||||||||||||

| James C. D'Arecca, age 51, joined the Company as Executive Vice President, Chief Financial Officer in April 2022. Mr. D'Arecca previously served as Chief Financial Officer of TherapeuticsMD, Inc., a women's healthcare company, from June 2020 to April 2022. Prior to joining TherapeuticsMD, Inc., Mr. D’Arecca served as the Senior Vice President and Chief Accounting Officer of Allergen plc (formerly known as Actavis plc), a global pharmaceutical company, from August 2013 until its merger with AbbVie Inc. in May 2020. Mr. D’Arecca served as Chief Accounting Officer at Bausch & Lomb prior to joining Actavis plc and earlier in his career held finance and business development positions of increasing responsibility at Merck & Co., Inc. and Schering-Plough Corporation. Mr. D’Arecca began his career at PricewaterhouseCoopers LLP from 1992 to 2005, where he had an industry focus on pharmaceuticals, medical devices, and consumer products. Mr. D’Arecca earned a Bachelor of Science in Accounting from Rutgers University and a Master of Business Administration from Columbia University. He is a Certified Public Accountant. | |||||||||||||

| Anila Lingamneni, age 55, joined the Company as Executive Vice President, Chief Technology Officer in April 2020. Prior to joining the Company, Ms. Lingamneni served as Vice President, Renal R&D at Baxter International from February 2017 to March 2020, where she was responsible for the product portfolio delivering renal therapy solutions to dialysis patients, including devices, software, disposables and fluids. In this role, she led a globally distributed team of engineers and scientists to drive long-term product roadmap definition and therapy innovation and delivered critical product launches. From May 2013 to January 2017, Ms. Lingamneni also served as Vice President, Device Engineering at Baxter International, where she was responsible for all electromechanical devices and software applications for Baxter's medical device portfolio, including infusion systems, compounding systems, renal peritoneal and hemodialysis systems and acute renal therapy systems. Before joining Baxter, Ms. Lingamneni held several roles at General Electric Healthcare, including Chief Technology Officer of the X-Ray Diagnostic Imaging Business Unit. Ms. Lingamneni received a Bachelor of Science in Electrical and Electronics Engineering and a Master of Science in Mathematics from Birla Institute of Technology and Science in India, and she earned a Master of Science degree in Biomedical Engineering from Iowa State University. | |||||||||||||

HAEMONETICS CORPORATION | 2022 Proxy Statement 19

| Josep L. Llorens, age 60, joined the Company as Senior Vice President, Global Manufacturing and Supply Chain in August 2018. Mr. Llorens possesses over 30 years of experience in leading numerous turnarounds in global health care and consumer businesses across disposables, capital equipment, devices and software. Prior to joining the Company, Mr. Llorens held various operations and supply chain roles of increasing responsibility within the diagnostics and treatment, patient monitoring and cardiac care business of Philips, which he joined in 1992, most recently serving as Senior Vice President, Industrial Strategy and Advanced Manufacturing Engineering Leader for Philips Healthcare Diagnostic Imaging from January 2018 to August 2018. Mr. Llorens received a bachelor’s degree in Business Administration from the University of Barcelona and a master’s degree in Telecommunications Engineering from the Polytechnic University of Catalonia in Barcelona. He also holds an Executive Certificate in Technology, Operations and Value Chain Management from the MIT Sloan School of Management. | |||||||||||||

| Laurie A. Miller, age 49, was promoted to Senior Vice President, Chief Human Resources Officer of Haemonetics in August 2021. She brings to the Company over 25 years of experience in talent management and organizational development. Ms. Miller joined Haemonetics in 2016 and previously held positions as Vice President, Human Resources and Senior Director, Human Resources and Talent Management, where she helped build the Company’s collaborative, performance-driven culture, direct key employee-focused initiatives and create a strong workplace environment for employees. Prior to joining Haemonetics, Ms. Miller served in positions of increasing responsibility at Iron Mountain Inc., an enterprise information management company, including as Director of Human Resources, from February 2010 to April 2016. Earlier in her career, Ms. Miller held various Human Resources positions of broad and increasing responsibility at Dunkin’ Brands Group Inc., a global franchisor of quick service restaurants, and Shawmut Design and Construction, a construction management firm. Ms. Miller earned a Bachelor of Science in Business Management from Westfield State College and a Master of Science in Management from Emmanuel College. | |||||||||||||

| Stewart W. Strong, age 55, joined the Company as President, Global Hospital in September 2019. With more than 20 years of experience in interventional cardiology and radiology, general and cardiac surgery and vascular access procedures, Mr. Strong has a robust background developing and leading high performance teams across multiple functions in the medical device space. From February 2017 to September 2019, Mr. Strong served as President and General Manager of the interventional products business at Teleflex Incorporated, a global medical company, where he, among other responsibilities, led the expansion of the company’s interventional cardiology business through organic growth opportunities and strategic acquisitions. Mr. Strong also served as Vice President of North America Sales, Vascular Access and Global Vice President and General Manger, Cardiac Care at Teleflex between December 2013 and February 2017. Before joining Teleflex, Mr. Strong held leadership roles with several medical technology companies, including Vice President of Sales at Vidacare Corporation (prior to its acquisition by Teleflex in 2013) and positions of increasing responsibility at AtriCure, Inc., Medtronic plc’s heart valve division, and Johnson & Johnson’s ethicon endo-surgery division. Mr. Strong holds a Bachelor of Arts from the University of Connecticut. | |||||||||||||

20 HAEMONETICS CORPORATION | 2022 Proxy Statement

| Compensation Discussion and Analysis | ||

For purposes of the following Compensation Discussion and Analysis ("CD&A") and executive compensation disclosures, the individuals listed below are referred to collectively as our "Named Executive Officers." They are our President and Chief Executive Officer ("CEO"), our Executive Vice President, Chief Financial Officer as of the end of fiscal 2022 and our three other most highly compensated executive officers, based on fiscal 2022 compensation.

Named Executive Officer | Title | ||||

Christopher A. Simon | President and Chief Executive Officer | ||||

William P. Burke(1) | Executive Vice President, Chief Financial Officer | ||||

Michelle L. Basil | Executive Vice President, General Counsel | ||||

| Josep L. Llorens | Executive Vice President, Global Manufacturing and Supply Chain | ||||

Stewart W. Strong | President, Global Hospital | ||||

(1)Mr. Burke retired as Chief Financial Officer after the completion of fiscal 2022 and was succeeded by James D'Arecca in April 2022.

EXECUTIVE SUMMARY

The Compensation Committee of our Board (the "Compensation Committee" or the “Committee”) has adopted an integrated executive compensation program that is intended to align our Named Executive Officers’ interests with those of our shareholders and to promote the creation of shareholder value without encouraging excessive or unnecessary risk-taking. The Committee has tied a majority of our Named Executive Officers’ compensation to a number of key performance measures that contribute to or reflect shareholder value and link pay with performance. Specifically, in addition to a base salary, our Named Executive Officers’ total compensation includes annual short-term incentive compensation that is based on the Company’s attainment of objective pre-established financial performance metrics as well as annual long-term incentive compensation consisting of stock options, restricted stock units ("RSUs"), and performance share units ("PSUs") tied to relative total shareholder return. Our executive compensation program plays a significant role in our ability to attract and retain an experienced, successful executive team.

Fiscal 2022 Business Highlights