Form DEF 14A General Motors Co

Table of Contents

Check the appropriate box: | ||

☐ |

Preliminary Proxy Statement | |

☐ |

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | |

☑ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material under ss.240.14a-12 | |

Payment of Filing Fee (Check all boxes that apply): | ||

☑ |

No fee required | |

☐ |

Fee paid previously with preliminary materials | |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

Table of Contents

Table of Contents

Table of Contents

NOTICE OF 2023 ANNUAL MEETING OF SHAREHOLDERS

April 28, 2023

Dear Fellow Shareholders:

The Board of Directors of General Motors Company invites you to attend the 2023 Annual Meeting of Shareholders.

At the Annual Meeting, you will be asked to:

| • | Elect the 13 Board-recommended director nominees named in this Proxy Statement; |

| • | Ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2023; |

| • | Approve, on an advisory basis, named executive officer compensation; |

| • | Approve an amendment to the Company’s 2020 Long-Term Incentive Plan to increase the number of shares available for issuance thereunder; |

| • | Vote on Rule 14a-8 shareholder proposals, if properly presented at the meeting; and |

| • | Transact any other business that is properly presented at the meeting. |

A list of the Company’s registered shareholders will be available for examination for any purpose that is germane to the meeting for ten business days before the Annual Meeting. Shareholders may request to review the list by emailing the Company at [email protected].

This Proxy Statement is provided in conjunction with GM’s solicitation of proxies to be used at the Annual Meeting. For additional information about how to attend our Annual Meeting, see “General Information About the Annual Meeting” starting on page 105.

Thank you for your continued investment in General Motors Company.

By Order of the Board of Directors,

|

|

Craig B. Glidden Corporate Secretary 300 Renaissance Center Detroit, Michigan 48265 |

|

|

Meeting Information

|

|||||

|

Date: June 20, 2023

Time: 11:30 a.m. Eastern Time

Place: Online via live webcast at:

virtualshareholdermeeting.com/GM2023

Record Date: April 21, 2023

|

| |||||

|

Your Vote Is Important

|

||||||

|

Please promptly submit your vote by internet or telephone, or by signing, dating, and returning the enclosed proxy card or voting instruction form in the postage-paid envelope provided so that your shares will be represented and voted at the meeting.

We are first mailing these proxy materials to our shareholders on or about April 28, 2023.

|

||||||

|

How to Access the Proxy Materials Online

Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting of Shareholders to be Held on June 20, 2023:

Our Proxy Statement and 2022 Annual Report are available at investor.gm.com/shareholder. You may also scan the QR code below with your smartphone or other mobile device to view our Proxy Statement and Annual Report.

|

||||||

|

i |

Table of Contents

|

TO OUR FELLOW SHAREHOLDERS: |

|

Building on Record Performance in 2022 by Ramping EV Production in 2023 and Beyond

Last year was a year of leadership for GM: we were the best-selling automaker in the U.S., with the best initial quality and the highest customer loyalty. We also led the industry in key segments, gained the most U.S. market share, and were the fastest-growing of any high-volume manufacturer in total U.S. fleet sales. Despite a difficult industry environment, we delivered record financial performance. Our U.S. hourly employees shared in our success, earning record profit sharing of $500 million, bringing the three-year total payout to $1.2 billion.

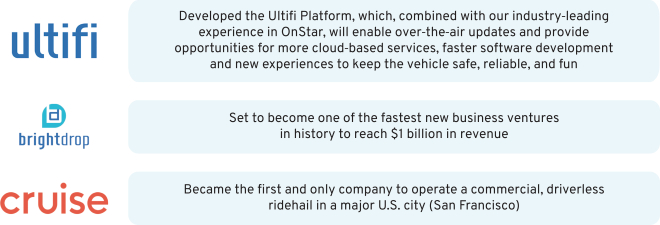

Looking ahead, we expect 2023 will be another strong year for GM, and a breakout year for our Ultium Platform. We are executing a product strategy across our ICE and EV portfolios designed to support strong pricing and grow our market share, especially with all-electric vehicles like the Cadillac LYRIQ and the Chevrolet Silverado EV, Blazer EV, and affordable Equinox EV. We are also accelerating businesses and technologies that will further drive revenue generation and profit growth, like BrightDrop and Cruise.

Board Evolution with Purpose and Impact

Delivering strong financial results during this period of high investment demonstrates the importance of recruiting strong directors to make sure our Board evolves with our business and remains a competitive advantage. We are executing our strategic Board refreshment and succession plan, which has bolstered the Board’s expertise with new, diverse directors that have deep industry knowledge in software, marketing, and cybersecurity. As we continue our work to refresh the Board, we would like to recognize Carol Stephenson, who is retiring from the Board and not standing for re-election at the Annual Meeting. The Board extends its sincere appreciation for Carol’s exemplary service since 2009 — particularly her insights that have helped enhance our compensation programs by strengthening the link between pay and performance.

On the ballot for the first time as director nominees this year are Joanne Crevoiserat, Jon McNeill, and Jan Tighe. Combined with our other director nominees, we believe these additions help create a Board with the right balance of skills, qualifications, and experience to create unprecedented opportunities for GM, drive long-term shareholder value, and execute our vision of a world with zero crashes, zero emissions, and zero congestion.

Annual Meeting Preview

At the Annual Meeting, we will provide an update on the Company’s transformation and performance, vote on several items related to our business, and shareholders will have the opportunity to ask questions. We encourage you to review this Proxy Statement to learn more about the Board, our governance practices, compensation programs and philosophy, and other important developments and priorities at GM.

Let us close by thanking you for your continued investment in GM.

Sincerely,

|

|

|

|

| |||

| Mary T. Barra |

Patricia F. Russo | |||||

| Chair and Chief Executive Officer | Independent Lead Director |

| ii |

|

Table of Contents

TABLE OF CONTENTS

| 1 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| Board Membership Criteria, Refreshment, and Succession Planning |

21 | |||

| 23 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 34 | ||||

| 37 | ||||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| 46 | ||||

| 47 | ||||

| 49 | ||||

| ITEM NO. 3 – PROPOSAL TO APPROVE, ON AN ADVISORY BASIS, NAMED EXECUTIVE OFFICER COMPENSATION |

50 | |||

| 51 | ||||

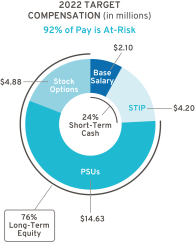

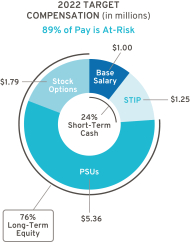

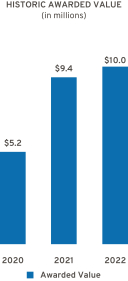

| Our Company Performance | 52 | |||

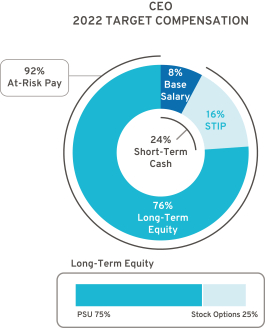

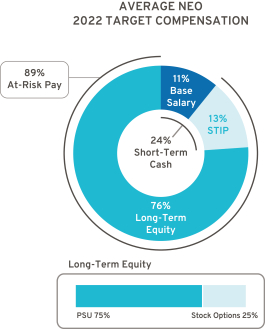

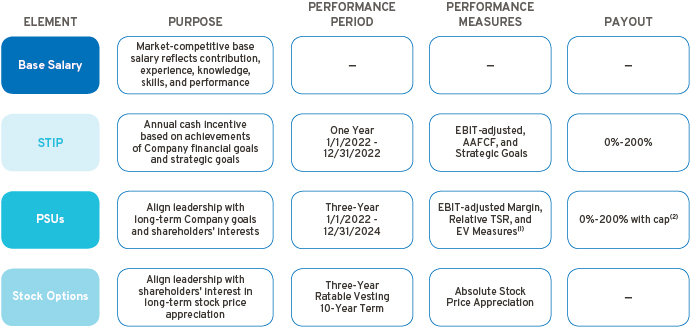

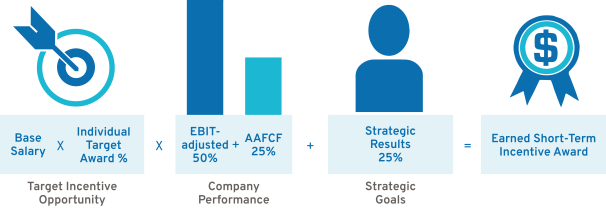

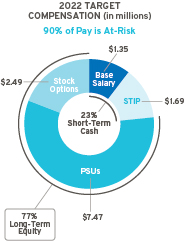

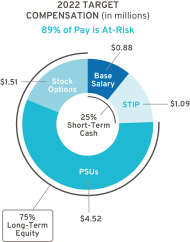

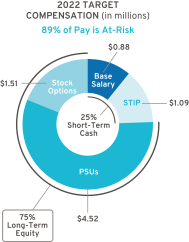

| Compensation Overview | 54 | |||

| Compensation Principles | 59 | |||

| Compensation Elements | 59 | |||

| Performance Measures | 61 | |||

| 64 | ||||

| 70 | ||||

| Compensation Committee Report | 73 | |||

Cautionary Note on Forward-Looking Statements: This Proxy Statement may include “forward-looking statements” within the meaning of the U.S. federal securities laws. Forward-looking statements are any statements other than statements of historical fact. Forward-looking statements represent our current judgement about possible future events. In making these statements, we rely upon assumptions and analysis based on our experience and perception of historical trends, current conditions, and expected future developments, as well as other factors we consider appropriate under the circumstances. We believe these judgements are reasonable, but these statements are not guarantees of any future events or financial results, and our actual results may differ materially due to a variety of factors, many of which are described in our 2022 Form 10-K and our other filings with the SEC. We caution readers not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events, or other factors that affect the subject of these statements, except where we are expressly required to do so by law.

Non-GAAP financial measures: See our 2022 Form 10-K and our other filings with the SEC for a description of certain non-GAAP measures used in this Proxy Statement, along with a description of various uses for such measures. Our calculation of these non-GAAP measures are set forth within these reports and Appendix A to this Proxy Statement, and may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related GAAP measures. When we present our total company EBIT-adjusted, GM Financial is presented on an EBT-adjusted basis.

Additional Information: References to “record” or “best” performance (or similar statements) in this Proxy Statement refer to General Motors Company, as established in 2009. In addition, certain figures included in the charts and tables in this Proxy Statement may not sum due to rounding. Simulated models and pre-production models are shown throughout; production vehicles will vary. For information on models shown, including availability, see each GM brand website for details.

|

iii |

Table of Contents

PROXY SUMMARY

Annual Meeting Overview

|

TIME & DATE |

PLACE |

RECORD DATE |

MATERIALS | |||

| 11:30 a.m. Eastern Time June 20, 2023 |

Virtual Meeting virtualshareholdermeeting.com/GM2023 |

April 21, 2023 | Available at investor.gm.com/shareholder | |||

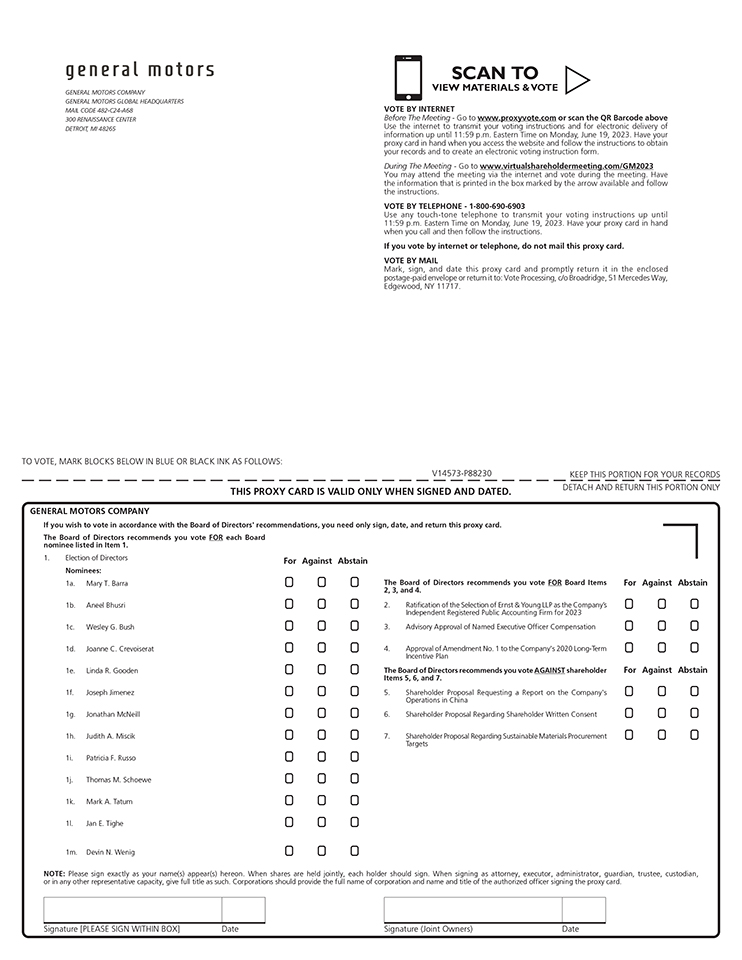

Proxy Voting Roadmap

Shareholders will be asked to vote on the following matters at the Annual Meeting:

|

VOTING MATTER |

BOARD VOTE RECOMMENDATION |

PAGE REFERENCE | ||

|

Item 1: Annual Election of Directors |

FOR each director nominee |

12 | ||

| Item 2: Proposal to Ratify the Selection of Ernst & Young LLP as the Company’s Independent Registered Public Accounting Firm for 2023 |

FOR |

46 | ||

| Item 3: Proposal to Approve, on an Advisory Basis, Named Executive Officer Compensation |

FOR |

50 | ||

| Item 4: Proposal to Approve Amendment No. 1 to the Company’s 2020 Long-Term Incentive Plan to Increase the Number of Shares Available for Issuance Thereunder |

FOR |

88 | ||

| Item 5: Shareholder Proposal Requesting a Report on the Company’s Operations in China |

AGAINST |

98 | ||

| Item 6: Shareholder Proposal Regarding Shareholder Written Consent |

AGAINST |

100 | ||

| Item 7: Shareholder Proposal Regarding Sustainable Materials Procurement Targets |

AGAINST |

102 | ||

|

1 |

Table of Contents

Snapshot of Your 2023 Board Nominees

|

Name & Principal Occupation |

Age |

Director Since |

Independent |

Committee Memberships | ||||||

|

|

Mary T. Barra Chair and Chief Executive Officer General Motors Company |

61 | 2014 | Executive – Chair | ||||||

|

|

Aneel Bhusri Chairman, Co-Founder & Co-Chief Executive Officer Workday, Inc. |

57 | 2021 |

|

Compensation Governance | |||||

|

|

Wesley G. Bush Retired Chairman & Chief Executive Officer Northrop Grumman Corporation |

62 | 2019 |

|

Audit Compensation – Chair Executive Finance | |||||

|

|

Joanne C. Crevoiserat Chief Executive Officer Tapestry, Inc. |

59 | 2022 |

|

Audit Finance Governance | |||||

|

|

Linda R. Gooden Retired Executive Vice President, Information Systems & Global Solutions Lockheed Martin Corporation |

70 | 2015 |

|

Audit Executive Risk and Cybersecurity – Chair | |||||

|

|

Joseph Jimenez Retired Chief Executive Officer Novartis AG |

63 | 2015 |

|

Compensation Executive Finance – Chair Risk and Cybersecurity | |||||

|

|

Jonathan McNeill Co-Founder and Chief Executive Officer DVx Ventures |

55 | 2022 |

|

None | |||||

|

|

Judith A. Miscik Chief Executive Officer Global Strategic Insights |

64 | 2018 |

|

Finance Risk and Cybersecurity | |||||

|

|

Patricia F. Russo Chair Hewlett Packard Enterprise Company |

70 | 2009 |

|

Compensation Executive Finance Governance – Chair | |||||

|

|

Thomas M. Schoewe Retired Executive Vice President & Chief Financial Officer Wal-Mart Stores, Inc. |

70 | 2011 |

|

Audit – Chair Executive Finance Risk and Cybersecurity | |||||

|

|

Mark A. Tatum Deputy Commissioner & Chief Operating Officer National Basketball Association |

53 | 2021 |

|

Audit Governance | |||||

|

|

Jan E. Tighe Retired Vice Admiral U.S. Navy |

60 | 2023 |

|

None | |||||

|

|

Devin N. Wenig Retired President & Chief Executive Officer eBay Inc. |

56 | 2018 |

|

Risk and Cybersecurity | |||||

| 2 |

|

Table of Contents

| u | 2023 Board Nominee Statistics |

|

3 |

Table of Contents

2022 Business Highlights

| u | Financial Highlights |

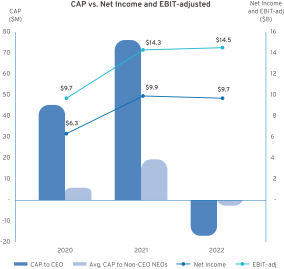

| $9.9B | Net income attributable to stockholders | $14.5B | EBIT-adjusted(1) | |||

| 6.3% | Net income margin | 9.2% | EBIT-adjusted(1) margin | |||

| $6.13 | EPS-diluted | $7.59 | EPS-diluted-adjusted(1) | |||

|

$156.7B |

Revenue |

$19.1B |

Automotive operating cash flow | |||

| $39.5B | Automotive liquidity at year-end(2) | $2.8B | Returned to shareholders via dividends and share repurchases | |||

|

3.6M |

Wholesale units |

9.2% |

Global Market Share | |||

| 1.1M | Full-size pickups, midsize pickups, and full-size SUVs sold in the U.S. | 16.0% | U.S. Market Share | |||

| 16.3K | EVs sold In the U.S. |

$51K | U.S. average transaction price | |||

| (1) | Non-GAAP financial measure. Refer to Appendix A for a reconciliation of non-GAAP financial measures to their closest comparable GAAP measure. |

| (2) | Consists of cash, cash equivalents, marketable debt securities, and borrowing capacity under our revolving credit facilities. |

| u | Performance Highlights |

| U.S. Market Leader #1 in total sales #1 in full-size pickup trucks #1 in full-size, large luxury SUVs #1 in luxury sports cars

|

Record Chevrolet Bolt EV and Bolt EUV deliveries |

Opened Ultium Cells JV battery plant in Warren, OH; Spring Hill, TN opening in mid-2023; Lansing, MI opening in late 2024 | ||

| Largest U.S. market share increase of any automotive manufacturer, up 1.6pp, with record ATPs | Cruise became the first commercial, driverless ridehail service in a major city when it launched in San Francisco, followed by commercial expansion into the Phoenix area and Austin |

Secured all EV raw material for 1M units of North American capacity in 2025, including more sustainable, local sourcing | ||

| 4 |

|

Table of Contents

Compensation Highlights

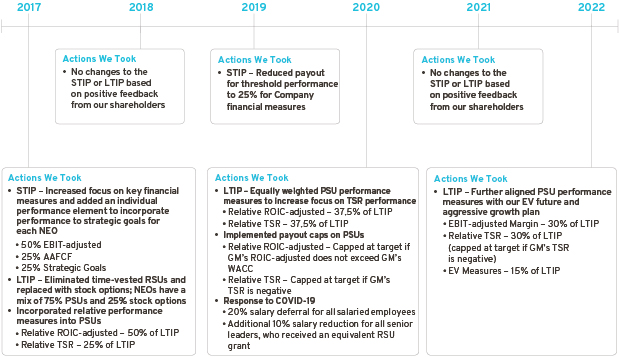

Our executive compensation program is designed to focus our leaders on key areas that drive the business forward, align to the short-term and long-term interests of our shareholders, and reward our leaders for delivering on the Company’s strategy and vision.

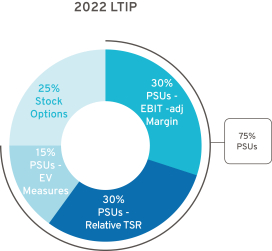

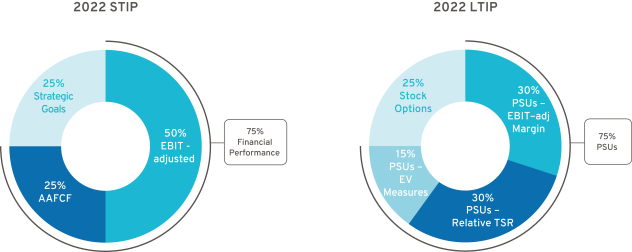

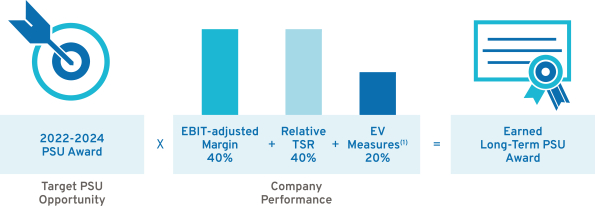

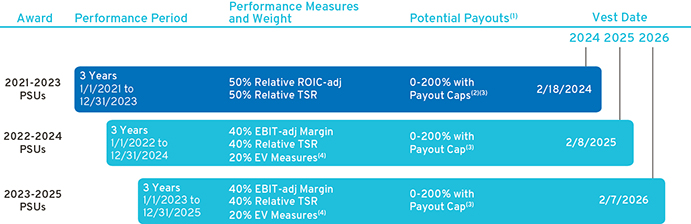

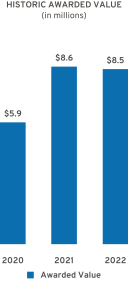

| u | 2022 LTIP Design Changes |

The 2022 LTIP is designed to align our executive compensation program with our all-electric future by driving leadership accountability for delivering on our EV commitments, directing additional focus on Company growth, which will better support our expansion into new markets and technologies, and aligning leadership with shareholder interest in stock price appreciation. The 2022 LTIP continues to have a mix of PSUs and stock options, and PSUs now include the following performance measures:

| PSUs – 75%

EBIT-adjusted Margin – Focuses leaders to pursue profitable growth opportunities and drive higher absolute margins on existing revenue bases.

Relative TSR – Focuses leaders to deliver shareholder returns that outperform our OEM peer group.

EV Measures – Focuses leaders to execute on our EV commitment of 1 million units of annual capacity in North America in 2025:

• GMNA EV Volume

• GMNA EV Launch Timing

• GMNA EV Launch Quality (modifier) |

|

Stock Options – 25%

Stock options continue to align leadership with shareholder interest in long-term stock price appreciation.

| u | New Compensation Committee Leadership |

In August 2022, Wesley Bush took over as the Compensation Committee Chair, replacing Carol Stephenson who transitioned to being a member of the Committee in anticipation of her retirement from the Board this year. Please see Mr. Bush’s letter to shareholders, which can be found on page 51. In his letter, he discusses the Compensation Committee’s key priorities for the year and its ongoing efforts to evolve our executive compensation program to align with shareholder feedback.

|

5 |

Table of Contents

Shareholder Engagement

The Company has an extensive shareholder outreach program and engages with institutional investors and other stakeholders to help the Board and management gain feedback on a variety of topics. The feedback received from these sessions is communicated to the Governance Committee and Compensation Committee throughout the year. In 2022, members of our Board or management team conducted over 45 stakeholder engagements, including with shareholders representing a majority of our common stock. In addition to those sessions, we participate in a number of activities throughout the year that provide the opportunity to communicate our strategy to shareholders and listen to a diverse set of opinions. A sample of such activity in 2022 included:

|

Patricia F. Russo Independent Lead Director |

“As the Independent Lead Director, I help make sure the Board receives regular input from our shareholders. Every year since 2016, the Board has invited at least one institutional shareholder to a Board meeting to provide its perspective on the Company’s strategic direction. In addition, I regularly meet with investors to discuss the Board’s composition and evolving skills, oversight of ESG risks and opportunities, enhancements to our executive compensation plans, critical public policy issues, and our ongoing efforts to build a more sustainable and resilient supply chain.” |

| 6 |

|

Table of Contents

The table below provides a summary of common themes we have heard that led to boardroom discussion and action:

| Message |

|

Actions | ||

| Requested to disclose Board priorities for future director recruitment and the succession plan with regards to diversity. | For a discussion of the actions taken to further evolve the Board’s composition, see page 21. We also amended our Corporate Governance Guidelines to formalize the Board’s (long-standing) practice of including highly qualified women and individuals from minority groups in the pool of candidates from which Board nominees are chosen. We also clarified that our definition of diversity includes nationality, gender, age, ethnicity, and sexual orientation. | |||

| Encouraged to modernize the Board’s approach to equity grants for non-employee Directors. | The Governance Committee conducted a comprehensive review of our non-employee director compensation program, which resulted in increasing the mandatory deferral requirement and stock ownership requirements. For more discussion of the changes, see page 23. | |||

| Prior shareholder proposals asked the Board to lower the Company’s threshold to call a special meeting. | In response to discussions with our shareholders, the Board recently amended GM’s Bylaws to provide that any shareholder or group of shareholders that own an aggregate of at least 15 percent of GM’s outstanding common stock may call a special meeting. | |||

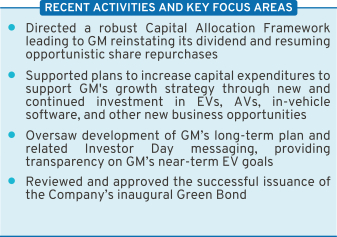

| Encouraged to return capital to shareholders as part of the Company’s capital allocation strategy. | In 2022, we reinstated the Company’s quarterly dividend and reinstated our share repurchase program, which had been temporarily paused at the outset of the COVID-19 pandemic. Following input from the Board, we felt that management had made significant progress on its key strategic initiatives and became confident in the Company’s capacity to fund growth while also returning capital to shareholders. | |||

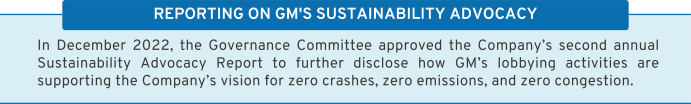

| Encouraged to continue to be transparent with the Company’s public policy priorities and take more action to create a resilient and secure supply chain ecosystem that incorporates decarbonization priorities and human rights. | We continued work with the Climate Action 100+ to publish the Company’s second Sustainability Advocacy Report, which discloses the company’s efforts to advocate for EV provisions within the Inflation Reduction Act of 2022 and the Infrastructure Investment and Jobs Act of 2021, which we believe support the goals of the Paris Agreement.

One of the main focus areas this year will be to continue momentum on building a resilient supply chain supporting our transition to EVs. Two recent examples of our actions include a $650 million equity investment and supply agreement with Lithium Americas Corp. to supply lithium sourced from the United States and a supply agreement with U.S. Steel for a U.S.-sourced sustainable steel solution that results in 75 percent fewer emissions. We also recently joined the First Movers Coalition with sustainable procurement commitments covering concrete, steel, and aluminum. | |||

| Encouraged to affirm that each director has sufficient time and availability to comply with the Company’s expectations. | We amended our Corporate Governance Guidelines to formalize an existing practice of the Governance Committee to ensure that each director has sufficient time to commit to the Company. In 2022, this review determined that each director nominee is fulfilling their obligations as a director of the Company. | |||

|

7 |

Table of Contents

Environmental, Social, and Governance Highlights

| u | Environmental Highlights |

| • | GM joined the First Movers Coalition with concrete, steel, and aluminum commitments |

| • | GM has secured enough renewable energy to power its U.S. sites by 2025 based on current projections |

| • | New Ultium Cells LLC battery plant opened in Ohio to support the scaling of production of our EVs |

| • | Record sales of Chevrolet Bolt EV and Bolt EUV in 2022 |

| Addressing Environmental Impact |

GM recognizes the importance of taking action to limit our environmental impact. We are focused on continuing to enhance the sustainability of our business. This includes identifying and managing climate-related risks and opportunities, and setting ambitious goals to reduce our impact. One of our goals is to be carbon neutral in our products and operations by 2040. Prioritizing transparency, we annually report on our GHG emissions in our Sustainability Report. We have also set environmental sustainability goals related to energy, water, and waste. For more information on our sustainability goals, progress, and our strategy, please see our 2022 Sustainability Report available at gmsustainability.com. | |

| Enhancing Supply Chain Resiliency |

To drive resiliency and sustainability across our supply chain, GM is engaging with suppliers, industry groups, and nonprofits. In 2022, we enhanced our Supplier Code of Conduct and invited Tier 1 suppliers to sign our ESG Partnership Pledge to demonstrate their commitment to principles of sustainability and human rights. By the end of 2022, 68 percent of our direct suppliers, by budgeted annual purchase value, had committed to the Pledge. We are also focused on forging long-term strategic relationships to build a North America-focused supply chain that spans the EV battery ecosystem — from raw materials to battery cells. In 2022, we announced several new strategic supply arrangements. | |

| Funding the Future |

In 2022, GM published a Sustainable Finance Framework, which we believe will help further align our financing activities with our sustainability strategy, and issued $2.25 billion of green bonds under the Framework, the proceeds of which were allocated to clean transportation solutions, as described in our Framework. | |

| Collaboration and Integration |

Sustainability is an important part of GM’s work to support an all-electric future, our sustainability strategy is weaved into our business strategy and both are focused on providing growth and long-term value. Working towards our sustainability and EV goals requires strong cross-functional collaboration. This work is overseen by our Board and executed by senior leaders across GM, including through our Office of Sustainability and ESG Disclosure Committee. | |

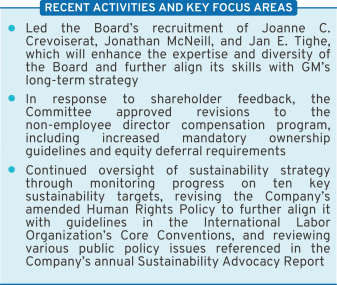

| Advocating and Engaging |

Accelerating the transition to a more sustainable, electric future requires collaboration across society. GM engages with businesses, nonprofits, and governments to develop sustainability initiatives, including public policy solutions to support decarbonizing transportation and the grid. For more information about our advocacy, please see our 2022 Sustainability Advocacy Report, available at investor.gm.com/esg. | |

| 8 |

|

Table of Contents

| u | Social Highlights |

| • | GM recognized as a DiversityInc Top 50 company for the 7th consecutive year |

| • | Top-ranked automotive corporation in the J.D. Power Initial Quality Study |

| • | Recognized in the top 50 companies in the 2023 JUST 100 rankings |

| • | $60 million donated to nonprofits, including 400+ U.S.-based organizations, and 158,000+ employee volunteer hours |

| Empowering Employees |

Our employees drive the innovation that powers GM. They create our products and are there every step of the journey — from the idea stage to the first time a vehicle is turned on. Our success is a result of their vision and dedication. Our Earn a Living. Make a Life. initiative celebrates some of the amazing people behind our products. We remain focused on offering competitive benefits and salaries to employees. We continue to add to the suite of learning, mentoring, and professional development opportunities available to employees. | |

| A Culture of Safety |

We envision a world with zero crashes. This vision and our customers’ safety is at the heart of what we do. Workplace safety is also a priority across GM. Safety efforts are focused on five tactical dimensions – culture, knowledge, systems, data, and risk mitigation – in support of our overriding commitment to live the values that return people home safely. Every person. Every site. Every day. | |

| A Diverse & Inclusive Workforce |

Maintaining a diverse, talented workforce and a workplace where all employees can thrive is a key priority at GM. From recruiting and hiring, to career progression and leadership training, we are working to continuously advance the inclusivity of our workplace. For more information about DE&I at GM, please see our 2022 Sustainability Report. | |

| Dealer and Supplier Engagement |

The impact of our Company extends beyond our own operations. GM recognizes this and engages with dealers and suppliers to support positive change. At the dealership level, GM is proud of our Minority Dealer Development Program and Women’s Retail Network. We also have a longstanding supplier diversity program, and in 2022, spent approximately $4.4 billion with diverse Tier 1 North American suppliers. We engage with suppliers to help align their actions with our values as a company. Our ESG Partnership Pledge invites certain suppliers to make key commitments related to the environment and labor, and we continue to enhance visibility across our supply chain. Additionally, in 2022, we published our first Corporate Human Rights Benchmark disclosure. | |

| Supporting Communities |

We create jobs and support local economies in the communities where we live and work. GM’s corporate giving seeks to fund inclusive and sustainable solutions to common social issues, with a focus on STEM education, community development, vehicle and road safety, and the city of Detroit. For more information, please see our 2022 Corporate Giving Report. | |

| Innovative and Accessible Technology |

As we move toward a carbon neutral future, we aspire to lead positive change and implement inclusive solutions that address everyone’s unique needs. One way in which we’re doing this is through our Ultium Platform, which is powering our expanding lineup of a wide range EVs across most segments and price points, helping to put everyone in an EV. We are also working to increase EV charging infrastructure and expand the availability of driverless rideshare services through Cruise. | |

|

9 |

Table of Contents

| u | Governance Highlights |

The Board is committed to governance structures and practices that protect shareholder value and important shareholder rights, including the following:

The Governance Committee regularly reviews these structures and practices and makes updates as appropriate. For example, in April 2023, in response to shareholder feedback and in consideration of governance best practices, the Board lowered the threshold for shareholders to call a special meeting to shares representing 15 percent of the Company’s voting power.

| 10 |

|

Table of Contents

Our Purpose, Values, and Behaviors

| u | Our Purpose |

To provide greater focus during a period of unprecedented change, we created a statement on the collective purpose of the GM team. It’s a simple but powerful statement that honors our heritage of innovation, captures who we are when we’re at our best, and guides us into our future:

We pioneer the innovations that move and connect people to what matters.

| u | Our Values |

| Customers

We put the customer at the center of everything we do. We listen intently to our customers’ needs. Each interaction matters. Safety and quality are foundational commitments, never compromised. |

Excellence

We act with integrity. We are driven by ingenuity and innovation. We have the courage to do and say what’s difficult. Each of us takes accountability for results, drives for continued efficiencies, and has the tenacity to win.

| |

| Relationships

Our success depends on our relationships inside and outside the Company. We encourage diverse thinking and collaboration from all over the world to create great customer experiences. |

Seek Truth

We pursue facts, respectfully challenge assumptions, and clearly define objectives. When we disagree, we provide additional context and consider multiple perspectives. | |

| u | Our Behaviors |

|

11 |

Table of Contents

| ITEM NO. 1: | ANNUAL ELECTION OF DIRECTORS | |

At the Annual Meeting, 13 directors will be nominated for election to GM’s Board of Directors. The Governance Committee evaluated the nominees in accordance with the Committee’s charter and our Corporate Governance Guidelines and submitted the nominees to the Board for approval.

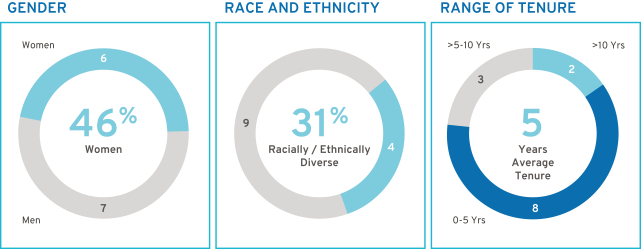

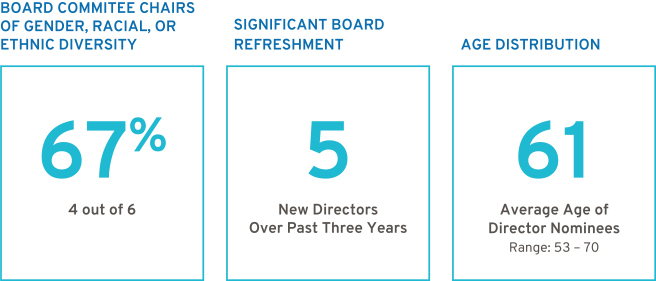

The Board believes that the director nominees’ diverse backgrounds, attributes, and experiences provide valuable insights for the Board’s oversight of the Company. Nine of the 13 nominees, or 69 percent, bring gender, racial, or ethnic diversity to the Board, including four of the six committee chairs.

Of the 13 director nominees, ten were previously elected at the 2022 annual meeting. Joanne C. Crevoiserat and Jonathan McNeill were elected to the Board in August 2022 and September 2022, respectively. Jan E. Tighe’s nomination is submitted by the Board for inclusion in this Proxy Statement and, if elected by shareholders, she will join the Board immediately following the Annual Meeting. Further information on the Board’s composition, as well as each nominee’s qualifications and relevant experience, are provided on the following pages.

As noted previously in this Proxy Statement, Carol Stephenson is not standing for re-election this year in accordance with the Company’s non-employee director retirement guidelines. We are grateful for the expertise and leadership she brought to the Board, including as Chair of the Compensation Committee from 2015 to 2022.

If elected, the director nominees will serve on the Board until the next annual meeting of shareholders, or until their successors are duly elected and qualified, or until their earlier resignation or removal. If any nominee becomes unable to serve, proxies will be voted for the election of such other person as the Board may designate, unless the Board chooses to reduce the number of directors standing for election. Each of the nominees has consented to being named in this Proxy Statement and serving on the Board if elected.

|

The Board recommends a vote FOR each of the nominees identified in this Proxy Statement.

|

FOR

|

| 12 |

|

Table of Contents

Board Experience and Expertise

| u | Skills Matrix |

Our director nominees collectively possess the expertise, leadership skills, and diversity of experiences and backgrounds to oversee management’s execution of its growth strategy and protect long-term shareholder value. The skills matrix below summarizes certain qualifications used by the Governance Committee in their evaluation of our director nominees.

| Director |

Public Co. CEO |

Industry | Manufacturing | Technology | Risk Management |

Finance | Marketing | Cyber | ESG Expertise | |||||||||

| M. Barra |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

|

|

SG | |||||||||

| A. Bhusri |

🌑 |

|

|

🌑 |

🌑 |

🌑 |

|

🌑 |

SG | |||||||||

| W. Bush |

🌑 |

|

🌑 |

🌑 |

🌑 |

🌑 |

|

🌑 |

ESG | |||||||||

| J. Crevoiserat |

🌑 |

|

🌑 |

|

🌑 |

🌑 |

🌑 |

|

ESG | |||||||||

| L. Gooden |

|

|

🌑 |

🌑 |

🌑 |

🌑 |

|

🌑 |

SG | |||||||||

| J. Jimenez |

🌑 |

|

🌑 |

|

🌑 |

🌑 |

🌑 |

|

EG | |||||||||

| J. McNeill |

|

🌑 |

🌑 |

🌑 |

🌑 |

|

🌑 |

|

ESG | |||||||||

| J. Miscik |

|

|

|

🌑 |

🌑 |

🌑 |

|

|

G | |||||||||

| P. Russo |

🌑 |

|

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

|

SG | |||||||||

| T. Schoewe |

|

|

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

🌑 |

SG | |||||||||

| M. Tatum |

|

|

|

|

🌑 |

|

🌑 |

|

SG | |||||||||

| J. Tighe |

|

|

|

🌑 |

🌑 |

|

|

🌑 |

SG | |||||||||

| D. Wenig |

🌑 |

|

|

🌑 |

🌑 |

🌑 |

🌑 |

|

G | |||||||||

To supplement the skills matrix, since 2021, the Board has also undertaken an annual ESG self-evaluation. The evaluation is designed to ensure that the Board possesses the requisite skills and expertise to oversee the Company’s ESG opportunities, priorities, and risks. The Governance Committee, led by our Independent Lead Director, leads this effort by asking directors to consider their expertise across 20 key ESG subject matter areas. Upon the conclusion of this evaluation in 2022, the Board determined that it has strong ESG expertise and possesses a broad range of skills, qualifications, and attributes that will support the Company’s sustainability commitments. Results of the Board’s ESG self-evaluation are represented on the skills matrix above and are highlighted in each of the director nominee biographies below.

|

13 |

Table of Contents

| u | Director Nominee Biographies |

|

Director Since: 2014 Age: 61 Independent: No Gender: Female Race/Ethnicity: White |

|

Director Since: 2009 Age: 70 Independent: Yes Gender: Female Race/Ethnicity: White | |||||

| Mary T. Barra | Patricia F. Russo | |||||||

|

Chair & CEO, General Motors Company |

Chair, Hewlett Packard Enterprise Company | |||||||

|

Committees: Executive (Chair)

Other Public Company Directorships: The Walt Disney Company

Prior Public Company Directorships: General Dynamics Corporation

Prior Experience: Ms. Barra is Chair and CEO of General Motors. She has served as Chair of the Board of Directors since January 2016 and has served as CEO since January 2014. Prior to becoming CEO, Ms. Barra served as GM’s Executive Vice President, Global Product Development, Purchasing and Supply Chain from 2013 to 2014; Senior Vice President, Global Product Development from 2011 to 2013; Vice President, Global Human Resources from 2009 to 2011; and Vice President, Global Manufacturing Engineering from 2008 to 2009. Ms. Barra began her career with GM in 1980.

Reasons for Nomination: Ms. Barra has in-depth knowledge of the Company and the global automotive industry; extensive senior leadership, strategic planning, operational, and business experience; and a strong engineering background with experience in global product development.

Spotlight on ESG Expertise: Ms. Barra has developed social expertise – in particular, workplace safety and human capital management – during her career at GM, which has included various senior leadership roles. As Chair and CEO, she has spearheaded many initiatives to align the Company’s culture with its transformation efforts and holds herself and the leadership team accountable for the development of GM employees. GM benefits from Ms. Barra’s experience in these areas as it seeks to be a safe and inclusive workplace. |

Committees: Compensation, Executive, Finance, Governance (Chair)

Other Public Company Directorships: Hewlett Packard Enterprise Company (Chair), KKR Management LLC, and Merck & Co. Inc.

Prior Public Company Directorships: Hewlett-Packard Company and Arconic, Inc.

Prior Experience: Ms. Russo served as Lead Director of Hewlett-Packard Company’s board of directors from 2014 to 2015. She was GM’s Independent Lead Director from March 2010 to January 2014, and in 2021, she was re-appointed to that role. Ms. Russo served as CEO of Alcatel-Lucent S.A. from 2006 to 2008; Chairman and CEO of Lucent Technologies, Inc. from 2003 to 2006; and President and CEO of Lucent Technologies from 2002 to 2006.

Reasons for Nomination: Ms. Russo has extensive senior leadership experience in corporate strategy, finance, sales and marketing, technology, and leadership development, as well as experience managing business-critical technology disruptions.

Spotlight on ESG Expertise: Ms. Russo has developed deep governance expertise – in particular, board governance – during her tenure as chair of Hewlett Packard Enterprise Company and service on the JUST Capital board. In these capacities, among others, she advocates for enhanced ESG standards for directors and the inclusion of ESG metrics to drive strategic decisions. GM benefits from Ms. Russo’s experience as it works to continue to provide ESG disclosures that are meaningful to our investors and other stakeholders. | |||||||

| 14 |

|

Table of Contents

|

Director Since: 2021 Age: 57 Independent: Yes Gender: Male Race/Ethnicity: Indian American |

|

Director Since: 2019 Age: 62 Independent: Yes Gender: Male Race/Ethnicity: White | |||||

| Aneel Bhusri | Wesley G. Bush | |||||||

|

Chairman, Co-Founder & Co-CEO, Workday, Inc. |

Retired Chairman & CEO, Northrop Grumman Corporation | |||||||

|

Committees: Compensation, Governance

Other Public Company Directorships: Workday, Inc.

Prior Public Company Directorships: Okta, Inc., Cloudera, Inc., Pure Storage, Inc., and Intel Corporation

Prior Experience: Mr. Bhusri is a Co-Founder and Co-CEO of Workday, Inc. and Chairman of its board. Before co-founding Workday in 2005, he held a number of leadership positions at PeopleSoft, Inc., including serving as Vice Chairman of the board and Senior Vice President responsible for product strategy, business development, and marketing. In addition to his role at Workday, Mr. Bhusri is an advisor at Greylock Partners, a leading venture capital firm.

Reasons for Nomination: Mr. Bhusri has extensive expertise in software, technology, and fostering growth companies from the start-up phase into mature, public companies. He also has strong leadership experience gained through his role as the CEO of a large, public technology company.

Spotlight on ESG Expertise: Mr. Bhusri has developed social expertise as the Co-Founder and Co-CEO of Workday. In that capacity, he advocates for human capital management solutions that focus, in part, on employee engagement. GM benefits from Mr. Bhusri’s experience in this area as it takes steps to be the most inclusive company in the world and seeks to minimize the impacts of the transition to EVs on employees. |

Committees: Audit, Compensation (Chair), Finance

Other Public Company Directorships: Dow Inc. and Cisco Systems Inc.

Prior Public Company Directorships: Norfolk Southern Corporation and Northrop Grumman Corporation

Prior Experience: Mr. Bush served as Chairman of Northrop Grumman’s board of directors from 2011 to 2019. He also served as the CEO of Northrop Grumman from 2010 to 2018. Prior to that, Mr. Bush served in numerous leadership roles at Northrop Grumman, including President and Chief Operating Officer, CFO, and President of the company’s Space Technology sector. He also served in a variety of leadership positions at TRW, Inc., before it was acquired by Northrop Grumman in 2002.

Reasons for Nomination: Mr. Bush has valuable experience in leading a manufacturing enterprise known for its advanced engineering and technology. He also has strong financial acumen gained through his finance leadership roles and has knowledge of key governance issues, including risk management.

Spotlight on ESG Expertise: Mr. Bush has developed environmental expertise as a member of the board of Conservation International. In that capacity, he leverages his scientific training to advocate for natural climate solutions. GM benefits from Mr. Bush’s experience in this area as it seeks to create a world with zero emissions. | |||||||

|

15 |

Table of Contents

|

Director Since: 2022 Age: 59 Independent: Yes Gender: Female Race/Ethnicity: White |

|

Director Since: 2015 Age: 70 Independent: Yes Gender: Female Race/Ethnicity: African American | |||||

| Joanne C. Crevoiserat | Linda R. Gooden | |||||||

|

CEO, Tapestry, Inc.

|

Retired Executive Vice President, Information Systems & Global Solutions, Lockheed Martin Corporation | |||||||

|

Committees: Audit, Finance, Governance

Other Public Company Directorships: Tapestry, Inc.

Prior Public Company Directorships: At Home Group Inc.

Prior Experience: Since October 2020, Ms. Crevoiserat has been CEO and a member of the board of Tapestry, Inc. Prior to her appointment as interim CEO in July 2020, she served as the CFO. She also previously served in senior roles at Abercrombie & Fitch Co., Kohl’s Inc., Wal-Mart Stores, Inc., and May Department Stores.

Reasons for Nomination: Ms. Crevoiserat has cultivated an extensive background in financial expertise and brand development. Her leadership capabilities demonstrated through her various senior leadership retail positions help the company as it grows its global consumer brands through consumer-centric, digital, and data-driven initiatives.

Spotlight on ESG Expertise: Ms. Crevoiserat developed social and environmental expertise – in particular, human rights, supply chain, and compliance – through her experience in the retail industry as she provides oversight of sustainable material sourcing. GM benefits from Ms. Crevoiserat’s experience in this area as it seeks to build a more sustainable supply chain aligned with its vision of zero emissions. |

Committees: Audit, Executive, Risk and Cybersecurity (Chair)

Other Public Company Directorships: The Home Depot, Inc. and Bright Health Group, Inc.

Prior Public Company Directorships: WGL Holdings, Inc., Washington Gas & Light Company, a subsidiary of WGL Holdings, Inc., and Automatic Data Processing, Inc.

Prior Experience: Ms. Gooden served as Executive Vice President, Information Systems and Global Solutions of Lockheed Martin Corporation from 2007 to 2013. She also served as Lockheed Martin’s Deputy Executive Vice President, Information and Technology Services from October to December 2006, and as its President, Information Technology from 1997 to December 2006.

Reasons for Nomination: Ms. Gooden has strong leadership capabilities demonstrated through her various senior leadership positions at Lockheed Martin. She also has significant expertise in operations and strategic planning, as well as an extensive background in information technology and cybersecurity.

Spotlight on ESG Expertise: Ms. Gooden developed social expertise through her leadership in the cybersecurity industry. In that capacity, she leverages her technical training to advocate for stringent privacy and data protection controls. GM benefits from Ms. Gooden’s experience in this area as it develops innovative software and autonomous driving solutions. | |||||||

| 16 |

|

Table of Contents

|

Director Since: 2015 Age: 63 Independent: Yes Gender: Male Race/Ethnicity: Hispanic |

|

Director Since: 2022 Age: 55 Independent: Yes Gender: Male Race/Ethnicity: White | |||||

| Joseph Jimenez | Jonathan McNeill | |||||||

|

Retired CEO, Novartis AG |

Co-Founder and CEO, DVx Ventures | |||||||

|

Committees: Compensation, Executive, Finance (Chair), Risk and Cybersecurity

Other Public Company Directorships: The Procter & Gamble Co., Century Therapeutics, Inc., and Graphite Bio, Inc.

Prior Public Company Directorships: Colgate-Palmolive Company and AstraZeneca plc

Prior Experience: Since 2019, Mr. Jimenez served as Co-Founder and Managing Partner of Aditum Bio, a biotechnology-focused venture capital firm. Prior to that, he served as CEO of Novartis AG from 2010 until his retirement in 2018. Mr. Jimenez led Novartis’ Pharmaceuticals Division from October 2007 to 2010 and its Consumer Health Division in 2007. From 2006 to 2007, he served as Advisor to the Blackstone Group L.P. Mr. Jimenez was also Executive Vice President, President, and CEO of Heinz Europe from 2002 to 2006; and President and CEO of H.J. Heinz Company North America from 1999 to 2002.

Reasons for Nomination: Mr. Jimenez has served as the CEO of a global company with significant research and development and capital spending in a highly regulated environment. He also has significant experience in finance, strategic planning, and consumer branding and marketing.

Spotlight on ESG Expertise: Mr. Jimenez developed environmental expertise addressing reductions in greenhouse gases, waste, effluents, and consumption of natural resources for various manufacturing facilities during his career as a pharmaceutical executive. GM benefits from his experience in this area as it transitions its manufacturing capabilities for an EV future. |

Committees: None

Other Public Company Directorships: Lululemon Athletica

Prior Public Company Directorships: None

Prior Experience: Since 2020, Mr. McNeill has served as CEO of DVx Ventures, a company focused on early-stage startups. Prior to founding DVx Ventures, he served as Chief Operating Officer of Lyft, Inc. from 2018 to 2019. From 2015 to 2018, he also served as President, global sales, delivery and service of Tesla, Inc., and led the team growing revenues from $2 billion to over $20 billion annually, across 33 countries.

Reasons for Nomination: Mr. McNeill has deep experience as both an entrepreneur and as an executive at scale. He is a demonstrated leader in the EV space with expertise in business models, software architecture, and cyber. Through his experience as a senior leader, he has founded and scaled multiple technology and retail companies. His innovative and entrepreneurial experience provide critical insights for the Company’s various growth businesses.

Spotlight on ESG Expertise: Mr. McNeill developed environmental expertise – in particular, on greenhouse gas emissions, air quality, and product design and lifecycle management – through his industry experience while driving adoption of EVs. GM benefits from Mr. McNeill’s experience in this area as it seeks to disrupt and become the leader in the EV and AV markets. | |||||||

|

17 |

Table of Contents

|

Director Since: 2018 Age: 64 Independent: Yes Gender: Female Race/Ethnicity: White |

|

Director Since: 2011 Age: 70 Independent: Yes Gender: Male Race/Ethnicity: White | |||||

| Judith A. Miscik | Thomas M. Schoewe | |||||||

|

CEO, |

Retired Executive Vice President & CFO, | |||||||

|

Committees: Finance, Risk and Cybersecurity

Other Public Company Directorships: Morgan Stanley and HP, Inc.

Prior Public Company Directorships: EMC Corporation and Pivotal Software, Inc.

Prior Experience: Ms. Miscik is the CEO of Global Strategic Insights and a Senior Advisor at Lazard Geopolitical Advisory. Previous to her current roles, she served as CEO and Vice Chairman of Kissinger Associates, Inc. from 2017 to 2022 and before that in other senior leadership positions. Prior to joining Kissinger Associates, Ms. Miscik was the Global Head of Sovereign Risk at Lehman Brothers from 2005 to 2008; and from 2002 to 2005, she served as Deputy Director for Intelligence at the U.S. Central Intelligence Agency, where she worked from 1983 to 2005.

Reasons for Nomination: Ms. Miscik has a unique and extensive background in intelligence, security, government affairs, and risk analysis, bringing valuable experience in assessing and mitigating geopolitical and macroeconomic risks in both the public and the private sectors.

Spotlight on ESG Expertise: Ms. Miscik has developed governance expertise – in particular, risk management – through years serving as a senior leader in the intelligence community, in various senior roles in the private sector, and through her role as Vice Chairman of the Council on Foreign Relations. GM benefits from Ms. Miscik’s experience in this area as it seeks to navigate various geopolitical risks and advocates for climate solutions. |

Committees: Audit (Chair), Executive, Finance, Risk and Cybersecurity

Other Public Company Directorships: Northrop Grumman Corporation

Prior Public Company Directorships: KKR Management LLC and PulteGroup, Inc.

Prior Experience: Mr. Schoewe served as Executive Vice President and CFO of Wal-Mart Stores, Inc. from 2000 to 2011. Prior to joining Wal-Mart, he held several senior roles at the Black & Decker Corporation, including CFO from 1993 to 1999. Before joining Black & Decker, Mr. Schoewe worked for Beatrice Companies where he was CFO and Controller of one of its subsidiaries, Beatrice Consumer Durables Inc.

Reasons for Nomination: Mr. Schoewe has extensive financial experience acquired through positions held as the CFO of large public companies, as well as expertise in internal controls, risk management, and mergers and acquisitions. He also has significant international experience through his service as an executive of large public companies with substantial international operations and large-scale transformational installations of global enterprise information technologies.

Spotlight on ESG Expertise: Mr. Schoewe developed social expertise – in particular, supply chain management – during his tenure as CFO at Black & Decker and Wal-Mart and currently as a member of the Audit Committee Leadership Network. In his current capacity, he leverages his training to advocate for improved performance of audit committees and more rigorous controls of ESG disclosures. GM benefits from Mr. Schoewe’s experience as we continue our efforts to provide comprehensive and meaningful ESG disclosures. | |||||||

| 18 |

|

Table of Contents

|

Director Since: 2021 Age: 53 Independent: Yes Gender: Male Race/Ethnicity: Black, Asian |

|

Director Since: 2023 Age: 60 Independent: Yes Gender: Female Race/Ethnicity: White | |||||

| Mark A. Tatum | Jan E. Tighe | |||||||

|

Deputy Commissioner & Chief Operating Officer,

|

Retired Vice Admiral | |||||||

|

Committees: Audit, Governance

Other Public Company Directorships: None

Prior Public Company Directorships: None

Prior Experience: Mr. Tatum joined the National Basketball Association (NBA) in 1999 and was appointed NBA Deputy Commissioner and Chief Operating Officer in 2014. Prior to that, he served in numerous leadership roles at the NBA, including Executive Vice President of Global Marketing Partnerships, Senior Vice President and Vice President of Business Development, Senior Director and Group Manager of Marketing Properties, and Director of Marketing Partnerships.

Reasons for Nomination: Mr. Tatum has extensive senior leadership experience in marketing and sales strategy, managing media relationships, and global business operations. He also has significant expertise driving customer engagement and operations globally through his leadership roles in the NBA.

Spotlight on ESG Expertise: Mr. Tatum has developed social expertise – in particular, in DE&I issues – as President of the NBA’s Social Justice Coalition as well as President of the NBA Foundation. In these roles, he advocates for social and racial justice and is working to drive economic opportunity and empowerment in the Black community. GM benefits from his experience in this area as it evolves its culture and seeks to become the most inclusive company in the world. |

Committees: None

Other Public Company Directorships: The Goldman Sachs Group, Inc., Huntsman Corporation, and IronNet Inc.

Prior Public Company Directorships: The Progressive Corporation (not standing for re-election at Progressive’s annual meeting on May 12, 2023)

Prior Experience: Vice Admiral Tighe retired from the U.S. Navy in 2018, having served as the Deputy Chief of Naval Operations for Information Warfare and Director of Naval Intelligence. Her prior Flag Officer assignments include command of the Navy’s Fleet Cyber Command, President of the Naval Postgraduate School, and Deputy Director of Operations at U.S. Cyber Command.

Reasons for Nomination: Vice Admiral Tighe cultivated her unique operational experience in complex cybersecurity matters, including operational technologies, information systems technology, technology risk management, and strategic assessments while serving in global operations roles for the U.S. Navy and the National Security Agency.

Spotlight on ESG Expertise: Vice Admiral Tighe has developed social expertise – in particular, in cybersecurity and data privacy – during her service as Commander of Fleet Cyber Command and Deputy Chief of Naval Operations for Information Warfare, where she managed key cybersecurity policies for both operational and information technology. GM will benefit from her experience in this area as it deploys more advanced EV and AV technologies and deals with enhanced regulatory expectations. | |||||||

|

19 |

Table of Contents

|

Director Since: 2018 Age: 56 Independent: Yes Gender: Male Race/Ethnicity: White |

|||||||

| Devin N. Wenig | ||||||||

|

Retired President & CEO, |

||||||||

|

Committees: Risk and Cybersecurity

Other Public Company Directorships: None

Prior Public Company Directorships: eBay Inc.

Prior Experience: Mr. Wenig served as President and CEO of eBay Inc. and as a member of its board of directors from July 2015 to August 2019. Prior to that time, he served as President of eBay’s Marketplaces business from September 2011 to July 2015. Prior to joining eBay, Mr. Wenig was CEO of Thomson Reuters Corporation’s largest division, Thomson Reuters Markets, from 2008 to 2011; Chief Operating Officer of Reuters Group plc from 2006 to 2008; and President of Reuters’ business divisions from 2003 to 2006.

Reasons for Nomination: Mr. Wenig has extensive senior leadership experience in software and technology, global operations, and strategic planning. He also has significant expertise leading both high-growth companies from the start-up phase and large, complex organizations.

Spotlight on ESG Expertise: Mr. Wenig has developed social expertise as founder of the Wenig Family Charitable Trust. In that capacity, he helps facilitate technology and data-led solutions to issues of inequality and access in the United States. GM benefits from his experience in this area as it expands its philanthropic efforts, such as our commitment to climate justice through our Climate Fund, dedicated to helping close equity gaps in the transition to EVs and other sustainable technology. |

||||||||

| 20 |

|

Table of Contents

Board Membership Criteria, Refreshment, and Succession Planning

The selection of qualified directors is fundamental to the Board’s successful oversight of GM’s strategy and enterprise risks. We seek directors who bring diverse viewpoints and perspectives, possess a variety of skills, professional experiences, and backgrounds, and effectively represent the long-term interests of shareholders. The priorities for recruiting new directors are continually evolving based on the Company’s strategic needs. It is important that the Board remains a strategic asset capable of overseeing and helping management address the risks, trends, and opportunities GM is facing now and in the future.

In evaluating potential director candidates, the Governance Committee considers, among other factors, the criteria included on the skills matrix on page 13, the skills and experience of our current directors, and certain additional characteristics that it believes one or more directors of the Board should possess based on an assessment of the needs of the Board at that time. In every case, director candidates must be able to contribute significantly to the Board’s discussion and decision-making on the broad array of complex issues facing GM. The Governance Committee also engages a reputable, qualified search firm to help identify and evaluate potential candidates. In addition, GM’s Corporate Governance Guidelines

include the general policy that non-employee directors will not stand for election after reaching age 72, with any exceptions requiring approval by the Board (there are currently no exceptions).

In 2022, the Governance Committee reviewed its Board succession plan and five-year roadmap on a quarterly basis to ensure the Board holds the relevant and necessary talent to serve the Company and its shareholders. The Governance Committee believes its succession planning and assessment will allow it to continue important recruitment efforts and identify new skill sets required as the Company’s strategy evolves. As a result of this work, the Board elected Ms. Crevoiserat and Mr. McNeill in 2022 and nominated Vice Admiral Tighe in 2023. The Governance Committee made these nominations by employing the process described below in the “Director Recruitment Process” section on page 22 and considering, among other factors, shareholders’ interest in board refreshment, preserving the Board’s diversity, and adding directors with experience in technology, industry, marketing, and cybersecurity. The Board believes its new directors will help ensure a seamless transition over the next several years as some directors retire in due course, as well as bolster its expertise as GM continues to execute its EV and growth strategy.

| u | Board Diversity |

Aligned with GM’s aspiration to be the most inclusive company in the world, our Board believes that candidates should reflect the diverse backgrounds of GM’s global workforce and customer base. In 2022, the Board amended the Company’s Corporate Governance Guidelines to clarify the Company’s commitment to actively seeking highly qualified women and individuals from minority groups to include in the pool from which Board nominees are selected. Our Board recognizes the value of overall diversity and

considers members’ and candidates’ opinions, perspectives, personal and professional experiences, and backgrounds, including gender, race, ethnicity, nationality, and sexual orientation. We believe the judgment and perspectives offered by a diverse Board improves the quality of decision-making and enhances the Company’s business performance. Such diversity can help the Board respond more effectively to the needs of customers, shareholders, employees, suppliers, and other stakeholders.

|

21 |

Table of Contents

| u | Candidate Recommendations |

The Governance Committee will consider director candidates recommended by shareholders. The Governance Committee will review the qualifications and experience of each recommended candidate using the same criteria

for candidates proposed by Board members and communicate its decision to the candidate or the shareholder who made the recommendation. Shareholder nominations must be submitted to the Company by the deadlines found on page 109.

| u | Director Recruitment Process |

| 22 |

|

Table of Contents

Non-Employee Director Compensation

Our non-employee directors receive cash compensation as well as equity compensation in the form of GM Deferred Share Units for their Board service under the Company’s Director

Compensation Plan. Compensation for our non-employee directors is set by the Board at the recommendation of the Governance Committee.

| u | Guiding Principles |

| • Fairly compensate directors for their responsibilities and time commitments.

• Attract and retain highly qualified directors by offering a compensation program consistent with those at companies of similar size, scope, and complexity.

• Align the interests of directors with our shareholders by providing a significant portion of compensation in equity and requiring directors to continue to own our common stock (or common stock equivalents) throughout their tenure on the Board.

• Provide compensation that is simple and transparent to shareholders.

|

| u | Annual Review Process |

The Governance Committee annually assesses the form and amount of non-employee director compensation and recommends changes, if appropriate, to the Board. As part of its annual review in 2022, the Governance Committee retained a compensation consultant and outside legal counsel to assist in its review of director compensation data and practices. For purposes of this exercise, the Governance Committee primarily benchmarked against the executive compensation peer group described in the “Peer Group for Compensation Benchmarking” section on page 57.

In December 2022, following its review of GM’s non-employee director compensation structure,

the Governance Committee recommended, and the Board approved, the following program updates: (i) an increase in non-employee director compensation in recognition of the inflationary environment, (ii) an increase in the mandatory DSU deferral from 50 percent to 60 percent, and (iii) an increase in the stock ownership requirement from $500,000 to $650,000 within five years. Non-employee director compensation for 2023 is set forth in detail below. The Board believes these changes further align the non-employee director compensation program with shareholder interests through increased stock ownership.

| u | Director Stock Ownership and Holding Requirements |

| • Each non-employee director is required to own our common stock or DSUs with a market value of at least $650,000.

• Each non-employee director has up to five years from the date they are first elected to the Board to meet this ownership requirement.

• Non-employee directors are prohibited from selling any GM securities or derivatives of GM securities, such as DSUs, while they are members of the Board.

• Ownership guidelines are reviewed each year to confirm they continue to be effective in aligning the interests of the Board and our shareholders.

|

All of our non-employee directors are in compliance with our stock retention requirements.

|

23 |

Table of Contents

| u | Annual Compensation |

The 2022 and 2023 compensation for non-employee directors is described in the table below. The Independent Lead Director and committee chairs receive additional compensation due to the increased workload and additional responsibilities associated with these positions. In particular, Ms. Russo’s compensation as Independent Lead Director reflects the

additional time commitment for this role, which includes, among other responsibilities, attending all committee meetings and attending meetings with the Company’s CEO. For additional information about the roles and responsibilities of our Independent Lead Director, see “The Role of the Independent Lead Director” on page 29.

| Compensation Element |

2022 Structure ($) |

2023 Structure ($) |

||||||

| Board Retainer | 305,000 | 325,000 | ||||||

| Independent Lead Director Fee | 100,000 | 100,000 | ||||||

| Audit Committee Chair Fee | 35,000 | 35,000 | ||||||

| All Other Committee Chair Fees (excluding the Executive Committee) |

25,000 | 25,000 | ||||||

Starting in 2023, non-employee directors are required to defer at least 60 percent (compared to 50 percent in 2022) of their annual Board retainer into DSUs under the Director Compensation Plan. Directors may elect to defer their remaining Board retainer or amounts payable (if any) for serving as

a committee chair or Independent Lead Director into additional DSUs. The fees for a director who joins or leaves the Board or assumes additional responsibilities during the year are prorated for the director’s period of service.

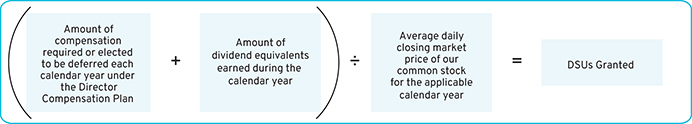

| u | How Deferred Share Units Work |

Each DSU is equal in value to one share of GM common stock and is fully vested upon grant, but does not have voting rights. DSUs will not be available for disposition until after the director leaves the Board. After leaving the Board, the director will receive a cash payment or payments based on the number of DSUs in the director’s account valued at the average daily closing market price for the quarter immediately

preceding payment. Directors will be paid in a lump sum or in annual installments for up to five years, based on their deferral elections. All DSUs granted are rounded up to the nearest whole unit. Any portion of the retainer that is deferred into DSUs may also earn dividend equivalents, which are credited at the end of each calendar year to each director’s account in the form of additional DSUs. DSUs granted are determined as follows:

| 24 |

|

Table of Contents

| u | Other Compensation |

We provide certain additional benefits to non-employee directors.

| Type | Purpose | |

| u Company Vehicles |

We provide directors with the use of Company vehicles and electric vehicle charging stations to provide feedback on our products as well as enhance the public image of our vehicles. Retired directors also receive the use of a Company vehicle for a period of time. Participants are charged with imputed income based on the lease value of the vehicles and are responsible for associated taxes. | |

| u Personal Accident Insurance(1) |

We provide personal accident insurance coverage in the event of accidental death or dismemberment. Directors are responsible for associated taxes on the imputed income from the coverage. | |

| (1) | Ms. Barra, our sole employee director, does not receive additional compensation for her Board service other than the personal accident insurance benefit described above, the value of which is reported for Ms. Barra in the Summary Compensation Table on page 74. |

Non-employee directors are not eligible to participate in any of the savings or retirement programs available to our employees. Other than as described in this section, there are no separate benefit plans for directors.

2022 Non-Employee Director Compensation Table

The table below shows the compensation that each non-employee director received for their 2022 Board and committee service.

| Director |

Fees Earned or ($) |

Stock Awards(2) ($) |

All Other ($) |

Total ($) |

||||||||||||

| Aneel Bhusri |

152,500 | 127,529 | 10,969 | 290,998 | ||||||||||||

| Wesley G. Bush(4) |

195,000 | 127,529 | 15,490 | 338,019 | ||||||||||||

| Joanne C. Crevoiserat(5) |

57,950 | 51,974 | 2,226 | 112,150 | ||||||||||||

| Linda R. Gooden |

177,500 | 127,529 | 18,823 | 323,852 | ||||||||||||

| Joseph Jimenez |

177,500 | 127,529 | 42,740 | 347,769 | ||||||||||||

| Jonathan McNeill(6) |

38,125 | 34,784 | 60 | 72,969 | ||||||||||||

| Jane L. Mendillo(7) |

68,625 | 51,503 | 14,870 | 134,998 | ||||||||||||

| Judith A. Miscik |

152,500 | 127,529 | 16,819 | 296,848 | ||||||||||||

| Patricia F. Russo |

277,500 | 127,529 | 23,723 | 428,752 | ||||||||||||

| Thomas M. Schoewe |

187,500 | 127,529 | 45,240 | 360,269 | ||||||||||||

| Carol M. Stephenson |

165,000 | 127,529 | 33,928 | 326,457 | ||||||||||||

| Mark A. Tatum |

152,500 | 127,529 | 24,990 | 305,019 | ||||||||||||

| Devin N. Wenig |

182,500 | 127,529 | 28,263 | 338,292 | ||||||||||||

| Margaret C. Whitman(8) |

79,850 | 62,705 | 2,432 | 144,987 | ||||||||||||

| (1) | As described above, a director may elect to defer all or a portion of their annual cash retainer into DSUs. This column reflects director compensation eligible to be paid in cash, which consists of 50 percent (for 2022) of the annual Board retainer and any applicable fees for committee chairs, the Independent Lead Director, and in the case of Mr. Bush and Mr. Wenig, for service on the Cruise LLC board of directors. Each of the following directors elected to |

|

25 |

Table of Contents

| receive DSUs in lieu of such amounts eligible to be paid in cash in the following amounts: Mr. Bhusri — $152,500; Mr. Bush — $195,000; Ms. Crevoiserat — $57,950; Mr. Jimenez — $177,500; Mr. McNeill — $19,063; Ms. Mendillo — $68,625; Ms. Russo — $277,500; Ms. Stephenson — $82,500; Mr. Wenig — $182,500; and Ms. Whitman — $79,850. |

| (2) | Reflects aggregate grant date fair value of DSUs granted in 2022, which does not include any cash fees that directors voluntarily elected to receive as DSUs. Grant date fair value is calculated by multiplying the number of DSUs granted by the closing price of GM common stock on December 30, 2022, which was $33.64. The holders of DSUs may also receive dividend equivalents, which are reinvested in additional DSUs based on the market price of the common stock on the date the dividends are paid. |

| (3) | The following table provides more information on the type and amount of benefits included in the All Other Compensation column. |

| Director |

Company ($) |

Other(b) ($) |

Total ($) |

|||||||||

| Aneel Bhusri |

10,729 | 240 | 10,969 | |||||||||

| Wesley G. Bush |

15,250 | 240 | 15,490 | |||||||||

| Joanne C. Crevoiserat |

2,146 | 80 | 2,226 | |||||||||

| Linda R. Gooden |

18,583 | 240 | 18,823 | |||||||||

| Joseph Jimenez |

42,500 | 240 | 42,740 | |||||||||

| Jonathan McNeill |

— | 60 | 60 | |||||||||

| Jane L. Mendillo |

14,750 | 120 | 14,870 | |||||||||

| Judith A. Miscik |

16,579 | 240 | 16,819 | |||||||||

| Patricia F. Russo |

23,483 | 240 | 23,723 | |||||||||

| Thomas M. Schoewe |

45,000 | 240 | 45,240 | |||||||||

| Carol M. Stephenson |

33,688 | 240 | 33,928 | |||||||||

| Mark A. Tatum |

24,750 | 240 | 24,990 | |||||||||

| Devin N. Wenig |

28,023 | 240 | 28,263 | |||||||||

| Margaret C. Whitman |

2,292 | 140 | 2,432 | |||||||||

| a. | The Company vehicle program includes the estimated annual lease value of the Company vehicles driven by directors. We include the annual lease value because it is more reflective of the value of the Company vehicle perquisite than the Company’s incremental costs, which are generally significantly lower because the Company manufactures and ordinarily disposes of Company vehicles for a profit, resulting in minimal incremental costs, if any. Taxes related to imputed income are the responsibility of the director. |

| b. | Reflects the cost of premiums for providing personal accident insurance (annual premium cost of $240 per person is prorated, as applicable, for the period of service). |

| (4) | Mr. Bush was appointed Chair of the Compensation Committee on June 13, 2022. |

| (5) | Ms. Crevoiserat joined the Board on August 15, 2022. |

| (6) | Mr. McNeill joined the Board on September 30, 2022. |

| (7) | Ms. Mendillo retired from the Board on June 13, 2022. |

| (8) | Ms. Whitman retired from the Board on July 15, 2022. |

| 26 |

|

Table of Contents

[THIS PAGE INTENTIONALLY LEFT BLANK]

Table of Contents

CORPORATE GOVERNANCE

The Board of Directors

GM is governed by a Board of Directors and committees of the Board that meet throughout the year to ensure that the CEO and other senior management are operating the Company in a competent and ethical manner. The Board is elected by our shareholders to oversee and provide guidance on the Company’s business and affairs. It is the ultimate decision-making body of the Company, except for those matters reserved for shareholders by law or pursuant to the Company’s corporate governance documents. Among other things, the Board oversees the Company’s strategy

and execution of the strategic plan. In addition, it oversees management’s proper safeguarding of the assets of the Company, maintenance of appropriate financial and other internal controls, compliance with applicable laws and regulations, and proper governance. The Board is committed to sound corporate governance policies and practices that are designed and routinely assessed to enable the Company to operate its business responsibly, with integrity, and to position GM to compete more effectively, sustain its success, and build long-term shareholder value.

| u | Board Size |

The Board sets the number of directors from time to time by a resolution adopted by a majority of the Board. The Governance Committee reassesses the suitability of the Board’s size at least annually. The Board has the flexibility to increase or decrease the size of the Board as circumstances warrant, though the Company’s Certificate of Incorporation limits the total number of directors to 17. There are currently 13 members of the

Board. If all of the Board’s nominees are elected, the Board will be composed of 13 members immediately following the Annual Meeting as a result of Ms. Stephenson’s retirement and Vice Admiral Tighe’s election. If any nominee is unable to serve as a director, or if any director leaves the Board between annual meetings, the Board may reduce the number of directors or elect an individual to fill the resulting vacancy.

| u | Director Independence |

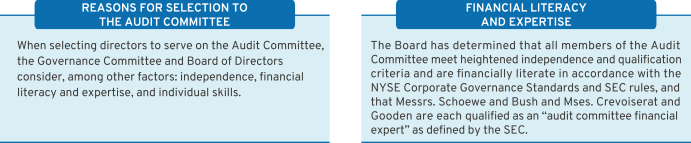

GM’s Bylaws and Corporate Governance Guidelines define our standards for director independence and reflect applicable NYSE and SEC requirements. At least two-thirds of our directors must be independent under these standards. In addition, all members of the Audit Committee and the Compensation Committee must meet heightened independence standards under applicable NYSE and SEC rules. For a director to be “independent,” they must have no disqualifying relationships, as defined in the NYSE standards, and the Board must determine that the director has no material relationship with the Company other than the individual’s service as a director.

The Governance Committee completed its annual assessment in February 2023 regarding the independence of each director and made recommendations to the Board. Consistent with the standards described above, the Board has reviewed all relationships between the Company

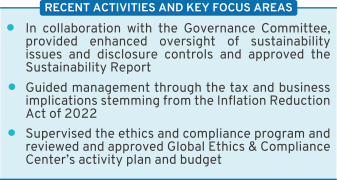

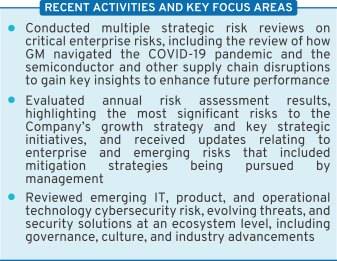

and each director and director nominee and considered all relevant quantitative and qualitative criteria. The Board has affirmatively determined that, other than Ms. Barra who serves as our CEO, all directors and director nominees are currently independent and, if applicable, were independent throughout 2022. In addition, the Board affirmatively determined that all of the director nominees who currently serve on the Audit Committee and the Compensation Committee are independent as required by the heightened NYSE and SEC criteria described above.