Form DEF 14A GNC HOLDINGS, INC. For: Apr 25

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

GNC HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

300 Sixth Avenue

Pittsburgh, Pennsylvania 15222

March 26, 2018

Dear Stockholder,

You are cordially invited to attend a Special Meeting of Stockholders of GNC Holdings, Inc. (the “Company”) to be held on April 25, 2018 at 8:30 a.m., Eastern Time, at the Omni William Penn, 530 William Penn Place, Sternwheeler Room, Pittsburgh, Pennsylvania 15219 (the “Special Meeting”).

On February 13, 2018, the Company entered into a Securities Purchase Agreement with Harbin Pharmaceutical Group Holdings Co., Ltd. (the “Investor”), pursuant to which the Company agreed to issue and sell to the Investor, and the Investor agreed to purchase from the Company, 299,950 shares of a newly created series of convertible preferred stock of the Company, to be designated as “Series A Convertible Preferred Stock” (the “Convertible Preferred Stock”), for a purchase price of $1,000 per share, or an aggregate purchase price of approximately $300 million. The Convertible Preferred Stock will be convertible into shares of the Company’s Class A common stock, par value $0.001 per share (the “Common Stock”), at an initial conversion price of $5.35 per share, subject to customary antidilution adjustments, and will accrue cumulative preferential dividends, payable quarterly in arrears, at an annual rate of 6.50% of the stated value of the Convertible Preferred Stock. The transaction is subject to customary closing conditions, including receipt of all necessary regulatory and governmental approvals, approval of our stockholders and the entry by the parties into a commercial joint venture in China.

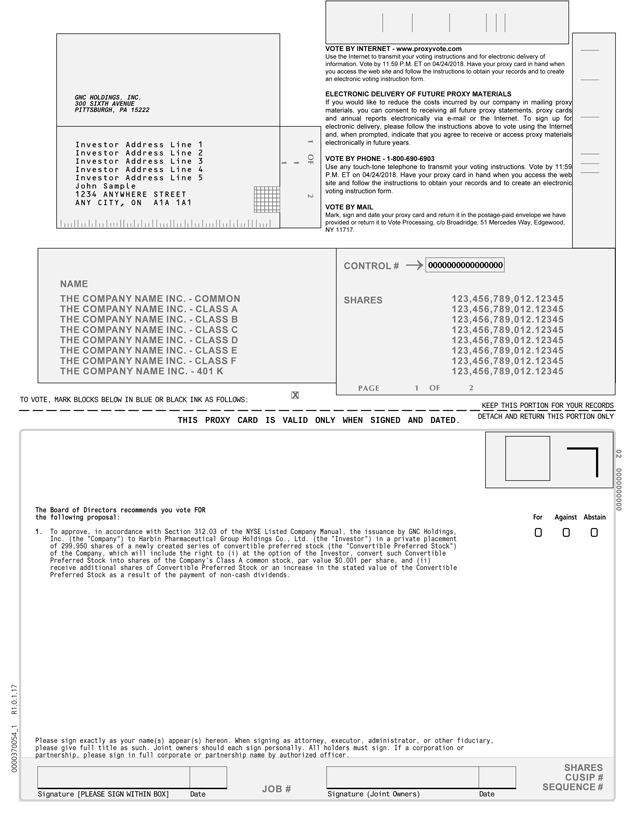

At the Special Meeting, you will be asked to consider and vote on a proposal to approve, in accordance with Section 312.03 of the NYSE Listed Company Manual, the issuance of the Convertible Preferred Stock to the Investor, which Convertible Preferred Stock will include the right to (i) at the option of the Investor, convert such Convertible Preferred Stock into shares of the Company’s Common Stock and (ii) receive additional shares of Convertible Preferred Stock or an increase in the stated value of the Convertible Preferred Stock as a result of the payment of non-cash dividends (the “Share Issuance”).

Our Board of Directors unanimously recommends that you vote “FOR” the Share Issuance.

Stockholders of record at the close of business on March 23, 2018 are entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof.

Your interest in the Company and your vote are very important to us. The enclosed proxy materials contain detailed information regarding the proposal that will be considered at the Special Meeting. We encourage you to read the proxy materials and vote your shares as soon as possible. You may vote your proxy via the Internet or telephone or, if you received a paper copy of the proxy materials, by mail by completing and returning the proxy card in the accompanying prepaid reply envelope.

Whether or not you plan to attend the Special Meeting, please complete, date, sign and return, as promptly as possible, the enclosed proxy card in the accompanying prepaid reply envelope, or submit your proxy by telephone or the Internet. If you attend the Special Meeting and vote in person, your vote by ballot will revoke any proxy previously submitted.

If your shares of Common Stock are held in “street name” by your bank, brokerage firm or other nominee, your bank, brokerage firm or other nominee will be unable to vote your shares of Common Stock without instructions from you. You should instruct your bank, brokerage firm or other nominee to vote your shares of Common Stock in accordance with the procedures provided by your bank, brokerage firm or other nominee.

Table of Contents

If you have any questions or need assistance voting your shares of Common Stock, please contact Georgeson LLC, our proxy solicitor, by calling toll-free at (888) 607-9107.

On behalf of the Company, I would like to express our appreciation for your ongoing interest in GNC.

| Very truly yours, |

|

|

| Kenneth A. Martindale |

| Chief Executive Officer |

Table of Contents

GNC HOLDINGS, INC.

NOTICE OF

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 25, 2018

| DATE AND TIME | 8:30 a.m., Eastern Time, on April 25, 2018 | |

| PLACE | Omni William Penn, 530 William Penn Place, Sternwheeler Room, Pittsburgh, Pennsylvania 15219 | |

| ITEMS OF BUSINESS | To consider and vote on a proposal to approve, in accordance with Section 312.03 of the NYSE Listed Company Manual, the issuance by GNC Holdings, Inc. (the “Company”) to Harbin Pharmaceutical Group Holdings Co., Ltd. (the “Investor”) in a private placement of 299,950 shares of a newly created series of convertible preferred stock (the “Convertible Preferred Stock”) of the Company, which will include the right to (i) at the option of the Investor, convert such Convertible Preferred Stock into shares of the Company’s Class A common stock, par value $0.001 per share, and (ii) receive additional shares of Convertible Preferred Stock or an increase in the stated value of the Convertible Preferred Stock as a result of the payment of non-cash dividends (the “Share Issuance”). | |

| RECORD DATE | You are entitled to vote only if you were a stockholder of record at the close of business on March 23, 2018. | |

| PROXY VOTING | It is important that your shares be represented and voted at the Special Meeting. Whether or not you plan to attend the Special Meeting, we urge you to vote online at www.proxyvote.com or via telephone by calling 1-800-690-6903, or to complete and return a proxy card in the accompanying prepaid reply envelope (no postage is required). | |

| REQUIRED VOTE | Pursuant to the rules of the New York Stock Exchange, the approval of the Share Issuance requires the affirmative vote of a majority of the shares present (in person or by proxy) and entitled to vote at the Special Meeting. | |

March 26, 2018

|

|

| Kevin G. Nowe |

| Senior Vice President, Chief Legal Officer and Secretary |

Table of Contents

| Page | ||||

| 1 | ||||

| QUESTIONS ABOUT THE SPECIAL MEETING AND THESE PROXY MATERIALS |

1 | |||

| 8 | ||||

| 23 | ||||

| 23 | ||||

| 40 | ||||

| 44 | ||||

| 45 | ||||

| 49 | ||||

| 51 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

53 | |||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| A-1 | ||||

- i -

Table of Contents

300 Sixth Avenue

Pittsburgh, Pennsylvania 15222

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 25, 2018

The Board of Directors (the “Board”) of GNC Holdings, Inc., a Delaware corporation (the “Company,” “we,” “us,” or “our”), has prepared this document to solicit your proxy to vote upon certain matters at a special meeting of our stockholders (the “Special Meeting”).

These proxy materials contain information regarding the Special Meeting, to be held on April 25, 2018, beginning at 8:30 a.m., Eastern Time, at the Omni William Penn, 530 William Penn Place, Sternwheeler Room, Pittsburgh, Pennsylvania 15219, and at any adjournments or postponements thereof.

It is anticipated that we will begin mailing this proxy statement and proxy card to our stockholders on or about March 26, 2018. The information regarding stock ownership and other matters in this proxy statement is as of March 23, 2018 (the “Record Date”), unless otherwise indicated.

QUESTIONS ABOUT THE SPECIAL MEETING AND THESE PROXY MATERIALS

Why am I receiving this proxy statement?

We are sending you this proxy statement because the Board is soliciting your proxy to vote at the Special Meeting to be held on April 25, 2018, at 8:30 a.m., Eastern Time, at the Omni William Penn, 530 William Penn Place, Sternwheeler Room, Pittsburgh, Pennsylvania 15219, and any adjournments or postponements of the Special Meeting. This proxy statement summarizes information that is intended to assist you in making an informed vote on the proposal to be considered at the Special Meeting.

What is the purpose of the Special Meeting?

On February 13, 2018, the Company entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with Harbin Pharmaceutical Group Holdings Co., Ltd. (the “Investor”), pursuant to which the Company agreed to issue and sell to the Investor, and the Investor agreed to purchase from the Company, 299,950 shares of a newly created series of convertible preferred stock of the Company, to be designated as “Series A Convertible Preferred Stock” (the “Convertible Preferred Stock”), for a purchase price of $1,000 per share, or an aggregate purchase price of approximately $300 million. The transaction is subject to customary closing conditions, including receipt of all necessary regulatory and governmental approvals, approval of our stockholders and entry into the Joint Venture (as defined below). The Convertible Preferred Stock will be convertible into shares of the Company’s Class A common stock, par value $0.001 per share (the “Common Stock”), at an initial conversion price of $5.35 per share, subject to customary antidilution adjustments (the “Conversion Price”), and will accrue cumulative preferential dividends, payable quarterly in arrears, at an annual rate of 6.50% of the Stated Value (as defined below). The terms of the Convertible Preferred Stock will be set forth in the certificate of designations of preferences, rights and limitations for the Convertible Preferred Stock (the “Certificate of Designations”) to be filed by the Company with the Secretary of State of the State of Delaware prior to the closing of the transaction. The Certificate of Designations is described in more detail in the section entitled “Description of the Convertible Preferred Stock” below.

In connection with the Securities Purchase Agreement, we will enter into a stockholders agreement (the “Stockholders Agreement”) with the Investor, which will provide for certain rights and responsibilities of the

1

Table of Contents

parties in connection with the Investor’s investment and the governance of the Company, and a registration rights agreement (the “Registration Rights Agreement”) with the Investor, which will provide for the obligation of the Company, at the request of the Investor, to register the resale of the Common Stock underlying the Convertible Preferred Stock with the U.S. Securities and Exchange Commission (the “SEC”). In addition, the Securities Purchase Agreement provides for the parties to use reasonable best efforts to negotiate definitive documentation with respect to a commercial joint venture in China (the “Joint Venture”), pursuant to which, among other things, the Joint Venture would be granted an exclusive right to use the Company’s trademarks and manufacture and distribute the Company’s products in China (excluding Hong Kong, Taiwan and Macau). The Company would receive royalties on all products sold by the Joint Venture. The Joint Venture would be owned 65% by the Investor and 35% by the Company. The Stockholders Agreement, the Registration Rights Agreement and the Joint Venture are described in more detail in the section entitled “Description of the Transaction Documents” below.

Additionally, on February 28, 2018, the Company completed the refinancing of the Company’s Existing Credit Agreement (as defined below), which provided for (i) the amendment and restatement of the Company’s Existing Credit Agreement to extend the maturity date of certain term loans of the Company, (ii) the repayment in full and termination of the Company’s revolving credit facility, (iii) the repayment of a portion of the Company’s existing term loans and (iv) the entrance into a new asset-based term loan facility. These financing-related transactions satisfy the condition to completion of the issuance, purchase and sale of the Convertible Preferred Stock with respect to the Credit Agreement Refinancing (as defined in the Securities Purchase Agreement). More information regarding these financing-related transactions can be found in the section entitled “Description of the Share Issuance” below.

In accordance with the Securities Purchase Agreement and applicable rules, regulations and guidance of the New York Stock Exchange (the “NYSE”), the Company is calling the Special Meeting to consider and vote upon a proposal to approve, in accordance with Section 312.03 of the NYSE Listed Company Manual, the issuance of the Convertible Preferred Stock to the Investor, which Convertible Preferred Stock will include the right to (i) at the option of the Investor, convert such Convertible Preferred Stock into shares of the Company’s Common Stock and (ii) receive additional shares of Convertible Preferred Stock or an increase in the stated value of the Convertible Preferred Stock as a result of the payment of non-cash dividends (the “Share Issuance”).

How does the Board recommend that I vote?

After consulting with its financial advisors and outside legal counsel and after reviewing and considering the terms and conditions of the Share Issuance and the factors more fully described in this proxy statement, the Board unanimously (i) approved the Securities Purchase Agreement and the other transaction documents and the transactions contemplated thereby, including the Share Issuance; (ii) determined that the terms of the Securities Purchase Agreement and the other transaction documents and the transactions contemplated thereby, including the Share Issuance, are fair to, and in the best interests of, the Company and its stockholders; (iii) directed that the Share Issuance be submitted to the stockholders of the Company for approval; (iv) recommended approval of the Share Issuance by the Company’s stockholders; and (v) declared that the Securities Purchase Agreement and the other transaction documents and the transactions contemplated thereby, including the Share Issuance, are advisable.

The Board unanimously recommends that the Company’s stockholders vote “FOR” the proposal to approve the Share Issuance.

What are the principal conditions to consummation of the Share Issuance?

The obligations of the Company and the Investor to complete the issuance, purchase and sale of the Convertible Preferred Stock are subject to the satisfaction or waiver (to the extent permitted by applicable law) by the Company and the Investor at or prior to the Closing of the following conditions:

| • | the approval of the Share Issuance by the Company’s stockholders; |

2

Table of Contents

| • | the receipt of the PRC Approvals and CFIUS Clearance (each as defined below); |

| • | the entrance into the Joint Venture; and |

| • | other customary conditions, including, among other things, accuracy of representations and warranties and compliance with covenants by the parties. |

The Company and the Investor (i) have agreed that the condition that the Company complete the Credit Agreement Refinancing has been satisfied, and (ii) have determined that no filings are required with respect to the Share Issuance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), and that, accordingly, the condition with respect to an HSR Act filing is deemed to be satisfied.

See the section entitled “Description of the Transaction Documents—Securities Purchase Agreement—Conditions to Completion of the Issuance, Purchase and Sale of the Convertible Preferred Stock” below for a full description of the conditions to consummating the Share Issuance.

What happens if the Share Issuance is not completed?

If the Share Issuance is not approved by the Company’s stockholders, or if another condition to the consummation of the Share Issuance is not satisfied, the Share Issuance will not be completed and the Securities Purchase Agreement may be terminated.

Under specified circumstances following the termination of the Securities Purchase Agreement, we may be required to pay the Investor a termination fee or to reimburse certain of the Investor’s transaction expenses, or we may be entitled to receive a reverse termination fee from the Investor, as described in the section entitled “Description of the Transaction Documents—Securities Purchase Agreement— Termination of the Securities Purchase Agreement” below.

Why is stockholder approval necessary for the Share Issuance?

Our Common Stock is listed on the NYSE and we are subject to the NYSE rules and regulations. Section 312.03(c) of the NYSE Listed Company Manual requires stockholder approval prior to any issuance of common stock, or of securities convertible into common stock, in any transaction or series of related transactions if (1) the common stock to be issued has, or will have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding before the issuance of such stock or of securities convertible into or exercisable for common stock, or (2) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of the common stock or of securities convertible into or exercisable for common stock.

At the closing of the Share Issuance, the Convertible Preferred Stock to be sold to the Investor will be convertible, at the option of the Investor, into 56,065,421 shares of Common Stock (subject to adjustment), which represents greater than 20% of both the voting power and number of shares of our Common Stock outstanding prior to the issuance. Because the sale of the Convertible Preferred Stock to the Investor exceeds 20% of both the voting power and number of shares of our Common Stock outstanding prior to the issuance and would implicate Section 312.03(c) of the NYSE Listed Company Manual and, since the NYSE rules do not define “change of control,” possibly 312.03(d) of the NYSE Listed Company Manual, we must seek stockholder approval prior to making such issuance. Further, we are obligated to seek such stockholder approval pursuant to the Securities Purchase Agreement.

When and where is the Special Meeting?

The Special Meeting will take place on April 25, 2018 at 8:30 a.m., Eastern Time, at the Omni William Penn, 530 William Penn Place, Sternwheeler Room, Pittsburgh, Pennsylvania 15219.

3

Table of Contents

Pursuant to our Fifth Amended and Restated Bylaws (the “Bylaws”), either our Board or the presiding person of the Special Meeting has the power to recess and/or adjourn the meeting, for any or no reason, to another place, date and time. We intend to adjourn the Special Meeting to solicit additional proxies if there are insufficient votes at the Special Meeting to approve the Share Issuance.

If the Special Meeting is adjourned to another time or place, the Company may transact any business which might have been transacted at the original meeting. If the meeting is adjourned for 30 days or fewer and no new record date is set for the adjourned meeting, the time and place of the adjourned meeting will be announced at the Special Meeting and no other notice will be sent to stockholders.

Who may vote?

Stockholders of record of our Common Stock at the close of business on the Record Date are entitled to receive these proxy materials and to vote their respective shares at the Special Meeting. Each share of Common Stock is entitled to one vote on each matter that is properly brought before the Special Meeting. As of the Record Date, there were 83,661,965 shares of Common Stock issued and outstanding.

How do I vote?

We encourage you to vote your shares via the Internet. How you vote will depend on how you hold your shares of Common Stock.

Stockholders of Record

If your Common Stock is registered directly in your name with our transfer agent, American Stock, Transfer & Trust Company, LLC, you are considered a stockholder of record with respect to those shares, and a full paper set of these proxy materials is being sent directly to you. As a stockholder of record, you have the right to vote by proxy.

You may vote by proxy in any of the following three ways:

Internet. Go to www.proxyvote.com to use the Internet to transmit your voting instructions. Have your proxy card in hand when you access the website.

Phone. Call 1-800-690-6903 using any touch-tone telephone to transmit your voting instructions. Have your proxy card in hand when you call.

Mail. Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided, or return it in your own envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

Voting by any of these methods will not affect your right to attend the Special Meeting and vote in person. However, for those who will not be voting in person at the Special Meeting, your final voting instructions must be received by no later than 11:59 p.m., Eastern Time, on April 24, 2018.

Beneficial Owners

Most of our stockholders hold their shares through a broker, bank or other nominee, rather than directly in their own name. If you hold your shares in one of these ways, you are considered the beneficial owner of shares held in street name, and the proxy materials are being forwarded to you by your broker, bank or nominee, who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote. Your broker, bank or nominee has enclosed a voting

4

Table of Contents

instruction form for you to use in directing the broker, bank or nominee on how to vote your shares. If you hold your shares through an NYSE member brokerage firm, that member brokerage firm does not have the discretion to vote shares it holds on your behalf without instructions from you with respect to the Share Issuance. For more information, see “What is a broker ‘non-vote’?” below.

May I attend the Special Meeting and vote in person?

Yes. All stockholders of record as of the Record Date may attend the Special Meeting and vote in person. Stockholders will need to present proof of ownership of our Common Stock as of the Record Date, such as a bank or brokerage account statement, and a form of personal identification to be admitted to the Special Meeting. No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Special Meeting.

Even if you plan to attend the Special Meeting in person, we encourage you to complete, sign, date and return the enclosed proxy to ensure that your shares of our Common Stock will be represented at the Special Meeting. If you attend the Special Meeting and vote in person, your vote by ballot will revoke any proxy previously submitted.

If you are a beneficial owner and hold your shares of Common Stock in “street name” through a broker, bank or nominee, you should instruct your broker, bank or nominee on how you wish to vote your shares of Common Stock using the instructions provided by your broker, bank or nominee. Your broker, bank or nominee cannot vote on the proposal to approve the Share Issuance without your instructions. If you hold your shares of Common Stock in “street name,” because you are not the stockholder of record, you may not vote your shares of Common Stock in person at the Special Meeting unless you request and obtain a valid proxy in your name from your broker, bank or nominee.

Can I change my vote?

Yes. If you are the stockholder of record, you may revoke your proxy before it is exercised by doing any of the following:

| • | voting again over the Internet or by telephone prior to 11:59 p.m., Eastern Time, on April 24, 2018; |

| • | timely sending a letter to us stating that your proxy is revoked; |

| • | signing a new proxy and timely sending it to us; or |

| • | attending the Special Meeting and voting by ballot. |

Beneficial owners should contact their broker, bank or nominee for instructions on changing their votes.

How many votes must be present to hold the Special Meeting?

A “quorum” is necessary to hold the Special Meeting. A quorum is considered present if a majority of the votes entitled to be cast by the stockholders entitled to vote at the Special Meeting are represented in person or by proxy at the Special Meeting. Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Broker “non-votes” will not be counted as present and entitled to vote for purposes of determining a quorum at the Special Meeting.

How many votes are needed to approve the Share Issuance?

Pursuant to the rules of the NYSE, the approval of the Share Issuance requires the affirmative vote of a majority of the shares present (in person or by proxy) and entitled to vote at the Special Meeting. This means that there must be more votes “FOR” the proposal than the aggregate of votes “AGAINST” the proposal plus abstentions at the Special Meeting. Broker “non-votes” will have no effect on the outcome of this vote.

5

Table of Contents

What is an abstention?

An abstention is a properly signed proxy card that is marked “ABSTAIN.”

Pursuant to the rules of the NYSE, abstentions are counted as present for purposes of determining a quorum, but will be counted as votes “AGAINST” the proposal to approve the Share Issuance.

What is a broker “non-vote?”

A broker “non-vote” occurs when a broker, bank or nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received timely instructions from the beneficial owner. Under current applicable rules, the proposal to approve the Share Issuance at the Special Meeting is not a “discretionary” item upon which NYSE member brokerage firms that hold shares as nominee may vote on behalf of the beneficial owners if such beneficial owners have not furnished voting instructions by the tenth day before the Special Meeting. Therefore, NYSE member brokerage firms that hold shares as a nominee may not vote on behalf of the beneficial owners on the Share Issuance unless you provide voting instructions.

If an NYSE member brokerage firm holds your Common Stock as a nominee, please instruct your broker how to vote your Common Stock. This will ensure that your shares are counted.

Broker “non-votes” will not be counted as present and entitled to vote for purposes of determining a quorum at the Special Meeting and will have no effect on the vote to approve the Share Issuance.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares of our Common Stock in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares of Common Stock are registered in more than one name, you will receive more than one proxy card. Please complete, date, sign and return each proxy card and voting instruction card that you receive. Each proxy card you receive comes with its own prepaid return envelope; if you submit a proxy by mail, make sure you return each proxy card in the return envelope that accompanies that proxy card or return it in your own envelope to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

Will any other matters be acted on at the Special Meeting?

Pursuant to our Bylaws, only such business as is specified in this proxy statement will be conducted at the Special Meeting.

Where can I find the voting results of the Special Meeting?

The Company intends to announce preliminary voting results at the Special Meeting and publish final results in a Current Report on Form 8-K that will be filed with the SEC following the Special Meeting. All reports that the Company files with the SEC are publicly available when filed. See the section entitled “Where You Can Find More Information” below.

Who pays for this proxy solicitation?

We will pay the expenses of soliciting proxies. In addition to solicitation by mail, proxies may be solicited in person or by telephone or other means by our directors or associates for no additional compensation. We will reimburse brokerage firms and other nominees, custodians and fiduciaries for costs incurred by them in mailing these proxy materials to the beneficial owners of Common Stock held of record by such persons.

6

Table of Contents

In addition, we have retained Georgeson LLC to assist in the solicitation of proxies and otherwise in connection with the Special Meeting for an estimated fee of $8,500, plus reimbursement of certain reasonable expenses.

Who should I call with other questions?

If you have additional questions about these proxy materials or the Special Meeting, please contact:

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

Banks, Brokers and Shareholders

Call Toll-Free (888) 607-9107

7

Table of Contents

DESCRIPTION OF THE SHARE ISSUANCE

While we believe that the summary below describes the material terms of the Share Issuance, it may not contain all of the information that is important to you, and is qualified in its entirety by the relevant instruments and agreements themselves, which were included as an exhibit to our Current Report on Form 8-K filed with the SEC on February 13, 2018, and are incorporated by reference herein. We encourage you to read the relevant instruments and agreements themselves in their entirety. Further, representations, warranties and covenants in the Securities Purchase Agreement are not intended to function or to be relied on as public disclosures. For more information about accessing the information that we file with the SEC, please see the section entitled “Where You Can Find More Information” below.

Overview

On February 13, 2018, the Company entered into the Securities Purchase Agreement with the Investor, pursuant to which the Company agreed to issue and sell to the Investor, and the Investor agreed to purchase from the Company, 299,950 shares of newly created Convertible Preferred Stock for a purchase price of $1,000 per share, or an aggregate purchase price of approximately $300 million. The transaction is subject to customary closing conditions, including receipt of all necessary regulatory and governmental approvals, approval of our stockholders and entry into the Joint Venture. The Convertible Preferred Stock will be convertible into shares of the Company’s Common Stock at the Conversion Price, and will accrue cumulative preferential dividends, payable quarterly in arrears, at an annual rate of 6.50% of the Stated Value. The terms of the Convertible Preferred Stock will be set forth in the Certificate of Designations to be filed by the Company with the Secretary of State of the State of Delaware prior to the closing of the transaction. The Certificate of Designations is described in more detail in the section entitled “Description of the Convertible Preferred Stock” below.

In connection with the Securities Purchase Agreement, we will enter into, together with the Investor, the Stockholders Agreement, which will provide for certain rights and responsibilities of the parties in connection with the Investor’s investment and the governance of the Company, and the Registration Rights Agreement, which will provide for the obligation of the Company, at the request of the Investor, to register the resale of the Common Stock underlying the Convertible Preferred Stock with the SEC. In addition, the Securities Purchase Agreement provides for the parties to use reasonable best efforts to negotiate definitive documentation with respect to the Joint Venture, pursuant to which, among other things, the Joint Venture would be granted an exclusive right to use the Company’s trademarks and manufacture and distribute the Company’s products in China (excluding Hong Kong, Taiwan and Macau). The Company would receive royalties on all products sold by the Joint Venture. The Joint Venture would be owned 65% by the Investor and 35% by the Company. The Stockholders Agreement, the Registration Rights Agreement and the Joint Venture are described in more detail in the section entitled “Description of the Transaction Documents” below.

Additionally, on February 28, 2018, the Company completed the refinancing of the Company’s Existing Credit Agreement, which provides for (i) the amendment and restatement of the Company’s Existing Credit Agreement to extend the maturity date of certain term loans of the Company, (ii) the repayment in full and termination of the Company’s revolving credit facility, (iii) the repayment of a portion of the Company’s existing term loans and (iv) the entrance into a new asset-based term loan facility. These financing-related transactions satisfy the condition to completion of the issuance, purchase and sale of the Convertible Preferred Stock with respect to the Credit Agreement Refinancing (as defined in the Securities Purchase Agreement). Additional information regarding these amendments to the Company’s Existing Credit Agreement can be found in the section entitled “—The Credit Agreement Refinancing” below.

Use of Proceeds

Pursuant to the Securities Purchase Agreement, the Company will use the proceeds of the Share Issuance for (i) the repayment, in whole or in part, of the Company’s outstanding indebtedness under its credit agreement,

8

Table of Contents

dated as of November 26, 2013, with JPMorgan Chase Bank, N.A. as administrative agent, as amended (the “Existing Credit Agreement”), (ii) repayment of fees and expenses in connection with the transaction and (iii) other general corporate purposes as may be mutually agreed by the Company and the Investor.

The Credit Agreement Refinancing

On February 28, 2018, the Company entered into certain amendments to its Existing Credit Agreement and a new ABL credit agreement (collectively, the “Credit Agreement Refinancing”), pursuant to which the Company has agreed to:

| • | the amendment and restatement of the Existing Credit Agreement in order to, among other things, extend the Tranche B Term Loan maturity date with respect to the term loans of consenting term loan lenders to the earlier to occur of (1) March 4, 2021 and (2) May 16, 2020, which is the date that is 91 days prior to the stated maturity of the 1.50% Convertible Senior Notes due August 15, 2020 (the “Convertible Senior Notes”) under that certain indenture dated as of August 10, 2015 among GNC Holdings, Inc., GNC Corporation, General Nutrition Centers, Inc., certain other subsidiaries party thereto, and Bank of New York Mellon Trust Company, N.A., as trustee (or, if between such dates, the date that is 91 days prior to the stated maturity of any debt that refinances the Convertible Senior Notes), unless (in the case of this clause (2)), all amounts exceeding $50,000,000 of the Convertible Senior Notes have been repaid or converted prior to such date (any such repayment or conversion, the “Existing Indenture Discharge”); |

| • | the termination of the “Revolving Credit Commitment” and repayment in full of the outstanding “Revolving Credit Loans” (each as defined in the Existing Credit Agreement); |

| • | the repayment of a portion of the existing term loans that are extended as described above; and |

| • | the entry into (a) a new asset-based term loan facility advanced on a “first-in, last-out” basis in an aggregate principal amount of $275,000,000 with a maturity date of the earlier to occur of (1) December 2022 and (2) May 16, 2020 (or, if between such dates, the date that is 91 days prior to the stated maturity of any debt that refinances the Convertible Senior Notes), unless (in the case of this clause (2)) the Existing Indenture Discharge has occurred which will consist of (x) cash funded loans the proceeds of which will be used to prepay a portion of the term loans of certain extending lenders under the Existing Credit Agreement and (y) loans that will be issued in exchange for a portion of the term loans of other extending lenders under the Existing Credit Agreement and (b) a new asset-based revolving credit facility in an aggregate principal amount of up to $100,000,000 with a maturity date of the earlier to occur of (1) the date that is four and one-half years after February 28, 2018 and (2) May 16, 2020 (or, if between such dates, the date that is 91 days prior to the stated maturity of any debt that refinances the Convertible Senior Notes) unless (in the case of this clause (2)) the Existing Indenture Discharge has occurred. |

Parties to the Transactions

GNC Holdings, Inc.

GNC Holdings, Inc. (NYSE: GNC) is headquartered in Pittsburgh, PA and is a leading global specialty health, wellness and performance retailer.

The Company connects customers to their best selves by offering a premium assortment of health, wellness and performance products, including protein, performance supplements, weight management supplements, vitamins, herbs and greens, wellness supplements, health and beauty, food and drink and other general merchandise. This assortment features proprietary “GNC” and nationally recognized third-party brands.

The Company’s diversified, multi-channel business model generates revenue from product sales through company-owned retail stores, domestic and international franchise activities, third-party contract manufacturing,

9

Table of Contents

e-commerce and corporate partnerships. As of December 31, 2017, the Company had approximately 9,000 locations, of which approximately 6,700 retail locations are in the United States (including approximately 2,400 Rite Aid franchise store-within-a-store locations) and franchise operations in approximately 50 countries.

Harbin Pharmaceutical Group Holding Co., Ltd. and Harbin Pharmaceutical Group Co., Ltd.

Harbin Pharmaceutical Group Holding Co., Ltd., referred to as “Hayao”, is headquartered in Harbin City Heilongjiang Province, China and is one of the leading pharmaceutical and VMS (vitamins, minerals and supplements) companies in China.

The Investor has a broad portfolio of OTC (Over-The-Counter), Rx (prescription) and VMS products, and is also engaged in pharma distribution and retail pharmacy businesses. The Investor has many national renowned brands in China that have very high consumer awareness including “San Jing,” and command leading market share in the mineral supplements category.

The Investor owns controlling interests in two subsidiaries listed on the Shanghai Stock Exchange: Harbin Pharmaceutical Group Co., Ltd. (SHSE: 600664), which focuses on the OTC, Rx and VMS business, and HPGC Renmintongtai Pharmaceutical Corporation (SHSE: 600829), which focuses on the distribution and retail pharmacy business.

The Investor has access to an extensive distribution and retailing network by directly operating more than 300 chain retail pharmacies and collaboration with approximately 800 drug and VMS distributors to build nationwide coverage in China.

Background of the Share Issuance

The Board and management periodically review and assess the Company’s operations and financial performance, business strategy, the various trends and conditions affecting the nutritional supplement industry and a variety of strategic alternatives reasonably available to the Company. In this regard, the Board and management periodically explore potential commercial partnership opportunities for the Company in China, aiming to enhance the Company’s position in China and capitalize on the substantial market opportunities for the Company’s products. In addition, as early as May 2016, the Board began to discuss the approaching maturity of the Company’s credit facilities and potential debt refinancing alternatives, as well as potential equity investment alternatives to reduce the Company’s leverage and position the Company for future growth.

In February 2017, the Company began initial discussions with Goldman Sachs & Co. LLC (“Goldman Sachs”) regarding potential commercial partnership opportunities for the Company in China. In May 2017, Goldman Sachs was engaged as financial advisor to the Company in connection with its exploration of potential commercial partnerships in China. In connection with this process, Goldman Sachs contacted twenty potential partners, including seventeen potential strategic partners and three potential private equity sponsors. The Company subsequently entered into confidentiality agreements with twenty-four entities representing seventeen potential partners interested in exploring a potential Chinese partnership and furnished due diligence information and engaged in discussions with such parties. Seven parties, including the Investor, submitted initial proposals for potential Chinese partnerships and the Company and Goldman Sachs engaged in discussions with such parties.

In the spring of 2017, at the instruction of the Board, the Company approached existing lenders under the Existing Credit Agreement, seeking to amend and extend the credit facilities thereunder. However, the Company could not reach an agreement on favorable terms for such a transaction at that time. Then, in the late summer and fall of 2017, in light of the approaching maturity of the Existing Credit Agreement, the Board and management accelerated their efforts to explore and execute potential debt refinancing alternatives. In November 2017, the Company sought to complete a private placement offering of senior secured notes under Rule 144A under the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder (the “Securities Act”)

10

Table of Contents

and to enter into a new credit facility, with the goal of using the proceeds of each to refinance the loans outstanding under the Existing Credit Agreement. However, the Company could not reach an agreement on favorable terms, so the Board continued to explore potential debt refinancing alternatives. Subsequently, the Board engaged Goldman Sachs as its strategic financial advisor to help the Board evaluate alternatives to optimize the Company’s capital structure and enhance stockholder value. The Company issued a press release to announce the engagement of Goldman Sachs in such capacity on December 4, 2017.

Also in the fall of 2017, in connection with pending discussions regarding a Chinese joint venture, the Company began considering the possibility of a private placement equity investment in the Company by the potential Chinese joint venture partners. At the Board’s request, the Company and Goldman Sachs held discussions with the Investor and the other potential Chinese joint venture partners regarding an equity or other junior capital investment in the Company (the “Potential Equity Investment”).

In December 2017, the Board directed Goldman Sachs to approach certain holders of its Convertible Senior Notes to explore the possibility of exchanging, in privately negotiated transactions, a portion of their holdings of the Convertible Senior Notes for Common Stock. As a result of these discussions, on December 20, 2017, the Company executed exchange agreements with certain holders of the Convertible Senior Notes to exchange $98,935,000 in aggregate principal amount of the Convertible Senior Notes for an aggregate of 14,626,473 newly issued shares of Common Stock, together with approximately $0.5 million in cash.

At the Board’s request in January 2018, the Company and Goldman Sachs contacted certain lenders holding, in the aggregate, a significant portion of the outstanding principal amount of the term loans under the Existing Credit Agreement (the “Ad Hoc Group”) to discuss a potential amendment of the Existing Credit Agreement to, among other things, (i) extend the maturity date, in whole or in part, of the outstanding term loan indebtedness thereunder and (ii) permit the entering into and incurrence of indebtedness under a new asset-based term loan facility and a new asset-based revolving credit facility (collectively, the “Potential Credit Agreement Refinancing”). The Company subsequently entered into confidentiality agreements with each of the members of the Ad Hoc Group, which provided for the right of either party to publicly disclose communications between the Company and the Ad Hoc Group related to the Potential Credit Agreement Refinancing if no agreement was reached with respect to the Potential Credit Agreement Refinancing prior to February 12, 2018.

By late January 2018, the Company had received three indications of interest from potential Chinese partners, including the Investor, and seven indications of interest from potential US domestic investors, regarding Potential Equity Investments in the Company. The indications of interest from each potential Chinese partner were conditioned upon the concurrent negotiation of a Chinese joint venture with such Chinese partner. The indication of interest from the Investor contemplated an investment in convertible preferred stock with a conversion price at a premium to current trading values and that would result in the Investor holding a majority of the outstanding voting power following the proposed investment. The indications of interest from the other potential Chinese partners contemplated an investment in Common Stock priced at current trading values. The indications of interest from the potential US domestic investors contemplated second lien “mezzanine” debt accompanied with warrants, convertible debt, and preferred convertible-debt, at interest rates significantly above the dividend yield proposed by the Investor.

On January 23, 2018, the Company and its advisors provided a Potential Equity Investment term sheet for a Common Stock investment, at a premium to current trading values, to the three potential Chinese partners, including the Investor and the two additional Chinese parties (respectively, “Party A” and “Party B”), together with term sheets for potential Chinese joint ventures with such parties.

On January 25, 2018, after reviewing initial proposals for the Potential Equity Investment from the potential Chinese and US investors and initial feedback on the Company’s term sheets from the potential Chinese investors, the Board, after consulting with management, Goldman Sachs and Latham, decided to focus on the potential Chinese investors, given the relative attractiveness of those potential transactions compared to the

11

Table of Contents

indications of interest from potential US investors. The Board authorized management and the advisors to continue to exchange term sheets for a Potential Equity Investment and a potential Chinese joint venture with either Investor, Party A or Party B. The Board explored these Potential Equity Investments, working to develop one or more definitive transaction proposals prior to the beginning of the Chinese New Year holiday during the week of February 12, 2018, to facilitate the negotiations around the Potential Credit Agreement Refinancing and to avoid possible delays in a transaction with the Chinese parties during the holiday season. This timeline also aligned with the February 12, 2018 deadline by which the members of the Ad Hoc Group could require the Company to disclose all material non-public information regarding discussions of the Potential Credit Agreement Refinancing.

Also on January 25, 2018, the Board formed a transaction committee of independent directors to oversee the day to day negotiations of the Potential Equity Investment and Potential Credit Agreement Refinancing. The Board also directed management to engage Valuation Research Corporation (“VRC”) as an independent financial advisor to review and analyze the price to be paid for any Common Stock and the conversion price of any convertible preferred stock proposed to be issued by the Company in connection with the Potential Equity Investment and to deliver a written opinion to the Board as to the fairness, from a financial point of view, of the price to be paid for any Common Stock and the conversion price of any convertible preferred stock issued in connection with the Potential Equity Investment.

The Investor and Party B submitted revised drafts of the proposed Potential Equity Investment term sheet on or about January 29, 2018 and February 2, 2018, respectively. The Investor proposed to purchase convertible perpetual preferred stock in the Company with a conversion price of $4.60 and a dividend yield of 8.0%, whereas Party B proposed to purchase Common Stock at a price based on the 30-day volume weighted average price of Common Stock as of the day immediately preceding the Company’s announcement of completion of the Potential Credit Agreement Refinancing. Both parties requested majority ownership in an exclusive Chinese joint venture with the Company as a condition to the Potential Equity Investment and continued to negotiate a separate term sheet with the Company for such a joint venture. Although the Company and its advisors continued to engage in discussions with Party A, Party A did not submit an updated proposal and indicated it would need additional time to move forward with the Potential Equity Investment. At the direction of the Board, the Company continued to negotiate with the Investor and Party B, exchanging revised term sheets for the Potential Equity Investment and China joint venture with each party. With respect to the Investor, the Company proposed to issue convertible perpetual preferred stock in the Company with a conversion price of $6.00 and a dividend yield of 5.0%.

On February 4, 2018, to afford the Company the opportunity to meet the timeline contemplated by the Board, the Company and its advisors furnished draft definitive documentation for the Potential Equity Investment to the Investor and Party B, based on the latest Potential Equity Investment term sheets with the respective parties. Party B continued to express an interest in a transaction with the Company, but did not provide further counterproposals to the terms and definitive documents offered by the Company. The Investor engaged with the Company, Goldman Sachs and Latham to negotiate the definitive terms and documents of the Potential Equity Investment. Between February 4, 2018 and February 11, 2018, the Company, the Investor and their respective financial and legal advisors engaged in extensive negotiations regarding the Potential Equity Investment and exchanged numerous drafts of the Securities Purchase Agreement, the Stockholders Agreement, the Registration Rights Agreement, the Certificate of Designations and the other related transaction documents, including the key terms of the Joint Venture, which would be a condition to completion of the Potential Equity Investment. During this time, Goldman Sachs continued to engage in discussions with Party B around a potential transaction, but Party B did not submit a formal counterproposal to the terms and definitive documents offered by the Company. The Company, Goldman Sachs and Latham also engaged in extensive negotiations with the Ad Hoc Group regarding the Potential Credit Agreement Refinancing.

On February 10, 2018, the Board met with management, and representatives of Goldman Sachs and Latham. The Board received an update on the status of the discussions regarding the Potential Equity Investment and the

12

Table of Contents

Potential Credit Agreement Refinancing and determined to meet again on February 11, 2018 for an additional update and to determine the path forward for each transaction.

On February 11, 2018, the Board reconvened with management and its advisors to discuss the then-current terms of (i) the Securities Purchase Agreement and the other related transaction documents and (ii) the Potential Credit Agreement Refinancing. Goldman Sachs and Latham discussed the financial and legal terms, respectively, of the agreements and the proposals for each key term that had been exchanged between the Company and the Investor. After evaluation and discussion of factors raised by management and the financial and legal advisors, as well as other factors related thereto, the Board instructed management and the advisors to continue to negotiate the few remaining open items and seek to finalize the necessary documents. On February 12, 2018, after further negotiations with the Investor to finalize the remaining open points in the Potential Equity Investment, the Board met with management and representatives of Goldman Sachs, Latham and VRC in order for the Board to consider formally approving the Securities Purchase Agreement and the other related transaction documents for the Potential Equity Investment. Goldman Sachs and Latham provided the Board with an update on the final terms of the transaction and VRC delivered its written opinion to the Board to the effect that, subject to the assumptions, limitations, qualifications and conditions set forth therein, the Conversion Price of the Convertible Preferred Stock was fair, from a financial point of view, to the Company. After a discussion of the Securities Purchase Agreement, the transactions contemplated thereby and factors raised by management and the advisors, the Board: (i) unanimously approved the Share Issuance and the other transactions with the Investor; (ii) determined that the terms of the Securities Purchase Agreement and the other transaction documents and the transactions contemplated thereby, including the Share Issuance, were advisable, substantively and procedurally fair to, and in the best interests of, the Company and its stockholders; (iii) directed that the Share Issuance be submitted to the stockholders of the Company for approval; and (iv) recommended approval of the Share Issuance by the Company’s stockholders. On February 13, 2018, the Company and the Investor executed the Securities Purchase Agreement and announced that the Ad Hoc Group had indicated its support with respect to the Potential Credit Agreement Refinancing, subject to definitive documentation on terms and conditions consistent in all material respects with the two term sheets related thereto filed by the Company with the SEC as Exhibit 99.2 to its Current Report on Form 8-K on February 13, 2018.

Thereafter, Goldman Sachs and Latham continued to negotiate with the Ad Hoc Group and other lenders to move the Potential Credit Agreement Refinancing towards execution of the definitive documentation. On February 28, 2018, the Company entered into definitive agreements with respect to the Potential Credit Agreement Refinancing, which extended the maturity date of the term loans held by approximately 87% of the term lenders to March 2021, entered into a new $100 million ABL revolving credit facility, exchanged a portion of the extended term loans for ABL FILO term loans and entered into new ABL FILO term loans in an aggregate principal amount, when taken together with the extended term loans exchanged for ABL FILO term loans, of $275 million. The Company and the Investor agree that such definitive documentation satisfies the closing condition in the Securities Purchase Agreement related to the Credit Agreement Refinancing. Additional information regarding these financing-related transactions can be found in the section entitled “—The Credit Agreement Refinancing” above.

Opinion of the Financial Advisor to the Company

At the request of the Board, VRC rendered its written opinion to the Board that, as of February 12, 2018, and based upon and subject to the factors, qualifications and assumptions set forth therein, the Conversion Price of the Convertible Preferred Stock to be issued and sold by the Company in the Transaction (defined below) was fair from a financial point of view to the Company.

The full text of the written opinion of VRC, dated February 12, 2018, which sets forth assumptions made, procedures followed, matters considered and limitations and qualifications on the review undertaken in connection with the opinion, is attached as Annex I to this proxy statement. VRC provided its opinion for the information and assistance of the Board in connection with the Board’s consideration of the transactions contemplated by the issuance and sale of the Convertible Preferred Stock (the “Transaction”). The VRC

13

Table of Contents

opinion is not a recommendation as to the issuance or sale of the Convertible Preferred Stock or any other matter.

In connection with rendering the opinion described above and performing its related financial analyses, VRC reviewed, among other things:

| • | the form of the Securities Purchase Agreement, together with the forms of other documents related to the Transaction and referred to therein; |

| • | annual reports to stockholders and Annual Reports on Form 10-K of the Company for the five fiscal years in between and including those ended December 31, 2011 and December 31, 2016, respectively; |

| • | certain interim reports to stockholders and Quarterly Reports on Form 10-Q of the Company; certain other communications from the Company to its stockholders; |

| • | certain publicly available research analyst reports for the Company; |

| • | certain internal financial analyses and forecasts for the Company for the four full years ended 2021, prepared by the Company’s management and approved for VRC’s use by the Company and the Board in connection with the Transaction (collectively, the “Forecasts”); |

| • | the reported price and trading activity for the Common Stock; and |

| • | the financial terms of certain recent business combinations in the same industry as the Company and in other industries. |

VRC also held discussions with members of the senior management of the Company regarding senior management’s assessment of the past and current business operations, financial condition and future prospects of the Company and the strategic rationale for, and the potential benefits to the Company of, the Transaction. VRC also compared certain financial and stock market information for the Company with similar information for certain other companies the securities of which are publicly traded, including a review of the current and historical market prices and trading volume for the Company’s publicly traded securities, and the historical market prices and certain financial data of publicly traded securities of certain other companies that VRC deemed to be relevant. Finally, VRC performed such other financial studies, inquiries and analyses, and considered such other factors and information, as VRC deemed appropriate.

For purposes of rendering the written opinion described above, VRC, with the Company’s consent, relied upon and assumed the accuracy and completeness of all of the financial, legal, regulatory, tax, accounting and other information provided to, or discussed with or reviewed by, VRC, without assuming any responsibility for independent verification or update thereof. In that regard, VRC assumed that the Forecasts were reasonably prepared in good faith and were based upon assumptions that were reasonable and reflected the best then currently available estimates and judgments of the Company’s management as to the matters covered thereby, and that the Company approved the Forecasts for VRC’s use in connection with VRC’s opinion.

Further, with the Company’s consent, VRC assumed without independent verification that (i) all procedures required by law to be taken in connection with the Transaction had been, or would be, duly, validly and timely taken and that the Transaction would be consummated in a manner that complied with all applicable laws and regulations and that conformed in all material respects to the description thereof set forth in its written opinion; (ii) the Transaction would be consummated in a timely manner in accordance with the terms and conditions set forth in the forms of the related definitive agreements and other documents provided to VRC; and (iii) each of the Board and the Company was in compliance in all material respects (and would remain in compliance in all material respects) with any and all applicable laws, rules or regulations of any and all relevant legal or regulatory authorities.

VRC’s opinion did not address the underlying business decision of the Company to issue the Convertible Preferred Stock or the purchase price thereof; nor did the VRC opinion address any legal, regulatory, tax or accounting matters. VRC’s opinion addressed only the fairness from a financial point of view to the Company, as of February 12, 2018, of the Conversion Price. VRC’s opinion did not express any view on, and did not address,

14

Table of Contents

(i) any other term or aspect of the Transaction, (ii) any term or aspect of any other agreement or instrument contemplated by the Transaction, or entered into, or amended in connection with, the Transaction, or (iii) the impact of the Transaction on the holders of any class of securities of the Company, any creditors of the Company, or any other constituency of the Company.

VRC’s opinion was necessarily based on economic, monetary, market and other conditions as in effect on, and the information made available to VRC as of, the date of the opinion (and in each case to the extent that such information could be evaluated by VRC as of such date), and VRC assumed no responsibility for updating, revising or reaffirming its opinion based on circumstances, developments or events occurring after the date of its opinion. In addition, VRC did not express any opinion as to the impact of the Transaction and the conversion of the Convertible Preferred Stock to Common Stock on the solvency or viability of the Company or the ability of the Company to pay its obligations when and as they come due. VRC’s opinion was approved by a fairness opinion committee of VRC.

VRC did not make any independent evaluation of the Company’s (or any other party’s) solvency or creditworthiness nor did it make any physical inspection or independent appraisal or evaluation of any of the assets, properties or liabilities (contingent or otherwise) of the Company or any other party. VRC’s fairness opinion did not express any opinion regarding the liquidation value of any entity or business. In addition, VRC did not undertake any independent analysis of any potential or actual litigation, regulatory action, possible unasserted claims or other contingent liabilities to which the Company is or may be a party or of which it may be the subject, or of any governmental investigation of any possible unasserted claims or other contingent liabilities to which the Company is or may be a party or otherwise may be subject.

VRC’s opinion was not intended to constitute a recommendation to the Board, the Company or any other party as to how they should vote or otherwise act with respect to any matters relating to the Transaction. The opinion does not represent an assurance, warranty, or guarantee that the Conversion Price is the highest or best amount that can be obtained in connection with the Transaction or any other transaction.

In rendering its opinion, VRC did not initiate any discussions with, or solicit any indications of interest from, any third parties with respect to the Company or the Transaction. VRC’s opinion was rendered only as of the date thereof and addressed only the Transaction, and did not speak to or address any period thereafter or any subsequent business transaction, acquisition, dividend, share repurchase, debt or equity financing, recapitalization, restructuring or other actions, transactions or events not specifically referred to in the opinion. Furthermore, VRC’s opinion did not represent an assurance, guarantee, or warranty that the Company will not breach, or default on or under, any of its debt covenants or other obligations or liabilities, nor did VRC make any assurance, guarantee, or warranty that any covenants, financial or otherwise, associated with any financing or existing indebtedness would not be breached in the future.

The following is a summary of the material financial analyses delivered by VRC to the Board in connection with rendering the opinion described above. The following summary, however, does not purport to be a complete description of the financial analyses performed by VRC, nor does the order of analyses described represent the relative importance or weight given to those analyses by VRC. Some of the summaries of the financial analyses include information presented in tabular format. The tables must be read together with the full text of each summary and are alone not a complete description of VRC’s financial analyses. Except as otherwise noted, the following quantitative information, to the extent that it is based on market data, is based on market data as it existed on or before February 12, 2018, and is not necessarily indicative of current market conditions.

VRC reviewed Wall Street analyst research and analyst targeted prices for the Common Stock. The analysts’ target prices for the Common Stock ranged from $2.50 per share to $7.00 per share.

VRC analyzed the Conversion Price in relation to the closing price of the Common Stock as of the undisturbed date (February 12, 2018). This analysis indicated that the Conversion Price represented a premium of 27.7% based on the Common Stock price of $4.19 as of market close on February 12, 2018.

15

Table of Contents

VRC also calculated the Company’s enterprise value using three separate methodologies: (i) the Company’s market stock price as of February 12, 2018, plus the face value of outstanding debt, minus cash on hand, (ii) the Company’s market stock price as of February 12, 2018, plus the market value of outstanding debt, and (iii) the Company’s equity assuming all primary shares had a price equivalent to the Conversion Price, plus the book value of outstanding debt, which resulted in implied enterprise values of $1,584.5 million, $1,398.7 million, and $1,755.4 million, respectively.

Illustrative Discounted Cash Flow Analysis

VRC performed an illustrative discounted cash flow analysis of the Company based on forecasted estimates of unlevered free cash flows of the Company to derive an illustrative range of implied enterprise values and present values per share for the Company. VRC noted that the illustrative discounted cash flow analysis assumed the Company continued as a going concern and did not consider the risk of breach or default on or under any of the Company’s debt covenants or other obligations or liabilities. VRC performed the illustrative discounted cash flow analysis using discount rates ranging from 12.0% to 13.0%, reflecting estimates of the Company’s weighted average cost of capital. VRC discounted to present value, as of February 12, 2018, (i) estimates of unlevered free cash flow for the Company from February 12, 2018 through December 31, 2018, and then annually through December 31, 2021 as reflected in the Forecasts and (ii) a range of illustrative terminal values for the Company, which were calculated by applying perpetuity growth rates ranging from 1.5% to 2.5%, to a terminal year estimate of the free cash flow to be generated by the Company, as reflected in the Forecasts. VRC derived such discount rates by application of the capital asset pricing model, which requires certain company-specific inputs, including the industry’s target capital structure weightings, cost of debt, future applicable marginal tax rate and a beta for the company, as well as certain financial metrics for the United States financial markets generally. VRC estimated the range of perpetuity growth rates utilizing its professional judgment and experience, taking into account the Forecasts and market expectations regarding long-term real growth of gross domestic product and inflation. VRC’s derived ranges of illustrative enterprise values for the Company by adding the ranges of present values it derived as described above. The derived illustrative enterprise values ranged from $1,843.0 million to $2,143.1 million. VRC then subtracted from the range of illustrative enterprise values it derived for the Company the net debt of the Company as of February 12, 2018, to derive a range of illustrative equity values for the Company. VRC then divided each illustrative equity value it derived by the number of primary outstanding shares of the Company, as provided by the management of the Company, to derive a range of illustrative present values per share of Common Stock ranging from $7.28 to $10.87.

Selected Companies Analysis

VRC reviewed and compared certain financial information for the Company to corresponding financial information, ratios and public market multiples for the following publicly traded corporations in the specialty retail industry (collectively referred to as the selected companies):

| • | Bed Bath & Beyond Inc. |

| • | Dick’s Sporting Goods, Inc. |

| • | The Michaels Companies, Inc. |

| • | Party City Holdco Inc. |

| • | Sally Beauty Holdings, Inc. |

| • | Vitamin Shoppe, Inc. |

| • | William-Sonoma, Inc. |

Although none of the selected companies is directly comparable to the Company, VRC chose the aforementioned companies because they are publicly traded companies with business operations that, for purposes of analysis, may be considered similar to the Company’s in market size or in certain results of operations of the Company.

16

Table of Contents

With respect to each of the selected companies, VRC calculated and compared various financial multiples and such company’s EV. As used herein, “EV” means the market capitalization of a company that VRC derived based on the closing price of the shares of such company’s common stock and the number of shares of common stock outstanding on a fully diluted basis, plus the book value of debt, less the book value of liquid cash and cash equivalents, as a multiple of estimated EBITDA for the last twelve months (“LTM”) and calendar years 2018 and 2019, as provided by Capital IQ. As used herein, “EBITDA” means, with respect to a company, earnings before interest, taxes, depreciation and amortization (as adjusted for certain non-recurring charges). Unless otherwise noted, all EV calculations were determined based on publicly available information as of February 12, 2018.

| EV/EBITDA | ||||||||||||||||

| Company Name | BEV | LTM | 2018E | 2019E | ||||||||||||

| Bed Bath & Beyond Inc. |

$ | 4,112.7 | 3.5x | 3.9x | 4.5x | |||||||||||

| Dick’s Sporting Goods, Inc. |

$ | 3,919.7 | 5.4x | 5.2x | 6.0x | |||||||||||

| The Michaels Companies, Inc. |

$ | 7,417.6 | 8.9x | 8.6x | 8.6x | |||||||||||

| Party City Holdco Inc. |

$ | 3,552.7 | 9.7x | 8.4x | 8.0x | |||||||||||

| Sally Beauty Holdings, Inc. |

$ | 4,155.6 | 6.8x | 6.9x | 7.0x | |||||||||||

| Vitamin Shoppe, Inc. |

$ | 225.7 | 2.9x | 4.3x | 4.0x | |||||||||||

| Williams-Sonoma, Inc. |

$ | 4,645.6 | 7.0x | 7.0x | 6.8x | |||||||||||

| High |

9.7x | 8.6x | 8.6x | |||||||||||||

| Upper Quartile |

7.9x | 7.7x | 7.5x | |||||||||||||

| Mean |

6.3x | 6.3x | 6.4x | |||||||||||||

| Median |

6.8x | 6.9x | 6.8x | |||||||||||||

| Lower Quartile |

4.4x | 4.8x | 5.2x | |||||||||||||

| Low |

2.9x | 3.9x | 4.0x | |||||||||||||

VRC then applied an illustrative range of 2018 estimated EBITDA multiples of 6.5x to 7.5x to the Company’s 2018 estimated EBITDA and an illustrative range of 2019 estimated EBITDA multiple of 6.0x to 7.0x to the Company’s 2019 estimated EBITDA to derive a range of implied enterprise values of $1,515.8 million to $1,855.6 million. VRC then subtracted from the range of illustrative enterprise values it derived for the Company the net debt of the Company as of February 12, 2018, to derive a range of illustrative equity values for the Company. VRC then divided the range of illustrative equity values it derived by the number of primary outstanding shares of the Company, as provided by the management of the Company, to derive a range of illustrative values per share of Common Stock ranging from $3.37 to $7.43.

Selected Transactions Analysis

VRC analyzed certain information relating to certain selected control transactions in the retail industry since 2012. For each of the selected transactions, VRC calculated and compared various financial multiples, financial ratios and other financial information. Although none of the operations of companies in the selected transactions are directly comparable to the Company, such transactions were chosen because the related companies have operations that, for purposes of analysis, may be considered similar to the Company’s operations in certain results of operations and product profiles. VRC noted that the selected transactions represent acquisitions of control of the relevant companies, whereas the Transaction is not a control transaction.

17

Table of Contents

The applicable information for the selected transactions is summarized below.

| Date | Acquirer | Target | EBITDA | |||

| 10/18/2017 | Hin Sang Group Holding Co. Ltd. | Fullshare Holdings Limited | 7.7x | |||

| 9/12/2017 | Sycamore Partners | Staples, Inc. | 5.3x | |||

| 8/28/2017 | Amazon.com, Inc. | Whole Foods Market, Inc. | 10.3x | |||

| 6/1/2017 | LetterOne Retail | Holland and Barrett Retail Limited | 11.8x | |||

| 5/18/2017 | 1111267 B.C. Ltd. | Immunotec Inc. | 4.1x | |||

| 4/21/2016 | Apollo Global Management, LLC | The Fresh Market, Inc. | 7.0x | |||

| 2/18/2016 | 3K Limited Partnership | Calloway’s Nursery, Inc. | 5.2x | |||

| 2/5/2016 | Steinhoff International | Mattress Firm Holding Corp. | 11.0x | |||

| 2/5/2016 | Mattress Firm, Inc. | Sleepy’s | 11.1x | |||

| 1/31/2016 | CVC Capital Partners Limited | PETCO Animal Supplies, Inc. | 10.0x | |||

| 12/18/2015 | The Kroger Co. | Roundy’s, Inc. | 7.0x | |||

| 12/10/2015 | Sycamore Partners | Belk, Inc. | 6.9x | |||

| 12/2/2015 | BPS Direct, L.L.C. | Cabela’s Incorporated | 10.6x | |||

| 8/21/2015 | Ascena Retail Group, Inc. | ANN INC. | 9.2x | |||

| 8/2/2015 | NA | Barnes & Noble, Inc. | 6.5x | |||

| 7/13/2015 | Bluestem Brands, Inc. | Orchard Brands Corporation | 5.8x | |||

| 6/29/2015 | BootBarn Inc. | Shelpers, Inc. | 9.9x | |||

| 3/11/2015 | BC Partners | PetSmart, Inc. | 9.0x | |||

| 10/20/2014 | Mattress Firm, Inc. | The Sleep Train | 16.7x | |||

| 5/29/2014 | Signet Jewelers Limited |

Zale Corporation |

7.4x | |||

| 4/1/2014 | Ares Management |

Guitar Center |

9.2x | |||

| 10/3/2013 | Jarden Corp. |

Yankee Candle Group LLC |

8.9x | |||

| 6/12/2013 | Sycamore Partners |

Hot Topic, Inc. |

8.7x | |||

| 3/28/2013 | Leon’s Furniture Limited |

The Brick Ltd. |

7.4x | |||

| 3/18/2013 | Tempur-Pedic International Inc. |

Sealy Corporation |

7.6x | |||

| 12/31/2012 | Starbucks Corporation |

Teavana |

17.9x | |||

| 11/27/2012 | Berkshire Hathaway Inc. |

OTC Direct, Inc. |

7.1x | |||

| 8/1/2012 | Advent International |

Serta/Simmons |

10.0x | |||

| 7/27/2012 | Thomas H. Lee |

Party City Holdings Inc. |

10.2x | |||

| 6/28/2012 | Bed Bath & Beyond Inc. |

Cost Plus, Inc. |

12.7x | |||

| 6/12/2012 | Ascena Retail Group, Inc. |

Charming Shoppes Inc. |

10.2x | |||

| Min | 4.1x | |||||

| Lower Quartile |

7.1x | |||||

| Median | 9.0x | |||||

| Average | 9.1x | |||||

| Upper Quartile |

10.3x | |||||

| Max | 17.9x | |||||

18

Table of Contents