Form DEF 14A GCM Grosvenor Inc. For: Apr 26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

__________________________________

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ | ||||||||||

Check the appropriate box:

☐ | Preliminary Proxy Statement | ||||

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

☒ | Definitive Proxy Statement | ||||

☐ | Definitive Additional Materials | ||||

☐ | Soliciting Material under §240.14a-12 | ||||

GCM Grosvenor Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. | ||||||||||

☐ | Fee paid previously with preliminary materials. | ||||||||||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||||||||

GCM Grosvenor Inc.

NOTICE & PROXY STATEMENT

Annual Meeting of Stockholders

June 8, 2022

1:00 p.m. Central time

i

GCM GROSVENOR INC.

900 MICHIGAN AVENUE, SUITE 1100

CHICAGO, ILLINOIS 60611

April 26, 2022

To Our Stockholders:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of GCM Grosvenor Inc. at 1:00 p.m. Central time, on Wednesday, June 8, 2022. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. There is no physical location for the Annual Meeting.

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/GCMG2022 and entering your 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. Please see the section called “Who can attend the Annual Meeting?” on page 6 of the proxy statement for more information about how to attend the meeting online.

Whether or not you attend the Annual Meeting online, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or if you received paper copies of these materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you have previously received our Notice of Internet Availability of Proxy Materials, then instructions regarding how you can vote are contained in that notice. If you have received a proxy card, then instructions regarding how you can vote are contained on the proxy card. If you decide to attend the Annual Meeting virtually, you will be able to vote online, even if you have previously submitted your proxy.

I and the other members of the Board of Directors look forward to greeting you at the Annual Meeting, and appreciate your continued interest in and support of GCM Grosvenor Inc.

Sincerely,

Michael J. Sacks

Chief Executive Officer and Chairman

ii

TABLE OF CONTENTS

| Page | |||||

iii

CERTAIN DEFINITIONS

As used in the accompanying proxy statement, unless otherwise indicated, references to “GCM,” the “Company,” “we,” “us,” and “our,” and similar references refer collectively to GCM Grosvenor Inc. and its consolidated subsidiaries.

Unless the context otherwise requires, references in this proxy statement to:

•“A&R LLLPA” are to the Fifth Amended and Restated Limited Liability Limited Partnership Agreement of GCMH;

•“AUM” are to assets under management;

•“Business Combination” or “Transaction” are to the transactions contemplated by the Transaction Agreement;

•“Bylaws” are to our Amended and Restated Bylaws;

•“Charter” are to our Amended and Restated Certificate of Incorporation;

•“Closing” are to the consummation of the Business Combination;

•“Closing Date” are to November 17, 2020;

•“Class A common stock” are to our Class A common stock, par value $0.0001 per share;

•“Class B common stock” are to our Class B common stock, par value $0.0001 per share;

•“Class C common stock” are to our Class C common stock, par value $0.0001 per share;

•“GCM Grosvenor” are to GCMH, its subsidiaries, and GCM LLC;

•“GCM LLC” are to GCM, L.L.C., a Delaware limited liability company;

•“GCM private placement warrants” are to the warrants for Class A common stock (which are in identical form of private placement warrants but in the name of GCM Grosvenor Inc.);

•“GCM V” are to GCM V, LLC, a Delaware limited liability company;

•“GCMH” are to Grosvenor Capital Management Holdings, LLLP, a Delaware limited liability limited partnership;

•“GCMHGP LLC” are to GCMH GP, L.L.C., a Delaware limited liability company;

•“GCMH Equityholders” are to Holdings, Management LLC, Holdings II and Progress Subsidiary;

•“GCMLP” are to Grosvenor Capital Management, L.P., an Illinois limited partnership;

•“Grosvenor common units” are to units of partnership interests in GCMH entitling the holder thereof to the distributions, allocations, and other rights accorded to holders of partnership interests in GCMH;

•“Holdings” are to Grosvenor Holdings, L.L.C., an Illinois limited liability company;

•“Holdings II” are to Grosvenor Holdings II, L.L.C., Delaware limited liability company;

•“IntermediateCo” are to GCM Grosvenor Holdings, LLC (formerly known as CF Finance Intermediate Acquisition, LLC), a Delaware limited liability company;

•“Key Holders” are to Michael J. Sacks, GCM V and the GCMH Equityholders;

•“lock-up shares” are to (a) the shares of our common stock received by the voting parties on the Closing Date, (b) any shares of our common stock received by any voting party after the Closing Date pursuant to a direct exchange or redemption of Grosvenor common units held as of the Closing Date under the A&R LLLPA and (c) the GCM private placement warrants held by the voting parties as of the Closing Date and any shares of our common stock issued to the voting parties upon exercise thereof;

•“Management LLC” are to GCM Grosvenor Management, LLC, a Delaware limited liability company;

•“Mosaic” are to Mosaic Acquisitions 2020, L.P.;

1

•“Mosaic Transaction” are to a transaction, effective January 1, 2020, by which GCMH and its affiliates transferred certain indirect partnerships interests related to historical investment funds managed by GCMH and its affiliates to Mosaic;

•“Nasdaq rules” are to the rules of the Nasdaq Stock Market LLC;

•“PIPE Investors” are to the qualified institutional buyers and accredited investors that agreed to purchase shares of Class A common stock in a private placement in connection with the execution of the Transaction Agreement and the Business Combination;

•“Progress Subsidiary” are to GCM Progress Subsidiary LLC, a Delaware limited liability company;

•“Registration Rights Agreement” are to that certain Amended and Restated Registration Rights Agreement, dated as of November 17, 2020, by and among us, CF Finance Holdings, LLC, the GCMH Equityholders and the PIPE Investors;

•“SEC” are to the U.S. Securities and Exchange Commission;

•“Stockholders’ Agreement” are to that certain Stockholders’ Agreement to be entered into by and among us, the GCMH Equityholders and GCM V;

•“Sunset Date” are to the date the GCMH Equityholders beneficially own a number of voting shares representing less than 20% of the number of shares of Class A common stock beneficially owned by the GCMH Equityholders immediately following the Closing Date (assuming, for this purpose, that all outstanding Grosvenor common units are and were exchanged at the applicable measurement time by the GCMH Equityholders for shares of Class A common stock in accordance with the A&R LLLPA and without regard to the lock-up or any other restriction on exchange);

•“Transaction Agreement” are to the definitive transaction agreement, dated as of August 2, 2020, by and among CF Finance Acquisition Corp., IntermediateCo, CF Finance Holdings, LLC, GCMH, the GCMH Equityholders, GCMHGP LLC, GCM V and us;

•“voting party” are to GCM V and the GCMH Equityholders; and

•“voting shares” are to our securities that are beneficially owned by a voting party that may be voted in the election of our directors, including any and all of our securities acquired and held in such capacity subsequent to the date of the Transaction Agreement.

2

GCM GROSVENOR INC.

900 Michigan Avenue, Suite 1100

Chicago, Illinois 60611

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD WEDNESDAY, JUNE 8, 2022

The Annual Meeting of Stockholders (the “Annual Meeting”) of GCM Grosvenor Inc., a Delaware corporation (the “Company”), will be held at 1:00 p.m. Central time on Wednesday, June 8, 2022. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/GCMG2022 and entering your 16-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting will be held for the following purposes:

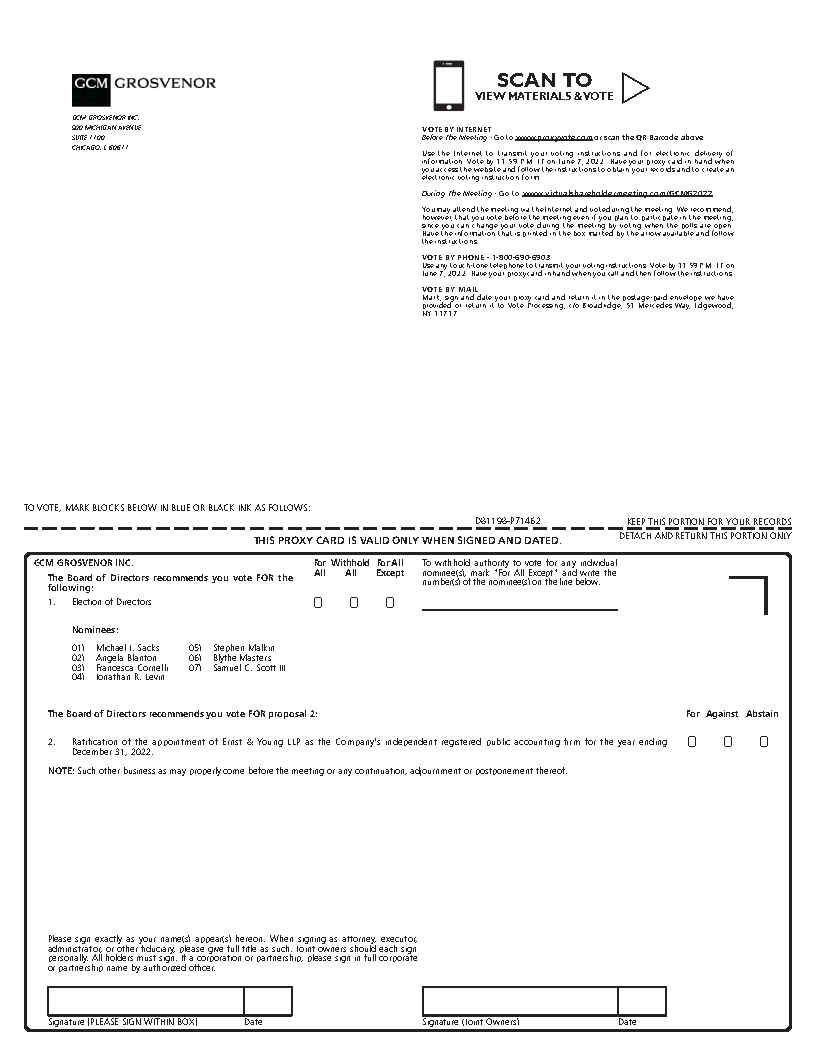

•To elect Michael J. Sacks, Angela Blanton, Francesca Cornelli, Jonathan R. Levin, Stephen Malkin, Blythe Masters and Samuel C. Scott III as directors to serve until the 2023 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified;

•To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and

•To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

Holders of record of our Class A common stock and our Class C common stock as of the close of business on April 11, 2022 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Annual Meeting for a purpose germane to the meeting by sending an email to Maria Lennox, Secretary, at investorrelations@gcmlp.com, stating the purpose of the request and providing proof of ownership of Company stock. The list of these stockholders will also be available on the bottom of your screen during the Annual Meeting after entering the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting online, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors

Burke J. Montgomery

Managing Director and General Counsel

Chicago, Illinois

April 26, 2022

3

GCM GROSVENOR INC.

900 Michigan Avenue, Suite 1100

Chicago, Illinois 60611

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation by the Board of Directors of GCM Grosvenor Inc. of proxies to be voted at our Annual Meeting of Stockholders to be held on Wednesday, June 8, 2022 (the “Annual Meeting”), at 1:00 p.m. Central time, and at any continuation, postponement, or adjournment of the Annual Meeting. The Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/GCMG2022 and entering your 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials.

Holders of record of shares of our Class A common stock and Class C common stock (together, our “common stock”), as of the close of business on April 11, 2022 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting, and will vote together as a single class on all matters presented at the Annual Meeting. As of the Record Date, there were 43,744,954 shares of Class A common stock outstanding and entitled to vote at the Annual Meeting and 144,235,246 shares of Class C common stock outstanding and entitled to vote at the Annual Meeting, representing approximately 25% and 75% of the voting power of our common stock, respectively. Each share of Class A common stock is entitled to one vote per share and each share of Class C common stock is entitled to 0.903626996 votes per share on any matter presented to stockholders at the Annual Meeting.

This proxy statement and the Company’s Annual Report to Stockholders for the year ended December 31, 2021 (the “2021 Annual Report”) will be released on or about April 26, 2022 to our stockholders on the Record Date.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON WEDNESDAY, JUNE 8, 2022

This Proxy Statement and our 2021 Annual Report to Stockholders are available at

http://www.proxyvote.com/

Proposals

At the Annual Meeting, our stockholders will be asked:

•To elect Michael J. Sacks, Angela Blanton, Francesca Cornelli, Jonathan R. Levin, Stephen Malkin, Blythe Masters and Samuel C. Scott III as directors to serve until the 2023 Annual Meeting of Stockholders, and until their respective successors shall have been duly elected and qualified;

•To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and

•To transact such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment of the Annual Meeting.

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

4

Recommendations of the Board

The Board of Directors (the “Board”) recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of common stock will be voted on your behalf as you direct. If not otherwise specified, the shares of common stock represented by the proxies will be voted, and the Board recommends that you vote:

•FOR the election of Michael J. Sacks, Angela Blanton, Francesca Cornelli, Stephen Malkin, Jonathan R. Levin, Blythe Masters and Samuel C. Scott III as directors to serve until the 2023 Annual Meeting of Stockholders; and

•FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Information About This Proxy Statement

Why you received this proxy statement. You are viewing or have received these proxy materials because GCM’s Board is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the SEC and that is designed to assist you in voting your shares.

Notice of Internet Availability of Proxy Materials. As permitted by SEC rules, GCM is making this proxy

statement and its 2021 Annual Report available to its stockholders electronically via the Internet. On or about April

26, 2022, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”)

containing instructions on how to access this proxy statement and our 2021 Annual Report and vote online. If you

received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you

specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important

information contained in the proxy statement and 2021 Annual Report. The Internet Notice also instructs you on

how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to

receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials

contained on the Internet Notice.

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact Broadridge Financial Solutions, Inc. at 1-866-540-7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact Broadridge at the above phone number or address.

5

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Who is entitled to vote at the Annual Meeting?

The Record Date for the Annual Meeting is April 11, 2022. You are entitled to vote at the Annual Meeting only if you were a stockholder of record at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of Class A common stock is entitled to one vote per share and each outstanding share of Class C common stock is entitled to 0.903626996 votes per share for all matters before the Annual Meeting in accordance with the provisions of our Charter and the Stockholders Agreement. Holders of Class A common stock and Class C common stock vote together as a single class on any matter (including the election of directors and the ratification of our independent registered public accounting firm) that is submitted to a vote of our stockholders, unless otherwise required by law or our Charter. At the close of business on the Record Date, there were 43,744,954 shares of Class A common stock and 144,235,246 shares of Class C common stock outstanding and entitled to vote at the Annual Meeting, representing approximately 25% and 75% voting power of our common stock, respectively.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in “street name”?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. See “How do I vote—Beneficial Owners of Shares Held in ‘Street Name’” below for additional information.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting online or by proxy, of the holders of a majority in voting power of the common stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

Who can attend the Annual Meeting?

GCM has decided to hold the Annual Meeting entirely online this year. You may attend and participate in the Annual Meeting by visiting the following website: www.virtualshareholdermeeting.com/GCMG2022. To attend and participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. The meeting webcast will begin promptly at [1:00 p.m. Central time]. We encourage you to access the meeting prior to the start time. Online check-in will begin at 12:45 p.m., Central time, and you should allow ample time for the check-in procedures.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, the Chairperson of the Annual Meeting is authorized by our Amended and Restated Bylaws to adjourn the meeting, without the vote of stockholders.

What does it mean if I receive more than one Internet Notice or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Internet Notice or set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

6

How do I vote?

Stockholders of Record. If you are a stockholder of record, you may vote:

•by Internet—You can vote over the Internet at www.proxyvote.com by following the instructions on the Internet Notice or proxy card;

•by Telephone—You can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card;

•by Mail—You can vote by mail by signing, dating and mailing the proxy card, which you may have received by mail; or

•Electronically at the Meeting—If you attend the meeting online, you will need the 16-digit control number included in your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials to vote electronically during the meeting.

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Central time, on June 7, 2022. To participate in the Annual Meeting, including to vote via the Internet or telephone, you will need the 16-digit control number included on your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials.

Whether or not you expect to attend the Annual Meeting online, we urge you to vote your shares as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. If you submit your proxy, you may still decide to attend the Annual Meeting and vote your shares electronically.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in “street name” through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Internet and telephone voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote your shares online at the Annual Meeting, you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. You will need to obtain your own Internet access if you choose to attend the Annual Meeting online and/or vote over the Internet.

Can I change my vote after I submit my proxy?

Yes.

If you are a registered stockholder, you may revoke your proxy and change your vote:

•by submitting a duly executed proxy bearing a later date;

•by granting a subsequent proxy through the Internet or telephone;

•by giving written notice of revocation to the Secretary of GCM prior to the Annual Meeting; or

•by voting online at the Annual Meeting.

Your most recent proxy card or Internet or telephone proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Secretary before your proxy is voted or you vote online at the Annual Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote online at the Annual Meeting using your 16-digit control number or otherwise voting through your bank or broker.

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc., our inspector of election, will tabulate and certify the votes.

7

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are indicated on page 5 of this proxy statement, as well as with the description of each proposal in this proxy statement.

Will any other business be conducted at the Annual Meeting?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Why hold a virtual meeting?

As part of our effort to maintain a safe and healthy environment for our directors, members of management and stockholders who wish to attend the Annual Meeting, in light of the ongoing COVID-19 pandemic, we believe that hosting a virtual meeting this year is in the best interest of the Company and its stockholders. A virtual meeting also enables increased stockholder attendance and participation because stockholders can participate from any location around the world. You will be able to attend the Annual Meeting online and submit your questions by visiting www.virtualshareholdermeeting.com/GCMG2022. You also will be able to vote your shares electronically at the Annual Meeting by following the instructions above.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website, and the information for assistance will be located on www.virtualshareholdermeeting.com/GCMG2022.

Will there be a question and answer session during the Annual Meeting?

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer questions submitted online during the meeting that are pertinent to the Company and the meeting matters, as time permits. Only stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “Who can attend the Annual Meeting?” will be permitted to submit questions during the Annual Meeting. Each stockholder is limited to no more than two questions. Questions and answers may be grouped by topic, and substantially similar questions may be grouped and answered as one. We will not address questions that are not pertinent to the business of the Company or the business of the Annual Meeting, or that we otherwise believe are not appropriate under the circumstances.

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and broker non-votes be treated?

| Proposal | Votes required | Effect of Votes Withheld / Abstentions and Broker Non-Votes | ||||||||||||

| Proposal 1: Election of Directors | The plurality of the votes cast. This means that the seven (7) nominees receiving the highest number of affirmative “FOR” votes will be elected as directors. | Votes withheld and broker non-votes will have no effect. | ||||||||||||

| Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | The affirmative vote of the holders of a majority of the votes cast. | Abstentions will have no effect. We do not expect any broker non-votes on this proposal. | ||||||||||||

What is a “vote withheld” and an “abstention” and how will votes withheld and abstentions be treated?

A “vote withheld,” in the case of the proposal regarding the election of directors, or an “abstention,” in the case of the proposal regarding the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, represents a stockholder’s affirmative choice to decline to vote on a proposal.

8

Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld have no effect on the election of directors. Abstentions have no effect on the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm.

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the election of directors. Broker non-votes count for purposes of determining whether a quorum is present.

Where can I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC after the Annual Meeting.

9

PROPOSALS TO BE VOTED ON

Proposal 1: Election of Directors

At the Annual Meeting, seven (7) directors are to be elected to hold office until the Annual Meeting of Stockholders to be held in 2023 and until each such director’s respective successor is elected and qualified or until each such director’s earlier death, resignation or removal.

We currently have seven (7) directors on our Board. Our current directors, who are also director nominees for election at the Annual Meeting, are Michael J. Sacks, Angela Blanton, Francesca Cornelli, Jonathan R. Levin, Stephen Malkin, Blythe Masters and Samuel C. Scott III. The Board has nominated each of the foregoing director candidates to serve as directors until the 2023 Annual Meeting.

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the seven (7) nominees receiving the highest number of affirmative “FOR” votes will be elected as directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

Upon consummation of the Business Combination, we entered into the Stockholders’ Agreement with the GCMH Equityholders and GCM V, pursuant to which, among other things, (i) GCM V was granted rights to designate all seven directors for election to our Board (and GCM V and the GCMH Equityholders will vote in favor of such designees) and (ii) GCM V and the GCMH Equityholders agreed to vote their voting shares in favor of any recommendations by our Board until the Sunset Date. As a result of the Stockholders’ Agreement and the aggregate voting power of the parties to the agreement, we expect that the parties to the agreement acting in conjunction will control the election of directors at GCM. For more information, see “Corporate Governance—Stockholders Agreement.”

In accordance with our Charter and Bylaws, the Board will stand for election for one-year terms that expire at the following year’s annual meeting. Pursuant to our Charter, the total number of directors constituting the Board shall be not less than three (3) and not more than twenty (20), with the then-authorized number of directors being fixed by the Board from time-to-time, which number is currently seven (7) members. Subject to obtaining any required stockholder votes or consents under the Stockholders’ Agreement (or complying with any stockholders’ designation rights under our Stockholders’ Agreement), newly created directorships resulting from any increase in the authorized number of directors or any vacancies on the Board resulting from death, resignation, retirement, disqualification, removal from office or other cause shall be filled solely by the affirmative vote of the remaining directors then in office, even if less than a quorum of the Board. Subject to obtaining any required stockholder votes or consents under the Stockholders’ Agreement, our directors may be removed from office at any time, with or without cause and only by the affirmative vote of the holders of a majority of our outstanding common stock entitled to vote in the election of directors.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of common stock represented thereby for the election as a director of the person whose name and biography appears below. In the event that any of Mr. Sacks, Ms. Blanton, Dr. Cornelli, Mr. Levin, Mr. Malkin, Ms. Masters or Mr. Scott should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by the Board or the Board may elect to reduce its size. The Board has no reason to believe that any of the director nominees will be unable to serve if elected. Each of the director nominees has consented to being named in this proxy statement and to serve if elected.

Vote required

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the seven (7) nominees receiving the highest number of affirmative “FOR” votes will be elected as directors.

Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

10

Recommendation of the Board of Directors

| The Board unanimously recommends a vote FOR the election of each of the below director nominees. | ||||

The current members of the Board who are also nominees for election to the Board as directors are as follows:

| Name | Age | Position with the Company | ||||||||||||

| Michael J. Sacks | 59 | Chairman of the Board and Chief Executive Officer | ||||||||||||

| Jonathan R. Levin | 40 | President and Director | ||||||||||||

| Angela Blanton | 51 | Director | ||||||||||||

| Francesca Cornelli | 59 | Director | ||||||||||||

| Stephen Malkin | 60 | Director | ||||||||||||

| Blythe Masters | 53 | Director | ||||||||||||

| Samuel C. Scott III | 77 | Lead Independent Director | ||||||||||||

The principal occupations and business experience, for at least the past five years, of each director nominee for election at the Annual Meeting are as follows:

Michael J. Sacks

Michael J. Sacks has served as our Chief Executive Officer and Chairman of our Board since our formation in July 2020. Mr. Sacks is also GCM Grosvenor’s Chief Executive Officer, having joined GCM Grosvenor in 1990 and soon after being named its Chief Executive Officer in 1994. Under Mr. Sacks’ leadership, GCM Grosvenor grew from its position as an early participant in a cottage industry to its current position as one of the largest independent open architecture alternative asset platforms. Mr. Sacks is engaged civically serving on a number of nonprofit boards. He graduated from Tulane University with a B.S. in Economics and holds a general course certificate from the London School of Economics. In addition, Mr. Sacks holds an M.B.A. from the Kellogg Graduate School of Management at Northwestern University and a J.D. from Northwestern University’s Pritzker School of Law. Mr. Sacks is well qualified to serve on our Board because of his experience with GCM and GCM Grosvenor, including in his capacity as Chief Executive Officer of each entity.

Jonathan R. Levin

Jonathan R. Levin has served as our President since our formation in July 2020 and as a member of our Board since November 2020. Mr. Levin joined GCM Grosvenor in 2011 and became its President in 2017. Mr. Levin also serves as Chair of the Global Investment Council and a member of the Private Equity, Real Estate and Infrastructure Investment Committee, the Labor Impact Fund Investment Committee, and the Strategic Investments Investment Committee of GCM Grosvenor. Prior to joining GCM Grosvenor, Mr. Levin was the Treasurer and Head of Investor Relations at Kohlberg Kravis Roberts & Co. (“KKR”), where he worked from 2004 to 2011, where he was responsible for managing KKR’s balance sheet investments, engaging with public investors and industry analysts, and leading strategic projects. Prior to his role as Treasurer and Head of Investor Relations, Mr. Levin worked in KKR’s private equity business and focused on investments in the financial services industry. Mr. Levin began his career as an Analyst in the private equity group of Bear Stearns. Mr. Levin holds an A.B. in Economics from Harvard College and is a member of the board of directors of the Ann & Robert H. Lurie Children’s Hospital of Chicago and the Museum of Contemporary Art Chicago. Mr. Levin is well qualified to serve on our Board because of his experience with GCM and GCM Grosvenor, including in his capacity as President of each entity, and his experience in the asset management industry.

Angela Blanton

Angela Blanton has served as a member of our Board since November 2020. Ms. Blanton has served as Carnegie Mellon University’s vice president for Finance and chief financial officer since 2017 after serving as interim vice president and chief financial officer in 2016. Ms. Blanton has over 20 years of experience spanning finance, project management and engineering disciplines within the higher education, financial services and manufacturing industries. Prior to joining Carnegie Mellon, Ms. Blanton was chief financial officer for PNC Investments Brokerage from February 2015 to December 2015. Ms. Blanton serves on the boards of Pittsburgh Public Theater, where she serves as the Chair of the Education and Community Engagement Committee, National

11

Association of College and University Business Officers, and Leadership Pittsburgh Inc. Ms. Blanton received a bachelor of science in electrical engineering from the University of Michigan and her MBA from the Tepper School of Business at Carnegie Mellon University. We believe Ms. Blanton is well qualified to serve on our Board because of her experience as a chief financial officer and in the financial services industry.

Francesca Cornelli

Francesca Cornelli has served as a member of our Board since November 2020. Dr. Cornelli is the dean of Northwestern University’s Kellogg School of Management, a position she has held since August 1, 2019. She is also a professor of finance and holds the Donald P. Jacobs Chair in Finance. Prior to that, she was a professor of finance and deputy dean at London Business School from 1994 to 2019. Dr. Cornelli’s research interests include corporate governance, private equity, privatization, bankruptcy, IPOs and innovation policy. She has been an editor of the Review of Financial Studies and previously served on the board of editors of the Review of Economic Studies and as an associate editor at the Journal of Finance. She is a research fellow at the Center for Economic and Policy Research, and previously served as a director of the American Finance Association. Dr. Cornelli has previously taught at the Wharton School of the University of Pennsylvania, the Fuqua School of Business at Duke University, The London School of Economics, the Indian School of Business in Hyderabad and the New Economic School in Moscow. She has also served as an independent board member of several global corporations, including Banca Intesa SanPaolo from 2016 to 2019, Telecom Italia from 2014 to 2018, American Finance Association from 2013 to 2016, and Swiss Re International and Swiss Re Holdings from 2013 to 2019. In January 2016, she helped create and became a board member of AFFECT, a committee of the American Finance Association designed to promote the advancement of women academics in the field of finance. We believe Dr. Cornelli is well qualified to serve on our Board due to her experience as an academic in finance and governance, and her experience on boards of directors of other companies.

Stephen Malkin

Stephen Malkin has served on as a member of our Board since November 2020. Mr. Malkin is President of Ranger Capital Corporation, a position he has held continuously since departing from his position as a senior executive of GCM Grosvenor in 2005. Mr. Malkin was associated with GCM Grosvenor from 1992 through 2005, during most of which time he served on GCM Grosvenor’s Management Committee and shared management responsibilities with Mr. Sacks. Mr. Malkin was also a member of GCM Grosvenor’s Absolute Return Strategies Investment Committee and shared responsibility for portfolio management as well as the evaluation, selection, and monitoring of various Absolute Return Strategies investments. Prior to his role with GCM Grosvenor, from 1988 through 1991, Mr. Malkin worked in various management positions for JMB Realty Corporation, focusing on non-real estate corporate acquisition opportunities. From 1983 to 1986, Mr. Malkin was an analyst with Salomon Brothers Inc. in Chicago and Tokyo. He received a B.B.A. from the University of Michigan and an M.B.A. in Finance from the Wharton School of the University of Pennsylvania. We believe Mr. Malkin is well qualified to serve on our Board because of his management and investment experience with GCM Grosvenor, including as a former GCM Grosvenor Management Committee member and Absolute Return Strategies Investment Committee member, and his experience as an investment professional with over 35 years’ experience.

Blythe Masters

Blythe Masters has served as a member of our Board since November 2020. Ms. Masters is an experienced financial services and technology executive and currently a Founding Partner at the private equity and venture capital firm Motive Partners. Ms. Masters is President of Motive Capital Corp II, the special purpose acquisition corporation sponsored by Motive’s funds. From March 2015 until December 2018, she was the chief executive officer of Digital Asset. Ms. Masters was previously a senior executive at J.P. Morgan, which she left in 2014 following the sale of the physical commodities business that she built. Ms. Masters was a member of the Corporate & Investment Bank Operating Committee and the firm’s Executive Committee. Positions at J.P. Morgan included Head of Global Commodities, Head of Corporate & Investment Bank Regulatory Affairs, CFO of the Investment Bank, Head of Global Credit Portfolio and Credit Policy & Strategy, Head of North American Structured Credit Products, Co-Head of Asset Backed Securitization and Head of Global Structured Credit. Ms. Masters has held a number of board positions throughout her career. She currently serves on the board of directors of Forge Global Holdings, Inc., CAIS, Credit Suisse Group, serving as chair of the Digital

12

Transformation and Technology Committee and as Chair of Credit Suisse Holdings (USA), Inc. She is chair of the Wilshire Digital Asset Advisory Group, and advisory board member of the US Chamber of Digital Commerce, Figure Technologies, Maxex and SandboxAQ. She is a member of the Brookings Institution Taskforce on Financial Stability and P.R.I.M.E. Finance (the Hague-based Panel of Recognized International Market Experts in Finance). She previously served as chair of the board of directors of Santander Consumer USA Holdings from June 2015 to July 2016, chair of the board of Phunware having served on this board from December 2019 to April 2021, board member of A.P. Moller Maersk from 2020 to 2022 and CEO and board member of Motive Capital Corp from 2021 to 2022. She is the former chair of the Global Financial Markets Association, having served on this board from 2009 to 2014, former chair of the Securities Industry and Financial Markets Association having served on this board from 2004 to 2014, and former chair of the Linux Foundation’s Hyperledger project. Ms. Masters has a B.A. in economics from the University of Cambridge. We believe Ms. Masters is well qualified to serve on our Board due to her expertise in the financing and banking sector and her experience on boards of directors of other companies.

Samuel C. Scott III

Samuel C. Scott III has served as a member of our Board since November 2020. Prior to his retirement in 2009, Mr. Scott served as Chairman and Chief Executive Officer, since 2001, and President and Chief Operating Officer, since 1997, of Corn Products International, Inc., a leading global ingredients solutions provider now known as Ingredion Incorporated. Mr. Scott previously served as President of CPC International’s Corn Refining division from 1995 to 1997 and President of American Corn Refining from 1989 to 1997. In addition to his public board service, Mr. Scott also serves on the board of The Chicago Council on Global Affairs, the Board of Trustees of the Ringling College of Art and Design, the board of the Northwestern Medical Group and the board of the American Business Immigration Coalition. Mr. Scott served on the board of directors of BNY Mellon from 2003 to 2022, where he served as a member of its Audit Committee, its Human Resources and Compensation Committee and its Corporate Governance, Nominating & ESG Committee. Mr. Scott served on the board of Motorola Solutions, Inc. from 1993 until 2019 and was its lead director from 2015 to 2019. Mr. Scott also served on the board of Abbott Laboratories from 2007 until 2020. Mr. Scott received both a Bachelor of Science degree and a Master in Business Administration degree from Fairleigh Dickinson University. We believe Mr. Scott is well qualified to serve on our Board due to his experience as an executive and on boards of directors of other companies.

| Board Diversity Matrix (As of April 26, 2022) | ||||||||||||||

| Total Number of Directors | 7 | |||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||

| Part I: Gender Identity | ||||||||||||||

| Directors | 3 | 4 | 0 | 0 | ||||||||||

| Part II: Demographic Background | ||||||||||||||

| African American or Black | 1 | 1 | 0 | 0 | ||||||||||

| Alaskan Native or Native American | 0 | 0 | 0 | 0 | ||||||||||

| Asian | 0 | 0 | 0 | 0 | ||||||||||

| Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||||||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||||||||

| White | 2 | 3 | 0 | 0 | ||||||||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||||||||

| LGBTQ+ | 0 | |||||||||||||

| Did Not Disclose Demographic Background | 0 | |||||||||||||

13

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm

Our Audit Committee has appointed Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. Our Board has directed that this appointment be submitted to our stockholders for ratification at the Annual Meeting. Although ratification of our appointment of Ernst & Young LLP is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

Ernst & Young LLP also served as our independent registered public accounting firm for the fiscal year ended December 31, 2021. Neither the accounting firm nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non-audit related services. A representative of Ernst & Young LLP is expected to attend the Annual Meeting and to have an opportunity to make a statement and be available to respond to appropriate questions from stockholders.

In the event that the appointment of Ernst & Young LLP is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent auditors for the fiscal year ending December 31, 2023. Even if the appointment of Ernst & Young LLP is ratified, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change is in the interest of the Company.

Vote Required

This proposal requires the affirmative vote of the holders of a majority of the votes cast. Abstentions are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal. Because brokers have discretionary authority to vote on the ratification of the appointment of Ernst & Young LLP, we do not expect any broker non-votes in connection with this proposal.

Recommendation of the Board of Directors

| The Board of Directors unanimously recommends a vote FOR the Ratification of the Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2022. | ||||

14

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee has reviewed the audited consolidated financial statements of GCM Grosvenor Inc. (the “Company”) for the fiscal year ended December 31, 2021 and has discussed these financial statements with management and the Company’s independent registered public accounting firm. The Audit Committee has also received from, and discussed with, the Company’s independent registered public accounting firm various communications that such independent registered public accounting firm is required to provide to the Audit Committee, including the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the Securities and Exchange Commission.

The Company’s independent registered public accounting firm also provided the Audit Committee with a formal written statement required by PCAOB Rule 3526 (Communications with Audit Committees Concerning Independence) describing all relationships between the independent registered public accounting firm and the Company, including the disclosures required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence. In addition, the Audit Committee discussed with the independent registered public accounting firm its independence from the Company.

Based on its discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Blythe Masters (Chair)

Angela Blanton

Francesca Cornelli

Samuel C. Scott III

15

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND OTHER MATTERS

The following table summarizes the fees of Ernst & Young LLP, our independent registered public accounting firm, billed to us for each of the last two fiscal years for audit services and billed to us in each of the last two fiscal years for other services (dollars in thousands).

| Year Ended December 31, | ||||||||

| Fee Category | 2021 | 2020 | ||||||

Audit Fees(1) | $ | 1,224 | $ | 1,068 | ||||

Audit-Related Fees(2) | 796 | 2,995 | ||||||

Tax Fees(3) | 1,008 | 1,605 | ||||||

All Other Fees(4) | 45 | — | ||||||

| Total Fees | $ | 3,073 | $ | 5,668 | ||||

____________

(1) Audit fees consist of fees for the audit of our consolidated financial statements, the review of the interim financial statements included in our quarterly reports on Form 10-Q, and other professional services provided in connection with statutory and regulatory filings or engagements.

(2) Audit-related fees consist of other audit and attest services not required by statute or regulation.

(3) Tax fees consist of fees for tax-related services, including tax compliance and tax advice related to transactions.

(4) All other fees consist of due diligence related to potential transactions.

Pre-Approval Policies and Procedures

The Audit Committee has adopted a policy (the “Pre-Approval Policy”) that sets forth the procedures and conditions pursuant to which audit and non-audit services proposed to be performed by the independent auditor may be pre-approved. The Pre-Approval Policy generally provides that we will not engage Ernst & Young LLP to render any audit, audit-related, tax or permissible non-audit service unless the service is either (i) explicitly approved by the Audit Committee (“specific pre-approval”) or (ii) entered into pursuant to the pre-approval policies and procedures described in the Pre-Approval Policy (“general pre-approval”). Unless a type of service to be provided by Ernst & Young LLP has received general pre-approval under the Pre-Approval Policy, it requires specific pre-approval by the Audit Committee or by a designated member of the Audit Committee to whom the committee has delegated the authority to grant pre-approvals. Any proposed services exceeding pre-approved cost levels or budgeted amounts will also require specific pre-approval. For both types of pre-approval, the Audit Committee will consider whether such services are consistent with the SEC's rules on auditor independence. The Audit Committee will also consider whether the independent auditor is best positioned to provide the most effective and efficient service, for reasons such as its familiarity with the Company's business, people, culture, accounting systems, risk profile and other factors, and whether the service might enhance the Company's ability to manage or control risk or improve audit quality. All such factors will be considered as a whole, and no one factor should necessarily be determinative. The Audit Committee periodically reviews and generally pre-approves any services (and related fee levels or budgeted amounts) that may be provided by Ernst & Young LLP without first obtaining specific pre-approvals from the Audit Committee or the Chair of the Audit Committee. The Audit Committee may revise the list of general pre-approved services from time to time, based on subsequent determinations.

16

EXECUTIVE OFFICERS

The following table identifies our current executive officers:

| Name | Age | Position with the Company | ||||||||||||

Michael J. Sacks(1) | 59 | Chairman of the Board and Chief Executive Officer | ||||||||||||

Pamela Bentley(2) | 50 | Chief Financial Officer | ||||||||||||

Jonathan R. Levin(3) | 40 | President and Director | ||||||||||||

Frederick E. Pollock(4) | 42 | Chief Investment Officer | ||||||||||||

Sandra Hurse(5) | 56 | Chief Human Resources Officer | ||||||||||||

| (1) | See biography on page 11 of this proxy statement. | ||||

| (2) | Ms. Bentley serves as our Chief Financial Officer and is a member of the firm’s Operations Committee. She is responsible for managing the financial functions of the firm including overseeing activities related to corporate and fund accounting, treasury and cash management, financial planning and reporting, tax, and operational due diligence while also playing a vital role in the firm’s strategic initiatives. Prior to joining GCM Grosvenor, Ms. Bentley spent 15 years with The Carlyle Group, a publicly traded global investment firm, where her most recent role was Chief Accounting Officer and Managing Director. Previously, she was a Vice President of Finance and Investor Relations at Transaction Network Services, Inc. and a Senior Manager at Arthur Andersen LLP. Ms. Bentley received her Bachelor of Business Administration from the University of Michigan’s Ross School of Business. She is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants. Ms. Bentley is a member of and Chair of the Board of Directors of Junior Achievement of Greater Washington. | ||||

| (3) | See biography on page 11 of this proxy statement. | ||||

| (4) | Mr. Pollock serves as our Chief Investment Officer. Mr. Pollock joined GCM Grosvenor in 2015 and became Chief Investment Officer in 2019. Mr. Pollock also serves as Head of GCM Grosvenor’s Strategic Investments Group and on all of GCM Grosvenor’s Investment Committees, the Global Investment Council, the Diversity & Inclusion Governing Committee and the ESG Committee. Prior to joining GCM Grosvenor, Mr. Pollock had various roles at Morgan Stanley from 2006 to 2015, most recently within its merchant banking division, specializing in infrastructure investing, with responsibility for deal sourcing, due diligence, and management as a board member of various portfolio companies. Mr. Pollock helped form the infrastructure investment group at Morgan Stanley and to structure and raise capital for its initial funds. Prior to joining Morgan Stanley, Mr. Pollock worked at Deutsche Bank, where he made investments for the firm and on behalf of clients. He received his Bachelor of Science summa cum laude in Economics from the University of Nevada and his Juris Doctor magna cum laude from Harvard Law School. | ||||

| (5) | Ms. Hurse serves as our Chief Human Resources Officer. Ms. Hurse joined GCM Grosvenor as Chief Human Resources Officer in 2018. Ms. Hurse serves as a member of GCM Grosvenor’s ESG Committee and Diversity & Inclusion Governing Committee. Prior to joining GCM Grosvenor, Ms. Hurse held various positions at Bank of America from 2013 to 2018, most recently serving as Global Head of Human Resources for Corporate and Investment Banking. Previously, Ms. Hurse also held leadership roles in Talent Management and Talent Acquisition at Goldman Sachs & Co. from 2006 to 2013 and J.P. Morgan Chase & Co. from 1998 to 2006. She received a Bachelor of Business Administration in Finance from Bernard M. Baruch College and a Master of Business Administration in Marketing from the University of Michigan. Ms. Hurse has served on the Board of Angi since November 2021, including on its Executive Compensation and Compensation Committees. Ms. Hurse serves as a Board Member for the Harlem School of the Arts, the Council for Urban Professionals and the Thurgood Marshall College Fund, where she is a member of the finance committee. | ||||

17

CORPORATE GOVERNANCE

General

Our Board has adopted Corporate Governance Guidelines, a Code of Business Conduct and Ethics, and a charter for our Audit Committee to assist the Board in the exercise of its responsibilities and to serve as a framework for the effective governance of the Company. You can access our Audit Committee charter, our Corporate Governance Guidelines, and our Code of Business Conduct and Ethics on our website at www.gcmgrosvenor.com/corporate-governance, or by writing to our Secretary at our offices at 900 North Michigan Avenue, Suite 1100, Chicago, Illinois 60611.

Board Composition

Our Board currently consists of seven members: Michael J. Sacks, Angela Blanton, Francesca Cornelli, Jonathan R. Levin, Stephen Malkin, Blythe Masters and Samuel C. Scott III. Subject to obtaining any required stockholder votes or consents under the Stockholders’ Agreement, our directors may be removed from office at any time, with or without cause and only by the affirmative vote of the holders of a majority of our outstanding common stock entitled to vote in the election of directors.

Stockholders’ Agreement

Pursuant to the Stockholders’ Agreement, GCM V has rights to designate seven directors for election to our Board and GCM V and the GCMH Equityholders will vote in favor of such designees at any annual or special meeting of stockholders in which directors are elected. Under the terms of the Stockholders’ Agreement, until the Sunset Date, all of our directors are designated by GCM V, of whom three must qualify as “independent directors” under the Nasdaq rules and one must qualify as an “audit committee financial expert” as defined under the rules of the SEC. Thereafter, such designations will be determined by our Board. Pursuant to the terms of the Stockholders’ Agreement, GCM V has the right to remove any of the directors designated by GCM V and will have the exclusive right to designate directors to fill vacancies created by reason of death, removal or resignation of any director designated by GCM V.

Director Independence and Controlled Company Exemption

We are a “controlled company” under the Nasdaq rules. As a result, we qualify for exemptions from, and have elected not to comply with, certain corporate governance requirements under the rules, including the requirements that we have a compensation committee and a nominating committee that are composed entirely of independent directors. We do not maintain a compensation committee or a nominating committee. Even though we are a controlled company, we are required to comply with the rules of the SEC and the Nasdaq rules relating to the membership, qualifications and operations of our audit committee.

The Nasdaq rules define a “controlled company” as a company of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company. As of April 11, 2022, the Key Holders control approximately 75% of the combined voting power of the Company’s common stock, and control a majority of the voting power of the Company so long as the outstanding Class C common stock represents at least 9.1% of the Company’s total outstanding common stock. Accordingly, we qualify as a “controlled company”. If we cease to be a controlled company and our Class A common stock continues to be listed on the Nasdaq Global Market, we will be required to comply with the Nasdaq requirements for non-controlled companies by the date our status as a controlled company changes or within specified transition periods applicable to certain provisions, as the case may be.

In making its independence determinations, the Board reviewed and discussed information provided by the directors with regard to each director’s business and personal activities and any relationships they have with us and our management. As a result of this review, our Board determined that Ms. Blanton, Dr. Cornelli, Ms. Masters and Mr. Scott are “independent directors” as defined under the applicable Nasdaq rules, representing four of our seven directors.

In addition, each of the member of the Audit Committee, Ms. Blanton, Dr. Cornelli, Ms. Masters and Mr. Scott, meets the heightened independence standards required for audit committee members under the applicable Nasdaq rules and SEC rules. There are no family relationships among any of our directors or executive officers.

18

Director Candidates

As discussed above, we are a controlled company and do not have a nominating committee. Subject to the terms of the Stockholders’ Agreement, the Board is primarily responsible for searching for qualified director candidates for election to the Board and filling vacancies on the Board. The Board currently does not have a policy with regard to the consideration of any director candidates recommended by stockholders, other than pursuant to the Stockholders’ Agreement, but may implement such a policy in the future. The Board believes it is appropriate not to have such a policy in place at this time, in light of the Board designation rights provided to GCM V in the Stockholders’ Agreement.

In evaluating the suitability of individual candidates (both new candidates and current Board members), the Board, in approving (and, in the case of vacancies, appointing) candidates for election, will consider candidates who have a high level of personal and professional integrity, strong ethics and values and the ability to make mature business judgments. In evaluating director candidates, the Board may also consider the following criteria as well as any other factor that they may deem to be relevant: experience in corporate management, such as serving as an officer or former officer of a publicly held company; experience as a board member of another publicly held company; professional and academic experience relevant to our industry; strength of the candidate’s leadership skills; candidate’s experience in finance and accounting and/or executive compensation practices; whether the candidate has the time required for preparation, participation and attendance at Board meetings and committee meetings, if applicable; and the candidate’s geographic background, gender, age and ethnicity, including gender identification or identification as an underrepresented minority or as LGBTQ+. In addition, the Board will consider whether there are potential conflicts of interest with the candidate’s other personal and professional pursuits. The Board is committed to actively seeking out highly qualified women and individuals from minority groups to include in the pool from which new Board candidates are chosen. Each individual will be evaluated in the context of the Board as a whole, with the objective of recommending a group that can best perpetuate the success of the Company’s business.

Communications from Stockholders

The Board will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. Our Secretary is primarily responsible for monitoring communications from stockholders and for providing copies or summaries to the directors as he considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that our Secretary and Chairman of the Board consider to be important for the directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we tend to receive repetitive or duplicative communications. Stockholders who wish to send communications on any topic to the Board should address such communications to the Board in writing: c/o Secretary, GCM Grosvenor Inc., 900 North Michigan Avenue, Suite 1100, Chicago, Illinois 60611.

Board Leadership Structure and Role in Risk Oversight

Our Bylaws and Corporate Governance Guidelines provide our Board with flexibility to combine or separate the positions of Chairman of the Board and Chief Executive Officer in accordance with its determination that utilizing one or the other structure would be in the best interests of our Company. Currently, the roles are combined, with Mr. Sacks serving as Chairman of the Board and Chief Executive Officer. Our Board has determined that combining the roles of Chairman of the Board and Chief Executive Officer is in the best interests of our Company and its stockholders at this time because it promotes unified leadership by Mr. Sacks and allows for a single, clear focus for management to execute the Company's strategy and business plans.

Our Corporate Governance Guidelines provide that whenever the Chair of the Board is also a member of management or is a director that does not otherwise qualify as an independent director, the independent directors may elect a lead director whose responsibilities include, but are not limited to, presiding over all meetings of the Board at which the Chair of the Board is not present, including any executive sessions of the independent directors; approving Board meeting schedules and agendas; and acting as the liaison between the independent directors and the Chair of the Board, as appropriate. Currently, Mr. Scott serves as our Lead Independent Director.

Due to the strong leadership of Mr. Sacks, coupled with the independent oversight provided by our Lead Independent Director and our independent Audit Committee, our Board has concluded that our current leadership

19

structure is appropriate at this time. However, our Board will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Risk assessment and oversight are an integral part of our governance and management processes. Our Board encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. Throughout the year, senior management intends to review these risks with the Board at regular Board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks. Our Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through its Audit Committee, which oversees risks inherent in its area of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including business continuity risks, such as risks relating to the COVID-19 pandemic, and our Audit Committee is responsible for overseeing our major financial and cybersecurity risk exposures and the steps our management has taken to monitor and control these exposures. The Audit Committee also monitors compliance with legal and regulatory requirements and considers and approves or disapproves any related person transactions. The Board does not believe that its role in the oversight of our risks affects the Board’s leadership structure.

Code of Ethics

We have a written Code of Business Conduct and Ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the Code of Business Conduct and Ethics is posted on our website, www.gcmgrosvenor.com/corporate-governance In addition, we intend to post on our website all disclosures that are required by law or the rules of Nasdaq concerning any amendments to, or waivers from, any provision of the Code of Business Conduct and Ethics.

Anti-Hedging Policy

Our Board has adopted an Insider Trading Compliance Policy, which applies to all of our directors, officers and employees. The policy prohibits our directors, officers and employees and any entities they control from purchasing financial instruments such as prepaid variable forward contracts, equity swaps, collars, and exchange funds, or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company’s equity securities, or that may cause an officer, director, or employee to no longer have the same objectives as the Company’s other stockholders.

Responsible Investing, Diversity Initiatives, and Corporate Citizenship

We are committed to acting in the long-term interests of all of our stakeholders. This philosophy drives us to invest responsibly, operate our business with integrity, and build a diverse and inclusive workplace where our employees can thrive. It also motivates us to volunteer and provide resources for organizations that strengthen the communities where we live and work. By focusing on these initiatives, we believe we are contributing to a successful future – for our clients, our employees, the industry, and our communities. We illustrate our commitment to impact investing, responsible business practices, and industry leadership in our annual Impact Report, which is available on our website at www.gcmgrosvenor.com/impact-report/. The information in our Impact Report and on our website are not incorporated by reference in, and do not form a part of, this proxy statement or any other SEC filing.

Environmental, Social, and Governance and Impact

Incorporating Environmental, Social, and Governance (“ESG”) factors into our business is part of our core values. It is our belief that by investing and running our business responsibly, promoting a sustainable environment, fostering a more diverse industry and workforce, and staying active in our communities, we truly can make a positive impact. A formal ESG Policy guides our actions, which is available on our website at www.gcmgrosvenor.com/corporate-governance/. Neither our ESG Policy nor our website are incorporated by reference in, nor do they form a part of, this proxy statement or any other SEC filing. Our ESG Policy provides

20

a framework for how we apply ESG considerations regarding our business, how we engage with the communities, and how we pursue, evaluate, and implement investments. Employees are required to read the document and we expect that they abide by its guidelines.

As of December 31, 2021 we had approximately $17.4 billion of AUM dedicated to ESG and impact investments, which has increased at a 25% compound annual growth rate since 2019.1 We have dedicated efforts in a number of ESG- and impact-related themes, including infrastructure investments where we believe partnering with union labor enhances risk-adjusted returns, investing with firms owned by women or minority professionals, and other impact-related themes like regionally targeted and clean energy. Given our size and scale, we believe we are well placed within the industry to drive broader integration of ESG factors among investors in alternatives. Therefore, we are engaged in multiple partnerships with organizations committed to enhancing integration of ESG factors and driving greater industry transparency.

Deep Bench of Talent and Strong Corporate Culture

At our firm, we believe culture is one of our most important and defensible assets. We believe in setting the right tone at the top as it relates to compliance and carrying it throughout the organization. That investment in culture is reflected in the stability and diversity of our team as well as the fact that we do not operate on a star system and therefore are not beholden to any one individual. We are committed to investing responsibly, operating our business with integrity, and building a diverse and inclusive workplace where our employees can thrive.

As of December 31, 2021, we had 524 employees, including 169 investment professionals, operating in eight offices throughout the United States and in Toronto, London, Frankfurt, Hong Kong, Seoul and Tokyo. In addition to what we believe is a competitive compensation structure, we promote a work environment that is interesting and challenging, providing our employees the opportunity to grow professionally. As of December 31, 2021, our current employees, former employees and the firm had approximately $673 million of their own capital (including through leveraged vehicles) invested into our various investment programs, which we believe aligns our interests with those of our clients.