Form DEF 14A Fabrinet For: Dec 13

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 | |

FABRINET

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

$ | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

NOTICE OF 2018 ANNUAL MEETING OF SHAREHOLDERS

| Annual Meeting Date: Thursday, December 13, 2018

Time: 9:00 a.m., Pacific time

Location: Wilson Sonsini Goodrich & Rosati, 650 Page Mill Road, Palo Alto, California 94304

|

Meeting Agenda

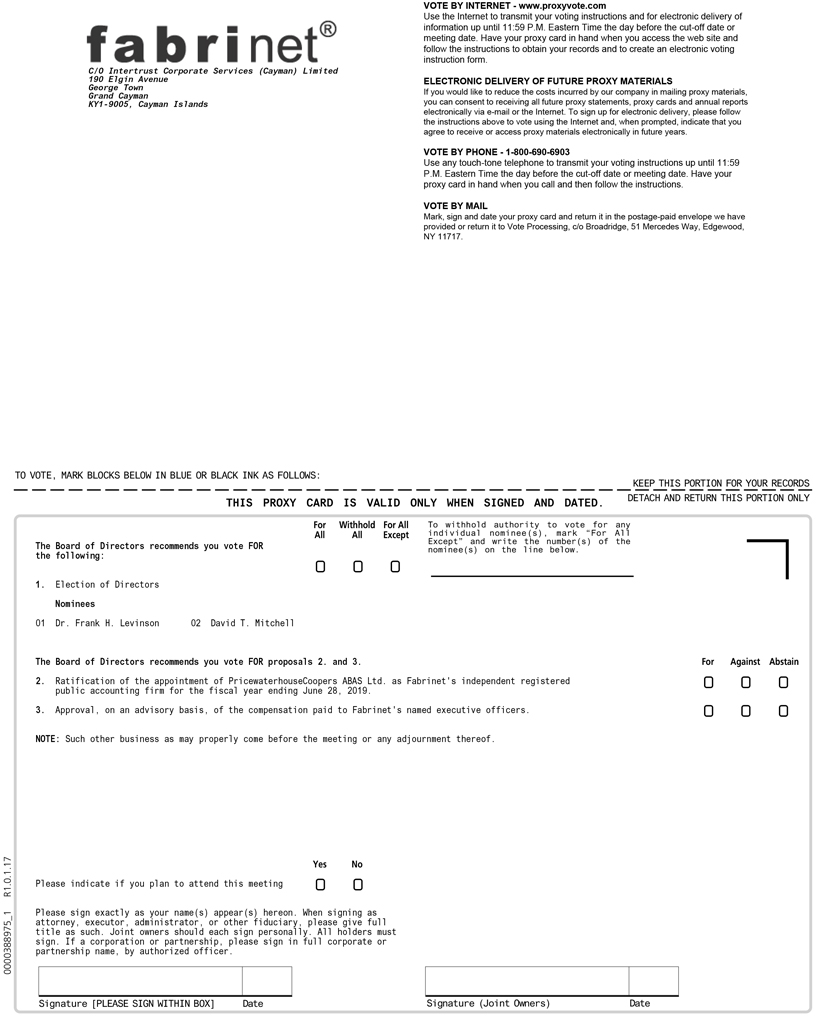

| 1. | Elect two Class III directors listed in the accompanying proxy statement and recommended by Fabrinet’s board of directors to serve for a term of three years, or until their respective successors have been duly elected and qualified; |

| 2. | Ratify the appointment of PricewaterhouseCoopers ABAS Ltd. as Fabrinet’s independent registered public accounting firm for Fabrinet’s fiscal year ending June 28, 2019; |

| 3. | Hold an advisory vote to approve the compensation paid to Fabrinet’s named executive officers; and |

| 4. | Transact such other business as may properly come before the meeting, or any adjournment or postponement thereof. |

These items of business are more fully described in the proxy statement accompanying this notice. Any action on the items of business described above may be considered at Fabrinet’s 2018 Annual Meeting of Shareholders (the “Annual Meeting”) at the time and on the date specified above, or at any time and date to which the meeting may be properly adjourned or postponed.

Record Date

Only shareholders of record at the close of business on October 15, 2018, are entitled to notice of and to vote at the Annual Meeting, and at any postponements or adjournments of the meeting.

Voting

Your vote is very important. Even if you plan to attend the Annual Meeting in person, we encourage you to read the proxy statement and to vote as quickly as possible, to ensure your vote is recorded. For specific instructions on how to vote your shares, please follow the procedures outlined in your Notice of Internet Availability of Proxy Materials, or refer to the section of the proxy statement entitled “Questions and Answers About the Annual Meeting and Procedural Matters.”

Thank you for your ongoing support of Fabrinet.

| By order of the Board of Directors,

|

| /s/ David T. Mitchell

|

| David T. Mitchell |

| Chairman of the Board of Directors |

Grand Cayman, Cayman Islands

October 19, 2018

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on Thursday, December 13, 2018

The proxy statement and our 2018 Annual Report to Shareholders are available at www.proxyvote.com.

|

Table of Contents

PROXY STATEMENT

FOR 2018 ANNUAL MEETING OF SHAREHOLDERS

-i-

Table of Contents

| Page | ||||

| PROPOSAL TWO—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

17 | |||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| PROPOSAL THREE—ADVISORY VOTE TO APPROVE COMPENSATION PAID TO NAMED EXECUTIVE OFFICERS |

18 | |||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| Attendance at Annual Meetings of Shareholders by the Board of Directors |

21 | |||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| Process for Recommending Candidates for Election to the Board of Directors |

23 | |||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| 54 | ||||

| 54 | ||||

| A-1 | ||||

-ii-

Table of Contents

| Date: | Thursday, December 13, 2018 | |

| Time: | 9:00 a.m., Pacific time | |

| Location: | Wilson Sonsini Goodrich & Rosati, 650 Page Mill Road, Palo Alto, California 94304 | |

| Record Date: | October 15, 2018 | |

| Voting: | Shareholders as of the record date are entitled to vote. Shareholders may cast one vote for each ordinary share held by them as of the record date on all matters properly presented at the Annual Meeting. At the close of business on the record date, there were 36,831,482 ordinary shares outstanding and entitled to vote at the Annual Meeting, as well as 1,289,103 ordinary shares outstanding and held as treasury shares. | |

| Admission to Meeting: | You are invited to attend the Annual Meeting if you were a shareholder of record or a beneficial owner as of the record date. You should bring photo identification for entrance to the Annual Meeting. The meeting will begin promptly at 9:00 a.m., Pacific time, and you should leave ample time for the check-in procedures. Shareholders may request directions to the offices of Wilson Sonsini Goodrich & Rosati by calling (650) 493-9300. | |

Matters to Be Voted on at the Annual Meeting

| Matter |

|

Board Recommendation |

Page Reference for More Information | |||

| Proposal 1: | Election of two Class III directors | FOR each nominee | Page 11 | |||

| Proposal 2: | Ratification of the appointment of PricewaterhouseCoopers ABAS Ltd. as Fabrinet’s independent auditor for the fiscal year ending June 28, 2019 | FOR | Page 17 | |||

| Proposal 3: | Advisory vote to approve named executive officer compensation | FOR | Page 18 | |||

-1-

Table of Contents

Business and Financial Highlights

During fiscal 2018, we saw a decrease in customers’ demand for optical communications manufacturing services, particularly telecom manufacturing services and a slower growth rate in the data center market after a peak year in fiscal 2017, which was partially offset by an increase in customers’ demand for non-optical communications manufacturing services. For fiscal 2018, we reported annual revenue of $1,371.9 million, a decrease of $48.6 million, or 3.4%, compared to record annual revenue of $1,420.5 million for fiscal 2017. The following table illustrates our fiscal 2018 results in terms of revenue, gross margin, net income, net income per diluted share and fiscal-end closing share price, relative to fiscal 2017:

| Fiscal 2018(1) | Fiscal 2017 | % Change | ||||

| Revenue | $1,371.9 million | $1,420.5 million | (3.4)% | |||

| GAAP gross margin | 11.2% | 12.1% | (7.4)% | |||

| Non-GAAP gross margin(2) | 11.7% | 12.5% | (6.4)% | |||

| Net income | $84.2 million | $97.1 million | (13.3)% | |||

| Net income per diluted share | $2.21 | $2.57 | (14.0)% | |||

| Non-GAAP net income(2) | $113.5 million | $127.4 million | (10.9)% | |||

| Non-GAAP net income per diluted share(2) | $2.98 | $3.37 | (11.6)% | |||

| Closing share price (on last trading day of fiscal year) | $36.89 | $42.66 | (13.5)% | |||

| (1) | Please see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended June 29, 2018 (filed with the Securities and Exchange Commission on August 22, 2018), for a more detailed discussion of our fiscal 2018 financial results. |

| (2) | Please refer to Appendix A for a reconciliation of this non-GAAP financial measure to the most directly comparable financial measure calculated in accordance with generally accepted accounting principles in the United States (“GAAP”). |

Other fiscal 2018 highlights include:

| • | We saw record growth from non-optical communications programs during the fourth quarter of fiscal 2018 as we continued to diversify our markets and customer base. Overall revenue from non-optical communications programs during the fourth quarter of fiscal 2018 was $103 million, up 30% from the fourth quarter of fiscal 2017 and up 13% from the third quarter of fiscal 2018. Both our industrial laser and automotive businesses saw all-time record quarterly revenue in the fourth quarter of fiscal 2018, with industrial laser revenue increasing 36% from the fourth quarter of fiscal 2017 and 8% from the third quarter of fiscal 2018 to $47 million, and automotive revenue increasing 34% from the fourth quarter of fiscal 2017 and 20% from the third quarter of fiscal 2018 to $26 million. |

| • | In August 2017, we announced that our board of directors had approved a share repurchase program to permit us to repurchase up to $30.0 million worth of our issued and outstanding ordinary shares in the open market. In February 2018, our board of directors approved an increase of $30.0 million to this share repurchase authorization, bringing the aggregate authorization to $60.0 million. During fiscal 2018, we repurchased 1,289,103 ordinary shares, or approximately $42.4 million worth of our ordinary shares, which offset dilution from issuances under our equity incentive plans. |

| • | In September 2017, we hired Seamus Grady as our new Chief Executive Officer. |

| • | In March 2018, we began laying the groundwork for a new facility in Israel, where we expect to continue our proven model of providing local “new product introduction” services, helping our customers with design for manufacturability, and then transferring those programs to Thailand for volume manufacturing. |

-2-

Table of Contents

Executive Compensation Program Highlights

Our executive compensation program is designed to be heavily weighted towards compensating our executives based on company performance. To that end, we have implemented executive compensation policies and practices that reinforce our pay-for-performance philosophy and align with commonly viewed best practices and sound governance principles. The following chart summarizes these policies and practices:

Fiscal 2018. Our fiscal 2018 executive compensation program continued to use key performance measures (revenue and non-GAAP gross margin) to link executive compensation with Fabrinet’s performance. Taking into account the results of previous stockholder advisory votes on our executive compensation and feedback received from shareholders during the summer of 2016 as well as ongoing outreach to shareholders since then, the Compensation Committee approved our fiscal 2018 executive compensation program with the following key components:

| • | A mix of long-term and short-term compensation components align executive interests with shareholders and serve to attract, retain and motivate executives. |

| • | More than 60% of the target total compensation (64% for our current CEO, 66% for our former CEO, 63% for COO and 63% for CFO) was variable and performance-based, and a substantial portion (79% for our current CEO, 75% for our former CEO, 60% for COO and 65% for CFO) was equity-based. Target total compensation consists of annual base salary, target bonus opportunity under our cash-based incentive plan and the aggregate grant date fair value of time-based and performance-based equity award grants in fiscal 2018. |

| • | We negotiated our current CEO’s target total compensation when he joined us in September 2017 to be significantly lower (on an annualized basis) than our former CEO’s target total compensation. |

| • | We increased the annual base salaries of our former CEO (by 6%), COO (by 6%) and CFO (by 8%). |

| • | Two-thirds of the equity awards granted to each of our named executive officers in fiscal 2018 consisted of performance-based restricted share units (PSUs) with challenging two-year cumulative performance targets. |

-3-

Table of Contents

| • | We established challenging performance goals at the beginning of fiscal 2018 to determine payouts under our cash-based incentive compensation plan following the completion of fiscal 2018. Because we did not achieve such pre-established performance goals, and consistent with our pay for performance philosophy, no bonuses were actually paid to our named executive officers under our fiscal 2018 cash-based incentive plan. |

| • | We increased the target amount (13% for our former CEO, 14% for COO and 11% for CFO) that could become payable to each of our named executive officers under our fiscal 2018 cash-based incentive plan. However, no bonuses were actually paid to our named executive officers under our fiscal 2018 cash-based incentive plan based on actual achievements under the rigorous plan metrics. |

The Compensation Committee also continued its dialogue with shareholders on our executive compensation practices by soliciting the views of institutional investors representing approximately 48% of our shares outstanding as of June 30, 2017, and having discussions in October 2017 with investors representing approximately 24% of our shares outstanding as of June 30, 2017, including four of our ten then-largest shareholders.

Fiscal 2019 Updates. In August 2018, the Compensation Committee approved our fiscal 2019 executive compensation program with the following key components:

| • | We continue to use a mix of long-term and short-term compensation components to align executive interests with shareholders and attract, retain and motivate executives. |

| • | We increased the annual base salary of our current CEO (by 11%). No other executive officers received raises for fiscal 2019. |

| • | We increased the percentage of equity awards granted in fiscal 2019 that are performance-based from 67% in fiscal 2018 to 70% for our current CEO, 71% for our COO and 70% for our CFO in fiscal 2019. The performance-based equity awards continue to consist of PSUs with challenging two-year cumulative performance targets. |

| • | Our cash-based incentive plan for fiscal 2019 continues to use annual revenue and non-GAAP gross margin as the sole performance measures that will determine payouts, if any, following the completion of fiscal 2019. |

| • | We increased the target amount that may become payable to our current CEO (by 15%) under our fiscal 2019 cash-based incentive plan. No other executive officers received increases in their target amounts. |

The Compensation Committee plans to continue its practice of shareholder outreach regarding our executive compensation practices by soliciting the views of institutional investors representing approximately 50% of our shares outstanding as of June 29, 2018, including our ten largest shareholders as of that date. The Compensation Committee expects to contact such shareholders between the filing of this proxy statement and the date of our 2018 annual meeting of shareholders.

-4-

Table of Contents

c/o Intertrust Corporate Services (Cayman) Limited

190 Elgin Avenue

George Town

Grand Cayman KY1-9005

Cayman Islands

PROXY STATEMENT

FOR 2018 ANNUAL MEETING OF SHAREHOLDERS

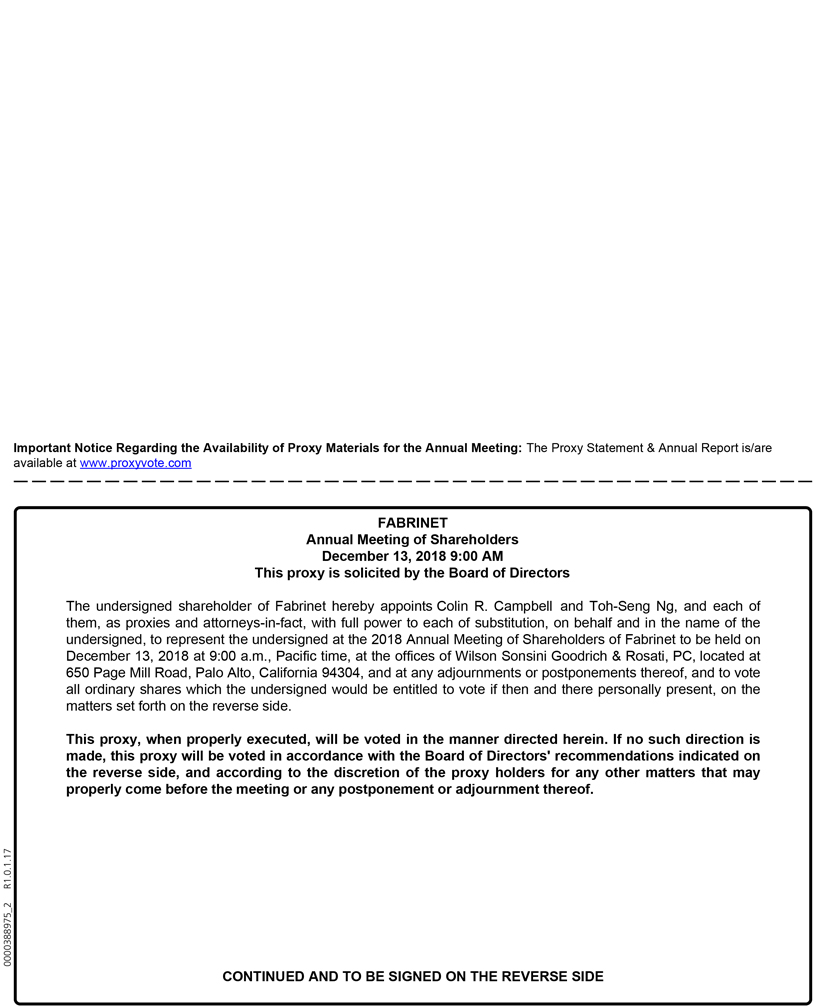

This proxy statement is being provided to holders of ordinary shares of Fabrinet at the close of business on the record date (October 15, 2018) in connection with the solicitation of proxies by Fabrinet’s board of directors (the “Board”) for use at Fabrinet’s 2018 Annual Meeting of Shareholders, and any postponements, adjournments or continuations thereof (the “Annual Meeting”), for the purpose of considering and acting upon the matters set forth in this proxy statement and the accompanying notice. The Annual Meeting will be held on Thursday, December 13, 2018, at the offices of Wilson Sonsini Goodrich & Rosati, 650 Page Mill Road, Palo Alto, California 94304, commencing at 9:00 a.m., Pacific time.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND PROCEDURAL MATTERS

| Q: |

| A: | You are invited to attend the Annual Meeting if you were a shareholder of record or a beneficial owner as of October 15, 2018 (the “Record Date”). You should bring photo identification for entrance to the Annual Meeting. The meeting will begin promptly at 9:00 a.m., Pacific time, and you should leave ample time for the check-in procedures. Shareholders may request directions to the offices of Wilson Sonsini Goodrich & Rosati by calling (650) 493-9300. |

| Q: |

| A: | You may vote your Fabrinet ordinary shares if our records show that you owned your shares at the close of business on the Record Date. At the close of business on the Record Date, there were 36,831,482 ordinary shares outstanding and entitled to vote at the Annual Meeting, as well as 1,289,103 ordinary shares outstanding and held as treasury shares. You may cast one vote for each ordinary share held by you as of the Record Date on all matters presented. |

| Q: | Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? |

| A: | In accordance with rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we began sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders of record and beneficial owners on or about October 19, 2018. |

All shareholders will be able to access the proxy materials on the website referred to in the Notice, or to request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy can be found in the Notice. In addition, shareholders may request the proxy materials be sent by mail or email on an ongoing basis. Choosing to receive future proxy materials by email will save us the cost of printing and mailing documents to you, and will reduce the impact of our annual meetings on the environment.

-5-

Table of Contents

| Q: |

| A: | The proposals scheduled to be voted on at the Annual Meeting are: |

| Proposal One: |

Election of two Class III directors listed in this proxy statement and recommended by the Board to serve for a term of three years, or until their respective successors have been duly elected and qualified;

| |

| Proposal Two: |

Ratification of the appointment of PricewaterhouseCoopers ABAS Ltd. as our independent registered public accounting firm for our fiscal year ending June 28, 2019; and

| |

| Proposal Three: |

An advisory vote to approve the compensation paid to our named executive officers. |

| Q: |

| A: | The Board recommends that you vote your shares: |

| • | “FOR” each of the nominees listed in this proxy statement and recommended by the Board for election as Class III directors (Proposal One); |

| • | “FOR” the ratification of the appointment of PricewaterhouseCoopers ABAS Ltd. as our independent registered public accounting firm for our fiscal year ending June 28, 2019 (Proposal Two); and |

| • | “FOR” the approval, on an advisory basis, of the compensation paid to our named executive officers (Proposal Three). |

| Q: | What is the voting requirement to approve each of the proposals and how are votes counted? |

| A: | A plurality of the votes cast is required for the election of directors (Proposal One). You may vote “FOR” or “WITHHOLD” on each nominee for election as director. The nominees for director receiving the highest number of affirmative votes will be elected as directors. Abstentions and broker non-votes will not affect the outcome of the election. However, as set forth under “Corporate Governance—Majority Voting Policy in Uncontested Elections,” we have a policy that if a director receives more “Withhold” votes than “For” votes in an uncontested election such as this one, the director shall offer his or her resignation for consideration by the Board. |

The affirmative vote of a majority of the votes cast is required to (1) ratify the appointment of PricewaterhouseCoopers ABAS Ltd. as our independent registered public accounting firm for our fiscal year ending June 28, 2019 (Proposal Two), and (2) approve, on an advisory basis, the compensation paid to our named executive officers (Proposal Three). You may vote “FOR,” “AGAINST” or “ABSTAIN” on these proposals. Abstentions have the same effect as votes against these proposals. However, broker non-votes are not deemed to be votes cast and, therefore, are not included in the tabulation of voting results on these proposals.

All shares entitled to vote and represented by properly submitted proxies received prior to the Annual Meeting (and not revoked) will be voted at the Annual Meeting in accordance with the instructions indicated by such proxy. If no instructions are indicated on such proxy, the shares represented by that proxy will be voted as recommended by the Board.

| Q: | How many shares must be present or represented to conduct business at the Annual Meeting? |

| A: | The presence of the holders of at least one-third of the total shares entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Such shareholders are counted as present at the meeting if (1) they are present in person at the Annual Meeting or (2) have properly submitted a proxy. |

Abstentions and broker “non-votes” are counted as present and entitled to vote and are, therefore, included for the purposes of determining whether a quorum is present at the Annual Meeting.

-6-

Table of Contents

A broker “non-vote” occurs when a nominee holding shares for a beneficial owner has not received voting instructions from the beneficial owner, and the broker does not have, or declines to exercise, discretionary authority to vote those shares.

| Q: |

| A: | Shares held in your name as the shareholder of record may be voted in person at the Annual Meeting. Shares held beneficially in street name may be voted in person at the Annual Meeting only if you obtain a “legal proxy” from the broker, bank or nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend you also submit your vote as described in the Notice and as described below, so your vote will be counted even if you later decide not to attend the meeting. |

| Q: | How can I vote my shares without attending the Annual Meeting? |

| A: | Whether you hold shares directly as the shareholder of record or beneficially in street name, you may direct how your shares are voted without attending the Annual Meeting. If you are a shareholder of record, you may vote by submitting a proxy; please refer to the voting instructions in the Notice or below. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, bank or nominee; please refer to the voting instructions provided to you by your broker, bank or nominee. |

By Internet—Shareholders of record with Internet access may submit proxies until 11:59 p.m., Eastern time, on December 12, 2018, by following the “Vote by Internet” instructions described in the Notice, or by following the instructions at www.proxyvote.com. Most Fabrinet shareholders who hold shares beneficially in street name may vote by accessing the website specified in the voting instructions provided by their brokers, trustees or nominees. If you are a beneficial owner, please check the voting instructions provided by your broker, trustee or nominee for information regarding Internet voting availability.

By telephone—Depending on how your shares are held, you may be able to vote by telephone. If this option is available to you, you will have received information with the Notice or the voting instructions provided by your broker, bank or nominee explaining this procedure.

By mail—Shareholders of record may request a paper proxy card from Fabrinet and indicate their vote by completing, signing and dating the card where indicated and by returning it in the prepaid envelope that will be included with the proxy card. Please follow the procedures outlined in the Notice to request a paper proxy card.

| Q: | What is the difference between holding shares as a shareholder of record and as a beneficial owner? |

| A: | Shareholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, you are considered the “shareholder of record” with respect to those shares, and we have sent the Notice directly to you. As a shareholder of record, you have the right to grant your voting proxy directly to us or to a third party, or to vote in person at the Annual Meeting. |

Beneficial Owner. If your shares are held in a brokerage account or by a bank or nominee, you are considered the “beneficial owner” of shares held in “street name,” and the Notice is being forwarded to you by your broker, bank or nominee (who is considered the shareholder of record with respect to those shares). As the beneficial owner, you have the right to direct your broker, bank or nominee how to vote your shares. Your broker, bank or nominee has enclosed or provided voting instructions for you to use in directing the broker, bank or nominee how to vote your shares. You are also invited to attend the Annual Meeting. However, because you are not the shareholder of record, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from your broker, bank or nominee giving you the right to vote the shares at the Annual Meeting.

-7-

Table of Contents

If you hold your shares through a broker and do not provide your broker with specific voting instructions, your broker will have the discretion to vote your shares only on routine matters. As a result:

| • | Your broker will not have the authority to exercise discretion to vote your shares with respect to the election of directors and the advisory vote to approve the compensation paid to our named executive officers because the rules of The New York Stock Exchange (“NYSE”) treat those matters as non-routine; but |

| • | Your broker will have the authority to exercise discretion to vote your shares with respect to the ratification of the appointment of PricewaterhouseCoopers ABAS Ltd. as our independent registered public accounting firm for our fiscal year ending June 28, 2019, because NYSE rules treat that matter as routine. |

| Q: | What happens if additional matters are presented at the Annual Meeting? |

| A: | If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named as proxy holders will have discretion to vote on those matters in accordance with their best judgment. We do not currently anticipate that any other matters will be raised at the Annual Meeting. |

| Q: |

| A: | Subject to any rules your broker, bank or nominee may have, you may change your vote at any time before your proxy is voted at the Annual Meeting. |

If you are the shareholder of record, you may change your vote by (1) granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the voting methods described above (and until the applicable deadline for each method), (2) providing a written notice of revocation to our Corporate Secretary, c/o Fabrinet USA, Inc., 4900 Patrick Henry Drive, Santa Clara, CA 95054 prior to your shares being voted, or (3) attending the Annual Meeting and voting in person. Attending the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically request this.

If you are the beneficial owner of shares held in street name, you may change your vote by (1) submitting new voting instructions to your broker, bank or nominee, or (2) attending the Annual Meeting and voting in person if you first have obtained a legal proxy from your broker, bank or nominee giving you the right to vote your shares at the Annual Meeting.

| Q: | What happens if I decide to attend the Annual Meeting but I have already voted or submitted a proxy card covering my shares? |

| A: | Subject to any rules your broker, bank or nominee may have, you may attend the Annual Meeting and vote in person even if you have already voted or submitted a proxy card. Any previous votes that were submitted by you will be superseded by the vote you cast at the Annual Meeting. Please be aware that attendance at the Annual Meeting will not, by itself, revoke a proxy. |

If a broker, bank or nominee beneficially holds your shares in street name and you wish to attend the Annual Meeting and vote in person, you must obtain a legal proxy from the broker, bank or nominee holding your shares that gives you the right to vote the shares.

| Q: | What should I do if I receive more than one set of voting materials? |

| A: | If you received more than one Notice, voting instruction card or set of proxy materials, your shares are registered in more than one name or brokerage account. Please follow the instructions on each Notice or voting instruction card that you receive, to ensure that all of your shares are voted. |

-8-

Table of Contents

| Q: |

| A: | Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Fabrinet or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to Fabrinet’s management. |

| Q: |

| A: | We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Form 8-K filed with the SEC within four business days after the Annual Meeting, which will also be available in the “Investors—Financials—SEC Filings” section of our website at www.fabrinet.com. |

| Q: | Who will bear the cost of soliciting votes for the Annual Meeting? |

| A: | We will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. We may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners for their reasonable expenses in forwarding solicitation material to such beneficial owners. Our directors, officers and employees also may solicit proxies in person or by other means of communication. Such directors, officers and employees will not be additionally compensated, but may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. |

If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur.

| Q: | What is the deadline to propose actions for consideration at next year’s annual meeting of shareholders or to nominate individuals to serve as directors? |

| A: | You may submit proposals, including recommendations of director candidates, for consideration at future shareholder meetings. |

For inclusion in Fabrinet’s proxy materials—Shareholders may present proper proposals for inclusion in our proxy statement and for consideration at our next annual meeting of shareholders by submitting their proposals in writing to our Corporate Secretary in a timely manner. In order to be included in the proxy statement for our 2019 annual meeting of shareholders, shareholder proposals must be received by our Corporate Secretary no later than June 21, 2019, and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

To be brought before an annual meeting—In addition, our memorandum and articles of association establish an advance notice procedure for shareholders who wish to present certain matters before an annual meeting of shareholders.

Nominations for the election of directors only can be made (1) by or at the direction of the Board, or (2) by a shareholder who has delivered written notice to our Corporate Secretary within the Notice Period (as defined below) and who was a shareholder at the time of such notice and as of the record date for such meeting. The notice must contain specified information about the nominees and about the shareholder proposing such nominations.

Our memorandum and articles of association also provide that the only business that may be conducted at an annual meeting is business that is (1) properly brought before the meeting in accordance with our proxy materials with respect to such meeting, (2) properly brought before the meeting by or at the direction of the Board, or (3) properly brought before the meeting by a shareholder who has delivered written notice to our Corporate Secretary, c/o Fabrinet USA, Inc., 4900 Patrick Henry Drive, Santa Clara, CA 95054 within the

-9-

Table of Contents

Notice Period (as defined below) and who is a shareholder at the time of such notice and as of the record date for such meeting. The notice must contain specified information about the matters to be brought before such meeting and about the shareholder proposing such matters.

The “Notice Period” is defined as that period not less than 45 days nor more than 75 days prior to the one year anniversary of the date on which we first mailed our proxy materials or a notice of availability of proxy materials (whichever is earlier) to shareholders in connection with the preceding year’s annual meeting of shareholders. As a result, the Notice Period for the 2019 annual meeting of shareholders will start on August 5, 2019 and end on September 4, 2019.

If a shareholder who has notified us of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, we need not present the proposal for vote at such meeting.

A copy of the full text of the provisions of our memorandum and articles of association discussed above may be obtained by writing to our Corporate Secretary, c/o Fabrinet USA, Inc., 4900 Patrick Henry Drive, Santa Clara, CA 95054, or by accessing Fabrinet’s filings on the SEC’s website at www.sec.gov.

All notices of proposals by shareholders, whether or not included in our proxy materials, should be sent to our Corporate Secretary, c/o Fabrinet USA, Inc., 4900 Patrick Henry Drive, Santa Clara, CA 95054.

| Q: | How may I obtain a separate set of proxy materials or the 2018 Annual Report? |

| A: | If you share an address with another shareholder, each shareholder may not receive a separate copy of our proxy materials and 2018 Annual Report. Upon written request we will promptly send a separate copy of our proxy materials and 2018 Annual Report, without charge, to any shareholder at a shared address where a single copy of the documents was delivered. Shareholders may request additional copies of our proxy materials and 2018 Annual Report by contacting our investor relations at [email protected], or writing to Fabrinet, c/o Fabrinet USA, Inc., 4900 Patrick Henry Drive, Santa Clara, CA 95054, Attention: Investor Relations. Shareholders who share an address and receive multiple copies of our proxy materials and 2018 Annual Report can also request to receive a single copy by following the instructions above. |

This proxy statement provides information about the matters to be voted on at the 2018 Annual Meeting and additional information about Fabrinet and its executive officers and directors. Some of the information is provided as of the end of our 2016, 2017 or 2018 fiscal years, and some information is more recent. Our fiscal years end on the last Friday of June of each calendar year. Our 2016, 2017 and 2018 fiscal years ended on June 24, 2016, June 30, 2017, and June 29, 2018, respectively. Our 2019 fiscal year will end on June 28, 2019.

-10-

Table of Contents

PROPOSAL ONE

Our amended and restated memorandum and articles of association provide that the number of our directors will be fixed from time to time by the Board, but may not consist of more than 15 directors. The Board presently consists of six directors who are divided into three classes with overlapping three-year terms as follows:

| Class III Directors |

Class I Directors |

Class II Directors | ||

| Dr. Frank H. Levinson* | Dr. Homa Bahrami | Seamus Grady | ||

| David T. Mitchell | Rollance E. Olson | Thomas F. Kelly |

| * | As disclosed in the proxy statement for our 2017 annual meeting of shareholders, in order to make the classes of directors as even as possible, the Board moved Dr. Levinson from Class II to Class III following his reelection as a Class II director at our 2017 annual meeting of shareholders. |

Upon expiration of the term of a class of directors, directors for that class will be elected for three-year terms at the annual meeting of shareholders in the year in which that term expires.

Three candidates have been nominated for election at the Annual Meeting as Class III directors for a three-year term expiring in 2021. Upon the recommendation of the Nominating & Corporate Governance Committee, the Board nominated Dr. Frank H. Levinson and David T. Mitchell for election as Class III directors. Biographical information for each of the nominees is set forth below.

Each nominee has consented to being named in this proxy statement and to serving as a director if elected, and we have no reason to believe any nominee will be unavailable to serve. In the event Dr. Levinson or Mr. Mitchell is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who may be proposed by the Nominating & Corporate Governance Committee and designated by the Board to fill the vacancy.

If you sign your proxy or voting instruction card or vote by telephone or over the Internet, but do not give instructions with respect to the election of directors, your shares will be voted for the three persons recommended by the Board. If you wish to give specific instructions with respect to the election of directors, you may do so by indicating your instructions on your proxy or voting instruction card, or when you vote by telephone or over the Internet. If you do not give voting instructions to your broker, your broker will not vote your shares on this matter.

Recommendation of the Board of Directors

The Board recommends a vote “FOR” the election of Dr. Frank H. Levinson and David T. Mitchell to the Board.

The names of the members of the Board, their ages, their positions with Fabrinet and other biographical information as of October 15, 2018, are set forth below. A discussion of the qualifications, attributes and skills of each of the directors and the director nominee that led the Board and the Nominating & Corporate Governance

-11-

Table of Contents

Committee to conclude that he or she should serve as a director follows each of the biographies below. There are no family relationships among any of our directors or executive officers.

| Committee |

Other Public Co. Boards | |||||||||||||||

| Name |

Age | Director Since |

Position with Fabrinet |

Independent |

AC |

CC |

NCGC | |||||||||

| David T. (Tom) Mitchell |

76 | 2000 | Founder and Chairman of the Board (Director Nominee) | 0 | ||||||||||||

| Seamus Grady |

51 | 2017 | Chief Executive Officer and Director | 0 | ||||||||||||

| Dr. Homa Bahrami |

63 | 2012 | Director | ✓ | ✓ | Chair | 0 | |||||||||

| Thomas F. Kelly |

65 | 2010 | Director | ✓ | Chair | ✓ | 0 | |||||||||

| Dr. Frank H. Levinson |

65 | 2001 | Director (Director Nominee) | ✓ | ✓ | Chair | 1 | |||||||||

| Rollance E. Olson |

75 | 2004 | Lead Independent Director | ✓ | ✓ | 0 | ||||||||||

| AC – Audit Committee |

CC – Compensation Committee | NCGC – Nominating & Corporate Governance Committee |

David T. (Tom) Mitchell is our founder and has served as our non-employee chairman of the Board since June 2018. Mr. Mitchell previously served as our executive chairman of the Board from September 2017 until June 2018, as our chief executive officer and chairman of the Board from our inception in 2000 until September 2017, and as our president from 2000 to January 2011. In 1979, Mr. Mitchell co-founded Seagate Technology, a disk drive manufacturing company. Mr. Mitchell served as the president of Seagate Technology from 1983 to 1991. From 1992 to 1995, Mr. Mitchell served as the chief operating officer of Conner Peripherals, a disk drive manufacturing company. From 1995 to 1998, Mr. Mitchell served as the chief executive officer of JTS Corp., a mobile disk drive manufacturing company. During his tenure in the data storage industry, Mr. Mitchell established manufacturing operations in Singapore, Thailand, Malaysia, the PRC and India. Mr. Mitchell was a member of the board of directors of GigOptix, Inc. from June 2012 through July 2013. Mr. Mitchell earned a bachelor of science degree in economics from Montana State University.

Among other skills and qualifications, Mr. Mitchell brings to the Board extensive knowledge and understanding of Fabrinet’s business, operations and employees, having founded Fabrinet and served on the Board since our inception, as well as more than 30 years of experience in an array of executive management roles within the disk drive and optoelectronics manufacturing industries.

Seamus Grady has served as our chief executive officer and on the Board since September 2017. Prior to joining us, Mr. Grady served as executive vice president and chief operating officer, mechanical systems division, at Sanmina Corporation, an electronics manufacturing services company, from October 2012 to May 2017. Prior to that, Mr. Grady held various operations roles at Sanmina beginning in 2000, including as senior vice president medical division, from June 2011 to October 2012, and senior vice president global medical operations from March 2009 to June 2011. From 1999 to 2000, Mr. Grady served as director of materials and supply chain management at Lucent Technologies Inc. (formerly Ascend Communications). From 1989 to 1999, Mr. Grady served in a variety of operations roles at Manufacturers Services Limited (now Celestica), an electronic manufacturing and supply chain services company. Mr. Grady holds a B. Tech in Manufacturing Technology from the National University of Ireland, Galway (NUIG).

Among other skills and qualifications, Mr. Grady brings to the Board broad and deep experience in the electronics manufacturing services industry, including overseeing operations at multiple international facilities.

Dr. Homa Bahrami has served on the Board since August 2012. Dr. Bahrami has been a Senior Lecturer at the Haas School of Business, University of California, Berkeley. She is also a Faculty Director of the Center for Executive Education and a board member of the Center for Teaching Excellence at the Haas School of Business,

-12-

Table of Contents

where she has served on the faculty since 1986. Dr. Bahrami was a member of the board of directors of FEI Company (acquired by Thermo Fisher Scientific Inc. in 2016) from February 2012 through September 2016, where she served on the audit and compensation committees, and a member of the board of directors of FormFactor, Inc. from 2004 through 2010. Dr. Bahrami earned a bachelor of arts degree with honors in sociology and social administration from Hull University and a master of science degree in industrial administration and a doctor of philosophy degree in organizational behavior from Aston University in the United Kingdom.

Among other skills and qualifications, Dr. Bahrami brings to the Board experience in organizational design and executive development for global enterprises.

Thomas F. Kelly has served on the Board since 2010. Since August 2017, Mr. Kelly has served as chief executive officer of ID Experts, a provider of software and services for cyber breach and identity fraud protection. From March 2015 until its acquisition by Fortinet in June 2016, Mr. Kelly served as chief executive officer of AccelOps, a provider of network security monitoring and analytics solutions. From June 2010 to January 2014, Mr. Kelly served as chief executive officer and president of Moxie Software, a provider of enterprise social software. From June 2006 to June 2009, Mr. Kelly was chairman of the board of MontaVista Software (acquired by Cavium Networks, Inc. in 2009), a provider of Linux-based development software, where he was also chairman, president and chief executive officer from June 2006 to June 2008. From February 2008 to January 2009, Mr. Kelly was president and chief executive officer of Epicor Software, an enterprise resource planning software company, where he also served on the board of directors from 2000 to 2009. In 2004 and 2005, Mr. Kelly was with Trident Capital, a venture capital company. From 2001 to 2004, he was chairman, president and chief executive officer of BlueStar Solutions (acquired by Affiliated Computer Services, Inc. in 2004), an enterprise resource planning software hosting company. From 1998 to 2001, Mr. Kelly was chairman and chief executive officer of Blaze Software, Inc. (acquired by Brokat Infosystems AG in 2001). Prior to that, he served as chief financial officer or chief operating officer at several software and semiconductor companies, including Cirrus Logic, Inc., Frame Technology, Cadence Design Systems, Valid Logic Corporation and Analog Design Tools. Earlier in his career he was with Arthur Anderson & Company. Mr. Kelly was a member of the board of directors of FEI Company (acquired by Thermo Fisher Scientific Inc. in 2016) from September 2003 through September 2016, where he served as chairman of the board and chairman of the audit committee. He is also on the Board of Regents of Santa Clara University. Mr. Kelly earned a bachelor of science degree in economics from Santa Clara University.

Among other skills and qualifications, Mr. Kelly brings to the Board audit and financial reporting expertise as well as managerial and operational experience gained from his service on the audit committees of multiple public companies and his roles at Cadence Design Systems, Cirrus Logic, Frame Technology, Epicor Software, Trident Capital and various emerging growth technology companies.

Dr. Frank H. Levinson has served on the Board since 2001. Since 2006, Dr. Levinson has served as the managing director of Small World Group, a group primarily involved in investing in and growing small companies. Dr. Levinson served as the chairman of the board of directors and chief technical officer of Finisar Corporation, a provider of fiber optic components and network performance test and monitoring systems, from August 1999 to January 2006, and remained as a director of Finisar until August 2008. From 1988 to 1999, Dr. Levinson served as the chief executive officer of Finisar. From January 1986 to February 1988, Dr. Levinson served as the optical department manager at Raynet, Inc., a fiber optic systems company and, from April 1985 to December 1985, as the chief optical scientist at Raychem Corporation. From January 1984 to July 1984, Dr. Levinson was a member of the technical staff at Bellcore, a provider of services and products to the communications industry. From 1980 to 1983, Dr. Levinson was as a member of the technical staff at AT&T Bell Laboratories. Since July 2014, Mr. Levinson has been a member of the board of directors of Interlink Electronics, Inc., where he currently serves as chairman of the compensation committee and a member of the audit and nominating and governance committees. Dr. Levinson earned a bachelor of science degree in mathematics and physics from Butler University, and a master’s degree in astronomy and a doctor of philosophy degree in astronomy from the University of Virginia.

-13-

Table of Contents

Among other skills and qualifications, Dr. Levinson brings to the Board executive leadership and management experience in a global organization and semiconductor industry experience, having served as chairman of the board of directors, chief technical officer and chief executive officer of Finisar Corporation.

Rollance E. Olson has served on the Board since 2004, including as lead independent director since January 2011. From 1986 to 2011, Mr. Olson served as chief executive officer of Parts Depot Inc., a wholesale automotive replacement parts and supplies business in Virginia. From 1980 to 1985, Mr. Olson served as the president of Brake Systems, Inc., and from 1973 to 1980, Mr. Olson served in various positions at Bendix Corporation, an automotive safety brake and control systems company, including as general manager of the Fram/Autolite division, general manager of the Bendix automotive aftermarket division and corporate staff consultant. From 1968 to 1973, Mr. Olson served as a management consultant and project leader with Booz, Allen & Hamilton, a management and technology consultant firm. Mr. Olson’s business career started with Honeywell, Inc. in Minneapolis, Minnesota. Mr. Olson also served on the board of directors for several privately owned retail and technology companies. He served as a board member (9 years) and chairman of the board of the largest automotive aftermarket trade association, and was a guest lecturer at the Darden School of Business (University of Virginia). Mr. Olson earned a bachelor of arts degree from the University of Minnesota.

Among other skills and qualifications, Mr. Olson brings to the Board executive leadership and management experience gained from his service as chief executive officer of Parts Depot Inc. for more than 25 years.

Compensation for Fiscal 2018

The following table presents information regarding the compensation earned or paid in fiscal 2018 to individuals who were members of the Board at any time during fiscal 2018, and who also were not our employees. We refer to those directors as non-employee directors. During fiscal 2018, Mr. Grady and Mr. Mitchell did not receive additional compensation for their service as a director.

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1)(2) |

Total ($) |

|||||||||

| Homa Bahrami |

89,500 | 164,974 | 254,474 | |||||||||

| Thomas Kelly |

102,500 | 164,974 | 267,474 | |||||||||

| Frank Levinson |

95,500 | 164,974 | 260,474 | |||||||||

| Rollance Olson |

189,000 | 164,974 | 353,974 | |||||||||

| (1) | Reflects the aggregate grant date fair value of the shares in accordance with FASB Accounting Standards Codification Topic 718 (“ASC 718”). The assumptions used in the valuation of these awards are set forth in the notes to our consolidated financial statements, which are included in our Annual Report on Form 10-K for the year ended June 29, 2018, filed with the SEC on August 22, 2018. These amounts do not correspond to the actual value that will be realized by the directors. |

| (2) | The following table presents the aggregate number of shares underlying unvested stock awards and outstanding options held by each of our non-employee directors as of the end of fiscal 2018. |

| Name |

Aggregate Number of Shares Underlying Unvested Stock Awards |

Aggregate Number of Shares Underlying Outstanding Options |

||||||

| Dr. Bahrami |

5,581 | — | ||||||

| Mr. Kelly |

5,581 | — | ||||||

| Dr. Levinson |

5,581 | — | ||||||

| Mr. Olson |

5,581 | — | ||||||

-14-

Table of Contents

Standard Director Compensation Arrangements for Fiscal 2018

During fiscal 2018, non-employee directors received the following cash compensation for their service on the Board:

| • | an annual retainer of $63,000; |

| • | $45,000 per year for serving as Chairman of the Board (applicable only if the chairman is a non-employee director); |

| • | $120,000 per year for serving as lead independent director of the Board (applicable only if the chairman is an employee director); |

| • | $12,500 per year for each member of the Audit Committee (or $30,000 if such member is the chairperson); |

| • | $9,500 per year for each member of the Compensation Committee (or $20,000 if such member is the chairperson); and |

| • | $6,000 per year for each member of the Nominating & Corporate Governance Committee (or $14,000 if such member is the chairperson). |

Non-employee directors also receive the following equity compensation for their service on the Board:

| • | upon joining the Board, an award of restricted share units prorated to reflect a value equal to: $165,000, divided by the closing price of Fabrinet’s ordinary shares on the NYSE on the date of grant and multiplied by the number of days beginning with the date the director joins the Board and ending on the day immediately preceding the one year anniversary of the prior year’s annual shareholder meeting, divided by 365 days; and |

| • | on the date of each annual shareholder meeting, an award of restricted share units valued at $165,000 based on the closing price of Fabrinet’s ordinary shares on the NYSE on the date of each such annual shareholder meeting. |

Restricted share units granted to directors generally will vest in full on January 1 following the next annual meeting of shareholders after the date of grant, provided the director continues to serve through such date.

Standard Director Compensation Arrangements for Fiscal 2019

In June 2018, the Board approved the following cash and equity compensation for service by non-employee directors on the Board, effective June 30, 2018 (the beginning of fiscal 2019).

| • | an annual retainer of $65,000; |

| • | $200,000 per year for serving as Chairman of the Board (applicable only if the chairman is a non-employee director), which was approved by the Board in connection with Mr. Mitchell’s transition from executive chairman of the Board to non-employee Chairman of the Board in light of Mr. Mitchell’s ongoing significant involvement with Fabrinet and the valuable leadership and guidance he provides to Fabrinet; |

| • | $45,000 per year for serving as lead independent director of the Board (applicable only if the chairman is not an independent director); |

| • | $12,500 per year for each member of the Audit Committee (or $33,000 if such member is the chairperson); |

| • | $10,000 per year for each member of the Compensation Committee (or $21,000 if such member is the chairperson); |

-15-

Table of Contents

| • | $6,000 per year for each member of the Nominating & Corporate Governance Committee (or $15,000 if such member is the chairperson); |

| • | upon joining the Board on or after June 30, 2018, and effective as of the date an individual becomes a non-employee member of the Board, an award of restricted share units, on a prorated basis, to cover a number of our ordinary shares equal to: $200,000, divided by the closing price of Fabrinet’s ordinary shares on the New York Stock Exchange on the date of grant, and multiplied by the ratio of (i) the number of days beginning with the date the director joins the Board and ending on the day immediately preceding the one year anniversary of the prior year’s annual shareholder meeting, divided by (ii) 365 days, with the resulting number rounded down to the nearest whole share (an “Initial Grant”); and |

| • | on the date of each annual shareholder meeting of Fabrinet occurring on or after June 30, 2018, an award of RSUs covering a number of our ordinary shares equal to: $200,000, divided by the closing price of Fabrinet’s ordinary shares on the New York Stock Exchange on the date of each such annual shareholder meeting, rounded down to the nearest whole share (an “Ongoing Grant”), provided that the individual is a non-employee director as of such date of grant. |

Restricted share units granted pursuant to an Initial Grant and an Ongoing Grant will be scheduled to vest in full on January 1 following the next annual meeting of shareholders after the applicable date of grant, provided the director continues to remain a service provider to Fabrinet through such date. For the avoidance of doubt, an individual who becomes a non-employee director as a result of ceasing to be an employee will be eligible to receive an Initial Grant. Any non-employee member of the Board who is not continuing as a Board member following the applicable annual meeting will not receive an Ongoing Grant with respect to such annual meeting.

Any Initial Grants and Ongoing Grants will be automatic and nondiscretionary. Any Initial Grants and Ongoing Grants will be granted subject to the terms and conditions of Fabrinet’s Amended and Restated 2010 Performance Incentive Plan (the “Plan”) and form of Restricted Share Unit Agreement previously approved for use under the Plan. Any RSUs subject to an Initial Grant or Ordinary Grant that vest will be settled in ordinary shares of Fabrinet, and the par value of ordinary shares of Fabrinet issued upon such settlement will be considered to have been paid with past services rendered.

In addition, as part of Mr. Mitchell’s separation agreement entered into with us on June 29, 2018, as discussed further under “Potential Payments Upon Termination or Change in Control” below, Mr. Mitchell will be eligible to receive continued tax equalization benefits under our expatriate policy, and each outstanding award of RSUs and PSUs granted by us to Mr. Mitchell in connection with his employment with us that were outstanding when he transitioned from his role as executive chairman of our Board to a non-employee member of the Board and its chairman will remain outstanding and subject to the terms of the applicable award agreement and equity plan governing the awards, including continued vesting while Mr. Mitchell remains a non-employee member of the Board.

See “Corporate Governance Matters” below for additional information regarding the Board.

-16-

Table of Contents

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed PricewaterhouseCoopers ABAS Ltd. and its network firm (“PwC”) as our independent registered public accounting firm for our fiscal year ending June 28, 2019. Although ratification by shareholders is not required by any applicable legal requirements, the Board has determined it is desirable to request ratification of this selection by our shareholders. Notwithstanding its selection, the Audit Committee, in its discretion, may appoint a new independent registered public accounting firm at any time during the year if the Audit Committee believes that such a change would be in the best interests of Fabrinet and its shareholders. If our shareholders do not ratify the appointment of PwC, the Audit Committee may reconsider its selection.

A representative of PwC is expected to be present at the meeting, will have the opportunity to make a statement if he or she desires to do so, and is expected to be available to respond to appropriate questions.

Recommendation of the Board of Directors

The Board recommends a vote “FOR” the ratification of the appointment of PricewaterhouseCoopers ABAS Ltd. as Fabrinet’s independent registered public accounting firm for Fabrinet’s fiscal year ending June 28, 2019.

The following table presents fees paid or accrued by Fabrinet for audit and other services rendered by PwC for fiscal 2018 and fiscal 2017.

| Fiscal 2018 | Fiscal 2017 | |||||||

| Audit Fees(1) |

$ | 1,186,832 | $ | 1,058,551 | ||||

| Audit-Related Fees |

— | — | ||||||

| Tax Fees(2) |

— | 20,814 | ||||||

| All Other Fees(3) |

130,960 | 67,500 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 1,317,792 | $ | 1,146,865 | ||||

|

|

|

|

|

|||||

| (1) | Audit Fees consist of fees for professional services provided in connection with the audit of our annual consolidated financial statements, the review of our quarterly consolidated financial statements, and audit services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements for those fiscal years, such as statutory audits, as well as out of pocket expenses. |

| (2) | Tax fees consist of fees for international tax consulting services. |

| (3) | All other fees consist of fees for providing consent letters and accounting advisory services during the fiscal year. |

Pre-Approval of Audit and Non-Audit Services

Pursuant to its charter, the Audit Committee is required to (1) review and approve, in advance, the scope and plans for all audits and audit fees and (2) approve, in advance, all non-audit services to be performed by our independent auditors.

All services and fees of PwC were pre-approved by the Audit Committee.

-17-

Table of Contents

PROPOSAL THREE

ADVISORY VOTE TO APPROVE COMPENSATION PAID TO NAMED EXECUTIVE OFFICERS

In accordance with SEC rules, we are providing our shareholders with the opportunity to vote to approve, on an advisory or non-binding basis, the compensation of our named executive officers (or “Named Officers”) as disclosed in this proxy statement in accordance with rules of the SEC. This proposal, commonly known as a “say-on-pay” proposal, gives our shareholders the opportunity to express their views on our Named Officers’ compensation as a whole. This vote is not intended to address any specific item of compensation or any specific Named Officer, but rather the overall compensation of all of our Named Officers and the compensation philosophy, policies and practices described in this proxy statement. We currently hold our say-on pay vote every year.

While this advisory vote to approve executive compensation is non-binding, it will provide information to us regarding investor sentiment about our executive compensation philosophy, policies and practices, which the Compensation Committee will be able to consider when making future executive compensation decisions. The Board and the Compensation Committee value the opinions of shareholders and, to the extent there is any significant vote against the Named Officer compensation as disclosed in this proxy statement, will endeavor to communicate with shareholders to better understand the concerns that influenced the vote, consider those shareholders’ concerns and evaluate whether any actions are necessary to address those concerns.

We urge shareholders to read the “Executive Compensation” section of this proxy statement, and in particular the information discussed under the heading “Executive Compensation—Compensation Discussion and Analysis”, which describes in more detail how our executive compensation policies and procedures operate and are designed to achieve our compensation objectives. We believe that our executive compensation program is working to ensure management’s interests are aligned with our shareholders’ interests to support long-term value creation. Accordingly, pursuant to Section 14A of the Exchange Act, you are being asked to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that Fabrinet’s shareholders approve, on an advisory basis, the compensation of Fabrinet’s named executive officers, as disclosed in Fabrinet’s Proxy Statement for the 2018 Annual Meeting of Shareholders pursuant to the executive compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables, and related narrative disclosures.”

Recommendation of the Board of Directors

The Board recommends a vote “FOR” the approval, on an advisory basis, of the compensation paid to our Named Officers.

-18-

Table of Contents

The Audit Committee assists the Board in fulfilling its responsibilities for oversight of the integrity of our financial statements, our internal accounting and financial controls, our compliance with legal and regulatory requirements, the organization and performance of our internal audit function and the qualifications, independence and performance of our independent registered public accounting firm.

Our management is responsible for establishing and maintaining internal controls and preparing our consolidated financial statements. The independent registered public accounting firm is responsible for auditing the financial statements. It is the responsibility of the Audit Committee to oversee these activities.

The Audit Committee has:

| • | Reviewed and discussed the audited financial statements with management and with PricewaterhouseCoopers ABAS Ltd., our independent registered public accounting firm; |

| • | Discussed with PricewaterhouseCoopers ABAS Ltd. the matters required to be discussed under the rules adopted by the Public Company Accounting Oversight Board (the “PCAOB”); and |

| • | Received the written disclosures and the letter from PricewaterhouseCoopers ABAS Ltd. required by applicable requirements of the PCAOB regarding PricewaterhouseCoopers ABAS Ltd.’s communications with the Audit Committee concerning independence and has discussed with PricewaterhouseCoopers ABAS Ltd. its independence. |

Based upon these discussions and review, the Audit Committee recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended June 29, 2018, for filing with the United States Securities and Exchange Commission.

Respectfully submitted by the members of the Audit Committee of the Board of Directors.

Thomas F. Kelly (Chairman)

Dr. Homa Bahrami

Dr. Frank H. Levinson

-19-

Table of Contents

Corporate Governance Guidelines

We have adopted Corporate Governance Guidelines that establish the corporate governance policies the Board intends to follow in overseeing our business in accordance with its fiduciary duties. The Corporate Governance Guidelines are available in the “Investors—Governance” section of our website at www.fabrinet.com.

We are committed to maintaining the highest standards of ethical conduct, with business practices and principles of behavior that support this commitment. Accordingly, the Board has adopted a Code of Business Conduct, which is applicable to all of our directors, officers (including our principal executive officer and senior financial and accounting officers) and employees. The Code of Business Conduct is available in the “Investors—Governance” section of our website at www.fabrinet.com. We will disclose on our website any amendments to the Code of Business Conduct, as well as any waivers, required to be disclosed by SEC or NYSE rules.

Majority Voting Policy in Uncontested Elections

The Board endorses the principle of using a majority voting standard for uncontested elections of directors. Accordingly, in an election of directors such as this one, a nominee who receives more “Withhold” votes than “For” votes is expected to promptly tender his or her resignation as a director to the Board for consideration. After considering any information the Board deems appropriate, the Board will act to accept or reject each tendered director resignation. Any director who tenders a resignation under the majority voting policy may not participate in the action of the Board regarding whether to accept or reject his or her tender of resignation.

Our Corporate Governance Guidelines provide that the Board will fill the chairman and chief executive officer positions based upon what it believes is in our best interests at any point in time. Mr. Mitchell served in both positions until his retirement as chief executive officer in September 2017. We separated the two roles effective upon this transition, with Mr. Mitchell continuing as executive chairman of the Board from September 2017 until June 2018, and as a non-employee chairman of the Board beginning in June 2018. The Board believes that as our founder and having served as our chief executive officer from our inception until September 2017, Mr. Mitchell is in the best position to direct the focus and attention of the Board on the areas most relevant for us and our shareholders, as Mr. Mitchell is the most familiar with our business, industry and strategic priorities. In the role of chairman, Mr. Mitchell also is able to provide strong and valuable leadership for us both internally and externally.

In addition, our Corporate Governance Guidelines provide that if the chairman is not independent, the Board shall appoint a lead independent director. Rollance Olson has served as our lead independent director since January 2011. The lead independent director’s duties include coordinating the activities of the independent and other non-employee directors, coordinating the agenda for and moderating sessions of the independent and other non-employee directors, and facilitating communications among the entire Board.

Our independent directors meet in executive session at each regularly scheduled meeting of the Board, and at such other times as necessary or appropriate as determined by the independent directors. Our lead independent director presides at such executive sessions of the Board.

The Board is responsible for the oversight of our enterprise risk management. Together with its committees, the Board ensures that any material risks relevant to us or our business are appropriately considered and

-20-

Table of Contents

addressed. Our management team is responsible for day-to-day risk management. Management’s responsibilities include identifying, evaluating and addressing potential risks that may exist at the enterprise, strategic, financial and operating levels and the development of processes for mitigating these risks, and the Board, together with its committees, oversees management in its execution of these responsibilities. At periodic meetings of the Board and its committees, and in other meetings and discussions, our management reports to and seeks guidance from the Board and its committees, as applicable, with respect to matters that could affect our business. In addition, our legal counsel provides reports of legal risks to the Board and its committees. Similarly, our chief financial officer provides reports to the Audit Committee concerning financial, tax and audit related risks. In addition, the Audit Committee receives periodic reports from management on our compliance programs and efforts, investment policy and practices.

The Board reviews the strategic, financial and operational risks inherent in our business through its consideration of the various matters presented to the Board or its committees by management for review or approval. Furthermore, each board committee regularly reviews and evaluates various aspects of enterprise risk as part of its specific functions and responsibilities delegated by the Board. The Audit Committee considers risk in connection with its oversight of our financial review and reporting processes and regulatory and corporate compliance matters. In addition, the Audit Committee is responsible for the oversight and review of certain risk management policies, including our insurance, investment and business continuity policies. The Compensation Committee considers risk in connection with its oversight of the design and administration of our compensation policies, plans and programs. The Nominating & Corporate Governance Committee considers risk in connection with its oversight of our governance structure, policies and processes, including conflicts of interest (other than related party transactions reviewed by the Audit Committee).

We believe that the Board’s role is consistent with our leadership structure, with our chief executive officer and management primarily responsible for enterprise risk management, and with the Board and its committees providing oversight of these efforts.

Contacting the Board of Directors

Shareholders and other interested parties may communicate directly with our lead independent director by sending an email to [email protected]. Communications received at this email address are automatically routed directly to our lead independent director. Shareholders and other interested parties who wish to communicate with the Board may do so by sending an email to [email protected] or a written communication addressed to Fabrinet, c/o Fabrinet USA, Inc., 4900 Patrick Henry Drive, Santa Clara, CA 95054, Attention: Board of Directors. Our legal counsel reviews all incoming communications from shareholders and other interested parties (except for communications sent directly to the lead independent director, mass mailings, product complaints or inquiries, job inquiries, business solicitations and patently offensive or otherwise inappropriate material) and, as appropriate, routes such communications to the appropriate member(s) of the Board, or if none is specified, to the executive chairman of the Board.

Attendance at Annual Meetings of Shareholders by the Board of Directors

Although we do not have a formal policy regarding attendance by members of the Board at our annual meeting of shareholders, we encourage, but do not require, directors to attend. All of our directors attended our 2017 annual meeting of shareholders.

Our ordinary shares are listed on the NYSE. Pursuant to the NYSE listing standards, independent directors must comprise a majority of the Board, and each member of our Audit, Compensation and Nominating & Corporate Governance Committees must be independent. A director will only qualify as an “independent director” if, in the opinion of the Board, that director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

-21-

Table of Contents

Audit Committee members also must satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of the Audit Committee may not, other than in his or her capacity as a member of the Audit Committee, the Board, or any other board committee: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from us or any of our subsidiaries; or (2) be an affiliated person of us or any of our subsidiaries.

Compensation Committee members must satisfy additional independence criteria set forth under the NYSE listing standards. In order for a member of the Compensation Committee to be considered independent, the Board must consider all factors specifically relevant to determining whether a director has a relationship to us that is material to that director’s ability to be independent from management in connection with the duties of a Compensation Committee member, including, but not limited to: (1) the source of compensation of such director, including any consulting, advisory, or other compensatory fee paid by us to such director; and (2) whether such director is affiliated with us, any of or subsidiaries, or an affiliate of any of our subsidiaries.

The Board has reviewed the independence of each director and determined that Dr. Bahrami, Mr. Kelly, Dr. Levinson and Mr. Olson, representing four of our six directors, do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the applicable rules and regulations of the SEC and the NYSE listing standards. In making these determinations, the Board considered the current and prior relationships that each non-employee director has with us and all other facts and circumstances the Board deemed relevant.

During fiscal 2018, the Board held twelve meetings and also took certain actions by written consent. Each of our directors attended at least 75% of the meetings of the Board and the committees on which he or she served during fiscal 2018. The Board has established an Audit Committee, a Compensation Committee and a Nominating & Corporate Governance Committee, each of which has the composition and responsibilities described below.

Audit Committee