Form DEF 14A FTI CONSULTING, INC For: Jun 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | ☐ | | | Preliminary Proxy Statement | |

| | ☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| | ☒ | | | Definitive Proxy Statement | |

| | ☐ | | | Definitive Additional Materials | |

| | ☐ | | | Soliciting Material Pursuant to Sec.240.14a-12 | |

| | FTI CONSULTING, INC. | |

| | (Name of Registrant as Specified In Its Charter) | |

| | | |

| | | |

| | (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

Payment of Filing Fee (Check the appropriate box):

| | ☒ | | | No fee required. | | |||

| | ☐ | | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | | |||

| | | | 1) | | | Title of each class of securities to which transaction applies: | | |

| | | | | | | |||

| | | | 2) | | | Aggregate number of securities to which transaction applies: | | |

| | | | | | | |||

| | | | 3) | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | | |

| | | | | | | |||

| | | | 4) | | | Proposed maximum aggregate value of transaction: | | |

| | | | | | | |||

| | | | 5) | | | Total fee paid: | | |

| | | | | | | |||

| | ☐ | | | Fee paid previously with preliminary materials. | | |||

| | ☐ | | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | | |||

| | | | 1) | | | Amount Previously Paid: | | |

| | | | | | | |||

| | | | 2) | | | Form, Schedule or Registration Statement No.: | | |

| | | | | | | |||

| | | | 3) | | | Filing Party: | | |

| | | | | | | |||

| | | | 4) | | | Date Filed: | | |

| | | | | | | |||

555 12th Street NW

Washington, D.C. 20004

+1.202.312.9100

April 19, 2021

DEAR FELLOW SHAREHOLDERS:

You are invited to join us at the Annual Meeting of Shareholders of FTI Consulting, Inc., a Maryland corporation, on Wednesday, June 2, 2021, at 9:30 a.m., Eastern Daylight Time, at our executive office located at 555 12th Street NW, Washington, D.C. 20004.

Attached you will find a Notice of Meeting and our Proxy Statement, which contains information regarding the proposals that the Board of Directors is submitting to a vote of the shareholders, as well as instructions on how to vote your shares of common stock.

If you plan to attend the meeting in person, you must register in advance by no later than May 20, 2021 and obtain an admission ticket. Please respond affirmatively to the request for that information on the Internet or mark that box on the proxy card if you received paper copies of the proxy materials. You will be asked to present your admission ticket and valid picture identification, such as a driver’s license or passport, to enter the meeting. Cameras, recording devices and other electronic devices will not be permitted at the meeting.

Whether or not you attend the meeting in person, your vote is important to us. You can ensure that your shares are represented by promptly authorizing a proxy to vote your shares by telephone or the Internet or by completing, signing, dating and returning your proxy card or voting instruction card in the return envelope provided to you. Instructions on how to vote your shares or authorize a proxy to vote your shares begin on page 2 of the Proxy Statement.

Finally, the 2021 annual meeting of shareholders is currently scheduled to be held at 555 12th Street NW, Washington, D.C. 20004. However, as part of our precautions regarding the coronavirus disease 2019 (COVID-19), we are planning for the possibility that the annual meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be set forth in a press release issued by the Company and available at https://ir.fticonsulting.com/ press-releases and https://www.virtualshareholdermeeting.com/FCN2021 where you will also find information on how to attend the virtual meeting.

Sincerely,

Gerard E. Holthaus

Chairman of the Board

FTI CONSULTING, INC. NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | | Meeting Date: June 2, 2021 | | |  | | | Meeting Place: 555 12th Street NW Washington, D.C. 20004 | | |  | | | Meeting Time: 9:30 a.m. (EDT) | | |  | | | Record Date: March 4, 2021 |

ITEMS OF BUSINESS AND VOTE RECOMMENDATIONS:

| | Proposal Number | | | Proposal | | | Board Voting Recommendation | |

| | No. 1 | | | Elect as directors the eight nominees named in the Proxy Statement | | | FOR each nominee | |

| | No. 2 | | | Ratify the appointment of KPMG LLP as FTI Consulting, Inc.’s independent registered public accounting firm for the year ending December 31, 2021 | | | FOR | |

| | No. 3 | | | Vote on an advisory (non-binding) resolution to approve the compensation of the named executive officers for the year ended December 31, 2020 at the 2021 annual meeting of shareholders | | | FOR | |

| | | | The transaction of any other business that may properly come before the meeting or any postponement or adjournment thereof | | | N/A | | |

| | Postponements and Adjournments: | | | Any action on the items of business described above may be considered at the meeting, at the time and on the date specified above or at any time and date to which the meeting may be properly postponed or adjourned. | | |||

| | In-Person Meeting Admission: | | | Admission will be by ticket only. Please follow the advance registration instructions set forth in the section of the Proxy Statement titled “Information about the Annual Meeting and Voting—How Do I Attend the Annual Meeting?”beginning on page 5 of the Proxy Statement. If you do not provide an admission ticket and comply with the photo identification requirements outlined on page 5, you will not be admitted to the 2021 annual meeting. Cameras, recording devices and other electronic devices will not be permitted at the 2021 annual meeting. | | |||

| | Annual Meeting Location: | | | The 2021 annual meeting of shareholders is currently scheduled to be held at 555 12th Street NW, Washington, D.C. 20004. However, as part of our precautions regarding the coronavirus disease 2019 (COVID-19), we are planning for the possibility that the annual meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be set forth in a press release issued by the Company and available at https://ir.fticonsulting.com/press-releases and https://www.virtualshareholdermeeting.com/FCN2021 where you will also find information on how to attend the virtual meeting. | | |||

| | Voting: | | | YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the meeting, we hope you will vote as soon as possible. For specific instructions on how to vote your shares or authorize a proxy to vote your shares, please refer to the section titled “Information about the Annual Meeting and Voting” beginning on page 2 of the Proxy Statement. Make sure to have your proxy card or voting instruction form in hand to vote as follows: | | |||

| | | In-person at the in-person Annual Meeting | | |  | | | By telephone at +1.800.690.6903 | | |  | | | Over the Internet at www.proxyvote.com | | |  | | | By mailing your completed proxy card in the envelope provided |

By Order of the Board of Directors,  Joanne F. Catanese Associate General Counsel and Corporate Secretary April 19, 2021 |

| | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to Be Held on June 2, 2021 (the “Annual Meeting”): We mailed a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement for the Annual Meeting and our 2020 Annual Report on or about April 19, 2021. Our Proxy Statement and Annual Report are available online at www.proxyvote.com. | |

This Proxy Summary highlights certain information contained elsewhere in this proxy statement (“Proxy Statement”) for the annual meeting of shareholders on June 2, 2021. This Proxy Summary does not contain all the information that you should consider. Please read the entire Proxy Statement carefully before voting.

GENERAL INFORMATION

| | Date: | | | June 2, 2021 | |

| | Time: | | | 9:30 a.m., Eastern Daylight Time | |

| | Location: * | | | FTI Consulting, Inc. 555 12th Street NW Washington, D.C. 20004 | |

| | Record Date: | | | Close of business on March 4, 2021 | |

| | Stock Symbol: | | | FCN | |

| | Exchange: | | | New York Stock Exchange | |

| | Common Stock Outstanding as of the Close of Business on the Record Date Entitled to Vote at the Annual Meeting: | | | 34,217,718 shares of common stock, par value $0.01 per share (“Common Stock”) | |

| | Registrar and Transfer Agent: | | | American Stock Transfer & Trust Company | |

| | State of Incorporation: | | | Maryland | |

| | Year of Incorporation: | | | 1982 | |

| | Public Company Since: | | | 1996 | |

| | Corporate Website: | | | www.fticonsulting.com | |

* | The 2021 annual meeting of shareholders is currently scheduled to be held at 555 12th Street NW, Washington, D.C. 20004. However, as part of our precautions regarding the coronavirus disease 2019 (COVID-19), we are planning for the possibility that the annual meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be set forth in a press release issued by the Company and available at https://ir.fticonsulting.com/press-releases and https://www.virtualshareholdermeeting.com/FCN2021 where you will also find information on how to attend the virtual meeting. |

Forward-Looking Information Statement

. This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current facts, including statements regarding our environmental and other sustainability plans and goals, made in this document are forward-looking. We use words such as anticipates, believes, expects, future, intends and similar expressions to identify forward-looking statements. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Actual results could differ materially for a variety of reasons. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on February 25, 2021. Website references and references to policies and reports throughout this document are provided for convenience only, and the content of referenced websites, policies and reports is not incorporated by reference into this document.i

FIVE SEGMENTS, ONE PURPOSE

FTI Consulting is a global business advisory firm dedicated to helping organizations manage change, mitigate risk and resolve disputes: financial, legal, operational, political and regulatory, reputational and transactional. With more than 6,300 employees located in 28 countries, we are the firm our clients call on when their most important issues are at stake.

iii

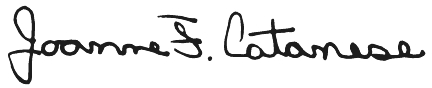

2020 ACHIEVEMENTS

2020 presented unprecedented challenges for individuals and organizations across the globe. FTI Consulting’s top-line growth in the face of the coronavirus disease 2019 (COVID-19) (“COVID-19”) pandemic, in the face of all the challenges it has created for our clients and for our teams is a powerful testament to the strength of our enterprise, its relevance to clients facing major events, and, most important, the dedication and resilience of our more than 6,300 employees across the globe.

(1) | Equity market capitalization has been calculated by multiplying the number of total shares of Common Stock outstanding on December 31, 2020, by the closing price per share on December 31, 2020. |

See Appendix B for the definitions of earnings per diluted share (“EPS”), as adjusted (“Adjusted EPS”), Free Cash Flow and other non-GAAP financial measures for financial reporting purposes referred to in this Proxy Statement and the reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures.

iv

OUR STRATEGY FOR SUSTAINABLE GROWTH

Sustainable growth in professional services comes from attracting, developing and promoting great professionals with ambitions to grow their businesses. Over the last several years, our financial results have shown that if we do the right things for our business over any medium-term period, even though quarters and market conditions can fluctuate, through those efforts we can build a powerful growth engine.

This means not overreacting to temporary factors that are out of management’s control and being willing to support our strong businesses and professionals in the face of short-term market headwinds because we believe over any multi-year period, the financial performance of great professional services firms is dictated by the fundamentals of the business, such as:

• | Investing to promote, support and attract talented professionals who can strengthen and build leading positions in areas of critical client needs. |

• | Investing EBITDA behind key growth areas in which we have a right to win. |

• | Leveraging investments to build positions that will support profitable growth on a sustained basis through a variety of economic conditions. |

• | Actively evaluating and considering opportunistic acquisitions but committing on a day-in, day-out basis to growth by organic means. |

• | Maintaining a strong balance sheet and committing to using our strong cash flow generation to enhance shareholder returns. |

• | Creating a diverse, inclusive and high-performing culture where our professionals can grow their career and achieve their full potential. |

• | Being a responsible corporate citizen that drives positive change in the communities in which we do business. |

v

Our Strategy in Action – A Powerful Platform for Sustainable Growth

(1) | See Appendix B |

(2) | 2017 GAAP EPS includes $44.9 million, or $1.14 per share, benefit from the impact of adopting the 2017 U.S. Tax Cuts and Jobs Act. |

vi

LIVING OUR CORE VALUES IN TRYING TIMES – OUR RESPONSE TO COVID-19

In a year that brought so many challenges, our teams did an incredible job of keeping our people safe and supporting them and their families, all while delivering for our clients and supporting our communities in unprecedented ways.

Our People

By April 2020, approximately 95% of our people around the world were working remotely, a level that has been largely maintained through the beginning of 2021. To address the evolving restrictions across the 28 countries in which FTI Consulting does business, our Chief Human Resources Officer and Chief Risk and Compliance Officer formed a Global COVID-19 Taskforce of professionals representing human resources, real estate and facilities, information technology and communications to keep our people both safe and informed. We also committed to supporting our people in various ways:

• | Continued to pay our employees whose job responsibilities normally reside in the office. |

• | Enhanced our focus and commitment to flexible work hours to allow our people to meet personal and family commitments. |

• | Global COVID-19 Taskforce updated all staff on a weekly basis on COVID-19-related developments and policies. |

• | Increased investment and support for information technology services, enabling business continuity. |

• | Expanded our employee assistance program offerings and policies, including introducing enhanced childcare, elder care and mental health services. |

• | Maintained investment in developing our people, by providing talent development training to 96% of professionals by swiftly virtualizing our talent development offering to support remote learning. |

• | Facilitated virtual teaming events to maintain strong morale and connectivity across our global workforce. |

• | Provided those who are working in our offices with personal protective equipment (“PPE”). |

• | Established policies and procedures for a safe return to work, where applicable. |

Our Clients

From the onset of the pandemic, our teams leveraged their expertise, collaborating and innovating to deliver for our clients as they faced unparalleled challenges, including, among other examples:

• | Advising numerous clients within industries most impacted by the COVID-19 pandemic, e.g., airlines, REITs, restaurants, entertainment venues and gyms, on their liquidity issues. |

• | Working with the Office of the Mayor of the City of New York to help source, vet and recommend qualified suppliers for 12 critical categories of medical PPE items, ultimately sourcing and distributing over $300 million worth of PPE. |

• | Helping New York City-based Mt. Sinai Health face the unprecedented COVID-19 surge by planning for its tremendous needs in terms of clinical staffing, system deployment and surge capacity. |

• | Supporting numerous vaccine producers with attaining regulatory approval of their COVID-19 vaccines within countries and across continents. |

• | Moving client data from our review centers to a secure and virtually managed review platform, ensuring business continuity. |

• | Implementing new processes for digital forensics to collect and analyze data remotely. |

• | Introducing proprietary tools to support enhanced virtual testimony for our backlogged court system. |

vii

Our Communities

The COVID-19 pandemic shaped the course of 2020 and has continued to impact people around the world in many different ways. The global crisis caused or created lasting effects on communities and industries of all kinds, from healthcare and food security, to elderly and disabled care, to educational and professional development, and more. While many events were canceled, and traditional volunteering opportunities grew increasingly limited, FTI Consulting experts responded to the COVID-19 pandemic in various creative ways with one common goal: to help make a difference.

Of the many ways FTI Consulting employees rolled up their sleeves and helped their communities persevere through the pandemic, some of the highlights include:

• | Supporting frontline healthcare workers by cooking and delivering healthy meals to COVID-19 testing sites and hospitals, as well as making charitable donations to support healthcare organizations. |

• | Making and distributing masks in their communities by utilizing their sewing skills and by procuring personal protective equipment to share with FTI Consulting colleagues in other parts of the world. |

• | Assisting vulnerable members of their communities, from mowing lawns and shoveling driveways to working with community organizations to coordinate food deliveries and making time to connect with vulnerable individuals whose mental health could benefit from connection and support. |

• | Providing pro bono expertise to organizations that work to alleviate the effects of COVID-19, including analyzing the economic and social impacts of COVID-19 in developing countries for the Humanitarian Aid Relief Trust and serving as internal communications and public relations experts for the UK National Health Service. |

• | Donating funds allocated for office holiday parties to charitable organizations dedicated to addressing global hunger in the wake of COVID-19. |

• | In addition to the tremendous volunteering and pro bono efforts, FTI Consulting employees raised more than $500,000 through donations and corporate matching to support over 75 community-based organizations helping those most impacted by the COVID-19 pandemic. |

viii

ENVIRONMENTAL, SOCIAL AND GOVERNANCE PRACTICES, POLICIES, PROGRESS AND ACHIEVEMENTS

The Company’s policies relating to Environmental, Social & Governance (“ESG”) topics can be found on the Governance section of the Company’s website at www.fticonsulting.com/about/governance. FTI Consulting’s core values guide our approach to ESG topics:

Environmental: FTI Consulting recognizes that climate change is a global threat and one of the most significant environmental challenges of our time. The Company and our employees are committed to doing our part in addressing climate change and reducing the Company’s collective environmental impact.

Social: We seek to foster a diverse and inclusive culture, to be the Company of choice for professionals to build and advance in their career and to empower our people to do good in our communities.

Governance: Our approach to corporate governance is informed by principled actions, effective decision making and appropriate monitoring of compliance, risks and performance.

Environmental

Sustainability

• | 18% reduction in global office square footage per employee from 2018 to 2020. |

• | 36% reduction in total energy consumed (megawatt hours) from 2018 to 2020. |

• | Reduced emissions intensity per employee from 7.05 MT CO2e in 2018 to 6.53 MT CO2e in 2019 and 2.59 MT CO2e in 2020. |

• | 65% of employees sit in LEED-certified (or equivalent) buildings. |

• | Commitment to reducing environmental impact from the Company’s office locations by focusing on: |

— | Occupying building locations that are LEED-certified (or equivalent). |

— | Implementing energy efficiency measures for all new office build outs. |

— | Utilizing materials that meet stringent guidelines for reduced emissions. |

— | Minimizing the creation of waste and implementing waste diversion practices regarding office operations. |

• | Recent office build outs that include installations of bottle filler stations have offset the landfill waste associated with 100,000 single-use plastic bottles annually. |

• | Server infrastructure has been 90+% virtualized. |

• | For more information about FTI Consulting’s Environmental practices and the methodology used to calculate environmental impact, please review the Company’s Environmental Responsibility & Climate Change Disclosure Policy. |

ix

Social

Corporate Citizenship

• | Participant of the United Nations’ Global Compact. |

• | FTI Consulting professionals supported more than 1,500 charitable organizations in 2020 through the Company’s Corporate Citizenship Program. |

• | Since 2018, FTI Consulting professionals have provided more than 15,000 hours of volunteer service. |

• | Since 2018, FTI Consulting professionals have donated more than $5.7 million in pro bono services to community-based organizations. |

• | Employees are provided up to 35 hours each year to participate in a pro bono project that count toward their utilization. |

• | Employees receive a full day of FTI Consulting-sponsored volunteer time and are eligible to participate in the Company’s Employee Matching Gift Program. |

• | More than 85 Corporate Citizenship Champions across the globe serve as advocates for corporate citizenship at the local office level. |

Diversity, Inclusion & Belonging

• | Signatory of the CEO Action for Diversity & Inclusion™ pledge. |

• | Introduced our Action Plan to Turbocharge Diversity, Inclusion & Belonging Initiatives, centered around four pillars: |

— | Reinvigorate our efforts to support, promote and retain diverse talent. |

— | Double-down on efforts to attract diverse talent. |

— | Leverage our expertise to help the world more broadly. |

— | Keep the dialogue alive. |

• | Created, hired and assimilated Global Diversity, Inclusion & Belonging Team to drive efforts globally. |

• | 80% of our Named Executive Officers represent diverse groups. |

• | 40% of our Executive Committee represents diverse groups. |

• | Published our workforce gender and ethnicity demographics data for U.S.- and UK-based employees. |

• | Reached goal of 100 female Senior Managing Directors in 2020, an increase of 15% compared to 2019. |

• | Increased women in management positions by 37% in 2020 compared to 2018. |

• | Achieved 50/50 gender balance in university and graduate hiring in 2020. |

• | Increased hiring of Black professionals by 43% in the U.S. and 70% in the UK in 2020 compared to 2019. |

• | Increased hiring of Asian professionals by 36% in the U.S. in 2020 compared to 2019. |

• | Set goal of reaching 165 female Senior Managing Directors by 2025, an increase of 65% compared to 2020. |

• | Set goal of reaching 120 underrepresented minority (“URM”) Senior Managing Directors by 2025, representing a more than doubling of URM Senior Managing Directors compared to 2020. |

• | Extended our 50/50 gender balance hiring target to include Consultant and Senior Consultant levels in 2020. |

• | 1,621 Director level and above professionals have completed inclusive culture training, with 350 participating virtually in 2020. |

• | For more information, please view our Global Diversity, Inclusion & Belonging Strategy. |

x

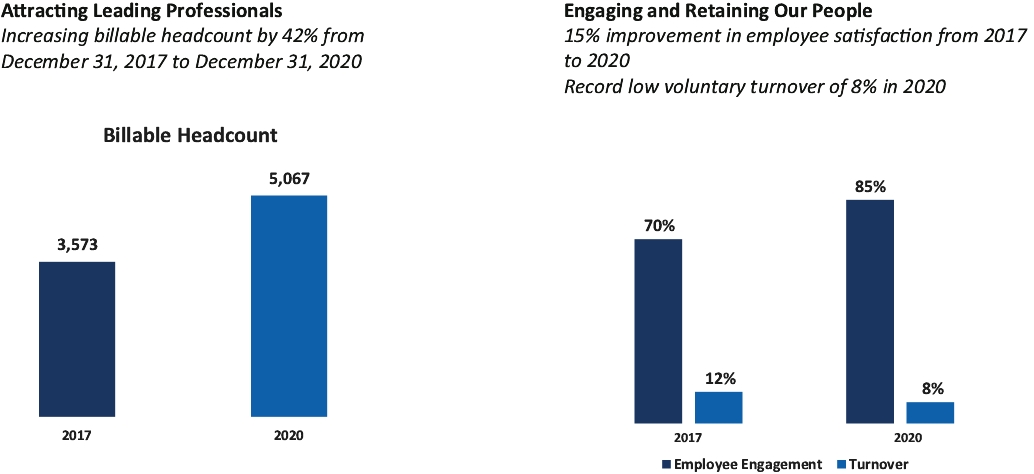

Human Capital

• | Employee voluntary turnover rate of 8% in 2020, marking the lowest voluntary turnover rate in Company history. |

• | Achieved the highest-ever annual employee engagement scores, with 85% job satisfaction in 2020 (1). |

• | Expanded employee assistance program offerings and policies, including introducing enhanced childcare, elder care and mental health services. |

• | Our Global Health & Safety and Human Rights policies protect the health and safety of our people and uphold individual human rights across our global platform. |

• | Established policies and procedures in response to the COVID-19 pandemic for a safe return to work, where applicable. |

Professional Development

• | 96% of employees participated in talent development training programs in 2020, up from 83% in 2019. |

• | Employees logged 74,678 total training hours in 2020, more than double the 31,268 hours logged in 2019. |

• | Average annual training hours per employee of 13.0 hours in 2020 compared to 7.1 hours in 2019. |

• | Globalized FTI University, resulting in a doubling of professionals attending FTI University compared to 2019. |

• | 895 professionals were selected for and completed leadership training programs in 2020. |

• | Offered 595 webinar training sessions in 2020 to support our remote workforce. |

• | Employees reported an 87% satisfaction rating for talent development courses taken in 2020. |

• | Over 1,000 professionals promoted in 2020, a record number. |

Governance

Board Oversight

• | The Nominating, Corporate Governance and Social Responsibility Committee oversees FTI Consulting’s ESG strategy and performance. |

Best Practice Board Leadership

• | 87.5% of the Board represents independent directors. |

• | Independent non-employee Chairman of the Board. |

• | 100% independent committee membership. |

• | Annual election of directors by majority in uncontested elections, with director resignation policy. |

• | 25% of directors are female. |

• | 25% of directors are based outside of the U.S. |

(1) | Employee engagement statistics are based on employee responses to the Company’s 2020 Great Place to Work® survey. |

xi

Shareholder Rights

• | No poison pill. |

• | No outstanding enhanced voting rights shares. |

Compliance & Business Ethics

• | Code of Ethics and Business Conduct Policy supported by training offered to all employees globally. |

• | Privacy Policy and mandatory periodic information technology security and privacy training. |

• | Third-party contractors must acknowledge FTI Consulting’s Anti-Corruption Policy and Vendor Code of Conduct. |

• | Policy on Reporting Concerns and Non-Retaliation and access to anonymous FTI Consulting Integrity Helpline. |

• | Policy on Insider Information and Insider Trading supported by training offered to all employees globally. |

• | Maintain policies related to specific legal and business requirements, such as anti-corruption laws, privacy laws and international sanctions rules. |

xii

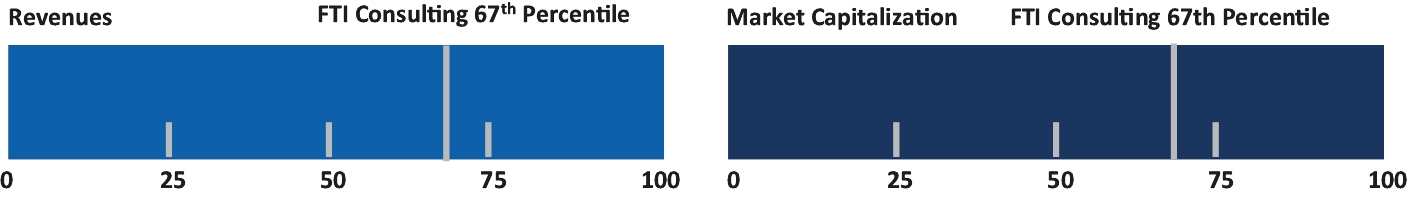

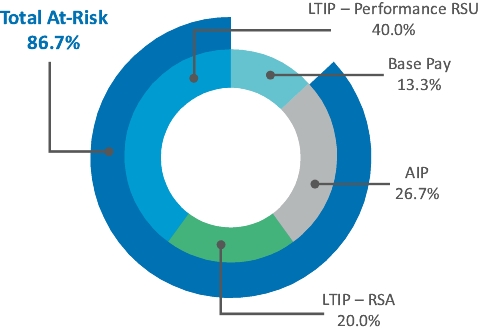

KEY ELEMENTS OF 2020 COMPENSATION PROGRAM

Executive compensation is strongly linked to the financial and operational performance of the Company. The charts below demonstrate that the Company’s executive compensation program of base pay, AIP and long-term incentive pay (“LTIP”) balances fixed and at-risk pay, with 86.7% of the CEO’s target annual total compensation at-risk and 66.7% of our other named executive officers’ target annual total compensation at-risk:

| | 2020 CEO’s Compensation at Target | | | 2020 Other NEOs’ Compensation at Target | |

| |  | | |  | |

2020 SHAREHOLDER ENGAGEMENT AND OUTREACH

CONSIDERATION OF MOST RECENT SAY-ON-PAY VOTE RESULTS

At our 2020 annual meeting of shareholders, our shareholders expressed support for our executive compensation program with approximately 99.3% of the votes cast in favor of our say-on-pay proposal approving named executive officer compensation for the year ended December 31, 2019. Our compensation decisions were informed by discussions in the second half of 2019 with our shareholders holding approximately 60.0% of our outstanding shares. These discussions reinforced our belief that the changes we have adopted over the past several years were responsive to our shareholders’ feedback. See the section titled “Information about Our Executive Officers and Compensation—Compensation Discussion and Analysis—What Guides Our Program—How We Make Compensation Decisions—The Decision-Making Process” beginning on page 42 of this Proxy Statement.

ROBUST SHAREHOLDER ENGAGEMENT AND OUTREACH

We have a robust shareholder engagement program that proactively offers shareholders access to management and the Board at multiple touchpoints throughout the year. We regularly speak with a broad spectrum of our shareholders on a variety of topics. Such communications allow us to provide perspective on Company policies and practices, stay attuned to shareholder sentiment on a variety of issues, and address shareholder concerns with our policies and practices, when appropriate. Generally, we communicate with our major shareholders through our executive management and investor relations professionals. Periodically, our Chairman of the Board and Chair of the Compensation Committee communicate with major shareholders as well, which allows our directors to directly solicit and receive our shareholders’ views on our strategy, performance and executive compensation program.

xiii

| | |||

| | | Fall Informed by our summer report, we extend an invitation to our 20 largest shareholders to assess corporate governance and compensation trends and practices that are important to them. Winter Report shareholder feedback from our fall meetings to the Board and use shareholder feedback to enhance our proxy disclosure and make appropriate changes to our governance practices and executive compensation program. Spring Conduct follow-up conversations with our largest shareholders and extend an invitation to our 20 largest shareholders to discuss important issues that will be considered at our upcoming annual meeting. Summer Prepare a report for the Board that includes a review of voting results and feedback we received from our shareholders during the proxy season. This discussion informs outreach and engagement plans for our meetings with shareholders during the fall. |

xiv

BOARD COMPOSITION AND CHARACTERISTICS

Our director nominees are a diverse group of experienced business leaders who provide unique perspectives to the Company’s business discussions and strategic plans, which we believe is critical to ensuring that we maintain a high-functioning Board. Collectively, the tenure of our director nominees balances deep experience at the Company with fresh perspectives. Our director nominees also have diverse expertise and skills that enable them to effectively carry out their duties and responsibilities. Since 2014, we have added three new directors as part of our ongoing Board refreshment process, improving the Board’s gender diversity by adding a second female director and enhancing the Board’s collective expertise — notably in finance and accounting, global business and other public company board experience.

87.5% Independent Directors | | | 25% Female Directors | | | 9.4 Years Average Tenure (50% - 5 to 7 years) | | | 67 Average Age | | | 25% Directors Based Outside of U.S. |

Detailed information on each of our eight nominees can be found in the section titled “Information about the Board of Directors and Committees—Information about the Nominees for Director” beginning on page 12 of this Proxy Statement.

| | | | | | | | | | Committee Membership | | ||||||||||

| | Director | | | Age | | | Director Since | | | Independent Directors | | | Audit | | | Compensation | | | Nominating, Corporate Governance and Social Responsibility | |

| | Gerard E. Holthaus Lead Independent Director of WillScot Mobile Mini Holdings Corp. | | | 71 | | | 2004 | | |  | | | • | | | • | | | | |

| | Steven H. Gunby President and Chief Executive Officer of FTI Consulting, Inc. | | | 63 | | | 2014 | | | | | | | | | | ||||

| | Brenda J. Bacon President and Chief Executive Officer of Brandywine Senior Living LLC | | | 70 | | | 2006 | | | ✔ | | | | | • | | | C | | |

| | Mark S. Bartlett Former Partner at Ernst & Young LLP | | | 70 | | | 2015 | | | ✔ | | | • | | | | | | ||

| | Claudio Costamagna Chairman of CC e Soci S.r.l. | | | 65 | | | 2012 | | | ✔ | | | | | C | | | | ||

| | Sir Vernon Ellis Former Chair of the Board of Trustees of the British Council | | | 73 | | | 2012 | | | ✔ | | | • | | | | | • | | |

| | Nicholas C. Fanandakis Senior Advisor to the Chief Executive Officer of DuPont de Nemours, Inc. | | | 65 | | | 2014 | | | ✔ | | | C | | | | | | ||

| | Laureen E. Seeger Chief Legal Officer of the American Express Company | | | 59 | | | 2016 | | | ✔ | | | | | • | | | • | | |

| Independent Chairman of the Board |

C | Committee Chair |

xv

SUMMARY OF VOTING PROPOSALS AND BOARD RECOMMENDATIONS

| | Proposal Number | | | Proposal | | | Board Voting Recommendation | |

| | No. 1 | | | Elect as directors the eight nominees named in the Proxy Statement | | | FOR each nominee | |

| | Each of the eight incumbent directors has been nominated by the Board to stand for reelection as directors of the Company. Each nominee, if elected, will serve as a director for a term until the next annual meeting of shareholders and until his or her successor is duly elected and qualifies, or until his or her death, resignation, retirement or removal (whichever occurs first). (See page 11) | | ||||||

| | No. 2 | | | Ratify the appointment of KPMG LLP as FTI Consulting, Inc.’s independent registered public accounting firm for the year ending December 31, 2021 | | | FOR | |

| | Our Audit Committee has appointed KPMG LLP (“KPMG”) as the independent registered public accounting firm to audit our books and records for the year ending December 31, 2021. KPMG has acted as our auditor since 2006. We are offering shareholders the opportunity to ratify the appointment of our independent registered public accounting firm as a matter of good corporate governance practice. (See page 28) | | ||||||

| | No. 3 | | | Vote on an advisory (non-binding) resolution to approve the compensation of the named executive officers for the year ended December 31, 2020 at the 2021 annual meeting of shareholders | | | FOR | |

| | In accordance with applicable law and the preference of our shareholders to cast an advisory (non-binding) vote on say-on-pay every year, we are affording our shareholders the opportunity to cast an advisory (non-binding) vote to approve the following resolution: | | ||||||

| | “RESOLVED, that the shareholders approve, on an advisory (non-binding) basis, the compensation of the Company’s named executive officers for the year ended December 31, 2020 as described in the Proxy Statement for the 2021 Annual Meeting of Shareholders.” (See page 29) | | ||||||

| | | | The transaction of any other business that may properly come before the meeting or any postponement or adjournment thereof | | | N/A | | |

xvi

555 12th Street NW

Washington, D.C. 20004

+1.202.312.9100

April 19, 2021

The Annual Meeting of Shareholders of FTI Consulting, Inc., a Maryland corporation (the “Company” or “FTI Consulting”), will be held on June 2, 2021 (the “Annual Meeting”), at 9:30 a.m., Eastern Daylight Time, at FTI Consulting’s principal executive office, which is located at 555 12th Street NW, Washington, D.C. 20004.

Our Board of Directors (our “Board”) is soliciting our shareholders’ proxies to be voted at our Annual Meeting. Shareholders of the Company as of the close of business on March 4, 2021, the record date for the Annual Meeting (the “Record Date”), are entitled to notice of, and to vote at, the Annual Meeting or any postponement or adjournment of the Annual Meeting.

This proxy statement (“Proxy Statement”) provides information that you should read before you vote (or authorize a proxy to vote) on the proposals that will be presented to you at the Annual Meeting and is intended to assist you in deciding how to vote your shares of common stock, par value $0.01 per share (“Common Stock”), of the Company.

On or about April 19, 2021, we began mailing or emailing to shareholders of record as of the close of business on the Record Date a Notice of Internet Availability of Proxy Materials (“Notice”) containing instructions on how to access this Proxy Statement and our Annual Report to Shareholders for the year ended December 31, 2020 (the “Annual Report”) online, and we began sending a full set of the proxy materials and Annual Report to shareholders who previously requested paper copies.

Finally, the Annual Meeting is currently scheduled to be held at 555 12th Street NW, Washington, D.C. 20004. However, as part of our precautions regarding the coronavirus disease 2019 (COVID-19), we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be set forth in a press release issued by the Company and available at https://ir.fticonsulting.com/press-releases and https://www.virtualshareholdermeeting.com/FCN2021 where you will also find information on how to attend the virtual meeting.

1

WHY AM I RECEIVING THESE PROXY MATERIALS?

You are invited to attend the Annual Meeting and are entitled to consider and vote on the items of business described in this Proxy Statement. The proxy materials include the Notice and our Annual Report. If you received a paper copy of these materials by mail or email, the proxy materials also include a proxy card or voting instruction card for the Annual Meeting.

The information in this Proxy Statement describes (i) the proposals to be considered and voted on at the Annual Meeting, (ii) the voting process, (iii) the eight nominees for director named in this Proxy Statement, (iv) information about our Board and committees of our Board (collectively, the “Committees”), (v) the compensation of our named executive officers (each an “NEO,” and collectively, the “NEOs”) and non-employee directors for the year ended December 31, 2020, and (vi) certain other information we are required or have chosen to provide to you.

WHY DID I RECEIVE A NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS?

We are sending a Notice, by mail or email, to many shareholders instead of paper copies of the proxy materials and Annual Report. All shareholders receiving the Notice will find instructions on how to access this Proxy Statement and our Annual Report on the website referred to in the Notice or how to request a printed set of these materials at no charge. Choosing to receive future proxy materials and annual reports over the Internet or by email will save us the cost of printing and mailing documents and will reduce the impact on the environment of holding annual meetings. Your election to receive the proxy materials and annual reports over the Internet or by email will remain in effect until it is terminated. Your Notice will contain instructions on how to:

• | view our proxy materials for the Annual Meeting on the Internet; |

• | view our Annual Report on the Internet; |

• | vote your shares of Common Stock of the Company or authorize a proxy to vote your shares; and |

• | instruct us to send future proxy materials to you by mail or electronically by email. |

WHY DID I RECEIVE PAPER COPIES OF THE PROXY MATERIALS AND ANNUAL REPORT?

We are providing some of our shareholders, including shareholders who have previously requested paper copies of the proxy materials and Annual Report and some of our shareholders who live outside the United States (“U.S.”), with paper copies of this Proxy Statement and the Annual Report, instead of the Notice. In addition, any shareholder may request to receive proxy materials and annual reports in printed form by mail or electronically by email or over the Internet on an ongoing basis.

HOW CAN I REQUEST PAPER COPIES OF THE PROXY MATERIALS AND ANNUAL REPORT?

Shareholders will find instructions about how to obtain paper copies of the proxy materials and Annual Report in the Notice or the email you receive. Additionally, we will promptly send a copy of the Annual Report to you at no charge upon written request to our Corporate Secretary at FTI Consulting, Inc., 6300 Blair Hill Lane, Suite 303, Baltimore, MD 21209 or by email to [email protected].

WHEN AND WHERE WILL THE COMPANY HOLD THE ANNUAL MEETING?

The Annual Meeting will be held on Wednesday, June 2, 2021, at 9:30 a.m., Eastern Daylight Time. If held in person, the Annual Meeting will be held at our executive office located at 555 12th Street NW, Washington, D.C. 20004, telephone no. +1.202.312.9100.

However, as part of our precautions regarding the coronavirus disease 2019 (COVID-19), we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be set forth in a press release issued by the Company and available at https://ir.fticonsulting.com/ press-releases and https://www.virtualshareholdermeeting.com/FCN2021 where you will also find information on how to attend the virtual meeting.

2

WHO MAY VOTE AT THE ANNUAL MEETING?

You may vote all of the shares of our Common Stock that you own as of the close of business on the Record Date. You may cast one vote for each share that you own. As of the close of business on the Record Date, 34,217,718 shares of our Common Stock were issued and outstanding and entitled to vote at the Annual Meeting.

WHAT IS A QUORUM?

A quorum must be present at the Annual Meeting in order to transact business. A quorum will be established if shareholders entitled to cast a majority of all votes entitled to be cast are represented at the Annual Meeting, either in person or by proxy. If a quorum is not established, no business may be conducted at the Annual Meeting, in which case the Annual Meeting may be adjourned without a vote of shareholders by the chairman of the Annual Meeting until such time as a quorum is present, with no notice other than announcement at the Annual Meeting.

Proxies received and marked as abstentions from voting on a proposal and broker non-votes are counted for determining whether a quorum is present. A “broker non-vote” results when a trust, broker, bank, or other nominee or fiduciary that holds shares for another person has not received voting instructions from the owner of the shares and, under the applicable rules of the New York Stock Exchange (the “NYSE”), does not have the discretionary authority to vote on a matter. If a properly executed proxy has not been returned, the holder is not present for quorum purposes unless actually present in person at the Annual Meeting.

WHAT AM I VOTING ON, HOW MANY VOTES ARE REQUIRED TO ELECT DIRECTORS AND APPROVE THE OTHER PROPOSALS, AND HOW DOES THE BOARD RECOMMEND I VOTE?

| | Proposal No. 1: Elect as directors the eight nominees named in the Proxy Statement | | | As there are eight nominees for the eight director seats up for election, each nominee will be elected as a director if he or she receives the affirmative vote of a majority of the total votes cast “FOR” and “WITHHELD” with respect to his or her election as a director at the Annual Meeting. Any abstentions or broker non-votes are not counted as votes cast either “FOR” or “WITHHELD” with respect to a director’s election and will have no effect on the election of directors. The Board recommends a vote FOR the election of each nominee as a director. | |

| | Proposal No. 2: Ratify the appointment of KPMG LLP (“KPMG”) as FTI Consulting, Inc.’s independent registered public accounting firm for the year ending December 31, 2021 | | | Ratification of the appointment of KPMG as the Company’s independent registered public accounting firm for the year ending December 31, 2021 requires a majority of the votes cast on the proposal at the Annual Meeting to be voted “FOR” this proposal. Abstentions will not count as votes cast either “FOR” or “AGAINST” Proposal No. 2 and will have no effect on the results of the vote on this proposal. Discretionary voting is permitted by the NYSE on this proposal, and, therefore, we do not anticipate any broker non-votes for this proposal. The Board recommends a vote FOR the ratification of the appointment of KPMG. | |

| | Proposal No. 3: Vote on an advisory (non-binding) resolution to approve the compensation of the named executive officers for the year ended December 31, 2020 at the 2021 Annual Meeting of Shareholders | | | The approval of an advisory resolution approving the compensation of our named executive officers for the year ended December 31, 2020 as described in this Proxy Statement for the Annual Meeting requires a majority of the votes cast on this proposal at the Annual Meeting to be voted “FOR” this proposal. Abstentions and broker non-votes will not be counted as votes cast either “FOR” or “AGAINST” Proposal No. 3 and will have no effect on this proposal. However, this proposal is an advisory (non-binding) proposal. The Board recommends a vote FOR the advisory (non-binding) resolution to approve the compensation of our named executive officers for the year ended December 31, 2020 as described in the Proxy Statement for the 2021 annual meeting of shareholders. | |

3

If you sign, date and return a proxy card but do not complete voting instructions for a proposal, your shares will be voted with respect to such proposal by the named proxies in accordance with the Board’s above recommendations and in the discretion of the proxy holder on any other matter that may properly come before the Annual Meeting or any postponement or adjournment thereof.

CAN I VOTE MY SHARES BY FILLING OUT AND RETURNING THE NOTICE?

No. The Notice identifies the items to be considered and voted on at the Annual Meeting, but you cannot vote by marking and returning the Notice. The Notice provides instructions on how to authorize a proxy to vote your shares of Common Stock by Internet, by telephone or by requesting a paper proxy card, or how to vote in person by attending and submitting a ballot at the Annual Meeting.

WHO PAYS THE COSTS OF THE PROXY SOLICITATION?

The Company will pay the cost of soliciting proxies. In addition to the mailing or emailing of the Notice, the proxy materials and the Annual Report, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our officers, directors and employees, who will not receive any additional compensation for such solicitation activities.

WHAT DOES IT MEAN IF I RECEIVED MORE THAN ONE PROXY CARD OR VOTING INSTRUCTION CARD?

If you receive more than one proxy card or voting instruction card, it means that you have multiple accounts with our transfer agent and/or a broker, trust, bank, or other nominee or fiduciary or you may hold shares in different ways or in multiple names (such as through joint tenancy, trusts and custodial accounts). Please vote all your shares.

WILL MY SHARES BE VOTED IF I DO NOT COMPLETE, SIGN, DATE AND RETURN MY PROXY CARD OR VOTING INSTRUCTION CARD, OR VOTE BY SOME OTHER METHOD?

If you are a registered “record” shareholder and you do not authorize a proxy to vote your shares of Common Stock by Internet, by telephone or by completing, signing, dating and returning a paper proxy card or voting instruction card, your shares will not be voted unless you attend the Annual Meeting and vote in person. In addition, if you sign, date and return a proxy card but do not complete voting instructions for a proposal, your shares will be voted with respect to such proposal by the named proxies in accordance with the Board’s recommendations and in the discretion of the proxy holder on any other matter that may properly come before the Annual Meeting or any postponement or adjournment thereof.

If your shares are held in a brokerage account or by a trust, bank, or other nominee or fiduciary, you are considered the “beneficial owner” of shares held in “street name,” and the Notice or proxy materials were forwarded to you by that organization. In order to vote your shares, you must follow the voting instructions forwarded to you by or on behalf of that organization. Brokerage firms, trusts, banks, and other nominees and fiduciaries are required to request voting instructions for shares they hold on behalf of customers and others. As the beneficial owner, you have the right to direct the record holder how to vote, and you are also invited to attend the Annual Meeting. We encourage you to provide instructions to your broker, trust, bank, or other nominee or fiduciary on how to vote your shares. Since a beneficial owner is not the record shareholder, you may not vote the shares at the Annual Meeting unless you obtain a legal proxy from the record holder giving you the right to vote the shares at the meeting. We note that obtaining a legal proxy may take several days.

Even if you do not provide voting instructions on your voting instruction card, if you hold shares through an account with a broker, trust, bank, or other nominee or fiduciary, your shares may be voted. Brokerage firms have the authority under NYSE rules to vote shares for which their customers do not provide voting instructions on certain “routine” matters. Proposal No. 2, to ratify the appointment of KPMG as our independent registered public accounting firm for the year ending December 31, 2021, is considered a routine matter for which brokers, trusts, banks, and other nominees and fiduciaries may vote in the absence of specific instructions.

When a proposal is not considered “routine” and the broker, trust, bank, or other nominee or fiduciary has not received voting instructions from the beneficial owner of the shares with respect to such proposal, such firm cannot vote the shares on that proposal. All proposals, other than Proposal No. 2, are non-routine proposals. Votes that cannot be cast by a broker, trust, bank, or other nominee or fiduciary on non-routine matters are known as “broker non-votes.”

4

HOW CAN I REVOKE MY PROXY AND CHANGE MY VOTE PRIOR TO THE ANNUAL MEETING?

You may change your vote at any time prior to the vote taken at the Annual Meeting. You may revoke or change your vote in any one of four ways:

• | You may notify our Corporate Secretary, at our office at 6300 Blair Hill Lane, Suite 303, Baltimore, MD 21209 or by email to [email protected], in writing that you wish to revoke your proxy. |

• | You may submit a proxy dated later than your original proxy. |

• | You may attend the Annual Meeting and vote by ballot if you are a shareholder of record. Merely attending the Annual Meeting will not by itself revoke a previously authorized proxy. You must submit a ballot and vote your shares of Common Stock at the Annual Meeting. |

• | For shares you hold beneficially or in street name, you may change your vote by following the specific voting instructions provided to you by the record holder to change or revoke any instructions you have already provided or, if you obtained a legal proxy from your broker, trust, bank, or other nominee or fiduciary giving you the right to vote your shares, by attending the Annual Meeting and voting. Again, attendance alone will not by itself revoke a previously authorized proxy. |

The Annual Meeting is currently scheduled to be held at 555 12th Street NW, Washington, D.C. 20004. However, as part of our precautions regarding the coronavirus disease 2019 (COVID-19), we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be set forth in a press release issued by the Company and available at https://ir.fticonsulting.com/press-releases and https://www.virtualshareholdermeeting.com/FCN2021 where you will also find information on how to attend the virtual meeting.

If you plan to attend the Annual Meeting, you must register in advance by no later than May 20, 2021 and follow these instructions to gain admission. Attendance at the Annual Meeting is limited to shareholders as of the close of business on the Record Date or their authorized proxy holders or representatives. Cameras, sound or video recording equipment, cellular telephones, smartphones or other similar equipment, and electronic devices will not be allowed in the meeting room. To gain admission to an in-person Annual Meeting, you must present an admission ticket and valid picture identification, such as a driver’s license or passport.

• | If You Vote by Mail. If you are a shareholder of record and receive your proxy materials by mail, you must mark the box on the proxy card you return to the Company indicating that you will attend the Annual Meeting. Your admission ticket is attached to your proxy card. |

• | If You Vote by Internet. If you are a shareholder of record and receive your materials electronically and authorize a proxy to vote your shares of Common Stock via the Internet, there will be instructions to follow when voting to register to attend the Annual Meeting and print out your admission ticket. |

• | Beneficial Owners. If you are a beneficial owner, bring the notice or voting instruction card that you received from the record holder to be admitted to the Annual Meeting. You will also be asked to present your brokerage statement reflecting your ownership of shares as of the close of business on the Record Date. You will not be able to vote your shares at the Annual Meeting without a legal proxy from the record holder. |

• | Authorized Proxy Holder or Named Representatives. If you are a shareholder as of the close of business on the Record Date and intend to appoint another individual as a proxy holder or authorized named representative to attend the Annual Meeting on your behalf, you must send a written request for an admission ticket by regular mail to our Corporate Secretary at FTI Consulting, Inc., 6300 Blair Hill Lane, Suite 303, Baltimore, MD 21209, by fax to +1.410.951.4878 or by email to [email protected]. Each shareholder may appoint only one proxy holder or authorized representative to attend the meeting on his or her behalf. Requests for authorized proxy holders or named representatives to attend the Annual Meeting must be received by no later than Thursday, May 20, 2021. Please include the following information when submitting your request: (i) your name and complete mailing address; (ii) proof that you own shares of Common Stock of the Company as of the close of business on the Record Date (such as a brokerage statement showing your name and address or a letter from the |

5

brokerage firm, trust, bank, or other nominee or fiduciary holding your shares); (iii) a signed authorization appointing such individual to be your authorized named representative at the meeting, which includes the individual’s name, mailing address, telephone number and email address, and a description of the extent of his or her authority; and (iv) a legal proxy if you intend such representative to vote your shares at the meeting.

• | We reserve the right to deny entry to the Annual Meeting if the above conditions are not satisfied. |

On or about April 19, 2021, we began sending a Notice of Internet Availability of Proxy Materials, including Internet availability of the Annual Report, or the Notice of the Annual Meeting, this Proxy Statement and the Annual Report in paper copies, to the Company’s shareholders of record as of the close of business on the Record Date. The Annual Report does not constitute a part of the proxy solicitation materials. The Annual Report provides you with additional information about the Company. Copies of our Notice of Annual Meeting, Proxy Statement and Annual Report are available on the Company’s website at https://www.fticonsulting.com under “About—Governance— Annual Reports & Proxy Statements—Annual Reports” and “About—Governance—Annual Reports & Proxy Statements—Proxy Statements.”

6

IDENTIFICATION OF CANDIDATES AS DIRECTORS FOR ELECTION AT THE ANNUAL MEETING

Our Board currently consists of eight directors, seven of whom are independent. During the first quarter of each year, the Board and each Committee conducts a self-assessment, which helps to inform the director nomination process. The Nominating, Corporate Governance and Social Responsibility Committee works with our Board to develop the qualifications, attributes and experience required of Board nominees in light of current Board composition, our business and operations, our long-term and short-term plans, applicable legal and listing requirements, and other factors the Nominating, Corporate Governance and Social Responsibility Committee considers relevant.

The Nominating, Corporate Governance and Social Responsibility Committee is authorized, in its sole discretion, to engage outside search firms and consultants to assist with the process of identifying and qualifying candidates for nomination as directors and has the sole authority to negotiate the fees and terms of the retention of such advisors.

The Nominating, Corporate Governance and Social Responsibility Committee evaluates incumbent directors for reelection each year as if they were new candidates. It may identify other candidates for nomination as directors, if necessary, through recommendations from our directors, management, employees, shareholders or outside consultants, as well as through the formal shareholder nomination process described under the section titled “Corporate Governance—Shareholder Nominees for Director” on page 27 of this Proxy Statement. The Nominating, Corporate Governance and Social Responsibility Committee will evaluate candidates in the same manner, regardless of the source of the recommendation.

As part of its refreshment efforts, the Nominating, Corporate Governance and Social Responsibility Committee focuses on ensuring that the non-employee director candidates are independent and have a diverse skill set based on industry and company specific knowledge and will bring unique perspectives to the Board. The Nominating, Corporate Governance and Social Responsibility Committee will also consider gender and other diversity-related attributes when evaluating candidates. Specifically, the refreshment process entails:

7

Key director attributes that are considered by the Nominating, Corporate Governance and Social Responsibility Committee and the Board include:

• | Leadership Experience. Experience holding a significant leadership position in a complex organization or experience dealing with complex problems, including a practical understanding of strategy, processes, risk management and other factors that accelerate growth and change. |

• | Finance or Accounting Experience. Experience with finance and/or financial reporting that demonstrates an understanding of finance and financial information and processes. |

• | Services or Industry Experience. Experience with our key practice offerings or client industries — such as capital markets, mergers and acquisitions, restructuring, consulting, energy, financial institutions, healthcare and telecom, media and technology — to deepen the Board’s understanding and knowledge of our business. |

• | Government Experience. Experience working constructively and proactively with governments and agencies, both foreign and domestic. |

• | Other Public Company Board Experience. Experience serving on the boards and board committees of other public companies provides an understanding of corporate governance practices and trends and insights into board management and the relationships among the board, the chief executive officer and other members of senior management. |

• | Global Experience. Experience managing or growing companies outside the U.S. or with global companies to broaden our knowledge, help direct our global expansion and help navigate the hurdles of doing business outside the U.S. |

• | Diversity. Diversity of gender, background, professional skills and work experience to bring unique perspectives to the Board to help broaden the Company’s understanding and knowledge of the markets we serve. |

In addition, the Nominating, Corporate Governance and Social Responsibility Committee and the Board consider other factors, as they determine to be appropriate, including:

• | Integrity and Credibility. High ethical standards and strength of character in the candidate’s personal and professional dealings and a willingness to be held accountable. |

• | Business Judgment. Mature and practical judgment and a history of making good business decisions in good faith and in a manner that will be in the best interests of the Company and its stakeholders. |

• | Collaborative Work Ethic. Ability to work together with other directors and management to carry out his or her duties in the best interests of the Company and its stakeholders. |

• | Need for Expertise. The extent to which the candidate has some quality or experience that would fill a present need on the Board. |

• | Sufficient Time. The candidate is willing to devote sufficient time and effort to the affairs of the Company, as well as other factors related to the ability and willingness of the candidate to serve on the Board. |

• | Independence. The non-employee director candidate qualifies as independent under the rules of the Company’s Categorical Standards of Director Independence, which can be found in the Governance section of the Company’s website at www.fticonsulting.com/about/governance, and the NYSE’s corporate governance rules. |

8

QUALIFICATIONS OF THE INCUMBENT DIRECTORS

Our director nominees are a diverse group of experienced business leaders who provide unique perspectives to the Company’s business discussions and strategic plans, which we believe is critical to ensuring that we maintain a high-functioning Board. Collectively, the tenure of our director nominees balances deep experience at the Company with fresh perspectives. Our director nominees also have diverse expertise and skills that enable them to effectively carry out their duties and responsibilities.

| | Director | | | Leadership | | | Finance and Accounting | | | Services or Industry | | | Government | | | Other Public Company Board Experience | | | Global | | | Diversity | | | Independence | | |||

| |  | | | Brenda J. Bacon | | | • | | | • | | | • | | | • | | | • | | | | | • | | | • | | |

| |  | | | Mark S. Bartlett | | | • | | | • | | | • | | | | | • | | | • | | | | | • | | ||

| |  | | | Claudio Costamagna | | | • | | | • | | | • | | | | | • | | | • | | | | | • | | ||

| |  | | | Vernon Ellis | | | • | | | • | | | • | | | • | | | | | • | | | | | • | | ||

| |  | | | Nicholas C. Fanandakis | | | • | | | • | | | • | | | | | • | | | • | | | | | • | | ||

| |  | | | Steven H. Gunby | | | • | | | • | | | • | | | | | • | | | • | | | | | | |||

| |  | | | Gerard E. Holthaus | | | • | | | • | | | • | | | | | • | | | • | | | | | • | | ||

| |  | | | Laureen E. Seeger | | | • | | | | | • | | | | | • | | | • | | | • | | | • | | ||

During the first quarter of 2021, the Nominating, Corporate Governance and Social Responsibility Committee discussed with each incumbent director his or her ability to continue to serve as a director if he or she were to be nominated by the Board and reelected by shareholders at the Annual Meeting. All of the incumbent directors welcome the opportunity to continue to serve as a director of the Company if reelected by shareholders at the Annual Meeting.

9

CHARACTERISTICS OF THE INCUMBENT DIRECTORS

Since 2014, we have added three new directors, improving the Board’s gender diversity by adding a second female director and enhancing the Board’s collective expertise — notably in finance and accounting, global business and other public company board experience. Director refreshment has resulted in a diverse group of independent directors with low average tenure, gender diversity and significant experience.

87.5% Independent Directors | | | 25% Female Directors | | | 9.4 Years Average Tenure (50% - 5 to 7 years) | | | 67 Average Age | | | 25% Directors Based Outside of U.S. |

2021 NOMINATIONS OF CANDIDATES AS DIRECTORS FOR ELECTION AT THE ANNUAL MEETING

Following its consideration of the above factors, as well as the qualifications of the incumbent directors, including their ability to continue to serve as directors of the Company following the Annual Meeting, the Nominating, Corporate Governance and Social Responsibility Committee recommended, and the Board nominated, all eight of the incumbent directors to stand for reelection by shareholders at the Annual Meeting:

| | 2021 Director Nominees | | |||

| | Brenda J. Bacon | | | Nicholas C. Fanandakis | |

| | Mark S. Bartlett | | | Steven H. Gunby | |

| | Claudio Costamagna | | | Gerard E. Holthaus | |

| | Vernon Ellis | | | Laureen E. Seeger | |

The Board has established Categorical Standards of Director Independence, which are the same as the NYSE Section 303A standards governing director independence as currently in effect, and recognizes that a director is “independent” if he or she does not have a material relationship with the Company (directly or as a partner, shareholder or officer of an organization that has a relationship with the Company), considering all facts and circumstances that the Board determines are relevant. Our Categorical Standards of Director Independence are available on the Company’s website at https://www.fticonsulting.com/~/media/Files/us-files/our-firm/guidelines/categorical-standards-for-director-independence.pdf. Based on those standards, the Board, upon the recommendation of the Nominating, Corporate Governance and Social Responsibility Committee, affirmatively determined that, other than Steven H. Gunby, the seven current non-employee directors named above who are standing for reelection at the Annual Meeting are independent. Steven H. Gunby is not considered independent since he is our President and Chief Executive Officer (our “CEO”).

In making its independence determinations, the Board considered that Brenda J. Bacon is Chief Executive Officer of Brandywine Senior Living LLC, and Laureen E. Seeger is Chief Legal Officer of the American Express Company, each a client of the Company. The Board found that Ms. Bacon and Ms. Seeger are each independent, after concluding that the Company’s engagements with each employer and its subsidiaries are in the ordinary course of the Company’s business on substantially the same terms as transactions with other clients of the Company for similar services, and neither Ms. Bacon nor Ms. Seeger has received any direct or indirect personal and pecuniary benefits from any such client engagements or transactions. The aggregate fees from such engagements with each of Brandywine Senior Living LLC and its subsidiaries and the American Express Company and its subsidiaries amounted to less than the greater of $1.0 million or 2% of each of such company’s consolidated gross revenues for each year ended December 31, 2018, December 31, 2019 and December 31, 2020.

In addition, during each of the years ended December 31, 2018, December 31, 2019 and December 31, 2020, the Company has not made charitable contributions to any organization in which a director serves as an employee, officer, director or trustee, which in any single year exceeded the greater of $1.0 million or 2% of such organization’s gross revenues.

10

Each of the eight incumbent directors nominated by the Board is standing for reelection at the Annual Meeting. Each nominee, if elected, will serve as a director until the next annual meeting of shareholders and until his or her successor is duly elected and qualifies or until his or her death, resignation, retirement or removal (whichever occurs first).

We do not know of any reason why any nominee would be unable to serve as a director, if elected. If any nominee is unable to serve or for good cause will not serve, which is not anticipated, the Nominating, Corporate Governance and Social Responsibility Committee may identify and recommend a candidate or candidates to the Board as a potential substitute nominee or nominees, and, if the Board agrees with the Nominating, Corporate Governance and Social Responsibility Committee’s recommendation, it will nominate such person(s). If that happens, all valid proxies will be voted “FOR” the election of the substitute nominee or nominees designated by the Board. Alternatively, the Board may determine to keep a vacancy open or reduce the size of the Board. Shareholders may not vote for a greater number of persons than the number of nominees named.

More detailed information about each of the eight nominees is provided in the section of this Proxy Statement titled “Information about the Board of Directors and Committees—Information about the Nominees for Director” beginning on page 12 of this Proxy Statement.

Our policy is that all incumbent directors are expected to attend the annual meeting of shareholders, except in cases of serious illness or extreme hardship.

Shareholder Approval Required. Each nominee will be elected as a director if he or she receives the affirmative vote of a majority of the total votes cast “FOR” and “WITHHELD” with respect to his or her election as a director at the Annual Meeting. Abstentions or broker non-votes are not counted as votes cast either “FOR” or “WITHHELD” with respect to a director’s election and will have no effect on the election of directors. Any incumbent director who does not receive the required vote will be subject to our mandatory resignation policy, which is described in the section of this Proxy Statement titled “Corporate Governance—Our Significant Corporate Governance Policies and Practices” beginning on page 23 of this Proxy Statement.

The Board of Directors Unanimously Recommends That You Vote FOR the Election of All Eight Nominees as Directors.

11

All of the nominees were elected as directors of the Company at the 2020 annual meeting of shareholders held on June 3, 2020 (the “2020 Annual Meeting”). Information about each of the eight incumbent directors nominated to stand for election at the Annual Meeting is detailed below:

| | 2021 Nominees for Director | | | Principal Occupation and Business Experience | |

| |  Brenda J. Bacon Independent Director Director Since: 2006 Age: 70 | | | Brenda Bacon has been President and Chief Executive Officer of Brandywine Senior Living LLC for more than 15 years. Ms. Bacon co-founded Brandywine Living in 1996. Brandywine Senior Living LLC currently has 32 operating properties in seven states, with additional communities in development. Brandywine Living is a growing platform for luxury senior living with supportive services. Ms. Bacon served as Chief of Management and Planning, a cabinet-level position for the State of New Jersey under former New Jersey Governor James J. Florio from 1989 to 1993. During President Clinton’s first term, Ms. Bacon was on loan to the Presidential Transition Team, as co-chair for the transition of the Department of Health and Human Services. Public Company Directorships and Committees: Hilton Grand Vacations Inc. [Member of Audit Committee and Nominating and Corporate Governance Committee] Other Select Non-Public Directorships and Committees: Argentum [Director] Rowan University [Trustee] [Member of University Advancement Committee] | |

| |  Mark S. Bartlett Independent Director Director Since: 2015 Age: 70 | | | Mark Bartlett has extensive accounting and financial services experience, having retired as a Partner of Ernst & Young LLP, a leading accounting firm, in June 2012. Mr. Bartlett joined Ernst & Young in 1972 and worked there until his retirement, serving as Managing Partner of the firm’s Baltimore office and Senior Client Service Partner for the Mid-Atlantic region. He is a certified public accountant. Public Company Directorships and Committees: Rexnord Corporation [Lead Independent Director] [Member of Audit Committee and Executive Committee] T. Rowe Price Group, Inc. [Chair of Audit Committee and Member of Executive Compensation and Management Development Committee] WillScot Mobile Mini Holdings Corp. [Chair of Audit Committee and Member of Compensation Committee and Related Party Transactions Committee] Past Public Company Directorships: WillScot Corp. Other Select Non-Public Directorships and Committees: The Baltimore Life Companies [Chair of Audit Committee] | |

12

| | 2021 Nominees for Director | | | Principal Occupation and Business Experience | |

| |  Claudio Costamagna Independent Director Director Since: 2012 Age: 65 | | | Claudio Costamagna is Chairman of CC e Soci S.r.l., a financial advisory firm he founded in June 2007, and CC Holdings S.r.L., its parent. Mr. Costamagna has extensive experience in investment banking, having served for 18 years, until April 2006, in various positions with The Goldman Sachs Group, Inc., culminating as Chairman of the Investment Banking Division in Europe, the Middle East and Africa from December 2004 to March 2006. Past Public Company Directorships: Advanced Accelerator Applications S.A. [Chairman] Other Select Non-Public Directorships and Committees: CC e Soci S.r.l. [Chairman] Finavedi S.p.A. Italiana Petroli S.p.A. Salini Costruttori S.p.A | |

| |  Sir Vernon Ellis Independent Director Director Since: 2012 Age: 73 | | | Sir Vernon Ellis served as Chair of the Board of Trustees of the British Council, the United Kingdom’s international organization for cultural relations and education opportunities, from March 2010 to March 2016. He has extensive experience in international management consulting, having retired from Accenture (UK) Limited, a leading global professional services firm, in March 2010, after holding the position of Senior Advisor from January 2008 to March 2010 and International Chairman from January 2001 to December 2007 and holding other major operational roles prior to 2001. Other Select Non-Public Directorships and Committees: Martin Randall Travel Ltd. [Chairman] | |

13

| | 2021 Nominees for Director | | | Principal Occupation and Business Experience | |

| |  Nicholas C. Fanandakis Independent Director Director Since: 2014 Age: 64 | | | Nicholas Fanandakis has served as Senior Advisor to the Chief Executive Officer of DuPont de Nemours, Inc. (“DuPont”), a leading global research and technology-based science company, since February 2020. In June 2019, Mr. Fanandakis retired as an Executive Vice President of DuPont after 40 years of service. Mr. Fanandakis helped lead the company through the merger with The Dow Chemical Company and then subsequent separations. From November 2009 to September 1, 2017, Mr. Fanandakis served as Chief Financial Officer and Executive Vice President of DuPont and led the company through major portfolio transformations. Mr. Fanandakis joined DuPont in 1979 as an accounting and business analyst. Mr. Fanandakis also served in a variety of plant, marketing, product management and business director roles. Mr. Fanandakis served as Group Vice President of DuPont Applied BioSciences from 2008 to 2009. Mr. Fanandakis also served as Vice President and General Manager of DuPont Chemical Solutions Enterprise from 2003 until February 2007, when he was named Vice President of DuPont Corporate Plans. Public Company Directorships and Committees: Duke Energy Corp. [Member of Audit Committee and Finance and Risk Management Committee] ITT Inc. [Member of Audit Committee and Compensation Committee] | |