Form DEF 14A FIRST CITIZENS BANCSHARE

Table of Contents

☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material Under Rule 240.14a-12 | |

☒ |

No fee required. | |||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

Table of Contents

4300 Six Forks Road

Raleigh, North Carolina 27609

NOTICE OF VIRTUAL ANNUAL MEETING OF STOCKHOLDERS

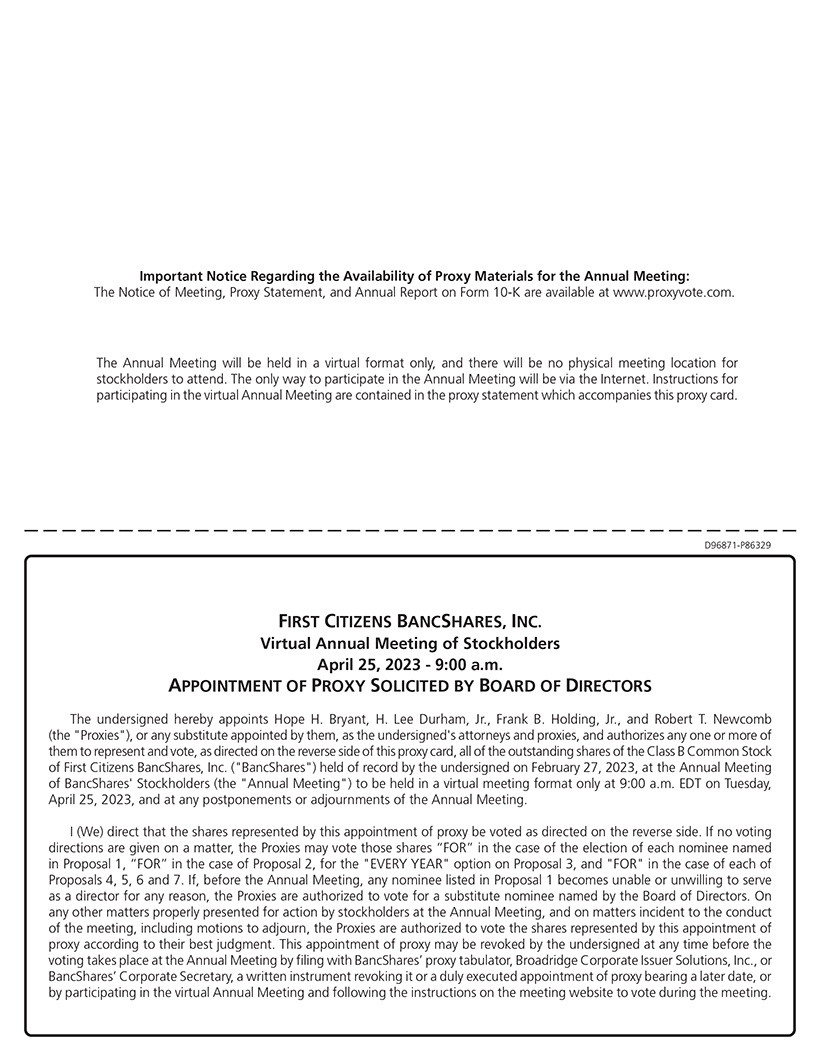

The Annual Meeting of stockholders of First Citizens BancShares, Inc. will be held at 9:00 a.m. EDT on Tuesday, April 25, 2023, in a virtual meeting format only at www.virtualshareholdermeeting.com/FCNCA2023. A virtual annual meeting is a meeting in which stockholders, management, and directors are not physically in the same room but attend the meeting through means of remote communication. Stockholders may participate in the Annual Meeting virtually via live audio webcast, and they may submit written questions during the meeting, but there will be no physical meeting location for stockholders to attend the Annual Meeting.

The purposes of the meeting are:

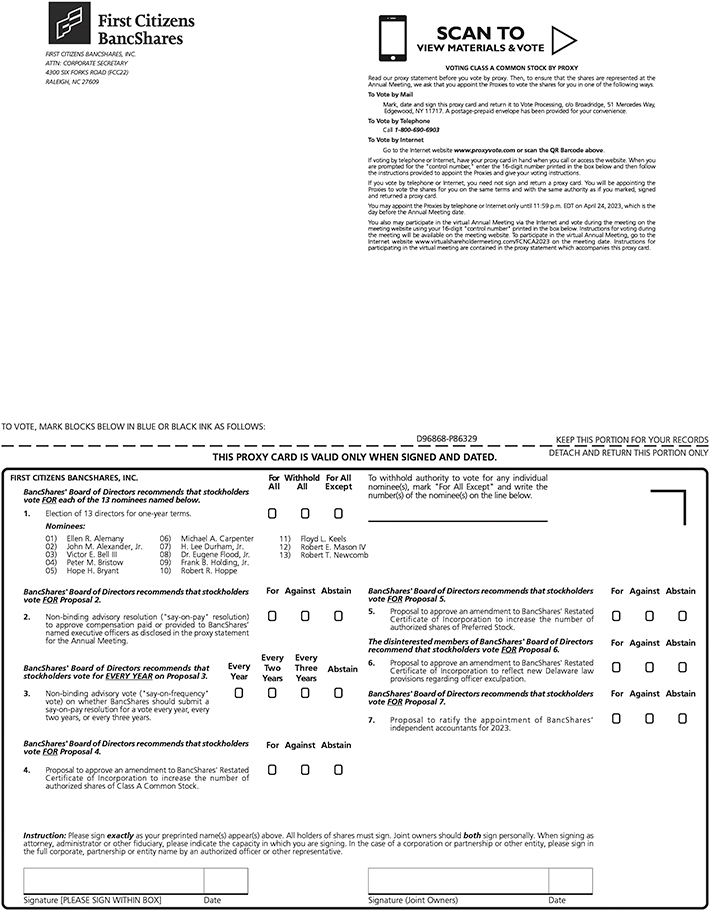

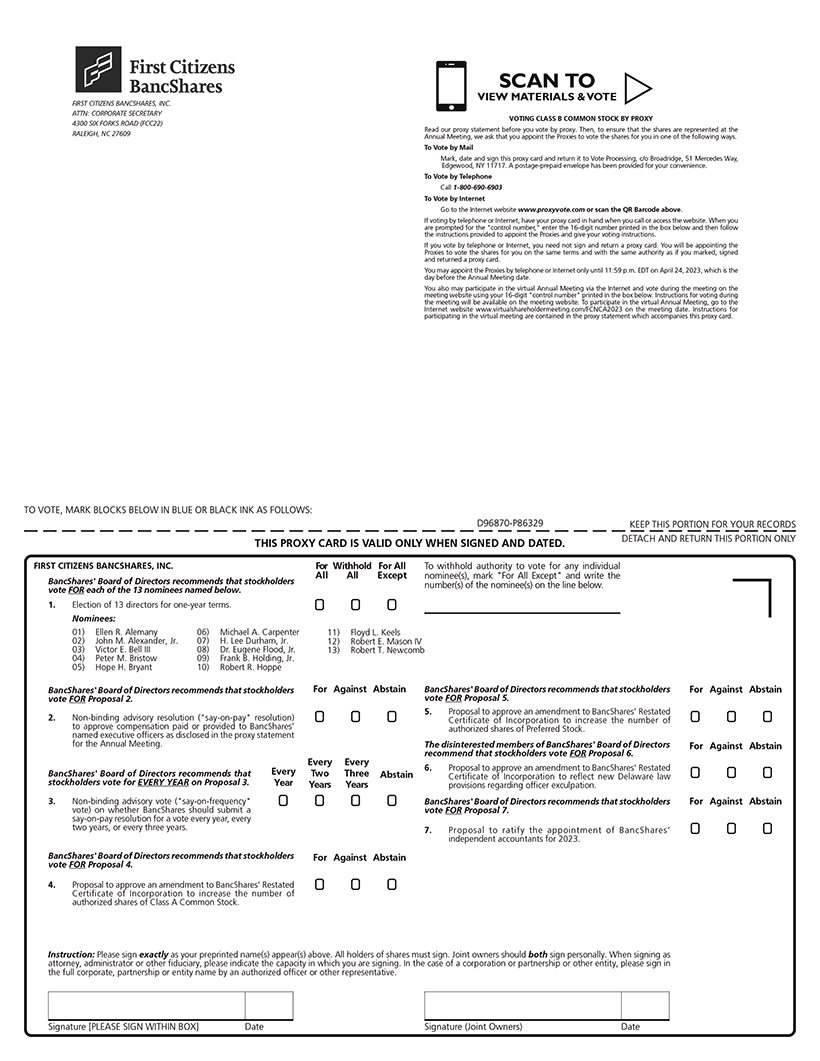

| 1. | Election of Directors: To elect 13 directors for one-year terms; |

| 2. | Advisory Vote on Executive Compensation: To vote on a non-binding advisory resolution to approve compensation paid or provided to our named executive officers as disclosed in our proxy statement for the Annual Meeting (a “say-on-pay” resolution); |

| 3. | Advisory Vote on the Frequency of “Say-On-Pay” Votes. To hold a non-binding advisory vote on whether we should submit a say-on-pay resolution for a vote of our stockholders every year, every two years, or every three years (a “say-on-frequency” vote); |

| 4. | Increase in Authorized Shares of Class A Common Stock: To vote on a proposal to approve and adopt an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of our Class A Common Stock; |

| 5. | Increase in Authorized Shares of Preferred Stock: To vote on a proposal to approve and adopt an amendment to our Restated Certificate of Incorporation to increase the number of authorized shares of our Preferred Stock; |

| 6. | Officer Exculpation: To vote on a proposal to approve and adopt an amendment to our Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation; and |

| 7. | Ratification of Appointment of Independent Accountants: To vote on a proposal to ratify the appointment of KPMG LLP as our independent accountants for 2023. |

Our Board of Directors unanimously recommends that you vote:

“FOR” each of the nominees named in the enclosed proxy statement for election as directors;

“FOR” Proposal 2; on Proposal 3, for us to submit a “say-on-pay” resolution for an advisory vote of our stockholders “EVERY YEAR;” and

“FOR” Proposals 4, 5 and 7.

The disinterested members of our Board of Directors unanimously recommend that you vote “FOR” Proposal 6.

In addition to the matters listed above, at the Annual Meeting our stockholders will vote on such other matters as may properly come before the meeting. The Board of Directors currently knows of no matters that may be voted upon at the Annual Meeting other than the matters listed above.

The record date for the determination of stockholders entitled to vote at the Annual Meeting is February 27, 2023 (the “Record Date”). You are entitled to participate remotely in the Annual Meeting if you were a holder of record, or the beneficial owner in “street name,” of shares of our Class A Common Stock or Class B Common Stock as of the close of business on the Record Date. Stockholders may cast one vote for each share of our Class A Common Stock and 16 votes for each share of our Class B Common Stock they held on the Record Date.

Table of Contents

To attend the Annual Meeting, go to www.virtualshareholdermeeting.com/FCNCA2023 on the meeting date and enter your unique 16-digit “Control Number” which is printed on the proxy card you received with your copy of our Proxy Statement or, if you are the beneficial owner of shares held in street name, on the voting instruction form you received from your bank, broker, or other nominee that is the record holder of your shares. The Control Number appears on the portion of your proxy card or voting instruction form that you retain. During the Annual Meeting, you may listen to the proceedings, submit written questions and, if you are a record holder of shares, vote your shares or, if your shares are held in street name, submit your voting instructions to your broker or other nominee, by following the instructions available on the meeting website. If you wish to participate in the Annual Meeting but no longer have your Control Number, record holders of shares may obtain their Control Numbers by calling Broadridge Corporate Issuer Solutions at 855-449-0981 for assistance, and beneficial holders of shares held in street name should call their bank, broker or other nominee.

Help and technical support for accessing and participating in the virtual Annual Meeting will be available on the day of the meeting by calling 844-986-0822 (U.S.) or 303-562-9302 (International). You may begin to log into the meeting website at 8:45 a.m. EDT on the meeting date.

You are invited to participate in the virtual Annual Meeting. However, if you are the record holder of your shares of our common stock, we ask that you appoint the Proxies named in the enclosed proxy statement to vote your shares for you by signing, dating, and returning the enclosed proxy card, or following the instructions in the proxy statement and on your proxy card to appoint the Proxies by telephone or Internet. If your shares are held in street name by a broker or other nominee, the record holder of your shares must vote them for you, so you should follow your broker’s or nominee’s directions and give it instructions as to how you want it to vote your shares. Even if you plan to participate in the Annual Meeting, voting by proxy, or giving voting instructions to your broker or nominee, will help us ensure that your shares are represented and that a quorum is present at the meeting. If you sign a proxy card or appoint the Proxies by telephone or Internet, you may later revoke your appointment or change your vote by following the instructions in the accompanying proxy statement, or by attending the Annual Meeting remotely and voting shares you hold of record on the meeting website. Attending the Annual Meeting alone will not revoke a proxy card.

In the unlikely event that, for any reason, we are not able to convene the Annual Meeting, or if, after being convened, the meeting is interrupted and cannot be continued, including due to loss of internet connectivity or communications capabilities, power failure, or other technical difficulties, the meeting will be adjourned. If a verbal or written announcement of a later date and time for reconvening the meeting is made during the meeting or on the meeting website, the meeting will be reconvened on that date and at that time in a virtual meeting format at the same web address listed above (www.virtualshareholdermeeting.com/FCNCA2023). In the event of such an adjournment, no further notice of the date and time of the reconvened meeting will be given. The instructions described in the accompanying proxy statement for accessing, participating in, and voting at the original meeting will apply to any such reconvened meeting.

This notice and the enclosed proxy statement and proxy card are being mailed to our stockholders on or about March 13, 2023.

By Order of the Board of Directors

Matthew G. T. Martin

Corporate Secretary

Table of Contents

PROXY STATEMENT TABLE OF CONTENTS

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| 35 | ||||

| Tax and Accounting Considerations; Deductibility of Executive Compensation |

35 | |||

| 36 | ||||

| 37 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 44 |

| 46 | ||||

| 46 | ||||

| 48 | ||||

| 50 | ||||

| 54 | ||||

| 57 | ||||

| 59 | ||||

| 61 | ||||

| 61 | ||||

| 62 | ||||

| 66 | ||||

| 67 | ||||

| 67 | ||||

| 68 | ||||

| 70 | ||||

| 70 | ||||

| 71 | ||||

| 71 | ||||

| 73 | ||||

| 75 | ||||

| 76 | ||||

| PROPOSAL 3: ADVISORY VOTE ON THE FREQUENCY OF SAY-ON-PAY VOTES |

78 | |||

| 79 | ||||

| 81 | ||||

| 83 | ||||

| PROPOSAL 7: RATIFICATION OF APPOINTMENT OF INDEPENDENT ACCOUNTANTS |

84 | |||

| 84 | ||||

| 85 | ||||

| 86 | ||||

| 91 | ||||

| 92 | ||||

| 93 | ||||

| A-1 | ||||

| B-1 | ||||

| C-1 | ||||

| D-1 | ||||

| E-1 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE VIRTUAL STOCKHOLDER MEETING TO BE HELD ON APRIL 25, 2023.

The notice of meeting, proxy statement and annual report to security holders are available at:

www.proxyvote.com.

In connection with the solicitation of proxy appointments for the Annual Meeting, we have not authorized anyone to give you any information, or make any representation, that is not contained in this proxy statement. If anyone gives you any other information or makes any other representation, you should not rely on it as having been authorized by us.

Table of Contents

|

Physical Address: 4300 Six Forks Road Raleigh, North Carolina 27609

Principal Office Mailing Address: Post Office Box 27131 Raleigh, North Carolina 27611-7131 |

PROXY STATEMENT

VIRTUAL ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is dated March 6, 2023, and is being furnished to our stockholders on or about March 13, 2023, by the Board of Directors of First Citizens BancShares, Inc., in connection with our solicitation of proxy appointments in the form of the enclosed proxy card for use at the 2023 Annual Meeting of our stockholders and at any adjournments of the meeting.

SUMMARY

This summary highlights information about our company and information contained elsewhere in this proxy statement, but it does not contain all the information that you should consider. You should carefully read this entire proxy statement and the detailed financial information contained in our Annual Report on Form 10-K for the year ended December 31, 2022, which accompanies this proxy statement, before you vote. Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

2023 Annual Meeting of Stockholders

| Time and Date Tuesday, April 25, 2023 9:00 a.m. EDT |

Virtual Location www.virtualshareholdermeeting.com/FCNCA2023 |

Record Date February 27, 2023 | ||

Voting Securities

Our voting securities are the outstanding shares of our Class A Common Stock (“Class A Common”) and Class B Common Stock (“Class B Common”). On the Record Date for the meeting, there were 13,502,763 and 1,005,185 outstanding shares of Class A Common and Class B Common, respectively. You may cast one vote for each share of Class A Common, and 16 votes for each share of Class B Common, that you held of record on the Record Date on each director to be elected and on each other matter voted on by stockholders at the Annual Meeting. Votes may not be cumulated in the election of directors.

Proposals and Voting Recommendations

At the Annual Meeting, our stockholders will vote on the following proposals:

| Proposal Number |

Description | Votes Required for Approval |

Voting Recommendation | Page | ||||

|

1 |

Election of 13 directors |

Plurality of votes cast in election by holders of Class A Common and Class B Common represented at the meeting and voting together as one class |

|

9 | ||||

| 2 |

“Say on pay” vote on executive compensation |

Majority of votes entitled to be cast with respect to shares of Class A Common and Class B Common represented at the meeting and voting together as one class |

|

76 | ||||

| 3 |

“Say on frequency” vote on executive compensation |

The option receiving the most votes of holders of Class A Common and Class B Common represented at the meeting and voting together as one class will be considered to be the preference of our stockholders |

“EVERY YEAR” |

78 | ||||

Table of Contents

| Proposal Number |

Description | Votes Required for Approval |

Voting Recommendation | Page | ||||

| 4 |

Proposal to amend Restated Certificate of Incorporation to increase the number of authorized shares of our Class A Common Stock |

Majority of votes entitled to be cast with respect to (i) all outstanding shares of Class A Common and Class B Common voting together as one class, and of (ii) all outstanding shares of Class A Common voting as a separate class |

|

79 | ||||

| 5 |

Proposal to amend Restated |

Majority of votes entitled to be cast with respect to all outstanding shares of Class A Common and Class B Common voting together as one class |

|

81 | ||||

| 6 |

Proposal to amend Restated |

Majority of votes entitled to be cast with respect to all outstanding shares of Class A Common and Class B Common voting together as one class |

|

83 | ||||

| 7 |

Ratification of appointment of independent accountants |

Majority of votes entitled to be cast with respect to shares of Class A Common and Class B Common represented at the meeting and voting together as one class |

|

84 | ||||

Stockholders also will vote on such other matters as may properly come before the meeting. Our Board of Directors currently knows of no matters that may be voted on at the Annual Meeting other than the matters listed above.

Proxy Voting Methods

Record holders of our common stock may vote in the following ways. More detailed instructions for voting are contained in this proxy statement under the heading “FREQUENTLY ASKED QUESTIONS ABOUT THE VIRTUAL ANNUAL MEETING.”

|

|

|

| |||

| INTERNET Visit www.proxyvote.com and follow the instructions on your proxy card. |

TELEPHONE Call 1-800-690-6903 and follow the instructions on your proxy card. |

Sign, date, and mail your proxy card in the enclosed envelope. |

DURING THE MEETING Vote online during the meeting by following the instructions on page 86. |

Even if you plan to participate remotely in the virtual Annual Meeting, to ensure that your shares will be represented at the meeting we encourage record holders of shares to vote their shares in advance online, by phone or by mail, and beneficial holders of shares held in “street name” to give their voting instructions in advance to their banks, brokers or other nominees.

2023 Director Nominees

The 13 nominees for election as directors at the Annual Meeting are listed below. Further information regarding the nominees is contained in this proxy statement under the heading “PROPOSAL 1. ELECTION OF DIRECTORS.”

| Name and Age |

Principal Occupation |

Independent Director? |

Committee Memberships | Board Tenure |

2022 Board and Committee Meeting Attendance | |||||||||||||

| Audit | CNG | Risk | Trust | Executive | ||||||||||||||

| Ellen R. Alemany 67 |

Special Advisor to our Chairman and CEO | — | — | — | — | — | — | 1 year | 100% | |||||||||

| John M. Alexander, Jr. 73 | Manager, McKnitt and Associates, LLC |

|

|

— | — |

Chairman |

— | 33 years | 100% | |||||||||

| Victor E. Bell, III 66 |

Chairman and President, Marjan, Ltd. |

|

— |

|

|

— | — | 21 years | 100% | |||||||||

2

Table of Contents

| Name and Age |

Principal Occupation |

Independent Director? |

Committee Memberships | Board Tenure |

2022 Board and Committee Meeting Attendance | |||||||||||||

| Audit | CNG | Risk | Trust | Executive | ||||||||||||||

| Peter M. Bristow 57 |

Our and FCB’s President | — | — | — | — | — | — | 9 years | 100% | |||||||||

| Hope H. Bryant 60 |

Our and FCB’s Vice Chairwoman | — | — | — | — |

|

|

17 years | 89% | |||||||||

| Michael A. Carpenter 75 |

Retired; former Chief Executive Officer, Ally Financial, Inc. |

|

|

— | — | — | — | 1 year | 100% | |||||||||

| H. Lee Durham, Jr. 74 |

Retired Certified Public Accountant; former partner, Pricewaterhouse- Coopers LLP |

|

Chairman |

|

— | — |

|

20 years | 94% | |||||||||

| Dr. Eugene Flood, Jr. 67 |

Managing Partner, A Capella Partners; retired President and Chief Executive Officer, Smith Breeden Associates |

|

— |

|

|

— | (1) | (1) | ||||||||||

| Frank B. Holding, Jr. 61 |

Our and FCB’s Chairman and Chief Executive Officer | — | — | — | — | — |

Chairman |

30 years | 100% | |||||||||

| Robert R. Hoppe 71 |

Retired Certified Public Accountant; former partner, Pricewaterhouse- Coopers LLP |

|

— | — |

Chairman |

— |

|

9 years | 100% | |||||||||

| Floyd L. Keels 75 |

Retired; former President and Chief Executive Officer, Santee Electric Cooperative, Inc. |

|

|

— | — |

|

— | 9 years | 100% | |||||||||

| Robert E. Mason IV 64 |

Chairman, Robert E. Mason and Associates, Inc. |

|

— |

|

|

— | — | 16 years | 100% | |||||||||

| Robert T. Newcomb 62 |

Former Owner and President and current employee, Newcomb and Company |

|

|

Chairman |

— | — |

|

21 years | 100% | |||||||||

| (1) | Dr. Flood was first appointed by the Board to serve as our and FCB’s director, and as a member of the committees indicated above, effective January 1, 2023. |

Current Board Profile

| New Nominees in the Last 2 years |

Median Tenure |

Median Age |

Diverse by Race or Gender |

Independent | ||||

| 4 of 14 (29%) | 12.5 Years | 67 | 4 of 14 (29%) | 10 of 14 (71%) | ||||

3

Table of Contents

Board Diversity

The table below contains information regarding the diversity of our Board of Directors.

| BOARD DIVERSITY MATRIX (as of March 6, 2023) | ||||||||

| Total number of directors |

14 | |||||||

| Female | Male | Non-Binary | Did not Disclose Gender |

|||||||||||||

| Part I: Gender Identity |

||||||||||||||||

| Number of directors based on gender identity |

2 | 12 | — | — | ||||||||||||

| Part II: Demographic Background |

|

|||||||||||||||

| African American or Black |

— | 2 | — | — | ||||||||||||

| Alaskan Native or Native American |

— | — | — | — | ||||||||||||

| Asian |

— | — | — | — | ||||||||||||

| Hispanic or Latinx |

— | — | — | — | ||||||||||||

| Native Hawaiian or Pacific Islander |

— | — | — | — | ||||||||||||

| White |

2 | 9 | — | — | ||||||||||||

| Two or more races or ethnicities |

— | — | — | — | ||||||||||||

| LGBTQ+ |

— | |||||||||||||||

| Did not disclose demographic background |

2 | |||||||||||||||

| BOARD DIVERSITY MATRIX (as of March 4, 2022) | ||||||||

| Total number of directors |

14 | |||||||

| Female | Male | Non-Binary | Did not Disclose Gender |

|||||||||||||

| Part I: Gender Identity |

||||||||||||||||

| Number of directors based on gender identity |

2 | 12 | — | — | ||||||||||||

| Part II: Demographic Background |

|

|||||||||||||||

| African American or Black |

— | 1 | — | — | ||||||||||||

| Alaskan Native or Native American |

— | — | — | — | ||||||||||||

| Asian |

— | — | — | — | ||||||||||||

| Hispanic or Latinx |

— | — | — | — | ||||||||||||

| Native Hawaiian or Pacific Islander |

— | — | — | — | ||||||||||||

| White |

2 | 10 | — | — | ||||||||||||

| Two or more races or ethnicities |

— | — | — | — | ||||||||||||

| LGBTQ+ |

— | |||||||||||||||

| Did not disclose demographic background |

2 | |||||||||||||||

Human Capital

It is important to us that our associates feel included, valued, respected, and heard in a workplace that supports and encourages an inclusive culture. Our commitment to inclusion, equity, and diversity enhances associate and customer experiences, builds relationships, and drives innovation of our products and services.

In addition to fostering an inclusive workplace environment for associates, a top priority for our senior management is ensuring that we attract, retain, and develop talented associates who will meet the future needs of FCB as we grow. We make talent attraction and retention a priority by offering internal career mobility, opportunities to upskill via individual development plans, a total rewards package that emphasizes a holistic approach to well-being, and a thoughtful approach to performance management.

We value relationships and create opportunities for our associates to broaden their networks through business resource groups or charitable events in the communities where our associates live and work. At FCB, associates are our most critical resource. By prioritizing them, we can meet our key business objectives — attracting, developing, and retaining the talent needed to support our ongoing business trajectory.

Information about our inclusion, equity, and diversity commitment, focus and strategies is available on our website at www.firstcitizens.com/about-us/inclusion-equity-diversity.

4

Table of Contents

Risk Management

2022 Business Highlights

For the year ended December 31, 2022, our net income was $1.10 billion, or $67.40 per common share on a diluted basis, compared to $547 million, or $53.88 per common share on a basic and diluted basis, in 2021. The $551 million, or 101%, increase was primarily due to our merger with CIT. Our return on average assets was 1.01% during 2022 compared to 1.00% during 2021. Our return on average common equity was 11.15% and 12.84% for 2022 and 2021, respectively.

| ● Transformational Merger — We successfully completed the acquisition of CIT on January 3, 2022, our largest acquisition to date. CIT had consolidated total assets of approximately $53.24 billion as of December 31, 2021. This transformational merger brought together complementary strengths of both organizations, combining our robust retail franchise and full suite of banking products with CIT’s strong market position in nationwide commercial lending and direct digital banking. We substantially completed integration efforts in 2022 and are now focused on creating positive operating leverage by growing revenues and optimizing our operations. |

| ● Net Interest Income — Net interest income for the year ended December 31, 2022, was $2.95 billion, an increase of $1.56 billion, or 112%, compared to the same period of 2021. This increase was primarily due to the CIT merger, loan growth and higher yields on interest-earning assets, partially offset by higher rates paid on interest-bearing deposits and a decline in interest income on SBA-PPP loans. |

| ● Net Interest Margin Expansion — Net interest margin for the year ended December 31, 2022, was 3.14%, an increase of 48 basis points compared to 2.66% in 2021. The increase in net interest margin was driven by an increase in earning assets, improved earning asset yields and an improved mix of earnings assets given strong loan growth, partially offset by higher funding costs. |

| ● Noninterest Income Improvement — Noninterest income for the year ended December 31, 2022, was $2.14 billion, an increase of $1.63 billion compared to $508 million for 2021. The year ended December 31, 2022, includes a gain on acquisition of $431 million. The remaining increase was primarily driven by the added activity from the CIT merger, including rental income on operating lease equipment of $864 million. |

| ● Organic Loan Growth — Loan growth was strong in 2022 and loans totaled $70.78 billion at December 31, 2022, an increase of $38.41 billion, or 84%, since December 31, 2021, driven primarily by the addition of $32.71 billion in loans from the CIT merger and $5.70 billion in organic growth. During 2022, we continued to see growth in our branch network, as well as growth in our commercial bank from a number of our industry verticals, business capital, as well as growth in mortgage loans. |

5

Table of Contents

| ● Asset Quality Remained Solid, But is Normalizing — Net charge-offs totaled 0.12% of average loans during 2022, up from 0.03% during 2021. The allowance for credit losses as a percentage of total loans was 1.30% at December 31, 2022, an increase of 75 basis points from 0.55% at December 31, 2021 primarily due to the loans and leases acquired in the CIT merger. Nonperforming assets as a percentage of total loans was 0.95% as of December 31, 2022, increasing from a historic low of 0.49% at December 31, 2021 due to both the CIT merger and an increase in problem assets. |

| ● Well-Capitalized — We remain well-capitalized with a total risk-based capital ratio of 13.18%, a Tier 1 risk-based capital ratio of 11.06%, a common equity Tier 1 ratio of 10.08% and a Tier 1 leverage ratio of 8.99% at December 31, 2022. During the second half of 2022, we returned $1.24 billion in capital to our stockholders with the execution of a share repurchase program where we repurchased 1,500,000 shares of our Class A Common. |

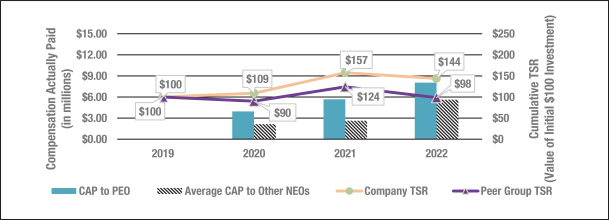

2022 Executive Compensation Actions and Decisions

| Compensation, Nominations and Governance (“CNG”) Committee Objectives |

2022 CNG Committee Compensation Actions and Decisions in Support of Objectives | |

| ● Rewarding sustained long-term performance and long-term service and loyalty. |

● LTIP Award Payments and Grants. Approved the grant of new cash-based performance awards under FCB’s Long-Term Incentive Plan (the “LTIP”) for a three-year performance period (2022-2024) based on the same performance criteria as in prior years (growth in the tangible book value per share of our common stock plus cumulative dividends paid per share on the stock), but with increased performance goals as compared to awards in prior years to account for the impact of our merger with CIT on the attainability of performance goals. | |

| ● Balancing business risk with sound financial policy and stockholders’ interests, and aligning the interests of our executive officers with the long-term interests of our stockholders by encouraging growth in the value of our company and our stockholders’ investments. |

● Continued Focus on Performance-Based Compensation Relative to Total Compensation. Recommended no increases for 2022 in the base salaries of our named executive officers, or the “target” opportunity levels of LTIP awards for the 2022-2024 performance period, but increased the individual “stretch” opportunity levels with respect to new performance-based LTIP awards. ● LTIP Performance Goals. Continued to base LTIP performance awards primarily on the growth in tangible book value, which the CNG Committee believes is a key driver of long-term value, and increased the “target” and “stretch” performance goals for the 2022-2024 performance period. | |

| ● Enabling us to attract, motivate and retain qualified executive officers. |

● Merger Performance Plan. Approved the Merger Performance Plan (“MPP”) to motivate and reward eligible associates who have significant involvement in and responsibility for post-acquisition processes by offering them cash incentives dependent on realization of benefits to our company and stockholders of mergers we engage in. The Committee approved award opportunities under the MPP for the 2022 performance period with performance goals tied to timely achievement of integration and conversion milestones and the realization of merger cost savings and synergies, as well as individual performance, related to our merger with CIT. | |

6

Table of Contents

| Compensation, Nominations and Governance (“CNG”) Committee Objectives |

2022 CNG Committee Compensation Actions and Decisions in Support of Objectives | |

| ● Providing compensation to our executive officers that is competitive with comparable financial services companies. |

● Future Pay Competitiveness. With the CNG Committee’s independent compensation consultant, continued to assess the future competitiveness of our executives’ compensation against larger regional financial institutions with which we compete following our merger with CIT. | |

Corporate Governance Highlights

| Board Structure | ● Annual Election of all Directors. Directors are elected for one-year terms. ● Retirement Policy. No person is eligible to stand for election as a director at any stockholder meeting following the calendar year in which he or she reaches 75 years of age, subject to waivers that the Board considers compelling. ● Board and Committee Evaluation. The CNG Committee conducts annual Board and committee performance self-assessments encompassing duties and responsibilities, Board and committee structure, culture, process and execution. | |

| Director Independence | ● Independent Director Nominees. Nine of 13 director nominees are independent. ● Annual Independence Determination. The CNG Committee reviews the independence of outside directors each year in connection with the Boards’ annual determination of director independence. ● Annual Election of Lead Independent Director. Independent directors each year elect a Lead Independent Director who has broad authority and responsibility over Board governance and operation. ● Key Committees Independent. Independent directors comprise 100% of each of the Audit, CNG and Risk Committees. ● Regular Executive Sessions. Independent directors meet in executive session on a regular basis without members of management present. ● Ability to Hire Outside Experts and Consultants. Independent directors and committees have the ability to hire outside experts and consultants and conduct independent investigations. ● Interaction with Senior Executives and Associates. Directors have significant interaction with senior executives and access to other associates. | |

| Other Governance Practices | ● Clawback Policy. The clawback policy included in our Incentive Compensation Policy (which we expect to amend during 2023 to conform to new listing requirements to be adopted by The Nasdaq Stock Market) permits us to recoup certain incentive compensation payments in the event that a significant accounting restatement occurs due to material non-compliance with any financial reporting requirement under Federal securities laws, a performance metric or calculation used in determining performance-based compensation was materially inaccurate, or a significant violation of our Code of Ethics, as determined by the CNG Committee, results in a financial or reputational impact on FCB. ● CEO Evaluations. The CNG Committee conducts annual evaluations of our CEO’s performance. | |

7

Table of Contents

|

|

● Human Capital Management. The Risk Committee, through the Operational Risk and Compliance Risk Committees, and with the Human Resources Department, oversees human capital management risks, including strategies and initiatives on hiring, retention, inclusion, equity and diversity, associate well-being, and engagement. ● Cyber Risk/Business Continuity. The Risk Committee periodically reviews information security policies and technology risk management programs and practices that are designed to protect data, records, and proprietary information, and it reviews reports on our business continuity and disaster recovery program that is designed to safeguard against disruptions such as cyber events, natural disaster and man-made events. ● Stock Ownership Requirement. Each director is encouraged to own an amount of our stock that is significant in light of his or her financial means. ● No Hedging of our Common Stock. Our hedging policy prohibits our directors and executive officers from hedging any shares of our common stock. ● No Pledging of our Common Stock. Our pledging policy generally prohibits any director or executive officer from pledging any shares of our common stock that he or she owns or controls, subject to “grandfathered” pledges and exceptions approved by the Audit Committee for pledge arrangements that are not reasonably likely to pose a material risk to our company or the market for our common stock. |

Proxy Statement Definitions

In this proxy statement, except where the context indicates otherwise:

| ● | “you,” “your” and similar terms refer to the stockholder receiving it; |

| ● | “we,” “us,” “our” and similar terms refer to First Citizens BancShares, Inc. and, as the context may require, collectively to us and First-Citizens Bank & Trust Company, our bank subsidiary; |

| ● | “FCB” refers to First-Citizens Bank & Trust Company; |

| ● | “FCB-SC” refers to the former First Citizens Bank and Trust Company, Inc., Columbia, South Carolina, which, along with its parent holding company, First Citizens Bancorporation, Inc., we acquired in a merger transaction during 2014; |

| ● | “CIT” refers to CIT Group Inc. and, as the context may require, collectively to CIT and CIT Bank, N.A., OneWest Bank, and Mutual of Omaha Bank, CIT’s former bank subsidiaries, which we acquired in a merger effective on January 3, 2022; and |

| ● | “SEC” refers to the Securities and Exchange Commission. |

8

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors recommends that you vote “FOR” each of the nominees named below.

General

Our Bylaws provide that:

| ● | our Board of Directors will consist of not less than five nor more than 30 members, and our Board is authorized to set and change the actual number of our directors from time to time within those limits; and |

| ● | our directors are elected each year at the Annual Meeting for terms of one year or until their deaths, resignations, retirements, removals or disqualifications, or until their successors have been duly elected and qualified. |

Our company and FCB each has a board of directors. Historically, the membership of FCB’s Board has been the same as the membership of our Board, and we expect that to continue. Accordingly, we expect to appoint the nominees elected to our Board at the Annual Meeting to also serve as members of the Board of FCB for the year following the meeting.

During 2022, our Board of Directors consisted of 14 directors and the Board has set the number of our directors at 13 for the year following the Annual Meeting. Following the recommendation of our Compensation, Nominations and Governance Committee, our Board has nominated 13 of our current directors named below for re-election at the Annual Meeting. The nominees include Dr. Eugene Flood, Jr., who was appointed as a director effective January 1, 2023, to fill the vacancy resulting from the retirement of Daniel L. Heavner on December 31, 2022. Our fourteenth current director, Vice Admiral John R. Ryan, USN (Ret.), who was nominated after he reached age 75 pursuant to a waiver of the Board’s previous retirement policy, has not been nominated for reelection at the Annual Meeting. If before the Annual Meeting any nominee becomes unable or unwilling to serve as a director for any reason, including without limitation death, resignation, withdrawal or removal, and if a substitute nominee is not named by our Board, the number of directors to be elected at the Annual Meeting will be reduced accordingly.

Nominees

In recommending that our Board of Directors nominate our 13 directors named below for re-election, the Board’s Compensation, Nominations and Governance Committee considered a number of factors, including each director’s individual qualifications, attributes, and skills described in their listings below and the other factors described under the caption “COMMITTEES OF OUR BOARD — Compensation, Nominations and Governance Committee.” Additionally, with respect to nominees who were members of our Board during 2022, the Committee considered each director’s preparedness for, engagement in, and contributions to meetings and deliberations of the Boards and committees on which they serve. Set forth below is a listing of and information about each of the 13 nominees.

9

Table of Contents

|

Ellen R. Alemany Our and FCB’s Vice Chairwoman

|

PRINCIPAL OCCUPATION

∎ First Citizens BancShares and FCB ∎ Special Advisor to our Chairman and CEO (effective January 1, 2023) ∎ Former Vice Chairwoman (January through December 2022) ∎ Employed by FCB since 2022

∎ CIT Group Inc. and its subsidiary, CIT Bank, N.A. ∎ Chairwoman and Chief Executive Officer (2016-2022) ∎ Director, CIT Group Inc. (2014-2022)

∎ RBS Americas (“RBS”) ∎ Head of management structure that oversees Royal Bank of Scotland’s American business (2007-2013)

∎ RBS Citizens Financial Group, Inc. (subsidiary of RBS) ∎ Chief Executive Officer and Chairwoman (2008-2013)

∎ CitiGroup (1987-2007) ∎ Chief Executive Officer, Global Transaction Services (2006-2007) ∎ Executive Vice President, Commercial Business Group (2003-2006) ∎ President and Chief Executive Officer, CitiCapital (2001-2006)

KEY EXPERIENCE AND QUALIFICATIONS

∎ Visible and active community leader: Extensive community and public leadership experience, including as a member of the Global Board of Advisors of Operation Hope.

∎ Management and financial experience: Over 42 years of management experience in banking and financial services, including chief executive experience with a large, multinational commercial bank, as well as global financial management and regulatory experience.

∎ Corporate governance expertise: Service on boards of directors and board committees of public companies and large nonprofits.

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Director, Center for Discovery and Partnership for New York City ∎ Member, Global Board of Advisors of Operation Hope ∎ Member, Advisory Board of the Mayor’s Fund to Advance New York City ∎ Member, Board of Trustees for The Conference Board ∎ Former Director, Automatic Data Processing, Inc. | |

|

Age: 67

Director Since: January 2022

Independent Director: No

Current Board Committee Service: ∎ None

Other Current Public Company Directorships ∎ Fidelity National Information Services, Inc. ∎ Dun & Bradstreet Holdings, Inc. | ||

|

| ||

|

| ||

|

| ||

10

Table of Contents

|

John M. Alexander, Jr.

|

PRINCIPAL OCCUPATION

∎ Manager, McKnitt and Associates, LLC (commercial real estate)

∎ Former Chairman and Chief Executive Officer, Cardinal International Trucks, Inc. (truck dealer)

KEY EXPERIENCE AND QUALIFICATIONS

∎ Visible and active community leader: Extensive community and public leadership experience includes service as a member of the North Carolina State Senate.

∎ Management and financial experience: More than 50 years in managing and operating a successful truck dealership.

∎ Corporate governance expertise: Service on boards of directors and board committees of not-for-profit entities and foundations.

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Former member, North Carolina State Senate ∎ Member, Board of Trustees, YMCA of the Triangle | |

|

Age: 73

Director Since: 1990

Independent Director: Yes

Current Board Committee Service: ∎ Audit Committee ∎ Trust Committee of FCB’s Board (Chairman)

Other Current Public Company Directorships ∎ None

| ||

|

Victor E. Bell III

|

PRINCIPAL OCCUPATION

∎ Chairman and President, Marjan, Ltd. (real estate and other investments)

KEY EXPERIENCE AND QUALIFICATIONS

∎ Management and financial experience: More than 41 years managing, operating and growing a family-owned real estate and investment business.

∎ Market expertise: Familiarity with real estate, real estate-related investment, the medical community and area universities.

∎ Corporate governance expertise: Service on boards of directors and board committees of not-for-profit entities and foundations.

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Board of Visitors, Saint Mary’s School ∎ Chairman and President, North Carolina Museum of History Foundation ∎ Chairman and President, Ravenscroft Foundation ∎ Vice Chairman, A. E. Finley Foundation ∎ Member, Board of Trustees, YMCA of the Triangle ∎ Chairman and President, White Memorial Presbyterian Church Foundation ∎ Past Member, Board of Visitors, UNC Lineberger Comprehensive Cancer Center | |

|

Age: 66

Director Since: 2002

Independent Director: Yes

Current Board Committee Service: ∎ Compensation, Nominations and Governance Committee ∎ Risk Committee

Other Current Public Company Directorships ∎ None

| ||

11

Table of Contents

|

Peter M. Bristow Our and FCB’s President

|

PRINCIPAL OCCUPATION

∎ First Citizens BancShares and FCB ∎ President (since 2014) ∎ Employed by FCB since 2014 ∎ First Citizens Bancorporation, Inc. and FCB-SC ∎ Executive Vice President and Chief Operating Officer (2001-2014)

KEY EXPERIENCE AND QUALIFICATIONS

∎ Strong leader with extensive management and financial experience:

∎ Market Expertise: Intimate knowledge of FCB’s South Carolina and Georgia banking markets.

∎ Corporate governance expertise: Service on boards of directors and board committees of not-for-profit entities and foundations.

∎ Significant family ownership in our company.

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Director, North Carolina Community Foundation ∎ Member, Board of Trustees, Saint Mary’s School ∎ Director, North Carolina Museum of Art Foundation

| |

|

Age: 57

Director Since: 2014

Independent Director: No

Current Board Committee Service: ∎ None

Other Current Public Company Directorships ∎ None

Family Relationship: ∎ Mr. Bristow is the brother-in-law of Mr. Holding and Mrs. Bryant

| ||

|

Hope H. Bryant Our and FCB’s Vice Chairwoman |

PRINCIPAL OCCUPATION

∎ First Citizens BancShares and FCB ∎ Vice Chairwoman (since 2011) ∎ Executive Vice President (2002-2011) ∎ Employed by FCB since 1986

KEY EXPERIENCE AND QUALIFICATIONS

∎ Strong leader with extensive management and financial experience: Over 32 years of experience with FCB, including managing expansion into new markets and as President of our former subsidiary, IronStone Bank.

∎ Visible and active community leader: Extensive community and industry leadership experience, including past service on the board of directors of the North Carolina Bankers Association.

∎ Corporate governance expertise: Service on boards of directors and board committees of not-for-profit entities and foundations and non-public community financial institutions.

∎ Other Financial Institution Experience: Serves as a director of Southern BancShares (N.C.), Inc., and Fidelity BancShares (N.C.), Inc., and their respective bank subsidiaries.

∎ Significant personal ownership in our company.

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Board of Advisors, YMCA of the Triangle ∎ Member, President’s Council, 2022 U.S. Women’s Open ∎ Member, Board of Trustees, Woodberry Forest School ∎ Past Member, Ravenscroft School Advisory Board ∎ Past Director, North Carolina Bankers Association | |

|

Age: 60

Director Since: 2006

Independent Director: No

Current Board Committee Service: ∎ Executive Committee ∎ Trust Committee of FCB’s Board

Other Current Public Company Directorships ∎ None

Family Relationship: ∎ Mrs. Bryant is the sister of Mr. Holding and the sister-in-law of Mr. Bristow

| ||

12

Table of Contents

|

Michael A. Carpenter |

PRINCIPAL OCCUPATION

∎ Retired banking executive ∎ Ally Financial, Inc. ∎ Chief Executive Officer and Director (2009-2015)

∎ CitiGroup (1998-2006) ∎ Chairman and Chief Executive Officer, Citigroup Alternative Investments (2002-2006) ∎ Chairman and Chief Executive Officer, Citigroup’s Global Corporate and Investment Bank (1998-2002)

KEY EXPERIENCE AND QUALIFICATIONS

∎ Visible and active community leader: Extensive community and public leadership experience including as Chairman of the Board of Year Up South Florida, a not-for-profit offering students a pathway to success.

∎ Management and financial experience: Over 36 years of experience in executive management, finance, asset management and restructurings, as well as expertise in capital markets and capital management.

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Chairman, Year Up South Florida ∎ Director, Rewards Network ∎ Director, Client 4 Life Group ∎ Director, Validity Capital ∎ Chairman, Law Finance Group ∎ Former Director, CIT Group Inc. and subsidiary CIT Bank, N.A. ∎ Former Board Member, US Stock Exchange ∎ Former Director, General Signal Corp ∎ Former Director, Loews Cineplex ∎ Former Director, New York City Investment Fund ∎ Former Director, US Retirement Partners | |

|

Age: 75

Director Since: January 2022

Independent Director: Yes

Current Board Committee Service: ∎ Audit Committee

Other Current Public Company Directorships ∎ AutoWeb, Inc. | ||

|

| ||

|

| ||

|

| ||

|

| ||

|

H. Lee Durham, Jr. Audit Committee Financial Expert

|

PRINCIPAL OCCUPATION

∎ Retired Certified Public Accountant ∎ Former partner, PricewaterhouseCoopers LLP

KEY EXPERIENCE AND QUALIFICATIONS

∎ Extensive financial and accounting experience: 32 years in public accounting with a significant portion dedicated to bank and public company clients.

∎ Corporate governance experience: Has served as director, chairman of the audit committee, chairman of the nominations and corporate governance committee, member of the compensation committee and lead independent director of another public financial services company.

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Past Director, Charlotte Regional Sports Commission ∎ Past Member, North Carolina Innovation Council | |

|

Age: 74

Director Since: 2003

Independent Director: Yes

Current Board Committee Service: ∎ Audit Committee (Chairman) ∎ Compensation, Nominations and Governance Committee ∎ Executive Committee

Other Current Public Company Directorships ∎ None

| ||

13

Table of Contents

|

Dr. Eugene Flood, Jr.

|

PRINCIPAL OCCUPATION

∎ Managing Partner, A Cappella Partners (family office focused on business, for profit and not-for-profit board activity, community services and philanthropic efforts) (since 2013)

∎ Senior Advisor, Selby Lane Digital, Inc. (investment adviser in alternatives space) (since 2022)

∎ Managing Partner, Next Sector Capital (investment fund) (2015-2022)

∎ President and Chief Executive Officer, Smith Breeden Associates (asset management firm) (2000-2011)

∎ TIAA-CREF (asset management and retirement planning firm) ∎ Executive Vice President (2011-2012) ∎ Member, CREF Board of Trustees and CREF Mutual Fund Board of Trustees (2004-2011)

∎ Morgan Stanley (investment banking and financial services firm) (1987-1999)

∎ Assistant Professor of Finance, Stanford Business School (1982-1987)

KEY EXPERIENCE AND QUALIFICATIONS

∎ Extensive investment management and financial expertise: 31 years in the asset management industry

∎ Academic background: With a PhD from MIT, has an academic background in economics, which enables him to provide valuable insights on global macroeconomic trends, business strategy, business expansion and financial matters.

∎ Corporate governance: Service on board of directors and its committees for a publicly traded company; prior board of trustees experience for large organization; service on nonprofit advisory and foundation boards

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Director, Chairman of Risk Committee and Member of Audit Committee, of Janus Henderson Group plc Board of Directors ∎ Director, Grubb Properties (real estate investment manager) ∎ Chairman, Advisory Board, Institute for Global Health and Infectious Diseases, University of North Carolina at Chapel Hill ∎ Member, Board of Trustees, Research Corporation for Science Advancement ∎ Member, Investing Committee, Boston Children’s Hospital ∎ Member, Steering Board, Eshelman Institute ∎ Member, Advisory Council of the Milken Center for Advancing the American Dream ∎ Member, Advisory Board of C Street Advisory Group ∎ Former Trustee, Financial Accounting Foundation ∎ Former Director, The Foundation of the Carolinas

| |

|

Age: 67

Director Since: 2023

Independent Director: Yes

Current Board Committee Service: ∎ Risk Committee ∎ Trust Committee of FCB’s Board

Other Current Public Company Directorships ∎ Janus Henderson Group plc

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

14

Table of Contents

|

Frank B. Holding, Jr. Our and FCB’s Chairman and and Chief Executive Officer

|

PRINCIPAL OCCUPATION

∎ First Citizens BancShares and FCB ∎ Chairman (since 2009) ∎ Chief Executive Officer (since 2008) ∎ President (1994-2009) ∎ Employed by FCB since 1983

KEY EXPERIENCE AND QUALIFICATIONS

∎ Strong leader with extensive management and financial experience: Over 39 years of experience with FCB. Has an intimate knowledge of our business and its culture, values, goals and strategic operations.

∎ Visible and active community leader: Service on boards of directors and board committees of not-for-profit entities and foundations.

∎ Corporate governance expertise: Extensive public and business leadership experience including serving as a director and member of various committees of other public and non-public companies.

∎ Significant personal ownership in our company.

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Member, Advisory Board, Duke Energy Corporation ∎ Chairman, Board of Trustees, Blue Cross and Blue Shield of North Carolina ∎ Director, Global Transpark Foundation ∎ Director, Mount Olive Pickle Company ∎ Past Trustee, Wake Forest University ∎ Past Director (former Chairman), North Carolina Chamber Foundation ∎ Past Director (former Chairman), North Carolina Chamber of Commerce ∎ Past Vice Chairman and Director, Institute for Defense and Business

| |

|

Age: 61

Director Since: 1993

Independent Director: No

Current Board Committee Service: ∎ Executive Committee (Chairman)

Other Current Public Company Directorships ∎ None

Family Relationship: ∎ Mr. Holding is the brother of Mrs. Bryant and the brother-in-law of Mr. Bristow

| ||

|

| ||

|

Robert R. Hoppe Risk Management Expert

|

PRINCIPAL OCCUPATION ∎ Retired Certified Public Accountant ∎ Former partner, PricewaterhouseCoopers LLP

KEY EXPERIENCE AND QUALIFICATIONS

∎ Extensive financial and accounting experience: 34 years in public accounting serving clients in the public, private, nonprofit and governmental sectors and industries, including manufacturing, healthcare, distribution, utilities and smaller financial service clients.

∎ Corporate governance experience: Prior service as director and vice chairman of the audit and risk committees for another financial institution. Active in civic and professional organizations throughout his career.

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Director (past Chairman), Salvation Army of Greater Charlotte ∎ Former director of First Citizens Bancorporation, Inc. and FCB-SC

| |

|

Age: 71

Director Since: 2014

Independent Director: Yes

Current Board Committee Service: ∎ Executive Committee ∎ Risk Committee (Chairman)

Other Current Public Company Directorships ∎ None

| ||

15

Table of Contents

|

Floyd L. Keels

|

PRINCIPAL OCCUPATION

∎ Retired ∎ Former President and Chief Executive Officer, Santee Electric Cooperative, Inc. (electric power provider)

KEY EXPERIENCE AND QUALIFICATIONS

∎ Extensive management and business experience: Over 40 years in the electric utilities industry including 16 years as President and Chief Executive Officer of Santee Electric Cooperative, Inc. headquartered in Kingstree, South Carolina.

∎ Visible and active community leader: Service on boards of directors of not-for-profit entities and foundations.

∎ Corporate governance experience: Prior service as director and member of the Community Reinvestment Committee for another financial institution.

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ President of the Board, William Penn Harrison Scholarship Fund ∎ Director, Greater Lake City Alliance ∎ Board Member, Francis Marion University Development Foundation ∎ Past Director and Treasurer, Eastern Carolina Community Foundation ∎ Former director of First Citizens Bancorporation, Inc. and FCB-SC

| |

|

Age: 75

Director Since: 2014

Independent Director: Yes

Current Board Committee Service: ∎ Audit Committee ∎ Trust Committee of FCB’s Board

Other Current Public Company Directorships ∎ None

| ||

|

Robert E. Mason IV

|

PRINCIPAL OCCUPATION

∎ Chairman and past Chief Executive Officer, Robert E. Mason and Associates, Inc. (industrial automation and engineering services)

KEY EXPERIENCE AND QUALIFICATIONS

∎ Extensive management and business experience: Over 36 years of experience in managing, operating and growing a successful industrial automation and engineering services business with a national and international business perspective.

∎ Corporate governance experience: Service on boards of directors and board committees of not-for-profit entities and foundations.

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Board Member, Crosland Foundation ∎ Past Member, Board of Trustees, Episcopal High School, Alexandria, VA ∎ Former Member, Advisory Board of UNC Charlotte Lee College of Engineering | |

|

Age: 64

Director Since: 2007

Independent Director: Yes

Current Board Committee Service: ∎ Compensation, Nominations and Governance Committee ∎ Risk Committee

Other Current Public Company Directorships ∎ None

| ||

16

Table of Contents

|

Robert T. Newcomb Lead Independent Director

|

PRINCIPAL OCCUPATION

∎ Former President and owner and current employee, Newcomb and Company (mechanical contractors)

KEY EXPERIENCE AND QUALIFICATIONS

∎ Extensive management and business experience: Over 32 years of experience in managing, operating and growing a successful mechanical contracting company.

∎ Corporate governance experience: Service on boards of directors and board committees of not-for-profit entities.

OTHER PROFESSIONAL EXPERIENCE AND COMMUNITY INVOLVEMENT

∎ Director, Raleigh Cemetery Association (Oakwood Cemetery) ∎ Member, Board of Trustees (former Annual Campaign Chair), YMCA of the Triangle | |

|

Age: 62

Director Since: 2002

Independent Director: Yes

Current Board Committee Service: ∎ Compensation, Nominations and Governance Committee (Chairman) ∎ Audit Committee ∎ Executive Committee

Other Current Public Company Directorships ∎ None

| ||

Our Board of Directors unanimously recommends that you vote “FOR” each of the 13 nominees named above.

The 13 nominees who receive the highest numbers of votes will be elected.

17

Table of Contents

CORPORATE GOVERNANCE

Our Board of Directors has adopted Corporate Governance Guidelines that, together with our Bylaws, establish various processes related to the structure and leadership of our Board and the governance of our organization.

Director Independence

Determination of Independent Directors. Our Corporate Governance Guidelines require that a majority of the members of our Board be “independent” and that each year our Board review transactions, relationships, and other arrangements involving our directors and determine which of the directors the Board considers to be independent. In making those determinations, the Board applies the independence criteria contained in the listing requirements of The Nasdaq Stock Market (“Nasdaq”). The Board has directed our Compensation, Nominations and Governance Committee to assess each outside director’s independence each year and report its findings to the Board in connection with the Board’s annual determinations. In addition, between those annual determinations, the Committee is directed to monitor the status of each director on an ongoing basis and inform the Board of changes in factors or circumstances that may affect a director’s ability to exercise independent judgment in carrying out his or her duties as a director. The following table lists our current directors and persons who served as directors during 2022 whom our Board believes were during their terms of office, and will be if re-elected, “independent” directors under Nasdaq’s criteria.

| John M. Alexander, Jr. | Dr. Eugene Flood, Jr. | Floyd L. Keels | ||

| Victor E. Bell III | Daniel L. Heavner | Robert E. Mason IV | ||

| Michael A. Carpenter | Robert R. Hoppe | Robert T. Newcomb | ||

| H. Lee Durham, Jr. | Vice Admiral John R. Ryan, USN (Ret.) |

In addition to the specific Nasdaq criteria, in assessing each director’s or nominee’s independence, the Compensation, Nominations and Governance Committee and the Board consider whether they believe transactions that are disclosable in our proxy statements as “related person transactions,” as well as any other transactions, relationships, arrangements or other factors known to the Committee or the Board, could impair that director’s ability to exercise independent judgment in carrying out his or her duties as a director. In its determination that our current directors named above are independent, the Committee and the Board considered those transactions and relationships described or referenced below under the heading “TRANSACTIONS WITH RELATED PERSONS,” as well as: (1) FCB’s lending relationships with directors who are loan customers and whose loans are subject to laws and regulations pertaining to loans to directors of banks (including the requirement that those loans be approved by a majority of FCB’s full Board); and (2) services in connection with the construction or renovation of facilities owned, leased, or managed by FCB that are provided from time to time on a competitive bid basis, as a mechanical subcontractor through unrelated general contractors, by a company previously owned by Mr. Newcomb which he sold during 2016 but has remained with as an employee to provide consultation to the new owner.

Executive Sessions of Independent Directors. Our independent directors meet separately in executive session, without the Chairman, other members of management, or non-independent directors, in conjunction with each regular quarterly meeting of our Board. At their discretion, they may hold additional separate meetings, and such a meeting will be held at the request of any independent director.

Lead Independent Director. Under our Corporate Governance Guidelines, if the Chairman elected by our Board is not an independent director, then each year our Compensation, Nominations and Governance Committee will nominate and our independent directors will select a separate “Lead Independent Director.” Robert T. Newcomb, who currently serves as Chairman of our Compensation, Nominations and Governance Committee, has been designated and currently serves as our Lead Independent Director.

Under the Guidelines, the duties of our Lead Independent Director include:

| ● | convening and presiding at executive sessions and separate meetings of our independent directors, and serving as the liaison between the independent directors and our Chairman and management; |

| ● | consulting with the Chairman regarding decisions reached, or suggestions made, at executive sessions and separate meetings of independent directors; |

| ● | consulting with the Chairman regarding the schedule, agenda, and information for Board meetings; |

| ● | consulting with the Chairman with respect to consultants who may report directly to the Board; |

18

Table of Contents

| ● | consulting with the Chairman and management as to the quality, quantity, and timeliness of information provided to the Board by management; |

| ● | being available, as appropriate, for communications with our stockholders; and |

| ● | performing such other duties and exercising such other authority as is described elsewhere in the Guidelines and as the Board may from time to time determine. |

A special meeting of the Board or any committee of the Board, or of the independent directors, will be called at the Lead Independent Director’s request. Also, while our Chairman sets the agenda for each Board meeting and any director may propose agenda items, a matter will be placed on the agenda for any Board or committee meeting at the Lead Independent Director’s request.

Board Leadership Structure

Our and FCB’s Boards perform their oversight roles through various committees whose members are appointed by the Boards after consideration of the recommendations of our independent Compensation, Nominations and Governance Committee. Those committees may be established as separate committees of our or FCB’s Board or as joint committees of the Boards. Each Board annually elects a Chairman whose duties are described in our and FCB’s Bylaws and, currently, our Chief Executive Officer, Frank B. Holding, Jr., serves as Chairman of both Boards. Mr. Holding has served as our Chairman since 2009. Although our Bylaws contemplate that our Chairman will be considered an officer, under our Corporate Governance Guidelines our Board will exercise its judgment and discretion in the selection of its Chairman and may select any of its members as Chairman. The Board has no formal policy as to whether our Chief Executive Officer will or may serve as Chairman or whether any other director, including an independent director, may be elected to serve as Chairman.

In practice our Board has found that having a combined Chairman and Chief Executive Officer role allows for more productive board meetings. As Chairman, Mr. Holding is responsible for leading board meetings and meetings of stockholders, generally setting the agendas for board meetings (subject to the requests from our Lead Independent Director and other directors), and providing information to the other directors in advance of meetings and between meetings. Mr. Holding’s direct involvement in our operations makes him best positioned to lead strategic planning sessions and determine the time allocated to each agenda item in discussions of our short- and long-term objectives. As a result, our Board currently believes that maintaining a structure that combines the roles of Chairman and Chief Executive Officer is the appropriate leadership structure for our company.

Because our Chief Executive Officer currently serves as Chairman and members of our management beneficially own large percentages of our voting stock, our Board recognizes the potential for management’s influence over the Boards and the Boards’ processes to diminish the effectiveness of our independent directors and the independent directors’ ability to influence our policies and the Boards’ decisions. As a result, and as required by our Corporate Governance Guidelines, our independent directors have designated a separate Lead Independent Director who has the duties and authority described above under the caption “Lead Independent Director,” including the calling of meetings of the Boards and their committees and placement of matters on the agendas for Board and committee meetings.

Our independent directors meet regularly in executive session, giving them opportunities to discuss any concerns without management being present, and, as described below under the heading “COMMITTEES OF OUR BOARDS,” all matters pertaining to executive compensation, the selection of nominees for election as directors, the appointment of members of Board committees, the approval of transactions with related persons, and various other governance matters, are subject to the review and approval or recommendation of Board committees made up entirely of independent directors. Our Corporate Governance Guidelines also provide that:

| ● | all independent directors have full access to any member of management and to our and FCB’s independent accountants and internal auditors for the purpose of discussing and understanding issues relating to our business; |

| ● | upon request, our management will arrange for our outside advisors to be made available for discussions with the Board, any Board committee, our independent directors as a group, or individual directors; and |

| ● | the Boards, each Board committee, and our independent directors as a group, in each case by a majority vote, have the authority to retain independent advisors from time to time, at our expense, who are separate from and unrelated to our regular advisors. |

Our Board believes the provisions described above enhance the effectiveness of our independent directors and provide for a leadership structure that is appropriate for our company, without regard to whether our Chairman is an independent director.

19

Table of Contents

Director Retirement Policy

Pursuant to an amendment and restatement of our director retirement policy approved by the Board during January 2023, no person is eligible to stand for election to the Board at any stockholder meeting following the calendar year in which he or she reaches age 75. Prior to the amendment and restatement, directors were subject to mandatory retirement effective on December 31 of the year during which they reached age 75. Daniel L. Heavner reached age 75 during 2022 and retired from the Board effective December 31, 2022. The retirement policy may be waived by the Board for reasons that it considers compelling and, in connection with the appointment of Michael A. Carpenter and Vice Admiral John R. Ryan, USN (Ret.), former directors of CIT, to serve as our directors following our merger with CIT, the Board waived the retirement policy with respect to each of them until the 2023 Annual Meeting. Because of his extensive large bank experience and valuable perspective as we continue the process of integrating the operations of CIT into FCB, the Board found compelling reasons to extend the waiver for an additional year with respect to Mr. Carpenter, who reached age 75 during 2022, and has nominated him for reelection at the Annual Meeting. Mr. Ryan reached age 77 during 2022 and is not a nominee for reelection at the Annual Meeting.

Service on Other Public Company Boards

Our Corporate Governance Guidelines do not restrict directors’ abilities to serve on the boards of other companies. However, the Guidelines state our expectation that our directors’ service as directors of other companies may not interfere with their ability to devote the time and attention required to fulfill their duties and responsibilities to us and our stockholders. As indicated in the table below, during the past five years certain of our current directors have served, and continue to serve, on the boards of other public companies.

| Director |

Service as Director of | |

| Ellen R. Alemany (1) |

Fidelity National Information Services, Inc. (since 2014) Dun & Bradstreet Holdings, Inc. (since 2021) | |

| Michael A. Carpenter (1) |

AutoWeb, Inc. (since 2012) SVF Investment Corp 3 (2021-2022) | |

| Dr. Eugene Flood, Jr. |

Janus Henderson Group plc (since 2017) | |

| Vice Admiral John R. Ryan, USN (Ret.) (1) |

Barnes & Noble Education, Inc. (since 2015) | |

| (1) | Mrs. Alemany, Mr. Carpenter and Mr. Ryan also served as directors of CIT until consummation of our merger with CIT effective January 3, 2022. |

Boards’ Role in Risk Management

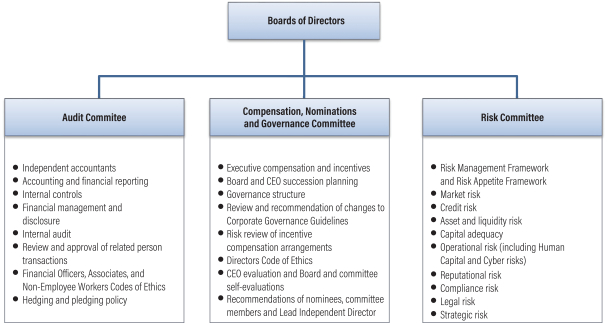

Risk is inherent in any business. We are subject to extensive regulation specific to the banking industry that requires us to assess and manage the risks we face, and, during their periodic examinations, our banking regulators assess our and the Boards’ performance in that regard. As more fully described in our Annual Report on Form 10-K for the year ended December 31, 2022, which accompanies this proxy statement, our merger with CIT more than doubled our assets and significantly increased the breadth and complexity of our business and has increased regulatory scrutiny of our risk management process. Our Boards strive to ensure that risk management is a part of our business culture and that our policies and procedures for identifying, assessing, monitoring, and managing risk are part of the decision-making process. As is the case with other management functions, and with accountability and support from all company associates, our senior management has primary responsibility for day-to-day management of the risks we face. However, the Boards’ role in risk oversight is an integral part of our overall Risk Management Framework. The Boards administer their risk oversight function primarily through committees which may be established as separate or joint committees of our and/or FCB’s Boards, including a joint Risk Committee.

The Boards’ Risk Committee has adopted and approved our Risk Management Framework and has approved our Risk Appetite Framework and Statement and recommended them to our Boards for final approval. The Risk Committee structure is designed to allow for information flow and escalation of risk-related issues. The Risk Committee monitors adherence to our Risk Management Framework and Risk Appetite Framework and Statement and provides a report on risk management to the Boards on at least a quarterly basis, and our Chief Risk Officer provides regular reports to the Boards and our Executive Committee. Management and independent risk functions make regular reports to the Risk Committee on key risk areas, such as capital, liquidity, market, credit, compliance, and operational risks, including human capital and cyber risks. In addition, the Risk Committee may coordinate with the Audit Committee for the review of financial statement and related risks, information security, and other areas of joint responsibility, and with the Compensation, Nominations and Governance Committee for review of compensation and corporate governance-related risks. Information regarding the function and responsibilities of these three committees is contained below under the heading “COMMITTEES OF OUR BOARDS.”

20

Table of Contents

We believe our regulatory environment and our committee structure result in our Boards being more active in risk management oversight than the boards of corporations that are not regulated, or that are not regulated as extensively, as financial institutions. The involvement of our committees in the Boards’ oversight function enhances our Boards’ effectiveness and leadership structure by providing opportunities for outside directors to become more familiar with our and FCB’s critical operations and more engaged in the Boards’ activities with respect to risk management.

Attendance by Directors at Meetings

Board of Directors Meetings. Our Board of Directors met five times during 2022. Our Corporate Governance Guidelines provide that directors are expected to regularly attend meetings of the Boards and of the committees on which they serve (subject to circumstances that make their absence unavoidable), to review materials provided to them in advance of meetings, and to participate actively in discussions at meetings and in the work of the committees on which they serve. During 2022, 12 of our then-current directors attended 100%, while two directors attended 89% and 94%, respectively, of the aggregate number of meetings held during their terms of office by our Board and any committees of the Boards on which they served.

Annual Meetings. Attendance by our directors at Annual Meetings of our stockholders gives directors an opportunity to hear the concerns of stockholders who attend those meetings, and it gives those stockholders access to our directors that they may not have at any other time. In order to facilitate directors’ attendance, we schedule our Annual Meetings on the same dates as regular meetings of the Boards of Directors. Our Board recognizes that our outside directors have their own business interests and are not our associates, and that it is not always possible for them to attend Annual Meetings. However, our Board believes that attendance by directors at our Annual Meetings is beneficial to us and to our stockholders, and our Corporate Governance Guidelines provide that our directors are strongly encouraged to attend each Annual Meeting. Each of our 14 then-current directors participated in our last Annual Meeting which was held virtually during April 2022.

Communications with Our Board

Our Board of Directors encourages our stockholders to communicate their concerns and other matters related to our business, and the Board has established a process by which you may send written communications to the Board or to one or more individual directors. You may address and mail your communication to:

Board of Directors

First Citizens BancShares, Inc.

Attention: Corporate Secretary

Post Office Box 27131 (Mail Code FCC22)

Raleigh, North Carolina 27611-7131

You also may send communications by email to [email protected]. You should indicate whether your communication is directed to the entire Board of Directors, to a particular committee of the Board or its Chairman, or to one or more individual directors. All communications will be reviewed by our Corporate Secretary and, with the exception of communications our Corporate Secretary considers to be unrelated to our or FCB’s business, forwarded to the intended recipients.

Code of Ethics

Our Board of Directors has adopted three codes of ethics that apply separately to our and FCB’s financial officers, directors, and all associates (including our financial officers), respectively. Copies of the three Codes are posted on FCB’s website and may be found at ir.firstcitizens.com/corporate-governance/governance-documents. We have a separate Non-Employee Workers Code of Ethics that applies to all non-associates engaged on a temporary basis through a contractual agreement to provide services to FCB. Both the Financial Officers Code of Ethics and Associates Code of Ethics cover our Chief Executive Officer, Chief Financial Officer, Treasurer, and other senior financial officers who have primary responsibility for our financial reporting and accounting functions. Among other things, all four Codes are intended to promote:

| ● | honest and ethical conduct; |

| ● | the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| ● | full, fair, accurate, timely, and understandable disclosure in reports and documents that we file with or submit to the SEC and banking regulators and in other public communications we make; |

21

Table of Contents

| ● | compliance with applicable governmental laws, rules and regulations; |

| ● | prompt internal reporting of violations of the Codes and accounting issues to the Boards’ Audit Committee and, in the case of violations of the Directors Code of Ethics, also to the Compensation, Nominations and Governance Committee; and |

| ● | accountability for adherence to the Codes. |

We have established means by which officers, associates, customers, suppliers, stockholders or others may submit confidential and anonymous reports regarding ethical or other concerns about our company, FCB, or any of our associates. Reports may be submitted online through FCB’s website at www.firstcitizens.com/privacy-security/report-ethical-concerns, online through a third party provider at secure.ethicspoint.com/domain/media/en/gui/14505/index.html, or by telephone by calling 800-UREPORT (or 800-873-7678). We intend to satisfy the disclosure requirement under Item 5.05 of Current Report on Form 8-K regarding an amendment to or waiver from a provision of our Financial Officers Code of Ethics by posting that information on our Internet website at ir.firstcitizens.com/corporate-governance/governance-documents.

Human Capital Management