Form DEF 14A Evolus, Inc. For: Jun 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

___________________________________

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ||||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| ý | Definitive Proxy Statement | ||||

| ¨ | Definitive Additional Materials | ||||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | ||||

EVOLUS, INC.

_________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. | |||||||||||||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||||||||||||

| 1) | Title of each class of securities to which transaction applies: | |||||||||||||

| 2) | Aggregate number of securities to which transaction applies: | |||||||||||||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||||||||

| 4) | Proposed maximum aggregate value of transaction: | |||||||||||||

| 5) | Total fee paid: | |||||||||||||

| ¨ | Fee paid previously with preliminary materials. | |||||||||||||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||||||||

| 1) | Amount Previously Paid: | |||||||||||||

| 2) | Form, Schedule or Registration Statement No.: | |||||||||||||

| 3) | Filing Party: | |||||||||||||

| 4) | Date Filed: | |||||||||||||

Evolus, Inc.

520 Newport Center Drive, Suite 1200

Newport Beach, CA 92660

April 26, 2021

Dear Stockholder:

It is my pleasure to invite you to attend the Annual Meeting of Stockholders of Evolus, Inc. which will be held on June 8, 2021, at 8:00 a.m., Pacific time. This year’s Annual Meeting will be a virtual meeting via live webcast on the Internet. You will be able to attend the Annual Meeting, vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/EOLS2021 and entering the control number included in the Notice of Internet Availability or proxy card that you receive. You will not be able to attend the Annual Meeting in person.

During the Annual Meeting, stockholders will be asked to elect three Class III directors and to ratify the appointment of Ernst & Young LLP as our independent auditor for 2021. Each of these matters is important, and we urge you to vote in favor of the election of each of the director nominees and the ratification of the appointment of our independent auditor.

We are taking advantage of the Securities and Exchange Commission rule that allows us to furnish proxy materials to our stockholders over the Internet. This e-proxy process expedites the delivery of proxy materials to our stockholders, lowers our costs and reduces the environmental impact of the Annual Meeting. Today, we are sending to each of our stockholders who has not elected an alternative means of delivery a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement for the Annual Meeting and our 2020 Annual Report to Stockholders, as well as how to vote via proxy either by telephone or over the Internet. The Notice of Internet Availability of Proxy Materials also contains instructions to allow you to request copies of the proxy materials to be sent to you by mail. Stockholders who have elected to receive copies of our proxy materials delivered via mail or e-mail will be receiving the Proxy Statement, a proxy card and the Annual Report by mail or e-mail, as applicable.

It is important that you vote your shares of common stock at the Annual Meeting or by proxy, regardless of the number of shares you own. You will find the instructions for voting on the Notice of Internet Availability of Proxy Materials or proxy card received. We appreciate your prompt attention.

The board of directors invites you to attend the Annual Meeting virtually via live webcast so that management can answer your questions and comment on business developments and trends. Thank you for your support, and we look forward to the Annual Meeting.

Sincerely,

David Moatazedi

President and Chief Executive Officer

Evolus, Inc.

520 Newport Center Drive, Suite 1200

Newport Beach, CA 92660

Notice of Annual Meeting of Stockholders

Evolus, Inc., a Delaware corporation (“Evolus”), will hold its Annual Meeting of Stockholders (the “Annual Meeting”) on June 8, 2021, at 8:00 a.m., Pacific time. This year’s Annual Meeting will be a virtual meeting via live webcast on the Internet. You will be able to attend the Annual Meeting, vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/EOLS2021 and entering the control number included in the Notice of Internet Availability or proxy card that you receive. You will not be able to attend the Annual Meeting in person.

The purposes for the Annual Meeting are to consider and vote upon:

1. Election of David Moatazedi, Vikram Malik and Karah Parschauer as Class III directors to serve until Evolus’ 2024 annual meeting of stockholders and until their respective successors are duly elected and qualified.

2. Ratification of the appointment of Ernst & Young LLP as Evolus’ independent registered public accounting firm for the year ending December 31, 2021.

3. Such other matters as properly come before the Annual Meeting or any postponement or adjournment thereof.

The accompanying Proxy Statement more fully describes these matters and we urge you to read the information contained in the Proxy Statement carefully. The board of directors recommends a vote “FOR” the election of each of Mr. Moatazedi, Mr. Malik, and Mrs. Parschauer to Evolus’ board of directors and “FOR” the ratification of the appointment of Ernst & Young LLP as Evolus’ independent registered public accounting firm for the year ending December 31, 2021.

The board of directors has fixed the close of business on April 12, 2021 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

Whether or not you expect to attend the Annual Meeting via live webcast, please submit a proxy as soon as possible to instruct how your shares are to be voted at the Annual Meeting. A stockholder may submit a proxy by following the instructions set forth on the Notice of Internet Availability of Proxy Materials or proxy card. A stockholder who receives a paper copy of the proxy card by mail will also receive a postage-paid, addressed envelope that can be used to return the completed proxy card. If you participate in and vote your shares at the Annual Meeting, your proxy will not be used.

A list of all stockholders entitled to vote at the Annual Meeting will be available for examination at our principal executive offices at 520 Newport Center Drive, Suite 1200, Newport Beach, California 92660, for ten days before the Annual Meeting, and during the Annual Meeting such list will be available for examination at www.virtualshareholdermeeting.com/EOLS2021 by using the control number on your proxy card, voting instruction form, or Notice of Internet Availability.

On behalf of the board of directors,

David Moatazedi

President and Chief Executive Officer

Newport Beach, California

April 26, 2021

Important Notice Regarding Availability of Proxy Materials for Annual Meeting on June 8, 2021: Evolus’ Notice of Annual Meeting of Stockholders, Proxy Statement and 2020 Annual Report to Stockholders are available at www.proxyvote.com. | ||

Evolus, Inc.

520 Newport Center Drive, Suite 1200

Newport Beach, CA 92660

Proxy Statement dated April 26, 2021

2021 Annual Meeting of Stockholders

Evolus, Inc., a Delaware corporation, is furnishing this Proxy Statement and related proxy materials in connection with the solicitation by its board of directors of proxies to be voted at its 2021 Annual Meeting of Stockholders and any postponement or adjournment thereof. Evolus, Inc. is providing these materials to the holders of record of its common stock, $0.00001 par value per share, as of the close of business on the record date of April 12, 2021 and is first making available or mailing the materials on or about April 26, 2021.

The Annual Meeting is scheduled to be held as follows:

Date | June 8, 2021 | |||||||

Time | 8:00 a.m., Pacific Time | |||||||

Webcast Address | www.virtualshareholdermeeting.com/EOLS2021 | |||||||

You will not be able to attend the Annual Meeting in person.

Your vote is important.

Please see the detailed information that follows in the Proxy Statement.

1

2021 Proxy Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. References in this Proxy Statement to “Evolus,” and to “we,” “us,” “our” and similar terms, refer to Evolus, Inc.

Annual Meeting of Stockholders

Time and Date | 8:00 a.m., Pacific time, on June 8, 2021 | ||||

Live Webcast Address | www.virtualshareholdermeeting.com/EOLS2021 | ||||

Record Date | Close of business on April 12, 2021 | ||||

Voting | Stockholders will be entitled to one vote for each outstanding share of common stock they hold of record as of the record date. | ||||

Total Votes Per Proposal | 43,737,814 votes, based on 43,737,814 shares of common stock outstanding as of the record date. | ||||

Annual Meeting Agenda

| Proposal | Board Recommendation | ||||

Election of David Moatazedi, Vikram Malik, and Karah Parschauer as Class III directors | FOR ALL | ||||

Ratification of appointment of independent auditor for 2021 | FOR | ||||

How to Cast Your Vote

You can vote by any of the following methods:

Until 11:59 p.m., EDT, on June 7, 2021 | At the Annual Meeting on June 8, 2021 | |||||||

Internet: From any web-enabled device: www.proxyvote.com Telephone: 1-800-690-6903 Mail: Completed, signed and returned proxy card | Online: Vote during the Annual Meeting via the Internet at www.virtualshareholdermeeting.com/EOLS2021 | |||||||

Proposal 1 - Election of Directors

As the first proposal, we are asking stockholders to elect David Moatazedi, Vikram Malik, and Karah Parschauer, each of whom currently serve as members of the board of directors, as Class III directors to serve until Evolus’ 2024 annual meeting of stockholders and until their respective successors are duly elected and qualified. The following information pertains to each director nominee as of April 23, 2021.

2

Director Since | Experience/ | Independent | Committee | Other Public | ||||||||||||||||||||||

| Name | Age | Occupation | Qualifications | Yes | No | Memberships | Company Boards | |||||||||||||||||||

| David Moatazedi | 43 | 2018 | President and Chief Executive Officer of Evolus, Inc. | ● Industry ● Leadership | þ | None | None | |||||||||||||||||||

| Vikram Malik | 58 | 2018 | President of Priveterra Acquisition Corp. Managing Partner of Strathspey Crown Holdings Group, LLC. | ● Industry ● Finance | þ | None | ● Priveterra Acquisition Corp. | |||||||||||||||||||

| Karah Parschauer | 43 | 2019 | General Counsel and Executive Vice President of Ultragenyx Pharmaceutical, Inc. | ● Industry ● Legal | þ | ● Audit ●Compensation ● Nominating and Corporate Governance (Chair) | ● Arcturus Therapeutics, Ltd. | |||||||||||||||||||

3

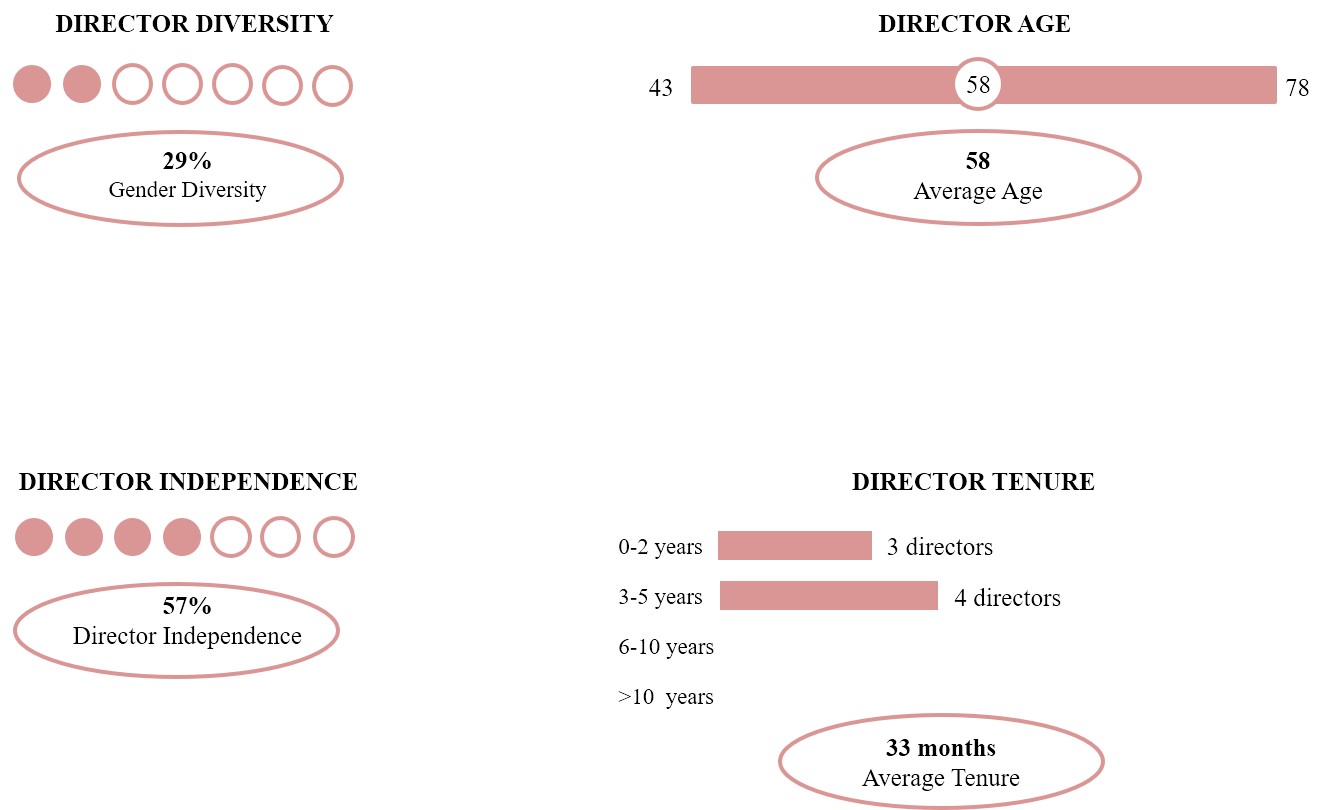

Board Representation

Proposal 2 - Ratification of Appointment of Independent Auditor for 2021

We are asking stockholders to ratify the audit committee’s appointment of Ernst & Young LLP as Evolus’ independent registered public accounting firm for the year ending December 31, 2021.

4

EXPLANATORY NOTE

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act. As an emerging growth company, we provide in this Proxy Statement the scaled disclosure permitted under the JOBS Act. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted.

Under the JOBS Act, we will remain an “emerging growth company” until the earliest of: (i) the last day of the fiscal year during which we have total annual gross revenue of $1.07 billion or more; (ii) the last day of the fiscal year following the fifth anniversary of the closing of our initial public offering on February 12, 2018, or the IPO; (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt; and (iv) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended, or the Exchange Act (we will qualify as a large accelerated filer as of the first day of the first fiscal year after we (1) have more than $700 million in outstanding common equity held by our non-affiliates, (2) have been public for at least 12 months and (3) are no longer eligible to use the requirements for smaller reporting companies under the revenue test under the Exchange Act; the value of our outstanding common equity will be measured each year on the last day of our second fiscal quarter).

WEBSITE REFERENCES

Throughout this Proxy Statement, we make references to additional information available on our corporate website at www.evolus.com or https://investors.evolus.com/. All references to our website are provided for convenience only and the content on our website does not constitute a part of this Proxy Statement and is not deemed incorporated by reference into this Proxy Statement or any other public filing made with the SEC.

5

VIRTUAL ANNUAL MEETING

This year the Annual Meeting of Stockholders of Evolus, Inc., which we refer to as the Annual Meeting, will be held on June 8, 2021 via live audio webcast. You will not be able to attend the Annual Meeting in person. Any stockholder will be able to attend the Annual Meeting, vote and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/EOLS2021 and entering the control number included in the Notice of Internet Availability, proxy card or voting instruction form that you receive. The Annual Meeting webcast will begin promptly at 8:00 a.m., Pacific Time. We encourage you to access the Annual Meeting webcast prior to the start time.

Benefits of a Virtual Annual Meeting

•We believe a virtual-only meeting format facilitates stockholder attendance and participation by enabling all stockholders to participate fully, equally and without cost, using an Internet-connected device from any location around the world. In addition, the virtual-only meeting format increases our ability to engage with all stockholders, regardless of size, resources or physical location and enables us to protect the health and safety of all attendees, particularly in light of the coronavirus (“COVID-19”) pandemic.

•Our board of directors annually considers the appropriate format of our annual meeting of stockholders. As part of our effort to maintain a safe and healthy environment for our directors, members of management and stockholders who wish to attend the Annual Meeting, and in light of the COVID-19 pandemic, our board of directors believes that hosting a virtual Annual Meeting is in our best interest and the best interest of our stockholders and enables increased stockholder attendance and participation. Furthermore, our board of directors has determined that hosting a virtual annual meeting of stockholders will provide expanded access, improved communication, and cost savings.

•Stockholders of record and beneficial owners as of the close of business on April 12, 2021 (the “Record Date”), will have the ability to submit questions directly to our management and board of directors and vote electronically at the Annual Meeting via the virtual-only meeting platform, with procedures designed to ensure the authenticity and correctness of your voting instructions.

•We believe that the virtual-only meeting format will give stockholders the opportunity to exercise the same rights as if they had attended an in-person meeting and believe that these measures will enhance stockholder access and encourage participation and communication with our board of directors and management.

Attendance at the Virtual Annual Meeting

•All stockholders of our common stock as of the Record Date will be able to attend the Annual Meeting, vote and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/EOLS2021 and entering the control number included in the Notice of Internet Availability or proxy card that you receive. Members of the public will also be permitted to attend the meeting, but will not be permitted to ask questions during the meeting.

•If you were a stockholder as of the Record Date, you may vote shares held in your name as the stockholder of record or shares for which you are the beneficial owner but not the stockholder of record electronically during the Annual Meeting through the online virtual annual meeting platform by following the instructions provided when you log in to the online virtual annual meeting platform.

•We encourage you to access the Annual Meeting webcast prior to the start time. Online check-in will begin, and stockholders may begin submitting written questions, at 7:45 a.m., Pacific Time, and you should allow ample time for the check-in procedures.

•We will have technicians ready to assist with any technical difficulties you may have accessing the Annual Meeting, voting at the Annual Meeting or submitting questions at the Annual Meeting. If you encounter any difficulties accessing the virtual-only Annual Meeting platform, including any difficulties with your 16-digit control number or submitting questions, please call 1-800-586-1548 (toll free) or 303-562-9288 (international) or the technical support number that will be posted on the Annual Meeting log-in page.

If we experience technical difficulties at the Annual Meeting and are not able to resolve them within a reasonable amount of time, we will adjourn the Annual Meeting to a later date and will provide notice of the date and time of such adjourned meeting at www.virtualshareholdermeeting.com/EOLS2021 and on a Current Report on Form 8-K that we will file with the SEC. For additional information on how you can attend any postponement or adjournment of the Annual Meeting, see “Questions and Answers About the Annual Meeting—-What happens if the Annual Meeting is postponed or adjourned” below.

6

Please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

Questions at the Virtual Annual Meeting

•Stockholders will have the opportunity to submit questions beginning at 7:45 a.m., Pacific Time, on the date of the Annual Meeting by following the instructions on the virtual-only Annual Meeting platform.

•Following the presentation of all proposals at the Annual Meeting, we will spend up to 15 minutes answering as many stockholder-submitted questions that comply with the meeting rules of conduct, which will be posted on the online virtual annual meeting platform. We will publish appropriate questions submitted in accordance with the Annual Meeting rules of conduct with answers, including those questions which were not addressed directly during the Annual Meeting due to time constraints, on our investor relations website at https://investors.evolus.com/ soon after the Annual Meeting. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

YOU WILL NOT BE ABLE TO ATTEND THE ANNUAL MEETING IN PERSON

7

Questions and Answers about the Annual Meeting

Q: When and where will the Annual Meeting be held?

A: The Annual Meeting will be held on June 8, 2021 via live audio webcast. You will not be able to attend the Annual Meeting in person. The Annual Meeting webcast will begin promptly at 8:00 a.m., Pacific Time. See “Virtual Annual Meeting” above for further information about our virtual Annual Meeting. The use of cameras, recording devices, cell phones, and other electronic devices is strictly prohibited during the Annual Meeting.

Q: What materials have been prepared for stockholders in connection with the Annual Meeting?

A: We are furnishing you and other stockholders of record with the following proxy materials, which we refer to as the proxy materials:

•our Annual Report on Form 10‑K for the fiscal year ended December 31, 2020 (including our audited consolidated financial statements), which we refer to as the Annual Report;

•this Proxy Statement for the 2021 Annual Meeting, which we refer to as this Proxy Statement and which also includes a letter from our President and Chief Executive Officer to stockholders, and a Notice of 2021 Annual Meeting of Stockholders; and

•a Notice of Internet Availability of Proxy Materials, which we refer to as the Notice of Internet Availability or a proxy card, each of which includes a control number for use in submitting proxies.

These materials were first mailed to stockholders and made available on the Internet on or about April 26, 2021.

If, in accordance with the instructions provided in the Notice of Internet Availability, you request or in the past have requested a printed set of proxy materials, you will receive by mail, at no charge, printed copies of the 2020 Annual Report, this Proxy Statement, a proxy card for the Annual Meeting and a pre-addressed envelope to be used to return the completed proxy card.

If, in accordance with the instructions provided in the Notice of Internet Availability, you request or in the past have requested that a set of proxy materials be emailed to you, you will receive by email, at no charge, electronic copies of the 2020 Annual Report and this Proxy Statement.

Q: Why was I mailed a Notice of Internet Availability rather than a printed set of proxy materials?

A: In accordance with rules adopted by the Securities and Exchange Commission, or SEC, we are furnishing the proxy materials to stockholders who have not previously elected to receive our proxy materials by mail or e-mail by providing access via the Internet, instead of mailing printed copies. This process expedites the delivery of proxy materials to our stockholders, lowers our costs and reduces the environmental impact of the Annual Meeting. The Notice of Internet Availability tells you how to access and review the proxy materials on the Internet and how to vote on the Internet. It also provides instructions you may follow to request paper or emailed copies of the proxy materials.

Q: Are the proxy materials available via the Internet?

A: Yes. You can access and review the proxy materials for the Annual Meeting at www.proxyvote.com. In order to submit your proxies, however, you will need to refer to the Notice of Internet Availability sent to you or the proxy card mailed to you to obtain your 16-digit control number and other personal information needed to vote by proxy or during the Annual Meeting.

Q: What is a proxy?

A: The term “proxy,” when used with respect to stockholder, refers to either a person or persons legally authorized to act on the stockholder’s behalf or a format that allows the stockholder to vote without being physically present at the Annual Meeting.

Because it is important that as many stockholders as possible be represented at the Annual Meeting, the board of directors is asking that you review this Proxy Statement carefully and then vote by following the instructions set forth on the Notice of Internet Availability or the proxy card. We recommend that you submit a proxy in advance to authorize the voting of

8

your shares at the Annual Meeting so that your vote will be counted if you are unable to attend the Annual Meeting. David Moatazedi and Lauren Silvernail have each been designated as proxy holders and will be authorized to vote the shares represented by all properly submitted proxies. All shares represented by valid proxies will be voted in accordance with the stockholder’s specific instructions. See also “What happens if I do not give specific voting instructions?” below.

Q: What matters will the stockholders vote on at the Annual Meeting?

A: Proposal 1 - Election of David Moatazedi, Vikram Malik and Karah Parschauer as Class III directors to serve until Evolus’ 2024 annual meeting of stockholders and until their respective successors are duly elected and qualified.

Proposal 2 - Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2021.

Proposal 2 to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm is advisory only and is not binding on us. Our board of directors will consider the outcome of the vote on this item in considering what action, if any, should be taken in response to the vote by stockholders.

Q: Who can vote at the Annual Meeting?

A: Stockholders of record of common stock at the close of business on April 12, 2021, the record date, will be entitled to vote at the Annual Meeting. As of the record date, there were a total of 43,737,814 shares of common stock outstanding, each of which will be entitled to one vote on each proposal. As a result, up to a total of 43,737,814 votes can be cast on each proposal.

Q: Who counts the votes?

A: Votes at the Annual Meeting will be tabulated by a representative of Broadridge Financial Solutions, Inc., who will serve as the Inspector of Elections.

Q: What is a stockholder of record?

A: A stockholder of record is a stockholder whose ownership of our common stock is reflected directly on the books and records of our transfer agent, Computershare Trust Company, N.A.

Q: What does it mean for a broker or other nominee to hold shares in “street name”?

A: Most of our stockholders hold their shares through a broker, bank or other nominee (that is, in “street name”) rather than directly in their own name. If your shares are held in street name, you are considered the “beneficial stockholder” of such shares and the proxy materials were made available to you by the organization holding your shares.

An organization that holds your beneficially owned shares in street name will generally vote in accordance with the instructions you provide. If your shares are held in a brokerage account and you do not provide the broker with voting instructions with respect to a proposal, the broker’s authority to vote your shares will depend upon whether the proposal is considered a “routine” or a non-routine matter.

•The broker generally has discretionary authority to vote your beneficially owned shares on routine items for which you have not provided voting instructions to the broker. The only routine matter expected to be voted on at the Annual Meeting is the ratification of the appointment of our independent auditor for 2021 (Proposal 2).

•The broker generally may not vote on non-routine matters, including the election of directors (Proposal 1). If the broker exercises its discretionary authority to vote your shares on any routine matter at the meeting (e.g. Proposal 2), your shares will constitute “broker non-votes” on Proposal 1.

For the purpose of determining a quorum, we will treat as present at the Annual Meeting any proxies that are voted on any of the two proposals to be acted upon by the stockholders, including withhold votes, abstentions or broker non-votes.

Q: How do I vote my shares if I do not attend the Annual Meeting?

A: If you are a stockholder of record, you may vote prior to the Annual Meeting as follows:

9

•Via the Internet: You may vote via the Internet by going to www.proxyvote.com, in accordance with the voting instructions on the Notice of Internet Availability and the proxy card. Internet voting is available 24 hours a day until 11:59 p.m., Eastern time, on June 7, 2021. You will be given the opportunity to confirm that your instructions have been recorded properly.

•By Telephone: You may vote by calling 1-800-690-6903 and following the instructions provided on the telephone line. Telephone voting is available 24 hours a day until 11:59 p.m., Eastern time, on June 7, 2021. Easy-to-follow voice prompts will allow you to vote your shares and confirm that your instructions have been recorded properly.

•By Mail: If you obtain a proxy card by mail, you may vote by returning the completed and signed proxy card in a postage-paid return envelope that will be provided with the proxy card.

For your information, voting via the Internet is the least expensive to Evolus, followed by telephone voting, with voting by mail being the most expensive.

If you hold shares in street name, meaning you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, you should have received a notice containing voting instructions from that organization rather than from us. Please follow the voting instructions in the notice to ensure that your vote is counted.

Q: Can I vote during the Annual Meeting?

A: Both stockholders of record and beneficial owners of shares of our common stock as of the Record Date may vote personally during the Annual Meeting. Instructions on how to vote while participating in the Annual Meeting live via the Internet will be posted at www.virtualshareholdermeeting.com/EOLS2021. You will need the 16-digit control number included on your Notice of Internet Availability, proxy card, voting instruction form or included in the email to you if you received the proxy materials by email in order to be able to vote your shares or submit questions during the Annual Meeting.

Our common stock is the only class of our securities authorized to vote at the Annual Meeting; stockholders are not entitled to cumulative voting rights in the election of directors.

Q: May I change my vote or revoke my proxy?

A: Yes. If you are a stockholder of record and previously delivered a proxy, you may subsequently change or revoke your proxy at any time before it is exercised by:

•filing a written notice of revocation with a later date than the proxy with our Secretary before the Annual Meeting;

•voting via the Internet or telephone at a later time;

•submitting a completed and signed proxy card with a later date; or

•voting via the Internet during the Annual Meeting.

If you are a beneficial owner of shares held in street name, you should contact your bank, broker or other nominee for instructions as to whether, and how, you can change or revoke your proxy.

Attendance at the Annual Meeting will not by itself constitute a revocation of a proxy.

Q: What happens if I do not give specific voting instructions?

A: If you are a stockholder of record and you return a proxy card without giving specific voting instructions, the proxy holders will vote your shares in the manner recommended by the board of directors on both proposals presented in this Proxy Statement and as they may determine in their discretion on any other matters properly presented for a vote at the Annual Meeting.

Q: Who is paying for this proxy solicitation?

A: We will pay for the entire cost of preparing, assembling, printing and mailing the Notice of Internet Availability, this Proxy Statement and the materials used in the solicitation of proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees

10

will not be paid any additional compensation for soliciting proxies. We will also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. We may retain the services of a proxy solicitation firm if, in the board of director’s view, it is deemed necessary or advisable. Although we do not currently expect to retain such a firm, we estimate that the fees of any such firm retained by us could be up to $50,000 plus out-of-pocket expenses, all of which would be paid by us.

Q: What does it mean if I receive more than one Notice of Internet Availability or proxy card?

A: If you receive more than one Notice of Internet Availability, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each Notice of Internet Availability and proxy card you receive to ensure that all of your shares are voted.

Q: What if other matters are presented at the Annual Meeting?

A: If a stockholder of record provides a proxy by voting in any manner described in this Proxy Statement, the proxy holders will have the discretion to vote on any matters, other than the two proposals presented in this Proxy Statement, that are properly presented for consideration at the Annual Meeting. We do not know of any other matters to be presented for consideration at the Annual Meeting.

Q: What happens if the Annual Meeting is postponed or adjourned?

A: Except as noted below, your proxy may be voted at the postponed or adjourned Annual Meeting and you will still be able to change your proxy until it is voted. In that event, we expect that any adjournment of the Annual Meeting can be accessed at the same website listed above and you may vote at any postponement or adjournment using your same 16-digit control number.

If the adjourned meeting is more than 30 days after the date of the Annual Meeting, which we do not expect, we will be required to fix a new record date for the adjourned meeting and, in that case, we will furnish new proxy materials for the adjourned Annual Meeting.

Q: Where can I find the voting results of the Annual Meeting?

A: Our intention is to announce the preliminary voting results at the Annual Meeting and to publish the final results within four business days after the Annual Meeting on a Current Report on Form 8-K to be filed with the SEC.

11

Vote Required for Election or Approval

Introduction

Evolus’ only voting securities are the outstanding shares of common stock. As of the record date, which is the close of business on April 12, 2021, there were 43,737,814 shares of common stock outstanding, each of which will be entitled to one vote on each proposal.

Only stockholders of record as of the record date will be entitled to notice of, and to vote at, the Annual Meeting. A majority of the outstanding shares of common stock entitled to vote at the Annual Meeting will constitute a quorum for the transaction of business at the Annual Meeting. For the purpose of determining a quorum, we will treat as present at the Annual Meeting any proxies that are voted on any matter to be acted upon by the stockholders, as well as withheld votes, abstentions or any broker non-votes.

Proposal 1 - Election of Directors

Each director will be elected by a plurality of the votes cast with respect to that director. Under this voting standards, the three director nominees receiving the highest number of affirmative votes will be elected as Class III directors to serve until the 2024 annual meeting of stockholders and until their respective successors are duly elected and qualified. Shares voted “withhold” and broker non-votes will not be counted in determining the outcome of a director nominee’s election.

Proposal 2 - Ratification of Appointment of Independent Auditor for 2021

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2021 must be approved by affirmative votes constituting a majority of the shares of common stock that are present or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions will count as votes against this proposal, since shares with respect to which the stockholder abstains will be deemed present and entitled to vote. Because this proposal is considered a routine matter, discretionary votes by brokers will be counted.

12

Corporate Governance

Board of Directors Overview

Under our organizational documents and the Delaware General Corporation Law, our business and affairs are managed by or under the direction of our board of directors, which selectively delegates responsibilities to its standing committees.

The board of directors maintains an audit committee, a compensation committee and a nominating and corporate governance committee. The board of directors has adopted charters for each of the committees, and those charters are to be reviewed annually by the committees and the board of directors. Each of the audit, compensation and nominating and corporate governance committee charters is available to our stockholders at www.evolus.com.

The committees have the functions and responsibilities described in the corresponding sections below.

Independence of Directors

Under the rules of the Nasdaq Global Market, or Nasdaq, independent directors must comprise a majority of a listed company’s board within twelve months from the date of listing. In addition, Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent within twelve months from the date of listing.

Audit committee members must also satisfy additional independence criteria, including those set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and compensation committee members must also satisfy additional independence criteria, including those set forth in Rule 10C-1 of the Exchange Act. Under Nasdaq rules, a director will qualify as an “independent director” only if, in the opinion of that company’s board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In order to be considered independent for purposes of Rule 10A-3 under the Exchange Act, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board or any other board committee: (a) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries, other than compensation for board service; or (b) be an affiliated person of the listed company or any of its subsidiaries. In order to be considered independent for purposes of Rule 10C-1 under the Exchange Act, each member of the compensation committee must be a member of the board of the listed company and must otherwise be independent. In determining independence requirements for members of compensation committees, the national securities exchanges and national securities associations are to consider relevant factors, including: (a) the source of compensation of a member of the board of a listed company, including any consulting, advisory or other compensatory fee paid by the listed company to such member; and (b) whether a member of the board of a listed company is affiliated with the listed company, a subsidiary of the listed company or an affiliate of a subsidiary of the listed company.

The board of directors undertook a review of the independence of each director and considered whether each director has a material relationship with Evolus that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities as a director. Based upon information requested from and provided by each director regarding each director’s business and personal activities and relationships as they may relate to us and our management, including the beneficial ownership of our capital stock by each non-employee director and the transactions involving them described in the section entitled “Certain Relationships and Related-Person Transactions,” the board of directors has determined that each of Peter Farrell, David Gill, Robert Hayman, and Karah Parschauer qualify as independent directors in accordance with the rules of Nasdaq and Rules 10C-1 and 10A-3 under the Exchange Act. Each of Bosun Hau and Kristine Romine, M.D. also qualified as independent directors in accordance with the rules of Nasdaq during the period of their service on the board of directors in 2020.

Transition from Controlled Company - Fully Independent Committees

Under the Nasdaq rules, a company is a “controlled company” if more than 50% of the combined voting power for the election of directors is held by an individual, group or another company. Prior to May 20, 2019, ALPHAEON Corporation, or Alphaeon, owned more than 50% of our combined voting power and we were considered a “controlled company”. In 2019 Alphaeon changed its name to AEON Biopharma, Inc. and contributed all of the shares it held in the Company to Alphaeon 1, LLC. The Company continues to refer to the renamed AEON Biopharma, Inc. as “Alphaeon” and Alphaeon 1, LLC as Alphaeon 1, LLC.

13

As of March 13, 2020, we no longer utilized the “controlled company” exemptions to the corporate governance requirements of Nasdaq and since that time have complied with the following corporate governance requirements:

•that a majority of the board of directors consists of independent directors;

•that we have a nominating and corporate governance committee that is comprised entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and

•that we have a compensation committee that is comprised entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities.

Code of Conduct

We have a Code of Conduct applicable to all directors, officers and employees of Evolus and its subsidiaries. We have posted the Code of Conduct on our website www.evolus.com. We will post any amendments to the Code of Conduct on our website. In accordance with the requirements of the SEC and Nasdaq, we will also post waivers applicable to any of our officers or directors from provisions of the Code of Conduct on our website. We have not granted any such waivers to date.

We have implemented whistleblower procedures, which establish formal protocols for receiving and handling complaints from employees. Employees should communicate any concerns regarding accounting or auditing matters promptly to their supervisor or Evolus’ Compliance Officer.

Policy on Pledging and Hedging of Company Shares

As part of our Insider Trading Policy adopted by our Board of Directors and applicable to our directors, officers and employees, their immediate family members sharing the same household and any family members who do not live in their household but whose transactions in the our securities are directed by employees, officers and directors or are subject to the control or influence by such persons, such as parents or children who consult with such persons before they trade in our securities (collectively, “Insiders”), Insiders are not permitted to engage in any short sale of our securities, transact in any publicly traded options, pledge shares as collateral for a loan or margin Evolus securities in a margin account or purchase financial instruments (including zero-cost collars and forward sale contracts), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our securities.

Board Oversight of Risk

The board of directors has responsibility for the oversight of our risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business and the steps we take to manage them. The risk oversight process includes receiving regular reports from committees of the board of directors and members of senior management to enable the board of directors to understand our risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic, cybersecurity and reputational risk.

The board of directors is responsible for monitoring and assessing strategic risk exposure, while the audit committee considers and discusses our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our audit committee, nominating and corporate governance committee and compensation committee support our board of directors in discharging its oversight duties and address risks inherent in their respective areas. We believe this division of responsibilities is an effective approach for addressing the risks we face and that our board leadership structure supports this approach.

Board Leadership Structure

The board of directors recognizes that it is important to determine an optimal board leadership structure to ensure the independent oversight of management as the company continues to grow. As a general policy, we believe that separation of the positions of Chairman of our board of directors and our Chief Executive Officer reinforces the independence of our board of directors from management, creates an environment that encourages objective oversight of management’s performance and enhances the effectiveness of our board of directors as a whole. As such, Mr. Moatazedi, our Chief Executive Officer, does not serve as the Chairman of the board of directors.

14

The board of directors has concluded that our current leadership structure is appropriate at this time and allows the board of directors to fulfill its role with appropriate independence and is in the best interest of our stockholders. However, the board will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Audit Committee

The principal responsibilities of the audit committee include:

•evaluating the performance, independence and qualifications of our independent registered public accounting firm and determining whether to retain our existing independent registered public accounting firm or engage a new independent registered public accounting firm;

•reviewing and approving the engagement of our independent registered public accounting firm to perform audit services and any permissible non-audit services;

•reviewing our annual and quarterly financial statements and reports and discussing the statements and reports with our independent registered public accounting firm and management;

•furnishing the audit committee report required by SEC rules to be included in the proxy statement;

•reviewing with our independent registered public accounting firm and management significant issues that arise regarding accounting principles and financial statement presentation and matters concerning the scope, adequacy and effectiveness of our financial controls;

•reviewing and approving related party transactions and administering our Code of Conduct;

•reviewing our major financial risk exposures, including the guidelines and policies to govern the process by which risk assessment and risk management is implemented;

•reviewing our internal audit function, our disclosure controls and procedures and our accounting and financial reporting processes, including the purpose, authority, budget and staffing of each; and

•reviewing and evaluating on an annual basis the performance of the audit committee, including compliance of the audit committee with its charter.

Our independent auditor is ultimately accountable to the audit committee. The audit committee has the ultimate authority and responsibility to select, evaluate, approve terms of retention and compensation of, and, where appropriate, replace the independent auditor. Both our independent registered public accounting firm and management periodically meet privately with our audit committee, at least annually.

The current members of the audit committee are David Gill, who serves as chair, Karah Parschauer and Peter Farrell. Mrs. Parschauer is standing for re-election at the Annual Meeting. The board has determined that each of the audit committee members is financially literate. The board of directors also determined that each of the current members of the audit committee is independent, as defined in the listing standards of Nasdaq and Rule 10A-3 under the Exchange Act. The board of directors has also determined that Mr. Gill is an audit committee financial expert in accordance with the standards of the SEC. The audit committee held four meetings in 2020.

Compensation Committee

The principal responsibilities of the compensation committee include:

•reviewing, modifying and approving (or if it deems appropriate, making recommendations to the full board of directors regarding) our overall compensation strategy and policies;

•reviewing and approving the compensation, the performance goals and objectives relevant to the compensation, and other terms of employment of our executive officers;

•reviewing and approving (or if it deems appropriate, making recommendations to the full board of directors regarding) the equity incentive plans, compensation plans and similar programs advisable for us, as well as administering, modifying, amending or terminating existing plans and programs;

15

•reviewing incentive-based compensation arrangements and determining whether they encourage excessive risk-taking, reviewing and discussing the relationship between risk management policies and practices and compensation, and evaluating compensation policies and practices that could mitigate any such risk;

•reviewing and approving the terms of any employment agreements, severance arrangements, change in control protections and any other compensatory arrangements for our executive officers;

•making recommendations to the board regarding director compensation; and

•preparing the annual compensation committee report to the extent required by SEC rules.

The current members of the compensation committee are Robert Hayman, who serves as chair, David Gill and Karah Parschauer. Mrs. Parschauer is standing for re-election at the Annual Meeting. The board of directors also determined that each of the current members of the compensation committee is independent, as defined in the listing standards of Nasdaq.

The compensation committee may form subcommittees and delegate to its subcommittees such power and authority as it deems appropriate from time to time under the circumstances. The compensation committee has no current intention to delegate any of its responsibilities to a subcommittee but the board of directors has delegated certain responsibilities of the compensation committee to a stock awards committee, with Mr. Moatazedi as its sole member, and given the stock awards committee limited authority to approve and establish the terms of equity awards granted to eligible participants (who are not executive officers or members of the board of directors) under our equity incentive plan. The compensation committee may confer with the board of directors in determining the compensation for the Chief Executive Officer. In determining compensation for executive officers other than the President and Chief Executive Officer, the compensation committee considers, among other things, the recommendations of the President and Chief Executive Officer.

The compensation committee held ten meetings in 2020. The compensation committee has the sole authority to retain, oversee and terminate any compensation consultant to be used to assist in the evaluation of executive compensation and to approve the consultant’s fees and retention terms.

During our fiscal year ended December 31, 2020, our compensation committee engaged the services of compensation consulting firms Compensia, Inc. (“Compensia) and Mercer (US) Inc. (“Mercer”) to advise the compensation committee regarding the amount and types of compensation that we provide to our executives and directors and how our compensation practices compared to the compensation practices of other companies. Compensia and Mercer each reports directly to the compensation committee. The compensation committee believes that Compensia and Mercer do not have any conflicts of interest in advising the compensation committee under applicable SEC and Nasdaq rules.

For 2020, the compensation committee engaged Compensia specifically to:

•participate in discussions with the compensation committee and selected members of senior management regarding our historical pay practices, incumbent roles and responsibilities, compensation philosophy and equity grant alternatives;

•develop a peer group of publicly traded and comparable life science and aesthetics companies that we compete with for business, executive talent and investor capital;

•review and assess the executive compensation practices disclosed by companies in the peer group;

•review and assess our executive compensation program;

•review equity grant practices for us and our industry peers, including topics such as equity plan dilution, annual share usage, prevalence of long-term incentive award vehicles and mix, and equity stakes for named executive officers;

•recommend an equity grant strategy to assist us in providing ongoing long-term incentive awards to executives and assist with equity grand modeling; and

•review and assess our non-employee director compensation program.

For 2020, Mercer provided advice with respect to executive and employee retention arrangements considered by our compensation committee.

Nominating and Corporate Governance Committee

16

The principal responsibilities of the nominating and corporate governance committee include:

•identifying, reviewing and evaluating candidates to serve on our board of directors consistent with criteria approved by our board of directors;

•evaluating director performance on the board and applicable committees of the board and determining whether continued service on our board is appropriate;

•reviewing communications from stockholders directed to the board, including evaluating nominations by stockholders of candidates for election to our board of directors;

•overseeing evaluations of the board of directors, individual directors and the committees of the board of directors;

•monitoring and recommending modifications to our Insider Trading Policy, as necessary and advisable; and

•reviewing and evaluating on an annual basis the performance of the nominating and corporate governance committee, including compliance of the audit committee with its charter.

The current members of the nominating and corporate governance committee are Karah Parschauer, who serves as chair, and Peter Farrell. Mrs. Parschauer is standing for re-election at the Annual Meeting. The board of directors also determined that each of the current members of the nominating and corporate governance committee is independent, as defined in the listing standards of Nasdaq.

The nominating and corporate governance committee has the sole authority to elect, retain, terminate and approve the fees and other retention terms of consultants or search firms used to identify director candidates and to assist in the evaluation of director performance. Due to changes in the composition of the committee during 2020, the nominating and corporate governance committee did not hold a meeting in 2020 and instead the full board of directors executed the duties normally delegated to the nominating and corporate governance committee.

Consideration of Director Candidates

Stockholder Recommendations

The nominating and corporate governance committee will consider candidates for director recommended by stockholders. If a stockholder wishes to recommend a director candidate, he or she should submit such recommendation in writing to the Chair, Nominating and Corporate Governance Committee, care of the Corporate Secretary at Evolus, Inc., 520 Newport Center Drive, Suite 1200, Newport Beach, CA 92660. The nominating and corporate governance committee may request additional information concerning the director candidate as it deems reasonably required to determine the eligibility and qualification of the director candidate to serve as a member of the board of directors.

Stockholders recommending candidates for consideration by our nominating and corporate governance committee in connection with the next annual meeting of stockholders should submit their written recommendation no later than January 1 of the year of that meeting. All recommendations will be brought to the attention of the nominating and corporate governance committee, and the nominating and corporate governance committee shall evaluate such director nominees in accordance with the same criteria applicable to the evaluation of all director nominees.

Stockholder Nominations

Stockholders who wish to nominate a person for election as a director in connection with an annual meeting of stockholders (as opposed to making a recommendation to the nominating and corporate governance committee as described above) must mail notice in proper written form, including all required information as specified in the bylaws, to the Corporate Secretary at Evolus, Inc., 520 Newport Center Drive, Suite 1200, Newport Beach, CA 92660. For more information, and for more detailed requirements including the time periods in which to send such nominations, please refer to our Amended and Restated Bylaws, filed as Exhibit 3.2 to our Current Report on Form 8-K (File No. 001-38381), filed with the SEC on February 12, 2018 and see the section “Stockholder Proposals for 2022 Annual Meeting”

Meetings and Attendance

We expect directors to regularly attend meetings of the board of directors and of all committees on which they serve and to review the materials sent to them in advance of those meetings. The board of directors generally expects to hold four regular meetings per year and to meet on other occasions when circumstances require. As part of the board of directors’ regularly

17

scheduled meetings, the non-employee directors meet in executive session. Directors spend additional time preparing for board of directors and committee meetings, and we may call upon directors for advice between meetings. The board of directors held fifteen meetings in 2020. Each director attended 75% or more of the aggregate number of meetings of the board of directors and of the committees on which he or she served that were held during the portion of the last fiscal year for which he or she was a director or committee member.

In addition, although we have no formal policy requiring attendance, directors are encouraged to attend the Annual Meeting and we expect nominees for election at each annual meeting of stockholders to participate in the Annual Meeting. All incumbent directors attended our annual meeting in May 2020.

18

Certain Relationships and Related-Person Transactions

Procedures for Approval of Related Person Transactions

Pursuant to the charter of the audit committee, the audit committee is responsible for reviewing, approving and ratifying in advance any “related person transactions.” For purposes of the charter of the audit committee only, a “related person transaction” is a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which we and any “related person” are participants and had or will have a direct or indirect material interest, involving an amount that exceeds $120,000. A “related person” is any executive officer, director or a holder of more than 5% of any class of our equity, including any of their immediate family members and any entity owned or controlled by such persons.

Our audit committee will review, on an annual basis, the previously approved related person transactions that are continuous in nature to determine whether such transactions should continue.

Related Party Transactions

The following is a description of transactions since January 1, 2019 to which we have been a party, in which the amount involved exceeded or will exceed the lesser of $120,000 and 1% of the average of our total assets at year end for the last two completed fiscal years, and in which any of our directors, executive officers or beneficial owners of more than 5% of our capital stock, or an affiliate or immediate family member thereof, had or will have a direct or indirect material interest, other than compensation, termination and change-in-control arrangements. The transactions set forth below were approved by the audit committee. We believe we have executed all of the transactions set forth below on terms no less favorable to us than we could have obtained from unaffiliated third parties. It is our intention to ensure that all future transactions between us and our officers, directors and principal stockholders and their affiliates are approved by the audit committee.

Stockholder Agreement

On December 14, 2017, we entered into a stockholder agreement with Alphaeon, DI, as collateral agent, and Longitude. The stockholder agreement provides Alphaeon with certain registration rights. Alphaeon’s rights were assigned to Alphaeon 1, LLC in January 2020.

Subject to certain limitations, Alphaeon 1, LLC may request that we register for resale all or a portion of its shares of common stock. Alphaeon 1, LLC may also request that we file an automatic shelf registration statement on Form S-3 that covers the registrable securities requested to be registered, to the extent we are eligible to do so. Depending on certain conditions, and in addition to other exclusions, we may defer a demand registration for up to 90 days in any twelve-month period.

In the event that we propose to register any of our securities under the of Securities Act of 1933, as amended, or the Securities Act, either for our account or for the account of our other security holders, Alphaeon is entitled to certain piggyback registration rights allowing it to include its shares in the registration, subject to certain marketing and other limitations. As a result, whenever we propose to file a registration statement under the Securities Act, Alphaeon 1, LLC is entitled to notice of the registration.

The stockholder agreement provides that we must pay all registration expenses (other than the underwriting discounts and commissions) in connection with effecting any demand registration or shelf registration. The stockholder agreement contains customary indemnification and contribution provisions by us for the benefit of Alphaeon 1, LLC and its affiliates and, in limited situations, by Alphaeon for the benefit of us and any underwriters with respect to written information furnished to us by Alphaeon and stated by Alphaeon to be specifically included in any registration statement, prospectus or related document.

The registration rights remain in effect with respect to any shares covered by the stockholder agreement until (i) all such shares have been sold pursuant to an effective registration statement under the Securities Act, or (ii) such time as Rule 144 or another similar exemption under the Securities Act is available for the sale of all of the shares without limitation during a three-month period without registration.

Exclusive Distribution and Supply Agreement with Clarion Medical Technologies Inc.

On November 30, 2017, we entered into an exclusive distribution and supply agreement, or the distribution agreement, with Clarion Medical Technologies Inc., or Clarion. The distribution agreement provides terms pursuant to which we will exclusively supply our product to Clarion in Canada. Clarion was previously a wholly-owned subsidiary of Alphaeon. However, pursuant to previous agreements among Alphaeon, Clarion, and previous equity holders of Clarion, the previous equity holders of Clarion had the option, and have exercised such option, to unwind Alphaeon’s acquisition of Clarion. As a result, Alphaeon and SCH, jointly and severally owe the equity holders of Clarion an unwinding fee of $9.6 million, or the

19

unwinding fee. We have agreed that the unwinding fee will be reduced, on a dollar-for-dollar basis, pursuant to the terms of the distribution agreement. The distribution agreement sets forth that a portion of the proceeds received from each unit of product purchased by Clarion shall be paid directly to the previous equity holders of Clarion, and will reduce, on a dollar-for-dollar basis, the amount of the unwinding fee Alphaeon owes. We are not contractually obligated to pay the unwinding fee to the previous equity holders of Clarion. In the event that the distribution agreement is terminated or if we fail to provide product to Clarion in Canada, Alphaeon and SCH will remain jointly and severally liable to the previous equity holders of Clarion for the balance of the unwinding fee. In addition, if Alphaeon or SCH repays the unwinding fee in full at any time, the agreement may be terminated by us or if continued, we will no longer utilize a portion of the proceeds received from the sale of each unit of product to reduce the unwinding fee and will thereafter realize the full proceeds of each sale of a unit of product to Clarion.

In addition, Alphaeon and SCH have agreed with Clarion to pay the unpaid amount of the unwinding fee on December 31, 2022, if demanded by the previous equity holders of Clarion.

The distribution agreement will terminate upon the earlier of the fifth anniversary of the approval of our NDS from Health Canada for the product, or at such time the unwinding fee is paid in full. Thereafter, the distribution agreement may be renewed by mutual agreement of the parties. We or Clarion may terminate the distribution agreement if the other party materially breaches without cure for sixty days or becomes insolvent, seeks protection under any bankruptcy proceeding, or such proceeding is instituted against the other party and not dismissed within sixty days.

The service revenue related to the sale of Jeuveau® through Clarion in 2019 was recorded based on terms that were not in the scope of the distribution agreement and resulted in no reduction of the unwinding fee owed by Alphaeon.

In March 2021, we entered into an addendum to the distribution agreement, or the addendum, pursuant to which the distribution agreement would no longer reduce the unwinding fee on a dollar-for-dollar basis. Prior to the entry into the addendum, we did not reduce the amount of the unwinding fee owed by Alphaeon.

Employment of David Moatazedi’s Brother-In-Law

Since September 2018, we have employed Mr. Moatazedi’s brother-in-law as a Marketing Manager and Analyst. He receives compensation commensurate with his level of experience and other employees having similar responsibilities. His offer letter provides for a base salary of $130,000 on an annual basis, a bonus target of 15% of base salary depending on achievement of certain company and individual performance metrics, an option to purchase up to 5,000 shares of common stock on our standard form of Stock Option Agreement as well as participation in our general employee welfare programs. The total salary paid to Mr. Moatazedi’s brother-in-law for each of 2020 and 2019 was approximately $135,000 and $130,000, respectively. He received 1,223 restricted stock units and an option to purchase 1,988 shares in 2020, and an option to purchase 2,000 shares of common stock in 2019, and bonuses for 2020 and 2019 performance of approximately $27,500 and $21,000, respectively. He is not considered an officer under Section 16 of the Exchange Act and does not report directly to Mr. Moatazedi.

Consulting and Services Arrangement with David Moatazedi’s Brother-in-Law

Since 2018, we have engaged an IT consulting firm that is owned by another one of Mr. Moatazedi’s brothers-in-law to provide consulting services, including direct consulting by the brother-in-law, and certain general IT services. The total amounts paid to the IT consulting firm in 2020 and 2019 were approximately $56,600 and $233,000, respectively, and the firm will continue to provide services in 2021.

Certain Transactions with Medytox

As of April 23, 2021, Medytox, Inc., or Medytox, owned 6,762,652 shares of our common stock, par value $0.00001 per share, or approximately 15.5% of our outstanding shares of common stock. These shares were issued to Medytox in connection with the Medytox/Allergan Settlement Agreements described below.

Medytox/Allergan Settlement Agreements

Effective February 18, 2021, we entered into a Settlement and License Agreement with Medytox, and Allergan, Inc. and Allergan Limited, or collectively Allergan, which we refer to as the U.S. Settlement Agreement and another Settlement and License Agreement with Medytox which we refer to as the ROW Settlement Agreement. We refer to the U.S. Settlement Agreement and the ROW Settlement Agreement collectively as the Medytox/Allergan Settlement Agreements.

20

Under the Medytox/Allergan Settlement Agreements, we obtained (i) a license to commercialize, manufacture and to have manufactured for us certain products identified in the Medytox/Allergan Settlement Agreements, including Jeuveau® (the “Licensed Products”), in the United States and other territories where we license Jeuveau®, (ii) the dismissal of outstanding litigation against us, including an action before the International Trade Commission brought by Medytox, which we refer to as the ITC Action, a rescission of related remedial orders that resulted from the ITC Action, and the dismissal of a civil case in the Superior Court of California against us, which we refer to together with any claims (including claims brought in Korean courts) with a common nexus of fact as the Medytox/Allergan Actions, and (iii) releases of claims against us for the Medytox/Allergan Actions. In exchange, we agreed to (i) make cash payments of $35.0 million in multiple payments over two years to Allergan and Medytox, (ii) pay to Allergan and Medytox certain royalties on the sale of Jeuveau®, based on a certain dollar amount per vial sold of Licensed Product by us or on our behalf in the United States, from December 16, 2020 to September 16, 2022, (iii) from December 16, 2020 to September 16, 2022, pay to Medytox a low-double digit royalty on net sales of Jeuveau® sold by us or on our behalf in territories we have licensed outside the United States; (iv) from September 16, 2022 to September 16, 2032, pay to Medytox a mid-single digit royalty percentage on net sales of Jeuveau® in the United States and all territories we have licensed outside the United States, (v) issue to Medytox of 6,762,652 shares of our common stock, par value $0.00001 per share, which we issued on February 18, 2021, and (vi) enter into a Registration Rights Agreement pursuant to which we granted certain registration rights to Medytox with respect to such shares of common stock beginning as of March 31, 2022. From December 16, 2021 to March 31, 2021 we have not made any payments under the Medytox/Allergan Settlement Agreements.

Certain Transactions with Daewoong

As of April 23, 2021, Daewoong Pharmaceutical Co., Ltd., or Daewoong, owned 3,136,869 shares of our common stock, par value $0.00001 per share, or approximately 7.2% of our outstanding shares of common stock. These shares were issued to Daewoong on May 23, 2021 upon the conversion of a $40 million Convertible Promissory Note we previously issued to Daewoong on July 6, 2020 pursuant to a Convertible Promissory Note Conversion Agreement we entered into with Daewoong on March 23, 2021 as part of the 2021 Daewoong Arrangement described below.

Daewoong License and Supply Agreement

In 2013, we and Daewoong entered into a license and supply agreement, as amended, which we refer to as the Daewoong Agreement, pursuant to which we have an exclusive distribution license to Jeuveau® from Daewoong for aesthetic indications in the United States, EU, Great Britain, Canada, Australia, Russia, C.I.S., and South Africa, as well as co-exclusive distribution rights with Daewoong in Japan. Under the Daewoong Agreement, we are required to make certain minimum annual purchases in order to maintain the exclusivity of the license. These minimum purchase obligations are contingent upon the occurrence of future events, including receipt of governmental approvals and our future market share in various jurisdictions. Under the Daewoong Agreement, Daewoong is responsible for all costs related to the manufacturing of Jeuveau®, including costs related to the operation and upkeep of its manufacturing facility, and we are responsible for all costs related to obtaining regulatory approval, including clinical expenses, and commercialization of Jeuveau®.

On March 23, 2021, as part of the 2021 Daewoong Arrangement, we entered into a Third Amendment to the Supply Agreement, which amends the Daewoong Agreement and which we refer to as the “Daewoong Agreement Amendment.” Under the Daewoong Agreement Amendment, the Daewoong Agreement was amended to: (i) expand the territory within which we may distribute Jeuveau® to certain countries in Europe; (ii) reduce the period of time with respect to which we are required to deliver binding forecasts to Daewoong; (iii) introduce certain limitations on Daewoong’s ability to convert our exclusive license for certain territories to a non-exclusive license in the event we fail to meet certain minimum purchase requirements for such territory; (iv) adjust the minimum purchase requirements and reduce the transfer price per vial of Jeuveau® applicable to various territories; (v) require that any Jeuveau® supplied by Daewoong match certain shelf-life thresholds; and (vi) prohibit us from sharing certain confidential information regarding Daewoong with Medytox or its affiliates or representatives. From March 23, 2021 to March 30, 2021, we did not pay any amounts to Daewoong pursuant to the Daewoong Agreement, as amended

2021 Daewoong Arrangement

On March 23, 2021, we also entered into a Confidential Settlement and Release Agreement with Daewoong, which we refer to as the Daewoong Settlement Agreement. We refer to the Daewoong Settlement Agreement, the Convertible Promissory Note Conversion Agreement and the Daewoong Agreement Amendment described above collectively as the 2021 Daewoong Arrangement.

Under the 2021 Daewoong Arrangement, (i) Daewoong agreed to (a) pay us an amount equal to $25.5 million, which we received on April 6, 2021, (b) pay certain reasonable legal fees incurred by our litigation counsel in connection with its defense

21

of the ITC Action (including any appeal of the resulting remedial orders), (c) cancel all remaining milestone payments of up to $10.5 million in the aggregate under the Daewoong Agreement, and (d) reimburse us certain amounts (calculated on a dollar amount per vials sold basis in the United States) for sales of Licensed Products, partially offsetting the royalty payments we are required to pay Medytox and Allergan pursuant to the U.S. Settlement Agreement; and (ii) we agreed to (y) release certain claims we may have against Daewoong or certain of its affiliates and representatives related to the allegations made in or the subject matter of the Medytox/Allergan Actions, or any orders, remedies and losses resulting from the Medytox/Allergan Actions, and (z) coordinate with Daewoong on certain matters related to the Medytox/Allergan Actions.

Director and Executive Compensation and Indemnification Agreements

Please see “Director Compensation” and “Executive Compensation” for a discussion regarding the compensation of our non-employee directors and our executive officers.

We enter into indemnification agreements with our directors and executive officers upon their election to office. These indemnification agreements may require us, among other things, to indemnify our directors and officers for some expenses, including attorneys’ fees, judgments, fines and settlement amounts incurred by a director or officer in any action or proceeding arising out of his or her service as one of our directors or officers, or any of our subsidiaries or any other company or enterprise to which the person provides services at our request.

22

Director Compensation

Our director compensation program is intended to enhance our ability to attract, retain and motivate non-employee directors of exceptional ability and to promote the common interest of directors and stockholders in enhancing the value of our common stock. The board of directors reviews director compensation at least annually. The compensation committee has the sole authority to engage a consulting firm to evaluate director compensation.