Form DEF 14A Echo Global Logistics, For: Jun 11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant R | ||||||||

Filed by a Party other than the Registrant o | ||||||||

| Check the appropriate box: | ||||||||

| o | Preliminary Proxy Statement | |||||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| R | Definitive Proxy Statement | |||||||

| o | Definitive Additional Materials | |||||||

| o | Soliciting Material Pursuant to §240.14a-12 | |||||||

| Echo Global Logistics, Inc. | ||||||||||||||

| (Name of Registrant as Specified In Its Charter) | ||||||||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||||||||

| Payment of Filing Fee (Check the appropriate box): | ||||||||||||||

| R | No fee required. | |||||||||||||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||||||||

| (5) | Total fee paid: | |||||||||||||

| o | Fee paid previously with preliminary materials. | |||||||||||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||||||||

| (1) | Amount Previously Paid: | |||||||||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||||||||

| (3) | Filing Party: | |||||||||||||

| (4) | Date Filed: | |||||||||||||

Echo Global Logistics, Inc.

600 West Chicago Avenue, Suite 725

Chicago, Illinois 60654

April 30, 2021

To Our Stockholders:

On behalf of the Board of Directors and management of Echo Global Logistics, Inc., we cordially invite you to attend the annual meeting of stockholders (the "Annual Meeting") to be held on Friday, June 11, 2021, at 9:00 a.m., Central Daylight Time. Due to the continuing public health impact of the coronavirus ("COVID-19") pandemic, and out of concern for the health and safety of our stockholders, employees and directors, this year's Annual Meeting will once again be a virtual meeting of the stockholders. You will be able to attend the Annual Meeting online, vote your shares electronically, and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/ECHO2021 and entering your control number. If you lose your control number, you may listen to the Annual Meeting by dialing 844-940-4935 (toll free) or 639-380-0064 (toll), but you will not be able to vote, ask questions or access the list of stockholders as of the record date. You will not be able to attend the Annual Meeting in person.

The proxy statement relates to 2020 performance and compensation, neither of which were negatively affected by the COVID-19 pandemic. During 2020, we smoothly implemented our business continuity plan and equipped our employees with the tools and technology they needed to continue to fully perform their job functions while away from the office. Despite all the challenges that were presented in our country and across the globe, we're fortunate that the freight industry was able to rebound and remains strong. The following pages contain the formal notice of the Annual Meeting, the proxy statement and the proxy card. Please review this material for information concerning the business to be conducted at the Annual Meeting and the nominees for election as directors.

The purpose of the Annual Meeting is to consider and vote upon proposals to (i) elect six directors, named in this proxy statement, to serve until the 2022 annual meeting of stockholders or until their respective successors are elected and qualified, (ii) ratify the appointment of our independent registered public accounting firm for 2021, (iii) approve, on an advisory, non-binding basis, the compensation of our named executive officers, (iv) to approve the amendment and restatement of the Echo Global Logistics, Inc. 2008 Stock Incentive Plan (our "2008 Stock Incentive Plan"), and (v) transact such other business as may properly come before the Annual Meeting. In addition to the specific matters to be acted upon, there will be a report on the progress of the Company and an opportunity for questions of general interest to our stockholders.

We are pleased to take advantage of the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to stockholders via the Internet. These rules allow us to provide you with the information you need while lowering the costs and environmental impact associated with printing and mailing proxy materials for the Annual Meeting. On or about April 30, 2021, we will mail to our stockholders a notice containing instructions on how to access the proxy materials and vote on the matters described above. In addition, the notice will include instructions on how you can request a paper copy of the proxy materials.

Whether or not you plan to attend the Annual Meeting virtually, your vote is important, and we encourage you to vote your shares promptly via the Internet or by telephone or mail. Instructions regarding these methods of voting are contained on the notice regarding the availability of proxy materials for the Annual Meeting.

Sincerely yours,

| |||||

| Douglas R. Waggoner | |||||

| Chief Executive Officer and Chairman of the Board | |||||

Echo Global Logistics, Inc.

600 West Chicago Avenue, Suite 725

Chicago, Illinois 60654

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 11, 2021

April 30, 2021

Stockholders of Echo Global Logistics, Inc.:

Notice is hereby given that the annual meeting of stockholders (the "Annual Meeting") of Echo Global Logistics, Inc., a Delaware corporation (the "Company"), will be held on Friday, June 11, 2021, at 9:00 a.m., Central Daylight Time. Due to the continuing public health impact of the coronavirus outbreak ("COVID-19"), and out of concern for the health and safety of our stockholders, directors and employees, this year's Annual Meeting will once again be a virtual meeting of the stockholders. You will be able to attend the Annual Meeting online, vote your shares electronically, and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/ECHO2021 and entering your control number. If you lose your control number, you may listen to the Annual Meeting by dialing 844-940-4935 (toll free) or 639-380-0064 (toll), but you will not be able to vote, ask questions or access the list of stockholders as of the record date. You will not be able to attend the Annual Meeting in person.

The meeting will be held for the following purposes:

1.To elect six directors of the Company, named in this proxy statement, to serve until the 2022 annual meeting of stockholders or until their respective successors are elected and qualified;

2.To ratify the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2021;

3.To approve, on an advisory, non-binding basis, the compensation of our named executive officers;

4.To approve the amendment and restatement of our 2008 Stock Incentive Plan; and

5.To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof.

These items of business, including the nominees for director, are more fully described in the proxy statement accompanying this notice. The Board of Directors has fixed the close of business on April 16, 2021 as the record date for determining the stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

We are pleased to take advantage of the Securities and Exchange Commission ("SEC") rules that allow issuers to furnish proxy materials to stockholders via the Internet. On or about April 30, 2021, we will mail to our stockholders a notice containing instructions on how to access the proxy materials and vote on the matters described above. In addition, the notice will include instructions on how you can request a paper copy of the proxy materials.

All stockholders are cordially invited to attend the virtual Annual Meeting. However, whether or not you plan to attend the Annual Meeting virtually, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the materials accompanying this Notice. If you submit your proxy and then decide to attend the Annual Meeting to vote your shares electronically, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the proxy statement.

| By Order of the Board of Directors, | ||

Peter M. Rogers Chief Financial Officer and Corporate Secretary | ||

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on June 11, 2021.

This Proxy Statement and the 2020 Annual Report are available at: www.proxyvote.com. You will need your assigned control number to vote your shares. Your control number can be found on your proxy card.

TABLE OF CONTENTS

| INFORMATION ABOUT THE ANNUAL MEETING AND VOTING | |||||

| Annual Meeting Information | |||||

| Voting Information | |||||

| PROPOSALS TO BE VOTED ON | |||||

| Proposal 1: Election of Directors | |||||

| Proposal 2: Ratification of Independent Registered Public Accounting Firm | |||||

| Proposal 3: Advisory Approval of the Compensation of Our Named Executive Officers | |||||

| Proposal 4: Approval of the Amendment and Restatement of the 2008 Stock Incentive Plan | |||||

| BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | |||||

| Board Leadership Structure | |||||

| Board of Directors' Role in Risk Oversight | |||||

| Meetings and Committees of the Board of Directors | |||||

| Stockholder Engagement and Communications to the Board | |||||

| Governance Documents | |||||

| Compensation Committee Interlocks and Insider Participation | |||||

| Attendance at Annual Meeting | |||||

| Anti-Hedging Policy | |||||

| STOCK OWNERSHIP | |||||

| Security Ownership of Certain Beneficial Owners and Management | |||||

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | |||||

| EXECUTIVE AND DIRECTOR COMPENSATION | |||||

| Executive Officers/Named Executive Officers | |||||

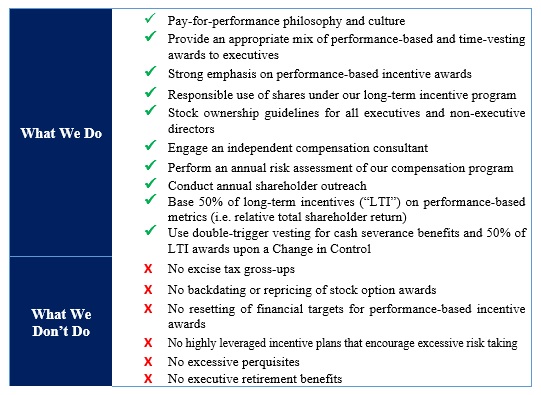

| Compensation Discussion and Analysis | |||||

| Report of the Compensation Committee | |||||

| Executive Compensation | |||||

| Summary Compensation Table | |||||

2020 Grants of Plan-Based Awards | |||||

Outstanding Equity Awards at 2020 Fiscal Year-End | |||||

2020 Option Exercises and Stock Vested Table | |||||

2020 Pension Benefits | |||||

2020 Nonqualified Deferred Compensation | |||||

| Employment Agreements | |||||

| Potential Payments Upon Termination or Change in Control | |||||

| CEO Pay Ratio | |||||

| Compensation and Risk | |||||

2020 Director Compensation | |||||

Outstanding Equity Awards of Our Directors at 2020 Fiscal Year-End | |||||

| AUDIT COMMITTEE REPORT | |||||

| FEES BILLED FOR SERVICES RENDERED BY PRINCIPAL REGISTERED PUBLIC ACCOUNTING FIRM | |||||

| OTHER INFORMATION | |||||

Stockholder Proposals for the 2022 Annual Meeting | |||||

| Expenses of Solicitation | |||||

| Householding | |||||

| Other Matters | |||||

| APPENDIX A - RECONCILIATION OF NON-GAAP FINANCIAL MEASURES | |||||

| APPENDIX B - AMENDED AND RESTATED ECHO GLOBAL LOGISTICS, INC. 2008 STOCK INCENTIVE PLAN | |||||

Echo Global Logistics, Inc.

600 West Chicago Avenue, Suite 725

Chicago, Illinois 60654

PROXY STATEMENT

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

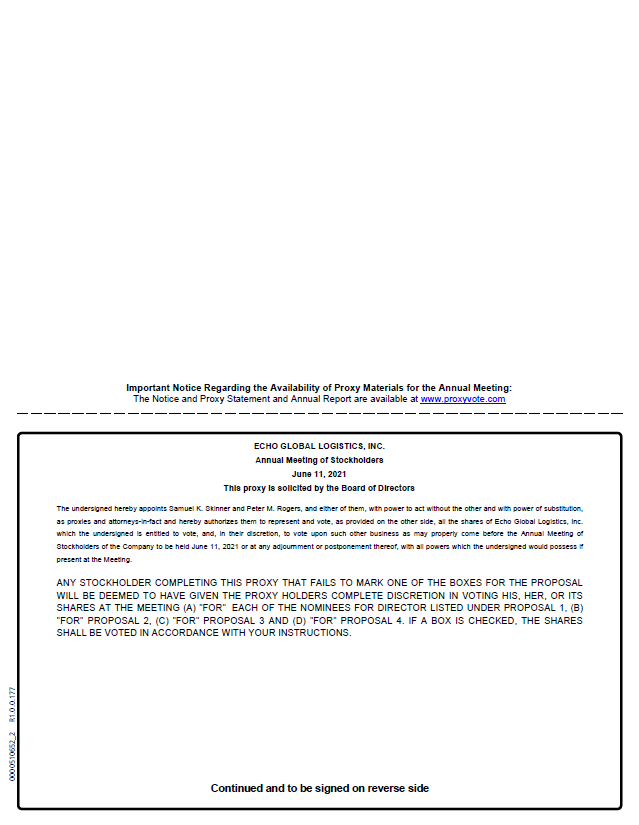

This proxy statement and enclosed proxy card are being furnished to stockholders commencing on or about April 30, 2021 in connection with the solicitation by the Board of Directors (the "Board") of Echo Global Logistics, Inc., a Delaware corporation ("Echo," the "Company," "we," "us," or "our"), of proxies for use in voting at the 2021 annual meeting of stockholders (the "Annual Meeting"). You are receiving the proxy materials because the Board is seeking your permission (or proxy) to vote your shares at the Annual Meeting on your behalf. This proxy statement presents information that is intended to help you in reaching a decision on voting your shares of common stock. Only stockholders of record at the close of business on April 16, 2021, the record date, are entitled to vote at the Annual Meeting. As of April 16, 2021, there were 26,635,553 shares of common stock outstanding and entitled to vote.

Annual Meeting Information

Date and Virtual Meeting Information. The Annual Meeting will be held virtually on Friday, June 11, 2021 at 9:00 a.m., Central Daylight Time. To participate in the Annual Meeting visit www.virtualshareholdermeeting.com/ECHO2021 using your desktop or mobile device and enter the control number included on your proxy card.

Admission. Only record or beneficial owners of the Company's common stock, or their proxies, may participate in the Annual Meeting. To participate in the Annual Meeting, you will need the control number included in your Notice Regarding the Availability of Proxy Materials, your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in a bank or brokerage account, instructions should also be provided on the voting instructions form. If you lose your control number, you may join the Annual Meeting as a "Guest" or by dialing 877-303-6235 (toll free) or 631-291-4837 (toll) and referencing "Echo Global Logistics," but you will not be able to vote, ask questions or access the list of stockholders as of the record date.

Voting Information

Record Date. The record date for the Annual Meeting is April 16, 2021. You may vote all shares of the Company's common stock that you owned as of the close of business on that date. Each share of common stock entitles you to one vote on each item to be voted on at the Annual Meeting. Cumulative voting is not permitted. On the record date, there were 26,635,553 shares of common stock outstanding and entitled to vote. We have no other voting securities.

Confidential Voting. Your vote will be confidential except (a) as may be required by law, (b) as may be necessary for the Company to assert or defend claims, (c) in the case of a contested election of director(s) or (d) at your express request.

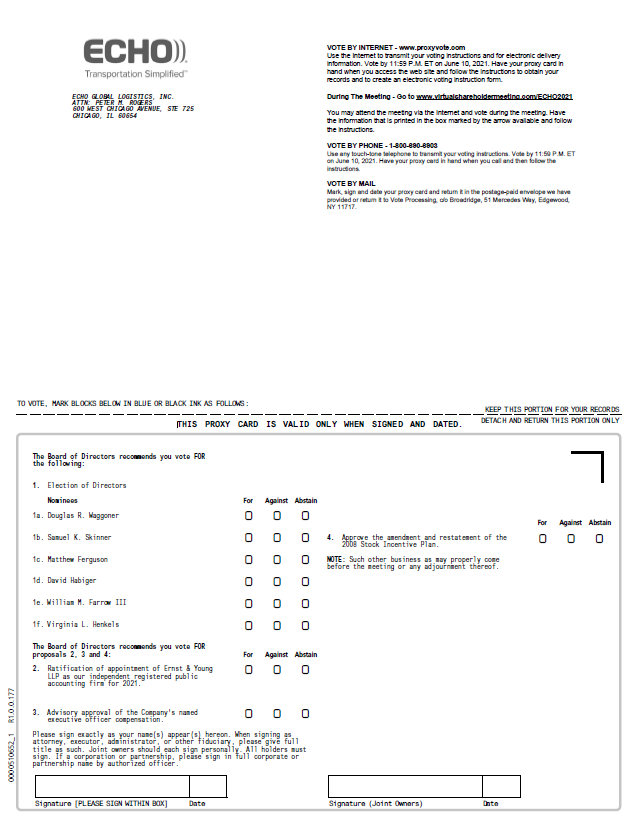

Vote by Proxy. If your shares of common stock are held in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered the stockholder of record with respect to those shares. As the stockholder of record, you can vote your shares on matters presented at the Annual Meeting or by proxy. There are three ways to vote by proxy:

1.By Telephone - Stockholders can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card;

2.By Internet - You can vote over the Internet at www.proxyvote.com by following the instructions on the proxy card; or

3.By Mail - You can vote by mail by signing, dating and mailing your proxy card.

Any proxy given pursuant to such solicitation by a stockholder of record and received in time for the Annual Meeting will be voted as specified in such proxy. If no instructions are given, proxies will be voted FOR the election of the nominees listed below under the caption "PROPOSALS TO BE VOTED ON--Proposal 1: Election of Directors," FOR the ratification of the appointment of Ernst & Young LLP as independent registered public accounting firm for the Company's fiscal year ending December 31, 2021 under "PROPOSALS TO BE VOTED ON--Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm," FOR advisory approval of the compensation of our named executive officers as disclosed in this proxy statement under "PROPOSALS TO BE VOTED ON--Proposal 3: Advisory Approval of the Compensation of Our Named Executive Officers," FOR the approval of the amendment and restatement of our 2008 Stock Incentive Plan under "PROPOSALS TO BE VOTED ON--Proposal 4: Approval of the Amendment and Restatement of the 2008 Stock Incentive

1

Plan," and in the discretion of the proxies named on the proxy card, with respect to any other matters properly brought before the Annual Meeting and any adjournments thereof.

Submitting Voting Instructions for Shares Held Through a Broker. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in "street name," and these proxy materials are being forwarded to you by your broker, bank or nominee who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or nominee on how to vote and are also invited to attend the Annual Meeting virtually by following instructions, which should be provided on the voting instruction form provided by your bank or brokerage firm. Street name stockholders should check the voting instruction cards used by their brokers or nominees for specific instructions on methods of voting. If your shares are held in street name, you must contact your broker or nominee to revoke your proxy.

If you hold shares through a broker, follow the voting instructions you receive from your broker. If you want to vote at the Annual Meeting, follow the instructions on the voting instruction form provided by your bank or brokerage firm. If you do not submit voting instructions to your broker, your broker may still be permitted to vote your shares in certain cases. A broker non-vote occurs when a broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker or nominee does not have discretionary voting power and has not received instructions from the beneficial owner. If you do not give your broker or nominee instructions on how to vote your shares, your broker or nominee can vote your shares with respect to "routine" items but not with respect to "non-routine" items. "Proposal 1: Election of Directors," "Proposal 3: Advisory Approval of the Compensation of Our Named Executive Officers," and "Proposal 4: Approval of the Amendment and Restatement of our 2008 Stock Incentive Plan" are non-routine matters for which your broker or nominee may not vote without explicit instructions from you. "Proposal 2: Ratification of Independent Registered Public Accounting Firm" is a routine matter for which your broker or nominee may vote your shares without explicit instructions from you.

Quorum. In order to carry on the business of the Annual Meeting, we must have a quorum. This means that stockholders representing at least 50% of the common stock issued and outstanding as of the record date must be present at the Annual Meeting, either by participating virtually or by proxy. Abstentions and broker non-votes are counted as present for purposes of establishing a quorum, but broker non-votes are not considered "present" for purposes of voting on non-routine matters.

Revoking Your Proxy. You may revoke your proxy at any time by (1) providing written notice to Peter M. Rogers, Corporate Secretary, Echo Global Logistics, Inc., 600 West Chicago Avenue, Suite 725, Chicago, Illinois 60654 at any time prior to the voting thereof, (2) submitting a proxy with a later date or (3) participating in the Annual Meeting and voting electronically.

Vote Required to Elect Directors. In order to be elected, director nominees must receive the affirmative vote of a majority of the votes cast in the election of directors. In other words, a nominee for director must receive more votes "FOR" his or her election than votes "AGAINST" such nominee. The size of the Board is currently set at six members. Abstentions and broker non-votes will have no effect on the election of directors.

Vote Required to Adopt Other Proposals. "Proposal 2: Ratification of Independent Registered Public Accounting Firm" requires the affirmative vote of a majority of the shares of common stock represented at the Annual Meeting and entitled to vote thereon. Abstentions will have the same effect as a vote against the ratification of the independent registered accounting firm, and there will be no broker non-votes with respect to this proposal, as it is a routine item.

"Proposal 3: Advisory Approval of the Compensation of Our Named Executive Officers" requires the affirmative vote of a majority of the shares of common stock represented at the Annual Meeting and entitled to vote thereon. The vote is on the total compensation package provided to the named executive officers, as described in the Compensation Discussion and Analysis and related compensation tables. Abstentions will have the same effect as a vote against the advisory approval of the compensation of our Named Executive Officers. Broker non-votes will have no effect on the advisory approval of the compensation of our Named Executive Officers. The stockholder vote will not be binding on the Company or the Board and may not be construed as (1) overruling their decision, (2) creating or implying any addition or change to the Board's fiduciary duties, or (3) restricting or limiting stockholders' ability to make proposals for inclusion in proxy materials related to executive compensation.

"Proposal 4: Approval of the Amendment and Restatement of the 2008 Stock Incentive Plan" requires the affirmative vote of a majority of the shares of common stock represented at the Annual Meeting and entitled to vote thereon. Abstentions will have the same effect as a vote against this proposal. Broker non-votes will have no effect on this proposal.

Director Nominations. For a stockholder to nominate an individual to serve as a director at the 2022 annual meeting of stockholders, the stockholder must follow the procedures outlined in this proxy statement under the caption "OTHER INFORMATION—Stockholder Proposals for the 2022 Meeting." Stockholders may also designate a director nominee to be considered by the Board for recommendation to the stockholders at the 2022 Annual Meeting by following the procedures

2

outlined in this proxy statement under the caption "BOARD OF DIRECTORS AND CORPORATE GOVERNANCE—Meetings and Committees of the Board of Directors—Nominating and Corporate Governance Committee."

PROPOSALS TO BE VOTED ON

Proposal 1: Election of Directors

Nominees

The size of the Board is currently set at six members. At the Annual Meeting, the stockholders will elect six directors to serve until the 2022 Annual Meeting of stockholders or until their respective successors are elected and qualified. Unless marked otherwise, proxies received will be voted "FOR" the election of each of the six nominees named below. Any director vacancy occurring after the election may be filled by a majority vote of the remaining directors. In accordance with the Company's by-laws, a director appointed to fill a vacancy will be appointed to serve until the next annual meeting of stockholders held for the election of directors.

All nominees have consented to be named in this proxy statement and to serve as directors, if elected. If any nominee is unable or unwilling to serve as a director at the time of the Annual Meeting, the persons who are designated as proxies intend to vote, in their discretion, for such other persons, if any, as may be designated by the Board. As of the date of this proxy statement, the Board has no reason to believe that any of the persons named herein will be unable or unwilling to serve as a nominee or as a director, if elected.

The Company believes that the Board as a whole should encompass a range of talent, skill, diversity and expertise enabling it to provide sound guidance with respect to the Company's operations and interests. In addition to considering a candidate's background and accomplishments, candidates are reviewed in the context of the current composition of the Board and the evolving needs of our business. The Company does not have a formal policy with regard to the consideration of diversity in identifying candidates, but the Nominating and Corporate Governance Committee strives to nominate candidates with a variety of complementary skills so that, as a group, the Board will possess the appropriate level of talent, skills and expertise to oversee the Company's business. The Company regularly assesses the size of the Board, whether any vacancies are expected due to retirement or otherwise, and the need for particular expertise on the Board. The Company's policy is to have at least a majority of directors qualify as "independent directors" as defined in the rules of the Nasdaq Global Market. Currently, five of our six directors are independent.

The Nominating and Corporate Governance Committee seeks candidates with strong reputations and experience in areas relevant to the strategy and operations of the Company, particularly in industries and growth segments that the Company serves. Each director nominee holds or has held senior positions in complex organizations and has operating experience that meets this objective, as described below. In these positions, the director nominees have also gained experience in core management skills, such as strategic and financial planning, public company financial reporting, corporate governance, risk management and leadership development. Each of our directors also has experience serving on boards of directors or trustees and committees of other companies.

The Nominating and Corporate Governance Committee also believes that each of the nominees and current directors has other key attributes that are important to an effective board: integrity and demonstrated high ethical standards; sound judgment; analytical skills; the ability to engage management and each other in a constructive and collaborative fashion; diversity of origin, background, experience, and thought; and the commitment to devote significant time and energy to service on the Board and its committees.

3

The names of the Company's current directors and director nominees, their ages as of April 16, 2021, their recent employment or principal occupation, the names of other public companies for which they currently serve as a director or have served as a director within the past five years, and their period of service as director of the Company are set forth below:

| Name | Age | Position | |||||||||

| Douglas R. Waggoner | 62 | Chairman of the Board and Chief Executive Officer | |||||||||

Samuel K. Skinner(1)(2)(3) | 82 | Lead Independent Director | |||||||||

Matthew Ferguson(1)(2) | 54 | Director | |||||||||

David Habiger(1)(2) | 52 | Director | |||||||||

William M. Farrow III(1)(3) | 66 | Director | |||||||||

Virginia L. Henkels(1)(3) | 52 | Director | |||||||||

_______________________________________________________________________________

(1)Member of our Audit Committee.

(2)Member of our Compensation Committee.

(3)Member of our Nominating and Corporate Governance Committee.

There are no family relationships among any of the directors or executive officers of the Company. Our Board has affirmatively determined that five of our six director nominees, Messrs. Skinner, Ferguson, Habiger, and Farrow and Ms. Henkels, are "independent directors" as defined in the rules of the Nasdaq Global Market.

Douglas R. Waggoner has served as our Chief Executive Officer since December 2006 and on our Board since February 2008. In June 2015, the Board appointed Mr. Waggoner to serve as Chairman of the Board. Since April 2015, Mr. Waggoner has also served on the board of directors of SP Plus Corporation, a provider of, among other things, professional parking, ground transportation and logistics services, and Daylight Transport, a leading expedited LTL carrier. Prior to joining Echo, Mr. Waggoner founded SelecTrans, LLC, a freight management software provider based in Chicago, Illinois. From April 2004 to December 2005, Mr. Waggoner served as the Chief Executive Officer of USF Bestway, and from January 2002 to April 2004, he served as the Senior Vice President of Strategic Marketing for US Freightways Corporation. Mr. Waggoner served as the President and Chief Operating Officer of Daylight Transport from April 1999 to January 2002, Executive Vice President from October 1998 to April 1999, and Chief Information Officer from January 1998 to October 1998. From 1986 to 1998, Mr. Waggoner held a variety of positions in sales, operations, marketing and engineering at Yellow Transportation before eventually leaving the company as the Vice President of Customer Service. Mr. Waggoner holds a Bachelor of Science degree in Economics from San Diego State University. Mr. Waggoner provides the Board significant transportation industry-specific operations management and leadership experience.

Samuel K. Skinner first joined our Board in September 2006 and served as our non-executive Chairman of the Board from February 2007 to June 2015. Since June 2017, Mr. Skinner has served as the Board's Lead Independent Director. Since May 2004, Mr. Skinner has been of counsel at the law firm Greenberg Traurig, LLP where he is the Chair of the Chicago Governmental Affairs Practice. Mr. Skinner served as Chairman, President and Chief Executive Officer of US Freightways Corporation from July 2000 to May 2003, and from 1993 to 1998 he served as President of Commonwealth Edison Company and its holding company, Unicom Corporation. During his time at US Freightways, it was one of the largest transportation and logistics companies in the country until its merger with YRC. Mr. Skinner served as the Chief of Staff to President George H.W. Bush from December 1991 to August 1992, and from 1989 to 1991, he served as the Secretary of Transportation. In 1975, he was appointed by President Gerald R. Ford as the United States Attorney for the Northern District of Illinois. Mr. Skinner formally served as Vice Chairman of the Board of Virgin America Airlines. He previously served on the boards of Navigant Consulting, Inc., Virgin America and the Chicago Board Options Exchange (CBOE), Inc. Mr. Skinner currently serves as director of Darley Manufacturing. Mr. Skinner holds a Bachelor of Science degree in Accounting from the University of Illinois and a Juris Doctor from DePaul University College of Law. Mr. Skinner brings to the Board extensive leadership experience and transportation and logistics industry experience in both the public and private sectors, operations management skills and experience with corporate governance and regulatory matters, having served as the chief executive officer of a large public company and a director of several public companies for over 10 years.

Matthew Ferguson has served on our Board since February 2010. Mr. Ferguson currently serves as the non-executive chairman of CareerBuilder.com, an online recruiting service. From June 2004 to September 2018, Mr. Ferguson served as the Chief Executive Officer and as its Chief Operating Officer, and as Senior Vice President from 2000 to 2004. Mr. Ferguson is a partner at Woodington Management, LLC, a real estate management company. He is also Chairman of the Board of DataClover, a company that offers customer service technology for the auto industry. He received a Bachelor of Arts degree from Indiana University, a Master of Business Administration degree from the University of Chicago and a Juris Doctor degree from Northwestern University. Mr. Ferguson brings to the Board extensive leadership experience, operations management

4

skills and experience with corporate governance and regulatory matters, having served as chief executive officer of a large global company and its partnership with several publicly-held entities.

David Habiger has served on our Board since December 2012. Since March 2018, Mr. Habiger has served as President and Chief Executive Officer of J.D. Power. From April 2015 to June 2016, Mr. Habiger served as the Chief Executive Officer of Textura Corporation. From June 2011 to July 2012, Mr. Habiger served as the Chief Executive Officer of NDS Group Ltd. until it was acquired by Cisco Systems. From February 1993 to February 2011, Mr. Habiger held various roles including serving as President and Chief Executive Officer at Sonic Solutions, a digital media software company. Since 2016, Mr. Habiger is a director of GrubHub, serving on the Audit and Compensation Committees, a director of Xperi, serving as Chairmen of the board and a member of the Audit Committee, and a director of Stamps.com, serving as a member of the Compensation Committee. Mr. Habiger currently sits on the private boards for Conviva since February 2018, Legend3D since December 2016, Klein Tools since July 2012, Follett since September 2012, Backstop Solutions since September 2013, Sovos since April 2016. Mr. Habiger is an advisor of MDP since 2014, Rush University Medical Center since 2017, and the Chicago Federal Reserve since 2020. Previously, Mr. Habiger was a director for Control4, Enova, Immersion, DTS, RealD and Textura. Additionally, from January 2013 to October 2019, Mr. Habiger was a Venture Partner at the Pritzker Group and from October 2012 to January 2020, Mr. Habiger served as Senior Advisor to Silver Lake Partners. Mr. Habiger received his Bachelor of Arts degree from St. Norbert College and a Master of Business Administration degree from the University of Chicago. He is a member of the National Association of Corporate Directors. Mr. Habiger brings to the Board extensive leadership and management experience, having served as the chief executive officer of two public companies, as well as public company board experience.

William M. Farrow III has served on our Board since June 2017. Mr. Farrow is the co-founder and retired President and Chief Executive Officer of Urban Partnership Bank, a community development financial institution created in 2010 to help prevent financial devastation in moderate income communities in Chicago, Detroit and Cleveland. Mr Farrow is the owner of Winston and Wolfe LLC, established in 2009, offering professional advisory services. Mr. Farrow currently serves on the boards of WEC Energy Group, CoBank, the Chicago Board Options Exchange (CBOE) and Northshore University HealthSystem. From 2013 to 2018, Mr. Farrow served as a Director of the Federal Reserve Bank of Chicago as the Chair of the Audit Committee and a member of the Systems Operations Committee. In 2001, Mr. Farrow joined the Chicago Board of Trade as Executive Vice President, CIO and member of the Office of the President. From 1986 to 2001, Mr. Farrow held multiple senior positions at the First National Bank of Chicago, including Head of Treasury Management Sales. In 1979, Mr. Farrow was a consultant for Arthur Anderson & Company. Mr. Farrow received his Bachelor of Arts degree from Augustana College and his Master of Business Administration degree from Northwestern University's Kellogg Graduate School of Management. Mr. Farrow brings to the Board extensive leadership and management experience as well as experience in financial management strategy.

Virginia L. Henkels has served on our Board since September 2018. Since November 2020, Ms. Henkels has served as Chief Financial Officer and Secretary of Empowerment & Inclusion Capital I Corp, a special purpose acquisition company. From 2008 to 2017, Ms. Henkels served as Executive Vice President, Chief Financial Officer, and Treasurer of Swift Transportation Company, a then-publicly traded transportation services company, where she led numerous capital market transactions including its 2010 initial public offering. From 2004 to 2008, she also held various finance and accounting leadership positions with increasing responsibilities at Swift Transportation and from 1990 to 2002 at Honeywell International, Inc., a worldwide diversified technology and manufacturing leader, including an expatriate international assignment. Ms. Henkels has been a director for Viad Corp. since November 2011, where she served on the Audit Committee. In May 2019, Ms. Henkels became Chair of the Audit Committee and joined the Corporate Governance and Nominating Committee for Viad Corp. In September 2017, Ms. Henkels became a director for LCI Industries and a member of the Audit Committee and Compensation Committee. In May 2018, Ms. Henkels became Chair of the Audit Committee for LCI Industries. Ms. Henkels holds a Masters of Business Administration degree from Arizona State University and a Bachelor of Business Administration degree from University of Arizona. Ms. Henkels is currently a member of the National Association of Corporate Directors and the Women's Corporate Director organizations. Ms. Henkels is a former Certified Public Accountant and brings to the Board extensive experience in finance, accounting, capital markets, and investor relations as well as experience in strategy development, risk management, mergers and acquisitions, audit, corporate culture, and corporate governance.

Required Vote

In order to be elected, director nominees must receive the affirmative vote of a majority of the votes cast in the election of directors. In other words, a nominee for director must receive more votes "FOR" his or her election than votes "AGAINST" such nominee.

5

Recommendation of the Board of Directors

THE BOARD RECOMMENDS A VOTE "FOR" THE ELECTION OF THE FOLLOWING DIRECTORS: DOUGLAS R. WAGGONER, SAMUEL K. SKINNER, MATTHEW FERGUSON, DAVID HABIGER, WILLIAM M. FARROW III AND VIRGINIA L. HENKELS.

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm

Ernst & Young LLP has served as the Company's independent registered public accounting firm since 2007 and has been appointed by the Audit Committee to continue as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2021. In the event that ratification of this selection is not approved by a majority of the shares of common stock of the Company represented at the Annual Meeting in person or by proxy and entitled to vote on the matter, the Audit Committee and the Board will review the Audit Committee's future selection of an independent registered public accounting firm.

Representatives of Ernst & Young LLP will be participating in the virtual Annual Meeting. The representatives will have an opportunity to make a statement and will be available to respond to appropriate questions.

Required Vote

The affirmative vote of the holders of a majority of the Company's common stock present at the Annual Meeting in person or by proxy and entitled to vote on this proposal is required to approve the ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for the current fiscal year.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS A VOTE "FOR" RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2021.

Proposal 3: Advisory Approval of the Compensation of Our Named Executive Officers

Under Section 14A of the Securities Exchange Act of 1934, enacted pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the Company is required to provide a stockholder advisory vote, at least every three years, to approve the compensation of our named executive officers, as disclosed in our Compensation Discussion and Analysis, related compensation tables, and other related material under the compensation disclosure rules of the SEC set forth in this proxy statement. Based on feedback from our stockholders at the 2017 Annual Meeting, our Board elected to provide this vote on an annual basis. At our 2020 annual meeting, in a non-binding vote, over 88% of shares cast voted in favor of our executive compensation program and practices disclosed in our 2020 proxy statement.

This advisory vote will not be binding on or overrule any decisions by our Board, will not create or imply any additional fiduciary duty on the part of the Board, and will not restrict or limit the ability of our stockholders to make proposals for inclusion in proxy materials related to executive compensation. However, our Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements. Our Board has determined that the best way to allow our stockholders to vote on the Company's executive pay programs and policies is through the following resolution:

RESOLVED, that the stockholders approve the compensation of our named executive officers as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission (which includes the Compensation Discussion and Analysis, the compensation tables, and related material).

Required Vote. Approval of this proposal will require the affirmative vote of a majority of the holders of our common stock represented in person or by proxy and entitled to vote at the Annual Meeting.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS A VOTE "FOR" ADVISORY APPROVAL OF THE COMPENSATION OF THE COMPANY'S NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT.

6

Proposal 4: Approval of the Amendment and Restatement of our 2008 Stock Incentive Plan

A proposal will be presented at the Annual Meeting to approve the amendment and restatement of the Amended and Restated Echo Global Logistics, Inc. 2008 Stock Incentive Plan, which we refer to as the 2008 Stock Incentive Plan. The 2008 Stock Incentive Plan was originally adopted by the Board of Directors effective October 1, 2009, and was later amended on June 2, 2010, June 20, 2012 and April 18, 2017 by our Board and approved by Company's stockholders. On April 22, 2021, our Board approved the amendment and restatement of the 2008 Stock Incentive Plan, subject to stockholder approval. The amendment and restatement of the 2008 Stock Incentive Plan (i) increases the maximum number of shares of common stock that may be issued under the 2008 Stock Incentive Plan by 850,000 from 3,400,000 (plus any shares that are subject to grant under our 2005 Stock Option Plan) to 4,250,000 (plus any shares that are or become available for grant under our 2005 Stock Option Plan), (ii) increases that total (equity and non-equity) compensation limit applicable to non-employee directors from $400,000 to $650,000 in the applicable calendar year and (iii) to make certain additional clarifying and administrative updates to the 2008 Plan, including technical amendments to reflect recent changes to Section 162(m) of the Internal Revenue Code (the "Code").

Approval of the amendment and restatement of our 2008 Stock Incentive Plan requires the affirmative vote of the majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote.

A summary of the material provisions of the 2008 Stock Incentive Plan, as amended and restated, is set forth below. A copy of the 2008 Stock Incentive Plan, as amended and restated, is set forth in Appendix B. The following general description of certain features of the 2008 Stock Incentive Plan is qualified in its entirety by reference to the provisions of the 2008 Stock Incentive Plan set forth in Appendix B. Unless otherwise indicated, terms used in this summary shall have the meanings set forth in the 2008 Stock Incentive Plan.

Description of the 2008 Stock Incentive Plan

Purpose of the 2008 Stock Incentive Plan

The 2008 Stock Incentive Plan was established by the Company to:

•promote the success and enhance the value of the Company by linking the personal interests of participants to those of Company stockholders and by providing participants with an incentive for outstanding performance; and

•provide flexibility to the Company in its ability to motivate, attract, and retain the services of participants upon whose judgment, interest and special effort the successful conduct of its business is largely dependent.

The 2008 Stock Incentive Plan permits the Company to grant stock options, stock appreciation rights, restricted stock, restricted stock units, performance shares, and other stock awards and forms of incentive compensation to all participants in the 2008 Stock Incentive Plan. Any option granted under the 2008 Stock Incentive Plan may be either an incentive stock option, which we refer to as an ISO, or a non-qualified stock option, which we refer to as a NQSO.

Eligibility and Limits on Awards

Any employee, consultant or director of the Company or an affiliate selected by the Committee is eligible to receive awards under the 2008 Stock Incentive Plan. As of December 31, 2020, the Company and its affiliates had approximately 2,593 employees and five non-employee directors eligible to participate in the plan. No consultant were eligible to participate in the 2008 Stock Incentive Plan as of Deember 31, 2020. The specific employees, consultants and directors who will be granted awards under the 2008 Stock Incentive Plan and the type and amount of any such awards will be determined by the Compensation Committee of the Board (the "Committee").

The 2008 Stock Incentive Plan limits the maximum amount of awards that may be granted to participants. The maximum number of shares of our common stock that may be delivered to participants and their beneficiaries under the 2008 Stock Incentive Plan is 4,250,000, which includes the 850,000 shares added pursuant to this amendment and restatement. The maximum number of shares of common stock that may be delivered to participants and their beneficiaries with respect to ISOs under the 2008 Stock Incentive Plan is 500,000 shares. The maximum number of shares and share equivalent units that may be granted to any one participant during any one calendar year period is 500,000 shares. The maximum number of shares and share equivalent units that may be granted to any one non-employee director during any one calendar year is 500,000 shares, provided that during such calendar year the total (equity and non-equity) compensation to such non-employee directors shall not exceed $650,000.

7

Administration

The authority to control and manage the operation and administration of the 2008 Stock Incentive Plan is vested in the Committee. To the extent not prohibited by applicable law or the applicable rules of any stock exchange, the Board in its discretion may determine that the 2008 Stock Incentive Plan will be administered by another committee appointed by the Board whose composition satisfies the "nonemployee director" requirements of Rule 16b-3 under the Exchange Act and the regulations of Rule 16b-3 under the Exchange Act and the "independent director" requirements of the Nasdaq Marketplace Rules, or any successor regulations or provisions.

The Committee has the authority and discretion to select employees, directors and consultants to participate in the 2008 Stock Incentive Plan, determine the sizes and types of awards, determine the terms and conditions of awards in a manner consistent with the 2008 Stock Incentive Plan, construe and interpret the 2008 Stock Incentive Plan and any agreement or instrument entered into under the 2008 Stock Incentive Plan, establish, amend or waive rules and regulations for the 2008 Stock Incentive Plan's administration, amend the terms and conditions of any outstanding award to the extent they are within the discretion of the Committee as provided in the 2008 Stock Incentive Plan, and make all other determinations that may be necessary or advisable for the administration of the 2008 Stock Incentive Plan.

Except to the extent prohibited by applicable securities laws or the 2008 Stock Incentive Plan, the Committee may delegate some or all of its authority under the 2008 Stock Incentive Plan to any person or persons selected by it.

Shares Reserved for Awards & Limitations on Vesting

Subject to our stockholders' approval of this amendment and restatement, the maximum number of shares of our common stock that may be delivered under the 2008 Stock Incentive Plan is 4,250,000 shares. The closing price of the Company's common stock on the Nasdaq Global Market on April 16, 2021 was $32.88 per share.

To the extent any shares of our common stock covered by an award are not delivered because the award is forfeited, canceled, or otherwise terminated, then such shares shall not be deemed to have been delivered for purposes of determining the number of shares of our common stock available for delivery under the 2008 Stock Incentive Plan. To the extent any shares of our common stock covered by an award were (i) delivered by attestation to, or withheld by, the Company in connection with the exercise of an option awarded under the 2008 Stock Incentive Plan or in payment of any required income tax withholding for the exercise of an option or the taxable event related to any other award awarded under the 2008 Stock Incentive Plan, (ii) repurchased by the Company on the open market or (iii) not issued due to a net settlement of an award, such shares shall be deemed to have been delivered for purposes of determining the number of shares of our common stock available for delivery under the 2008 Stock Incentive Plan.

In the event of a corporate transaction involving the Company (including, without limitation, any merger, reorganization, consolidation, recapitalization, separation, liquidation, split-up, or share combination) and certain other non-recurring events, the Committee shall adjust awards in any manner determined by the Committee to be an appropriate and equitable means to prevent dilution or enlargement of rights.

All awards granted under the 2008 Stock Incentive Plan must have a minimum vesting period of one year, except if an award agreement or a written employment agreement, provides for accelerated vesting in the case of death, disability, retirement, termination without cause, termination for good reason or any other termination of service, or the occurrence of a change in control, provided that the Committee may only grant awards covering five percent or fewer of the total number of shares authorized under the 2008 Stock Incentive Plan without respect to the aforementioned minimum vesting requirements.

Stock Options

The 2008 Stock Incentive Plan permits the granting of stock options. The grant of an option entitles the participant to purchase shares of our common stock at an exercise price established by the Committee. Any option granted under the 2008 Stock Incentive Plan may be either an ISO or an NQSO, as determined in the discretion of the Committee.

An option shall become vested and exercisable in accordance with such terms and conditions and during such periods as may be established by the Committee and set forth in the applicable award agreement. In no event, however, shall an option expire later than ten years after the date of its grant. The exercise price of each option shall be established by the Committee; provided, however, that the exercise price of an incentive stock option shall not be less than 100% of the fair market value of a share of our common stock on the date of grant.

8

The full exercise price for shares of our common stock purchased upon the exercise of any option shall be paid at the time of such exercise:

•in cash;

•by tendering previously acquired shares (provided that the shares that are tendered must have been held by the participant for at least six months prior to the payment date) duly endorsed for transfer to the Company or shares issuable to the participant upon exercise of the option; or

•by a combination of the above-mentioned payment methods.

Except in connection with certain recapitalization events or for the purpose of preserving the benefits or potential benefits of the awards, or reductions of the exercise price approved by the Company's stockholders, the exercise price for any outstanding option may not be decreased after the date of grant, including via any cancellation or substitution.

No dividends or dividend equivalents shall be paid in connection with the options.

Stock Appreciation Rights

The 2008 Stock Incentive Plan permits the granting of stock appreciation rights ("SARs"). The grant price of a SAR is determined by the Committee, but the grant price for a SAR intended to be exempt from Section 409A of the Code ("Section 409A") shall be equal to or greater than the fair market value of a share of our common stock on the date of grant. The term of a SAR may not exceed ten years. A SAR may be exercised upon the terms and conditions imposed by the Committee. Upon exercise of a SAR, a participant will receive payment equal to the number of SARs exercised multiplied by the excess of the fair market value of a share of our common stock on the date of exercise over the grant price. Payment of a SAR may be made in cash, shares of our common stock, or a combination of cash and shares, as determined by the Committee.

Except in connection with certain recapitalization events or for the purpose of preserving the benefits or potential benefits of the awards, or reductions of the exercise price approved by the Company's stockholders, the grant price for any outstanding SAR may not be decreased after the date of grant, including via any cancellation or substitution.

No dividends or dividend equivalents shall be paid in connection with the SAR.

Restricted Stock and Restricted Stock Units

The 2008 Stock Incentive Plan permits the granting of restricted stock and restricted stock units. The grant of a share of restricted stock entitles the participant to receive a share of our common stock upon completing a specified period of service with the Company or its affiliates and/or the achievement of specific performance objectives. The grant of a restricted stock unit entitles the participant to receive a payment of a share of our common stock upon completing a specified period of service with the Company or its affiliates and/or the achievement of specific performance objectives.

Grants of restricted stock and restricted stock units become vested in accordance with such terms and conditions and during such periods as may be established by the Committee and set forth in the applicable award agreement. Selected participants may elect (or be required, as to bonuses) to defer a portion of their salary and/or bonus in exchange for restricted stock units. Each participant who elects to make a deferral will be credited under the 2008 Stock Incentive Plan with a number of restricted stock units equal to no less than the amount of the deferral divided by the fair market value of a share of our common stock on the date of the grant of the restricted stock units.

Participants holding shares of restricted stock during the restriction period may exercise full voting rights with respect to those shares. No dividends will be paid under a grant of restricted stock or restricted stock units unless subject to the same vesting conditions as the underlying restricted stock or restricted stock units.

Performance Shares

The 2008 Stock Incentive Plan permits the granting of performance shares. Each performance share must have an initial value equal to the fair market value of a share of our common stock on the date of grant. The Committee will set the performance periods and performance objectives that, depending on the extent to which they are met, will determine the number of performance shares payable in cash, shares or a combination of cash and shares, as applicable. No dividends will be paid under a performance share grant, unless subject to the same vesting conditions as the underlying performance share.

9

Other Stock Awards

Subject to the terms of the 2008 Stock Incentive Plan, other stock awards may be granted to participants in such amounts and upon such terms, and at any time from time to time, as the Committee determines, provided that no dividends shall be paid unless subject to the same vesting conditions as the underlying other Stock Award.

Performance Measures

The performance measures used for purposes of awards (both those granted on or prior to the date of the Annual Meeting and those granted after the date of such meeting) may include, but are not limited to any of the following (or an combination of the same):

•earnings before interest and taxes;

•earnings before interest, taxes, depreciation and amortization;

•net earnings;

•operating earnings or income;

•earnings growth;

•net income (absolute or competitive growth rates comparative);

•net income applicable to shares of common stock;

•cash flow, including operating cash flow, free cash flow, discounted cash flow return on investment

•cash flow in excess of cost of capital;

•earnings per share of common stock;

•return on stockholders' equity (absolute or peer-group comparative);

•stock price and/or total shareholder or stockholder return (absolute or peer-group comparative);

•absolute and/or relative return on common stockholders' equity;

•absolute and/or relative return on capital;

•absolute and/or relative return on assets;

•economic value added (income in excess of cost of capital);

•customer satisfaction;

•expense reduction;

•ratio of operating expenses to operating revenues;

•gross revenue or revenue by pre-defined business segment (absolute or competitive growth rates comparative);

•revenue backlog;

•margins realized on delivered services;

•employee engagement.

The Committee may specify any reasonable definition of the performance measure(s) it used. Such definitions may provide for reasonable adjustments and may include or exclude items, including, but not limited to: realized investment gains and losses; items determined to be unusual in nature, infrequent in occurrence or unusual in nature and infrequent in occurrence; other unusual or non-recurring items; gains or losses on the sale of assets; changes in accounting principles or the application thereof; currency fluctuations, acquisitions, divestitures, or necessary financing activities; recapitalizations, including stock splits and dividends; expenses for restructuring or productivity initiatives; and other objective measures.

The Committee will have the discretion to adjust targets set for pre-established performance objectives.

Transfers

Except as otherwise provided by the Committee and except as designated by the participant by will or by the laws of descent and distribution, awards under the 2008 Stock Incentive Plan are not transferable. However, subject to the conditions of the 2008 Stock Incentive Plan and the applicable award agreement and any such additional conditions as the Committee may

10

impose, a participant may transfer NQSOs as a gift to certain trusts maintained solely for the benefit of the participant's spouse or children or designate the trusts to which the Company may issue NQSOs, but under no circumstances will a participant be permitted to transfer a stock option to a third-party financial institution without prior stockholder approval.

Change in Control

In the event of a change in control, unless otherwise provided in an award agreement or a written employment agreement and unless an award is assumed or substituted (for equivalent value) by the successor or acquiring company, all outstanding awards will fully vest, except for awards subject to performance measures, which will be treated as vesting at the higher of actual results or target (pro-rated based on the time elapsed through the performance period). Additionally, the Committee has limited discretion to provide (i) accelerated vesting in the event of a change in control if a participant is terminated without cause or for good reason in connection with such change in control and (ii) limited single trigger vesting with respect to awards subject to performance measures in the event of a change in control.

The term "change in control" is defined in "--Potential Payments upon Termination or Change in Control."

Federal Income Tax Consequences

Nonqualified Stock Options

Under the current tax rules, NQSOs granted under the 2008 Stock Incentive Plan will not be taxable to a participant at grant, but generally will result in taxation at exercise, at which time the participant will recognize ordinary income in an amount equal to the difference between the option's exercise price and the fair market value of the shares on the exercise date.

The Company will be entitled to deduct a corresponding amount as a business expense in the year the participant recognizes this income.

Incentive Stock Options

Under the current tax rules, an employee will generally not recognize ordinary income on receipt or exercise of an ISO so long as he or she has been an employee of the Company or its subsidiaries from the date the ISO was granted until three months before the date of exercise; however, the amount by which the fair market value of the shares on the exercise date exceeds the exercise price is generally an adjustment in computing the employee's alternative minimum tax in the year of exercise. If the employee holds the shares of our common stock received on exercise of the ISO for one year after the date of exercise (and for two years from the date of grant of the ISO), any difference between the amount realized upon the disposition of the shares and the amount paid for the shares will be treated as long-term capital gain (or loss, if applicable) to the employee. If the employee exercises an ISO and satisfies these holding period requirements, the Company may not deduct any amount in connection with the ISO. If an employee exercises an ISO but engages in a "disqualifying disposition" by selling the shares acquired on exercise before the expiration of the one- and two-year holding periods described above, the employee generally will recognize ordinary income (for regular income tax purposes only) in the year of the disqualifying disposition equal to the excess, if any, of the fair market value of the shares on the date of exercise over the exercise price; and any excess of the amount realized on the disposition over the fair market value on the date of exercise will be taxed as long- or short-term capital gain (as applicable). If, however, the fair market value of the shares on the date of the disqualifying disposition is less than on the date of exercise, the employee will recognize ordinary income equal only to the difference between the amount realized on the disqualifying disposition and the exercise price. In either event, the Company will be entitled to deduct an amount equal to the amount constituting ordinary income to the employee in the year of the disqualifying disposition.

Stock Appreciation Rights

Under the current tax rules, a participant will generally not recognize income, and we will not be entitled to a deduction from income, at the time of grant of a SAR. When the SAR is exercised, the participant will recognize ordinary income equal to the difference between the aggregate grant price and the fair market value, as of the date the SAR is exercised, of our common stock. The participant's tax basis in shares acquired upon exercise of a stock-settled SAR will equal the amount recognized by the participant as ordinary income. We will generally be entitled to a federal income tax deduction, in the tax year in which the SAR is exercised, equal to the ordinary income recognized by the participant as described above. If the participant holds shares acquired through exercise of a stock-settled SAR for more than one year after the exercise of the SAR, the capital gain or loss realized upon the sale of those shares will be a long-term capital gain or loss. The participant's holding period for shares acquired upon the exercise of a stock-settled SAR will begin on the date of exercise.

11

Restricted Stock and Restricted Stock Units

The Company is required to withhold taxes to comply with federal and state laws applicable to the value of shares of restricted stock when they vest. Upon the lapse of the applicable restrictions, the value of the restricted stock generally will be taxable to the participant as ordinary income and deductible by the Company. Restricted stock units generally are subject to tax at the time of payment, provided the award has previously vested, and the Company will generally have a corresponding deduction when the participant recognizes income.

Performance Shares/Other Stock Awards

Performance shares and other stock awards are generally subject to tax at the time of payment and we generally will have a corresponding deduction when the participant recognizes income.

Section 409A

To the extent that Section 409A is applicable, we intend to administer the 2008 Stock Incentive Plan and any grants made thereunder in a manner consistent with the requirements of Section 409A, and any regulations and other guidance promulgated with respect to Section 409A by the U.S. Department of Treasury or Internal Revenue Service. The Committee may permit or require a participant to defer receipt of cash or shares of common stock that would otherwise be due to the participant under the 2008 Stock Incentive Plan or otherwise create a deferred compensation arrangement (as defined in Section 409A of the Code) in accordance with the terms of the 2008 Stock Incentive Plan. The deferral of an award under the 2008 Stock Incentive Plan or compensation otherwise payable to the participant will be set forth in the terms of the award agreement or as elected by the participant pursuant to such rules and procedures as the Committee may establish. Any such initial deferral election by a participant will designate a time and form of payment and will be made at such time as required by and in accordance with Section 409A. Any deferred compensation arrangement created under the 2008 Stock Incentive Plan will be distributed at such times as provided in an award agreement or a separate election form and in accordance with Section 409A. No distribution of a deferral will be made pursuant to the 2008 Stock Incentive Plan if the Committee determines that a distribution would (i) violate applicable law; (ii) be in violation of Section 409A; or (iii) violate a loan covenant or similar contractual requirement of the Company causing material harm to the Company. In any such case, a distribution will be made at the earliest date at which the Committee determines such distribution would not trigger clause (i), (ii) or (iii) above. All awards under the 2008 Stock Incentive Plan are intended either (i) to be exempt from Section 409A or (ii) to comply with Section 409A, and will be administered in a manner consistent with that intent.

Withholding

The Company has the right to deduct or withhold, or require the participant to remit to the Company, up to the maximum amount the Company determines is necessary to satisfy federal, state and local taxes, domestic or foreign, required by applicable law or regulation to be withheld with respect to any taxable event arising under the 2008 Stock Incentive Plan. The Company may withhold shares of our common stock to satisfy up to the maximum withholding tax required upon a taxable event arising under the 2008 Stock Incentive Plan, but the participant may elect, subject to the approval of the Committee, to deliver to the Company the necessary funds to satisfy the withholding obligation, in which case there will be no reduction in the shares of our common stock otherwise distributable to the participant.

Tax Advice

The preceding discussion is based on U.S. income tax laws and regulations presently in effect, which are subject to change, and the discussion does not purport to be a complete description of the U.S. income tax aspects of the 2008 Stock Incentive Plan. A participant may also be subject to state and local income taxes in connection with the grant of awards under the 2008 Stock Incentive Plan. The Company suggests that participants consult with their individual tax advisors to determine the applicability of the tax rules to the awards granted to them in their personal circumstances.

Governing Law and Forum

In general, to the extent not pre-empted by federal law, Illinois law will govern any disputes arising under the 2008 Stock Incentive Plan and such disputes must be heard in a state or local court located in the state of Illinois, Cook county.

Other Information

The 2008 Stock Incentive Plan was originally effective on October 1, 2009. This amendment and restatement of the 2008 Stock Incentive Plan will be effective April 19, 2021, subject to stockholder approval, and, subject to the right of the Committee to amend or terminate the 2008 Stock Incentive Plan, will remain in effect as long as any awards under it are outstanding;

12

provided, however, that no awards may be granted under the 2008 Stock Incentive Plan after the ten-year anniversary of the original effective date of the 2008 Stock Incentive Plan.

The Committee may, at any time, amend, suspend or terminate the 2008 Stock Incentive Plan, and the Committee may amend any award agreement; provided that no amendment may, in the absence of written consent to the change by the affected participant, materially alter or impair any rights or obligations under an award already granted under the 2008 Stock Incentive Plan.

As required by law or if so required pursuant to a written policy adopted by the Company, awards shall be subject (including on a retroactive basis) to clawback, forfeiture or similar requirements (and such requirements shall be deemed incorporated by reference into all outstanding award agreements).

New Plan Benefits and Other Matters

The Committee has discretion to determine the type, terms and conditions and recipients of awards granted under the 2008 Stock Incentive Plan. Accordingly, since future awards under 2008 Stock Incentive Plan will be made at the discretion of the Committee, it is not currently possible to determine the amount of the awards that will be received by any director, officer, consultant or employee of the Company in the future if the amendment and restatement of the 2008 Stock Incentive Plan is approved.

On April 16, 2021, the Nasdaq Global Market reported a closing price of $32.88 for our common stock. The following table sets forth information regarding securities authorized for issuance under our equity compensation plans as of December 31, 2020.

Equity Compensation Plan Information

| Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options | Weighted-Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in the First Column)(1) | ||||||||||||||

| Equity Compensation Plans Approved by Security Holders | 8,389 | $ | 14.42 | 700,048 | |||||||||||||

| Equity Compensation Plans Not Approved by Security Holders | — | $ | — | — | |||||||||||||

| Total | 8,389 | $ | 14.42 | 700,048 | |||||||||||||

(1) Includes shares remaining available for future issuance under our 2008 Stock Incentive Plan as of December 31, 2020.

13

Summary of Outstanding Performance Awards (2017 - 2020)

| Performance-Based Awards (Shares) | |||||

| # of Shares | |||||

| Non-vested at December 31, 2017 | 196,760 | ||||

| Granted | 97,966 | ||||

| Vested (or Earned) | (40,868) | ||||

| Forfeited | (68,200) | ||||

| Non-vested at December 31, 2018 | 185,658 | ||||

| Granted | 105,543 | ||||

| Vested (or Earned) | (13,267) | ||||

| Forfeited | (102,792) | ||||

| Non-vested at December 31, 2019 | 175,142 | ||||

| Granted | 139,191 | ||||

| Vested (or Earned) | (37,188) | ||||

| Forfeited | (112,689) | ||||

| Non-vested at December 31, 2020 | 164,456 | ||||

RESOLVED, that the stockholders approve the amendment and restatement of the 2008 Stock Incentive Plan.

Required Vote. Approval of this proposal will require the affirmative vote of a majority of the holders of our common stock represented in person or by proxy and entitled to vote at the Annual Meeting. Abstentions will have the same effect as a vote against these matters because they are considered present and entitled to vote, but are not voted.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS A VOTE "FOR" THE APPROVAL OF THE AMENDMENT AND RESTATEMENT OF OUR 2008 STOCK INCENTIVE PLAN.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Board Leadership Structure

Our Board is led by our Chairman and CEO, Douglas R. Waggoner. In accordance with Company policy, the Board of Directors sets high standards for the Company's employees, officers and directors. It is the duty of the Board and its leadership to serve as a prudent fiduciary for stockholders and to oversee the management of the Company's business. We believe that having Mr. Waggoner serve as Chairman and CEO is the most appropriate structure for the Company, as Mr. Waggoner can unify his responsibility for setting the strategic direction of the Company with his role of providing guidance to the leadership team as Chairman of the Board. Our current Lead Independent Director, Samuel K. Skinner, serves as a liaison between senior management and the Company's independent directors, and presides at executive sessions of the Board. The role of Lead Independent Director was created in June 2015 to further enhance the Board's independence and corporate governance. We believe our current board leadership structure strengthens the alignment between the Board and the day-to-day operations of the Company and is most appropriate for the Company at this time.

Board Diversity

Echo’s philosophy is to retain a Board of Directors that is both vastly experienced and diverse in thought, leadership, and experience. Echo’s Board embraces knowledge and understanding of diverse geographies, cultures, personalities, and work styles, as well as people from various backgrounds, including race, disability, gender, sexual orientation, religion, belief, and age.

Echo’s Board firmly believes that appointments should be based on merit as well as what will complement and expand the skills, knowledge, and experience of the Board as a whole.

14

The following table provides additional information about our Board diversity:

| Board of Directors | # of Directors | |||||||

| Number of Non-Executive Directors on Board | 5 | |||||||

| Number of Independent Directors | 5 | |||||||

| Number of Corporate Executive Officers on Board | 1 | |||||||

| Number of Women on the Board | 1 | |||||||

| Number of Minorities on the Board | 1 | |||||||

Board of Directors' Role in Risk Oversight

Risk assessment and oversight are a critical part of our corporate governance and management processes. Our Board encourages management to promote a culture that incorporates risk management into both our overall corporate strategy and our day-to-day business operations. It is management's responsibility to identify, evaluate, manage and mitigate risk within the context of our strategic plans and to bring to the Board's attention the most material risks facing the Company. It is the Board's responsibility to oversee our overall risk management processes and to ensure that management is taking appropriate action to manage material risks. The Board has delegated certain risk management oversight tasks to the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee in their respective areas of financial statement compliance and financial reporting, compensation plans and policies, and general corporate governance practices.

The Board also relies on the external audit of financial information, the Company's internal control structure, the Company's insurance advisors and the historically conservative practices of the Company to provide comfort on the Company's ability to manage its risks.

Code of Ethics and Business Conduct

Echo is committed to acting with uncompromising honesty and integrity. Every employee is required to sign the Echo Employee Handbook, which includes the Code of Ethics and Business Conduct. Echo performs internal audits to ensure compliance with this requirement. The Code of Ethics and Business Conduct provides guidance to employees on adhering to this commitment, while recognizing that it does not address every situation an employee is likely to encounter. This code is therefore not a substitute for an employee's responsibility and accountability to exercise good judgment and obtain guidance on appropriate business conduct. Echo also incorporates further ethics content in its induction training and within other sections of the Echo Employee Handbook.

Equal Employment Opportunity