Form DEF 14A Eastern Bankshares, Inc. For: May 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x | ||||||||

| Filed by a Party other than the Registrant ☐ | ||||||||

| Check the appropriate box: | ||||||||

| ☐ Preliminary Proxy Statement | ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||||

x Definitive Proxy Statement | ||||||||

| ☐ Definitive Additional Materials | ||||||||

| ☐ Soliciting Material Pursuant to Rule 14a-12 | ||||||||

Eastern Bankshares, Inc.

(Name of the Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. | ||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | ||||

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

| ☐ | Fee paid previously with preliminary materials. | ||||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

April 1, 2021

Dear Shareholder:

I am pleased to invite you to attend the 2021 Annual Meeting of Shareholders of Eastern Bankshares, Inc. The meeting will be held on Monday, May 17 at 12:00 p.m. online via the Internet at https://agm.issuerdirect.com/ebc and at our corporate offices located at 265 Franklin Street, Boston, Massachusetts 02110. Details regarding the business to be conducted at the meeting are described in the enclosed notice of the meeting and proxy statement.

Shareholders will receive a notice describing how to access our proxy materials over the Internet and how to request to receive a paper copy of the proxy materials by mail. Our proxy materials include this proxy statement and our 2020 annual report to shareholders, containing our audited financial statements and information about our business.

Your vote is very important. You can ensure your shares of our common stock are voted at the meeting by submitting your instructions by telephone, the Internet, or in writing by returning your proxy card or voting form. We encourage you to consider attending our 2021 Annual Meeting of Shareholders virtually through the Internet.

Thank you for your support and continued interest in Eastern Bankshares, Inc.

Sincerely,

ROBERT F. RIVERS

Chair of the Board of Directors and

Chief Executive Officer

April 1, 2021

To Shareholders of

Eastern Bankshares, Inc.

NOTICE OF ANNUAL MEETING

The 2021 Annual Meeting of Shareholders of Eastern Bankshares, Inc. will be held on Monday, May 17, 2021, at 12:00 p.m. online via the Internet at https://agm.issuerdirect.com/ebc and at our corporate office located at 265 Franklin Street, Boston, Massachusetts 02110. The purpose of the meeting is to consider and take action upon the following matters:

| 1. | to elect four directors for a three-year term expiring in 2024; | ||||

| 2. | to hold an advisory vote on executive compensation; | ||||

| 3. | to hold an advisory vote on the frequency of future executive compensation advisory votes; | ||||

| 4. | to ratify the appointment of Ernst & Young LLP by the Audit Committee of our Board of Directors as our company’s independent registered public accounting firm for the 2021 fiscal year; and | ||||

| 5. | to vote on such other business as may properly be brought before the meeting and any adjournment of the meeting. | ||||

The record date for the determination of the shareholders entitled to receive notice of and to vote at the meeting is March 12, 2021. Our stock transfer books will remain open.

Our Bylaws require that the holders of a majority of the shares of our common stock, issued and outstanding and entitled to vote at the meeting, be present online or in person, or represented by proxy at the meeting in order to constitute a quorum for the transaction of business. Accordingly, it is important that your shares be represented at the meeting regardless of the number of shares you may hold. Please ensure that your shares of our common stock are present and voted at the meeting by submitting your instructions by telephone, the Internet, or in writing by completing, signing, dating and returning your proxy card or voting form. If you choose to attend the 2021 annual meeting virtually, you may also vote your shares through the Internet during the meeting. Due to state laws and our corporate safety protocols related to the COVID-19 pandemic, shareholders will not be able to be present at our corporate office for the meeting.

You are entitled to participate in the 2021 Annual Meeting if you were a shareholder at the close of business on March 12, 2021, the record date, or hold a legal proxy for the meeting provided by your bank, broker or nominee as of such record date. To access, participate in, and vote your shares virtually at the 2021 Annual Meeting, visit https://agm.issuerdirect.com/ebc and enter your control number:

•Shareholders of record must enter the control number found on their proxy card or the Notice of Internet Availability of Proxy Materials.

•If your shares are held in “street name” through a broker, bank or other nominee, in order to participate in the annual meeting virtually, you must first obtain a legal proxy from your broker, bank or other nominee reflecting the number of shares of Eastern Bankshares, Inc. common stock you held as of the record date, your name and email address. You must then obtain a new control number from Continental Stock Transfer & Trust Company, LLC, our transfer agent, by presenting the legal proxy to Continental. You should submit a request for a new control number to Continental by emailing proxy@continentalstock.com no later than 5:00 p.m. on Wednesday, May 14, 2021.

•Plan participants in the Company's 401(k) Plan and/or Employee Stock Ownership Plan must enter the control number found on their vote authorization form or the Notice of Internet Availability of Proxy Materials.

If you join the meeting virtually, you can submit questions in writing during the meeting through the Q&A tab on the virtual platform. We intend to answer as many questions that pertain to company matters as time allows during the meeting. Questions that are substantially similar may be grouped or not answered to ensure we are able to answer every question in this virtual format.

A complete list of registered shareholders will be made available to shareholders of record at the meeting and in accordance with our Bylaws by emailing annualmeeting@easternbank.com.

This notice, the proxy and proxy statement are sent to you by order of our Board of Directors on behalf of the company.

| |||||

| KATHLEEN C. HENRY | |||||

| Executive Vice President, General Counsel and | |||||

| Corporate Secretary | |||||

TABLE OF CONTENTS

| Page | |||||

PROXY STATEMENT

We are furnishing this proxy statement (the "Proxy Statement") in connection with the solicitation of proxies by the Board of Directors (which we sometimes refer to as the “Board”) of Eastern Bankshares, Inc. (which we may also refer to as “we,” “us,” or the “Company” throughout this Proxy Statement) for use at our 2021 annual meeting of shareholders ("Annual Meeting") to be held on Monday, May 17, 2021 at 12:00 p.m. online via the Internet at https://agm.issuerdirect.com/ebc and at our corporate office located at 265 Franklin Street, Boston, MA 02110, and at any adjournment of that meeting. The mailing address of our executive office is 265 Franklin Street, Boston, MA 02110. The notice of annual meeting, this Proxy Statement and the enclosed proxy are being first furnished to our shareholders on or about April 1, 2021.

INTERNET AVAILABILITY OF PROXY MATERIALS

Our proxy materials are available over the Internet. You will receive a Notice of Internet Availability of Proxy Materials (the “Notice”) on or about April 5, 2021 to comply with the 40-day requirement pursuant to Rule 14a-16(a) of the the Securities and Exchange Act of 1934, as amended (the "Exchange Act"). The Notice contains instructions on how to access our proxy materials, including our Proxy Statement in connection with the Annual Meeting and our 2020 annual report to shareholders ("Annual Report"), and submit your proxy or vote authorization form. The Notice also provides information on how to request paper copies of our proxy materials if you prefer. If you have previously requested a paper copy of the proxy materials, you will receive a paper copy of our proxy materials by mail. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials electronically unless you elect otherwise. If you receive more than one Notice, it means that your shares are registered in more than one name or are registered in different accounts. In order to vote the shares you own, you must vote pursuant to the instructions on each Notice.

VOTING PROCEDURES

Purpose of Annual Meeting

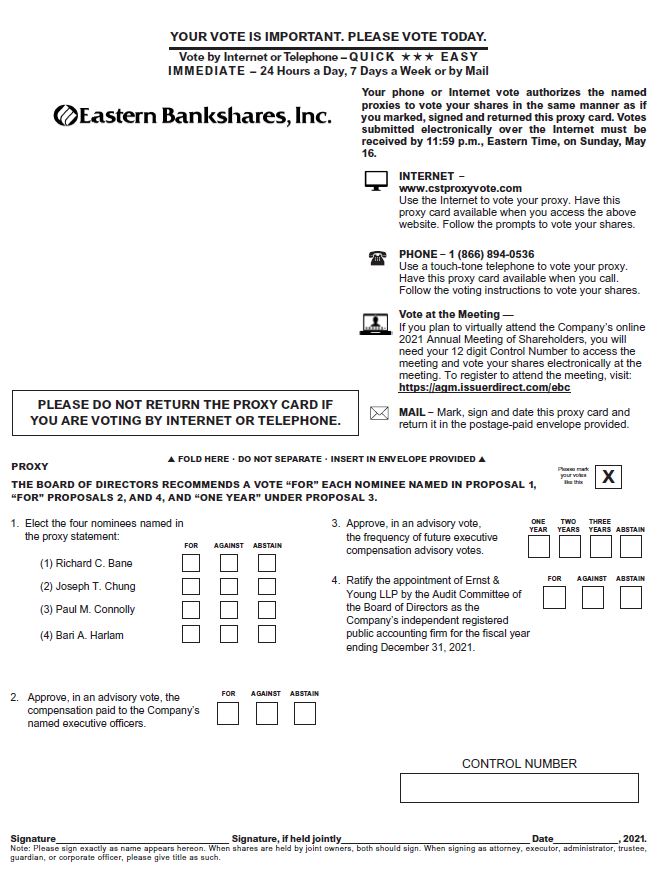

Shareholders entitled to vote at the Annual Meeting will consider and act upon the matters outlined in the notice of meeting accompanying this Proxy Statement, including the election of four individuals, each to be elected for a three-year term expiring in 2024 (Proposal 1); approval, by non-binding advisory vote, of the compensation of our named executive officers ("NEOs") (Proposal 2); to recommend, by non-binding advisory vote, the frequency of future executive compensation advisory votes (Proposal 3); and ratification of the appointment by the Audit Committee of our Board of Directors of Ernst & Young LLP as our independent registered public accounting firm for the 2021 fiscal year (Proposal 4).

Voting Securities and Record Date

Only shareholders of record at the close of business on March 12, 2021 ("Record Date"), are entitled to vote at the meeting or any adjournment of the meeting. Each share is entitled to one vote. Our outstanding capital stock entitled to vote at the meeting as of March 12, 2021, consisted of 186,758,154 shares of our common stock, $0.01 par value per share. Each holder of record of our common stock on the Record Date is entitled to one vote per share of common stock held, except that, as provided in our Articles of Organization and under applicable law, if anyone owns more than 10% of our common stock without prior approval of the Federal Reserve Board and the Massachusetts Commissioner of Banks, shares in excess of 10% will not be counted as shares entitled to vote.

In accordance with our amended and restated bylaws ("Bylaws") a list of shareholders of record as of the Record Date ("Shareholder List") will be available for inspection by any shareholder, beginning two (2) business days after notice is given of the meeting and continuing through the Annual Meeting. The Shareholder List may be accessed during the Annual Meeting by contacting the Corporate Secretary or by submitting an email to annualmeeting@easternbank.com and requesting access to the Shareholder List. In addition, you may contact our Corporate Secretary by submitting an email to annualmeeting@easternbank.com and requesting a time to view the Shareholder List virtually, for any purpose germane to the Annual Meeting, between the hours of 9:00 a.m. and 5:00 p.m., local time, on any business day from April 7, 2021 up to the time of the Annual Meeting.

The Bylaws have not been amended since the completion of our initial public offering ("IPO").

Quorum

The holders of a majority of the shares of our common stock that are issued and outstanding and entitled to vote at the meeting constitute a quorum for the transaction of business at the meeting. If a quorum is not present, the meeting will be adjourned until a quorum is obtained. For purposes of determining the presence or absence of a quorum, abstentions and broker non-votes will be counted as present. A “broker non-vote” is a proxy from a broker or other nominee indicating that such person has not received instructions from the beneficial owner on a particular matter with respect to which the broker or other

1

nominee does not have discretionary voting power. Brokers have the discretion to vote their clients’ proxies only on routine matters. At our Annual Meeting, only the ratification of our auditors is a routine matter.

Attending the Annual Meeting

We encourage our shareholders as of the Record Date to attend the 2021 Annual Meeting virtually. Please note the process required to access the meeting, which vary depending on the nature of your individual ownership interest:

| Type of Ownership | Nature of Ownership | Accessing the Annual Meeting Virtually | ||||||

| Record Holder | Your shares are represented by ledger entries in your own name directly registered with our transfer agent, Continental Stock Transfer & Trust ("Continental") | Enter your unique shareholder Control Number (found on your Notice or proxy card) on the registration webpage for the Annual Meeting to register for and gain access to the meeting | ||||||

| Held in "Street Name" | Your shares are held for your benefit in the name of a broker, bank or other intermediary | •First, obtain a legal proxy from your broker, bank or other nominee reflecting the number of shares of our common stock you held as of the record date, your name and email address. •Second, obtain a new control number from Continental, by presenting the legal proxy to Continental. You should submit a request for a new control number to Continental by emailing a copy of your legal proxy to proxy@continentalstock.com with a subject line "Eastern Bankshares Annual Meeting". Requests for registration must be received by Continental no later than 5:00 p.m. Eastern Time on May 14, 2021. •Third, enter the newly-obtained control number on the registration webpage for the Annual Meeting to register for and gain access to the meeting. | ||||||

| Participant in Company's 401(k) Plan or ESOP | Your shares are held for your benefit in the name of an independent trustee of the applicable plan, namely the Company's 401(k) Plan and/or its Employee Stock Ownership Plan ("ESOP") | Enter your unique shareholder Control Number (found on your Notice or vote authorization form) on the registration webpage for the Annual Meeting to register for or gain access to the meeting. Please note that the trustees of the applicable plans vote on behalf of plan participants, based on voting instructions received from participants. The deadline for providing voting instructions to the trustees is May 9, 2021. Plan participants may attend, but may not provide voting instructions at, the Annual Meeting. | ||||||

Due to state laws and our corporate safety protocols related to the COVID-19 pandemic, shareholders will not be able to be present at our corporate office for the meeting. We encourage you to participate in the Annual Meeting virtually. Even if you plan to attend the Annual Meeting virtually, we encourage you to vote in advance by Internet, telephone, or mail so that your vote will be counted in the event that you later decide not to attend the Annual Meeting.

Manner of Voting

Each share of common stock you hold is entitled to one vote for or against a proposal. Shares entitled to be voted at the Annual Meeting can only be voted if the shareholder of record of such shares is present at the meeting (either in-person or virtually), returns a signed proxy card, or authorizes proxies to vote his or her shares by telephone or over the Internet. Shares represented by valid proxy will be voted in accordance with your instructions. If you choose to vote your shares by telephone or over the Internet, you may do so until the dates and times set forth below, by following the instructions on the proxy card or the Notice.

2

Shareholders of Record

If you are a shareholder of record of our common stock as of the Record Date, you may vote in one of the following ways:

| By Internet | by following the Internet or mobile voting instructions included in the proxy card and Notice at any time up until 11:59 p.m., Eastern Time, on Sunday, May 16, 2021. | ||||

| By Telephone | by following the telephone voting instructions included in the proxy card and Notice at any time up until 11:59 p.m., Eastern Time, on Sunday, May 16, 2021. | ||||

| By Mail | by marking, dating and signing your printed proxy card (if requested and received by mail) in accordance with the instructions on it and returning it by mail in the pre-addressed reply envelope provided with the proxy materials for receipt prior to the Annual Meeting. | ||||

| By Internet during the Annual Meeting | by following the Internet voting instructions included in the Notice or proxy card during the Annual Meeting | ||||

You may revoke your proxy at any time before the shares are voted at the Annual Meeting by entering new voting instructions by telephone or over the Internet before 11:59 p.m. Eastern Time on Sunday, May 16, 2021, by written notice received by our Corporate Secretary before the Annual Meeting, by executing and returning a new proxy bearing a later date or by voting at the meeting. Attendance at the Annual Meeting without voting by ballot will not revoke a previously submitted proxy.

You may specify your choices by marking the appropriate box on the proxy card. If your proxy card is signed and returned without specifying choices, your shares will be voted in accordance with the recommendations of our Board of Directors and as the individuals named as proxy holders on the proxy card deem advisable on all other matters that may properly come before the meeting. The Board of Directors recommends that you vote for the listed nominees for director; for the approval of an advisory vote on compensation paid to our NEOs, for the approval of every one year as the frequency for shareholder advisory votes on executive compensation, and for ratification of the appointment by the Audit Committee of our Board of Directors of our independent registered public accounting firm.

Shareholders in "Street Name"

If you hold your shares in “street name” through a broker, bank or other representative, generally the broker or other representative may only vote the shares that it holds for you in accordance with your instructions. However, if the broker or other representative has not timely received your instructions, it may vote on certain matters for which it has discretionary voting authority.

The vote on election of directors, the advisory vote on executive compensation, and the advisory vote on the frequency of future executive compensation advisory votes are non-discretionary voting matters and your broker will not be able to vote on these matters without receiving your instructions. The vote to ratify the appointment of our independent registered public accounting firm is a discretionary matter and your broker has discretionary authority to vote on that proposal. Your broker or other representative will generally provide detailed voting instructions with your proxy materials. These instructions may include information on whether your shares can be voted by telephone or over the Internet and the manner in which you may revoke your votes.

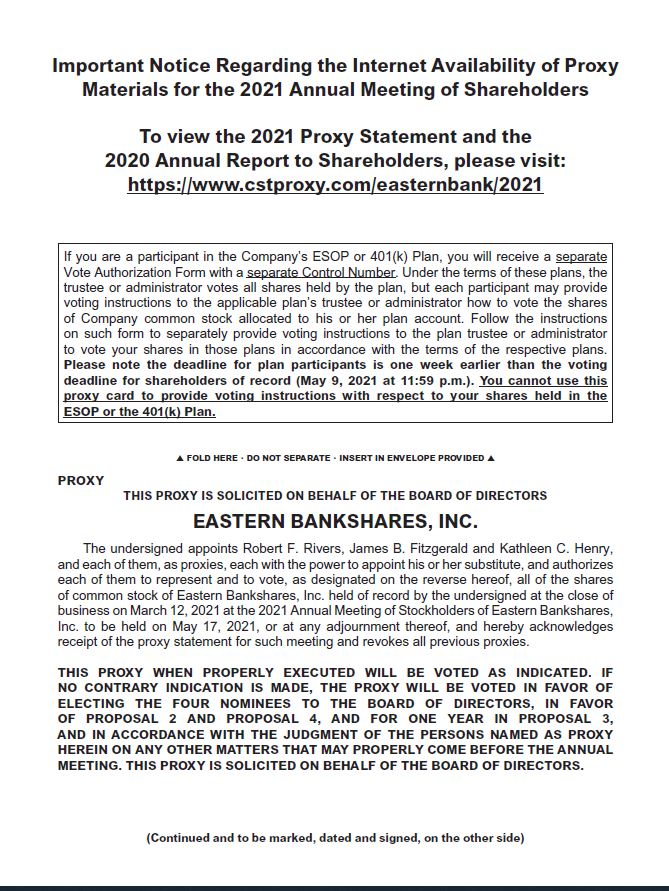

Participants in the Company's 401(k) Plan or ESOP

If you are a participant in the Company's ESOP or 401(k) Plan, you will receive a Notice by e-mail, unless you otherwise requested to receive the Notice by mail. Under the terms of these plans, the trustee or administrator votes all shares held by the plan, but each participant may direct the trustee or administrator how to vote the shares of our common stock allocated to his or her plan account. Using the control number received in your Notice, follow the instructions above (for "Shareholders of Record") to provide your voting instructions by Internet or telephone. If you own shares through any of these plans and you do not provide your voting instructions by 11:59 p.m., Eastern Time, on Sunday, May 9, 2021, the respective plan trustees or administrators will vote your shares in accordance with the terms of the respective plans. Please note that the deadline for plan participants to provide voting instructions (May 9, 2021) is one week earlier than the voting deadline for shareholders of record (May 16, 2021). In addition, due to the earlier voting deadline for plan participants, you cannot provide your voting instructions at the Annual Meeting (either virtually or in-person). However, you may still attend the Annual Meeting and ask questions.

3

Even if you plan to attend the Annual Meeting virtually, we encourage you to vote in advance by Internet, telephone, or mail so that your vote will be counted in the event that you later decide not to attend the Annual Meeting. | ||||||||||||||

Vote Required

Assuming a quorum is present at the Annual Meeting, the vote required to adopt each of the proposals is as follows:

•Election of Directors (Proposal 1). The election of directors is determined by a majority of the votes cast in person or by proxy by the shareholders entitled to vote on the election of directors in an uncontested election. Under our Bylaws, a nominee will be elected to the Board of Directors if the votes cast “for” the nominee’s election exceed the votes cast “against” the nominee’s election. Abstentions and broker non-votes are not counted as votes “for” or “against” a nominee and will have no effect upon the outcome of the vote on the election of directors.

•All Other Matters: Advisory Vote on Executive Compensation (Proposal 2); Advisory Vote on Frequency of Future Executive Compensation Advisory Votes (Proposal 3); and Ratification of the Appointment by the Audit Committee of our Board of Directors of Our Independent Registered Public Accounting Firm (Proposal 4). All other matters are determined by a majority of the votes cast by the holders of the shares present or represented by proxy at the Annual Meeting and voting on each matter. Under our Bylaws, abstentions and broker non-votes will have no effect on the determination of whether shareholders have approved these proposals.

4

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of shares of our common stock as of March 12, 2021, with respect to:

•those persons we know to beneficially own more than 5% of the outstanding shares of our common stock based on our review of filings made with the Securities and Exchange Commission ("SEC");

•each of our NEOs, directors, and director nominees; and

•all of our directors and executive officers as a group.

Unless otherwise indicated, the address of any person or entity listed is c/o Eastern Bankshares, Inc., 265 Franklin Street, Boston, MA 02110 The applicable percentage of beneficial ownership is based on 186,758,154 shares of our common stock outstanding as of March 12, 2021.

Beneficial ownership is determined in accordance with the rules of the SEC. Unless otherwise indicated, we believe, based on information furnished by such persons, that each person listed below has sole voting and investment power with respect to the shares of Company common stock shown as beneficially owned. Securities that may be beneficially acquired within 60 days of March 12, 2021 are deemed to be beneficially owned by the person holding such securities for the purpose of computing ownership of such person, but are not treated as outstanding for the purpose of computing the ownership of any other person.

| Name of Beneficial Owner | Director or Indirectly Held (#)(1)(2) | Right to Acquire (#)(3) | Total Amount and Nature of Beneficial Ownership of Common Stock (#) | Percentage of Common Stock (%) | ||||||||||

| The Vanguard Group (4) | 15,889,055 | 8.51% | ||||||||||||

| Principal Trust Company (5) | 14,940,652 | 8.00% | ||||||||||||

| BlackRock, Inc. (6) | 11,466,094 | 6.14% | ||||||||||||

| Richard C. Bane | 120,000 | - | 120,000 | * | ||||||||||

| Luis A. Borgen (7) | 100,000 | - | 100,000 | * | ||||||||||

| Joseph T. Chung | 50,000 | - | 50,000 | * | ||||||||||

| Paul M. Connolly | 12,500 | - | 12,500 | * | ||||||||||

| Bari A. Harlam (8) | 30,000 | - | 30,000 | * | ||||||||||

| Diane S. Hessan (9) | 42,000 | - | 42,000 | * | ||||||||||

| Richard E. Holbrook (8) | 196,500 | - | 196,500 | * | ||||||||||

| Deborah C. Jackson (10) | 32,500 | - | 32,500 | * | ||||||||||

| Peter K. Markell | 100,000 | - | 100,000 | * | ||||||||||

| Robert F. Rivers (11) | 200,104 | - | 200,104 | * | ||||||||||

| Greg A. Shell | 200,000 | - | 200,000 | * | ||||||||||

| Paul D. Spiess (12) | 100,000 | - | 100,000 | * | ||||||||||

| Quincy L. Miller (13) | 84,624 | - | 84,624 | * | ||||||||||

| James B. Fitzgerald (14) | 150,104 | - | 150,104 | * | ||||||||||

| All Directors and Executive Officers as a group (23 persons)(15) | 1,917,932 | - | 1,917,032 | 1.03% | ||||||||||

* Less than 1%

(1)The number of shares beneficially owned by each shareholder is determined under the rules of the SEC, and the information provided is not necessarily indicative of beneficial ownership for any other purpose. Unless otherwise indicated, as determined under such rules, each shareholder has sole investment and voting power (or shares such power with his or her spouse) with respect to the shares reported in this table. The inclusion of any shares deemed beneficially owned does not constitute an admission of beneficial ownership of such shares.

5

(2)For executive officers, shares directly or indirectly held includes shares held by the Company's ESOP, including in the amounts of 104 shares for each of Mr. Rivers, Mr. Miller and Mr. Fitzgerald, respectively. Fractional shares have been rounded down.

(3)Consists of shares of the Company's common stock which the named individual or group has the right to acquire within 60 days of March 12, 2021.

(4)The address of The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. The Vanguard Group filed as the parent holding company of Vanguard Asset Management, Limited; Vanguard Fiduciary Trust Company; Vanguard Global Advisors, LLC; Vanguard Group (Ireland) Limited; Vanguard Investments Australia Ltd; Vanguard Investments Canada Inc.; Vanguard Investments Hong Kong Limited; and Vanguard Investments UK, Limited. The information about The Vanguard Group is based on its Schedule 13G filed with the SEC on February 10, 2021, and is as of December 31, 2020.

(5)The address of Principal Trust Company is 1013 Centre Road Ste 300, Wilmington DE 19805-1265. The ESOP is subject to the Employee Retirement Income Security Act of 1974 (“ERISA”). Delaware Charter Guarantee & Trust Company dba Principal Trust Company acts as the Directed Trustee of the ESOP (“Trust”). As of December 31, 2020, the Trust held 14,940,652 shares of the Company's common stock. The securities reported include all shares held of record by the Trustee. The Trustee follows the directions of the investment fiduciary named in the ESOP, or other parties designated in the ESOP’s trust agreement with respect to voting and disposition of shares. The Trustee, however, is subject to certain fiduciary duties under ERISA as limited in the trust agreement. The Trustee disclaims beneficial ownership of the shares of common stock that are the subject of the Schedule 13G filed with the SEC by Principal Trust Company on February 11, 2021, which is as of December 31, 2020.

(6)The address of BlackRock, Inc. is 55 East 52nd Street New York, NY 10055. BlackRock, Inc. filed as the parent holding company of BlackRock Advisors, LLC; BlackRock Asset Management Canada Limited; BlackRock Fund Advisors; BlackRock Institutional Trust Company, National Association; BlackRock Financial Management, Inc; and BlackRock Investment Management, LLC. The information about BlackRock, Inc. is based on its Schedule 13G filed with the SEC on February 2, 2021, and is as of December 31, 2020.

(7)Consists of (i) 53,730 shares held directly and (ii) 46,270 shares held in an individual retirement account ("IRA").

(8)Shares held in joint tenancy with spouse.

(9)Consists of (i) 40,0000 shares held directly; and (ii) 2,000 shares held by Crimson Seed Capital, LLC, which is controlled by Ms. Hessan's spouse and of which Ms. Hessan disclaims beneficial ownership except to the extent of any pecuniary interest therein.

(10)Consists of (i) 13,500 shares held directly and (ii) 19,000 shares held in an IRA.

(11)Consists of (i) 200,000 shares held in joint tenancy with spouse and (ii) 104 shares held by the Company's ESOP.

(12)Consists of (i) 50,000 shares held directly and (ii) 50,000 shares held by spouse.

(13)Consists of (i) 83,240 shares held through IRAs, (ii) 1,280 shares held by spouse's IRA, and (iii) 104 shares held by the Company's ESOP.

(14)Consists of (i) 17,769 shares held in Mr. Fitzgerald's 401(k) plan account, (ii)132,231 shares held in joint tenancy with spouse, and (iii) 104 shares held by the Company's ESOP.

(15)Includes (i) 1,361,241 shares held directly or indirectly with spouse or spouse's entity; (ii) 227,510 shares in IRAs, (iii) 327,033 shares held in 401(k) plan accounts, and (iv) 1,248 shares held by the Company's ESOP.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, executive officers and beneficial owners of more than 10% of our common stock to file with the SEC initial reports of ownership and reports of changes in ownership of our securities. Based solely upon a review of these filings, all Section 16(a) filing requirements applicable to such persons were complied with during 2020 on a timely basis.

6

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors is divided into three classes of directors serving staggered three-year terms, with each class being as equal in number as possible. Directors for each class are elected at the annual meeting of shareholders held in the year in which the term for their class expires. We have four directors who are standing for election at the Annual Meeting. If re-elected, each director nominee would hold office until our annual meeting of shareholders in 2024 and thereafter until his or her respective successor has been elected.

Based on the recommendation of our Nominating and Governance Committee, our Board of Directors has nominated Richard C. Bane, Joseph T. Chung, Paul M. Connolly and Bari A. Harlam for election as directors for the three-year term expiring at the 2024 annual meeting of shareholders. Messrs. Bane, Chung and Connolly and Ms. Harlam are each currently a member of our Board of Directors. If any nominee becomes unable to serve as a director, the proxy holders may vote the proxy for the election of a substitute nominee to be designated by our Board of Directors. We do not expect that any nominee will be unable to serve. Directors serve until the expiration of their terms and until their successors have been elected and qualified or until their earlier retirement or their resignation, death or removal in accordance with our Bylaws.

Recommendation

As described below, each of our nominees has considerable professional and business expertise. Our Board of Directors recommends a vote “FOR” each nominee based on its carefully considered judgment that the experience, qualifications, attributes and skills of each nominee qualify him or her to serve on our Board of Directors and its belief that the election of Messrs. Bane, Chung and Connolly and Ms. Harlam as directors is in the best interests of our Company.

Information regarding the names, ages, principal occupations and employment during the past five years of each of our directors is provided below. We have also included information about each director’s specific experience, qualifications, attributes or skills that led the Board of Directors to conclude that he or she should serve as a director. Unless we have specifically noted below, no corporation or organization referred to below is a subsidiary or affiliate of the Company. There are no family relationships among any of our directors and executive officers. Information on the stock ownership of our directors is provided in this Proxy Statement under the heading “Security Ownership of Certain Beneficial Owners and Management”. Information regarding the compensation of our directors is provided in this Proxy Statement under the heading “Director Compensation.”

Nominees for Class I Director for the Three-Year Term That Will Expire in 2024

| Richard C. Bane | Experience | |||||||

| Age 65 | Richard C. Bane has served as a director of Eastern Bank since 2001 and as a trustee of its predecessor holding company, Eastern Bank Corporation, since 1996. He is the Chairman and Chief Executive Officer of Bane Care Management LLC, which operates skilled nursing facilities and assisted living facilities in Massachusetts, where he has been employed since 1994. Mr. Bane formerly served as Chairman of the Massachusetts Senior Care Association, the state’s largest professional provider group, and chairs that organization’s Payment Reform Task Force and Legislative Committees. He lectures frequently on many aspects of senior care services and post-acute care and is considered one of New England’s senior care industry leaders. Mr. Bane is also involved in a wide range of corporate and community service activities. He is also a Board member of Targeted Risk Assurance Company and Steward Carney Hospital in Dorchester, MA. Mr. Bane holds an A.B. in Economics from Dartmouth College, and an MBA from Harvard Business School. He was also awarded an Honorary Doctorate from Salem State University. | |||||||

| Qualifications | ||||||||

| We believe Mr. Bane’s extensive executive management experience and civic leadership qualify him to serve on our Board of Directors. | ||||||||

7

| Joseph T. Chung | Experience | |||||||

| Age 56 | Joseph T. Chung has served as a director of Eastern Bank and trustee of its predecessor holding company, Eastern Bank Corporation, since 2014. He is co-founder and CEO of Kinto, a care coaching platform for family caregivers looking after loved ones with Alzheimer’s Disease and related dementias, where he has served since 2019. He is also co-founder and Managing Director of Redstar Ventures, an innovative venture foundry developing a series of new companies through a topdown, market driven process, positions he has held since 2010. Prior to Kinto and Redstar, Mr. Chung was Chairman and CEO of Allurent and co-founder, Chairman and Chief Technology Officer of Art Technology Group, a publicly traded, global enterprise software company. Mr. Chung holds B.S. and M.S. degrees in Computer Science from the Massachusetts Institute of Technology, and he conducted his graduate work at MIT’s Media Lab. He is a Venture Partner at the Media Lab’s E14 Fund. | |||||||

| Qualifications | ||||||||

| We believe Mr. Chung’s extensive expertise in innovation and technology qualifies him to serve on our Board of Directors. | ||||||||

| Paul M. Connolly | Experience | |||||||

| Age 71 | Paul M. Connolly has served as a director of Eastern Bank and a trustee of its predecessor holding company, Eastern Bank Corporation, since 2011. Mr. Connolly retired in 2010 as the First Vice President and Chief Operating Officer at the Federal Reserve Bank of Boston, a position he had held since 1994. As Chief Operating Officer of the Federal Reserve Bank of Boston, Mr. Connolly had the responsibility for the Bank’s financial services, information technology, finance, and support and administrative activities. Mr. Connolly joined The Federal Reserve Bank in 1975. Throughout his 36-year career, he served in a variety of positions in information technology, payments, planning and economic research, served on the Federal Reserve Financial Services Policy Committee and had national leadership responsibility for payment services and financial management. He currently serves on the board of directors for John Hancock Life Insurance Company and received an MBA from Harvard Business School and an A.B. from Boston College. | |||||||

| Qualifications | ||||||||

| We believe Mr. Connolly’s extensive banking and regulatory experiences qualify him to serve on our Board of Directors. | ||||||||

| Bari A. Harlam | Experience | |||||||

| Age 59 | Bari A. Harlam has served as a director of Eastern Bank and a trustee of its predecessor holding company, Eastern Bank Corporation, since 2014. Ms. Harlam is the co-founder of Trouble, LLC, a position she has held since April 2020, and currently serves as a member of the Board of Directors of the Mohawk Group, Inc., Champion Petfoods, LP, OneWater Marine, Inc., and Rite Aid Corporation. From April 2018 to March 2020, Ms. Harlam served as the Chief Marketing Officer for Hudson's Bay Company. Prior to that, she served as the Executive Vice President of Membership, Marketing, and Analytics for BJ's Wholesale Club, beginning in 2012. Before that, she was Chief Marketing Officer at Swipely, a technology startup and served as Senior Vice President of Marketing for CVS Health Corporation. Ms. Harlam has also served on the faculties of The Wharton School at the University of Pennsylvania, Columbia University's Graduate School of Business, and the University of Rhode Island. She received her B.S., M.S., and Ph.D. from the University of Pennsylvania, The Wharton School of Business. Her work has been published in a variety of journals including Marketing Science, Journal of Marketing Research, and the Journal of Business Research. | |||||||

| Qualifications | ||||||||

| We believe Ms. Harlam's extensive marketing and analytics expertise qualifies her to serve on our Board of Directors. | ||||||||

Our directors listed below are not up for election this year and each will continue in office for the remainder of his or her specified term of office or until his or her earlier resignation, death or removal in accordance with our Bylaws.

8

Class II Directors Continuing in Office (Term Will Expire in 2022)

| Richard E. Holbrook | Experience | |||||||

| Age 69 | Richard E. Holbrook currently serves as director and Chair Emeritus of Eastern Bank. Mr. Holbrook retired as Chair and Chief Executive Officer of Eastern Bank in 2016, having served in those roles since 2007. He also served as a trustee of its predecessor holding company, Eastern Bank Corporation, since 2001. Mr. Holbrook joined Eastern Bank in 1996 as Chief Financial Officer and Executive Vice President and was named President and Chief Operating Officer of Eastern Bank and Eastern Bank Corporation in 2001. He has more than 25 years of banking experience as a commercial lender, trust officer and planning and financial manager. During his leadership at Eastern, Mr. Holbrook served as the Federal Advisor Council representative for the First Federal Reserve District, meeting quarterly to discuss business and financial conditions with the Federal Reserve Board of Governors in Washington, D.C. Mr. Holbrook also served on the Board of Directors of the Federal Reserve Bank of Boston, and on the executive committee of the Boston Chamber of Commerce. He is also the former chair of the Massachusetts Bankers Association. He received his undergraduate degree from Yale University and his MBA from Harvard Business School. | |||||||

| Qualifications | ||||||||

| We believe Mr. Holbrook’s experience working in the banking industry, particularly his decades of experience on our executive management team, qualifies him to serve on our Board of Directors. | ||||||||

| Deborah C. Jackson | Experience | |||||||

| Age 69 | Deborah C. Jackson, the Lead Director of Eastern Bank, has served as a director of Eastern Bank since 2000 and as a trustee of its predecessor holding company, Eastern Bank Corporation, since 2001. She serves as the President of Cambridge College in Cambridge Massachusetts, a position she has held since 2011. Prior to that, Ms. Jackson served for nearly a decade as CEO of the American Red Cross of Eastern Massachusetts, one of the nation's largest Red Cross units. Prior to that, she served as Vice President of the Boston Foundation where she managed its $50 million grant and initiatives program. Throughout her career, Ms. Jackson has served and continues to serve on numerous commissions, task forces and boards including the Boston Green Ribbon Commission; the Mayor's Task Force to Eliminate Racial and Ethnic Disparities in Health Care; the "City to City" program focusing on national and global best practices for urban policies; and the American Red Cross National Diversity Advisory Council. Ms. Jackson served for over 15 years on the board of the American Student Assistance Corporation, the nation's first student loan guarantor agency; and she has served on the Boston College Carroll School of Management's Advisory Board, and the boards of Milton Academy and Harvard Pilgrim Health Care. She also served as Chairman of the Board of Directors of the Association of Independent Colleges and Universities in Massachusetts and was a board member of the New England Chapter of The National Association of Corporate Directors. In addition, Ms. Jackson served as the Chair of the Audit Committee and on the Board of Directors of the Boston Stock Exchange. She currently serves on the Board of Directors of John Hancock Investments and on the board of the Amwell Corporation. Ms. Jackson attended Hampton University, graduated from Northeastern University with a B.A. and she pursued graduate studies in urban studies and planning from the Massachusetts Institute of Technology. Ms. Jackson is also the recipient of Honorary Doctorate degrees from Curry College and Merrimack Valley College. Ms. Jackson was a fellow of the British American Project of Johns Hopkins University, and previously served as a fellow of the Harvard University Advanced Leadership Institute and the Harvard University Institute for College Presidents. | |||||||

| Qualifications | ||||||||

| We believe Ms. Jackson's extensive executive, civic, community and board leadership experience qualifies her to serve on our Board of Directors. | ||||||||

| Peter K. Markell | Experience | |||||||

| Age 65 | Peter K. Markell has served as a director of Eastern Bank and a trustee of its predecessor holding company, Eastern Bank Corporation, since 2006. He is Executive Vice President of Administration and Finance, Chief Financial Officer and Treasurer for Mass General Brigham. He joined Mass General Brigham in 1999. Prior to that, he was a partner at Ernst & Young LLP. A Certified Public Accountant, Mr. Markell is a Boston College graduate with a B.A. in Accounting and Finance and serves on the Board of Boston College where he has served as both chairman of the Board and Chairman of the Finance Committee. | |||||||

| Qualifications | ||||||||

| We believe Mr. Markell’s extensive executive, accounting, and board leadership experience qualify him to serve on our Board of Directors. | ||||||||

9

| Greg A. Shell | Experience | |||||||

| Age 45 | Greg A. Shell has served as a director of Eastern Bank and a trustee of its predecessor holding company, Eastern Bank Corporation, since 2018. Prior to joining the Board, he served on the Bank’s Investment Advisory committee. Since 2016, Mr. Shell has served as Managing Director of Bain Capital, coleading the Double Impact Fund, Bain Capital’s private equity fund focused on social impact. Prior to joining Bain Capital, Mr. Shell was a Portfolio Manager at Grantham, Mayo, Van Otterloo (“GMO”), a global investment management firm. Prior to that, he was a Senior Equity Analyst in the Global Equity Research group at Columbia Management Group, a global investment management firm. Mr. Shell has served on the New England Advisory Committee of the Federal Reserve Bank of Boston, and as a Director at Harvard Pilgrim Health Care, Fiduciary Trust, Massachusetts General Hospital and the Boston Foundation. Mr. Shell earned his MBA from Harvard Business School and received a B.S. from the Massachusetts Institute is Technology. | |||||||

| Qualifications | ||||||||

| We believe Mr. Shell’s financial and investment experience, as well as his civic leadership qualifies him to serve on our Board of Directors. | ||||||||

Class III Directors Continuing in Office (Term Will Expire in 2023)

| Luis A. Borgen | Experience | |||||||

| Age 51 | Luis A. Borgen has been a director of Eastern Bank and a trustee of its predecessor holding company, Eastern Bank Corporation, since 2016. Since 2019, he has been the Chief Financial Officer for athenahealth, Inc., a leading cloud-based developer and provider of healthcare software that automates and manages revenue cycle management and electronic health records for physician practices and health systems. Prior to that, he was Chief Financial Officer for Vistaprint, an e-commerce company that produces marketing products for small and micro businesses. Prior to that, he served as Chief Financial Officer for two publicly traded companies: DAVIDsTEA (from 2012-2017) and DaVita Inc. (from 2010-2012). Beginning in 1997, Mr. Borgen served in increasing roles of responsibility at Staples, Inc. leading to his appointment as Senior Vice President, Finance for the U.S. Retail business. He served in the U.S. Air Force from 1992 to 1997 and attained the rank of Captain. Mr. Borgen holds a B.S. in Management from the United States Air Force Academy, an M.S. in Finance from Boston College and an MBA with Honors from the University of Chicago. Mr. Borgen is also a CFA charterholder. | |||||||

| Qualifications | ||||||||

| We believe Mr. Borgen’s experience with financial accounting matters and oversight of the financial reporting process of public companies qualifies him to serve on our Board of Directors. | ||||||||

| Diane S. Hessan | Experience | |||||||

| Age 66 | Diane S. Hessan has served as a director of Eastern Bank and a trustee of its predecessor holding company, Eastern Bank Corporation, since 2016. She currently serves as CEO of Salient Ventures, an investment and advisory company with a portfolio of angel investments focused on technology companies, a position she has held since November 2016. Previously, she was CEO of Startup Institute, which is dedicated to helping people transform their careers to succeed in the innovation economy. She is also Chairman of C Space, where she was Founder and CEO for 14 years. C Space (formerly Communispace) is a market research company, which builds online communities to help marketers generate consumer insights. Ms. Hessan serves on the boards of Tufts University, MassChallenge, Panera, Brightcove, The Schlesinger Group and Beth Israel Deaconess Medical Center, and received her MBA from Harvard Business School and her B.A. in Economics and English from Tufts University. Ms. Hessan has also received Honorary Doctorate degrees from Bentley University and the New England College of Business. | |||||||

| Qualifications | ||||||||

| We believe Ms. Hessan’s executive experience, entrepreneurial passion and customer-centric, data driven perspective qualify her to serve on our Board of Directors. | ||||||||

10

| Robert F. Rivers | Experience | |||||||

| Age 56 | Robert F. Rivers is the Chief Executive Officer and Chair of the Board of Directors of Eastern Bankshares, Inc. and has served as the Chief Executive Officer and Chair of the Board of Directors of Eastern Bank since January 1, 2017. Mr. Rivers joined Eastern Bank in 2006 as its Vice Chair and Chief Banking Officer, becoming President in 2007, Chief Operating Officer in 2012 and an Eastern Bank director in 2015. He has also served as a trustee of Eastern Bank's predecessor holding company, Eastern Bank Corporation, since 2007. Prior to joining Eastern, from 1991 to 2005, Mr. Rivers held a number of staff and line leadership positions at M&T Bank in Buffalo, NY. Immediately prior to joining Eastern, he was an Executive Vice President for Retail Banking at the former Commercial Federal Bank in Omaha, Nebraska, following 14 years at M&T Bank. Mr. Rivers serves as Foundation Board Chair of the Dimock Center, as Chair of the Massachusetts Business Roundtable, is a member of the executive committee of the Greater Boston Chamber of Commerce, and is a trustee of Stonehill College. He also serves on the Board of the Lowell Plan and on the Advisory Boards of the Lawrence Partnership and the JFK Library Foundation, and the Boston Women’s Workforce Council. A leader in Boston’s business community, Mr. Rivers has been recognized as a champion for social justice issues, having led the “Yes on 3” campaign to protect the rights of members of the LGBTQ+ community. He received his undergraduate degree from Stonehill College and holds an MBA from the University of Rochester. | |||||||

| Qualifications | ||||||||

| We believe that Mr. Rivers is qualified to serve as a director based upon his experience as our Chief Executive Officer beginning in January 2017, his prior service as one of our senior executive officers, his prior senior management positions at other banks, and his familiarity with the communities that Eastern serves, including through his involvement with numerous non-profit organizations in the greater Boston area. | ||||||||

| Paul D. Spiess | Experience | |||||||

| Age 71 | Paul D. Spiess has served as a director of Eastern Bank and a trustee of its predecessor holding company, Eastern Bank Corporation, since 2014. He has spent forty-five years in the banking and financial services industry, serving as former Chairman of the Board of Centrix Bank and Trust, which merged with Eastern in 2014. He also served as Executive Vice President and Chief Operating Officer of CFX Bank in Keene, New Hampshire from 1993 to 1997. From 2004 to 2010, Mr. Spiess served in the office of the Governor of New Hampshire as an insurance and banking advisor. From 2000 to 2004, he served as a state legislator in Concord, New Hampshire, during which time he served on the House Commerce Committee. From 1983 to 1993, Mr. Spiess was Founder and President of Colonial Mortgage, Inc., of Amherst, New Hampshire. From 2004 through 2010, Mr. Spiess served as a health care advisor to New Hampshire Governor John Lynch and as Chairman of the Citizen’s Health Initiative. He graduated with a B.A. from Colby College in 1971 and earned an M.B.A degree from Boston University in 1977. | |||||||

| Qualifications | ||||||||

| We believe Mr. Spiess’s extensive knowledge of banking operations and credit risk, his experience in the banking and mortgage industries, and his board leadership experience qualify him to serve on our Board of Directors. | ||||||||

11

CORPORATE GOVERNANCE

Our Board of Directors believes that good corporate governance is important to ensure that our Company is managed for the long-term benefit of its shareholders. Current copies of our Corporate Governance Guidelines, Code of Conduct, and charters for our Audit, Compensation, Nominating and Governance, and Risk Management Committees are available on our website, investor.easternbank.com, in the Governance section under the caption “Governance Documents.” We may also use our website in the future to make certain disclosures required by the rules of The Nasdaq Global Select Market ("Nasdaq"), on which our common stock is listed.

| Corporate Governance Highlights | |||||

| We have implemented several important measures that are designed to promote long-term stakeholder value: | |||||

| ☑ | To facilitate board refreshment, we have adopted a director retirement policy in our Corporate Governance Guidelines pursuant to which any director who reaches the age of 75 while serving as a director will retire from the Board effective as of the end of the year in which he or she turns 75. | ||||

| ☑ | We intend to seek an advisory vote annually on the compensation of our Named Executive Officers, who are the three executive officers shown in the compensation tables in this Proxy Statement. We believe this practice underscores the careful consideration we intend to give to our shareholders’ views on our compensation practices. | ||||

| ☑ | We have established a compensation clawback policy that will enable the Company to recoup cash and incentive compensation from executive officers in the event of certain financial restatements. | ||||

| ☑ | We have adopted equity ownership guidelines for directors, which set minimum ownership requirements based on a multiple of the cash portion of the annual base retainer then in effect. | ||||

| ☑ | Our Insider Trading Policy prohibits our executives and directors from pledging and hedging our common stock, in order to further the alignment between shareholders and our executives and directors. | ||||

Director Independence

Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, family and other relationships, including those relationships described under the section of this Proxy Statement entitled “Certain Relationships and Related Party Transactions,” our Board of Directors has determined that each of the following directors qualifies as an “independent director,” as defined in the listing requirements of Nasdaq: Mses. Jackson, Harlam and Hessan and Messrs. Bane, Borgen, Chung, Connolly, Markell, Shell and Spiess. Neither Mr. Rivers nor Mr. Holbrook qualify as an “independent director” under the Nasdaq rules. Mr. Rivers is not considered independent because he currently serves as our chief executive officer. Mr. Holbrook served as chief executive officer from January 1, 2007 through December 31, 2016. In making these determinations on the independence of our directors, our Board of Directors considered the relationships that each such non-employee director has with our Company and all other facts and circumstances our Board of Directors deemed relevant in determining independence. Our Board of Directors also determined that each member of the Audit, Compensation, and Nominating and Governance Committees satisfies the independence standards for such committees established by the SEC and the Nasdaq listing rules, as applicable.

The Company has also adopted a Director Independence Policy that incorporates the requirements for independence set forth in the SEC and Nasdaq independence rules, as well as an Audit Committee Independence Policy that establishes separate and higher standards of independence for members of the Audit Committee, consistent the SEC and Nasdaq rules, as well as guidelines of the Federal Deposit Insurance Corporation. Our Board of Directors has determined that each of Mses. Jackson, Harlam and Hessan and Messrs. Bane, Borgen, Chung, Connolly, Markell, Shell and Spiess is an "independent director" under the Director Independence Policy and that each of Messrs. Bane, Borgen, Connolly, Markell and Spiess meets the enhanced independence standards for Audit Committee members set forth in the Company's Audit Committee Independence Policy.

Board Composition and Leadership Structure of the Board of Directors

Our Board of Directors oversees and advises our chief executive officer and management team, exercising their business judgment in good faith to ensure the long-term interests of our shareholders are being served. As of April 1, 2021, our Board of Directors was composed of 12 directors.

The Board does not have a fixed policy regarding the separation of the offices of chair of the Board of Directors and chief executive officer and believes that it should maintain the flexibility to select the chair of the Board of Directors and its

12

board leadership structure, from time to time, based on the criteria that it deems to be in the best interests of the Company and its shareholders. At this time, the offices of the chair of the Board of Directors and the chief executive officer are combined, with Mr. Rivers serving as chair and chief executive officer. He has served in this role since January 2017. With over 30 years of experience in the financial services industry, including over 14 years with us, Mr. Rivers has the knowledge, expertise, and experience to understand the opportunities and challenges facing our Company, as well as the leadership and management skills to promote and execute our values and strategy.

In accordance with what we believe are governance best practices, the Board of Directors has established the position of Lead Director. As further set forth in the Corporate Governance Guidelines, the Lead Director is independent, and is recommended by our Nominating and Governance Committee and elected by the Board of Directors. Since January 2018, Ms. Jackson has served in that role, performing many of the functions that an independent chair would perform for the Company. Those functions include serving as a key source of communication between the independent directors and the chief executive officer, consulting with the chair of the Board of Directors in establishing the agenda for each meeting of the Board, presiding in executive sessions of meetings of the Board of Directors, and coordinating the agenda for and leading meetings of the independent directors, as needed.

The Company believes that having the same person serve as chief executive officer and chair focuses leadership, responsibility, and accountability in a single person and that having a Lead Director provides for effective checks and balances and the ability of the independent directors to work effectively in the board setting. The Board of Directors reviews its leadership structure periodically in light of the composition of the Board of Directors and the needs of the Company and its shareholders.

Committees of our Board of Directors

Our Board of Directors has established four standing committees: an Audit Committee, a Compensation Committee, a Nominating and Governance Committee, and a Risk Management Committee, each with the composition and responsibilities described below. Each committee operates under a charter that has been approved by our Board of Directors. Current copies of the committee charters are posted on our website, investor.easternbank.com, in the Governance section under the caption “Governance Documents.”

The table below reflects the composition of the Board’s four standing committees as of April 1, 2021:

| Audit Committee | Compensation Committee | Nominating and Governance Committee | Risk Management Committee | |||||||||||

| Richard C. Bane | µ | £ | £ | £ | ||||||||||

| Luis A. Borgen | £ | £ | £ | |||||||||||

| Joseph T. Chung | £ | £ | ||||||||||||

| Paul M. Connolly | £ | £ | µ | £ | ||||||||||

| Bari A. Harlam | £ | |||||||||||||

| Diane S. Hessan | £ | £ | ||||||||||||

| Richard E. Holbrook | £ | |||||||||||||

| Deborah C. Jackson (1) | £ | £ | ||||||||||||

| Peter K. Markell | £ | µ | £ | £ | ||||||||||

| Robert F. Rivers (2) | £ | |||||||||||||

| Greg A. Shell | £ | |||||||||||||

| Paul D. Spiess | £ | £ | µ | |||||||||||

µ Committee Chair £ Committee Member | ||||||||||||||

(1)Lead independent director

(2)Chair of the Board of the Directors

13

Attendance at Meetings

In 2020, our Board of Directors met 21 times, the Audit Committee met nine times, the Compensation Committee met six times, the Nominating and Governance Committee met six times, and the Risk Management Committee met four times. Each director attended over 75% of all meetings of our Board of Directors and committees on which he or she served that were held during 2020. Our directors are encouraged to attend the Annual Meeting, to the extent practicable.

Board Self-Evaluation and Individual Director Evaluation

Our Board of Directors conducts an annual self-evaluation of the Board’s performance as a whole to determine whether it and its committees are functioning effectively. The Nominating and Governance Committee receives comments from all directors and reports the results of the board and committee evaluations to the Board of Directors and its committees. The results are discussed with the full Board of Directors and among the respective committees, as applicable. Our Board of Directors believes such evaluations are valuable tools in assessing the Board’s effectiveness in performing its oversight of management and fulfilling its responsibilities.

Audit Committee

The current members of our Audit Committee are Mr. Bane (chair), and Messrs. Borgen, Connolly, Markell and Spiess and their committee report is included in this Proxy Statement under the heading “Audit Committee Report.” Each of the Audit Committee members is independent under the listing standards of Nasdaq, including under Rule 10A-3 of the Exchange Act, and our Audit Committee Independence Policy. Each of our independent directors Messrs. Markell and Borgen has been designated by our Board of Directors as an “audit committee financial expert” (as defined in applicable SEC regulations). None of the Audit Committee members is an employee of ours or any of our subsidiaries, nor simultaneously serves on the audit committees of more than two public companies, including ours.

| Our Audit Committee is responsible for assisting the Board in overseeing and monitoring: | |||||

• | the integrity of the Company’s financial statements and other financial information provided by the Company to its shareholders; | ||||

• | the integrity of the accounting and financial reporting processes of the Company, and the audit of the Company’s financial statements; | ||||

• | the Company’s compliance with legal, regulatory and public disclosure requirements; | ||||

• | the appointment, qualifications, independence, performance and retention of the Company’s independent external auditor; and | ||||

• | the performance of the Company’s internal audit function. | ||||

The Audit Committee meets regularly with management and our independent registered public accounting firm to discuss the annual audit of our financial statements, our disclosures in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our annual and quarterly reports filed with the SEC, the quarterly reviews of our financial statements and our quarterly and annual earnings disclosures prior to their release. The Audit Committee also reviews the experience and qualifications of the lead partner and other senior members of Ernst & Young LLP, our independent registered public accounting firm (“Ernst & Young” or "EY"), including compliance with applicable rotation requirements, and considers whether there should be rotation of the firm itself.

The Audit Committee has authority under its charter to obtain advice and assistance from outside legal counsel, accounting or other outside advisors as deemed appropriate to perform its duties and responsibilities.

14

Compensation Committee

The current members of the Compensation Committee are Mr. Markell (chair), Ms. Jackson and Messrs. Bane, Borgen, Chung, Connolly and Spiess. Each member of the Compensation Committee is independent under the listing standards of Nasdaq, including the heightened standards that apply to compensation committee members.

| The Compensation Committee is responsible for: | |||||

• | reviewing and approving compensation of executive officers (other than the chief executive officer) and recommending the chief executive officer’s compensation for approval by the independent members of the Board of Directors; | ||||

• | reviewing and proposing goals and objectives relevant to the chief executive officer’s compensation and evaluating the chief executive officer’s performance in light of such goals and objectives; | ||||

• | overseeing the Company’s various compensation and benefits plans; | ||||

• | overseeing senior management succession planning; | ||||

• | making recommendations to the Board regarding the adoption of new incentive compensation and equity-based plans, and administering our existing incentive compensation plans; | ||||

• | making recommendations to the Board regarding compensation of our directors; | ||||

• | overseeing the Company's diversity, equity and inclusion ("DE&I") programs, including oversight of the Company's assessment of its DE&I policies and practices; | ||||

• | oversight of talent management programs, including employee engagement surveys and development initiatives; and | ||||

• | reviewing and approving the general design and terms of any significant non-executive compensation and benefits plans. | ||||

The Compensation Committee has authority under its charter to obtain advice and assistance from outside legal counsel, compensation consultants or other outside advisors as deemed appropriate to perform its duties and responsibilities. For 2020, the Compensation Committee engaged an independent compensation consultant, Willis Towers Watson ("Willis Towers"), to advise on compensation matters and provide experiential guidance on what is considered fair and competitive practice in our industry, primarily with respect to the compensation of our executive officers, and also with regard to director compensation. In December 2020, the Compensation engaged a new independent compensation consultant, Pearl Meyer & Partners, LLC ("Pearl Meyer"), to advise regarding similar matters.

The Compensation Committee has the authority to delegate to subcommittees of the Compensation Committee, to the chair of the Compensation Committee, or one or more of our executive officers, as permitted under applicable law. References to the Compensation Committee in this proxy statement also refer to its subcommittees and its delegates, where applicable.

Compensation Committee Interlocks and Insider Participation

During 2020, none of our officers, former officers or employees served on our Compensation Committee. None of our executive officers serves or has served as a member of the board of directors, compensation committee, or other board committee performing equivalent functions of any entity that has one or more executive officers serving as one of our directors or on our Compensation Committee.

15

Nominating and Governance Committee

The current members of the Nominating and Governance Committee are Mr. Connolly (chair), Mses. Jackson and Hessan and Messrs. Bane, Chung and Markell. Each member of the Nominating and Governance Committee is independent under the listing standards of Nasdaq.

| The Nominating and Governance Committee is responsible for: | |||||

• | identifying, evaluating and recruiting qualified persons to serve on our Board of Directors; | ||||

• | selecting, or recommending to the Board for selection, nominees for election as directors; | ||||

• | reviewing and recommending the composition of the Board’s standing committees; | ||||

• | onboarding new directors and overseeing director education; | ||||

• | reviewing and assessing the Company’s Corporate Governance Guidelines; and | ||||

• | overseeing compliance with our Related Party Transactions Policy; and | ||||

• | annually evaluating the performance, operations, size and composition of our Board of Directors and its committees. | ||||

The Nominating and Governance Committee has authority under its charter to obtain advice and assistance from outside legal counsel other outside advisors as deemed appropriate to perform its duties and responsibilities.

Nomination of Directors

The Nominating and Governance Committee of our Board of Directors identifies and evaluates director candidates and recommends to our Board of Directors qualified candidates for nomination as directors for election at our annual meeting of shareholders or to fill vacancies on our Board of Directors. The process followed by the Nominating and Governance in fulfilling its responsibilities includes requests to board members and others for recommendations, meetings to evaluate biographical information, experience and other background material relating to potential candidates, and interviews of selected candidates.

In considering candidates, the Nominating and Governance Committee reviews a candidates' qualifications and independence based on the criteria set forth in the Company's Corporate Governance Guidelines, its Director Independence Policy, Audit Committee Independence Policy, the Nominating and Governance Committee's charter (or the charter of a particular committee). The Nominating and Governance Committee considers the composition of the Board or committees; succession planning; and current challenges and needs of the Board, its committees, the Company and the Bank, while taking into account the professional and business experience, leadership, skill, expertise, judgment, background, collegiality, diversity, availability, teamwork, and other aspects of the candidates.

While we do not have a formal policy on board diversity, we are proud of the diversity and talent of our board and our management team, and our Nominating and Governance Committee and Board of Directors have affirmed their commitment to actively seeking women, diverse and/or LGBTQ+ candidates for the pool from which director candidates are selected. Our current Board of Directors composition is 25% women and 17% Black, 8% Asian and 8% Latino/x. The Nominating and Governance Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. The Nominating and Governance Committee believes that the backgrounds and qualifications of our Company’s directors, considered as a group, should provide a significant breadth of experience, knowledge and abilities to assist our Board of Directors in fulfilling its responsibilities. Nominees are not discriminated against on the basis of race, religion, national origin, sex, sexual orientation, gender identity or expression, disability or any other basis prohibited by law.

After completing its evaluation of potential nominees, the Nominating and Governance Committee makes a recommendation to our Board of Directors as to the persons who should be nominated for election to our Board of Directors, and our Board of Directors determines the nominees after considering the recommendation and report of the committee.

The Nominating and Governance Committee will consider candidates recommended by individual shareholders in accordance with the procedures and other requirements set forth in the Bylaws. Names and credentials must be provided to the committee on a timely basis for consideration prior to the Annual Meeting. Shareholders who wish to recommend an individual to the Nominating and Governance Committee for consideration as a potential candidate for director should submit the individual’s name, together with appropriate supporting documentation, to the Nominating and Governance Committee at the following address: Nominating and Governance Committee, c/o Corporate Secretary, Eastern Bankshares, Inc., 265 Franklin

16

Street, Boston, Massachusetts 02110. A submission will be considered timely if it is made during the timeframes disclosed in this proxy statement under “Shareholder Proposals.” If our Board of Directors determines to nominate and recommend for election a shareholder-recommended candidate, then the candidate’s name will be included in our company’s proxy card for the next annual meeting of shareholders.

Risk Management Committee

The Risk Management Committee of our Board of Directors assists the board in fulfilling its oversight responsibilities with respect to oversight of Eastern Bank's enterprise risk management ("ERM") practices and procedures, as well as its ERM framework ("ERM Framework"). The current members of the Risk Management Committee are Mr. Spiess (chair), Mses. Harlam and Hessan and Messrs. Bane, Borgen, Connolly, Holbrook, Markell, Rivers and Shell. The chair of the Risk Management Committee meets the criteria contained in the Federal Reserve Board’s Enhanced Prudential Standards (12 C.F.R. 252.33(a)(4)(ii)), as is required under this committee's charter.

| The Risk Management Committee is responsible for oversight of ERM framework, which includes the following designated risk domains: credit, capital, liquidity, market, operations, cyber, compliance and regulatory, strategic and emerging, reputation, and conduct and culture, and which oversight includes: | |||||

• | oversight of the design, implementation and operation of the ERM Framework, approval of ERM policies, and risk monitoring practices by the Bank's enterprise risk management committee; | ||||

• | review reports related to the Bank's risk profile; | ||||

• | review of management's assessments in connection with the Bank's credit risk management and provide related reports to the Audit Committee; | ||||

• | review capital, liquidity, and interest rate risks within the business and advise the Board with respect to the adequacy of capital allocated; | ||||

• | oversight of regulatory compliance, operational and cyber risk; and | ||||

• | review adequacy of major insurance policies and coverage and related reports from the Bank's subsidiary, Eastern Insurance Group LLC. | ||||

The Risk Management Committee has authority under its charter to obtain advice and assistance from outside legal counsel other outside advisors as deemed appropriate to perform its duties and responsibilities.

Board Role in Risk Oversight

Our Board of Directors administers its internal controls and risk management oversight function directly and through its Audit, Compensation and Risk Management Committees. In general, management is responsible for the day-to-day management of the risks our Company faces, while the Board of Directors, acting as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

Our Board of Directors has formed the Risk Management Committee to assist it in fulfilling its oversight responsibilities with respect to management’s identification, evaluation, management and monitoring of our Company’s critical enterprise risks, including major operational, strategic and financial risks inherent in our business.

The Board of Directors and the Audit Committee regularly discuss with management and our independent auditors our major risk exposures, their potential financial impact on our company, and the steps we take to manage these risks. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements. In addition, the Audit Committee discusses policies with respect to our internal auditors and the independent auditors.

The Compensation Committee assesses whether our compensation arrangements encourage inappropriate risk-taking, and whether risks arising from our compensation arrangements are reasonably likely to have a material adverse effect on the Company. See “Compensation Disclosure and Analysis” below for information regarding the Compensation Committee’s assessment of risks arising from our compensation practices.

17

Board Refreshment

Our Board of Directors believes that our board represents a balance of experience in the industries served by our Company and in the financial and business communities, which provides effective guidance and oversight to management. Our Board of Directors also recognizes the desire to keep our Board of Directors “refreshed” and has adopted a policy limiting director tenure to age 75 for members. Directors retire at the end of the year in which they turn age 75.

Communications with Directors

Shareholders and other interested parties who wish to send written communications on any topic to our Board of Directors, or the presiding director of executive sessions of the non-employee and independent directors, may do so by addressing such communications to our Board of Directors, c/o Corporate Secretary, Eastern Bankshares, Inc., 265 Franklin Street, Boston, Massachusetts 02110. Communications will be distributed to the chair of the Board, the Lead Independent Director or the other members of the Board as appropriate depending on the facts and circumstances outlined in the communication received.

Code of Business Conduct and Ethics

Our company’s Code of Conduct is applicable to all our employees, officers and directors, as well as those representing the Company in an official capacity. A current copy of our Code of Conduct is posted on our website at investor.easternbank.com under “Governance Documents” in the “Corporate Governance” section. We intend to satisfy disclosure requirements of the SEC and Nasdaq regarding amendments to, or waivers of, our Code of Conduct by providing information on our website.

Certain Relationships and Related Party Transactions