Form DEF 14A DTF TAX-FREE INCOME INC For: Feb 26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 |

DTF Tax-Free Income Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

DTF TAX-FREE INCOME INC.

200 S. Wacker Drive, Suite 500

Chicago, Illinois 60606

(800) 338-8214

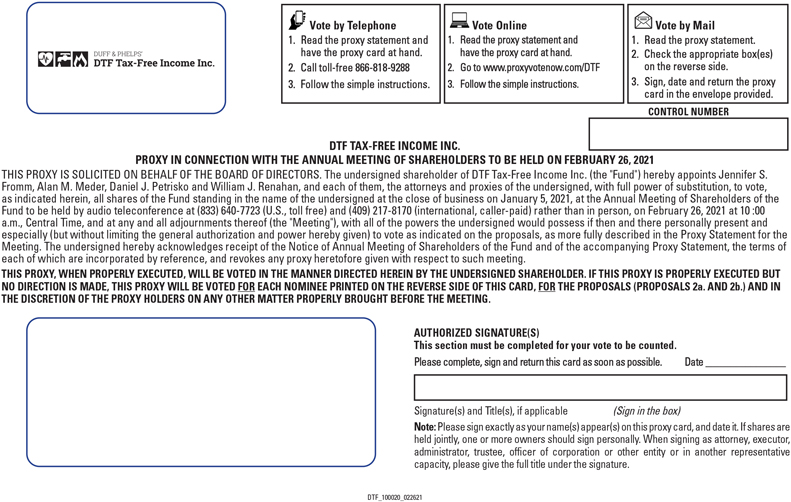

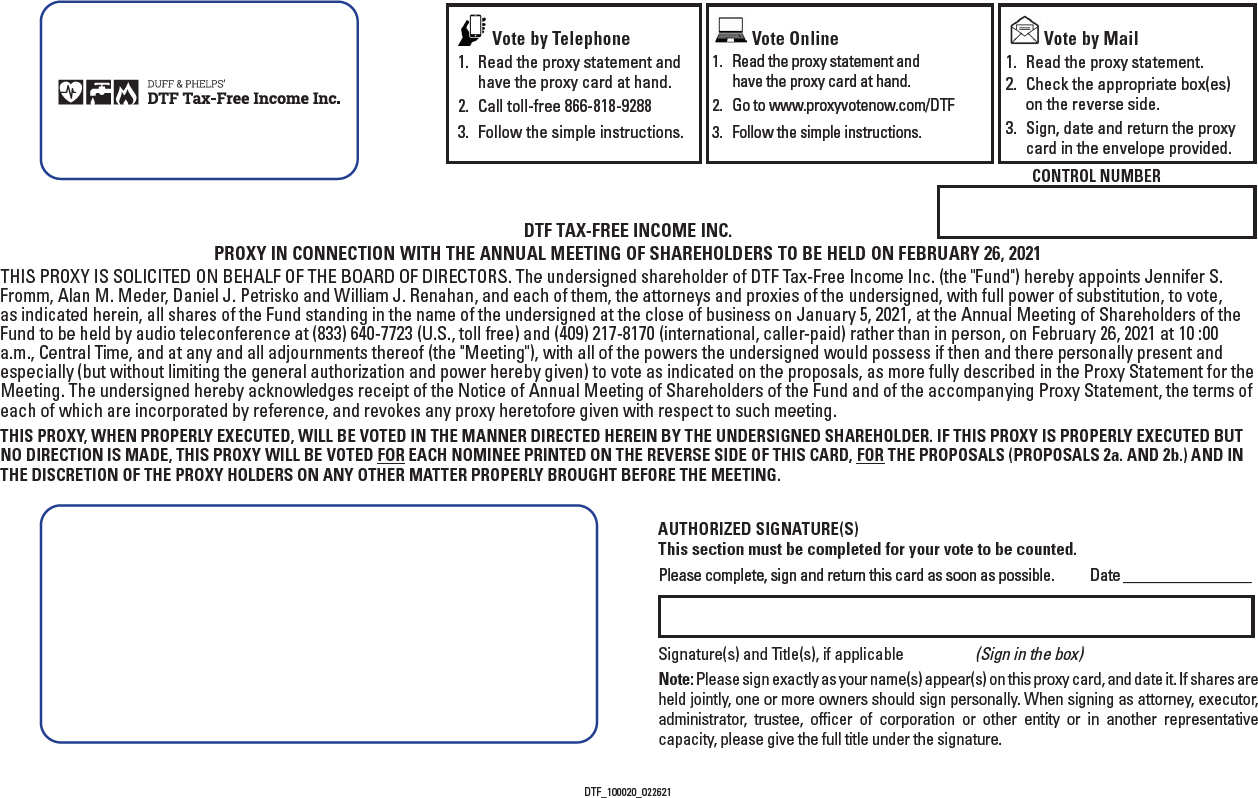

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

February 26, 2021

The annual meeting of shareholders of DTF Tax-Free Income Inc. (the “Fund”) will be held on February 26, 2021 at 10 a.m., Central Time, by audio teleconference at (833) 640-7723 (U.S., toll free) and (409) 217-8170 (international, caller-paid), as part of our effort to maintain a safe and healthy environment, to:

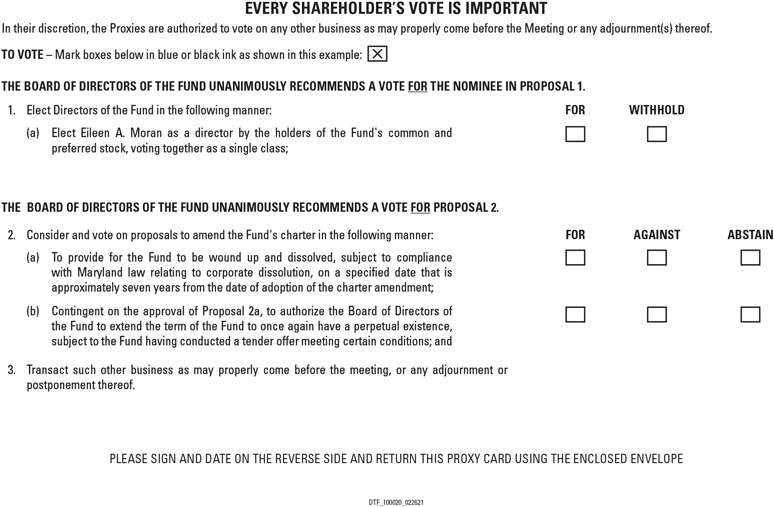

| 1. | Elect directors of the Fund in the following manner: |

| a. | Elect Eileen A. Moran as a director by the holders of the Fund’s common and preferred stock, voting together as a single class; |

| b. | Elect Donald C. Burke as a director by the holders of the Fund’s preferred stock, voting as a separate class; |

| 2. | Consider and vote on proposals to amend the Fund’s charter in the following manner: |

| a. | To provide for the Fund to be wound up and dissolved, subject to compliance with Maryland law relating to corporate dissolution, on a specified date that is approximately seven years from the date of adoption of the charter amendment; |

| b. | Contingent on the approval of Proposal 2a, to authorize the Board of Directors of the Fund to extend the term of the Fund to once again have a perpetual existence, subject to the Fund having conducted a tender offer meeting certain conditions; and |

| 3. | Transact such other business as may properly come before the meeting, or any adjournment or postponement thereof. |

Shareholders of record at the close of business on January 5, 2021 are entitled to vote at the meeting.

For the Board of Directors of the Fund,

JENNIFER S. FROMM, Secretary

January 12, 2021

SHAREHOLDERS, WE NEED YOUR PROXY VOTE IMMEDIATELY.

YOUR VOTE IS VITAL. THE MEETING OF SHAREHOLDERS WILL HAVE TO BE ADJOURNED WITHOUT CONDUCTING ANY BUSINESS IF FEWER THAN A MAJORITY OF THE SHARES ELIGIBLE TO VOTE ARE REPRESENTED. IN THAT EVENT, THE FUND WOULD ADJOURN THE MEETING AND CONTINUE TO SOLICIT VOTES IN AN ATTEMPT TO OBTAIN A QUORUM. TO AVOID THE EXPENSE OF AND THE POSSIBLE DELAY CREATED BY SUCH A SOLICITATION, PLEASE VOTE YOUR PROXY IMMEDIATELY. YOU AND ALL OTHER SHAREHOLDERS WILL BENEFIT FROM YOUR COOPERATION.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on February 26, 2021: The proxy statement for the 2021 annual meeting, the form of proxy card and the annual report for the most recently ended fiscal year are available to the Fund’s shareholders at www.dpimc.com/dtf. You can obtain directions to the annual meeting by contacting the Fund’s administrator at (833) 604-3163 (toll-free) or [email protected].

PROXY STATEMENT

The board of directors (the “Board”) of DTF Tax-Free Income Inc. (“DTF” or the “Fund”) is soliciting proxies from the shareholders of the Fund for use at the annual meeting of shareholders to be held on February 26, 2021 and at any adjournment or postponement of that meeting. A proxy may be revoked at any time before it is voted, either by virtually attending and voting at the meeting or by written notice to the Fund or delivery of a later-dated proxy.

Summary of Proposals to Be Voted Upon

| Proposal | Classes of Shareholders Entitled to Vote | |||

| 1a. | Election of Eileen A. Moran as a director of the Fund | common and preferred stock | ||

| 1b. | Election of Donald C. Burke as a director of the Fund | preferred stock | ||

| 2a. | A proposal to amend the Fund’s charter to provide for the Fund to be wound up and dissolved, subject to compliance with Maryland law relating to corporate dissolution, on a specified date that is approximately seven years from the date of adoption of the charter amendment | common and preferred stock | ||

| 2b. | Contingent on the approval of Proposal 2a, a proposal to further amend the Fund’s charter to authorize the Board of Directors of the Fund to extend the term of the Fund to once again have a perpetual existence, subject to the Fund having conducted a tender offer meeting certain conditions | common and preferred stock | ||

Shareholders of record of the Fund at the close of business on January 5, 2021 are entitled to notice of and to participate in the meeting. On the record date: the Fund had 8,520,685 shares of common stock and 650 shares of preferred stock outstanding. Each share of common stock outstanding on the record date entitles the holder thereof to one vote for each director being elected by the common stock (with no cumulative voting permitted) and to one vote on each other matter. Each share of preferred stock outstanding on the record date entitles the holder thereof to one vote for each director being elected by the preferred stock (with no cumulative voting permitted) and to one vote on each other matter.

This proxy statement is first being mailed on or about January 12, 2021. The Fund will bear the cost of the annual meeting and this proxy solicitation.

DTF TAX-FREE INCOME INC.

QUESTIONS & ANSWERS REGARDING THE ANNUAL MEETING

These Questions and Answers are only summaries of the matters they discuss. They do not contain all of the information that may be important to you. You should read the entire document carefully.

Question 1. Why did you send me these materials?

Answer: These materials have been sent to you because you owned shares of the Fund, either directly or beneficially, as of January 5, 2021, which is the record date for determining the shareholders of the Fund entitled to notice of and to vote at the annual meeting of shareholders of the Fund and any postponements or

1

adjournments thereof (the “Annual Meeting”). The Board of Directors of the Fund (the “Board”) urges you to review the information contained in these materials before voting on the proposals that will be presented at the Annual Meeting.

Question 2. Why is the shareholder meeting being held?

Answer: At the Annual Meeting, you are being asked to vote on the election of directors of the Fund (as in prior years) as well as proposals to amend the Fund’s charter (the governing document of the Fund) in the following two ways (the “Charter Amendment”):

| • | to establish a limited term of existence for the Fund and cause the Fund to liquidate on March 1, 2028, or such earlier date as may be determined by the Fund’s Board, and |

| • | if the above proposal is approved, to authorize the Board of Directors of the Fund to extend the term of the Fund to once again have a perpetual existence, subject to the Fund having conducted a tender offer meeting certain conditions. For additional information regarding the requirements of such a tender offer, see Question 5 below. |

Question 3. How does the Board recommend that I vote?

Answer: The Board, including all of the directors who are not “interested persons” (as defined in the Investment Company Act of 1940 (the “1940 Act”)) of the Fund (the “Independent Directors”), unanimously recommends that shareholders vote FOR the Charter Amendment. If you return your proxy card without an indication as to how you wish to vote, the representatives holding proxies will vote in accordance with the recommendations of the Board.

Question 4. Why is the Board recommending that I vote for the Charter Amendment?

Answer: As discussed more fully below, the Board expects the Charter Amendment to benefit Fund shareholders in a number of ways, including, but not limited to, the following:

| • | that the Charter Amendment would treat all shareholders equally and enable them to receive net asset value for their shares on the liquidation date, while preserving the benefits of the closed-end fund structure for a seven-year period, including the potential for the Fund to enhance investment returns through the use of leverage and the ability to fully invest its portfolio without having to manage daily cash inflows and/or redemptions; |

| • | that the conversion of the Fund to a seven-year term fund is consistent with the Fund’s fixed-income strategy and would provide for an orderly liquidation of the Fund at the end of the seven-year period; |

| • | that the Charter Amendment would create the potential for immediate improvement in the Fund’s share price and for further narrowing of the discount to net asset value (“NAV”) as the liquidation date approaches, which would allow shareholders to exit the Fund at a price closer to NAV if investment considerations dictated a sale of their shares prior to the liquidation date; and |

| • | that the Charter Amendment would allow the Fund to continue to benefit from the leverage provided by its Remarketable Variable Rate MuniFund Term Preferred Shares (“RVMTP Shares”), which will first become subject to remarketing in November 2023. |

2

In addition, the Charter Amendment is being recommended by the Board pursuant to a standstill agreement (the “Standstill Agreement”) between the Fund and its largest shareholder, Karpus Investment Management (“Karpus”). For further information regarding the Standstill Agreement, see “Amendment of the Fund’s Charter — Background” below.

Question 5. If the Charter Amendment is approved, what will happen seven years from now?

Answer: The Charter Amendment provides that the Fund will have a limited period of existence and targets a liquidation date for the Fund of March 1, 2028 (the “Termination Date”). If Proposal 2a and Proposal 2b are both approved by the required vote, there are three possible outcomes, depending on the subsequent actions taken by the Board:

| • | The Board could determine to wind up the Fund prior to the Termination Date. In accordance with the Maryland General Corporation Law and the Fund’s charter, the Board may, at any time, adopt a resolution declaring that the dissolution of the Fund is advisable and presenting a proposal for such dissolution to shareholders for approval at an annual meeting or special meeting of shareholders. Approval of the Charter Amendment would not preclude the Board from taking such action at any time prior to the Termination Date. |

| • | The Board could cause the Fund to conduct an “Eligible Tender Offer.” For these purposes, an “Eligible Tender Offer” means a tender offer to purchase 100% of the Fund’s then outstanding common stock at a price equal to the NAV per share on the expiration date of the tender offer, where such expiration date is within the 12 month period prior to the Termination Date. |

| • | If, based on the number of shares of common stock tendered, the Fund would have remaining net assets of at least $75 million, a majority of the Board could vote to extend the Fund’s limited existence and go back to having a perpetual existence. If a majority of the Board does not vote to extend the Fund’s limited existence, the Fund would be wound down and liquidated on the Termination Date. |

| • | If, based on the number of shares of common stock tendered, the Eligible Tender Offer would result in the Fund having less than $75 million of net assets, the tender offer would be cancelled, and the Fund would be wound down and liquidated on the Termination Date. |

| • | The Board could determine not to conduct an Eligible Tender Offer and the Fund would be liquidated on the Termination Date. |

If only Proposal 2a is approved by the required vote, and Proposal 2b is not approved, then the Fund will be liquidated on the Termination Date, unless the Board determines to wind up the Fund prior to the Termination Date, as provided in the first bullet point above. If Proposal 2a is not approved by the required vote, the Board may still propose to the Fund’s shareholders to wind up the Fund at any time, subject to compliance with Maryland General Corporation Law and the Fund’s charter.

Under each of the above scenarios that results in the liquidation of the Fund, holders of the Fund’s then outstanding common stock would receive their proportion of the net assets of the Fund. In other words, they will be distributed an amount of cash equal to 100% of their NAV per share. Prior to any liquidating distribution to holders of common stock, the holders of the Fund’s RVMTP Shares then outstanding will be entitled to receive a liquidating distribution equal to the liquidation preference for such shares, plus an amount equal to all unpaid dividends and other distributions on such shares accumulated to (but excluding) the date fixed for such distribution or payment on such shares, as provided in the Fund’s charter.

3

Question 6. What happens if the Charter Amendment is not approved by Fund shareholders?

Answer: The Charter Amendment requires the approval of the holders of a majority of the Fund’s outstanding common stock and preferred stock, voting as a single class. Pursuant to the Standstill Agreement, Karpus has agreed to vote all of the common stock owned by it on the record date for approval of the Charter Amendment. Based on the most recent Schedule 13D/A filed by Karpus, Karpus owns approximately 24% of the Fund’s shares of common stock outstanding on the record date for the Annual Meeting. If the Charter Amendment is not approved by the shareholders, it will not become effective and the Fund will continue to have a perpetual existence subject to the existing terms of the Charter. The Board will then consider such alternatives as it determines to be in the best interests of shareholders, including further solicitation of shareholders or re-proposing the Charter Amendment. Failure to successfully adopt the Charter Amendment will not result in the termination of the Standstill Agreement. If Proposal 2a is not approved, Proposal 2b will become moot (irrespective of whether it receives a favorable vote), and no changes will be made to the Fund’s charter.

Question 7. How can I vote my shares?

Answer: You may authorize your proxy by mail, phone or internet or by virtually attending and voting at the Annual Meeting. To authorize your proxy by mail, please mark your vote on the accompanying proxy card and sign, date and return the card in the postage-paid envelope provided. If you choose to authorize your proxy by phone or internet, please refer to the instructions found on the proxy card accompanying this Proxy Statement/Prospectus.

Question 8. What if I want to revoke my proxy?

Answer: Shareholders who execute proxy cards or record their voting instructions via telephone or the Internet may revoke their proxies at any time prior to the time they are voted by giving written notice to the Secretary of the Fund, by delivering a subsequently dated proxy (including via telephone or the Internet) prior to the date of the Special Meeting or by virtually attending and voting at the Annual Meeting. Merely attending the Annual Meeting, however, will not revoke a previously submitted proxy.

Question 9. How will a quorum be established for the Annual Meeting?

Answer: The presence in person or by proxy of shareholders entitled to vote a majority of the Fund’s outstanding shares of stock will constitute a quorum.

Broker non-votes and abstentions will be included in determining the existence of a quorum at the Annual Meeting. A broker non-vote occurs when a broker holding shares for a beneficial owner does not vote on a particular matter because (i) the broker does not have discretionary voting power with respect to that matter and (ii) has not received instructions from the beneficial owner. The election of directors at the Annual Meeting is considered “routine” (which means that a broker is permitted to exercise its discretion to vote shares in customer accounts without instructions from the customer). However, the proposal to approve the Charter Amendment is “non-routine” (which means that a broker is not permitted to exercise its discretion to vote shares in customer accounts without instructions from the customer).

Question 10. Will my vote make a difference?

Answer: Yes. Your vote is important and makes a difference in the governance of the Fund, no matter how many shares you own. Your prompt response will help ensure that the Charter Amendment can be implemented. We encourage all shareholders to participate in the governance of the Fund.

4

Question 11. Will anyone be contacting me regarding my vote?

Answer: The Fund has retained a proxy solicitor, Di Costa Partners LLC, who may contact you regarding your vote.

Question 12. Who should I call if I have questions?

Answer: If you have questions about the Charter Amendment proposal or about voting procedures, please call the Fund’s proxy solicitor, Di Costa Partners LLC, toll free at (833) 290-2573.

1. ELECTION OF DIRECTORS

The Board of the Fund is responsible for the overall management and operations of that Fund. As of the date of this proxy statement, the Board of the Fund is comprised of seven directors. Directors of the Fund are divided into three classes and are elected to serve staggered three-year terms.

The persons named in the enclosed proxy intend to vote in favor of the election of the persons named below (unless otherwise instructed). Each of the nominees has consented to serve as a director of the Fund, if elected. In case any of the nominees should become unavailable for election for any unforeseen reason, the persons designated in the proxy will have the right to vote for a substitute.

Election of Directors (Proposals 1a and 1b)

At the meeting, holders of common and preferred stock, voting as a single class, are entitled to elect one director for a term ending in 2024 and the holders of preferred stock, voting as a separate class, are entitled to elect one director for a term ending in 2024, in each case to serve until the annual meeting of shareholders in that year and until their respective successors are elected and qualified. A plurality of votes cast at the meeting by the holders of common and preferred stock, voting as a single class, as to the director representing the common and preferred stock is necessary to elect that director. A plurality of votes cast at the meeting by the holders of preferred stock as to the director representing the preferred stock is necessary to elect that director. Abstentions and broker-non-votes are counted for purposes of determining whether a quorum is present at the meeting, but will not affect the determination of whether a director candidate has received a plurality of votes cast.

Biographical Information about Nominees and Continuing Directors

Set forth in the table below are the names and certain biographical information about the nominees for the position of director and the continuing directors of the Fund. Except as noted, all of the directors are elected by the holders of the Fund’s common and preferred stock voting as a single class. In addition to DTF, all of the Fund’s directors also serve on the board of directors of three other closed-end investment companies that are advised by Duff & Phelps Investment Management Co., the Fund’s investment adviser (the “Adviser”): DNP Select Income Fund Inc. (“DNP”), Duff & Phelps Utility and Infrastructure Fund Inc. (“DPG”) and Duff & Phelps Utility and Corporate Bond Trust Inc. (“DUC”).

All of the directors of the Fund, with the exception of Mr. Partain, are classified as independent directors because none of them are “interested persons” of the Fund, as defined in the Investment Company Act of 1940 (the “1940 Act”). Mr. Partain is an “interested person” of the Fund by reason of his position as President and Chief Executive Officer of the Fund, and because prior to January 1, 2021, he served as President, Chief Investment Officer and employee of the Adviser. The term “Fund Complex” refers to the Funds and all other investment companies advised by affiliates of Virtus Investment Partners, Inc. (“Virtus”), the Adviser’s parent company. The address for all directors is c/o Duff & Phelps Investment Management Co., 200 South Wacker Drive, Suite 500, Chicago, Illinois 60606.

5

| Name, Address and Age |

Positions |

Term of |

Principal |

Number of Portfolios in Fund Complex Overseen by Director |

Other | |||||||

| Nominees—Independent Directors | ||||||||||||

| Donald C. Burke(1) Age: 60 |

Director | Nominee for term expiring in 2024; Director since 2014 | Private investor since 2009; President and Chief Executive Officer, BlackRock U.S. Funds 2007-2009; Managing Director, BlackRock Inc. 2006-2009; Managing Director, Merrill Lynch Investment Managers 1990-2006 | 72 | Director, Avista Corp. (energy company); Trustee, Goldman Sachs Fund Complex 2010-2014; Director, BlackRock Luxembourg and Cayman Funds 2006-2010 | |||||||

| Mr. Burke was selected to serve on the Board because of his extensive experience with mutual funds, including as president and chief executive officer of a major fund complex, and subsequently as an independent trustee of another major fund complex, and because of his knowledge of the utility industry derived from his service on the board of a public company involved in the production, transmission and distribution of energy. | ||||||||||||

| Eileen A. Moran Age: 66 |

Director and Vice Chairperson of the Board | Nominee for term expiring in 2024; Director since 1996 | Private investor since 2011; President and Chief Executive Officer, PSEG Resources L.L.C. (investment company) 1990-2011 | 4 | ||||||||

| Ms. Moran was selected to serve on the Board because of her experience in managing a large portfolio of assets, a significant portion of which were invested in the electric and natural gas utility industry. | ||||||||||||

| Continuing Directors—Independent Directors | ||||||||||||

| Geraldine M. McNamara(1) Age: 69 |

Director | Term expires 2023; Director of the Fund since 2003 | Private investor since 2006; Managing Director, U.S. Trust Company of New York 1982-2006 | 72 | ||||||||

| Ms. McNamara was selected to serve on the Board because her experience of advising individuals on their personal financial management has given her an enhanced understanding of the goals and expectations that individual investors bring to the Funds. | ||||||||||||

6

| Name, Address and Age |

Positions |

Term of |

Principal |

Number of Portfolios in Fund Complex Overseen by Director |

Other | |||||||

| Robert J. Genetski(1) Age: 78 |

Director | Term expires 2022; Director of the Fund since 2009 | Co-owner, Good Industries, Inc. (branding company) since 2014; President, Robert Genetski & Associates, Inc. (economic and financial consulting firm) since 1991; Senior Managing Director, Chicago Capital Inc. (financial services firm) 1995-2001; former Senior Vice President and Chief Economist, Harris Trust & Savings Bank; author of several books | 4 | ||||||||

| Dr. Genetski was selected to serve on the Board because of his academic and professional qualifications as an economist and a published author and speaker on economic topics and his experience in overseeing investment research and asset management operations. | ||||||||||||

| Philip R. McLoughlin Age: 74 |

Director | Term expires 2022; Director of the Fund since 1996 | Private investor since 2010; Partner, CrossPond Partners, LLC (investment management consultant) 2006-2010; Managing Director, SeaCap Partners LLC (strategic advisory firm) 2009-2010 | 72 | Chairman of the Board, Lazard World Trust Fund (closed-end fund; f/k/a The World Trust Fund) 2010-2019 (Director 1991-2019) | |||||||

| Mr. McLoughlin was selected to serve on the Board because of his understanding of asset management and mutual fund operations and strategy gained from his experience as chief executive officer of an asset management company and chief investment officer of an insurance company. | ||||||||||||

7

| Name, Address and Age |

Positions |

Term of |

Principal |

Number of Portfolios in Fund Complex Overseen by Director |

Other | |||||||

| David J. Vitale Age: 74 |

Director and Chairman of the Board | Term expires 2023; Director of the Fund since 2005 | Advisor, Ariel Investments, LLC since 2019; Chairman, Urban Partnership Bank 2010-2019; President, Chicago Board of Education 2011-2015; Senior Advisor to the CEO, Chicago Public Schools 2007-2008 (Chief Administrative Officer 2003-2007); President and Chief Executive Officer, Board of Trade of the City of Chicago, Inc. 2001-2002; Vice Chairman and Director, Bank One Corporation 1998-1999; Vice Chairman and Director, First Chicago NBD Corporation, and President, The First National Bank of Chicago 1995-1998; Vice Chairman, First Chicago Corporation and The First National Bank of Chicago 1993-1998 (Director 1992-1998; Executive Vice President 1986-1993) | 4 | Director, United Continental Holdings, Inc. (airline holding company); Ariel Investments, LLC; Wheels, Inc. (automobile fleet management) and Chairman, Urban Partnership Bank 2010-2019 | |||||||

| Mr. Vitale was selected to serve on the Board because of his extensive experience as an executive in both the private and public sector, his experience serving as a director of other public companies and his knowledge of financial matters, capital markets, investment management and the utilities industry. | ||||||||||||

8

| Name, Address and Age |

Positions |

Term of |

Principal |

Number of Portfolios in Fund Complex Overseen by Director |

Other | |||||||

| Continuing Director—Interested Director | ||||||||||||

| Nathan I. Partain, CFA Age: 64 |

President, Chief Executive Officer and Director | Term expires 2022; Director of the Fund since 2007 | Consultant to the Adviser since January 2021; President and Chief Investment Officer of the Adviser 2005-December 2020 (Executive Vice President 1997-2005); Director of Utility Research, Duff & Phelps Investment Research Co. 1989-1996 (Director of Equity Research 1993-1996 and Director of Fixed Income Research 1993); President and Chief Executive Officer of DNP Select Income Fund Inc. since 2001 (Chief Investment Officer 1998-2017; Executive Vice President 1998-2001; Senior Vice President 1997-1998); President and Chief Executive Officer of DUC and DTF since 2004 and of DPG since 2011 | 4 | Chairman of the Board and Director, Otter Tail Corporation (manages diversified operations in the electric, plastics, manufacturing and other business operations sectors) | |||||||

| Mr. Partain was selected to serve on the Board because of his significant knowledge of the Funds’ operations as Chief Executive Officer of the Funds and President of the Adviser, and because of his experience serving as a director of another public utility company and chairman of its board and audit committee. | ||||||||||||

| (1) | Elected (or nominated to be elected) by the holders of the Fund’s preferred stock, voting as a separate class. |

9

Board Leadership Structure

The Board believes that the most appropriate leadership structure for the Fund is for the Chairman of the Board to be an independent director, in order to provide strong, independent oversight of the Fund’s management and affairs, including the Fund’s risk management function. Accordingly, while the Chief Executive Officer of the Fund will generally be a member of the Board, he or she will not normally be eligible to serve as Chairman of the Board. The independent Chairman of the Board presides at meetings of the shareholders, meetings of the Board and meetings of independent directors. In addition, the independent Chairman of the Board takes part in the meetings and deliberations of all committees of the Board, facilitates communication among directors and communication between the Board and the Fund’s management and is available for consultation with the Fund’s management between Board meetings. The Board has four standing committees, which are described below: the executive committee, the audit committee, the contracts committee, and the nominating and governance committee.

The executive committee of the Board is currently comprised of Mr. Vitale (Chairman), Mr. Burke, Ms. McNamara and Ms. Moran, and has authority, with certain exceptions, to exercise the powers of the Board between Board meetings.

The audit committee of the Board is currently comprised of all independent directors of the Fund (Mr. Burke, Chairman) and makes recommendations regarding the selection of the Fund’s independent registered public accounting firm and meets with representatives of that accounting firm to determine the scope of and review the results of each audit and assists the Board in overseeing the Fund’s accounting, auditing, financial reporting and internal control functions.

The contracts committee of the Board is currently comprised of all independent directors of the Fund (Ms. Moran, Chairperson) and makes recommendations regarding the Fund’s contractual arrangements for investment management and administrative services, including the terms and conditions of such contracts.

The nominating and governance committee of the Board is currently comprised of all independent directors of the Fund (Ms. McNamara, Chairperson) and selects nominees for election as directors, recommends individuals to be appointed by the Board as officers of the Fund and members of Board committees and makes recommendations regarding other Fund governance and Board administration matters. The committee also oversees the Board’s continuing education program, which includes quarterly presentations for directors covering a variety of topics, including, among other topics, (i) the industries and types of investments in which the Fund invests, (ii) investment techniques utilized by the Fund, (iii) current developments in securities law and the mutual fund industry, (iv) best practices in corporate and mutual fund governance and (v) enterprise risk management, cybersecurity, and other emerging issues.

During the Fund’s fiscal year ended October 31, 2020, the Board met ten times; the audit committee met twice; the nominating and governance committee met three times; the contracts committee met twice; and the executive committee did not meet, but acted once by written consent. Each director attended at least 75% in the aggregate of the meetings of the Board and of the committees on which he or she served.

Risk Oversight. The audit committee charter provides that the audit committee is responsible for discussing with management the guidelines and policies that govern the process by which management assesses and manages the Fund’s major financial risk exposures. The contracts committee charter provides that in assessing whether the Fund’s investment advisory agreement and administration agreement should be continued, the

10

contracts committee is to give careful consideration to the risk oversight policies of the Adviser and the Fund’s administrator, respectively. In addition, the audit committee and the full Board receive periodic reports on enterprise risk management from the chief risk officer of the Adviser.

Nomination of Directors. The nominating and governance committee acts under a written charter that was most recently amended on December 17, 2020. A copy of the charter is available on the Fund’s website at www.dpimc.com/dtf and in print to any shareholder who requests it. None of the members of the nominating and governance committee are “interested persons” of the Fund as defined in Section 2(a)(19) of the 1940 Act. In identifying potential director nominees, the nominating and governance committee considers candidates recommended by one or more of the following sources: the Fund’s current directors, the Fund’s officers, the Fund’s shareholders and any other source the committee deems appropriate. The committee may, but is not required to, retain a third-party search firm at the Fund’s expense to identify potential candidates. Shareholders wishing to recommend candidates to the nominating and governance committee should submit such recommendations to the Secretary of the Fund, who will forward the recommendations to the committee for consideration. See also “Shareholder Proposals and Nominations” under “Other Information” below.

Criteria for Director Nominations. The goal of the Fund is to have a board of directors comprising individuals with a diversity of business, educational and life experiences (including, without limitation, with respect to accounting and finance, business and strategic judgment, investment management and financial markets, and knowledge of the industries in which the Fund invests) that will enable them to constructively review, advise and guide management of the Fund. The annual Board self-evaluation process includes consideration of whether the Board’s composition represents an appropriate balance of skills and diversity for the Fund’s needs. In evaluating potential director nominees, including nominees recommended by shareholders, the nominating and governance committee considers such qualifications and skills as it deems relevant but does not have any specific minimum qualifications that must be met by a nominee. The committee considers, among other things:

| • | the extent to which the candidate’s business, educational and life experiences will add to the diversity of the Board; |

| • | whether the candidate will qualify as a director who is not an “interested person” of the Fund; |

| • | the absence of any real or apparent conflict of interest that would interfere with the candidate’s ability to act in the best interests of the Fund and its shareholders; |

| • | the contribution that the candidate can make to the Board by virtue of his or her education, business experience and financial expertise; |

| • | the interplay of the candidate’s skills and experience with the skills and experience of other Board members; |

| • | whether the candidate is willing to commit the time necessary to attend meetings and fulfill the responsibilities of a director; and |

| • | the candidate’s personality traits, including integrity, independence, leadership, sound business judgment and the ability to work effectively with the other members of the Board. |

With respect to the renomination of incumbent directors, past service to the Board is also considered.

11

Diversity, Equity and Inclusion. In selecting nominees for the position of director, and in appointing officers of the Fund, the nominating and governance committee is required by its charter to consider and seek out candidates who are women or members of racial or ethnic minority groups in order to help promote diversity, equity and inclusion among the members of the Board and the officers of the Fund.

Retirement Policy. The bylaws of the Fund establish a mandatory retirement age of 78 for directors of the Fund. Specifically, no person who has attained the age of 78 years is eligible for election or reelection as a director, and no incumbent director who attains the age of 78 years is qualified to continue serving as a director following the adjournment of the next succeeding annual meeting of shareholders, and therefore his or her service on the Board will automatically terminate at such time. None of the director nominees or incumbent directors are 78 years or older as of the date of this proxy statement or will be 78 years or older as of the scheduled date of the annual meeting, other than Mr. Genetski, an incumbent director, who will retire effective upon the adjournment of the annual meeting of shareholders that is the subject of this Proxy Statement.

Officers of the Fund

The officers of the Fund are elected at the March meeting of the Board. The officers receive no compensation from the Fund, but are also officers of the Adviser, the Fund administrator or an employee of an affiliate of the Adviser and receive compensation in such capacities. Information about Nathan I. Partain, the President and Chief Executive Officer of the Fund, is provided above under the caption “Continuing Director—Interested Director.” The address for all officers listed below is c/o Duff & Phelps Investment Management Co., 200 South Wacker Drive, Suite 500, Chicago, Illinois 60606, except as noted.

| Name, Address |

Position(s) Held with Fund and |

Principal Occupation(s) | ||

| Jennifer S. Fromm Age: 47 |

Vice President and Secretary of the Fund since March 2020 | Vice President of Virtus Investment Partners, Inc. since 2016 and Senior Counsel, Legal of Virtus Investment Partners Inc. and/or certain of its subsidiaries since 2007; Vice President, Chief Legal Officer, Counsel and Secretary of Duff & Phelps Select MLP and Midstream Energy Fund Inc., Virtus Global Multi-Sector Income Fund Inc. and Virtus Total Return Fund Inc. since 2020; Vice President of various Virtus-affiliated open-end funds since 2017 and Assistant Secretary since 2008; Vice President, Chief Legal Officer, Counsel and Secretary of Virtus Variable Insurance Trust and Virtus Alternative Solutions Trust since 2013; various officer positions of Virtus affiliates since 2008 |

12

| Name, Address |

Position(s) Held with Fund and |

Principal Occupation(s) | ||

| Timothy M. Heaney, CFA Virtus Investment Partners, Inc. One Financial Plaza Hartford, CT 06103 Age: 55 |

Chief Investment Officer of the Fund since 2004 and Vice President since 1997 (Portfolio Manager 1997-2004) | Senior Managing Director of the Adviser since 2014 (Senior Vice President 2004-2014; Vice President 1997-2004); Senior Portfolio Manager, Fixed Income, Newfleet Asset Management, LLC since 2011; Portfolio Manager, Virtus Tax-Exempt Bond Fund since 2012; Portfolio Manager, Virtus CA Tax-Exempt Bond Fund since 1997; Senior Managing Director, Fixed Income, Virtus Investment Advisors, Inc. (and predecessor firms) 2006-2011 (Managing Director, Fixed Income 1997-2006; Director, Fixed Income Research 1996-1997; Investment Analyst 1992-1996) | ||

| Lisa H. Leonard Virtus Investment Partners, Inc. One Financial Plaza Hartford, CT 06103 Age: 57 |

Vice President of the Fund since 2006 | Managing Director of the Adviser since 2014 (Vice President 2006-2014; Assistant Vice President 1998-2006); Portfolio Manager, Virtus Tax-Exempt Bond Fund since 2012; Portfolio Manager, Fixed Income, Newfleet Asset Management, LLC since 2011; Managing Director, Fixed Income, Virtus Investment Advisors, Inc. (and predecessor firms) 2006-2011 (Director, Fixed Income 1998-2006, Director, Investment Operations 1994-1998, Fixed Income Trader 1987-1994) | ||

| Alan M. Meder, CFA, CPA Age: 61 |

Treasurer of the Fund since 2000 and Principal Financial and Accounting Officer and Assistant Secretary since 2002 | Chief Risk Officer of the Adviser since 2001 and Senior Managing Director since 2014 (Senior Vice President 1994-2014); Member, Board of Governors of CFA Institute 2008-2014 (Chair 2012-2013; Vice Chair 2011-2012); Member, Financial Accounting Standards Advisory Council 2011-2014 | ||

| Daniel J. Petrisko, CFA Age: 60 |

Senior Vice President of the Fund since 2017 and Assistant Secretary since 2015 | Executive Managing Director of the Adviser since 2017 (Senior Managing Director 2014-2017, Senior Vice President 1997-2014; Vice President 1995-1997) | ||

| William J. Renahan Age: 51 |

Chief Compliance Officer since March 2020; Vice President since 2015 (Secretary 2015-March 2020) | Secretary of the Adviser since 2014; Chief Compliance Officer since 2019 (Senior Counsel 2015-2019); Senior Legal Counsel and Vice President, Virtus Investment Partners, Inc. 2012-2018; Managing Director, Legg Mason, Inc. (and predecessor firms) 1999-2012 | ||

13

| Name, Address |

Position(s) Held with Fund and |

Principal Occupation(s) | ||

| Dianna P. Wengler Robert W. Baird & Co. Incorporated 500 West Jefferson Street Louisville, KY 40202 Age: 60 |

Vice President and Assistant Secretary of the Fund since 2014 | Senior Vice President and Director—Fund Administration, Robert W. Baird & Co. Incorporated since 2019; Senior Vice President, J.J.B. Hilliard, W.L Lyons, LLC 2016-2019 (Vice President 1990-2015); Senior Vice President, Hilliard-Lyons Government Fund, Inc. 2006-2010 (Vice President 1998-2006; Treasurer 1988-2010) |

The following table provides certain information relating to the equity securities beneficially owned by each director or director nominee as of October 31, 2020, (i) in the Fund and (ii) on an aggregate basis, in any registered investment companies overseen or to be overseen by the director or nominee within the same family of investment companies as the Fund, in each case based on information provided to the Fund, including information furnished by the Fund’s service providers.

| Dollar Range of Equity Securities Owned in the Fund |

Aggregate Dollar Range of Equity Securities in All Funds Overseen or to be Overseen by Director or Nominee in Family of Investment Companies |

|||||||

| Independent Directors |

||||||||

| Donald C. Burke |

$10,001–$50,000 | Over $100,000 | ||||||

| Robert J. Genetski |

$1–$10,000 | Over $100,000 | ||||||

| Philip R. McLoughlin |

$10,001–$50,000 | Over $100,000 | ||||||

| Geraldine M. McNamara |

$10,001–$50,000 | Over $100,000 | ||||||

| Eileen A. Moran |

$50,001–$100,000 | Over $100,000 | ||||||

| David J. Vitale |

None | $50,001–$100,000 | ||||||

| Interested Director |

||||||||

| Nathan I. Partain |

None | Over $100,000 | ||||||

Based on information provided to the Funds, including information furnished by the Funds’ service providers, as of October 31, 2020, none of the independent directors, or their immediate family members, owned any securities of the Adviser or any person (other than a registered investment company) directly or indirectly controlling, controlled by or under common control with the Adviser.

14

The following table sets forth the aggregate compensation paid to each director by each of the Funds with respect to its most recently completed fiscal year and by the Fund Complex with respect to the fiscal year ended October 31, 2020.

COMPENSATION TABLE(1)

| Name of Director |

Aggregate Compensation from DTF |

Aggregate Compensation from DNP, DPG and DUC(2) |

Aggregate Compensation from Other Funds in Fund Complex(2) |

Total Compensation from Fund Complex Paid to Directors(2) |

||||||||||||

| Independent Directors |

||||||||||||||||

| Donald C. Burke |

$ | 6,277 | $ | 85,723 | $ | 280,000 | $ | 372,000 | ||||||||

| Robert J. Genetski |

5,731 | 78,269 | — | 84,000 | ||||||||||||

| Philip R. McLoughlin |

5,731 | 78,269 | 521,250 | 605,250 | ||||||||||||

| Geraldine M. McNamara |

6,277 | 85,723 | 280,000 | 372,000 | ||||||||||||

| Eileen A. Moran |

6,277 | 85,723 | — | 92,000 | ||||||||||||

| David J. Vitale |

9,143 | 124,857 | — | 134,000 | ||||||||||||

| Interested Director |

||||||||||||||||

| Nathan I. Partain |

0 | 0 | 0 | 0 | ||||||||||||

| (1) | Because each director serves as a director of each of DNP, DPG, DUC and DTF, directors receive a single set of fees as remuneration for their service to all four funds: (i) each director not affiliated with the Adviser receives a retainer fee of $84,000 per year; (ii) the chairpersons of the audit committee, contracts committee and nominating and governance committee each receive an additional retainer fee of $8,000 per year; and (iii) the Chairman of the Board receives an additional retainer fee of $50,000 per year. Directors and officers affiliated with the Adviser receive no compensation from the Funds for their services as such. In addition to the amounts shown in the table above, all directors and officers who are not interested persons of the Funds or the Adviser or affiliated with a Fund administrator are reimbursed for the expenses incurred by them in connection with their attendance at a meeting of the Board or a committee of the Board. The Funds do not have a pension or retirement plan applicable to their directors or officers. |

| (2) | Please refer to the table on the preceding pages for the number of investment companies in the Fund Complex overseen by each director. As noted in the table, in addition to DNP, DPG, DUC and DTF, Mr. Burke, Mr. McLoughlin and Ms. McNamara each oversee 68 additional funds that are advised by affiliates of Virtus. |

The Board of the Fund, including all of the independent directors, unanimously recommends a vote “FOR” the election of the two nominees for director named above.

2. AMENDMENT OF THE FUND’S CHARTER

Charter Amendment (Proposals 2a and 2b)

At a meeting held on November 23, 2020, the Board unanimously declared the proposed Charter Amendment to be advisable and directed that it be submitted to the Fund’s shareholders for consideration at the 2021 annual meeting of the Fund. The text of the proposed Charter Amendment is attached hereto as Exhibit A and all references to the Charter Amendment herein are qualified in their entirety by reference to the attached

15

Charter Amendment. The federal securities laws require that different components of the Charter Amendment each be voted upon separately by the Fund’s shareholders. Accordingly, the Board adopted resolutions on January 6, 2021, providing for shareholders to consider and vote upon Proposals 2a and 2b as follows:

| 2a. | A proposal to amend the Fund’s charter to provide for the Fund to be wound up and dissolved, subject to compliance with Maryland law relating to corporate dissolution, on a specified date that is approximately seven years from the date of adoption of the charter amendment; and |

| 2b. | Contingent on the approval of Proposal 2a, a proposal to further amend the Fund’s charter to authorize the Board of Directors of the Fund to extend the term of the Fund to once again have a perpetual existence, subject to the Fund having conducted a tender offer meeting certain conditions. |

The Board recommends that shareholders APPROVE the Charter Amendment.

Background

On September 16, 2019, Karpus, a significant shareholder of DUC (which is another closed-end fund advised by the Adviser), submitted a non-binding shareholder proposal to be voted on at DUC’s March 24, 2020 annual meeting of shareholders (the “2020 DUC Annual Meeting”), requesting that the DUC Board authorize a self-tender offer for all of the outstanding shares of DUC at or close to NAV and if more than 50% of DUC’s outstanding shares were submitted for tender, that the tender offer be cancelled and the Fund be liquidated or converted into an open-end fund (the “2020 DUC Shareholder Proposal”). In its supporting statement, Karpus pointed to the fact that DUC’s common stock had traded at a discount to NAV over the preceding one-year, three-year and five-year periods.

On February 3, 2020, in a telephone conversation with representatives of the Adviser, the Karpus representatives noted that the common stock of DNP (another closed-end fund managed by the Adviser) had a long history of trading at a premium most of the time and offered the suggestion of merging DUC into DNP as another possible approach to addressing the DUC discount. The Karpus representatives further suggested that DTF also be merged into DNP. The management of DTF, DUC and DNP then asked Mayer Brown LLP, counsel to the three funds and their independent directors, to provide legal advice to the DTF, DUC and DNP Boards as to the corporate, regulatory and tax implications of the potential mergers suggested by Karpus. On March 5, 2020, Mayer Brown LLP advised, among other things, that a merger of DUC into DNP could be accomplished as a tax-free reorganization, but that a merger of DTF into DNP could not be accomplished as a tax-free reorganization because there would be no continuity between DTF’s tax-exempt bond portfolio and investment objectives and DNP’s taxable bond and equity portfolio and investment objectives. Neither the DTF Board nor the DUC Board took any action with regard to a potential merger at that time, as the 2020 DUC Annual Meeting was imminent. At the 2020 DUC Annual Meeting on March 24, 2020, a majority of votes cast were voted against the 2020 DUC Shareholder Proposal.

Aware that Karpus had continued to increase its ownership of common stock of DTF subsequent to the conversation of February 3, 2020 and the 2020 DUC Annual Meeting at which the 2020 DUC Shareholder Proposal had failed to pass, the Boards of DTF and DUC anticipated the possibility that Karpus would initiate further action. At the regular quarterly Board meeting on September 16, 2020, Board members discussed their willingness to seek other ways to address DTF’s trading discount to NAV.

16

On September 17, 2020, Karpus gave DTF written notice of its intention to: (i) nominate its own slate of directors at DTF’s 2021 annual meeting of shareholders, (ii) submit a non-binding shareholder proposal at that meeting to declassify the DTF Board and cause all directors to stand for election each year instead of serving staggered three-year terms; and (iii) submit a binding shareholder proposal to terminate DTF’s investment advisory agreement with the Adviser (the “2021 Karpus Proposals”). On the same date, Karpus notified DUC of its intention to submit similar proposals at DUC’s 2021 annual meeting of shareholders. However, in Schedule 13D/A filings that Karpus filed on September 18, 2020 with respect to DTF and DUC, Karpus announced its willingness to enter into discussions with the DTF Board and the DUC Board in furtherance of reaching a mutually agreeable resolution.

At a joint Board meeting held on October 15, 2020, the DTF Board and DUC Board received a report from the Adviser regarding informal discussions it had held with representatives of Karpus. The Adviser reported that its discussion with Karpus relating to DTF had focused on the possibility of one or more tender offers to address DTF’s discount to NAV, although Karpus expressed willingness to entertain alternative proposals. In the DTF Board’s ensuing discussion of whether conducting one or more such tender offers would be an appropriate way to address Karpus’s concerns about DTF’s discount, the DTF Board was mindful of both the 2021 Karpus Proposals and Karpus’s large ownership position in DTF at the time (24.04% according to a Schedule 13D/A filed by Karpus on October 6, 2020). After extensive deliberation, the DTF Board authorized the Adviser to engage in negotiations with Karpus in an effort to find a mutually acceptable solution that would be in the best interests of the shareholders of DTF and would avoid a lengthy and expensive proxy contest. At the same time, the DUC Board authorized the Adviser to engage in negotiations with Karpus with respect to DUC, in which Karpus also held a large ownership position (39.2% according to a Schedule 13D/A filed by Karpus on October 6, 2020).

Following the October 15, 2020 joint Board meeting, the Adviser proceeded to negotiate non-disclosure agreements with Karpus on behalf of each of DTF, DUC and DNP, which agreements were entered into on October 27, 2020. Thereupon the Adviser commenced negotiations with Karpus in an effort to find a way to address Karpus’s concerns about DTF’s and DUC’s discounts that would be in the best interests of DTF and DUC and all of their shareholders.

At a joint meeting held on November 4, 2020, the Adviser informed the DTF Board, DUC Board and DNP Board that it had negotiated with the representatives of Karpus the principal terms of a course of action, with respect to each of DTF and DUC, which Karpus would be willing to accept in lieu of pursuing the 2021 Karpus Proposals with respect to those funds. In the case of DTF, the proposed course of action was for DTF to conduct a self-tender offer for 17.5% of its outstanding shares of common stock and to convert into a term fund with an expiration in seven years. In the case of DUC, the proposed course of action was a merger of DUC with and into DNP. The Adviser then presented a detailed analysis of the proposed courses of action and the potential benefits each of them would provide to each of DTF, DUC and DNP and their respective shareholders. In the case of DTF, the DTF Board considered the various benefits to DTF and its shareholders that are enumerated below. After extensive discussion, each of the DTF Board, the DUC Board and the DNP Board approved the principal terms of each proposed course of action as being fair and reasonable to DTF, DUC and DNP, respectively, and in the best interests of each respective fund and its shareholders, and authorized the Adviser to continue its negotiations with Karpus, in consultation with counsel to the funds and the independent directors of the funds, in an effort to reach definitive agreements with Karpus and to prepare implementing resolutions and other documents, in each case for consideration by the respective Boards at a future meeting.

17

In the ensuing weeks, representatives of the Adviser, in consultation with counsel to the funds and their independent directors, negotiated the terms of the Standstill Agreement between DTF and Karpus, pursuant to which the DTF Board undertook to authorize a tender offer for 17.5% of its outstanding shares of common stock and to approve the Charter Amendment to convert to a seven-year term fund and submit the Charter Amendment to shareholders of the Fund for approval. In addition, Karpus undertook in the Standstill Agreement, among other things, to vote its shares of DTF common stock in favor of the Charter Amendment, and, subject only to the consummation of the tender offer (and not to the success of the Charter Amendment) to formally withdraw the 2021 Karpus Proposals and to refrain from activist shareholder activities with respect to DTF until the earliest of: (a) November 23, 2023, or (b) such other date as the parties may agree in writing. The Adviser also negotiated standstill agreements with Karpus on behalf of DUC, DPG (another closed-end fund advised by the Adviser) and Duff & Phelps Select MLP and Midstream Energy Fund Inc. (a closed-end fund sub-advised by the Adviser).

At a meeting held on November 23, 2020, the DTF Board approved the DTF tender offer and proposal to convert to a seven-year term fund as described above and voted to submit the proposed Charter Amendment to effectuate the conversion to the DTF shareholders for their approval. The DTF Board also approved the Standstill Agreement between DTF and Karpus as being in the best interests of DTF and its shareholders. At the same time, the DUC Board and the DNP Board approved the proposed merger of DUC into DNP and called a special meeting of DUC shareholders to seek their approval for the merger. The DUC Board also approved the standstill agreement between DUC and Karpus.

Material Provisions of the Charter Amendment

The Charter Amendment provides for a limited period of existence for the Fund (which currently has a perpetual existence). Specifically, the Charter Amendment provides for a liquidation date for the Fund of March 1, 2028 (the “Termination Date”). If Proposal 2a and Proposal 2b are both approved there are three possible outcomes, depending on the subsequent actions taken by the Board:

| • | The Board could determine to wind up the Fund prior to the Termination Date. In accordance with the Maryland General Corporation Law and the Fund’s charter, the Board may, at any time, adopt a resolution declaring that the dissolution of the Fund is advisable and presenting a proposal for such dissolution to shareholders for approval at an annual meeting or special meeting of shareholders. Approval of the Charter Amendment would not preclude the Board from taking such action at any time prior to the Termination Date. |

| • | The Board could cause the Fund to conduct an “Eligible Tender Offer.” For these purposes, an “Eligible Tender Offer” means a tender offer to purchase 100% of the Fund’s then outstanding common stock at a price equal to the NAV per share on the expiration date of the tender offer, where such expiration date is within the 12 month period prior to the Termination Date. |

| • | If, based on the number of shares of common stock tendered, the Fund would have remaining net assets of at least $75 million, a majority of the Board could vote to extend the Fund’s limited existence and go back to having a perpetual existence. If a majority of the Board does not vote to extend the Fund’s limited existence, the Fund would be wound down and liquidated on the Termination Date. |

| • | If, based on the number of shares of common stock tendered, the Eligible Tender Offer would result in the Fund having less than $75 million of net assets, the tender offer would be cancelled, and the Fund would be wound down and liquidated on the Termination Date. |

| • | The Board could determine not to conduct an Eligible Tender Offer and the Fund would be liquidated on the Termination Date. |

18

If only Proposal 2a is approved by the required vote, and Proposal 2b is not approved, then the Fund will be liquidated on the Termination Date, unless the Board determines to wind up the Fund prior to the Termination Date, as provided in the first bullet point above. If Proposal 2a is not approved by the required vote, the Board may still propose to the Fund’s shareholders to wind up the Fund at any time, subject to compliance with Maryland General Corporation Law and the Fund’s charter.

Under each of the above scenarios that results in the liquidation of the Fund, holders of the Fund’s common stock then outstanding would receive their proportion of the net assets of the Fund. In other words, they will be distributed an amount of cash equal to 100% of their NAV per share. Prior to any liquidating distribution to holders of common stock, the holders of the Fund’s RVMTP Shares then outstanding will be entitled to receive a liquidating distribution equal to the liquidation preference for such shares, plus an amount equal to all unpaid dividends and other distributions on such shares accumulated to (but excluding) the date fixed for such distribution or payment on such shares, as provided in the Fund’s charter.

Board Considerations in Recommending the Charter Amendment

The primary factors considered by the Board with regard to the Charter Amendment included, but were not limited to, the following:

| • | that the Charter Amendment would treat all shareholders equally and enable them to receive net asset value for their shares on the liquidation date, while preserving the benefits of the closed-end fund structure for a seven-year period, including the potential for the Fund to enhance investment returns through the use of leverage and the ability to fully invest its portfolio without having to manage daily cash inflows and/or redemptions; |

| • | that the conversion of the Fund to a seven-year term fund is consistent with the Fund’s fixed-income strategy and would provide for an orderly liquidation of the Fund at the end of the seven-year period; |

| • | that the Charter Amendment would create the potential for immediate improvement in the Fund’s share price and for further narrowing of the discount to NAV as the liquidation date approaches, which would allow shareholders to exit the Fund at a price closer to NAV if investment considerations dictated a sale of their shares prior to the liquidation date; |

| • | that the Charter Amendment would allow the Fund to continue to benefit from the leverage provided by its RVMTP Shares, which will first become subject to remarketing in November 2023; |

| • | the limited availability of alternative options to address the Fund’s long-term trading discount and the fact that this option is acceptable to the Fund’s largest shareholder, Karpus; |

| • | the benefits to the Fund of the Standstill Agreement between the Fund and Karpus, pursuant to which Karpus agreed to withdraw its 2021 shareholder proposals and to refrain from activist shareholder activities until November 23, 2023 (assuming that the tender offer is completed within the time period specified in the Standstill Agreement); |

| • | that the Charter Amendment may reduce the likelihood of other activist shareholder proposals in the future and thereby avoid the expenses that the Fund would incur to address any such proposals; and |

| • | that the Adviser recommended to the Board that it approve the Charter Amendment. |

In considering the approval of the Charter Amendment, the Board did not identify any factor as all-important or all-controlling and instead considered these factors collectively in light of the Fund’s facts and

19

circumstances. After considering the above factors and based on the deliberations and its evaluation of the information provided to it, the Board declared the Charter Amendment to be advisable and recommended that the Fund’s shareholders approve the Charter Amendment.

Potential Disadvantage of the Proposed Charter Amendment

The Charter Amendment provides for a liquidation date for the Fund of March 1, 2028. Under each of the scenarios that results in the liquidation of the Fund (see “Material Provisions of the Charter Amendment” above), holders of the Fund’s then outstanding common stock would receive their proportion of the net assets of the Fund. In other words, they will be distributed an amount of cash equal to 100% of their NAV per share. As a result, they will no longer own shares of a municipal bond fund and, unless they choose to continue to hold the cash, will need to seek out and evaluate other investment options.

Preferred Stock

Prior to any liquidating distribution to holders of common stock, the holders of the Fund’s RVMTP Shares stock then outstanding will be entitled to receive a liquidating distribution equal to the liquidation preference for such shares, plus an amount equal to all unpaid dividends and other distributions on such shares accumulated to (but excluding) the date fixed for such distribution or payment on such shares, as provided in the Fund’s charter.

The Fund’s charter requires a separate class vote of the holders of the Fund’s preferred stock for any charter amendment that would materially and adversely affect any preference, right or power of such preferred stock or such holders. Although the term redemption date of the RVMTP Shares is November 2, 2050, the Fund does not believe that the establishment of an earlier Termination Date for the Fund of March 1, 2028 would materially and adversely affect any preference, right or power of the RVMTP Shares or their holders, since the existing terms of the RVMTP Shares already permit the Fund to optionally redeem the RVMTP Shares on or after November 2, 2022 for a redemption price equal to the amount of the liquidating distribution described above, without paying any early redemption premium. Accordingly, no separate class vote of the holders of the Fund’s preferred stock is required to approve the Charter Amendment.

Required Vote

Approval of Proposals 2a and 2b will each require the affirmative vote of the holders of a majority of the Fund’s outstanding shares of common stock and preferred stock, voting together as a single class. Abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present at the meeting, and will also have the effect of a vote “against” the proposal.

When the Charter Amendment Would Become Effective

If approved by the Fund’s shareholders, the Charter Amendment would become effective as of the date when Articles of Amendment are filed with the State Department of Assessments and Taxation of the State of Maryland or as of such other date as set forth in the Articles of Amendment, not to exceed 30 days after the Articles of Amendment are filed with the Department. It is expected that the Articles of Amendment, if the proposed amendment is approved by the shareholders, would be filed as soon as practicable following the annual meeting. The exact timing of the filing, however, would be determined by the Fund, which reserves the right to delay the filing for up to six months following shareholder approval. In addition, the Fund reserves the right, notwithstanding shareholder approval and without further action by the shareholders, to elect not to proceed with

20

the amendment if, at any time prior to the effective time of the Articles of Amendment, the Board, in its sole discretion, determines that the amendment is no longer in the best interests of the Fund or its shareholders.

Recommendation of the Board

The Board of the Fund believes that the Charter Amendment is advisable and in the best interests of the Fund.

Accordingly, the Board unanimously recommends that shareholders of the Fund vote FOR the approval of the Charter Amendment.

OTHER BUSINESS

Management is not aware of any other matters that will come before the meeting. If any other business should come before the meeting, however, your proxy, if signed and returned, will give discretionary authority to the persons designated in it to vote according to their best judgment.

OTHER INFORMATION

The Adviser. Duff & Phelps Investment Management Co. acts as investment adviser for the Fund. The address of the Adviser is 200 S. Wacker Drive, Suite 500, Chicago, Illinois 60606. The Adviser (together with its predecessor) has been in the investment management business for more than 75 years and, as of November 30, 2020, had approximately $10.5 billion in client accounts under discretionary management. The Adviser is an indirect, wholly-owned subsidiary of Virtus, a public company whose common stock is traded on the NASDAQ Global Market under the trading symbol “VRTS.”

The Administrator. Robert W. Baird & Co. Incorporated (“Baird”) serves as administrator of the Fund. The address of Baird is 500 West Jefferson Street, Louisville, KY 40202. Founded in 1919, Baird is an employee-owned, international financial services firm with more than $285 billion in client assets. Baird provides private wealth management, asset management, investment banking, capital markets and private equity services to clients through its offices in the United States, Europe and Asia.

Shareholders. The following table shows shares of common stock of the Fund as to which each director and director nominee, and all directors and executive officers of the Funds as a group, had or shared power over voting or disposition at October 31, 2020. The directors, director nominees and executive officers of the Fund owned no shares of preferred stock of the Fund. Shares are held with sole power over voting and disposition except as noted. The shares of common stock held by each of the persons listed below and by all directors and executive officers as a group represented less than 1% of the outstanding common stock of the Fund.

| Shares of common stock |

||||

| Donald C. Burke(1) |

1,000 | |||

| Robert J. Genetski |

150 | |||

| Philip R. McLoughlin |

1,736 | |||

| Geraldine M. McNamara(1) |

3,434 | |||

| Eileen A. Moran |

4,604 | |||

21

| Shares of common stock |

||||

| Nathan I. Partain(1)(2) |

11,555 | |||

| David J. Vitale(2) |

None | |||

| Directors and executive officers as a group(1)(2)(3) |

39,534 | |||

| (1) | Mr. Burke had shared power to vote and/or dispose of 1,000 of the shares listed as owned by him. Ms. McNamara had shared power to vote and/or dispose of 3,434 of the shares listed as owned by her. Mr. Partain had shared power to vote and/or dispose of 11,555 of the shares listed as owned by him. The directors and executive officers, in the aggregate, had shared power to vote and/or dispose of 32,311 of the shares listed as owned by the directors and executive officers as a group. |

| (2) | Mr. Partain disclaims beneficial ownership of 11,555 of the shares listed as owned by him. The directors and executive officers, in the aggregate, disclaim beneficial ownership of 11,555 of the shares listed as owned by the directors and executive officers as a group. |

| (3) | The group of directors and executive officers consists of 14 individuals. |

To the Fund’s knowledge, as of the date of this proxy statement, the only persons (including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934 (the “1934 Act”)) who beneficially own more than 5% of any class of the Fund’s voting securities (as determined in accordance with Rule 13d-3 under the 1934 Act) are the persons identified in the following table. Except as otherwise indicated, the information in this table is based on information provided in Schedule 13D and 13G filings made with the Securities and Exchange Commission by each of the persons listed.

| Name of Beneficial Owner |

Class of Shares | Number of Shares |

Percentage of Class |

|||||||||

| Karpus Management, Inc. (“Karpus Investment Management”)(6) |

Common stock | 2,044,912 | 24 | % | ||||||||

| 183 Sully’s Trail, Pittsford, New York 14534 |

||||||||||||

| JPMorgan Chase Bank, National Association(8) |

Preferred stock | 650 | 100.00 | % | ||||||||

| 1111 Polaris Parkway, Columbus, OH 43240 |

||||||||||||

| (1) | Based on a Schedule 13D/A filed by Karpus Investment Management, on November 30, 2020. In that filing, Karpus Investment Management stated that it has sole voting and dispositive power over all securities owned by it. |

| (2) | Based on a Schedule 13G filed by JPMorgan Chase Bank, National Association, on October 30, 2020. In that filing, JPMorgan Chase Bank stated that voting and consent power over all securities owned by it has been assigned to a voting trust pursuant to a Voting Trust Agreement, dated November 2, 2020 among JPMorgan Chase Bank, Lord Securities Corporation, as trustee (the “Voting Trustee”) and Institutional Shareholder Services Inc. (the “Voting Consultant”). The Voting Trust provides that with respect to voting or consent matters relating to the voting rights assigned to the Voting Trust, the Voting Consultant analyzes such voting or consent matters and makes a recommendation to the Voting Trustee on voting or consenting. The Voting Trustee is obligated to follow any such recommendations of the Voting Consultant when providing a vote or consent. |

Section 16(a) Beneficial Ownership Reporting Compliance. Section 30(h) of the 1940 Act imposes the filing requirements of Section 16 of the 1934 Act upon (i) the Fund’s directors and officers, (ii) the Fund’s investment adviser and certain of their affiliated persons and (iii) every person who is directly or indirectly the beneficial owner of more than 10% of any class of the Fund’s outstanding securities (other than short-term paper). Based solely on a review of the copies of Section 16(a) forms furnished to the Fund, or written

22

representations that no Forms 5 were required, the Fund believes that during the Fund’s most recently completed fiscal year all such filing requirements were complied with.

Report of the Audit Committee. The Fund’s independent directors comprise the audit committee of the Fund and act under a written charter which sets forth the audit committee’s responsibilities. A copy of the audit committee charter is available on the Fund’s website at www.dpimc.com/dtf and in print to any shareholder who requests it. Each of the members of the audit committee is independent as defined in the listing standards of the New York Stock Exchange. In connection with the audit of the Fund’s 2020 audited financial statements, the audit committee: (1) reviewed and discussed the Fund’s 2020 audited financial statements with management, (2) discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T, (3) received and reviewed the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and (4) discussed with the independent accountant its independence from the Fund and its management. Based on the foregoing reviews and discussions, the audit committee recommended to the board of directors that the Fund’s audited financial statements be included in the Annual Report to Shareholders for filing with the Securities and Exchange Commission.

The Audit Committee

Donald C. Burke (Chairman)

Robert J. Genetski

Philip R. McLoughlin

Geraldine M. McNamara

Eileen A. Moran

David J. Vitale

Independent Registered Public Accounting Firm. The 1940 Act requires that the Fund’s independent registered public accounting firm be selected by the vote, cast in person, of a majority of the members of the Board who are not interested persons of the Fund. In addition, the listing standards of the New York Stock Exchange vest the audit committee, in its capacity as a committee of the Board, with responsibility for the appointment, compensation, retention and oversight of the work of the Fund’s independent registered public accounting firm. In accordance with the foregoing provisions, the firm of Ernst & Young LLP (“Ernst & Young”) has been selected as independent registered public accounting firm of the Fund to perform the audit of the financial books and records of the Fund for the fiscal year ending October 31, 2021. A representative of Ernst & Young is expected to be present at the annual meeting of shareholders and will be available to respond to appropriate questions and will have an opportunity to make a statement if the representative so desires.

Pre-Approval of Audit and Non-Audit Services. The Fund is responsible for the appointment, compensation and oversight of the work of the independent registered public accounting firm. As part of this responsibility, the Fund’s audit committee is required to pre-approve the audit and non-audit services performed by the independent accountant in order to assure that they do not impair the independent accountant’s independence from the Fund. Accordingly, the Fund’s audit committee has adopted a joint audit and non-audit services pre-approval policy (the “Joint Audit Committee Pre-Approval Policy”), which sets forth the procedures and the conditions pursuant to which services proposed to be performed by the independent accountant may be pre-approved. Each engagement of an independent accountant to render audit or non-audit services to the Fund must be either (i) a specific service pre-approved by the Fund’s audit committee or the chairman of the audit

23

committee, to whom the committee has delegated the authority to grant such pre-approvals between scheduled meetings of the committee, or (ii) come within the scope of a general pre-approval granted under the Joint Audit Committee Pre-Approval Policy. As provided in the Joint Audit Committee Pre-Approval Policy, unless a type of service has received general pre-approval (i.e., the proposed services are pre-approved without consideration of specific case-by-case services by the audit committee), then the service will require specific pre-approval by the audit committee if the proposed service is to be provided by the independent accountant. As provided in the Joint Audit Committee Pre-Approval Policy, any proposed services exceeding pre-approved cost levels or budgeted amounts require specific pre-approval by the audit committee. In deciding whether to grant pre-approval for such services, the audit committee, or the chairman of the audit committee acting under delegated authority, as the case may be, will consider whether such services are consistent with the SEC’s rules on auditor independence. Additionally, the audit committee, or the chairman of the audit committee acting under delegated authority, as the case may be, will also consider whether the independent accountant is best positioned to provide the most effective and efficient service, after considering a number of factors as a whole, with no one factor being necessarily determinative.