Form DEF 14A D & Z Media Acquisition For: Dec 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

SCHEDULE 14A

________________

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant |

☒ |

|

|

Filed by a party other than the Registrant |

☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material under § 240.14a-12 |

D AND Z MEDIA ACQUISITION CORP.

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

D AND Z MEDIA ACQUISITION CORP.

2870 Peachtree Road NW, Suite 509

Atlanta, GA 30305

NOTICE OF SPECIAL MEETING IN LIEU OF THE

2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD DECEMBER 7, 2022

To the Stockholders of D and Z Media Acquisition Corp.:

You are cordially invited to attend the special meeting in lieu of the 2022 annual meeting of stockholders (the “special meeting”) of D and Z Media Acquisition Corp. (“DNZ,” “Company,” “we,” “us” or “our”) to be held at 12:00 p.m. Eastern Time on December 7, 2022 as a virtual meeting.

The special meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the special meeting online, vote and submit your questions during the special meeting by visiting https://www.cstproxy.com/dandzmedia/2022.

Even if you are planning on attending the special meeting online, please promptly submit your proxy vote by telephone, or, if you received a printed form of proxy in the mail, by completing, dating, signing and returning the enclosed proxy, so your shares will be represented at the special meeting. Instructions on voting your shares are on the proxy materials you received for the special meeting. Even if you plan to attend the special meeting online, it is strongly recommended you complete and return your proxy card before the special meeting date, to ensure that your shares will be represented at the special meeting if you are unable to attend.

The accompanying proxy statement is dated November 15, 2022 and is first being mailed to stockholders on or about that date. The sole purpose of the special meeting is to consider and vote upon the following proposals:

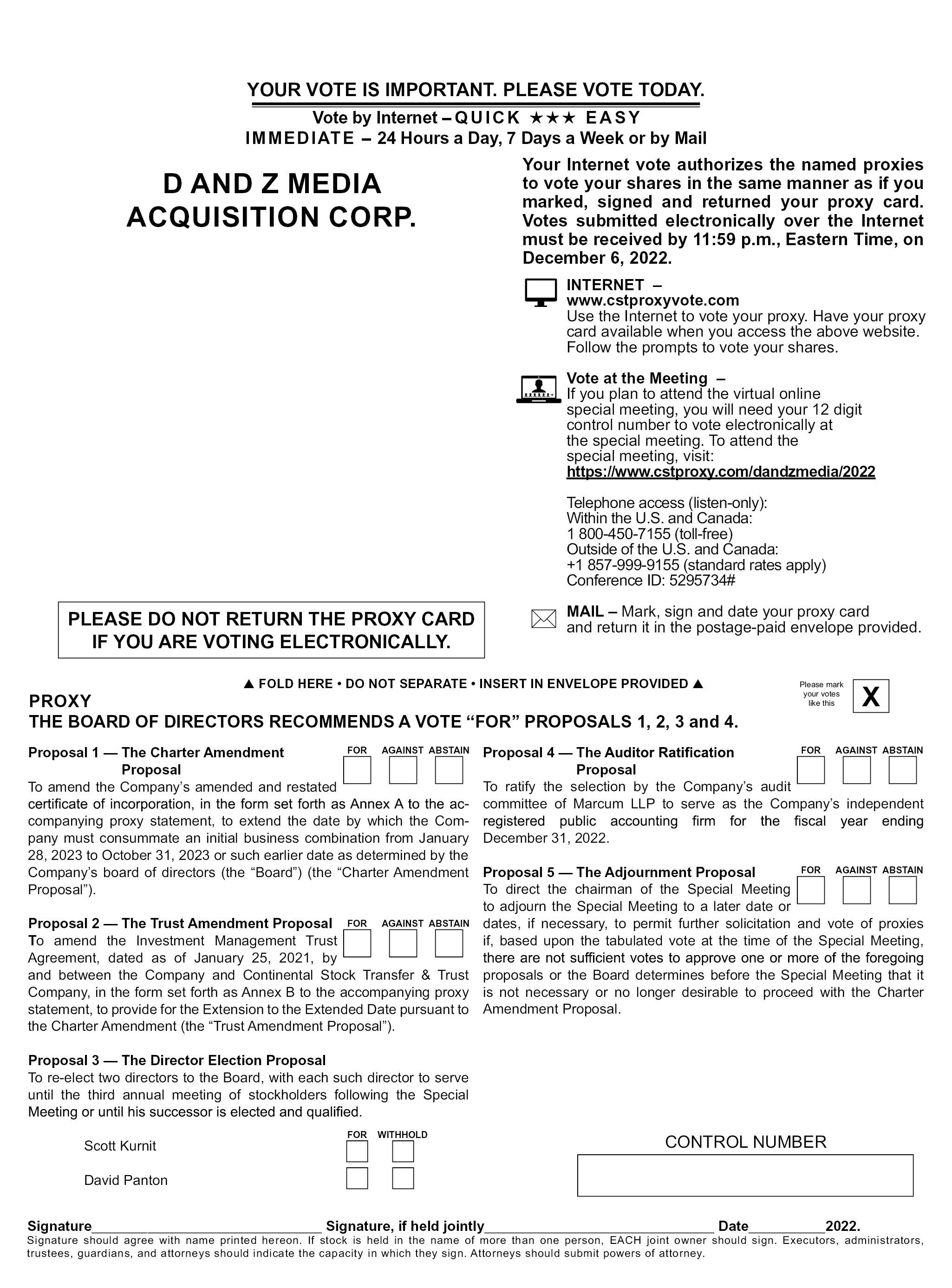

• Proposal No. 1 — The Charter Amendment Proposal — a proposal to amend our amended and restated certificate of incorporation (our “charter”), in the form set forth as Annex A to the accompanying proxy statement (the “Charter Amendment”), to extend the date by which we must consummate an initial business combination (the “Extension”) from January 28, 2023 to October 31, 2023 or such earlier date as determined by our board of directors (the “Board”) (such later date, the “Extended Date”, and such proposal, the “Charter Amendment Proposal”);

• Proposal No. 2 — The Trust Amendment Proposal — a proposal to amend the Investment Management Trust Agreement, dated as of January 25, 2021 (the “Trust Agreement”), by and between the Company and Continental Stock Transfer & Trust Company, in the form set forth as Annex B to the accompanying proxy statement (the “Trust Amendment”), to provide for the Extension to the Extended Date pursuant to the Charter Amendment (the “Trust Amendment Proposal”);

• Proposal No. 3 — The Director Election Proposal — a proposal to re-elect two directors to the Board, with each such director to serve until the third annual meeting of stockholders following the special meeting or until his successor is elected and qualified (the “Director Election Proposal”);

• Proposal No. 4 — The Auditor Ratification Proposal — a proposal to ratify the selection by our audit committee of Marcum LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (the “Auditor Ratification Proposal”); and

• Proposal No. 5 — The Adjournment Proposal — a proposal to direct the chairman of the special meeting to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve one or more of the foregoing proposals or the Board determines before the special meeting that it is not necessary or no longer desirable to proceed with the Charter Amendment Proposal and the Trust Amendment Proposal (the “Adjournment Proposal”).

Each of the Charter Amendment Proposal and the Trust Amendment Proposal is cross-conditioned on the approval of each other. Each of the Charter Amendment Proposal, the Trust Amendment Proposal, the Director Election Proposal, the Auditor Ratification Proposal and the Adjournment Proposal is more fully described in the accompanying proxy statement. The Adjournment Proposal will only be presented to our stockholders in the event, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve one or more of the other proposals set forth in the accompanying proxy statement or the Board determines before the special meeting that it is not necessary or no longer desirable to proceed with the Charter Amendment Proposal and the Trust Amendment Proposal.

The purpose of the Charter Amendment Proposal and the Trust Amendment Proposal is to allow us more time to complete an initial business combination. The final prospectus for our initial public offering (the “IPO”, and such prospectus, the “IPO Prospectus”) and our charter provide that we have until January 28, 2023 to complete an initial business combination. While we are currently in discussions with respect to business combination opportunities, we have not yet executed a definitive agreement for an initial business combination. We currently anticipate entering into such an agreement with one of our prospective targets, but the Board currently believes that there will not be sufficient time before January 28, 2023 to consummate an initial business combination. Accordingly, the Board believes that, in order to be able to consummate an initial business combination, we will need to obtain the Extension. Therefore, the Board has determined that it is advisable to extend the date that we have to consummate an initial business combination to the Extended Date. In the event that we enter into a definitive agreement for an initial business combination prior to the special meeting, we will issue a press release and file a Current Report on Form 8-K with the Securities and Exchange Commission announcing such proposed business combination.

Holders of shares of our Class A common stock, par value $0.0001 per share (“Class A common stock”), included as part of the units sold in the IPO (“public shares”, and such holders, the “public stockholders”) may elect to redeem all or a portion of their shares for their pro rata portion of the funds available in the trust account in connection with the Charter Amendment Proposal and the Trust Amendment Proposal (the “Election”) regardless of whether such public stockholders vote “FOR” or “AGAINST” the Charter Amendment Proposal and the Trust Amendment Proposal, and the Election can also be made by public stockholders who abstain, do not vote, or do not instruct their broker or bank how to vote, at the special meeting. Public stockholders may make the Election regardless of whether such public stockholders were holders as of the record date. We believe that such redemption right protects the public stockholders from having to sustain their investments for an unreasonably long period if we do not consummate a suitable initial business combination in the timeframe initially contemplated by our charter. In addition, regardless of whether public stockholders vote “FOR” or “AGAINST” the Charter Amendment Proposal and the Trust Amendment Proposal, abstain, do not vote, or do not instruct their broker or bank how to vote, at the special meeting, if the Charter Amendment Proposal and the Trust Amendment Proposal are approved by the requisite vote of stockholders and the Extension is implemented, the remaining public stockholders will retain their right to redeem their public shares for their pro rata portion of the funds available in the trust account upon consummation of an initial business combination.

To exercise your redemption rights, you must tender your shares to our transfer agent at least two business days prior to the special meeting. You may tender your shares by either delivering your share certificate to the transfer agent or by delivering your shares electronically using the Depository Trust Company’s DWAC (Deposit/Withdrawal At Custodian) system. If you hold your shares in street name, you will need to instruct your bank, broker or other nominee to withdraw the shares from your account in order to exercise your redemption rights.

We estimate that the per-share pro rata portion of the trust account will be approximately $10.04 at the time of the special meeting, based on the approximate amount of $288.8 million held in the trust account as of September 30, 2022. The closing price of our Class A common stock on the New York Stock Exchange on November 14, 2022 was $9.99. Accordingly, if the market price were to remain the same until the date of the special meeting, exercising redemption rights would result in a public stockholder receiving approximately $0.05 more for each share than if such stockholder sold its public shares in the open market. We cannot assure public stockholders that they will be able to sell their public shares in the open market, even if the market price per share is higher than the redemption price stated above, as there may not be sufficient liquidity in our securities when such stockholders wish to sell their shares.

If the Charter Amendment Proposal and the Trust Amendment Proposal are not approved (or if such proposals are approved and the Extension is not implemented) and we do not consummate an initial business combination by January 28, 2023, as contemplated by the IPO Prospectus and in accordance with our charter, or if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented but we do not consummate an initial business combination by the Extended Date, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest earned on the funds held in the trust account and not previously released to us (less taxes payable and up to $100,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidating distributions, if any), and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and the Board, liquidate and dissolve, subject, in each case, to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. There will be no redemption rights or liquidating distributions with respect to our warrants, which will expire worthless if we do not complete an initial business combination by January 28, 2023 or, if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented, the Extended Date.

Our initial stockholders, including D and Z Media Holdings LLC (our “sponsor”), certain of our officers and directors and their affiliates (together with their permitted transferees, the “initial stockholders”), collectively beneficially own an aggregate of 7,187,500 shares (“founder shares”) of Class B common stock, par value $0.0001 per share (“Class B common stock”, and together with our Class A common stock, “common stock”), representing 20% of our issued and outstanding shares of common stock. Our initial stockholders, officers and directors have agreed to waive their redemption rights in connection with the consummation of an initial business combination or the approval of certain amendments to our charter, including with respect to the Charter Amendment Proposal, and to waive their rights to liquidating distributions from the trust account with respect to the founder shares if we do not complete an initial business combination by January 28, 2023 or, if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented, the Extended Date. As a consequence of such waivers, any liquidating distribution that is made will be only with respect to the public shares; however, such persons would be entitled to liquidating distributions from the trust account with respect to any public shares they hold.

The affirmative vote of at least sixty-five percent (65%) of all then outstanding shares of our common stock entitled to vote thereon at the special meeting is required to approve each of the Charter Amendment Proposal and the Trust Amendment Proposal, a plurality of the shares of our common stock entitled to vote thereon and voted in person (by virtual attendance) or by proxy at the special meeting is required for the re-election of the directors in the Director Election Proposal, and the affirmative vote of at least a majority of the shares of our common stock entitled to vote thereon and voted in person (by virtual attendance) or by proxy at the special meeting is required to approve each of the Auditor Ratification Proposal and the Adjournment Proposal.

Approval of the Charter Amendment Proposal and the Trust Amendment Proposal is a condition to the implementation of the Extension. As contemplated by the IPO Prospectus and in accordance with our charter, we will not proceed with the Extension if the number of redemptions of public shares causes us to have less than $5,000,001 of net tangible assets following approval of the Charter Amendment Proposal and the Trust Amendment Proposal. Notwithstanding stockholder approval of the Charter Amendment Proposal and the Trust Amendment Proposal, the Board will retain the right to abandon and not implement the Extension at any time without any further action by our stockholders.

The Board has fixed the close of business on November 3, 2022 as the date for determining the stockholders entitled to receive notice of and vote at the special meeting and any adjournment thereof. Only holders of record of shares of our common stock on that date are entitled to have their votes counted at the special meeting or any adjournment thereof.

You are not being asked to vote on an initial business combination at this time. If the Extension is implemented and you do not make the Election to redeem all of your public shares in connection with the Extension, you will retain the right to vote on an initial business combination when it is submitted to the public stockholders (provided that you are a stockholder on the record date for a meeting to consider such business

combination) and the right to redeem your public shares for a pro rata portion of the trust account in the event an initial business combination is approved and completed or we have not consummated an initial business combination by the Extended Date.

After careful consideration of all relevant factors, the Board has determined that the Charter Amendment Proposal, the Trust Amendment Proposal, the Director Election Proposal, the Auditor Ratification Proposal and, if presented, the Adjournment Proposal, are advisable and unanimously recommends that you vote or give instruction to vote “FOR” such proposals.

Under Delaware law and our bylaws, no other business may be transacted at the special meeting.

Enclosed is the proxy statement containing detailed information concerning the Charter Amendment Proposal, the Trust Amendment Proposal, the Director Election Proposal, the Auditor Ratification Proposal, the Adjournment Proposal and the special meeting. Whether or not you plan to attend the special meeting, we urge you to read this material carefully and vote your shares.

|

Dated: November 15, 2022 |

By Order of the Board of Directors, |

|

|

/s/ Betty Liu |

||

|

Betty Liu |

||

|

Chairman, President and Chief Executive Officer |

Your vote is important. If you are a stockholder of record, please sign, date and return your proxy card as soon as possible to make sure that your shares are represented at the special meeting. If you are a stockholder of record, you may also cast your vote online at the special meeting. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank how to vote your shares, or you may cast your vote online at the special meeting by obtaining a proxy from your brokerage firm or bank. Your failure to vote or instruct your broker or bank how to vote will have the same effect as voting “AGAINST” the Charter Amendment Proposal and the Trust Amendment Proposal, and an abstention will have the same effect as voting “AGAINST” the Charter Amendment Proposal and the Trust Amendment Proposal. Abstentions, broker non-votes and withhold votes (as applicable), while considered present for the purposes of establishing a quorum, will not count as votes cast for the other proposals and will have no effect on the outcome of the vote on the other proposals. Failure to vote in person (by virtual attendance) or by proxy at the special meeting will have no effect on the outcome of the vote on the other proposals.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting in Lieu of the 2022 Annual Meeting of Stockholders to be held on December 7, 2022: This notice of special meeting, the accompanying proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 are available at https://www.cstproxy.com/dandzmedia/2022.

TO EXERCISE YOUR REDEMPTION RIGHTS: (1) IF YOU HOLD SHARES OF CLASS A COMMON STOCK THROUGH UNITS, YOU MUST ELECT TO SEPARATE YOUR UNITS INTO THE UNDERLYING PUBLIC SHARES AND PUBLIC WARRANTS PRIOR TO EXERCISING YOUR REDEMPTION RIGHTS WITH RESPECT TO THE PUBLIC SHARES, (2) YOU MUST SUBMIT A WRITTEN REQUEST TO THE TRANSFER AGENT BY 5:00 P.M. EASTERN TIME ON DECEMBER 5, 2022 (TWO BUSINESS DAYS BEFORE THE SPECIAL MEETING) THAT YOUR PUBLIC SHARES BE REDEEMED FOR CASH, AND (3) DELIVER YOUR SHARES OF CLASS A COMMON STOCK TO THE TRANSFER AGENT, PHYSICALLY OR ELECTRONICALLY USING THE DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT WITHDRAWAL AT CUSTODIAN) SYSTEM, IN EACH CASE IN ACCORDANCE WITH THE PROCEDURES AND DEADLINES DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT. IF YOU HOLD THE SHARES IN STREET NAME, YOU WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT YOUR BANK OR BROKER TO WITHDRAW THE SHARES FROM YOUR ACCOUNT IN ORDER TO EXERCISE YOUR REDEMPTION RIGHTS.

D AND Z mEDIA ACQUISITION CORP.

2870 Peachtree Road NW, Suite 509

Atlanta, GA 30305

SPECIAL MEETING IN LIEU OF THE

2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD DECEMBER 7, 2022

PROXY STATEMENT

The special meeting in lieu of the 2022 annual meeting of stockholders (the “special meeting”) of D and Z Media Acquisition Corp. (“DNZ,” “Company,” “we,” “us” or “our”) to be held at 12:00 p.m. Eastern Time on December 7, 2022 as a virtual meeting.

The special meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the special meeting online, vote and submit your questions during the special meeting by visiting https://www.cstproxy.com/dandzmedia/2022.

Even if you are planning on attending the special meeting online, please promptly submit your proxy vote by telephone, or, if you received a printed form of proxy in the mail, by completing, dating, signing and returning the enclosed proxy, so your shares will be represented at the special meeting. Instructions on voting your shares are on the proxy materials you received for the special meeting. Even if you plan to attend the special meeting online, it is strongly recommended you complete and return your proxy card before the special meeting date, to ensure that your shares will be represented at the special meeting if you are unable to attend.

This proxy statement is dated November 15, 2022 and is first being mailed to stockholders on or about that date. The sole purpose of the special meeting is to consider and vote upon the following proposals:

• Proposal No. 1 — The Charter Amendment Proposal — a proposal to amend our amended and restated certificate of incorporation (our “charter”), in the form set forth as Annex A to this proxy statement (the “Charter Amendment”), to extend the date by which we must consummate an initial business combination (the “Extension”) from January 28, 2023 to October 31, 2023 or such earlier date as determined by our board of directors (the “Board”) (such later date, the “Extended Date”, and such proposal, the “Charter Amendment Proposal”);

• Proposal No. 2 — The Trust Amendment Proposal — a proposal to amend the Investment Management Trust Agreement, dated as of January 25, 2021 (the “Trust Agreement”), by and between the Company and Continental Stock Transfer & Trust Company, in the form set forth as Annex B to this proxy statement (the “Trust Amendment”), to provide for the Extension to the Extended Date pursuant to the Charter Amendment (the “Trust Amendment Proposal”);

• Proposal No. 3 — The Director Election Proposal — a proposal to re-elect two directors to the Board, with each such director to serve until the third annual meeting of stockholders following the special meeting or until his successor is elected and qualified (the “Director Election Proposal”);

• Proposal No. 4 — The Auditor Ratification Proposal — a proposal to ratify the selection by our audit committee of Marcum LLP (“Marcum”) to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (the “Auditor Ratification Proposal”); and

• Proposal No. 5 — The Adjournment Proposal — a proposal to direct the chairman of the special meeting to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve one or more of the foregoing proposals or the Board determines before the special meeting that it is not necessary or no longer desirable to proceed with the Charter Amendment Proposal and the Trust Amendment Proposal (the “Adjournment Proposal”).

The Charter Amendment Proposal and the Trust Amendment Proposal are essential to the overall implementation of the Board’s plan to extend the date that we have to complete an initial business combination. The purpose of the Charter Amendment Proposal and the Trust Amendment Proposal is to allow us more time to complete an initial business combination. The final prospectus for our initial public offering (the “IPO”, and such prospectus, the “IPO Prospectus”) and our charter provide that we have until January 28, 2023 to complete an initial business combination. While we are currently in discussions with respect to business combination opportunities, we have not yet executed a definitive agreement for an initial business combination. We currently anticipate entering into such an agreement with one of our prospective targets, but the Board currently believes that there will not be sufficient time before January 28, 2023 to consummate an initial business combination. Accordingly, the Board believes that, in order to be able to consummate an initial business combination, we will need to obtain the Extension. Therefore, the Board has determined that it is advisable to extend the date that we have to consummate an initial business combination to the Extended Date. In the event that we enter into a definitive agreement for an initial business combination prior to the special meeting, we will issue a press release and file a Current Report on Form 8-K with the Securities and Exchange Commission (the “SEC”) announcing such proposed business combination.

Holders of shares of our Class A common stock, par value $0.0001 per share (“Class A common stock”), included as part of the units sold in the IPO (“public shares”, and such holders, the “public stockholders”) may elect to redeem all or a portion of their shares for their pro rata portion of the funds available in the trust account in connection with the Charter Amendment Proposal and the Trust Amendment Proposal (the “Election”) regardless of whether such public stockholders vote “FOR” or “AGAINST” the Charter Amendment Proposal and the Trust Amendment Proposal, and the Election can also be made by public stockholders who abstain, do not vote, or do not instruct their broker or bank how to vote, at the special meeting. Public stockholders may make the Election regardless of whether such public stockholders were holders as of the record date. We believe that such redemption right protects the public stockholders from having to sustain their investments for an unreasonably long period if we do not consummate a suitable initial business combination in the timeframe initially contemplated by our charter. In addition, regardless of whether public stockholders vote “FOR” or “AGAINST” the Charter Amendment Proposal and the Trust Amendment Proposal, abstain, do not vote, or do not instruct their broker or bank how to vote, at the special meeting, if the Charter Amendment Proposal and the Trust Amendment Proposal are approved by the requisite vote of stockholders and the Extension is implemented, the remaining public stockholders will retain their right to redeem their public shares for their pro rata portion of the funds available in the trust account upon consummation of an initial business combination.

If the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented, the removal of the Withdrawal Amount (as defined below) from the trust account in connection with the Election will reduce our net asset value and the amount held in the trust account following the redemption, and the amount remaining in the trust account may be significantly reduced from the approximately $288.8 million that was in the trust account as of September 30, 2022. In such event, we may need to obtain additional funds to complete an initial business combination and there can be no assurance that such funds will be available on terms acceptable to us or at all.

If the Charter Amendment Proposal and the Trust Amendment Proposal are not approved (or if such proposals are approved and the Extension is not implemented) and we do not consummate an initial business combination by January 28, 2023, as contemplated by the IPO Prospectus and in accordance with our charter, or if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented but we do not consummate an initial business combination by the Extended Date, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest earned on the funds held in the trust account and not previously released to us (less taxes payable and up to $100,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidating distributions, if any), and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and the Board, liquidate and dissolve, subject, in each case, to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. There will be no redemption rights or liquidating distributions with respect to our warrants, which will expire worthless if we do not complete an initial business combination by January 28, 2023 or, if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented, the Extended Date.

Our initial stockholders, including D and Z Media Holdings LLC (our “sponsor”), certain of our officers and directors and their affiliates (together with their permitted transferees, the “initial stockholders”), collectively beneficially own an aggregate of 7,187,500 shares (“founder shares”) of Class B common stock, par value $0.0001 per share (“Class B common stock”, and together with our Class A common stock, “common stock”), representing 20% of our issued and outstanding shares of common stock. Our initial stockholders, officers and directors have agreed to waive their redemption rights in connection with the consummation of an initial business combination or the approval of certain amendments to our charter, including with respect to the Charter Amendment Proposal, and to waive their rights to liquidating distributions from the trust account with respect to the founder shares if we do not complete an initial business combination by January 28, 2023 or, if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented, the Extended Date. As a consequence of such waivers, any liquidating distribution that is made will be only with respect to the public shares; however, such persons would be entitled to liquidating distributions from the trust account with respect to any public shares they hold.

To protect amounts held in the trust account, our sponsor has agreed that it will be liable to us if and to the extent any claims by a third party for services rendered or products sold to us, or a prospective target business with which we have entered into a written letter of intent, confidentiality or other similar agreement or business combination agreement, reduce the amount of funds in the trust account to below the lesser of (i) $10.00 per public share and (ii) the actual amount per public share held in the trust account as of the date of the liquidation of the trust account, if less than $10.00 per public share due to reductions in the value of the trust assets, less taxes payable, provided that such liability will not apply to any claims by a third party or prospective target business who executed a waiver of any and all rights to the monies held in the trust account (whether or not such waiver is enforceable) nor will it apply to any claims under our indemnity of the underwriters of the IPO against certain liabilities, including liabilities under the Securities Act of 1933, as amended (the “Securities Act”). However, we have not asked our sponsor to reserve for such indemnification obligations, nor have we independently verified whether our sponsor has sufficient funds to satisfy its indemnity obligations and we believe that our sponsor’s only assets are our securities. Therefore, we cannot assure you that our sponsor would be able to satisfy those obligations. The per-share liquidation price for the public shares is anticipated to be approximately $10.04 (based on the approximate amount of $288.8 million held in the trust account as of September 30, 2022). Nevertheless, we cannot assure you that the per share distribution from the trust account, if we liquidate, will not be less than $10.04, plus interest, due to unforeseen claims of potential creditors.

Under the Delaware General Corporation Law (the “DGCL”), stockholders may be held liable for claims by third parties against a corporation to the extent of distributions received by them in a dissolution. The pro rata portion of our trust account distributed to the public stockholders upon the redemption of the public shares in the event we do not complete an initial business combination within the required time period may be considered a liquidating distribution under Delaware law. If the corporation complies with certain procedures set forth in Section 280 of the DGCL intended to ensure that it makes reasonable provision for all claims against it, including a 60-day notice period during which any third-party claims can be brought against the corporation, a 90-day period during which the corporation may reject any claims brought, and an additional 150-day waiting period before any liquidating distributions are made to stockholders, any liability of stockholders with respect to a liquidating distribution is limited to the lesser of such stockholder’s pro rata share of the claim or the amount distributed to the stockholder, and any liability of the stockholder would be barred after the third anniversary of the dissolution.

However, because we will not be complying with Section 280 of the DGCL, Section 281(b) of the DGCL requires us to adopt a plan, based on facts known to us at such time that will provide for our payment of all existing and pending claims or claims that may be potentially brought against us within the subsequent ten years. However, because we are a blank check company, rather than an operating company, and our operations have been limited to searching for prospective target businesses to acquire, the only likely claims to arise would be from our vendors (such as lawyers, investment bankers, etc.) or prospective target businesses.

The affirmative vote of at least sixty-five percent (65%) of all then outstanding shares of our common stock entitled to vote thereon at the special meeting is required to approve each of the Charter Amendment Proposal and the Trust Amendment Proposal, a plurality of the shares of our common stock entitled to vote thereon and voted in person (by virtual attendance) or by proxy at the special meeting is required for the re-election of the directors in the Director Election Proposal, and the affirmative vote of at least a majority of the shares of our common stock entitled to vote thereon and voted in person (by virtual attendance) or by proxy at the special meeting is required to approve each of the Auditor Ratification Proposal and the Adjournment Proposal.

Approval of the Charter Amendment Proposal and the Trust Amendment Proposal is a condition to the implementation of the Extension. As contemplated by the IPO Prospectus and in accordance with our charter, we will not proceed with the Extension if the number of redemptions of public shares causes us to have less than $5,000,001 of net tangible assets following approval of the Charter Amendment Proposal and the Trust Amendment Proposal. Notwithstanding stockholder approval of the Charter Amendment Proposal and the Trust Amendment Proposal, the Board will retain the right to abandon and not implement the Extension at any time without any further action by our stockholders.

Approval of the Charter Amendment Proposal and the Trust Amendment Proposal will constitute consent for us to instruct the trustee to (i) remove from the trust account an amount (the “Withdrawal Amount”) equal to the pro rata portion of funds available in the trust account relating to the redeemed public shares and (ii) deliver to the holders of such redeemed public shares their pro rata portion of the Withdrawal Amount. The remainder of such funds will remain in the trust account and be available for our use to complete an initial business combination on or before the Extended Date. Public stockholders who do not make the Election to redeem all of their public shares in connection with the Extension will retain their redemption rights and their ability to vote on an initial business combination (provided that they are stockholders on the record date for a meeting to consider such business combination) through the Extended Date if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented.

The record date for the special meeting is November 3, 2022. Record holders of our common stock at the close of business on the record date are entitled to vote or have their votes cast at the special meeting. On the record date there were 35,937,500 shares of our common stock issued and outstanding, consisting of 28,750,000 shares of Class A common stock and 7,187,500 shares of Class B common stock. Our warrants do not have voting rights.

This proxy statement contains important information about the special meeting and the proposals. Please read it carefully and vote your shares.

|

Page |

||

|

1 |

||

|

14 |

||

|

15 |

||

|

18 |

||

|

19 |

||

|

21 |

||

|

29 |

||

|

31 |

||

|

32 |

||

|

34 |

||

|

35 |

||

|

42 |

||

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

44 |

|

|

47 |

||

|

47 |

||

|

48 |

||

|

A-1 |

||

|

B-1 |

i

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

These Questions and Answers are only summaries of the matters they discuss. They do not contain all of the information that may be important to you. You should read carefully the entire document, including the Charter Amendment and the Trust Amendment included as annexes to this proxy statement.

|

Q. Why am I receiving this proxy statement? |

A. This proxy statement and the accompanying materials are being sent to you in connection with the solicitation of proxies by the Board, for use at the special meeting to be held at 12:00 p.m. Eastern Time on December 7, 2022 as a virtual meeting. This proxy statement summarizes the information that you need to make an informed decision on the proposals to be considered at the special meeting. We are a blank check company incorporated on October 7, 2020 as a Delaware corporation and formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses, which we refer to as an initial business combination. On January 28, 2021, we consummated the IPO of 28,750,000 units, including the issuance of 3,750,000 units as a result of the underwriters’ full exercise of their over-allotment option, from which we derived total gross proceeds of $287,500,000. Like most blank check companies, our charter provides for the return of the IPO proceeds held in trust to the public stockholders if no qualifying business combination is consummated on or before a certain date (in our case, January 28, 2023). The Board believes that it is advisable to continue our existence until the Extended Date in order to allow us more time to complete an initial business combination and is submitting proposals to amend our charter and the Trust Agreement to the stockholders to vote upon. In addition, we are proposing the re-election of two directors to the Board, the ratification of the selection by our audit committee of Marcum to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2022, and a measure to direct the chairman of the special meeting to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve one or more of the foregoing proposals or the Board determines before the special meeting that it is not necessary or no longer desirable to proceed with the Charter Amendment Proposal and the Trust Amendment Proposal. |

|

|

Q. What is included in these materials? |

A. These materials include: • this proxy statement for the special meeting; • a proxy card; and • our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on April 12, 2022 (our “2021 Form 10-K”). |

|

|

Q. What is being voted on? |

A. You are being asked to vote on: • a proposal to amend our charter, in the form set forth as Annex A to this proxy statement, to extend the date by which we must consummate an initial business combination from January 28, 2023 to the Extended Date; • a proposal to amend the Trust Agreement, in the form set forth as Annex B to this proxy statement, to provide for the Extension to the Extended Date pursuant to the Charter Amendment; • a proposal to re-elect two directors to the Board, with each such director to serve until the third annual meeting of stockholders following the special meeting or until his successor is elected and qualified; |

1

|

• a proposal to ratify the selection by our audit committee of Marcum to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and • a proposal to direct the chairman of the special meeting to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, there are not sufficient votes to approve one or more of the foregoing proposals or the Board determines before the special meeting that it is not necessary or no longer desirable to proceed with the Charter Amendment Proposal and the Trust Amendment Proposal. The Charter Amendment Proposal and the Trust Amendment Proposal are essential to the overall implementation of the Board’s plan to extend the date that we have to complete an initial business combination. In the event that we enter into a definitive agreement for an initial business combination prior to the special meeting, we will issue a press release and file a Current Report on Form 8-K with the SEC announcing such proposed business combination. Approval of the Charter Amendment Proposal and the Trust Amendment Proposal is a condition to the implementation of the Extension. As contemplated by the IPO Prospectus and in accordance with our charter, we will not proceed with the Extension if the number of redemptions of public shares causes us to have less than $5,000,001 of net tangible assets following approval of the Charter Amendment Proposal and the Trust Amendment Proposal. Notwithstanding stockholder approval of the Charter Amendment Proposal and the Trust Amendment Proposal, the Board will retain the right to abandon and not implement the Extension at any time without any further action by our stockholders. If the Extension is implemented, our stockholders’ approval of the Charter Amendment Proposal and the Trust Amendment Proposal will constitute consent for us to instruct the trustee to (i) remove the Withdrawal Amount from the trust account and (ii) deliver to the holders of such redeemed public shares their pro rata portion of the Withdrawal Amount, and to retain the remainder of the funds in the trust account for our use in connection with consummating an initial business combination on or before the Extended Date. If the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented, the removal of the Withdrawal Amount from the trust account in connection with the Election will reduce our net asset value and the amount held in the trust account following the redemption, and the amount remaining in the trust account may be significantly reduced from the approximately $288.8 million that was in the trust account as of September 30, 2022. In such event, we may need to obtain additional funds to complete an initial business combination and there can be no assurance that such funds will be available on terms acceptable to us or at all. |

||

|

If the Charter Amendment Proposal and the Trust Amendment Proposal are not approved (or if such proposals are approved and the Extension is not implemented) and we do not consummate an initial business combination by January 28, 2023, as contemplated by the IPO Prospectus and in accordance with our charter, or if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented but we do not consummate an initial business combination by the Extended Date, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate |

2

|

amount then on deposit in the trust account, including interest earned on the funds held in the trust account and not previously released to us (less taxes payable and up to $100,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidating distributions, if any), and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and the Board, liquidate and dissolve, subject, in each case, to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. There will be no redemption rights or liquidating distributions with respect to our warrants, which will expire worthless if we do not complete an initial business combination by January 28, 2023 or, if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented, the Extended Date. Our initial stockholders, officers and directors have agreed to waive their redemption rights in connection with the consummation of an initial business combination or the approval of certain amendments to our charter, including with respect to the Charter Amendment Proposal, and to waive their rights to liquidating distributions from the trust account with respect to the founder shares if we do not complete an initial business combination by January 28, 2023 or, if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented, the Extended Date. As a consequence of such waivers, any liquidating distribution that is made will be only with respect to the public shares; however, such persons would be entitled to liquidating distributions from the trust account with respect to any public shares they hold. We will pay the costs of liquidation from up to $100,000 of interest from the trust account and our remaining assets held outside of the trust account. |

||

|

Q. Why are we proposing the Charter Amendment Proposal and the Trust Amendment Proposal? |

A. Our charter provides for the return of the IPO proceeds held in trust to the public stockholders if no qualifying business combination is consummated on or before January 28, 2023. Accordingly, the Trust Agreement provides for the trustee to liquidate the trust account and distribute to each public stockholder its pro rata share of such funds if a qualifying business combination is not consummated on or before such date provided in our charter. As we explain below, we believe we will not be able to complete an initial business combination by that date. While we are currently in discussions with respect to business combination opportunities, we have not yet executed a definitive agreement for an initial business combination. We currently anticipate entering into such an agreement with one of our prospective targets, but the Board currently believes that there will not be sufficient time before January 28, 2023 to consummate such an initial business combination. Accordingly, the Board believes that, in order to be able to consummate an initial business combination, we will need to obtain the Extension. Therefore, the Board has determined that it is advisable to extend the date that we have to consummate an initial business combination to the Extended Date. In the event that we enter into a definitive agreement for an initial business combination prior to the special meeting, we will issue a press release and file a Current Report on Form 8-K with the SEC announcing such proposed business combination. |

3

|

Because we believe we will not be able to complete an initial business combination within the permitted time period under our charter, we have determined to seek stockholder approval to extend the date by which we must consummate an initial business combination. We believe that given our expenditure of time, effort and money on finding a potential initial business combination, circumstances warrant providing our stockholders an opportunity to consider an initial business combination. Accordingly, the Board is proposing the Charter Amendment Proposal and the Trust Amendment Proposal to extend our corporate existence. You are not being asked to vote on an initial business combination at this time. If the Extension is implemented and you do not make the Election to redeem all of your public shares in connection with the Extension, you will retain the right to vote on an initial business combination when it is submitted to the public stockholders (provided that you are a stockholder on the record date for a meeting to consider such business combination) and the right to redeem your public shares for a pro rata portion of the trust account in the event an initial business combination is approved and completed or we have not consummated an initial business combination by the Extended Date. |

||

|

Q. Why should I vote for the Charter Amendment Proposal and the Trust Proposal? |

A. The Board believes our stockholders should have an opportunity to evaluate a potential initial business combination with one or more of our prospective targets. Accordingly, the Board is proposing the Charter Amendment Proposal and the Trust Amendment Proposal to extend the date by which we must consummate an initial business combination until the Extended Date and to allow for the Election. The affirmative vote of at least sixty-five percent (65%) of all then outstanding shares of our common stock entitled to vote thereon at the special meeting is required to effect an amendment to our charter that would extend our corporate existence beyond January 28, 2023, and to effect any amendment to the Trust Agreement. Additionally, the IPO Prospectus and our charter require that all public stockholders have an opportunity to redeem their public shares in the case that our corporate existence is extended. We believe that this charter provision was included to protect our stockholders from having to sustain their investments for an unreasonably long period if we do not consummate a suitable initial business combination in the timeframe contemplated by our charter. Given our expenditure of time, effort and money on finding a potential initial business combination, we believe circumstances warrant providing those who would like to consider whether a potential initial business combination with one or more of our prospective targets is an attractive investment with an opportunity to consider such transaction, inasmuch as we are also affording public stockholders who wish to redeem their public shares the opportunity to do so, as required under our charter. Accordingly, we believe the Extension is consistent with our charter and the IPO Prospectus. |

|

|

Q. How do insiders intend to vote their shares? |

A. All of our initial stockholders, officers, directors and their affiliates are expected to vote any shares of our common stock over which they have voting control (including any public shares owned by them) in favor of the Charter Amendment Proposal, the Trust Amendment Proposal, the Director Election Proposal, the Auditor Ratification Proposal and the Adjournment Proposal. |

4

|

Our initial stockholders, officers, directors and their affiliates collectively beneficially own an aggregate of 7,187,500 founder shares, representing 20% of our issued and outstanding shares of common stock. Our initial stockholders, officers and directors have agreed to waive their redemption rights in connection with the consummation of an initial business combination or the approval of certain amendments to our charter, including with respect to the Charter Amendment Proposal, and to waive their rights to liquidating distributions from the trust account with respect to the founder shares if we do not complete an initial business combination by January 28, 2023 or, if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented, the Extended Date. However, such persons would be entitled to liquidating distributions from the trust account with respect to any public shares they hold if we do not complete an initial business combination by January 28, 2023 or, if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented, the Extended Date. Subject to applicable securities laws, our initial stockholders, officers, directors or their affiliates may purchase shares in privately negotiated transactions or in the open market either prior to or following the completion of an initial business combination, although they are under no obligation to do so. Such a purchase may include a contractual acknowledgement that such stockholder, although still the record holder of our shares, is no longer the beneficial owner thereof and therefore agrees not to exercise its redemption rights. In the event that our initial stockholders purchase shares in privately negotiated transactions from public stockholders who have already elected to exercise their redemption rights, such selling stockholders would be required to revoke their prior elections to redeem their shares. To the extent any such purchases by our initial stockholders, officers, directors or their affiliates are made in situations in which the tender offer rules restrictions on purchases apply, we will disclose in a Current Report on Form 8-K prior to the special meeting the following: (i) the number of public shares purchased outside of the redemption offer, along with the purchase price(s) for such public shares; (ii) the purpose of any such purchases; (iii) the impact, if any, of the purchases on the likelihood that the Charter Amendment Proposal and the Trust Amendment Proposal will be approved; (iv) the identities of the securityholders who sold to our initial stockholders, officers, directors or their affiliates (if not purchased on the open market) or the nature of the securityholders (e.g., five percent security holders) who sold such public shares; and (v) the number of public shares for which we have received redemption requests pursuant to its redemption offer. |

||

|

The purpose of such share purchases and other transactions would be to increase the likelihood of otherwise limiting the number of public shares electing to redeem. If such transactions are effected, the consequence could be to cause the Extension to be effectuated in circumstances where such effectuation could not otherwise occur. Consistent with SEC guidance, purchases of shares by the persons described above would not be permitted to be voted for a proposed initial business combination and could decrease the chances that a proposed initial business combination would be approved. In addition, if such purchases are made, the public “float” of our securities and the number of beneficial holders of our securities may be reduced, possibly making it difficult to maintain or obtain the quotation, listing or trading of our securities on a national securities exchange. |

5

|

We hereby represent that any of our securities purchased by our initial stockholders, officers, directors or their affiliates in situations in which the tender offer rules restrictions on purchases would apply would not be voted in favor of approving the Charter Amendment Proposal or the Trust Amendment Proposal. |

||

|

Q. What vote is required to approve each of the proposals? |

A. The affirmative vote of at least sixty-five percent (65%) of all then outstanding shares of our common stock entitled to vote thereon at the special meeting is required to approve each of the Charter Amendment Proposal and the Trust Amendment Proposal, a plurality of the shares of our common stock entitled to vote thereon and voted in person (by virtual attendance) or by proxy at the special meeting is required for the re-election of the directors in the Director Election Proposal, and the affirmative vote of at least a majority of the shares of our common stock entitled to vote thereon and voted in person (by virtual attendance) or by proxy at the special meeting is required to approve each of the Auditor Ratification Proposal and the Adjournment Proposal. A quorum of stockholders is necessary to hold a valid meeting. Holders of a majority in voting power of our issued and outstanding shares of common stock entitled to vote at the special meeting, present in person (by virtual attendance) or by proxy, constitute a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the special meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the special meeting may adjourn the special meeting to another date. As of the record date for the special meeting, 17,968,751 shares of our common stock would be required to achieve a quorum. If you do not vote, your action will have the effect of a vote against the Charter Amendment Proposal and the Trust Amendment Proposal and, if a valid quorum is otherwise established, no effect on the Director Election Proposal, the Auditor Ratification Proposal or the Adjournment Proposal. Likewise, abstentions, broker non-votes and withhold votes (as applicable) will have the effect of a vote against the Charter Amendment Proposal and the Trust Amendment Proposal and no effect on the Director Election Proposal, the Auditor Ratification Proposal or the Adjournment Proposal. |

|

|

Q. What if I don’t want to vote for the Charter Amendment Proposal or the Trust Amendment Proposal? |

A. If you do not want the Charter Amendment Proposal or the Trust Amendment Proposal to be approved, you must vote against, abstain or not vote on such proposals. If the Charter Amendment Proposal and the Trust Amendment Proposal are approved, and the Extension is implemented, the Withdrawal Amount will be withdrawn from the trust account and paid to the redeeming public stockholders. |

|

|

Q. Will you seek any further extensions to consummate an initial business combination? |

A. Other than the Extension until the Extended Date as described in this proxy statement, we do not currently anticipate seeking any further extensions to consummate an initial business combination. We have provided that all public stockholders, including those who vote for the Charter Amendment Proposal and the Trust Amendment Proposal, abstain, do not vote, or do not instruct their broker or bank how to vote, may make the Election to redeem all or a portion of their public shares into their pro rata portion of the trust account and, if the Extension is implemented, should receive the funds soon after the completion of the Charter Amendment and Trust Amendment. Those public stockholders who do not make the Election to redeem all of their public shares in connection with the Extension will retain redemption rights with respect to an initial business combination we may propose, or, if we do not consummate an initial business combination by the Extended Date, such holders will be entitled to their pro rata portion of the trust account on such date. |

6

|

Q. What happens if the Charter Amendment Proposal and the Trust Amendment Proposal are not approved? |

A. If the Charter Amendment Proposal and the Trust Amendment Proposal are not approved and we do not consummate an initial business combination by January 28, 2023, as contemplated by the IPO Prospectus and in accordance with our charter, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest earned on the funds held in the trust account and not previously released to us (less taxes payable and up to $100,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidating distributions, if any), and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and the Board, liquidate and dissolve, subject, in each case, to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. There will be no redemption rights or liquidating distributions with respect to our warrants, which will expire worthless if we do not complete an initial business combination by January 28, 2023. Our initial stockholders, officers and directors have agreed to waive their redemption rights in connection with the consummation of an initial business combination or the approval of certain amendments to our charter, including with respect to the Charter Amendment Proposal, and to waive their rights to liquidating distributions from the trust account with respect to the founder shares if we do not complete an initial business combination by January 28, 2023. As a consequence of such waivers, any liquidating distribution that is made will be only with respect to the public shares; however, such persons would be entitled to liquidating distributions from the trust account with respect to any public shares they hold. We will pay the costs of liquidation from up to $100,000 of interest from the trust account and our remaining assets held outside of the trust account. |

|

|

Q. If the Charter Amendment Proposal and the Trust Amendment Proposal are approved, what happens next? |

A. We will continue our efforts to execute a definitive agreement for an initial business combination with one or more of our prospective targets. If we execute such an agreement, we will seek to complete the potential initial business combination, which will involve: • completing proxy materials; • establishing a meeting date and record date for considering such potential initial business combination and distributing proxy materials to stockholders; • holding a special meeting to consider such potential initial business combination; and • if approved, consummating such potential initial business combination. We are seeking approval of the Charter Amendment Proposal and the Trust Amendment Proposal because we believe we will not be able to complete all of the above listed tasks prior to January 28, 2023. Upon approval of the Charter Amendment Proposal and the Trust Amendment Proposal by holders of at least sixty-five percent (65%) of all then outstanding shares of our common stock entitled to vote thereon at the special meeting, if the Board determines to implement the Extension, we will (i) file the Charter Amendment with the Secretary of State of the State of Delaware and (ii) enter into the Trust Amendment with Continental Stock Transfer & Trust Company. We will remain a reporting company under the Exchange Act, and our units, Class A common stock and warrants will remain publicly traded. We will then continue to attempt to complete an initial business combination by the Extended Date. |

7

|

If the Charter Amendment Proposal and the Trust Amendment Proposal are approved, the removal of the Withdrawal Amount from the trust account will reduce our net asset value and the amount remaining in the trust account and increase the percentage interest of our common stock held by our initial stockholders, directors, officers and their affiliates through their beneficial ownership of the founder shares. If the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented but we do not consummate an initial business combination by the Extended Date, or if the Extension is not implemented and we do not consummate an initial business combination by January 28, 2023, we will (i) cease all operations except for the purpose of winding up, (ii) as promptly as reasonably possible but not more than ten business days thereafter, redeem the public shares, at a per-share price, payable in cash, equal to the aggregate amount then on deposit in the trust account, including interest earned on the funds held in the trust account and not previously released to us (less taxes payable and up to $100,000 of interest to pay dissolution expenses), divided by the number of then outstanding public shares, which redemption will completely extinguish public stockholders’ rights as stockholders (including the right to receive further liquidating distributions, if any), and (iii) as promptly as reasonably possible following such redemption, subject to the approval of our remaining stockholders and the Board, liquidate and dissolve, subject, in each case, to our obligations under Delaware law to provide for claims of creditors and the requirements of other applicable law. There will be no redemption rights or liquidating distributions with respect to our warrants, which will expire worthless if we do not complete an initial business combination by January 28, 2023 or, if the Charter Amendment Proposal and the Trust Amendment Proposal are and the Extension is implemented, the Extended Date. |

||

|

Our initial stockholders, officers and directors have agreed to waive their redemption rights in connection with the consummation of an initial business combination or the approval of certain amendments to our charter, including with respect to the Charter Amendment Proposal, and to waive their rights to liquidating distributions from the trust account with respect to the founder shares if we do not complete an initial business combination by January 28, 2023 or, if the Charter Amendment Proposal and the Trust Amendment Proposal are approved and the Extension is implemented, the Extended Date. As a consequence of such waivers, any liquidating distribution that is made will be only with respect to the public shares; however, such persons would be entitled to liquidating distributions from the trust account with respect to any public shares they hold. We will pay the costs of liquidation from up to $100,000 of interest from the trust account and our remaining assets held outside of the trust account. Approval of the Charter Amendment Proposal and the Trust Amendment Proposal is a condition to the implementation of the Extension. As contemplated by the IPO Prospectus and in accordance with our charter, we will not proceed with the Extension if the number of redemptions of public shares causes us to have less than $5,000,001 of net tangible assets following approval of the Charter Amendment Proposal and the Trust Amendment Proposal. Notwithstanding stockholder approval of the Charter Amendment Proposal and the Trust Amendment Proposal, the Board will retain the right to abandon and not implement the Extension at any time without any further action by our stockholders. |

8

|

Q. Would I still be able to exercise my redemption rights if I vote against a potential initial business combination? |

A. Unless you make the Election to redeem all of your public shares in connection with the Extension, you will still be able to vote on an initial business combination when it is submitted to stockholders (provided that you are a stockholder on the record date for a meeting to consider such business combination). If you disagree with such business combination, you will retain your right to redeem your public shares upon consummation of such business combination in connection with the stockholder vote to approve such business combination, subject to any limitations set forth in our charter. |

|

|

Q. How do I attend the special meeting? |

A. The special meeting is to be held at 12:00 p.m. Eastern Time on December 7, 2022 as a virtual meeting. If you are a stockholder of record, you will be able to attend, vote your shares and submit questions during the special meeting via a live webcast available at https://www.cstproxy.com/dandzmedia/2022. You will need your control number for access. If you do not have your control number, contact Continental Stock Transfer & Trust Company, our transfer agent, by telephone at 917-262-2373 or by e-mail at [email protected]. If you hold your shares through a bank, broker or other intermediary, you will need to contact such bank, broker or other intermediary and obtain a legal proxy. Once you have your legal proxy, e-mail a copy of your legal proxy to our transfer agent at least five business days prior to the special meeting date to have a control number generated. You may also attend special the meeting telephonically by dialing 1-800-450-7155(toll-free within the United States and Canada) or +1 857-999-9155(outside of the United States and Canada, standard rates apply). The passcode for telephone access is 5295734#, but please note that you will not be able to vote or ask questions if you choose to attend the special meeting telephonically. |

|

|

Q. How do I change my vote? |

A. If you have submitted a proxy to vote your shares and wish to change your vote, you may do so by delivering a later-dated, signed proxy card to Morrow Sodali LLC, our proxy solicitor, prior to the date of the special meeting or by voting in person (by virtual attendance) at the special meeting. Virtual attendance at the special meeting alone will not change your vote. You also may revoke your proxy by sending a notice of revocation to: Morrow Sodali LLC, 333 Ludlow Street, 5th Floor, South Tower, Stamford, CT 06902. |

|

|

Q. How are votes counted? |

A. Votes will be counted by the inspector of election appointed for the special meeting, who will separately count “FOR”, “AGAINST” and “WITHHOLD” votes, abstentions and broker non-votes. The affirmative vote of at least sixty-five percent (65%) of all then outstanding shares of our common stock entitled to vote thereon at the special meeting is required to approve each of the Charter Amendment Proposal and the Trust Amendment Proposal, a plurality of the shares of our common stock entitled to vote thereon and voted in person (by virtual attendance) or by proxy at the special meeting is required for the re-election of the directors in the Director Election Proposal, and the affirmative vote of at least a majority of the shares of our common stock entitled to vote thereon and voted in person (by virtual attendance) or by proxy at the special meeting is required to approve each of the Auditor Ratification Proposal and the Adjournment Proposal. A quorum of stockholders is necessary to hold a valid meeting. Holders of a majority in voting power of our issued and outstanding shares of common stock entitled to vote at the special meeting, present in person (by virtual attendance) or by proxy, constitute a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the special meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the special meeting may adjourn the special meeting to another date. As of the record date for the special meeting, 17,968,751 shares of our common stock would be required to achieve a quorum. |

9

|

If you do not vote, your action will have the effect of a vote against the Charter Amendment Proposal and the Trust Amendment Proposal and, if a valid quorum is otherwise established, no effect on the Director Election Proposal, the Auditor Ratification Proposal or the Adjournment Proposal. Likewise, abstentions, broker non-votes and withhold votes (as applicable) will have the effect of a vote against the Charter Amendment Proposal and the Trust Amendment Proposal and no effect on the Director Election Proposal, the Auditor Ratification Proposal or the Adjournment Proposal. If your shares are held by your broker as your nominee (that is, in “street name”), you may need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items, but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of various national securities exchanges applicable to member brokerage firms. These rules provide that for routine matters your broker has the discretion to vote shares held in street name in the absence of your voting instructions. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes. |

||

|

Q. If my shares are held in “street name,” will my broker automatically vote them for me? |

A. With respect to the Charter Amendment Proposal, the Trust Amendment Proposal, the Director Election Proposal and the Adjournment Proposal, your broker can vote your shares only if you provide them with instructions on how to vote. You should instruct your broker to vote your shares. Your broker can tell you how to provide these instructions. Your broker may automatically vote your shares with respect to the Auditor Ratification Proposal. |

|

|

Q. What is a quorum requirement? |

A. A quorum of stockholders is necessary to hold a valid meeting. Holders of a majority in voting power of our issued and outstanding shares of common stock entitled to vote at the special meeting, present in person (by virtual attendance) or by proxy, constitute a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the special meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the special meeting may adjourn the special meeting to another date. As of the record date for the special meeting, 17,968,751 shares of our common stock would be required to achieve a quorum. |

|

|

Q. Who can vote at the special meeting? |

A. Only holders of record of our common stock at the close of business on November 3, 2022, the record date, are entitled to have their vote counted at the special meeting and any adjournments or postponements thereof. On the record date, 35,937,500 shares of our common stock, consisting of 28,750,000 shares of Class A common stock and 7,187,500 shares of Class B common stock, were outstanding and entitled to vote. Stockholder of Record: Shares Registered in Your Name. If on the record date your shares were registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person (by virtual attendance) at the special meeting or vote by proxy. |

10

|

Beneficial Owner: Shares Registered in the Name of a Broker or Bank. If on the record date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the special meeting online. However, since you are not the stockholder of record, you may not vote your shares in person (by virtual attendance) at the special meeting unless you request and obtain a valid proxy from your broker or other agent. Stockholders are urged to vote their proxies by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage paid envelope, or to direct their brokers or other agents on how to vote the shares in their accounts, as applicable. |

||

|

Q. How does the Board recommend I vote? |

A. After careful consideration of all relevant factors, the Board has determined that the Charter Amendment Proposal, the Trust Amendment Proposal, the Director Election Proposal, the Auditor Ratification Proposal and, if presented, the Adjournment Proposal, are advisable and unanimously recommends that you vote or give instruction to vote “FOR” such proposals. |

|

|

Q. What interests do our initial stockholders, directors and officers have in the approval of the proposals? |

A. Our initial stockholders, directors and officers have interests in the proposals that may be different from, or in addition to, your interests as a stockholder. These interests include ownership of the founder shares and warrants that may become exercisable in the future and the possibility of future compensatory arrangements. See the section of this proxy statement entitled “Proposal No. 1 — The Charter Amendment Proposal — Interests of Our Initial Stockholders, Directors and Officers.” |

|

|