Form DEF 14A Cactus, Inc. For: May 20

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| Cactus, Inc. | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Cactus, Inc.

920 Memorial City Way, Suite 300

Houston, Texas 77024

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

To the stockholders of Cactus, Inc.:

Notice is hereby given that the 2020 Annual Meeting of Stockholders (the "Annual Meeting") of Cactus, Inc. (the "Company") will be held at the Company's corporate headquarters at 920 Memorial City Way, Suite 300, Houston, Texas 77024, on May 20, 2020 at 9:00 a.m. Central Time. The Annual Meeting is being held for the following purposes:

- 1.

- To

elect to the Company's Board of Directors the three Class III directors set forth in the accompanying Proxy Statement, each of whom will hold office until

the 2023 Annual Meeting of Stockholders and until his successor is elected and qualified or until his earlier death, resignation or removal;

- 2.

- To

ratify the appointment of PricewaterhouseCoopers LLP as the Company's independent registered public accounting firm for the fiscal year ending

December 31, 2020; and

- 3.

- To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Holders of record of the Company's Class A common stock (NYSE: WHD) and Class B common stock (together, the "Common Stock") at the close of business on April 13, 2020, the record date for the Annual Meeting, are entitled to receive notice of and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting.

The proxy materials relating to the Annual Meeting are first being mailed on or about April 17, 2020.

If your shares are held in street name, you will receive instructions from the holder of record detailing how to direct the voting of your Common Stock. Internet voting will also be offered to stockholders holding shares of Common Stock in street name.

We urge you to review the enclosed proxy materials carefully and to submit your proxy or voting instructions as soon as possible so that your Common Stock will be represented at the Annual Meeting.

| By Order of the Board of Directors, | ||

David Isaac General Counsel, Vice President of Administration and Secretary |

Houston,

Texas

April 14, 2020

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 20, 2020

The Notice of 2020 Annual Meeting of Stockholders, the Proxy Statement and the Company's Annual Report on Form 10-K for the year ended December 31, 2019 are available at https://www.astproxyportal.com/ast/22025.

i

Cactus, Inc.

920 Memorial City Way, Suite 300

Houston, Texas 77024

PROXY STATEMENT

2020 ANNUAL MEETING

OF STOCKHOLDERS

The Board of Directors (the "Board") of Cactus, Inc. (the "Company") requests your proxy for the Company's 2020 Annual Meeting of Stockholders (the "Annual Meeting") that will be held on May 20, 2020 at 9:00 a.m. Central Time at the Company's corporate headquarters, at 920 Memorial City Way, Suite 300, Houston, Texas 77024. By granting the proxy, you authorize the persons named on the proxy to represent you and vote your shares at the Annual Meeting. Those persons will also be authorized to vote your shares to adjourn the Annual Meeting from time to time and to vote your shares at any adjournments or postponements of the Annual Meeting. We are soliciting proxies from holders of our Class A common stock, par value $0.01 per share (our "Class A Common Stock"), and our Class B common stock, par value $0.01 per share (our "Class B Common Stock"). We refer to our Class A Common Stock and our Class B Common Stock together as our "Common Stock."

We are a holding company that was incorporated as a Delaware corporation on February 17, 2017 for the purpose of facilitating the Company's initial public offering (our "IPO") and to become the sole managing member of Cactus Wellhead, LLC ("Cactus LLC"). Our IPO closed on February 12, 2018. In this proxy statement (this "Proxy Statement"), the terms "the Company," "we," "us," "our" and similar terms when used in the present tense, prospectively or for historical periods since February 12, 2018, refer to the Company and its subsidiaries, including Cactus LLC, and for historical periods prior to February 12, 2018, refer to Cactus LLC and its subsidiaries, unless the context indicates otherwise.

Purpose of the Annual Meeting

The purpose of the Annual Meeting is for our stockholders to consider and act upon the proposals described in this Proxy Statement and any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof.

Proposals to be Voted Upon at the Annual Meeting

At the Annual Meeting, our stockholders will be asked to consider and vote upon the following two proposals:

- •

- Proposal ONE: To elect to the Board the three Class III directors set forth in this Proxy Statement, each of whom will hold office until

our 2023 Annual Meeting of Stockholders and until his successor is elected and qualified or until his earlier death, resignation or removal; and

- •

- Proposal TWO: To ratify the appointment of PricewaterhouseCoopers LLP ("PwC") as our independent registered public accounting firm for the fiscal year ending December 31, 2020.

In addition, any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof will be considered. Management is presently aware of no other business to come before the Annual Meeting.

Recommendation of the Board

The Board recommends that you vote FOR the election to the Board of each of the director nominees ("Proposal ONE"); and FOR the ratification of the appointment of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2020 ("Proposal TWO").

1

Voting at the Annual Meeting

Our Class A Common Stock and Class B Common Stock are the only classes of securities that entitle holders to vote generally at meetings of the Company's stockholders. Holders of Class A Common Stock and Class B Common Stock will vote together as a single class on all matters presented at the Annual Meeting. Each share of Common Stock outstanding at the close of business on April 13, 2020 (the "Record Date") entitles the holder to one vote at the Annual Meeting.

If on the Record Date you hold shares of our Common Stock that are represented by stock certificates or registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote in person at the Annual Meeting or by proxy. Whether or not you plan to attend the Annual Meeting in person, you may vote by Internet by following the instructions on the enclosed proxy card or by signing and returning by mail the enclosed proxy card. Whether or not you plan to attend the Annual Meeting, we urge you to vote by way of the Internet or by filling out and returning the proxy card. If you submit a proxy but do not give voting instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of the Board stated in this Proxy Statement.

Any proxy given pursuant to this solicitation may be revoked by the person submitting such proxy at any time before its use by (1) delivering a written notice of revocation addressed to Cactus, Inc., Attn: General Counsel, 920 Memorial City Way, Suite 300, Houston, Texas 77024, (2) duly executing a proxy bearing a later date, (3) voting again by Internet or (4) attending the Annual Meeting and voting in person. Your last vote or proxy will be the vote or proxy that is counted. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you vote or specifically so request.

If on the Record Date you hold shares of our Common Stock in an account with a brokerage firm, bank or other nominee, then you are a beneficial owner of the shares and hold such shares in "street name," and these proxy materials will be forwarded to you by that organization. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in their account, and the nominee has enclosed or provided voting instructions for you to use in directing it how to vote your shares. The nominee that holds your shares, however, is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you bring to the Annual Meeting a letter from your broker, bank or other nominee confirming your beneficial ownership of the shares. Whether or not you plan to attend the Annual Meeting, we urge you to vote by following the voting instructions provided to you to ensure that your vote is counted.

If you are a beneficial owner and do not vote, and your broker, bank or other nominee does not have discretionary power to vote your shares, your shares may constitute "broker non-votes." Shares that constitute broker non-votes will be counted for the purpose of establishing a quorum at the Annual Meeting. Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting. Stockholders may receive more than one set of proxy materials and multiple proxy cards or voting instruction cards. For example, stockholders who hold shares in more than one brokerage account may receive separate sets of proxy materials for each brokerage account in which shares are held. Stockholders of record whose shares are registered in more than one name will receive more than one set of proxy materials. You should vote in accordance with all sets of proxy materials you receive relating to our Annual Meeting to ensure that all of your shares are counted.

Quorum Requirement for the Annual Meeting

The presence at the Annual Meeting, whether in person or by valid proxy, of the persons holding a majority of shares of Common Stock outstanding on the Record Date will constitute a quorum,

2

permitting us to conduct our business at the Annual Meeting. On the Record Date, there were 47,397,824 shares of Class A Common Stock and 27,957,699 shares of Class B Common Stock outstanding, held by one and five stockholders of record, respectively. Abstentions (i.e., if you or your broker marks "ABSTAIN" on a proxy) and broker non-votes will be considered to be shares present at the Annual Meeting for purposes of establishing a quorum. Broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal and generally occur because the broker (1) does not receive voting instructions from the beneficial owner and (2) lacks discretionary authority to vote the shares. Brokers and other nominees have discretionary authority to vote on the ratification of our independent registered public accounting firm for clients who have not provided voting instructions. However, without voting instructions from their clients, they cannot vote on "non-routine" proposals, including the election of directors.

Required Votes

Election of Directors. Each director will be elected by the affirmative vote of the plurality of the votes validly cast on the election of directors at the Annual Meeting. Abstentions and broker non-votes are not taken into account in determining the outcome of the election of directors.

Ratification of our Independent Registered Public Accounting Firm. Approval of the proposal to ratify the Audit Committee's appointment of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2020 requires the affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy and entitled to be voted on the matter at the annual meeting. Broker non-votes are not taken into account in determining the outcome of this proposal, and abstentions will have the effect of a vote against this proposal.

Default Voting

A proxy that is properly completed and submitted will be voted at the Annual Meeting in accordance with the instructions on the proxy. If you properly complete and submit a proxy, but do not indicate any contrary voting instructions, your shares will be voted "FOR" the election to the Board of each of the director nominees listed in Proposal ONE and "FOR" Proposal TWO.

If any other business properly comes before the stockholders for a vote at the meeting, your shares will be voted in accordance with the discretion of the holders of the proxy.

Other Matters to Be Voted on at the Annual Meeting

The Board is not currently aware of any business to be acted on at the Annual Meeting other than that which is described in the Notice of 2020 Annual Meeting of Stockholders and this Proxy Statement. If, however, other matters are properly brought to a vote at the Annual Meeting, the persons designated as proxies will have discretion to vote or to act on these matters according to their best judgment. In the event there is a proposal to adjourn or postpone the Annual Meeting, the persons designated as proxies will have discretion to vote on that proposal.

3

PROPOSAL ONE:

ELECTION OF DIRECTORS

The Board has nominated the following individuals for election as Class III directors of the Company, to serve for three-year terms beginning at the Annual Meeting and expiring at our 2023 Annual Meeting of Stockholders and until either they are re-elected, or their successors are elected and qualified or until their earlier death, resignation or removal:

Scott

Bender

Bruce Rothstein

Gary Rosenthal

Scott Bender, Bruce Rothstein and Gary Rosenthal are currently serving as directors of the Company. If Scott Bender, Bruce Rothstein and Gary Rosenthal are re-elected to the Board, the size of the Board will remain at eight members. Biographical information for each director nominee is contained in the "Directors and Executive Officers" section below.

The Board has no reason to believe that its director nominees will be unable or unwilling to serve if elected. If a director nominee becomes unable or unwilling to accept nomination or election, either the number of the Company's directors will be reduced or the persons acting under the proxy will vote for the election of a substitute nominee that the Board recommends.

Vote Required

The election of directors in this Proposal ONE requires the affirmative vote of a plurality of the votes validly cast on the election of directors. Neither abstentions nor broker non-votes will have any effect on the outcome of the election of directors.

Recommendation

The Board unanimously recommends that stockholders vote FOR the election to the Board of each of the director nominees.

4

DIRECTORS AND EXECUTIVE OFFICERS

The directors and executive officers of the Company are:

Name

|

Age | Title | |||

|---|---|---|---|---|---|

| Bruce Rothstein | 67 | Chairman of the Board of Directors | |||

| Scott Bender | 66 | President, Chief Executive Officer and Director | |||

| Joel Bender | 60 | Senior Vice President, Chief Operating Officer and Director | |||

| Melissa Law | 46 | Director, Audit Committee member and Compensation Committee member | |||

| Michael McGovern | 68 | Director, Compensation Committee Chairman and Audit Committee member | |||

| John (Andy) O'Donnell | 71 | Director, Audit Committee member, Compensation Committee member and Nominating and Governance Committee member | |||

| Gary Rosenthal | 70 | Director, Nominating and Governance Committee Chairman and Compensation Committee member | |||

| Alan Semple | 60 | Director, Audit Committee Chairman and Nominating and Governance Committee member | |||

| Steven Bender | 37 | Vice President of Operations | |||

| Stephen Tadlock | 41 | Vice President, Chief Financial Officer and Treasurer | |||

| David Isaac | 59 | General Counsel, Vice President of Administration and Secretary | |||

The Company's directors are divided into three classes serving staggered three-year terms. Each year, the directors of one class stand for re-election as their terms of office expire. Messrs. McGovern and O'Donnell are designated as Class I directors, and their terms of office expire in 2021. Joel Bender, Alan Semple and Ms. Law are designated as Class II directors, and their terms of office will expire in 2022. Messrs. Scott Bender, Rothstein and Rosenthal are designated as Class III directors, and, assuming the stockholders reelect them to the Board as set forth above in "Proposal One: Election of Directors," their terms of office expire in 2023.

Set forth below is biographical information about each of our directors and executive officers.

Our Directors

Bruce Rothstein—Chairman of the Board. Bruce Rothstein has been our Chairman of the Board since 2011. Mr. Rothstein has been a Member of Cadent Energy Partners LLC ("Cadent Energy Partners"), a natural resources private equity firm that invests in companies in the North American energy industry, since co-founding Cadent Energy Partners in 2003. From November 2005 until November 2017, Mr. Rothstein served on the board of directors of Array Holdings, Inc., formerly a portfolio company of Cadent Energy Partners. From May 2006 to August 2016, he served on the board of directors of Vedco Holdings, Inc., formerly a Cadent Energy Partners portfolio company. From December 2007 to April 2016, Mr. Rothstein served on the board of directors of Torqued-Up Energy Services, Inc., formerly a Cadent Energy Partners portfolio company. From December 2008 until February 2012, Mr. Rothstein served as a director of Ardent Holdings, LLC, a portfolio company of Cadent Energy Partners. Mr. Rothstein graduated from Cornell University in 1974 with a Bachelor of Arts in Mathematics and New York University's Stern School of Business in 1985 with a Master of Business Administration. We believe that Mr. Rothstein's extensive financial and energy investment experience brings valuable skills to our Board and qualifies him to serve on our Board.

Scott Bender—President, Chief Executive Officer and Director. Scott Bender has been our President and Chief Executive Officer and one of our directors since 2011, when he and Mr. Joel Bender founded Cactus LLC. Prior to founding Cactus LLC, Mr. Bender was President of Wood Group

5

Pressure Control from 2000 to 2011. He began his career in 1977 as President of Cactus Wellhead Equipment, a subsidiary of Cactus Pipe that was eventually sold to Cooper Cameron Corporation in 1996. Mr. Bender graduated from Princeton University in 1975 with a Bachelor of Science in Engineering and the University of Texas at Austin in 1977 with a Master of Business Administration. We believe that Mr. Bender's significant experience in the oil field services industry and his founding and leading of Cactus LLC bring important skills to our Board and qualifies him to serve on our Board. Mr. Bender is the father of Steven Bender, our Vice President of Operations, and the brother of Joel Bender, our Senior Vice President and Chief Operating Officer and one of our directors.

Joel Bender—Senior Vice President, Chief Operating Officer and Director. Joel Bender has been our Senior Vice President and Chief Operating Officer and one of our directors since 2011, when he and Mr. Scott Bender founded Cactus LLC. Prior to founding Cactus LLC, Mr. Bender was Senior Vice President of Wood Group Pressure Control from 2000 to 2011. He began his career in 1984 as Vice President of Cactus Wellhead Equipment, a subsidiary of Cactus Pipe that was eventually sold to Cooper Cameron Corporation in 1996. Mr. Bender graduated from Washington University in 1981 with a Bachelor of Science in Engineering and the University of Houston in 1985 with a Master of Business Administration. We believe that Mr. Bender's significant experience in the oil field services industry and his founding and leading of Cactus LLC bring important skills to our Board and qualifies him to serve on our Board. Mr. Bender is the brother of Scott Bender, our President and Chief Executive Officer and one of our directors.

Melissa Law—Director. Ms. Law was appointed by the Board to fill the newly created Board seat in January 2020. Ms. Law is an accomplished executive leader with significant experience in the oilfield services industry and more recent experience in the food & beverage ingredient industry. Ms. Law currently serves as the President of Global Operations for Tate & Lyle since September 2017. As a member of the Executive Leadership team, Ms. Law is responsible for leading the EHS, Quality, and Sustainability Programs, the end to end supply chain and logistics function as well as the global manufacturing and engineering organizations. Prior to joining Tate and Lyle, Ms. Law held various roles of increasing responsibility at Baker Hughes Incorporated from 1997 to 2017. At Baker Hughes, Ms. Law had full profit and loss responsibility for Baker Hughes' Global Specialty Chemical Business from 2014-2017 as well as Baker Hughes' Australasia geo-market from 2013-2104. Prior to those roles, Ms. Law held various other senior leadership roles in technology, manufacturing and operations at Baker Hughes. Ms. Law is a graduate of the University of Houston from where she holds a Master of Science in Environmental Chemistry. We believe Ms. Law's qualifications to serve on the board include her 20 years of experience in the energy industry and her multi-industry executive leadership and management experiences.

Michael McGovern—Director. Mr. McGovern has served as one of our directors since 2011. He currently serves as our Compensation Committee chairman. He served as Executive Advisor to Cadent Energy Partners from January 2008 to December 2014 and has served as Chairman and Chief Executive Officer of Sherwood Energy, LLC, a Cadent Energy Partners portfolio company, since March 2009. Mr. McGovern has also served as a director of GeoMet, Inc., an independent energy company, from September 2010 until December 2018. He also currently serves on the board of directors of Nuverra Environmental Solutions, Inc. since August 2017 and Ion Geophysical (NYSE: IO) since June 2019. Mr. McGovern served on the board of directors of Quicksilver Resources Inc. from March 2013 until August 2016 and of Probe Holdings, Inc. from February 2014 until July 2017. He has also served on the board of directors of Fibrant (f/k/a DSM Caprolactam) from May 2016 to June 2019. Mr. McGovern also served on the board of directors of Sonneborn, Inc. from 2012 to December 2016. Mr. McGovern graduated from the Centenary College of Louisiana in 1973 with a Bachelor of Science in Business. We believe Mr. McGovern's qualifications to serve on our Board include his 40 years of experience in the energy industry and his extensive executive leadership and management experience, including as Chief Executive Officer of several public companies.

6

John (Andy) O'Donnell—Director. Mr. O'Donnell has served as one of our directors since January 2015. Mr. O'Donnell served as an officer of Baker Hughes Incorporated from 1998 until his retirement in January 2014. In his most recent role he served as Vice President, Office of the CEO of Baker Hughes Incorporated. Prior to that he held multiple leadership positions within Baker Hughes Incorporated, including President of Western Hemisphere, President of BJ Services, President of Baker Petrolite and President of Baker Hughes Drilling Fluids. He was responsible for the process segment, which was divested in early 2004. Mr. O'Donnell also managed Project Renaissance, an enterprise-wide cost savings effort, completed in 2001. Prior to that he served as Vice President Manufacturing for Baker Oil Tools and Plant Manager for Hughes Tool Company. He joined Hughes Tool Company in 1975 starting his career as a systems analyst. Mr. O'Donnell served as an officer and aviator in the U.S. Marine Corps and holds a B.S. degree from the University of California, Davis. He is a member of the board of directors of CIRCOR International, Inc., where he serves on the Compensation Committee and the Nominating and Governance Committee. We believe Mr. O'Donnell's qualifications to serve on our Board include his years of experience in the energy industry and his extensive executive leadership and management experience, including as an officer of Baker Hughes Incorporated from 1998 until 2014.

Gary Rosenthal—Director. Mr. Rosenthal has served as one of our directors since January 2018. He currently serves as our Nominating and Governance Committee chairman. Mr. Rosenthal has been a partner in The Sterling Group, L.P., a private equity firm based in Houston, Texas, since January 2005. Since September 2019, Mr. Rosenthal has served as Chairman of the Board of Highline Aftermarket LLC with whom he has served as a director since April 2016. Additionally, he has served as Chairman of the Board of Polychem Investments LLC since March 2019 and from October 2013 until February 2018, he was Chairman of the Board of Safe Fleet Investments LLC. All three of these companies are Sterling Group portfolio companies. Mr. Rosenthal served, from 2001 until 2018, as a director and chairman of the Compensation Committee of Oil States International, Inc. Mr. Rosenthal served as Chairman of the Board of Hydrochem Holdings, Inc. from May 2003 until December 2004. From August 1998 to April 2001, he served as Chief Executive Officer of AXIA Incorporated, a diversified manufacturing company. From 1991 to 1994, Mr. Rosenthal served as Executive Chairman and then after its initial public offering, as Chairman and Chief Executive Officer of Wheatley—TXT Corp., a manufacturer of pumps and valves for the oil field. Mr. Rosenthal holds J.D. and A.B. degrees from Harvard University. We believe that Mr. Rosenthal's qualifications to serve on our Board include his extensive executive leadership experience and his experience in the energy sector.

Alan Semple—Director. Mr. Semple has served as one of our directors since April 2017. He currently serves as our Audit Committee chairman. Since December 2015, Mr. Semple has served as a member of the board of directors and the Audit Committee of Teekay Corporation, a leading provider of international crude oil and gas marine transportation services, and as the Audit Committee Chairman since March 2018. Since May 2019, Mr. Semple has served as a member of the Board of Directors and Chairman of the Audit Committee of Teekay GP, LLC, the general partner of Teekay LNG Partners, LP. He was formerly Director and Chief Financial Officer at John Wood Group PLC (Wood Group), a provider of engineering, production support and maintenance management services to the oil and gas and power generation industries, a role he held from 2000 until his retirement in May 2015. Prior to this, he held a number of senior finance roles in Wood Group since 1996. Mr. Semple graduated from the University of Strathclyde (Glasgow, Scotland) in 1979 with a Bachelor of Arts degree in Business Administration and is a member of the Institute of Chartered Accountants of Scotland. We believe that Mr. Semple's 30 years of finance experience, primarily in the energy industry, makes him qualified to serve on our Board.

7

Our Executive Officers

Steven Bender—Vice President of Operations. Steven Bender has been our Vice President of Operations since 2011. From 2005 to 2011, Mr. Bender served as Rental Business Manager of Wood Group Pressure Control. Mr. Bender graduated from Rice University in 2005 with a Bachelor of Arts in English and Hispanic Studies and the University of Texas at Austin in 2010 with a Master of Business Administration. Mr. Bender is the son of Scott Bender, our President and Chief Executive Officer and one of our directors.

Stephen Tadlock—Vice President, Chief Financial Officer and Treasurer. Mr. Tadlock has been our Vice President, Chief Financial Officer and Treasurer since March 2019. He was our Vice President and Chief Administrative Officer from March 2018 until March 2019 and joined our company in June 2017 as our Vice President of Corporate Services. Mr. Tadlock previously worked at Cadent Energy Partners LLC from 2007 to 2017, where he most recently served as a Partner from 2014 to 2017. While at Cadent Energy Partners LLC, Mr. Tadlock managed investments across all energy sectors and worked with Cactus LLC since its founding in 2011 as a board observer. Prior to joining Cadent Energy Partners LLC, Mr. Tadlock was a consultant to Cairn Capital, a London based asset management firm. Previously he was associate to the CEO of SoundView, a publicly traded investment bank in Old Greenwich, Connecticut. Mr. Tadlock began his career as an analyst at UBS Investment Bank in New York, New York. Mr. Tadlock served as a director and chairman of Polyflow Holdings, LLC until his resignation in 2018. Mr. Tadlock also served as a director of Composite Energy Services, LLC and Energy Services Holdings, LLC until his respective resignations in 2017. Mr. Tadlock graduated from Princeton University in 2001 with a Bachelor of Science in Engineering in Operations Research and from the Wharton School at the University of Pennsylvania in 2007 with a Master of Business in Administration.

David Isaac—General Counsel, Vice President of Administration and Secretary. David Isaac has been our General Counsel, Vice President of Administration and Secretary since 2018. Mr. Isaac previously worked at Rockwater Energy Solutions, Inc. from 2011 to 2017 where he most recently served as Senior Vice President of Human Resources and General Counsel. While at Rockwater, Mr. Isaac led the Human Resources, HSE, and Legal functions of the organization. Prior to joining Rockwater, Mr. Isaac was the Vice President of Human Resources and General Counsel of Inmar, Inc. a private business-process outsourcing and reverse logistics firm in Winston-Salem, North Carolina. Previously he served as Senior Vice President of Human Resources at Wachovia Bank, also in Winston-Salem, North Carolina. Before Wachovia, Mr. Isaac performed legal and human resources functions for Baker Hughes, Inc. and its subsidiaries in Houston, Texas. Mr. Isaac graduated from The College of William & Mary in 1983 with a Bachelor of Arts in Economics and from The Ohio State University in 1986 with a Juris Doctor.

8

The Compensation Committee reviewed and discussed the Compensation Discussion and Analysis required by Item 402 of Regulation S-K promulgated by the Securities and Exchange Commission (the "SEC") with management of the Company, and, based on such review and discussions, the Compensation Committee recommended to the Board that such Compensation Discussion and Analysis be included in the Company's Proxy Statement for the 2020 Annual Meeting.

| Compensation Committee of the Board of Directors | ||

Michael McGovern, Chairman Melissa Law, Member John (Andy) O'Donnell, Member Gary Rosenthal, Member |

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion and Analysis ("CD&A") provides information about the compensation objectives and policies for our principal executive officer, our principal financial officer and our three other most highly compensated executive officers (collectively our named executive officers or "NEOs") during the last completed fiscal year and is intended to place in perspective the information contained in the executive compensation tables that follow this discussion. Throughout this discussion, the following individuals are referred to as our NEOs and are included in the Summary Compensation Table which follows:

Name

|

Position | |

|---|---|---|

| Scott Bender | President, Chief Executive Officer and Director | |

| Joel Bender | Senior Vice President, Chief Operating Officer and Director | |

| Stephen Tadlock | Vice President, Chief Financial Officer and Treasurer(1) | |

| Brian Small | Senior Finance Director and Former Chief Financial Officer(2) | |

| Steven Bender | Vice President of Operations | |

| David Isaac | General Counsel, Vice President of Administration and Secretary |

- (1)

- On

March 15, 2019, Mr. Tadlock became our Vice President, Chief Financial Officer and Treasurer, completing the management transition announced in

November 2018. Prior to that time, Mr. Tadlock served as our Vice President and Chief Administrative Officer.

- (2)

- Mr. Small stepped down from the position of Chief Financial Officer on March 15, 2019 and transitioned to the role of Senior Finance Director.

Executive Compensation Philosophy and Objectives

The core principle of our executive compensation philosophy is to pay for performance that is aligned with our business strategy and drives growth in shareholder value over the short and long term. Accordingly, a significant portion of the compensation that we pay to our NEOs is in the form of variable, "at-risk" cash and equity incentives. The following compensation objectives are considered in setting the compensation components for our executive officers:

- •

- Attraction and retention: providing compensation opportunities that reflect competitive market practices so that we can attract and retain key executives responsible not only for our continued growth and profitability, but also for ensuring proper corporate governance while carrying out the goals and plans of the Company;

9

- •

- Paying for performance: linking a

significant portion of compensation to variable, "at-risk" incentive compensation with realized values dependent upon financial, operational, and stock price performance to ensure that compensation

earned by our NEOs reflects our performance; and

- •

- Shareholder alignment: providing a balance of short-term and long-term incentive opportunities with a majority of NEO compensation in the form of equity in order to ensure alignment of interests between our NEOs and our shareholders, and to promote an ownership culture among our executive officers.

Our compensation philosophy is supported by the following principal pay elements:

| |

|

Grounding Principles | ||||||

|---|---|---|---|---|---|---|---|---|

Element

|

Key Characteristic | Attraction & Retention |

Pay for Performance |

Shareholder Alignment |

||||

Base Salary |

• Annual fixed cash compensation |

|||||||

|

• Critical factor in attracting and retaining qualified talent |

X |

||||||

Short-term Incentives (STI) |

• Annual variable cash award |

|||||||

|

• Awards are tied to achievement of key financial and safety objectives |

X |

X |

X |

||||

Long-term Incentives (LTI) |

• Provided in the form of time-vested and (new for 2020) performance vested equity |

|||||||

|

• Promotes alignment with shareholders by tying a majority of NEO compensation to creation of long-term value and by encouraging NEOs to build meaningful equity ownership |

X |

X |

X |

||||

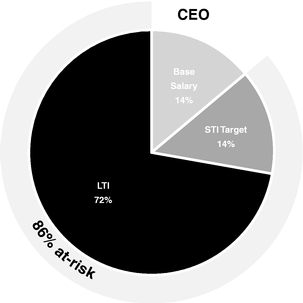

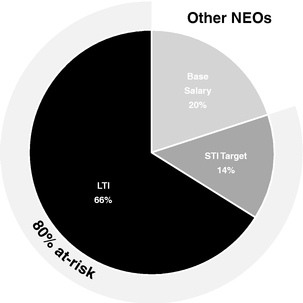

Target Pay Mix

As evidence of our emphasis on at-risk, incentive-based pay, the charts below show the mix of total direct compensation of our Chief Executive Officer and our other NEOs for 2019. These charts illustrate that a majority of NEO total direct compensation is at-risk (86% for our Chief Executive Officer and an average of 80% for our other NEOs). Starting in 2020, 50% of LTI value for our Chief Executive Officer will be provided in the form of performance-based long-term incentives. In addition,

10

50% of LTI value for our Chief Operating Officer and 33% of LTI value for our other NEOs will be provided in the form of performance-based long-term incentives.

|

|

Compensation Program Governance

We have worked extensively and deliberately to develop a thoughtful, fair, and effective compensation program for our NEOs that helps us to deliver long-term sustainable growth to our stockholders. The following chart highlights several features of our compensation practices that are intended to meet our objectives:

| |

What We Do | What We Don't Do |

||||

|---|---|---|---|---|---|---|

| X | Significant majority of pay at risk | × | No excessive perquisites | |||

| X | 50% of CEO LTI value performance-based* | × | No guaranteed bonuses | |||

| X | Balance of short- and long-term incentives | × | No excise tax gross-ups | |||

| X | Clawback policy for all executive officers that applies to cash and equity incentives | × | Prohibition on hedging, pledging, and short sales by insiders | |||

| X | Share ownership guidelines for NEOs and directors | × | Prohibition on option repricing | |||

| X | Regularly evaluate risks of our compensation policy | |||||

| X | Independent compensation consultant | |||||

| X | One-year minimum vesting requirement for LTIP grants* | |||||

- *

- New for 2020

11

2019 Say on Pay and Say on Frequency

At our 2019 Annual Meeting, a plurality of our stockholders expressed their preference for an advisory vote on executive compensation occurring every three years, and we have implemented their recommendation.

At our 2019 Annual Meeting, we also held our first advisory vote on compensation for our NEOs ("Say on Pay"). In that vote our stockholders expressed their support, with 94% of the shares of our Class A Common Stock and Class B Common Stock present or represented by proxy at the 2019 Annual Meeting voting in support our executive compensation policies and practices for our NEOs during 2018.

Our Compensation Committee values the opinions of our shareholders regarding NEO compensation. In reviewing our program, our Compensation Committee considered the results of last year's advisory vote on executive compensation and the support expressed by stockholders in their overall assessment of our programs. Our Compensation Committee elected to apply similar principles in determining the types and amounts of compensation to be paid to our NEOs for 2019.

How We Make Compensation Decisions

Role of the Compensation Committee

The Compensation Committee has the responsibility for reviewing and approving the compensation policies, programs, and plans for our senior officers (including our NEOs) and our non-employee directors. The Compensation Committee's responsibilities include administering our Management Incentive Plan ("MIP"), which provides for annual cash incentive opportunities, and our long-term incentive plan (the "LTIP"), which provides for the grant of equity-based awards. The Compensation Committee reviews the CD&A section of our annual proxy statement and produces the Compensation Committee Report with respect to our executive compensation disclosures for inclusion in the annual proxy statement. In addition, the Compensation Committee regularly reviews current best compensation and governance practices to ensure that our executive compensation program is consistent with recent developments and market practice. In overseeing the compensation of our directors and officers, our Compensation Committee considers various analyses and perspectives provided by its independent compensation consultant and by Company management. Subject in certain circumstances to Board approval, the Compensation Committee has the sole authority to make final decisions with respect to our executive compensation program, and the Compensation Committee is under no obligation to use the input of other parties. For more detailed information regarding the Compensation Committee, please refer to the Compensation Committee Charter, which may be accessed via our website at www.CactusWHD.com by selecting "Investors," "Corporate Governance" and then "Governance Documents."

Role of Independent Compensation Consultant

Pearl Meyer & Partners, LLC ("Pearl Meyer") serves as independent compensation consultant for, and reports directly to, the Compensation Committee. Representatives of Pearl Meyer attend Compensation Committee meetings as requested and communicate with the Compensation Committee informally between meetings as necessary. Pearl Meyer assists and advises the Compensation Committee on all aspects of our executive compensation program. Services provided by the independent compensation consultant include:

- •

- reviewing the compensation and stock performance peer groups and recommending changes, as necessary;

- •

- reviewing executive compensation based on an analysis of market-based compensation data;

12

- •

- analyzing the effectiveness of our executive compensation program and recommending changes, as necessary; and

- •

- evaluating how well our executive compensation adheres to program objectives.

To facilitate the delivery of these services to the Compensation Committee, Pearl Meyer interfaces with our management, primarily with our General Counsel and VP of Administration. In 2019, Pearl Meyer did not provide any services to the Company other than those requested by the Compensation Committee in Pearl Meyer's role as the Committee's independent advisor.

Other than those services requested by the Compensation Committee, Pearl Meyer did not have any business or personal relationships with members of the Compensation Committee or executives of the Company, did not own any of the Company's Common Stock and maintained policies and procedures designed to avoid such conflicts of interest. As such, the Compensation Committee determined the engagement of Pearl Meyer in 2019 did not create any conflicts of interest.

Role of Executive Officers in Compensation Decisions

With respect to the compensation of the NEOs other than our Chief Executive Officer, the Compensation Committee considers the recommendations of our Chief Executive Officer and each NEO's individual performance. In light of our NEOs' integral role in establishing and executing the Company's overall operational and financial objectives, the Compensation Committee requests that our NEOs provide the initial recommendations on the appropriate goals for the qualitative and quantitative performance metrics used in our short-term cash incentive program. However, the Committee is under no obligation to follow those recommendations, and only Compensation Committee members are allowed to vote on decisions regarding NEO compensation.

The Compensation Committee may invite any NEO to attend Compensation Committee meetings to report on the Company's progress with respect to the annual quantitative and qualitative performance metrics, but any such officer is excluded from any decisions or discussions regarding his individual compensation. In addition, the Board has granted limited authority to Scott Bender, our Chief Executive Officer, to make awards under the LTIP to certain individuals who are not executive officers.

Role of Competitive Benchmarking

In the exercise of its duties, the Compensation Committee periodically evaluates the Company's executive compensation against that of comparable companies. The Compensation Committee does not set specific percentile goals against competitive data for purposes of determining executive compensation levels. In establishing individual compensation opportunities, the Committee considers this competitive data as well as a variety of other factors including individual performance, competencies, scope of responsibility, and internal equity.

The Compensation Committee considers the competitive market to consist of the oilfield services industry broadly as well as other similarly sized companies in related industries who could potentially compete with us for executive talent. The Committee periodically reviews data for a selected peer group approved by the Compensation Committee (the "peer group") as well as for broader general industry companies of comparable size and business complexity (compensation survey data), as

13

provided to the Committee by their independent advisor. For the 2019 compensation analysis, the Company used the following peer group companies:

| 2019 Compensation Peer Group | ||

|---|---|---|

| Archrock, Inc. | NCS Multistage Holdings, Inc. | |

| Core Laboratories, NV | Newpark Resources, Inc. | |

| Dril-Quip, Inc. | Oil States International, Inc. | |

| Forum Energy Technologies | Pioneer Energy Services Corp. | |

| Frank's International, NV | RPC, Inc. | |

| Helix Energy Solutions Group, Inc. | USA Compression Partners, LP | |

In selecting comparison companies, the Compensation Committee considered various factors including each company's participation in the energy services sector as well as market capitalization, annual revenues, business complexity, profitability, returns on equity and assets, the number of divisions/segments, countries in which they operate and total number of employees. The selected peer companies are reviewed from time to time to ensure their continued appropriateness for comparative purposes.

Elements of Compensation

Base Salary

Base salary is the guaranteed element of an executive's direct compensation and is intended to provide a foundation for a competitive overall compensation opportunity for the executive. The Compensation Committee reviews each executive's base salary annually. Executive officer base salaries are determined after an evaluation that considers the executive's prior experience and breadth of knowledge and which also considers compensation data from peer group companies and other similarly sized companies in businesses comparable to the Company's, the Company's and the executive's performance, and any significant changes in the executive's responsibilities. The Compensation Committee considers all these factors together plus overall industry conditions.

Salaries for our Chief Executive Officer and our Chief Operating Officer in 2018 and 2019 remained unchanged from 2017. Effective February 17, 2019, after discussions regarding competitive market data with Pearl Meyer, the Board approved a salary of $335,000 for Stephen Tadlock, who completed his transition to Chief Financial Officer on March 15, 2019.

NEO

|

2018 Base Salary |

2019 Base Salary |

Percent Increase During 2019 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Scott Bender |

$ | 300,000 | $ | 300,000 | 0 | % | ||||

Joel Bender |

300,000 | 300,000 | 0 | % | ||||||

Stephen Tadlock |

250,000 | 335,000 | 34 | % | ||||||

Brian Small |

(1 | ) | 250,000 | — | ||||||

Steven Bender |

(1 | ) | 300,000 | — | ||||||

David Isaac |

(1 | ) | 300,000 | — | ||||||

- (1)

- Cactus was an Emerging Growth Company from our IPO until the end of 2019, and as such, in our 2019 proxy statement, we only reported information regarding the compensation of our Chief Executive Officer and our two next most highly compensated executive officers. Accordingly, Brian Small, Steven Bender and David Isaac were not NEOs for any years prior to 2019.

In March 2020, the Compensation Committee of the Board, after discussions with Pearl Meyer, approved base salaries for certain of the Company's executive officers, including certain of the

14

Company's NEOs. The approved 2020 base salaries, were unchanged from 2019. In late March 2020, in light of the challenging economic environment, management elected to implement base salary reductions as follows: Messrs. Scott Bender, Joel Bender, Steven Bender and Brian Small have each agreed to 50% salary cuts from the amounts shown in the table and Messrs. Tadlock and Isaac have agreed to 25% salary cuts.

Short Term Incentives

Our NEOs are eligible for an annual incentive bonus which is designed to focus executives on execution of our annual plan, which is linked to our long-term strategy. Execution against our annual corporate plan is important to drive long-term shareholder value by improving financial strength, managing costs and investing in projects that will deliver future value. We employ financial and safety performance metrics to further specific objectives of our strategy, such as EBITDA and total recordable incident rate.

On February 15, 2019, after discussions with Pearl Meyer, the Board approved a performance-based bonus plan for 2019, the 2019 Management Incentive Plan (the "2019 MIP"), pursuant to which all eligible Company employees, including NEOs, would be eligible to receive a cash bonus upon the achievement of certain financial performance and safety metrics.

Under the 2019 MIP, executive officers, including NEOs, were eligible to receive base cash bonus payments equal to a certain specified percentage of their annual base salaries ("Target Bonus") in the event that the Company met the specified performance targets. The approved 2019 Target Bonus for each of the Company's NEOs is set forth in the table below as a percentage of such executive's 2019 base salary:

NEO

|

2019 Target Bonus Opportunity (percent of Salary) |

|||

|---|---|---|---|---|

Scott Bender |

100 | % | ||

Joel Bender |

100 | % | ||

Stephen Tadlock |

50 | % | ||

Brian Small |

40 | % | ||

Steven Bender |

75 | % | ||

David Isaac |

50 | % | ||

Target Bonus Opportunity

For NEOs, the MIP has two performance parameters on which the bonus is calculated. The first parameter is Earnings Before Interest, Taxes, Depreciation and Amortization, excluding exceptional items, as defined by the Board (EBITDA), which is weighted as 90% of the bonus opportunity. Participants begin to earn a bonus payout when EBITDA performance reaches Threshold EBITDA which is set at 80% of Target EBITDA. Participants are eligible for a Stretch bonus opportunity if actual EBITDA exceeds Target EBITDA. The maximum Stretch bonus payment is achieved when EBITDA performance reaches 120% of Target EBITDA. The maximum Stretch payment is 40% of the full, non-stretch bonus payment. The calculation of the EBITDA portion of the bonus payout is linear between Threshold and Target and between Target and Stretch. The second parameter is Total Recordable Incident Rate ("TRIR") which is defined as the number of employees per 100 full-time employees that have been involved in a recordable injury or illness in the pertinent period. TRIR is weighted as 10% of the bonus opportunity. Participants begin to earn a bonus payout when TRIR performance reaches Threshold TRIR of 1.85. A full bonus payout on the TRIR parameter is achieved when safety performance reaches Target TRIR of 1.50 or lower. The calculation of the TRIR portion of the bonus payout is linear between Threshold and Target. Depending upon Company performance,

15

actual payouts under the 2019 MIP may be between 0% and 140% of the Target Bonus opportunity for each NEO.

| |

EBITDA | Payout | |||||

|---|---|---|---|---|---|---|---|

| |

($ in millions) |

|

|||||

Threshold |

$ | 169.60 | 0 | % | |||

Target |

212.00 | 100 | % | ||||

Stretch |

254.40 | 140 | % | ||||

| |

TRIR | Payout | |||||

|---|---|---|---|---|---|---|---|

Threshold |

1.85 | 0 | % | ||||

Target |

1.50 | 100 | % | ||||

2019 Award Determination

Performance under the MIP is assessed relative to pre-established goals approved by the Committee near the beginning of the fiscal year. For 2019, the Compensation Committee approved performance objectives under the 2019 MIP after considering a combination of factors including alignment with the Company's business strategy, 2019 budget, investor expectations, recommendations from management, and the Committee's assessment of management's ability to impact outcomes.

In 2019, the actual EBITDA performance was $229.0 million. which exceeded Target EBITDA. Based on this result, in addition to earning a full target bonus on the EBITDA component, executives also earned 40.1% of their 40% stretch opportunity, an additional 16.2% of the full, non-stretch bonus calculation. The 2019 TRIR performance was 1.64 which is between Threshold and Target performance. Based on this performance NEOs were eligible for 59.2% payout on the TRIR parameter. In total, NEOs will receive a payout for the 2019 MIP of approximately 111.3% of Target. The table below summarizes the metrics and performance standards approved for the 2019 MIP, and management's level of achievement under the plan:

| |

Threshold | Target | Stretch | Actual | % of Target |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(in millions) |

|||||||||||||||

EBITDA(1) |

$ | 169.6 | $ | 212.0 | $ | 254.4 | $ | 229.0 | 108 | % | ||||||

- (1)

- Earnings before interest, taxes, depreciation and amortization excluding any exceptional items as defined by the Board.

| |

Threshold | Target | Actual | % of Target |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

TRIR(1) |

1.85 | 1.50 | 1.64 | 59.2 | % | ||||||||

- (1)

- Total Recordable Incident Rate (TRIR) is the number of employees per 100 full-time employees that have been involved in a recordable injury or illness in the pertinent period.

The following table shows the calculation of the non-stretch bonus payment:

Parameter

|

Percent of Target |

Weighting | Percent Earned |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

EBITDA |

100 | % | 90 | % | 90.0 | % | ||||

TRIR |

59.2 | % | 10 | % | 5.9 | % | ||||

Total |

95.9 | % | ||||||||

16

The table below shows the aggregate bonus calculation including both the non-stretch bonus payment and the stretch bonus:

Non-Stretch Bonus Percent |

95.9 | % | ||

Stretch Bonus Component (16.2% of Non-Stretch Bonus) |

15.4 | % | ||

Total Bonus Percentage |

111.3 | % |

Long-Term Incentives

In order to incentivize individuals providing services to us or our affiliates, in 2018 the Board adopted a long-term incentive plan (the "LTIP"). The LTIP provides for the grant, from time to time, at the discretion of the Board or a committee thereof, of stock options, stock appreciation rights, restricted stock, restricted stock units, stock awards, dividend equivalents, other stock-based awards, cash awards, substitute awards and performance awards. The Board has delegated to the Compensation Committee the authority to administer the LTIP, including the power to determine the eligible individuals to whom awards will be granted, the number and type of awards to be granted and the terms and conditions of awards. In addition, the Board has granted limited authority to Scott Bender, our Chief Executive Officer, to make awards under the LTIP to certain individuals who are not executive officers.

The primary purpose of awards under our LTIP is to enforce direct alignment between the long-term interests of our NEOs and those of our shareholders through the use of multi-year vesting and realized value of equity incentives that is contingent upon our stock price performance. Awards of equity under the LTIP also promote long-term share ownership by our NEOs, a goal which is further supported by the adoption of share ownership guidelines in 2019.

2019 LTIP Awards.

On March 11, 2019, our NEOs received grants of restricted stock units ("RSUs") under our LTIP in the following amounts:

NEO

|

Total RSUs Granted |

Total Grant Date Value |

|||||

|---|---|---|---|---|---|---|---|

Scott Bender |

40,139 | $ | 1,499,994 | ||||

Joel Bender |

40,139 | 1,499,994 | |||||

Stephen Tadlock |

40,218 | 1,502,947 | |||||

Steven Bender |

16,055 | 599,975 | |||||

David Isaac |

12,041 | 449,972 | |||||

The restricted stock unit awards will vest in three equal annual installments beginning on the first anniversary of the grant date.

2020 LTIP Awards

Beginning in 2020, our Compensation Committee approved the addition of performance share units (PSUs) to our long-term incentive program. Under the 2020 PSU program, NEOs may earn shares based upon the company's Return on Capital Employed (ROCE) performance over the next two

17

or three years. The table below summarizes some of the key design characteristics of our 2020 PSU awards:

NEO

|

PSUs as a Percent of 2020 LTI Value |

Performance Metric | Performance Period | Maximum Payout as Percent of Target Units |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

CEO & COO |

50 | % | Return on Capital Employed | 3 years | 200 | % | |||||

Other NEOs |

33 | % | Return on Capital Employed | 2 years & 3 years | 200 | % | |||||

Retirement, Health and Welfare Benefits

The Company offers retirement, health and welfare benefits to substantially all of its U.S. employees including executive officers. Executive officers are eligible for these benefits on the same basis as other employees. Health and welfare benefits we offer to our employees include: medical, vision and dental coverage, life insurance, accidental death and dismemberment, short and long-term disability insurance, flexible spending accounts and employee assistance.

The Company offers a defined contribution 401(k) retirement plan to substantially all of its U.S. employees, including the NEOs. Participants may contribute from 1% to 85% of their base pay and cash incentive compensation (subject to U.S. Internal Revenue Service ("IRS") limitations), and the Company makes matching contributions under this plan on the first 7% of the participant's compensation (100% match of the first 3% employee contribution and 50% match on the next 4% employee contribution). Company matching contributions vest 20% per year on the first five anniversaries of the respective employee's hire date.

Perquisites

We provide Scott Bender, Joel Bender, Stephen Tadlock, Steven Bender and Brian Small with bi-weekly vehicle allowances. Additionally, Scott Bender receives a gasoline reimbursement.

Other Compensation Practices and Policies

Compensation Risk

Our compensation policies and practices are designed to provide rewards for short-term and long-term performance, both on an individual basis and at the entity level. In general, optimal financial and operational performance, particularly in a competitive business, requires some degree of risk-taking. Our compensation strategies are designed to encourage company growth and appropriate risk taking but not to encourage excessive risk taking. We also attempt to design the compensation program for our larger general employee population so that it does not inappropriately incentivize our employees to take unnecessary risks in their day to day activities. We recognize, however, that there are trade-offs and that it can be difficult in specific situations to maintain the appropriate balance. As such, we continue to evaluate our programs with a goal of preventing them from becoming materially imbalanced one way or the other.

Our compensation arrangements contain certain design elements that are intended to minimize the incentive for taking unwarranted risk to achieve short-term, unsustainable results. Those elements include a maximum amount that can be earned under our annual incentive cash compensation program.

We also provide compensation to our NEOs in the form of a reasonable base salary. We want our executives to be motivated to achieve Cactus's short-term and long-term goals, without sacrificing our financial and corporate integrity in trying to achieve those goals. While an executive's overall compensation should be strongly influenced by the achievement of specific financial and operational

18

targets, we also believe that a portion of an executive's compensation should be awarded in components that provide a degree of financial certainty.

In combination with our risk management practices, we do not believe that risks arising from our compensation policies and practices for our employees, including our NEOs, are reasonably likely to have a material adverse effect on us.

Clawback Policy

In June 2019, our Board adopted the Executive Compensation Clawback Policy (the "Clawback Policy"). In the event of a restatement of our financial statements (other than a restatement caused by a change in applicable accounting rules or interpretations), the result of which is that any performance-based compensation paid under an incentive compensation plan would have been a lower amount had it been calculated based on such restated results, the Compensation Committee may seek to recover for the benefit of the Company the after tax portion of the difference between the compensation actually paid to the executive and the corrected amount based on the restated financial results.

Stock Ownership Guidelines

As of December 13, 2019, the Committee has established stock ownership guidelines for our NEOs and non-employee directors. The approved guidelines are as follows:

Position

|

Required Level of Ownership | |

|---|---|---|

| Chief Executive Officer | 6 times base salary | |

| Other NEOs | 2 times base salary | |

| Non-Employee Directors | 3 times annual cash retainer for Board service |

Stock ownership levels must be achieved by each NEO or non-employee director within five years of becoming subject to the guidelines, or within five years of any material change to the guideline level of ownership. As of February 28, 2020, all of our NEOs and non-employee directors have met or exceeded the ownership expectations under the guidelines other than Mr. Isaac and Ms. Law.

Employment, Severance, and Change-in-Control Agreements

Employment Agreements

In February 2018, in connection with our IPO, we amended and restated our employment agreements with Messrs. Scott and Joel Bender (as amended and restated, each, an "Employment Agreement"). Each Employment Agreement reflects the executive's base salary of $300,000 and has an initial three-year term that will extend automatically for one-year periods thereafter unless advance written notice by either party is provided. Under the Employment Agreements, each of Messrs. Scott and Joel Bender are entitled to receive severance compensation if his employment is terminated under certain conditions, such as a termination by the executive officer for "good reason" or by us without "cause," each as defined in the agreements and further described below under "—Potential Payments upon Termination or Change of Control." In addition, the agreements provide for:

- •

- specified minimum base salaries;

- •

- participation in all of our employee benefit plans to the extent the executive is eligible thereunder;

- •

- termination benefits, including, in specified circumstances, severance payments; and

- •

- an annual bonus of up to 100% of annual base salary in the good faith discretion of the Board if the executive satisfies budgetary and performance goals, as determined annually by the Board.

19

On February 21, 2019, we amended the Employment Agreements to provide that Scott Bender and Joel Bender shall be eligible to receive an additional annual bonus of up to 40% of the regular annual bonus actually paid, determined in the good faith discretion of the Board if the executive satisfies additional budgetary and performance goals, as determined annually by the Board.

We have not entered into separate severance agreements with Messrs. Scott and Joel Bender and instead rely on the terms of each executive's Employment Agreement to dictate the terms of any severance arrangements. The Employment Agreements do not provide for accelerated or enhanced cash payments or health and welfare benefits upon a change in control but do provide for salary continuation payments and subsidized health and welfare benefits upon the termination of the executive's employment for "good reason" or without "cause." Mr. Tadlock will be eligible to receive severance payments should a merger or sale transaction result in Mr. Tadlock being terminated by the new entity. In addition, Mr. Isaac will be eligible to receive severance payments should he be subject to a Qualifying Termination prior to the third anniversary of his commencement date. Severance payments that could become payable to Messrs. Scott and Joel Bender, Mr. Tadlock and Mr. Isaac pursuant to these arrangements have been described in more detail below under "—Potential Payments upon Termination or Change of Control—Employment Agreements."

Non-Compete Agreements

In connection with our IPO, on February 12, 2018, Cactus LLC entered into amended and restated noncompetition agreements (each, a "Noncompetition Agreement") with each of Scott Bender and Joel Bender. Each of the Noncompetition Agreements provide that, for a period of one year following termination of his employment, Scott Bender and Joel Bender will not (i) compete against us in connection with our business, (ii) solicit or induce any of our employees to leave his or her employment with us or hire any of our employees or (iii) solicit or entice customers who were our customers within the one-year period immediately prior to his date of termination to cease doing business with us or to begin doing business with our competitors. Pursuant to his employment arrangement with the Company, Mr. Isaac is subject to the same restrictions.

20

Summary Compensation Table

The following table sets forth information regarding the compensation awarded to, earned by or paid to our NEOs during the year ended December 31, 2019.

Name and Principal Position

|

Year | Salary ($) |

Bonus ($) |

Non Equity Incentive Plan Compensation ($)(1) |

Stock Awards ($)(2) |

All Other Compensation ($)(3) |

Total ($) |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Scott Bender, |

2019 | 300,000 | — | 334,835 | 1,499,994 | 29,102 | 2,163,931 | |||||||||||||||

(President, Chief Executive Officer |

2018 | 300,000 | — | 300,000 | 1,000,008 | 31,135 | 1,631,143 | |||||||||||||||

and Director)(4) |

2017 | 260,096 | — | 300,000 | — | 24,726 | 584,822 | |||||||||||||||

Joel Bender, |

2019 |

300,000 |

— |

334,835 |

1,499,994 |

30,120 |

2,164,949 |

|||||||||||||||

(Senior Vice President, Chief |

2018 | 300,000 | — | 300,000 | 1,000,008 | 30,070 | 1,630,078 | |||||||||||||||

Operating Officer and Director)(4) |

2017 | 260,096 | — | 300,000 | — | 14,386 | 574,482 | |||||||||||||||

Stephen Tadlock, |

2019 |

321,923 |

— |

180,971 |

1,502,947 |

24,773 |

2,030,614 |

|||||||||||||||

(Vice President, Chief Financial |

2018 | 250,000 | — | 120,298 | 1,875,015 | 23,780 | 2,269,093 | |||||||||||||||

Officer and Treasurer)(5) |

||||||||||||||||||||||

Brian Small, |

2019 |

250,000 |

— |

111,611 |

— |

27,620 |

389,231 |

|||||||||||||||

(Senior Finance Director and |

||||||||||||||||||||||

Former Chief Financial Officer)(5) |

||||||||||||||||||||||

Steven Bender, |

2019 |

296,154 |

— |

248,489 |

599,975 |

25,789 |

1,170,407 |

|||||||||||||||

(Vice President of Operations)(5) |

||||||||||||||||||||||

David Isaac, |

2019 |

296,154 |

— |

165,659 |

449,972 |

14,260 |

926,045 |

|||||||||||||||

(General Counsel, Vice President |

||||||||||||||||||||||

of Administration and |

||||||||||||||||||||||

Secretary)(5) |

||||||||||||||||||||||

- (1)

- Amounts

of "Non-Equity Incentive Plan Compensation" paid to each applicable NEO were made pursuant to the Company's short-term incentive program. For a description

of this plan please see "Compensation Discussion and Analysis—Elements of Compensation—Short-Term Incentives."

- (2)

- The amounts reported in this column represent the aggregate grant date fair value of restricted stock unit awards granted to each NEO and computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 ("FASB ASC Topic 718"). The grant date fair value is determined by the average price of the trading high and trading low of our Class A common stock on the effective date of the grant. For additional information about restricted stock unit awards granted during 2018, see "Outstanding Equity Awards at 2019 Fiscal Year-End" below. For more information about our LTIP, see "Compensation Discussion and Analysis—Elements of Compensation—Long-Term Incentives."

21

- (3)

- Amounts reflected within the "All Other Compensation" column are comprised of the following amounts:

Name

|

Year | Employer Contributions to 401(k) Plan ($) |

Vehicle Allowance ($) |

Gas Reimbursement ($) |

Total ($) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Scott Bender |

2019 | 14,375 | 14,400 | 327 | 29,102 | |||||||||||

|

2018 | 15,670 | 14,400 | 1,065 | 31,135 | |||||||||||

|

2017 | 13,545 | 10,800 | 381 | 24,726 | |||||||||||

Joel Bender |

2019 | 15,720 | 14,400 | — | 30,120 | |||||||||||

|

2018 | 15,670 | 14,400 | — | 30,070 | |||||||||||

|

2017 | 3,586 | 10,800 | — | 14,386 | |||||||||||

Stephen Tadlock |

2019 | 10,373 | 14,400 | — | 24,773 | |||||||||||

|

2018 | 9,380 | 14,400 | — | 23,780 | |||||||||||

Brian Small |

2019 | 13,220 | 14,400 | — | 27,620 | |||||||||||

Steven Bender |

2019 | 11,389 | 14,400 | — | 25,789 | |||||||||||

David Isaac |

2019 | 14,260 | — | — | 14,260 | |||||||||||

- (4)

- Although

Messrs. Scott and Joel Bender each serve on the Board, they are not compensated for their services as directors.

- (5)

- Mr. Tadlock was not an NEO for any years prior to 2018. Brian Small, Steven Bender and David Isaac were not NEOs for any years prior to 2019.

Grants of Plan Based Awards

The following table provides information about equity and non-equity awards granted to our NEOs in 2019, including the following: (1) the grant date; (2) the estimated possible payouts under the non-equity incentive plan, which is discussed in "Compensation Discussion and Analysis—Elements of Compensation—Short-term Incentives" and "—Long-term Incentives," included herein; (3) the number of restricted stock awards pursuant to the Company's LTIP; and (4) the fair value of each equity award.

| |

|

Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | All Other Stock Awards: Number of Shares of Stock or Units (#)(2) |

|

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

Grant Date Fair Value of Stock Awards ($)(3) |

|||||||||||||||||

Name

|

Grant Date |

Threshold ($) |

Target ($) |

Maximum ($) |

|||||||||||||||

Scott Bender |

0 | 300,000 | 420,000 | ||||||||||||||||

|

3/11/2019 | — | — | — | 40,139 | 1,499,994 | |||||||||||||

Joel Bender |

0 | 300,000 | 420,000 | ||||||||||||||||

|

3/11/2019 | — | — | — | 40,139 | 1,499,994 | |||||||||||||

Stephen Tadlock |

0 | 167,500 | 234,500 | ||||||||||||||||

|

3/11/2019 | — | — | — | 40,218 | 1,502,947 | |||||||||||||

Brian Small |

0 | 100,000 | 140,000 | ||||||||||||||||

Steven Bender |

0 | 225,000 | 315,000 | ||||||||||||||||

|

3/11/2019 | — | — | — | 16,055 | 599,975 | |||||||||||||

David Isaac |

0 | 150,000 | 210,000 | ||||||||||||||||

|

3/11/2019 | — | — | — | 12,041 | 449,972 | |||||||||||||

- (1)

- Amounts in these columns represent the threshold, target, and maximum estimated payouts for 2019 MIP bonus awards. The actual value of bonuses paid to our NEOs for 2019 under this

22

program can be found in the "Non-Equity Incentive Plan Compensation" column of the Summary Compensation Table above.

- (2)

- This

column includes the number of restricted stock units granted to our NEOs during 2019. See "Compensation Discussion and Analysis—Elements of

Compensation—Long-Term Incentives—2019 LTIP Awards" for more information regarding these restricted stock units.

- (3)

- The amounts shown in this column represent the grant date fair value of each equity award computed in accordance with FASB ASC Topic 718.

Outstanding Equity Awards at 2019 Fiscal Year-End

The following table reflects information regarding outstanding restricted stock units held by our NEOs as of December 31, 2019.

Name

|

Grant Date | Number of Shares or Units of Stock That Have Not Vested (#) |

Market Value of Shares or Units That Have Not Vested ($)(1) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Scott Bender |

2/7/2018 | 35,088 | (2) | 1,204,220 | ||||||

|

3/11/2019 | 40,139 | (3) | 1,377,571 | ||||||

| | | | | | | | | | | |

|

75,227 | 2,581,791 | ||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Joel Bender |

2/7/2018 | 35,088 | (2) | 1,204,220 | ||||||

|

3/11/2019 | 40,139 | (3) | 1,377,571 | ||||||

| | | | | | | | | | | |

|

75,227 | 2,581,791 | ||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Stephen Tadlock |

2/7/2018 | 65,790 | (2) | 2,257,913 | ||||||

|

3/11/2019 | 40,218 | (3) | 1,380,282 | ||||||

| | | | | | | | | | | |

|

106,008 | 3,638,195 | ||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Brian Small |

2/7/2018 | 2,632 | (2) | 90,330 | ||||||

| | | | | | | | | | | |

|

2,632 | 90,330 | ||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Steven Bender |

2/7/2018 | 21,052 | (2) | 722,505 | ||||||

|

3/11/2019 | 16,055 | (3) | 551,007 | ||||||

| | | | | | | | | | | |

|

37,107 | 1,273,512 | ||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

David Isaac |

10/24/2018 | 6,077 | (4) | 208,563 | ||||||

|

3/11/2019 | 12,041 | (3) | 413,247 | ||||||

| | | | | | | | | | | |

|

18,118 | 621,810 | ||||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- The

market value of these units is based on the closing price of the Company's Class A Common Stock on December 31, 2019 ($34.32), the last trading day

of the fiscal year.

- (2)

- Reflects

RSUs which vest over two years in equal annual installments on February 7, 2020 and February 7, 2021.

- (3)

- Reflects

RSUs which vest over three years in equal annual installments on March 11, 2020, March 11, 2021 and March 11, 2022.

- (4)

- Reflects RSUs which vest over two years in equal annual installments on October 24, 2020 and October 24, 2021.

23

Stock Vested

The following table provides information for our NEOs on the number of shares of Class A Common Stock acquired upon the vesting of RSU awards and the value realized in 2019, in each case before payment of any applicable withholding tax.

| |

Stock Awards(1) | ||||||