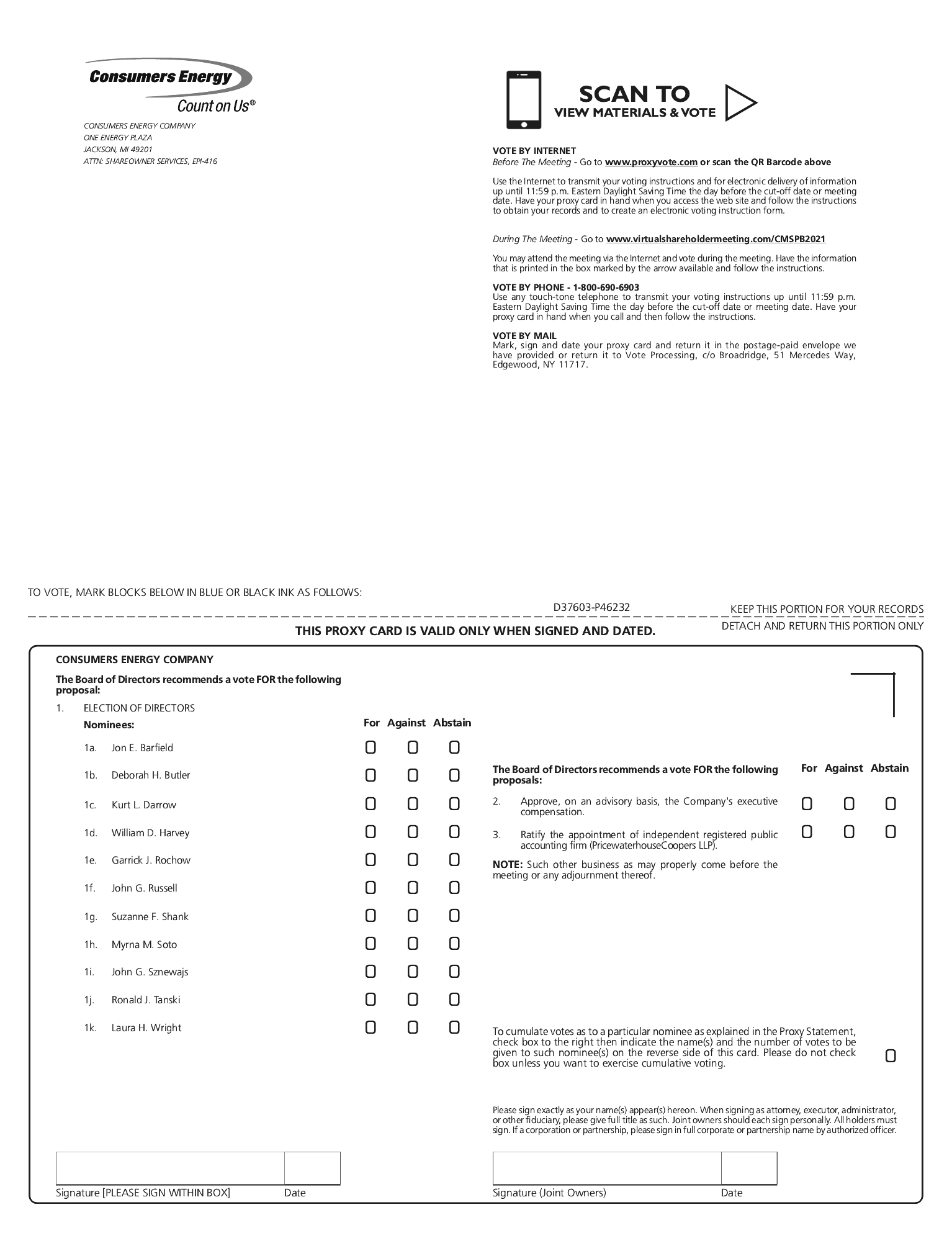

A director nomination that is not submitted for inclusion in the proxy statement but instead is sought to be presented directly at the Annual Meeting, must comply with the advance notice provisions in our Bylaws.

Any recommendation or nomination submitted by a shareholder regarding a director candidate must be submitted within the time frame provided in our Bylaws for director nominations and must include (a) a statement from the proposed nominee that he or she has consented to the submission of the recommendation or nomination and (b) such other information about the proposed nominee(s) and/or nominating shareholder(s) as is required by our Bylaws.

Written notice must be sent to the Corporate Secretary, One Energy Plaza, Jackson, Michigan 49201. You may access our Bylaws at www.cmsenergy.com/corporategovernance.

Director Candidate Qualifications

Director candidates are sought whose particular background, experiences and qualities meet the needs of the Board. The Board values high standards of integrity, business ethics and sound judgment, which add value, perspective and expertise to the Board’s deliberations. The Governance Committee assesses, on a regular basis, the qualifications needed by the Board in light of the Board’s current composition and recommends changes to the Board when appropriate; and determines from time to time other criteria for selection and retention of Board members. The Governance Committee has not established any specific, minimum qualifications that must be met by director candidates or identified any specific qualities or skills that the directors must possess. However, as stated in our Principles, the Board will include a broad spectrum of diverse business, political, academic, demographic and social interests. The Governance Committee takes a wide range of factors into account in evaluating the suitability of director candidates, including experience in business, leadership, regulated utility, sustainability and environment, risk management, customer experience, safety, governance, accounting, finance, legal, information technology, lean practices, and compensation and human resources, which will bring a diversity of thought, perspective, approach and opinion to the Board. The Governance Committee does not have a single method for identifying director candidates but will consider candidates suggested by a wide range of sources.

Rochow is standing for election by the shareholders for the first time at this Annual Meeting. Rochow was initially identified as a potential nominee by the Board and recommended for nomination by the Governance Committee. Rochow was elected to the Board effective December 1, 2020. Rochow is the only director nominee for the Annual Meeting who is standing for election by the shareholders for the first time.

The Board believes that diversity in tenure adds value, perspective and expertise to the Board’s deliberations, with longer-tenured directors bringing a deep understanding of the Corporation and shorter-tenured directors bringing a fresh perspective. Over the past eight years, the Board has added nine new directors. Director term limits, included in our Principles, state that Directors (other than the CEO) first elected after January 2017, may not serve on the Board for more than 15 years and Committee chairs (other than the Executive Committee) may not serve in such role for more than five years.

Directors Barfield, Butler, Darrow, Harvey, Russell, Shank, Soto, Sznewajs, Tanski, and Wright are “independent”, and Director Stephen E. Ewing who retired in 2020, was “independent” as determined by the Board, in accordance with the NYSE listing standards, applicable rules and regulations of the SEC, our more stringent Independence Standards, as set forth in our Principles,

Tweet

Tweet Share

Share