Form DEF 14A CIMPRESS plc For: Nov 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant þ | ||

Filed by a Party other than the Registrant o | ||

| Check the appropriate box: | |||||||||||

| o | Preliminary Proxy Statement | o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||||||

| þ | Definitive Proxy Statement | ||||||||||

| o | Definitive Additional Materials | ||||||||||

| o | Soliciting Material Pursuant to Section 240.14a-12 | ||||||||||

CIMPRESS PLC

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. | |||||||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||

| 1) | Title of each class of securities to which transaction applies: | |||||||

| 2) | Aggregate number of securities to which transaction applies: | |||||||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||

| 4) | Proposed maximum aggregate value of transaction: | |||||||

| 5) | Total fee paid: | |||||||

| o | Fee paid previously with preliminary materials: | |||||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||||||

| 1) | Amount previously paid: | |||||||

| 2) | Form, Schedule or Registration Statement No.: | |||||||

| 3) | Filing Party: | |||||||

| 4) | Date Filed: | |||||||

CIMPRESS PLC

Building D, Xerox Technology Park, Dublin Road

Dundalk, Co. Louth A91 H9N9

Ireland

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

Cimpress plc will hold its 2021 Annual General Meeting of Shareholders:

on Tuesday, November 30, 2021

at 6:30 p.m. Greenwich Mean Time

at the offices of Matheson

70 Sir John Rogerson's Quay

Dublin 2

Ireland

MATTERS TO BE ACTED UPON AT THE ANNUAL GENERAL MEETING:

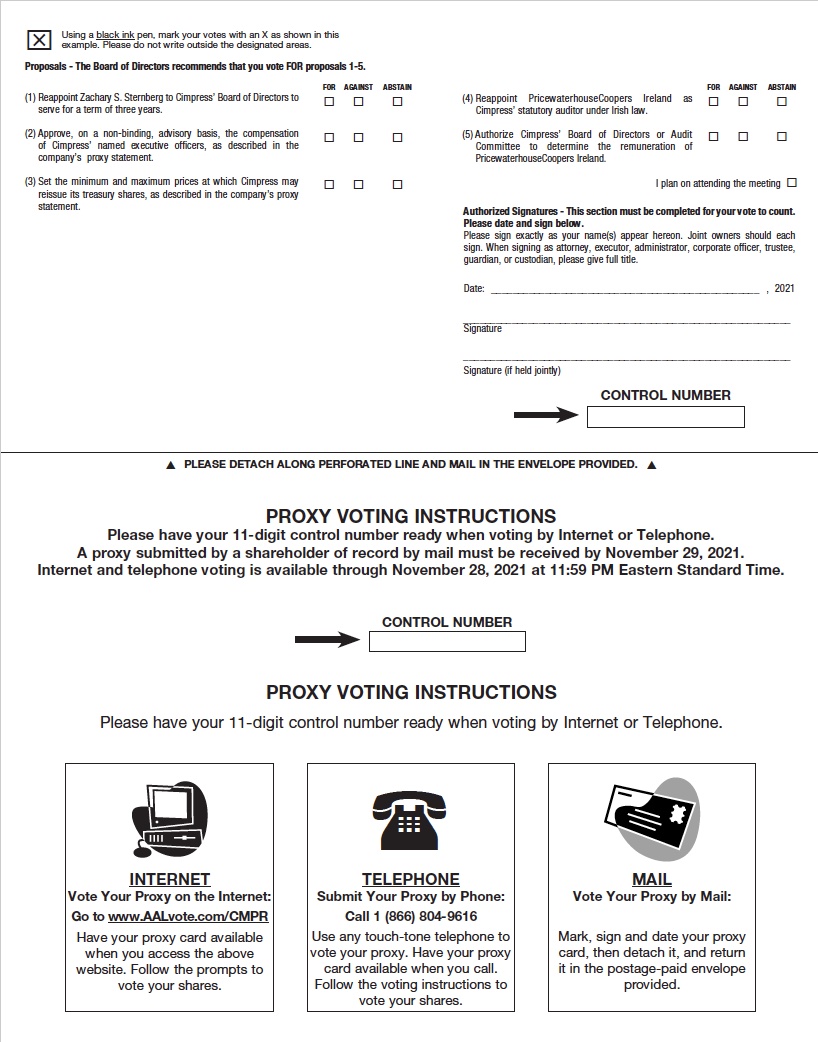

(1) Reappoint Zachary S. Sternberg to our Board of Directors to serve for a term of three years ending at the conclusion of our annual general meeting of shareholders in 2024

(2) Approve, on a non-binding, advisory basis, the compensation of our named executive officers, as described in this proxy statement

(3) Set the minimum price at which we may reissue our treasury shares at $0 and the maximum price at which we may reissue our treasury shares at an amount equal to 200% of the market price of our ordinary shares on the Nasdaq Global Select Market, or Nasdaq, or any other securities exchange where our shares are then traded, until May 30, 2023

(4) Reappoint PricewaterhouseCoopers Ireland as our statutory auditor under Irish law to hold office until the conclusion of our annual general meeting of shareholders in 2022

(5) Authorize our Board of Directors or Audit Committee to determine the remuneration of PricewaterhouseCoopers Ireland in its capacity as our statutory auditor under Irish law

(6) Transact other business, if any, that may properly come before the meeting or any adjournment of the meeting

Each Proposal other than Proposal 3 will be proposed as ordinary resolutions under Irish law, requiring, in each case, at least a simple majority of the votes cast to be in favor of the resolution for the resolution to pass. Proposal 3 will be proposed as a special resolution under Irish law, requiring at least 75% of the votes cast to be in favor of the resolution for the resolution to pass.

During the annual general meeting, management will present, for consideration by the shareholders, our statutory financial statements under Irish law for the fiscal year ended June 30, 2021 (including the reports of the directors and the Irish statutory auditor thereon) and a review of Cimpress' affairs.

Our Board of Directors has no knowledge of any other business to be transacted at the annual general meeting.

Shareholders of record at the close of business on October 14, 2021 are entitled to attend and vote at the annual general meeting, or to appoint one or more proxies to attend, speak, and vote instead of the shareholder at the annual general meeting. A proxy need not be a shareholder. To be valid, a proxy must be received no later than 4:00 p.m. Eastern Standard Time on November 29, 2021 at one of the address(es) and otherwise in the manner described in the attached proxy statement. Your vote is important regardless of the number of shares you own. Whether or not you expect to attend the meeting, please complete and promptly return the proxy card or voter instruction form in accordance with the instructions that we or your bank or brokerage firm have provided. Your prompt response will ensure that your shares are represented at the annual general meeting. You can change your vote and revoke your proxy by following the procedures described in this proxy statement.

Please read the attached proxy statement for additional information on the matters to be considered at the annual general meeting. The proxy statement is incorporated into this notice by this reference.

All shareholders are cordially invited to attend the annual general meeting.

By order of the Board of Directors,

Founder, Chairman and Chief Executive Officer

October 19, 2021

CIMPRESS PLC

Building D, Xerox Technology Park, Dublin Road

Dundalk, Co. Louth, A91 H9N9

Ireland

PROXY STATEMENT FOR ANNUAL GENERAL MEETING OF SHAREHOLDERS

to be held on November 30, 2021

This proxy statement contains information about the 2021 Annual General Meeting of Shareholders of Cimpress plc which we refer to in this proxy statement as the annual meeting or the meeting. We will hold the annual meeting on Tuesday, November 30, 2021 at the offices of Matheson, 70 Sir John Rogerson's Quay, Dublin 2, Ireland. The meeting will begin at 6:30 p.m. Greenwich Mean Time.

We are furnishing this proxy statement to you in connection with the solicitation of proxies by the Board of Directors of Cimpress plc (which is also referred to as we, us, the company, or Cimpress in this proxy statement) for use at the annual meeting and at any adjournment of the annual meeting.

We are first mailing or making available the Notice of Annual General Meeting, this proxy statement, and our Annual Report to Shareholders for the fiscal year ended June 30, 2021 on or about October 20, 2021.

Important Notice Regarding the Availability of Proxy Materials for the 2021 Annual General Meeting of Shareholders:

This Proxy Statement, the 2021 Annual Report to Shareholders, and the statutory financial statements under Irish law for the fiscal year ended June 30, 2021 (including the reports of our directors and our Irish statutory auditor thereon) are available for viewing, printing and downloading at http://www.viewproxy.com/Cimpress/2021. We will furnish without charge a copy of this proxy statement and our Annual Report on Form 10-K for the fiscal year ended June 30, 2021, as filed with the United States Securities and Exchange Commission, or SEC, as well as the statutory financial statements under Irish law for the fiscal year ended June 30, 2021 (including the reports of our directors and our Irish statutory auditor thereon), to any shareholder who requests it by emailing ir@cimpress.com or writing to Cimpress plc, c/o Cimpress USA Incorporated, Attention: Investor Relations, 170 Data Drive, Waltham, MA 02451, USA. This proxy statement and our Annual Report on Form 10-K are also available on the SEC’s website at www.sec.gov.

For this annual meeting, we are taking advantage of the SEC rule allowing companies to furnish proxy materials to their shareholders over the Internet. We believe that this e-proxy process expedites shareholders' receipt of proxy materials, while lowering the costs and reducing the environmental impact of our annual meeting. On or about October 20, 2021 we are mailing to our beneficial shareholders a notice containing instructions on how to access our proxy statement and 2021 Annual Report to Shareholders and how to vote online. All other shareholders will continue to receive a paper copy of this proxy statement, proxy card and Annual Report by mail. The Notice of Internet Availability contains instructions on how you can (i) receive a paper copy of the proxy statement, proxy card and Annual Report if you only received a Notice by mail or (ii) elect to receive your proxy statement and Annual Report over the Internet if you received them by mail this year.

i

TABLE OF CONTENTS

| Section | Page Number | ||||

ii

INFORMATION ABOUT OUR DIRECTORS AND EXECUTIVE OFFICERS

Our Board of Directors:

The Board of Directors of Cimpress plc consists of five independent, non-employee directors and Robert Keane, our Chief Executive Officer, who serve for rotating terms of up to three years. The Board appointed Dessislava Temperley as a director effective September 15, 2021, and John Gavin's term as director ends at the conclusion of the 2021 annual meeting, at which time Cimpress' Board will consist of five directors.

| Name | Age | Board Position | Cimpress Director Since | Current Term Expires at our Annual General Meeting In: | Independent Director | ||||||||||||

| Robert S. Keane | 58 | Chairman | January 1995 | 2022 | No | ||||||||||||

| Sophie A. Gasperment | 57 | Non-Employee Director | November 2016 | 2023 | Yes | ||||||||||||

| John J. Gavin, Jr. | 66 | Non-Employee Director | August 2006 | 2021* | Yes | ||||||||||||

| Zachary S. Sternberg | 36 | Non-Employee Director | November 2017 | 2021 | Yes | ||||||||||||

| Dessislava Temperley | 48 | Non-Employee Director | September 2021 | 2024 | Yes | ||||||||||||

| Scott J. Vassalluzzo | 49 | Non-Employee Director | January 2015 | 2022 | Yes | ||||||||||||

*Mr. Gavin is retiring and decided not to stand for re-election at the 2021 annual meeting.

ROBERT S. KEANE has served as our President, Chief Executive Officer, and Chairman since he founded Cimpress in January 1995. From 1988 to 1994, Mr. Keane was an executive at Flex-Key Corporation, an original equipment manufacturer of keyboards, displays and retail kiosks used for desktop publishing. Mr. Keane has also served on the Board of Directors of Astronics Corporation, a leading supplier of advanced technologies and products to the global aerospace, defense and other mission critical industries, since December 2019. Mr. Keane brings to Cimpress' Board his experience growing Cimpress from inception in 1995 to $2.6 billion of revenue in our 2021 fiscal year, his understanding of the drivers of intrinsic value per share, and his knowledge of Cimpress' customer needs, business model and markets.

SOPHIE A. GASPERMENT has served as Senior Advisor to Boston Consulting Group since November 2019, where her primary focus is to support their Consumer and Digital Acceleration practices. Ms. Gasperment previously held multiple senior management positions at L’Oréal, the world’s leading beauty company, from September 1986 to November 2018. This included Chief Executive Officer and Executive Chairman of The Body Shop International, the iconic British retailer spanning 60 countries and ca. 20,000 people strong, from July 2008 to October 2013, as well as Managing Director, L’Oréal UK and Ireland, from January 2004 to January 2008. More recently, from January 2014 to November 2018, Ms. Gasperment was L’Oréal's Group General Manager leading Strategic Prospective and Financial Communication. Since June 2010, Ms. Gasperment has served on the board of Accor, a Euronext-listed company and a world leader in hospitality, and is currently Chair of that board's Appointments, Compensation and CSR Committee and a member of the Audit and Compliance Committee. Since May 2018, Ms. Gasperment has served on the supervisory board of D’Ieteren, a Euronext-listed global company, and is a member of the Appointments and Compensation Committee. Since December 2018, Ms. Gasperment has also served on the board of Kingfisher plc, a FTSE 100 Home Improvement international company, and is currently Chair of that board's Responsible Business Committee and a member of the Nomination Committee. Since September 2020, Ms. Gasperment has served on the board of directors of Givaudan SA, the world leading flavour and fragrances company that is publicly traded on the SIX Swiss Exchange. In addition to serving on the Board of Directors of Cimpress plc, Ms. Gasperment serves on the supervisory board of Vistaprint B.V., a wholly owned Dutch subsidiary of Cimpress. Ms. Gasperment brings to Cimpress' Board her leadership and strategy skills and perspective, her international

1

brand-building expertise, her experience of digital transformation and acceleration, her acumen in both consumer goods and retail, as well as her experience on the boards of other public companies and her broader business experience in multi-cultural environments.

JOHN J. GAVIN, JR. serves on the board of Varonis Systems, Inc., a provider of data governance solutions for unstructured data. Mr. Gavin previously served as Chief Financial Officer of BladeLogic, Inc., a provider of data center automation software, from January 2007 through June 2008, when it was acquired by BMC Software, and as Chief Financial Officer of Navisite, Inc., a provider of information technology hosting, outsourcing and professional services, from April 2004 through December 2006. Prior to Navisite, Mr. Gavin served as the Chief Financial Officer of Cambridge Technology Partners and Data General Corporation. Mr. Gavin also spent ten years at Price Waterhouse LLP (now PricewaterhouseCoopers LLP), an accounting firm, in various accounting and audit positions including as Senior Manager in charge of multi-national audits. In addition to serving on the Board of Directors of Cimpress plc, Mr. Gavin also serves on the supervisory board of Vistaprint B.V., a wholly owned Dutch subsidiary of Cimpress. Mr. Gavin brings to Cimpress' Board his extensive experience as chief financial officer of several growing companies, his experience on the boards of other public companies, and ten years as an independent auditor. Mr. Gavin is a certified public accountant.

ZACHARY S. STERNBERG is the co-founder and Managing Member of the General Partner of The Spruce House Partnership, a New York-based investment partnership. Spruce House invests in public and private companies globally and seeks to partner with management teams that are focused on growing the per share value of their companies over the long-term. Spruce House holds 9.0% of Cimpress' outstanding shares and has been a shareholder of Cimpress since 2011. Mr. Sternberg also serves on the boards of directors of Victoria PLC, an international manufacturer and distributor of innovative flooring products, and GTT Communications, Inc., the owner/operator of a global Tier 1 internet network and provider of a comprehensive suite of cloud networking services. Mr. Sternberg brings to Cimpress' Board his perspective as a material and long-term shareholder of Cimpress with a deep understanding of the importance of long-term stewardship of capital informed by more than a decade of successful investment experience.

DESSISLAVA TEMPERLEY joined the Cimpress Board of Directors on September 15, 2021 and also serves on the boards of Coca-Cola Europacific Partners PLC, a British multinational bottling company, and Corbion N.V., a Dutch food and biochemicals company. Ms. Temperley previously served as Group Chief Financial Officer of Beiersdorf AG, a German multinational company that manufactures personal-care products and pressure-sensitive adhesives, from July 2018 through June 2021. Ms. Temperley spent 14 years at Nestlé, from April 2004 through June 2018, serving in various roles including Head of Investor Relations, CFO of Nestle Purina Petcare (EMENA), Head of Global Planning and Performance Monitoring, Controller, and Finance Director. Ms. Temperley brings to Cimpress' Board a wealth of financial and operating expertise from her over 20 years of experience in various finance leadership roles at multinational companies. The Board has determined that Ms. Temperley is an audit committee financial expert, as defined under SEC rules, and plans to appoint her chair of the Audit Committee at the expiration of John Gavin's term as director at the conclusion of this 2021 annual meeting.

SCOTT J. VASSALLUZZO is a Managing Member of Prescott General Partners LLC ("PGP"), an investment adviser registered with the SEC that holds 15% of Cimpress' outstanding shares. PGP serves as the general partner of three private investment limited partnerships, including Prescott Associates L.P. (together, the "Prescott Partnerships"). Mr. Vassalluzzo joined the Prescott organization in 1998 as an equity analyst, became a general partner of the Prescott Partnerships in 2000, and transitioned to Managing Member of PGP following Prescott's reorganization in January 2012. Prior to 1998, Mr. Vassalluzzo worked in public accounting at Coopers & Lybrand (now PricewaterhouseCoopers LLP) and was a certified public accountant. Mr. Vassalluzzo serves on the boards of directors of Credit Acceptance Corporation, an auto finance company providing automobile loans and other related financial products, and World Acceptance Corporation, a personal installment loan company. Mr. Vassalluzzo brings to Cimpress' Board his advocacy for the priorities of long-termism and intrinsic value per share, his appreciation and understanding of the perspectives of our other long-term shareholders, and his experience on the boards and board committees of other publicly traded companies.

2

Our Executive Officers:

| Name | Title | Age | Joined Cimpress | ||||||||

| Robert S. Keane | Founder, Chief Executive Officer, and Chairman | 58 | January 1995 | ||||||||

| Sean E. Quinn | Executive Vice President and Chief Financial Officer | 42 | October 2009 | ||||||||

| Maarten Wensveen | Executive Vice President and Chief Technology Officer | 41 | October 2011 | ||||||||

ROBERT S. KEANE: Mr. Keane's biography is in the "Our Board of Directors" section above.

SEAN E. QUINN has served as our Chief Financial Officer since October 2015 and as Executive Vice President since July 2016. Mr. Quinn previously served as Senior Vice President from October 2015 to July 2016, as Chief Accounting Officer from November 2014 to October 2015, as Vice President, Corporate Finance from January 2014 to October 2015, as Global Controller from April 2012 to November 2014, and in various other financial roles from October 2009 to April 2012. Before joining Cimpress, Mr. Quinn was a certified public accountant with KPMG LLP from September 2001 to October 2009 in the firm’s Philadelphia, London, and Boston offices.

MAARTEN WENSVEEN has served as our Executive Vice President and Chief Technology Officer since February 2019. Mr. Wensveen previously served as Senior Vice President from January 2017 to February 2019 and Vice President of Technology from February 2015 to January 2017. Mr. Wensveen joined Cimpress in November 2011 when we acquired Albumprinter, and he served in various roles at Albumprinter including IT Manager from December 2006 to June 2012.

There are no family relationships among any of Cimpress' directors and executive officers. No arrangements or understandings exist between any director and any other person pursuant to which such person is to be selected for appointment to the Board of Directors.

3

PROPOSAL 1 - REAPPOINT ZACHARY S. STERNBERG TO OUR BOARD OF DIRECTORS

The members of our Board of Directors serve for rotating terms of up to three years. In accordance with the recommendation of the Nominating Committee of the Board, our Board recommends the reappointment of Zachary S. Sternberg for a three-year term ending at the conclusion of our annual general meeting of shareholders in 2024 because of his perspective as a material and long-term shareholder of Cimpress with a deep understanding of the importance of long-term stewardship of capital informed by more than a decade of successful investment experience.

You can find more information about Mr. Sternberg in the section of this proxy statement entitled “INFORMATION ABOUT OUR DIRECTORS AND EXECUTIVE OFFICERS.”

Our Board of Directors recommends that you vote FOR the reappointment of Mr. Sternberg to the Board.

PROPOSAL 2 - ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

At the annual meeting, we are asking our shareholders to approve the compensation of our named executive officers, as described in the Compensation Discussion and Analysis section, executive compensation tables, and accompanying narrative disclosures below. This is an advisory vote, meaning that this proposal is not binding on us, but our Compensation Committee takes shareholder feedback into account when designing our executive compensation program, which has received more than 96% approval from our shareholders at each of our last eight annual general meetings of shareholders.

At our annual general meeting in 2017, a majority of our shareholders voted to hold the advisory vote to approve our executive compensation on an annual basis. Therefore, we intend to put forth at each annual general meeting of shareholders an advisory vote on the compensation of our named executive officers for the immediately preceding fiscal year.

Our Board of Directors recommends that you vote FOR the approval of the compensation of our named executive officers, as described below.

COMPENSATION DISCUSSION AND ANALYSIS

Executive Overview

Our success depends on our ability to attract and retain top talent in a competitive marketplace, and to motivate that talent to achieve outstanding performance. In determining the compensation of our executive officers, our Compensation Committee begins with an analysis of the competitiveness of our executive compensation program and, as a starting point, seeks to pay our executives total compensation (including base salary and target long-term incentive award values) at the 75th percentile of the competitive market. The Compensation Committee then applies its own discretion to take into account any other factors it may deem relevant in any given fiscal year, such as general economic conditions, the internal equity of compensation among our executives, each executive’s experience and role, individual performance, and, particularly in fiscal year 2021, the impact of the COVID-19 pandemic. The Committee does not assign specific weights to particular factors but considers them together in determining compensation.

We have designed our compensation program to encourage our executives and employees to manage to the long-term success of Cimpress in line with our uppermost financial objective and to forgo short-term actions and metrics except to the extent those short-term actions and metrics support our long-term goals. Cimpress' uppermost financial objective is to maximize our intrinsic value per share, or IVPS, which we define as (a) the unlevered free cash flow per diluted share that, in our best judgment, will occur between now and the long-term future, appropriately discounted to reflect our cost of capital, minus (b) net debt per diluted share. We define unlevered free cash flow as free cash flow plus cash interest expense related to borrowing. We believe that the compound annual growth rate, or CAGR, of the three-year moving average of the daily closing share price of Cimpress’ ordinary shares, or 3YMA, over a multiple-year period is a proxy for the change in our IVPS over the same time frame. Accordingly, our long-term incentive compensation (LTI) program features performance share unit (PSU) awards

4

representing a right to receive Cimpress ordinary shares based on the performance of our 3YMA CAGR over a multiple-year period.

In fiscal year 2021, the COVID-19 pandemic had a material adverse effect on our business, financial results, customers, and markets. The pandemic also underscored the effect that sustained downward pressure on our share price due to macroeconomic factors beyond our control can have on our LTI awards, especially our PSUs, and the importance of retaining top talent capable of guiding Cimpress through difficult times. In response to the pandemic, we made adjustments to our LTI program in fiscal year 2021, including the following:

1.We diversified the program to include restricted share units (RSUs) that pay out in Cimpress ordinary shares over the first four years after grant, in addition to longer-term, higher-risk PSUs.

2.We used a two-year moving average of the daily closing share price of Cimpress' ordinary shares (2YMA), instead of the three-year moving average, as the baseline against which the performance of our fiscal year 2021 PSU awards will be measured. On each of the measurement dates during the performance period, we will calculate a CAGR by comparing the 3YMA on the measurement date against the 2YMA baseline to determine whether the CAGR performance condition has been satisfied. We chose to use a 2YMA as the baseline to enhance the value of our PSU awards in retaining talented employees. During fiscal year 2021 the 2YMA was lower than the 3YMA, and we expect that comparing the lower 2YMA to the future 3YMA will make the achievement of the CAGR performance condition easier, but still challenging, in recognition of the exceptional macroeconomic conditions of the pandemic.

3.We delayed until February 2021 the determination and grant of fiscal year 2021 LTI awards due to the uncertainty caused by the pandemic.

The changes to our LTI program described in #1 and #2 above did not apply to the LTI awards granted to Robert Keane, our Chief Executive Officer. Mr. Keane signed a PSU Limitation Agreement with Cimpress providing that, until June 30, 2023, he will continue to receive all of his long-term incentive compensation in the form of PSUs, the maximum number of PSUs we may grant him in any fiscal year is 75,000, and the performance conditions in his PSU awards must be that the 3YMA CAGR equal or exceed 11% over a performance period of six to ten years. In fiscal year 2021 Mr. Keane received 99% of his total compensation, including his base salary, Board retainer fees, and LTI, in the form of PSUs with a 3YMA baseline for measuring performance.

Sean Quinn, our Chief Financial Officer, and Maarten Wensveen, our Chief Technology Officer, were entitled to receive annual LTI awards in February 2021 consisting of a mix of 75% PSUs and 25% RSUs (based on target values), with the opportunity for the executive officers to elect to receive 100% PSUs and no RSUs if they wished. Mr. Wensveen elected to receive 100% of his annual LTI award granted in February 2021 as PSUs.

Pay for Performance

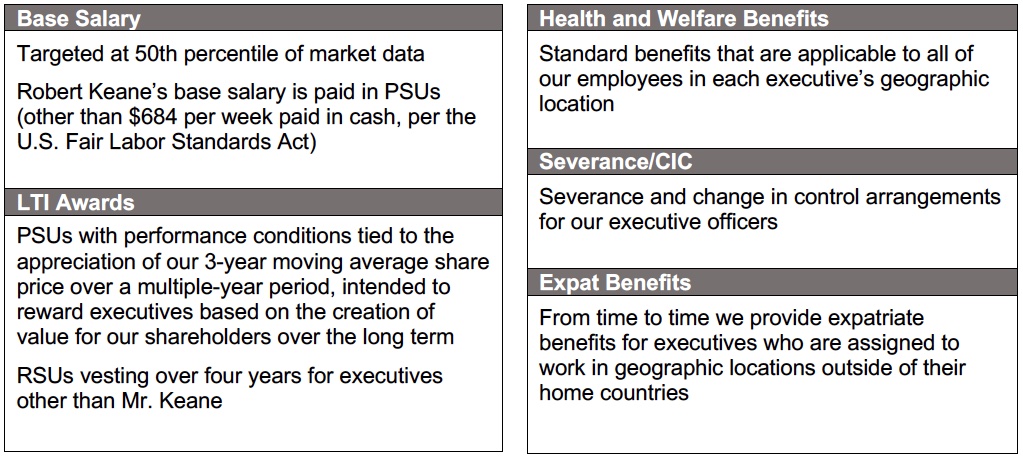

For fiscal year 2021, the principal elements of our compensation program for our named executive officers included:

5

Under our pay-for-performance philosophy, the compensation of our executives and other employees at higher levels in the organization is more heavily weighted toward variable compensation based on our performance, and base salary generally accounts for a smaller portion of these employees’ total compensation packages. The percentiles of competitive market data that we use to evaluate the compensation of our named executive officers are designed to ensure that our executive officers will receive total compensation significantly below the median if Cimpress does not perform well and significantly above the median for Cimpress' extraordinary performance. In accordance with this philosophy, the Compensation Committee initially allocates the compensation of our executive officers within the percentiles listed below, and then may use its discretion to adjust each executive officer’s compensation to reflect other factors such as general economic conditions, the internal equity of compensation among our executives, and the executive’s experience, role, and individual performance.

•Base salary at the 50th percentile of competitive market data

•Target total compensation (base salary plus target LTI award values) at the 75th percentile of competitive market data

When considering the competitiveness of our executive compensation program for fiscal year 2021, our Compensation Committee took into account a compensation analysis that we developed internally using published compensation survey data, as well as detailed historical compensation analyses for each executive officer, but did not use a compensation peer group or engage a compensation consultant. The Compensation Committee set the total target fiscal year 2021 compensation of Sean Quinn and Maarten Wensveen at significantly above the 75th percentile of market data because both executives are serving in dual roles as Chief Financial Officer (Mr. Quinn) and Chief Technology Officer (Mr. Wensveen) of both Cimpress and Vistaprint, our largest business, and because the Compensation Committee believes that retaining these executives is critical to the success of Cimpress and Vistaprint and that their performance and contributions to Cimpress and Vistaprint warranted target compensation above the 75th percentile.

Base Salary

For fiscal year 2021, our Compensation Committee maintained the base salaries of Robert Keane and Sean Quinn at their fiscal year 2020 levels and increased Maarten Wensveen's base salary by 25% to bring his salary more in line with other Cimpress executives. Beginning in the second half of fiscal year 2019, in order to tie Mr. Keane's compensation as fully as possible to Cimpress' long-term performance, Mr. Keane's base salary and director fees are paid almost entirely in PSUs. In fiscal year 2021, we paid Mr. Keane's compensation in PSUs other than $56,237 paid in cash, representing the minimum annual salary for exempt employees under the U.S. Fair Labor Standards Act plus the amount of LTI compensation payable to Mr. Keane that exceeded the 75,000 PSUs per fiscal year limit set forth in his PSU Limitation Agreement.

In the fourth quarter of fiscal year 2020, in light of the effects of the COVID-19 pandemic on Cimpress' business and financial results, we implemented a temporary 50% reduction in the base salaries of our named executive officers other than Robert Keane and granted to each impacted executive an RSU award having the same value as the executive's salary reduction for the quarter. These RSU awards vested in full on August 15, 2020, at which time each RSU was automatically converted into ordinary shares of Cimpress plc on a one-to-one basis. Because Mr. Keane already received almost all of his compensation in the form of PSUs, as noted above, he was not included in the salary reduction program.

Long-Term Incentive Program

Our LTI program is designed to focus our executives and employees on long-term performance and maximizing our IVPS. Although in recent fiscal years PSU awards were the primary LTI compensation vehicle for our named executive officers, the COVID-19 pandemic underscored the effect that sustained downward pressure on our share price due to macroeconomic factors beyond our control can have on our PSU awards, as well as the importance of retaining top talent capable of guiding Cimpress through difficult times. Accordingly, in fiscal year 2021 we diversified our LTI program to include RSU awards for employees and executives other than Robert Keane, in addition to PSU awards. Mr. Keane received his LTI awards entirely in the form of PSUs in fiscal year 2021 in accordance with his PSU Limitation Agreement.

Performance Share Units. Each PSU represents a right to receive between 0 and 2.5 ordinary shares of Cimpress plc upon the satisfaction of both service-based vesting over time and performance conditions relating to the 3YMA CAGR over a period determined by the Board. We refer to the issuance of Cimpress ordinary shares

6

pursuant to a PSU upon satisfaction of both conditions as a Performance Dependent Issuance. With challenging performance hurdles and performance periods extending multiple years into the future, PSU awards are designed to encourage our executives and employees to manage to a long-term time horizon.

First condition to a Performance Dependent Issuance: Service-based Vesting. PSUs granted to employees generally vest 25% per year over four years so long as the employee remains employed by Cimpress. However, service-based vesting is not sufficient for payout; PSU service-based vesting events are the dates after which the participant gains the future right to a Performance Dependent Issuance with respect to their then-vested PSUs, subject to achievement of the relevant performance conditions.

If a participant resigns or is terminated other than for cause, they retain all PSUs that have satisfied the service-based vesting condition as of their resignation or termination date. If Cimpress achieves the performance thresholds described below, the former participant would receive Cimpress ordinary shares upon settlement of the PSUs, even though they no longer have an employment, director, or other service relationship with Cimpress.

Second condition to a Performance Dependent Issuance: 3YMA Performance. For each PSU award, we calculate a baseline moving average share price as of a specified date at the time of grant for two purposes: to establish the number of units to be granted and to establish the baseline for future performance measurement. On each measurement date during the performance period determined by our Board of Directors we calculate the 3YMA as of such date, and on the first measurement date that the 3YMA, as compared to the baseline moving average share price, equals or exceeds a minimum CAGR set by the Board, the performance condition would be satisfied.

3YMA Performance Criteria for our CEO. PSU awards granted in fiscal year 2021 to Robert Keane have a baseline equal to the 3YMA on the grant date and a performance period of six to ten years, to encourage focus on Cimpress' performance over the long term. Beginning on the sixth anniversary of the grant date, and on each anniversary thereafter through year ten, we will calculate the 3YMA as of such date. On the first of these measurement dates that the 3YMA equals or exceeds a CAGR of 11% as compared to the baseline 3YMA, the performance condition would be satisfied, and we would issue to Mr. Keane the number of Cimpress ordinary shares determined by multiplying the number of PSUs subject to the award by the applicable performance-based multiplier. The performance-based multiplier begins at 125% for an 11% 3YMA CAGR and increases on a sliding scale to 250% for a 3YMA CAGR of 20% or above. If the 3YMA CAGR does not reach at least 11% on any of the sixth through tenth anniversaries of the grant date, then the PSU award would be terminated and no Cimpress ordinary shares would be issued with respect to the award.

3YMA Performance Criteria for Executive Officers other than our CEO. PSU awards granted in fiscal year 2021 to executive officers other than Robert Keane have a baseline equal to the 2YMA on the grant date and a performance period of four to eight years. We set the baseline for these PSU awards at the 2YMA of $95.46 as of the grant date, which was lower than the 3YMA of $108.31 on that date, in recognition that the exceptionally challenging macroeconomic conditions of the pandemic and sustained downward pressure on Cimpress' share price had a significant negative impact on the value and likelihood of payout with respect to the PSU awards granted to the executives in previous fiscal years. We expect that comparing the lower 2YMA baseline to the 3YMA on future measurement dates will make the achievement of the CAGR performance condition easier, but still challenging. For PSU awards granted in fiscal year 2022, we reverted to a 3YMA baseline.

Beginning on the fourth anniversary of the grant date, and on each anniversary thereafter through year seven, we will calculate the 3YMA as of such date. On the first of these measurement dates that the 3YMA equals or exceeds a CAGR of 9%, as compared to the 2YMA baseline, the performance condition would be satisfied, and we would issue to the participant the number of Cimpress ordinary shares determined by multiplying the number of PSUs subject to the award by the applicable performance-based multiplier. The performance-based multiplier begins at 100% for a 9% CAGR and increases on a sliding scale to 250% for a CAGR of 20% or above. If the CAGR has not reached at least 9% on any of the fourth through seventh anniversaries of the grant date and thus a Performance Dependent Issuance has not yet occurred, then the threshold CAGR level

7

for 3YMA performance at the eighth anniversary of the grant date, as compared to the baseline 2YMA, is lowered to 7%, and if the 3YMA performance meets or exceeds a 7% CAGR on the eighth anniversary the recipient would still receive Cimpress ordinary shares, but at a lower multiple beginning at 75% for a 7% CAGR and increasing on a sliding scale to 250% for a CAGR of 20% or above.

If none of the CAGR performance goals are achieved by the eighth anniversary of the grant date, then the PSU award would be terminated and no Cimpress ordinary shares would be issued with respect to the award.

The actual closing price of the Cimpress shares issued upon the Performance Dependent Issuance may be higher or lower than the 3YMA used to calculate the number of shares issued at such time.

Restricted Share Units. In fiscal year 2021, in order to enhance the retention value of our LTI program in light of the adverse effects of the COVID-19 pandemic on our share price and thus on the likelihood of achievement of the 3YMA performance targets in our PSU awards, we added RSU awards to our LTI program for executives and employees other than Mr. Keane. Our RSU awards typically vest annually over four years, and upon vesting each RSU is automatically converted into ordinary shares of Cimpress plc on a one-to-one basis so long as Cimpress continues to employ the recipient on the vesting date. Our executive officers other than Mr. Keane received a supplemental RSU award on July 1, 2020 to help retain and incent them to continue to guide Cimpress through difficult times and in recognition of the added difficulty of achieving the 3YMA performance targets in the PSU awards they had received in previous years due to the adverse effects of the pandemic on our share price. Our executive officers other than Mr. Keane were also eligible to receive annual LTI awards in February 2021 consisting of a mix of 75% PSUs and 25% RSUs (based on target values), with the opportunity for the executives to elect to receive 100% PSUs and no RSUs if they wished. Mr. Wensveen elected to receive 100% of his annual LTI award granted in February 2021 as PSUs.

Cash Retention Bonuses. In past years, we allowed our executive officers other than Mr. Keane to elect to receive a portion of their LTI awards in the form of cash retention bonuses, subject to a minimum threshold that was required to be allocated to PSUs. The cash retention bonuses pay the employee a fixed amount in equal payments over several years (typically four years) so long as Cimpress continues to employ the recipient. Although we no longer grant cash retention bonuses to executives, Mr. Quinn still holds cash retention bonus awards that were granted in previous fiscal years and that continued to vest, with the incremental vested amounts being earned, in fiscal year 2021.

Benefit Programs

The Compensation Committee believes that all employees based in the same geographic location should have access to similar levels of health and welfare benefits, and therefore our executive officers are eligible for the same health and welfare benefits, including medical, dental, vision, and disability plans, group life and accidental death and disability insurance and other benefit plans, as those offered to other employees in their location.

U.S.-based employees may participate in a 401(k) plan that provides a company match of up to 50% on the first 6% of the participant’s eligible compensation that is contributed, subject to certain limits under the United States Internal Revenue Code of 1986, or US Tax Code, with company matching contributions vesting over a four-year period. As part of the cost reductions we executed due to the COVID-19 pandemic, we suspended the 401(k) matching contributions for U.S. employees from April 2020 through the end of September 2020.

We also provide customary pension plans to our European employees.

Perquisites

In general, executives are not entitled to benefits that are not otherwise available to all other employees who work in the same geographic location, although we do pay for a driver for Mr. Keane so that he can work during his commute. We also from time to time enter into arrangements with some of our named executive officers to reimburse them for living and relocation expenses and tax preparation fees and associated tax gross-ups relating to their work outside of their home countries. You can find more information about these arrangements in the Summary Compensation Table of this proxy statement.

8

Executive Retention and Other Agreements

We have entered into executive retention agreements with all of our executive officers. Under the executive retention agreements, if we terminate an executive officer’s employment other than for cause, death, or disability or the executive terminates his or her employment for good reason before a change in control of Cimpress or within one year after a change in control (as cause, disability, good reason, and change in control are defined in the agreements), then the executive is entitled to receive:

•A lump sum severance payment equal to two years’ salary and annual bonus, in the case of Mr. Keane, or one year’s salary and annual bonus, in the case of the other executive officers. Because we no longer grant annual bonuses to our executives and employees, this amount would include only salary.

•With respect to any outstanding annual or multi-year cash incentive award under our previous cash performance incentive plan, a pro rata portion, based on the number of days from the beginning of the then current performance period until the date of termination, of his or her target incentive. Because we no longer grant awards under the cash performance incentive plan to our executives and employees, this amount would be zero.

•The continuation of all other employment-related health and welfare benefits for up to two years after the termination in the case of Mr. Keane, or up to one year after the termination in the case of our other executive officers.

Both the executive retention agreements and our PSU awards have change in control provisions. The executive retention agreements provide that, upon a change in control of Cimpress, all equity awards (other than PSUs) granted to each executive officer will accelerate and become fully vested, and each executive’s annual or multi-year cash incentive awards under our previous cash performance incentive plan would accelerate such that the executive would receive a portion of his or her target bonus for the remaining performance period after the change in control. None of our executives currently holds any share options, but if they did, then the exercise period of the share options would be extended in certain circumstances if the executive's employment terminated after a change in control of Cimpress.

The equity plans and agreements that govern our PSUs provide that, upon a change in control, all PSUs that have satisfied the applicable service-based vesting conditions will be settled for Cimpress ordinary shares in accordance with the terms of the awards if the actual price paid per share to holders of Cimpress' securities in connection with the change in control equals or exceeds the CAGR performance goals set forth in the award agreements.

Our Compensation Committee decided that we would no longer include any excise tax gross-up provisions in any executive retention agreements we enter into with new executives after August 1, 2012, and accordingly, the only current executive officer who has an excise tax gross-up provision in his agreement is Mr. Keane. If Mr. Keane is required to pay any excise tax pursuant to Section 4999 of the US Tax Code as a result of compensation payments made to him, or benefits he obtained (including the acceleration of equity awards), in connection with a change in ownership or control of Cimpress, we are required to pay him an amount, referred to as a gross-up payment, equal to the amount of such excise tax plus any additional taxes attributable to such gross-up payment. However, if reducing Mr. Keane's compensation payments by up to $50,000 would eliminate the requirement to pay an excise tax under Section 4999 of the US Tax Code, then Cimpress has the right to reduce the payment by up to $50,000 to avoid triggering the excise tax and thus avoid providing gross-up payments to Mr. Keane.

9

The following table sets forth information on the potential payments to our named executive officers upon their termination or a change in control of Cimpress, assuming that a termination or change in control took place on June 30, 2021.

| Name | Cash Payment ($)(1) | Accelerated Vesting of RSUs and PSUs ($)(2) | Benefits ($)(3) | Tax Gross-Up Payment ($)(4) | Total ($) | |||||||||||||||||||||||||||

| Robert S. Keane | ||||||||||||||||||||||||||||||||

| • | Termination Without Cause or With Good Reason | 3,500,000 | — | 68,699 | — | 3,568,699 | ||||||||||||||||||||||||||

| • | Change in Control | — | 35,912,764 | — | — | 35,912,764 | ||||||||||||||||||||||||||

| • | Change in Control w/ Termination Without Cause or With Good Reason | 3,500,000 | 35,912,764 | 68,699 | — | 39,481,463 | ||||||||||||||||||||||||||

| Sean E. Quinn | ||||||||||||||||||||||||||||||||

| • | Termination Without Cause or With Good Reason | 800,000 | — | 22,486 | — | 822,486 | ||||||||||||||||||||||||||

| • | Change in Control | — | 10,524,443 | — | — | 10,524,443 | ||||||||||||||||||||||||||

| • | Change in Control w/ Termination Without Cause or With Good Reason | 800,000 | 10,524,443 | 22,486 | — | 11,346,929 | ||||||||||||||||||||||||||

| Maarten Wensveen | ||||||||||||||||||||||||||||||||

| • | Termination Without Cause or With Good Reason | 750,000 | — | 22,198 | — | 772,198 | ||||||||||||||||||||||||||

| • | Change in Control | — | 5,514,817 | — | — | 5,514,817 | ||||||||||||||||||||||||||

| • | Change in Control w/ Termination Without Cause or With Good Reason | 750,000 | 5,514,817 | 22,198 | — | 6,287,015 | ||||||||||||||||||||||||||

_____________

| (1) | Amounts in this column for Termination Without Cause or With Good Reason represent severance amounts payable under the executive retention agreements. | |||||||||||||||||||||||||||||||||||||

| (2) | Amounts in this column represent the value, based on $108.41 per share, which was the closing price of our ordinary shares on Nasdaq on June 30, 2021, the last trading day of our 2021 fiscal year, of (1) unvested RSUs that would vest and (2) shares that would be issued pursuant to vested PSUs upon the triggering event described in the first column. For PSUs, we assumed the price paid per share to holders of Cimpress' shares in connection with the change in control would represent a CAGR equal to the target performance goal for the PSU awards. | |||||||||||||||||||||||||||||||||||||

| (3) | Amounts reported in this column represent the estimated cost of providing employment related benefits (such as insurance for medical, dental, and vision) during the period the named executive officer is eligible to receive those benefits under the executive retention agreements, which is two years for Mr. Keane and one year for the other named executive officers. | |||||||||||||||||||||||||||||||||||||

| (4) | None of our executive officers other than Mr. Keane have excise tax gross-up provisions in their agreements. We calculate the amount of tax gross up to which Mr. Keane would have been entitled if a triggering event had occurred on June 30, 2021 and determined that he would not have been entitled to a gross-up payment. | |||||||||||||||||||||||||||||||||||||

The Role of Company Executives in the Compensation Process

Although the Compensation Committee makes the final decisions about executive compensation, the Committee also takes into account the views of our Chief Executive Officer, who makes initial recommendations with respect to the compensation of executive officers other than himself. Other employees of Cimpress also participate in the preparation of materials presented to or requested by the Compensation Committee for use and consideration at Compensation Committee meetings.

10

Share Ownership Guidelines and Policy on Hedging

We have share ownership guidelines for all of our executive officers and members of our Board of Directors. The guidelines require our executive officers and directors to hold Cimpress equity, including ordinary shares they hold directly or indirectly, unvested RSUs, vested and unvested PSUs, and vested, unexercised, in-the-money share options, with a value, based on the two-year trailing average of the closing prices of Cimpress' ordinary shares on Nasdaq, equal to or greater than a multiple of the executive officer’s annual base salary or the director's annual retainer, as follows:

•Chief Executive Officer: 5 times annual base salary

•Other executive officers: 3 times annual base salary

•Board of Directors: 3 times Board annual cash retainer

We give each executive officer and Board member four years from his or her initial appointment as a Cimpress officer or director to comply with the share ownership guidelines. As of June 30, 2021, all executive officers and directors had satisfied their ownership guideline requirement.

Our Insider Trading Policy prohibits Cimpress' executive officers, directors, and employees from engaging in any derivative or hedging transactions in Cimpress securities, including but not limited to short sales, put options, call options, collars, futures contracts, forward contracts, and swaps.

Compensation Committee Report

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis contained in this proxy statement. Based on the Compensation Committee’s review and discussions with management, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement.

Compensation Committee of the

Board of Directors

Scott J. Vassalluzzo, Chair

Sophie A. Gasperment

Zachary S. Sternberg

11

SUMMARY COMPENSATION TABLES

Summary Compensation Table

The following table summarizes the compensation earned in each of the last three fiscal years by:

(i) our principal executive officer,

(ii) our principal financial officer, and

(iii) our other executive officer as of June 30, 2021.

Throughout this proxy statement, we refer to the individuals listed in (i) through (iii) above as our named executive officers.

| Name and Principal Position | Year | Salary ($)(1) | Bonus ($)(2) | Share Awards ($)(3) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||||||||||||||

| Robert S. Keane | 2021 | 35,568 | 20,669 | 8,283,797 | 0 | 8,340,034 | ||||||||||||||||||||||||||||||||

| Chairman and | 2020 | 29,888 | — | 9,338,794 | 31,100 | 9,399,782 | ||||||||||||||||||||||||||||||||

| Chief Executive Officer | 2019 | 863,628 | — | 11,369,327 | 47,965 | 12,280,920 | ||||||||||||||||||||||||||||||||

| Sean E. Quinn | 2021 | 803,077 | 241,875 | 4,667,581 | 5,931(4) | 5,718,464 | ||||||||||||||||||||||||||||||||

| Executive Vice President | 2020 | 710,769 | 354,375 | 3,199,628 | 4,000 | 4,268,772 | ||||||||||||||||||||||||||||||||

| and Chief Financial Officer | 2019 | 769,774 | 354,375 | 2,836,524 | 7,620 | 3,968,293 | ||||||||||||||||||||||||||||||||

| Maarten Wensveen | 2021 | 756,317 | — | 4,032,234 | 133,957(5) | 4,922,508 | ||||||||||||||||||||||||||||||||

| Executive Vice President and | 2020 | 530,769 | — | 2,554,745 | 33,535 | 3,119,049 | ||||||||||||||||||||||||||||||||

| Chief Technology Officer | 2019 | 501,923 | — | 548,018 | 35,991 | 1,085,932 | ||||||||||||||||||||||||||||||||

_____________

| (1) | For Mr. Keane, the amounts in this column for fiscal years 2021 and 2020 represent the aggregate minimum salary for exempt employees under the U.S. Fair Labor Standards Act, which is paid in cash. Beginning in the second half of fiscal year 2019, Mr. Keane began receiving substantially all of his compensation, including base salary and Board retainer fees, in the form of PSUs. | |||||||

| (2) | The amount in this column for Mr. Keane in fiscal year 2021 represents the amount of LTI compensation payable to him that exceeded the 75,000 PSUs per fiscal year limit set forth in his PSU Limitation Agreement and was instead paid to him as a cash bonus. The amounts reported in this column for Mr. Quinn represent the payment of cash retention bonuses that were granted in previous fiscal years and vested in the years shown. | |||||||

| (3) | The amounts reported in this column represent a dollar amount equal to the grant date fair value of the share awards as computed in accordance with FASB ASC Topic 718. You can find the assumptions we used in the calculations for these amounts in Note 11 to our audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2021. See footnote 5 to the Grants of Plan-Based Awards in the Fiscal Year Ended June 30, 2021 table for the value of the PSUs granted in 2021 assuming the maximum achievement of the performance conditions. | |||||||

| (4) | This amount represents our matching contributions under our 401(k) deferred savings retirement plans. | |||||||

| (5) | $74,575 of this amount represents our payment of state tax in connection with Mr. Wensveen's repatriation to the United States, $30,981 of this amount represents a tax gross up associated with the payment of state tax, $9,328 represents our payment of storage rental fees and import taxes associated with the storage of Mr. Wensveen's personal effects in Switzerland after his repatriation to the United States, $7,954 represents a tax gross up associated with the storage rental fees and import taxes, $1,850 represents tax preparation fees paid, $1,020 represents a tax gross up for tax preparation fees, and $8,250 of this amount represents our matching contributions under our 401(k) deferred savings retirement plan. | |||||||

12

Grants of Plan-Based Awards in the Fiscal Year Ended June 30, 2021

The following table contains information about plan-based awards granted to each of our named executive officers during the fiscal year ended June 30, 2021.

| All Other Share Awards: Number of Shares or Units | Grant Date Fair Value of Share Awards | |||||||||||||||||||||||||||||||||||||

| Estimated Future Payouts | ||||||||||||||||||||||||||||||||||||||

| Under Equity Incentive Plan Awards(1) | ||||||||||||||||||||||||||||||||||||||

| Threshold | Target | Maximum | ||||||||||||||||||||||||||||||||||||

| Name | Grant Date | (#) | (#)(2) | (#)(3) | (#)(4) | ($)(5) | ||||||||||||||||||||||||||||||||

| Robert S. Keane | 8/15/2020(6) | — | 17,902 | 35,805 | 1,350,295 | |||||||||||||||||||||||||||||||||

| 8/15/2020(7) | — | 1,108 | 2,217 | 83,627 | ||||||||||||||||||||||||||||||||||

| 11/15/2020(8) | — | 1,403 | 2,807 | 86,034 | ||||||||||||||||||||||||||||||||||

| 2/15/2021(9) | — | 73,335 | 146,670 | 6,763,840 | ||||||||||||||||||||||||||||||||||

| Sean E. Quinn | 7/1/2020(10) | 15,953 | 1,199,985 | |||||||||||||||||||||||||||||||||||

| 2/15/2021(11) | 5,958 | 624,935 | ||||||||||||||||||||||||||||||||||||

| 2/15/2021(9) | — | 19,641 | 49,102 | 2,842,662 | ||||||||||||||||||||||||||||||||||

| Maarten Wensveen | 7/1/2020(10) | 13,294 | 999,975 | |||||||||||||||||||||||||||||||||||

| 2/15/2021(9) | — | 20,951 | 52,377 | 3,032,259 | ||||||||||||||||||||||||||||||||||

___________________________

| (1) | These columns represent PSU awards. Each PSU represents a right to receive between 0 and 2.5 Cimpress ordinary shares upon the satisfaction of (A) service-based vesting, and (B) performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares. | |||||||

| (2) | For Mr. Keane, these amounts represent the number of Cimpress ordinary shares issuable six to ten years after the grant date if he fully satisfies the service-based vesting condition described in footnote 6, 7, 8, or 9, as applicable, and the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). For the named executive officers other than Mr. Keane, these amounts represent the number of Cimpress ordinary shares issuable four to eight years after the grant date if the executive officer fully satisfies the service-based vesting condition described in footnote 9 and the 3YMA CAGR is 9% to 9.99% on any of the fourth through eighth anniversaries of the grant date (multiplier of 100%). | |||||||

| (3) | For Mr. Keane, these amounts represent the number of Cimpress ordinary shares issuable six to ten years after the grant date if he fully satisfies the service-based vesting condition described in footnote 6, 7, 8, or 9, as applicable, and the 3YMA CAGR is 20% or above on any of the sixth through tenth anniversaries of the grant date (multiplier is 250%). For the named executive officers other than Mr. Keane, these amounts represent the number of Cimpress ordinary shares issuable four to eight years after the grant date if the executive officer fully satisfies the service-based vesting condition described in footnote 9 and the 3YMA CAGR is 20% or above on any of the fourth through eighth anniversaries of the grant date (multiplier of 250%). | |||||||

| (4) | The amounts reported in this column represent RSU awards. | |||||||

| (5) | The amounts reported in this column represent the grant date fair value for the RSU and PSU awards computed in accordance with FASB ASC Topic 718. You can find the assumptions we used in the calculations for these amounts in Note 11 to our audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended June 30, 2021. The maximum value of the PSUs granted in fiscal year 2021 assuming the maximum achievement of the performance conditions, which we estimated by multiplying the maximum number of shares issuable pursuant to each PSU award by the closing price of our ordinary shares on Nasdaq on the applicable grant date, or on the last trading date immediately before the grant date if the grant date is not a trading date, is $19,240,485 in the aggregate for all of Mr. Keane's PSU awards, $5,150,309 for Mr. Quinn, and $5,493,824 for Mr. Wensveen. | |||||||

| (6) | This PSU award was granted to Mr. Keane in lieu of his base salary for his role as Chief Executive Officer in fiscal year 2021. The service-based vesting condition of this PSU award is that 25% of the original number of PSUs vest on each of September 30, 2020, December 31, 2020, March 31, 2021, and June 30, 2021 so long as Mr. Keane continues to be an eligible participant under Cimpress' 2020 Equity Incentive Plan on such vesting date. | |||||||

| (7) | This PSU award was granted to Mr. Keane in lieu of his $100,000 cash retainer fee for his role as a member of our Board of Directors in fiscal year 2021. The service-based vesting condition of this PSU award is that 25% of the original number of PSUs vest on each of September 30, 2020, December 31, 2020, March 31, 2021, and June 30, 2021 so long as Mr. Keane continues to be an eligible participant under Cimpress' 2020 Equity Incentive Plan on such vesting date. | |||||||

| (8) | This is the annual PSU award granted to the members of our Board of Directors, including Mr. Keane. The service-based vesting condition of this PSU award is that 25% of the PSUs vest on November 24 of each of 2021 through 2024 so long as Mr. Keane continues to be an eligible participant under Cimpress' 2020 Equity Incentive Plan on such vesting date. | |||||||

| (9) | The service-based vesting condition of the PSUs reported in this row is that 25% of the original number of PSUs vest on June 30 of each of 2021 through 2024 so long as the executive officer continues to be an eligible participant under Cimpress' 2020 Equity Incentive Plan on such vesting date. | |||||||

13

| (10) | 25% of the original number of RSUs subject to this award vest on July 1 of each of 2021 through 2024 so long as the executive officer continues to be an eligible participant under Cimpress' 2011 Equity Incentive Plan on such vesting date. | |||||||

| (11) | 25% of the original number of RSUs subject to this award vest on August 15 of each of 2021 through 2024 so long as the executive officer continues to be an eligible participant under Cimpress' 2020 Equity Incentive Plan on such vesting date. | |||||||

14

Outstanding Equity Awards at June 30, 2021

The following table contains information about unvested RSUs and unearned shares subject to PSUs as of June 30, 2021 for each of our named executive officers.

| Share Awards | ||||||||||||||||||||||||||

| Number of Share Units That Have Not Vested | Market Value of Share Units That Have Not Vested | Equity Incentive Plan Awards: Number of Unearned Shares | Equity Incentive Plan Awards: Market Value of Unearned Shares | |||||||||||||||||||||||

| Name | (#)(1) | ($)(2) | (#)(3) | ($)(4) | ||||||||||||||||||||||

| Robert S. Keane | 93,750(5) | 10,163,438 | ||||||||||||||||||||||||

| 78,970(6) | 8,561,138 | |||||||||||||||||||||||||

| 73,498(7) | 7,967,918 | |||||||||||||||||||||||||

| 8,895(8) | 964,307 | |||||||||||||||||||||||||

| 1,428(9) | 154,809 | |||||||||||||||||||||||||

| 436(10) | 47,267 | |||||||||||||||||||||||||

| 71,726(11) | 7,775,816 | |||||||||||||||||||||||||

| 18,663(12) | 2,023,256 | |||||||||||||||||||||||||

| 1,147(12) | 124,346 | |||||||||||||||||||||||||

| 1,398(13) | 151,557 | |||||||||||||||||||||||||

| 17,902(14) | 1,940,756 | |||||||||||||||||||||||||

| 1,108(14) | 120,118 | |||||||||||||||||||||||||

| 1,403(15) | 152,099 | |||||||||||||||||||||||||

| 73,335(16) | 7,950,247 | |||||||||||||||||||||||||

| Sean E. Quinn | 15,953(17) | 1,729,465 | 24,301(5) | 2,634,471 | ||||||||||||||||||||||

| 5,958(18) | 645,907 | 20,306(6) | 2,201,373 | |||||||||||||||||||||||

| 18,898(7) | 2,048,732 | |||||||||||||||||||||||||

| 22,952(19) | 2,488,226 | |||||||||||||||||||||||||

| 19,641(20) | 2,129,281 | |||||||||||||||||||||||||

| Maarten Wensveen | 13,294(17) | 1,441,203 | 14,400(5) | 1,561,104 | ||||||||||||||||||||||

| 6,016(6) | 652,195 | |||||||||||||||||||||||||

| 3,651(7) | 395,805 | |||||||||||||||||||||||||

| 18,362(19) | 1,990,624 | |||||||||||||||||||||||||

| 20,951(20) | 2,271,298 | |||||||||||||||||||||||||

___________________

| (1) | These amounts represent the number of Cimpress ordinary shares issuable pursuant to RSU awards upon vesting. | |||||||

| (2) | The market value of the unvested RSUs is determined by multiplying the number of RSUs by $108.41 per share, which was the closing price of our ordinary shares on Nasdaq on June 30, 2021, the last trading day of our 2021 fiscal year. | |||||||

| (3) | These amounts represent the number of Cimpress ordinary shares issuable pursuant to PSU awards if the applicable service-based vesting condition and 3YMA CAGR performance conditions described in the footnotes below are satisfied for such PSU award. | |||||||

| (4) | The market value of the unearned PSUs is determined by multiplying the number of shares that would be issuable if the conditions described in footnote 3 were achieved by $108.41 per share, which was the closing price of our ordinary shares on Nasdaq on June 30, 2021, the last trading day of our 2021 fiscal year. | |||||||

| (5) | This amount represents the number of Cimpress ordinary shares issuable six to ten years after the grant date of August 15, 2016 if the named executive officer fully satisfies the service-based vesting condition and the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). The service-based vesting condition has been fully satisfied for these PSUs, but the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until August 15, 2022 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

15

| (6) | This amount represents the number of Cimpress ordinary shares issuable six to ten years after the grant date of August 15, 2017 if the named executive officer fully satisfies the service-based vesting condition and the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). The service-based vesting condition has been fully satisfied for these PSUs, but the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until August 15, 2023 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

| (7) | This amount represents the number of Cimpress ordinary shares issuable six to ten years after the grant date of August 15, 2018 if the named executive officer fully satisfies the service-based vesting condition and the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). The service-based vesting condition for these PSUs is that 25% of the original number of PSUs vest on June 30 of each of 2019 through 2022 so long as the officer continues to be an eligible participant under Cimpress' 2016 Performance Equity Plan on each vesting date. However, the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until August 15, 2024 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

| (8) | This amount represents the number of Cimpress ordinary shares issuable six to ten years after the grant date of February 15, 2019 if the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). The service-based vesting condition has been fully satisfied for these PSUs, but the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until February 15, 2025 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

| (9) | This amount represents the number of Cimpress ordinary shares issuable six to ten years after the grant date of February 15, 2019 if Mr. Keane fully satisfies the service-based vesting condition and the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). The service-based vesting condition for these PSUs is that 25% of the original number of PSUs vest on November 12 of each of 2019 through 2022 so long as Mr. Keane continues to be an eligible participant under Cimpress' 2016 Performance Equity Plan on each vesting date. However, the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until February 15, 2025 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

| (10) | This amount represents the number of Cimpress ordinary shares issuable six to ten years after the grant date of February 15, 2019 if the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). The service-based vesting condition has been fully satisfied for these PSUs, but the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until February 15, 2025 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

| (11) | This amount represents the number of Cimpress ordinary shares issuable six to ten years after the grant date of August 15, 2019 if Mr. Keane fully satisfies the service-based vesting condition and the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). The service-based vesting condition for these PSUs is that 25% of the original number of PSUs vest on June 30 of each of 2020 through 2023 so long as Mr. Keane continues to be an eligible participant under Cimpress' 2016 Performance Equity Plan on each vesting date. However, the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until August 15, 2025 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

| (12) | This amount represents the number of Cimpress ordinary shares issuable six to ten years after the grant date of August 15, 2019 if the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). The service-based vesting condition has been fully satisfied for these PSUs, but the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until August 15, 2025 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

| (13) | This amount represents the number of Cimpress ordinary shares issuable six to ten years after the grant date of November 15, 2019 if Mr. Keane fully satisfies the service-based vesting condition and the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). The service-based vesting condition of these PSUs is that 25% of the PSUs vest on November 21 of each of 2020 through 2023 so long as Mr. Keane continues to be an eligible participant under Cimpress' 2016 Performance Equity Plan on such vesting date. However, the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until November 15, 2025 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

| (14) | This amount represents the number of Cimpress ordinary shares issuable six to ten years after the grant date of August 15, 2020 if the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). The service-based vesting condition has been fully satisfied for these PSUs, but the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until August 15, 2026 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

16

| (15) | This amount represents the number of Cimpress ordinary shares issuable six to ten years after the grant date of November 15, 2020 if Mr. Keane fully satisfies the service-based vesting condition and the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). The service-based vesting condition of these PSUs is that 25% of the PSUs vest on November 24 of each of 2021 through 2024 so long as Mr. Keane continues to be an eligible participant under Cimpress' 2016 Performance Equity Plan on such vesting date. However, the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until November 15, 2026 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

| (16) | This amount represents the number of Cimpress ordinary shares issuable six to ten years after the grant date of February 15, 2021 if Mr. Keane fully satisfies the service-based vesting condition and the 3YMA CAGR is 11% to 11.99% on any of the sixth through tenth anniversaries of the grant date (multiplier of 125%). The service-based vesting condition for these PSUs is that 25% of the original number of PSUs vest on June 30 of each of 2021 through 2024 so long as Mr. Keane continues to be an eligible participant under Cimpress' 2020 Equity Incentive Plan on each vesting date. However, the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until February 15, 2027 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

| (17) | These RSU awards vest as to 25% of the original number of units on July 1 of each of 2021 through 2024, on each of which dates we will automatically issue one ordinary share for each vested unit so long as the named executive officer continues to be an eligible participant under Cimpress' 2011 Equity Incentive Plan on that date. | |||||||

| (18) | This RSU award vests as to 25% of the original number of units on August 15 of each of 2021 through 2024, on each of which dates we will automatically issue one ordinary share for each vested unit so long as Mr. Quinn continues to be an eligible participant under Cimpress' 2020 Equity Incentive Plan on that date. | |||||||

| (19) | This amount represents the number of Cimpress ordinary shares issuable four to eight years after the grant date of August 15, 2019 if the named executive officer fully satisfies the service-based vesting condition and the 3YMA CAGR is 9% to 9.99% on any of the fourth through eighth anniversaries of the grant date (multiplier of 100%). The service-based vesting condition for these PSUs is that 25% of the original number of PSUs vest on June 30 of each of 2020 through 2023 so long as the officer continues to be an eligible participant under Cimpress' 2016 Performance Equity Plan on each vesting date. However, the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until August 15, 2023 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

| (20) | This amount represents the number of Cimpress ordinary shares issuable four to eight years after the grant date of February 15, 2021 if the named executive officer fully satisfies the service-based vesting condition and the 3YMA CAGR is 9% to 9.99% on any of the fourth through eighth anniversaries of the grant date (multiplier of 100%). The service-based vesting condition for these PSUs is that 25% of the original number of PSUs vest on June 30 of each of 2021 through 2024 so long as the officer continues to be an eligible participant under Cimpress' 2020 Equity Incentive Plan on each vesting date. However, the PSUs are not earned, and no shares are issuable pursuant to the PSUs, until February 15, 2025 at the earliest (unless there is an earlier change in control) and only if the performance conditions relating to the CAGR of the 3YMA of Cimpress' ordinary shares are satisfied. | |||||||

Option Exercises and Shares Vested in the Fiscal Year Ended June 30, 2021

The following table contains information about option exercises and vesting of RSUs on an aggregated basis during fiscal year 2021 for each of our named executive officers.

| Option Awards | Share Awards | |||||||||||||||||||||||||

| Name | Number of Shares Acquired on Exercise (#) | Value Realized on Exercise (1)($) | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting (2)($) | ||||||||||||||||||||||

| Robert S. Keane | 105,240 | 5,459,851 | — | — | ||||||||||||||||||||||

| Sean E. Quinn | — | — | 2,143 | 204,249 | ||||||||||||||||||||||

| Maarten Wensveen | — | — | 1,607 | 153,163 | ||||||||||||||||||||||

_________________________

| (1) | The value received on exercise of share options is determined by multiplying the number of shares exercised by the difference between the closing sale price of our ordinary shares on Nasdaq on the date of exercise and the exercise price. | |||||||||||||||||||||||||

| (2) | The value realized on vesting of RSUs is determined by multiplying the number of shares that vested by the closing sale price of our ordinary shares on Nasdaq on the vest date, or on the last trading date immediately before the vest date if the vest date is not a trading date. | |||||||||||||||||||||||||

17

CEO Pay Ratio

Mr. Keane's fiscal year 2021 annual total compensation was $8,340,034, as reported in the Summary Compensation Table above, and the fiscal year 2021 annual total compensation of our median compensated employee other than Mr. Keane was $27,136. The ratio of the median employee's total compensation to Mr. Keane's total compensation is 1-to-307. $8,283,797 of Mr. Keane's total compensation for fiscal year 2021 was in the form of PSU awards that will pay out six to ten years after grant only if the 3YMA CAGR performance conditions are met.