Form DEF 14A Bunge LTD For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x | |

Filed by a Party other than the Registrant o | |

Check the appropriate box: | |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a-12 |

BUNGE LIMITED

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): | ||

x | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

Notice of Annual General Meeting

of Shareholders and

2018 Proxy Statement

April 12, 2018

| Bunge Limited 50 Main Street White Plains, New York, 10606 U.S.A |

April 12, 2018

Dear Shareholder:

You are cordially invited to attend our Annual General Meeting of Shareholders, which will be held on Thursday, May 24, 2018 at 10:00 am, Eastern Time, at the Sofitel Hotel, 45 West 44th Street, in New York City. The proxy statement contains important information about the Annual General Meeting, the proposals we will consider and how you can vote your shares.

2017 marked a year of strategic and financial transformation for Bunge. Amidst the backdrop of an extremely challenging agribusiness industry environment, management and the Board proactively took steps to navigate these headwinds and position Bunge for future growth. This approach was exemplified by the announcement of our agreement to acquire a majority interest in IOI Loders Croklaan, a world leader in B2B oils solutions. The Loders acquisition, which was completed in early 2018, delivers on our stated objective to expand our value-added business by accelerating our growth in B2B semi-specialty and specialty oils, giving us a comprehensive product offering with leading innovation, application capabilities and sustainability programs. We also embarked on an ambitious global cost reduction program, aimed at reengineering our organizational and cost structure, which will advance our growth agenda and create significant value for our shareholders. We have also taken steps to exit non-strategic business areas, further enabling our focus on our core businesses.

As we move forward with these efforts, a key priority of our Board and management is ensuring robust outreach and engagement with our shareholders on the topics that matter most to them. We view our proxy statement as an important piece of our shareholder communications program. We encourage you to carefully review the information in the proxy statement as well as our annual report.

Your vote is very important to us. We encourage you to vote as soon as possible, regardless of whether you will attend the Annual General Meeting. This will help us ensure that your vote is represented at the Annual General Meeting.

As we look ahead, we are excited about the tremendous value creation opportunities in front of us as our dedicated management team continues to execute on our business strategy. On behalf of the Board of Directors and the management of Bunge, I extend our appreciation for your investment in Bunge. We look forward to seeing you at the Annual General Meeting.

|

L. Patrick Lupo Chairman of the Board of Directors |

| Bunge Limited 50 Main Street White Plains, New York, 10606 U.S.A |

NOTICE OF

ANNUAL GENERAL MEETING OF SHAREHOLDERS

Bunge Limited's 2018 Annual General Meeting of Shareholders will be held on May 24, 2018 at 10:00 am, Eastern Time, at the Sofitel Hotel, 45 West 44th Street, in New York City. At the Annual General Meeting, we will discuss and you will vote on the following proposals:

• | Proposal 1 — the election of the 10 directors named in the proxy statement to our Board of Directors; |

• | Proposal 2 — the appointment of Deloitte & Touche LLP as our independent auditors for the fiscal year ending December 31, 2018 and the authorization of the Audit Committee of the Board of Directors to determine the independent auditors' fees; and |

• | Proposal 3 — the approval of a non-binding advisory vote on the compensation of our named executive officers. |

Shareholders will also consider and act on such other matters as may properly come before the meeting or any adjournments or postponements thereof.

We will also present at the Annual General Meeting the consolidated financial statements and independent auditors' reports for the fiscal year ended December 31, 2017, copies of which can be found in our 2017 Annual Report that accompanies this notice.

March 29, 2018 is the record date for determining which shareholders are entitled to notice of, and to vote at, the Annual General Meeting and at any subsequent adjournments or postponements. You will be required to bring certain documents with you to be admitted to the Annual General Meeting. Please read carefully the sections in the proxy statement on attending and voting at the Annual General Meeting to ensure that you comply with these requirements.

Your vote is very important. Whether or not you plan to attend the Annual General Meeting in person, please promptly vote by mail, Internet or telephone so that your shares will be represented at the Annual General Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting to be held on May 24, 2018: Our 2018 Proxy Statement is available at www.bunge.com/2018proxy.pdf and our 2017 Annual Report is available at www.bunge.com/2017ar.pdf.

By order of the Board of Directors.

| |

April 12, 2018 | Carla L. Heiss Secretary |

TABLE OF CONTENTS

Key Qualifications | |

Current Board of Directors Snapshot | |

Board Structure and Size | |

Board Tenure and Refreshment | |

Sustainability | |

Pay Ratio Disclosure | |

i

B-1 | |

ii

PROXY STATEMENT SUMMARY |

This summary highlights certain information contained in this proxy statement. As it is only a summary, please review the entire proxy statement before voting.

Annual General Meeting Information

Ÿ Time and Date: | Thursday, May 24, 2018, at 10:00 am Eastern Time |

Ÿ Location: | Sofitel Hotel, 45 West 44th Street, New York, NY 10036. |

Ÿ Record Date: | Shareholders of record as of the close of business on March 29, 2018 are entitled to vote. |

Ÿ Voting: | Each outstanding common share is entitled to one vote. You may vote by telephone, internet, mail or by attending the Annual General Meeting. Please see "How Do I Vote?" on page 6. |

Ÿ Attendance: | To attend, please follow the instructions contained in "How do I attend the Annual General Meeting?" on page 6. |

Proposals and Voting Recommendations

Proposal | Board's Voting Recommendation | Vote Required For Approval | Page References (for more detail) | |

Proposal 1. | Election of Directors | FOR EACH NOMINEE | MAJORITY OF VOTES CAST | |

Proposal 2. | Appointment of Independent Auditors | FOR | MAJORITY OF VOTES CAST | |

Proposal 3. | Advisory Vote to Approve Named Executive Officer Compensation | FOR | MAJORITY OF VOTES CAST | |

1

Director Nominees

The Board of Directors has nominated the 10 directors named below for election at the Annual General Meeting and recommends FOR the election of each director nominee. Each nominee is currently a director of the Company. The following table provides summary information about each nominee, including committee assignments. (See "Election of Directors" for additional information regarding the nominees.)

Name | Independent | Audit (1) | Compensation (2) | FRPC (3) | CGNC (4) | SCRC (5) |

Ernest G. Bachrach Director since 2001 | Ÿ | Ÿ(C) | Ÿ | |||

Vinita Bali Director since 2018 | Ÿ | Ÿ | Ÿ | |||

Enrique H. Boilini Director since 2001 | Ÿ | Ÿ | Ÿ(C) | |||

Carol M. Browner Director since 2013 | Ÿ | Ÿ | Ÿ | Ÿ(C) | ||

Paul Cornet de Ways-Ruart Director since 2015 | Ÿ | Ÿ | Ÿ | Ÿ | ||

Andrew Ferrier Director since 2012 | Ÿ | Ÿ | Ÿ | Ÿ | ||

Kathleen Hyle Director since 2012 | Ÿ | Ÿ(C) | Ÿ | |||

L. Patrick Lupo* Director since 2006 | Ÿ | Ÿ | Ÿ(C) | |||

John E. McGlade Director since 2014 | Ÿ | Ÿ | Ÿ | |||

Soren Schroder** Director since 2013 | ||||||

Ÿ = Member | (C) = Chair | (*) = Board Chairman | (**) = Chief Executive Officer | |

(1) | Audit: Audit Committee | (2) Compensation: Compensation Committee | (3) FRPC: Finance and Risk Policy Committee | |

(4) | CGNC: Corporate Governance and Nominations Committee | (5) SCRC: Sustainability and Corporate Responsibility Committee | ||

Key Qualifications

Our diverse and international Board has a broad range of relevant and complementary skills, qualifications and experience, including the key qualifications listed below. The details of each director’s qualifications, experience and skills are included in each director’s profile.

2

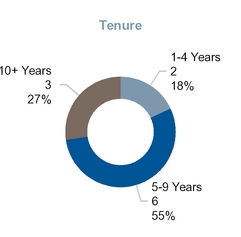

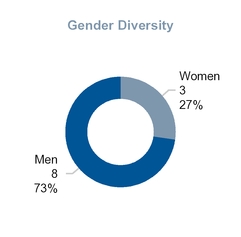

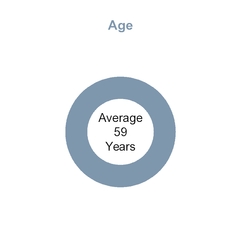

Current Board of Directors Snapshot

Corporate Governance Highlights

Our commitment to good corporate governance practices includes the following:

• | Separate Chairman and CEO. |

• | Independent non-executive Chairman. |

• | Declassified Board. |

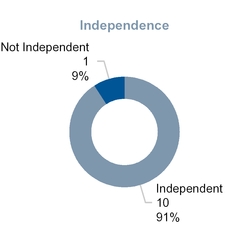

• | Ten out of 11 independent Board members and fully independent Board committees. |

• | Commitment to Board refreshment, with six of 11 directors having joined the Board within the past five years. |

• | Director retirement age of 72. |

• | Majority voting for directors. |

• | Independent directors meet regularly in executive sessions. |

• | Diverse and international Board with broad range of key skills, qualifications and experience. |

• | Annual Board review of Company strategy. |

• | Active risk oversight by full Board and committees. |

• | Board commitment to sustainability and corporate citizenship. |

• | Robust Board self-assessment and director nomination processes. |

• | Rigorous stock ownership guidelines for directors and executive officers. |

• | Long-standing, robust investor outreach program. |

• | Holders of 10% or more of our common shares have the ability to call a special meeting. |

• | No poison pill. |

• | Board takes active role in management succession planning. |

3

2017 Financial and Strategic Highlights

2017 marked a year of strategic and financial transformation for Bunge. Highlights of our operational, strategic, and financial achievements are provided below:

• | Announced the acquisition of IOI Loders Croklaan, which will significantly increase our value added platform and business balance. |

• | Launched a Global Competitiveness Program, designed to achieve a significant reengineering of the Company and deliver $250 million of run rate SG&A savings by the end of 2019. |

• | Delivered $40 million of SG&A cost savings under the Global Competitiveness Program and $110 million of industrial cost savings in 2017, exceeding our targets for both programs. |

• | Generated approximately $1 billion of operating cash flows and $900 million in funds from operations (adjusted)(1). |

• | On the back of strong cash generation, we continued our prudent focus on capital allocation, reducing capital expenditures by $122 million compared to 2016 and $188 million below our original 2017 target. |

• | Returned approximately $300 million to shareholders through dividends, our 16th year of consecutive dividend increases. |

(1) | Funds from operations (adjusted) is a non-GAAP financial measure. For further information on non-GAAP financial measures, including a reconciliation to the most directly comparable U.S. GAAP financial measure, see Appendix B to this proxy statement. |

Executive Compensation Highlights

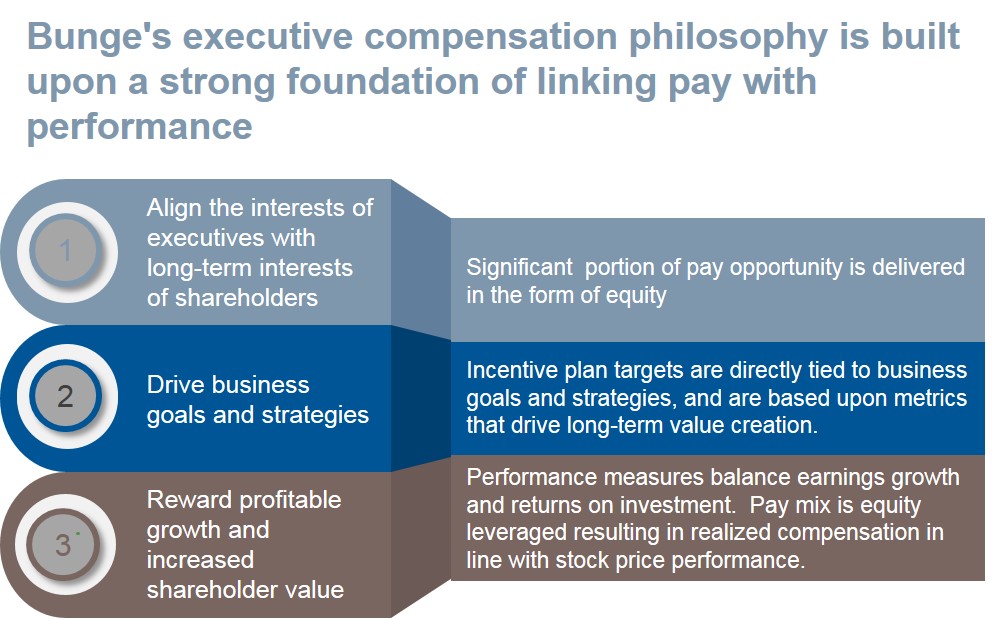

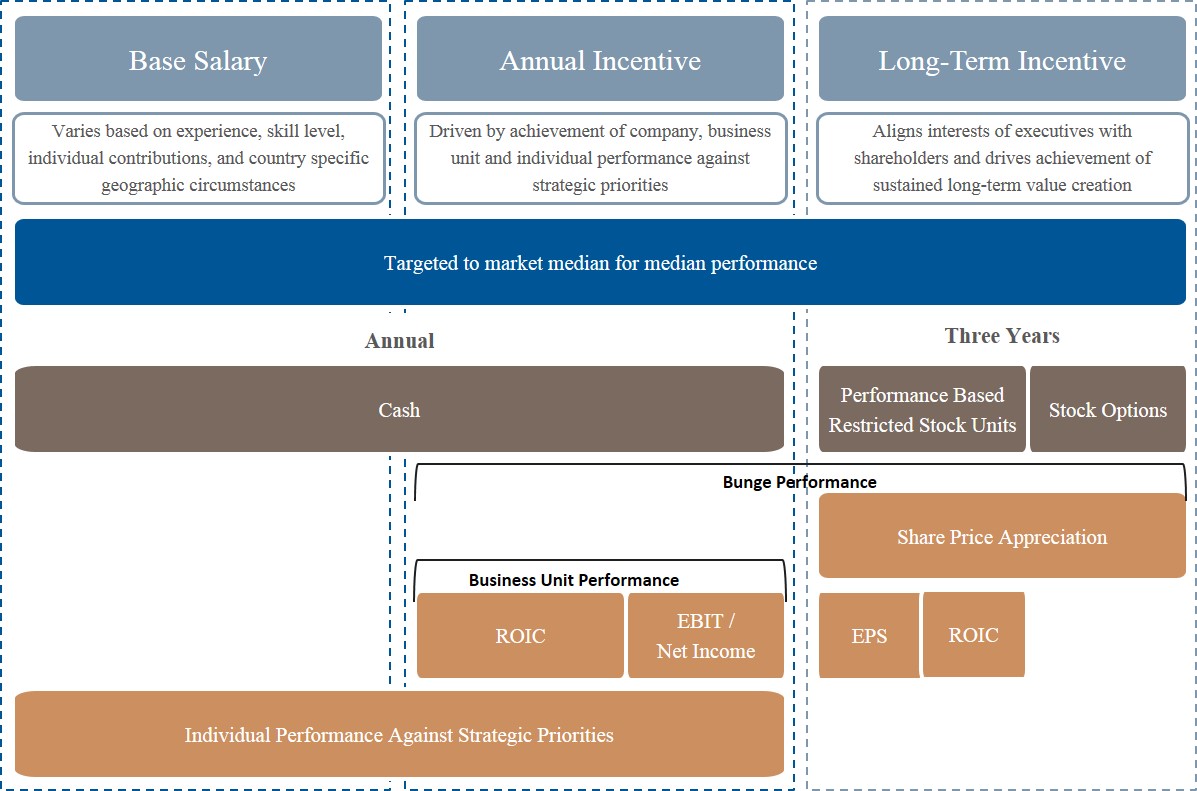

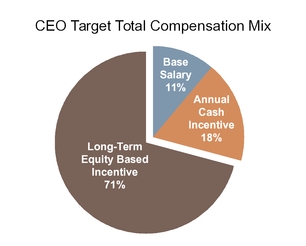

Bunge's executive compensation philosophy is built upon a strong foundation of linking pay with performance over the long-term and is structured to:

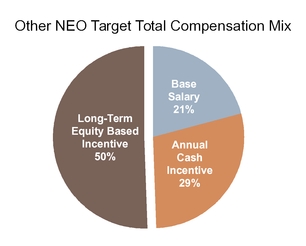

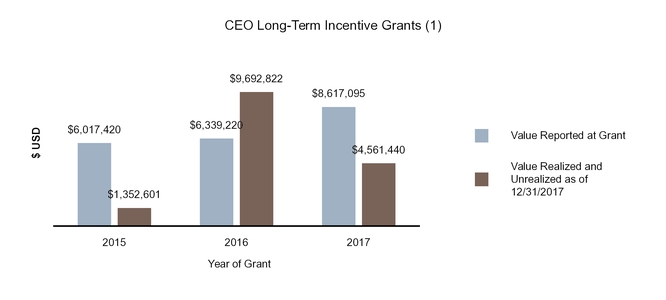

• | Align the interests of executives with the long-term interests of shareholders. The majority of NEO pay opportunity is delivered in the form of performance-based equity. |

• | Drive business goals and strategies. Incentive plan targets are directly tied to business goals and strategies, and are based upon metrics that drive long-term value creation. |

• | Reward profitable growth and increased shareholder value. Performance measures balance earnings growth and returns on investment. The pay mix is equity leveraged resulting in realized compensation in line with stock price performance. |

4

INFORMATION ABOUT THIS PROXY STATEMENT AND THE ANNUAL GENERAL MEETING |

Questions and Answers about Voting Your Common Shares

Why did I receive this Proxy Statement?

Bunge Limited ("Bunge" or the "Company") has furnished these proxy materials to you because Bunge's Board of Directors is soliciting your proxy to vote at the Annual General Meeting of Shareholders on May 24, 2018 (the "Annual General Meeting"). This proxy statement contains information about the items being voted on at the Annual General Meeting and important information about Bunge. Bunge's 2017 Annual Report, which includes Bunge's 2017 Annual Report on Form 10-K, is also being furnished together with this proxy statement. If you received printed versions of these materials by mail, these materials also include the proxy card or voting instruction form for the Annual General Meeting. Bunge is making its proxy materials first available to shareholders on or about April 12, 2018.

Bunge has sent these materials to each person who is registered as a holder of its common shares in its register of shareholders (such owners are often referred to as "holders of record" or "registered holders") as of the close of business on March 29, 2018, the record date for the Annual General Meeting.

Bunge has requested that banks, brokerage firms and other nominees who hold Bunge common shares on behalf of the owners of the common shares (such owners are often referred to as "beneficial shareholders" or "street name holders") as of the close of business on March 29, 2018 forward either a Notice (defined below) or a printed copy of these materials, together with a proxy card or voting instruction form, to those beneficial shareholders. Bunge has agreed to pay the reasonable expenses of the banks, brokerage firms and other nominees for forwarding these materials.

Finally, Bunge has provided for these materials to be sent to persons who have interests in Bunge common shares through participation in the Company share funds of the Bunge Retirement Savings Plan, the Bunge Savings Plan and the Bunge Savings Plan—Supplement A. Although these persons are not eligible to vote directly at the Annual General Meeting, they may, however, instruct the trustees of the plans on how to vote the common shares represented by their interests. The enclosed proxy card will also serve as voting instructions for the trustees of the plans. If you do not provide voting instructions for shares held for you in any of these

plans, the trustees will vote these shares in the same ratio as the shares for which voting instructions are provided.

Shareholders who owned our common shares as of the close of business on the record date for the Annual General Meeting are entitled to attend and vote at the Annual General Meeting and adjournments or postponements of the Annual General Meeting. The share register will not be closed between the record date and the date of the Annual General Meeting. A poll will be taken on each proposal to be put to the Annual General Meeting.

What is Notice and Access and why did Bunge elect to use it?

As permitted by regulations of the Securities and Exchange Commission, Notice and Access provides companies with the ability to make proxy materials available to shareholders electronically via the Internet. Bunge has elected to provide many of our shareholders with a Notice of Internet Availability of Proxy Materials ("Notice") instead of receiving a full set of printed proxy materials in the mail. The Notice is a document that provides instructions regarding how to:

• | view our proxy materials on the Internet; |

• | vote your shares; and |

• | request printed copies of these materials, including the proxy card or voting instruction form. |

On or about April 12, 2018, we began mailing the Notice to certain beneficial shareholders and posted our proxy materials on the website referenced in the Notice. See "Notice of Internet Availability of Proxy Materials" in this proxy statement for more information about where to view our proxy materials on the Internet.

As more fully described in the Notice, shareholders who received the Notice may choose to access our proxy materials on the website referenced in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The selected delivery choice will remain in effect until changed by the shareholder. If you have previously elected to receive our proxy materials electronically,

5

you will continue to receive access to those materials by email unless you elect otherwise.

How many votes do I have?

Every holder of a common share will be entitled to one vote per share for the election of each director and to one vote per share on each other matter presented at the Annual General Meeting. On March 29, 2018, there were 140,903,795 common shares issued and outstanding and entitled to vote at the Annual General Meeting.

What proposals are being presented at the Annual General Meeting?

Shareholders are being asked to vote on the following matters at the Annual General Meeting:

• | Proposal 1 — election of the 10 directors named in this proxy statement; |

• | Proposal 2 — the appointment of Deloitte & Touche LLP as our independent auditors and authorization of the Audit Committee of the Board to determine the auditors' fees; and |

• | Proposal 3 — the approval of a non-binding advisory vote on the compensation of our named executive officers. |

Other than the matters set forth in this proxy statement and matters incidental to the conduct of the Annual General Meeting, Bunge does not know of any business or proposals to be considered at the Annual General Meeting. If any other business is proposed and properly presented at the Annual General Meeting, the proxies received from our shareholders give the proxy holders the authority to vote on the matter at their discretion.

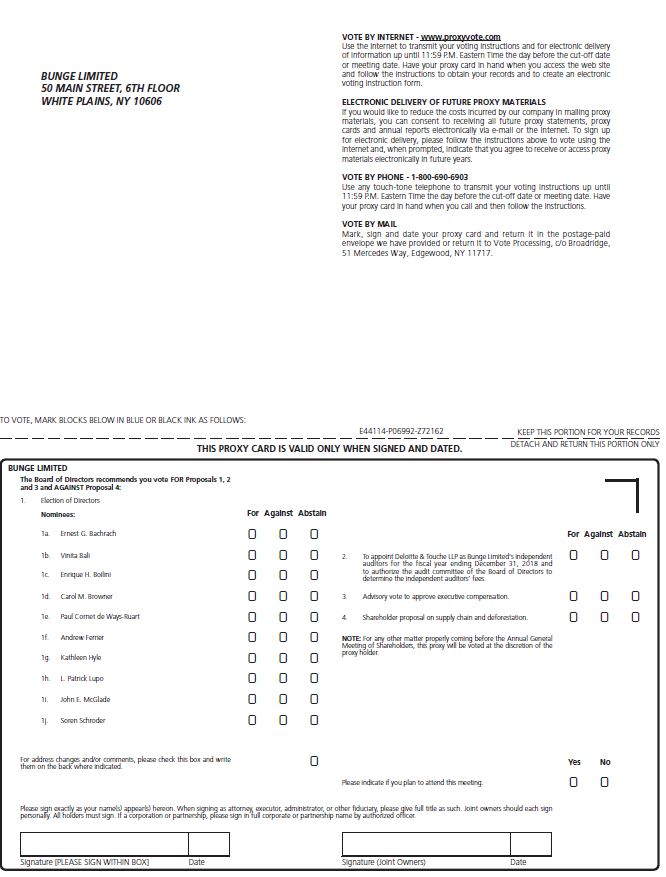

How do I attend the Annual General Meeting?

For admission to the Annual General Meeting, shareholders of record should bring the admission ticket attached to the enclosed proxy card, as well as a form of photo identification, to the shareholders' check-in area, where their ownership will be verified. Those who have beneficial ownership of common shares held by a bank, brokerage firm or other nominee must bring account statements or letters from their banks or brokers showing that they own Bunge common shares, together with a form of photo identification. Registration will begin at 9:00 a.m., EDT, and the Annual General Meeting will begin at 10:00 a.m., EDT.

How do I vote?

You can exercise your vote in the following ways:

• | By Telephone or the Internet: If you are a shareholder of record, you may appoint your proxy by telephone, or electronically through the Internet, by following the instructions on your proxy card. If you are a beneficial shareholder, please follow the instructions on your Notice or voting instruction form. |

• | By Mail: If you are a shareholder of record, you can appoint your proxy by marking, dating and signing your proxy card and returning it by mail in the enclosed postage-paid envelope. If you are a beneficial shareholder and received or requested printed copies of the proxy materials, you can vote by following the instructions on your voting instruction form. |

• | At the Annual General Meeting: If you are planning to attend the Annual General Meeting and wish to vote your common shares in person, we will give you a ballot at the meeting. Shareholders who own their common shares in street name are not able to vote at the Annual General Meeting unless they have a proxy, executed in their favor, from the holder of record of their shares. You must bring this additional proxy to the Annual General Meeting. |

Your vote is very important. Even if you plan to be present at the Annual General Meeting, we encourage you to vote as soon as possible.

What if I return my proxy card but do not mark it to show how I am voting?

If you sign and return your proxy card or voting instruction form but do not indicate instructions for voting, your common shares will be voted "FOR" each of Proposals 1, 2 and 3 [and "AGAINST" Proposal 4. With respect to any other matter which may properly come before the Annual General Meeting, your common shares will be voted at the discretion of the proxy holders.

May I change or revoke my proxy?

You may change or revoke your proxy at any time before it is exercised in one of four ways:

• | Notify our Secretary in writing at the address provided below before the Annual General Meeting that you are revoking your proxy; |

• | Use the telephone or the Internet to change your proxy; |

• | Submit another proxy card (or voting instruction form if you hold your common shares in street name) with a later date; or |

6

• | If you are a holder of record, or a beneficial holder with a proxy from the holder of record, vote in person at the Annual General Meeting. |

You may not revoke a proxy simply by attending the Annual General Meeting. To revoke a proxy, you must take one of the actions described above. Any written notice of revocation must be sent to the attention of our Secretary at 50 Main Street, White Plains, New York 10606, U.S.A., or by facsimile to (914) 684-3497.

What does it mean if I receive more than one Notice or set of proxy materials?

It means that you have multiple accounts at the transfer agent and/or with banks and stock brokers. Please vote all of your common shares. Beneficial shareholders sharing an address who are receiving multiple Notices or copies of proxy materials will need to contact their broker, bank or other nominee to request that only a single copy of each document be mailed to all shareholders at the shared address in the future. In addition, if you are the beneficial owner, but not the record holder, of Bunge's common shares, your broker, bank or other nominee may deliver only one copy of the Notice or proxy materials to multiple shareholders who share an address unless that nominee has received contrary instructions from one or more of the shareholders. Bunge will deliver promptly, upon written or oral request, a separate copy of the Notice, proxy statement or 2017 Annual Report to a shareholder at a shared address to which a single copy of the documents was delivered. Shareholders who wish to receive a separate copy of these documents should submit their request to Bunge's Investor Relations department by telephone at (914) 684-2800 or by submitting a written request to 50 Main Street, White Plains, New York 10606, U.S.A., Attention: Investor Relations.

Can I receive future proxy materials electronically?

Shareholders can help us conserve natural resources and reduce the cost of printing and mailing proxy statements and annual reports by opting to receive future mailings electronically. To enroll, please visit our website at www.bunge.com, click on the "Investors—Shareholder Info & Services—Electronic Delivery Enrollment" links and follow the instructions provided.

What constitutes a quorum?

The presence at the start of the Annual General Meeting of at least two persons representing, in person or by proxy, more than one-half of our

outstanding common shares will constitute a quorum for the transaction of business.

What vote is required in order to approve each proposal?

The affirmative vote of a majority of the votes cast is required to elect each of the nominees for director (Proposal 1). As this is an uncontested election, any nominee for director who receives a greater number of votes "against" his or her election than votes "for" such election will not be elected to the Board and the position on the Board that would have been filled by the director nominee will become vacant.

The affirmative vote of a majority of the votes cast is also required to approve the appointment of our independent auditors (Proposal 2) and the non-binding advisory vote on executive officer compensation (Proposal 3).

Proposal 3 is an advisory vote only and, as discussed in the proposal later in this proxy statement, the voting results are not binding on us. However, consistent with our record of shareholder engagement, our Board will review the results of the vote and will take them into account in considering the compensation of our executive officers.

Pursuant to Bermuda law, (i) common shares which are represented by "broker non-votes" (i.e., common shares held by brokers which are represented at the Annual General Meeting but with respect to which the broker is not empowered to vote on a particular proposal) and (ii) common shares represented at the Annual General Meeting which abstain from voting on any matter, are not included in the determination of the common shares voting on such matter, but are counted for quorum purposes.

Under the rules of the New York Stock Exchange ("NYSE"), if you do not submit specific voting instructions to your broker, your broker will not have the ability to vote your common shares in connection with Proposals 1 and 3. Accordingly, if your common shares are held in street name and you do not submit voting instructions to your broker, your common shares will be treated as broker non-votes for these proposals.

How will voting on any other business be conducted?

Other than the matters set forth in this proxy statement and matters incident to the conduct of the Annual General Meeting, we do not know of any business or proposals to be considered at the Annual General Meeting. If any other business is properly proposed and presented at the Annual General Meeting, the proxies received from our shareholders

7

give the proxy holders the authority to vote on the matter at the discretion of the proxy holders.

Who will count the votes?

Broadridge will act as the inspector of election and will tabulate the votes.

Deadline for Appointment of Proxies by Telephone or the Internet or Returning Your Proxy Card

Bunge shareholders should complete and return the proxy card as soon as possible. To be valid, your proxy card must be completed in accordance with the instructions on it and received by us no later than 11:59 p.m., EDT, on May 23, 2018. If you appoint your proxy by telephone or the Internet, we must receive your appointment no later than 11:59 p.m., EDT, on May 23, 2018. If you participate in the Bunge share funds of the Bunge Retirement Savings Plan, the Bunge Savings Plan or the Bunge Savings Plan — Supplement A, you must also submit your voting instructions by this deadline in order to allow the plan trustees time to receive your voting instructions and vote on behalf of the plans. If your common shares are held in street name and you are voting by mail, you should return your voting instruction form in accordance with the instructions on that form or as provided by the bank, brokerage firm or other nominee who holds Bunge common shares on your behalf.

Solicitation of Proxies

We will bear the cost of the solicitation of proxies, including the preparation, printing and mailing of proxy materials and the Notice. We will furnish copies of these proxy materials to banks, brokers, fiduciaries and custodians holding shares in their names on behalf of beneficial owners so that they may forward these proxy materials to our beneficial owners.

We have retained Innisfree M&A Incorporated to assist us in the distribution of the proxy materials and to act as proxy solicitor for the Annual General Meeting for a fee of $15,000 plus reasonable out-of-pocket expenses. In addition, we may supplement the original solicitation of proxies by mail with solicitation by telephone and other means by our directors, officers and/or other employees. We will not pay any additional compensation to these individuals for any such services.

8

CORPORATE GOVERNANCE |

The following sections provide an overview of Bunge's corporate governance policies and practices, including with respect to Board tenure and refreshment, independence of directors, Board leadership, risk oversight, shareholder outreach and the structure and key aspects of our Board and committee operations. The Board regularly reviews our policies and processes in the context of current corporate governance trends, regulatory changes and recognized best practices.

Board Structure and Size

As of the date of this proxy statement, our Board consists of 11 directors (decreasing to ten upon the expiration of Mr. Fibig's current term at the Annual General Meeting). Following the full declassification of the Board at the 2017 Annual General Meeting, all directors will be elected to one-year terms at the 2018 Annual General Meeting.

Board Tenure and Refreshment

The Board actively reviews and refreshes its membership. Given the complexity and long-term nature of our business, we believe that a mix of longer-tenured, experienced directors and newer directors with fresh perspectives contributes to an effective Board. In furtherance of this objective, the Board maintains an active Board succession and refreshment program led by the Corporate Governance and Nominations Committee. Since 2013, the Board has added six new directors and had five directors leave the Board, including several long-tenured directors. As a result, six of our 11 current directors have served on the Board for less than five years. This ongoing Board refreshment process has also resulted in an increase in the depth and scope of qualifications and diversity represented on the Board.

The Board has adopted a Board retirement age of 72; however, it does not impose director tenure limits as the Board believes that imposing limits on director tenure could arbitrarily deprive it of the valuable contributions of its most experienced members. Accordingly, length of Board service is one of a variety of factors considered by the Corporate Governance and Nominations Committee in making director nomination recommendations to the Board. Additionally, we have implemented full declassification of our Board, which means each director must be re-nominated by the Board on an annual basis. This provides the Board with the opportunity to consider the optimal mix of skills, qualifications and experience each year.

Board Independence

The Board is composed of a substantial majority of independent directors. In accordance with the listing standards of the NYSE, to be considered independent, a director must have no material relationship with Bunge directly or as a partner, shareholder or officer of an organization that has a relationship with Bunge. The NYSE has also established enhanced independence standards applicable to members of our audit committee and our compensation committee.

The Board annually reviews commercial and other relationships between directors or members of their immediate families and Bunge in order to make a determination regarding the independence of each director. To assist it in making these determinations, the Board has adopted categorical standards of director independence which are set forth in Annex A to our Corporate Governance Guidelines, which are included as Appendix A to this proxy statement and are also available through the "Investors — Corporate Governance" section of our website, www.bunge.com. Transactions, relationships and arrangements between a director and Bunge that are within our independence standards are deemed immaterial, subject to NYSE standards. Additionally, Bunge's bye-laws provide that no more than two directors may be employed by Bunge or any company or entity which is controlled by Bunge.

In making its independence determinations, the Board considers relevant facts and circumstances, including that in the normal course of business, purchase and sale and other commercial and charitable transactions or relationships may occur between Bunge and other companies or organizations with which some of our directors or their immediate family members are affiliated. In 2017, Bunge made sales in the ordinary course of business to Anheuser-Busch InBev S.A., where Mr. Cornet de Ways-Ruart serves as a director; had ordinary course business relationships with Telecom Argentina S.A., where Mr. Boilini served as a director during the year; and had commercial and charitable relationships with a charitable organization where Mr. Boilini serves as a board member.

9

Based on the evaluation and criteria described above, the Board has determined that the following directors are independent: Messrs. Bachrach, Boilini, Cornet de Ways-Ruart, Ferrier, Fibig, Lupo and McGlade and Mses. Bali, Browner and Hyle. Mr. Schroder is not considered an independent director due to his position as an executive officer of Bunge. Accordingly, ten of our 11 directors are independent and our Board's committees are comprised solely of independent directors.

Board Leadership Structure

Our Board does not have a requirement that the roles of Chief Executive Officer and Chairman of the Board be either combined or separated, because the Board believes this determination should be made based on the best interests of Bunge and its shareholders at any point in time based on the facts and circumstances then facing the Company. Demonstrating the Board's commitment to making these thoughtful and careful determinations, our Board has separated the Chairman and CEO roles since 2013 at the time of Mr. Schroder's appointment as CEO, and L. Patrick Lupo has served as the Company's independent, non-executive Chairman since January 1, 2014. The Board believes that its current leadership structure is in the best interests of the Company and its shareholders at this time and demonstrates its commitment to independent oversight, which is a critical aspect of effective governance.

Additionally, as described above, our Board is characterized by a substantial majority of independent directors as well as Board committees that are comprised entirely of independent directors. As a result, independent directors oversee critical matters, including the integrity of our financial statements, the evaluation and compensation of executive management, the selection of directors, Board performance and our risk management practices.

Board Meetings and Committees

The Board normally has five regularly scheduled in person meetings per year, and committee meetings are normally held in conjunction with Board meetings. Additionally, the Board holds telephonic meetings to receive updates on the Company's business and as circumstances may require. Our Board met 11 times in 2017. All directors serving on the Board as of December 31, 2017 attended at least 75% of the combined Board and committee meetings on which they served during the last fiscal year.

Our bye-laws give our Board the authority to delegate its powers to committees appointed by the Board. We have five standing Board committees: the Audit Committee, the Compensation Committee, the Finance and Risk Policy Committee, the Corporate Governance and Nominations Committee and the Sustainability and Corporate Responsibility Committee. Each committee is comprised entirely of independent directors, and the members of the Audit Committee and the Compensation Committee also meet the enhanced independence rules of the SEC and NYSE applicable to such committees. Each of our committees is authorized and assured of appropriate funding to retain and consult with external advisors and counsel. Our committees are required to conduct meetings and take action in accordance with the directions of the Board, the provisions of our bye-laws and the terms of their respective committee charters. Each committee has the power under its charter to sub-delegate the authority and duties designated in its charter to subcommittees or individual members of the committee as it deems appropriate, unless prohibited by law, regulation or any NYSE listing standard. Copies of all our committee charters are available on our website, www.bunge.com. Please note that the information contained in or connected to our website is not intended to be part of this proxy statement.

Audit Committee. Pursuant to its charter, our Audit Committee's primary role is to assist the Board in fulfilling its responsibility for oversight of:

• | the quality and integrity of our financial statements and related disclosure; |

• | our compliance with legal and regulatory requirements; |

• | the independent auditor's qualifications, independence and performance; and |

• | the performance of our internal audit and control functions. |

Please see the Audit Committee Report included in this proxy statement for information about our 2017 fiscal year audit. The Audit Committee met 11 times in 2017. The Audit Committee meets separately with our independent auditor and also in executive sessions with members of management and our chief audit executive from time to time as deemed appropriate by the committee. Additionally, the Audit Committee periodically meets in executive sessions at which only the Audit Committee members are in attendance, without any members of our management

10

present. The members of our Audit Committee are Mses. Browner and Hyle (chair) and Messrs. Boilini, Cornet de Ways-Ruart and Fibig. Our Board has determined that each of Mr. Boilini and Ms. Hyle qualifies as an audit committee financial expert. In accordance with our Audit Committee charter, no committee member may simultaneously serve on the audit committees of more than two other public companies without the prior approval of the Board.

Compensation Committee. Our Compensation Committee designs, reviews and oversees Bunge's executive compensation program. Under its charter, the committee, among other things:

• | reviews and approves corporate goals and objectives relevant to the compensation of our CEO, evaluates the performance of the CEO in light of these goals and objectives and sets the CEO's compensation based on this evaluation; |

• | reviews the evaluations by the CEO of the direct reports to the CEO and approves and oversees the total compensation packages for the direct reports to the CEO; |

• | reviews and approves employment, consulting, retirement and severance agreements and arrangements for the CEO and direct reports to the CEO; |

• | reviews and makes recommendations to the Board regarding our incentive compensation plans, including our equity incentive plans, and administers our equity incentive plans; |

• | establishes and reviews our executive and director share ownership guidelines; |

• | reviews our compensation practices to ensure that they do not encourage unnecessary and excessive risk taking; and |

• | makes recommendations to the Board on director compensation. |

Pursuant to its charter, the Compensation Committee is empowered to hire outside advisors as it deems appropriate to assist it in the performance of its duties. The Compensation Committee has sole authority to retain or terminate any such compensation consultants or advisors and to approve their fees. For additional information on the Compensation Committee's role, its use of outside advisors and their roles, as well as the committee's processes and procedures for the consideration and determination of executive compensation, see "Executive Compensation — Compensation Discussion and Analysis" beginning on page 23 of this proxy statement.

The Compensation Committee met seven times in 2017. The members of our Compensation Committee are Messrs. Bachrach (chairman), Ferrier, Lupo and McGlade.

Corporate Governance and Nominations Committee. Our Corporate Governance and Nominations Committee is responsible for, among other things:

• | monitoring, advising and making recommendations to the Board with respect to the law and practice of corporate governance and the duties and responsibilities of directors of public companies, as well as overseeing our corporate governance initiatives and related policies; |

• | leading the Board in its annual performance evaluation and overseeing the self-evaluations of each Board committee; |

• | identifying and recommending to the Board nominees for election or re-election to the Board, or for appointment to fill any vacancy that is anticipated or has arisen on the Board (see "— Nomination of Directors" for more information); |

• | reviewing and making recommendations to the Board regarding director independence; and |

• | overseeing our related person transaction policies and procedures. |

The Corporate Governance and Nominations Committee met five times in 2017. The members of our Corporate Governance and Nominations Committee are Messrs. Bachrach and Lupo (chairman) and Mses. Browner and Hyle.

Finance and Risk Policy Committee. Our Finance and Risk Policy Committee ("FRPC") is responsible for supervising the quality and integrity of our financial and risk management practices. As further described below under "— Risk Oversight," the FRPC reviews and approves our risk management policies and risk limits on a periodic basis and advises our Board on financial and risk management practices. The FRPC met six times in 2017.

11

The members of the FRPC are Ms. Bali and Messrs. Boilini (chairman), Cornet de Ways-Ruart, Ferrier, Fibig and McGlade.

Sustainability and Corporate Responsibility Committee. Our Sustainability & Corporate Responsibility Committee ("SCRC") provides oversight of Bunge's policies, strategies and programs with respect to sustainability and corporate social responsibility, including matters related to the environment, human rights, community relations, supply chains, nutrition and health, food safety, public affairs, philanthropy and other matters. The SCRC met five times in 2017. The members of the SCRC are Mses. Bali and Browner (chair) and Messrs. Cornet de Ways-Ruart and Ferrier.

Risk Oversight

Our Board of Directors oversees management's approach to risk management, which is designed to support the achievement of our strategic objectives and enhance shareholder value. For the Board, fundamental aspects of its risk management oversight activities include:

• | understanding the Company's strategy and the associated major risks inherent in our operations and corporate strategy; |

• | crafting the right Board for our Company, including establishing an appropriate committee structure to carry out its oversight responsibilities effectively; and |

• | overseeing implementation by management of appropriate risk management and control procedures and developing and maintaining an open, ongoing dialogue with management about major risks facing the Company. |

Our Board has considered the most effective organizational structure to appropriately oversee major risks for our Company. It has established a dedicated Board committee, the FRPC, which enables greater focus at the Board level on financial risk oversight tailored to our business and industries. The FRPC has responsibility for oversight of the quality and integrity of our financial and risk management practices relating to the following key areas: commodities risk, foreign exchange risk, liquidity, interest rate and funding risk, credit and counterparty risk, country risk, new trading or investing business activity risk and capital structure. The FRPC reviews and approves corporate risk policies and limits associated with the Company's risk appetite. The FRPC meets regularly with our CEO, Chief Financial Officer, chief risk officer, treasurer and other members of senior management to receive regular updates on our risk profile and risk management activities.

Additionally, each of our other Board committees considers risks within its area of responsibility. For example, our Audit Committee focuses on risks related to the Company’s financial statements, the financial reporting process and accounting and financial controls. The Audit Committee receives an annual risk assessment briefing from our chief audit executive, as well as periodic update briefings, and reviews and approves the annual internal audit plan that is designed to address the identified risks. The Audit Committee also reviews key risk considerations relating to the annual audit with our independent auditors. The Audit Committee also assists the Board in fulfilling its oversight responsibility with respect to legal and compliance matters, including meeting with and receiving periodic briefings from our chief legal officer and other members of our legal and compliance staff. The Audit Committee also oversees our information technology programs, including cybersecurity risk and preparedness.

In developing and overseeing our compensation programs, the Compensation Committee seeks to create incentives that are appropriately balanced and do not motivate employees to take imprudent risks. See "Compensation and Risk" on page 46 of this proxy statement for more information.

Our Corporate Governance and Nominations Committee oversees risks related to the Company's governance structure and processes. This includes its role in identifying individuals qualified to serve as Board members, and its leadership of the annual Board self-assessment process that is aimed at ensuring that the Board is functioning effectively and is able to meet all of its responsibilities, including risk oversight.

The Sustainability and Corporate Responsibility Committee is engaged in oversight of sustainability and social responsibility matters, including supply chain and food safety matters, and related reputational and business risks.

All of our Board committees regularly report on their activities to the full Board to promote effective coordination and ensure that the entire Board remains apprised of major risks, how those risks may interrelate, and how management addresses those risks.

12

Corporate Governance Guidelines and Code of Conduct

Our Board has adopted Corporate Governance Guidelines that set forth our corporate governance objectives and policies and, subject to our bye-laws, govern the functioning of the Board. Our Corporate Governance Guidelines are available on our website, www.bunge.com. Please note that information contained in or connected to our website is not intended to be part of this proxy statement.

The Code of Conduct sets forth our commitment to ethical business practices, reinforces various corporate policies and reflects our values, vision and culture. Our Code of Conduct applies to all of our directors, officers and employees worldwide, including our CEO and senior financial officers. Our Code of Conduct is available on our website. We intend to post amendments to and waivers (to the extent applicable to certain officers and our directors) of our Code of Conduct on our website.

Executive Sessions of Our Board

Our Corporate Governance Guidelines provide that the non-management directors shall meet without management directors at regularly scheduled executive sessions and at such other times as they deem appropriate. Our Board has adopted a policy that the non-management directors will meet without management directors present at each regularly scheduled in person Board meeting. Our non-executive, independent Chairman presides over these sessions.

Communications with Our Board

To facilitate the ability of shareholders to communicate with our Board and to facilitate the ability of interested persons to communicate with non-management directors, the Board has established a physical mailing address to which such communications may be sent. This physical mailing address is available on our website, www.bunge.com, through the "Investors — Corporate Governance" section.

Communications received are initially directed to our legal department, where they are screened to eliminate communications that are merely solicitations for products and services, items of a personal nature not relevant to us or our shareholders and other matters that are improper or irrelevant to the functioning of the Board or Bunge. All other communications are forwarded to the relevant director, if addressed to an individual director or a committee chairman, or to the members of the Corporate Governance and Nominations Committee if no particular addressee is specified.

Board Member Attendance at Annual General Meetings

It is the policy of our Board that our directors attend each annual general meeting of shareholders. In 2017, all of our then serving directors attended our Annual General Meeting.

Shareholder Outreach and Engagement

Shareholder outreach is a key priority of our Board and management, and through our shareholder outreach program, we engage with our investors to gain valuable insights into the current and emerging issues that matter most to them, including with respect to corporate governance, executive compensation, sustainability and other matters. Over each of the past five years, our independent Chairman and management have engaged with institutional investors representing approximately 35% to 40% of our outstanding shares. Feedback from these discussions is relayed to the Board of Directors. Additionally, outside of the shareholder outreach program, we interact with institutional and individual shareholders throughout the year on a wide range of issues.

Sustainability

We are committed to being responsible corporate citizens. This means creating maximum value while having minimum impact on the environment.

Our philosophy is to “Act, Conserve and Engage,” and we live by four clear principles:

• | We contribute to the economic and social development of the communities where we work. |

• | We aim for good environmental performance by adopting and promoting proven, culturally sensitive and pragmatic best practices. |

13

• | We partner with others to promote and apply sustainable practices. |

• | We communicate openly. |

To achieve our goals, we have established a robust governance structure, overseen by our Board’s Sustainability and Corporate Responsibility Committee. This committee oversees the development of relevant sustainability and corporate social responsibility policies, strategies and programs, including performance goals, risk management and disclosure. We continuously seek to enhance the transparency and sustainability of our value chains, reduce the environmental impact of our operations, strengthen engagement with key stakeholders and increase our reporting and disclosure. For more information, about our sustainability efforts, please see www.bunge.com/sustainability.

Board and Committee Evaluations

The Board conducts annual self-evaluations to determine whether it and its committees are functioning effectively. As part of the Board self-evaluation process, our independent Chairman interviews each director to obtain his or her assessment of the effectiveness of the Board and committees, as well as director performance and Board dynamics. Additionally, each committee annually reviews its own performance through written questionnaires and assesses the adequacy of its charter. The process is designed and overseen by the Corporate Governance and Nominations Committee, which is chaired by our independent Chairman, and the results of the evaluations are discussed by the full Board.

Nomination of Directors

As provided in its charter, the Corporate Governance and Nominations Committee identifies and recommends to the Board nominees for election or re-election to the Board and will consider nominees submitted by shareholders. The Corporate Governance and Nominations Committee, in its commitment to our Corporate Governance Guidelines, strives to nominate director candidates who exhibit high standards of ethics, integrity, commitment and accountability and who are committed to promoting the long-term interests of our shareholders. In addition, all nominations attempt to ensure that the Board shall encompass a range of talent, skill and relevant expertise sufficient to provide sound guidance with respect to our operations and interests. The committee strives to recommend candidates who complement the current members of the Board and other proposed nominees so as to further the objective of having a Board that reflects a diversity of background and experience with the necessary skills to effectively perform the functions of the Board and its committees. In that regard, from time to time, the Corporate Governance and Nominations Committee may identify certain skills or attributes as being particularly desirable to help meet specific Board needs that have arisen or are expected to arise. When the Corporate Governance and Nominations Committee reviews a potential new candidate, it looks specifically at the candidate's qualifications in light of the needs of the Board at that time given the then-current mix of director attributes. Additionally, the Corporate Governance and Nominations Committee annually reviews the tenure, performance, skills and contributions of existing Board members to the extent they are candidates for re-election. Directors eligible for re-election abstain from Board discussions regarding their nomination and from voting on such nomination.

Under the Corporate Governance Guidelines, directors must inform the Chairman of the Board and the Chairman of the Corporate Governance and Nominations Committee in advance of accepting an invitation to serve on another public company board. In addition, no director may sit on the board, or beneficially own more than 1% of the outstanding equity securities, of any of our competitors in our principal lines of business.

In connection with the director nominations process, the Corporate Governance and Nominations Committee may identify candidates through recommendations provided by members of the Board, management, shareholders or other persons, and has also engaged professional search firms to assist in identifying or evaluating qualified candidates. Ms. Bali, who joined the Board in January 2018, was identified through a professional search firm. The Corporate Governance and Nominations Committee will review and evaluate candidates taking into account available information concerning the candidate, the qualifications for Board membership described above and other factors that it deems relevant. In conducting its review and evaluation, the Committee may solicit the views of other members of the Board, senior management and third parties, conduct interviews of proposed candidates and request that candidates meet with other members of the Board. The Committee will evaluate candidates recommended by shareholders in the same manner as candidates recommended by other persons. The Corporate

14

Governance and Nominations Committee has not received any nominations for director from shareholders for the Annual General Meeting.

In accordance with our bye-laws, shareholders who wish to propose a director nominee must give written notice to our Secretary at our registered address at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda, not later than 120 days before the first anniversary of the date on which Bunge's proxy statement was distributed to shareholders in connection with the prior year's annual general meeting. If no annual general meeting was held in the prior year or if the date of the annual general meeting has been changed by more than 30 days from the date contemplated in the prior year's proxy statement, the notice must be given before the later of (i) 150 days prior to the contemplated date of the annual general meeting and (ii) the date which is 10 days after the date of the first public announcement or other notification of the actual date of the annual general meeting. Where directors are to be elected at a special general meeting, such notice must be given before the later of (i) 120 days before the date of the special general meeting and (ii) the date which is 10 days after the date of the first public announcement or other notification of the date of the special general meeting. In each case, the notice must include, as to each person the shareholder proposes to nominate for election or re-election as director, all information relating to that person required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which includes such person's written consent to being named in the proxy statement as a nominee and to serving as a director if elected, and evidence satisfactory to Bunge that such nominee has no interests that would limit such nominee's ability to fulfill their duties of office. Bunge may require any nominee to furnish such other information as reasonably may be required by Bunge to determine the eligibility of such nominee to serve as a director. A shareholder may propose a director nominee to be considered by our shareholders at the annual general meeting provided that the notice provisions in our bye-laws as set forth above are met, even if such director nominee is not nominated by the Corporate Governance and Nominations Committee. A shareholder may also recommend director candidates for consideration by the Corporate Governance and Nominations Committee at any time. Any such recommendations should include the nominee's name and qualifications for Board membership.

15

PROPOSAL 1 — ELECTION OF DIRECTORS |

Election of Directors

Our Board has nominated each of the 10 nominees listed below for election at the Annual General Meeting, each to hold office until next year's Annual General Meeting. The Board has nominated each of these directors based on the recommendation of the Corporate Governance and Nominations Committee. Each nominee is presently a member of the Board and has agreed to serve if elected. Mr. Andreas Fibig will be stepping down from the Board when his current term expires on the date of the Annual General Meeting. Following the Annual General Meeting, the size of the Board therefore will be reduced from 11 to ten members.

The Board believes that its members possess a variety of skills, qualifications and experience that contribute to the Board's ability to oversee our operations and the growth of our business. The following paragraphs set forth information about the nominees.

Nominees

| Ernest G. Bachrach, 65 Mr. Bachrach has been a member of our Board since 2001. He is a former partner and member of the board of directors of Advent International Corporation, a global private equity firm. He worked at Advent from 1990 to 2015 and held several senior positions during that time, including chairman of the firm's Latin American investment committee. He also served on Advent's global executive committee for 12 years. Prior to joining Advent, Mr. Bachrach was Senior Partner, European Investments, for Morningside Group, a private investment group. He is a member of the Endeavor Global, Inc. boards in Miami and Peru. He has a B.S. in Chemical Engineering from Lehigh University and an M.B.A. from Harvard Graduate School of Business Administration. Mr. Bachrach also serves on the Board of Governors of the Lauder Institute of the Wharton School of the University of Pennsylvania. Skills and Qualifications: Mr. Bachrach's skills and experience as a former senior leader of a private equity firm provide our Board with knowledge of financial markets, financial expertise and experience in mergers and acquisitions, business development and corporate strategy. He also brings to the Board international business and board experience. |

| Vinitia Bali, 62 Ms. Bali has been a member of our Board since January 2018. She served as Chief Executive Officer of Britannia Industries, a publicly listed food company in India, from 2005 to 2014. Prior to that, she was Head of the Business Strategy practice in the U.S. at the Zyman Group, a consulting firm. She started her career in India at a Tata Group company in 1977, and joined Cadbury India in 1980, subsequently working for Cadbury in the United Kingdom, Nigeria and South Africa until 1994. From 1994 to 2003, she held senior positions in marketing and general management at The Coca-Cola Company in the U.S. and Latin America, becoming Global Head of Corporate Strategy in 2001. Ms. Bali serves as an advisory board member of PwC India, and is a non-executive director on the boards of Smith & Nephew plc, as well as several Indian companies, including CRISIL Ltd. and Syngene International Limited. She is a former non-executive director of Syngenta International AG. She also chairs the Board of the Global Alliance for Improved Nutrition (GAIN). Skills and Qualifications: Ms. Bali brings to our Board extensive leadership, management, operations, marketing, and international experience in the food industry and emerging markets, as well as public policy experience. |

16

| Enrique H. Boilini, 56 Mr. Boilini has been a member of our Board since 2001. He is a senior managing director of Lone Star Latin American Acquisitions LLC, an affiliate of Lone Star Funds, a global private equity firm. He is also a Managing Member at Yellow Jersey Capital, LLC, an investment management company which he established in 2002. Prior to establishing Yellow Jersey Capital, Mr. Boilini was a Managing Member of Farallon Capital Management, LLC and Farallon Partners, LLC, two investment management companies, since 1996. Mr. Boilini joined Farallon in 1995 as a Managing Director. Prior to that, Mr. Boilini also worked at Metallgesellschaft Corporation, as the head trader of emerging market debt and equity securities, and also served as a Vice President at The First Boston Corporation, where he was responsible for that company's activities in Argentina. Mr. Boilini is a former member of the Board of TELECOM Argentina. He has also been a visiting professor at IAE Business School at Universidad Austral in Buenos Aires. Mr. Boilini received an M.B.A. from Columbia Business School in 1988 and a Civil Engineering degree from the University of Buenos Aires School of Engineering. Skills and Qualifications: Mr. Boilini brings to the Board significant financial, risk management and capital markets acumen, including knowledge of derivatives. He brings international business and board experience to the Board and also qualifies as an audit committee financial expert. |

| Carol M. Browner, 62 Ms. Browner has been a member of our Board since August 2013. She is a senior counselor at Albright Stonebridge Group, a global advisory firm that provides strategic counsel to businesses on government relations, macroeconomic and political risks, regulatory issues, market entry strategies, and environmental, social and corporate governance issues. From 2009 to 2011, she served as Assistant to President Barack Obama and director of the White House Office of Energy and Climate Change Policy. From 2001 to 2008, Ms. Browner was a founding principal of the Albright Group and Albright Capital Management LLC. Previously, she served as Administrator of the Environmental Protection Agency from 1993 to 2001. She chairs the board of the League of Conservation Voters. She holds a J.D. and B.A. from the University of Florida. Skills and Qualifications: Ms. Browner brings to the Board significant experience in regulation and public policy, the environment and sustainability, agriculture, energy and renewable fuels and advising large, complex organizations in both the public and private sectors. |

| Paul Cornet de Ways-Ruart, 50 Mr. Cornet de Ways-Ruart joined our Board in July 2015. He held senior roles at Yahoo! EMEA from 2006-2011, where he led Corporate Development before becoming its Senior Finance Director and Chief of Staff. Previously, Mr. Cornet de Ways-Ruart was Director of Strategy at Orange UK, a mobile network operator and internet service provider, and worked with McKinsey & Company in London and Palo Alto, California. He holds a Master's Degree in Engineering and Management from the Catholic University of Louvain and an MBA from the University of Chicago. Mr. Cornet de Ways-Ruart serves on the Board of Directors of Anheuser-Busch Inbev, Floridienne Group, Adrien Invest SCRL and several privately held companies. Skills and Qualifications: Mr. Cornet de Ways-Ruart brings to the Board experience in corporate strategy and M&A, international experience, as well as valuable insights into the food and beverage industry, including customer perspectives. |

17

| Andrew Ferrier, 59 Mr. Ferrier has been a member of our Board since 2012. He is Executive Chairman of Canz Capital Limited, a private investment company he founded in 2011. He served as Chief Executive Officer of Fonterra Co-operative Group Ltd., a leading New Zealand-based international dairy company, from 2003 to 2011. Previously, he served as President and Chief Executive Officer of GSW Inc., a Canadian consumer durable goods manufacturer, from 2000 to 2003. Prior to 2000, Mr. Ferrier spent 16 years in the sugar industry working in Canada, the United States, the United Kingdom and Mexico. From 1994 to 1999, Mr. Ferrier worked for Tate & Lyle, first as President of Redpath Sugars and subsequently as President and Chief Executive Officer of Tate & Lyle North America Sugars Inc. Mr. Ferrier has served as Chairman of New Zealand Trade and Enterprise, the national economic development agency, since November 2012 and since October 2014 has been Chairman of Orion Health Ltd. He also serves as a councillor of the University of Auckland. Skills and Qualifications: Mr. Ferrier's experience as a former chief executive of a large international enterprise focused on agricultural exports, and his experience as a former senior executive in the sugar industry, provides our Board with extensive knowledge of agricultural and commodity industries, international experience and strategic, operational, management and marketing expertise. |

| Kathleen Hyle, 59 Ms. Hyle has been a member of our Board since 2012. She served as Senior Vice President of Constellation Energy and Chief Operating Officer of Constellation Energy Resources from November 2008 until her retirement in June 2012 following the completion of the merger of Constellation Energy with Exelon Corporation. From June 2007 to November 2008, Ms. Hyle served as Chief Financial Officer for Constellation Energy Nuclear Group and for UniStar Nuclear Energy, LLC, a strategic joint venture between Constellation Energy and Électricité de France. Ms. Hyle held the position of Senior Vice President of Finance for Constellation Energy from 2005 to 2007 and Senior Vice President of Finance, Information Technology, Risk and Operations for Constellation New Energy from January to October 2005. Prior to joining Constellation Energy, Ms. Hyle served as the Chief Financial Officer of ANC Rental Corp., the parent company of Alamo Rent-A-Car and National Rent-A-Car; Vice President and Treasurer of Auto-Nation, Inc.; and Vice President and Treasurer of The Black and Decker Corporation. Ms. Hyle is currently a director of AmerisourceBergen Corporation and is a former director of The ADT Corporation. She also serves on the Board of Trustees of Center Stage in Baltimore, MD. and is a former trustee of the Loyola University Maryland Sellinger School of Business and Management. Skills and Qualifications: Ms. Hyle brings to our Board extensive financial experience, enabling her to provide critical insight into, among other things, our financial statements, accounting principles and practices, internal control over financial reporting and risk management processes. Ms. Hyle qualifies as an audit committee financial expert. In addition, Ms. Hyle brings extensive management, operations, mergers and acquisitions, technology, corporate governance and regulatory compliance experience to our Board. |

18

| L. Patrick Lupo, 67 Mr. Lupo has been a member of our Board since 2006. He was appointed non-executive Chairman of our Board effective January 1, 2014, and previously served as our Lead Independent Director since 2010. He is the former chairman and chief executive officer of DHL Worldwide Express (DHL). Mr. Lupo joined DHL in 1976. He served as chairman and CEO from 1986 to 1997 and as executive chairman from 1997 to 2001. During his tenure at DHL, he also served as CEO, The Americas, and general counsel. Mr. Lupo received a law degree from the University of San Francisco and a B.A. degree from Seattle University. He is a former director of O2 plc, Ladbrokes plc (formerly Hilton Group plc) and a former member of the supervisory board of Cofra, AG. Skills and Qualifications: Mr. Lupo's experience as former chairman and chief executive officer of a major global logistics company provides valuable leadership, strategic, operations, management, financial and risk management skills to our Board, as well as insights into logistics, a critical element of our business. Additionally, his legal and governance experience provides our Board with important perspectives. |

| John E. McGlade, 64 Mr. McGlade has been a member of our Board since August 2014. He was chairman, president and CEO of Air Products from 2008 to 2014. He joined Air Products in 1976 and held positions in the company's Chemicals and Process Industries, Performance Materials and Chemicals Group divisions. He was appointed president and chief operating officer of Air Products in 2006 and retained the title of president when he was named as chairman and CEO two years later. Mr. McGlade serves on the board of directors of The Goodyear Tire & Rubber Company. He is a trustee of The Rider-Pool Foundation and the ArtsQuest Foundation, and a former trustee of Lehigh University. Skills and Qualifications: Mr. McGlade's background as a former chairman and chief executive of a global, publicly traded industrial business provides him valuable corporate leadership experience in international operations, strategy, management, finance, risk management, mergers and acquisitions and governance. |

| Soren Schroder, 56 Mr. Schroder became our CEO in June 2013. He has been a member of our Board since May 2013. From 2010 to 2013 he was CEO, Bunge North America, leading Bunge's business operations in the United States, Canada and Mexico. Since joining Bunge in 2000, he has served in a variety of agribusiness leadership roles at the Company in the United States and Europe. Prior to joining Bunge, he worked for over 15 years at Continental Grain and Cargill. He received a B.A. in Economics from Connecticut College. Skills and Qualifications: Having spent his career in the agribusiness industry, including as chief executive officer of our Company, Mr. Schroder brings to the Board extensive experience in international operations, management, commodity markets and risk management, strategy, financial experience, mergers and acquisitions and governance of a large, global publicly-traded company. |

OUR BOARD RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF EACH OF THE NOMINEES FOR DIRECTOR.

19

DIRECTOR COMPENSATION |

Our compensation program for non-employee directors is designed to enable us to attract, retain and motivate highly qualified directors to serve on our Board. It is also intended to further align the interests of our directors with those of our shareholders. Annual compensation for our non-employee directors in 2017 was comprised of a mix of cash and equity-based compensation. The Compensation Committee periodically receives competitive information on the status of Board compensation for non-employee directors from its independent compensation consultant and is responsible for recommending to the Board changes in director compensation. In 2017, after review of the competitive landscape, no changes were made to compensation of the Board of Directors.

Director Compensation Table

The following table sets forth the compensation for non-employee directors who served on our Board during the fiscal year ended December 31, 2017.

Non-Employee Director Compensation (1) | ||||

Name | Fees Earned or Paid in Cash($) | Stock Awards(2)(3)($) | All Other Compensation (4) | Total($) |

Ernest G. Bachrach | $115,000 | $149,756 | $877,170 | $1,141,926 |

Enrique H. Boilini | $125,000 | $149,756 | $274,756 | |

Carol M. Browner | $125,000 | $149,756 | $274,756 | |

Paul Cornet de Ways-Ruart | $111,000 | $149,756 | $260,756 | |

William Engels (5) | $41,667 | $0 | $41,667 | |

Andrew Ferrier | $100,000 | $149,756 | $249,756 | |

Andreas Fibig | $110,000 | $149,756 | $259,756 | |

Kathleen Hyle | $121,000 | $149,756 | $270,756 | |

L. Patrick Lupo | $215,000 | $385,211 | $600,211 | |

John E. McGlade | $100,000 | $149,756 | $249,756 | |

(1) | Represents compensation earned in 2017. |

(2) | Each of the non-employee directors serving on the Board on the close of business on the date of Bunge's 2017 Annual General Meeting received an annual grant of 1,815 restricted stock units ("RSUs") on May 25, 2017. Mr. Engels did not receive a grant of RSUs as he stepped down from the Board on the date of the 2017 Annual General Meeting. Annual grants vest on the first anniversary of the date of grant (May 25, 2018), provided the director continues to serve on the Board on such date. In addition, as part of Mr. Lupo's compensation for serving as non-executive Chairman, he was granted 1,030 RSU's on January 3, 2017 for service from January 1st through May 24th (vesting on May 25, 2017) and 1,945 RSUs on May 25, 2017 for service from May 25, 2017 through May 24, 2018 (vesting on the first anniversary of the date of grant). The two Chairman grants for Mr. Lupo were made to align his awards with the annual grant cycle. The average of the high and low sale prices of Bunge's common shares on the New York Stock Exchange on January 3, 2017 was $72.79 and on May 25, 2017 was $82.51. |

(3) | The amounts shown reflect the full grant date fair value of the award for financial reporting purposes in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 ("ASC Topic 718") (without any reduction for risk of forfeiture) as determined based on applying the assumptions used in Bunge's audited financial statements. See Note 24 to the audited consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2017 regarding assumptions underlying the valuation of equity awards. Other than the RSUs reported above and associated dividend equivalents, no director had any other stock awards outstanding as of December 31, 2017. The number of awards granted and outstanding excludes dividend equivalents. The closing price of Bunge's common shares on the NYSE on December 29, 2017 was $67.08. |

(4) | Represents the distribution of Mr. Bachrach’s entire account balance under the Bunge Limited Deferred Compensation Plan for Non-Employee Directors. Pursuant to Section 457A of the Internal Revenue Code, all amounts credited under this plan were required to be distributed to participants no later than December 31, 2017. Mr. Bachrach’s account balance was distributed to him in Bunge Common Shares |

(5) | Mr. Engels stepped down from the Board effective May 25, 2017. |

Directors' Fees. Non-employee directors received the following fees in 2017: (i) an annual retainer fee of $100,000; (ii) an annual grant of time-based restricted stock units with a targeted value of $140,000, (iii) an annual fee of $15,000 for service as committee chair on any committee, except for the Chair of the Audit Committee, who received an annual fee of $20,000 due to the added workload and responsibilities of this committee; and (iv) an annual fee for each member of the Audit Committee of $10,000 due to the added workload and responsibilities of

20

this committee. No fees are paid for service as a member of any other Board committee. In 2017, our non-executive Chairman received a supplemental annual retainer consisting of $100,000 in cash and a targeted value of $150,000 in time-based restricted stock units. In addition, although directors do not receive an annual Board or committee meeting attendance fee, if the Board and/or a committee meets in excess of ten times in a given year, each director receives a fee of $1,000 for each additional meeting attended.

Bunge also reimburses non-employee directors for reasonable expenses incurred by them in attending Board meetings, committee meetings and shareholder meetings.