Form DEF 14A BrightSphere Investment For: Jun 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý | ||||||||

Filed by a Party other than the Registrant o | ||||||||

| Check the appropriate box: | ||||||||

| o | Preliminary Proxy Statement | |||||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| ý | Definitive Proxy Statement | |||||||

| o | Definitive Additional Materials | |||||||

| o | Soliciting Material under §240.14a-12 | |||||||

| BRIGHTSPHERE INVESTMENT GROUP INC. | ||||||||

| (Name of Registrant as Specified In Its Charter) | ||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||

| Payment of Filing Fee (Check all boxes that apply): | ||||||||

| ý | No fee required | |||||||

| o | Fee paid previously with preliminary materials | |||||||

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||||||

| BRIGHTSPHERE Investment Group Inc. | |||||||

200 Clarendon Street, 53rd Floor

Boston, Massachusetts 02116

Boston, Massachusetts 02116

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS | |||||||||||

To the Holders of Common Stock of BrightSphere Investment Group Inc.:

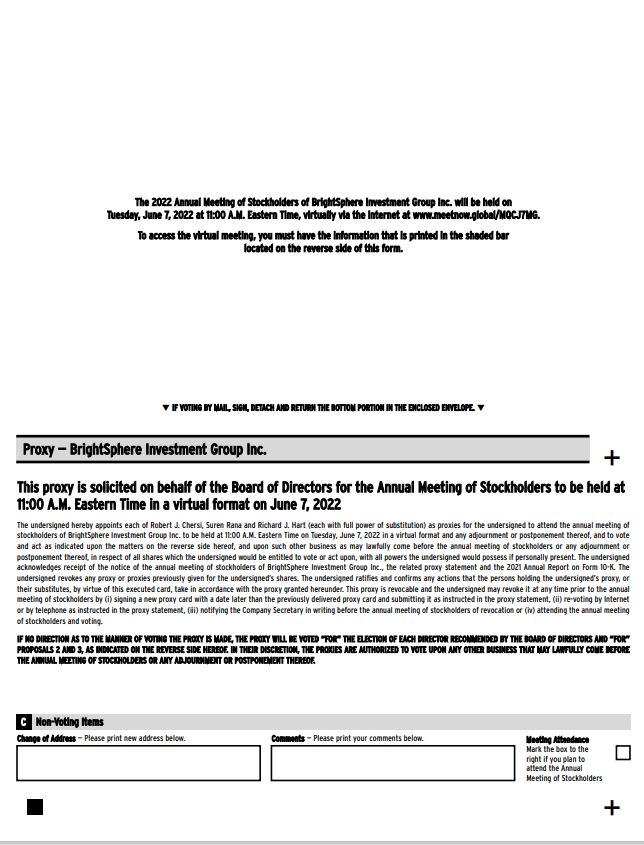

Notice is hereby given that the 2022 annual meeting of stockholders (the “Annual Meeting”) of BrightSphere Investment Group Inc. (the “Company”) will be held at 11:00 a.m. Eastern Time on Tuesday, June 7, 2022. For convenience purposes, and to facilitate stockholder access to the Annual Meeting, we will hold the Annual Meeting in a virtual format. Stockholders as of April 13, 2022, the record date for the Annual Meeting, will be able to access, attend and participate in the live Annual Meeting webcast at www.meetnow.global/MQCJ7MG. A list of stockholders of record will be available electronically during the meeting. Stockholders can gain access to the Annual Meeting by accessing the link above and selecting “I have a Control Number.” Stockholders can then enter their control number shown on the notice of internet availability or proxy card previously received. If you hold shares beneficially through a bank, broker or other nominee, you must register in advance to access, attend and participate in the Annual Meeting. For additional information on how to attend the Annual Meeting, see “How do I attend the meeting, ask a question and/or vote at the meeting?” on page 4 of the accompanying proxy statement.

Details regarding the Annual Meeting, the business to be conducted at the Annual Meeting, and information about the Company that you should consider when you vote your shares of common stock of the Company, par value $0.001 per share (“Common Stock”), are described in the accompanying proxy statement.

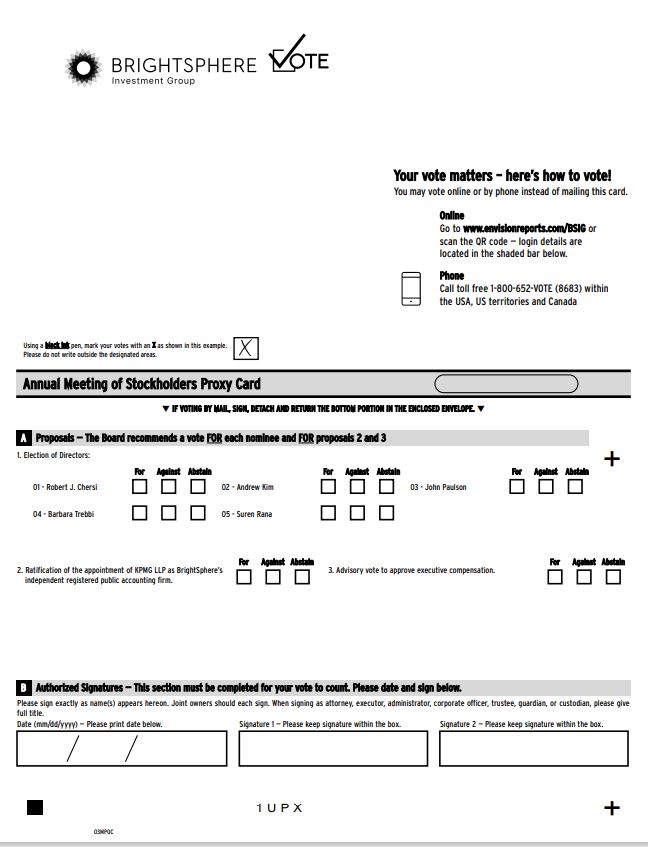

At the Annual Meeting, you will be asked to consider and vote on the following proposals:

1.Proposal 1—Vote to elect directors of the Company:

To elect five directors to serve on the Company’s Board of Directors (the “Board”) until the Company’s 2023 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified, on the following basis:

1.01—To re-elect Mr. Robert J. Chersi as a director of the Company;

1.02—To re-elect Mr. Andrew Kim as a director of the Company;

1.03—To re-elect Mr. John Paulson as a director of the Company;

1.04—To re-elect Ms. Barbara Trebbi as a director of the Company; and

1.05—To re-elect Mr. Suren Rana as a director of the Company.

2.Proposal 2—Vote regarding ratification of independent registered public accounting firm:

To ratify the appointment of KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm for the year ending December 31, 2022.

3.Proposal 3—Advisory vote on executive compensation:

To approve, on an advisory basis, the compensation of the Company’s named executive officers as described in the accompanying proxy statement under the section titled Compensation Discussion and Analysis and the tabular and narrative disclosure contained in the accompanying proxy statement.

Other business.

To transact such other business that is properly presented at the Annual Meeting and any adjournments or postponements thereof.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES REFERENCED ABOVE AND “FOR” THE APPROVAL OF PROPOSALS 2 AND 3.

The Company is a corporation incorporated under the laws of Delaware. In accordance with the Certificate of Incorporation and the Bylaws, the election of directors shall be decided by a majority of the votes cast and all other matters shall be decided by the affirmative vote of a majority of shares present in person or represented by proxy at the meeting and entitled to vote thereon.

You may vote if you were the record owner of Common Stock at the close of business on April 13, 2022.

We are pleased to take advantage of the Securities and Exchange Commission rules that allow us to furnish proxy materials to our stockholders on the internet instead of mailing paper copies. We believe these rules allow us to provide you with the information that you need while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting virtually. Whether you plan to attend the Annual Meeting virtually or not, we urge you to vote in accordance with the instructions set forth in the proxy statement and submit your proxy by the Internet, telephone or, if you received printed proxy materials, by mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the Annual Meeting.

| BY ORDER OF THE BOARD OF DIRECTORS | |||||

| /s/ RICHARD J. HART | |||||

Richard J. Hart Chief Legal Officer and Secretary | |||||

200 Clarendon Street, 53rd Floor

Boston, Massachusetts 02116

April 19, 2022

TABLE OF CONTENTS

| PAGE | |||||

| BRIGHTSPHERE Investment Group Inc. | |||||||

200 Clarendon Street, 53rd Floor

Boston, Massachusetts 02116

PROXY STATEMENT FOR BRIGHTSPHERE INVESTMENT GROUP INC.

2022 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 7, 2022 | ||

This proxy statement, along with the accompanying notice of the 2022 annual meeting of stockholders (the “Annual Meeting”), contains information about the Annual Meeting, including any adjournments or postponements of the Annual Meeting. We are holding the Annual Meeting at 11:00 a.m. Eastern Time on Tuesday, June 7, 2022. For convenience purposes, and to facilitate stockholder access to the Annual Meeting, we will hold the Annual Meeting in a virtual format. Stockholders as of April 13, 2022, the record date for the Annual Meeting, will be able to access and attend the live Annual Meeting webcast at www.meetnow.global/MQCJ7MG. Stockholders can gain access to the Annual Meeting by accessing the link above and selecting “I have a Control Number.” Stockholders can then enter their control number shown on the notice of internet availability or proxy card previously received. If you hold shares beneficially through a bank, broker or other nominee, you must register in advance to access, attend and participate in the Annual Meeting. For additional information on how to attend the Annual Meeting, see “How do I attend the meeting, ask a question and/or vote at the meeting?” on page 4 of this proxy statement.

On July 12, 2019, BrightSphere Investment Group Inc., a Delaware corporation, became the publicly traded parent company of BrightSphere Investment Group plc (“BrightSphere UK”) and its operating subsidiaries (the “Redomestication”). Throughout this proxy statement, references to “BrightSphere,” “the Company,” “we” and “us” (i) for periods until the completion of the Redomestication, refer to BrightSphere Investment Group plc and (ii) for periods after the completion of the Redomestication, refer to BrightSphere Investment Group Inc.

This proxy statement relates to the solicitation of proxies by our Board of Directors (the “Board”) for use at the Annual Meeting.

On or about April 19, 2022, we will commence delivery to our stockholders of record as of April 13, 2022 a notice of internet availability of proxy materials (the “Notice of Internet Availability”) instead of paper copies of this proxy statement, the Notice of Annual Meeting and our Annual Report to Stockholders on Form 10-K. The Notice of Internet Availability includes instructions on how to access our proxy materials and how to vote your shares, as well as instructions on how to receive a paper copy of the proxy materials, if you prefer. We are also making our proxy materials available to all stockholders electronically via the Internet.

1

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING TO BE HELD ON JUNE 7, 2022

This proxy statement is available for viewing, printing and downloading at www.bsig.com. Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2021 on the website of the Securities and Exchange Commission at www.sec.gov, or in the “Public Filings” section of the “Investor Relations” section of our website at www.bsig.com.

2

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company soliciting my proxy?

The Board is soliciting your proxy to vote at the Annual Meeting to be held at 11:00 a.m. Eastern Time on Tuesday, June 7, 2022 and any adjournments or postponement of the Annual Meeting. The proxy statement along with the accompanying Notice of Annual Meeting summarizes the purposes of the Annual Meeting and the information you need to know to vote at the Annual Meeting.

Why is the Company holding the Annual Meeting in a virtual format?

For convenience purposes, and to facilitate stockholder access to the Annual Meeting, we will hold the Annual Meeting in a virtual format.

Why did I receive a “Notice of Internet Availability of Proxy Materials” but no proxy materials?

We are distributing our proxy materials to stockholders via the Internet under the “Notice and Access” approach permitted by rules of the SEC. This approach benefits the environment, while providing a timely and convenient method of accessing the materials and voting. On April 19, 2022, we will begin mailing the Notice of Internet Availability to all stockholders of record as of April 13, 2022 (the “Record Date”). The Notice of Internet Availability includes instructions on how to access our proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and how to vote your shares. The Notice of Internet Availability also contains instructions on how to receive a paper copy of the proxy materials, if you prefer.

Who can vote?

You are entitled to attend and vote at the Annual Meeting only if, as of the close of business on the Record Date, you were a stockholder who owned Common Stock of the Company, par value $0.001 per share (“Common Stock”), registered directly in your name through our share transfer agent, Computershare Trust Company, N.A., or you have stock certificates registered in your name (in each case, a “Registered Holder”), or if you hold a valid legal proxy for the Annual Meeting if you are a beneficial holder and hold your shares through an intermediary, such as a bank or broker (“Beneficial Holder”). On the Record Date, there were 41,425,469 shares of Common Stock outstanding and entitled to vote. The shares of Common Stock are our only class of voting shares outstanding.

How do I vote?

Whether you plan to attend the Annual Meeting virtually or not, we urge you to vote by proxy. All shares of Common Stock represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted as instructed via Internet or telephone, or, if you received a proxy card by mail, in accordance with your instructions on the proxy card. You may specify whether your shares of Common Stock should be voted for, against or abstain with respect to each of such proposals. If you properly submit a proxy without giving specific voting instructions, your shares of Common Stock will be voted in accordance with the Board’s recommendations as noted below. Voting by proxy will not affect your right to attend the Annual Meeting virtually. If you are a Registered Holder, you may vote:

•By Internet. You may vote via the internet by going to www.investorvote.com/BSIG and following the instructions to submit your vote.

3

•By telephone. You may vote by telephone by calling toll free 1-800-652-VOTE within the United States, U.S. territories and Canada and following the instructions to submit your vote.

•By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares of Common Stock voted, they will be voted in accordance with the Board’s recommendations as noted below.

•During the Annual Meeting. You may attend the Annual Meeting virtually on Tuesday, June 7, 2022 at 11:00 a.m. Eastern Time and vote during the meeting. For instructions on how to vote at the meeting, see “How do I attend the meeting, ask a question and/or vote at the meeting?” below.

Telephone and Internet voting for stockholders of record will be available 24 hours a day. If you give instructions as to your proxy appointment through the Internet or by telephone, such instructions must be received by 11:59 p.m. Eastern Time on June 6, 2022. If you properly give instructions as to your proxy appointment through the Internet, by telephone or by executing and returning a paper proxy card, and your proxy appointment is not subsequently revoked, your shares of Common Stock will be voted in accordance with your instructions. If you are a stockholder of record and you execute and return a proxy card but do not give instructions, your proxy will be voted in accordance with the Board’s recommendations as noted below.

If your shares of Common Stock are held in “street name” (held in the name of a bank, broker or other nominee), you will receive instructions from such bank, broker or other nominee. You must follow the instructions of the bank, broker or other nominee in order for your shares of Common Stock to be voted. Telephone and Internet voting also will be offered to stockholders owning shares of Common Stock through certain banks and brokers.

How do I attend the meeting, ask a question and/or vote at the meeting?

Registered Holders

If you are a Registered Holder, you will be able to attend the Annual Meeting online, ask a question and vote by visiting www.meetnow.global/MQCJ7MG. Stockholders can gain access to the Annual Meeting by accessing the link above and selecting “I have a Control Number.” Stockholders can then enter their control number shown on the notice of internet availability or proxy card previously received. As a Registered Holder, you do not need to register in advance to virtually attend the Annual Meeting.

Beneficial Holders

If you are a Beneficial Holder and want to attend the Annual Meeting online, ask a question and vote, you must register in advance using the instructions below.

Contact your bank, broker or other nominee to obtain a legal proxy and submit proof of your proxy power (“Legal Proxy”) reflecting your BrightSphere holdings along with your name and email address to Computershare.

These requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on June 3, 2022. You will receive a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to us at the following:

4

By email: Forward the email from your broker granting you a Legal Proxy, or attach an

image of your Legal Proxy, to legalproxy@computershare.com

By mail: Computershare

BrightSphere Investment Group Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

A Beneficial Owner that has registered in advance for the Annual Meeting should then follow the instructions referenced above for Registered Holders to attend the meeting.

Stockholders who wish to submit questions may do so electronically starting at the time of check-in or during the meeting by clicking the message icon on the meeting page.

Guests are permitted to attend the Annual Meeting online by visiting www.meetnow.global/MQCJ7MG and choosing the “Guest” option.

The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Participants should ensure that they have a strong internet connection wherever they intend to participate in the meeting. We encourage participants to access the meeting prior to the start time. A “help” link on the meeting page will provide further assistance should they need it or they may call 1-888-724-2416.

You do not need to attend the Annual Meeting to vote your shares of Common Stock. Shares of Common Stock represented by valid proxies, received in time for the Annual Meeting and not revoked prior to the Annual Meeting will be voted at the Annual Meeting. For instructions on how to change or revoke your proxy, see “May I change or revoke my proxy?” below.

Appointing a proxy

If you are a stockholder who is entitled to attend and vote at the Annual Meeting, you are entitled to appoint a proxy to exercise all of your rights to attend, participate and vote at the Annual Meeting. A proxy does not need to be a stockholder of the Company but must attend the Annual Meeting virtually to represent you. You may appoint more than one proxy provided that each proxy is appointed to exercise rights attached to different shares. You may not appoint more than one proxy to exercise rights attached to any one share. Appointment of a proxy does not preclude you from attending the Annual Meeting virtually. Attending the Annual Meeting virtually will not in and of itself revoke a previously submitted proxy. To terminate your proxy appointment you must deliver a notice of termination to us at least 24 hours before the start of the Annual Meeting. The notice of termination may be (i) delivered by post or by hand in hard copy form to BrightSphere, 200 Clarendon Street, 53rd Floor, Boston, MA 02116, Attention: Secretary or (ii) received in electronic form at info@bsig.com with a subject title “Revocation of Previous Proxy Appointment-Attention: Secretary.” A corporate entity which is a stockholder can appoint one or more corporate representatives who may exercise, on its behalf, all its powers as a stockholder, provided that no more than one corporate representative exercises powers over the same share.

How many votes do I have?

Each share of Common Stock that you own entitles you to one vote.

5

How does the Board recommend that I vote on the proposals?

The affirmative vote of a majority of the shares of Common Stock cast at the Annual Meeting is required to approve the election of directors and each other proposal requires the affirmative vote of a majority of shares present in person or represented by proxy at such meeting and entitled to vote thereon. The Board recommends that you vote as follows:

•FOR the election of all nominees for director named in this proxy statement;

•FOR the ratification of the appointment of KPMG as our independent registered public accounting firm for the 2022 fiscal year; and

•FOR advisory approval of the compensation of our named executive officers.

If any other matter is presented at the Annual Meeting, your proxy provides that your shares of Common Stock will be voted by the proxy holder listed in the proxy in accordance with his best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

May I change or revoke my proxy?

If you give us your proxy, you may change or revoke it at any time before the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

•if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above;

•by re-voting by Internet or by telephone as instructed above; or

•if you are a Registered Holder or a Beneficial Holder who has registered to attend the meeting, by re-voting during the Annual Meeting.

Attending the Annual Meeting virtually will not in and of itself revoke a previously submitted proxy. To terminate your proxy appointment you may also deliver a notice of termination to the Company at least 24 hours before the start of the Annual Meeting. The notice of termination may be (i) delivered by post or by hand in hard copy form to BrightSphere, 200 Clarendon Street, 53rd Floor, Boston, MA 02116, Attention: Secretary or (ii) received in electronic form at info@bsig.com with a subject title “Revocation of Previous Proxy Appointment—Attention: Secretary.”

If your shares are held in the name of a broker, bank or other nominee, that institution will instruct you as to how your vote may be changed.

Your most current vote, whether by telephone, Internet, proxy card or during the Annual Meeting is the one that will be counted.

What if I receive more than one Notice of Internet Availability, proxy card or voting instruction form?

You may receive more than one Notice of Internet Availability, proxy card or voting instruction form if you hold shares of Common Stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How do I vote?” for each account to ensure that all of your shares of Common Stock are voted.

6

Will my shares be counted if I do not vote or provide instructions or if I abstain?

If your shares of Common Stock are registered in your name, they will not be counted if you do not vote as described above under “How do I vote?” If your shares of Common Stock are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares of Common Stock as described above, the bank, broker or other nominee that holds your shares of Common Stock has the authority to vote your unvoted shares of Common Stock only on routine matters without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares of Common Stock will be voted at the Annual Meeting on all matters and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares of Common Stock on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

Your bank, broker or other nominee is prohibited from voting your uninstructed shares of Common Stock on non-routine matters. Thus, if you hold your shares of Common Stock in street name and you do not instruct your bank, broker or other nominee how to vote with respect to the non-routine matters, votes will not be cast on such proposals on your behalf.

Broker non-votes and abstentions have different effects on the outcomes of the proposals. Broker non-votes are not considered votes cast or counted as shares present and entitled to vote and have no impact on the election of directors or other non-routine proposals. Abstentions are counted in the number of shares present and entitled to vote and, accordingly, have the same effect as votes against each of the proposals except the election of directors. Abstentions are not counted as votes cast and have no effect on the election of directors.

What proposals are considered “routine” or “non-routine”?

Although the determination of whether a broker will have discretionary voting power for a particular item is typically determined only after proxy materials are filed with the SEC, we expect Proposal 2 (ratification of the appointment of KPMG as our independent registered public accounting firm for 2022) to be considered a routine matter under the rules of the New York Stock Exchange (the “NYSE”). A broker, bank or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to occur in connection with Proposal 2.

Proposals 1 and 3 (the election of directors and the advisory vote on executive compensation) are expected to be considered non-routine under the rules of the NYSE (the “NYSE Rules”). A broker, bank or other nominee may not vote on these non-routine matters without specific voting instructions from the beneficial owner. As a result, there may be broker non-votes with respect to Proposals 1 and 3.

Where can I find the voting results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting, and we will publish preliminary, or final, if available, results in a Current Report on Form 8-K within four business days of the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K/A to disclose the final voting results within four business days after the final voting results are known.

7

What are the costs of soliciting these proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward the Notice of Internet Availability or other proxy materials to their beneficial owners and to obtain authority to execute proxies. We will then reimburse them for their expenses.

What constitutes a quorum for the Annual Meeting?

The quorum for the Annual Meeting is the holders of a majority of the issued and outstanding shares of Common Stock entitled to vote at the Annual Meeting, present in person or represented by proxy.

Householding of annual disclosure documents

SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single set of our proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our notices of internet availability, notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single set of proxy materials this year, but you would prefer to receive your own copy, please contact our transfer agent, Computershare Trust Company, N.A., by calling their toll free number: 1-866-281-0717.

If you do not wish to participate in householding and would like to receive your own notice of internet availability in future years, follow the instructions described below. Conversely, if you share an address with another BrightSphere stockholder and together both of you would like to receive only a single set of proxy materials, follow these instructions:

•If your shares of Common Stock are registered in your own name, please contact our transfer agent, Computershare Trust Company, N.A., and inform them of your request by calling them at 1-866-281-0717 or writing them at Computershare Trust Company, N.A., P.O. BOX 30170, College Station, TX 77842.

•If a bank, broker or other nominee holds your shares of Common Stock, please contact the bank, broker or other nominee directly and inform them of your request. Be sure to include your name, the name of your brokerage firm and your account number.

8

PROPOSAL 1—ELECTION OF DIRECTORS | ||

Our business and affairs are managed under the direction of our Board. Our Board has accepted the recommendation of the Nominating and Corporate Governance Committee and voted to nominate Robert J. Chersi, Andrew Kim, John Paulson, Barbara Trebbi and Suren Rana for re-election at the Annual Meeting to serve as directors, until their respective successors have been elected and qualified. Each of the nominees is currently serving as a director of our Company.

Set forth below are the names of the nominees, their ages, their offices in the Company, if any, their principal past occupations or past employment, the length of their tenure as directors and the names of other companies in which such persons hold or have held directorships. Additionally, information about the specific experience, qualifications, attributes or skills that led to our Board’s conclusion at the time of filing of this proxy statement that each person listed below should serve as a director is set forth below.

On May 17, 2019, in connection with the Redomestication, the Company entered into a Stockholder Agreement with Paulson & Co. Inc. (“Paulson”) containing substantially similar rights to the rights provided to Paulson under its shareholder agreement with the Company prior to the Redomestication (the “Stockholder Agreement”). Each of Messrs. Kim and Paulson were originally appointed to the Board pursuant to the rights provided to Paulson under the shareholder agreement. For this year’s Annual Meeting, Mr. Kim was nominated for election to the Board pursuant to the ongoing rights provided to Paulson under the Stockholder Agreement, which currently entitles Paulson to nominate one director. In advance of the Annual Meeting, Mr. Chersi and Ms. Trebbi, as the disinterested members of the Nominating and Corporate Governance Committee discussed that, notwithstanding the fact that Paulson had the right to designate one nominee only, they believed that it was in the best interest of the Company and its stockholders to again nominate Mr. Paulson for election to the Board due to his extensive experience in the financial services industry, his experience on the Board and familiarity with the Company and his contributions to the Company as Chair of the Board. The disinterested directors considered the Company’s Criteria for Identifying Properly Qualified Directorial Candidates, which includes, among other things, a candidate’s relevant knowledge, skills and experience in offering guidance to the Company’s management. For additional information regarding the Stockholder Agreement, see “Certain Relationships and Related Person Transactions—Stockholder Agreement.”

The Directors currently determined to be independent by the Board are: Ms. Trebbi and Messrs. Chersi, Kim and Paulson.

| Name | Age | Position with the Company | ||||||||||||

| Mr. John Paulson | 66 | Chairman | ||||||||||||

| Mr. Robert J. Chersi | 60 | Lead Independent Director | ||||||||||||

| Mr. Andrew Kim | 40 | Director | ||||||||||||

| Ms. Barbara Trebbi | 55 | Director | ||||||||||||

| Mr. Suren Rana | 42 | President, Chief Executive Officer and Director | ||||||||||||

A stockholder may (i) vote for the election of a nominee for director, (ii) vote against the election of a nominee for director or (iii) abstain from voting for a nominee for director.

Unless a proxy contains instructions to the contrary, it is intended that the proxies will be voted FOR each of the five nominees for director named above, to hold office until the 2023 annual meeting of stockholders or until their respective successors are duly elected and qualified. We have no reason to believe that any of the nominees will not be available to serve as a director. However, if any nominee

9

should become unavailable to serve for any reason, the proxies will be voted for such substitute nominees as may be designated by the Board.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RE-ELECTION OF ALL NOMINEES, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR OF SUCH RE-ELECTION UNLESS A STOCKHOLDER INDICATES OTHERWISE ON THE PROXY. | ||

John A. Paulson has been a member of our Board since November 2018 and Chairman of our Board since April 2020. Mr. Paulson currently serves as President of Paulson & Co. Inc. and has served in this role since the firm was founded in 1994. Prior to founding Paulson & Co., Mr. Paulson was a general partner of Gruss Partners and a managing director in mergers and acquisitions at Bear Stearns. Mr. Paulson received his Masters of Business Administration from Harvard Business School and his undergraduate degree from New York University.

Mr. Paulson’s qualifications to serve on the Board include his deep knowledge of financial transactions and investments as well as his leadership abilities in founding and leading Paulson & Co. This knowledge and these qualifications will allow Mr. Paulson to provide valuable insight to the Board, especially in the area of Company strategy.

Robert J. Chersi has been a member of our Board since March 2016 and our Lead Independent Director since November 2018. Mr. Chersi has been with Pace University since 2013, currently serving as the Executive Director for its Center for Global Governance, Reporting & Regulation, as well as an adjunct professor in its Department of Finance & Economics. In addition, since 2013, Mr. Chersi has served as the Helpful Executive in Reach (HEIR) in the Department of Accounting and Information Systems at Rutgers University, and has acted in an advisory capacity to financial services industry clients as an individual as well as through Chersi Services LLC, which he founded in 2014. Prior to joining Pace, Mr. Chersi was a member of the Executive Committee and Chief Financial Officer of Financial Services at Fidelity Investments in Boston, from 2008 to 2012. While at Fidelity, as CFO, Mr. Chersi led the finance, compliance, risk management, business consulting and strategic new business development functional organizations. From 1988 to 2008, Mr. Chersi served in numerous positions at UBS AG, including CFO of U.S. Wealth Management and Deputy CFO of Global Wealth Management and Business Banking. Mr. Chersi had several executive leadership positions while at UBS, including service on the UBS AG Group Managing Board from 2004 to 2008, which played an important role in developing and implementing the firm’s direction, values and principles and in promoting its global culture. He began his career as an audit manager in the Financial Service Practice of KPMG LLP in 1983. Mr. Chersi currently serves as a member of the Advisory Board of the Pace University Lubin School of Business, and has previously been a member of the board, Audit Committee and Risk Committee of UBS Bank USA, a member of the board of PW Partners R&D III, Chairman of the Board of Trustees of the UBS USA Foundation, a member of the board of Bon Secours New Jersey/St. Mary’s Hospital Foundation and a Trustee of Fidelity Investments’ Political Action Committee. Mr. Chersi also currently serves as a member of the Board of Trustees of Thrivent Funds. Previously, Mr. Chersi was also a Director of E*TRADE Financial Corporation, as well as member of the E*TRADE Bank board, the E*TRADE Audit Committee and the E*TRADE Risk Oversight Committee until the completion of E*TRADE’s merger with Morgan Stanley on October 2, 2020. He has held the Certified Public Accountant designation, and is a 1983 graduate of Pace University, where he earned a BBA in Accounting, summa cum laude.

Mr. Chersi’s qualifications to serve on our Board include his extensive experience in the financial services industry and deep knowledge of corporate governance, financial reporting and regulatory compliance. In addition, his background in risk management, business consulting and strategic business development will be valuable to our Board.

10

Andrew Kim has been a member of our Board since July 2019. Mr. Kim is currently a Partner at Paulson & Co. Inc., which he joined in July 2009. Prior to working at Paulson, Mr. Kim was an analyst at Perry Capital from September 2005 to July 2007 and at Goldman Sachs from July 2004 to September 2005. Mr. Kim received his Masters of Business Administration from Harvard Business School and his undergraduate degree from the University of Michigan.

Mr. Kim’s qualifications to serve on our Board include his deep knowledge of financial transactions and investments gained through his career in the financial services industry. This knowledge will allow Mr. Kim to provide valuable insight to the Board.

Barbara Trebbi has been a member of our Board since January 2018. Ms. Trebbi was a General Partner and co-managing partner at Mercator Asset Management, L.P. (“Mercator”) until October 2017. At Mercator, which she joined in 2000, she was a senior member of the investment team, with a focus on international equities, in particular, continental European investments, as well as Asia and other emerging markets. Her clients included a wide range of institutional investors and sub-advisory accounts. Ms. Trebbi started her career in 1988 as an international equity research analyst at Mackenzie Investment Management Inc. and progressed over 12 years to become head of international equities. She has over 30 years of international investment experience. Ms. Trebbi is a Chartered Financial Analyst, a member of the CFA Institute and also is a member of the CFA Society of South Florida, where she served as President from 1994 to 1995. She also serves on a number of non-profit boards related to primary, secondary and higher education. Ms. Trebbi received a Graduate Diploma from the London School of Economics and Political Science and a B.S. degree from the University of Florida.

Ms. Trebbi’s qualifications to serve on our Board include her deep investment experience, with a particular emphasis on international investments. This experience, combined with extensive knowledge of the institutional and sub-advisory markets, will allow her to provide valuable insight to our Board.

Suren Rana has been our President and Chief Executive Officer and a member of our Board since April 2020. Before being appointed as the Company’s President, Chief Executive Officer and a Director of the Company, Mr. Rana was the Company’s Chief Financial Officer, a position he had held since January 2019. Prior to joining the Company, Mr. Rana was a partner at H Plus Capital, a private market investment management firm, from August 2018 to January 2019. Mr. Rana has been involved in the financial services sector for more than fifteen years. Mr. Rana was a member of the Company's Board from November 2017 to August 2018. He served as the Chief Investment Officer at HNA Capital International from September 2016 to August 2018. He served as an investment banker at UBS from November 2015 to August 2016, Royal Bank of Canada from September 2011 to November 2014 and Merrill Lynch from 2005 to 2008 where he advised clients on M&A, IPOs, financings and other strategic matters. He also served as a Principal at Equifin Capital Partners from September 2008 to September 2011, where he led control investments in the financial services sector. Mr. Rana began his career at GE Capital with responsibilities in credit risk management and audit. Mr. Rana received an MBA from Harvard Business School, a graduate degree from the Indian Institute of Management Ahmedabad and a bachelor’s degree from the University of Delhi.

Mr. Rana’s qualifications to serve on our Board include his extensive investment and financial knowledge, particularly relating to financial services companies. His experience with regard to M&A, financing and other strategic matters provides valuable insight to the Board.

11

INFORMATION CONCERNING EXECUTIVE OFFICERS

Executive Officers

The following table sets forth certain information regarding our executive officers as of April 13, 2022.

| Name | Age | Position | ||||||||||||

| Suren Rana | 42 | President, Chief Executive Officer and Director | ||||||||||||

| Richard J. Hart | 45 | Chief Legal Officer and Secretary | ||||||||||||

| Christina Wiater | 40 | Principal Financial Officer and Principal Accounting Officer | ||||||||||||

For the biographical information of Mr. Rana, see “Proposal 1—Election of Directors” above.

Mr. Hart, age 45, is the Company’s Chief Legal Officer, a position he has held since 2018, and he is responsible for all legal and compliance matters at the Company. Previously, Mr. Hart was the Company’s Corporate General Counsel and has held various other roles in the Company’s legal department since 2010. Prior to joining the Company, Mr. Hart was a Senior Associate in the corporate department of Goodwin Procter LLP. Mr. Hart received a B.A. from the University of Richmond and a Juris Doctor from Boston University School of Law.

Ms. Wiater, age 40, is the Company’s Principal Financial Officer, Principal Accounting Officer and Controller. She has served as the Company’s Principal Financial Officer and Principal Accounting Officer since 2020 and as the Company's Controller since 2018. She was the Company's Assistant Controller from 2013 to 2018, where she was responsible for all accounting and control processes. Prior to joining the Company, Ms. Wiater was previously a Manager at PricewaterhouseCoopers LLP in their audit practice where she focused on private equity and asset management companies. Ms. Wiater received a B.S. in Business Administration and a M.S. in Accounting from Babson College. She is also a certified public accountant.

12

CORPORATE GOVERNANCE

Director Independence

Our business and affairs are managed under the direction of our Board. Our Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. A majority of the directors serving on our Board must qualify as independent directors and each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee must consist solely of independent directors. Our Board annually (or otherwise as necessary) makes an affirmative determination regarding the independence of each director. An “independent” director meets the NYSE’s definition of independence as well as the Board’s independence standards, as determined by the Board in its business judgment. In determining Director independence, the Board confirms that none of the independent Directors has a material relationship with the Company which would impair his or her independence from management or otherwise compromise his or her ability to act as an independent director. Among other things, the Board takes into consideration that Messrs. Paulson and Kim are affiliated with Paulson, which has the right to nominate a director for election to the Board (as discussed under “Certain Relationships and Related Party Transactions—Relationship with Paulson—Stockholder Agreement,”), and that Paulson currently owns over twenty percent (20%) of the outstanding shares of our Common Stock. The Board has determined, however, that a significant ownership stake, rather than creating a material relationship with management of the Company that may impair the ability to exercise independent judgment, instead creates a strong alignment of interest among Messrs. Paulson and Kim and the Company’s stockholders. The Board further believes that Messrs. Paulson and Kim provide valuable, independent-minded insight and judgment to the Board.

The Board has affirmatively determined that Ms. Trebbi and Messrs. Chersi, Kim and Paulson are independent under the NYSE Rules.

Committees of the Board and Meetings

Meeting Attendance

During the fiscal year ended December 31, 2021 (“fiscal year 2021”), there were 17 formal meetings of the Board, and the various committees of the Board met a total of 20 times (9 Audit Committee meetings, 2 Nominating and Corporate Governance Committee meetings and 9 Compensation Committee meetings). In addition, the Compensation Committee acted by written consent one time during fiscal year 2021. No director attended fewer than 75% of the total number of meetings of the Board and of committees of the Board on which he or she served during fiscal year 2021. The Board has adopted a policy under which each member of the Board is expected to attend, in person or telephonically, each annual meeting of our stockholders absent exigent circumstances that prevent their attendance. All directors were in attendance virtually at our 2021 annual meeting of stockholders.

Audit Committee

Our Audit Committee met 9 times during fiscal year 2021. The Audit Committee currently consists of Ms. Trebbi and Messrs. Chersi and Kim. Mr. Chersi is the Chair of the Audit Committee. Mr. Chersi has been a member of our Audit Committee since March 1, 2016. Ms. Trebbi has been a member of our Audit Committee since September 12, 2018. Mr. Kim, who was originally appointed to the Audit Committee pursuant to Section 3.2 of the Stockholder Agreement, has been a member of our Audit Committee since June 24, 2020. The Board determined that each member of the Audit Committee meets the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the NYSE Rules and is “financially literate” as such term is defined in the NYSE Rules. In

13

addition, the Board determined that each of Ms. Trebbi and Mr. Chersi is an “audit committee financial expert” within the meaning of SEC regulations and the NYSE Rules.

The Audit Committee has a charter that sets forth the Audit Committee’s purpose and responsibilities, which include (i) assisting the Board in fulfilling its oversight responsibilities over the financial reports and other financial information filed with the SEC, (ii) recommending to the Board the appointment of our independent auditors and evaluating their independence, (iii) reviewing our audit procedures and controls, and (iv) overseeing our internal audit function and risk and compliance function. Please also see the report of the Audit Committee set forth elsewhere in this proxy statement.

A copy of the Audit Committee’s written charter is publicly available on our website at www.bsig.com.

Compensation Committee

Our Compensation Committee met 9 times during fiscal year 2021. The Compensation Committee is currently composed of Ms. Trebbi and Messrs. Chersi and Kim. Ms. Trebbi is the Chair of our Compensation Committee. Ms. Trebbi was appointed as a member of our Compensation Committee effective June 19, 2018. Mr. Chersi was appointed as a member of our Compensation Committee effective June 23, 2017. Mr. Kim was appointed as a member of our Compensation Committee effective September 9, 2019. Our Board has determined that each member of the Compensation Committee is independent under NYSE Rules. The Compensation Committee of our Board has consisted entirely of independent directors since May 19, 2017.

The Compensation Committee has a charter that sets forth the Compensation Committee’s purpose and responsibilities, which include annually reviewing and approving the compensation of our executive officers and reviewing and making recommendations with respect to our equity incentive plans.

The Compensation Committee’s processes and procedures for the consideration and determination of executive compensation as well as disclosure regarding the role of the Company’s compensation consultant are set forth below in “Compensation Discussion and Analysis.”

A copy of the Compensation Committee’s written charter is publicly available on our website at www.bsig.com.

Please also see the report of the Compensation Committee set forth elsewhere in this proxy statement.

14

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee met 2 times during fiscal year 2021. The Nominating and Corporate Governance Committee is currently composed of Ms. Trebbi and Messrs. Chersi and Paulson. Mr. Paulson is the Chair of our Nominating and Corporate Governance Committee. Our Board has determined that Ms. Trebbi and Messrs. Chersi and Paulson are independent under the NYSE Rules. Mr. Chersi was appointed as a member of our Nominating and Corporate Governance Committee effective June 23, 2017. Ms. Trebbi was appointed as a member of our Nominating and Corporate Governance Committee effective April 18, 2018. Mr. Paulson was appointed as a member of our Nominating and Corporate Governance Committee effective November 30, 2018. The Nominating and Corporate Governance Committee has a charter that sets forth the Nominating and Corporate Governance Committee’s purpose and responsibilities, which include reviewing and recommending nominees for election as directors, assessing the performance of our directors, reviewing Corporate Governance Guidelines for our Company, reviewing and recommending for approval to the non-interested directors of the Board the directors’ compensation on a biennial basis and reviewing sustainability and environmental, social and governance matters of relevance to the Company.

Under our current corporate governance policies, the Nominating and Corporate Governance Committee may consider director candidates recommended by stockholders as well as from other sources, such as other directors or officers, third party search firms or other appropriate sources. For all potential candidates, the Nominating and Corporate Governance Committee may consider all factors it deems relevant, such as a candidate’s integrity, personal and professional reputation, experience and expertise, business judgment, ability to devote time, possible conflicts of interest, concern for the long-term interests of the stockholders, independence, range of backgrounds and experience and the extent to which the candidate would fill a present need on the Board. In general, persons recommended by stockholders will be considered on the same basis as candidates from other sources. If a stockholder wishes to nominate a candidate for director who is not to be included in our proxy statement, it must follow the procedures described in our Bylaws and in “Stockholder Proposals and Nominations For Director” at the end of this proxy statement.

Although the Nominating and Corporate Governance Committee does not have a formal policy with regard to diversity, the Nominating and Corporate Governance Committee considers a broad range of backgrounds and experiences (including, among others, gender, geographic, experiential, racial and ethnic diversity) when selecting potential nominees for membership on the Board. Among our five (5) nominees for election to the Board, eighty percent (80%) self-identify as women or individuals from underrepresented communities (meaning, an individual who self-identifies as Black, African American, Hispanic, Latino, Asian, Pacific Islander, Native American, Native Hawaiian, or Alaska Native, or who self-identifies as gay, lesbian, bisexual, or transgender).

A copy of the Nominating and Corporate Governance Committee’s charter is publicly available on the Company’s website at www.bsig.com.

Executive Sessions of Independent Directors

In accordance with the NYSE Rules and our Corporate Governance Guidelines, our independent Directors meet in regularly scheduled executive sessions without management present. If the Chairman of our Board is an independent Director, the Chairman of our Board will preside at these non-management sessions. If the Chairman of our Board is unavailable or is a management director, the Lead Independent Director or another independent Director is chosen by the independent Directors to preside at these meetings.

15

Board Leadership Structure and Role in Risk Oversight

Mr. Paulson serves as the Chairman of our Board and Mr. Rana serves as our President and Chief Executive Officer and a member of our Board. Mr. Paulson was appointed Chairman of our Board, effective April 1, 2020. The Board has no set policy with respect to the separation of the offices of Chairman and the Chief Executive Officer and believes it is in the best interest of the Company to retain flexibility based on the current business needs of the Company. Pursuant to the Company’s corporate governance guidelines, the independent directors elected Mr. Chersi as the Lead Independent Director in November 2018, when the Company’s previous President and Chief Executive Officer was appointed as Executive Chairman. When Mr. Paulson assumed the role of Chairman, it was determined that the Board would benefit from the continuation of Mr. Chersi as Lead Independent Director, despite the fact that Mr. Paulson is also an independent Director. Among other duties as determined by the Board from time to time, the Lead Independent Director may function as the Chairman in the event the existing Chairman is unable to for any reason.

The Board oversees the business and affairs of our Company including all aspects of risk, which includes risk assessment and risk management, focusing on, among other things, major strategic risks (e.g. acquisitions and dispositions and investment performance). In executing its risk oversight function, the Board has delegated to the Audit Committee the direct oversight over risk functions. However, the Audit Committee is not responsible for day to day management of risk. The Audit Committee reviews and subsequently reports to the Board any issues which arise with respect to the performance of our risk function including operational risks and risks relating to the quality or integrity of our financial statements. The Audit Committee also, at least annually, reviews our policies with respect to risk assessment and risk management.

Corporate Responsibility

We understand that we have a broader responsibility to strengthen the society of which we are part. Our long-term success is closely connected to being part of our local communities. We support these communities through both financial support and volunteering our time, skills, and expertise.

Additionally, we have developed a program for promoting sustainability, and helped identify ways for employees to reduce their carbon footprint, both at work and at home. Our biggest direct environmental impact is through the buildings that we use. We therefore work hard to improve their environmental performance by refitting existing units and building or leasing more environmentally friendly new ones.

Acadian Asset Management LLC integrates ESG throughout its investment process and applied across all portfolios. Factors included in the core investment process account for governance and management quality, carbon emissions, and social issues such as geopolitical risk and labor standards. In addition, an active research agenda looks to integrate other ESG signals into the process at a broad level and at the clients’ request, including data around diversity, equality, and inclusion.

Website Availability of our Corporate Governance Guidelines

A copy of our Corporate Governance Guidelines is publicly available on the Company’s website at www.bsig.com.

16

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during fiscal year 2021 are set forth above under “—Compensation Committee.” No member of the Compensation Committee was, during fiscal year 2021, or previously, an officer or employee of BrightSphere. No executive officer of the Company serves on the compensation committee or board of directors of another company that has an executive officer that serves on our Compensation Committee or Board.

Stockholder and Other Interested Party Communications to the Board

Generally, stockholders and other interested parties who have questions or concerns should contact our Investor Relations department at (617) 369-7300. However, any stockholders or other interested parties who wish to address questions regarding our business directly with the Board, or any individual director, should direct his or her questions in writing to the Board of BrightSphere at 200 Clarendon Street, 53rd Floor, Boston, MA 02116. Communications will be distributed to the Board, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communications. Stockholders and other interested parties may communicate directly with the Company’s independent Directors by sending a letter addressed to the attention of the independent Directors of BrightSphere, 200 Clarendon Street, 53rd Floor, Boston, MA 02116.

Items that are unrelated to the duties and responsibilities of the Board may be excluded, such as:

•junk mail and mass mailings;

•resumes and other forms of job inquiries;

•surveys; and

•solicitations or advertisements.

In addition, any material that is unduly hostile, threatening or illegal in nature may be excluded, provided that any communication that is filtered out will be made available to any independent director upon request.

17

PROPOSAL 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | ||

The Audit Committee has appointed KPMG as our independent registered public accounting firm to audit our financial statements for the fiscal year ending December 31, 2022. The Board proposes that the stockholders ratify this appointment. KPMG audited our financial statements for the fiscal year ended December 31, 2021. We expect that representatives of KPMG will be present at the Annual Meeting, will be able to make a statement if they so desire and will be available to respond to appropriate questions.

In deciding to appoint KPMG, the Audit Committee reviewed auditor independence issues and existing commercial relationships with KPMG and concluded that KPMG has no commercial relationship with the Company that would impair its independence for the fiscal year ending December 31, 2022.

The following table presents fees for professional audit services rendered by KPMG for the audit of our annual financial statements for the years ended December 31, 2021, and December 31, 2020, and fees billed for other services rendered by KPMG during those periods.

| Type of Fee | 2021 | 2020 | ||||||||||||

Audit fees(1) | $ | 2,191,827 | $ | 2,247,825 | ||||||||||

Audit related fees(2) | $ | 172,000 | $ | 203,000 | ||||||||||

Tax fees(3) | $ | 4,500 | ||||||||||||

| All other fees | — | — | ||||||||||||

| Total | $ | 2,363,827 | $ | 2,455,325 | ||||||||||

(1)Audit fees consisted of audit work performed in the audit of financial statements, as well as work generally only the independent registered public accounting firm can reasonably be expected to provide, such as statutory audits.

(2)Audit related fees consisted principally of audits of an employee benefit plans, and special procedures related to regulatory filings.

(3)Tax fees consisted principally of assistance with matters related to domestic and international tax compliance and reporting.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has the sole authority to approve the scope, fees and terms of all audit engagements, as well as all permissible non-audit engagements of the independent registered public accounting firm (the “External Auditor”). Consistent with SEC policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation for and overseeing the work of the External Auditor. The Audit Committee pre-approves all audit and permissible non-audit services to be performed for us by the External Auditor. These services may include audit services, audit-related services, tax services and other services. On an annual basis, the Audit Committee considers whether the provision of non-audit services by our External Auditor, on an overall basis, is compatible with maintaining the External Auditor’s independence from management.

In addition to the pre-approval procedures described immediately above, the Audit Committee has adopted a written Pre-Approval Policy for Non-Audit Services Provided by External Accounting Firms (the “Non-Audit Services Policy”). Under the Non-Audit Services Policy, the Audit Committee must pre-approve the provision of non-audit services to be performed for us by any external accounting firm,

18

subject to a de minimis threshold. Requests for non-audit services to be performed for us by an external accounting firm are submitted to the Chair of the Audit Committee via written request. The Chair of the Audit Committee reviews the request with the other members of the Audit Committee and the Audit Committee determines whether to approve the request. The Non-Audit Services Policy sets forth certain non-audit services prohibited to be performed by external accounting firms.

In the event the stockholders do not ratify the appointment of KPMG as our independent registered public accounting firm, the Audit Committee will reconsider its appointment.

The affirmative vote of a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting is required to ratify the appointment of the independent registered public accounting firm.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE TO RATIFY THE APPOINTMENT OF KPMG AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2022, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR OF SUCH RATIFICATION UNLESS A STOCKHOLDER INDICATES OTHERWISE ON THE PROXY. | ||

19

REPORT OF AUDIT COMMITTEE

The Audit Committee currently consists of Ms. Trebbi and Messrs. Chersi and Kim. Mr. Chersi is the Chair of the Audit Committee. Mr. Chersi has been a member of our Audit Committee since March 1, 2016. Ms. Trebbi has been a member of our Audit Committee since September 12, 2018. Mr. Kim, appointed to the Audit Committee pursuant to Section 3.2 of the Stockholder Agreement, has been a member of our Audit Committee since June 24, 2020. The Board determined that each member of the Audit Committee meets the independence requirements of Rule 10A-3 under the Exchange Act and the NYSE Rules and is “financially literate” as such term is defined in the NYSE Rules. In addition, the Board determined that each of Ms. Trebbi and Mr. Chersi is an “audit committee financial expert” within the meaning of SEC regulations and the NYSE Rules. The Audit Committee held 9 meetings during the fiscal year ended December 31, 2021.

The Audit Committee assists the Board in fulfilling its oversight responsibilities of the financial reports and other financial information filed with the SEC, recommends to the Board the appointment of BrightSphere’s independent auditors and evaluates their independence, reviews BrightSphere’s financial reporting procedures and controls, and oversees BrightSphere’s internal audit, risk and compliance functions. The Audit Committee’s role and responsibilities are set forth in the Audit Committee Charter adopted by the Board, which is available on BrightSphere’s website at www.bsig.com. The Audit Committee reviews and reassesses its charter annually and recommends any changes to the Board for approval. The Audit Committee is responsible for overseeing BrightSphere’s overall financial reporting process, and for the appointment, compensation, retention and oversight of the work of the Company’s external auditor. In fulfilling its responsibilities for the financial statements for fiscal year 2021, the Audit Committee took the following actions:

•Reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2021 with management and KPMG, our independent registered public accounting firm;

•Discussed with KPMG the matters required to be discussed in accordance with Auditing Standard No. 16-Communications with Audit Committees;

•Received written disclosures and a letter from KPMG regarding its independence as required by applicable requirements of the Public Company Accounting Oversight Board (the “PCAOB”) regarding KPMG communications with the Audit Committee and the Audit Committee further discussed with KPMG its independence. The Audit Committee also considered the status of pending litigation, taxation matters and other areas of oversight relating to the financial reporting and the audit process that the Audit Committee determined appropriate;

•Discussed with KPMG the independence of KPMG from BrightSphere and its management, and concluded that KPMG is independent; and

•Reviewed and discussed with management and KPMG the critical audit matters and the significant accounting policies applied by BrightSphere in its financial statements.

Management also reports to the Audit Committee and the Board regarding enhancements made to our risk management processes and controls in light of evolving market, business, regulatory and other conditions, including those related to privacy and cyber security.

20

BrightSphere’s management is responsible for the financial reporting process, for the preparation, presentation and integrity of financial statements in accordance with generally accepted accounting principles in the United States and for the establishment and effectiveness of BrightSphere’s internal controls and procedures designed to assure compliance with accounting standards and laws and regulations. BrightSphere’s independent auditors are responsible for auditing those financial statements in accordance with generally accepted auditing standards, attesting to the effectiveness of BrightSphere’s internal control over financial reporting and expressing an opinion as to whether those audited financial statements fairly present, in all material respects, the financial position, results of operation and cash flows of BrightSphere in conformity with generally accepted accounting principles in the United States. The Audit Committee monitors and reviews these processes. Members of the Audit Committee rely without independent verification on the information provided to them and on the representations made by management and BrightSphere’s independent auditors. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s review and discussions referred to above do not assure that the audit of the Company’s financial statements has been carried out in accordance with the standards of the PCAOB, that the financial statements are presented in accordance with generally accepted accounting principles in the United States or that KPMG is in fact “independent.”

The Audit Committee evaluates the independent auditor’s qualifications, performance and independence, including the performance of the independent auditor’s lead partner, taking into consideration the opinions of management and the Company’s internal auditors. The Audit Committee and its Chair ensure the rotation of the lead partner and the audit partner responsible for reviewing the audit to the extent required by law, are directly involved in the selection of the new lead partner and the audit partner responsible for reviewing the audit and consider whether regular rotation of the audit firm is necessary or appropriate to ensure continuing auditor independence. The Audit Committee reports on its evaluation and conclusions, and any actions taken pursuant thereto, to the Board. The Audit Committee and the Board believe that the retention of KPMG as the Company’s independent auditor for the year ending December 31, 2022 is in the best interests of the Company and its stockholders. Based on this evaluation, the Audit Committee decided to retain KPMG to serve as independent auditors for the year ending December 31, 2022. In considering the retention of KPMG, the Audit Committee considers, among other things, the quality of the services provided, KPMG’s capability and knowledge in the industry, tenure as the Company’s auditor and knowledge of the Company and its operations. Under the Audit Committee Charter, the Audit Committee has the authority to appoint the independent auditor.

KPMG has acted as the Company’s independent registered public accounting firm continuously since the Company became a public company in 2014.

Based on the Audit Committee’s review of the audited financial statements and discussions with management and KPMG, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 for filing with the SEC.

| Members of the BrightSphere Audit Committee Robert J. Chersi (Chair) Andrew Kim Barbara Trebbi | |||||

21

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee of our Board has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K, which appears elsewhere in this proxy statement, with our management. Based on this review and discussion, the Compensation Committee has recommended to the Board that the Compensation Discussion and Analysis be included in our proxy statement and in BrightSphere Investment Group Inc.’s Form 10-K filed with the SEC on February 28, 2022.

| Members of the BrightSphere Investment Group Inc. Compensation Committee Barbara Trebbi (Chair) Robert J. Chersi Andrew Kim | |||||

22

Compensation Discussion and Analysis

Introduction

The following compensation discussion and analysis (“CD&A”) provides information on the compensation arrangements of our CEO and our other named executive officers (“NEOs’) for 2021 and should be read together with the compensation tables and related disclosures set forth below.

Our CD&A is presented in the following sections:

•Recent Company Performance

•Summary of Governance Practices

•2021 Executive Compensation Program Structure

◦Base Salary

◦Incentive Awards

◦Employee Benefit Programs

•2021 Compensation

•Other Compensation Committee Policies and Practices

◦Comparator Group

◦Compensation Committee

◦Our Compensation Consultant

◦Risk Considerations in our Compensation Programs

•Impact of Tax and Accounting Policies

Recent Company Performance

The Company’s performance was exceptionally strong in 2021 as measured by our financial performance and strategic re-positioning. In particular, during 2021, the Company:

•Completed the divestitures of four affiliates. The proceeds received from these transactions as well as the divestitures that occurred in 2020 unlocked the high intrinsic value embedded in our business relative to our legacy stock price.

•Simplified our business model and repositioned our Company to operate as a pure-play and differentiated systematic asset manager focused on high-demand areas, such as multi-asset class, ESG, managed volatility and long-short strategies.

•Continued to outperform for our clients, with approximately 85% of strategies by revenue exceeding their benchmarks over the prior 1-, 3-, 5-, and 10- year periods as of December 31, 2021.

•Delivered GAAP income of $828m compared to $287m in 2020, representing a 288% increase year over year, driven by gains on divestitures.

•Delivered Economic Net Income (ENI) of $118 million compared to $88 million in 2020, representing a 34% increase year over year (see Appendix for reconciliation of GAAP to ENI), in spite of divesting six of our seven affiliates during 2020 and 2021.

•Returned $1.1 billion of capital to stockholders by buying back 45% of our outstanding shares through a self tender offer in December 2021.

•Paid down $125 million in outstanding BSIG notes.

•Achieved recognition of our significant business success with our stock price increasing to a post-IPO all-time high.

23

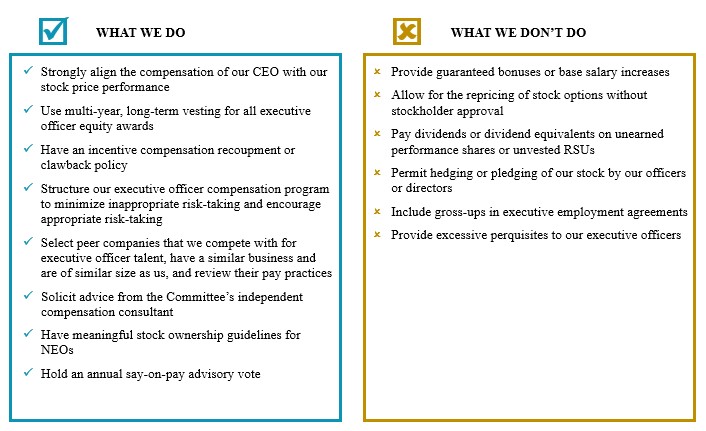

Summary of Governance Practices

The Compensation Committee regularly reviews industry best practices in executive compensation. We have implemented many best-practice features intended to enhance the alignment of executive compensation with the interests of our stockholders.

2021 Executive Compensation Program Structure

Our compensation program for 2021 is based on clear and consistent objectives and alignment with our stockholders. Our compensation program intended to:

•Align our NEOs’ compensation with long-term increases in value for stockholders

•Reward individual efforts and our Company’s overall financial and strategic performance

•Reflect our culture and values

•Be competitive with our peers, helping us to attract, motivate and retain top-caliber executive talent

The specific elements of our compensation program include:

Base Salary: Each of our NEOs earns a fixed base salary during his or her employment. Our NEOs’ base salaries are intended to provide a degree of financial certainty and stability to our executive pay program. After review of comparator group data, and taking into account the annual incentive compensation payable to our NEOs, the Compensation Committee did not adjust the base salaries of our NEOs in 2021.

Incentive Awards: The Company provides its NEOs with various forms of incentive compensation that are intended to recognize the performance of the individual NEO and the overall Company. Depending on the year and the individual NEO, these forms of incentive compensation have been delivered in cash incentives, premium-priced stock options and time-base restricted stock units (“RSUs”).

24

2021 Annual Incentive Compensation:

Suren Rana, President and Chief Executive Officer: On February 12, 2022, Mr. Rana was paid a cash incentive of $12,000,000 in recognition of his extraordinary leadership and the Company’s strong performance in 2021 as described above. Importantly, Mr. Rana’s leadership resulted in the following:

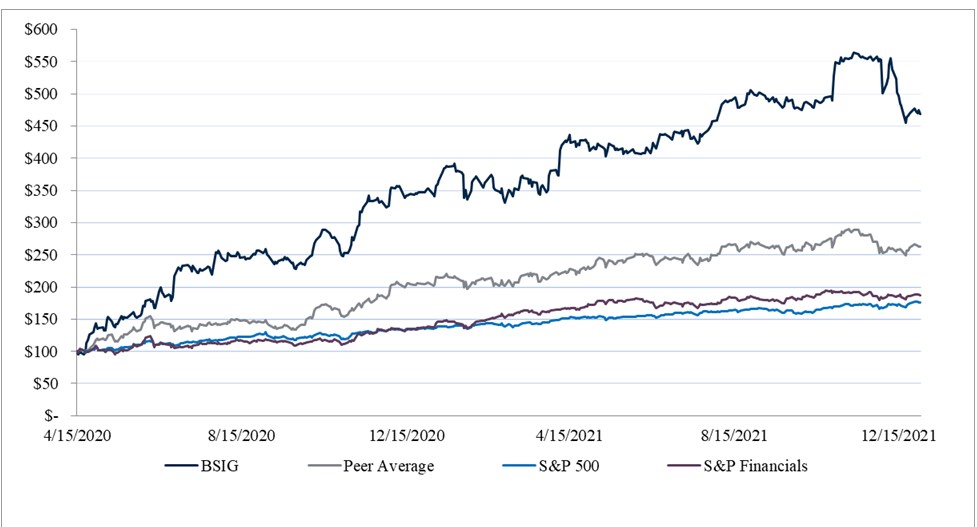

•From the time of his appointment as CEO on April 15, 2020 through December 31, 2021, our Company’s stock price increased to nearly five times its prior level, from $5.23 to $25.60, with this share price increase resulting in approximately an $800 million increase in market value. Our stock price return outperformed the average stock price of our peers by over 200% during this period. See stock price performance chart below.

•We completed the divestitures of four affiliates. The proceeds received from these transactions as well as from the additional divestitures that occurred in 2020 unlocked the high intrinsic value embedded in our business relative to our legacy stock price.

•We simplified our business model and repositioned our Company to operate as a pure-play and differentiated systematic asset manager focused on high-demand areas, such as multi-asset class, ESG, managed volatility and long-short strategies.

•We returned $1.1 billion of capital to stockholders by buying back 45% of our outstanding shares through a self tender offer in December 2021.

Stock Performance from time of CEO Appointment through December 31, 2021

Christina Wiater, Principal Financial and Accounting Officer: On September 30, 2021, in accordance with the terms of her employment agreement, Ms. Wiater received an incentive award of $850,000 in connection with the divestitures of all except one affiliate which constituted an extraordinary corporate event. Under her agreement, Ms. Wiater was not eligible for and did not receive any other form of incentive compensation in respect of 2021.

Richard Hart, Chief Legal Officer: Mr. Hart is eligible to receive annual incentive compensation in an amount and form that is determined based on the Compensation Committee’s discretionary assessment of the Company’s financial performance, Mr. Hart’s individual performance, competitive market data and other related factors.

In recognition of the Company’s and Mr. Hart’s strong performance in 2021, Mr. Hart was awarded 2021 total annual incentive compensation of $1,200,000 with this amount split between a cash award of $720,000 and time-based RSUs with an approximate grant date value of $480,000. For Mr. Hart, the split between the cash payment and the time-based RSUs was based on the deferral schedule determined by the Compensation Committee as described below.

•The first $100,000 of the total incentive to be paid in cash,

25

•the next tier of incentive from $100,001 to $200,000 is paid 65% in cash and 35% in RSUs,

•the next tier of the total incentive from $200,001 to $500,000 is paid 60% in cash and 40% in

RSUs,

RSUs,

•for incentives over $500,000, the tier from $500,001 to $1,000,000 is split 55% cash and 45%

RSUs, and

RSUs, and

•the tier for incentives in excess of $1,000,000 is split evenly between cash and RSUs.

The number of RSUs granted to Mr. Hart was determined by dividing the dollar value of the RSU portion of his annual incentive compensation by the closing price of a share of our Common Stock on the date immediately prior to the date of grant, generally subject to his continued employment with us. Any dividends payable with respect to Common Stock underlying the RSUs will be subject to the same vesting conditions as the RSUs to which the dividends relate.