Form DEF 14A BOYD GAMING CORP

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material pursuant to § 240.14a-12. |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2023 NOTICE OF ANNUAL MEETING & PROXY STATEMENT

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 4, 2023 |

TO THE STOCKHOLDERS OF BOYD GAMING CORPORATION:

You are invited to attend our 2023 Annual Meeting of Stockholders, which will be held on May 4, 2023 at 1:00 p.m., Pacific Daylight Time. This year’s Annual Meeting will be conducted virtually via a live audio webcast. Our executive corporate offices, located at 6465 South Rainbow Boulevard in Las Vegas, Nevada, will serve as the statutory location from which the Annual Meeting will be hosted. However, you will only be able to attend the Annual Meeting, submit your questions and vote online during the meeting via electronic communication at http://www.virtualshareholdermeeting.com/BYD2023. By logging into this site, you will be deemed present at the Annual Meeting. Our stockholders will consider and vote on the following matters at the Annual Meeting:

| 1. | To elect eight members to our board of directors to serve until the next annual meeting of stockholders or until their respective successors have been duly elected and qualified. |

| 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. |

| 3. | To hold an advisory vote on executive compensation. |

| 4. | To hold an advisory vote on the frequency of the advisory stockholder vote on the compensation of our named executive officers. |

| 5. | To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

The foregoing items of business are more fully described in the proxy statement attached to and made part of this notice.

Our board of directors has fixed the close of business on March 10, 2023 as the record date for determining the stockholders entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof.

We are mailing a Notice of Internet Availability of Proxy Materials (the “Internet Availability Notice”) instead of a paper copy of this proxy statement and our 2022 Annual Report to stockholders. The Internet Availability Notice contains instructions on how to access those documents over the internet and on how to request a paper copy of our proxy materials, including this proxy statement, our 2022 Annual Report and a form of proxy card or voting instruction card, as applicable. All stockholders who have previously requested a paper copy of the proxy materials by mail will receive a paper copy rather than the Internet Availability Notice.

All stockholders are invited to attend the virtual Annual Meeting conducted via live audio webcast. However, whether or not you expect to attend the Annual Meeting online, we urge you to vote as promptly as possible by following the instructions included in this proxy statement or by following the instructions detailed in the Internet Availability Notice, as applicable, in order to ensure your representation and the presence of a quorum at the Annual Meeting. If you mail your proxy card or vote by telephone or online, you may still decide to attend the Annual Meeting and vote your shares in person.

By Order of the Board of Directors

Marianne Boyd Johnson

Co-Executive Chair

Las Vegas, Nevada

March 22, 2023

TABLE OF CONTENTS

| 1 | ||||

| 2 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 |

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 26 | ||||

| 27 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| Proposal 2—Ratification of |

34 | |||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| Proposal 4—Advisory Vote on the Frequency of Advisory Stockholder Vote on Compensation |

37 | |||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 44 |

|

|

|

SUMMARY

Our Board of Directors (“Board”) is soliciting proxies for our 2023 Annual Meeting of Stockholders. This summary highlights information you will find in this proxy statement. We encourage you to review the entire proxy statement before you vote, as this is only a summary.

|

MEETING INFORMATION

|

||||||||

| • Date and Time: |

May 4, 2023 at 1:00 p.m. PDT | |||||||

| • Location: |

Virtual only, at http://www.virtualshareholdermeeting.com/BYD2023 | |||||||

| • Record Date: |

March 10, 2023 | |||||||

| • Proxy Mailing Date:

|

On or about March 22, 2023 |

HOW TO VOTE

|

|

By internet: Visit the website listed on your proxy card |

|

By phone: Call the telephone number on your proxy card. |

|

By mail: Sign, date and return the proxy card if you elected to receive one |

|

During the meeting: Vote during the annual meeting when the polls are open |

AGENDA AND VOTE RECOMMENDATIONS:

| Matter | Board Vote Recommendation | |||

| Proposal 1 |

Election of Directors |

FOR | ||

| Proposal 2 |

Ratification of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2023 | FOR | ||

| Proposal 3 |

Approval, on an advisory basis, of the compensation of our Named Executive Officers | FOR | ||

| Proposal 4 |

Approval, on an advisory basis, of the frequency of the advisory stockholder vote on the compensation of our named executive officers | FOR | ||

In this proxy statement:

| • | “we,” “us”, the “Company” and “Boyd Gaming” mean Boyd Gaming Corporation, a Nevada corporation, unless otherwise indicated; and |

| • | “Annual Meeting” means our 2023 Annual Meeting of Stockholders to be held on May 4, 2023 at 1:00 p.m. PDT, and any adjournment or postponement thereof. Stockholders may only attend the Annual Meeting virtually. Please visit http://www.virtualshareholdermeeting.com/BYD2023. |

|

1 |

|

Our Approach to

Business: Boyd Style

Founded in 1975, we are a leading geographically diversified operator of 28 gaming entertainment properties in ten states and manager of a tribal casino in northern California. We are also a strategic partner and 5% equity owner of FanDuel Group, the nation’s leading online sports betting operator. Boyd Gaming is built on a philosophy we call “Boyd Style”, which means sharing our success with others, treating our stakeholders with respect and honesty, and making sure our home communities are better places because we are a part of them. We believe our commitment to Environmental, Social and Corporate Governance (“ESG”) initiatives supports and enhances our ability to create long-term stockholder value.

OUR ESG PILLARS

ENVIRONMENT

| ◾ | Conserving Energy and Water |

| ◾ | Reducing Carbon Emissions |

| ◾ | Diverting Waste from Landfill |

PEOPLE

| ◾ | Promoting Workforce Diversity & Inclusion |

| ◾ | Sharing our Success with Team Members |

| ◾ | Promoting Safety and Protecting Team Members |

| ◾ | Responsible Gaming |

COMMUNITIES

| ◾ | Corporate Philanthropy |

| ◾ | Supporting Education |

| ◾ | Workplace Giving |

| ◾ | Partnering with Diverse Suppliers |

|

2 |

|

ENVIRONMENT |

| • | Conserving Energy and Water: Through our investments in “green” technology and continual changes throughout our operations, Boyd Gaming is committed to making consistent and meaningful reductions in our water and energy consumption. In 2022, we continued to make progress in these areas compared to our 2017 baseline levels. |

| • | Reducing Carbon Emissions: In concert with our energy conservation measures, we support the fight against climate change through a focus on meaningful reductions in our carbon emissions. We anticipate that our continued energy savings will result in further reductions in our Scope I and Scope II emissions compared to our 2017 baseline. |

| • | Diverting Waste from Landfill: We have formed “Green Teams” consisting of team members at every Boyd Gaming property, tasked with identifying and implementing ways to reduce the amount of waste sent to landfills through recycling and composting programs. We achieved an overall waste diversion rate of over 53.6% in 2022, and we continue to enhance our efforts to reach our goal of 60% by 2025. |

|

OUR PEOPLE |

| • | Promoting Workforce Diversity & Inclusion: As the top-ranked gaming company in Newsweek magazine’s 2023 listing of “America’s Greatest Workplaces for Diversity,” we believe that our diverse workforce makes us a stronger company. We are committed to creating opportunities for team members of every background, gender and ethnicity, as evidenced by our “majority minority” and majority female workforce. |

| • | Sharing our Success with Team Members: As part of our commitment to being an employer of choice, we have announced a pathway to a $15 per hour minimum wage for all non-tipped, non-represented team members by mid-2023. Additionally, we offer our team members an attractive package of benefits, including a 401(k) with company match, paid time off, health, dental and vision coverage, life, disability and critical illness insurance, and student loan reimbursement and tuition reimbursement programs. |

| • | Promoting Safety and Protecting Team Members: Thanks to our comprehensive workplace safety programs and training, we continued to maintain our industry’s lowest overall workplace injury rates in 2022. Additionally, we have implemented robust programs to protect team members from wrongdoing, including universal anti-harassment training and a 24/7 anonymous “whistleblower” hotline. |

| • | Responsible Gaming: We are committed to promoting responsible gaming throughout our nationwide operations and doing our part to assist those who experience harm from gambling. We make annual contributions to national and state problem gambling organizations, post prominent responsible gaming signage throughout our properties, and require all Boyd Gaming team members to participate in annual responsible gaming training. Additionally, we have formed an internal committee of executives from across the Company tasked with reviewing our responsible gaming practices and implementing operational and marketing improvements to further enhance our responsible gaming initiatives. |

|

3 |

|

|

OUR COMMUNITIES |

| • | Corporate Philanthropy: As part of our commitment to strengthen and serve our communities, we contributed more than $45 million over the last three years to non-profit organizations serving the communities in which we operate. Our charitable giving focuses on our strategic priorities of Community & Culture, Education, and Health & Human Services. |

| • | Supporting Education: We actively support both K-12 and higher education in our communities, contributing nearly $3 million to educational non-profits in 2022. Additionally, we support the continued development of our team members through our leadership development coursework and our tuition reimbursement program. |

| • | Workplace Giving: To facilitate charitable donations by our team members, we have implemented “Giving the Boyd Way,” an online charitable giving and volunteering platform. Since this program was introduced in 2020, Boyd Gaming team members have contributed over $1.5 million through Giving the Boyd Way to non-profit organizations across the country. |

| • | Partnering with Diverse Suppliers: Our Company is focused on leveraging our supply chain to create purchasing opportunities for diverse businesses in our communities. Boyd Gaming seeks to identify opportunities to purchase from and partner with small and midsized businesses, minority-owned business enterprises and/or women-owned business enterprises, veteran-owned business enterprises, and businesses owned and operated by members of the LGBTQ community. |

|

4 |

EFFECTIVE

GOVERNANCE

With one of the most experienced leadership teams in the casino industry, we pride ourselves on offering our guests an outstanding entertainment experience, delivered with unwavering attention to customer service. We fulfill this mission while demonstrating the highest level of integrity, which starts in the boardroom and carries through to each of our properties. Through teamwork, respect, and a disciplined approach to executing on our goals, we strive to maximize stockholder value, to be a leader in our industry, and to provide meaningful opportunities for our employees and throughout our communities.

As part of its ongoing commitment to good corporate governance, the Board has adopted Corporate Governance Guidelines setting forth the Board’s corporate governance practices and adopted written charters for each of the Audit Committee, the Compensation Committee and the Governance and Nominating Committee. The Board has also adopted our Code of Business Conduct and Ethics that includes policies for directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees. The Corporate Governance Guidelines, Audit Committee Charter, Compensation Committee Charter, Governance and Nominating Committee Charter, and Code of Business Conduct and Ethics referenced above are each available in the “Investors – Governance” section of our website at www.boydgaming.com. Web links throughout this document are provided for convenience only and are not intended to be active hyperlinks to the referenced websites. Information contained on our website is not part of this proxy statement.

CORPORATE GOVERNANCE HIGHLIGHTS

We continually review our governance practices with a focus on promoting our commitment to delivering long-term stockholder value, strengthening the Board’s accountability, and maintaining a high level of public trust in our Company.

|

|

|

|||||||

|

5 |

|

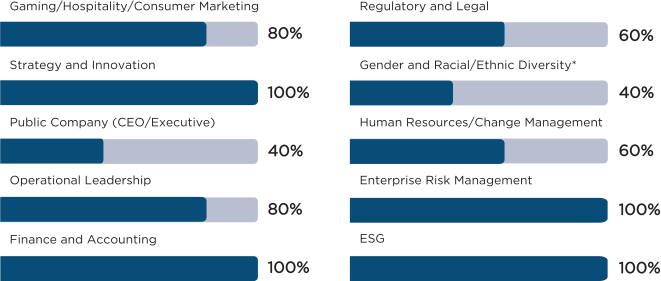

BOARD QUALIFICATIONS AND EXPERIENCE

The Corporate Governance and Nominating Committee annually performs an assessment of our Board’s composition with a view that diversity, inclusive of gender, race and experience, is a critical component of sound corporate governance. The following outlines a subset of the attributes of our independent directors identified during the assessment.

* Includes all independent and non-independent members running for re-election.

DIRECTOR NOMINEES

| Marianne Boyd Johnson

Co-Executive Chair and Executive Vice President

Director Since: 1990

Age: 64

Other Public Company |

EXPERIENCE:

Ms. Johnson has served as a Director of the Company since 1990 and as Vice Chair of the Board since 2001. She has been Co-Chair of the Board since January 2021. Ms. Johnson has also been an Executive Vice President of the Company since 2008, which followed more than 10 years of service with the senior management team and 15 years of service in various operational positions within the Company. Ms. Johnson also serves as the Company’s Chief Diversity Officer.

Ms. Johnson has served on the board of directors of Western Alliance Bancorporation since 1995, where she also serves as a member of the compensation committee and governance committee. She is a director at large of the Nevada Health and Bioscience Corporation, a nonprofit corporation. Ms. Johnson is the daughter of William S. Boyd and the sister of William R. Boyd.

Ms. Johnson brings considerable public company experience in two highly regulated industries—gaming and banking. She also has experience in developing and promoting diversity and inclusion programs. | |

|

6 |

| Keith E. Smith

President, Chief Executive Officer and Director

Director Since: 2005

Age: 62

Other Public Company Boards: SkyWest, Inc. |

EXPERIENCE:

As President and Chief Executive Officer of Boyd Gaming Corporation, Keith Smith leads one of the largest and most respected casino entertainment companies in the United States.

An industry veteran with more than 35 years of gaming experience, Mr. Smith first joined Boyd Gaming Corporation in 1990. He was promoted to Executive Vice President of Operations in 1998, Chief Operating Officer in 2001, and President in 2005. In January 2008, Mr. Smith was named Chief Executive Officer of Boyd Gaming. Mr. Smith has also been a member of the Company’s Board of Directors since April 2005.

Mr. Smith currently serves on the board of directors of regional airline operator SkyWest, Inc. where he serves as audit committee Chair. He previously served as chairman of the Los Angeles branch of the Federal Reserve Bank of San Francisco, chairman of the American Gaming Association, chairman of the Nevada Resort Association, and vice chairman of the Las Vegas Convention and Visitors Authority.

Mr. Smith brings a meaningful depth of experience and perspective from over 35 years in the gaming industry, including with respect to strategic operations, management and financial matters along with his service on industry, financial and other public company boards. | |

| William R. Boyd

Director and Vice President

Director Since: 1992

Age: 63

Other Public Company Boards: None |

EXPERIENCE:

Mr. Boyd has served as Vice President of the Company since December 1990 and as a Director since September 1992. He also serves as chair of the Company’s corporate compliance committee and is a member of the Company’s diversity council. Prior to his current position, Mr. Boyd held various administrative and operations positions within the Company since 1978. Mr. Boyd serves on the board of directors of the Better Business Bureau of Southern Nevada.

Mr. Boyd has served over 40 years in the gaming industry, and his contributions while serving as Chair of the Company’s compliance committee have provided valuable perspective to both management and the Board regarding compliance matters across the Company. |

| Peter M. Thomas

Presiding Director

Director Since: 2004

Age: 73

Other Public Company Boards: None |

EXPERIENCE:

Mr. Thomas is the Managing Director of Thomas & Mack Co. LLC, a commercial real estate development and management company. He also served as President and Chief Operating Officer of Bank of America, Nevada and its predecessor, Valley Bank of Nevada, for nearly 13 years. Mr. Thomas was a member of the board of directors of City National Bank from 2003 to 2022, which prior to its acquisition in November 2015 was publicly held. Mr. Thomas was a board member of the Los Angeles Branch of the Federal Reserve Bank of San Francisco from January 2003 to December 2008.

Mr. Thomas brings extensive experience in the banking and finance industry from his prior service on the board of the Los Angeles Branch of the Federal Reserve Bank of San Francisco and prior service on other public company boards along with significant perspective regarding commercial real estate matters that are key to the Company’s operations. |

|

7 |

|

| Christine J. Spadafor

Director

Director Since: 2009

Age: 67

Other Public Company Boards: None |

EXPERIENCE:

Ms. Spadafor is the Chief Executive Officer of SpadaforClay Group, Inc., a management consulting firm working at the intersection of strategy, operations, risk management, regulatory compliance, ESG and Diversity, and Equity and Inclusion initiatives. Ms. Spadafor has experience as a corporate, university, and non-profit board director and has served in executive leadership capacities, including Chief Executive Officer of St. Jude’s Ranch for Children. Ms. Spadafor is a commentator on BBC World Service’s “Business Matters” global radio broadcast and podcast, a lecturer in the Visiting Executive Program at Tuck School of Business at Dartmouth, and is a lecturer/presenter at Harvard Medical School and other Harvard graduate programs. She is a speaker/keynote at seminars, meetings and podcasts addressing agile leadership, gender equity, and board governance, including the US Chamber of Commerce, and is a contributor to Forbes, Fortune, Inc., and other business journals. The American Bar Association/Direct Women recognized her as one of the nation’s top 20 female attorneys with business expertise to serve on corporate boards.

Ms. Spadafor contributes broad business and management experiences to our Board and brings a sound foundation for understanding and applying strategic approaches to operational issues, both domestically and internationally. Her education and broad expertise in public health and human capital management, as well as in environmental, social and governance matters further enhances the Company’s approach to such issues, from both a strategic and an operational perspective. | |

| John R. Bailey

Director

Director Since: 2015

Age: 62

Other Public Company Boards: None |

EXPERIENCE:

Mr. Bailey is managing partner of Bailey Kennedy, a Las Vegas law firm which he founded in 2001. Mr. Bailey has more than 35 years of legal experience, with a particular focus on business practices, commercial corporate litigation, healthcare law and gaming law. Mr. Bailey has served in board positions with a wide range of regulatory and community organizations over the last 15 years, including as Chair of the Nevada State Athletic Commission, Chair of the Nevada State Bar Moral Character and Fitness Committee, Chair of the Governing Board of the Andre Agassi College Preparatory Academy, Member of the Southern Nevada District Court Review Commission, and a Director of the Council for a Better Nevada, the Las Vegas Global Economic Alliance, The Public Education Foundation and The Smith Center for the Performing Arts. He previously served on the board of directors of SHFL Entertainment, Inc., at the time a publicly traded company.

Mr. Bailey introduces perspectives and best practices based on his more than 35 years in the practice of law, including his past service on regulatory boards and his prior service within the gaming industry on the board of directors of a publicly traded company. |

|

8 |

| A. Randall Thoman

Director

Director Since: 2019

Age: 71

Other Public Company Boards: Southwest Gas Holdings, Inc. |

EXPERIENCE:

Mr. Thoman is the principal of Thoman International, LLC, a business advisory and consulting firm, which he formed in 2009. Prior to his current responsibilities, Mr. Thoman held several positions at Deloitte & Touche LLP (“Deloitte”) during a more than 30-year career with the firm, including serving as a partner from 1991 until his retirement in 2009. For more than 15 years, Mr. Thoman served as the primary technical partner in Deloitte’s Las Vegas office, having responsibility for the technical interpretation and application of accounting principles and audit standards and the review of all reporting issues and financial statements for Nevada-based clients registered with the Securities and Exchange Commission (“SEC”). Currently, he is on the board of Southwest Gas Holdings and serves as the audit committee chairman. He previously served on the board of directors of SLS Las Vegas and SHFL entertainment, Inc.

Mr. Thoman has extensive experience and expertise in audit and financial accounting, including more than 30 years as a Certified Public Accountant in addition to his extensive experience regarding technical accounting matters and management. Mr. Thoman also provides perspective as a result of his service on other boards of directors of public companies and within the gaming industry. | |

| Paul W. Whetsell

Director

Director Since: 2015

Age: 72

Other Public Company Boards: Hilton Grand Vacations, Inc. |

EXPERIENCE:

Mr. Whetsell previously served as Vice Chairman of Loews Hotels Holding Corporation and as President and Chief Executive Officer from January 2012 until 2015. Mr. Whetsell has served as President and Chief Executive Officer of Capstar Hotel Company since 2006. Currently, Mr. Whetsell is on the board of Hilton Grand Vacations, Inc. and serves as the Chair of the compensation committee. Mr. Whetsell served on the board of NVR, Inc., a publicly traded company, from 2007 until his retirement from that board in 2018. Mr. Whetsell was a member of the American Hotel & Lodging Association’s Industry Real Estate and Financing Advisory Council and previously served on the Board of Governors of the National Association of Real Estate Investment Trusts (NAREIT). Mr. Whetsell currently serves on the board of the Cystic Fibrosis Foundation and the non-profit First Book.

Mr. Whetsell provides significant operational and strategic expertise from his more than 35 years of senior management responsibilities within the hospitality industry, his active involvement in lodging and hospitality associations and his service on other public company boards. |

After many years of distinguished service, William S. Boyd will be retiring from the Board on May 4, 2023 at the expiration of his current term. At such time the Board will appoint him as Chairman Emeritus of the Company, although he will not be a member of the Board.

Our Board held a total of eight meetings during 2022. Each of our current directors attended at least 75% of the Board meetings and the committees of the Board on which the director served that were held during the applicable period of service. We encourage, but do not require, our directors to attend our annual stockholder meetings. Each of our directors attended the 2022 annual meeting of stockholders.

Identifying and Evaluating Director Nominees

Our Corporate Governance and Nominating Committee uses a variety of methods to identify and evaluate director nominees. Candidates may come to the attention of the Corporate Governance and Nominating Committee via our current Board members, professional search firms, stockholders or other persons. These candidates will be evaluated by our Corporate Governance and Nominating Committee and may be considered at any point during the year.

The Corporate Governance and Nominating Committee considers diversity as one of many factors in the identification and evaluation of potential director nominees. The overriding principle guiding our director nomination process is a desire to ensure that our Board serves the interests of our stockholders. We believe that

|

9 |

|

having diverse skills, experiences and perspectives represented on the Board maximizes stakeholder value. The Committee may consider the following elements, among others, when evaluating director nominees:

| ✓ | Gender and ethnicity; |

| ✓ | Financial and accounting acumen; |

| ✓ | Personal and professional integrity; |

| ✓ | Business or management experience; |

| ✓ | Leadership and strategic planning experience; and |

| ✓ | Ability to understand and execute on Boyd Gaming’s business. |

The Corporate Governance and Nominating Committee annually performs an assessment of our Board’s composition regarding age, skills and experience and the effectiveness of its efforts to consider diversity in its director nomination process. The Committee believes its director nomination process, including its policy of considering diversity, has created a Board with diverse backgrounds and experiences that collectively serves the interests of our stockholders well.

Stockholders may also recommend a director candidate for consideration by submitting a recommendation to the Corporate Governance and Nominating Committee Chair, c/o our Corporate Secretary, at 6465 South Rainbow Boulevard, Las Vegas, Nevada 89118, no later than 60 days prior to the date of the 2024 Annual Meeting of Stockholders. Such notice must include the candidate’s name, biographical data, relationship to the stockholder and other relevant information. Stockholders may nominate director candidates for election by following the timing, eligibility, procedural and any other requirements set forth in our Amended and Restated Bylaws as described further in Stockholder Proposals; Other Matters.

Director Independence

Our Corporate Governance Guidelines require that our Board consist of a majority of independent directors consistent with the New York Stock Exchange (“NYSE”) listing standards. These standards require the Board to determine, among other things, that our independent directors have no material relationship with Boyd Gaming other than as a director. The Board considers all known relevant facts and circumstances about the relationships bearing on the independence of a director or nominee and also considers sales and purchases of products and services in the ordinary course of business between Boyd Gaming and other companies where a director or immediate family member may have a relationship.

Applying these standards, each of the following individuals is considered an “independent director”:

| John R. Bailey | ||||

| Christine J. Spadafor | ||||

| A. Randall Thoman | ||||

| Peter M. Thomas | ||||

| Paul W. Whetsell |

Board Leadership Structure and Role in Risk Oversight

Our Board is responsible for company-wide risk oversight, with our senior management bearing primary responsibility for managing these risks. The Board has separated the positions of Chair and CEO because it believes that the separation of the positions best enables the Board to ensure that our businesses, risks, opportunities and affairs are managed effectively and in the best interests of our stockholders. The Board’s oversight functions are primarily coordinated through each of our Board committees. Each of the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee receives regular updates from management and works with management to assess potential risk exposures and understand the controls in place to mitigate potential impacts of such risks. In turn, our Board committees report to the full Board at least four times per year regarding their respective areas of risk oversight responsibilities.

Gaming and Regulatory Risk Management: We take our duty to be a responsible member of the gaming industry seriously. Our Corporate Compliance Committee oversees our Company’s gaming and regulatory compliance programs, which include gaming operations, government regulations, and financial crime prevention such as anti-money laundering (AML) compliance and procedures. To ensure proper visibility and transparency, the Corporate Compliance Committee is chaired by a member of our Board of Directors who provides regular reports of each meeting directly to the Corporate Governance and Nominating Committee.

|

10 |

Cybersecurity Risk Management: Led by a dedicated Information Security team, Boyd Gaming operates with the highest degree of integrity in designing, delivering and maintaining a comprehensive program that safeguards our systems, services and data from cybersecurity-related threats. Supporting these efforts, Boyd Gaming team members are required to take regular information security training, ensuring our entire team is aware of the latest risks in cybersecurity and is prepared to do their part to keep our systems and information secure. Our Chief Information Security Officer and Senior Vice President of Legal Operations and Compliance provide day-to-day oversight of our data privacy and cybersecurity programs. These positions report directly to the Chief Information Officer (CIO) and to the General Counsel, respectively. Our Chief Information Officer in turn provides the full Board quarterly updates on cybersecurity and data protection matters, our information and data security initiatives and practices, and any developments in the threat environments that we face.

ESG and Risk Management: Our Board and management understand that operating on a foundation of corporate responsibility, community and stewardship are key to ensuring the Company’s long-term success. Our Corporate Governance and Nominating Committee is responsible for overseeing the Company’s strategies related to sustainability, diversity and stewardship (collectively, our “ESG Initiatives”), with clear communication to the other committees and the full Board on these topics. The Committee actively engages with management regarding the execution of our ESG Initiatives and the proper public disclosure of these topics.

Board Committees

Our Board has three standing committees as outlined below, each comprised of independent directors. The charters for each of these committees are available on our website at www.boydgaming.com.

| Director* |

Audit Committee | Compensation Committee | Corporate Governance and Nominating Committee | |||

| John R. Bailey |

● | ● | ||||

| Christine J. Spadafor |

F | C | ||||

| A. Randall Thoman |

C, F | |||||

| Peter M. Thomas |

F | C | ● | |||

| Paul W. Whetsell |

● | ● | ||||

| Committee Meetings in 2022 |

12 | 4 | 4 | |||

| * | C: Chair, F: Audit Committee Financial Expert as defined in applicable SEC rules. |

| • | Audit Committee: Our Audit Committee is responsible for supervising our financial controls, appointing our independent registered public accounting firm, managing our financial statement and disclosure processes, meeting with our officers regarding our financial controls, acting on recommendations of our auditors and taking such further actions as the Audit Committee deems necessary to complete an audit of our books and accounts. |

| • | Corporate Governance and Nominating Committee: The Corporate Governance and Nominating Committee’s responsibilities include assisting the Board in identifying qualified individuals to become Board members, recommending the composition and compensation of the Board and its committees, conducting annual reviews of each director’s independence and making recommendations to the Board based on its findings, recommending to the Board the director nominees for election at the annual meeting of stockholders, establishing and monitoring a process of assessing our Board’s effectiveness, and developing and recommending to the Board and implementing a set of corporate governance principals and procedures applicable to the Company. The Corporate Governance and Nominating Committee also oversees the Company’s ESG Initiatives. |

| • | Compensation Committee: Our Compensation Committee oversees all compensation policies for employees, making recommendations to the Board regarding compensation matters, determining compensation for the Chief Executive Officer and providing oversight of our compensation philosophy as described under “Compensation Discussion and Analysis.” In addition, the Compensation Committee administers the Company’s stock plans and determines the terms and conditions of issuances thereunder. |

|

11 |

|

The Compensation Committee has the authority to retain consultants to assist in evaluating various elements of our compensation programs and in making compensation determinations, including for our Chief Executive Officer. The Compensation Committee continued its engagement of Exequity, LLP (“Exequity”) throughout 2022 to provide compensation-related analyses and consulting services. Our CEO also provides recommendations to the Compensation Committee for each Named Executive Officer (other than himself) and for members of our management committee (“Management Committee”), which performs an active role in the leadership and strategy for the development, operations and growth of the Company. The Compensation Committee determined that Exequity is independent and has not created any conflict of interest.

Compensation Committee Interlocks and Insider Participation

During 2022, the members of our Compensation Committee consisted of Messrs. Bailey, Thomas, and Whetsell. None of the Company’s executive officers serves as a director or member of the compensation committee of another entity that has one or more executive officers serving as a director of the Company or on the Company’s Compensation Committee.

Communicating with our Board

Our stockholders and other interested parties may communicate with our Board by writing to:

Boyd Gaming Corporation

6465 South Rainbow Boulevard, Las Vegas, Nevada 89118

Attn: Corporate Secretary

Communications will be reviewed by our Corporate Secretary and, if determined to be relevant to our operations and policies, they will be forwarded to our Board or our presiding director, as appropriate.

DIRECTOR COMPENSATION

Our non-employee director compensation program consists of cash retainers and an annual grant of restricted stock units (RSUs). The annual cash retainer component is available to non-employee directors as follows.

| Board Service | - Annual fee of $90,000 | |

| Presiding Director Service | - Annual fee of $30,000 | |

| Audit Committee Service | - Chair annual fee of $30,000 - Member annual fee of $15,000 | |

| Compensation Committee Service | - Chair annual fee of $25,000 - Member annual fee of $10,000 | |

| Corporate Governance and Nominating Committee Service | - Chair annual fee of $20,000 - Member annual fee of $10,000 | |

All non-employee directors also receive a stock award equal to $200,000 on each annual meeting date. Beginning in 2021, stock awards granted to directors in recognition of their Board service fully vest on the grant date and are paid in shares of our common stock. All grants made to non-employee Board members prior to 2021 will be fully released upon the Director’s retirement from our Board.

|

12 |

The following table sets forth the compensation earned for director services by each non-employee director during the fiscal year ended December 31, 2022.

| Name(1) |

Fees Earned or Paid in Cash ($)(2) |

Stock Awards ($)(3) |

All Other Compensation ($)(4) |

Total ($) | ||||||||||||||||

| Peter M. Thomas |

170,000 | 200,000 | 14,435 | 384,435 | ||||||||||||||||

| Christine J. Spadafor |

125,000 | 200,000 | 9,778 | 334,778 | ||||||||||||||||

| A. Randall Thoman |

120,000 | 200,000 | 14,435 | 334,435 | ||||||||||||||||

| John R. Bailey |

110,000 | 200,000 | 14,435 | 324,435 | ||||||||||||||||

| Paul W. Whetsell |

110,000 | 200,000 | 14,435 | 324,435 | ||||||||||||||||

| (1) | Neither Messrs. William S. Boyd, William R. Boyd, or Smith, nor Ms. Johnson receive compensation for serving as a member of the Board, but they are compensated for their service as executive officers. For more information, see “Compensation Discussion and Analysis” and “Transactions with Related Persons.” |

| (2) | Includes amounts deferred under our Deferred Compensation Plan to the extent of such individual’s participation. The plan permits a participating director to defer up to 100% of his or her director fees that are paid in cash. |

| (3) | Reflects the grant date fair value of awards made pursuant to our Stock Incentive Plan, as determined in accordance with Accounting Standards Codification (“ASC”) 718. The grant date fair value for awards is measured based on the fair market value of our common stock on the date of grant, calculated as the closing price for our common stock. Assumptions used in the calculation of these amounts are included in Note 11, “Stockholders’ Equity and Stock Incentive Plans,” to our audited financial statements for the fiscal year ended December 31, 2022 included in our Annual Report on Form 10-K filed with the SEC on February 24, 2023. |

| (4) | Each of our non-employee directors was eligible to participate in our Medical Expense Reimbursement Plan for fiscal year 2022, which covers medical expenses incurred by plan participants and their spouses that are not covered by other medical plans. Represents amounts paid in the form of plan premiums and/or received as reimbursement under the plan for the fiscal year ended December 31, 2022. |

|

13 |

|

COMPENSATION

DISCUSSION

AND ANALYSIS

Our named executive officers (“NEOs”) for the fiscal year ended December 31, 2022 are:

| ◾ | William S. Boyd, Co-Executive Chair of the Board; |

| ◾ | Keith Smith, President and Chief Executive Officer; |

| ◾ | Josh Hirsberg, Executive Vice President, Chief Financial Officer and Treasurer; |

| ◾ | Stephen Thompson, Executive Vice President, Operations; and |

| ◾ | Theodore Bogich, Executive Vice President, Operations. |

Our Compensation Philosophy

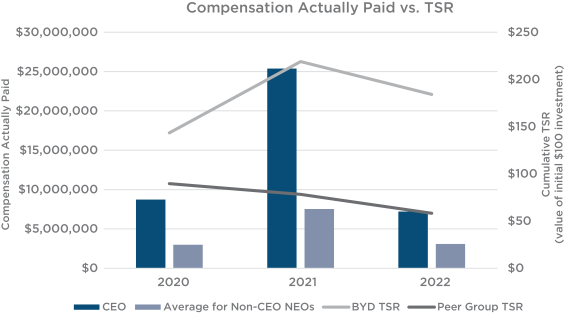

We are focused on generating sustainable value for our stockholders by demonstrating operational excellence, delivering positive financial results, and maintaining a disciplined yet forward-looking approach to capital deployment and strategic opportunities. We also value our commitment to returning capital to our stockholders.

We were able to achieve our 2022 goals of sustaining operating momentum and achieving record revenue and EBITDAR performance, all while maintaining efficiency as indicated by our favorable operating margins. We remain focused on growing revenues and building loyalty among our core customers while successfully managing expenses. We also took an important step forward in our online growth strategy, marked by our acquisition of Pala Interactive, which gives us the talent and technology to continue to build a successful online casino business. We also continued progress on our ESG and diversity initiatives, which included reducing energy consumption and natural resources and lowering carbon emissions compared to our 2017 baseline, promoting a companywide waste diversion program, and continuing progress in the area of diversity of our workforce.

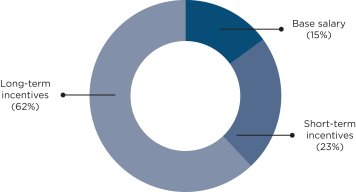

We seek to align the compensation packages of our NEOs with this long-term strategy. To achieve this, we tie a meaningful portion of compensation to achieving predetermined goals and reward individual contributions to our overall success. Our pay principles are structured to appropriately balance achievement of short- and long-term goals and promote our philosophy of being innovative yet disciplined. Mr. Smith’s 2022 compensation was allocated as follows:

|

14 |

We seek to align executive interests with our stockholders and all stakeholders by setting performance incentives that provide a clear path to achieving long-term value. This philosophy carries into our executive pay design in the following ways:

| ◾ | Total executive compensation is targeted at the 50th percentile of the Company’s peer group |

| ◾ | Annual cash incentives are performance-based |

| ◾ | Long-term compensation is approximately 50% performance-based and 100% equity-denominated |

| ◾ | Executives are subject to stock ownership guidelines |

| ◾ | None of our executives has an employment agreement |

We believe our NEO compensation packages are competitive with other leading companies in the gaming and hospitality industries, which generally fall into three categories: (i) core gaming companies; (ii) gaming technology/equipment companies; and (iii) resort/hotel operators. Our compensation consultant, Exequity, assists us in conducting peer group analyses with a view toward establishing NEO total compensation that is competitive with our peers. The peer group considered for purposes of setting 2022 pay consisted of the following: Caesars Entertainment Corp.; Churchill Downs, Inc.; Las Vegas Sands Corp.; MGM Resorts International; Penn National Gaming, Inc.; Red Rock Resorts, Inc., Wynn Resorts, Ltd.; Extended Stay America, Inc.; Hilton Grand Vacations, Inc.; Hyatt Hotels Corp.; Marriott Vacations Worldwide Corporation; Scientific Games Corporation; Six Flags Entertainment Corp.; and Vail Resorts, Inc.

Short-Term Performance Incentives

We believe our management team’s focus on executing on our strategy and commitment to sustaining operating momentum and maintaining operational efficiencies has allowed Boyd Gaming to successfully achieve record Company financial results.

The Compensation Committee continued its philosophy of executing on a measured approach to 2022 compensation, approving a design for the short-term incentive program based on a twelve-month performance period that considered a mix of Adjusted Earnings Before Interest, Taxes, Depreciation, Amortization and Rent (“Adjusted EBITDAR”)1 and demonstrating meaningful progress toward achieving the Company’s diversity and ESG Initiatives.

| 1 | Adjusted EBITDAR is a non-GAAP financial measure. For supplemental financial data and corresponding reconciliation of Adjusted EBITDAR to the most comparable GAAP measure, please see Note 14 to our financial statements in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022. |

| Metric |

Weight | Threshold | Target** | Maximum | ||||||||||

| Adjusted EBITDAR |

90% | $1,125,218* | $1,406,523 | $1,687,828* | ||||||||||

| ESG and Diversity Growth |

10% | — | — | — | ||||||||||

| * | Performance at 80% of target would have resulted in a payout of 50% of an executive’s target, and performance at 120% would have resulted in a payout of 200% of an executive’s target. |

| ** | Level of achievement of the ESG and Diversity Growth metric was based on the Company’s overall progress regarding ESG and Diversity initiatives. |

Maximum payout under the short-term incentive plan is capped at 200% of target. Actual 2022 Adjusted EBITDAR equaled $1,390,509, which resulted in 98.9% achievement under the plan, and the Compensation Committee determined the Company’s achievement of ESG and Diversity growth to be at 110%. This resulted in a blended payout under the short-term incentive plan of 100%, which was paid entirely in 2023.

|

15 |

|

Long-Term Performance Incentives

We believe long-term compensation should serve both as an incentive for achieving longer term Company performance goals and as a retention tool for our executives. We also believe that stock price appreciation and ownership in the Company are valuable incentives that align executive and stakeholder interests. Our NEOs receive long-term incentive compensation in the form of RSUs, Performance Shares and Career Shares. Our Annual long-term incentive grants to our NEOs are comprised 50% of RSUs and 50% of Performance Shares. Long-term incentives for the 2022 target period were granted as follows:

| Executive |

Target Performance Shares ($) | Target RSUs ($) | ||||||||

| William S. Boyd |

$790,751 | $790,751 | ||||||||

| Keith Smith |

$3,106,498 | $3,106,498 | ||||||||

| Josh Hirsberg |

$1,016,641 | $1,016,641 | ||||||||

| Stephen Thompson |

$734,245 | $734,245 | ||||||||

| Theodore Bogich |

$734,245 | $734,245 | ||||||||

Performance Shares: Performance Share grants comprise approximately 50% of an executive’s annual long-term compensation. In February 2022, the Compensation Committee granted target Performance Shares as follows:

| Executive |

2022 Annual Grant | |

| William S. Boyd |

11,559 | |

| Keith Smith |

45,410 | |

| Josh Hirsberg |

14,861 | |

| Stephen Thompson |

10,733 | |

| Theodore Bogich |

10,733 | |

Performance Share achievement with respect to the 2020-2022 performance period was measured by Net Revenue growth and Adjusted EBITDAR growth, with possible achievement ranging from 0% to a maximum of 200%. Company performance for this period resulted in a payout at 200%.

RSUs: Time-based RSU grants comprise the remaining approximate 50% of an executive’s annual long-term compensation. In February 2022, the Compensation Committee granted target RSUs as follows:

| Executive |

2022 Annual Grant | |

| William S. Boyd |

11,559 | |

| Keith Smith |

45,410 | |

| Josh Hirsberg |

14,861 | |

| Stephen Thompson |

10,733 | |

| Theodore Bogich |

10,733 | |

Career Shares Program:

Our NEOs participate in our Career Shares Program, which provides for additional capital accumulation opportunities for retirement and is intended to reward long-service executives. The Career Shares Program provides for the grant of RSUs (“Career RSUs” or “Career Shares”) under our Stock Incentive Plan to senior management, including each of our Named Executive Officers. Each Career RSU entitles a holder to one share of restricted common stock, except that Career RSUs do not have voting rights and do not entitle the holder to receive dividends. Each NEO receives an annual grant of Career Shares equal to 15% of his base salary. The Career Shares may be converted to common stock only at separation of service from the Company and are subject to vesting as outlined in “Grants of Plan-Based Awards”.

|

16 |

Perquisites and Other Benefits

We provide our NEOs with perquisites that we believe are reasonable, competitive and consistent with our overall executive compensation program. We provide certain of our NEOs with use of our corporate aircraft and provide Mr. Boyd with use of a corporate car that is owned by the Company, as provided in the “Summary Compensation Table.” In addition, we provide country club memberships for Messrs. Boyd and Smith, which are used for both business and personal purposes, and Mr. Boyd receives an annual payment of $250,000 in consideration of foregoing certain split-dollar life insurance arrangements that the Company terminated in 2003. The amount of all unreimbursed costs related to these memberships for 2022 are reported as other compensation in the “Summary Compensation Table.”

Messrs. William S. Boyd, Smith and Hirsberg are eligible to participate in our Medical Expense Reimbursement Plan, which covers medical expenses incurred by participants and their spouses that are not covered by other medical plans. We also provide our NEOs with additional life insurance coverage than is generally made available to our other employees. See “—Summary Compensation Table”.

Our senior management members, including our Named Executive Officers, also are eligible to participate in our other benefit plans and programs on the same terms as other employees. These plans include our 401(k) plan and medical, vision and dental insurance. In addition, our senior management members and our non-employee directors are eligible to participate in our deferred compensation plan on the same terms as other eligible management-level employees.

Risk Considerations in Our Compensation Programs

Risk-taking is an essential part of growing a business, and prudent risk management is necessary to deliver long-term, sustainable stockholder value. In 2022, we reviewed compensation policies that can raise or lower our compensation risk profile, whether individually or collectively. This review includes our compensation strategy, annual and long-term incentive plan designs, executive severance agreements, benefits and perquisites, governance practices, and other policies and practices.

We believe the process we followed is complete and sufficient for determining whether the Company’s practices are reasonably likely to encourage excessive risk taking. The Compensation Committee believes that our executive compensation program supports the objectives described above without encouraging inappropriate or excessive risk-taking.

Stock Ownership Guidelines

We believe having a meaningful ownership interest in the Company is an important tool to promote the long-term benefit of all Company stockholders. Our stock ownership guidelines require ownership by our NEOs based on a multiple of the participant’s base salary, as follows:

|

|

Multiple of Base Salary | |

| Executive Chair of the Board |

5x | |

| Chief Executive Officer |

5x | |

| Executive Vice Presidents |

3x | |

Our non-employee director stock ownership guidelines require each independent Board member to hold Company stock at least equal to five times the annual cash retainer received by the Director.

Clawback Policy

Under our clawback policy, we may, under certain circumstances, recoup the value of cash, equity or equity-linked incentive compensation tied to performance metrics and paid to our NEOs. If it is determined that an NEO’s misconduct led to or contributed to financial reporting that requires restatement, we may require such executive officer to reimburse us for incentive compensation received by the executive officer to the extent such compensation is in excess of that which would have been paid to the executive officer had it been based on the financial statements as restated. Recoupment applies to payments made within three years of the date when the applicable restatement is disclosed.

|

17 |

|

In addition, our equity award agreements provide that, in addition to being subject to the Company’s clawback policy, the awards may be subject to forfeiture or recoupment if the award recipient violates restrictive covenants or company policies or otherwise engages in activity that has caused, or could reasonably be expected to cause, significant economic or reputational harm to the Company.

The Company intends to adopt a clawback policy consistent with the requirements of the Exchange Act Rule 10D-1 after the New York Stock Exchange releases final listing standards in accordance with such rule.

Anti-Hedging Policy

Our NEOs are subject to Company policies that prohibit them from entering into hedging or monetization transactions involving the Company’s securities, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars, exchange funds or otherwise.

Leadership Transition

After many years of distinguished service, William S. Boyd will be retiring from the Board on May 4, 2023 at the expiration of his current term. Mr. Boyd co-founded Boyd Gaming with his father in 1975, beginning with one hotel and casino in Las Vegas and becoming one of the largest casino entertainment companies in the United States. The Company has grown and thrived under Mr. Boyd’s leadership, and he will leave behind a legacy of integrity, philanthropy, service and excellence.

At the expiration of his term, the Board will appoint Mr. Boyd as Chairman Emeritus of the Company, although he will not be a member of the Board. In his capacity as Chairman Emeritus, Mr. Boyd will be entitled to (i) office space and administrative support, (ii) reimbursement of reasonable business expenses, (iii) an annual salary of $900,000, and (iv) medical and other benefits in accordance with our programs and policies. Mr. Boyd will not be eligible to participate in any of the Company’s annual or long-term bonus or incentive programs.

Compensation Committee Report

We have reviewed and discussed with management the Compensation Discussion and Analysis. Based on our review and discussions, we recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement.

Peter M. Thomas, Chair

Paul W. Whetsell

John R. Bailey

Members, Compensation Committee

|

18 |

COMPENSATION TABLES

SUMMARY COMPENSATION TABLE

The following table sets forth the compensation earned for services performed for us, or our subsidiaries, during the fiscal years ended December 31, 2020, 2021, and 2022 by each of our NEOs.

| Name and Principal Position |

Year | Salary ($)(1)(2) |

Bonus ($) |

Stock Awards ($)(3)(4) |

Non-Equity Incentive Plan Compensation ($)(5) |

All Other Compensation ($)(6) |

Total ($) |

|||||||||||||||||||||

| William S. Boyd |

2022 | 1,065,000 | — | 1,741,230 | 1,065,000 | 294,514 | 4,165,744 | |||||||||||||||||||||

| Co-Executive Chair of the Board |

2021 | 1,065,000 | 250,000 | 2,748,152 | 1,977,492 | 59,112 | 6,099,756 | |||||||||||||||||||||

| 2020 | 865,346 | 952,900 | 159,746 | — | 59,315 | 2,037,307 | ||||||||||||||||||||||

| Keith Smith |

2022 | 1,500,000 | — | 6,430,512 | 2,400,000 | 39,209 | 10,369,721 | |||||||||||||||||||||

| President and Chief |

2021 | 1,450,000 | — | 8,940,265 | 4,307,776 | 42,741 | 14,740,782 | |||||||||||||||||||||

| 2020 | 1,178,170 | 1,531,200 | 213,746 | — | 50,490 | 2,973,606 | ||||||||||||||||||||||

| Josh Hirsberg |

2022 | 800,000 | — | 2,138,274 | 800,000 | 25,804 | 3,764,078 | |||||||||||||||||||||

| Executive Vice President, Treasurer and Chief Financial Officer |

2021 | 700,000 | — | 2,693,396 | 1,299,760 | 25,479 | 4,718,635 | |||||||||||||||||||||

| 2020 | 634,399 | 462,000 | 100,487 | — | 25,480 | 1,222,366 | ||||||||||||||||||||||

| Stephen Thompson |

2022 | 700,000 | — | 1,562,248 | 630,000 | 5,033 | 2,897,281 | |||||||||||||||||||||

| Executive Vice President, Operations |

2021 | 625,000 | — | 1,979,611 | 1,044,450 | 4,733 | 3,653,794 | |||||||||||||||||||||

| 2020 | 566,428 | 371,250 | 90,000 | — | 4,733 | 1,032,411 | ||||||||||||||||||||||

| Theodore Bogich |

2022 | 700,000 | — | 1,562,248 | 630,000 | 5,033 | 2,897,281 | |||||||||||||||||||||

| Executive Vice President, Operations |

2021 | 625,000 | — | 1,979,611 | 1,044,450 | 4,733 | 3,653,794 | |||||||||||||||||||||

| 2020 | 566,428 | 371,250 | 90,000 | — | 4,733 | 1,032,411 | ||||||||||||||||||||||

| (1) | Includes amounts deferred to the extent of such individual’s participation in our 401(k) Profit Sharing Plan and Trust and our Deferred Compensation Plan. |

| (2) | Each NEO accepted a temporary salary reduction in 2020 in response to the financial impacts of the COVID-19 pandemic. The 2020 salary rates as originally approved by the Compensation Committee were as follows: Mr. Boyd ($1,065,000), Mr. Smith ($1,450,000); Mr. Hirsberg ($700,000); Mr. Thompson ($625,000), and Mr. Bogich ($625,000). Salary reported for 2022 reflects salary payment practices during the pandemic. |

| (3) | Reflects the grant date fair value as determined in accordance with ASC 718. The value is based on the fair market value of our common stock on the grant date, calculated as the closing price for our common stock. Assumptions used in the calculation of these amounts are included in Note 11 to our audited financial statements under the caption “Stockholders’ Equity and Stock Incentive Plans” included in our Annual Reports on Form 10-K filed with the SEC. |

| (4) | Includes Career RSUs, time-based RSUs and Performance Shares awarded as part of the regularly scheduled 2022 annual grant. Each Performance Share represents a contingent right to receive up to a maximum of two shares of our common stock, subject to cliff vesting and satisfaction of certain performance metrics. Performance Share reported amounts assume performance metrics were achieved at target performance levels. |

| (5) | Reflects the short-term incentive payment approved by the Compensation Committee under the 2000 MIP. |

|

19 |

|

| (6) | Includes the following perquisites and personal benefits: |

| Name |

401(k) Contributions |

Life Insurance Premiums |

Medical Reimbursements(A) |

Use of Corporate Aircraft and Company Car(B) |

Other Benefits(C) | ||||||||||||||||||||

| William S. Boyd |

$ | 4,575 | $ | 301 | $ | 28,788 | $ | 5,710 | $ | 255,140 | |||||||||||||||

| Keith Smith |

4,575 | 602 | 20,195 | 7,901 | 5,936 | ||||||||||||||||||||

| Josh Hirsberg |

4,575 | 602 | 20,628 | — | — | ||||||||||||||||||||

| Stephen Thompson |

4,575 | 458 | — | — | — | ||||||||||||||||||||

| Theodore Bogich |

4,575 | 458 | — | — | — | ||||||||||||||||||||

| (A) | Represents payments made under our Medical Expense Reimbursement Plan, which includes plan premiums, company-sponsored health care plan premiums and amounts received as reimbursements under this plan. |

| (B) | Represents the aggregate incremental cost to the Company for use of our corporate aircraft by “Messrs. Boyd and Smith and, for Mr. Boyd, use of a Company car. |

| (C) | Represents country club membership for Messrs. Boyd and Smith and $250,000 paid to Mr. Boyd as compensation for the loss of a benefit that Mr. Boyd previously received under certain split-dollar life insurance arrangements that the Company terminated in December 2003. |

|

20 |

Grants of Plan-Based Awards

The following table sets forth information regarding each grant of an award made under our incentive plans to our NEOs during the fiscal year ended December 31, 2022.

| Name | Award Type |

Grant Date |

Date of Compensation Committee Action(5) |

Estimated Possible Payouts Under Non-Equity Incentive Plan Awards |

Estimated Future Payouts Under Equity Incentive Plan Awards—Number of Shares or Units |

All Other (#) |

All Other Option Awards: Number of Securities Underlying Options (#) |

Exercise or Base Price of Option Awards ($/Sh) |

Grant Date Fair Value of Equity Awards ($)(6) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Threshold ($) |

Target ($) |

Maximum ($) |

Threshold (#) |

Target (#) |

Maximum (#) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| William S. Boyd |

Short-term incentive(1) |

— | — | 532,500 | 1,065,000 | 2,130,000 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Career RSUs(2) | 01/19/22 | 12/07/06 | — | — | — | — | — | — | 2,460 | — | — | 159,728 | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

RSUs(3) | 02/18/22 | — | — | — | — | — | — | — | 11,559 | — | — | 790,751 | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Performance Shares(4) | 02/18/22 | — | — | — | — | 5,780 | 11,559 | 23,118 | — | — | — | 790,751 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Keith E. Smith |

Short-term incentive(1) |

— | — | 1,200,000 | 2,400,000 | 4,800,000 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Career RSUs(2) | 01/19/22 | 12/07/06 | — | — | — | — | — | — | 3,350 | — | — | 217,516 | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

RSUs(3) | 02/18/22 | — | — | — | — | — | — | — | 45,410 | — | — | 3,106,498 | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Performance Shares(4) | 02/18/22 | — | — | — | — | 22,705 | 45,410 | 90,820 | — | — | — | 3,106,498 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Josh Hirsberg |

Short-term incentive(1) |

— | — | 400,000 | 800,000 | 1,600,000 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Career RSUs(2) | 01/19/22 | 12/07/06 | — | — | — | — | — | — | 1,617 | — | — | 104,992 | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

RSUs(3) | 02/18/22 | — | — | — | — | — | — | — | 14,861 | — | — | 1,016,641 | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Performance Shares(4) | 02/18/22 | — | — | — | — | 7,431 | 14,861 | 29,722 | — | — | — | 1,016,641 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Stephen Thompson |

Short-term incentive(1) |

— | — | 315,000 | 630,000 | 1,260,000 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Career RSUs(2) | 01/19/22 | 12/07/06 | — | — | — | — | — | — | 1,444 | — | — | 93,759 | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

RSUs(3) | 02/18/22 | — | — | — | — | — | — | — | 10,733 | — | — | 734,245 | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Performance Shares(4) | 02/18/22 | — | — | — | — | 5,367 | 10,733 | 21,466 | — | — | — | 734,245 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Theodore Bogich |

Short-term incentive(1) |

— | — | 315,000 | 630,000 | 1,260,000 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Career RSUs(2) | 01/19/22 | 12/07/06 | — | — | — | — | — | — | 1,444 | — | — | 93,759 | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

RSUs(3) | 02/18/22 | — | — | — | — | — | — | — | 10,733 | — | — | 734,245 | |||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Performance Shares(4) | 02/18/22 | — | — | — | — | 5,367 | 10,733 | 21,466 | — | — | — | 734,245 | |||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | Represents short-term cash bonus for fiscal year 2022 under the 2000 MIP. Actual award amount is measured by Adjusted EBITDAR performance and progress toward Diversity and ESG initiatives, as approved by the Board. “Threshold” represents achieving a performance level that is 80% of the target operating budget amount; “Target” represents achieving 100% of the target operating budget amount; and “Maximum” represents achieving 120% or more of the target operating budget amount. |

| (2) | Represents Career RSUs granted pursuant to our Career Shares Program under our Stock Incentive Plan. Each Career RSU represents a contingent right to receive one share of our common stock at the time of retirement based on the grantee’s attained age and years of continuous service at the time of retirement. To receive any payout under the Career Shares Program, grantees must be at least 55 years of age and must have been continually employed by us for a minimum of ten years. Retirement after ten years of service will entitle a grantee to 50% of his or her Career RSUs. The amount increases to 75% after 15 years and 100% following 20 years of employment. In the event of a grantee’s death or permanent disability, or following a change in control of the Company, the grantee will be deemed to have attained age 55 and the Career RSUs will immediately vest and convert into shares of our common stock based on the grantee’s years of continuous service through the date of the qualifying event. See “Compensation Discussion and Analysis—Career Shares Program.” |

| (3) | Represents RSUs granted under our Stock Incentive Plan. RSUs are subject to vesting and are subject to continued service through the applicable vesting date (except as otherwise provided in the applicable award). |

| (4) | Each Performance Share represents a contingent right to receive up to a maximum of two shares of our common stock, subject to satisfaction of certain performance metrics. The Performance Shares are subject to forfeiture and other terms and conditions contained in the award agreement and our Stock Incentive Plan. |

|

21 |

|

| (5) | Career RSUs are based on the base salary of the participant in effect on December 31 of the immediately preceding year and the closing stock price of our common stock on January 2 or, if January 2 is not a business day, then the next business day. |

| (6) | Represents the aggregate ASC 718 value of awards made in 2022. Amounts reported for Performance Shares assume that the performance metrics were achieved at the target performance level. |

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth information regarding unexercised stock options and unvested stock awards for each of our NEOs outstanding as of December 31, 2022.

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

Number of (#) |

Market or Payout Value of Shares, Units or Other Rights That Have Not Vested ($)(1) |

Equity Incentive (#) |

Equity Incentive Rights That Have Not Vested ($)(1) | ||||||||||||||||||||||||||||||||

| William S. Boyd |

— | — | — | — | — | — | 11,559 | (3) | 630,312 | |||||||||||||||||||||||||||||||

|

|

— | — | — | — | 11,559 | (4) | 630,312 | |

— |

|

— |

|||||||||||||||||||||||||||||

|

|

— | — | — | — | 14,508 | (5) | 791,121 | 14,508 | (7) | 791,121 | ||||||||||||||||||||||||||||||

|

|

— | — | — | — | 13,333 | (6) | 727,049 | — | — | |||||||||||||||||||||||||||||||

| Keith Smith |

— | — | — | — | — | — | 45,410 | (3) | 2,476,207 | |||||||||||||||||||||||||||||||

|

|

— | — | — | — | 45,410 | (4) | 2,476,207 | |

— |

|

— |

|||||||||||||||||||||||||||||

|

|

— | — | — | — | 47,668 | (5) | 2,599,336 | 47,668 | (7) | 2,599,336 | ||||||||||||||||||||||||||||||

|

|

— | — | — | — | 46,666 | (6) | 2,544,697 | — | — | |||||||||||||||||||||||||||||||

| Josh Hirsberg |

32,000 | — | 9.86 | 11/07/2023 | 34,741 | (2) | 1,894,427 | 14,861 | (3) | 810,370 | ||||||||||||||||||||||||||||||

|

|

23,431 | — | 11.57 | 12/10/2024 | — | — | |

— |

|

— |

||||||||||||||||||||||||||||||

|

|

21,549 | — | 19.98 | 10/29/2025 | 14,861 | (4) | 810,370 | — | — | |||||||||||||||||||||||||||||||

|

|

23,924 | — | 17.75 | 11/08/2026 | 14,508 | (5) | 791,121 | 14,508 | (7) | 791,121 | ||||||||||||||||||||||||||||||

|

|

— | — | — | — | 13,333 | (6) | 727,048 | — | — | |||||||||||||||||||||||||||||||

| Stephen Thompson |

— | — | — | — | — | — | 10,733 | (3) | 585,270 | |||||||||||||||||||||||||||||||

|

|

— | — | — | — | 10,733 | (4) | 585,270 | |

— |

|

— |

|||||||||||||||||||||||||||||

|

|

— | — | — | — | 10,363 | (5) | 565,094 | 10,363 | (7) | 565,094 | ||||||||||||||||||||||||||||||

|

|

— | — | — | — | 10,000 | (6) | 545,300 | — | — | |||||||||||||||||||||||||||||||

| Theodore Bogich |

— | — | — | — | 12,460 | (2) | 679,444 | 10,733 | (3) | 585,270 | ||||||||||||||||||||||||||||||

|

|

— | — | — | — | 10,733 | (4) | 585,270 | — | — | |||||||||||||||||||||||||||||||

|

|

— | — | — | — | — | — | 10,363 | (7) | 565,094 | |||||||||||||||||||||||||||||||

|

|

— | — | — | — | 10,363 | (5) | 565,094 | — | — | |||||||||||||||||||||||||||||||

|

|

— | — | — | — | 10,000 | (6) | 545,300 | — | — | |||||||||||||||||||||||||||||||

| (1) | Represents the value based on the closing price of our common stock on December 30, 2022 of $54.53, which was the last trading day in 2022, multiplied by the aggregate number of Career RSUs, RSUs or Performance Shares, as applicable. |

| (2) | Represents unvested Career RSUs. Each Career RSU represents a contingent right to receive one share of our common stock. The vested Career RSUs will be paid in shares of our common stock at the time of retirement based on the grantee’s attained age and years of continuous service at the time of retirement. As of December 31, 2022, Mr. Hirsberg was 50% vested and Mr. Bogich was 75% vested in each of their respective Career RSUs. See “Compensation Discussion and Analysis—Career Shares Program.” |

| (3) | Represents Performance Shares granted under our Stock Incentive Plan on February 18, 2022. Each Performance Share represents a contingent right to receive up to a maximum of two shares of our common stock, subject to three-year cliff vesting and satisfaction of certain performance metrics. Amounts reported assume performance metrics were achieved at target. |

|

22 |

| (4) | Represents RSUs granted under our Stock Incentive Plan on February 18, 2022. The RSUs vest in full on the third anniversary of the grant date. |

| (5) | Represents RSUs granted under our Stock Incentive Plan on February 18, 2021. The RSUs vest in full on the third anniversary of the grant date. |

| (6) | Represents one-time grant of RSUs in recognition of the efforts during the Pandemic. One-third of the RSUs vest on each of the first, second, and third anniversaries of the grant date. |

| (7) | Represents Performance Shares granted under our Stock Incentive Plan on July 14, 2021. Each Performance Share represents a contingent right to receive up to a maximum of two shares of our common stock, subject to three-year cliff vesting and satisfaction of certain performance metrics. Amounts reported assume performance metrics were achieved at target. |

Option Exercises and Stock Vesting

The following table sets forth information regarding the exercise of stock options and the vesting of stock awards for each of our NEOs during the fiscal year ended December 31, 2022.

| OPTION AWARDS | STOCK AWARDS | ||||||||||||||||||||||||

| Name | Number of Shares Acquired on Exercise (#) |

Value Realized on Exercise ($) |

Number of Shares Acquired on Vesting (#) |

Value Realized on Vesting ($)(1)(2) |

|||||||||||||||||||||

| William S. Boyd |

— | — | 94,435 | 6,421,858 | |||||||||||||||||||||

| Keith Smith |

165,951 | 9,879,303 | 283,199 | 19,209,469 | |||||||||||||||||||||

| Josh Hirsberg |

— | — | 78,904 | 5,331,708 | |||||||||||||||||||||

| Stephen Thompson |

— | — | 59,032 | 3,996,054 | |||||||||||||||||||||

| Theodore Bogich |

— | — | 58,882 | 3,985,618 | |||||||||||||||||||||

| (1) | Represents Career RSUs, time-based RSUs and Performance Shares that vested during 2022. |

| (2) | With respect to Performance Shares, the value realized is based on $70.94, the closing market price on February 28, 2022, the performance determination date. |

Non-Qualified Deferred Compensation

Our Deferred Compensation Plan provides for the deferral of compensation on a basis that is not tax-qualified. Under the plan, our NEOs may defer up to 80% of their base salary and up to 100% of their incentive compensation. We did not make any discretionary matching contributions or discretionary additions to a participant’s account in 2022. The following table sets forth amounts deferred, including under our predecessor plan, for the year ended December 31, 2022:

| Name | Executive Contributions in Last Fiscal Year ($) |

Aggregate Earnings (Losses) in Last Fiscal Year ($) |

Aggregate Balance at Last Fiscal Year End ($) | ||||||||||||

| William S. Boyd |

— | — | — | ||||||||||||

| Keith E. Smith |

— | (193,091 | ) | 829,727 | |||||||||||

| Josh Hirsberg |

|

— |

(120,166 | ) | 497,327 | ||||||||||

| Stephen S. Thompson |

— | (265,211 | ) | 1,815,422 | |||||||||||

| Theodore A. Bogich |

— | (65,166 | ) | 1,308,375 | |||||||||||

|

23 |

|

Potential Payments upon Termination or Change in Control

Under the terms of our 2000 MIP, Change in Control Plan (“CIC Plan”) and our equity incentive plans, including the individual award agreements under our equity incentive plans, payments may be made to our Named Executive Officers upon their termination of employment or a change in control of the Company. The description of the plans is qualified by reference to the complete text of the plans, which have been filed with the SEC. We have not entered into any severance agreements with our currently serving NEOs.

The following table sets forth the estimated payments that would be made to each of our NEOs upon voluntary termination, involuntary termination—not for cause, involuntary termination—for cause, a qualifying termination in connection with a change in control, and death or permanent disability. The payments would be made pursuant to the plans identified in the preceding paragraph. The information set forth in the table assumes:

| • | The termination event occurred on December 30, 2022 (the last business day of our last completed fiscal year); |

| • | The price per share of our common stock on the date of termination is $54.53 per share (the closing market price of our common stock on December 30, 2022, the last trading day in 2022); |

| • | For purposes of the short-term/annual awards under the 2000 MIP, (i) the NEO has earned and is paid their target bonus, as applicable, under the 2000 MIP; |

| • | All payments are made in a lump sum on the date of termination; |

| • | The vesting of all unvested stock options, RSUs, Performance Shares and Career RSUs held by the executives (treating as unvested those Performance Shares that vested and settled based on the Compensation Committee’s subsequent determination of 2022 performance) is immediately accelerated in full upon a change of control pursuant to discretionary authority of the plan administrator granted pursuant to the particular plan (if not otherwise accelerated pursuant to the terms of the applicable award agreements, terms of the CIC Plan or pursuant to “long service” benefits); |

| • | The portion of in-the-money stock options and other equity awards that are subject to accelerated vesting in connection with the termination are immediately exercised and the shares received upon exercise (or upon settlement in the case of RSUs, Performance Shares and Career RSUs) are immediately resold at the assumed price per share of our common stock on the date of termination; and |

| • | Any vested Career RSUs held by the executives are immediately resold at the assumed price per share of our common stock on the date of termination. |

|

24 |