Form DEF 14A BEYOND MEAT, INC. For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | ||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| ☒ | Definitive Proxy Statement | ||||

| ☐ | Definitive Additional Materials | ||||

| ☐ | Soliciting Material under §240.14a-12 | ||||

BEYOND MEAT, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||

| (5) | Total fee paid: | |||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||

| (1) | Amount Previously Paid: | |||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||

| (3) | Filing Party: | |||||||

| (4) | Date Filed: | |||||||

BEYOND MEAT, INC.

119 STANDARD STREET, EL SEGUNDO, CALIFORNIA 90245

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 8:00 a.m. Pacific Time on Wednesday, May 19, 2021

Dear Stockholders of Beyond Meat, Inc.:

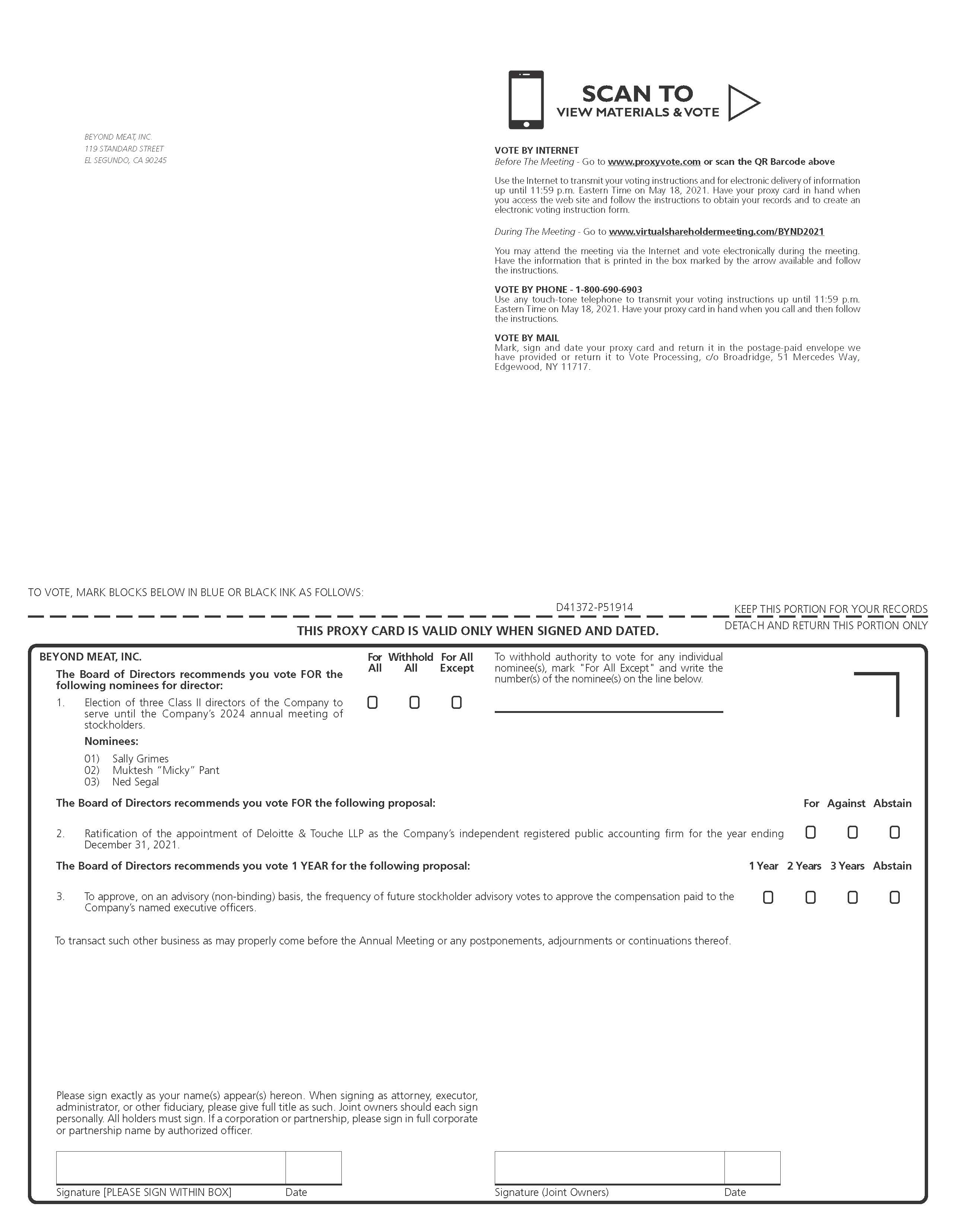

The 2021 annual meeting of stockholders (the “Annual Meeting”) of Beyond Meat, Inc., a Delaware corporation (“Beyond Meat”), will be held virtually, via live webcast at www.virtualshareholdermeeting.com/BYND2021, on Wednesday, May 19, 2021 at 8:00 a.m. Pacific Time, for the following purposes, as more fully described in the accompanying proxy statement:

1.To elect three Class II directors to serve until our 2024 annual meeting of stockholders and until their successors are duly elected and qualified;

2.To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our year ending December 31, 2021;

3.To hold an advisory (non-binding) vote on the frequency of future stockholder advisory votes to approve the compensation paid to the company’s named executive officers; and

4.To transact such other business as may properly come before the Annual Meeting or any postponements, adjournments or continuations thereof.

Our board of directors has fixed the close of business on March 23, 2021 as the record date (the “Record Date”) for the Annual Meeting. Stockholders of record as of the Record Date are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

On or about April 9, 2021, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement and our annual report. The Notice provides instructions on how to vote and includes instructions on how to receive a paper copy of our proxy materials by mail. The accompanying proxy statement and our annual report can be accessed directly at the following Internet address: www.proxyvote.com. You will be asked to enter the sixteen-digit control number located on your Notice or proxy card.

We appreciate your continued support of Beyond Meat.

By Order of the Board of Directors,

Ethan Brown

Founder, President, Chief Executive Officer and Board Member

El Segundo, California

April 9, 2021

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the virtual Annual Meeting, you are urged to vote and submit your proxy by following the voting procedures described in the proxy card. Even if you have voted by proxy, you may still vote during the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote during the meeting, you must follow the instructions from your broker, bank or other nominee.

TABLE OF CONTENTS

| PAGE | |||||

Communications with the Board of Directors | |||||

i |  | 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement | PAGE | |||||

ii |  | 2021 Proxy Statement | 2021 Proxy Statement | ||

BEYOND MEAT, INC.

PROXY STATEMENT

FOR 2021 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 8:00 a.m. Pacific Time on Wednesday, May 19, 2021

This proxy statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2021 annual meeting of stockholders (the “Annual Meeting”) of Beyond Meat, Inc., a Delaware corporation (“Beyond Meat”), and any postponements, adjournments or continuations thereof. The Annual Meeting will be held virtually via live webcast on Wednesday, May 19, 2021 at 8:00 a.m. Pacific Time. The Annual Meeting can be accessed via the Internet at www.virtualshareholdermeeting.com/BYND2021 where you will be able to attend and listen to the Annual Meeting live, submit questions and vote your shares electronically at the Annual Meeting. You will not be able to attend the Annual Meeting physically in person.

Our board of directors has fixed the close of business on March 23, 2021 as the record date (the “Record Date”) for the Annual Meeting. Stockholders of record as of the Record Date are entitled to notice of and to vote at the Annual Meeting. The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this proxy statement, the form of proxy and our annual report is first being mailed on or about April 9, 2021 to all stockholders entitled to vote at the Annual Meeting.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING

The information provided in the “question and answer” format below is for your convenience only. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

Why are you holding a virtual Annual Meeting and how can stockholders attend?

We will be hosting the Annual Meeting via live webcast only. In addition to supporting the health and well-being of our stockholders and other meeting participants during the coronavirus (“COVID-19”) pandemic, we also believe hosting our Annual Meeting virtually helps to expand access, facilitate stockholder attendance, reduce costs and enable improved communication. It also reduces the environmental impact of our Annual Meeting. To participate in our virtual Annual Meeting, visit www.virtualshareholdermeeting.com/BYND2021 with your 16-digit control number included in the Notice, on your proxy card if you are a stockholder of record of shares of common stock, or included with your voting instructions received from your broker, bank or other nominee if you are a street name stockholder, as described below.

The Annual Meeting live webcast will begin promptly at 8:00 a.m. Pacific Time on Wednesday, May 19, 2021. Stockholders may vote and submit questions while attending the meeting online. We encourage you to access the meeting prior to the start time. Online check-in will begin at 7:45 a.m. Pacific Time, and you should allow ample time for the check-in procedures. The virtual Annual Meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and mobile phones) running the most updated version of applicable software and plugins. Participants should ensure they have a strong Internet

2021 Proxy Statement |  | 1

| 1

| 1

| 1QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING | ||

connection wherever they intend to participate in the Annual Meeting. Participants should allow plenty of time to log in and ensure that they can hear streaming audio prior to the start of the virtual Annual Meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting platform at www.virtualshareholdermeeting.com/BYND2021.

What matters am I voting on and how does the board of directors recommend that I vote?

PROPOSAL | BOARD OF DIRECTORS VOTING RECOMMENDATION | ||||

PROPOSAL NO. 1 The election of three Class II directors to serve until our 2024 annual meeting of stockholders and until their successors are duly elected and qualified. | FOR each nominee | ||||

PROPOSAL NO. 2 Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our year ending December 31, 2021. | FOR | ||||

PROPOSAL NO. 3 Advisory (non-binding) vote on the frequency of future stockholder advisory votes to approve the compensation paid to the company’s named executive officers. | FOR ONE YEAR FREQUENCY | ||||

Other than the three items of business described in this proxy statement, we are not aware of any other business to be acted upon at the Annual Meeting. You may be asked to consider any other business that properly comes before the Annual Meeting.

Who is entitled to vote?

Holders of our common stock as of the close of business on the Record Date may vote at the Annual Meeting. As of the Record Date, there were 63,007,488 shares of our common stock outstanding. In deciding all matters at the Annual Meeting, each share of our common stock held by a stockholder on the Record Date will be entitled to one vote for each of the director nominees and one vote for each of the other proposals. We do not have cumulative voting rights for the election of directors.

Stockholders of Record: Shares Registered in Your Name

If shares of our common stock are registered directly in your name with our transfer agent, EQ Shareowner Services, you are considered the stockholder of record with respect to those shares, and the Notice was provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy and indicate your voting choices directly to the individuals listed on the proxy card or to vote virtually at the Annual Meeting. Throughout this proxy statement, we refer to these registered stockholders as “stockholders of record.”

Street Name Stockholders

If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and the Notice was forwarded to you by your broker, bank or other nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares in the manner provided in the voting instructions you receive from your broker, bank or other

2 |  | 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING | ||

nominee. However, because a street name stockholder is not the stockholder of record, you may not vote your shares of our common stock virtually at the Annual Meeting unless you follow your broker, bank or other nominee’s procedures for obtaining a legal proxy. Throughout this proxy statement, we refer to stockholders who hold their shares through a broker, bank or other nominee as “street name stockholders.”

How many votes are needed for approval of each proposal?

PROPOSAL | VOTE NEEDED FOR APPROVAL AND EFFECT OF ABSTENTIONS AND BROKER NON-VOTES | ||||

PROPOSAL NO. 1 The election of three Class II directors to serve until our 2024 annual meeting of stockholders and until their successors are duly elected and qualified. | Our amended and restated bylaws (“Bylaws”) state that, to be elected, a nominee must receive a plurality of the votes of the shares present in person or represented by proxy and entitled to vote on the election of directors at the Annual Meeting. “Plurality” means that the individuals who receive the highest number of votes cast “FOR” are elected as directors. As a result, any shares not voted “FOR” a particular nominee (whether as a result of withholding a vote or a broker non-vote) will have no effect on the outcome of this proposal. | ||||

PROPOSAL NO. 2 Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our year ending December 31, 2021. | The ratification of the appointment of Deloitte & Touche LLP requires the affirmative vote of the holders of a majority of the voting power of the shares of our common stock entitled to vote on the proposal that are present in person or represented by proxy at the Annual Meeting and are voted for or against the proposal. Abstentions are not considered votes for or against this proposal, and thus, will have no effect on the outcome of this proposal. Broker non-votes will also have no effect on the outcome of this proposal. | ||||

PROPOSAL NO. 3 Advisory (non-binding) vote on the frequency of future stockholder advisory votes to approve the compensation paid to the company’s named executive officers. | For the advisory (non-binding) vote on the frequency of future stockholder advisory votes to approve the compensation paid to the company’s named executive officers, the frequency receiving the highest number of votes from the holders of shares present in person or by proxy at the Annual Meeting and entitled to vote thereon will be considered the frequency preferred by the stockholders. Abstentions are not considered votes for or against this proposal, and thus, will have no effect on the outcome of this proposal. Broker non-votes will also have no effect on the outcome of this proposal. However, because this proposal is a non-binding advisory vote, the result will not be binding on our board of directors or our company. Our board of directors and our human capital management and compensation committee will consider the outcome of the vote when determining how often we should submit to stockholders an advisory vote to approve the compensation paid to our named executive officers. | ||||

Voting results will be tabulated and certified by the inspector of election appointed for the Annual Meeting.

2021 Proxy Statement |  | 3

| 3

| 3

| 3QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING | ||

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting to properly hold an annual meeting and conduct business under our Bylaws and Delaware law. The presence in person or represented by proxy of the holders of a majority of the voting power of the shares of stock issued and outstanding and entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting. Abstentions and broker non‑votes are counted as shares present and entitled to vote for purposes of determining a quorum.

How do I vote?

If you are a stockholder of record, there are five ways to vote:

•By Internet at www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on May 18, 2021 (have your Notice or proxy card in hand when you visit the website);

•By toll-free telephone at 1-800-690-6903 until 11:59 p.m. Eastern Time on May 18, 2021 (have your Notice or proxy card in hand when you call);

•By scanning the QR code in your Notice or proxy card with your mobile device until 11:59 p.m. Eastern Time on May 18, 2021;

•By completing and mailing your proxy card (if you received printed proxy materials) to be received prior to the Annual Meeting; or

•By attending the virtual meeting by visiting www.virtualshareholdermeeting.com/BYND2021, where you may vote electronically and submit questions during the Annual Meeting. Please have your Notice or proxy card in hand when you visit the website.

VOTING VIA THE INTERNET, MOBILE DEVICE OR BY TELEPHONE IS FAST AND CONVENIENT, AND YOUR VOTE IS IMMEDIATELY CONFIRMED AND TABULATED. VOTING EARLY WILL HELP AVOID ADDITIONAL SOLICITATION COSTS AND WILL NOT PREVENT YOU FROM VOTING ELECTRONICALLY DURING THE ANNUAL MEETING IF YOU WISH TO DO SO.

If you are a street name stockholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to direct your broker, bank or other nominee on how to vote your shares. As discussed above, if you are a street name stockholder, you may not vote your shares electronically at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

If you have questions about the matters described in this proxy statement, how to submit your proxy or if you need additional copies of this proxy statement, the proxy card or voting instructions, you should contact Innisfree M&A Incorporated, our proxy solicitor, toll-free at (888) 750-5834. Banks and brokers may call collect at (212) 750-5833.

Can I change my vote?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

•entering a new vote by Internet, mobile device or by telephone;

•completing and returning a later-dated proxy card;

•notifying the Secretary of Beyond Meat, Inc., in writing, at Beyond Meat, Inc., 119 Standard Street, El Segundo, California 90245; or

•attending and voting electronically at the virtual Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy).

4 |  | 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING | ||

If you are a street name stockholder, your broker, bank or other nominee can provide you with instructions on how to change your vote.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Ethan Brown (our President and Chief Executive Officer) and Teri L. Witteman (our Chief Legal Officer and Secretary) have been designated as proxy holders by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors as described in this proxy statement. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is postponed, adjourned or continued, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy instructions, as described above.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. The Notice containing instructions on how to access this proxy statement and our annual report is first being mailed on or about April 9, 2021 to all stockholders entitled to vote at the Annual Meeting.

Stockholders may request to receive all future proxy materials in printed form by mail or electronically by email by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact and the cost of our annual meetings of stockholders.

How are proxies solicited for the Annual Meeting?

We have retained the services of Innisfree M&A Incorporated (“Innisfree”) to aid in the solicitation of proxies and will pay Innisfree a base fee of $25,000 for these services, plus any related costs and expenses. We will bear the total expense of the solicitation that will include, in addition to the amounts paid to Innisfree, amounts paid for printing and postage and to reimburse banks, brokerage firms and others for their expenses in forwarding proxy solicitation material. Although the principal distribution of proxy materials will be through the Internet, solicitation of proxies will also be made by mail. In addition, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Our directors and employees will not be paid any additional compensation for soliciting proxies.

How may my broker, bank or other nominee vote my shares if I fail to provide timely directions?

Brokers, banks and other nominees holding shares of our common stock in street name for their customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other nominee will have discretion to vote your shares on our sole “routine” matter: the proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our year ending December 31, 2021. Absent direction from you, your broker, bank or other nominee will not have discretion to vote on the election of directors and the advisory (non-binding) vote on the frequency of future stockholder advisory votes to approve the compensation paid to our named executive officers which are both “non-routine” matters. If the broker, bank or other nominee that holds your shares in street name returns a proxy card without voting on a non-routine proposal because it did not receive voting instructions from you on that proposal, this is referred to as a “broker non-vote.” Broker non‑votes are considered in determining whether a quorum exists at the Annual Meeting. The effect of broker non‑votes on the outcome of each proposal

2021 Proxy Statement |  | 5

| 5

| 5

| 5QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING | ||

to be voted on at the Annual Meeting is explained above under “How many votes are needed for approval of each proposal?”

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to the Current Report on Form 8-K as soon as they become available.

What is the deadline to propose stockholder actions and director nominations for consideration at next year’s annual meeting of stockholders?

Rule 14a-8 Stockholder Proposals

As prescribed by Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), stockholders may present proper proposals for inclusion in our proxy statement and for consideration at next year’s annual meeting of stockholders. For a Rule 14a-8 stockholder proposal to be timely and considered for inclusion in our proxy statement for our 2022 annual meeting of stockholders, the proposal must comply with all applicable requirements of Rule 14a-8 and our Secretary must receive the written proposal at our principal executive offices not later than December 10, 2021. Stockholder proposals should be addressed to:

Beyond Meat, Inc.

Attention: Secretary

119 Standard Street

El Segundo, California 90245

Advance Notice Stockholder Proposals

Our Bylaws also establish an advance notice procedure for stockholders who wish to present a proper proposal, including director nominations, before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Any such advance notice stockholder proposal, including director nominations, must comply with all of the requirements set forth in our restated certificate of incorporation, Bylaws and applicable laws, rules and regulations. Our Bylaws provide that, for business to be properly brought before an annual meeting by a stockholder, (i) the stockholder must be a stockholder of record at the time of the giving of the notice, (ii) the stockholder must be entitled to vote at the meeting, (iii) the business must be a proper matter for stockholder action, and (iv) the stockholder must give timely written notice to our Secretary, which notice must contain the information specified in our Bylaws. For an advance notice stockholder proposal, including director nominations, to be timely for our 2022 annual meeting of stockholders, our Secretary must receive the written proposal at our principal executive offices at the address listed directly above:

•not earlier than January 19, 2022; and

•not later than February 18, 2022.

In the event that we hold our 2022 annual meeting of stockholders more than 30 days before or more than 60 days after the one-year anniversary of the Annual Meeting, notice of an advance notice stockholder proposal must be received no earlier than the close of business on the 120th day before our 2022 annual meeting of stockholders and no later than the close of business on the later of the following two dates:

•the 90th day prior to our 2022 annual meeting of stockholders; or

•the 10th day following the day on which public announcement of the date of the 2022 annual meeting of stockholders is first made.

6 |  | 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING | ||

You are advised to review our Bylaws, which contain additional requirements regarding advance notice stockholder proposals, including director nominations.

Availability of Bylaws

A copy of our Bylaws is available via the SEC’s website at https://www.sec.gov. You may also contact our Secretary at the address set forth above for a copy of the relevant Bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

2021 Proxy Statement |  | 7

| 7

| 7

| 7BOARD OF DIRECTORS

AND CORPORATE GOVERNANCE

Board of Directors Composition

Under our restated certificate of incorporation, our board of directors may establish the authorized number of directors from time to time by resolution. Our board of directors is currently composed of nine members. Each director’s term continues until the election and qualification of his or her successor, or his or her earlier death, resignation, disqualification or removal. Our restated certificate of incorporation provides that no director may be removed from our board of directors except for cause and only by the affirmative vote of the holders of at least two‑thirds of the voting power of the then-outstanding shares of stock entitled to vote generally in the election of directors.

Our board of directors is divided into three classes of directors each serving a staggered three-year term. Only one class of directors will be elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective three-year terms. Directors are assigned to each class in accordance with resolutions adopted by our board of directors, with the number of directors in each class to be divided as nearly equal as reasonably possible. In the event of any increase or decrease in the authorized number of directors, each director then serving will continue as a director of the class of which the director is a member, and the newly created or eliminated directorships resulting from such increase or decrease will be apportioned by our board of directors among the three classes of directors so that no one class has more than one director more than any other class.

Our restated certificate of incorporation provides that, unless otherwise determined by our board of directors or as provided by law, any vacancy occurring on our board of directors and any newly created directorship resulting from any increase in the authorized number of directors will be filled by the affirmative vote of a majority of the directors then in office. Any director elected to fill a vacancy or a newly created directorship will hold office for a term expiring at the annual meeting of stockholders at which the term of office of the class to which the director has been assigned expires and until such director’s successor has been duly elected and qualified, or until such director’s earlier death, resignation, disqualification or removal.

Director Candidate Selection and Evaluation

Our board of directors is responsible for nominating members for election to our board of directors and for filling vacancies on the board of directors that may occur between annual meetings of stockholders. Our nominating and corporate governance committee is responsible for identifying, evaluating and recommending candidates to our board of directors for board membership. Our nominating and corporate governance committee may use outside consultants to assist in identifying candidates. When formulating its board membership recommendations, our nominating and corporate governance committee may also consider advice and recommendations from stockholders, our board, management and others as it deems appropriate.

Stockholder Recommendations

Stockholders who wish to recommend individuals for consideration by our nominating and corporate governance committee to become nominees for election to our board of directors may do so by delivering a written recommendation addressed to Beyond Meat, Inc., Attn: Secretary, 119 Standard Street, El Segundo, California 90245, no later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the preceding year’s annual meeting.

With respect to such director nominee, submissions must include (i) the individual’s full name, age and business and residence address, (ii) the individual’s principal occupation or employment, (iii) the number of shares of our common stock beneficially owned by the individual and the date or dates such shares were acquired, (iv) all other information relating to the individual that would be required to be disclosed in the solicitations of proxies for the

8 |  | 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

election of directors in an election contest or Section 14(a) under the Exchange Act, (v) whether such individual meets the independence requirements of Nasdaq and (vi) any additional information required by our Bylaws. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Identification and Evaluation of Nominees for Directors

Our nominating and corporate governance committee annually reviews the needs of the board of directors in terms of independence, skills and characteristics in connection with evaluating recommendations for election or re-election. | ||

Candidates are identified with input from our board of directors, stockholders, management and outside consultants. | ||

Our nominating and corporate governance committee considers certain factors, including, but not limited to, the qualifications, independence, integrity, diversity, skills, financial and other expertise, breadth of experience, knowledge about our business or industry and recommends nominees to the board of directors. | ||

Our board of directors evaluate the qualifications of the recommended candidates and selects nominees. | ||

Our stockholders vote on director nominees at our annual meeting of stockholders. | ||

Our nominating and corporate governance committee is responsible for developing and recommending to our board of directors for determination any specific minimum qualifications that must be met, any specific qualities or skills that are necessary for one or more of our board members to possess, and the desired qualifications, expertise and characteristics of our board members, with the goal of developing an experienced and highly qualified board with a diverse background and skillset, that contribute to the total mix of viewpoints and experience represented on our board of directors. In evaluating potential candidates for our board of directors, our nominating and corporate governance committee will consider these factors, as well as director tenure, in light of the specific needs of our board of directors at that time and any legal requirements. Our nominating and corporate governance committee evaluates each individual in the context of our board as a whole, with the objective of recommending for nomination directors that will best serve the interests of the company and our stockholders. Among the criteria our nominating and corporate governance committee and our board may consider are experience and diversity; and with respect to diversity, our board may consider such factors as gender, race, ethnicity, differences in professional background, experience at policy-making levels in business, finance and other areas, education, skill and other individual qualities and attributes. Our nominating and corporate governance committee, in making its recommendations, will also consider the number of other public company boards and other boards of which a prospective nominee is a member, as well as a prospective nominee’s other professional responsibilities. Directors are expected to regularly attend meetings of our board of directors and committees on which such director sits, and to review prior to meetings material distributed in advance for such meetings.

Our nominating and corporate governance committee evaluates nominees recommended by stockholders in the same manner as it evaluates other nominees.

2021 Proxy Statement |  | 9

| 9

| 9

| 9BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

Selection of 2021 Director Nominees

In 2020, our nominating and corporate governance committee retained Boardspan, a board management, recruiting and governance firm, to assist with identifying potential director nominees. The functions performed by Boardspan included identifying qualified candidates, conducting interviews and presenting qualified candidates to our nominating and corporate governance committee for consideration. Based on the recommendation of the nominating and corporate governance committee, our board of directors has nominated Sally Grimes, Muktesh “Micky” Pant and Ned Segal for election to the board as Class II directors. Mr. Segal is an incumbent director. Ms. Grimes and Mr. Pant were brought to the attention of the nominating and corporate governance committee and recommended by non-management members of our board and our CEO. In 2020, Mr. Pant served as a consultant to Beyond Meat. Ms. Grimes and Mr. Pant have been nominated for election to the seats currently held by Bernhard van Lengerich and Donald Thompson, each of whom will serve out the remainder of their terms as Class II directors through the Annual Meeting.

The experiences, qualifications and skills of each of the nominees for election as a director at the Annual Meeting and for each of the continuing members of our board of directors that our board of directors considered in the nomination of such director or in concluding why the director should continue serving on our board, are included below the individual biographies on the following pages. Our board of directors concluded that each nominee should serve as a director based on the specific experience and attributes listed below and, in the case of Mr. Segal, his previous service on our board of directors, including the insight each nominee brings to our board of directors’ functions and deliberations.

| BOARD OF DIRECTORS EXPERIENCE AND SKILLS | |||||||||||

| ü | Managing High Growth Businesses | ü | Board and Executive Leadership | ||||||||

| ü | Finance and Accounting | ü | Public Company Board Membership | ||||||||

| ü | Risk Management | ü | Operation of Global Organizations | ||||||||

| ü | Technology and Cyber Risk | ü | Sustainability and Corporate Responsibility | ||||||||

| ü | Research, Development and Innovation | ü | Diversity | ||||||||

| ü | Consumer Packaged Goods | ü | Entrepreneurship | ||||||||

10 |  | 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

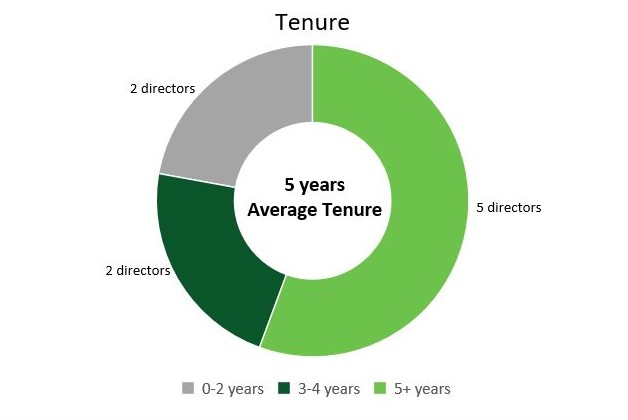

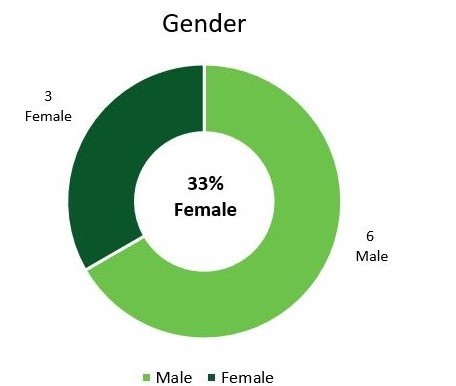

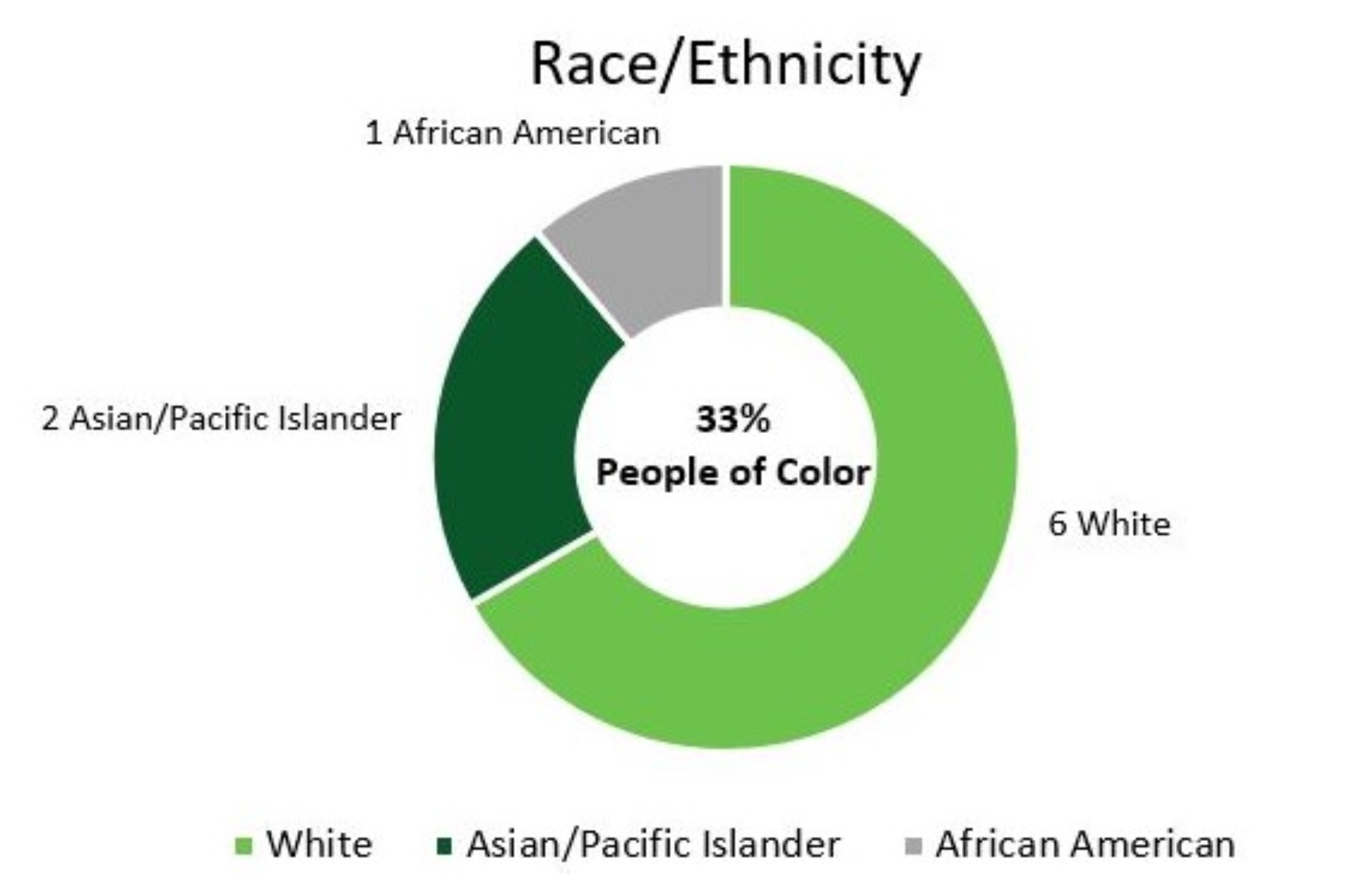

Board Diversity and Tenure

Our board of directors believes that a diversity of experience, tenure, gender, race, ethnicity, age and other factors contributes to effective governance over the affairs of the company for the benefit of its stockholders. We do not have a formal policy on director diversity; however, our corporate governance guidelines recommend that nominees be selected on the basis of a number of factors, including diversity. There are no limits on the number of three-year terms that may be served by a director and there is no fixed retirement age for directors. Our average tenure of all continuing directors and director nominees is five years.

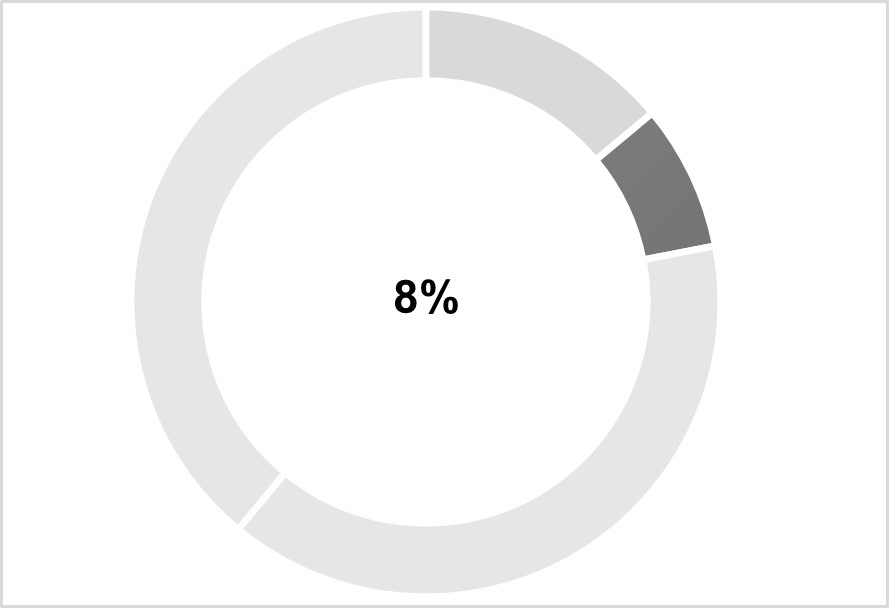

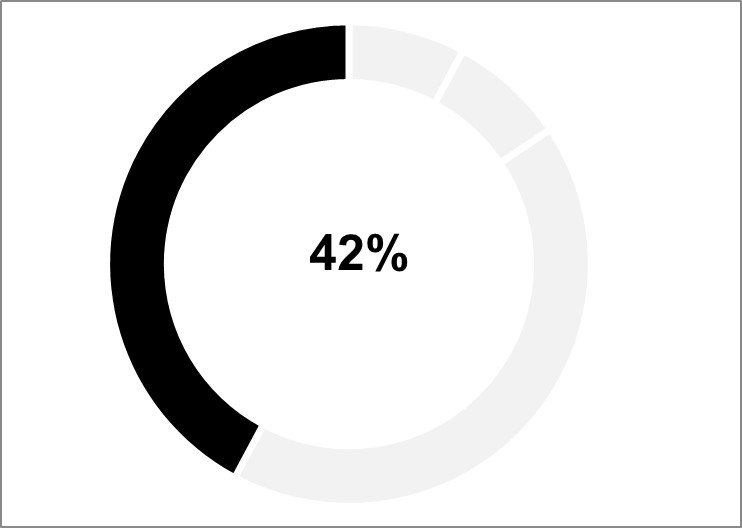

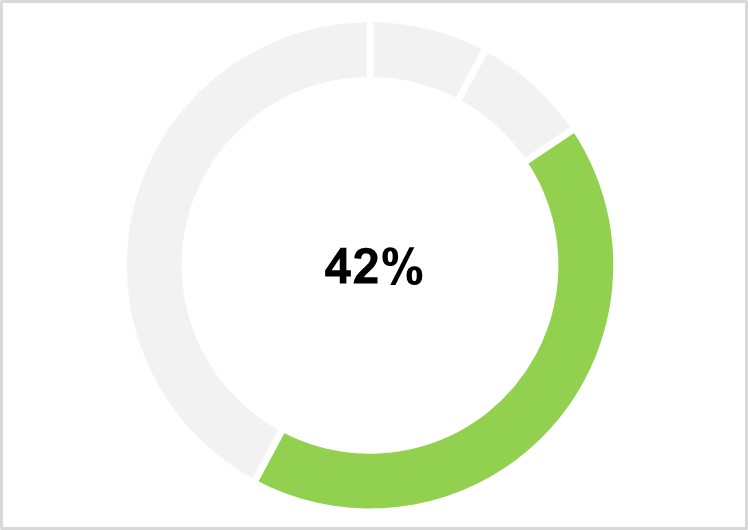

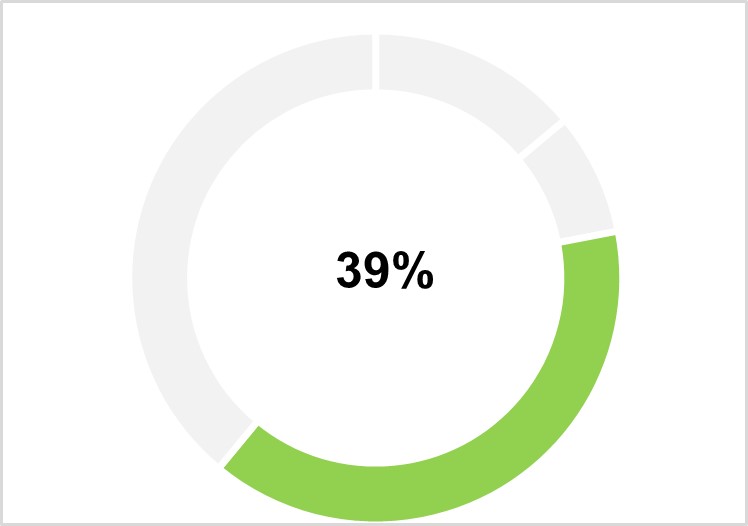

Assuming all of the proposed Class II director nominees are elected, 33% of our board of directors will be diverse based on gender as well as race/ethnicity.

|  | ||||

2021 Proxy Statement |  | 11

| 11

| 11

| 11BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

Information Regarding Director Nominees and Continuing Directors

The following table sets forth the names, ages as of March 31, 2021, and certain other information for each of the nominees for election as a director at the Annual Meeting and for each of the continuing members of our board of directors following the Annual Meeting. Full biographical information follows the table.

| NAME | CLASS | AGE | POSITION | DIRECTOR SINCE | CURRENT TERM EXPIRES | EXPIRATION OF TERM FOR WHICH NOMINATED | INDEPENDENT | AUDIT COMMITTEE | HUMAN CAPITAL MANAGEMENT AND COMP. COMMITTEE | NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | ||||||||||||||||||||||

| Director Nominees: | ||||||||||||||||||||||||||||||||

| Sally Grimes | II | 50 | Nominee | - | - | 2024 | X | |||||||||||||||||||||||||

| Ned Segal | II | 46 | Director/ Nominee | 2018 | 2021 | 2024 | X |   | ||||||||||||||||||||||||

| Muktesh “Micky” Pant | II | 66 | Nominee | - | - | 2024 | X | |||||||||||||||||||||||||

| Continuing Directors: | ||||||||||||||||||||||||||||||||

| Ethan Brown | III | 49 | Founder, President, CEO and Director | 2009 | 2022 | - | ||||||||||||||||||||||||||

| Diane Carhart | III | 66 | Director | 2016 | 2022 | - | X |   | ||||||||||||||||||||||||

Seth Goldman(C) | I | 55 | Director | 2013 | 2023 | - | ||||||||||||||||||||||||||

Raymond J. Lane(L) | III | 74 | Director | 2015 | 2022 | - | X |  | ||||||||||||||||||||||||

| Christopher Isaac “Biz” Stone | I | 47 | Director | 2012 | 2023 | - | X |  | ||||||||||||||||||||||||

| Kathy N. Waller | I | 62 | Director | 2018 | 2023 | - | X |   |  | |||||||||||||||||||||||

Legend: (C) Chair of the Board | (L) Lead Independent Director |  Chair |

Chair |  Member |

Member |  Audit Committee Financial Expert

Audit Committee Financial Expert

Chair |

Chair |  Member |

Member |  Audit Committee Financial Expert

Audit Committee Financial ExpertNominees for Director

SALLY GRIMES

Director Nominee

Sally Grimes has served as the Chief Executive Officer of Clif Bar & Company since June 2020. Prior to joining Clif Bar, Ms. Grimes served in a number of senior roles at Tyson Foods (NYSE:TSN), including the Group President of Prepared Foods for Tyson Foods from August 2017 to January 2020, President of Retail from January 2017 to August 2017 and Chief Global Growth Officer & President, International from August 2014 to January 2017. Ms. Grimes joined Tyson Foods through the acquisition of The Hillshire Brands Company, where she served as Chief Innovation Officer & President, Gourmet Foods Group from July 2012 to August 2014. Prior to joining Hillshire, Ms. Grimes served as Global Vice President of Marketing for Sharpie at Newell Rubbermaid from June 2007 to July 2012. Ms. Grimes also held several roles during her time in brand management at Kraft Foods from July 1997 to June 2007.

Ms. Grimes has been recognized by leading business publications including being named one of Fortune’s Most Powerful Women to Watch in 2019 and one of Fast Company’s Most Creative People in Business in 2012. She was also recognized by Crain’s Business as one of The Most Powerful Women in Chicago Business in 2019. Ms. Grimes has served on the board of directors of the Midtown Educational Foundation and the Economic Club of Chicago since June 2019. Ms. Grimes also served on the board of directors of Numerator, a Vista Private Equity portfolio company, from October 2019 to October 2020. Ms. Grimes holds a BS degree in Finance from Valparaiso University and an MBA from the University of Chicago Booth School of Business. We believe that Ms. Grimes is

12 |  | 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

qualified to serve on our board of directors due to her extensive experience working in the food industry and her significant leadership experience.

MUKTESH “MICKY” PANT

Director Nominee

Muktesh “Micky” Pant retired from Yum Brands in January 2018 after 13 years of service, most recently as the Chief Executive Officer of Yum China Holdings (NYSE:YUMC). Mr. Pant joined Yum Brands in 2005 as its Chief Marketing Officer and served in a number of senior roles of increasing responsibility, including Chief Executive Officer of Yum Restaurants International, Chief Executive Officer of KFC Globally, President of Taco Bell International and Chief Concept Officer of Yum Brands. Mr. Pant was appointed Chief Executive Officer of the China Division of Yum Brands in 2015 and played a key role in the spin-off of Yum China as a separate company and its successful listing on the New York Stock Exchange in 2016. In 2018, Mr. Pant retired as Chief Executive Officer of Yum China Holdings and served as Vice Chairman of the Board and Senior Advisor until May 2020. Mr. Pant served as a consultant to Beyond Meat from March 3, 2020 through December 31, 2020 pursuant to a consulting agreement between Mr. Pant and the company.

Mr. Pant has four decades of experience in marketing and international business and has lived and worked in the United States, China, the United Kingdom and India. Prior to working for Yum Brands, Mr. Pant worked at Reebok International, serving in various roles from 1994 to 2004, including Chief Marketing Officer. Mr. Pant also worked at PepsiCo India from 1992 to 1994 and at Unilever in India and the United Kingdom from 1976 to 1990.

Mr. Pant has been a member of the board of directors of Primavera Capital Acquisition Corporation, a special purpose acquisition company listed on the NYSE (NYSE:PV-UN) since January 2021. Mr. Pant previously served as a member of the board of directors of Pinnacle Foods (NYSE:PF) from December 2014 to June 2018 and as a member of its audit committee from 2015 to 2018. Mr. Pant holds a B Tech degree in Chemical Engineering from the Indian Institute of Technology, Kanpur and is a recipient of the Institute’s Distinguished Alumnus Award. We believe that Mr. Pant is qualified to serve on our board of directors because of his extensive experience working in the food and beverage industry, including leadership positions with quick serve restaurants, and his public company board experience.

NED SEGAL

Member of the Audit Committee

Ned Segal has served as a member of our board of directors since November 2018. Mr. Segal has served as the Chief Financial Officer of Twitter, Inc. (NYSE: TWTR) since August 2017. From January 2015 to August 2017, Mr. Segal served as Senior Vice President of Finance of Intuit Inc. (NASDAQ: INTU), a business and financial software company. From April 2013 to January 2015, Mr. Segal served as Chief Financial Officer of RPX Corporation, a former publicly traded company that provides patent risk management and discovery services. From 1996 to April 2013, Mr. Segal held various positions at The Goldman Sachs Group, Inc. (NYSE: GS), most recently as Head of Global Software Investment Banking. Mr. Segal has been a member of the board of directors of TS Innovation Acquisitions Corp. (NASDAQ: TSAI) since November 2020 and currently serves on its Audit Committee and Chair of its Compensation Committee. Mr. Segal holds a BS degree in Spanish from Georgetown University. We believe that Mr. Segal is qualified to serve on our board of directors because of his experience in finance at a number of major public companies.

Continuing Directors

ETHAN BROWN

Founder, President and Chief Executive Officer

Ethan Brown is the founder of Beyond Meat and has served as our President and Chief Executive Officer and as a member of our board of directors since our inception in 2009. He also serves as a director of The PLANeT Partnership, our joint venture with PepsiCo, Inc., and served as our Secretary since our inception to September

2021 Proxy Statement |  | 13

| 13

| 13

| 13BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

2018. Mr. Brown began his career with a focus on clean energy and the environment, serving as an energy analyst for the National Governors’ Center for Best Practices. He then joined Ballard Power Systems (NASDAQ: BLDP), a hydrogen fuel-cell company, being promoted from an entry-level manager to reporting directly to the Chief Executive Officer before leaving to found Beyond Meat.

Mr. Brown also created and opened a center for fuel reformation and has held several industry positions, including Vice Chairman of the Board at The National Hydrogen Association and Secretary of the United States Fuel Cell Council. He is a Henry Crown Fellow at the Aspen Institute and, along with Beyond Meat, is the recipient of the United Nation’s highest environmental accolade, Champion of the Earth (2018). Mr. Brown holds an MBA from Columbia University, an MPP with a focus on Environment from the University of Maryland and a BA in History and Government from Connecticut College. We believe Mr. Brown’s strategic vision for our company and his expertise in technology and business operations makes him qualified to serve on our board of directors.

DIANE CARHART

Member of the Audit Committee

Diane Carhart has served as a member of our board of directors since January 2016. In March 2021, Ms. Carhart retired as Chief Financial Officer of the US Yogurt Division of Lactalis, a multinational dairy products corporation, a position she held since October 2020. Ms. Carhart served as Chief Financial Officer of Stonyfield Farm, Inc., an organic yogurt maker, from April 1992 to October 2020, and also served as Chief Operating Officer from August 2006 to October 2020. Ms. Carhart has a BS degree in Accounting from the University of Connecticut and an MBA degree with a finance concentration from Boston University. We believe that Ms. Carhart is qualified to serve on our board of directors because she has more than 40 years in accounting, finance and operations management with 29 years in the food industry.

SETH GOLDMAN

Chair of the Board

Seth Goldman joined Beyond Meat as a member of our board of directors in February 2013. Mr. Goldman served as Executive Chair of Beyond Meat from October 2015 through February 2020. Mr. Goldman is the Co-Founder of Eat the Change, and has served as Chief Change Agent of Eat the Change since March 2020. He is also a co-founder of PLNT Burger, a quick-serve restaurant concept. Mr. Goldman was the TeaEO Emeritus and Innovation Catalyst for The Coca-Cola Company’s Venturing & Emerging Brands, a part-time position he held from November 2015 through December 2019. Mr. Goldman co-founded Honest Tea Inc., a bottled organic tea company, in February 1998, which was later sold to The Coca-Cola Company, and previously served as Honest Tea’s President and TeaEO until 2015.

In 2015, Mr. Goldman was named the #1 Disruptor by Beverage World and Beverage Executive of the Year by Beverage Industry magazine. He has also been recognized as an Ernst & Young Entrepreneur of the Year and by the Washington DC Business Hall of Fame. In 2018, Partnership for a Healthier America recognized Mr. Goldman with its Visionary CEO award. Mr. Goldman is the co-chair of the Yale School of Management’s Entrepreneurship Advisory Board and, since January 2008, has served on the advisory board of Bethesda Green, a local sustainability non-profit he co-founded. He also served on the board of Ripple Foods, a dairy-free plant-based milk company from November 2015 to October 2020, the advisory board of the American Beverage Association from 2013 to 2019 and the Yale School of Management from July 2013 to March 2020. Mr. Goldman is a National Association of Corporate Directors ("NACD") Board Leadership Fellow and has demonstrated his commitment to boardroom excellence by completing NACD's comprehensive corporate governance program for directors.

Mr. Goldman has a BA degree in Government from Harvard College and a Masters of Private & Public Management degree from Yale School of Management and is a Henry Crown Fellow of the Aspen Institute. We believe that Mr. Goldman is qualified to serve on our board of directors due to his extensive experience working at fast-growing brands in the food and beverage industry, his experience founding and building an entrepreneurial company and his knowledge of sustainable business practices.

14 |  | 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

RAYMOND J. LANE

Lead Independent Director

Member of the Human Capital Management and Compensation Committee

Raymond J. Lane has served as a member of our board of directors since February 2015. Mr. Lane has been a Managing Partner at GreatPoint Ventures, a venture capital firm, since March 2015. Mr. Lane has served as a Partner Emeritus and Advisor of Kleiner, Perkins, Caufield & Byers LLC, a venture capital firm, since April 2013 and was a Managing Partner of Kleiner, Perkins, Caufield & Byers LLC from September 2000 to April 2013. Mr. Lane has served on the board of directors of Hewlett Packard Enterprise Company (NYSE: HPE) from November 2015 to the present and is currently a member of its Technology Committee. In addition, Mr. Lane previously served as executive Chairman of Hewlett-Packard Company from September 2011 to April 2013 and as non-executive Chairman of Hewlett-Packard Company from November 2010 to September 2011.

Prior to joining Kleiner Perkins, Mr. Lane was President and Chief Operating Officer and a director of Oracle Corporation, a software company. Mr. Lane serves on the Board of Trustees of Carnegie Mellon University, including as Chairman of the Board from July 2009 to July 2015. He also serves on the board of directors of Special Olympics International. Mr. Lane holds a BS degree in Mathematics and an honorary Ph.D. in Science from West Virginia University. We believe that Mr. Lane is qualified to serve on our board of directors due to his experience in working with entrepreneurial companies and his experience on other public company boards of directors.

CHRISTOPHER ISAAC “BIZ” STONE

Chair of the Nominating and Corporate Governance Committee

Christopher Isaac “Biz” Stone has served as a member of our board of directors since January 2012. Mr. Stone is a Co-founder of Twitter, Inc. (NYSE: TWTR) where he has served as Creative Director since 2006 with a hiatus as Advisor between 2012 and 2017. Mr. Stone was the Co-Founder and Chief Executive Officer at Jelly Industries, Inc. from January 2013 to March 2017. Mr. Stone served as Special Advisor to the founders of Pinterest from March 2017 to March 2018, has been a Visiting Fellow at Oxford University since August 2015, has served as an advisor to The Global AI Council since August 2018, and is an active angel investor in companies such as Slack, Square and Intercom. In addition to Twitter, Inc., Mr. Stone co-founded A Medium Corporation in January 2012, which provides an online publishing platform, and has served as a member of its board of directors since January 2012 and as Creative Director from February 2012 to April 2013.

Mr. Stone was also Chairman of the Board of Polaroid Swing, Inc. from July 2016 to November 2017 and was an independent director of Workpop, Inc. from September 2014 until May 2017. His honors include Inc. magazine’s Entrepreneur of the Decade, TIME magazine’s 100 Most Influential People in the World, GQ magazine’s Nerd of the Year and The Economist’s “Innovation Award.” We believe that Mr. Stone is qualified to serve on our board of directors due to his extensive experience in working with entrepreneurial companies.

KATHY N. WALLER

Chair of the Audit Committee

Member of the Nominating and Corporate Governance Committee

Kathy N. Waller has served as a member of our board of directors since November 2018. Ms. Waller retired from The Coca-Cola Company (NYSE: KO) in March 2019 after more than 30 years of service, most recently as Executive Vice President, Chief Financial Officer and President, Enabling Services prior to her retirement. Ms. Waller joined The Coca-Cola Company in 1987 as a senior accountant in the Accounting Research Department and served in a number of accounting and finance roles of increasing responsibility. From July 2004 to August 2009, Ms. Waller served as Chief of Internal Audit. In December 2005, she was elected Vice President of The Coca-Cola Company, and in August 2009, she was elected Controller. In August 2013, she became Vice President, Finance and Controller, assuming additional responsibilities for corporate treasury, corporate tax and finance capabilities, and served in that position until April 2014, when she was appointed Chief Financial Officer and elected Executive Vice President. Ms. Waller assumed expanded responsibility for The Coca-Cola

2021 Proxy Statement |  | 15

| 15

| 15

| 15BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

Company’s strategic governance areas when she was also appointed to serve as President, Enabling Services, on May 1, 2017.

Ms. Waller has been a member of the board of directors of Delta Air Lines, Inc. (NYSE: DAL) since July 2015, and currently serves on its Audit, Corporate Governance and Personnel and Compensation Committees. Ms. Waller has been a member of the board of directors of CGI Inc. (NYSE: GIB) since December 2018 and currently serves on its Audit and Risk Management Committee. Ms. Waller joined the board of directors of Cadence Bancorporation in May 2019 and serves on its Risk Committee and Compensation Committee. Previously she served on the board of directors of Coca-Cola FEMSA, S.A.B. de C.V and Monster Beverage Corporation. In addition, she is a member of the Board of Trustees of Spelman College and The Woodruff Arts Center. She received a BA degree in History from the University of Rochester and an MBA in Accounting and Finance from the Simon Business School at the University of Rochester. We believe that Ms. Waller is qualified to serve on our board of directors because she has more than 30 years of experience in accounting and finance at a major public company.

Corporate Governance Strengths

We are committed to good corporate governance, which promotes the long-term interests of our stockholders and strengthens our board of directors and management accountability and helps build public trust in Beyond Meat. Highlights of our corporate governance practices include the following:

| ü | Over 60% of incumbent directors are independent | ü | Lead independent director | ||||||||

| ü | Single class of stock with equal voting rights | ü | 100% independent committee members | ||||||||

| ü | No hedging of company securities by directors or officers with limited exceptions for pledging | ü | Diverse board and robust director nominee selection process | ||||||||

| ü | Director participation in orientation and continuing education | ü | Robust code of business conduct and ethics and corporate governance guidelines | ||||||||

| ü | Risk oversight by full board and committees | ü | Annual board of directors and committee self‑evaluations | ||||||||

| ü | Periodic reviews of committee charters, code of business conduct and ethics and corporate governance guidelines | ü | All audit committee members qualify as “audit committee financial experts” under SEC rules | ||||||||

Director Independence

Our common stock is listed on the Nasdaq Global Select Market (“Nasdaq”). The listing rules of this stock exchange generally require that a majority of the members of a listed company’s board of directors be independent. The Nasdaq independence definition includes a series of objective tests, including that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his or her family members has engaged in various types of business dealings with us. Under Nasdaq rules, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

In addition, the Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent. Audit committee members and human capital management and compensation committee members must also satisfy the independence criteria set forth in Rule 10A-3 and Rule 10C-1, respectively, under the Exchange Act. To be considered to be independent for purposes of Rule 10A-3 and under Nasdaq rules, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the

16 |  | 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

board of directors, or any other board of directors committee: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or (2) be an affiliated person of the listed company or any of its subsidiaries. To be considered independent for purposes of Rule 10C-1 and under Nasdaq rules, our board of directors must affirmatively determine that each member of the human capital management and compensation committee is independent, including a consideration of all factors specifically relevant to determining whether the director has a relationship to the company which is material to that director’s ability to be independent from management in connection with the duties of a human capital management and compensation committee member, including, but not limited to: (i) the source of compensation of such director, including any consulting, advisory or other compensatory fee paid by the company to such director; and (ii) whether such director is affiliated with the company, a subsidiary of the company or an affiliate of a subsidiary of the company.

Our board of directors undertook a review of its composition, the composition of its committees and the independence of our directors and director nominees, and considered whether any director or director nominee has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director and director nominee concerning his or her background, employment and affiliations, including family relationships and direct and indirect investments in plant-based food companies and other businesses, our board of directors determined that each of Messrs. Lane, Pant, Stone, Segal and Thompson and Mses. Carhart, Grimes and Waller do not have relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors or director nominees is “independent” as that term is defined under the applicable rules of the SEC and the listing standards of Nasdaq. For Mr. Pant, the board of directors also took into account his consulting agreement with Beyond Meat, which terminated on December 31, 2020, in determining Mr. Pant's independence. Messrs. Brown, Goldman and Dr. van Lengerich are not independent under Nasdaq’s independence standards. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director and director nominee has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the transactions involving them described in the section titled “Related Person Transactions.” There are no family relationships among any of our directors, director nominees or executive officers.

2021 Proxy Statement |  | 17

| 17

| 17

| 17BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

Board of Directors Leadership Structure

Our board of directors recognizes that it is important to determine an optimal board leadership structure to ensure the independent oversight of management as our company continues to grow. Under our corporate governance guidelines, our board of directors does not require the separation of the offices of the chair and the chief executive officer. Our board of directors may choose its chair in any way that it considers in the best interests of our company. The duties of the chair of the board, lead independent director and chief executive officer are set forth in the following table and further described below.

| CHAIR OF THE BOARD | LEAD INDEPENDENT DIRECTOR | CHIEF EXECUTIVE OFFICER | ||||||

•Provides guidance to the Chief Executive Officer | •Calls special meetings of our board of directors | •Sets strategic direction of the company | ||||||

•Presides over meetings of the full board of directors | •Presides over executive sessions of the independent directors | •Sets the day-to-day leadership and performance of our company | ||||||

•Calls special meetings of our board of directors | •Serves as a liaison between the chair and the chief executive officer and the independent directors | •Provides general supervision, direction and control of the business and affairs of the company | ||||||

•Consults with the chair and the chief executive officer regarding information sent to our board of directors in connection with its meetings | •Presides at all meetings of the stockholders | |||||||

Currently, Seth Goldman serves as chair of the board and Ethan Brown serves as chief executive officer. Mr. Goldman served as executive chair from October 2015 through February 2020. Raymond J. Lane serves as our lead independent director. Our chief executive officer is responsible for setting the strategic direction for our company and the day-to-day leadership and performance of our company, while our chair of the board provides guidance to our chief executive officer and presides over meetings of the full board of directors. Our board of directors believes that this overall structure of a separate chair of the board and chief executive officer, combined with a lead independent director, results in an effective balancing of responsibilities, experience and independent perspectives that meets the current corporate governance needs and oversight responsibilities of our board of directors.

Our board of directors has concluded that the current leadership structure is appropriate at this time. However, our nominating and corporate governance committee will periodically consider this leadership structure and make recommendations to the board of directors with respect thereto as our nominating and corporate governance committee deems appropriate.

Lead Independent Director; Executive Sessions of Independent Directors

Under our Bylaws, our board of directors may, in its discretion, elect a lead independent director from among its members that are independent directors. Raymond J. Lane currently serves as our lead independent director.

Under our Bylaws, our lead independent director will preside at all meetings at which the chair of the board is not present, may call special meetings of our board of directors, and will exercise such other powers and duties as may be assigned by our board of directors. Under our corporate governance guidelines, our lead independent director will, among other things, preside over executive sessions of the independent directors; serve as a liaison between the chair and the chief executive officer and the independent directors; consult with the chair and the chief executive officer regarding information sent to our board of directors in connection with its meetings; have the authority to call meetings of our board of directors and meetings of the independent directors; be available under appropriate circumstances for consultation and direct communication with stockholders; and perform such other functions and responsibilities as requested by our board of directors from time to time. Our lead independent

18 |  | 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

director will also encourage direct dialogue between all directors (particularly those with dissenting views) and management.

To encourage and enhance communication among independent directors, and as required under applicable Nasdaq rules, our independent directors will meet in regularly scheduled executive sessions, on a periodic basis but no less than twice a year, at which only independent directors are present. Any independent director can request that an additional executive session be scheduled.

Role of the Board in Risk Oversight

One of the key functions of our board of directors is to oversee our risk management process. Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through our board of directors as a whole, as well as through various standing committees of our board of directors that address the risks inherent in their respective areas of oversight as described below. This risk process includes regular discussions with management about our major risk exposures, their potential impact on our business and management strategies for adequately mitigating and managing identified risks.

BOARD OF DIRECTORS | ||||||||

•Oversees the company’s program to prevent and detect violations of law, regulation or company policies and procedures. | •Monitors and assesses strategic risk exposure. | •Reviews periodic reports from each of the committees on their areas of risk oversight. | ||||||

AUDIT COMMITTEE | ||||||||

•Reviews our major financial risk exposures and the steps our management has taken to monitor and control these exposures. | •Monitors compliance with legal and regulatory requirements. | •Reviews cybersecurity risks and incidents and any other risks and incidents relevant to the Company’s computerized information system controls and security. | ||||||

HUMAN CAPITAL MANAGEMENT AND COMPENSATION COMMITTEE | ||||||||

•Assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk‑taking. | •Oversees and assesses and risks associated with the company’s human capital management policies and strategies. | •Employs an independent compensation consultant to assist in designing and reviewing compensation programs, including the potential risks created by the programs. | ||||||

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | ||||||||

•Oversees risks associated with board organization, membership and structure, and corporate governance. | •Monitors risks associated with the company’s environmental, social and governance program. | •Oversees compliance with key corporate governance policies, including the company’s corporate governance guidelines. | ||||||

Information Security and Risk Oversight

The audit committee, which is comprised entirely of independent directors, is responsible for reviewing cybersecurity risks and incidents relevant to the company’s computerized information system controls and security. To mitigate risks posed by cybersecurity incidents and attacks, we have developed a cybersecurity program led by the company’s Senior Director of IT, that is designed to protect the confidentiality, integrity and availability of the company’s products, data and systems. The Senior Director of IT provides the audit committee with a cybersecurity report at least annually which outlines the cybersecurity business support across the organization, external risks and mitigation strategies, risks and opportunities, monitoring and incident reporting, data loss prevention tools, key systems and IT controls.

2021 Proxy Statement |  | 19

| 19

| 19

| 19BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

Environmental, Social and Governance Oversight

Our mission is to create nutritious plant-based meats that taste delicious and deliver a consumer experience that is indistinguishable from that provided by animal-based meats. We strive to operate in an honest, socially responsible and environmentally sustainable manner and are committed to help solve the major health and global environmental issues which we believe are caused in part by an animal-based protein diet and existing industrial livestock production. Beyond Meat's brand commitment, Eat What You Love™, represents a strong belief that there is a better way to feed our future and the planet. By shifting from animal-based meat to plant-based meat, we can positively impact four growing global issues: human health, climate change, constraints on natural resources and animal welfare.

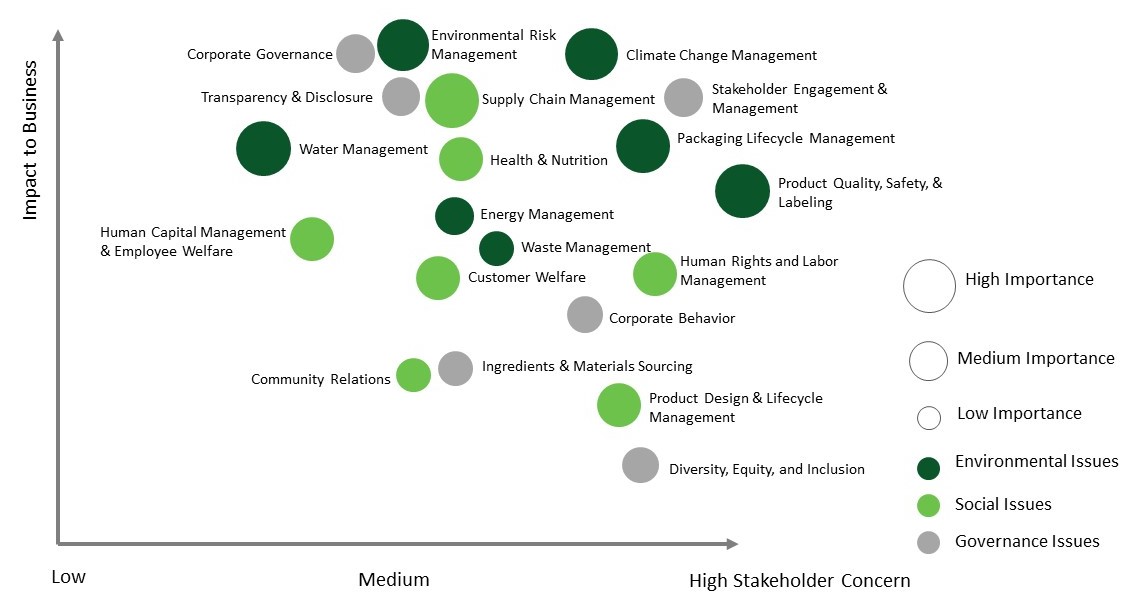

We understand the importance of integrating Environmental, Social and Governance (“ESG”) factors into our day-to-day business strategy, particularly given the critical role that our mission plays in our strategy and operations. As part of the development of our ESG program, we have conducted a materiality analysis to determine which ESG issues are relevant to our business (“ESG Materiality Analysis”). The relevant ESG issues that we identified as a result of the ESG Materiality Analysis are displayed in the image below.

The environmental impacts of our products, climate change management, the safety and quality of the products we produce and how we manage our supply chain were all identified as highly relevant as a result of the ESG Materiality Analysis. We continue to work on leveraging the ESG Materiality Analysis to create comprehensive ESG goals that will assist us with our commitment to ensuring responsible and sustainable business practices within our organization.

20 |  | 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement

| 2021 Proxy Statement BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

Environmental

Carbon Footprint

We completed our first carbon footprint assessment in 2020 to better understand the emissions produced at every stage in the value chain. This exercise has informed our thinking on the areas of opportunity for reducing our carbon footprint throughout our business and will be a critical component of our ESG strategy.

Water Efficiency Facility Practices

In our facilities, we leverage a series of practices to enable the efficient use of water. We use reverse osmosis practices that improve water quality and our ability to reuse potable water. We offer resource management training programs, and we are in the process of implementing a supplier code of conduct that covers environmental and social expectations for our suppliers.

Social

Employee Health and Safety during COVID-19

The health and safety of our employees is a top priority for us. As a result, during COVID-19, we established a COVID-19 cross-functional task force that meets regularly and continually monitors and tracks relevant data including guidance from local, national and international health agencies. This task force works closely with our senior leadership team and is instrumental in making critical, timely decisions. In response to COVID-19, we have taken, and continue to take, the following safety measures to ensure the health and safety of our employees as well as the communities in which we operate:

•Allow employees to work remotely where feasible;

•Engaged an epidemiologist advisor to establish appropriate safety standards across all of our locations;

•Engaged an industrial hygienist to check the air quality and overall safety practices at our El Segundo offices;

•Implemented enhanced safety measures including mandatory face coverings, physical distance requirements, temperature checks, deep cleaning and disinfectant protocols, and hand sanitizing stations for employees continuing critical on-site work at all locations;

•Provide employee-wide training on COVID-19 safety measures;

•Reorganized the lay-out of our innovation lab in El Segundo to allow for increased social distancing;

•Implemented staggered shifts for employees continuing critical on-site work at all locations to allow for increased social distancing;

•Restrict company travel to essential business travel that requires prior multi-level approvals; and

•Provide free onsite weekly COVID-19 testing for all employees located at our El Segundo offices.

The task force is committed to continuing to communicate to our employees as more information is available to share and also continues to evaluate our operations in light of federal, state and local guidance, evolving data concerning COVID-19 and the best interests of our employees.

Feeding Our Communities

To address COVID-19’s impact on rising food insecurity, particularly in low-income and marginalized communities, we committed to a Feed A Million+ pledge. Mobilizing our brand ambassadors, initiative partners and celebrity influencers, in 2020 we donated and distributed more than one million Beyond Burgers and nourishing meals at no cost to food banks, healthcare workers, frontline responders and communities in need across the country.

2021 Proxy Statement |  | 21

| 21

| 21

| 21BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | ||

Governance

ESG Oversight

Our nominating and corporate governance committee, with the assistance of the ESG Executive Steering Committee (“ESG Committee”) comprised of certain members of our executive management team, will have oversight responsibility of our ESG program. The ESG Committee is responsible for reviewing our progress towards achieving our sustainability goals as well as reviewing ESG trends and reporting ESG risks that could impact our operations, performance and reputation to the nominating and corporate governance committee.

As part of our ESG governance oversight, we plan to develop and implement ESG-related policies that outline our perspective on and approach to managing our ESG risks and opportunities.

Human Capital Management

Our board of directors believe that our human capital management initiatives are vital to the success of our company and is actively engaged in overseeing our people and culture strategy. In 2021, our board of directors delegated oversight responsibility of our human capital management efforts including, but not limited to, diversity, equity and inclusion, and development and retention, to our compensation committee, which was renamed the human capital management and compensation committee.

Diversity and Inclusion