Form DEF 14A Arcus Biosciences, Inc. For: Jun 03

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

|

Filed by the Registrant |

|

☒ |

|

Filed by a Party other than the Registrant |

|

☐ |

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒Definitive Proxy Statement

☐Definitive Additional Materials

☐Soliciting Material Pursuant to § 240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

Title of each class of securities to which transaction applies:

Aggregate number of securities to which transaction applies:

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

Proposed maximum aggregate value of transaction:

Total fee paid:

Form, Schedule or Registration Statement No.:

Filing Party:

Date Filed:

3928 Point Eden Way

Hayward, CA 94545

(510) 694-6200

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 3, 2021

Dear Stockholder:

You are cordially invited to attend the 2021 Annual Meeting of Stockholders, or the Annual Meeting, of Arcus Biosciences, Inc., a Delaware corporation (“Arcus”). The Annual Meeting will be held on Thursday, June 3, 2021 at 8:30 a.m. Pacific Time. The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast. You will be able to attend the virtual Annual Meeting and submit your questions and vote your shares online during the meeting by visiting www.virtualshareholdermeeting.com/RCUS2021 and using your 16-digit control number to enter the virtual Annual Meeting. The stockholder list will also be available during the Annual Meeting at www.virtualshareholdermeeting.com/RCUS2021. Instructions on how stockholders of record can view the stockholder list during the Annual Meeting are posted at www.virtualshareholdermeeting.com/RCUS2021. The Annual Meeting will be held for the following purposes:

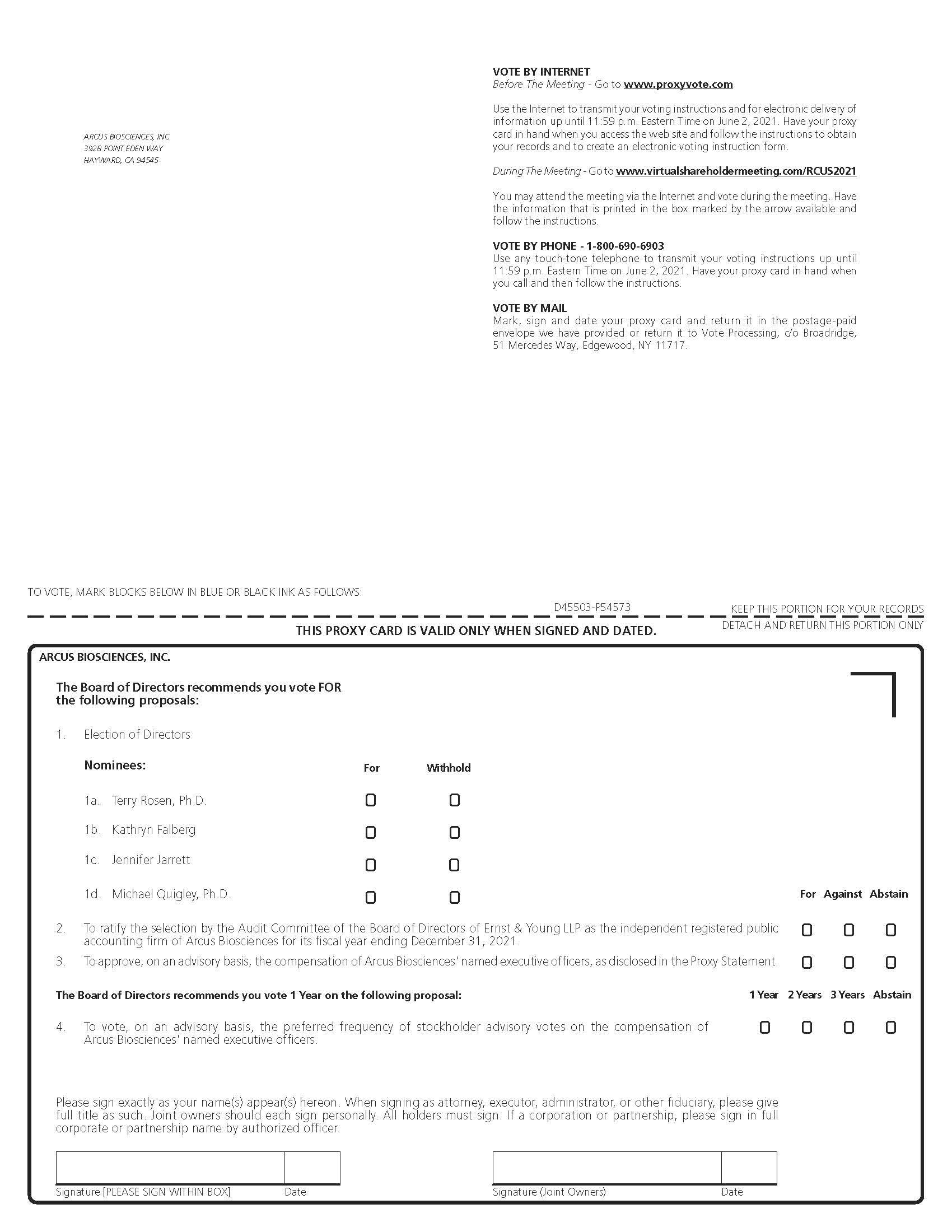

|

1. |

To elect the Board of Directors’ nominees for director to hold office until the 2023 Annual Meeting of Stockholders and until their successors are duly elected and qualified. |

|

2. |

To ratify the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of Arcus for its fiscal year ending December 31, 2021. |

|

3. |

To approve, on an advisory basis, the compensation of Arcus’s named executive officers, as disclosed in this Proxy Statement. |

|

4. |

To vote, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of Arcus’s named executive officers. |

|

5. |

To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is April 9, 2021. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held Virtually on Thursday, June 3, 2021.

The proxy statement and annual report to stockholders

are available at www.proxyvote.com

By Order of the Board of Directors

/s/ Terry Rosen___

Terry Rosen, Ph.D.

Chief Executive Officer and Chairman of the Board

Hayward, California

April 20, 2021

You are cordially invited to attend our annual meeting virtually via live webcast at www.virtualshareholdermeeting.com/RCUS2021. Whether or not you expect to attend the meeting, please vote as soon as possible. You may vote over the Internet or by a toll-free telephone number. If, however, you requested to receive paper proxy materials, then you may vote by mailing a completed, signed and dated proxy card or voting instruction card in the envelope provided with the proxy card or voting instruction card. Please note that any stockholder attending the virtual Annual Meeting may vote online during the meeting, even if the stockholder has already returned a proxy card or voting instruction card. Please see the instructions in the attached proxy statement and on your proxy card or voting instruction card, or on your Notice of Internet Availability of Proxy Materials previously received.

ARCUS BIOSCIENCES, INC.

3928 Point Eden Way

Hayward, CA 94545

(510) 694-6200

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 3, 2021

To be held virtually at www.virtualshareholdermeeting.com/RCUS2021

on Thursday, June 3, 2021 at 8:30 am Pacific

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 3, 2021

This proxy statement and our 2020 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, are available on our website at www.proxyvote.com. We intend to mail the notice regarding the availability of proxy materials on or about April 23, 2021 to all stockholders of record entitled to vote at the annual meeting.

|

MEETING AGENDA |

||||

|

|

|

|

|

|

|

Proposal No. |

|

Proposal |

|

Board Vote Recommendation |

|

|

|

|

|

|

|

1 |

|

To elect the Board of Directors’ nominees for director to hold office until the 2024 Annual Meeting of Stockholders and until their successors are duly elected and qualified. |

|

For each Arcus director nominee |

|

|

|

|

|

|

|

2 |

|

To ratify the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of Arcus for its fiscal year ending December 31, 2021. |

|

For |

|

|

|

|

|

|

|

3 |

|

To approve, on an advisory basis, the compensation of Arcus’s named executive officers, as disclosed in this Proxy Statement. |

|

For |

|

|

|

|

|

|

|

4 |

|

To vote, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of Arcus’s named executive officers. |

|

One Year |

|

|

|

|

|

|

Table of Contents

|

|

|

Page |

|||

|

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING |

1 |

||||

|

7 |

|||||

|

|

Nominee for Election for a Three-year Term Expiring at the 2024 Annual Meeting |

8 |

|||

|

|

Directors Continuing in Office Until the 2022 Annual Meeting |

9 |

|||

|

|

Directors Continuing in Office Until the 2023 Annual Meeting |

11 |

|||

|

12 |

|||||

|

|

12 |

||||

|

|

12 |

||||

|

|

12 |

||||

|

|

12 |

||||

|

|

13 |

||||

|

|

|

13 |

|||

|

|

|

14 |

|||

|

|

|

14 |

|||

|

|

|

15 |

|||

|

|

|

15 |

|||

|

|

16 |

||||

|

|

17 |

||||

|

|

17 |

||||

|

|

17 |

||||

|

PROPOSAL 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

18 |

||||

|

|

18 |

||||

|

|

18 |

||||

|

19 |

|||||

|

21 |

|||||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

22 |

||||

|

23 |

|||||

|

25 |

|||||

|

|

25 |

||||

|

|

|

Narrative Explanation of Compensation Arrangements with our Named Executive Officers |

25 |

||

|

|

28 |

||||

|

|

29 |

||||

|

31 |

|||||

|

|

32 |

||||

|

33 |

|||||

|

34 |

|||||

|

|

34 |

||||

|

|

34 |

||||

|

36 |

|||||

|

37 |

|||||

i

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board of Directors (sometimes referred to as the “Board”) of Arcus Biosciences, Inc. is soliciting your proxy to vote at the 2021 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

What is included in the proxy materials?

The proxy materials include:

|

|

• |

This proxy statement, which includes information regarding the proposals to be voted on at the Annual Meeting, the voting process, corporate governance, the compensation of our directors and certain executive officers, and other required information; |

|

|

• |

Our 2020 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2020; and |

|

|

• |

The proxy card or a voting instruction card for the Annual Meeting (which you will receive if you have requested paper copies of this proxy statement and our Annual Report). |

We intend to mail the Notice on or about April 23, 2021 to all stockholders of record entitled to vote at the annual meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after May 3, 2021.

How do I attend the annual meeting?

We will be hosting the Annual Meeting only by means of a live audio webcast. There will not be a physical meeting location and you will not be able to attend the meeting in person physically. The live audio webcast will be held on Thursday, June 3, 2021, and will begin promptly at 8:30 a.m. local time. Online check-in will begin approximately 15 minutes prior to the start of the Annual Meeting. We encourage our stockholders to access the meeting in advance of the designated start time to have ample time for check-in procedures. To attend the Annual Meeting virtually via the internet, please visit www.virtualshareholdermeeting.com/RCUS2021. You will need the 16-digit control number included in the Notice or on the proxy card.

Why are you holding a virtual annual meeting?

Due to COVID, the annual meeting will be conducted via a live audio webcast and online shareholder tools. We have implemented the virtual format in order to provide a safe experience for our stockholders and other meeting participants, which will facilitate stockholder attendance and participation from any location around the world, at no cost. However, you will bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies. A virtual annual meeting also makes it possible for more stockholders (regardless of size, resources or physical location) to have direct access to information more quickly, while saving our stockholders time and money. We also believe that the online tools we have selected will increase stockholder communication. For example, the virtual format allows stockholders to communicate with us in advance of, and during, the annual meeting so they can ask us questions.

1.

Who can vote at the annual meeting?

Stockholders of record and beneficial owners at the close of business on April 9, 2021, the record date, will be able to vote their shares electronically during the Annual Meeting by using the 16-digit control number. Instructions on how to vote while participating in the Annual Meeting live via the Internet are posted at www.virtualshareholdermeeting.com/RCUS2021. On this record date, there were 70,991,112 shares of common stock outstanding and entitled to vote.

If you do not have your 16-digit control number, you will be able to access and listen to the Annual Meeting, but you will not be able to vote your shares or submit questions during the Annual Meeting. See caption below titled “Attending the Annual Meeting as a Guest.”

Stockholder of Record: Shares Registered in Your Name

If on April 9, 2021 your shares were registered directly in your name with Arcus’s transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote online at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 9, 2021 your shares were held, not in your name, but rather in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account. You are also invited to attend the virtual annual meeting. Beneficial stockholders as of the record date who want to be able to attend and vote at the Annual Meeting can attend using the 16-digit control number found on the notice and instructions received from their broker or other nominee.

Attending the Annual Meeting as a Guest

Guests may enter the Annual Meeting in “listen-only” mode by entering the Annual Meeting at www.virtualshareholdermeeting.com/RCUS2021 and entering the information requested in the “Guest Login” section. Guests will not have the ability to vote at the Annual Meeting.

Who can ask questions at the Annual Meeting?

If you are attending the Annual Meeting as a stockholder of record or as a beneficial owner, questions can be submitted by accessing the meeting center at www.virtualshareholdermeeting.com/RCUS2021, entering your 16-digit control number and following the instructions. Instructions on how to ask questions and participate in the Annual Meeting are posted at www.virtualshareholdermeeting.com/RCUS2021. Guests will not have the ability to ask questions during the Annual Meeting.

List of Stockholders

A list of stockholders entitled to vote at the Annual Meeting will be available for examination for any purpose germane to the Annual Meeting during normal business hours for ten days prior to the Annual Meeting at our corporate headquarters. Due to the COVID-19 pandemic, please email us at [email protected] to arrange a time to review. The stockholder list will also be available during the Annual Meeting at www.virtualshareholdermeeting.com/RCUS2021. Instructions on how stockholders of record can view the stockholder list during the Annual Meeting are posted at www.virtualshareholdermeeting.com/RCUS2021.

2.

What am I voting on?

There are four matters scheduled for a vote:

|

|

• |

Election of directors (Proposal 1); |

|

|

• |

Ratification of appointment by the Audit Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of Arcus for its fiscal year ending December 31, 2021 (Proposal 2). |

|

|

• |

To approve, on an advisory basis, the compensation of Arcus’s named executive officers as disclosed in the Proxy Statement (Proposal 3). |

|

|

• |

To vote, on an advisory basis, the preferred frequency of stockholder advisory votes on the compensation of Arcus’s named executive officers (Proposal 4). |

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the annual meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote, to the extent permitted by SEC rules, on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all of the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For the ratification of appointment by the Audit Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of Arcus for its fiscal year ending December 31, 2021, you may vote “For” or “Against” or abstain from voting. For the approval, on an advisory basis, of the compensation of Arcus’s named executive officers, you may vote “For” or “Against” or abstain from voting. For the preferred frequency of stockholder advisory votes on the compensation of Arcus’s named executive officers, you may vote “1 Year”, “2 Years”, or “3 Years” or abstain from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote online at the annual meeting, vote by proxy over the telephone, vote by proxy through the internet, or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote online even if you have already voted by proxy.

|

|

• |

To vote online during the virtual annual meeting, attend the annual meeting at www.virtualshareholdermeeting.com/RCUS2021 and vote your shares during the virtual Annual Meeting. You will need your 16-digit control number provided in the Notice or proxy card in order to gain access to the virtual Annual Meeting. |

|

|

• |

To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered to you and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

|

|

• |

To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your telephone vote must be received by 11:59 p.m. Eastern Time, on June 2, 2021, to be counted. |

|

|

• |

To vote through the internet, go to http://www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. Your internet vote must be received by 11:59 p.m. Eastern Time, on June 2, 2021, to be counted. |

3.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice or voting instruction card containing voting instructions from that organization rather than from Arcus. Simply follow the voting instructions in the Notice or voting instruction card to ensure that your vote is counted. To vote online at the virtual Annual Meeting, you can do so using the 16-digit control number found on the notice and instructions received from your broker or other agent. Whether or not you plan to attend the virtual Annual Meeting, please vote by proxy as directed in your Notice or voting instruction card as soon as possible to ensure your vote is counted. You may still attend the virtual Annual Meeting and vote online during the meeting even if you have already voted by proxy.

Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

Can I vote my shares by completing and returning the Notice?

No. The Notice will, however, provide instructions on how to vote by telephone, by Internet, by requesting and returning a paper proxy card or voting instruction card, or by voting online at the virtual Annual Meeting.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 9, 2021.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card by telephone, through the internet or online at the virtual annual meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of all nominees for director (Proposal 1), “For” the ratification of the independent registered public accounting firm (Proposal 2), “For” the approval, on an advisory basis, of the compensation of our named executive officers (Proposal 3) and “1 year” on the preferred frequency of stockholder advisory votes on the compensation of the company’s named executive officers (Proposal 4). If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares, to the extent permitted by SEC rules, using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. In this regard, under the rules of the New York Stock Exchange (NYSE), brokers, banks and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. In this regard, Proposals 1, 3 and 4 are considered to be “non-routine” under NYSE rules meaning that your broker may not vote your shares on those proposals in the absence of your voting instructions. However, Proposal 2 is considered to be a “routine” matter under NYSE rules meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 2.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

4.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

|

|

• |

You may submit another properly completed proxy card with a later date. |

|

|

• |

You may grant a subsequent proxy by telephone or through the internet. |

|

|

• |

You may send a timely written notice that you are revoking your proxy to Arcus Biosciences, Inc.’s Secretary at 3928 Point Eden Way, Hayward, CA 94545. |

|

|

• |

You may attend the virtual annual meeting and vote online. Simply attending the meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent, or you may attend the virtual annual meeting and vote online. Simply attending the meeting will not, by itself, revoke your proxy.

When are stockholder proposals and director nominations due for next year’s annual meeting?

If you wish to submit a proposal to be considered for inclusion in the proxy materials we prepare for next year’s annual meeting, your proposal must be submitted in writing by December 24, 2021, to Arcus Biosciences, Inc., 3928 Point Eden Way Hayward, CA 94545, Attention: Secretary. However, if our 2022 annual meeting of stockholders is held before May 5, 2022, or after July 3, 2022, then your proposal must be received a reasonable time before we print and mail our proxy statement for the 2022 Annual Meeting of Stockholders.

If you wish to submit a proposal (including a director nomination) at the meeting that is not to be included in next year’s proxy materials, you must do so no earlier than February 3, 2022, and no later than March 5, 2022, to Arcus Biosciences, Inc., 3928 Point Eden Way Hayward, CA 94545, Attention: Secretary. If such proposal is submitted after March 5, 2022, it will be considered untimely; provided, however, that if our 2022 Annual Meeting of Stockholders is held before May 4, 2022, or after August 2, 2022, then your proposal must be received no earlier than 120 days prior to such annual meeting and not later than the close of business on the later of (a) the 90th day prior to such meeting and (b) the 10th day following the day on which notice of the date of the 2022 Annual Meeting of Stockholders is mailed or public disclosure is made, whichever occurs first. You are also advised to review our bylaws, which contain a description of the information required to be submitted as well as additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for Proposal 1 to elect the directors, votes “For,” “Withhold” and broker non-votes, with respect to Proposals 2 and 3, votes “For”, “Against,” abstentions and, if applicable, broker non-votes, and with respect to Proposal 4, votes for “1 Year,” “2 Years”, “3 Years,” abstentions and, if applicable, broker non-votes.

5.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in street name does not give voting instructions to his or her broker, bank or other securities intermediary holding his or her shares as to how to vote on matters deemed to be “non-routine” under NYSE rules, the broker, bank or other such agent cannot vote the shares. These un-voted shares are counted as “broker non-votes.” Proposals 1, 3 and 4 are considered to be “non-routine” under NYSE rules and we therefore expect broker non-votes to exist in connection with those proposals.

How many votes are needed to approve each proposal?

For the election of directors, the four nominees receiving the most “For” votes from the holders of shares present or represented by proxy and entitled to vote on the election of the director will be elected. Only votes “For” will affect the outcome. “Withheld” and broker non-votes will have no effect.

To be approved, Proposal No. 2, ratification of the selection of Ernst & Young LLP as Arcus’s independent registered public accounting firm for fiscal year ending December 31, 2021, must receive “For” votes from the holders of a majority of shares present or represented by proxy and cast at the meeting. If you “Abstain” from voting, your abstention will not count as a vote being cast, and will have no effect. We do not expect any broker non-votes on Proposal 2.

To be approved, Proposal No. 3, approval of the compensation of our named executive officers, must receive “For” votes from the holders of a majority of shares present or represented by proxy and cast at the meeting. Abstentions and broker non-votes will have no effect.

For Proposal No. 4, the preferred frequency of advisory votes on executive compensation, the frequency receiving a majority of votes from shares present or represented by proxy and cast at the meeting will be the frequency preferred. If no frequency receives a majority of votes from shares present or represented by proxy and cast at the meeting, we will deem the frequency receiving the most votes to be the frequency preferred by stockholders. Abstentions and broker non-votes will have no effect.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the virtual meeting, present by means of remote communication as authorized by the Board in its sole discretion, or represented by proxy. On the record date, there were 70,991,112 shares outstanding and entitled to vote. Thus, the holders of 35,495,557 shares must be present at the virtual meeting or represented by proxy at the virtual meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the virtual meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the meeting or the holders of a majority of shares present at the virtual meeting or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8‑K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

6.

Election of DirectorS

Arcus’s Board of Directors is divided into three classes, and each class has a three-year term. The terms of the Class III directors expire at the 2021 Annual Meeting of Stockholders, the terms of the Class I directors expire at the 2022 Annual Meeting of Stockholders, and the terms of the Class II directors expire at the 2023 Annual Meeting of Stockholders. Vacancies on the Board may be filled only by persons appointed by a majority of the remaining directors. A director appointed by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

There are four directors in the class whose terms of office expire in 2021. If elected at the annual meeting, each of the nominees would serve until the 2024 annual meeting and until his or her successor has been duly elected and qualified, or, if sooner, until his or her death, resignation or removal. Dr. Rosen and Ms. Falberg were previously elected by our stockholders. Ms. Jarrett was recommended for appointment to our Board of Directors by our Chief Executive Officer, and was appointed as a director by our Board in January 2019. Dr. Quigley was designated pursuant to the Investor Rights Agreement entered into between Arcus and Gilead Sciences, Inc. in May 2020, and appointed as a director by our Board in January 2021. We invite and encourage our directors and nominees for director to attend the annual meeting, but have no formal policy regarding their attendance at our annual meetings. All of the directors at the time attended the 2020 Annual Meeting of Stockholders.

Directors are elected by a plurality of the votes of the holders of shares present or represented by proxy and entitled to vote on the election of directors. Accordingly, the four nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the four nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by Arcus. Each nominee has agreed to serve if elected. Arcus’ management has no reason to believe that any nominee will be unable to serve.

The following table sets forth information regarding our directors as of February 1, 2021:

|

NAME |

|

CLASS |

|

AGE |

|

POSITION HELD WITH THE COMPANY |

|

Terry Rosen, Ph.D. |

|

III |

|

61 |

|

Chief Executive Officer, Director and Chairman |

|

Juan Carlos Jaen, Ph.D. |

|

II |

|

63 |

|

President and Director |

|

Yasunori Kaneko, M.D.(1)(2)(3) |

|

I |

|

67 |

|

Director |

|

Patrick Machado, JD(3) |

|

I |

|

56 |

|

Director |

|

Antoni Ribas, M.D., Ph.D. |

|

I |

|

54 |

|

Director |

|

Andrew Perlman, M.D., Ph.D.(3)(4) |

|

I |

|

73 |

|

Director |

|

David Lacey, M.D.(1)(4) |

|

II |

|

68 |

|

Director |

|

Merdad Parsey, M.D., Ph.D. |

|

II |

|

57 |

|

Director |

|

Kathryn Falberg(1)(2) |

|

III |

|

60 |

|

Director |

|

Michael Quigley, Ph.D. |

|

III |

|

39 |

|

Director |

|

Jennifer Jarrett |

|

III |

|

50 |

|

Chief Operating Officer and Director |

|

(1) |

Member of the Audit Committee. |

|

(2) |

Member of the Compensation Committee. |

|

(3) |

Member of the Nominating and Corporate Governance Committee. |

|

(4) |

On April 16, 2021, the Board of Directors appointed Dr. Perlman to the Audit Committee in place of Dr. Lacey and appointed Dr. Lacey to the Nominating and Corporate Governance Committee in place of Dr. Perlman. |

7.

The following is a brief biography of each nominee and each director whose term will continue after the annual meeting.

Nominee for Election as a Class III Director for a Three-year Term Expiring at the 2024 Annual Meeting

Kathryn Falberg has served as a member of our Board since September 2017. She served as the Executive Vice President and Chief Financial Officer of Jazz Pharmaceuticals plc, a biopharmaceutical company, from March 2012 to March 2014, after serving as its Senior Vice President and Chief Financial Officer since December 2009. From 2001 through 2009, Ms. Falberg worked with a number of smaller companies while serving as a corporate director and audit committee chair for several companies. From 1995 to 2001, Ms. Falberg was with Amgen, Inc., where she served as Senior Vice President, Finance and Strategy, and Chief Financial Officer and prior to that as Vice President, Chief Accounting Officer, and Vice President, Treasurer. Ms. Falberg holds an M.B.A. in Finance and B.A. in Economics from the University of California, Los Angeles and is an inactive certified public accountant. Ms. Falberg also serves as a member of the boards of directors, and on the audit committees, of biopharmaceutical companies Urogen Pharma Ltd., Tricida Inc. and Nuvation Bio, and is a member of the board of directors of a technology company, The Trade Desk, Inc. Ms. Falberg previously served on the boards of directors of Aimmune Therapeutics, Inc., Axovant Sciences, Ltd., BioMarin Pharmaceutical Inc., Medivation, Inc., Halozyme Therapeutics, Inc., aTyr Pharma, Inc., and multiple other companies. We believe Ms. Falberg is able to make valuable contributions to our Board of Directors due to her extensive business experience as an executive in the pharmaceutical industry and her service as a director and audit committee member of various other companies.

Jennifer Jarrett has served as our Chief Operating Officer since October 2020 and as a member of our Board since January 2019. Ms. Jarrett served as Vice President, Corporate Development and Capital Markets at Uber, Inc. from January 2019 to October 2020 and prior to that, served as our Chief Operating and Financial Officer from June 2018 to January 2019, and as our Chief Business Officer and Chief Financial Officer from March 2017 to June 2018. From April 2016 to September 2016, Ms. Jarrett was the Chief Financial Officer of Medivation, Inc., a biopharmaceutical company, which was acquired by Pfizer Inc. Prior to that, Ms. Jarrett spent 20 years in investment banking, most recently as Managing Director at Citigroup from July 2010 to April 2016, where she was responsible for managing their west coast life sciences investment banking practice. Before that, Ms. Jarrett was a Director and Managing Director at Credit Suisse from 2000 to 2010, and an associate at Donaldson, Lufkin & Jenrette from 1998 to 2000. During her tenure as an investment banker, Ms. Jarrett covered biotechnology and pharmaceutical companies, primarily in the San Francisco Bay Area. She currently serves on the board of directors of Arena Pharmaceuticals, Inc., Syndax Pharmaceuticals, Inc. and Consonance HFW, and previously served on the board of Audentes Therapeutics until its acquisition by Astellas Pharma Inc. in January 2020. Ms. Jarrett holds a B.A. in Economics, cum laude, from Dartmouth College and an M.B.A. from Stanford Graduate School of Business. We believe that Ms. Jarrett should serve as a director due to her extensive business experience in the pharmaceutical industry, her deep operational knowledge of the company and her service as a director of various other biopharmaceutical companies.

Michael Quigley, Ph.D. has served as a member of our Board since January 2021. Dr. Quigley is currently the Senior Vice President of Research Biology at Gilead, overseeing the company's biology teams and preclinical programs as well as protein biotherapeutics and computational biology and bioinformatics efforts across all therapeutic areas, a role he has held since February 2020. From January 2016 to February 2020, he held roles of increasing responsibility within the biology oncology discovery organization at Bristol-Myers Squibb, most recently as Vice President and Head, Tumor Microenvironment Modulation Thematic Research Center and site head of the company’s Redwood City, California location. In that role, he was responsible for setting strategy for the oncology discovery portfolio and business development activities, overseeing target identification, validation and preclinical development of large and small molecule therapeutics. Prior to joining Bristol-Myers Squibb, Dr. Quigley led teams in Oncology Discovery at MedImmune and Janssen. He also serves on the board of directors of Pionyr Immunotherapeutics and on the scientific advisory board of Enara Bio. Dr. Quigley received his B.S. in Marine Science (Biology) from Eckerd College, his Ph.D. in Immunology from Duke University and completed his post-doctoral studies at the Dana-Farber Cancer Institute, Department of Pediatric Oncology. Dr. Quigley was selected to be appointed to Arcus’s Board of Directors pursuant to the investor rights agreement between Arcus and Gilead and we believe he can make valuable contributions to our Board of Directors due to his extensive research experience in the biopharmaceutical industry.

8.

Terry Rosen, Ph.D. is our co-founder and has served as the Chairman of our Board of Directors since December 2017, our Chief Executive Officer since May 2015 and as a member of our Board since April 2015. He also served as the Chief Executive Officer of PACT Pharma, Inc., a biopharmaceutical company, from November 2016 to December 2017. Immediately prior to the founding of our company, Dr. Rosen served briefly in April 2015 as the Chief Executive Officer of FLX Bio, Inc., a biopharmaceutical company that was spun-off by Flexus Biosciences, Inc., a biopharmaceutical company. Previously, Dr. Rosen co-founded (with Dr. Jaen) and served as the Chief Executive Officer of Flexus Biosciences, Inc. from October 2013 to April 2015, when it was acquired by Bristol-Myers Squibb. Prior to that, Dr. Rosen was at Amgen, Inc., a biopharmaceutical company, from 2004 to January 2013 where he most recently served as Vice President of Therapeutic Discovery from 2011 to January 2013. He also worked at Tularik Inc., a biopharmaceutical company, from 1993 to 2004 when it was acquired by Amgen, Pfizer Central Research, a biopharmaceutical company, from 1987 to 1993, and Abbott Laboratories, a health care company, from 1985 to 1987. Dr. Rosen serves on the board of trustees of the Salk Institute, the California Life Sciences Association and the Berkeley Foundation. He also serves on the boards of Ideaya Biosciences, Inc., PACT Pharma, Epiodyne, Inc., Simcha Therapeutics Holding Company, LLC and Sonoma Biotherapeutics. Dr. Rosen also serves on the scientific advisory board of Sirenas, LLC. Dr. Rosen holds a B.S. in Chemistry from the University of Michigan and a Ph.D. in Chemistry from the University of California, Berkeley. We believe that Dr. Rosen should serve as a director based on his position as one of our founders and as our Chief Executive Officer, his extensive experience in general management and business development and his experience in the field of biosciences.

The Board Of Directors Recommends

A Vote In Favor Of Each Nominee.

Directors Continuing in Office as a Class I Director Until the 2022 Annual Meeting

Yasunori Kaneko, MD has served as a member of our Board since May 2015. Dr. Kaneko was a Managing Director at Skyline Venture Partners, L.P., a venture capital firm, from January 1999 to January 2019. Dr. Kaneko previously served as Chief Financial Officer and Vice President, Business Development at Tularik, Inc., a biopharmaceutical company, at various times from 1992 until 1999. Dr. Kaneko served as a Senior Vice President and Chief Financial Officer of Ionis Pharmaceuticals, Inc., a pharmaceutical company, which went public in May 1991 during his tenure from 1991 to 1992. Dr. Kaneko began his career at Genentech, Inc., a biotechnology company, where he served in a business development role, from 1981 to 1987 and as head of corporate finance in the investment banking division of Paribas Capital Markets LTD, from 1987 to 1991. Dr. Kaneko is a member of the Stanford Interdisciplinary Life Sciences Council and serves on the board of Provigate Inc. Dr. Kaneko served on the board of Nippon Paint Holdings Co., Ltd. from March 2018 to March 2020, and previously served on the board of LeukoSite Inc., a biopharmaceutical company, until its merger with Millennium Pharmaceuticals, Inc. in 1999. Dr. Kaneko received an undergraduate degree and a medical degree from Keio University in Tokyo, and an M.B.A. from Stanford Graduate School of Business. We believe Dr. Kaneko is able to make valuable contributions to our Board of Directors due to his educational background in medicine, as well as his experience in the life science, pharmaceutical and related financial industries.

Patrick Machado, JD has served as a member of our Board since December 2019. Mr. Machado has over two decades of experience growing biopharmaceutical organizations from development through commercialization. He has extensive operational experience, having led finance, business development and legal functions at multiple companies. Mr. Machado co-founded and served as Chief Financial Officer and Chief Business Officer at Medivation, Inc. until his retirement in 2014 and served as a member of Medivation’s Board of Directors from 2014 until its acquisition for approximately $14 billion by Pfizer in 2016. During his tenure at Medivation, Mr. Machado helped lead the company through substantial growth and challenges, providing strong leadership during the clinical development and successful commercial launch of XTANDI® in prostate cancer. Prior to Medivation, Mr. Machado worked at ProDuct Health, Inc. where he held positions as Chief Financial Officer, Senior Vice President of Business Development and General Counsel; Mr. Machado was also responsible for working with national health plans in the U.S. to expand access to patients in need of ductal lavage. Earlier in his career, Mr. Machado served as chief legal counsel to the Chiron Technologies business unit at Chiron Corporation and led the transaction teams for all substantial Chiron Technologies collaborations. Prior to joining Chiron, Mr. Machado worked for Morrison & Foerster LLP, a leading international law firm, and for the Massachusetts Supreme Judicial Court. Mr. Machado also serves as a member of the board of directors of Adverum Biotechnologies, Inc., Chimerix, Inc., Xenon Pharmaceuticals and Turning Point Therapeutics, Inc. and previously served on the board of directors of Endocyte, Inc., Inotek Pharmaceuticals Corporation (now Rocket Pharmaceuticals, Inc.), Axovant Sciences, Inc., Medivation, Inc., Principia Biopharma Inc. and SCYNEXIS,

9.

Inc. Mr. Machado received his J.D. degree from Harvard Law School and holds both a Bachelor of Science degree in Economics and a Bachelor of Arts degree in German from Santa Clara University in California. We believe Mr. Machado is able to make valuable contributions to our Board of Directors due to his extensive business experience as an executive in the pharmaceutical industry.

Andrew Perlman, MD, Ph.D. has served as a member of our Board since December 2020. Dr. Perlman currently serves as Managing Director and Head of non-clinical Development of X-37, LLC, an artificial intelligence-enabled drug discovery company since November 2018. He is also Managing Director and Chief Medical Officer of Velocity Pharmaceutical Development, a pharmaceutical company that acquires attractive drug candidates and rapidly advances them through a commercially relevant clinical proof-of-concept, a position he has held since 2011. Dr. Perlman also served as President of Vitesse Biologics, a biotech company focused on the development of antibody and protein-based therapeutics in the areas of immunology, hematology, and oncology, which was a joint collaboration among Velocity Pharmaceutical Development, Shire and the Mayo Clinic, until its acquisition in December 2020. From 2004 to October 2016, Dr. Perlman was CEO at Innate Immune Inc., a biotech company focused on developing therapies for asthma and autoimmune diseases. From 1993 to 2004, Dr. Perlman served as Vice President and then Executive Vice President of Tularik Inc. (acquired by Amgen), except for nine months in 2002 when he served as CEO of Affymax. At Tularik, Dr, Perlman’s responsibilities included clinical trial design and implementation, business development and financing activities, culminating with Tularik's acquisition by Amgen in 2004 for $1.3 billion. Dr. Perlman began his notable career in drug development at Genentech, where he played a key role in the development, FDA approval, and marketing of Nutropin, a human growth hormone, and was responsible for the development of Genentech’s portfolio of endocrine drugs and drug candidates. Dr. Perlman also serves as an advisor to various companies, including venture capital firms 8VC, V2M Capital, and Avestria Ventures and biotechnology companies Hexagon Bio, Mantra Bio, and Hinge Bio. Dr. Perlman has a B.S. from MIT, an M.D. and a Ph.D. in physiology from New York University. He did his Ph.D. research in the laboratory of Nobel laureate Professor Eric Kandel and received postgraduate clinical training at Stanford School of Medicine and NYU. From 1984 to 1987 he was an assistant professor at Stanford University where he engaged in clinical work, teaching and research on hypertension. We believe Dr. Perlman is able to make valuable contributions to our Board of Directors due to his extensive business, finance and development experience in the biopharmaceutical industry.

Antoni Ribas, MD, Ph.D. has served as a member of our Board since October 2019. Dr. Ribas is an internationally recognized physician-scientist who conducts translational and clinical research aimed at understanding how the immune system can be used to treat cancer. He has been a leader in the research and clinical development of multiple types of therapeutic agents, including immune checkpoint inhibitors, gene-engineered T cells, and BRAF-targeted therapies. His efforts have been instrumental in transforming the treatment paradigm for oncology patients, particularly those with malignant melanoma, having served as principal investigator for multiple trials, including those involving the breakthrough cancer therapy, Keytruda®. Dr. Ribas is Professor of Medicine, Surgery, and Molecular and Medical Pharmacology at the University of California Los Angeles (UCLA), Director of the Tumor Immunology Program at the UCLA Jonsson Comprehensive Cancer Center, and Director of the Parker Institute for Cancer Immunotherapy Center at UCLA. He is currently the President-Elect for the American Association for Cancer Research (AACR). Dr. Ribas has founded or advised several successful biopharma companies in addition to Arcus, such as Kite Pharma and Flexus Biosciences. Most recently, he co-founded PACT Pharma, a company developing personalized cancer neoantigen-targeted T cell therapies, together with Professors David Baltimore and Jim Heath and Arcus co-founders, Terry Rosen and Juan Jaen. Dr. Ribas has been a member of the Arcus Scientific Advisory Board since its creation in 2015 and also serves on its Clinical Advisory Board. Dr. Ribas received MD and Ph.D. degrees from the Universidad de Barcelona (Spain). He completed his internship and residency in medical oncology at the University Hospital Vall d’Hebron (Barcelona, Spain) and conducted postdoctoral research at UCLA. Following a fellowship in hematology/oncology in the Department of Medicine at UCLA, he has held numerous faculty and administrative positions at UCLA since 2001. Dr. Ribas has received a myriad of awards and honors, including the AACR-CRI Lloyd J. Old Award in Cancer Immunology, the AACR Richard and Hinda Rosenthal Award and the National Cancer Institute (NCI) Outstanding Investigator Award. Dr. Ribas has also served on the board of directors of leading scientific organizations such as the AACR and the Society for Immunotherapy for Cancer (SITC). We believe Dr. Ribas is able to make valuable contributions to our Board of Directors due to his extensive experience in medicine and clinical research.

10.

Directors Continuing in Office as a Class II Director Until the 2023 Annual Meeting

Juan Carlos Jaen, Ph.D. is our co-founder and has served as our President since May 2015 and as a member of our Board since April 2015. He also served as the President of PACT Pharma, Inc., a biopharmaceutical company, from November 2016 until December 2017. Immediately prior to the founding of our company, Dr. Jaen served briefly in April 2015 as the President of FLX Bio, Inc. Previously, Dr. Jaen co-founded (with Dr. Rosen) and served as the President and Head of Research and Development at Flexus Biosciences, Inc. from October 2013 to April 2015, when it was acquired by Bristol-Myers Squibb. Prior to that, Dr. Jaen served as Senior Vice President of Drug Discovery and as the Chief Scientific Officer of ChemoCentryx, Inc., a biopharmaceutical company, from 2007 to September 2013. From 2004 to 2006, Dr. Jaen was Vice President of Chemistry at Amgen Inc. and from 1996 to 2004, Dr. Jaen held positions as Director of Medicinal Chemistry and Vice President of Chemistry at Tularik, Inc. Prior to that, Dr. Jaen held several positions in drug discovery and program management, from 1983 to 1996, at the Parke-Davis Pharmaceutical Research division of Warner-Lambert Company, a pharmaceutical company. Dr. Jaen also serves on the board of directors of R2M Pharma, Inc., PACT Pharma, Inc., Breakpoint Therapeutics GmbH, Hexagon Bio, Inc., Shasqi, Inc. and the Bella Charitable Foundation. Dr. Jaen holds a B.S. in Chemistry from the Universidad Complutense de Madrid and a Ph.D. in Organic Chemistry from the University of Michigan. We believe that Dr. Jaen should serve as a director based on his position as one of our founders and as our President, his extensive experience in general management and business development and his experience in the field of biomedical research.

David Lacey, MD has served as a member of our Board since May 2020. Dr. Lacey was Senior Vice President of Discovery Research at Amgen from 2006 to 2011 and was at Amgen from 1994 to 2011. At the end of his tenure he oversaw a research organization of ~1200 encompassing four broad therapeutic areas: Inflammation, Oncology, Metabolic Disorders and Neurosciences that utilized both large and small molecules to interdict validated targets across these focus areas. Kepivance, Prolia, Xgeva, and Repatha were among a number of drugs that emerged from Amgen laboratories while under his supervision. Since retiring from Amgen he has assisted a number of private companies either as a scientific adviser or independent director, sometimes both. He currently serves on the Board of Directors of Argenx, Atreca, Inbiomotion, and Nurix. He obtained both his B.A. and M.D. from the University of Colorado and received his formal training in Anatomic Pathology at Washington University in St. Louis, Missouri. We believe Dr. Lacey is able to make valuable contributions to our Board of Directors due to his extensive experience in drug discovery and management of large research organizations.

Merdad Parsey, MD, Ph.D. has served as a member of our Board since July 2020. Dr. Parsey is currently the Chief Medical Officer of Gilead Sciences, where he is responsible for overseeing Gilead’s global clinical development and medical affairs organizations, a role he has held since November 2019. From October 2015 to November 2019, Dr. Parsey served as Senior Vice President of Early Clinical Development at Genentech, where he led clinical development for areas including inflammation, oncology and infectious diseases. Prior to Genentech, Dr. Parsey served as President and CEO of 3-V Biosciences (now Sagimet BioSciences). Prior to Sagimet BioSciences, Dr. Parsey held development roles at Sepracor, Regeneron and Merck and was Assistant Professor of Medicine and Director of Critical Care Medicine at the New York University School of Medicine. Dr. Parsey completed his MD and Ph.D. at the University of Maryland, Baltimore, his residency in Internal Medicine at Stanford University and his fellowship in Pulmonary and Critical Care Medicine at the University of Colorado. He currently also serves on the Board of Directors for Sagimet BioSciences. Dr. Parsey was selected to be appointed to Arcus’s Board of Directors pursuant to the investor rights agreement between Arcus and Gilead and we believe he is able to make valuable contributions to our Board of Directors due to his extensive clinical development experience.

11.

Independence of The Board of Directors

As required under the New York Stock Exchange (“NYSE”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. The Board consults with Arcus’s counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of NYSE, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and Arcus, its senior management and its independent auditors, the Board has affirmatively determined that the following six directors are independent directors within the meaning of the applicable NYSE listing standards: Ms. Falberg, Dr. Kaneko, Dr. Lacey, Mr. Machado, Dr. Perlman and Dr. Ribas. In making this determination, the Board found that none of these directors had a material or other disqualifying relationship with Arcus. Dr. Rosen, Dr. Jaen and Ms. Jarrett are not independent by virtue of being executive officers of Arcus, and Drs. Quigley and Parsey are not independent by virtue of their relationship with Gilead.

Our Bylaws and Corporate Governance Guidelines provide our Board with the flexibility to combine or separate the positions of Chairman of the Board and Chief Executive Officer. Dr. Rosen currently serves as our Chairman of the Board and Dr. Kaneko serves as our lead independent director. As lead independent director, Dr. Kaneko presides over periodic meetings of our independent directors, serves as a liaison between our Chief Executive Officer and the independent directors and performs such additional duties as our Board of Directors may otherwise determine and delegate. We believe that our current leadership structure is appropriate as it allows our Board of Directors to benefit from Dr. Rosen’s in-depth knowledge of our business in formulating and implementing strategic initiatives, provides a unified leadership to confront challenges facing our business, and enhances our ability to communicate our message and strategy clearly and consistently to stockholders. We will continue to periodically review our leadership structure and may make changes in the future if appropriate.

Role of the Board in Risk Oversight

One of the key functions of our Board of Directors is informed oversight of our risk management process. In particular, our Board of Directors is responsible for monitoring and assessing strategic risk exposure. Our executive officers are responsible for the day-to-day management of the material risks we face. Our Board of Directors administers its oversight function directly as a whole, as well as through various standing committees that address risks inherent in their respective areas of oversight. Our Audit Committee oversees the management of risks associated with our financial reporting, accounting and auditing matters; our Compensation Committee oversees the management of risks associated with our compensation policies and programs; and our Nominating and Corporate Governance Committee oversees the management of risks associated with director independence, conflicts of interest, composition and organization of our Board of Directors and director succession planning. In connection with the COVID-19 outbreak, our Board has received regular updates from management on its impact to our employees, operations and business, and has input into the company’s evolving risk mitigation plans.

Meetings of The Board of Directors

The Board of Directors met ten times during the last fiscal year. As required under applicable NYSE listing standards, in fiscal year 2020, Arcus’s independent directors met in regularly scheduled executive sessions at which only independent directors were present. All of our directors attended at least 75% of the aggregate number of meetings of the Board and of the committees on which they served, held during the portion of the last fiscal year for which they were directors or committee members, respectively.

12.

Information Regarding Committees of the Board of Directors

The Board has three committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for fiscal 2020 for each of the Board committees (Drs. Rosen, Jaen, Parsey, Quigley, Ribas, and Ms. Jarrett, did not serve on any committees in 2020 or to date):

|

Name |

|

Audit |

|

Compensation |

|

Nominating and Corporate Governance |

|

Kathryn Falberg |

|

x* |

|

x |

|

|

|

Yasunori Kaneko |

|

x |

|

x* |

|

x* |

|

David Lacey(1)(4) |

|

x |

|

|

|

|

|

Patrick Machado(2) |

|

|

|

|

|

x |

|

Andrew Perlman(3)(4) |

|

|

|

|

|

x |

|

Total meetings in fiscal 2020 |

|

6 |

|

6 |

|

4 |

* Committee Chairperson

(1) Dr. Lacey was appointed to the Audit Committee in June 2020.

(2) Mr. Machado was appointed to the Nominating and Corporate Governance Committee in June 2020.

(3) Dr. Perlman joined the Board and the Nominating and Corporate Governance Committee in December 2020.

(4) On April 16, 2021, the Board of Directors appointed Dr. Perlman to the Audit Committee in place of Dr. Lacey and appointed Dr. Lacey to the Nominating and Corporate Governance Committee in place of Dr. Perlman.

Below is a description of each committee of the Board of Directors.

Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board of Directors has determined that each member of each committee meets the applicable NYSE rules and regulations regarding “independence” and each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to Arcus.

The Audit Committee of the Board of Directors is established by the Board in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to oversee Arcus’s corporate accounting and financial reporting processes and audits of its financial statements. For this purpose, the Audit Committee performs several functions. The Audit Committee assists our Board of Directors with:

|

|

• |

its oversight of the integrity of our consolidated financial statements; |

|

|

• |

our compliance with legal and regulatory requirements; the qualifications, independence and performance of the independent registered public accounting firm; and |

|

|

• |

the design and implementation of our financial risk assessment and risk management. |

Among other things, our Audit Committee is responsible for reviewing and discussing with our management the adequacy and effectiveness of our disclosure controls and procedures. The Audit Committee also discusses with our management and independent registered public accounting firm the annual audit plan and scope of audit activities, scope and timing of the annual audit of our consolidated financial statements, and the results of the audit, quarterly reviews of our consolidated financial statements and, as appropriate, initiates inquiries into certain aspects of our financial affairs. Our Audit Committee is responsible for establishing and overseeing procedures for the receipt, retention and treatment of any complaints regarding accounting, internal accounting controls or auditing matters, as well as for the confidential and anonymous submissions by our employees of concerns regarding questionable accounting or auditing matters. In addition, our Audit Committee has direct responsibility for the appointment, compensation, retention and oversight of the work of our independent registered public accounting firm. Our Audit Committee has sole authority to approve the hiring and discharging of our independent registered public accounting firm, all audit engagement terms and fees and all permissible non-audit engagements with the independent auditor. Our Audit Committee reviews and oversees all related person transactions in accordance with our policies and procedures.

13.

The Audit Committee is composed of three directors: Ms. Falberg, Dr. Kaneko and Dr. Perlman. On April 16, 2021, the Board of Directors determined that Dr. Lacey did not meet the heightened independence requirements for service on the Audit Committee as required by the rules and regulations of the SEC and, as a result, the listing standards of the New York Stock Exchange applicable to audit committee members. Upon making this determination, the Board of Directors appointed Dr. Perlman to the Audit Committee in place of Dr. Lacey and appointed Dr. Lacey to the Nominating and Corporate Governance Committee in place of Dr. Perlman. Due to Dr. Lacey serving on the Audit Committee at the time of the completion of the audit of our financial statements for the year ended December 31, 2020, his name appears under the “Report of the Audit Committee of the Board of Directors” below. Each member of our Audit Committee is independent under the rules and regulations of the SEC and the listing standards of the New York Stock Exchange applicable to audit committee members. Ms. Falberg is the chair of the Audit Committee. Our Board of Directors has determined that each of Ms. Falberg and Dr. Kaneko qualify as an audit committee financial expert within the meaning of SEC regulations and meet the financial sophistication requirements of the New York Stock Exchange. In addition, our Board of Directors has determined that Ms. Falberg’s simultaneous service on the audit committees of three other public companies does not impair the ability of Ms. Falberg to effectively serve on the Audit Committee. The Board of Directors has adopted a written Audit Committee charter that is available to stockholders on Arcus’s website at www.arcusbio.com.

Report of the Audit Committee of the Board of Directors

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2020 with management of the company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the Securities and Exchange Commission. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the company’s Annual Report on Form 10‑K for the fiscal year ended December 31, 2020.

Kathryn Falberg, Chair

Yasunori Kaneko

David Lacey

The Compensation Committee is composed of two directors: Dr. Kaneko and Ms. Falberg. Each member of Arcus’s Compensation Committee is independent (as independence is currently defined in NYSE Listed Company Manual Section 303A.02 as applied to compensation committee members). The Board has adopted a written Compensation Committee charter that is available to stockholders on Arcus’s website at www.arcusbio.com.

The Compensation Committee of the Board of Directors acts on behalf of the Board to review, adopt and oversee Arcus’s compensation strategy, policies, plans and programs, including:

|

|

• |

establishment of corporate and individual performance objectives relevant to the compensation of Arcus’s directors, officers and employees and evaluation of performance in light of these stated objectives; |

|

|

• |

review and approval of the compensation and other terms of employment or service, including severance and change-in-control arrangements, of our Chief Executive Officer and the other executive officers and directors; and |

|

|

• |

administration of Arcus’s equity compensation plans, pension and profit-sharing plans, deferred compensation plans and other similar plan and programs. |

Compensation Committee Processes and Procedures

Typically, the Compensation Committee meets at least annually and with greater frequency if necessary. The agenda for each meeting is usually developed by the Chair of the Compensation Committee, in consultation with the Chief Executive Officer. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by

14.

the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of Arcus. In addition, under the charter, the Compensation Committee has the authority to obtain, at the expense of Arcus, advice and assistance from compensation consultants and internal and external legal, accounting or other advisors and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. The Compensation Committee has direct responsibility for the oversight of the work of any consultants or advisers engaged for the purpose of advising the Compensation Committee. In particular, the Compensation Committee has the sole authority to retain, in its sole discretion, compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. Under the charter, the Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the Compensation Committee, other than in-house legal counsel and certain other types of advisers, only after taking into consideration six factors, prescribed by the SEC and NYSE, that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

Our Compensation Committee utilizes Radford, Inc. (“Radford”), a nationally-recognized compensation consulting firm, to assist the Compensation Committee in developing appropriate incentive plans for our directors and executives on an annual basis, to provide the Compensation Committee with advice and ongoing recommendations regarding material executive compensation decisions, and to review compensation proposals of management. The Compensation Committee reviewed the independence of Radford, taking into consideration the six factors prescribed by the SEC and NYSE. Based on this assessment, the Compensation Committee determined that the engagement of Radford does not raise any conflicts of interest. In addition, the Compensation Committee evaluated the independence of its other outside advisors to the Compensation Committee, including outside legal counsel, considering the same independence factors.

Under its charter, the Compensation Committee may form, and delegate authority to, subcommittees as appropriate. In 2018, the Compensation Committee formed an Equity Committee, currently composed of Dr. Jaen, to which it delegated authority to grant, without any further action required by the Compensation Committee, equity awards to employees who are not officers of Arcus. The purpose of this delegation of authority is to enhance the flexibility of equity administration within Arcus and to facilitate the timely grant of equity awards to non-management employees, including any annual grants to continuing employees, within specified limits approved by the Compensation Committee.

The specific determinations of the Compensation Committee with respect to executive compensation for fiscal year 2020 are described in greater detail in the “Executive Compensation” section of this proxy statement.

Compensation Committee Interlocks and Insider Participation

As noted above, Arcus’s Compensation Committee consists of Dr. Kaneko and Ms. Falberg. None of the members of our Compensation Committee has at any time during the past three years been one of our officers or employees. None of our executive officers currently serves or in the prior three years has served as a member of the Board of Directors or Compensation Committee of any entity that has one or more executive officers serving on our Board of Directors or Compensation Committee.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying, reviewing and evaluating candidates to serve as directors of Arcus (consistent with criteria approved by the Board), reviewing and evaluating incumbent directors, recommending to the Board for selection candidates for election to the Board of Directors, making recommendations to the Board regarding the membership of the committees of the Board, assessing the performance of the Board, and recommending to the board a set of corporate governance principles for Arcus.

15.

The Nominating and Corporate Governance Committee is composed of three directors: Dr. Kaneko, Mr. Machado and Dr. Perlman. Dr. Kaneko is the chair of the Nominating and Corporate Governance Committee. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in NYSE Listed Company Manual Section 303A.02). The Board has adopted a written Nominating and Corporate Governance Committee charter that is available to stockholders on Arcus’s website, www.arcusbio.com.

The Nominating and Corporate Governance Committee considers several factors in evaluating potential candidates for the Board. The director qualifications that the Nominating and Corporate Governance Committee has developed to date focus on what the Nominating and Corporate Governance Committee believes to be essential competencies to effectively serve on the Board, including possessing relevant expertise upon which to be able to offer advice and guidance to management, demonstrated excellence in his or her field, having the ability to exercise sound business judgment, having the commitment to rigorously represent the long-term interests of our stockholders, and having sufficient time to devote to the affairs of Arcus. The Nominating and Corporate Governance Committee identifies potential candidates by using its network of contacts as well as solicits additional potential candidates from the Board.

The Nominating and Corporate Governance Committee does not have a formal policy with regard to the consideration of diversity in identifying director nominees, but the Nominating and Corporate Governance Committee strives to nominate directors with a variety of individual backgrounds and complementary skills so that, as a group, the Board will possess the appropriate talent, skills and expertise to oversee Arcus’s business and operations.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Corporate Secretary at 3928 Point Eden Way, Hayward, CA 94545 at least 120 days prior to the anniversary date of the mailing of the proxy statement for the last annual meeting of stockholders and must include the following information:

|

|

• |

name and address of the nominating stockholder; |

|

|

• |

a representation that the nominating stockholder is a record holder; |

|

|

• |

a representation that the nominating stockholder intends to appear in person or by proxy at the annual meeting to nominate the person or persons specified; |

|

|

• |

information regarding each nominee that would be required to be included in a proxy statement; |

|

|

• |

a description of any arrangements or understandings between the nominating stockholder and the nominee; and |

|

|

• |

the consent of each nominee to serve as a director, if elected. |

The Nominating and Corporate Governance Committee will evaluate candidates recommended by a stockholder in the same manner as candidates identified any other person, including members of the Board.

Stockholder Communications With The Board Of Directors