Form DEF 14A ATHERSYS, INC / NEW For: Jun 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||

| x | Definitive Proxy Statement | |||||||

| ☐ | Definitive Additional Materials | |||||||

| ☐ | Soliciting Material Pursuant to Section 240.14a-12. | |||||||

Athersys, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||||||||||||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||||||||

| (5) | Total fee paid: | |||||||||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||||||||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||||||||||||

| (1) | Amount Previously Paid: | |||||||||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||||||||

| (3) | Filing Party: | |||||||||||||

| (4) | Date Filed: | |||||||||||||

| A MESSAGE FROM THE CHAIRMAN OF THE BOARD AND THE INTERIM CEO OF ATHERSYS | |||||

| Dear Stockholders: | |||||

On behalf of Athersys' Board of Directors, thank you for your investment and your support of the Athersys mission to bring innovative new therapies to patients in need. We are committed to building a global leader in regenerative medicine and cell therapy. We intend to develop and ultimately deliver innovative cell therapies that provide a substantial benefit to patients who face severe debilitation and loss of function, material erosion to quality of life, and risk to survival as a result of a serious condition or trauma. The year 2021 is an important period for the Company. We expect to see top-line results from our Japan partner’s ischemic stroke study, giving us our first look at late-stage clinical trial data for the MultiStem® treatment of ischemic stroke, while we further advance our own ischemic stroke and other clinical studies. We also expect to further advance our large-scale manufacturing processes to enable us to effectively serve large markets, such as ischemic stroke and other critical care areas, with our cell therapy product candidate. Favorable clinical trial results and viable large scale manufacturing processes would provide the foundation either through partnership or organic growth for successful commercialization, as we await the results of our own pivotal stroke trial. Last year, we had the opportunity to refresh our Board and recruited three independent directors, deepening our Board's diversity in gender, ethnicity, skill and expertise. The Board is committed to continuous improvement, and we have enhanced the environmental, social and governance (ESG) disclosures on our website and in the accompanying proxy statement. Members of our Board participated in stockholder engagement calls recently in an effort to learn what matters most to our investors and stakeholders, and we are grateful for the feedback we received. We understand that ESG integration is an evolution and not a revolution, and we are pleased to report these improvements, taking ESG concepts into our decision-making as we grow and transition to a commercial stage company. Your vote is important and needed. The Board of Directors unanimously recommends that you vote: "FOR" each of the director nominees and “FOR” the other three proposals. This year, we have a proposal on the ballot to increase the number of our authorized shares of common stock, an action which requires the approval of a majority of our outstanding shares of common stock. We ask for your vote to increase the number of our authorized shares of common stock. Athersys is on the cusp of a transition to a commercial-stage company, contingent upon positive data and regulatory approval, and as such, must prepare for a diverse set of options to allow for the capital needed for future growth. We hope you will join us at our virtual 2021 Annual Meeting of Stockholders, on Tuesday, June 15, 2021 at 8:30 a.m., Eastern Daylight Time. We are pleased to enclose the notice of our Annual Meeting, together with the proxy statement, the proxy and an envelope for returning the proxy. Thank you for being a part of our mission to bring MultiStem to patients around the world. Sincerely, Dr. Ismail Kola Chairman of the Board & Independent Director Mr. William (BJ) Lehmann Interim Chief Executive Officer, President and Chief Operating Officer | |||||

| /s/ Dr. Ismail Kola | /s/ Mr. William Lehmann | ||||

| Dr. Ismail Kola | Mr. William Lehmann | ||||

| Chairman of the Board, Independent Director | Interim Chief Executive Officer, President and Chief Operating Officer | ||||

April 29, 2021 | April 29, 2021 | ||||

| ||||||||||||||

| Building a Better Future Through Our Mission | ||||||||||||||

| We are committed to addressing areas of significant unmet medical need through the development of innovative regenerative medicine therapies that extend and enhance the quality of human life. | ||||||||||||||

| OUR CORE VALUES | ||||||||||||||

|  |  |  |  | ||||||||||

| Teamwork through Cooperation | Excellence and Innovation | Creating a Work Environment where Anything is Possible | Corporate and Personal Responsibility to Humanity and the Environment | Honesty and Integrity | ||||||||||

| Environmental, Social and Governance (ESG) Highlights | ||||||||||||||

| Athersys engages in stockholder outreach to discuss its business, compensation program, diversity and inclusion, and ESG matters. These conversations give us valuable insight into stockholder views and help inform our decisions. Stockholder feedback is summarized and shared with our Board of Directors. As part of our commitment to continuous improvement, we are expanding on the disclosures within this proxy statement and have outlined our ESG highlights. We have also created an ESG presentation that can be accessed at www.athersys.com/presentations. The information on our website, including our ESG presentation, is not, and will not be deemed to be, a part of this proxy statement or incorporated into any of our other filings with the Securities and Exchange Commission (SEC). | ||||||||||||||

| Environmental | |||||

| We have few environmental risks but take many opportunities to show environmental leadership. | |||||

| Environmental stewardship is part of our five core values, and we encourage our employees to be environmental leaders. | |||||

| Our Green Committee meets quarterly to discuss ways we can be more environmentally friendly. | |||||

| We have implemented environmentally-responsible waste collection, composting, recycling and disposal programs. | |||||

| We are using leading, environmentally-responsible and carbon-footprint principles as we plan for our manufacturing facility. | |||||

| We provide Company-sponsored philanthropic opportunities for employees. | |||||

| Social | |||||

| Our ability to help people extends well beyond working to treat some of the most devastating and expensive medical conditions. | |||||

| Our mission is to help patients around the world through the development of innovative therapies to treat areas of significant unmet medical need. | |||||

| Our employees are our brain trust. We value their commitment and reward them with competitive salaries, as well as health, wellness, retirement and benefit programs. All employees also participate in our annual stock-based awards program. | |||||

| We offer our employees internal advancement opportunities. | |||||

| We have a strong corporate culture with a unified mission to help patients and their families. | |||||

| We have a diverse management team and international workforce. | |||||

| We are implementing a Company-wide employee engagement survey in 2021 to seek ways to improve our corporate culture. | |||||

| We utilize development tools that enable us to focus on employee development and positively increase employee engagement. | |||||

| We encourage our employees, Board members, stockholders and patients to share their thoughts and we actively seek their perspectives. | |||||

Athersys Workforce Key Statistics1 | ||||||||||||||||||||

| 25% | 15% | 61% | 44% | |||||||||||||||||

| employees have been at the Company longer than 10 years | are diverse by ethnicity | are diverse by gender | hold advanced degrees | |||||||||||||||||

1 As of April 2021 | ||||||||||||||||||||

| Governance | |||||

| We have a strong governance structure that supports our leading scientific and development profile. | |||||

| Two-thirds of our Board members are independent. | |||||

| We hold annual elections for membership on the Board. | |||||

| Our Board is diverse, with the majority of the members diverse by ethnicity or gender. | |||||

| We have one class of voting shares, majority voting in the election of directors and no poison pill. | |||||

| We engage an experienced external consultant and use other comparative market information to evaluate our compensation practices each year, helping to ensure internal and external pay parity. | |||||

| Our Board provides strategic oversight on operational, resource, management and financial matters. | |||||

| We have a strong Board committee structure, with independent directors on the Audit, Compensation and Nominations and Corporate Governance Committees. | |||||

| We hold annual Board and committee self-assessment reviews. | |||||

| We have robust ethics and code of conduct policies. | |||||

TENURE, INDEPENDENCE, GENDER AND DIVERSITY OF THE BOARD OF DIRECTORS

| Director | Tenure | Independent | Gender Diversity (other than male) | Ethnic Diversity (other than Caucasian/European) | |||||||||||||

| 0-5 years | 6+ years | ||||||||||||||||

Ismail Kola, PhD (Med) v | ü | ü | ü | ||||||||||||||

| John Harrington, PhD | ü | ||||||||||||||||

| Hardy TS Kagimoto, MD | ü | ü | |||||||||||||||

| Katherine Kalin, MBA | ü | ü | ü | ||||||||||||||

| Lorin Randall, MBA | ü | ü | |||||||||||||||

| Baiju Shah, JD | ü | ü | ü | ||||||||||||||

| Kenneth Traub, MBA | ü | ||||||||||||||||

| Jane Wasman, JD | ü | ü | ü | ||||||||||||||

| Jack Wyszomierski, MS | ü | ü | |||||||||||||||

v Denotes Chair | |||||||||||||||||

| Board of Directors Key Statistics | ||||||||||||||||||||

| 56% | 67% | 33% | 22% | |||||||||||||||||

| have a tenure of 0-5 years | are Independent | are diverse by ethnicity | are diverse by gender | |||||||||||||||||

BOARD OF DIRECTORS EXPERIENCE MATRIX

| Director | Healthcare and Pharma | Medicine & Science | Business Leadership & Operations | Partnerships & Business Development | Financing & Accounting | ||||||||||||

Ismail Kola, PhD(Med) v | ü | ü | ü | ü | |||||||||||||

| John Harrington, PhD | ü | ü | ü | ü | |||||||||||||

| Hardy TS Kagimoto, MD | ü | ü | ü | ü | |||||||||||||

| Katherine Kalin, MBA | ü | ü | ü | ü | |||||||||||||

| Lorin Randall, MBA | ü | ü | ü | ||||||||||||||

| Baiju Shah, JD | ü | ü | ü | ||||||||||||||

| Kenneth Traub, MBA | ü | ü | ü | ü | |||||||||||||

| Jane Wasman, JD | ü | ü | ü | ||||||||||||||

| Jack Wyszomierski, MS | ü | ü | ü | ||||||||||||||

vDenotes Chair | |||||||||||||||||

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS ON

June 15, 2021

The 2021 Annual Meeting will be a virtual meeting. Due to the public health impact of the novel coronavirus (COVID-19) pandemic and to protect the health and safety of our stockholders, employees and their families, we will not hold an in-person meeting. The Company is holding a virtual Annual Meeting only and stockholders can participate online at http://www.virtualshareholdermeeting.com/ATHX2021 at the appointed date and time. To attend the Annual Meeting, you will need the 16-digit control number located on your proxy card. Please keep your control number in a safe place so it is available to you for the meeting. Using this control number, you will be able to participate in the live meeting. Please allow ample time for online check-in, which will begin at 8:15 a.m., Eastern Daylight Time, on June 15, 2021. | |||||

| ANNUAL MEETING OF STOCKHOLDERS | |||||

| Date and Time | June 15, 2021 at 8:30 AM EDT | ||||

| Website URL | http://www.virtualshareholdermeeting.com/ATHX2021 | ||||

| Record Date | April 23, 2021 | ||||

| Voting | Holders of outstanding shares of common stock as of the record are entitled to vote | ||||

| Stock Symbol | ATHX | ||||

| Exchange | The Nasdaq Capital Market | ||||

| Transfer Agent | Computershare | ||||

The 2021 Annual Meeting of Stockholders, or Annual Meeting, of Athersys, Inc., a Delaware corporation, will be held for the following purposes: | |||||

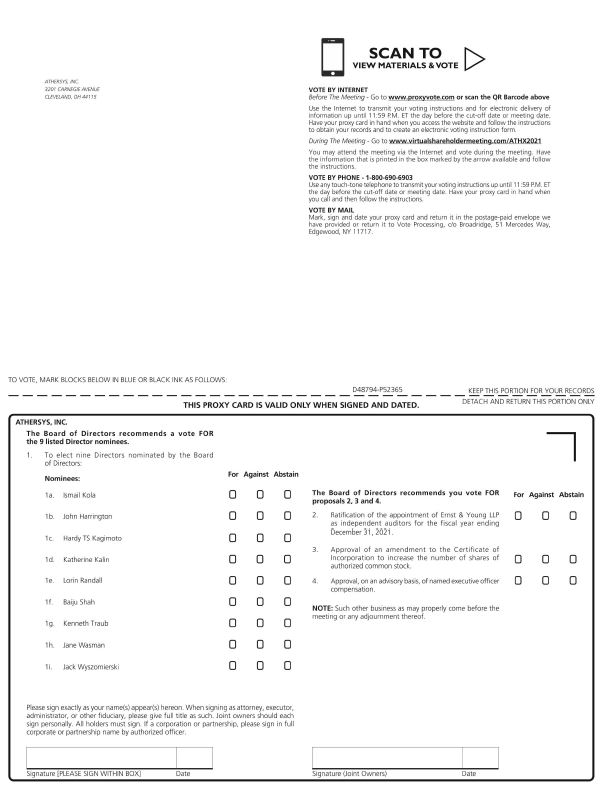

| 1 | To elect the nine Directors nominated by the Board of Directors; | ||||

| 2 | To ratify the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2021; | ||||

| 3 | To approve an amendment to our Certificate of Incorporation to increase the number of shares of authorized common stock; | ||||

| 4 | To approve, on an advisory basis, named executive officer compensation; and | ||||

| 5 | To consider other business as may properly come before the Annual Meeting or any adjournment thereof. | ||||

Your vote is very important to us. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. Stockholders of record at the close of business on Friday, April 23, 2021 are entitled to vote at the Annual Meeting. | ||||||||

| Your Board of Directors unanimously recommends that you vote: "FOR" the following: | ||||||||

| ü | FOR | Each of the nine Directors nominated by the Board of Directors; | ||||||

| ü | FOR | The ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2021; | ||||||

| ü | FOR | The approval of an amendment to our Certificate of Incorporation to increase the number of shares of authorized common stock; and | ||||||

| ü | FOR | The approval, on an advisory basis, of named executive officer compensation. | ||||||

| MANY WAYS TO VOTE | ||||||||||||||

| : | ) | * |  |  | ||||||||||

| BY INTERNET | BY PHONE | BY MAIL | IN PERSON | SCAN QR CODE | ||||||||||

| Visit www.proxyvote.com | Dial 1-800-690-6903 | Sign, date and return your proxy card or voting instruction form | Vote in person at the virtual meeting | Scan the QR code on your Proxy Card to vote. | ||||||||||

Even if you expect to attend the virtual Annual Meeting, please promptly complete, sign, date and mail the enclosed proxy. A self-addressed envelope is enclosed for your convenience. No postage is required if mailed in the United States. You may vote online during the Annual Meeting by following the instructions on the meeting website and if you have the 16-digit control number on your proxy card in the box marked by the arrow. Stockholders who attend the Annual Meeting may revoke their proxies and vote online during the meeting if they so desire. You may also vote electronically at www.proxyvote.com or telephonically at 1-800-690-6903 within the United States and Canada. | ||||||||||||||

| By Order of the Board of Directors | ||||||||||||||

| /s/ William Lehmann | ||||||||||||||

| William Lehmann | ||||||||||||||

| Secretary | ||||||||||||||

April 29, 2021 | ||||||||||||||

Athersys, Inc.

3201 Carnegie Avenue

Cleveland, Ohio 44115-2634

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 15, 2021

The 2021 Annual Meeting of Stockholders, or Annual Meeting, of Athersys, Inc., a Delaware corporation, which we refer to as the “Company,” “Athersys,” “we” and “us”, will be held on Tuesday, June 15, 2021, at 8:30 a.m., Eastern Daylight Time, at http://www.virtualshareholdermeeting.com/ATHX2021.

This proxy statement is furnished in connection with the solicitation by the Board of Directors of the Company, which we refer to as the Board, of proxies to be used at the Annual Meeting. This proxy statement and the related proxy are being mailed to stockholders commencing on or about May 6, 2021.

Stockholders of record of the Company at the close of business on Friday, April 23, 2021, or the Record Date, will be entitled to vote at the Annual Meeting. As of April 23, 2021, 220,821,507 shares of common stock, par value $0.001 per share, of the Company, which we refer to as Common Stock, were outstanding and entitled to vote. Stockholders have no right to cumulative voting as to any matter, including the election of Directors. Each share of Common Stock is entitled to one vote. At the Annual Meeting, inspectors of election shall determine the presence of a quorum and shall tabulate the results of the vote of the stockholders. The holders of a majority of the total number of outstanding shares of Common Stock entitled to vote must be present in person online or by proxy to constitute the necessary quorum for any business to be transacted at the Annual Meeting. Properly executed proxies marked “abstain,” as well as “broker non-votes,” as described below, will be considered “present” for purposes of determining whether a quorum has been achieved at the Annual Meeting.

Virtual Annual Meeting

As permitted by Delaware law and our bylaws, we have implemented the virtual annual meeting format in order to mitigate the public health impact of the COVID-19 pandemic and to protect the health and safety of our stockholders, employees and their families.

We remain sensitive to concerns regarding virtual meetings generally from investor advisory groups and other stockholder rights advocates who have voiced concerns that virtual meetings may diminish stockholder voice or reduce accountability. In preparation for the virtual Annual Meeting, (i) we will implement reasonable measures to verify that each person deemed present and permitted to vote at the meeting is a stockholder or proxy holder, (ii) we will implement reasonable measures to provide stockholders and proxy holders a reasonable opportunity to participate in the meeting and to vote on matters submitted to stockholders, including an opportunity to read or hear the proceedings of the meeting substantially concurrently with such proceedings, and (iii) we will maintain a record of any votes or other action taken by stockholders or proxy holders at the meeting. Additionally, the online format allows stockholders to communicate with us during the meeting so they can ask appropriate questions of the Board or management in accordance with the rules of conduct for the meeting. During the live Q&A session of the meeting, we will answer relevant questions as time permits.

Information regarding the ability of stockholders to ask questions during the Annual Meeting, related rules of conduct at the Annual Meeting, and procedures for posting appropriate questions received during the Annual Meeting, will be posted on our investor relations page in advance of the Annual Meeting. Similarly, matters addressing technical and logistical issues, including technical support during the Annual Meeting and related to accessing the Annual Meeting’s virtual meeting platform, will be available at: http://www.virtualshareholdermeeting.com/ATHX2021.

Attendance and Participation

Our completely virtual Annual Meeting will be conducted on the Internet via live webcast. You will be able to participate in the Annual Meeting online and submit your questions during the meeting; however, we encourage the submission of questions in advance by emailing ir@athersys.com. You also will be able to vote your shares electronically at the Annual Meeting; however, we encourage stockholders to submit their votes electronically in advance.

All stockholders of record as of the Record Date, or their duly appointed proxies, may participate in the

1

Annual Meeting. To participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card that accompanied your proxy materials, and may also be required to provide your full name to help us validate that you are a stockholder of record. The Annual Meeting webcast will begin promptly at 8:30 a.m., Eastern Daylight Time. We encourage you to access the meeting prior to the start time. Online access will begin at 8:15 a.m., Eastern Daylight Time.

The virtual meeting platform is fully supported across all browsers and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a strong internet connection wherever they intend to participate in the meeting. Participants should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the meeting.

Questions

Stockholders may submit questions prior to or during the Annual Meeting. If you wish to submit a question during the meeting, you must first provide your full name, then type your question into the “Ask a Question” field, and click “Submit”. Questions pertinent to meeting matters will be answered during the meeting, subject to time constraints.

Technical Difficulties

When you access the website at http://www.virtualshareholdermeeting.com/ATHX2021, we will have technicians ready to assist you with any technical difficulties you may have. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or during the meeting time, you will have access to technical support. Technical support will be available beginning at 8:15 a.m., Eastern Daylight Time, on June 15, 2021 through the conclusion of the Annual Meeting.

Required Vote, Abstentions, Broker Non-Votes and Related Matters

Brokers or other nominees who hold shares of Common Stock in “street name” for a beneficial owner of those shares typically have the authority to vote in their discretion on “routine” proposals when they have not received instructions from beneficial owners. However, brokers are not allowed to exercise their voting discretion with respect to the election of Directors or for the approval of other matters that are “non-routine,” without specific instructions from the beneficial owner. The vote required and the treatment of abstentions and broker non-votes for each proposal are described below.

Proposal One— Election of Directors is considered a non-routine matter, and without your instruction, your broker cannot vote your shares with respect to this proposal. The nominees for Director shall be elected by a majority of the votes cast in person or by proxy for the Director at the Annual Meeting. For this purpose, a majority of the votes cast shall mean that the number of shares voted “for” a Director’s election exceeds 50% of the number of votes cast, and votes cast shall exclude abstentions and broker non-votes. In any uncontested election of Directors, any incumbent director nominee who does not receive a majority of the votes cast shall promptly tender his or her resignation to the Board. The Board shall decide, taking into account the recommendation of the Nominations and Corporate Governance Committee of the Board, whether to accept or reject the tendered resignation, or whether other action should be taken.

Proposal Two— Ratification of the Appointment of Ernst & Young LLP as the Company’s Independent Auditors for the Fiscal Year Ending December 31, 2021 is considered to be a routine matter. Accordingly, we do not expect broker non-votes on this proposal. The affirmative vote of the holders of a majority of the shares cast for or against, in person or by proxy and entitled to vote, is necessary for the ratification of the appointment of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending December 31, 2021. Under the Company’s bylaws, abstentions will have no effect on this proposal. As an advisory vote, the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2021 is not binding on the Company.

Proposal Three— Approval of an Amendment to the Company’s Certificate of Incorporation to Increase the Number of Shares of Authorized Common Stock is considered a routine matter. Accordingly, we do not expect broker non-votes on this proposal. Under the General Corporation Law of the State of Delaware, the approval of this proposal requires the affirmative vote of a majority of the shares of Common Stock outstanding and entitled to vote

2

on such proposal at the Annual Meeting. Consequently, abstentions will have the effect of votes “against” the proposal.

Proposal Four— Approval, on an Advisory Basis, of Named Executive Officer Compensation is considered a non-routine matter, and without your instruction, your broker cannot vote your shares with respect to this proposal. Approval of this proposal requires the affirmative vote of a majority of the votes cast for or against, in person or by proxy and entitled to vote, on such proposal at the Annual Meeting. Under the Company’s bylaws, abstentions and broker non-votes will have no effect on this proposal.

The shares of Common Stock represented by all valid proxies received will be voted in the manner specified on the proxies. Where specific choices are not indicated on a valid proxy, the shares of Common Stock represented by such proxies received will be voted: (i) for the election of each of the nine Director nominees named in this proxy statement; (ii) for the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2021; (iii) for the approval of an amendment to our Certificate of Incorporation to increase the number of authorized shares of common stock; (iv) for the approval, on an advisory basis, of named executive officer compensation; and (v) in accordance with the best judgment of the persons named in the enclosed proxy, or their substitutes, for other business as may properly come before the Annual Meeting or any adjournment thereof.

Returning your completed proxy will not prevent you from voting in person at the Annual Meeting should you be present and desire to do so. In addition, you may revoke the proxy at any time prior to its exercise either by giving written notice to the Company or by submission of a later-dated proxy.

3

PROPOSAL ONE

ELECTION OF DIRECTORS

The Board currently consists of the following nine Directors: John J. Harrington, Hardy TS Kagimoto, Katherine Kalin, Ismail Kola, Lorin J. Randall, Baiju R. Shah, Kenneth H. Traub, Jane Wasman and Jack L. Wyszomierski, and their current term of office will expire at the Annual Meeting.

At each annual stockholders’ meeting, Directors are elected for a one-year term and hold office until their successors are elected and qualified or until their earlier removal or resignation. Newly created directorships resulting from an increase in the authorized number of Directors or any vacancies on the Board resulting from death, resignation, disqualification, removal or other cause may be filled by a majority vote of the remaining Directors then in office.

At the Annual Meeting, nine Directors are to be elected to hold office for a term of one year and until their successors are elected and qualified. The Board recommends that its nominees for Director be elected at the Annual Meeting. The nominees are John J. Harrington, Hardy TS Kagimoto, Katherine Kalin, Ismail Kola, Lorin J. Randall, Baiju R. Shah, Kenneth H. Traub, Jane Wasman and Jack L. Wyszomierski.

The composition of our Board is intentional and reflects the qualifications, skills and experience that are relevant to a biotechnology business. Our Board members have experience in the pharmaceutical and biotechnology sector and have expertise in business, science and medicine, and finance. In addition to the qualifications, skills and experience listed below, our Board members are committed to the Athersys mission and the core values of our Company - cooperation, excellence and innovation, responsibility to humanity and the environment, and honesty and integrity. Our Board also is committed to devoting the necessary time to the governance of our Company.

Pursuant to an investor rights agreement, referred to herein as the Investor Rights Agreement, entered into on March 14, 2018 between the Company and HEALIOS K.K., referred to herein as Healios, Healios has the right to nominate (i) one Director to the Board, if Healios owns less than 15% but more than 5% of our outstanding Common Stock, and (ii) two Directors to the Board, provided that Healios owns at least 15% of our outstanding Common Stock, so long as, in either case, the Collaboration Expansion Agreement entered into between the Company and Healios in June 2018 remains in effect. Healios currently owns approximately 7.5% of our outstanding Common Stock, and Dr. Kagimoto has been nominated to continue to serve as Healios’ nominee to the Board.

Additionally, pursuant to a cooperation agreement, referred to herein as the Cooperation Agreement, entered into on February 16, 2021 among the Company, Healios and Hardy TS Kagimoto, the Company agreed to appoint Kenneth H. Traub to the Board, to nominate Mr. Traub for election to the Board at the Annual Meeting and, subject to the satisfaction of certain conditions, to nominate Mr. Traub for election to the Board at the 2022 Annual Meeting of Stockholders as a director of the Company.

Ms. Kalin and Ms.Wasman were recommended to serve on the Board by non-employee independent directors and Mr. Shah was recommended to serve on the Board by our former Chief Executive Officer.

If any nominee becomes unavailable for any reason or should a vacancy occur before the election, which events are not anticipated, the proxies will be voted for the election of such other person as a Director as the Board may recommend. Information, including the qualifications, skills and experience each nominee for Director brings to the Board is outlined below.

4

| Ismail Kola, PhD (Med) | ÍIndependent | Age: 64 | ||||||||||||

| Chairman of the Board | ||||||||||||||

| DIRECTOR SINCE: | 2010 | ||||||||||||

| BOARD COMMITTEES: | Compensation Committee (Chair); Nominations and Corporate Governance Committee | |||||||||||||

| KEY SKILLS: | Healthcare & Pharma, Medicine & Science, Business Leadership & Operations, Partnerships & Business Development, Regulatory and Commercial Launch | |||||||||||||

Dr. Kola has served as our Director since October 2010 and Chairman of the Board since February 2021. Dr. Kola is a Senior Partner at Forepont Capital, a pharmaceutical venture capital company, since April 2019. He was Executive Vice President of UCB S.A. in Belgium, a biopharmaceutical company dedicated to the development of innovative medicines focused on the fields of central nervous system and immunology disorders, and President of UCB New Medicines, UCB’s discovery research through to proof-of-concept in man organization, from November 2009 until December 2017. Dr. Kola was Senior Vice President, Discovery Research and Early Clinical Research & Experimental Medicine at Schering-Plough Research Institute, the pharmaceutical research arm of Schering-Plough Corporation and Chief Scientific Officer at Schering-Plough Corporation, from March 2007 until his appointment at UCB. Prior to Schering-Plough, Dr. Kola held senior positions at Merck and Pharmacia Corporation. He was also Director of the Centre for Functional Genomics and Human Disease and a professor of Human Molecular Genetics at Monash Medical School in Australia. Dr. Kola has been a director of Mobius Medical, a private start-up company, and Infinion Biopharma, also a private start-up company since June 2018. He also serves as board member at Forepoint Capital since October 2019, GPN vaccines (a public but non-listed Australian Company) and is a member of the Scientific Advisory Board of GIMV, Belgium (GIMB.BR). Dr. Kola served on the boards of directors of Biotie Therapies, Inc. (NASDAQ: BITI) (and previously Synosia) from 2011 until 2016, Astex Therapeutics (NASDAQ: ASTX) from 2010 until 2013, Ondek Pty Ltd from 2009 to 2011, and Promega Corporation from 2003 to 2007. Dr. Kola received his Ph.D. (Med) in Medicine from the University of Cape Town, South Africa, his B.Sc. from the University of South Africa, and his B.Pharm. from Rhodes University, South Africa. Dr. Kola has authored 159 publications in scientific and medical journals and is the named inventor on at least a dozen patents. Dr. Kola holds Adjunct Professorships of Medicine at Washington University in St. Louis, Missouri, and Monash University Medical School; a Foreign Adjunct Professorship at the Karolinska Institute in Stockholm, Sweden; and was elected William Pitt Fellow at Pembroke College, Cambridge University, UK in 2008. Dr. Kola has also been appointed a Visiting Professor at Oxford University, Nuffield School of Medicine, Oxford UK, since September 2012. Qualification, Skills and Experience: We believe that Dr. Kola's years of experience enable him to provide the Board with important insight and leadership. He has led many teams that have brought medicines successfully to market and numerous drugs from the research stage to market or late stage development. These relevant experiences equip Dr. Kola to advise our Board on the many current issues facing our Company. | ||||||||||||||

5

| John Harrington, PhD | Age: 53 | |||||||||||||

| Executive Vice President and Chief Scientific Officer | ||||||||||||||

| DIRECTOR SINCE: | 1995 | ||||||||||||

| BOARD COMMITTEES: | N/A | |||||||||||||

| KEY SKILLS: | Healthcare & Pharma, Medicine & Science, Business Leadership & Operations, Partnerships & Business Development | |||||||||||||

Dr. Harrington co-founded Athersys in 1995 and has served as our Chief Scientific Officer, Executive Vice President and Director since our founding. Dr. Harrington led the development of the RAGE® technology, as well as its application for gene discovery, drug discovery and commercial protein production applications. He is a listed inventor on numerous issued or pending United States patents, has authored many scientific publications and has received awards for his work, including being named one of the top international young scientists by MIT Technology Review in 2002. Dr. Harrington has overseen the therapeutic product development programs at Athersys since their inception and is also focused on the clinical development and manufacturing of MultiStem®. During his career, he held positions at Amgen and Scripps Clinic. He received his B.A. in Biochemistry and Cell Biology from the University of California at San Diego and his Ph.D. in Cancer Biology from Stanford University. Qualifications, Skills and Experience: We believe that as our Executive Vice President and Chief Scientific Officer, Dr. Harrington is particularly well qualified to serve on the Board. His commitment and deep understanding of our Company, combined with his drive for innovation and excellence, position him well to serve on the Board. | ||||||||||||||

| Hardy TS Kagimoto, MD | Age: 44 | |||||||||||||

| DIRECTOR SINCE: | 2018 | ||||||||||||

| BOARD COMMITTEES: | N/A | |||||||||||||

| KEY SKILLS: | Healthcare & Pharma, Medicine & Science, Business Leadership & Operations, Partnerships & Business Development | |||||||||||||

Hardy TS Kagimoto, M.D., joined our Board of Directors in June 2018. In 2011 Dr. Kagimoto founded Healios (Tokyo Security Exchange Mothers: 4593), a biotechnology company focused on regenerative cell therapy, which became public in 2015, where he serves as Chairman and Chief Executive Officer. Dr. Kagimoto is also the President of Sighregen Co., Ltd., a joint venture established for the treatment of ophthalmic diseases and disorders. Dr. Kagimoto’s first biotech company was Aqumen Biopharmaceuticals, K.K., which he founded in 2005, and served as its Chairman, Chief Executive Officer and President. Aqumen successfully launched BBG (Brilliant Blue G), which gained de-facto-standard status in the ophthalmology community, globally. Dr Kagimoto currently serves on the Board of Directors of Organoid Neogenesis Laboratory, Inc. a subsidiary of Healios. Dr. Kagimoto received his medical degree from Kyushu University. Qualifications, Skills and Experience: Dr. Kagimoto is a serial entrepreneur and committed to the concept of curing as many patients as possible through technology. We believe that Dr. Kagimoto is able to use his experience of taking products from discovery through commercialization, his vision for the rapid progression of regenerative medicine products to treat disease and enrich quality of life, and his entrepreneurial and strategic expertise to guide our Board. | ||||||||||||||

6

| Katherine Kalin, MBA | ÍIndependent | Age: 58 | ||||||||||||

| DIRECTOR SINCE: | 2020 | ||||||||||||

| BOARD COMMITTEES: | Audit Committee; Compensation Committee | |||||||||||||

| KEY SKILLS: | Healthcare & Pharma, Business Leadership & Operations, Partnerships & Business Development, Financing & Accounting | |||||||||||||

Ms. Kalin joined our Board of Directors in November 2020. From 2012 to 2017, she was Corporate Vice President at Celgene, a global bio-pharmaceutical company, where she led corporate strategy. Ms. Kalin also held various leadership roles in marketing, sales and new business development at Johnson & Johnson from 2002 to 2011. Prior to joining Johnson & Johnson, Ms. Kalin was a partner in the global healthcare practice of McKinsey & Company. Ms. Kalin currently serves, since July 2020, as a non-executive director on the board of Genfit, S.A., a publicly traded, French, biopharmaceutical company, and since 2018 as a member of the board of directors of Brown Advisory LLC, an independent investment and strategic advisory firm and Clinical Genomics, a biotech developing evidence-based diagnostic tools for cancer. She is also a member of the Advisory Board of Stardog, an enterprise data company, FemHealth, a venture capital firm that seeks to invest in women’s health, and PRIMARI Analytics, an A.I. startup. During her career, she has worked in Europe, Asia and North America. Ms. Kalin received her M.B.A. from Harvard Business School and a B.A. in French from the University of Durham, UK. Qualifications, Skills and Experience: We believe that Ms. Kalin is a valuable member of our Board. Her more than 25 years of global experience as a senior executive in health care and professional services, across a range of operational and strategic business functions and an array of different therapeutic areas, will be invaluable, particularly as the Company moves toward commercialization. Furthermore, we believe that Ms. Kalin’s gender, as a woman, enhances the diversity of the Board and that having a more diverse Board leads to greater innovation, unique thinking and better governance. | ||||||||||||||

| Lorin Randall, MBA | ÍIndependent | Age: 77 | ||||||||||||

| DIRECTOR SINCE: | 2007 | ||||||||||||

| BOARD COMMITTEES: | Audit Committee (Chair); Compensation Committee | |||||||||||||

| KEY SKILLS: | Healthcare & Pharma, Business Leadership & Operations, Finance & Accounting | |||||||||||||

Mr. Randall has served as our Director since September 2007. Mr. Randall is an independent financial consultant and previously was Senior Vice President and Chief Financial Officer of Eximias Pharmaceutical Corporation, a development-stage drug development company, from 2004 to 2006. Prior to 2006, Mr. Randall held senior positions at i-STAT Corporation and CFM Technologies, Inc. Mr. Randall currently serves on the board of directors of Acorda Therapeutics, Inc. (NASDAQ: ACOR) since 2006. Mr. Randall served on the boards of directors of the following companies: Aurinia, Inc. (NASDAQ: AUPH; TSX: AUP) from 2016 to 2019, Tengion, Inc. (OTCQB: TNGN) from 2008 to 2014, Nanosphere, Inc. (NASDAQ: NSPH) from 2008 to 2016 and Opexa Therapeutics, Inc. (NASDAQ: OPXA) from 2007 to 2009. Mr. Randall received a B.S. in accounting from The Pennsylvania State University and an M.B.A. from Northeastern University. Qualifications, Skills and Experience: We believe Mr. Randall’s strong financial and human resources background provides expertise to the Board, including an understanding of financial statements, compensation policies and practices, corporate finance, developing and maintaining effective internal controls, accounting, employee benefits, investments and capital markets. These qualities also formed the basis for the Board’s decision to appoint Mr. Randall as Chairman of the Audit Committee. Further, given that he has served as a Director since 2007, during which time he has shown outstanding commitment and engagement with our Company, he also provides significant governance experience. | ||||||||||||||

7

| Baiju Shah, JD | ÍIndependent | Age: 49 | ||||||||||||

| DIRECTOR SINCE: | 2020 | ||||||||||||

| BOARD COMMITTEES: | Audit Committee; Nominations and Governance Committee | |||||||||||||

| KEY SKILLS: | Healthcare & Pharma, Business Leadership & Operations; Partnerships & Business Development | |||||||||||||

Mr. Shah joined our Board of Directors in November 2020. Mr. Shah is the President & Chief Executive Officer of the Greater Cleveland Partnership, a metropolitan business chamber that mobilizes private-sector leadership, expertise and resources to catalyze economic growth and prosperity in the region, since April 2021. Previously, since 2019, Mr. Shah had been the Senior Fellow for Innovation at The Cleveland Foundation where he focused on developing innovation partnerships. From 2012 to February 2019 Mr. Shah served as Chief Executive Officer and a member of the board of directors of BioMotiv, an accelerator company aligned with the Harrington Project for Discovery and Development, a U.S. and U.K. drug development initiative. Prior to BioMotiv, Mr. Shah was Chief Executive Officer, member of the board of directors, and a co-founder of BioEnterprise, a business that assists companies in securing resources and funding to support growth. Mr. Shah has been a member of the board of directors Invacare Corporation (NYSE: IVC) since 2011; he also served on the Advisory Board for Citizens Financial Group (NYSE: CFG) from 2012 to 2018. Mr. Shah also serves as a Senior Advisor to FasterCures, a Center of the Milken Institute and on the boards of several civic organizations and initiatives. He began his business career as a consultant with McKinsey & Company. Mr. Shah received a J.D. from Harvard Law School and a B.A. from Yale University. Qualifications, Skills and Experience: We believe that Mr. Shah's extensive senior executive experience, including as Chief Executive Officer and member of the board of directors, leading biotechnology businesses, provides a unique perspective on our strategy, operations, finances and corporate governance. We believe his business acumen is relevant, current and transferable to the challenges of our business and is an asset to our Board. | ||||||||||||||

| Kenneth Traub, MBA | Age: 59 | |||||||||||||

| DIRECTOR SINCE: | 2021 | ||||||||||||

| BOARD COMMITTEES: | N/A | |||||||||||||

| KEY SKILLS: | Business Leadership & Operations, Financing & Accounting, Strategy | |||||||||||||

Mr. Traub joined our Board of Directors in February 2021, and he previously served as a director from June 2020 to October 2020 and from 2012 to 2016. Mr. Traub currently serves as the Managing Member of Delta Value Group, LLC, an investment management firm since September 2019 and as the Managing Member of Delta Value Advisors LLC, a consulting firm, since October 2020. From December 2015 to January 2019, Mr. Traub was a Managing Partner at Raging Capital Management, LLC, an investment management firm. Prior to 2015, Mr. Traub has held senior positions at Ethos Management LLC, JDSU, American Bank Note Holographics, Voxware Inc. and Trans-Resources, Inc. Mr.Traub has served as a director since 2012 and as Chairman of the Board since 2017 of DSP Group, Inc. (NASDAQ: DSPG). Mr. Traub also currently serves as a director of Tidewater, Inc., (NYSE: TDW) since 2018. Mr. Traub previously served on the boards of directors of the following companies over the past five years: AM Castle & Co. (NYSE: CAS) from 2014 to 2016, MRV Communications, Inc. (NASDAQ: MRVC) as Chairman from 2011 to 2017, IDW Media Holdings (OTC: IDWM) from 2015 to 2018, Immersion Corporation, (NASDAQ: IMMR), from 2018 to 2019, Gulfmark, Inc. (NYSE: GLF) from 2017 to 2018 and Intermolecular, Inc. (NASDAQ: IMI) from 2016 to 2019. He also served as the Chairman of the Board of the New Jersey chapter of the Young Presidents Organization and on the board of the New Jersey chapter of the World Presidents Organization. Mr. Traub received a B.A. from Emory College and an M.B.A. from Harvard Business School. Qualifications, Skills and Experience: We believe that Mr. Traub's deep financial background and expertise in managing and growing companies to maximize stockholder value, as well as his experience and knowledge of the Company provides valuable insight to the Board. | ||||||||||||||

8

| Jane Wasman, JD | ÍIndependent | Age: 64 | ||||||||||||

| DIRECTOR SINCE: | 2020 | ||||||||||||

| BOARD COMMITTEES: | Compensation Committee; Nominations and Governance Committee (Chair) | |||||||||||||

| KEY SKILLS: | Healthcare & Pharma, Business Leadership & Operations; International Business; Partnerships & Business Development; Law | |||||||||||||

Ms. Wasman has served as Director since November 2020. Ms. Wasman was President, International & General Counsel and Corporate Secretary of Acorda Therapeutics, Inc., a publicly traded biopharmaceutical company, from 2012 through December 2019, managing its international, legal, quality, intellectual property and compliance functions, after serving in other executive roles at Acorda starting in 2004. Before joining Acorda, Ms. Wasman was employed with Schering-Plough Corporation, a global pharmaceutical company, for over eight years, holding various U.S. and international leadership positions, including Staff Vice President and Associate General Counsel. She currently chairs the board of directors of Sellas Life Sciences (NASDAQ: SLS), is a member of the board of directors of Rigel Pharmaceuticals (NASDAQ: RIGL) and Cytovia Therapeutics, a private biotechnology company. Additionally, Ms. Wasman has been a member of the board of directors and a member of the executive committee of the New York Biotechnology Association since 2007. She is co-founder of the NY Hub of BioDirector, an organization supporting board effectiveness and diversity. Ms. Wasman earned a J.D. from Harvard Law School and her undergraduate degree from Princeton University. Qualifications, Skills and Experience: Ms. Wasman is a strategic leader with almost 25 years in the biopharma industry, with extensive U.S. and international experience. Her knowledge and expertise in M&A, strategic development, corporate governance, international, litigation, commercial, compliance and government affairs and operational implementation make her an important addition to our Board. Furthermore, we believe that Ms.Wasman, as a woman, enhances gender diversity of the Board and that having a more diverse Board leads to greater innovation, unique thinking and better governance. | ||||||||||||||

| Jack Wyszomierski, MS | ÍIndependent | Age: 65 | ||||||||||||

| DIRECTOR SINCE: | 2010 | ||||||||||||

| BOARD COMMITTEES: | Audit Committee; Nominations and Governance Committee | |||||||||||||

| KEY SKILLS: | Healthcare & Pharma, Business Leadership & Operations; Financing & Accounting | |||||||||||||

Mr. Wyszomierski has served as a Director since June 2010. From 2004 until June 2009, Mr. Wyszomierski served as the Executive Vice President and Chief Financial Officer of VWR International, LLC, a supplier and distributor of laboratory supplies, equipment and supply chain solutions to the global research laboratory industry. From 1982 to 2004 Mr. Wyszomierski held positions of increasing responsibility at Schering-Plough Corporation, culminating with his appointment as Executive Vice President and Chief Financial Officer in 1996. Mr. Wyszomierski currently serves on the board of directors of SiteOne Landscape Supply, Inc. (NYSE: SITE) since 2016, Solenis, Inc., since 2014, Xoma Corporation (NASDAQ: XOMA) since 2010 and Exelixis, Inc. (NASDAQ: EXEL) since 2004. Mr. Wyszomierski was also a member of the board of directors at Unigene Laboratories, Inc. (OTC: UGNE). Mr. Wyszomierski holds a M.S. in Industrial Administration and a B.S. in Administration, Management Science and Economics from Carnegie Mellon University. Qualifications, Skills and Experience: We believe Mr. Wyszomierski’s years of experience as a Chief Financial Officer in the healthcare, life sciences and pharmaceutical industries and service as a director of multiple other public companies, well-qualifies him as a Director and a member of the Company's Audit Committee. | ||||||||||||||

The Board unanimously recommends that stockholders vote FOR the election of each of the nine Director nominees named in this proxy statement.

9

THE BOARD OF DIRECTORS AND ITS COMMITTEES

Director Independence

The Board reviews the independence of each Director at least annually. During these reviews, the Board will consider transactions and relationships between each Director (and his or her immediate family and affiliates) and the Company and our management to determine whether any such transactions or relationships are inconsistent with a determination that the Director was independent. The Board conducted its annual review of Director independence to determine if any transactions or relationships exist that would disqualify any of the individuals who serve as a Director under the rules of the NASDAQ Capital Market, or NASDAQ, or require disclosure under Securities and Exchange Commission, or SEC, rules. Based upon the foregoing review, the Board determined the following individuals are independent under the rules of the NASDAQ: Ms. Kalin, Dr. Kola, Mr. Randall, Mr. Shah, Ms. Wasman and Mr. Wyszomierski. The Board also determined that Dr. Lee E. Babiss, who served as a Director during 2020 until November 12, 2020, was independent under the rules of the NASDAQ. Currently, one member of management who also serves on the Board, Dr. Harrington, is our Executive Vice President and Chief Scientific Officer. Dr. Kagimoto is Chairman, Chief Executive Officer and President of Healios; the Company and Healios are parties to a licensing arrangement pursuant to which Athersys has received, and may continue to receive, significant payments. Dr. Harrington and Dr. Kagimoto are not considered independent under the independence rules of the NASDAQ. Mr. Traub is the Managing Member of Delta Value Advisors LLC, which currently provides consulting services to Healios. At this time, the Board has determined that Mr. Traub is not an independent Director under the NASDAQ rules due to his consulting relationship with Healios.

Our Board’s tenure, diversity and independence provide a balance of new perspectives, innovation and Company-specific knowledge needed to function effectively. Directors having a tenure of less than 5 years represent 56% of the members of the Board. Our Board is 33% diverse by ethnicity and 22% diverse by gender, and 67% of our Directors are independent.

The Board held nine meetings during fiscal year 2020. All of the Directors attended at least 75% of the total meetings held by the Board and by all committees on which they served during fiscal year 2020.

Attendance at Annual Meeting

Although the Company does not have a policy with respect to attendance by the Directors at the Annual Meeting, Directors are encouraged to attend. The Company held an annual meeting of stockholders last year, which was attended by all then-current Directors.

Committees

The Board has three standing committees: the Audit Committee, the Compensation Committee and the Nominations and Corporate Governance Committee. All members of these committees are independent directors. The Board has adopted a written charter for each of these committees. From time to time, the Board also conducts business through other duly appointed committees, such as the Pricing Committee. In February 2021, the Board formed an ad hoc CEO Search Committee to conduct and lead a search for one or more candidates to serve as Chief Executive Officer, and this committee will identify and evaluate the candidates for recommendation to the Board. The charters for the three standing committees, as well as our Directors' Code of Conduct and our Code of Business Conduct and Ethics for Employees and Officers, are posted and available under the Investor page on our website at www.athersys.com. Stockholders may request copies of these corporate governance documents, free of charge, by writing to Athersys, Inc., 3201 Carnegie Avenue, Cleveland, Ohio 44115, Attention: Corporate Secretary.

10

BOARD COMMITTEE COMPOSITION

| Director | Audit Committee | Compensation Committee | Nominations & Corporate Governance Committee | |||||||||||||||||

Ismail Kola, PhD (Med)v | ü | v | ü | |||||||||||||||||

| John Harrington, PhD | ||||||||||||||||||||

| Hardy TS Kagimoto, MD | ||||||||||||||||||||

| Katherine Kalin, MBA | ü | ü | ||||||||||||||||||

| Lorin Randall, MBA | ü | v | ü | |||||||||||||||||

| Baiju Shah, JD | ü | ü | ||||||||||||||||||

| Kenneth Traub, MBA | ||||||||||||||||||||

| Jane Wasman, JD | ü | ü | v | |||||||||||||||||

| Jack Wyszomierski, MS | ü | ü | ||||||||||||||||||

v Denotes Chair | ||||||||||||||||||||

Audit Committee

The Audit Committee is responsible for overseeing the accounting and financial reporting processes of the Company and the audits of the financial statements of the Company. The Audit Committee is also directly responsible for the appointment, compensation, retention and oversight of the work of the Company’s independent auditors, including the resolution of any disagreements between management and the auditors regarding financial reporting. Additionally, the Audit Committee approves all related-party transactions that are required to be disclosed pursuant to Item 404 of Regulation S-K. The current members of the Audit Committee are Ms. Kalin, Mr. Randall, Mr. Shah and Mr. Wyszomierski. The Board has determined that each of Mr. Randall and Mr. Wyszomierski is an “audit committee financial expert,” as defined in Item 407(d)(5)(ii) of Regulation S-K. The Audit Committee held five meetings during fiscal year 2020.

Compensation Committee

The Compensation Committee is responsible for, among other things, annually reviewing and approving, or recommending to the Board for approval, the salaries and other compensation, including stock incentives, of our executive officers, including our Chief Executive Officer. The Compensation Committee is also responsible for reviewing and recommending to the Board, with guidance from independent compensation consultants, as appropriate, the compensation of our non-employee Directors, engaging and determining the fees of compensation consultants, if any, and overseeing regulatory compliance with respect to compensation matters. The Compensation Committee reviews, or recommends to the Board for approval, corporate goals and objectives relevant to the compensation of the executive officers and evaluates the performance of the executive officers in light of those corporate goals and objectives. The Compensation Committee also considers the duties and responsibilities of the executive officers and approves, or recommends to the Board for approval, the compensation levels for those executive officers based on those evaluations and any other factors as it deems appropriate. In determining or recommending, as applicable, incentive compensation, the Compensation Committee also considers the Company’s performance and relative stockholder return, the value of similar awards to executive officers of comparable companies, and the awards given to the Company’s executive officers in past years. The Compensation Committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee of the Compensation Committee. For more information regarding the role of our Chief Executive Officer and compensation consultants in determining or recommending executive and director compensation, please see “Executive Compensation – Role of the Chief Executive Officer” and “Role of the Independent Compensation Consultant” below. During 2020, the members of the Compensation Committee were Dr. Babiss, Dr. Kola, Mr. Randall and Mr.Wyszomierski. The current members of the Compensation Committee are Ms. Kalin, Dr. Kola, Mr. Randall and Ms.Wasman. The Compensation Committee held four meetings during fiscal year 2020.

Nominations and Corporate Governance Committee

The Nominations and Corporate Governance Committee is responsible for, among other things, evaluating and recommending to the Board of Directors qualified nominees for election as Directors and qualified Directors for

11

committee membership, as well as developing and recommending to the Board corporate governance principles applicable to the Company. Additionally, the Nominations and Corporate Governance Committee will oversee the evolution of the Company’s ESG policies. The current members of the Nominations and Corporate Governance Committee are Dr. Kola, Mr. Shah, Ms. Wasman and Mr. Wyszomierski. The Nominations and Corporate Governance Committee held five meetings during fiscal year 2020.

The Nominations and Corporate Governance Committee identifies individuals qualified to become members of the Board and recommends candidates to the Board to fill new or vacant positions. Except as may be required by rules promulgated by NASDAQ or the SEC, there are currently no specific, minimum qualifications that must be met by each candidate for the Board, nor are there specific qualities or skills that are necessary for one or more of the members of the Board to possess. In recommending candidates, the Nominations and Corporate Governance Committee considers such factors as it deems appropriate, consistent with criteria approved by the Board. These factors may include judgment, skill, diversity, integrity, experience with businesses and other organizations of comparable size, experience in corporate governance, experience in business and human resource management, the interplay of the candidate’s experience with the experience of other members of the Board and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board. The Nominations and Corporate Governance Committee considers the breadth and diversity of experience brought by the various nominees for Director in functional areas including pharmaceutical, capital markets, biotechnology, commercialization, clinical and finance. The Nominations and Corporate Governance Committee recommends candidates to the Board based on these factors and also considers possible conflicts of interest when making its recommendations to the Board.

The Nominations and Corporate Governance Committee will give appropriate consideration to qualified persons recommended by stockholders for nomination as our Directors, provided that the stockholder delivers written notice to the Secretary of the Company, which contains the following information:

•the name and address of the stockholder and each Director nominee;

•a representation that the stockholder is entitled to vote and intends to appear in person or by proxy at the meeting;

•a description of any and all arrangements or understandings between the stockholder and each nominee;

•such other information regarding the nominee that would have been required to be included by the SEC in a proxy statement had the nominee been named in a proxy statement;

•a brief description of the nominee’s qualifications to be a Director; and

•the written consent of the nominee to serve as a Director if so elected.

The Nominations and Corporate Governance Committee evaluates candidates proposed by stockholders, if any, using the same criteria as for other candidates not nominated by stockholders.

The Board’s Role in Risk Oversight

The Board oversees the risk management of the Company. The full Board of Directors, as supplemented by the appropriate board committee in the case of risks that are overseen by a particular committee, reviews information provided by management in order for the Board to oversee its risk identification, risk management and risk mitigation strategies. The Board committees assist the full Board’s oversight of our material risks by focusing on risks related to the particular area of concentration of the relevant committee. For example, our Compensation Committee oversees risks related to our executive compensation plans and arrangements, our Audit Committee oversees the financial reporting and control risks, and our Nominations and Corporate Governance Committee oversees risks associated with the independence of the Board and potential conflicts of interest. Each committee reports on these discussions of the applicable relevant risks to the full Board during the committee reports portion of each Board meeting, as appropriate. The full Board incorporates the insight provided by these reports into its overall risk management analysis. We believe that the Board leadership structure complements our risk management structure because it allows our independent directors, through independent committees, to exercise effective oversight of the actions of management in identifying risks and implementing effective risk management policies and controls.

Certain Relationships and Related Person Transactions

We give careful attention to related person transactions because they may present the potential for conflicts of interest. We refer to “related person transactions” as those transactions, arrangements, or relationships in which:

12

•we were, are or are to be a participant;

•the amount involved exceeds $120,000; and

•any of our Directors, executive officers, nominees for Director or greater-than five percent stockholders (or any of their immediate family members) had or will have a direct or indirect material interest.

To identify related person transactions in advance, we rely on information supplied by our executive officers, Directors and certain significant stockholders. We maintain a comprehensive written policy for the review, approval or ratification of related person transactions, and our Audit Committee reviews all related person transactions identified by us. The Audit Committee approves or ratifies only those related person transactions that are determined by it to be, under all of the circumstances, in the best interest of the Company and its stockholders. Other than our arrangement with Healios as described below, no related person transactions occurred in fiscal 2020 that required a review by the Audit Committee.

Since 2016, we have had a collaboration with Healios to develop and commercialize MultiStem for the treatment of certain indications in Japan pursuant to the terms of a license agreement. In 2018, the collaboration was significantly expanded to include, among other things, an exclusive license to our technology for the development and commercialization of additional indications, for which we received additional license fees. Also in connection with that expansion, Healios purchased 12,000,000 shares of our Common Stock in 2018 for $21.1 million and thereby became an owner of greater than 5% of our outstanding Common Stock. Healios also received a warrant to purchase shares ("Warrant Shares") of Common Stock as part of this transaction, and in March 2020, Healios exercised the warrant in full for 4,000,000 Warrant Shares for which we received proceeds of approximately $7.0 million. We provide manufacturing and related services to Healios under our collaboration agreements, and such services are ongoing. In 2020, we received payments from Healios of approximately $2.3 million, primarily related to product supply revenues under our collaboration agreement.

On February 16, 2021, we, Healios and Dr. Kagimoto entered into the Cooperation Agreement. The Cooperation Agreement provides for the parties’ cooperation on certain commercial matters, including a commitment to work in good faith to finalize negotiations with a spirit of cooperation and transparency as quickly as possible on all aspects of their supply, manufacturing, information provision and regulatory support relationship. The Cooperation Agreement also provides for, among related matters, the dismissal with prejudice of the complaint filed by Dr. Kagimoto against us seeking the inspection of our books and records in the Court of Chancery of Delaware on November 21, 2020 (the “220 Litigation”). Pursuant to the terms of the Cooperation Agreement, the Company agreed to reimburse Healios and Dr. Kagimoto up to 35% of their reasonable, documented out-of-pocket fees and expenses (including legal expenses) incurred in connection with the Section 220 Litigation, up to a maximum of $500,000 in the aggregate, and $500,000 was paid in April 2021.

Communications with Directors

Information regarding how our stockholders and other interested parties may communicate with the Board of Directors as a group, with the non-management Directors as a group, or with any individual Director is included on the Contact Us page under “Our Company” on our website at www.athersys.com.

13

PROPOSAL TWO

RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS FOR

THE FISCAL YEAR ENDING DECEMBER 31, 2021

The Audit Committee of the Board has appointed Ernst & Young LLP as the independent auditors of the Company to examine the financial statements of the Company and its subsidiaries for the fiscal year ending December 31, 2021. During fiscal year 2020, Ernst & Young LLP examined the financial statements of the Company and its subsidiaries, including those set forth in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

Although stockholder approval of this appointment is not required by law or binding on the Audit Committee, the Board believes that stockholders should be given the opportunity to express their views on this matter. If the stockholders do not ratify the appointment of Ernst & Young LLP as the Company’s independent auditors, the Audit Committee will consider this vote in determining whether or not to continue the engagement of Ernst & Young LLP.

It is expected that representatives of Ernst & Young LLP will attend the Annual Meeting, with the opportunity to make a statement if so desired and will be available to answer appropriate questions.

Required Vote

The affirmative vote of the holders of a majority of the votes cast for or against, in person or by proxy and entitled to vote, is necessary for the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2021. Under the Company’s bylaws, abstentions will have no effect on this proposal. As this proposal is considered to be a routine matter, we do not expect broker non-votes on this proposal. As an advisory vote, the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2021 is not binding on the Company.

The Board unanimously recommends that stockholders vote FOR the ratification of the appointment of Ernst & Young LLP as independent auditors for the fiscal year ending December 31, 2021.

Audit Committee Pre-Approval Policy and Principal Accountant Fees and Services

The Audit Committee has adopted a formal policy on auditor independence requiring the pre-approval by the Audit Committee of all professional services rendered by the Company’s independent auditor prior to the commencement of the specified services. Additionally, the Audit Committee is directly involved in the selection of Ernst & Young LLP’s lead engagement partner, which occurs every five years. The year ended December 31, 2020 was the final year for the lead engagement partner and a new lead engagement partner will begin in 2021.

For the fiscal year ended December 31, 2020, 100% of the services described below were pre-approved by the Audit Committee in accordance with the Company’s formal policy on auditor independence.

Audit Fees. Fees paid to Ernst & Young LLP for the audit of the annual consolidated financial statements included in the Company’s Annual Reports on Form 10-K, for the reviews of the consolidated financial statements included in the Company’s Forms 10-Q and for services related to registration statements were $904,500 for the fiscal year ended December 31, 2020 and $861,950 for the fiscal year ended December 31, 2019.

Audit-Related Fees. There were no fees paid to Ernst & Young LLP for audit-related services in 2020 or 2019.

Tax Fees. Fees paid to Ernst & Young LLP associated with tax compliance and tax consultation were $41,000 and $60,506 for the fiscal years ended December 31, 2020 and 2019, respectively.

All Other Fees. There were no other fees paid to Ernst & Young LLP in 2020 or 2019.

14

AUDIT COMMITTEE REPORT

The Audit Committee of the Board is composed of at least three Directors who are independent and operates under a written Audit Committee charter adopted and approved by the Board. The Audit Committee annually selects the Company’s independent auditors. The written charter of the Audit Committee is posted and available under the Investor page under “Corporate Governance” on our website at www.athersys.com.

Management is responsible for the Company’s internal controls and financial reporting process. Ernst & Young LLP, the Company’s independent auditor, is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Audit Committee’s responsibility is to provide oversight to these processes.

In fulfilling its oversight responsibility, the Audit Committee relies on the accuracy of financial and other information, opinions, reports and statements provided to the Audit Committee. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Nor does the Audit Committee’s oversight assure that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or the audited financial statements are presented in accordance with generally accepted accounting principles.

The Audit Committee has reviewed and discussed with the Company’s management and Ernst & Young LLP the audited financial statements of the Company for the year ended December 31, 2020. The Audit Committee has also discussed with Ernst & Young LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC.

The Audit Committee has also received and reviewed the written disclosures and the letter from Ernst & Young LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding Ernst & Young LLP’s communications with the Audit Committee concerning independence and has discussed with Ernst & Young LLP such independent auditors’ independence. The Audit Committee has also considered whether Ernst & Young LLP’s provision of services to the Company beyond those rendered in connection with their audit and review of the Company’s financial statements is compatible with maintaining their independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

Audit Committee

Board of Directors

Lorin J. Randall

Katherine Kalin

Baiju R. Shah

Jack L. Wyszomierski

15

PROPOSAL THREE

APPROVAL OF AMENDMENT OF THE COMPANY’S CERTIFICATE OF INCORPORATION

TO INCREASE THE NUMBER OF SHARES OF AUTHORIZED COMMON STOCK

In April 2021, the Board approved, subject to receiving the approval of the holders of a majority of the outstanding shares of Common Stock, an amendment to our Certificate of Incorporation to increase the total number of shares of authorized Common Stock from 300,000,000 to 600,000,000 shares. As of April 23, 2021, and as further described below, the Company has approximately 50.4 million shares of Common Stock available for issuance, of which 35.0 million shares of Common Stock are reserved for issuance under a shelf registration statement that became effective in June 2020, and 6.6 million shares of Common Stock are reserved for issuance pursuant to our Common Stock Purchase Agreement with Aspire Capital Fund, LLC, referred to as our Equity Purchase Agreement. The proposed amendment is incorporated into “Section 1. Authorization of Shares” of our Certificate of Incorporation, a copy of which is set forth on Appendix A to this proxy statement and marked to show the proposed changes to the existing “Section 1. Authorization of Shares” of the Certificate of Incorporation.

The terms of the newly authorized shares of Common Stock will be identical to those of the currently outstanding shares of Common Stock. The authorization of additional shares of Common Stock will not alter the current number of issued shares. However, when any of the newly authorized shares of Common Stock are issued in a future transaction, it will reduce the current stockholders’ percentage ownership interest in the total outstanding shares of Common Stock since holders of Common Stock have no preemptive rights to purchase or subscribe for any unissued stock of the Company. Depending upon the circumstances under which newly authorized shares of Common Stock are issued, stockholders may experience a reduction in stockholders’ equity per share and voting power. The relative rights and limitations of the shares of Common Stock will remain unchanged.

Purpose for Increase and Effects of Increase on Authorized Common Stock

The Company currently has 300,000,000 authorized shares of Common Stock. As of April 23, 2021, there were 220,821,507 shares of Common Stock issued and outstanding and 50,381,803 shares of Common Stock available for issuance; and included in the 50,381,803 shares, there are 35,000,000 shares of Common Stock registered and available for issuance under our shelf registration statement and 6,640,000 shares of Common Stock registered under a resale shelf registration statement and reserved for issuance under our Equity Purchase Agreement. The Company had the following reserved shares of Common Stock as of March 31, 2021 in connection with its stock-based compensation plans: outstanding stock-based awards to acquire 21,788,078 shares of Common Stock and 7,008,612 shares of Common Stock available for new awards. Based on the number of outstanding and reserved shares of Common Stock, the Company has 8,741,803 shares of Common stock available for issuance.

The increase in our total authorized stock will provide us with greater flexibility with respect to our capital acquisition strategies, including potential equity financings, stock-based collaborative transactions and employee stock-based awards as we advance toward potential commercialization of our product candidates.

The increase in the number of authorized but unissued shares of Common Stock will enable the Company to issue shares from time to time as may be required for proper business purposes, such as raising additional capital for ongoing operations, business and asset acquisitions, stock splits and dividends, present and future employee benefit programs, inducement awards for key hires, and other corporate purposes without requiring further stockholder approval. Having a substantial number of authorized but unissued shares of Common Stock that are not reserved for specific purposes will allow us to take prompt action with respect to corporate opportunities that develop, without the delay and expense of convening a meeting of stockholders or obtaining the written consent of stockholders for the purpose of approving an increase in our capitalization. It is not the present intention of our Board to seek stockholder approval prior to any issuance of shares of Common Stock that would become authorized by the amendment unless otherwise required by law or regulation.

While the Board may entertain and seek future financing and collaborative opportunities, there are no definitive transactions contemplated at this time, and the amendment to our Certificate of Incorporation was not proposed with the intent that additional shares be utilized in any specific financing transaction, business development collaboration, or business or asset acquisition.

16