Form DEF 14A ASPEN AEROGELS INC For: Jun 01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material under Rule 14a-12 |

Aspen Aerogels, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

1) |

Title of each class of securities to which transaction applies: |

|

|

2) |

Aggregate number of securities to which transaction applies: |

|

|

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

4) |

Proposed maximum aggregate value of transaction: |

|

|

5) |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

|

|

1) |

Amount previously paid: |

|

|

2) |

Form, Schedule or Registration Statement No: |

|

|

3) |

Filing party: |

|

|

4) |

Date Filed: |

Northborough, Massachusetts

April 19, 2021

Dear Aspen Aerogels, Inc. Stockholder:

You are cordially invited to attend the 2021 annual meeting of stockholders of Aspen Aerogels, Inc. to be held at 9:00 a.m. Eastern Time on Thursday, June 1, 2021. As a result of the public health and travel guidance due to the COVID-19 pandemic, this year’s annual meeting will be conducted solely via live audio webcast on the Internet.

You will be able to attend our annual meeting, vote and submit your questions during the annual meeting by visiting https://www.virtualshareholdermeeting.com/ASPN2021. You will not be able to attend the annual meeting in person.

Details regarding the meeting, the business to be conducted at the meeting, and information about Aspen Aerogels that you should consider when you vote your shares are described in the accompanying proxy statement.

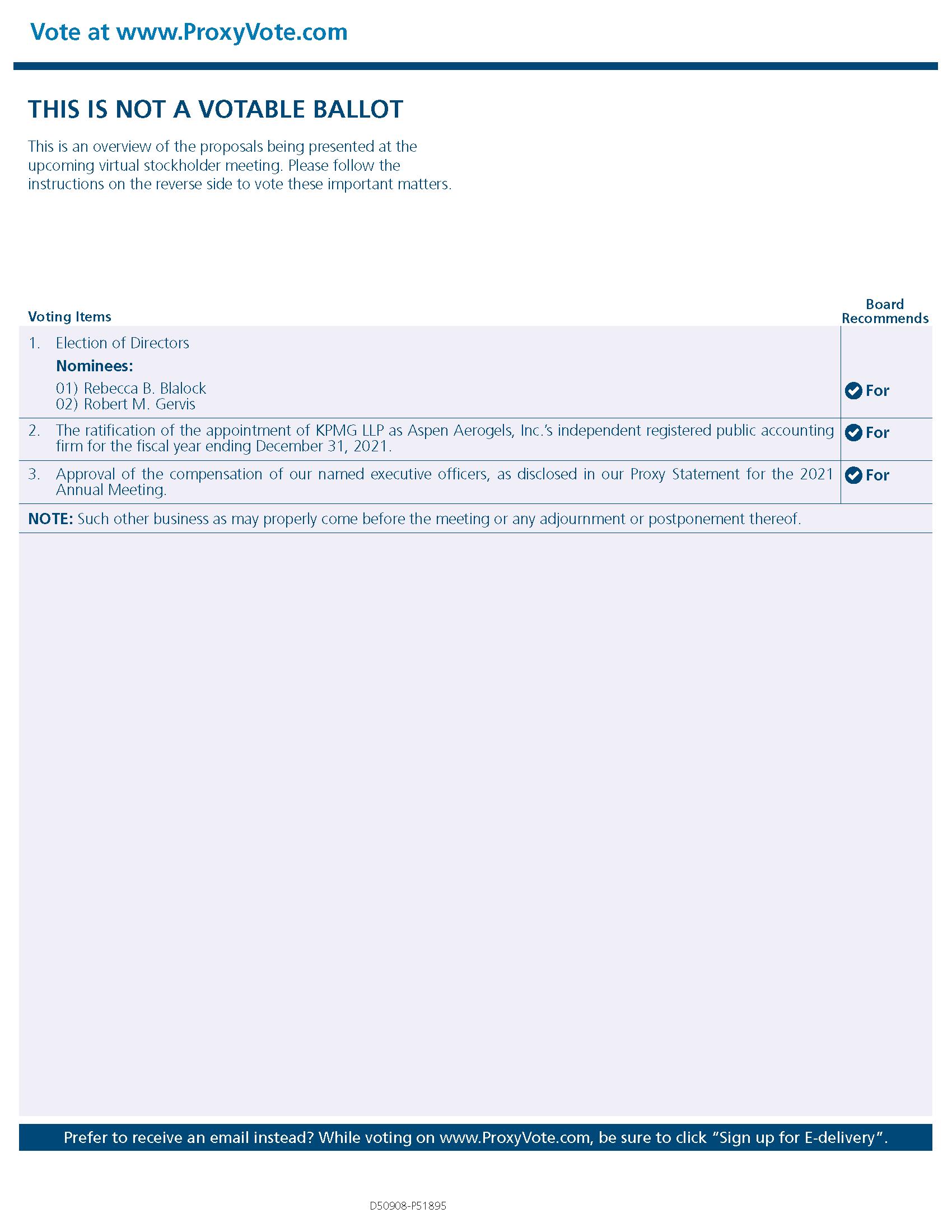

At the 2021 annual meeting, two persons will be elected to our board of directors. In addition, we ask stockholders to ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2021, and to approve, on an advisory basis, the compensation of the named executive officers, as disclosed in our Proxy Statement for the 2021 Annual Meeting. Our board of directors recommends the election of the two nominees to our board of directors and a vote in favor of proposals (i), (ii) and (iii). Such other business will be transacted as may properly come before the annual meeting.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to the majority of our stockholders over the Internet. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On or about April 19, 2021, we will send to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our 2021 annual meeting of stockholders and our 2020 annual report to stockholders. The Notice also provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of the proxy materials by mail.

We hope you will be able to attend the annual meeting. Whether you plan to attend the annual meeting or not, it is important that you cast your vote either virtually at the time of the annual meeting or by proxy. You may vote over the Internet as well as by telephone or by mail. When you have finished reading the proxy statement, you are urged to vote in accordance with the instructions set forth in the proxy statement. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

Thank you for your continued support of Aspen Aerogels, Inc. We look forward to seeing you at the annual meeting.

|

Sincerely, |

|

|

|

|

|

|

|

Donald R. Young |

|

President and Chief Executive Officer |

Aspen Aerogels, Inc.

30 Forbes Road, Building B

Northborough, MA 01532

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

TIME: 9:00 a.m. Eastern Time

DATE: June 1, 2021

ACCESS: https://www.virtualshareholdermeeting.com/ASPN2021

This year’s annual meeting will be a virtual meeting via live webcast on the Internet. You will be able to attend the annual meeting, vote and submit your questions during the meeting by visiting https://www.virtualshareholdermeeting.com/ASPN2021 and providing relevant information, including the control number included in the Notice of Internet Availability or the proxy card that you receive. For further information, please see the Questions and Answers about the Meeting beginning on page 1.

PURPOSES:

|

1. |

To elect Ms. Rebecca B. Blalock and Mr. Robert M. Gervis as directors to serve three-year terms expiring in 2024; |

|

2. |

To ratify the appointment of KPMG LLP as Aspen Aerogels, Inc.’s independent registered public accounting firm for the fiscal year ending December 31, 2021; |

|

3. |

To approve, on an advisory basis, the compensation of the named executive officers, as disclosed in our Proxy Statement for the annual meeting; and |

|

4. |

To transact such other business that is properly presented at the annual meeting and any adjournments or postponements thereof. |

WHO MAY VOTE:

You may vote if you were the record owner of Aspen Aerogels, Inc.’s common stock at the close of business on April 5, 2021 (the “Record Date”). A list of registered stockholders as of the close of business on the Record Date will be available at our corporate headquarters for examination by any stockholder for any purpose germane to the Annual Meeting for a period of at least 10 days prior to the Annual Meeting, provided the public health and travel advisory from relevant authorities in connection with the COVID-19 pandemic allows for such examination without posing risk to the health and safety of others. If you wish to view this list, please contact our Corporate Secretary at Aspen Aerogels, Inc., 30 Forbes Road, Building B, Northborough, Massachusetts 01532. Such list will also be available for examination by the stockholders during the Annual Meeting at https://www.virtualshareholdermeeting.com/ASPN2021.

All stockholders are cordially invited to attend the annual meeting. Whether you plan to attend the annual meeting or not, we urge you to vote by following the instructions in the Notice of Internet Availability of Proxy Materials that you previously received and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the meeting.

|

By Order of the Board of Directors |

|

|

|

|

|

|

|

Sahir C. Surmeli |

|

Secretary |

Northborough, Massachusetts

April 19, 2021

TABLE OF CONTENTS

|

|

|

PAGE |

|

|

1 |

|

|

Security Ownership of Certain Beneficial Owners and Management |

|

6 |

|

|

8 |

|

|

|

17 |

|

|

|

31 |

|

|

|

32 |

|

|

|

33 |

|

|

|

35 |

|

|

Proposal No. 2 - Independent Registered Public Accounting Firm |

|

36 |

|

|

38 |

|

|

|

|

|

|

|

39 |

|

|

|

39 |

|

|

|

39 |

i

Aspen Aerogels, Inc.

30 Forbes Road, Building B

Northborough, Massachusetts 01532

PROXY STATEMENT FOR THE ASPEN AEROGELS, INC.

2020 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 1, 2021

This proxy statement, along with the accompanying notice of 2021 annual meeting of stockholders, contains information about the 2021 annual meeting of stockholders of Aspen Aerogels, Inc., including any adjournments or postponements of the annual meeting. We are holding the annual meeting at 9:00 a.m., Eastern Time, on Thursday, June 1, 2021. As a result of the public health and travel guidance due to the COVID-19 pandemic, this year’s annual meeting will be conducted solely via live audio webcast on the Internet. You will be able to attend our annual meeting, vote and submit your questions during the annual meeting by visiting https://www.virtualshareholdermeeting.com/ASPN2021. You will not be able to attend the annual meeting in person.

In this proxy statement, we refer to Aspen Aerogels, Inc. as “Aspen Aerogels,” “the Company,” “we” and “us.”

This proxy statement relates to the solicitation of proxies by our board of directors for use at the annual meeting.

On or about April 19, 2021, we intend to begin sending to our stockholders entitled to vote the Important Notice Regarding the Availability of Proxy Materials containing instructions on how to access our proxy statement for the 2021 annual meeting of stockholders and our 2020 annual report.

ii

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON JUNE 1, 2021

This proxy statement and our 2020 annual report to stockholders are available for viewing, printing and downloading at www.proxyvote.com. In order to view, print or download these materials, please have the 12-digit control number(s) that appears on your notice or proxy card available. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2020 on the website of the Securities and Exchange Commission, or the SEC, at www.sec.gov, or in the “SEC Filings” tab of the “Financial Information” subsection of the “Investors” section of our website at www.aerogel.com. You may also obtain a printed copy of our Annual Report on Form 10-K, including our financial statements, from us, free of charge, by sending a written request to:

Aspen Aerogels, Inc.

Attn: Investor Relations

30 Forbes Road, Building B

Northborough, Massachusetts, 01532

Exhibits will be provided upon written request and payment of an appropriate processing fee.

iii

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

The board of directors of Aspen Aerogels is soliciting your proxy to vote at the 2021 Annual Meeting of Stockholders to be held virtually via live audio webcast, on Thursday, June 1, 2021 at 9:00 a.m. Eastern Time and any adjournments or postponements of the meeting, which we refer to as the annual meeting. This proxy statement along with the accompanying Notice of 2021 Annual Meeting of Stockholders summarizes the purposes of the meeting and the information you need to know to vote at the annual meeting.

We have made available to you on the Internet or have sent you this proxy statement, the Notice of Annual Meeting of Stockholders, the proxy card and a copy of our annual report on Form 10-K for the fiscal year ended December 31, 2020 because you owned shares of our common stock on April 5, 2021(“Record Date”). We will commence distribution of the Important Notice Regarding the Availability of Proxy Materials, which we refer to throughout this proxy statement as the Notice, and, if applicable, the proxy materials, to stockholders on or about April 19, 2021.

Why Did I Receive a Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

As permitted by the rules of the U.S. Securities and Exchange Commission, or the SEC, we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Most stockholders will not receive printed copies of the proxy materials unless they request them. We believe that this process should expedite stockholders’ receipt of proxy materials, lower the costs of the annual meeting and help to conserve natural resources. If you received the Notice by mail or electronically, you will not receive a printed or email copy of the proxy materials, unless you request one by following the instructions included in the Notice. Instead, the Notice instructs you as to how you may access and review all of the proxy materials and submit your proxy on the Internet. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares by following the instructions on the proxy card, in addition to the other methods of voting described in this proxy statement.

Why Are You Holding a Virtual Annual Meeting?

Due to the public health impact of the COVID-19 pandemic and to support the health and well-being of our stockholders, directors, officers and other participants, our 2021 Annual Meeting will be held in a virtual meeting format only. We have designed our virtual format to enhance, rather than constrain, stockholder access, participation and communication. For example, the virtual format allows stockholders to communicate with us in advance of, and during, the annual meeting so they can submit questions to our board of directors or management, as time permits. We will evaluate the effectiveness of the 2021 annual meeting and review other circumstances in 2022 to decide whether we will hold an in-person or a virtual annual meeting in 2022.

What happens if There Are Technical Difficulties during the Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual annual meeting, voting at the annual meeting or submitting questions at the annual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting login page.

Who Can Vote?

Only stockholders who owned our common stock at the close of business on April 5, 2021 are entitled to vote at the annual meeting. On this Record Date, there were 28,345,159 shares of our common stock outstanding and entitled to vote. Our common stock is our only class of voting stock.

If on the Record Date your shares of our common stock were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record.

If on the Record Date your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares at the annual meeting unless you request and obtain a valid proxy from your broker or other agent.

1

You do not need to attend the annual meeting to vote your shares. Shares represented by valid proxies, received in time for the annual meeting and not revoked prior to the annual meeting, will be voted at the annual meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the annual meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via the Internet or telephone. You may specify whether your shares should be voted FOR or WITHHELD for each nominee for director, and whether your shares should be voted FOR, AGAINST or ABSTAIN with respect to the other proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with our board of directors’ recommendations as noted below. Voting by proxy will not affect your right to attend the annual meeting. If your shares are registered directly in your name through our stock transfer agent, Computershare Trust Company, N.A., or you have stock certificates registered in your name, you may vote:

|

|

• |

By Internet or by telephone. Follow the instructions included in the Notice or, if you received printed materials, in the proxy card to vote over the Internet or by telephone. |

|

|

• |

By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with our board of directors’ recommendations as noted below. |

|

|

• |

At the time of the virtual meeting. If you attend the virtual meeting, you may vote your shares online at the time of the meeting. |

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on May 31, 2021.

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares at the time of the virtual annual meeting, you should contact your broker or agent to obtain a legal proxy or broker’s proxy card and vote your shares online at the time of the meeting.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The board of directors recommends that you vote as follows:

|

|

• |

“FOR” the election of the nominees for director; |

|

|

• |

“FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2021; and |

|

|

• |

“FOR” the advisory vote to approve the compensation of the named executive officers, as disclosed in this Proxy Statement. |

If any other matter is presented at the annual meeting, your proxy provides that your shares will be voted by one or both of the proxy holders listed in the proxy in accordance with his or their best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the annual meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the annual meeting. You may change or revoke your proxy in any one of the following ways:

|

|

• |

if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

|

|

• |

by re-voting by Internet or by telephone as instructed above; |

2

|

|

|

|

• |

by notifying Aspen Aerogels’ Secretary in writing before the annual meeting that you have revoked your proxy; or |

|

|

• |

by attending the annual meeting and voting virtually. Attending the annual meeting virtually will not in and of itself revoke a previously submitted proxy. You must specifically request at the annual meeting that it be revoked. |

Your most current vote, whether by telephone, Internet or proxy card is the vote that will be counted.

What if I Receive More Than One Notice or Proxy Card?

You may receive more than one Notice or proxy card if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on the ratification of the appointment of our independent registered public accounting firm (Proposal 2 of this proxy statement) without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the annual meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

Your bank, broker or other nominee does not have the ability to vote your uninstructed shares in the election of directors. Therefore, if you hold your shares in street name, it is critical that you cast your vote if you want your vote to be counted for Proposal Nos. 1 and 3 of this proxy statement.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

|

|

Proposal 1: Elect Directors |

The nominees for director who receive the most votes (also known as a “plurality” of the votes cast) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of the directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of the directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

|

|

|

|

|

|

Proposal 2: Ratify Appointment of Independent Registered |

The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to ratify the appointment of our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to appoint our independent registered public accounting firm. However, if our stockholders do not ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2021, the audit committee of our board of directors will reconsider its appointment. |

|

|

|

|

|

|

Proposal 3: Approve, on an advisory basis, the compensation of the named executive officers, as disclosed in this Proxy Statement |

The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal decides the result of the advisory vote. Abstentions will have no effect on the outcome of the proposal. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote.

|

3

Is Voting Confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspectors of Election, representatives of Broadridge Investor Communication Solutions, Inc., examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make on the proxy card or that you otherwise provide.

Where Can I Find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the annual meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the annual meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

What Constitutes a Quorum for the Annual Meeting?

The presence, at the meeting virtually or by proxy, of the holders of a majority of the voting power of all outstanding shares of our common stock entitled to vote at the annual meeting is necessary to constitute a quorum at the annual meeting. Votes of stockholders of record who are present at the annual meeting virtually or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Attending the Annual Meeting

The annual meeting will be held at 9:00 a.m. Eastern Time on Thursday, June 1, 2021. This year, our annual meeting will be held in a virtual meeting format only.

To attend the virtual annual meeting, go to https://www.virtualshareholdermeeting.com/ASPN2021 shortly before the meeting time, and follow the instructions for downloading the webcast. If you miss the annual meeting, you can view a replay of the webcast at the same location at least six months from the meeting. You need not attend the annual meeting in order to vote.

Householding of Annual Disclosure Documents

SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single Notice or, if applicable, a single set of our proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our Notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single Notice or, if applicable, a single set of proxy materials this year, but you would prefer to receive your own copy, please contact our transfer agent, Computershare Trust Company, N.A., by calling their toll free number, 1-800-368-5948.

4

If you do not wish to participate in householding and would like to receive your own Notice or, if applicable, set of Aspen Aerogels proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another Aspen Aerogels stockholder and together both of you would like to receive only a single Notice or, if applicable, set of proxy materials, follow these instructions:

|

|

• |

If your Aspen Aerogels shares are registered in your own name, please contact our transfer agent, Computershare Trust Company, N.A., and inform them of your request by calling them at 1-800-368-5948 or writing them at Computershare Investor Services, P.O. Box 505000, Louisville, Kentucky 40233-9814. |

|

|

• |

If a broker or other nominee holds your Aspen Aerogels shares, please contact the broker or other nominee directly and inform them of your request. Be sure to include your name, the name of your brokerage firm and your account number. |

5

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of April 5, 2021 for (a) the executive officers named in the Summary Compensation Table on page 20 of this proxy statement, (b) each of our directors and director nominees, (c) all of our current directors and executive officers as a group and (d) each stockholder known by us to own beneficially more than 5% of our common stock.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. We deem shares of common stock that may be acquired by an individual or group within 60 days of April 5, 2021 pursuant to the exercise of options or warrants or the vesting of restricted stock units (“RSUs”) to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table.

Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them based on information provided to us by these stockholders. Percentage of ownership is based on 28,345,159 shares of common stock outstanding on April 5, 2021.

|

|

|

Shares beneficially owned |

|

|||||

|

|

|

Number |

|

|

Percentage |

|

||

|

Name of Beneficial Owner |

|

|

|

|

|

|

|

|

|

Directors and Named Executive Officers: |

|

|

|

|

|

|

|

|

|

Donald R. Young (1) |

|

|

1,249,648 |

|

|

|

4.4 |

% |

|

John F. Fairbanks (2) |

|

|

538,626 |

|

|

|

1.9 |

% |

|

Corby C. Whitaker (3) |

|

|

213,148 |

|

|

* |

|

|

|

Rebecca B. Blalock (4) |

|

|

115,703 |

|

|

* |

|

|

|

Robert M. Gervis (5) |

|

|

288,947 |

|

|

|

1.0 |

% |

|

Steven R. Mitchell (6) |

|

|

141,373 |

|

|

* |

|

|

|

Mark L. Noetzel (7) |

|

|

157,717 |

|

|

* |

|

|

|

William P. Noglows (8) |

|

|

161,376 |

|

|

* |

|

|

|

Richard F. Reilly (9) |

|

|

153,773 |

|

|

* |

|

|

|

All directors and current executive officers as a group (12 persons) (10) |

|

|

3,778,156 |

|

|

|

13.3 |

% |

|

Five Percent Stockholders: |

|

|

|

|

|

|

|

|

|

GKFF Ventures I, LLC (11) |

|

|

3,167,322 |

|

|

|

11.2 |

% |

|

Oaktop Capital Management II, L.P. (12) |

|

|

2,939,758 |

|

|

|

10.4 |

% |

|

Telemark Asset Management, LLC (13) |

|

|

2,250,000 |

|

|

|

7.9 |

% |

|

BlackRock, Inc. (14) |

|

|

1,800,974 |

|

|

|

6.4 |

% |

|

* |

Represents beneficial ownership of less than 1% of the outstanding shares of our common stock. |

|

(1) |

Consists of 191,190 shares of our common stock held by Mr. Young, 1,057,732 shares of our common stock issuable upon the exercise of options exercisable within 60 days following April 5, 2021, and 726 shares issuable upon the exercise of options held by Mr. Young’s children, of which Mr. Young has sole voting power. |

|

(2) |

Consists of 120,733 shares of our common stock held by Mr. Fairbanks and 417,893 shares of our common stock issuable upon the exercise of options exercisable within 60 days following April 5, 2021. |

|

(3) |

Consists of 91,346 shares of our common stock held by Mr. Whitaker and 121,802 shares of our common stock issuable upon the exercise of options exercisable within 60 days following April 5, 2021. |

|

(4) |

Consists of 48,601 shares of our common stock (including unvested restricted stock) held by Ms. Blalock and 67,102 shares of our common stock issuable upon the exercise of options exercisable within 60 days following April 5, 2021. |

|

(5) |

Consists of 136,794 shares of our common stock (including unvested restricted stock) held by Mr. Gervis, 72,491 shares of our common stock held by the Robert Gervis 2014 Grantor Retained Annuity Trust, of which Mr. Gervis is a beneficiary and his spouse is trustee, and 79,662 shares of our common stock issuable upon the exercise of options exercisable within 60 days following April 5, 2021. |

|

(6) |

Consists of 64,043 shares of our common stock (including unvested restricted stock) held by Mr. Mitchell and 77,330 shares of our common stock issuable upon the exercise of options exercisable within 60 days following April 5, 2021. |

|

(7) |

Consists of 77,619 shares of our common stock (including unvested restricted stock) held by Mr. Noetzel and 80,098 shares of our common stock issuable upon the exercise of options exercisable within 60 days following April 5, 2021. |

|

(8) |

Consists of 84,043 shares of our common stock (including unvested restricted stock) held by Mr. Noglows and 77,333 shares of our common stock issuable upon the exercise of options exercisable within 60 days following April 5, 2021. |

6

|

(9) |

Consists of 74,043 shares of our common stock (including unvested restricted stock) held by Mr. Reilly and 79,730 shares of our common stock issuable upon the exercise of options exercisable within 60 days following April 5, 2021. |

|

(10) |

See footnotes 1 through 9. Also includes 75,559 shares of our common stock and 252,515 shares of our common stock issuable upon the exercise of options held by George L. Gould, Ph.D., our Chief Technology Officer, which are exercisable within 60 days following April 5, 2021; 43,493 shares of common stock and 212,180 shares of our common stock issuable upon exercise of options held by Kelley A. Conte, our Senior Vice President, Human Resources, which are exercisable within 60 days following April 5, 2021; and 45,033 shares of common stock and 129,065 share of our common stock issuable upon exercise of options held by Gregg R. Landes, Senior Vice President, Operations and Strategic Development, which are exercisable within 60 days following April 5, 2021. |

|

(11) |

Consists of 3,167,322 shares held by GKFF Ventures I, LLC (formerly known as Argonaut Ventures I, LLC) (“GKFF Ventures”). GKFF Ventures is managed by Ken Levit and Robert Thomas. George Kaiser Family Foundation (“GKFF”) is the sole equity owner of GKFF Ventures. Messrs. Levit and Thomas and GKFF may be deemed to share voting and investment control over the shares, which are beneficially owned by GKFF Ventures. Each of these individuals and GKFF disclaims beneficial ownership of the reported securities except to the extent of his or its pecuniary interest therein. The address of GKFF Ventures I, LLC is c/o George Kaiser Family Foundation, 7030 South Yale Avenue, Suite 600, Tulsa, Oklahoma 74136. This information is based on a Form 13F filed by George Kaiser Family Foundation with the SEC on February 11, 2021. |

|

(12) |

Consists of 2,939,758 shares of our common stock beneficially owned by Oaktop Capital Management II, L.P. in its capacity as an investment advisor. The address of Oaktop Capital Management II, L.P. is One Main Street, Suite 202, Chatham, NJ 07928. This information is based solely on a Form 13F filed by Oaktop Capital Management II, L.P. with the SEC on February 9, 2021. |

|

(13) |

Consists of 2,250,000 shares or our common stock beneficially owned by Telemark Asset Management, LLC, Telemark Fund, LP and Colin McNay. Telemark Asset Management, LLC is the investment adviser of Telemark Fund, LP. Colin McNay is the President and sole owner of Telemark Asset Management, LLC. The address of Telemark Asset Management, LLC is One International Place, Suite 4620 Boston MA, 02110. This information is based solely on the Schedule 13G filed by Telemark Asset Management, LLC with the SEC on February 12, 2021. |

|

(14) |

Consists of 1,800,974 shares of our common stock beneficially owned by Blackrock, Inc. The address of Blackrock, Inc. is 55 East 52nd Street, New York, NY 10055. This information is based solely on a Schedule 13G filed by Blackrock, Inc. with the SEC on February 2, 2021. |

7

MANAGEMENT AND CORPORATE GOVERNANCE

The Board of Directors

Our Restated Certificate of Incorporation and Restated Bylaws provide that our business is to be managed by or under the direction of our board of directors. Our board of directors is divided into three classes for purposes of election. One class is elected at each annual meeting of stockholders to serve for a three-year term. Our board of directors currently consists of seven members classified into three classes as follows: (1) Rebecca B. Blalock and Robert M. Gervis constitute the Class I directors and their current terms will expire at the 2021 annual meeting of stockholders (2) Mark L. Noetzel and William P. Noglows constitute the Class II directors and their current terms will expire at the 2022 annual meeting of stockholders and (3) Steven R. Mitchell, Richard F. Reilly and Donald R. Young constitute the Class III directors and their current terms will expire at the 2023 annual meeting of stockholders.

On February 24, 2021, our board of directors accepted the recommendation of the nominating and governance committee and voted to nominate Rebecca B. Blalock and Robert M. Gervis for re-election at the annual meeting for a term of three years to serve until the 2024 annual meeting of stockholders, and until their respective successors have been elected and qualified.

Set forth below are the names of those persons nominated for election as directors at the 2021 annual meeting and those directors whose terms do not expire this year, their ages, their positions in the Company, if any, their principal occupations or employment for at least the past five years, the length of their tenure as directors and the names of other public companies in which such persons hold or have held directorships during the past five years. Additionally, information about the specific experience, qualifications, attributes or skills that led to our board of directors’ conclusion at the time of filing of this proxy statement that each person listed below should serve as a director is set forth below:

|

Name |

|

Age |

|

Position |

|

Donald R. Young |

|

63 |

|

President, Chief Executive Officer and Director |

|

Rebecca B. Blalock |

|

65 |

|

Director |

|

Robert M. Gervis |

|

60 |

|

Director |

|

Steven R. Mitchell |

|

51 |

|

Director |

|

Mark L. Noetzel |

|

63 |

|

Director |

|

William P. Noglows |

|

63 |

|

Chairman of the Board |

|

Richard F. Reilly |

|

73 |

|

Director |

Donald R. Young has been our President, Chief Executive Officer and a member of our board of directors since November 2001. Prior to joining us, Mr. Young worked in the United States and abroad in a broad range of senior operating roles for Cabot Corporation, a leading global specialty chemical company. Prior to Cabot Corporation, Mr. Young worked in the investment business at Fidelity Management & Research. Mr. Young holds a BA from Harvard College and an MBA from Harvard Business School. The board has concluded that Mr. Young possesses specific attributes that qualify him to serve as a member of our board of directors, including the perspective and experience he brings as our Chief Executive Officer, which brings historic knowledge, operational expertise and continuity to our board of directors.

Rebecca B. Blalock has served on our board of directors since June 2016. Ms. Blalock is a partner at Advisory Capital LLC, which provides strategic consulting in the areas of energy and information technology. She has served in that role since October 2011. From October 2002 to October 2011, Ms. Blalock was Senior Vice President and Chief Information Officer of Southern Company, a Fortune 500 energy company. From 1979 to October 2002, Ms. Blalock served in various positions at Georgia Power and Southern Company Services, which are subsidiaries of Southern Company. Ms. Blalock’s management experience during her tenure at Georgia Power included serving as Vice President of Community and Economic Development from January 2000 to October 2002 and Director, Corporate Communication from February 1996 to February 2000. She currently serves on the advisor board of Valor Ventures LLC and on the Board of Ovaledge LLC. She had previously served on the Board of Directors of Hannon Armstrong Sustainable Infrastructure Capital, Inc. (NYSE:HASI), including on its Compensation Committee from March 15, 2017 until July 31, 2019 and on its Finance and Risk Committee from May 15, 2017 until July 31, 2019. She also serves on the Advisory Board of Sol America. Ms. Blalock is also a Trustee of the Woodruff Arts Foundation and serves on the Board of Councilors of The Carter Center. Ms. Blalock holds a BBA in Marketing from State University of West Georgia and an MBA in Finance from Mercer University. Ms. Blalock also completed the Program for Management Development (PMD) at Harvard Business School, received a cyber-security certificate from the Georgia Institute of Technology in 2017 and a Cyber Risk Oversight Certificate from National Association of Corporate Directors in 2018. The board has concluded that Ms. Blalock possesses specific attributes that qualify her to serve as a member of our board of directors, including the strategic insight, expertise and experience she has developed in senior executive management at a Fortune 500 company in the energy industry, particularly with information technology, as well as her experience with the business environment in Georgia.

8

Robert M. Gervis has served on our board of directors since January 2011. Mr. Gervis has been a self-employed advisor and investor since April 2009, as well as a member of various public and private company boards of directors. Prior to April 2009, Mr. Gervis served in various senior executive positions at Fidelity Investments from July 1994 to March 2009. Mr. Gervis’ management experience during his tenure with Fidelity Investments included serving as (i) Chief Executive Officer of an oil and natural gas exploration and production company from December 2002 to March 2006; (ii) Chief Operating Officer of an international, full-service real estate development and investment company from May 2002 to June 2003; (iii) Managing Director of a private equity division from March 2002 to March 2006, which invested in a broad range of industries, including technology, biotechnology, real estate, oil and gas exploration and production and telecommunications; and (iv) President of Ballyrock Investment Advisors from April 2006 to March 2009, a registered investment adviser which managed Fidelity Investments’ structured credit business. Prior to joining Fidelity Investments, Mr. Gervis was a partner at the law firm of Weil, Gotshal & Manges. He currently is an investor in, and occasionally serves on the boards of, private companies primarily in the Boston area. Mr. Gervis previously served as a director of Axiall Corporation (NYSE: AXLL) and Tronox Incorporated (NYSE: TROX). Mr. Gervis holds a BS in Industrial Engineering from Lehigh University and a JD from George Washington University. Mr. Gervis also is a CFA charter holder. The board has concluded that Mr. Gervis possesses specific attributes that qualify him to serve as a member of our board of directors, including his extensive experience in finance, capital markets and investing, his management skills, as well as his experience with sophisticated transactions as a corporate attorney. In addition, because Mr. Gervis has served on many boards of directors, the board has concluded that he has substantial experience regarding how boards can and should effectively oversee and manage companies, and a significant understanding of governance issues.

Steven R. Mitchell has served on our board of directors since August 2009. Mr. Mitchell has served as the Chief Executive Officer of Argonaut Private Capital L.P. since July 2016 prior to which he was the managing director of Argonaut Private Equity, LLC, or Argonaut, since November 2004. Prior to joining Argonaut, Mr. Mitchell was a principal in both Radical Incubation and 2929 Entertainment. He currently serves on the boards of directors of several public and privately owned companies, including Stepstone Group; Alkami Technology, Inc.; S&R Compression, LLC; DMB Pacific, LLC; Norberg-IES LLC; The Fred Jones Companies, LLC; JAC Holding Enterprises, Inc.; SEF Energy, LLC; Mammoth Carbon Products, LLC; MT Group Holdings, LLC; American Cementing, LLC; and Mark Young Construction, LLC. From 1996 to 1999, Mr. Mitchell was a corporate attorney at Gibson, Dunn & Crutcher LLP. Mr. Mitchell holds a BBA in Marketing from Baylor University and a JD from University of San Diego School of Law. The board has concluded that Mr. Mitchell possesses specific attributes that qualify him to serve as a member of our board of directors, including his experience building, investing in and growing several manufacturing, technology and product companies and his experience with sophisticated transactions as a corporate attorney. In addition, because Mr. Mitchell has served on many boards of directors, the board has concluded that he has substantial experience regarding how boards can and should effectively oversee and manage companies, and a significant understanding of governance issues.

Mark L. Noetzel has served on our board of directors since December 2009. Currently, he is a Managing Director of Akoya Capital Partners, LLC, working in the specialty chemicals segment. Mr. Noetzel has worked as a consultant to a number of public and private companies since May 2009. From June 2007 to May 2009, Mr. Noetzel was President and Chief Executive Officer of Cilion, Inc., a biofuels company. Prior to joining Cilion in 2007, he had served in several senior positions at BP plc, including Group Vice President, Global Retail, from 2003 until 2007, Group Vice President, B2B Fuels and New Markets, during 2001 and 2002 and Group Vice President, Chemicals, from 1997 until 2001. Prior to those senior management roles with BP plc, Mr. Noetzel served in other management and non-management roles with Amoco Corporation from 1981 until BP acquired Amoco in 1998. Mr. Noetzel served on the board of directors of Axiall Corporation (NYSE: AXLL) from September 2009 until Axiall was acquired by Westlake Chemical Corporation in August 2016. Mr. Noetzel served as Chairman of Axiall from January 2010 to March 2016. Mr. Noetzel also previously served on the board of Siluria Technologies Inc., a privately owned technology company until May 2019 and on the board of Dixie Chemical Company Inc., also privately owned, from September 2017 to November 2018. Mr. Noetzel holds a BA in Political Science from Yale University and an MBA from the Wharton School at University of Pennsylvania. The board has concluded that Mr. Noetzel possesses specific attributes that qualify him to serve as a member of our board of directors, including more than ten years of experience in senior executive management roles with large, international businesses within the chemical and fuel industries and his experience as chairman of the board of a public company.

William P. Noglows has served on our board of directors since our initial public offering in June 2014 and previously served on our board of directors from January 2011 to April 2013. Mr. Noglows has served as Chairman of the Board of CMC Materials, Inc., formerly known as Cabot Microelectronics Corporation since November 2003 and as President and Chief Executive Officer from November 2003 until December 2014. Mr. Noglows also serves on the boards of Littelfuse, Inc. and NuMat Technologies, Inc. From 1984 through 2003, Mr. Noglows served in various management positions at Cabot Corporation, culminating in serving as an executive vice president and general manager. Mr. Noglows had previously served as a director of Cabot Microelectronics from December 1999 until April 2002. Mr. Noglows holds a BS in Chemical Engineering from Georgia Institute of Technology. The board has concluded that Mr. Noglows possesses specific attributes that qualify him to serve as a member and chairman of our board of directors, including his experience as chief executive officer of a leading public company and his expertise in developing technology. In addition, because Mr. Noglows has served on boards of directors of two other public companies, the board has concluded that he

9

has significant experience regarding how boards can and should effectively oversee and manage companies, and a significant understanding of governance issues.

Richard F. Reilly has served on our board of directors since July 2010. For 31 years prior to his retirement in 2009, Mr. Reilly specialized in audits of manufacturing, technology and distribution companies with KPMG LLP, including 28 years in the role of senior audit partner. Prior to his tenure with KPMG LLP, Mr. Reilly worked in private industry, serving in various accounting management roles in technology and manufacturing companies. Mr. Reilly also served for ten years in the U.S. Army reserve as a combat engineer officer. Mr. Reilly served as a member of the board of trustees and as chair of the audit committee of Perkins School for the Blind, a non-profit institution headquartered in Boston, Massachusetts for nine years until November 2018, and currently serves as a member of the finance and audit committee for The Clergy Health and Retirement Trust of the Archdiocese of Boston. From November 2014 to March 2020, Mr. Reilly served on the board of directors and as chair of the audit committee of the NYSE-listed AquaVenture Holdings Limited until its acquisition by Culligan International Company. From November 2012 to December 2013, Mr. Reilly also served as a consultant to a Fortune 500 company related to finance, controls and governance issues at its subsidiary in India. Mr. Reilly holds a BS in Business Administration from Northeastern University and is a Certified Public Accountant. The board has concluded that Mr. Reilly possesses specific attributes that qualify him to serve as a member of our board of directors and to serve as chair of our audit committee, including a deep understanding of accounting principles and financial reporting rules and regulations, acquired over the course of his career at KPMG LLP and in private industry. In addition, we believe Mr. Reilly has significant experience overseeing, from an independent auditor’s perspective, the financial reporting processes of large public companies in a variety of industries with a global presence.

Director Independence

Our board of directors has reviewed the materiality of any relationship that each of our directors has with Aspen Aerogels, either directly or indirectly. Based upon this review, our board has determined that all of our directors other than Donald R. Young, our President and Chief Executive Officer, are “independent directors” as defined by the New York Stock Exchange.

Committees of the Board of Directors and Meetings

Meeting Attendance. During the fiscal year ended December 31, 2020, there were seven meetings of our board of directors, and the various committees of the board met a total of 21 times. No director attended fewer than 75% of the total number of meetings of the board and of committees of the board on which he or she served during fiscal year 2020. The board has adopted a policy under which each member of the board is strongly encouraged but not required to attend each annual meeting of our stockholders. All of our directors attended the annual meeting of our stockholders held in 2020.

Audit Committee. Our audit committee met nine times during fiscal year 2020. This committee currently has three members, Richard F. Reilly (chair), Rebecca B. Blalock and Mark L. Noetzel. Our audit committee’s role and responsibilities are set forth in the audit committee’s written charter and include the authority to retain and terminate the services of our independent registered public accounting firm. In addition, the audit committee reviews our annual and quarterly financial statements, considers matters relating to accounting policy and internal controls and reviews the scope of annual audits. All members of the audit committee satisfy the current independence standards promulgated by the SEC and by the New York Stock Exchange, as such standards apply specifically to members of audit committees. Our board of directors has determined that Mr. Reilly is an “audit committee financial expert,” as the SEC has defined that term in Item 407 of Regulation S-K.

Our audit committee is authorized to, among other matters:

|

|

• |

approve and retain the independent registered public accounting firm to conduct the annual audit of our financial statements; |

|

|

• |

review the proposed scope and results of the audit; |

|

|

• |

review accounting and financial controls with the independent registered public accounting firm and our financial and accounting staff; |

|

|

• |

review and approve transactions between us and our directors, officers and affiliates; |

|

|

• |

recognize and prevent prohibited non-audit services; |

|

|

• |

establish procedures for complaints received by us regarding accounting matters and any other complaints alleging a violation of our code of business conduct and ethics; |

|

|

• |

oversee internal audit functions; |

|

|

• |

review and evaluate our policies and procedures with respect to risk assessment and risk management; and |

10

|

|

|

|

• |

prepare the report of the audit committee that the rules of the SEC require to be included in our annual meeting proxy statement. |

Our audit committee typically meets quarterly and with greater frequency as necessary. The agenda for each meeting is set by the chair of the audit committee in consultation with the Chief Executive Officer and Chief Financial Officer. The audit committee meets regularly in executive session. However, from time to time, various members of management, and employees, outside advisors or consultants may be invited by the audit committee to make presentations, to provide financial, background information or advice, or to otherwise participate in audit committee meetings.

Please also see the report of the audit committee set forth elsewhere in this proxy statement.

A copy of the audit committee’s written charter is publicly available in the “Investors” section of our website at www.aerogel.com.

Compensation and Leadership Development Committee. Our compensation and leadership development committee (hereafter also referred to as our “compensation committee”) met eight times during fiscal 2020. This committee currently has three members, Robert M. Gervis (chair), William P. Noglows and Steven R. Mitchell. Our compensation committee’s role and responsibilities are set forth in the compensation committee’s written charter and includes reviewing, approving and making recommendations regarding our compensation policies, practices and procedures to ensure that legal and fiduciary responsibilities of the board of directors are carried out and that such policies, practices and procedures contribute to our success. Our compensation committee also administers our 2014 Employee, Director and Consultant Equity Incentive Plan (“2014 Plan”) and our employee cash bonus plan. The compensation committee is responsible for the determination of the compensation of our executive officers other than our Chief Executive Officer. The compensation of our Chief Executive Officer is determined by our board of directors upon the recommendation of our compensation committee. All members of the compensation committee qualify as independent under the definition promulgated by the New York Stock Exchange.

Our compensation committee is authorized to, among other matters:

|

|

• |

review and recommend compensation arrangements for management; |

|

|

• |

establish and review general compensation policies with the objective to attract and retain superior talent, to reward individual performance and to achieve our financial goals; |

|

|

• |

administer our equity incentive plans; |

|

|

• |

ensure appropriate leadership development and succession planning is in place; |

|

|

• |

oversee the evaluation of management; and |

|

|

• |

if applicable, prepare the report of the compensation committee that the rules of the SEC require to be included in our annual meeting proxy statement. |

Our compensation committee typically meets quarterly and with greater frequency if necessary. The agenda for each meeting is set by the chair of the compensation committee in consultation with the Chief Executive Officer. The compensation committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the compensation committee to make presentations, to provide financial or other background information or advice, or to otherwise participate in compensation committee meetings. The Chief Executive Officer does not participate in and is not present during any deliberations or determinations of the board of directors or the compensation committee regarding his compensation.

The compensation committee has the sole authority to obtain, at the expense of the Company, advice and assistance from compensation consultants, legal counsel, experts and other advisors that the compensation committee deems advisable in the performance of its duties. The compensation committee has the sole authority to approve any such consultants’ or advisors’ fees and other retention terms. The compensation committee may select any such consultant, counsel, expert or advisor to the compensation committee, only after taking into consideration factors that bear upon the advisor’s independence. The compensation committee has engaged Meridian Compensation Partners, LLC (“Meridian”) as its compensation consultant since 2014. The compensation committee assessed the independence of Meridian pursuant to SEC rules and other factors and concluded that Meridian’s work for the compensation committee does not raise any conflict of interest nor affect its independence.

Generally, the compensation committee’s process involves the establishment of corporate goals and objectives for the current year and determination of compensation levels. For executives other than the Chief Executive Officer, the compensation committee solicits and considers evaluations and recommendations submitted to the committee by the Chief Executive Officer. In the case of the

11

Chief Executive Officer, the evaluation is conducted by the compensation committee, which recommends any adjustments to his compensation levels and arrangements for approval by the board of directors. For all executives, as part of its deliberations, the compensation committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, total compensation that may become payable to executives in various hypothetical scenarios, executive stock ownership information, Company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels and recommendations of the compensation committee’s compensation consultant, if any, including analyses of executive compensation paid at other companies.

For 2020, Meridian assisted the compensation committee in fulfilling its responsibilities under its charter, including advising on compensation packages for executive officers, compensation program design and market practices generally. The compensation committee authorized Meridian to interact with management on behalf of the compensation committee, as needed in connection with advising the compensation committee, and Meridian participates in discussions with management and, when appropriate, outside legal counsel with respect to matters under consideration by the compensation committee.

A copy of the compensation committee’s written charter is publicly available in the “Investors” section of our website at www.aerogel.com.

Nominating and Governance Committee. Our nominating and governance committee met four times during fiscal year 2020 and currently has three members, Rebecca B. Blalock (chair), Robert M. Gervis and Mark L. Noetzel. The nominating and governance committee’s role and responsibilities are set forth in the nominating and governance committee’s written charter and include evaluating and making recommendations to the full board as to the size and composition of the board and its committees, evaluating and making recommendations as to potential candidates to serve on our board of directors, and evaluating current board members’ performance. All members of the nominating and governance committee qualify as independent under the definition promulgated by the New York Stock Exchange.

Our nominating and governance committee is authorized to, among other matters:

|

|

• |

identify and recommend director nominees for election to the board of directors; |

|

|

• |

review and recommend the compensation arrangements for our non-employee directors; |

|

|

• |

develop and recommend to the board of directors a set of corporate governance principles applicable to our Company; and |

|

|

• |

oversee the evaluation of our board of directors. |

Our nominating and governance committee may consider candidates recommended by stockholders as well as from other sources such as other directors or officers, third party search firms or other appropriate sources. Once identified, the nominating and governance committee will evaluate a candidate’s qualifications in accordance with our “Criteria for Nomination as a Director” appended to our nominating and governance committee’s written charter. Threshold criteria include a candidate’s personal integrity and sound judgment, business and professional skills and experience, independence, knowledge of our industry, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need on the board, and concern for the long-term interests of our stockholders.

If a stockholder wishes to propose a candidate for consideration as a nominee for election to our board of directors, the stockholder must follow the procedures described in our restated bylaws and in “Stockholder Proposals and Nominations for Director” at the end of this proxy statement. In general, persons recommended by stockholders will be considered in accordance with our “Policies and Procedures for Shareholders Submitting Nominating Recommendations” appended to our nominating and governance committee’s written charter. All stockholder recommendations for proposed director nominees must be addressed in writing to the nominating and governance committee, in care of our Secretary, at our principal offices and must be received by the deadlines set forth in this proxy statement under the heading “Stockholder Proposals and Nominations for Director.” The recommendation must be accompanied by the following information concerning each stockholder making the recommendation and the beneficial owner, if any, on whose behalf the nominations is made:

|

|

• |

the name and address, of the recommending stockholder, as they appear on the Company’s books, and of such beneficial owner, as well as his or her telephone number; |

|

|

• |

certain biographical and share ownership information about the stockholder, beneficial owner and any other proponent, including a description of any derivative transactions in the Company’s securities; |

|

|

• |

any other information relating to such stockholder and beneficial owner, if any, that would be required to be disclosed in a proxy statement or other filings required to be made in connection with the election of directors in a contested election pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, or the Exchange Act; |

12

|

|

• |

a description of all agreements, arrangements and understandings between such stockholder and beneficial owner, if any, and any other person or persons (including their names) in connection with such stockholder nomination; |

|

|

• |

if the recommending stockholder is not a stockholder of record, a statement from the record holder of the shares (usually a broker or bank) verifying the holdings of the stockholder and a statement from the recommending stockholder of the length of time that the shares have been held. Alternatively, the stockholder may furnish a current Schedule 13D, Schedule 13G, Form 3, Form 4 or Form 5 filed with the SEC reflecting the holdings of the stockholder, together with a statement of the length of time that the shares have been held; and |

|

|

• |

a statement from the stockholder as to whether the stockholder has a good faith intention to continue to hold the reported shares through the date of our next annual meeting of stockholders. |

The recommendation must be accompanied by the following information concerning the proposed nominee:

|

|

• |

a description of all direct and indirect compensation and other arrangements during the past three years, and any other material relationships, between such stockholder and beneficial owner, if any, and their respective affiliates, on the one hand, and each proposed nominee, and his or her respective affiliates, on the other hand, including, any agreements or understandings regarding the nomination and all information that would be required to be disclosed pursuant to Item 401, 403 and 404 of Regulation S-K promulgated under the Securities Act of 1933, as amended, or the Securities Act, if the stockholder making the nomination and any beneficial owner on whose behalf the nomination is made, if any, or any affiliate or associate thereof, were the “registrant” for purposes of such rule and the nominee were a director or executive officer of such registrant; |

|

|

• |

to the extent known by the stockholder, the name and address of any other securityholder of the Company who owns, beneficially or of record, any securities of the Company and who supports any nominee proposed by such stockholder; |

|

|

• |

a description of all relationships between the proposed nominee and any of our competitors, customers, suppliers, labor unions or other persons with special interests regarding the Company; |

|

|

• |

certain biographical information and contact information of the proposed nominee; |

|

|

• |

all other information relating to such person that would be required to be disclosed in solicitations of proxies for election of such nominees as directors, or is otherwise required, in each case, pursuant to Regulation 14A under the Exchange Act (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); and |

|

|

• |

additional disclosures relating to stockholder nominees for directors, including completed questionnaires and any other disclosures required by our Bylaws. |

The recommending stockholder must also furnish a statement supporting the stockholder’s view that the proposed nominee possesses the minimum qualifications prescribed by the committee for nominees, and describing the contributions that the nominee would be expected to make to the board and to the governance of the Company. The recommending stockholder must state whether, in its view, the proposed nominee, if elected, would represent all stockholders and not serve for the purpose of advancing or favoring any particular stockholder or other constituency of the Company. The recommendation must be accompanied by the written consent of the proposed nominee: (a) to be considered by the committee and interviewed if the committee chooses to do so in its discretion, and (b) if nominated and elected, to serve as a director.

If a recommendation is submitted by a group of two or more stockholders, the information regarding recommending stockholders set forth above must be submitted with respect to each stockholder in the group.

Our nominating and governance committee has not adopted a formal diversity policy in connection with the consideration of director nominations or the selection of nominees. However, the nominating and governance committee considers issues of diversity among its members in identifying and considering nominees for director, and will strive where appropriate to achieve a diverse balance of backgrounds, perspectives, experience, age, gender, ethnicity and national origin on the board of directors and its committees.

A copy of the nominating and governance committee’s written charter and our corporate governance guidelines are publicly available on the Investors section of our website at www.aerogel.com.

13

Compensation Committee Interlocks and Insider Participation

During our last fiscal year, the members of our compensation committee included Robert M. Gervis (chair), Steven R. Mitchell and William P. Noglows. No member of our compensation committee has at any time been an employee of ours. None of our executive officers serves as a member of another entity’s board of directors or compensation committee that has one or more executive officers serving as a member of our board of directors or compensation committee.

Board Leadership Structure and Role in Risk Oversight

The positions of Chairman of the Board and Chief Executive Officer are presently separated at our Company. We believe that separating these positions allows our Chief Executive Officer to focus on our day-to-day business, while allowing our Chairman of the Board to lead the board of directors in its fundamental role of providing advice to, and independent oversight of, management. Our board of directors recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman, particularly as the board of directors’ oversight responsibilities continue to grow. Our board of directors also believes that this structure ensures a greater role for the independent directors in the oversight of our Company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of our board of directors. Our board of directors believes its administration of its risk oversight function has not affected its leadership structure.

Our board of directors administers its risk oversight function directly and through its committees. The audit committee receives regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal, regulatory, strategic and reputational risks. The audit committee also periodically reviews our enterprise risk management program. As part of its charter, our audit committee regularly discusses with management our major risk exposures, their potential financial impact on our Company and the steps we take to manage them. In addition, our compensation committee assists the board of directors in fulfilling its oversight responsibilities with respect to the management and risks arising from our compensation policies and programs. Our nominating and governance committee assists the board of directors in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, succession planning for our directors and executive officers and corporate governance.

Stockholder Communications to the Board

Generally, stockholders and other interested parties who have questions or concerns should contact our Investor Relations team at 508-691-1111. However, any stockholders and other interested parties who wish to address questions regarding our business directly with the board of directors, or any individual director, must prepare the communication in written form and mail or hand deliver the same to the following address:

ATTN: SECURITY HOLDER COMMUNICATION

Board of Directors

Aspen Aerogels, Inc.

30 Forbes Road, Building B

Northborough, MA 01532

Such communications should not exceed 500 words in length and must be accompanied by the following information:

|

|

• |

a statement of the (i) type and amount of the securities of the Company that the person holds or (ii) a description of the person’s interest in the Company; |

|

|

• |

any special interest, meaning an interest not in the capacity as a stockholder of the Company, that the person has in the subject matter of the communication; and |

|

|

• |

the address, telephone number and e-mail address, if any, of the person submitting the communication. |

The following types of communications are not appropriate for delivery to directors under these procedures:

|

|

• |

communications regarding individual grievances or other interests that are personal to the party submitting the communication and could not reasonably be construed to be of concern to security holders or other constituencies of the Company (such as employees, members of the communities in which we operate our businesses, customers and suppliers) generally; |

|

|

• |

communications that advocate engaging in illegal activities; |

14

|

|

|

|

• |

communications that, under community standards, contain offensive, scurrilous or abusive content; and |

|

|

• |

communications that have no rational relevance to the business or operations of the Company. |

Communications will be distributed to the board, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communications. Items that are unrelated to the duties and responsibilities of the board may be excluded, such as:

|

|

• |

junk mail and mass mailings; |

|

|

• |

resumes and other forms of job inquiries; |

|

|

• |

surveys; and |

|

|