Form DEF 14A AMERICAN WOODMARK CORP For: Apr 30

| UNITED STATES | |||||||||||||||||

| SECURITIES AND EXCHANGE COMMISSION | |||||||||||||||||

| Washington, D.C. 20549 | |||||||||||||||||

| SCHEDULE 14A | |||||||||||||||||

| Proxy Statement Pursuant to Section 14(a) of the | |||||||||||||||||

| Securities Exchange Act of 1934 | |||||||||||||||||

| (Amendment No. ) | |||||||||||||||||

| Filed by the Registrant [X] | Filed by a Party other than the Registrant [ ] | ||||||||||||||||

| Check the appropriate box: | |||||||||||||||||

| [ ] Preliminary Proxy Statement | |||||||||||||||||

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||||||||||||

| [X] Definitive Proxy Statement | |||||||||||||||||

| [ ] Definitive Additional Materials | |||||||||||||||||

| [ ] Soliciting Material Pursuant to §240.14a-12 | |||||||||||||||||

| American Woodmark Corporation | |||||||||||||||||

| (Name of Registrant as Specified In Its Charter) | |||||||||||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||||||||||||||||

| Payment of Filing Fee (Check the appropriate box): | |||||||||||||||||

| [X] | No fee required. | ||||||||||||||||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | ||||||||||||||||

| (1) | Title of each class of securities to which transaction applies: | ||||||||||||||||

| (2) | Aggregate number of securities to which transaction applies: | ||||||||||||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||||||||||||||

| (4) | Proposed maximum aggregate value of transaction: | ||||||||||||||||

| (5) | Total fee paid: | ||||||||||||||||

| [ ] | Fee paid previously with preliminary materials. | ||||||||||||||||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and date of its filing. | ||||||||||||||||

| (1) | Amount Previously Paid: | ||||||||||||||||

| (2) | Form, Schedule or Registration Statement No.: | ||||||||||||||||

| (3) | Filing Party: | ||||||||||||||||

| (4) | Date Filed: | ||||||||||||||||

561 Shady Elm Road

Winchester, Virginia 22602

Notice of Annual Meeting of Shareholders

TO THE SHAREHOLDERS OF

AMERICAN WOODMARK CORPORATION:

The Annual Meeting of Shareholders ("Annual Meeting") of American Woodmark Corporation (the "Company") will be held at American Woodmark Corporation, 561 Shady Elm Road, Winchester, Virginia, on Thursday, August 26, 2021, at 9:00 a.m., Eastern Daylight Time, for the following purposes:

| 1. | To elect as directors the nine nominees listed in the attached proxy statement to serve a one-year term on the Company's Board of Directors; | |||||||

| 2. | To ratify the selection by the Audit Committee of the Board of Directors of KPMG LLP as the independent registered public accounting firm of the Company for the fiscal year ending April 30, 2022; | |||||||

| 3. | To approve on an advisory basis the Company's executive compensation; and | |||||||

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournments thereof. | |||||||

Only shareholders of record of shares of the Company's common stock at the close of business on June 18, 2021 will be entitled to vote at the Annual Meeting or any adjournments thereof.

Whether or not you plan to attend the Annual Meeting, please mark, sign, and date the enclosed proxy and promptly return it in the enclosed envelope. If for any reason you desire to revoke your proxy, you may do so at any time before it is voted.

All shareholders are cordially invited to attend the Annual Meeting.

| By Order of the Board of Directors | |||||

| Paul Joachimczyk | |||||

| Secretary | |||||

July 9, 2021

AMERICAN WOODMARK CORPORATION

561 Shady Elm Road

Winchester, Virginia 22602

Proxy Statement

PROXY SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. Please read the entire Proxy Statement carefully before voting. This Proxy Statement will be mailed to shareholders of American Woodmark Corporation (the "Company," "American Woodmark" or "us") on or about July 9, 2021.

| Annual Stockholders meeting | |||||

| Date | August 26, 2021 | ||||

| Time | 9:00 a.m. Eastern Daylight Time | ||||

| Place | American Woodmark Corporation Corporate Office | ||||

| 561 Shady Elm Road | |||||

| Winchester, Virginia 22602 | |||||

| Record date | June 18, 2021 | ||||

| Voting | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. | ||||

| Meeting Agenda | ||

•Election of nine directors

•Ratification of KPMG LLP as our independent registered public accounting firm for fiscal year ending April 30, 2022 ("fiscal year 2022")

•Advisory approval of executive compensation

•Transact other business that may properly come before the meeting

1

| Voting Matter and Vote Recommendation | |||||||||||||||||||||||

| Item | Board recommendation | Reasons for recommendations | More information | ||||||||||||||||||||

| 1. | Election of nine directors | FOR | The Board and Governance, Sustainability and Nominating Committee believe that the nine director nominees possess the skills and experience to effectively monitor performance, provide oversight, and advise management on the Company's long-term strategy. | Page 4 | |||||||||||||||||||

| 2. | Ratification of KPMG LLP as our independent registered public accounting firm for fiscal year 2022 | FOR | Based on the Audit Committee's assessment of KPMG's qualifications and performance, it believes that their retention for fiscal year 2022 is in the best interests of the Company. | Page 46 | |||||||||||||||||||

| 3. | Advisory approval of executive compensation | FOR | The Company's executive compensation programs demonstrate the Company's pay for performance philosophy. | Page 46 | |||||||||||||||||||

| Company Management Profile | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

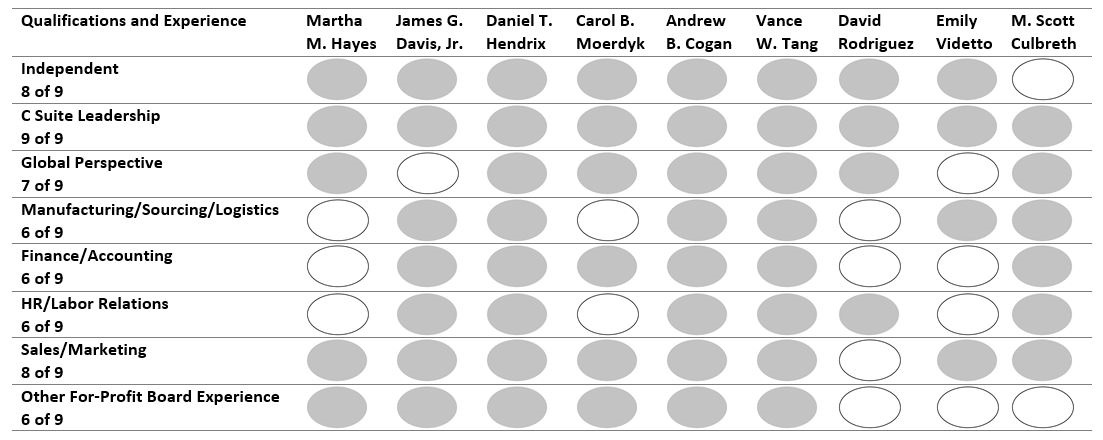

| The following table provides summary information about each current director. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Committee memberships | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Name | Age | Director since calendar year | Independent | Other public boards | AC | CC | GC | Attended at least 75% of Board and committee meetings | Up for election at current Annual Meeting | |||||||||||||||||||||||||||||||||||||||||||||||

| Martha M. Hayes | 70 | 1995 | Yes | 0 | C | M | Yes | Yes | ||||||||||||||||||||||||||||||||||||||||||||||||

| James G. Davis, Jr. | 62 | 2002 | Yes | 0 | M, F | C | Yes | Yes | ||||||||||||||||||||||||||||||||||||||||||||||||

| Daniel T. Hendrix | 66 | 2005 | Yes | 1 | M, F | Yes | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||

| Carol B. Moerdyk | 71 | 2005 | Yes | 1 | M, F | M | Yes | Yes | ||||||||||||||||||||||||||||||||||||||||||||||||

| Andrew B. Cogan | 58 | 2009 | Yes | 1 | C, F | Yes | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||

| Vance W. Tang | 54 | 2009 | Yes | 1 | M | M | Yes | Yes | ||||||||||||||||||||||||||||||||||||||||||||||||

| M. Scott Culbreth | 50 | 2020 | No | 0 | Yes | Yes | ||||||||||||||||||||||||||||||||||||||||||||||||||

| David A. Rodriguez | 62 | 2020 | Yes | 0 | M | M | Yes | Yes | ||||||||||||||||||||||||||||||||||||||||||||||||

| Emily C. Videtto | 39 | 2021 | Yes | 0 | M | Yes | Yes | |||||||||||||||||||||||||||||||||||||||||||||||||

AC - Audit Committee C - Chair

CC - Compensation and Social Principles Committee M - Member

GC - Governance, Sustainability and Nominating Committee F - Financial Expert

2

Voting Rights, Procedures, and Solicitation

Proxy Solicitation

This Proxy Statement, mailed to shareholders of American Woodmark Corporation (the "Company") on or about July 9, 2021, is furnished in connection with the solicitation of proxies by the Company's Board of Directors (the "Board") in the accompanying form for use at the 2021 Annual Meeting of Shareholders (the "Annual Meeting") to be held at American Woodmark Corporation, 561 Shady Elm Road, Winchester, Virginia, on Thursday, August 26, 2021, at 9:00 a.m., Eastern Daylight Time, and at any adjournments thereof. A copy of the annual report of the Company for the fiscal year ended April 30, 2021 is being mailed to you with this Proxy Statement.

In light of the COVID-19 pandemic, we are holding the Annual Meeting at our corporate headquarters. This will give us the greatest flexibility to make necessary adjustments to the room in to order hold the meeting as safely as possible and in accordance with current guidelines from the Center for Disease Control and Prevention (the "CDC") and the Commonwealth of Virginia. While we will be implementing measures to reduce the risk of COVID-19, we cannot guarantee the safety of all attendees due to the nature of the virus. We encourage you to submit your vote by proxy ahead of the meeting date so your vote will still be counted should you decide to not attend for health reasons.

We may require all attendees to practice "social distancing" and all attendees may be required to wear a mask for the duration of the Annual Meeting. To protect the health and safety of all attendees, we reserve the right to require temperature checks upon entry to the Annual Meeting and refuse entry or require removal of any person from the premises or Annual Meeting area should that person refuse to follow the safeguards described above or should a person exhibit cold or flu-like symptoms, or symptoms commonly associated with COVID-19. We request that anyone who exhibits these types of symptoms or has been in contact with someone that has exhibited such symptoms within 14 days of the Annual Meeting not attend. In the event we determine it will be unsafe to hold the meeting due to current pandemic conditions, we will adjourn or postpone the meeting to a later date.

In addition to the solicitation of proxies by mail, the Company's officers and other employees, without additional compensation, may solicit proxies by telephone and personal interview. The Company will bear the cost of all solicitation efforts. The Company also will request brokerage houses and other custodians, nominees and fiduciaries to forward soliciting material to the beneficial owners of the Company's common stock held as of the record date by those parties and will reimburse those parties for their expenses in forwarding soliciting material.

Record Date and Voting Rights

On June 18, 2021, the record date for determining the shareholders entitled to receive notice of and to vote at the Annual Meeting, there were 16,801,101 shares of common stock of the Company outstanding and entitled to vote. Each such share of common stock entitles the owner to one vote on each matter presented.

Revocability and Voting of Proxy

A form of proxy for use at the Annual Meeting and a return envelope for the proxy are enclosed. Any shareholder who provides a proxy may revoke such proxy at any time before it is voted. Proxies may be revoked by:

| • | filing with the Secretary of the Company written notice of revocation which bears a later date than the date of the proxy; | ||||||||||

| • | duly executing and filing with the Secretary of the Company a later dated proxy relating to the same shares; or | ||||||||||

| • | attending the Annual Meeting and voting in person. | ||||||||||

3

Votes will be tabulated by one or more inspectors of election. A proxy, if properly executed and not revoked, will be voted as specified by the shareholder. If the shareholder does not specify his or her choice but returns a properly executed proxy card, the shares will be voted as follows:

| • | "FOR" the election of the nine nominees for director named herein; | ||||||||||

| • | "FOR" the ratification of KPMG LLP as the independent registered public accounting firm of the Company for fiscal year 2022; | ||||||||||

| • | "FOR" the approval on an advisory basis of the compensation of the Company's named executive officers ("NEOs") as disclosed in this Proxy Statement; and | ||||||||||

| • | In the proxies' discretion on any other matters properly coming before the Annual Meeting or any adjournment thereof. | ||||||||||

A majority of the total outstanding shares of common stock of the Company entitled to vote on matters to be considered at the Annual Meeting, represented in person or by proxy, constitutes a quorum. Once a share is represented for any purpose at the Annual Meeting, it is deemed to be present for quorum purposes for the remainder of the meeting. Abstentions and shares held of record by a broker or its nominee ("Broker Shares") that are voted on any matter are included in determining the number of votes present or represented at the Annual Meeting. However, Broker Shares that are not voted on any matter at the Annual Meeting will not be included in determining whether a quorum is present at the meeting.

The Company's bylaws require that, in uncontested elections, each director receive a majority of the votes cast with respect to that director (the number of shares voted "for" a director nominee must exceed the number of votes cast "against" that nominee). Actions on all other matters to come before the meeting will be approved if the votes cast "for" that action exceed the votes cast "against" it. Abstentions and Broker Shares that are not voted on a particular matter are not considered votes cast and, therefore, will have no effect on the outcome of the election of directors or any other matter.

Participants in the American Woodmark Corporation Retirement Savings Plan will receive a proxy packet from the Company's transfer agent and registrar, Computershare Shareholder Services, enabling them to provide instructions for voting the shares of the Company's common stock held in their plan accounts. The Newport Group, the plan's administrator, will determine the number of shares beneficially owned by each participant and communicate that information to the transfer agent. Each participant's voting instructions must be properly executed and returned in the envelope provided in order for the participant's shares to be voted. If a participant does not return voting instructions, then the shares held in the participant's account will be voted by the trustee of the plan in the same manner as shares voted by other plan participants.

ITEM 1 – ELECTION OF DIRECTORS

The Board is currently comprised of nine members, each of whom have been recommended by the Governance, Sustainability and Nominating Committee to the Board and nominated by the Board for election at the Annual Meeting to continue to serve on the Board. Unless otherwise specified, if returned and properly executed, the enclosed proxy will be voted for the nine persons named below to serve until the next Annual Meeting and until their successors are elected and duly qualified. Each of the nominees listed below was elected by shareholders at the last annual meeting for a term expiring at the Annual Meeting, with the exception of Messrs. Culbreth and Rodriguez, who were elected by the Board on August 20, 2020, and Ms. Videtto, who was elected by the Board on February 22, 2021. Mr. Rodriguez and Ms. Videtto were each recommended by a third-party search firm.

The Governance, Sustainability and Nominating Committee is responsible for identifying and recommending to the Board nominees for election to the Board. In identifying potential nominees, the Governance, Sustainability and Nominating Committee considers candidates recommended by shareholders, current members of the Board or management, as well as any other qualified candidates that may come to the Governance, Sustainability and Nominating Committee's attention. From time to time, the Governance, Sustainability and Nominating Committee may engage an independent firm to assist in identifying potential director nominees. The Governance, Sustainability and Nominating Committee evaluates all potential director nominees in the same manner regardless of

4

the source of the recommendation. Please see Procedures for Shareholder Nominations of Directors beginning on page 13 for more information.

The Board believes that the Company's directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the Company's shareholders. When searching for new directors, the Governance, Sustainability and Nominating Committee considers a candidate's managerial experience, as well as business judgment, background, integrity, ethics and conflicts of interest. The Governance, Sustainability and Nominating Committee does not have a formal policy with respect to diversity; however, the Board and the Governance, Sustainability and Nominating Committee believe it is essential that Board members represent diverse backgrounds and viewpoints. The Governance, Sustainability and Nominating Committee considers issues such as diversity of professional experience, skills, viewpoints and education. In considering candidates for the Board, the Governance, Sustainability and Nominating Committee considers the entirety of each candidate's credentials in the context of these criteria. With respect to the nomination of continuing directors for re-election, the individual's contributions to the Board are also considered.

Each nominee listed below has consented to serve as a director, and the Company anticipates all of the nominees named below will be able to serve, if elected. If at the time of the Annual Meeting any nominee is unable or unwilling to serve, then shares represented by properly executed proxies will be voted at the discretion of the persons named therein for such other person as the Board of Directors may designate.

If a nominated director does not receive a majority of the votes cast at the Annual Meeting, Virginia law and the Company's bylaws provide that such director would continue to serve on the Board as a "holdover director." Under the bylaws, each incumbent director submits an advance, contingent, irrevocable offer of resignation that the Board may accept if the nominee does not receive a majority of the votes cast. In that situation, the Board's Governance, Sustainability and Nominating Committee would make a recommendation to the Board about whether to accept or reject the offer of resignation. The Board would act on the Governance, Sustainability and Nominating Committee's recommendation within 90 days after the date that the election results were certified and would promptly publicly disclose its decision and, if applicable, the rationale for rejecting the offer of resignation.

Information Regarding Nominees

The names and ages of the Company's nominees, their business experience, and other information regarding each nominee are set forth below.

Name | Age | Business Experience During the Last Five Years and Directorship(s) in Public Companies | Director of Company Since | ||||||||

| Martha M. Hayes | 70 | Retired from her role as Vice President Customer Development, Sara Lee | 1995 | ||||||||

| Corporation (a public company and manufacturer and marketer of consumer products) in 2006. Ms. Hayes's experience with marketing, business development and customer relationships during her 30-year career in the consumer products industry provides the Board with an important perspective on customer issues and opportunities. | ||||||||||

| James G. Davis, Jr. | 62 | President and Chief Executive Officer, James G. Davis Construction | 2002 | ||||||||

| Corporation (a private commercial general contractor) from 1979 to present; Director, Provident Bankshares Corporation (a public company and financial institution) from October 2006 to July 2009. Mr. Davis's career in the construction industry has been highlighted with leadership roles in operations. Mr. Davis's experience as a chief executive officer of a construction company provides the Board with an important perspective. | ||||||||||

5

Name | Age | Business Experience During the Last Five Years and Directorship(s) in Public Companies | Director of Company Since | ||||||||

| Daniel T. Hendrix | 66 | Chairman of Interface, Inc. (a public company and manufacturer of modular | 2005 | ||||||||

| flooring products) from October 2011 to present; President and Chief Executive Officer, from January 2020 to present and July 2001 to March 2017; Director, Interface, Inc. from 1996 to present. Mr. Hendrix's 30+ year career in the building products industry has been highlighted with leadership roles in finance and operations. Mr. Hendrix's experience as a chief executive officer of a publicly traded company in the building products industry provides the Board with an important perspective. | ||||||||||

| Carol B. Moerdyk | 71 | Retired; Senior Vice President, International, OfficeMax Incorporated (a | 2005 | ||||||||

| public company and office products retailer) from August 2004 to September 2007; Director, Libbey, Inc. (a public company and manufacturer of tableware) from 1998 to present. Ms. Moerdyk's 30+ year career in industry has been highlighted with leadership roles in finance and operations. Ms. Moerdyk's experience as a financial executive enables her to provide the Board with a valuable perspective. | ||||||||||

| Andrew B. Cogan | 58 | Chairman and Chief Executive Officer, Knoll, Inc. ("Knoll", a public | 2009 | ||||||||

| company and manufacturer of furnishings, textiles and fine leathers) from May 2018 to present; President and Chief Executive Officer, Knoll from May 2016 to May 2018; Chief Executive Officer, Knoll from April 2001 to May 2016; Director, Knoll from 1996 to present. Director, Interface, Inc. from 2013 to February 2020. As announced previously by Knoll, Knoll has entered into a definitive agreement to be acquired by Herman Miller, Inc. and Mr. Cogan plans to depart the combined company upon the closing of the transaction. Mr. Cogan's 25+ year career in the manufacturing industry has been highlighted with leadership roles in design and marketing. Mr. Cogan's experience as a chief executive officer of a publicly traded company provides the Board with a valuable perspective. | ||||||||||

| Vance W. Tang | 54 | Non-Executive Chair of the Board of Directors since 2020; Company | 2009 | ||||||||

| Lead Independent Director from 2019 to 2020; Retired; President and Chief Executive Officer of the U.S. subsidiary of KONE Corporation (a Finnish public company and a leading global provider of elevators and escalators) and Executive Vice President of KONE Corporation from 2007 to 2012; Director, Comfort Systems USA (a publicly traded provider of commercial and industrial heating, ventilation and air conditioning and building automation services) from December 2012 to present. Since 2012, Mr. Tang has served as President of VanTegrity Consulting providing leadership and strategy consulting to a range of clients. Mr. Tang's 25+ year career in industry has been highlighted with leadership roles in operations. Mr. Tang's former experience as a chief executive officer in the construction industry provides the Board with a valuable perspective. | ||||||||||

| M. Scott Culbreth | 50 | Company Chief Executive Officer and President from July 2020 to present; | 2020 | ||||||||

| Company Senior Vice President and Chief Financial Officer from February 2014 to July 2020. Mr. Culbreth's 20+ year career in the manufacturing industry has been highlighted with leadership roles in finance. Mr. Culbreth's role as the Company's Chief Executive Officer and former Chief Financial Officer provides the Board with intimate knowledge of the Company's operations and performance. | ||||||||||

6

Name | Age | Business Experience During the Last Five Years and Directorship(s) in Public Companies | Director of Company Since | ||||||||

| David A. Rodriguez | 62 | Executive Vice President and Global Chief Human Resources Officer, | 2020 | ||||||||

| Marriott International (a public company and worldwide operator, franchisor, and licensor of hotel, residential and timeshare properties) from 2006 to present; Director, HR Policy Association from 2008 to present; Director, American Health Policy Institute from 2017 to 2019. Mr. Rodriguez's 20+ year career in the hospitality industry has been highlighted with leadership roles in human resources. Mr. Rodriguez's experience as a chief human resources officer of a publicly traded company provides the Board with a valuable perspective. | ||||||||||

| Emily C. Videtto | 39 | Vice President and Chief Marketing Officer, Pella Corporation (a privately- | 2021 | ||||||||

| held manufacturer of windows and doors) from 2016 to present; Director, Window and Door Manufacturers Association from 2018 to present. Ms. Videtto's experience in the consumer durables space, as well as her expertise around marketing, digital and innovation provides the Board with a valuable perspective. | ||||||||||

7

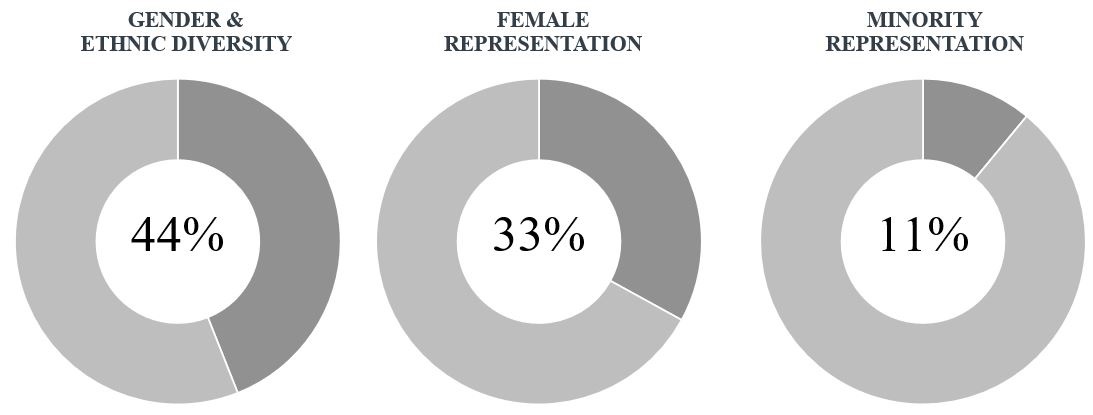

As illustrated in the tables above, our Board members bring instrumental depth, breadth, and perspective to our Company. We added two non-employee directors during fiscal 2021, which strengthened the Board's makeup, including from a diversity, gender, age, and qualifications standpoint. Each member of the Board has made numerous tours of American Woodmark facilities and customer sites. This gives them a first-hand look at innovative projects and processes as well as a valuable opportunity to interact with employees and customers. Our Board supports the Company's inclusive culture and its engagement in the communities where we live and work. Both as a group and as individuals, Board members keep themselves current on Board-related matters by reading corporate governance periodicals, attending meetings of the National Association of Corporate Directors, the Conference Board and other such organizations, and hearing from the Company's outside counsel and other experts on pertinent topics.

CORPORATE GOVERNANCE

Codes of Business Conduct and Ethics

In May 2021, as a part of its periodic review of our Code of Business Conduct and Ethics (the "Code") and the Code of Ethics for the Chief Executive Officer and all Senior Officers (the "Financial Officer Code"), the Board approved certain amendments to the Code. These amendments, among other things, expanded the scope of items covered by the Code, consolidated the principles found in the Financial Officer Code into the Code and more fully described the process for reporting potential violations of the Code and the mechanisms for holding any individual who violates the Code accountable. The amendments to the Code did not result in any explicit or implicit waiver of the Code or Financial Officer Code.

The Code applies to all directors, officers, and other employees of the Company, and sets forth important Company policies and procedures on conducting the Company's business in a legal, ethical, and responsible manner. The Code requires all employees, including officers, and directors to respect and obey all applicable laws and regulations when conducting the Company's business and includes policies addressing employee conduct and safety, equality and inclusion, conflicts of interest, insider trading, confidentiality, internal and external communications, environmental compliance, and other matters. The Code also sets forth Company policies and procedures for ensuring that disclosures in the Company's financial reports and documents filed with or furnished to the Securities and Exchange Commission ("SEC") and other public communications are full, fair, accurate, timely, and understandable.

The Code is available on the Governance Documents page of the Company's website at

https://investors.americanwoodmark.com/overview/documents/default.aspx. Any amendments to, or waivers from, any code provisions that apply to the Company's directors or executive officers will be promptly posted on the Governance Documents page of the Company's website. Any amendments to the Code or waivers from any provisions of the Code that apply to the Company's directors or executive officers must be approved by the Board. No amendments or waivers were requested or granted during the fiscal year ended April 30, 2021, except as described above.

Social and Environmental Responsibility Principles

American Woodmark is committed to social and environmental responsibility. Our culture and core values drive us to ensure that we as a company contribute to the communities in which we live and work. We aim to be a responsible business that meets the highest standards of ethics and professionalism through compliance and a proactive stance. To that end, the Board has adopted a policy for the Company of Social and Environmental Responsibility Principles that describes the Company's commitment to social and environmental responsibility. Under these principles, we at American Woodmark strive to:

| • | Engage our key stakeholders including employees, customers, shareholders and suppliers, to ensure their needs and concerns are heard and addressed, and if appropriate, incorporated into our strategy; | ||||||||||

| • | Integrate social and environmental impact considerations in our decision-making processes; | ||||||||||

| • | Maintain a safe, fair, and enriching working environment where all employees are treated with respect and are able to achieve their full potential; | ||||||||||

8

| • | Identify and minimize potential negative environmental impacts of our operations, including recycling and energy conservation initiatives; | ||||||||||

| • | Work with vendors in our supply chain to strengthen the social and environmental aspects of products and services we deliver to our customers; | ||||||||||

| • | Fund the American Woodmark Foundation and its support of non-profit organizations in the communities we operate; and | ||||||||||

| • | Encourage employees to volunteer through internally or externally organized events. | ||||||||||

A copy of these principles can be found on the Corporate Governance page of the Company's website at https://investors.americanwoodmark.com/overview/documents/default.aspx. Our approach is reviewed with our Board of Directors at least every two years and, if necessary, revised to ensure continuous improvements to our social and environmental efforts.

Board Structure

The Company's Board currently consists of nine directors, all of whom are subject to annual shareholder elections to one-year terms of service. Each of the Company's independent directors sits on at least one of the three standing Board committees, which include the Audit Committee, the Compensation and Social Principles Committee, and the Governance, Sustainability and Nominating Committee.

Upon the retirement of Cary S. Dunston as the Company's Chair and Chief Executive Officer in July 2020, and in keeping with the Company's past practice during transitions in the leadership of the Company, the Board determined to separate the positions of Chair and Chief Executive Officer and elected Mr. Tang, an independent director, to serve as Chair of the Board of Directors. Prior to being elected Chair, Mr. Tang served as the Company's Independent Lead Director. Since the Chair is now independent, the Company does not currently have an Independent Lead Director.

As Chair of our Board, Mr. Tang is responsible for chairing Board and shareholder meetings, setting the agendas for the Board meetings, attending meetings of the Board's committees with the approval of the respective committee if he is not a committee member, and assisting management in representing the Company to external groups as needed and as appropriate. His duties also include presiding over executive sessions of the Company's independent directors, facilitating information flow and communication among the directors and serving as a point of contact between the independent directors and the Chief Executive Officer. The Board elects its Chair annually.

Mr. Culbreth, as Chief Executive Officer, oversees the day-to-day affairs of the Company and directs the formulation and implementation of our strategic plans. Our Board believes that this leadership structure is currently the most appropriate for the Company because it allows our Chief Executive Officer to focus primarily on our business strategy and operations while leveraging the experience and abilities of our Chair to direct the business of the Board.

Our Board periodically reviews its leadership structure and recognizes that, depending on the circumstances, a different model might be appropriate. The Board has no fixed policy on whether the roles of Chair and Chief Executive Officer should be separate or combined, which provides the Board flexibility to choose a leadership structure based on the Company's needs and the Board's assessment of the Company's leadership at a given time. Our Governance, Sustainability and Nominating Committee Charter and Independent Lead Director Charter do provide that the Board appoint an independent lead director in the event the Chief Executive Officer is elected Chair or the Chair otherwise does not qualify as independent.

The Company's independent directors meet in regularly scheduled executive sessions at each of the Company's regularly scheduled Board meetings, without management present, and discuss such matters as certain Board policies, processes and practices, the performance and compensation of the Company's Chief Executive Officer, management succession and other matters relating to the Company and the functioning of the Board.

9

Risk Management Oversight

The Board, both directly and through its committees, has an active role in overseeing management of the Company's risks. The entire Board regularly reviews information concerning the Company's operations, liquidity, and competitive position and personnel, as well as the risks associated with each. The Company's Compensation and Social Principles Committee is responsible for overseeing the Company's management of risks relating to the Company's executive and long-term compensation plans and risks related to employee compensation in general. The Audit Committee oversees the Company's management of risks pertaining to internal controls, adherence to generally accepted accounting principles and financial reporting. The Governance, Sustainability and Nominating Committee oversees the Company's management of risks pertaining to potential conflicts of interest and independence of board members. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports about such risks.

Director Independence

The Board of Directors of the Company is composed of a majority of directors who are independent directors as defined under the NASDAQ Marketplace Rules. The Board's Audit and Compensation and Social Principles Committee members also meet additional independence requirements pursuant to the NASDAQ Marketplace Rules and SEC rules.

To be independent under the NASDAQ Marketplace Rules, the Board must determine that a director has no relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The NASDAQ Marketplace Rules specify certain persons who cannot be considered independent. The Board reviews the independence of all directors at least annually.

Based upon this review, the Board affirmatively determined that eight of its nine current directors are independent as defined by the NASDAQ Marketplace Rules. The independent directors are: Mr. Cogan, Mr. Davis, Ms. Hayes, Mr. Hendrix, Ms. Moerdyk, Mr. Rodriguez, Mr. Tang, and Ms. Videtto, each of whom is standing for election at the Annual Meeting. In addition, all of the members of the Audit Committee, the Compensation and Social Principles Committee, and the Governance, Sustainability and Nominating Committee are independent. The members of the Audit and Compensation and Social Principles Committees also meet the additional independence requirements applicable to them under the NASDAQ Marketplace Rules and SEC rules.

Communicating Concerns to the Board of Directors

The Audit Committee and the independent non-management directors have established procedures to enable any shareholder or employee who has a concern about the Company's conduct or policies, or any employee who has a concern about the Company's accounting, internal accounting controls or auditing matters, to communicate that concern directly to the Board, to the independent directors, or to the Audit Committee. Such communications may be confidential or anonymous. Such communications may be submitted by utilizing the ethics hotline, which is hosted by EthicsPoint's secure services:

Woodmark.ethicspoint.com

U.S.: 1-844-471-7681

Mexico: 001-844-240-4029

The Company's Director of Internal Audit reviews all such correspondence and, as appropriate, discloses details to the Audit Committee and the external auditors of the Company. The Audit Committee will review this information and determine a course of action as appropriate based on the information received.

The Audit Committee reviews and regularly provides the Board of Directors with a summary of all communications received from shareholders and employees and the actions taken or recommended to be taken if an action requires approval of the full Board as a result of such communications. Directors may, at any time, review a

10

log of all correspondence received by the Company which is addressed to the Board, members of the Board or the Audit Committee and may request copies of any such correspondence.

Board of Directors and Committees

The Company's Board of Directors presently consists of nine directors. The Board held eight meetings during fiscal year 2021. All of the directors attended at least 75% of the total number of Board meetings and meetings of all committees of the Board held during periods when they were members of the Board or such committees. The Board of Directors believes that attendance at the Company's annual meeting demonstrates a commitment to the Company, responsibility and accountability to shareholders, and support of management and employees. Therefore, it is a policy of the Board that all members attend the annual meeting of shareholders. All members of the Board attended last year's annual meeting. The Board of Directors also believes it is important to conduct location visits with the employees of the Company. Several Board members visited our manufacturing operations in Orange, Virginia and Moorefield, West Virginia. The majority of the Board visited our plant in Allegany, Maryland as part of the May Board meeting.

The Company's bylaws specifically allow for the Board to create one or more committees and to appoint members of the Board to serve on them. Our current standing committees are the Audit Committee, the Compensation and Social Principles Committee, and the Governance, Sustainability and Nominating Committee. The Board annually appoints individuals from among its independent members to serve on these three committees. Each committee operates under a written charter adopted by the Board, as amended from time to time. On an annual basis, each committee reviews and reassesses the adequacy of its committee charter. The Audit Committee is scheduled to meet at least quarterly and the Compensation and Social Responsibility and Governance, Sustainability and Nominating Committees meet as required, typically at least two to three times per year. The committees may hold special meetings as necessary. These committees report regularly to the full Board of Directors with respect to their fulfillment of the responsibilities and duties outlined in their respective charters. These charters can be found on the Corporate Governance page of the Company's website at https://investors.americanwoodmark.com/overview/documents/default.aspx.

In May 2021 (fiscal 2022), the Board revised the compensation committee charter to expressly charge the committee with oversight of our policies and practices with respect to social principles, including human capital matters. The Board also revised the governance committee charter to expressly charge the committee with oversight of our sustainability programs and initiatives. In connection with these revisions, the Board also renamed these committees as the Compensation and Social Principles Committee and the Governance, Sustainability and Nominating Committee, respectively.

Audit Committee

The Audit Committee consists of Mr. Cogan, who chairs the Committee, Mr. Davis, Mr. Hendrix, Ms. Moerdyk and Ms. Videtto. All members have been determined by the Board of Directors to be "independent" as defined under the NASDAQ Marketplace Rules and SEC rules, including the additional independence requirements applicable to audit committee members. The Board of Directors has determined that all of the current members of the Audit Committee, except Ms. Videtto, are "audit committee financial experts" as defined under SEC rules.

Purpose and Duties. The Audit Committee provides oversight for the integrity of the Company's financial statements, the Company's compliance with legal and regulatory requirements, the independence, and qualifications of the Company's independent registered public accounting firm, the performance of the internal audit function and independent registered public accounting firm, and the adequacy and competency of the Company's finance and accounting staff.

The Audit Committee's duties include but are not limited to: (1) selecting and overseeing the performance of the Company's independent registered public accounting firm, (2) reviewing the scope of the audits to be conducted by them, as well as the results of their audits, (3) overseeing the Company's financial reporting activities, including the Company's financial statements included in the Company's Annual Report on Form 10-K as well as the Company's Quarterly Reports on Form 10-Q, and the accounting standards and principles that are followed,

11

(4) approving audit and non-audit services provided to the Company by the Company's independent registered public accounting firm, (5) reviewing the organization and scope of the Company's internal audit function and internal controls, (6) reviewing and approving or ratifying transactions with related persons required to be disclosed under SEC rules, and (7) conducting other reviews relating to compliance by employees with Company policies and applicable laws.

The Audit Committee met eleven times during fiscal year 2021. The Audit Committee is governed by a written charter approved by the Board of Directors, which can be viewed on the Corporate Governance page of the Company's website at https://investors.americanwoodmark.com/overview/documents/default.aspx. The Report of the Audit Committee is found beginning on page 44.

Compensation and Social Principles Committee

The Compensation and Social Principles Committee is composed of Ms. Hayes, who chairs the Committee, Mr. Rodriguez and Mr. Tang. All members have been determined by the Board of Directors to be "independent" as defined under the NASDAQ Marketplace Rules and SEC rules, including the additional independence requirements applicable to Compensation and Social Principles committee members.

Purpose and Duties. The Compensation and Social Principles Committee is primarily concerned with designing and managing competitive compensation programs to facilitate the attraction and retention of talented senior executives and directors and overseeing the Company's policies and practices with respect to social principles, including human capital matters. The activities of the Compensation and Social Principles Committee include reviewing, evaluating, and approving senior executive compensation plans and evaluating and recommending director compensation plans for approval by the Board. The Compensation and Social Principles Committee also provides oversight for all of the Company's employee benefit plans and for the integration of social principles into the Company's business strategy and decision-making. The Compensation and Social Principles Committee delegates certain aspects of implementation and day-to-day management of compensation administration to officers of the Company.

The Compensation and Social Principles Committee's duties include but are not limited to: (1) reviewing, evaluating, and approving corporate goals and objectives relevant to the Chief Executive Officer's and other senior executive officers' compensation, (2) evaluating the Chief Executive Officer's and other senior executive officers' performance in light of those goals and objectives, (3) determining and approving the Chief Executive Officer's and other senior executive officers' compensation levels based on this evaluation, and (4) overseeing the compensation and benefit plans, policies, and programs of the Company, and (5) periodically reviewing the Company's practices with respect to, as risks associated with, human capital matters and other social principles, including community engagement and reputational matters, and evaluating the Company's progress towards achieving any objectives with respect to such matters.

The Compensation and Social Principles Committee determines the Chief Executive Officer's compensation after reviewing his performance with the independent directors of the Board and without members of management being present, and shares this information with the full Board. The Compensation and Social Principles Committee determines the compensation of the other senior executives after considering a recommendation from the Chief Executive Officer. The Compensation and Social Principles Committee does not delegate its authority with regard to executive compensation decisions.

The Compensation and Social Principles Committee administers and approves awards under the Company's 2016 Employee Stock Incentive Plan and the Company's 2015 Non-Employee Directors Restricted Stock Unit Plan.

The Compensation and Social Principles Committee met six times during fiscal year 2021. The Compensation and Social Principles Committee's charter can be viewed on the Corporate Governance page of the Company's website at https://investors.americanwoodmark.com/overview/documents/default.aspx. Additional information on the Company's philosophy and policies pertaining to executive compensation are addressed in the Compensation Discussion and Analysis beginning on page 16. The Compensation and Social Principles Committee Report can be found beginning on page 39.

12

Governance, Sustainability and Nominating Committee

The Governance, Sustainability and Nominating Committee is composed of Mr. Davis, who chairs the Committee, Ms. Hayes, Ms. Moerdyk, Mr. Tang, and Mr. Rodriguez. All members have been determined by the Board of Directors to be "independent" as defined under the NASDAQ Marketplace Rules.

Purpose and Duties. The Governance, Sustainability and Nominating Committee is responsible for identifying and recommending to the Board director nominees for the Board, recommending directors for appointment to committees and chairs, and ensuring that the size, composition, and practices of the Board best serve the Company and its shareholders, and overseeing the overall corporate governance of the Company and the Company's sustainability programs and initiatives. From time to time, the Committee may engage an independent firm to assist in identifying potential director nominees.

In evaluating candidates for nomination to serve on the Board, the Governance, Sustainability and Nominating Committee will assess the candidate's character and professional ethics, judgment, business experience, independence, understanding of the Company's or other related industries, and other factors deemed pertinent in light of the current needs of the Board. Each candidate will be recommended without regard to gender, race, age, religion or national origin. Specific qualities and skills established by the Committee for candidates, which are included in the Governance, Sustainability and Nominating Committee charter, include:

| • | each candidate must be an individual that has consistently demonstrated the highest character and integrity; | ||||||||||

| • | each candidate must have demonstrated professional and managerial proficiency, an openness to new and unfamiliar experiences and the ability to work in a team environment; | ||||||||||

| • | each candidate must be free of any conflicts of interest which would violate applicable law or regulation or interfere with the proper performance of the responsibilities of a director; | ||||||||||

| • | each candidate should possess substantial and significant experience which would be of particular relevance to the Company and its shareholders in the performance of the duties of a director; and | ||||||||||

| • | each candidate must demonstrate commitment to the responsibilities of being a director, including the investment of the time, energy, and focus required to carry out the duties of a director. | ||||||||||

The Governance, Sustainability and Nominating Committee's responsibilities also include, but are not limited to: (1) regularly assessing the effectiveness of the Board; (2) annually reviewing the performance of each director; (3) determining whether any director conflicts of interest exist; (4) reviewing any director related party transactions; (5) periodically reviewing the Company's corporate governance policies; and (6) ensuring the size, composition, and practices of the Board and its Committes are strutured in a way that best serves the objectives and interests of the Company, the Shareholders, and all primary constituents; and (7) reviewing, overseeing and monitoring the Company's strategies and efforts with respect to sustainability and corporate governance matters.

The Governance, Sustainability and Nominating Committee met six times during fiscal year 2021. The Governance, Sustainability and Nominating Committee's charter can be viewed on the Corporate Governance page of the Company's website at https://investors.americanwoodmark.com/overview/documents/default.aspx.

Procedures for Shareholder Nominations of Directors

A shareholder of record may nominate a person or persons for election as a director at the 2022 Annual Meeting if any such nomination is submitted in writing to the Secretary of the Company in accordance with the Company's bylaws and is received in the Company's principal executive offices on or before April 21, 2022. The nomination must include the name and address of the director nominee and a description of the director nominee's qualifications for serving as a director and the following information:

| • | the name and address of the shareholder making the nomination; | ||||||||||

13

| • | a representation that the shareholder is a record holder of the Company's common stock entitled to vote at the meeting and, if necessary, would appear in person or by proxy at the meeting to nominate the person or persons specified in the nomination; | ||||||||||

| • | a description of all arrangements or understandings between the shareholder and the nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder; | ||||||||||

| • | such other information regarding the nominee as would be required to be included in a proxy statement filed under the proxy rules of the SEC if the director nominee were to be nominated by the Board of Directors; | ||||||||||

| • | information regarding the nominee's independence as defined by applicable NASDAQ listing standards; and | ||||||||||

| • | the consent of the nominee to serve as a director of the Company if elected. | ||||||||||

The Governance, Sustainability and Nominating Committee may subsequently request additional information regarding the director nominee or the shareholder making the nomination. The Chair of the Governance, Sustainability and Nominating Committee may refuse to acknowledge the nomination of any person not made in compliance with these procedures.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

As a leading manufacturer of cabinetry in the U.S., American Woodmark is committed to conducting business in a manner that incorporates effective environmental, social, and governance practices in order to improve our long-term sustainability and results. Our governance efforts are described throughout this Proxy Statement and our environmental and social practices are summarized below. As discussed elsewhere in this Proxy Statement, in May 2021 (fiscal 2022), we revised our Board committee charters to expressly charge the renamed Governance, Sustainability and Nominating Committee with oversight of our sustainability programs and initiatives and the renamed Compensation and Social Principles Committee with oversight of our policies and practices with respect to social principles, including human capital matters.

Environmental and Sustainability Matters

We recognize the potential impact of our operations on the environment as well as the potential impact of environmental issues on our operations. We have established Corporate Environmental, Health and Safety programs with the goal of ensuring compliance with all applicable local, state and federal environmental and safety laws and regulations, and we monitor our performance under these programs through formal agency audits as well as internal audits. We have a formal program in place to identify opportunities in our manufacturing facilities to eliminate or minimize the use of certain hazardous materials and we seek to employ leading technologies to reduce emissions from our manufacturing operations to the extent practicable. We have implemented recycling and energy efficiency programs throughout our organization in an effort to reduce our consumption of resources. These efforts include manufacturing processes that repurpose wood waste into saleable products or divert it to other industries in order to reduce waste. We encourage appropriate suppliers of hardwood and other wood products to participate in a sustainable forestry program through formal training and advocacy, and we require all of our suppliers to comply with applicable environmental and safety laws and regulations.

In fiscal 2022 and beyond, we plan to further enhance our environmental and sustainability efforts by:

| • | Establishing internal working teams to improve our efforts related to sustainability and our environmental and social impact; | ||||||||||

| • | Developing internal scorecards to measure progress against our goals; | ||||||||||

| • | Developing a long-term vision for environmental sustainability; and | ||||||||||

| • | Increasing the amount of environmental and sustainability information we share with the public and investment community. | ||||||||||

14

Social Matters

The way we conduct our business and interact with our customers, our vendors, the communities in which we operate and other stakeholders is driven by our core principles of Customer Satisfaction, Integrity, Teamwork and Excellence. We define these principles as follows:

| • | Customer Satisfaction: Provide the best possible quality, service, and value to the greatest number of people by doing whatever is reasonable and sometimes unreasonable. | ||||||||||

| • | Integrity: Do what is right; act fairly and responsibly, care about the dignity of each person and be a good citizen within the community. | ||||||||||

| • | Teamwork: Understand that we must all work together in order to succeed. Realize that each person must contribute to the team to be part of the team. | ||||||||||

| • | Excellence: Strive to perform every job or action in a superior way. Be innovative, always helping others become the best they can be. | ||||||||||

By living out these principles, we believe we will be best positioned to attract, develop and retain a diverse and well-qualified workforce and to conduct our business in a responsible, ethical and professional manner.

Inclusion & Diversity

We are an equal opportunity employer and strive to create an environment free from discrimination and harassment and in which each employee is valued, treated with dignity and respect and managed in an inclusive manner. We believe that a workplace that encourages the interaction of different perspectives and backgrounds creates superior solutions, approaches and innovations. Accordingly, we aim to foster a culture where each employee has an equal opportunity to thrive and advance his or her career and is therefore engaged and invested in our continued success. We also seek to leverage each employee's unique ideas and perspectives in order to better understand our markets and customers and otherwise improve our business and operations.

We commissioned a team to understand inclusion and diversity at American Woodmark, which led to increased management training and learning opportunities designed to improve insight and effectiveness. We have Right Environment Councils in each of our locations to more effectively engage and connect with employees of all levels. These councils increase accountability with respect to company culture and engagement and serve as the main connection between the Company and local employees and communities. In fiscal 2020, we revised our employee engagement survey process to include an inclusion and diversity index and increase the frequency of formal employee feedback, which is currently solicited in the form of semi-annual pulse surveys. In fiscal 2021, we partnered with an inclusion and diversity consultant and established an Inclusion, Diversity, Equity and Awareness (IDEA) team in order to establish and refine an enterprise-wide inclusion and diversity strategy and propose specific initiatives to accelerate our efforts in this area. In fiscal 2021, we also developed and implemented an internal communication campaign to bolster further awareness of our Equal Employment Opportunity, anti-discrimination and anti-harassment policies, as well as our employee hotline reporting process.

In fiscal 2022 and beyond, we intend to continue to refine our inclusion and diversity strategy with the help of our IDEA team and to implement related initiatives. We also intend to:

| • | Continue to leverage our Career Orientation and Development program and Organizational Development Matrix, as well as other internal evaluation systems, to identify, recruit and train employees who are gender and/or racially/ethnically diverse for internal advancement opportunities; | ||||||||||

| • | Utilize structured, internal evaluation methods to identify qualified employees who are gender and/or racially/ethnically diverse for promotion to key sales and marketing roles; and | ||||||||||

| • | Deepen our relationships with Historically Black Colleges and Universities in order to improve the success of our existing participation in annual recruiting fairs and campus recruiting events. | ||||||||||

15

Employee Training

We invest a significant number of hours annually in onboarding, cultural, safety, regulatory, supervisory and managerial training activities. Through these activities, as well as our tuition reimbursement programs, executive development opportunities, formal and informal cross-training activities and other operational training offerings, we strive to establish American Woodmark as an organization dedicated to providing the training and development opportunities necessary to maintain a well-qualified workforce that upholds our social responsibilities by implementing our core principles on a daily basis.

Our training is designed and developed at the corporate and local site level in order to further our goals of enterprise alignment and local integration. We seldom adopt a "one and done" approach to training. Depending on the course, our training and development opportunities are offered on an on-demand, semi-annual, annual or biannual basis.

Philanthropy & Community Engagement

In order to care for and engage with our employees, we must care for and engage with the communities in which they live and work. We maintain a scholarship fund, the Holcombe Scholarship, which is available to children of full-time American Woodmark employees preparing for post-secondary education. The purpose of the scholarship fund is to encourage scholarship, service and continued learning in the children of American Woodmark employees and to support the development of future leaders who may return to the communities in which we operate. We also fund the American Woodmark Foundation, a 501(c)(3) organization, which was formed in 1995 solely for the philanthropic purposes of sustaining our communities, enabling the work and mission of charitable organizations and ensuring that we are a good neighbor in each of the communities in which we operate. The Foundation has invested over $6 million since inception. Also, given that we have a variety of operations across North America, we often utilize our Right Environment Councils to develop and implement our workforce and community engagement initiatives at the local level as opposed to relying solely on our corporate office to drive our engagement efforts. We believe this approach encourages increased employee engagement and better serves our communities.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis ("CD&A") contains information about the executive compensation program for our named executive officers ("NEOs") for fiscal year 2021 ("fiscal 2021"). Our NEOs for fiscal 2021 were the following:

•M. Scott Culbreth (President and Chief Executive Officer)

•Paul Joachimczyk (Vice President and Chief Financial Officer)

•Robert J. Adams, Jr. (Senior Vice President, Manufacturing and Technical Operations)

•Teresa M. May (Senior Vice President and Chief Marketing Officer)

•S. Cary Dunston (Former Chairman, President, and Chief Executive Officer)

•R. Perry Campbell (Former Senior Vice President, Sales and Commercial Operations)

Executive Leadership Changes

On July 9, 2020, Mr. Dunston retired and Mr. Culbreth was elected President and Chief Executive Officer, with Mr. Joachimczyk replacing Mr. Culbreth as Vice President and Chief Financial Officer. Mr. Campbell's employment was terminated on the same date. In connection with these leadership changes, we entered into separation agreements with Messrs. Dunston and Campbell which are described in more detail below under "Separation Agreements for Messrs. Dunston and Campbell." The Compensation and Social Principles Committee also increased Mr. Culbreth's and Mr. Joachimczyk's annual base salaries and maximum potential bonus opportunities in connection with their promotions, in each case taking into account each officer's experience, expected duties, existing pay levels, the compensation levels historically paid by the Company for these positions and comparable compensation levels paid by peer companies for similarly situated executives and other relevant factors. The fiscal 2021 compensation for each of these officers is discussed in more detail throughout the CD&A.

16

COVID-19 Impact on Fiscal Year 2021 Executive Compensation Program

In connection with other proactive measures taken in response to the impacts of COVID-19, base salaries for each of our NEOs were reduced at the election of each of the officers for the period between April 27, 2020 through July 31, 2020. Messrs. Culbreth, Adams and Campbell's and Ms. May's base salaries were each reduced by 25% during this period and Mr. Dunston's base salary was reduced by 50% during this period, The base salary of Mr. Joachimczyk and other Vice Presidents was reduced by 10% for the same period.

Our annual cash bonus plan has historically been tied to the achievement of the Company's annual financial goals. Due to COVID-19 and its extraordinary impact on the economic environment, the Board approved a separate budget for the first quarter of fiscal 2021 and the Compensation and Social Principles Committee approved a separate set of Company financial goals for the annual bonus plan tied to the first quarter of fiscal 2021 as well. This change applied to employees on the annual bonus plan, including our NEOs. The Board and Compensation and Social Principles Committee subsequently developed and approved a budget and related Company financial goals for the bonus plan for the remainder of fiscal 2021, once the impact of the COVID-19 pandemic had become more clear. The Company's financial goals for the annual bonus plan for fiscal 2021 were designed to be appropriately challenging and aligned with our shareholders' interests. Bonuses earned by the NEOs under the fiscal 2021 annual bonus plan were not paid until the financial statements had been certified at the end of fiscal 2021, consistent with our normal schedule.

Compensation Principles

The compensation provided to our senior leaders is driven by the following principles:

Aligned with shareholders - Compensation should align directly with the long-term interests of our shareholders. Our leaders are expected to be long-term shareholders. | Performance-Based - Compensation should be based on financial, operational, and cultural goals. The goals should be challenging, but achievable, in light of expected market conditions. | ||||

Company Focused - Our leader's contributions to the overall performance of the business are more important than their individual performance. This rewards strong teamwork and alignment. | Simple Design - Our compensation plan should be easy to understand, measure, and communicate. | ||||

Properly Balanced Compensation Components - The elements of the compensation plan should properly balance short- and long-term pay, fixed and variable components, and quantitative and qualitative measures. | Competitive Pay - Overall target compensation should be competitive (market median) compared to similar roles at peer group companies to ensure we are able to attract, retain, and motivate excellent leaders. | ||||

The Company's Compensation Program Goal

The goal of the Company's compensation program, as administered by the Compensation and Social Principles Committee, is to facilitate the creation of long-term value for its shareholders by attracting, motivating and retaining qualified senior leaders. To this end, the Company has designed and administered the Company's compensation program to appropriately reward its executives for sustained financial and operating performance, to align their interests with those of the Company's shareholders, and to encourage them to remain with the Company for long and rewarding careers. To achieve alignment with shareholder interests, the Company's compensation program provides significant, but appropriate, rewards for outstanding performance, as well as clear financial consequences for underperformance. The majority of the Company's senior executives' compensation is "at risk" in the form of annual and long-term incentive awards that are paid, if at all, based upon Company performance. While a significant portion of compensation may fluctuate with annual results, the total program is structured to emphasize long-term performance and sustained growth in shareholder value.

Key Considerations in Setting Pay

The following is a summary of the key considerations affecting the determination of compensation by the Compensation and Social Principles Committee for the Company's NEOs.

17

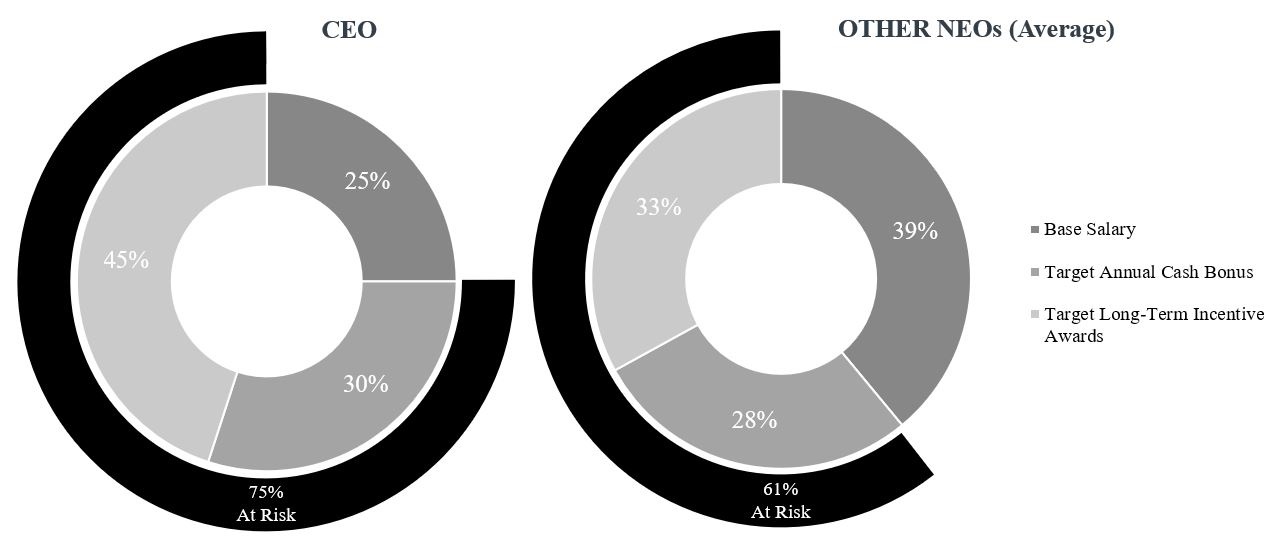

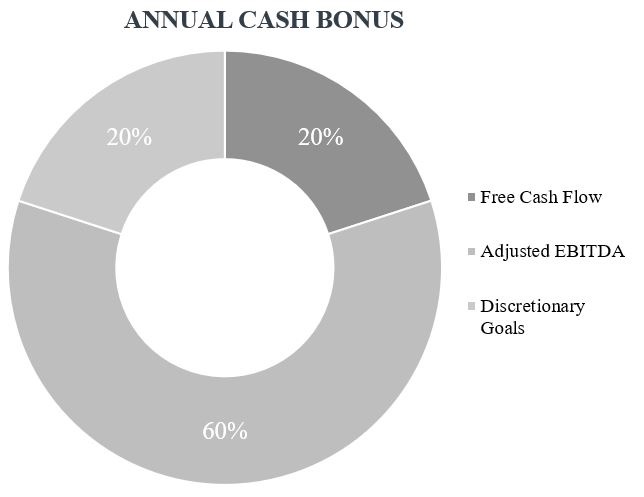

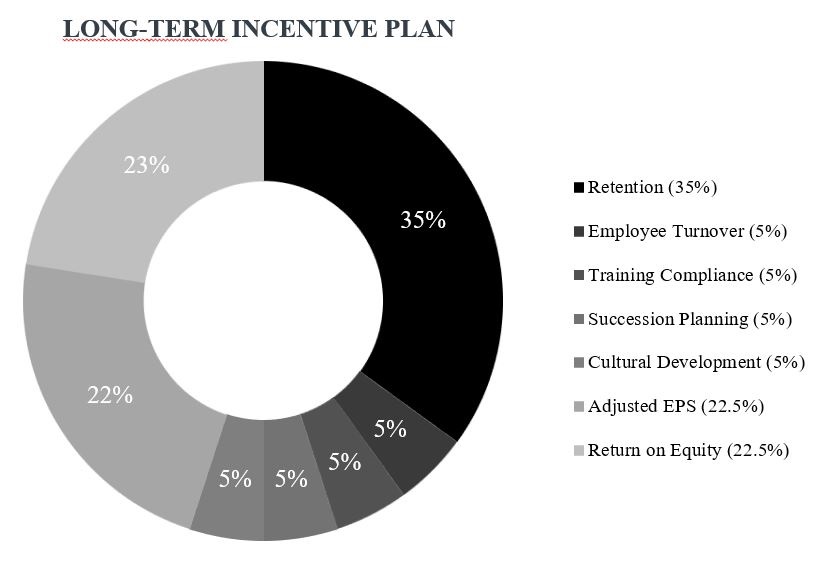

Performance-based Compensation. The majority of the targeted total compensation for the Company's NEOs is performance-based to achieve alignment with shareholder interests. Annual bonuses are only payable to NEOs if the Company achieves adjusted EBITDA, free cash flow, and discretionary goals in excess of specified threshold levels during its fiscal year. The majority of long-term incentives for our NEOs is tied to the Company's achievement of financial and cultural goals. The Company strives to establish challenging Company-wide targets that are appropriate given the expected level of performance given current and anticipated market conditions.

The above tables do not include Messrs. Dunston and Campbell. For Mr. Culbreth and other NEOs who were promoted during the year, the above calculations are based on each officer's annualized base salary, target annual bonus, and target long-term incentive award in his or her new role.

Balance of Long-Term Pay Opportunity versus Current Pay Opportunity. The Compensation and Social Principles Committee strives to provide an optimal balance between current and long-term compensation and cash versus equity compensation for the Company's executive officers. Current compensation is paid in cash in the form of a base salary and an annual bonus, primarily as a reward for recent performance, while long-term compensation is equity-based, to encourage the Company's executive officers to deliver excellent results over a longer period of time and to serve as a retention tool. The Compensation and Social Principles Committee has targeted a higher mix of long-term compensation as performance-based compensation for the Company's senior executive officers, including the NEOs.

Providing shareholders with an appropriate level of return on their investment is an important objective of the Company, the Board, and the Compensation and Social Principles Committee. As a result, performance that rewards the Company's shareholders factors prominently in the Compensation and Social Responsibility Committee's decisions about the type and amount of long-term compensation paid to the Company's executive officers.

Qualitative vs. Quantitative Factors. The Compensation and Social Principles Committee uses a broad range of both quantitative and qualitative factors to determine compensation. Quantitative factors are determined annually based upon the Company's overall goals and objectives. In general, qualitative factors include the executives' ability to build the organization and to lead the Company's attainment of its "CITE" principles of customer satisfaction, integrity, teamwork, and excellence. Additional qualitative factors considered by the Compensation and Social Principles Committee include the executives' contribution to achieving the Company's overall vision, the evaluation of the executives' performance against their stated objectives, their experience, skill sets, and the breadth and scope of their responsibilities.

Significance of Company Results. The Compensation and Social Principles Committee believes that the NEOs' contributions to the Company's overall performance are more important than their individual performance. Accordingly, a significant portion of the annual bonus opportunity and the long-term incentive opportunity for our NEOs is dependent upon the Company's financial performance, including (in relation to the annual bonus) its

18

adjusted EBITDA goals and free cash flow and (in relation to the long-term incentives) its adjusted EPS and return on average equity.

Consideration of Compensation Risk. The Company's compensation programs are discretionary, balanced, and focused on the long-term. Under this structure, the highest amount of compensation can be achieved through consistent superior performance over sustained periods of time. This provides strong incentives to manage the Company for the long term, while avoiding excessive risk in the short term. The elements of the Company's variable compensation program are balanced among current cash payments and longer-term equity awards. The Company uses a mix of quantitative and qualitative performance measures to assess achievement for its RSU awards to avoid placing excessive weight on a single performance measure. Annual bonus payouts are targeted at 120% of base salary for Mr. Culbreth and Mr. Dunston (prior to his retirement), 60% of base salary for Mr. Joachimczyk and 75% for the other NEOs with a maximum potential bonus of 1.67 times target bonus. The Company has also adopted stock ownership guidelines under which its NEOs are expected to hold a significant amount of Company stock on an ongoing basis, which the Compensation and Social Principles Committee believes helps mitigate compensation-related risk by focusing the officers' attention and efforts on the long-term stock performance of the Company.

Use of Independent Compensation Consultants and Peer Group Data. The Company, at the direction of the Compensation and Social Principles Committee, retains an independent compensation consultant every two to three years to assist the Compensation and Social Principles Committee by collecting compensation data regarding peer group companies, which is used by the Compensation and Social Principles Committee in reviewing and establishing executive compensation guidelines. The Compensation and Social Principles Committee considers this data, among other factors, when it determines the components and amounts of total compensation that are appropriate for the NEOs. In 2020, the Company retained Pearl Meyer & Partners ("Pearl Meyer") to evaluate the competitiveness of the Company's executive compensation program, the alignment of executive compensation and Company performance and update the Company's Competitive Peer Group for use in the evaluation of the Company's compensation practices. Pearl Meyer performs no other services for the Company other than those described in this section. The Compensation and Social Principles Committee has examined Pearl Meyer's relationship with the Compensation and Social Principles Committee members, the Company and the Company's management and has determined that Pearl Meyer's work has not raised any conflict of interest.

The Company's Competitive Peer Group was most recently updated in 2020 at the recommendation of Pearl Meyer and consists primarily of similar-sized companies in the furniture, home furnishing, and building products industries that may compete with the Company for executive talent and which investors may consider as investment alternatives to the Company. The Company's Competitive Peer Group includes:

| Apogee Enterprises, Inc. | Masonite International Corporation | ||||

| Advanced Drainage Systems, Inc. | Patrick Industries, Inc. | ||||

| Cornerstone Building Brands, Inc. | Simpson Manufacturing Co., Inc. | ||||

| Griffon Corporation | Sleep Number Corporation | ||||

| Herman Miller, Inc. | Steelcase Inc. | ||||

| HNI Corporation | Universal Forest Products, Inc. | ||||

| La-Z-Boy Incorporated | |||||

Results of 2020 Say on Pay Vote. At the Company's Annual Meeting of Shareholders held on August 20, 2020, 98.8% of votes cast by its shareholders (excluding abstentions and broker non-votes) approved on an advisory basis the Company's executive compensation program as disclosed in its 2020 proxy statement. In light of the overwhelming support that the 2020 say-on-pay proposal received, the Compensation and Social Principles Committee did not make any specific changes to the fiscal year 2021 executive compensation program in response to the vote.

Stock Ownership Guidelines. The Company has adopted guidelines for stock ownership by its NEOs. For Mr. Culbreth, the stock ownership guideline is equivalent to three times his base salary, and for Messrs. Joachimczyk and Adams and Ms. May, the stock ownership guideline is equivalent to their respective base salaries.

19

Executive officers have 3 years to comply with the ownership requirements after becoming an executive officer or being promoted to a position with a higher ownership guideline. The Company determines the amount of Company stock its NEOs hold by including all shares of stock owned outright by the individual as well as earned but unvested RSUs, so that a minimum ownership of Company stock is achieved. As of April 30, 2021, all NEOs meet or are on track to meet the ownership guideline established by the Company.

Clawback Policy. Starting with its RSU awards granted in June 2019, the Company has added a clawback provision to the terms of its employee RSU awards, authorizing the Company to cancel outstanding RSU awards or seek recovery of shares previously issued under RSU awards if the Company's financials are required to be restated during or within two years after the end of the applicable vesting period due to the Company's material noncompliance with federal securities laws. RSU awards are subject to clawback if the Committee determines that the awards would not have been earned or vested based on the restated financials or if the employee's misconduct contributed to the need for the restatement. RSU awards will also be subject to any other clawback requirements adopted by, or applicable to, the Company, pursuant to any law or any exchange listing requirement, including Section 954 of the Dodd Frank Act.

Anti-Hedging and Anti-Pledging Policy. The Company prohibits employees and directors from engaging in hedging transactions involving the Company's stock, including the purchase of financial instruments such as prepaid variable forwards, equity swaps, collars, and exchange funds. The Company also prohibits employees from holding the Company's stock in a margin account or pledging the Company's stock as collateral for any loan.

Elements of Compensation

The compensation program for executive officers for fiscal year 2021 consisted of the following elements:

Elements available to most salaried employees:

| • | base salary; | ||||||||||