Form DEF 14A ALAMO GROUP INC For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement | ||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| x | Definitive Proxy Statement | ||||

| o | Definitive Additional Materials | ||||

| o | Soliciting Material Pursuant to §240.14a-12 | ||||

| ALAMO GROUP INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | ||||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

| (1) | Title of each class of securities to which transaction applies: | ||||

| (2) | Aggregate number of securities to which transaction applies: | ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||

| (4) | Proposed maximum aggregate value of transaction: | ||||

| (5) | Total fee paid: | ||||

| o | Fee paid previously with preliminary materials. | ||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

| (1) | Amount Previously Paid: | ||||

| (2) | Form, Schedule or Registration Statement No.: | ||||

| (3) | Filing Party: | ||||

| (4) | Date Filed: | ||||

ALAMO GROUP INC.

1627 East Walnut Street

Seguin, Texas 78155

Dear Fellow Stockholders:

You are cordially invited to attend the 2021 Annual Meeting of Stockholders of Alamo Group Inc. Due to concerns relating to the COVID-19 pandemic, and to support the health and safety of our employees, directors and shareholders, the Annual Meeting will be held in a virtual-only format on Thursday, May 6, 2021, at 9:00 a.m. Central Daylight Time.

How to attend the 2021 virtual Annual Meeting of Shareholders

To attend the Annual Meeting you will need to visit www.virtualshareholdermeeting.com/ALG2021, and you will be required to enter the control number found on your proxy card, voting instruction form or notice you previously received. If you have difficulty accessing the Annual Meeting through the Annual Meeting Website, please call 1-844-986-0822 (toll-free) or 303-562-9302 (international) and technicians will be available to assist you. A list of stockholders entitled to vote at the Annual Meeting will be available during the entire time of the Annual Meeting at the Annual Meeting Website. You may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting.

Your vote is very important. Whether or not you expect to attend the virtual meeting and regardless of the number of shares you own, please mark, sign and mail the enclosed proxy in the envelope provided as soon as possible. Stockholders may also vote through the Internet or by telephone. Even if you vote in advance, you are still entitled to attend the virtual meeting and vote at the meeting. If you vote at the meeting, that vote will have the effect of revoking any prior vote.

Thank you for your support.

/s/ Roderick R. Baty

Roderick R. Baty

Chairman of the Board of Directors

March 15, 2021

ALAMO GROUP INC.

1627 East Walnut Street

Seguin, Texas 78155

____________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 6, 2021

____________________

To the Stockholders of

Alamo Group Inc.

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Alamo Group Inc. (the “Company”) will be held in a virtual-only format on Thursday, May 6, 2021, at 9:00 a.m. Central Daylight Time, for the following purposes:

1.to elect the seven (7) directors named in the proxy materials to the Board of Directors to serve until the next Annual Meeting of Stockholders or until their successors are elected and qualified;

2.to approve the compensation of the Company's named executive officers ("NEOs") on an advisory basis (the "say-on-pay proposal");

3.to ratify the Audit Committee’s appointment of KPMG LLP as the Company's independent auditors for the 2021 fiscal year; and

4.to transact such other business as may properly come before the meeting or any adjournment thereof.

In accordance with the Bylaws of the Company, the Board of Directors fixed the record date for the meeting as

March 15, 2021. Only stockholders of record at the close of business on that date will be entitled to vote at the meeting or any adjournment thereof.

Stockholders who do not expect to attend the virtual meeting are urged to sign the enclosed proxy and return it promptly. A return envelope is enclosed for that purpose. Stockholders may also vote through the Internet or by telephone. Instructions for voting through the Internet or by telephone are included on the proxy card.

A complete list of stockholders entitled to vote at the meeting, showing the address of each stockholder and the number of shares registered in the name of each stockholder, shall be open to examination by any stockholder, for any purpose germane to the meeting, during ordinary business hours, for a period of at least ten business days prior to the meeting, commencing April 22, 2021, at the offices of the Company’s Counsel, which is Clark Hill Strasburger, The Bakery Building, 2301 Broadway Street, San Antonio, Texas 78215-1157.

| By Order of the Board of Directors | ||

/s/ Edward T. Rizzuti | ||

| Edward T. Rizzuti | ||

| Secretary | ||

Dated: March 15, 2021

ALAMO GROUP INC.

1627 East Walnut Street

Seguin, Texas 78155

Proxy Statement for the Annual Meeting of Stockholders

To Be Held on May 6, 2021

GENERAL INFORMATION

The accompanying Proxy is solicited by the Board of Directors (the “Board of Directors” or the “Board”) of Alamo Group Inc., a Delaware corporation (the “Company,” “we,” “our,” or “us”), to be voted at the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 6, 2021, and at any meeting scheduled as a result of any adjournments thereof. The meeting will be held in a virtual-only format at 9:00 a.m. central time. To attend the Annual Meeting you will need to visit www.virtualshareholdermeeting.com/ALG2021, and you will be required to enter the control number found on your proxy card, voting instruction form or notice you previously received. This Proxy Statement and the accompanying Proxy are being mailed to stockholders on or about March 31, 2021. The Annual Report of the Company for fiscal 2020 including audited financial statements for the fiscal year ended December 31, 2020, and a proxy card are enclosed.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on

May 6, 2021: Our Proxy Statement and our Annual Report, which includes our Form 10-K for the fiscal year ended

December 31, 2020, are available free of charge on our website at: www.alamo-group.com/fr.

Voting and Proxies

Only holders of record of common stock, par value $.10 per share (“Common Stock”), of the Company at the close of business on March 15, 2021 (the “Record Date”) shall be entitled to vote at the meeting. There were 20,000,000 authorized shares of Common Stock and 11,899,169 shares of Common Stock outstanding on the Record Date. Each share of Common Stock is entitled to one vote. Any stockholder giving a proxy has the power to revoke the same at any time prior to its use by giving notice in person or in writing to the Secretary of the Company.

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock is necessary to constitute a quorum at the 2021 Annual Meeting of Stockholders and any adjournment thereof. By signing and returning the enclosed proxy card, you authorize the persons named as proxies on the proxy card to represent you at the meeting and vote your shares. If you are not present at the meeting, your shares can be voted only when represented by a proxy either pursuant to the enclosed proxy card or otherwise. You may indicate a vote on the enclosed proxy card in connection with any of the listed proposals, and your shares will be voted accordingly. If you indicate a preference to abstain from voting, no vote will be cast.

Votes Required to Approve a Proposal

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspectors of election appointed by the Company for the meeting. A majority of the outstanding shares of common stock present in person or represented by proxy constitutes a quorum for the transaction of business at the Annual Meeting. Abstentions and “broker non-votes” will be included in determining the presence of a quorum at the Annual Meeting. Where a stockholder’s proxy or ballot is properly executed and returned but does not provide voting instructions, the shares of such stockholder will nevertheless be counted as being present at the Meeting for the purpose of determining a quorum.

“Broker non-votes” occur when a person holding shares in street name, such as through a brokerage firm, does not provide instructions as to how to vote those shares and the broker does not then vote those shares on the stockholder’s behalf.

Each director will be elected by a majority of the votes cast with respect to such director. A “majority of the votes cast” means that the number of votes cast “for” a director exceeds the number of votes cast “against” that director. Abstentions and "broker non-votes" are not considered to be votes cast with respect to the election of directors. Under Delaware law, if the director is not elected at the annual meeting, the director will continue to serve on the Board as a “holdover director.” As required by the Company’s Bylaws, each director has submitted an irrevocable letter of resignation as director that becomes effective if he or she is not elected by stockholders and the Board accepts the resignation. If a director is not elected, the Nominating/Corporate Governance Committee will consider the director’s resignation and recommend to the Board whether to

1

accept or reject the resignation. The Board will decide whether to accept or reject the resignation and publicly disclose its decision and, if it rejects the resignation, the rationale behind the decision, within 90 days after the election results are certified.

Approval of the say-on-pay proposal requires the affirmative vote of a majority of the shares present in person or by proxy and entitled to vote at the Annual Meeting. Because your vote is advisory, it will not be binding on the Board or the Company. However, the Board will review the voting results and take them into consideration when making future decisions regarding executive compensation. Under New York Stock Exchange rules, if your broker holds your shares in its name, your broker is not permitted to vote your shares with respect to the say-on-pay proposal if your broker does not receive voting instructions from you. Abstentions are entitled to vote on this proposal and therefore will have the same effect as a negative vote on this proposal. Broker non-votes will have no impact on the proposal since they are not considered shares entitled to vote on the proposal.

The ratification of KPMG LLP’s appointment as the Company’s independent auditor requires the affirmative vote of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote thereat. Abstentions are present and entitled to vote and will thus have the same effect as a negative vote on the proposal to approve and ratify the appointment of KPMG LLP.

BENEFICIAL OWNERSHIP OF OUR COMMON STOCK

Listed in the following table are the only beneficial owners of more than five percent of the Company's outstanding Common Stock that the Company is aware of as of February 19, 2021. In addition, this table includes the outstanding voting securities beneficially owned by the Company’s directors, by its executive officers that are listed in the Summary Compensation Table, and by its directors and executive officers as a group as of February 19, 2021. Unless indicated otherwise below, the address of each person named on the table below is: c/o Alamo Group Inc., 1627 East Walnut Street, Seguin, Texas 78155.

2

Beneficial Owner of Common Stock | Amount and Nature of Beneficial Ownership(1) | Percent of Class(2) | |||||||||

| Henry Crown and Company c/o Brian Gilbert Gould & Ratner LLP 222 N. LaSalle Street, Suite 800 Chicago, IL 60601 | 1,700,000 | (3) | 14.29% | ||||||||

| BlackRock Inc. 55 East 52nd Street New York, NY 10055 | 1,506,128 | (4) | 12.66% | ||||||||

| The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | 657,050 | (5) | 5.52% | ||||||||

| Victory Capital Management Inc. 4900 Tiedeman Rd, 4th Floor Brooklyn, OH 44144 | 655,246 | (6) | 5.51% | ||||||||

| Dimensional Fund Advisors LP Building One 6300 Bee Cave Road Austin, TX 78746 | 650,992 | (7) | 5.47% | ||||||||

| Ronald A. Robinson | 238,648 | (8) | 2.01% | ||||||||

| Roderick R. Baty | 20,000 | (9) | * | ||||||||

| Eric P. Etchart | 7,555 | (9) | * | ||||||||

| Robert P. Bauer | 6,648 | (9) | * | ||||||||

| Tracy C. Jokinen | 4,536 | (9) | * | ||||||||

| Richard W. Parod | 5,116 | (9) | * | ||||||||

| Lorie L. Tekorius | 1,356 | (9) | * | ||||||||

| Dan E. Malone | 13,484 | (10) | * | ||||||||

| Jeffery A. Leonard | 17,964 | (8)(10) | * | ||||||||

| Richard H. Raborn | 9,327 | (8)(10) | * | ||||||||

| Edward T. Rizzuti | 9,339 | (8)(10) | * | ||||||||

| All Directors and Executive Officers (14 Persons) | 364,137 | (8)(10) | 3.06% | ||||||||

___________________

*Less than 1% of class.

1.In each case, the beneficial owner has sole voting and investment power, except as otherwise provided herein.

2.The calculation of percent of class is based on the number of shares of Common Stock outstanding as of February 19, 2021, being 11,896,421 shares.

3.Based on Schedule 13D/A, dated December 21, 2012, Bgear Investors LLC, a Delaware limited liability company, and Henry Crown and Company, an Illinois limited liability partnership, had shared voting and dispositive power over 1,361,700 shares, and Henry Crown and Company, a Delaware corporation, had sole voting and dispositive power over 338,300 shares as of December 31, 2012.

4.Based on Schedule 13G/A, dated January 27, 2021, by which BlackRock, Inc. reported that as of December 31, 2020, it had sole voting power over 1,494,496 shares and had shared voting power over none of the shares and sole dispositive power over 1,506,128 shares. BlackRock, Inc. reported beneficial ownership of the 1,506,128 shares as of December 31, 2020.

5.Based on Schedule 13G, dated February 10, 2021, by which The Vanguard Group reported that as of December 31, 2020, it had sole voting power over zero shares, had shared voting power over 20,769 shares and had sole dispositive power over 628,763 shares. The Vanguard Group reported beneficial ownership in 657,050 shares as of December 31, 2020.

6.Based on Schedule 13G/A, dated February 2, 2021, by which Victory Capital Management Inc. reported that as of December 31, 2020, it had sole voting power over 647,006 shares, had shared voting power over none of the shares, and had sole dispositive power over 655,246 shares. Victory Capital Management Inc. reported beneficial ownership in 655,246 shares as of December 31, 2020.

7.Based on Schedule 13G/A, dated February 12, 2021, by which Dimensional Fund Advisors LP reported that as of December 31, 2020, it had sole voting power over 614,170 shares, had shared voting power over none of the shares, and had sole dispositive power over 650,992 shares. Dimensional Fund Advisors LP reported beneficial ownership in 650,992 shares as of December 31, 2020.

8.Includes: unvested restricted stock awards that have power to vote and receive dividends as follows: 22,799 shares for Mr. Robinson; 3,717 shares for Mr. Malone; 4,822 shares for Mr. Leonard; 4,561 shares for Mr. Raborn; 3,542 shares for Mr. Rizzuti; and 5,582 shares for other executive officers.

9.Includes: unvested restricted stock awards that have power to vote and receive dividends as follows: 2,321 shares each for Mr. Baty, Mr. Etchart, Mr. Bauer and Ms. Jokinen; 2,176 shares for Mr. Parod; and 1,266 shares for Ms. Tekorius.

10.Includes: shares available for exercise under various stock options as follows: 3,000 shares for Mr. Leonard; 1,500 shares for Mr. Raborn; 4,100 shares for Mr. Rizzuti; and 4,100 shares for other executive officers.

3

PROPOSAL 1 - ELECTION OF DIRECTORS

The Bylaws of the Company provide that the number of directors which shall constitute the whole Board of Directors shall be fixed and determined from time to time by resolution adopted by the Board of Directors. Currently, the size of the Board of Directors has been fixed at seven (7) directors.

Each director elected at the Annual Meeting will serve until the next Annual Meeting of Stockholders or until a successor is elected and qualified. Unless otherwise instructed, shares represented by properly executed proxies in the accompanying form will be voted for the individuals nominated by the Board of Directors set forth below. Although the Board of Directors anticipates that the listed nominees will be able to serve, if at the time of the meeting any such nominee is unable or unwilling to serve, such shares may be voted at the discretion of the proxy holders for a substitute nominee. The Nominating/Corporate Governance Committee of the Board of Directors recommended the individuals listed below to the Board of Directors and the Board of Directors nominated them. Certain information concerning such nominees, including all positions with the Company and principal occupations during the last five years, is set forth below.

We have provided below information about our nominees, all of whom are incumbent directors, including their ages, years of service as directors, and business experience. We have also included information about each nominee’s specific experience, qualifications, attributes, or skills that led the Board to conclude that he/she should serve as one of our directors in light of our business and structure. All of our nominees bring to our Board extensive management and leadership experience gained through their service as executives and, in several cases, chief executive officers, chief operating officers or chief financial officers of diverse businesses. In these executive roles, they have taken hands-on, day-to-day responsibility for strategy and operations, including management of capital, risk and business cycles. In addition, several nominees bring private and public company board experience with either significant experience on other boards or long service on our board. This broadens their knowledge of board policies and processes, rules and regulations, issues and solutions.

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS

Roderick R. Baty, age 67, has been a director of the Company since August 2011 and was appointed Chairman of the Board on May 3, 2018. Mr. Baty served as Chairman and Chief Executive Officer of NN, Inc., from May 2001 until his retirement in May 2013. NN, Inc. is a publicly owned global manufacturer of industrial rubber and plastic products and precision metal components serving a variety of markets, including the automotive industry, original equipment manufacturers, HVAC, heavy equipment and many other industrial end markets. Mr. Baty joined NN, Inc. in 1995 as Vice President of Sales and Marketing/Chief Financial Officer and was elected to the Board of Directors. In 1997, he was named President and Chief Executive Officer, and was elected Chairman of the Board in 2001. Prior to joining NN, Inc., Mr. Baty served as President and Chief Operating Officer of Hoover Precision Products from 1990 to 1995. Hoover Precision Products is a North American specialist manufacturer of precision balls serving various industries, including automotive, aerospace, anti-friction bearings, pumps, medical, pen, and furniture applications. Mr. Baty brings to the Board senior executive leadership experience in the areas of public company governance, operational, financial and strategic management within industrial and international manufacturing companies.

Robert P. Bauer, age 62, has been a director of the Company since August 2015. Mr. Bauer serves as President and Chief Executive Officer and as a director of the L.B. Foster Company ("L.B. Foster"), a manufacturer, fabricator and distributor of products and services for transportation and energy infrastructure. L.B. Foster specializes in infrastructure maintenance material for freight and transit rail systems; construction products for highway bridges and ports; tubular products and services for pipeline and drilling applications; and precision metering solutions for pipelines. Mr. Bauer joined L.B. Foster in February of 2012. Prior to joining L.B. Foster, Mr. Bauer was President of the Refrigeration Business for Emerson Climate Technologies, a subsidiary of Emerson Electric Company, and served in various executive positions at Emerson Electric Company from 1994 until he was recruited to L.B. Foster. Mr. Bauer brings to the Board many years of experience in the global manufacturing environment, with valuable and extensive knowledge concerning global product marketing, new product development, strategic planning, corporate governance, and mergers and acquisitions.

Eric P. Etchart, age 64, has been a director of the Company since August 2015. From 2007 until his retirement in January 2016, Mr. Etchart served as Senior Vice President for the Manitowoc Company, Inc., a global manufacturer of cranes and food service equipment serving both residential and non-residential markets as well as infrastructure and power industries. Mr. Etchart was the President of the Manitowoc Crane Group from 2007 until 2015 and Senior Vice President of Business Development from 2015 until his retirement. Prior to joining Manitowoc, Mr. Etchart held various management positions for Potain S.A., a global manufacturer of tower cranes, until it was acquired by Manitowoc in 2001. Mr. Etchart is a National Association of Corporate Directors (NACD) fellow. Mr. Etchart brings to the Board over thirty years of global manufacturing

4

experience, extensive knowledge of and expertise in finance and marketing, and is a French national with over twenty years of management experience outside the U.S., which provides the Company with a meaningful international perspective on global markets.

Tracy C. Jokinen, age 52, has been a director of the Company since August 2016. She is the Executive Vice-President and Chief Financial Officer of Vyaire Medical, a global respiratory care company. Before joining Vyaire in March of 2020, Ms. Jokinen was the Executive Vice President and Chief Financial Officer of Acelity L.P. Inc. ("Acelity"), a leading global medical technology company, from June 2017 until October 2019 when Acelity was acquired by the 3M Company. Before joining Acelity in June of 2017, Ms. Jokinen served as the Chief Financial Officer of G&K Services, Inc. (“G&K”), a service-focused provider of branded uniform and facility services programs, from 2014 to 2017. Prior to her service as Chief Financial Officer of G&K, Ms. Jokinen spent 22 years with Valspar Corporation (“Valspar”), a global manufacturer of paints and coatings, in various positions of increasing responsibility. Most recently, she served as Valspar’s Vice President, Corporate Finance, where she led Valspar’s tax, treasury, investor relations, internal audit, operations, finance, and corporate accounting functions. Her previous positions at Valspar included Vice President, Finance & Strategy, and Vice President, Corporate Controller and Chief Accounting Officer. Ms. Jokinen's extensive and varied management experience, a significant portion of which was within the manufacturing sector, provides the Company with meaningful financial and accounting expertise as well as useful problem solving skills relevant to a large multinational manufacturing company.

Richard W. Parod, age 67, was appointed a director of the Company on December 14, 2017. Mr. Parod was the President and Chief Executive Officer and a director of the Lindsay Corporation ("Lindsay") from April 2000 until his retirement on December 1, 2017. Prior to Lindsay, Mr. Parod served as the Vice President and General Manager of the Toro Company's Irrigation Division from 1997 to 2000. Toro is a leading worldwide provider of outdoor turf, landscape, underground utility construction, irrigation and related equipment. In his role as President and CEO with Lindsay, a global manufacturer of agricultural and infrastructure equipment, Mr. Parod gained valuable executive leadership experience and he brings meaningful expertise in many areas relevant to the Company, including manufacturing operations, product development, sales and marketing, strategic planning, accounting and corporate governance.

Ronald A. Robinson, age 68, has been President, Chief Executive Officer and a director of the Company since 1999. Mr. Robinson previously was President of Svedala Industries, Inc. ("Svedala"), the U.S. subsidiary of Svedala Industries AB of Malmo, Sweden, a leading manufacturer of equipment and systems for the worldwide construction, mineral processing and materials handling industries. Mr. Robinson joined Svedala in 1992 when it acquired Denver Equipment Company of which he was Chairman and Chief Executive Officer. Mr. Robinson has a deep knowledge and understanding of our Company and our lines of business. Mr. Robinson has demonstrated his leadership abilities and his commitment to our Company. In December 2020, Mr. Robinson informed the Board of Directors of his intention to retire by mid-year 2021 and upon the appointment of his successor. The Board has been preparing for such a transition in Company leadership and anticipates naming a new President and CEO as Mr. Robinson's successor in the near term. It is Mr. Robinson's intention to remain as a member of the Company's Board of Directors following his retirement as President and CEO.

Lorie L. Tekorius, age 53, has been a director of the Company since December 2019. Ms. Tekorius is President and Chief Operating Officer of The Greenbrier Companies, Inc. ("Greenbrier"). Greenbrier is one of the leading designers, manufacturers and marketers of railroad freight car equipment in North America, Europe and South America. The company manufactures and markets marine barges in North America and is also a leading provider of freight railcar wheel services, parts, repair and refurbishment in North America. Ms. Tekorius has served as Greenbrier’s Chief Operating Officer since August 2018 and was promoted to President in August 2019. She has served in various management positions for the company since 1995, most recently as Executive Vice President and Chief Operating Officer and, prior to that, as Executive Vice President and Chief Financial Officer. Ms. Tekorius provides the Company with highly relevant experience in finance, accounting, public company governance, strategic planning, and global manufacturing operations.

5

The Board has delegated some of its authority to three Committees of the Board of Directors. These are the Audit Committee, Nominating/Corporate Governance Committee, and Compensation Committee. All three Committees have published charters on the Company’s website at www.alamo-group.com under the “Our Commitment” tab. The following table shows the current membership of each Committee of the Board (all members of which are independent) and the number of meetings held by each Committee during 2020:

Compensation Committee | Audit Committee | Nominating/Corporate Governance Committee | |||||||||

| Roderick R. Baty, Chairman of the Board | |||||||||||

| Robert P. Bauer | X | X | X | ||||||||

| Eric P. Etchart | X | Chair | |||||||||

| Tracy C. Jokinen | X | Chair | |||||||||

| Richard W. Parod | Chair | X | X | ||||||||

| Ronald A. Robinson | |||||||||||

| Lorie L. Tekorius | X | X | |||||||||

Number of Fiscal 2020 Meetings | 3 | 4 | 2 | ||||||||

INFORMATION CONCERNING DIRECTORS

None of the nominees for director or the executive officers of the Company has a familial relationship with any of the other executive officers or other nominees for director. In accordance with our Corporate Governance Guidelines, no director may serve on more than three public company boards of directors (including the Company's Board). Mr. Etchart has served as director of Graco Inc., a publicly traded company, since 2010 and is a member of the Audit and Compensation Committees of Graco. Mr. Etchart has also served as a director of the WD-40 Company, a publicly traded company, since December of 2016 where he is currently the chairman of the Nominating and Governance Committee and a member of the Finance Committee. Mr. Parod has served as a director of Raven Industries, Inc., a publicly traded company, since December of 2017 and is a member of their Audit Committee and Nominating/Corporate Governance Committee. Mr. Bauer is a director of L.B. Foster, a publicly traded company, where he also serves as President and Chief Executive Officer. Except as disclosed above, none of the directors or nominees is a director or has been a director over the past five years of any other company which has a class of securities registered under, or is required to file reports under, the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or of any company registered under the Investment Company Act of 1940, as amended.

Non-management directors may meet in executive session, without the Chief Executive Officer, at any time, and there are regularly scheduled non-management executive sessions at each meeting of the Board of Directors and Committees thereof. The Chairman of the Board and the Chair of each Committee preside over their respective executive sessions.

In determining independence, each year the Board affirmatively determines whether each director has any “material relationships” with the Company other than as a director. When assessing the “materiality” of a director’s relationship with the Company, the Board considers all relevant facts and circumstances, not merely from the director’s standpoint, but from that of the persons or organizations with which the director has an affiliation, and the frequency or regularity of the services, whether the services are being carried out at arm’s length in the ordinary course of business and whether the services are being provided substantially on the same terms to the Company as those prevailing at the time from unrelated parties for comparable transactions.

The Board of Directors has determined that all of its current directors except Mr. Robinson, President and CEO, have no material relationships with the Company or its auditors and are independent within the meaning of the New York Stock Exchange (“NYSE”) listing standards on director independence and the director independence standards established under the Company’s Corporate Governance Guidelines, which are available at www.alamo-group.com under the “Our Commitment” tab.

If you and other interested parties wish to communicate with the Board of Directors of the Company, you may send correspondence to the Corporate Secretary, Alamo Group Inc., 1627 East Walnut Street, Seguin, Texas 78155. The Secretary will submit your correspondence to the Board or to the appropriate Committee or Board member, as applicable. The Board’s policy regarding stockholder communication with the Board of Directors is available at www.alamo-group.com under the “Our Commitment” tab.

6

Stockholders and other interested parties may communicate with non-management directors of the Board by sending their correspondence to the Corporate Secretary, Alamo Group Inc., 1627 East Walnut Street, Seguin, Texas 78155.

Vote required. Each director will be elected by a majority of the votes cast with respect to such director. All proxies will be voted “FOR” these nominees unless a contrary choice is indicated. Shares voting “abstain” on any nominee for director will be excluded from the vote and will have no effect on the election of directors. Broker non-votes will also be excluded from the vote and will have no effect on the election of directors.

THE BOARD OF DIRECTORS HAS APPROVED THE SLATE OF DIRECTORS AND

RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL SEVEN NOMINEES, WHICH IS DESIGNATED AS PROPOSAL NO. 1 ON THE ENCLOSED PROXY. PROXIES SOLICITED BY THE BOARD WILL BE VOTED "FOR" EACH NOMINEE UNLESS OTHERWISE INSTRUCTED.

CORPORATE GOVERNANCE

Meetings and Committees of the Board

During the fiscal year ended December 31, 2020, the Board held six meetings. Each incumbent director attended in person or by phone 100% of the total number of meetings of the Board and Committees on which the director served during 2020. It is a policy of the Board that all directors attend the Annual Meeting of Stockholders. All of our directors attended the Annual Meeting of Stockholders in May 2020 which was held as a virtual meeting due to concerns relating to the COVID-19 pandemic.

Board Leadership Structure

The Board does not have a policy on whether the same person should serve as both the CEO and Chairman of the Board or, if the roles are separate, whether the chairman should be selected from the non-employee directors or should be an employee. The Board believes that it should have the flexibility to make these determinations at any given point in time in the way that it believes best to provide appropriate leadership for the Company at that time.

Currently, Mr. Baty serves as Chairman of the Board and Mr. Robinson serves as the CEO. The CEO is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while the Chairman of the Board sets the agenda for Board meetings and presides over meetings of the full Board. The Board believes that its current leadership structure is appropriate at this time.

The Board's Role in Strategic and Risk Oversight

Our Board takes an active role in overseeing management's development and implementation of its strategic plan. It receives a comprehensive overview of management's strategic plan for the Company's business at least annually and reviews periodic updates concerning the Company's execution of the plan, as well as updates from individual business units at regularly scheduled Board meetings during the course of the year. The Board provides insight and guidance to Company management and, if necessary, challenges management concerning the Company's overall strategic direction. The Board also monitors and analyzes the Company's financial results and approves all material acquisitions and significant capital expenditures.

The Board also has an active role in overseeing management of the Company’s risk. The Board regularly reviews information regarding the Company’s operational, financial, legal, cybersecurity, fraud and reputational risks which is usually conveyed to the Board by the senior management of the Company or by one of the Board’s Committees. The Board also continues to monitor risks posed to our European operations resulting from the UK's exit from the European Union. Because overseeing risk is an ongoing process and an inherent part of the Company’s strategic decisions, the Board discusses risk throughout the year at other meetings in relation to specific proposed actions.

The Board has delegated certain risk management oversight responsibility to the Board committees. The Audit Committee oversees risks related to the Company’s accounting, auditing, reporting, financial practices (including the integrity of the Company’s financial statements), cybersecurity, administration and financial controls, and compliance with legal and regulatory requirements. The Audit Committee also reviews and discusses the Company’s policies with respect to risk assessment and risk management. The Compensation Committee oversees risks relating to the Company’s compensation, incentive compensation, and equity-based compensation plans. The Nominating/Corporate Governance Committee oversees

7

risks relating to the composition and organization of the Board and the Company's governance practices, including environmental and social governance matters.

The Company believes that its leadership structure also enhances the risk oversight function of the Board. Our CEO regularly discusses material risks facing the Company with management and members of the Board. Our CEO, as a member of the Board, is also expected to report candidly to his fellow directors on his assessment of the material risks the Company faces, based upon the information he receives as part of his management responsibilities.

The Audit Committee

In January 2020, the Audit Committee of the Board of Directors consisted of Ms. Jokinen (Chair), Ms. Tekorius and Messrs. Bauer and Parod. The Committee met four times during fiscal 2020. All Committee members were present in person or by telephone at the meetings. The duties and responsibilities of the Committee include, among other things, to:

| - | appoint, approve compensation, and oversee the work of the independent auditor; | ||||

| - | review at least annually a report by the independent auditor describing the firm’s internal control procedures and any material issues raised by the most recent internal control review; | ||||

| - | preapprove all audit services and associated fees by the independent auditors; | ||||

| - | preapprove all permissible non-audit services to be provided by the independent auditor; | ||||

| - | review the independence of the independent auditor; | ||||

| - | review the scope of audit and resolve any difficulties or disagreements with management encountered during the audit or any interim periods; | ||||

| - | review and discuss with management and the independent auditor the annual audit and quarterly financial statements of the Company; | ||||

| - | recommend to the Board whether the financial statements should be included in the Annual Report on Form 10-K and in the quarterly reports on Form 10-Q, in both cases, as reviewed; | ||||

| - | review the adequacy and effectiveness of the Company’s internal controls; | ||||

| - | review the adequacy and effectiveness of the Company’s disclosure controls and management reports thereon; | ||||

| - | approve the scope of the internal auditor’s audit plan; | ||||

| - | review and approve earnings press releases, financial information and earnings guidance, if any; | ||||

| - | review financial risk assessment presented by management; | ||||

| - | oversee the Company’s compliance systems with respect to legal and regulatory requirements, review the Company’s Code of Business Conduct and Ethics and monitor compliance with such code; | ||||

| - | review complaints regarding accounting, internal accounting controls and auditing matters, including a way to report anonymously; | ||||

| - | review the Company’s adherence to regulations for the hiring of employees and former employees of the independent auditor; | ||||

| - | periodically review and evaluate the Company's policies and programs for identifying cybersecurity risks; and | ||||

| - | review and evaluate annually the qualifications, performance and independence of the independent auditor, including a review and evaluation of the lead partner of the independent auditor, and assure regular rotation of the lead audit partner as required by law. | ||||

The Audit Committee reports to the Board on its activities and findings.

The Board has determined that under current NYSE listing standards all members of the Committee are financially literate, are “Audit Committee financial experts,” and are independent under the Company’s Corporate Governance Guidelines and NYSE listing requirements, and that each has accounting or related financial management expertise as required by the NYSE listing standards. The Committee’s Charter and Corporate Governance Guidelines, which have been approved by the Board, are reviewed at least annually and may be viewed on the Company’s website www.alamo-group.com under the “Our Commitment” tab.

8

Report of the Audit Committee

The information contained in this report shall not be deemed to be “soliciting material” or “filed” with the Securities and Exchange Commission (the “SEC”) or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

The Audit Committee is currently comprised of four independent members of the Company’s Board of Directors. Each member of the Audit Committee is independent under applicable law and NYSE listing requirements. The duties and responsibilities of the Audit Committee are set forth in the Audit Committee Charter, which the Board of Directors reviews on an annual basis.

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal control over financial reporting. In fulfilling its oversight responsibilities in fiscal 2020, the Committee reviewed and discussed with management the Quarterly Reports on Form 10-Q and the audited financial statements included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2020, including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant adjustments, and the clarity of disclosures in the financial statements.

The Audit Committee has reviewed and discussed with management and with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and the audited financial statements. The Audit Committee has discussed with the independent auditors the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (the “PCAOB”) and the SEC. In addition, the Committee has received the written disclosures and the letter from the independent accountant required by the applicable requirements of the PCAOB regarding the independent accountant's communications with the Audit Committee concerning independence, and has discussed with the independent accountant the independent accountant's independence as described in Item 407(d)(3)(i) of Regulation S-K. The Committee has also considered the compatibility of non-audit services with the auditors’ independence.

The Audit Committee discussed with the independent auditors the overall scope and plans for their audit. They also discussed with management and the internal auditor the overall scope and plans for the Company’s assessment of internal control. The Committee meets with the independent auditors and the internal auditor, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls over financial reporting, and the overall quality of the Company’s financial reporting. The Committee met four times during fiscal 2020. All Committee members were present at the meetings.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board approved) that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2020, for filing with the SEC. The Audit Committee also recommended, subject to stockholder ratification, the appointment of KPMG LLP as the Company’s independent auditors for fiscal year 2021. Audit, audit-related and any permitted non-audit services provided to the Company by KPMG LLP are subject to preapproval by the Audit Committee.

| AUDIT COMMITTEE | ||

| Tracy C. Jokinen, Chair | ||

| Robert P. Bauer, Member | ||

| Richard W. Parod, Member | ||

| Lorie L. Tekorius, Member | ||

9

The Nominating/Corporate Governance Committee

In January 2020, the Nominating/Corporate Governance Committee consisted of Messrs. Etchart (Chair), Bauer and Parod and Ms. Tekorius. During 2020, the Committee held two meetings. All Committee members were present at the meetings. The Committee has the responsibility, among other things, to:

- | evaluate director candidates and has sole authority to retain a search firm in that effort, approve its fees and scope of service; | ||||

| - | recommend to the Board of Directors nominees for Board election by the stockholders based upon their qualifications, knowledge, skills, expertise, experience and diversity; | ||||

| - | review Board composition to reflect the appropriate balance of knowledge, skills, expertise, experience and diversity; | ||||

| - | review size of the Board and the frequency and structure of Board meetings; | ||||

| - | recommend to the Board the establishment, elimination, size and composition of standing Committees; | ||||

| - | review, at least annually, the Company's Code of Business Conduct & Ethics; | ||||

| - | review, at least annually, the Company's annual sustainability reporting data and annual sustainability report; | ||||

| - | make recommendations to the Board concerning public company governance matters based on trends and best practices, including on matters relating to environmental and social governance; | ||||

| - | oversee and establish procedures for the annual evaluation of the Board and management; and | ||||

| - | develop, recommend to the Board, and review annually a set of corporate governance guidelines. | ||||

The Board of Directors has determined that the members of the Committee are independent under the Company’s Corporate Governance Guidelines and NYSE listing requirements. The Committee’s Charter and the Company’s Corporate Governance Guidelines are reviewed at least annually and may be viewed on the Company’s website www.alamo-group.com under the “Our Commitment” tab.

The Nominating/Corporate Governance Committee will consider director candidates recommended by stockholders. The Committee’s Policy Regarding Director Candidates Recommended by Shareholders, the Company’s Corporate Governance Guidelines (including our standards of director independence), the charters of our Board Committees, and the Company’s Code of Business Conduct and Ethics are on our website www.alamo-group.com under the “Our Commitment” tab and are available in print at no charge to any stockholder who requests them by writing to Corporate Secretary, Alamo Group Inc., 1627 East Walnut Street, Seguin, Texas 78155.

Any stockholder of the Company who complies with the notice procedures set forth below and is a stockholder of record at the time such notice is delivered to the Company may make a director recommendation for consideration by the Nominating/Corporate Governance Committee. A stockholder may make recommendations at any time, but recommendations for consideration of a nominee at the Annual Meeting of Stockholders must be received not less than 120 days before the first anniversary of the date the proxy statement was released to stockholders in connection with the previous year’s annual meeting. Therefore, to submit a candidate for consideration for nomination at the 2022 Annual Meeting of Stockholders, a stockholder must submit the recommendation, in writing, by December 2, 2021. The written notice must demonstrate that it is being submitted by a stockholder of the Company and include information about each proposed director candidate, including name, age, business address, principal occupation, principal qualifications and other relevant biographical information. In addition, the stockholder must provide confirmation of each candidate’s consent to serve as a director. A stockholder must send recommendations to the Nominating/Corporate Governance Committee, Alamo Group Inc., 1627 East Walnut Street, Seguin, Texas 78155.

The Nominating/Corporate Governance Committee identifies, evaluates and recommends director candidates to the Board of Directors. In identifying and recommending nominees for positions on the Board of Directors, the Nominating/Corporate Governance Committee places primary emphasis on (i) judgment, character, expertise, skills and knowledge useful to the oversight of our business; (ii) diversity of viewpoints, backgrounds, experiences and other demographics; (iii) business or other relevant experience; and (iv) the extent to which the interplay of the nominee's expertise, skills, knowledge and experience with that of other members of the Board will build a board that is active, collegial and responsive to the needs of the Company. Although gender and diversity characteristics, such as race, ethnicity and nationality, are important considerations in the Committee’s process, the Committee and the Board of Directors do not have a formal policy with regard to the

10

consideration of gender and/or diversity in identifying director nominees. Nominees are not discriminated against on the basis of gender, race, religion, national origin, sexual orientation, disability or any other basis prescribed by law.

Upon identifying a director candidate, or considering a director candidate recommended by a stockholder, the Committee initially determines the need for additional or replacement Board members and evaluates all the director candidates under the criteria described above, based on the information the Committee receives with the recommendation or otherwise possesses, which may be supplemented by certain inquiries. If the Committee determines, in consultation with other Board members including the Chair, that a more comprehensive evaluation is warranted, the Committee may then obtain additional information about the director candidate’s background and experience, including by means of interviews. The Committee will then evaluate the director candidate further, again using the evaluation criteria described above. The Committee receives input on such director candidates from other directors, and recommends director candidates to the full Board of Directors for nomination. The Committee may engage a third party to assist in the search for director candidates or to assist in gathering information regarding a director candidate’s background and experience. If the Committee engages a third party, the Committee approves the fee that the Company pays for such services.

The Compensation Committee

In January 2020, the Compensation Committee of the Board of Directors consisted of Messrs. Parod (Chair), Bauer and Etchart and Ms. Jokinen. The Committee held three meetings in 2020. All Committee members were present at the meetings. The duties and responsibilities of the Committee include, among other things, to:

| - | review and approve, at least annually, the goals and objectives relevant to CEO compensation and the structure of the Company’s plans for executive compensation, incentive compensation, equity-based compensation and its general compensation, and employee benefit plans, and make recommendations to the Board; | ||||

| - | evaluate annual performance of the CEO in light of the goals of the Company’s executive compensation plans, and recommend his or her compensation based on this evaluation; | ||||

| - | in consultation with the CEO, review, evaluate and recommend to the Board the compensation of all executive officers and key managers; | ||||

| - | evaluate and recommend to the Board compensation of directors for Board and Committee service; | ||||

| - | review and recommend to the Board any severance agreement made with the CEO; | ||||

| - | review and recommend to the Board the amount and terms of all individual equity awards, including stock options, restricted stock or performance based equity awards; | ||||

| - | review executive officer and director compliance with stock ownership requirements; | ||||

| - | review and recommend to the Board all equity-based and incentive compensation plans that are subject to stockholder approval; and | ||||

| - | approve and issue the annual report on executive compensation required by the SEC for inclusion in the Company’s proxy statement. | ||||

The Compensation Committee may delegate its duties and responsibilities to subcommittees as it deems necessary and advisable. The role of our executive officers in determining compensation is discussed below under “Compensation Discussion and Analysis.” The Compensation Committee has the authority to retain, at the Company’s expense, compensation consultants and other advisers as it deems necessary to assist in the fulfillment of its duties. In 2020, the Compensation Committee engaged Pay Governance, LLC (the "Compensation Consultant") to provide consulting services regarding the Company's executive compensation program for 2020 and 2021. The Compensation Consultant provided (i) comparative market data and recommendations concerning potential compensation adjustments to 2020 annual cash incentive compensation for the Committee to consider in light of the impacts the COVID-19 pandemic had on the Company's business in 2020; (ii) recommendations concerning potential changes to PSU grants made in 2020 that were impacted by the COVID-19 pandemic; and (iii) market data information to assist with the setting of total executive compensation levels for 2021.

The Compensation Consultant provided no services to the Company other than the services provided to the Compensation Committee as outlined above. The Committee assessed the independence of the Compensation Consultant under both SEC and NYSE rules and determined that the Compensation Consultant is independent and the work of the Compensation Consultant did not raise any conflict of interest.

The Board of Directors has determined that the members of the Committee are independent under the Company’s Corporate Governance Guidelines, the NYSE listing requirements, the Exchange Act and the rules and regulations of the SEC.

11

The Committee’s Charter and the Company’s Corporate Governance Guidelines are reviewed at least annually and may be viewed on the Company’s website www.alamo-group.com under the “Our Commitment” tab.

Stock Ownership Guidelines

Consistent with our objective of aligning management's interests with the interests of our stockholders, the Company adopted formal stock ownership guidelines applicable to senior executives and non-employee directors of the Company. The guidelines require that the total value of the executive's or director's holdings of Company stock must equal or exceed the specified target values shown below:

| Title | Target Ownership | ||||

| Chief Executive Officer | 5 times annual base salary | ||||

| Division EVPs & CFO | 2.5 times annual base salary | ||||

| All other Section 16 Officers | 2 times annual base salary | ||||

| Other Key Senior Executives | 1 time annual base salary | ||||

| Outside Directors | 5 times annual cash retainer | ||||

Each senior executive and director is expected to meet the target ownership requirements within a period of five (5) years from the date of adoption of our guidelines (on or before May of 2023) or, for any newly hired/promoted executives or newly appointed directors, within five (5) years from the date of hire, promotion or appointment. Senior executives and directors are required to hold at least 50% of the net shares of Company stock obtained through the Company's equity compensation programs until the applicable ownership targets are achieved. Compliance with the stock ownership guidelines is measured annually and reported to the Compensation Committee. All of our NEOs and Directors, with the exception of Ms. Tekorius, who became a member of the Board in December 2019, have met share ownership requirements under our Stock Ownership Guidelines.

For purposes of calculating ownership value, we count (i) all vested Company stock owned directly and indirectly (e.g., held by a spouse or trust) including vested restricted stock and restricted stock units, (ii) all shares of time-based unvested restricted stock and restricted stock units, and (iii) the in-the-money value of vested but unexercised stock options. We do not count unvested stock options or unvested performance-based equity awards. The failure by an executive or director to achieve or to show sustained progress towards achievement of the applicable ownership target within the recommended time period(s) may result in the reduction of future long term incentive grants and/or a requirement that the executive/director retain all Company stock obtained through the vesting or exercise of any equity grants or the taking of any other action as may be appropriate.

Prohibition on Hedging and Pledging

The Company has adopted a policy prohibiting directors and executive officers from pledging Company stock as collateral for any outstanding obligation or entering into any transactions intended to hedge or offset any decrease in the market value of Company stock. Prior to 2020, the activity prohibited by our policy did not apply to the amount of Company stock held by our directors and executives in excess of their applicable share ownership requirement under the Company's Stock Ownership Guidelines. In 2020, we revised our policy concerning the hedging and pledging of Company stock to completely prohibit the hedging of Company stock by directors and executive officers of the Company and to completely prohibit the pledging of Company stock by directors and executive officers unless such pledging is expressly approved in advance by the Company's Board on an exception basis and, in the event any such approval by the Board is granted, pledging is only permissible with respect to Company stock held in excess of the share ownership requirement under our Stock Ownership Guidelines. To date, there have been no approvals provided by our Board with respect to pledging activity by any of our executive officers. Our policy concerning hedging and pledging of Company stock only applies to directors and executive officers of the Company and not to our general employee population.

12

Sustainability & Environmental and Social Governance Priorities

In 2019, we began an important initiative focused on increasing transparency regarding our environmental, social and governance priorities. We believe sustainability is a critical consideration for all aspects of our business and we are committed to promoting a corporate culture that builds sustainability into our strategic planning while incorporating it into our day-to-day business operations. Our efforts in this area have led to the development of a sustainability framework focused on the following three key areas:

•ENVIRONMENT

•PEOPLE AND COMMUNITY

•GOVERNANCE AND ETHICS

More details concerning our sustainability program can be found in our second annual Sustainability Report (published in March 2021) which may be viewed on the Company's website under the "Our Commitment" tab. Because we are committed to making ongoing improvements in our sustainability practices over time, we felt it was important to measure certain key indicators on an annual basis as follows:

| Focus Area | Metric | ||||

| Energy Usage | Gigajoules/metric tons ("MT") products shipped | ||||

| Renewable Electric Energy | Renewable electric energy/total electric energy used | ||||

| Emissions | Greenhouse gas emissions MT/MT of products shipped | ||||

| Water Usage | Water used (m3)/MT of products shipped | ||||

| Waste Generation | Landfill waste (Kg)/MT of products shipped | ||||

| Waste Recycling | Recycled waste (MT)/Landfill waste (MT) | ||||

| Employee Safety | Number of recordable injuries/100 employees | ||||

We chose the above metrics based on the Sustainability Accounting Standards Board ("SASB") standard for the Industrial Machinery and Goods Industry category. We have established future goals for the above indicators against which we will measure our ongoing performance as outlined in greater detail in our sustainability report.

Other Corporate Governance Information

We recognize that strong corporate governance contributes to long-term stockholder value. Accordingly, we are committed to sound governance practices including those described below.

•all of our directors, except our CEO, are independent

•all of the Committees of our Board are composed entirely of independent directors

•independent directors meet regularly in executive session without management present

•the Board regularly reviews with management the Company's overall strategic plan and risk assessment

•the Board and its committees conduct annual performance evaluations

•the Board conducts peer reviews of individual independent directors

•the Board conducts annual training for its members on relevant governance topics

•all directors are elected annually and by majority vote

•the Board is prioritizing diversity, equity and inclusion practices along with sustainability practices

•directors and officers are subject to stock ownership requirements

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company or one of our subsidiaries may occasionally enter into transactions with certain “related persons.” Our Board has adopted a written Related Person Transactions Policy (the “Policy”) governing the approval or ratification of Related Person Transactions by the Audit Committee or all of the disinterested members of the Board, if necessary.

13

For purposes of the Policy, a Related Person Transaction generally means any transaction outside the normal course of business and not arms-length involving an amount in excess of $120,000 cumulatively within a twelve month period in which the Company is a participant and in which a Related Person, as defined below, has a direct or indirect material interest. In addition, proposed charitable contributions, or pledges of charitable contributions in excess of $100,000 cumulatively within a twelve month period, by the Company to a charitable or nonprofit organization identified on the roster of Related Persons, are also subject to prior review and approval by the Audit Committee. A Related Person means (i) an executive officer or director of the Company or a nominee for director of the Company, (ii) a beneficial owner of more than 5% of any class of voting securities of the Company, (iii) an immediate family member of any of the persons identified in clauses (i) or (ii) hereof, or (iv) any firm, corporation or other entity in which any of the foregoing persons is employed or is a general partner or principal or in a similar position or in which such person has a 5% or greater beneficial ownership interest.

Prior to entering into the Related Person Transaction, (a) the Related Person, (b) the director, executive officer, nominee or beneficial owner who is an immediate family member of the Related Person, or (c) the relevant business manager responsible for the potential Related Person Transaction shall provide notice to the Company's General Counsel of the facts and circumstances of the proposed Related Person Transaction. The General Counsel shall advise the Chair of the Audit Committee of any Related Person Transaction of which he becomes aware.

Under the Policy, the Audit Committee shall consider each Related Person Transaction, unless the Audit Committee determines that the approval or ratification of such Related Person Transaction should be considered by all of the disinterested members of the Board of Directors.

In considering whether to approve or ratify any Related Person Transaction, the Audit Committee or the disinterested members of the Board of Directors, as the case may be, shall consider all factors that are relevant to the Related Person Transaction, including, without limitation, the following:

| - | the size of the transaction and the amount payable to a Related Person; | ||||

| - | the nature of the interest of the Related Person in the transaction; | ||||

| - | whether the transaction may involve a conflict of interest; and | ||||

| - | whether the transaction involves the provision of goods or services to the Company that are available from unaffiliated third parties and, if so, whether the transaction is on terms and made under circumstances that are at least as favorable to the Company as would be available in comparable transactions with or involving unaffiliated third parties. | ||||

There were no Related Party Transactions during the fiscal year ending December 31, 2020.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

All members of the Compensation Committee are independent directors, and none are present or past employees or officers of the Company or any of its subsidiaries. None of our executive officers has served on the Compensation Committee (or its equivalent) or board of directors of another company that, in turn, had an executive officer serving on our Compensation Committee.

14

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This section provides information regarding the compensation program in place for the Company’s principal executive officer, principal financial officer, and the three most highly compensated executive officers other than the principal executive officer and principal financial officer (“Named Executive Officers” or “NEOs”). All NEOs are listed in the 2020 Summary Compensation Table. This section also includes information regarding, among other things, the overall objectives of the Company’s executive compensation program and each element of compensation that we provide to our NEOs.

In 2020, our NEOs were:

| NAME | TITLE | ||||

| Ronald A. Robinson | President & CEO | ||||

| Dan E. Malone | EVP & CFO, Principal Financial Officer | ||||

| Jeffery A. Leonard | EVP Industrial Division | ||||

| Richard H. Raborn | EVP Agricultural Division | ||||

| Edward T. Rizzuti | VP, General Counsel & Secretary | ||||

2020 Company Performance

We began the year with strong results for the first two months of 2020, but the first quarter ended with the onset of the COVID-19 pandemic which negatively affected our business and financial results in the last month of the first quarter and throughout the remainder of the year. We achieved record net sales in 2020 due to contributions from our recently acquired Morbark and Dutch Power businesses but experienced a decline in net sales within our core business (after adjusting for acquisitions) and a decline in net income for the year due to COVID-19 related impacts on our business. Our Industrial Division was impacted more severely than our Agricultural Division as a result of the pandemic. When adjusting for the contribution effects of our Morbark and Dutch Power businesses, our Industrial Division experienced a decline of more than fifteen percent in net sales on a year-over-year basis while net sales in our Agricultural Division remained relatively flat on a year-over-year basis. Both of our Company's Divisions faced an extremely challenging environment that included temporary plant closures, supply chain issues and other operational disruptions that persisted throughout the year. Despite these challenges, we performed relatively well. Our Industrial Division was able to maintain operating income at a healthy level with significantly lower revenue while our Agricultural Division was able to improve its operating income significantly on flat revenue, all of which is a result of decisive action by our management team and an ongoing focus on cost control and asset management over the course of the year. We also ended the year with record backlog levels which we believe will benefit us in 2021.

As a result of sustained operational discipline combined with the execution of various Company-wide cost control and asset management initiatives that were implemented in early 2020 in response to the pandemic, we were successful in achieving strong cash flow which allowed us to reduce our total debt outstanding by $158.6 million for the full year. We also continued to work towards the successful integration of our recently acquired businesses and were successful in making meaningful improvements to our corporate sustainability program. In 2020, our leadership adapted to the changed environment brought on by the pandemic and delivered admirable results in the face of significant adversity. Despite the many challenges faced in 2020, among other things, we:

•achieved record net sales for the full year of $1.16 billion;

•achieved operating cash flow for the full year of $184.3 million, also a record for the Company

•finished the year with record backlog levels at $354 million;

•continued with the successful integration of our recently acquired Morbark and Dutch Power companies;

•began operations at our newly constructed Super Products facility in Mukwonago, Wisconsin;

•continued to execute on our goal of fewer, bigger and more efficient manufacturing plants;

•improved our sustainability program and published our 2nd annual corporate sustainability report; and

•enhanced safety measures across the Company for protection of our employees in response to COVID-19

15

Stockholder Returns

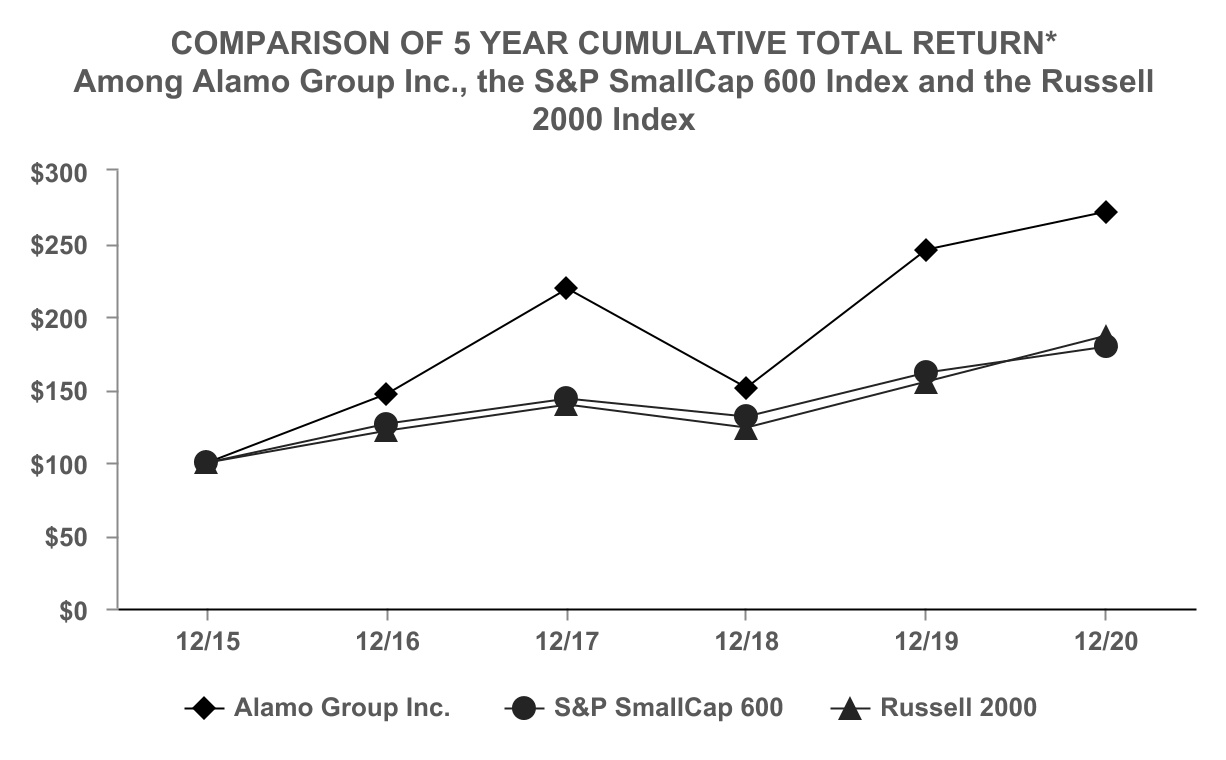

Our continued strong performance is reflected in the growth of our stock and the returns we have provided to our stockholders. We have maintained consistent annual increases in the dividends paid to our stockholders and our stock has achieved a greater than 270% return over the five year period beginning on December 31, 2015 and ending on December 31, 2020 as shown in the following graph:

*$100 invested on December 31, 2015 in stock or index, including reinvestment of dividends. | |||||

| Fiscal year ending December 31. | |||||

Copyright© 2021 Standard & Poor's, a division of S&P Global. All rights reserved. | |||||

Copyright© 2021 Russell Investment Group. All rights reserved. | |||||

| 12/15 | 12/16 | 12/17 | 12/18 | 12/19 | 12/20 | |||||||||||||||||||||||||||||||||

| Alamo Group Inc. | 100.00 | 146.97 | 218.99 | 150.69 | 245.89 | 271.48 | ||||||||||||||||||||||||||||||||

| S&P SmallCap 600 | 100.00 | 126.56 | 143.30 | 131.15 | 161.03 | 179.20 | ||||||||||||||||||||||||||||||||

| Russell 2000 | 100.00 | 121.31 | 139.08 | 123.76 | 155.35 | 186.36 | ||||||||||||||||||||||||||||||||

Response to COVID-19

With the onset of the pandemic and throughout its duration, our primary focus has been on the well-being of our employees, and we have taken various steps to protect their ongoing health and safety including, among other measures, regular facility sanitizations, wide distribution of hand sanitizer, daily temperature checks, reconfiguration of factory and office work stations to allow for appropriate distancing, cancellation of all unnecessary business travel, implementation of third party visitor restrictions, and modification of work schedules to include remote work.

We also quickly implemented various cost management and cash generation measures in order to mitigate the negative impacts to our financial health stemming from the pandemic. These measures included a reduction in inventory levels to match demand, limitations on capital expenditures, compensation freezes or reductions for salaried employees, the restriction of

16

business travel, the temporary suspension of our stock repurchase program, and the adjustment of staffing levels, among other items.

In terms of our compensation program, we took the following actions in response to COVID-19:

•Base Salaries. In April 2020, we reversed annual base salary increases for all NEOs and other executives and froze annual base salaries for most of our other salaried employees. Given improving conditions, in October 2020, we restored base salary increases for all of our NEOs and implemented base salary increases for salaried employees who were subject to salary freezes.

•Annual Cash Incentive Compensation. For our NEOs, our Compensation Committee awarded payouts for the objective portion of our annual cash incentive plan to corporate participants (including Mr. Robinson) by maintaining the incentive plan payout formula but extending the payout curve to below the prior threshold level, which resulted in a 31% formulaic payout for those participants. For Mr. Leonard and some of the Company's other Industrial Division EIP participants, whose objective performance is measured on the basis of EBIT and return on assets for the Industrial Division, the Committee approved a discretionary payout of 20% for the EBIT portion of the objective target in light of the operating income levels achieved in the Division for the year despite COVID impacts. No adjustment for the return on assets portion of the objective target was made for Mr. Leonard or the other Industrial Division EIP participants who did not reach the threshold payout level, and therefore no payout was made with respect to this portion of the objective target. There were also no adjustments made for Mr. Raborn given the relatively strong Agricultural Division results for the year. We did not issue any special bonus awards to any of our NEOs. The above annual cash incentive adjustments and payouts are described in more detail below in the Section entitled "2020 Annual Cash Incentive Compensation Outcomes."

•Long Term Equity Incentive Compensation. We did not make any changes to any of our outstanding performance share unit ("PSU") awards or time-based restricted stock ("RSA") awards, and we did not issue special equity awards to any of our NEOs in response to the COVID-19 pandemic.

Executive Compensation Philosophy and Objectives

The compensation program for NEOs is designed to attract, retain and reward talented executives who have the experience and ability to contribute materially to the Company’s long-term success and thereby build value for our stockholders. The program is intended to provide competitive base salaries as well as short-term and long-term incentives designed to align management and stockholder objectives and provide the opportunity for NEOs to participate in the success of the Company and its individual business units. In setting management pay levels, the Committee considers the Company’s historical practices, the past pay levels of the CEO and other NEOs, and Company and individual performance. The program’s annual cash incentive and its longer term equity incentive compensation provide potential upside for exceeding financial targets with downside risk for missing performance targets. This design balances retention with reward for delivering increased stockholder value and provides closely aligned objectives for Company management and stockholders. The Company’s success in retaining key employees is evidenced by the fact that the CEO and NEOs of the Company have an average tenure with the Company of approximately 10 years.

Changes in Long-Term Equity Compensation Program in 2020

While our overall compensation philosophy and objectives have not changed, the Compensation Committee remains focused on closely aligning executive compensation with overall Company performance. Accordingly, in 2020 we implemented changes to our long-term compensation program by adding a performance-based equity element, so that our long-term compensation program consists of both (i) RSAs with time-based vesting and (ii) PSU awards, which are more fully described below in the section entitled "Long-Term Equity Incentive Compensation." The Compensation Committee believes that performance-based equity awards should comprise a significant portion of total long-term incentive compensation and therefore determined that fifty percent (50%) of the value of total long-term incentive compensation for the Company's NEOs should be in the form of PSUs while the remaining fifty percent (50%) of value should consist of RSAs. In 2019, and in years prior to 2019, our long term compensation program consisted exclusively of RSAs.

Upon the Compensation Committee's recommendations, the Company's Board also approved: (i) double-trigger change of control agreements for NEOs and other Section 16 officers of the Company which provide severance compensation to executives under certain circumstances following a change in control of the Company; and (ii) the adoption of a recoupment (clawback) policy to allow for the recovery of performance-based compensation in connection with an accounting restatement by the Company.

17

The table below provides a summary of the elements of pay for our NEOs, following implementation of the changes to our compensation program in 2020:

| Compensation Element | Type | Purpose | ||||||

| Base Salary (Cash) | Fixed | Attract and retain executive talent | ||||||

| Annual Cash Incentive (Cash) | Performance-based | Align pay with the Company's and Division's annual financial performance | ||||||

| Time-Based RSAs (Equity) | Time-based | Retain executive talent while driving long- term shareholder value | ||||||

| Performance-Based PSUs (Equity) | Performance-based | Align compensation with the Company's long-term financial performance and stockholder interests | ||||||

Compensation and Governance Practices