Form DEF 14A ADAMS NATURAL RESOURCES For: Apr 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to (s) 240.14a-11(c) or (s) 240.14a-12 |

Adams Natural Resources Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notes:

Adams Natural Resources Fund, Inc.

500 E. Pratt Street, Suite 1300

Baltimore, MD 21202

Baltimore, MD 21202

| |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

|

February 23, 2021

To the Stockholders of

ADAMS NATURAL RESOURCES FUND, INC.:

Notice is hereby given that the Annual Meeting of Stockholders of ADAMS NATURAL RESOURCES FUND, INC., a Maryland corporation (the “Fund”), will be held at the Fund’s offices, 500 E. Pratt Street, Suite 1300, Baltimore, MD 21202, on Thursday, April 15, 2021, at 10:00 a.m., local time, for the following purposes:

(1)

to elect directors as identified in the Proxy Statement to serve until the annual meeting of stockholders in 2022 and until their successors are duly elected and qualify;

(2)

to ratify the appointment of PricewaterhouseCoopers LLP to serve as the Fund’s independent registered public accounting firm to audit the books and accounts of the Fund for the fiscal year ending December 31, 2021; and

(3)

to transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The Board of Directors unanimously recommends that stockholders vote in favor of Proposals (1) and (2).

Stockholders of record, as shown by the transfer agent’s books for the Fund, at the close of business on January 29, 2021, are entitled to notice of and to vote at this meeting. All Stockholders are cordially invited to attend the Annual Meeting.

| |

By order of the Board of Directors,

|

|

| |

Janis F. Kerns

General Counsel, Secretary & Chief Compliance Officer

|

|

Baltimore, MD

Note: Even if you plan to attend the meeting, stockholders are requested to fill in, sign, date and return the accompanying proxy in the enclosed envelope without delay. Stockholders may also authorize their proxies by telephone and internet as described further in the enclosed materials.

Because space will be limited, please call the Fund at (800) 638-2479 or send an email to [email protected] if you plan to attend the Annual Meeting.

GUIDE TO ADAMS NATURAL RESOURCES FUND’S 2021 PROXY STATEMENT

| | | | | | 2 | | | |

| | | | | | 2 | | | |

| | | | | | 3 | | | |

| | | | | | 3 | | | |

| | | | | | 3 | | | |

| | | | | | 3 | | | |

| | | | | | 3 | | | |

| | | | | | 3 | | | |

| | | | | | 4 | | | |

| | | | | | 5 | | | |

| | | | | | 9 | | | |

| | | | | | 9 | | | |

| | | | | | 10 | | | |

| | | | | | 10 | | | |

| | | | | | 10 | | | |

| | | | | | 10 | | | |

| | | | | | 11 | | | |

| | | | | | 11 | | | |

| | | | | | 13 | | | |

| | | | | | 14 | | | |

| | | | | | 15 | | | |

| | | | | | 16 | | | |

| | | | | | 16 | | | |

| | | | | | 16 | | | |

| | | | | | 16 | | | |

| | | | | | 17 | | | |

| | | | | | 17 | | | |

| | | | | | 17 | | |

1

Adams Natural Resources Fund, Inc.

500 E. Pratt Street, Suite 1300

Baltimore, MD 21202

Baltimore, MD 21202

| |

Proxy Statement

|

|

INTRODUCTION

The Annual Meeting of Stockholders of Adams Natural Resources Fund, Inc., a Maryland corporation (the “Fund”), will be held on Thursday, April 15, 2021, at 10:00 a.m., local time, at the Fund’s offices at 500 E. Pratt Street, Suite 1300, Baltimore, MD 21202, for the purposes set forth in the accompanying Notice of Annual Meeting and also set forth below. This proxy statement is furnished in connection with the solicitation by the Board of Directors of proxies to be used at the meeting and at any and all adjournments or postponements thereof and is first being sent to stockholders on or about February 23, 2021.

At the Annual Meeting, action is to be taken on (1) the election of a Board of Directors; (2) the ratification of the selection of an independent registered public accounting firm; and (3) the transaction of such other business as may properly come before the meeting or any adjournment or postponement thereof.

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to Be Held On April 15, 2021:

Stockholder Meeting to Be Held On April 15, 2021:

This Proxy Statement, the Notice of Annual Meeting, a form of the proxy, and the 2020 Annual Report to stockholders are all available on the internet at the following website:

http://www.astproxyportal.com/ast/13580/

http://www.astproxyportal.com/ast/13580/

How You May Vote and Voting By Proxy

You can provide voting instructions by using telephone or internet options as instructed in the enclosed proxy card, or by dating, executing and mailing the proxy card. You may also vote in person at the Annual Meeting, however, even if you intend to do so, please provide voting instructions by one of the methods described above. Except for Proposals (1) and (2), referred to above, the proxies confer discretionary authority on the persons named therein or their substitutes with respect to any business that may properly come before the meeting. Stockholders retain the right to revoke executed proxies at any time before they are voted by written notice to the Fund, by executing a later dated proxy, or by appearing and voting at the meeting. All shares represented at the meeting by proxies in the accompanying form will be voted, provided that such proxies are properly executed. In cases where a choice is indicated, the shares represented will be voted in accordance with the specifications so made. In cases where no specifications are made, the shares represented will be voted FOR Proposal (1) and FOR Proposal (2).

If your shares are held in the name of a bank, broker, or other holder of record, you will receive instructions from the holder of record that you must follow in order to vote your shares. If your shares are not registered in your own name and you plan to vote your shares in person at the Annual Meeting, you should contact your broker or agent to obtain a broker’s proxy card and bring it with you to the Annual Meeting in order to vote.

2

If you have questions regarding how to attend the meeting and vote in person, please contact the Secretary of the Fund by telephone at (800) 638-2479 or by email at [email protected].

Who May Vote

Only stockholders of record at the close of business on January 29, 2021, may vote at the Annual Meeting. The total number of shares of common stock of the Fund (“Common Stock”) outstanding and entitled to be voted on the record date was 24,078,457. Each share is entitled to one vote. The Fund has no other class of security outstanding.

Vote Requirement

For Proposal (1), referred to above, directors shall be elected by a plurality of the votes cast at the meeting. Proposal (2), referred to above, requires the affirmative vote of a majority of the votes cast at the meeting.

Quorum Requirement

A quorum is necessary to hold a valid meeting. If stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting are present in person or by proxy, a quorum will exist. Proxies received by the Fund that are marked “withhold authority” or abstain, or that constitute a broker non-vote, are counted as present for purposes of establishing a quorum. A broker non-vote occurs when a broker returns a valid proxy but does not vote on a particular matter because the broker does not have the discretionary voting power for that matter and has not received instructions from the beneficial owner. Proxies marked “withhold authority,” abstentions, and broker non-votes do not count as votes cast with respect to any proposal, and therefore, such proxies would have no effect on the outcome of Proposals (1) and (2), above.

Appraisal Rights

Under Maryland law, there are no appraisal or other dissenter rights with respect to any matter to be voted on at the Annual Meeting that is described herein.

Other Matters

The Fund will pay all costs of soliciting proxies for the Annual Meeting. Solicitation will be made by mail, and officers, employees, and agents of the Fund may also solicit proxies by telephone or personal interview. The Fund has retained AST Fund Solutions, LLC to assist in the solicitation of proxies. The Fund will pay AST Fund Solutions, LLC a fee for its services, not to exceed $2,500, and will reimburse AST Fund Solutions, LLC for its expenses, which the Fund estimates should be approximately $1,500. The Fund expects to request brokers and nominees who hold stock in their names to furnish this proxy material to their customers and to solicit proxies from them, and will reimburse such brokers and nominees for their out-of-pocket and reasonable clerical expenses in connection therewith.

Fund Complex

The Fund is part of Adams Funds (the “Fund Complex”), which is composed of the Fund and Adams Diversified Equity Fund, Inc. ("ADX"), a closed-end investment company that is also traded on the New York Stock Exchange.

3

Corporate Governance Highlights

Our corporate governance is structured by the Board of Directors with a focus on the best interests of the Fund and its shareholders and in a manner that aligns the interests of the Board and management with shareholders. Key features of this governance framework and the Board’s makeup include:

| |

Structure and Independence

|

| ||||||

| | • | | | 7 of 8 director nominees are independent | | |||

| | • | | | Annual election of all directors | | |||

| | • | | | Independent non-executive Chair | | |||

| | • | | | Annual Board and committee evaluations | | |||

| | • | | | Independent Audit, Compensation and Nominating & Governance committees | | |||

| | • | | | Risk and strategy oversight by the full Board and committees | | |||

| | • | | | Regular rotation of committee chairs and members | | |||

| | • | | | Executive session of independent directors at each regular meeting | | |||

| |

Succession and Diversity

|

| ||||||

| | • | | | Mandatory director retirement age | | |||

| | • | | | Term limit of 15 years | | |||

| | • | | | 2 of 8 directors joined in the last 3 1/2 years | | |||

| | • | | | 7 of 8 directors with a background in finance or investing | | |||

| | • | | | Extensive leadership experience; 4 former or current CEOs | | |||

| | • | | | 3 female directors, including the Chair of the Board | | |||

| | • | | | 4 of 8 directors 64 years old or younger | | |||

| |

Other Best Practices

|

| ||||||

| | • | | | 100% attendance at Board and committee meetings in 2020 | | |||

| | • | | | Active shareholder engagement with both institutional and individual investors | | |||

| | • | | | Significant share ownership requirements for directors and senior executives | | |||

| | • | | |

Discussions between the Chair and each independent director supplement formal Board assessment

|

| |||

| | • | | | Open access for directors to all employees | | |||

| | • | | |

Ability of the Board and its committees to engage independent advisors at their sole discretion

|

| |||

4

(1) NOMINEES FOR ELECTION AS DIRECTORS

Unless contrary instructions are given by the stockholder signing a proxy, it is intended that each proxy in the accompanying form will be voted at the Annual Meeting for the election of the following nominees to the Board of Directors to serve until the annual meeting of stockholders in 2022 and until their successors are duly elected and qualify, all of whom have consented to serve if elected:

| | Enrique R. Arzac | | | Roger W. Gale | | | Kathleen T. McGahran | |

| | Kenneth J. Dale | | | Mary Chris Jammet | | | Mark E. Stoeckle* | |

| | Frederic A. Escherich | | | Lauriann C. Kloppenburg | | | | |

If for any reason one or more of the above-named nominees shall become unable or unwilling to serve when the election occurs, proxies in the accompanying form will, in the absence of contrary instructions, be voted for the election of the other above-named nominees and may be voted for substitute nominees in the discretion of the persons named as proxies in the accompanying form. As an alternative to proxies being voted for substitute nominees, the size of the Board of Directors may be reduced so that there are no vacancies caused by an above-named nominee becoming unable or unwilling to serve. The directors elected will serve until the next annual meeting or until their successors are duly elected and qualify, unless otherwise provided in the Bylaws of the Fund.

The Board of Directors unanimously recommends that stockholders vote FOR the election of each of the nominees.

Information as to Nominees for Election as Directors (as of December 31, 2020)

Set forth below with respect to each nominee for director are his or her name, address and age, any positions held with the Fund, other principal occupations, other directorships during the past five years, business affiliations, the year in which he or she first became a director, and the number of shares of Common Stock of the Fund beneficially owned by him or her. Also set forth below is the number of shares of Common Stock of the Fund beneficially owned by all the directors and executive officers of the Fund as a group. A separate table is provided showing the dollar value range of the shares beneficially owned by each director.

*

Mr. Stoeckle is an “interested person,” as defined by the Investment Company Act of 1940, as amended, because he is an officer of the Fund.

5

| |

Name, Age, Positions with the Fund,

Other Principal Occupations and Other Directorships |

| |

Has

Been a Director Since |

| |

Number of

Portfolios in Fund Complex Overseen by Director or Nominee for Director |

| |

Shares of Common

Stock Beneficially Owned (a)(b)(c) |

| |||||||||

| | Independent Directors | | | | | | | | | | | | | | | | | | | |

| |

Enrique R. Arzac, Ph.D., 79, Professor Emeritus of Finance and Economics at the Graduate School of Business, Columbia University. Currently, a director of ADX(d), Mirae Asset Discovery Funds (3 open-end funds), ETF Securities USA LLC, and Credit Suisse Next Investors LLC. In addition, within the past five years, Dr. Arzac served as director of Aberdeen Asset Management Funds (6 open-end funds), Credit Suisse Asset Management Funds (2 closed-end investment companies and 8 open-end funds).

|

| | | | 1983 | | | | | | 2 | | | | | | 21,559 | | |

| |

Kenneth J. Dale, 64, Senior Vice President and Chief Financial Officer of The Associated Press. Formerly, Vice President, J.P. Morgan Chase & Co. Inc. Currently, a director of ADX (d).

|

| | | | 2008 | | | | | | 2 | | | | | | 11,458 | | |

| |

Frederic A. Escherich, 68, Private Investor. Formerly, Managing Director and head of Mergers and Acquisitions Research and the Financial Advisory Department of J.P. Morgan & Co. Inc. Currently, a director of ADX(d).

|

| | | | 2006 | | | | | | 2 | | | | | | 13,327 | | |

| |

Roger W. Gale, Ph.D., 74, President & CEO of GF Energy, LLC (consultants to electric power companies). Formerly, member of management group of PA Consulting Group (energy consultants). Currently, a director of ADX(d).

|

| | | | 2005 | | | | | | 2 | | | | | | 6,919 | | |

| |

Mary Chris Jammet, 53, Principal with Bristol Partners LLC. Previously served as Senior Vice President and Portfolio Manager at Legg Mason, Inc. (now Franklin Templeton). Currently, a director of ADX(d) and a director of MGM Resorts International. In addition, within the past five years, Ms. Jammet served as a director of Payless ShoeSource Inc.

|

| | | | 2020 | | | | | | 2 | | | | | | 4,385 | | |

| |

Lauriann C. Kloppenburg, 60, Retired Chief Strategy Officer and former Chief Investment Officer - Equity Group of Loomis Sayles & Company, LP (a U.S. investment management firm). Currently, a member of the investment committee of 1911 Office, LLC (a family office offering trust services) and Executive in Residence, Champlain College. Formerly, Executive in Residence, Hughey Center for Financial Services, Bentley University. Currently, a director of ADX(d).

|

| | | | 2017 | | | | | | 2 | | | | | | 1,911 | | |

| |

Kathleen T. McGahran, Ph.D., J.D., CPA, 70, President Emeritus & former CEO of

Pelham Associates, Inc. (an executive education provider). Adjunct Professor, Tuck School of Business, Dartmouth College. Formerly, Associate Dean and Director of Executive Education and Associate Professor, Columbia University. Currently, the Chair of the Board and a director of ADX(d) and a director of Scor Global Life Reinsurance and Scor Reinsurance of New York. |

| | | | 2003 | | | | | | 2 | | | | | | 16,656 | | |

| |

Interested Director

|

| | | | | | | | | | | | | | | | | | |

| |

Mark E. Stoeckle, 64, CEO of the Fund. Currently, also the CEO, President, and

a director of ADX(d). Formerly, Chief Investment Officer, U.S. Equities and Global Sector Funds, BNP Paribas Investment Partners. |

| | | | 2013 | | | | | | 2 | | | | | | 15,165 | | |

| | Directors and executive officers of the Fund as a group. | | | | | | | | | | | | | | | | | 91,380 | | |

(a)

To the Fund’s knowledge, except for 2,426 shares shown for Dr. McGahran, which are beneficially owned by her spouse and as to which she disclaims beneficial ownership, and the shares referred to in footnote (b) below, each director and officer had sole investment and sole voting power with respect to the shares shown opposite his or her name.

6

(b)

The amounts shown include vested but deferred stock units under the Fund’s 2005 Equity Incentive Compensation Plan (see “2005 Equity Incentive Compensation Plan” below) for the following directors; 10,562 held by Dr. Arzac, 5,894 held by Mr. Dale, and 800 held by Dr. McGahran. No such shares or units were held by Dr. Gale, Mr. Escherich, Ms. Jammet, Ms. Kloppenburg, or Mr. Stoeckle.

(c)

Calculated on the basis of 24,121,714 Common Stock outstanding on December 31, 2020, each director owned less than 1.0% of the Common Stock outstanding. The directors and executive officers as a group owned less than 1.0% of the Common Stock outstanding.

(d)

Non-controlled affiliate of the Fund (a closed-end investment company), which is part of the Fund Complex. The length of ADX Board service is identical to the period served for the Fund.

The address for each director is the Fund’s headquarters office, 500 E. Pratt Street, Suite 1300, Baltimore, MD 21202.

Additional information about each director follows (supplementing the information in the table above) describing some of the specific experience, qualifications, attributes, or skills each director possesses that led the Board to conclude he or she should serve as a director.

Independent Directors

1) Enrique R. Arzac, Ph.D.

Dr. Arzac brings to the Board extensive expertise in asset management and securities valuation, international finance, and corporate finance gained from his many years on the faculty of Columbia University’s Graduate School of Business, and through consulting with corporations and financial institutions for more than 35 years. Dr. Arzac has published many articles on corporate finance, valuation, portfolio management, and commodity markets in numerous academic journals. He has been deemed an audit committee financial expert, as that term is defined in federal securities regulations, by his fellow directors and has served as Chair of the Fund’s Audit Committee for several terms. In addition, Dr. Arzac’s service on the boards of other investment companies provides him with a deep understanding of investment company oversight.

2) Kenneth J. Dale

Mr. Dale brings broad expertise in financial management to the Board. He serves as Senior Vice President and Chief Financial Officer of The Associated Press (AP), one of the largest newsgathering organizations in the world. His responsibilities at AP include all corporate finance activities, internal audit, global real estate, and administrative services, and oversight of AP’s software business, ENPS. Prior to joining AP, Mr. Dale spent 21 years as an investment banker at J.P. Morgan Chase & Co. Inc., advising media and entertainment clients on mergers and acquisitions and corporate finance transactions. He has been deemed an audit committee financial expert, as that term is defined in federal securities regulations, by his fellow directors and currently serves as the Chair of the Fund’s Audit Committee.

3) Frederic A. Escherich

Mr. Escherich brings to the Board extensive knowledge of securities investing and stock valuation gained from his 25 years at J.P. Morgan & Co. Inc. During his tenure at J.P. Morgan, Mr. Escherich served as head of mergers and acquisitions research for many years, and his responsibilities included evaluating numerous issues related to maximizing shareholder value and setting policies and procedures in connection with the valuation of companies, the assessment of various transaction types, analytical techniques, and securities. Since retiring in 2002, Mr. Escherich has focused full-time on private investing and is familiar with the dynamics of today’s equity markets. He has been deemed an audit committee financial expert, as that term is defined in federal securities regulations, by his fellow directors and has served as the Chair of the Fund’s Audit Committee.

7

4) Roger W. Gale, Ph.D.

Dr. Gale brings to the Board in-depth knowledge of the electric power industry and U.S. and international energy policy from his service in private industry and the public sector. Dr. Gale has gained electric utility industry expertise through his many years of service as a consultant, and has been quoted on electric utility issues in leading business publications and television news programs. He previously served on the boards of a Fortune 500 energy conglomerate and a publicly-traded, geothermal energy company. Dr. Gale holds a Ph.D. in political science from the University of California, Berkeley.

5) Mary Chris Jammet

Ms. Jammet is a seasoned investment management professional and experienced corporate board member who brings more than 30 years of experience to Adams Funds. Currently a Principal with Bristol Partners LLC, Ms. Jammet served as Senior Vice President and Portfolio Manager at global asset management firm Legg Mason, Inc. (now Franklin Templeton), where she was responsible for $20 billion in client assets before retiring in 2013. Ms. Jammet is a member of the Board of Directors of MGM Resorts International (NYSE: MGM), and a former Corporate Director for Payless. She currently serves as an Advisor to Loyola University Maryland’s Finance Department and is a member of the National Association of Corporate Directors, as well as the Women Corporate Directors Foundation.

6) Lauriann C. Kloppenburg

Ms. Kloppenburg brings a wealth of knowledge of securities investing and the investment management industry to the Board, having served in many key roles at Loomis Sayles & Company, an investment management firm with more than $250 billion under management, and through her current role on the investment committee of a family office. During her more than 30-year career with Loomis Sayles, Ms. Kloppenburg was, at various times, the Director of Equity Research, Director of Large-Cap Equities, Chief Investment Officer - Equity Group, and Chief Strategy Officer, in addition to serving as a member of the firm’s board of directors. She has been deemed an audit committee financial expert, as that term is defined in federal securities regulations, by her fellow directors.

7) Kathleen T. McGahran, Ph.D.

Dr. McGahran has served as the Chair of the Fund’s Board of Directors since March 19, 2013. She is a CPA, a lawyer, and holds a Ph.D. in Accounting and Finance from New York University, and brings to the Board a very broad and valuable skill set. She is President Emeritus and former CEO of Pelham Associates, an executive education provider. She has served on the faculties of the Tuck School of Business at Dartmouth College, the Graduate School of Business at Columbia University, and the Stern School of Business at New York University. Dr. McGahran has expertise in financial analysis and has conducted financial analysis training programs for Wall Street firms and Fortune 500 companies. She has been deemed an audit committee financial expert, as that term is defined in federal securities regulations, by her fellow directors and has served as Chair of the Fund’s Audit Committee for several terms.

Interested Director

8) Mark E. Stoeckle

Mr. Stoeckle has been CEO of the Fund and ADX since February 11, 2013. He was elected to the Board of Directors of the Fund and ADX on February 14, 2013, and served as President of the Fund

8

from his election to that position on February 14, 2013 through January 21, 2015. Mr. Stoeckle’s distinguished career in financial services and asset management spans over 30 years, and he brings a wealth of investment and business experience to the role. Previously, he was Chief Investment Officer, U.S. Equities and Global Sector Funds, at the global investment management firm BNP Paribas Investment Partners.

Stock Ownership

|

Independent Directors

|

| |

Dollar Value of Shares Owned(1)

|

|

|

Enrique R. Arzac

|

| |

greater than $100,000

|

|

|

Kenneth J. Dale

|

| |

greater than $100,000

|

|

|

Frederic A. Escherich

|

| |

greater than $100,000

|

|

|

Roger W. Gale

|

| |

greater than $100,000

|

|

|

Mary Chris Jammet

|

| |

$50,001 - $100,000

|

|

|

Lauriann C. Kloppenburg

|

| |

$10,001 - $50,000

|

|

|

Kathleen T. McGahran

|

| |

greater than $100,000

|

|

|

Interested Director

|

| | | |

|

Mark E. Stoeckle

|

| |

greater than $100,000

|

|

(1)

As of December 31, 2020.

The Board has adopted equity ownership requirements for the directors and senior staff. Under these equity ownership requirements, the Chief Executive Officer, portfolio managers, research analysts, and other executive officers must own a certain value of equity in the Fund Complex with a cost basis equal to a multiple of salary. Non-employee directors must own at least $100,000 by cost basis of the Fund’s Common Stock within 10 years of joining the Board.

The nominees for election as directors of the Fund identified above are also the nominees for election to the Board of Directors of ADX, part of the Fund Complex.

Board Leadership Structure

Seven of the Fund’s eight directors are not “interested persons,” as defined by the Investment Company Act of 1940, as amended (the “Act”), and are independent directors. Mr. Stoeckle is the only member of the Board who is an “interested person” under the Act and thus is not an independent director. The Board has elected Dr. Kathleen T. McGahran, an Independent Director, to serve as the Chair of the Board.

Board’s Oversight of Risk Management for the Fund

The Board’s role in risk management of the Fund is that of oversight. The internal staff of portfolio managers, research analysts, and administrative personnel is responsible for the day-to-day management of the Fund, including risk management in such aspects as investment performance and investment risk, valuation risk, issuer and counterparty credit risk, compliance risk, and operational risk. As part of its oversight, the Board has delegated to the Audit Committee the primary role of overseeing the assessment and management of risks, including major financial risks, by the Fund’s management and the steps that management has taken to monitor and control such risks. The Audit Committee reports to the Board at least quarterly on its discussions of these items with management. In addition,

9

the Board, acting at its regularly scheduled meetings, receives reports from senior management, including the Fund’s portfolio management team, the Chief Compliance Officer, and the Chief Financial Officer. Between Board meetings, the Executive Committee, and/or the Chair of the Board, and/or the Chairman of the Audit Committee, as appropriate, interact with the CEO and other senior executives on any matter requiring action by or notice to the Board. The Board also receives periodic presentations from senior management regarding specific operational, compliance, or investment areas, such as business continuity, personal trading, valuation, investment research, and securities lending, and receives reports from the Fund’s General Counsel regarding regulatory, compliance, and governance matters. The Fund believes that its leadership structure enhances risk oversight. It should be noted that, in its oversight role, the Board is not a guarantor of the Fund’s investments or activities.

Process for Stockholders to Communicate with Board

The Board of Directors has implemented a process for stockholders of the Fund to send communications to the Board. Any stockholder desiring to communicate with the Board, or with specific individual directors, may do so by writing to the Secretary of the Fund at Adams Natural Resources Fund, Inc., 500 E. Pratt Street, Suite 1300, Baltimore, MD 21202, or by sending an email message to the Secretary at [email protected] Secretary has been instructed by the Board to promptly forward all such communications to the addressees indicated thereon.

Policy on Board of Directors’ Attendance at Annual Meetings

The Fund’s policy with regard to attendance by the Board of Directors at Annual Meetings is that all directors are expected to attend, absent unusual and extenuating circumstances that prohibit attendance. All of the directors then serving attended the 2020 Annual Meeting.

Section 16(a) Beneficial Ownership Reporting Compliance

Each director and officer of the Fund who is subject to Section 16 of the Securities Exchange Act of 1934, as amended, and persons who own more than ten percent of a registered class of the Fund’s securities are required to report to the Securities and Exchange Commission (the “Commission”) by a specified date his or her beneficial ownership of or transactions in the Fund’s securities. Based upon a review of filings with the Commission, such forms received by the Fund, and written representations that no other reports are required, the Fund believes that each director and officer, with one exception, filed all requisite reports with the Commission on a timely basis during 2020. Dr. McGahran purchased shares of the Fund on July 1 and July 2, and reporting was transposed, causing the July 1 transaction to be reported on the day after the deadline. The Fund had one greater-than-ten-percent shareholder, a group consisting of Ancora Advisors, LLC, Bulldog Investors, LLC, Phillip Goldstein and Andrew Dakos (the “Group”). Based upon a review of filings with the Commission, the Fund believes the Group may not have met their Section 16 reporting obligations during 2020.

Information as to Other Executive Officers

Set forth below are the names, ages, and positions with the Fund, as of December 31, 2020, of all executive officers of the Fund other than those who also serve as directors. Executive officers serve as such until the election of their successors.

Mr. James P. Haynie, 58, has served as President of the Fund since January 21, 2015, and before that, served as Executive Vice President from August 19, 2013 to January 21, 2015. He also served as the President of ADX from August 19, 2013 to January 21, 2015 and has served as the Executive Vice President of ADX since January 21, 2015. Prior to joining the Fund, he was Chief Investment Officer,

10

U.S. Equities at BNP Paribas Investment Partners from February - August 2013 and was Senior Portfolio Manager at BNP Paribas Investment Partners from 2005 to 2013.

Mr. Brian S. Hook, 51, has served as Vice President, Chief Financial Officer and Treasurer of the Fund and ADX since March 19, 2013. Prior thereto, he served as Chief Financial Officer and Treasurer of the Fund and ADX from March 20, 2012 to March 19, 2013, as Treasurer of the Fund and ADX from June 1, 2009 to March 20, 2012, and as Assistant Treasurer of the Fund and ADX from September 2008 to June 1, 2009. Prior to joining the Fund, he was a Vice President and Senior Manager at T. Rowe Price and a business assurance manager with Coopers & Lybrand L.L.P. prior thereto.

Ms. Janis F. Kerns, 57, has served as the General Counsel, Secretary and Chief Compliance Officer of the Fund and ADX since July 3, 2018, and as Assistant General Counsel from January 22, 2018 to July 3, 2018. Prior to joining the Fund in January 2018, she was Of Counsel in the Washington, D.C. office of Nelson, Mullins, Riley & Scarborough, LLP. Previously, Ms. Kerns served for three years on the staff of the U.S. Securities and Exchange Commission in the Division of Investment Management’s Office of Investment Company Regulation. Ms. Kerns has more than 25 years of legal and compliance experience in the investment management industry.

The address for each executive officer is the Fund’s headquarters office, 500 E. Pratt Street, Suite 1300, Baltimore, MD 21202.

|

Security Ownership of Management in the Fund(a)

|

| |

Shares of Common

Stock Beneficially Owned(b)(c) |

| |||

|

Name

|

| ||||||

|

James P. Haynie

|

| | | | 25,618 | | |

|

Brian S. Hook

|

| | | | 26,221 | | |

|

Janis F. Kerns

|

| | | | 1,994 | | |

(a)

As of December 31, 2020. Share ownership of directors and executive officers as a group is shown in the table beginning on page 6 and footnotes thereto.

(b)

To the Fund’s knowledge, each officer had sole investment and sole voting power with respect to the shares shown opposite his or her name.

(c)

Calculated on the basis of 24,121,714 shares of Common Stock outstanding on December 31, 2020, each of the executive officers listed herein owned less than 1.0% of the Common Stock outstanding.

Principal Stockholder

At December 31, 2020, the following principal stockholder was known by the Fund to own beneficially more than five percent of any class of the Fund’s voting securities.

|

Title of Class

|

| |

Name and Address of Beneficial Owner

|

| |

Amount and Nature of

Beneficial Ownership |

| |

Percent of Class

|

|

| Common Stock | | |

Adams Diversified Equity Fund, Inc.

500 E. Pratt Street, Suite 1300

Baltimore, Maryland 21202

|

| |

2,186,774 shares held directly

|

| |

9.1%

|

|

Board Meetings and Committees of the Board

The Board held fifteen meetings (seven regular meetings and eight special meetings) in 2020. Each director attended 100% of these meetings. Further information about the Board and its committees is provided below.

11

Audit Committee

Mr. Dale (Chair), Mr. Escherich, Dr. Gale, and Ms. Kloppenburg, each of whom is an independent director as such is defined by the rules of the New York Stock Exchange, and none of whom is an “interested person” as such is defined by the Act, constitute the membership of the Board’s Audit Committee, which met four times in 2020. The Board has determined each of Mr. Dale, Mr. Escherich, and Ms. Kloppenburg to be an audit committee financial expert, as that term is defined in federal securities regulations. The Board has adopted a written charter under which the Committee operates. A copy of the Audit Committee Charter (“Charter”) is available on the Fund’s website: adamsfunds.com. Set forth below is the report of the Committee:

Audit Committee Report

The purposes of the Audit Committee are set forth in the Committee’s written Charter. As provided in the Charter, the role of the Committee is to assist the Board of Directors in its oversight on matters relating to accounting, financial reporting, internal control, auditing, risk assessment and risk management, regulatory compliance activities, and other matters the Board deems appropriate. The Committee also selects the Fund’s independent registered public accounting firm in accordance with the provisions set out in the Charter. Management, however, is responsible for the preparation, presentation, and integrity of the Fund’s financial statements, and for the procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm is responsible for planning and carrying out proper audits.

In fulfilling its responsibilities, the Committee has reviewed and discussed the audited financial statements contained in the 2020 Annual Report of the Fund with the Fund’s management and with PricewaterhouseCoopers LLP (“PwC”), the Fund’s independent registered public accounting firm. In addition, the Committee has discussed with PwC the matters required to be discussed pursuant to Statement of Auditing Standards No. 61, as modified or supplemented. The Committee has also received from PwC the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding PwC’s communications with the Committee concerning independence, considered whether the provision of nonaudit services by PwC is compatible with maintaining PwC’s independence, and discussed with PwC its independence.

In reliance on the reviews and discussions with management and PwC referred to above, and subject to the limitations on the responsibilities and role of the Committee set forth in the Charter and discussed above, the Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Fund’s 2020 Annual Report for filing with the Securities and Exchange Commission.

Respectfully submitted on February 11, 2021, by the members of the Audit Committee of the Board of Directors:

| | | | |

Kenneth J. Dale, Chair

Frederic A. Escherich

Roger W. Gale

Lauriann C. Kloppenburg

|

|

Compensation Committee

Ms. Kloppenburg (Chair), Dr. Arzac, Dr. Gale, and Dr. Smith** constituted the membership of the Board’s Compensation Committee, which met two times in 2020. The Committee reviews and

12

recommends changes in the compensation of the directors, officers, and employees, including salaries and the cash incentive compensation plans in which the executive officers, officers and employees of the Fund are eligible to participate. The Board has adopted a written charter under which the Compensation Committee operates, a copy of which is available on the Fund’s website: adamsfunds.com.

Executive Committee

Dr. McGahran (Chair), Mr. Dale, Mr. Escherich, Ms. Kloppenberg, and Mr. Stoeckle constitute the membership of the Board’s Executive Committee, which met two times in 2020. The Committee has the authority of the Board of Directors between meetings of the Board except as limited by law, the Fund’s Bylaws, or Board resolution.

Nominating and Governance Committee

Mr. Escherich (Chair), Dr. Arzac, Mr. Dale, Ms. Jammet and Dr. Smith** constituted the membership of the Board’s Nominating and Governance Committee, which met four times in 2020. The Board has adopted a written charter under which the Nominating and Governance Committee operates, a copy of which is available on the Fund’s website: adamsfunds.com.

Each of the members of the Committee is an independent director as such is defined by the rules of the New York Stock Exchange and none is an “interested person” as such term is defined by the Act.

Among other responsibilities, the Committee supervises and reviews Board composition, director nominations, and corporate governance matters. For director nominations, the Committee leads the search for qualified director candidates, including canvassing, recruiting, evaluating and recommending nominees to the full Board. The Committee has used a third-party search firm to help identify candidates who may meet the needs of the Board.

Stockholders may recommend candidates for consideration by the Committee by writing to the Secretary of the Fund at the office of the Fund, 500 E. Pratt Street, Suite 1300, Baltimore, MD 21202, giving the candidate’s name, biographical data, and qualifications, and stating whether the candidate would be an “interested person” of the Fund. A written statement from the candidate, consenting to be named as a candidate, and if nominated and elected, to serve as a director, should accompany any such recommendation.

While the Board does not have a formal policy regarding the consideration of diversity in identifying Board candidates, in practice, the Committee and the full Board considers the diversity of skills, experience and/or perspective a prospective nominee would bring to the Board, both individually and in the context of the Board’s existing membership at the time such potential candidate is considered.

_________________

**Dr. Smith is retiring from the Board and is not standing for re-election.

Transactions with Adams Diversified Equity Fund, Inc.

The Fund shares certain expenses for research, accounting services, other office services (including proportionate salaries and other employee benefits), rent and related expenses, and miscellaneous expenses, such as office supplies, postage, subscriptions, and travel, with ADX. These expenses were paid by ADX and, on the date the payment was made, the Fund simultaneously paid to ADX its allocated share of such expenses, based on either estimated time spent for each fund, the

13

proportion of the size of the investment portfolios of the two funds, relative net assets of the two funds or, where possible, on an actual usage basis. In 2020, the funds incurred $14,550,626 in shared expenses, and ADX’s share of such expenses was $10,488,385.

Compensation of Directors and Executive Officers

During 2020, each director who is not an interested person, except for Dr. McGahran, received an annual retainer fee of $65,000. Dr. McGahran, the Board Chair, received an annual retainer fee of $85,000. The Chairperson of each committee received an additional annual retainer fee of $3,000 for that committee. The total amount of fees paid to independent directors in 2020 was $489,417.

The following table sets forth for each of the persons named below the aggregate compensation received from the Fund during the fiscal year ended December 31, 2020, for services in all capacities:

|

Name

|

| |

Position

|

| |

Aggregate

Compensation from the Fund(1)(2)(3)(4) |

| |

Total Compensation

from Fund and Fund Complex paid to Directors(5) |

| ||||||

| Mark E. Stoeckle | | | Chief Executive Officer(a) | | | | $ | 881,731 | | | | | | N/A | | |

| James P. Haynie | | | President | | | | | 547,904 | | | | | | N/A | | |

| Brian S. Hook | | | Vice-President, CFO, & Treasurer | | | | | 98,878 | | | | | | N/A | | |

| Independent Directors | | | | | | | | | | | | | | | | |

| Enrique R. Arzac | | | Director (c)(d) | | | | | 65,000 | | | | | $ | 130,000 | | |

| Kenneth J. Dale | | |

Director(a)(b)(d)

|

| | | | 68,000 | | | | | | 136,000 | | |

| Frederic A. Escherich | | |

Director(a)(b)(d)

|

| | | | 68,000 | | | | | | 136,000 | | |

| Roger W. Gale | | | Director (b)(c) | | | | | 66,500 | | | | | | 133,000 | | |

| Mary Chris Jammet | | | Director(d) | | | | | 5,417 | | | | | | 10,834 | | |

|

Lauriann C. Kloppenburg

|

| |

Director(a)(b)(c)

|

| | | | 66,500 | | | | | | 133,000 | | |

| Craig R. Smith* | | | Director (c)(d) | | | | | 65,000 | | | | | | 130,000 | | |

*

Dr. Smith is retiring from the Board and is not standing for re-election.

(1)

Of the amounts shown, direct salaries paid by the Fund to Messrs. Stoeckle, Haynie, and Hook were $262,500, $185,000, and $49,942, respectively.

(2)

Of their direct salaries, $15,750, $11,100, and $2,997 were deferred compensation to Messrs. Stoeckle, Haynie, and Hook, respectively, under the Fund’s Employee Thrift Plan and the Executive Nonqualified Supplemental Thrift Plan (see “Employee Thrift Plans” below). The non-employee directors do not participate in these Plans.

(3)

Of the amounts shown, $537,000, $313,000, and $39,100 were cash incentive compensation accrued for Messrs. Stoeckle, Haynie, and Hook, respectively, in 2020 and paid to them in 2021. These amounts include $32,220, $18,780, and $2,346 of deferred compensation to Messrs. Stoeckle, Haynie, and Hook, respectively, under the Fund’s Employee Thrift Plan and, for Messrs. Stoeckle and Haynie, under the Executive Nonqualified Supplemental Thrift Plan (see “Employee Thrift Plans” below).

(4)

Under the Employee Thrift Plans, the Fund makes contributions to match the contributions made by eligible employees and may, at the discretion of the Board of Directors, make an additional contribution. The amounts shown include the Fund’s matching contributions of $46,950, $28,705, and $6,165 made on behalf of Messrs. Stoeckle, Haynie, and Hook, respectively, in 2020, and an additional discretionary contribution of $35,281, $21,200, and $3,672 made for 2020 on behalf of Messrs. Stoeckle, Haynie, and Hook, respectively.

(5)

Includes total compensation paid to directors for service on the boards of investment companies in the Fund Complex, which is composed of two closed-end investment companies, including the Fund. Mr. Stoeckle receives no compensation for his services as a director of the Fund and ADX.

(a)

Member of Executive Committee

(b)

Member of Audit Committee

(c)

Member of Compensation Committee

(d)

Member of Nominating and Governance Committee

14

2005 Equity Incentive Compensation Plan

In 2005, the Board of Directors adopted and shareholders approved the Fund’s 2005 Equity Incentive Compensation Plan (“2005 Plan”). Stockholders reapproved the 2005 Plan in 2010, and it expired by its terms on April 27, 2015. The 2005 Plan was administered by the Compensation Committee, and awarded grants of restricted and deferred stock units and dividend equivalents on those units. All grants under the 2005 Plan vested prior to 2019. Certain restricted and deferred stock units awarded under the 2005 Plan, for which payment has been deferred by election of the recipient, remain outstanding. All deferred and outstanding awards represent rights to receive Fund stock.

Employee Thrift Plans

Employees of the Fund who have completed six months of service may defer up to 100% of base salary and cash incentive compensation to a tax qualified thrift plan (“Thrift Plan”) instead of being paid currently, and the Fund contributes an amount equal to 100% of each employee’s contribution (up to 6% of base salary and cash incentive compensation) but not in excess of the maximum permitted by law (see footnotes to the Compensation Table set forth on page 14 regarding 2020 contributions for the officers identified therein). The Fund also has the discretion to contribute annually to each employee’s thrift plan account an amount of up to 6% of the employee’s combined base salary and cash incentive compensation attributable to the prior year’s service with the Fund. All employee contributions are credited to the employee’s individual account. Employees may elect that their salary deferral and other contributions be invested in the common stock of the Fund or ADX, or a number of mutual funds, or a combination thereof. All of the Fund’s matching contribution is invested in accordance with the employee’s investment elections. An employee’s interest in amounts derived from the Fund’s contributions becomes non-forfeitable upon completion of 36 months of service or upon death or retirement. Payments of amounts not withdrawn or forfeited under the Thrift Plan may be made upon retirement or other termination of employment.

The Fund also maintains an Executive Nonqualified Supplemental Thrift Plan for eligible employees of the Fund (the “Nonqualified Plan”). The purpose of the Nonqualified Plan is to provide deferred compensation in excess of contribution limits imposed by the Internal Revenue Code on tax-qualified thrift plans, including the Thrift Plan described above. In accordance with such limitations, for 2020, the maximum annual amount that an individual can defer to the Thrift Plan is $19,500 for those under the age of 50, and $26,000 for those age 50 and over, and the maximum combined amount – consisting of both the employee’s contributions and the Fund’s matching contributions – that can go into the Thrift Plan is $57,000 per year for those under the age of 50 and $63,500 per year for those age 50 and over.

The Nonqualified Plan permits an eligible employee to contribute to the Nonqualified Plan up to the maximum amount of 6% of the employee’s salary and cash incentive compensation that he or she is prevented from contributing to the Thrift Plan because of the Internal Revenue Code’s limitations on annual contributions, and for the Fund to contribute the 100% matching contribution on that sum and/or the Fund’s discretionary contribution that would otherwise be limited by the Internal Revenue Code’s limitations on annual contributions. The employee’s contributions and the Fund’s contributions to the Nonqualified Plan are invested in eligible mutual funds in accordance with the employee’s investment elections.

Brokerage Commissions

During the past fiscal year, the Fund paid brokerage commissions in the amount of $267,606 on the purchase and sale of portfolio securities traded on the New York Stock Exchange and the National Association of Securities Dealers Automated Quotation System, and on swap transactions, substantially all of which were paid to brokers providing research and other investment services to the Fund. The

15

average per share commission rate paid by the Fund was $0.03. No commissions were paid to an affiliated broker.

Portfolio Turnover

The portfolio turnover rate (purchases or sales, whichever is lower, as a percentage of average portfolio value) for the past three years has been as follows:

| |

2020

|

| |

2019

|

| |

2018

|

|

| |

31.8%

|

| |

29.5%

|

| |

47.0%

|

|

Expense Ratio

The ratio of expenses to the average net assets of the Fund for the past three years has been as follows:

| |

2020

|

| |

2019

|

| |

2018

|

|

| |

1.47%

|

| |

0.97%

|

| |

0.79%

|

|

The Board of Directors unanimously recommends that stockholders vote FOR the election of each of the nominees for director.

(2) RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As permitted under the Act, the Audit Committee selected PricewaterhouseCoopers LLP, 100 E. Pratt Street, Suite 2600, Baltimore, MD 21202, an independent registered public accounting firm, for recommendation to the full Board as the independent registered public accounting firm to audit the books and accounts of the Fund for the year ending December 31, 2021. PricewaterhouseCoopers LLP was the Fund’s principal auditor during the year 2020. A majority of the members of the Board of Directors who are not “interested persons” (as defined by the Act) have approved the selection of PricewaterhouseCoopers LLP as the Fund’s independent registered public accounting firm for 2021. While not required under the Act, the Audit Committee and the Board of Directors have determined to submit for stockholder ratification the selection of PricewaterhouseCoopers LLP as the Fund’s independent registered public accounting firm for 2021 at the Annual Meeting. Representatives of PricewaterhouseCoopers LLP are expected to be present at the meeting to make a statement, if they so desire, and to respond to appropriate questions. The Fund has been informed that PricewaterhouseCoopers LLP does not have any direct financial or any material indirect financial interest in the Fund.

Independent Accountant Fees

Audit Fees

The aggregate fees for professional services rendered by the Fund’s independent registered public accounting firm, PricewaterhouseCoopers LLP, for the audit of the Fund’s annual financial statements for 2020 and 2019 were $90,090 and $87,470, respectively.

Audit-Related Fees

There were no audit-related fees in 2020 or 2019.

16

Tax Fees

The aggregate fees for professional services rendered to the Fund by PricewaterhouseCoopers LLP for the review of the Fund’s excise tax calculations and preparations of federal, state, and excise tax returns for 2020 and 2019 were $22,360 and $21,200, respectively.

All Other Fees

Other fees for services rendered to the Fund by PricewaterhouseCoopers LLP for 2020 and 2019 were $423 and $648, respectively. Fees were related to licenses for technical reference tools.

The Board’s Audit Committee has considered the provision by PricewaterhouseCoopers LLP of the services covered in this All Other Fees section and found that they are compatible with maintaining PricewaterhouseCoopers LLP’s independence.

Audit Committee Pre-Approval Policy

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent auditors. In assessing requests for services by the independent auditors, the Committee considers whether such services are consistent with the auditor’s independence; whether the independent auditors are likely to provide the most effective and efficient service based upon their familiarity with the Fund; and whether the service could enhance the Fund’s ability to manage or control risk or improve financial statement audit and review quality. The Committee may delegate pre-approval authority to its Chair. Any pre-approvals by the Chair under this delegation are to be reported to the Committee at its next scheduled meeting. All services performed for 2020 were pre-approved by the Committee.

The Board of Directors unanimously recommends ratification of the selection of

PricewaterhouseCoopers LLP.

PricewaterhouseCoopers LLP.

(3) OTHER MATTERS AND ANNUAL REPORT

As of the date of this proxy statement, management knows of no other business that will come before the meeting. Should other business be properly brought up, it is intended that proxies in the accompanying form will be voted thereon in accordance with the judgment of the person or persons voting such proxies.

The Annual Report of the Fund for the year ended December 31, 2020, including financial statements, is being mailed to all stockholders entitled to notice of and to vote at the Annual Meeting to be held on April 15, 2021. A copy of the Fund’s Annual Report will be furnished to other stockholders, without charge, upon request. You may request a copy by contacting the Secretary, at 500 E. Pratt Street, Suite 1300, Baltimore, MD 21202, by telephoning the Fund at (800) 638-2479, or by sending an email message to [email protected].

Stockholder Proposals or Nominations for 2022 Annual Meeting

Stockholder proposals for inclusion in the proxy statement and form of proxy relating to the 2022 Annual Meeting must be received at the office of the Fund, 500 E. Pratt Street, Suite 1300, Baltimore, MD 21202, no later than October 26, 2021.

17

In addition, for stockholder proposals or director nominations that a stockholder seeks to bring before the 2022 Annual Meeting, but does not seek to have included in the Fund’s proxy statement and form of proxy for that meeting, the following requirements apply: Pursuant to the Fund’s Bylaws, in order for stockholder proposals or nominations of persons for election to the Board of Directors to be properly brought before the 2022 Annual Meeting, any such stockholder proposal or nomination (including in the case of a nomination, the information required by the Fund’s advance notice Bylaws provisions) must be received at the office of the Fund no earlier than September 26, 2021 and no later than October 26, 2021. The Fund’s advance notice Bylaw requirements are separate from, and in addition to, the Commission’s requirements (including the timing requirements described in the preceding paragraph) that a stockholder must meet in order to have a stockholder proposal included in the proxy statement. Should the Fund determine to allow a stockholder proposal that is received by the Fund after October 26, 2021 to be presented at the 2022 Annual Meeting, the persons named as proxies in the form accompanying the proxy statement for such meeting will have discretionary voting authority with respect to such stockholder proposal.

18

|

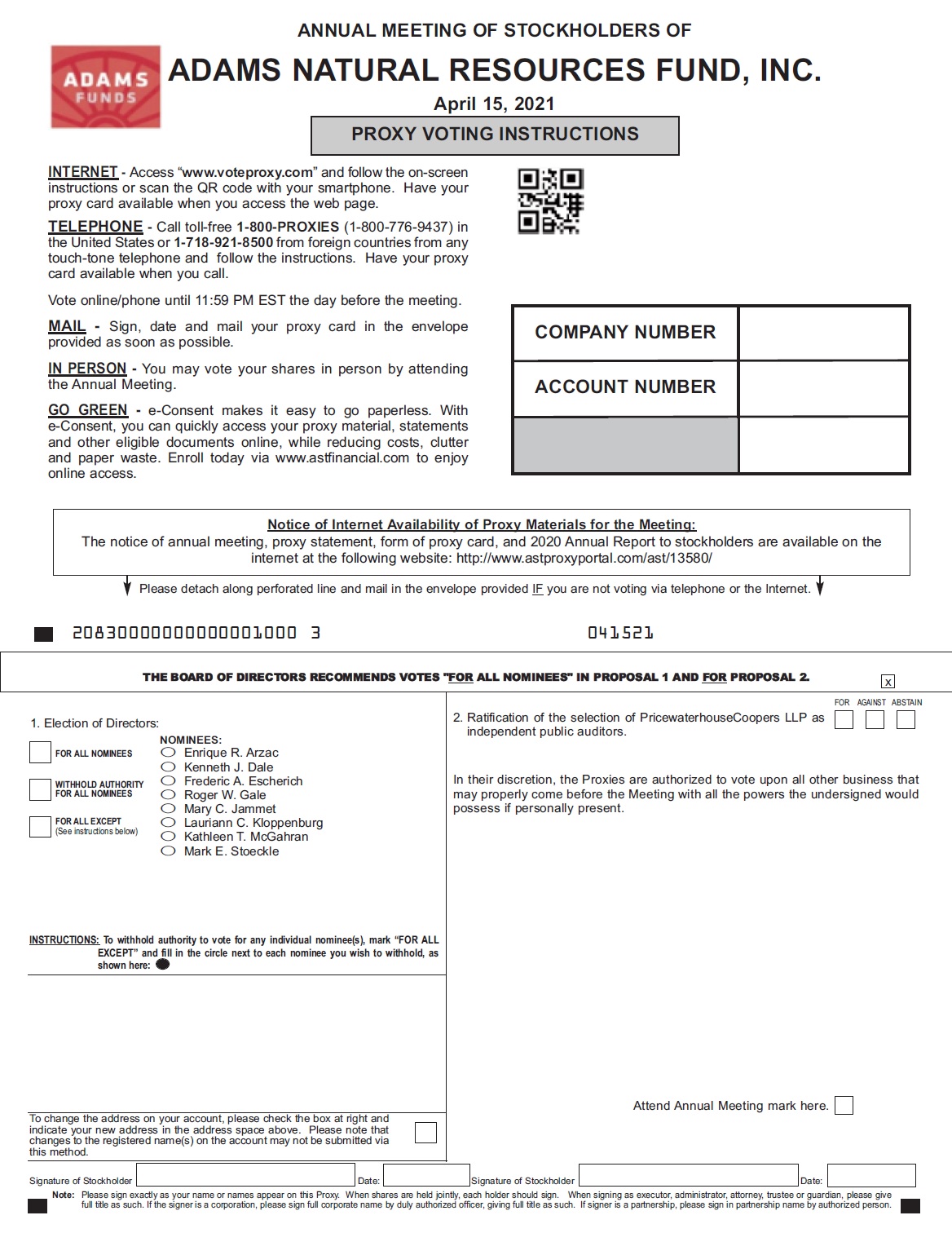

ANNUAL MEETING OF STOCKHOLDERS OF ADAMS NATURAL RESOURCES April 15, 2021 FUND, INC. INTERNET - Access “www.voteproxy.com” and follow the on-screen instructions or scan the QR code with your smartphone. Have your proxy card available when you access the web page. TELEPHONE - Call toll-free 1-800-PROXIES (1-800-776-9437) in the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone and follow the instructions. Have your proxy card available when you call. Vote online/phone until 11:59 PM EST the day before the meeting. MAIL - Sign, date and mail your proxy card in the envelope provided as soon as possible. IN PERSON - You may vote your shares in person by attending the Annual Meeting. GO GREEN - e-Consent makes it easy to go paperless. With e-Consent, you can quickly access your proxy material, statements and other eligible documents online, while reducing costs, clutter and paper waste. Enroll today via www.astfinancial.com to enjoy online access. Please detach along perforated line and mail in the envelope provided IF you are not voting via telephone or the Internet. 20830000000000001000 3 041521 independent public auditors. O Enrique R. Arzac FOR ALL NOMINEES may properly come before the Meeting with all the powers the undersigned would (See instructions below) O Kathleen T. McGahran Note: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. THE BOARD OF DIRECTORS RECOMMENDS VOTES "FOR ALL NOMINEES" IN PROPOSAL 1 AND FOR PROPOSAL 2. x 1. Election of Directors: NOMINEES: O Kenneth J. Dale WITHHOLD AUTHORITYO Frederic A. Escherich FOR ALL NOMINEESO Roger W. Gale O Mary C. Jammet FOR ALL EXCEPTO Lauriann C. Kloppenburg O Mark E. Stoeckle INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here: FOR AGAINST ABSTAIN 2. Ratification of the selection of PricewaterhouseCoopers LLP as In their discretion, the Proxies are authorized to vote upon all other business that possess if personally present. Attend Annual Meeting mark here. To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. Signature of Stockholder Date: Signature of StockholderDate: Notice of Internet Availability of Proxy Materials for the Meeting: The notice of annual meeting, proxy statement, form of proxy card, and 2020 Annual Report to stockholders are available on the internet at the following website: http://www.astproxyportal.com/ast/13580/ COMPANY NUMBER ACCOUNT NUMBER PROXY VOTING INSTRUCTIONS |

|

- 0 ADAMS NATURAL RESOURCES FUND, INC. PROXY FOR 2021 ANNUAL MEETING THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF ADAMS NATURAL RESOURCES FUND, INC. The undersigned stockholder of Adams Natural Resources Fund, Inc., a Maryland corporation (the “Fund”), hereby appoints James P. Haynie and Janis F. Kerns, or either of them, as proxies for the undersigned, with full power of substitution in each of them, to attend the Annual Meeting of Stockholders of the Fund to be held at 10:00 a.m., local time, on Thursday, April 15, 2021, at the offices of the Fund, 500 East Pratt Street, Suite 1300, Baltimore, Maryland 21202 and at any adjournment or postponement thereof, to cast on behalf of the undersigned all votes that the undersigned is entitled to cast at such meeting and otherwise to represent the undersigned at the meeting with all powers possessed by the undersigned if personally present at the meeting. The undersigned hereby acknowledges receipt of the Notice of Annual Meeting and Proxy Statement, the terms of each of which are incorporated by reference, and revokes any proxy heretofore given with respect to such meeting. The votes entitled to be cast by the undersigned will be cast as instructed on the reverse side. If this proxy is executed but no instruction is given, the votes entitled to be cast by the undersigned will be cast “FOR ALL NOMINEES" in Proposal 1 and "FOR" Proposal 2, as described in the Proxy Statement. The votes entitled to be cast by the undersigned will be cast in the discretion of the Proxy holder on any other matter that may properly come before the meeting or any adjournment or postponement thereof. (over) ADAMS NATURAL RESOURCES FUND, INC. 14475 1.1 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- William H. Reinhardt Elected Vice President – Research, Adams Diversified Equity Fund

- Comfort Systems USA Announces First Quarter 2024 Conference Call and Webcast

- Intelligent Living Application Group Inc. Granted Extension to Meet Nasdaq Minimum Bid Price Requirement

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share