Form DEF 14A ACELRX PHARMACEUTICALS For: Sep 23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant | ☑ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☑ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to § 240.14a-12 |

ACELRX PHARMACEUTICALS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

|

☑ |

No fee required. |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

ACELRX PHARMACEUTICALS, INC.

25821 Industrial Boulevard, Suite 400

Hayward, CA 94545

650-216-3500

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held September 23, 2022

Dear Stockholder:

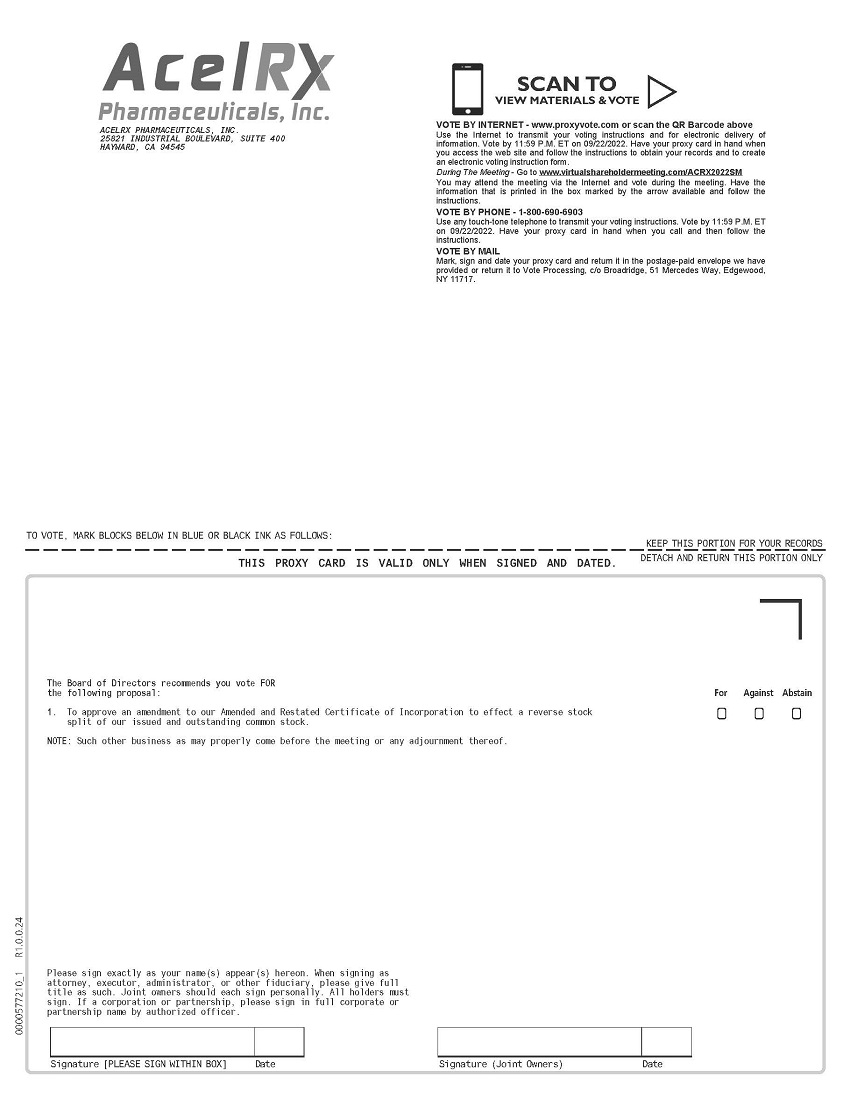

You are cordially invited to attend a Special Meeting of Stockholders of ACELRX PHARMACEUTICALS, INC., a Delaware corporation. The meeting will be held on September 23, 2022 at 10:00 a.m. Pacific Daylight Time virtually via the Internet at www.virtualshareholdermeeting.com/ACRX2022SM, or the Special Meeting, originating from Hayward, California. You will not be able to attend the Special Meeting in person. At the Special Meeting, you will be asked to consider and vote upon the following proposals:

|

1. |

To approve an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of our issued and outstanding common stock. |

|

2. |

To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the proxy statement that accompanies this notice.

In accordance with rules established by the Securities and Exchange Commission, we are providing you access to our proxy materials over the Internet. Accordingly, we plan to mail a Notice of Internet Availability of Proxy Materials, or the Notice, to our stockholders on or about August 12, 2022. The Notice will describe how to access and review our proxy materials, including our proxy statement. The Notice as well as the printed copy of proxy cards will also describe how you may submit your proxy via the Internet or by telephone. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice. In accordance with Delaware law, a list of stockholders entitled to vote at the Special Meeting will be available in electronic form during the Special Meeting at the following URL: www.virtualshareholdermeeting.com/ACRX2022SM and will be accessible during normal business hours for ten days prior to the Special Meeting at our principal place of business, 25821 Industrial Boulevard, Suite 400, Hayward, CA 94545.

The record date for the Special Meeting is August 5, 2022. Only stockholders of record at the close of business on that date are entitled to receive notice of and to vote at the Special Meeting or any postponement or adjournment thereof. Instructions on how to participate in the Special Meeting and demonstrate proof of stock ownership are posted at www.virtualshareholdermeeting.com/ACRX2022SM. The webcast of the Special Meeting will be archived for one year after the date of the Special Meeting at www.virtualshareholdermeeting.com/ACRX2022SM. Whether or not you plan to attend the Special Meeting, please vote as soon as possible.

|

By Order of the Board of Directors |

| /s/ Adrian Adams |

|

Adrian Adams |

|

Chairman |

Hayward, California

August 12, 2022

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to Be Held

on September 23, 2022 at 10:00 a.m. Pacific Daylight Time.

The proxy statement and notice

are available at www.proxyvote.com.

| Whether or not you expect to attend the Special Meeting, please vote by telephone or the Internet as instructed in these materials, or if you request or we deliver to you a proxy card in the mail, you may complete, date, sign and return that proxy. Regardless of the method used, please vote as promptly as possible in order to ensure your representation at the Special Meeting. You may also vote through our virtual web conference if you attend the Special Meeting, even if you have voted by proxy. |

TABLE OF CONTENTS

| Page | |

| QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING | 1 |

| PROPOSAL 1 APPROVAL OF AN AMENDMENT TO THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR ISSUED AND OUTSTANDING COMMON STOCK | 6 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 14 |

| OTHER MATTERS | 16 |

| Appendix A | A-1 |

ACELRX PHARMACEUTICALS, INC.

25821 Industrial Boulevard, Suite 400

Hayward, CA 94545

650-216-3500

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the Internet?

Pursuant to rules adopted by the Securities and Exchange Commission, or the SEC, we have elected to provide access to our proxy materials over the Internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials, or the Notice, because the Board of Directors, or the Board, of AcelRx Pharmaceuticals, Inc., is soliciting your proxy to vote at the 2022 Special Meeting of Stockholders, or the Special Meeting, including at any adjournments or postponements of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about August 12, 2022 to all stockholders of record entitled to vote at the Special Meeting.

How do I attend the Special Meeting?

Stockholders as of the record date and/or their authorized representatives are permitted to attend our Special Meeting. The Special Meeting will be held on September 23, 2022 at 10:00 a.m. Pacific Daylight Time virtually via the Internet at www.virtualshareholdermeeting.com/ACRX2022SM. Instructions on how to participate in the Special Meeting and demonstrate proof of stock ownership are posted at www.virtualshareholdermeeting.com/ACRX2022SM. You will not be able to attend the Special Meeting in person.

Why a Virtual-Only Online Meeting?

In light of the continuing coronavirus pandemic and fluctuating limitations on gatherings instituted by local and state government officials, we will conduct the Special Meeting virtually via the Internet to facilitate stockholder attendance and participation. The virtual format for the Special Meeting will enhance stockholder access by allowing our stockholders to participate fully, and equally, from any location around the world at no cost. Stockholder rights are not affected. The virtual meeting format will enhance, rather than constrain, stockholder access, participation, and communication because the online format allows stockholders to communicate with us during the Special Meeting so they can ask questions of our Board, management, and a representative from our independent registered public accounting firm. During the live Q&A session, we will answer appropriate questions as they come in, as time permits. We will re-assess the benefits of a virtual-only meeting in the future once the coronavirus pandemic subsides. Given the above listed factors, and the fact that no stockholders attended our physical 2020 annual meeting, we feel a virtual-only meeting is the right choice for AcelRx and its stockholders at this time.

What happens if there are technical difficulties during the Special Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Special Meeting, voting at the Special Meeting or submitting questions at the Special Meeting. If you encounter any difficulties accessing the virtual Special Meeting during the check-in or meeting time, please refer to the technical support information located at www.virtualshareholdermeeting.com/ACRX2022SM.

Who can vote at the Special Meeting?

Only stockholders of record at the close of business on August 5, 2022 will be entitled to vote at the Special Meeting. On this record date, there were 147,331,963 shares of common stock and 3,000 shares of Series A preferred stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on August 5, 2022 your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote by proxy or vote at the Special Meeting by going to www.virtualshareholdermeeting.com/ACRX2022SM and following the instructions regarding voting. Whether or not you plan to attend the Special Meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on August 5, 2022 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Special Meeting. Beneficial holders who attend the Special Meeting may also vote during the Special Meeting by going to www.virtualshareholdermeeting.com/ACRX2022SM and following the instructions regarding voting.

What am I voting on?

There is one matter scheduled for a vote:

|

● |

Approval of an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of our issued and outstanding common stock (Proposal 1). |

What are the Board’s voting recommendations; what votes are required?

A summary of the Special Meeting proposal is below. Every stockholder’s vote is important. Our Board urges you to vote your shares FOR the proposal.

|

Matter |

Page |

Board |

Vote Required for |

Effect of |

Effect of Broker |

|

Approval of an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of our issued and outstanding common stock |

6 |

FOR |

A majority of the combined voting power of the outstanding shares of common stock and Series A preferred stock voting together |

Against |

N/A |

To adopt and approve the reverse stock split proposal, the affirmative vote of holders of a majority of the combined voting power of the outstanding shares of common stock and Series A preferred stock entitled to vote on the proposal, voting together and counted as a single class, on the record date will be required. Abstentions and broker non-votes are not counted in determining the number of shares of common stock voted for or against. The votes of the Series A preferred stock will, to the extent cast on Proposal 1, automatically and without further action of holders of Series A preferred stock mirror votes cast by holders of common stock (excluding any shares of common stock that are not voted), without regard to abstentions or broker non-votes by holders of common stock. Because the voting standard for the reverse stock split proposal is a majority of the combined voting power of the outstanding shares of common stock and Series A preferred stock entitled to vote on the proposal, voting together and counted as a single class, abstentions and broker non-votes will, in one sense, have the effect of a vote “Against” the proposal. However, as further discussed under “Will choosing not to vote my shares have the same effect as casting a vote against the Reverse Stock Split Proposal,” because the Series A preferred stock has 1,000,000 votes per share on the reverse stock split and such votes must be counted in the same proportion as the aggregate shares of common stock voted on the reverse stock split proposal at the Special Meeting (excluding any shares of common stock that are not voted), the failure of a share of common stock to be voted on the reverse stock split proposal will effectively have no impact on the outcome of the vote.

Will choosing not to vote my shares have the same effect as casting a vote against the Reverse Stock Split Proposal?

No. If you prefer that the reverse stock split not be approved, you should cast your vote against the proposal. Approval of the reverse stock split proposal requires the affirmative vote of holders of a majority of the combined voting power of the outstanding shares of common stock and Series A preferred stock entitled to vote on the proposal, voting together and counted as a single class, assuming a quorum is present. Because the Series A preferred stock has 1,000,000 votes per share on the reverse stock split proposal and such votes must be counted in the same proportion as the aggregate shares of common stock that are voted on the reverse stock split proposal, the failure of a share of common stock to be voted will effectively have no impact on the outcome of the vote. However, shares of common stock voted against the reverse stock split proposal will have the effect of causing the proportion of Series A preferred stock voted against the proposal to increase accordingly and vice versa.

What if another matter is properly brought before the Special Meeting?

The Board knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought before the Special Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may vote “For” or “Against” or “Abstain” from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote at the Special Meeting by going to www.virtualshareholdermeeting.com/ACRX2022SM and following the instructions regarding voting or vote by proxy (i) over the telephone, (ii) through the Internet or (iii) using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the Special Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Special Meeting and vote by going to www.virtualshareholdermeeting.com/ACRX2022SM and following the instructions regarding voting even if you have already voted by proxy.

|

● |

To vote at the Special Meeting, go to www.virtualshareholdermeeting.com/ACRX2022SM and follow the instructions regarding voting. |

|

● |

To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the Special Meeting, we will vote your shares as you direct. |

|

● |

To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your vote must be received by 11:59 p.m., Eastern Daylight Time on September 22, 2022 to be counted. |

|

● |

To vote through the Internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. Your vote must be received by 11:59 p.m., Eastern Daylight Time on September 22, 2022 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Notice containing voting instruction from that organization rather than from AcelRx. Simply follow the voting instructions in the Notice to ensure that your vote is counted. Beneficial holders who attend the Special Meeting may also vote during the Special Meeting by going to www.virtualshareholdermeeting.com/ACRX2022SM and following the instructions regarding voting.

| Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies. |

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of August 5, 2022. Each share of Series A preferred stock you own is entitled to 1,000,000 votes as of August 5, 2022 with respect to Proposal 1 and any proposal to adjourn the Special Meeting, if necessary, and will vote together with the common stock as counted as a single class with respect to such matters; provided, however, that such shares of Series A preferred stock shall, to the extent cast, be voted in the same proportion as the aggregate shares of common stock are voted on Proposal 1 (excluding any shares of common stock that are not voted) and any proposal to adjourn the Special Meeting, if necessary. The Series A preferred stock is not entitled to vote on any other proposal or matter brought before the Special Meeting.

What if I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote through the Internet, by telephone, by completing a proxy card that may be delivered to you, or at the Special Meeting, your shares will not be voted. If you return a signed and dated proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Special Meeting.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares held in “street name” and you do not provide the organization that holds your shares with specific instructions, the organization that holds your shares may still be able to vote your shares in its discretion. In this regard, under the rules of the New York Stock Exchange, or NYSE, brokers, banks and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. Accordingly, if the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform our inspector of elections that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” When our inspector of elections tabulates the votes for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present, but will not be counted toward the vote total for any proposal. We encourage you to provide voting instructions to the organization that holds your shares to ensure that your vote is counted on the proposal.

Is the proposal considered “routine” or “non-routine”?

If the beneficial owner does not provide voting instructions, such beneficial owner’s broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters.

The approval of an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of our issued and outstanding common stock (Proposal 1) is considered to be a routine matter.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. We have retained Innisfree M&A Incorporated to assist in the solicitation of proxies for a fee of approximately $12,500, plus out-of-pocket expenses. Certain of our directors, officers and employees may participate in the solicitation of proxies, including electronically or by mail or telephone, without additional compensation.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Special Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

|

● |

You may submit another properly completed proxy card with a later date. |

|

● |

You may grant a subsequent proxy by telephone or through the Internet. |

|

● |

You may send a timely written notice that you are revoking your proxy to AcelRx’s Secretary at 25821 Industrial Boulevard, Suite 400, Hayward, CA 94545. |

|

● |

You may attend the Special Meeting and vote. Simply attending the Special Meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, with respect to the proposal, votes “For” and “Against” and abstentions. Broker non-votes have no effect and will not be counted towards the vote total for the Proposal 1.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested) and executive compensation, including the advisory stockholders vote on executive compensation. The one proposal, Proposal 1, the approval of an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of our issued and outstanding common stock, is a “routine” matter.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. The presence at the meeting, in person or by proxy, of the holders of at least one-third in voting power of the outstanding shares of common stock and Series A preferred stock, in the aggregate, and the holders of at least one-third of all issued and outstanding shares of common stock entitled to vote, on the record date will constitute a quorum. On the record date, there were 147,331,963 outstanding shares of common stock and 3,000 shares of Series A preferred stock outstanding. The presence of (i) the holders of common stock and Series A preferred stock holding at least 1,049,110,655 votes, and (ii) the holders of at least 49,110,655 shares of common stock will be required to establish a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the Chairman of the Board or the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Special Meeting?

Preliminary voting results will be announced at the Special Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Special Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

PROPOSAL 1

APPROVAL OF AN AMENDMENT TO THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR ISSUED AND OUTSTANDING COMMON STOCK

Description of the Proposed Reverse Stock Split

Our Board has approved, and is recommending that our stockholders approve, a proposed amendment to our Amended and Restated Certificate of Incorporation, to effect a reverse split of the issued and outstanding shares of the common stock at a ratio of between 1-for-10 and 1-for-30, with such ratio to be determined at the sole discretion of our Board, or the Reverse Stock Split. The form of proposed amendment to our Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split is attached as Appendix A to this proxy statement. The text of the proposed amendment is subject to revision to include such changes as may be required by the Secretary of State of the State of Delaware and as our Board deems necessary or advisable to effect the proposed amendment of the Amended and Restated Certificate of Incorporation. If a certificate of amendment is filed with the Secretary of State of the State of Delaware, the certificate of amendment to the certificate of incorporation will effect the Reverse Stock Split by reducing the outstanding number of shares of the common stock by the ratio to be determined by the Board, but will not increase the par value of the common stock, and will not change the number of authorized shares of the common stock. If the Board does not implement an approved Reverse Stock Split prior to the one-year anniversary of this meeting, the Board will seek stockholder approval before implementing any Reverse Stock Split after that time.

By approving Proposal 1 and the Reverse Stock Split, stockholders will approve the amendment to our Amended and Restated Certificate of Incorporation pursuant to which any whole number of outstanding shares, between and including ten and thirty, would be combined into one share of common stock and authorize our Board to file one certificate of amendment, as determined by our Board in the manner described herein. If approved, our Board may also elect not to effect any Reverse Stock Split and consequently not file any certificate of amendment to the Amended and Restated Certificate of Incorporation.

Nasdaq Listing Compliance

Our common stock is listed on the Nasdaq Global Market under the symbol “ACRX.” To maintain a listing on the Nasdaq Global Market, we must satisfy various listing maintenance standards established by Nasdaq Stock Market, LLC, or Nasdaq. If we are unable to meet the Nasdaq requirements, our common stock will be subject to delisting.

Among other things, we are required to comply with the continued listing requirements of the Nasdaq Global Market, including that the common stock maintain an average minimum closing price of $1.00 per share on the Nasdaq Global Market, or the Nasdaq Minimum Bid Requirement. We do not currently satisfy this Nasdaq Minimum Bid Requirement. Assuming our stockholders approve this proposal, our Board will determine whether to effect a Reverse Stock Split in the range of between 1-for-10 and 1-for-30, inclusive, at the ratio determined by our Board to be most likely sufficient to allow us to meet and maintain the Nasdaq Minimum Bid Requirement.

Reasons for the Reverse Stock Split

On December 3, 2021, Nasdaq notified us that on December 2, 2021, the average closing price of our common stock had closed below the required $1.00 per share for the prior 30 consecutive trading days, and, accordingly, that we did not comply with the applicable Nasdaq Minimum Bid Requirement. We were provided 180 calendar days by Nasdaq to regain compliance with this requirement and needed to provide written notice of our intention to cure the deficiency, including by a reverse stock split if necessary.

On June 1, 2022, Nasdaq notified us of our failure to regain compliance with the Nasdaq Minimum Bid Requirement and that our common stock was subject to delisting. We appealed Nasdaq’s determination and timely requested a hearing from the Nasdaq Hearings Panel, or the Panel, and subsequently delivered written materials for the Panel’s consideration in lieu of an oral hearing. On July 27, 2022, Nasdaq notified us that the Panel had granted us an additional time period to regain compliance on or before November 28, 2022, or the Additional Grace Period. The Panel advised us that the Additional Grace Period represents the full extent of the Panel’s discretion to grant continued listing while we are non-compliant with the Nasdaq Minimum Bid Requirement and should we fail to demonstrate compliance beyond the Additional Grace Period, the Panel will issue a final delisting determination and our common stock will be subject to delisting.

To regain compliance, the closing bid price of the common stock must be at least $1.00 per share for a minimum of ten consecutive business days within the Additional Grace Period. If it appears to Nasdaq staff that we are not able to cure the deficiency, or if we do not meet the other listing standards, Nasdaq could provide notice that our common stock will be subject to delisting.

Our Board has considered the potential harm to us of a delisting of the common stock and has determined that, if the common stock continues to trade below $1.00 per share, the consummation of the Reverse Stock Split is the best way to maintain liquidity by achieving compliance with the Nasdaq Minimum Bid Requirement. Our Board also believes that the current low per share market price of the common stock has a negative effect on the marketability of our existing shares. Our Board believes there are several reasons for this effect. First, certain institutional investors have internal policies preventing the purchase of low-priced stocks. Second, a variety of policies and practices of broker-dealers discourage individual brokers within those firms from dealing in low-priced stocks. Third, because the brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher priced stocks, the current share price of the common stock can result in individual stockholders paying transaction costs (commissions, markups or markdowns) that are a higher percentage of their total share value than would be the case if the share price of the common stock were substantially higher. This factor is also believed to limit the willingness of some institutions to purchase the common stock. Our Board anticipates that a Reverse Stock Split will result in a higher bid price for our common stock, which may help to alleviate some of these problems.

If this Proposal 1 is approved by the holders of the common stock and our Board decides to implement the Reverse Stock Split, our Board will determine the ratio of the Reverse Stock Split, in the range of between 1-for-10 and 1-for-30, inclusive, as determined in the judgment of our Board to be most likely sufficient to allow us to achieve and maintain compliance with the minimum $1.00 per share requirement for listing on the Nasdaq Global Market for the longest period of time while retaining a sufficient number of outstanding, tradeable shares to facilitate an adequate market.

We believe that maintaining listing on the Nasdaq Stock Market (either the Nasdaq Global Market or Nasdaq Capital Market) will provide us with a market for the common stock that is more accessible than if the common stock were traded on the OTC Bulletin Board or in the “pink sheets” maintained by the OTC Markets Group, Inc. Such alternative markets are generally considered to be less efficient than, and not as broad as, the Nasdaq Stock Market. Among other factors, trading on the Nasdaq Stock Market increases liquidity and may potentially minimize the spread between the “bid” and “asked” prices quoted by Market Makers (as defined in Nasdaq Rule 5005). Further, a Nasdaq Stock Market listing may enhance our access to capital, increase our flexibility in responding to anticipated capital requirements and facilitate the use of our common stock in any strategic or financing transactions that we may undertake. We believe that prospective investors will view an investment in us more favorably if our shares qualify for listing on the Nasdaq Stock Market as compared with the OTC markets.

Effects of the Reverse Stock Split

The Reverse Stock Split will be effected simultaneously for all issued and outstanding shares of common stock and the Reverse Stock Split ratio will be the same for all issued and outstanding shares of common stock. The Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in AcelRx, except that stockholders who would have otherwise received fractional shares will receive cash in lieu of such fractional shares. After the Reverse Stock Split, each share of the common stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to the common stock now authorized and common stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable. The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 under the Securities Exchange Act of 1934, as amended. We will continue to be subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended.

The following table sets forth the number of shares of the common stock that would be outstanding immediately after the Reverse Stock Split at various exchange ratios, based on the 147,331,963 shares of common stock outstanding as of August 5, 2022. The table does not account for fractional shares that will be paid in cash.

|

After Reverse Stock Split |

||||||||

|

Ratio of |

Approximate Shares of Outstanding |

Authorized Shares of Common Stock |

||||||

|

None |

147,331,963 | 200,000,000 | ||||||

|

1:10 |

14,733,196 | 200,000,000 | ||||||

|

1:11 |

13,393,814 | 200,000,000 | ||||||

|

1:12 |

12,277,663 | 200,000,000 | ||||||

|

1:13 |

11,333,227 | 200,000,000 | ||||||

|

1:14 |

10,523,711 | 200,000,000 | ||||||

|

1:15 |

9,822,130 | 200,000,000 | ||||||

|

1:16 |

9,208,247 | 200,000,000 | ||||||

|

1:17 |

8,666,586 | 200,000,000 | ||||||

|

1:18 |

8,185,109 | 200,000,000 | ||||||

|

1:19 |

7,754,313 | 200,000,000 | ||||||

|

1:20 |

7,366,598 | 200,000,000 | ||||||

|

1:21 |

7,015,807 | 200,000,000 | ||||||

|

1:22 |

6,696,907 | 200,000,000 | ||||||

|

1:23 |

6,405,737 | 200,000,000 | ||||||

|

1:24 |

6,138,831 | 200,000,000 | ||||||

|

1:25 |

5,893,278 | 200,000,000 | ||||||

|

1:26 |

5,666,613 | 200,000,000 | ||||||

|

1:27 |

5,456,739 | 200,000,000 | ||||||

|

1:28 |

5,261,855 | 200,000,000 | ||||||

|

1:29 |

5,080,412 | 200,000,000 | ||||||

|

1:30 |

4,911,065 | 200,000,000 | ||||||

If a stockholder owns 10,000 shares of common stock prior to the Reverse Stock Split, after the Reverse Stock Split that same stockholder would own:

|

Ratio of |

Shares of Common |

|||

|

None |

10,000 | |||

|

1:10 |

1,000 | |||

|

1:11 |

909 | |||

|

1:12 |

833 | |||

|

1:13 |

769 | |||

|

1:14 |

714 | |||

|

1:15 |

666 | |||

|

1:16 |

625 | |||

|

1:17 |

588 | |||

|

1:18 |

555 | |||

|

1:19 |

526 | |||

|

1:20 |

500 | |||

|

1:21 |

476 | |||

|

1:22 |

454 | |||

|

1:23 |

434 | |||

|

1:24 |

416 | |||

|

1:25 |

400 | |||

|

1:26 |

384 | |||

|

1:27 |

370 | |||

|

1:28 |

357 | |||

|

1:29 |

344 | |||

|

1:30 |

333 | |||

We are currently authorized to issue up to 200,000,000 shares of common stock under the Amended and Restated Certificate of Incorporation. The Reverse Stock Split will have no effect on the total number of shares of common stock we are authorized to issue under the Amended and Restated Certificate of Incorporation. Therefore, upon effectiveness of the Reverse Stock Split, the number of shares of common stock that are authorized and unissued will increase relative to the number of issued and outstanding shares. We may use the additional authorized and unissued shares of common stock resulting from the Reverse Stock Split to issue additional shares of common stock from time to time in equity financings, under our equity compensation plans or in connection with other matters. The Board currently has no plans, arrangements or understandings regarding the issuance of such additional authorized and unissued shares of common stock.

As of the record date, except for 3,000 shares of Series A preferred stock, there were no issued or outstanding shares of our preferred stock and no outstanding options or warrants to purchase shares of our preferred stock. The Reverse Stock Split will not impact the number of authorized or outstanding shares of our preferred stock.

Background of the Series A Preferred Stock

On August 3, 2022, we issued an aggregate of 3,000 shares of Series A preferred stock to one institutional investor for $300,000, and issued a warrant to purchase 1,623,008 shares of common stock to such investor, with an exercise price of $0.2033 per share, subject to certain anti-dilution adjustments and customary adjustments for stock splits, dividends and combinations. The shares of Series A preferred stock have a stated value of $100 per share and are convertible, following the effective date of a reverse stock split, into an aggregate of 1,623,008 pre-reverse split shares of common stock, subject to customary adjustments for stock splits, dividends and combinations. The terms of the Series A preferred stock are set forth in a Certificate of Designation of Preferences, Rights and Limitations of Series A Convertible Preferred Stock, or the Certificate of Designation, that we filed with the Secretary of State of the State of Delaware.

The Certificate of Designation provides, among other things, that except as otherwise provided in the Certificate of Designation or as otherwise required by law, the Series A preferred stock will have no voting rights (other than the right to vote as a class on certain matters as provided in the Certificate of Designation). However, pursuant to the provisions of the Certificate of Designation, each share of Series A preferred stock has the right to cast 1,000,000 votes per share of Series A preferred stock on this Proposal 1 or any proposal to adjourn the Special Meeting, if necessary, with the Series A preferred stock and common stock voting together and counted as a single class; provided, that the votes cast by the holders of the Series A preferred stock must be counted by us and voted in the same proportion as the shares of common stock that are voted on Proposal 1 (excluding any shares of common stock that are not voted) and any proposal to adjourn the Special Meeting, if necessary.

We believe that a significant number of our outstanding shares of common stock are held by a large number of retail stockholders, and that a number of large brokers have previously announced that they were eliminating the practice of discretionary voting of uninstructed shares on some or all matters identified as “routine” under the rules and guidance of applicable stock exchanges, such as Proposal 1, which proposal must be approved by the affirmative vote of the holders of a majority of the voting power of the outstanding shares. We believe that approving this Proposal 1 and giving authorization to the Board to determine, at its option, whether to effect a Reverse Stock Split, as described in this Proposal 1, is important to AcelRx and in our and our stockholders’ best interests. We determined to provide the investor who purchased the Series A preferred stock with the negotiated terms concerning the rights of the Series A preferred stock to secure sufficient investors who are committed to voting for this Proposal 1 and any proposal to adjourn the Special Meeting, if necessary.

Accounting Matters

The Reverse Stock Split will not affect the par value of the common stock. As a result, upon the effectiveness of the Reverse Stock Split, the stated capital on our balance sheet attributable to the common stock will be reduced proportionately based on the exchange ratio selected by our Board for the Reverse Stock Split, and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. The per share net income or loss and net book value of the common stock will be increased because there will be fewer shares of common stock outstanding. In addition, proportionate adjustments will be made to the per share exercise price and the number of shares issuable upon the exercise or settlement of all outstanding options, restricted stock units and warrants to purchase or acquire, as applicable, shares of common stock, and the number of shares reserved for issuance pursuant to our existing equity incentive, stock option and employee stock purchase plans will be reduced proportionately based on the exchange ratio selected by the Board for the Reverse Stock Split.

No Fractional Shares

No fractional shares of common stock will be issued as a result of the Reverse Stock Split. Instead, stockholders who otherwise would be entitled to receive fractional shares will be entitled to receive cash in an amount equal to the product obtained by multiplying (i) the closing sales price of the common stock as reported on the Nasdaq Global Market on the effective date of the certificate of amendment to the Amended and Restated Certificate of Incorporation by (ii) the number of shares of common stock held by such stockholder before the Reverse Stock Split that would otherwise have been exchanged for such fractional share interest. Holders of as many as 29 shares (if we were to implement a 1-for-30 Reverse Stock Split) of common stock would be eliminated as a result of the cash payment in lieu of any issuance of fractional shares or interests in connection with the Reverse Stock Split. The exact number by which the number of holders of the common stock would be reduced will depend on the Reverse Stock Split ratio adopted and the number of stockholders that hold less than the Reverse Stock Split ratio as of the effective date of the Reverse Stock Split. As of the record date, there were approximately 43 holders of record of the common stock. As a result of the Reverse Stock Split, assuming the maximum Reverse Stock Split ratio of 1-for-30 were selected, we estimate that cashing out fractional stockholders would potentially reduce that number of stockholders of record from 43 to 40.

Certain Risks Associated with the Reverse Stock Split

Before voting on this Proposal 1, stockholders should consider the following risks associated with effecting a Reverse Stock Split:

|

● |

Although we expect that a Reverse Stock Split will result in an increase in the market price of the common stock, we cannot assure you that a Reverse Stock Split will increase the market price of the common stock in proportion to the reduction in the number of shares of the common stock outstanding or result in a permanent increase in the market price. The effect that a Reverse Stock Split may have upon the market price of the common stock cannot be predicted with any certainty, and the history of similar reverse stock splits for companies in similar circumstances to ours is varied. The market price of the common stock is dependent on many factors, including our business and financial performance, general market conditions, prospects for future growth and other factors detailed from time to time in the reports we file with the SEC. Accordingly, the total market capitalization of the common stock after a Reverse Stock Split may be lower than the total market capitalization before a Reverse Stock Split and, in the future, the market price of the common stock following a Reverse Stock Split may not exceed or remain higher than the market price prior to a Reverse Stock Split. |

|

● |

Even if our stockholders approve a Reverse Stock Split and the Reverse Stock Split is effected, there can be no assurance that we will continue to meet the continued listing requirements of the Nasdaq Global Market. |

|

● |

A Reverse Stock Split may result in some stockholders owning “odd lots” of less than 100 shares of common stock on a post-split basis. These odd lots may be more difficult to sell, or require greater transaction costs per share to sell, than shares in “round lots” of even multiples of 100 shares. |

|

● |

Although the Board believes that the decrease in the number of shares of common stock outstanding as a consequence of a Reverse Stock Split and the anticipated increase in the market price of common stock could encourage interest in the common stock and possibly promote greater liquidity for stockholders, such liquidity could also be adversely affected by the reduced number of shares outstanding after the Reverse Stock Split. |

Potential Anti-Takeover Effect of the Reverse Stock Split

Upon effectiveness of the Reverse Stock Split, the number of authorized shares of common stock that are not issued or outstanding will increase relative to the number of shares of common stock that are issued and outstanding prior to the Reverse Stock Split. While this increase could, under certain circumstances, have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of the Board or contemplating a tender offer or other transaction for the combination of AcelRx with another company), Proposal 1 is not being proposed in response to any effort of which we are aware to accumulate shares of the common stock or to obtain control of AcelRx.

Effective Date

If our stockholders approve the Reverse Stock Split, the Reverse Stock Split would become effective at such time as it is deemed by our Board to be in the best interests of AcelRx and our stockholders and we file the amendment to our Amended and Restated Certificate of Incorporation. Even if the Reverse Stock Split is approved by our stockholders, our Board has discretion not to carry out or to delay in carrying out the Reverse Stock Split. If the Board does not implement an approved Reverse Stock Split prior to the one-year anniversary of this meeting, the Board will seek stockholder approval before implementing any Reverse Stock Split after that time. Upon the filing of the amendment, all of the pre-Reverse Stock Split shares will be converted into new common stock as set forth in the amendment.

Exchange of Stock Certificates

Some stockholders hold their shares of common stock in certificate form or a combination of certificate and book-entry form. Our transfer agent will act as the “exchange agent” for purposes of implementing the exchange of stock certificates. Stockholders holding pre-split shares that are certificated will be asked to surrender to the exchange agent certificates representing pre-split shares in exchange for certificates representing post-split shares in accordance with the procedures to be set forth in a letter of transmittal to be sent by the exchange agent. No new certificates will be issued to a stockholder until such stockholder has surrendered the stockholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Certain Material U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following is a summary of certain material federal income tax consequences of the Reverse Stock Split that generally are expected to be applicable to U.S. Holders (as defined below) of the common stock, but does not purport to be a complete discussion of all of the potential tax considerations relating thereto. This summary is based on the provisions of the United States federal income tax law (including the Internal Revenue Code of 1986, as amended, or the Code, applicable Treasury Regulations promulgated thereunder, and judicial authorities and current administrative rulings and practices as in effect on the date of this proxy statement). Changes to these laws could alter the tax consequences described below, possibly with retroactive effect, which may result in the U.S. federal income tax consequences of the Reverse Stock Split differing substantially from the consequences summarized below. We have not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the U.S. federal income tax consequences of the Reverse Stock Split, and there can be no assurance that the Internal Revenue Service or the courts will accept the positions expressed below. This summary assumes that the common stock will be, both before and after the Reverse Stock Split, held as a “capital asset,” as defined in the Code (i.e., generally, property held for investment). Further, it does not discuss the tax consequences of the Reverse Stock Split under state, local, foreign laws or under gift, excise or other non-income tax laws, or the application of the alternative minimum tax rules, the Medicare contribution tax on net investment income or the special tax accounting rules under Section 451(b) of the Code. This summary does not address the tax consequences of transactions effectuated prior or subsequent to, or concurrently with, the Reverse Stock Split (whether or not any such transactions are consummated in connection with the Reverse Stock Split), or the tax consequences to holders of options, warrants or similar rights to acquire common stock. In addition, this summary does not address the tax consequences applicable to a holder’s particular circumstances or to holders that are subject to special tax rules, including without limitation banks, financial institutions, insurance companies, regulated investment companies, mutual funds, real estate investment trusts, personal holding companies, foreign entities, nonresident alien individuals, broker-dealers, traders, tax-exempt entities, persons who hold common stock as a position in a hedging transaction, “straddle,” “conversion transaction” or other integrated or risk reduction transaction, persons whose common stock constitute qualified small business stock within the meaning of Section 1202 of the Code, holders who hold their common stock through individual retirement or other tax-deferred accounts, holders of common stock who are not U.S. Holders (as defined below), holders of common stock who have a functional currency for U.S. federal income tax purposes other than the U.S. dollar, holders who acquired their common stock in a transaction subject to the gain rollover provisions of Section 1045 of the Code, holders who acquired their common stock pursuant to the exercise of employee stock options or otherwise as compensation, or holders of common stock who are partnerships, limited liability companies that are not treated as corporations for U.S. federal income tax purposes, S corporations, or other pass-through entities or investors in such pass-through entities.

For purposes of this discussion, a U.S. Holder means a beneficial owner of common stock that is: (i) an individual who is a citizen or resident of the United States; (ii) a corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) created or organized in the United States or under the laws of the United States or any subdivision thereof, or the District of Columbia; (iii) an estate the income of which is includible in gross income for U.S. federal income tax purposes regardless of its source; or (iv) a trust (other than a grantor trust) if (A) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (B) it has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person.

THIS SUMMARY OF CERTAIN MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT IS FOR GENERAL INFORMATION ONLY AND IS NOT TAX ADVICE. EACH STOCKHOLDER IS URGED TO CONSULT WITH SUCH STOCKHOLDER’S OWN TAX ADVISOR WITH RESPECT TO THE TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT.

Tax Consequences of the Reverse Stock Split

The Reverse Stock Split should constitute a “recapitalization” for U.S. federal income tax purposes. A U.S. Holder that receives solely a reduced number of shares of common stock generally will not recognize gain or loss in the Reverse Stock Split. A U.S. Holder’s aggregate tax basis in the reduced number of shares of common stock should equal the U.S. Holder’s aggregate tax basis in its pre-Reverse Stock Split shares of common stock, and such U.S. Holder’s holding period in the reduced number of shares of common stock should include the holding period in its pre-Reverse Stock Split shares of common stock exchanged. Treasury Regulations provide detailed rules for allocating the tax basis and holding period of the shares of common stock surrendered to the shares of common stock received in a recapitalization pursuant to the Reverse Stock Split. U.S. Holders should consult their tax advisors as to application of the foregoing rules where shares of common stock were acquired at different times or at different prices.

No gain or loss will be recognized by AcelRx as a result of the proposed Reverse Stock Split.

Cash in Lieu of Fractional Shares

A U.S. Holder that receives cash in lieu of fractional share interests as a result of the Reverse Stock Split will be treated as having received the fractional shares pursuant to the Reverse Stock Split and then as having exchanged the fractional shares for cash in a redemption by AcelRx, and generally should recognize gain or loss equal to the difference, if any, between the amount of cash received in lieu of a fractional share and its adjusted basis allocable to the fractional share interests. Such gain or loss will be long-term capital gain or loss if the pre-Reverse Stock Split shares were held for more than one year. Long-term capital gains of individuals are generally subject to tax at reduced rates. There are limitations on the deductibility of capital losses under the Code. A U.S. Holder’s aggregate tax basis in the reduced number of shares of common stock, if any, should equal the U.S. Holder’s aggregate tax basis in its pre-Reverse Stock Split shares of common stock decreased by the basis allocated to the fractional share for which such U.S. Holder is entitled to receive cash, and the holding period of the reduced number of shares of common stock received, if any, should include the holding period of the pre-Reverse Stock Split shares of common stock exchanged.

Information Reporting and Backup Withholding

A holder of common stock may be subject to information reporting and backup withholding on cash paid in lieu of fractional shares in connection with the Reverse Stock Split. To avoid backup withholding, each holder of common stock that does not otherwise establish an exemption should provide its taxpayer identification number and comply with the applicable certification procedures. Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules generally will be allowed as a refund or credit against a U.S. Holder’s U.S. federal income tax liability, provided the required information is timely and properly furnished to the Internal Revenue Service. Holders of common stock should consult their tax advisors regarding their qualification for an exemption from backup withholding and the procedures for obtaining such an exemption, as well as the procedures for obtaining a credit or refund if backup withholding is imposed.

THE PRECEDING DISCUSSION IS INTENDED ONLY AS A SUMMARY OF CERTAIN MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO U.S. HOLDERS. IT IS NOT A COMPLETE ANALYSIS OR DISCUSSION OF ALL POTENTIAL TAX EFFECTS THAT MAY BE IMPORTANT TO A PARTICULAR HOLDER. ALL HOLDERS OF OUR COMMON STOCK SHOULD CONSULT THEIR OWN TAX ADVISORS AS TO THE SPECIFIC TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO THEM, INCLUDING RECORD RETENTION AND TAX-REPORTING REQUIREMENTS, AND THE APPLICABILITY AND EFFECT OF ANY U.S. FEDERAL, STATE, LOCAL AND NON-U.S. TAX LAWS.

No Dissenters’ Rights

Under applicable Delaware law, our stockholders are not entitled to dissenters’ or appraisal rights with respect to our proposed amendment to the Amended and Restated Certificate of Incorporation to effect the Reverse Stock Split. We will not independently provide our stockholders with any such right.

Vote Required

The affirmative vote of the holders of a majority of the combined voting power of the outstanding shares of common stock and Series A preferred stock, voting together and counted as a single class, on the record date is required to adopt and approve the amendment to our Restated Certificate to effect the Reverse Stock Split. The holders of common stock have the right to cast one vote per share of common stock on this proposal. The holders of Series A preferred stock have the right to cast 1,000,000 votes per share of Series A Preferred Stock, or an aggregate of 3,000,000,000 votes, on this proposal; provided, that such votes must be counted in the same proportion as the aggregate shares of common stock that are voted on this proposal (excluding any shares of common stock that are not voted), without regard to abstentions by holders of common stock or broker non-votes. As an example, if 50.5% of the votes cast by holders of common stock present, in person or by proxy, and entitled to vote are voted at the Special Meeting in favor of this proposal, we can count 50.5% of the votes cast by the holders of the Series A preferred stock as votes in favor of this proposal. Because the voting standard for this proposal is a majority of the combined voting power of the outstanding shares of common stock and Series A preferred stock entitled to vote on the proposal, voting together and counted as a single class, abstentions and broker non-votes will, in one sense, have the effect of a vote “Against” the proposal. However, if you prefer that the Reverse Stock Split proposal not be approved, you should cast your vote against the proposal. Since the Series A preferred stock has 1,000,000 votes per share on this proposal and such votes must be counted in the same proportion as the aggregate shares of common stock that are voted on this proposal at the Special Meeting, the failure of a share of common stock to be voted will effectively have no impact on the outcome of the vote. However, shares of common stock voted against the proposal will have the effect of causing the proportion of Series A preferred stock voted against the proposal to increase accordingly and vice versa. Because Proposal 1 is considered “routine” for these purposes, there will not be any broker non-votes for this proposal.

The Board of Directors Recommends

A Vote in Favor of Proposal 1.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of our common stock as of August 5, 2022 by:

|

● |

all those known by us to be beneficial owners of more than 5% of our common stock; |

|

● |

each director; |

|

● |

each named executive officer; and |

|

● |

all of our current executive officers and directors as a group. |

|

Beneficial Ownership(1) |

||||||||||||||||

|

Common Stock |

Preferred Stock |

|||||||||||||||

|

Name of Beneficial Owner |

Number of Shares |

% |

Number of Shares |

% |

||||||||||||

|

Stockholders Owning Greater than 5%: |

||||||||||||||||

|

Armistice Capital, LLC(2) |

12,314,479 | 8.4 | % | - | - | |||||||||||

|

Lincoln Park Capital Fund, LLC (3) |

1,623,008 | 1.1 | % | 3,000 | 100.0 | % | ||||||||||

|

Directors and Named Executive Officers: |

||||||||||||||||

|

Adrian Adams(4) |

343,750 | * | - | - | ||||||||||||

|

Richard Afable, M.D. (5) |

154,750 | * | - | - | ||||||||||||

|

Vincent J. Angotti(6) |

2,386,065 | 1.6 | % | - | - | |||||||||||

|

Marina Bozilenko(7) |

49,998 | * | - | - | ||||||||||||

|

Jill Broadfoot |

- | * | - | - | ||||||||||||

|

Stephen J. Hoffman, M.D., Ph.D.(8) |

153,750 | * | - | - | ||||||||||||

|

Pamela P. Palmer, M.D., Ph.D.(9) |

1,963,696 | 1.3 | % | - | - | |||||||||||

|

Howard B. Rosen(10) |

1,587,250 | 1.1 | % | - | - | |||||||||||

|

Mark Wan(11) |

153,750 | * | - | - | ||||||||||||

|

Raffi Asadorian(12) |

892,978 | * | - | - | ||||||||||||

|

All current executive officers and directors as a group (11 persons)(13) |

8,621,892 | 5.6 | % | - | - | |||||||||||

|

* |

Less than 1%. |

|

(1) |

This table is based upon information supplied by officers, directors and principal stockholders. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, we believe that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 147,331,963 shares of common stock and 3,000 shares of preferred stock outstanding on August 5, 2022, adjusted as required by rules promulgated by the SEC. The number of shares beneficially owned includes shares of common stock issuable pursuant to the exercise of stock options that are exercisable within 60 days of August 5, 2022. Shares issuable pursuant to the exercise of stock options that are exercisable stock options and restricted stock units vesting within 60 days of August 5, 2022, are deemed to be outstanding and beneficially owned by the person to whom such shares are issuable for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

|

(2) |

Based on information disclosed in a Schedule 13G filed with the SEC on February 15, 2022, by Armistice Capital, LLC (“Armistice Capital”) reporting ownership as of December 31, 2021. Includes 12,314,479 shares reported as beneficially owned by Armistice Capital, of which Armistice Capital reports sole voting power and sole dispositive power with respect to zero shares, and shared voting power and shared dispositive power with respect to 12,314,479 shares, and 12,314,479 shares reported as beneficially owned by Steven Boyd (“Mr. Boyd”), of which Mr. Boyd reports sole voting power and sole dispositive power with respect to zero shares, and shared voting power and shared dispositive power with respect to 12,314,479 shares. Armistice Capital is the investment manager of Armistice Capital Master Fund Ltd. (the “Master Fund”), the direct holder of the reported shares, and pursuant to an Investment Management Agreement, Armistice Capital exercises voting and investment power over these shares held by the Master Fund and thus may be deemed to beneficially own these shares held by the Master Fund. Mr. Boyd, as the managing member of Armistice Capital, may be deemed to beneficially own these shares held by the Master Fund. The Master Fund specifically disclaims beneficial ownership of these shares directly held by it by virtue of its inability to vote or dispose of such securities as a result of its Investment Management Agreement with Armistice Capital. Despite such shared beneficial ownership, the reporting persons disclaim that they constitute a statutory group within the meaning of Rule 13d-5(b)(1) of the Securities Exchange Act of 1934. The address for Armistice Capital and Mr. Boyd is 510 Madison Avenue, 7th Floor, New York, New York 10022. |

|

(3) |

The Series A preferred stock is not entitled to vote on the matters submitted to the stockholders at the Meeting, except with respect to the reverse stock split Proposal 1 and any adjournment of the Special Meeting. Lincoln Park Capital, LLC (“LPC”) is the Managing Member of Lincoln Park Capital Fund LLC (“Lincoln Park”). Rockledge Capital Corporation (“RCC”) and Alex Noah Investors, LLC (“Alex Noah”) are the managing Members of LPC. Josh Scheinfeld is the president and sole shareholder of RCC as well as a principal of LPC. Mr. Cope is the president and sole shareholder of Alex Noah, as well as a principal of LPC. As a result of the foregoing, Mr. Scheinfeld and Mr. Cope have shared voting and shared investment power over shares of common stock of the Company held directly by Lincoln Park. The address of Lincoln Park is 440 N. Wells Street, Suite 410, Chicago, Illinois 60654. The Series A preferred stock is subject to a 4.99% (or, upon prior notice by the holder, 9.99%) beneficial ownership limitation that prohibits the fund from converting any portion of the Series A preferred stock if, following such conversion, the holder’s ownership of our common stock would exceed that ownership percentage. Includes 1,623,008 shares of common stock underlying warrants issued to Lincoln Park. Excludes 1,623,008 shares of common stock issuable upon conversion of the outstanding shares of Series A preferred stock because the Series A preferred stock is not convertible until such time as we effect a reverse stock split which becomes effective. Such warrants also include a beneficial ownership cap which prohibits the issuance of any shares of common stock upon exercise of such warrants if such issuance would cause Lincoln Park’s beneficial ownership of our common stock to exceed 4.99% (or, upon prior notice by the holder, 9.99%) of our outstanding common stock. |

|

(4) |

Includes 147,500 shares issuable pursuant to stock options exercisable within 60 days of August 5, 2022. |

|

(5) |

Includes 132,500 shares issuable pursuant to stock options exercisable within 60 days of August 5, 2022. |

|

(6) |

Includes 1,959,166 shares issuable pursuant to stock options exercisable within 60 days of August 5, 2022. |

|

(7) |

Includes 34,999 shares issuable pursuant to stock options exercisable within 60 days of August 5, 2022. |

|

(8) |

Includes 132,500 shares issuable pursuant to stock options exercisable within 60 days of August 5, 2022. |

|

(9) |

Includes 1,375,693 shares issuable pursuant to stock options exercisable within 60 days of August 5, 2022. |

|

(10) |

Includes 1,508,500 shares issuable pursuant to stock options exercisable within 60 days of August 5, 2022. |

|

(11) |

Includes 132,500 shares issuable pursuant to stock options exercisable within 60 days of August 5, 2022. |

|

(12) |

Includes 715,031 shares issuable pursuant to stock options exercisable within 60 days of August 5, 2022. |

|

(13) |

Includes 6,921,204 shares issuable pursuant to stock options exercisable within 60 days of August 5, 2022. |

OTHER MATTERS

The Board knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

|

|

By Order of the Board of Directors |

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Adrian Adams |

|

|

|

Adrian Adams |

|

|

|

Chairman |

August 12, 2022

APPENDIX A

CERTIFICATE OF AMENDMENT TO THE

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION OF

ACELRX PHARMACEUTICALS, INC.

AcelRx Pharmaceuticals, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”), hereby certifies that:

FIRST: The name of this corporation is AcelRx Pharmaceuticals, Inc.

SECOND: The original name of the Corporation was “SuRx, Inc.”., and the date of filing the original Certificate of Incorporation of the Corporation with the Secretary of State of the State of Delaware is July 13, 2005.

THIRD: The Board of Directors of the Corporation, acting in accordance with the provisions of Sections 141 and 242 of the General Corporation Law of the State of Delaware, adopted resolutions amending Article IV, Section A of the Amended and Restated Certificate of Incorporation, as amended, to read in its entirety:

“A. This corporation is authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred Stock.” The total number of shares which this corporation is authorized to issue is 210,000,000 shares. 200,000,000 shares shall be Common Stock, each having a par value of $0.001. 10,000,000 shares shall be Preferred Stock, each having a par value of $0.001.

Effective at 5:01 p.m. Eastern time, on the date of the filing of this Certificate of Amendment to the Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware (the “Effective Time”), each [ten, eleven, twelve, thirteen, fourteen, fifteen, sixteen, seventeen, eighteen, nineteen, twenty, twenty-one, twenty-two, twenty-three, twenty-four, twenty-five, twenty-six, twenty-seven, twenty-eight, twenty-nine or thirty] shares of this corporation’s Common Stock, par value $0.001 per share, issued and outstanding shall be combined into one (1) share of Common Stock, par value $0.001 per share, of this corporation. No fractional shares shall be issued and, in lieu thereof, any holder of less than one share of Common Stock shall, upon surrender after the Effective Time of a certificate, which formerly represented shares of Common Stock that were issued and outstanding immediately prior to the Effective Time, be entitled to receive cash for such holder’s fractional share based upon the closing sales price of this corporation’s Common Stock as reported on the Nasdaq Global Market on the date this Certificate of Amendment to the Amended and Restated Certificate of Incorporation of this corporation is filed with the Secretary of State of the State of Delaware.”

FOURTH: This Certificate of Amendment to the Amended and Restated Certificate of Incorporation was submitted to the stockholders of the Corporation and was duly adopted and approved in accordance with the provisions of Section 242 of the General Corporate Law of the State of Delaware.

* * * * *

|

1 |

The board of directors (the “Board”) adopted a resolution approving twenty-one separate amendments to the Amended and Restated Certificate of Incorporation, as amended, of the Corporation. These amendments approve the combination of any whole number of shares of Common Stock between and including ten (10) and thirty (30) into one (1) share of Common Stock. By approving Proposal No. 1, you are approving each of the twenty-one amendments proposed by the Board. The Certificate of Amendment filed with the Secretary of State of the State of Delaware will include only that amendment determined by the Board to be in the best interests of the Corporation and its stockholders. The other twenty proposed amendments will be abandoned pursuant to Section 242(c) of the Delaware General Corporation Law. The Board may also elect not to do any reverse split in which all twenty-one proposed amendments will be abandoned. In accordance with these resolutions, the Board will not implement any amendment providing for a different split ratio. |

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its Chief Executive Officer this day of , 2022.

|

|

ACELRX PHARMACEUTICALS, INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

|

|

|

|

VINCENT J. ANGOTTI |

|

| CHIEF EXECUTIVE OFFICER | |||

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Nxera Pharma Notes Successful Development Progress of Partnered Schizophrenia Candidate NBI-1117568

- Shuffield Land Clearing & Services Specializes in Land Clearing and Utility Clearing Projects in Central Texas

- Isuzu Motors Limited Drives Forward with Anaqua as Intellectual Property Management Provider

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share