Form CB METSO CORP Filed by: Outotec OYJ

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form CB

TENDER OFFER/RIGHTS OFFERING NOTIFICATION FORM

Please place an X in the box(es) to designate the appropriate rule provision(s) relied upon to file this Form:

| Securities Act Rule 801 (Rights Offering) |

☐ | |||

| Securities Act Rule 802 (Exchange Offer) |

☒ | |||

| Exchange Act Rule 13e-4(h)(8) (Issuer Tender Offer) |

☐ | |||

| Exchange Act Rule 14d-1(c) (Third Party Tender Offer) |

☐ | |||

| Exchange Act Rule 14e-2(d) (Subject Company Response) |

☐ | |||

| Filed or submitted in paper if permitted by Regulation S-T Rule 101(b)(8) |

☐ | |||

Metso Corporation

(Name of Subject Company)

n/a

(Translation of Subject Company’s Name into English (if applicable))

Republic of Finland

(Jurisdiction of Subject Company’s Incorporation or Organization)

Outotec Oyj

(Name of Person(s) Furnishing Form)

Series 22 EUR 100,000,000 Fixed Rate Notes due 27 June 2022

(the “2022 Notes”) and

Series 24 EUR 300,000,000 1.125% Senior Notes due 13 June 2024

(the “2024 Notes”),

each issued by Metso Corporation

(Title of Class of Subject Securities)

No CUSIP numbers issued.

2022 Notes:

ISIN: XS0795500437; Common Code: 079550043

2024 Notes:

ISIN: XS1626574708; Common Code: 162657470

(CUSIP Number of Class of Securities (if applicable))

Minna Helppi

Töölönlahdenkatu 2

Helsinki

FI-00100

Finland

+358 20 484 100

(Name, Address (including zip code) and Telephone Number (including area code)

of Person(s) Authorized to Receive Notices and Communications on Behalf of Subject Company)

October 8, 2019

(Date Tender Offer/Rights Offering Commenced)

PART I - INFORMATION SENT TO SECURITY HOLDERS

| Item 1. | Home Jurisdiction Documents |

| Exhibit No. |

Description | |

| 99.1 | Consent Solicitation Memorandum, dated October 8, 2019 | |

| 99.2 | Notice of Meeting of the Holders of the 2022 Notes, dated October 8, 2019 | |

| 99.3 | Notice of Meeting of the Holders of the 2024 Notes, dated October 8, 2019 | |

| 99.4 | Press release regarding the consent solicitation, dated October 8, 2019 | |

| 99.5 | IIIA notice, dated October 8, 2019 | |

| 99.6 | Investor presentation, dated October 8, 2019 | |

| Item 2. | Informational Legends |

The required legend has been prominently included in the documents referred to in Item 1.

PART II - INFORMATION NOT REQUIRED TO BE SENT TO SECURITY HOLDERS

n/a

PART III - CONSENT TO SERVICE OF PROCESS

A written irrevocable consent and power of attorney on Form F-X is filed with the Securities and Exchange Commission concurrently with this Form CB on October 9, 2019.

2

PART IV - SIGNATURES

After due inquiry and to the best of our knowledge and belief, we certify that the information set forth in this statement is true, complete and correct.

| /s/ Jari Ålgars /s/ Nina Kiviranta (Signature) | ||

| Jari Ålgars Chief Financial Officer |

Nina Kiviranta General Counsel | |

| (Name and Title) | ||

| October 9, 2019 | ||

| (Date) | ||

3

Exhibit 99.1

IMPORTANT NOTICE

IMPORTANT: You must read the following disclaimer before continuing. The notice on this page applies to the Consent Solicitation Memorandum (the “Memorandum”) following this page, whether received by email or otherwise received as a result of electronic communication and you are therefore advised to read this notice carefully before reading, accessing or making any other use of the Memorandum. In reading, accessing or making any other use of the Memorandum, you agree to be bound by the terms and conditions on this page, including any modifications to them from time to time and any information you receive from us at any time.

THIS DOCUMENT (WHICH EXPRESSION WHEN USED IN THIS NOTICE INCLUDES THE MEMORANDUM) IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the contents of the Memorandum or the action you should take, you are recommended to seek your own financial advice, including in respect of any tax consequences, immediately from your stockbroker, bank manager, solicitor, accountant or other appropriately authorised independent financial adviser. Any individual or company whose Notes (as defined below) are held on its behalf by a broker, dealer, bank, custodian, trust company or other nominee must contact such entity if they wish to participate in the Consent Solicitation (as defined below) described in the Memorandum.

None of Citibank, N.A. as fiscal agent (the “Fiscal Agent”) under the Agency Agreements (as defined in the Memorandum), the other paying agents party thereto (together with the Fiscal Agent the “Paying Agents”), Metso Corporation (the “Issuer”), Lucid Issuer Services Limited (the “Tabulation Agent”) or Citigroup Global Markets Limited and Nordea Bank Abp as solicitation agents (the “Solicitation Agents”) appointed by the Issuer in respect of the Consent Solicitation (as defined below) makes any recommendation in connection with the solicitation.

Confirmation of your representations: You have been sent the Memorandum at your request and on the basis that you have confirmed to the Issuer and the Tabulation Agent that:

| (i) | you are a holder or a beneficial owner of the Notes (as defined in the Memorandum); |

| (ii) | you are not a person to whom it is unlawful to send the Memorandum or to make the invitation to participate in the Consent Solicitation (as defined in the Memorandum) under any other applicable law or regulation; |

| (iii) | you consent to delivery of the Memorandum and any amendments or supplements thereto by electronic transmission to you; and |

| (iv) | you are not a Sanctions Restricted Person (as defined in the Memorandum). |

You are reminded that the attached Memorandum has been delivered to you on the basis that you are a person into whose possession the Memorandum may lawfully be delivered in accordance with the laws of the jurisdiction in which you are located and/or resident and you may not, nor are you authorised to, deliver the Memorandum, electronically or otherwise, to any other person.

The distribution of this Memorandum in certain jurisdictions may be restricted by law and persons into whose possession this Memorandum comes are requested to inform themselves about, and to observe, any such restrictions. No action has been or will be taken in any jurisdiction in relation to the Consent Solicitation that would permit a public offering of securities.

This document has been sent to you in an electronic form. You are reminded that documents transmitted via this medium may be altered or changed during the process of electronic communication and consequently none of the Solicitation Agents, Paying Agents, the Tabulation Agent, or the Issuer or any person who controls such person, or, in each case, any director, officer, employee or agent of any such person or any affiliate of any such person, accepts any liability or responsibility whatsoever in respect of any differences or discrepancies between the Memorandum distributed to you in electronic format and the hard copy version available to you on request from the Issuer or the Tabulation Agent.

THE MEMORANDUM MAY NOT BE DOWNLOADED, FORWARDED OR DISTRIBUTED, IN WHOLE OR IN PART, TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER. ANY DOWNLOADING, FORWARDING, DISTRIBUTION OR REPRODUCTION OF THIS DOCUMENT IN WHOLE OR IN PART IS UNAUTHORISED. FAILURE TO COMPLY WITH THIS DIRECTIVE MAY RESULT IN A VIOLATION OF THE APPLICABLE LAWS AND REGULATIONS.

The Notes have not been and will not be registered under the U.S. Securities Act of 1933, as amended, or the securities law of any state or jurisdiction of the United States. Nothing in this electronic transmission constitutes an offer of securities in any jurisdiction in which such offer cannot be made in compliance with applicable laws.

Any materials relating to the Consent Solicitation do not constitute, and may not be used in connection with, any form of offer or solicitation in any place where such offers or solicitations are not permitted by law. If a jurisdiction requires that the Consent Solicitation be made by a licensed broker or dealer and any Solicitation Agent or any of their affiliates is such a licensed broker or dealer in that jurisdiction, the Consent Solicitation shall be deemed to be made by such Solicitation Agent or such affiliate, as the case may be, on behalf of the Issuer in such jurisdiction. For the avoidance of doubt, the role of the Solicitation Agents and their affiliates will not be deemed to extend to making the Consent Solicitation to or engaging with any U.S. Person (as defined in Regulation S of the U.S. Securities Act of 1933, as amended.

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION

CONSENT SOLICITATION MEMORANDUM

Solicitation of consents by

METSO CORPORATION

(incorporated with limited liability in the Republic of Finland)

(the “Issuer”)

in respect of the outstanding

Series 22 EUR 100,000,000 Fixed Rate Notes due 27 June 2022 (ISIN: XS0795500437;

Common Code: 079550043) (the “2022 Notes”)

Series 24 EUR 300,000,000 1.125 per cent. Senior Notes due 13 June 2024 (ISIN: XS1626574708;

Common Code: 162657470) (the “2024 Notes”)

issued under its €1,500,000,000 Euro Medium Term Note Programme

(each a “Series” and together, the “Notes”)

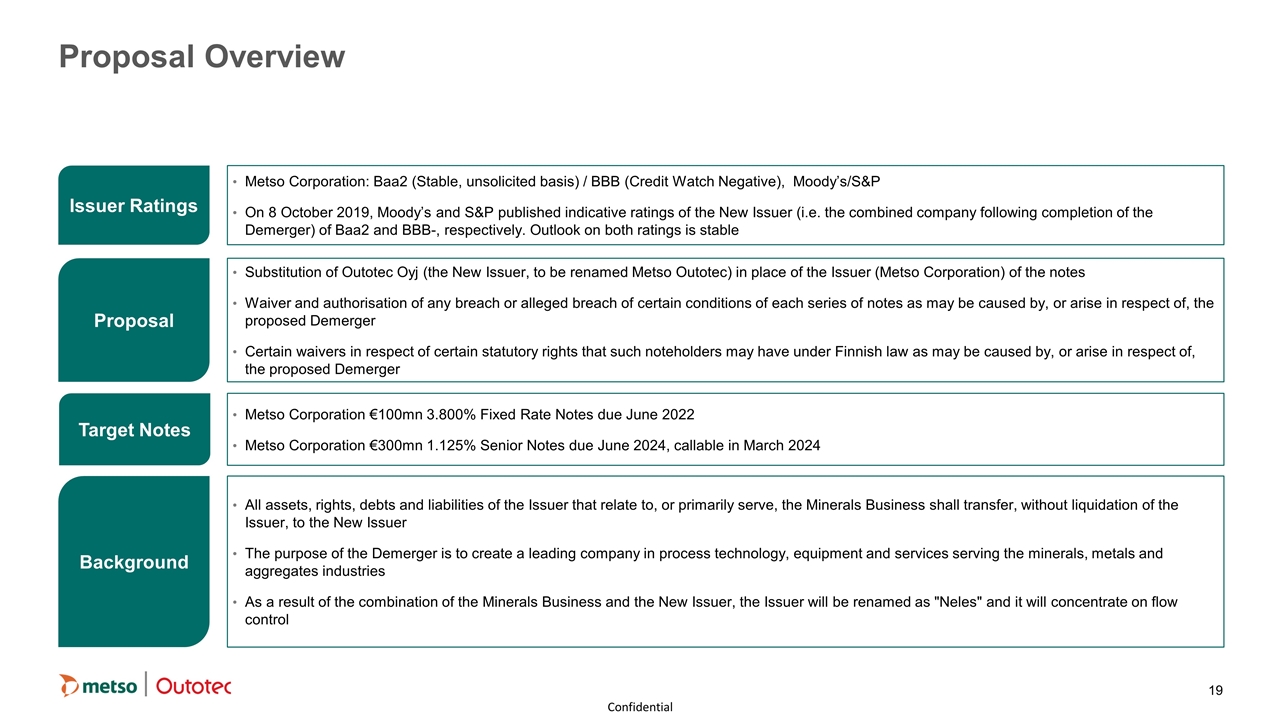

The Issuer is soliciting consents (the “Consent Solicitation”) from the beneficial holders of the outstanding Notes of each Series (the “Noteholders”) to consider and, if thought fit, pass an extraordinary resolution (each an “Extraordinary Resolution” and together, the “Extraordinary Resolutions”) at a separate meeting of Noteholders of each Series (each a “Meeting” and together, the “Meetings”) to sanction (a) the substitution of Outotec Oyj (the “New Issuer”) in place of the Issuer as the issuer of the Notes on the Effective Date (as defined herein) (the “Substitution”), (b) the waiver and authorisation of any breach or any alleged breach of certain of the Conditions (as defined herein) of the Notes as may be caused by, or arise in respect of, the proposed Demerger (as defined herein) and (c) certain waivers in respect of certain statutory rights that such Noteholders may have under Finnish law as may be caused by, or arise in respect of, the proposed Demerger, all as more fully described herein (the “Proposal”).

The Issuer is undertaking the Consent Solicitation by way of separate Extraordinary Resolutions passed at a Meeting in respect of each Series of Notes pursuant to Condition 17 (Meetings of Noteholders; Modification and Waiver) of the 2022 Notes and Condition 16 (Meetings of Noteholders; Modification and Waiver) of the 2024 Notes, as the case may be, and Schedule 4 (Provisions for Meetings of the Holders of Notes) of the amended and restated fiscal agency agreement dated 4 April 2012 (in respect of the 2022 Notes) and the amended and restated fiscal agency agreement dated 5 April 2017 (in respect of the 2024 Notes), each between the Issuer, the Fiscal Agent and the other Paying Agents (the “Agency Agreements”), all as more fully described herein.

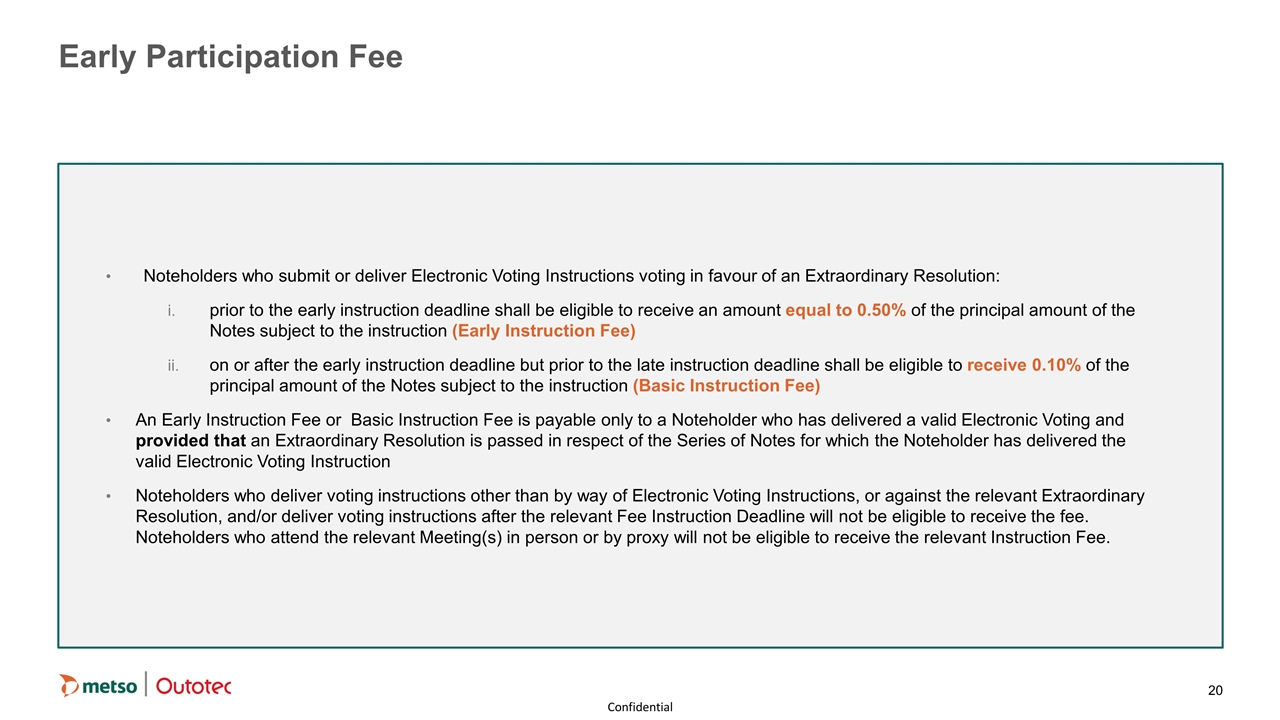

In relation to each Series of Notes, Noteholders who submit or deliver Electronic Voting Instructions (as defined herein) voting in favour of an Extraordinary Resolution (i) prior to the Early Instruction Deadline (as defined herein) shall be eligible to receive an amount equal to 0.50 per cent. of the principal amount of the Notes which are the subject of the Electronic Voting Instruction (the “Early Instruction Fee”) and (ii) on or after the Early Instruction Deadline but prior to the Late Instruction Deadline (as defined herein) shall be eligible to receive an amount equal to 0.10 per cent. of the principal amount of the Notes which are the subject of the Electronic Voting Instruction (the “Basic Instruction Fee”), subject in each case to the relevant Extraordinary Resolution being duly passed. Noteholders who submit or deliver Electronic Voting Instructions on or after the Early Instruction Deadline will not be eligible to receive the Early Instruction Fee and Noteholders who submit or deliver Electronic Voting Instructions after the Late Instruction Deadline will not be eligible to receive the Basic Instruction Fee.

None of the Solicitation Agents (as defined herein), the Paying Agents (as defined herein) or the Tabulation Agent (as defined herein) nor any of their respective affiliates makes any recommendation to Noteholders as to whether or not to agree to the Proposal and to vote in favour of the Extraordinary Resolutions.

Each notice convening each Meeting (each a “Notice of Meeting” and together the “Notices of Meetings”) was published on 8 October 2019. The Meeting for the 2022 Notes will start at 11 a.m. (Central European time) on 30 October 2019 and the Meeting for the 2024 Notes, will start at 11.15 a.m. (Central European time) on 30 October 2019, in each case at the office of Clifford Chance LLP, 10 Upper Bank Street, London E14 5JJ, United Kingdom, and at each Meeting an Extraordinary Resolution to approve the Proposal and its implementation in respect of the relevant Series of Notes will be considered and, if thought fit, passed. Copies of the Notices of Meetings are set out in Appendix 2 to this Consent Solicitation Memorandum (the “Memorandum”). See “Appendix 2: Notices of Meetings”.

- i -

Noteholders who submit or deliver Electronic Voting Instructions voting in favour of an Extraordinary Resolution will not be able to revoke or amend such instructions at any time except in the limited circumstances described herein. See “The Solicitation – Revocation Rights”. During the period commencing on the Late Instruction Deadline and ending at the conclusion of the relevant Meeting, Noteholders will not be able to submit or deliver Electronic Voting Instructions.

If a Meeting is adjourned, Noteholders who have not already submitted or delivered Electronic Voting Instructions prior to the Late Instruction Deadline may submit or deliver Electronic Voting Instructions during the period commencing at the conclusion of the original Meeting and ending on the Adjournment Instruction Deadline (but will not, for the avoidance of doubt, be entitled to either the Early Instruction Fee or the Basic Instruction Fee). During the period commencing on the Adjournment Instruction Deadline (as defined herein) and ending at the conclusion of the adjourned Meeting, Noteholders will not be able to submit or deliver Electronic Voting Instructions.

Noteholders who do not wish to submit an Electronic Voting Instruction may alternatively make arrangements to attend or be represented at the Meeting by following the procedures set out in the relevant Notice of Meeting. Such Noteholders will not however be eligible to receive either the Early Instruction Fee or the Basic Instruction Fee. Noteholders should note that Electronic Voting Instructions given and voting certificates obtained in respect of a Meeting shall remain valid for any such adjourned Meeting unless, in the case of Electronic Voting Instructions, revoked or amended in the limited circumstances permitted herein or, in the case of voting certificates, surrendered not less than 48 hours (as defined in the relevant Agency Agreement) before the time appointed for any adjourned meeting.

NOTICE TO U.S. HOLDERS: To the extent that this Consent Solicitation constitutes a deemed exchange of securities, this Consent Solicitation is being made in the United States in compliance with the application requirements of Section 14 of the U.S. Securities Exchange Act of 1934, as amended, and Regulation 14E thereunder, including taking into account the relief available pursuant to Rule 14d-1(c) thereunder. The Consent Solicitation is open to U.S. and non-U.S. holders of the Notes. The Consent Solicitation is subject to disclosure and procedural requirements, including with respect to the offer timetable, settlement procedures and timing of consideration, that are different from those applicable under U.S. domestic tender offer procedures, laws and practice. The Notes and any new securities resulting from the Consent Solicitation have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), and any such new securities are being offered and sold pursuant to the exemption from the registration requirements of the Securities Act provided by Rule 802 thereunder. Any new securities resulting from the Consent Solicitation will be “restricted securities” within the meaning of Rule 144(a)(3) under the Securities Act to the same extent as the Notes held by a holder before the Consent Solicitation. The Notes and any new securities resulting from the Consent Solicitation may only be offered and sold pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in accordance with other applicable securities laws.

This Consent Solicitation is made with respect to the securities of a foreign company. This Consent Solicitation is subject to disclosure requirements of a foreign country that are different from those of the United States, and with respect to the transaction timetable and the timing of payments, which are different from those under U.S. domestic tender offer procedures and rules. Financial statements and financial information included or referred to in this Memorandum have been prepared in accordance with foreign accounting standards that may not be comparable to the financial statements of United States companies. It may be difficult for you to enforce your rights and any claim you may have arising under the U.S. federal securities laws, since the Issuer is located in a foreign country, and some or all of its officers and directors may be residents of a foreign country. You may not be able to sue a foreign company or its officers or directors in a foreign court for violations of the U.S. securities laws. It may be difficult to compel a foreign company and its affiliates to subject themselves to a U.S. court’s judgment. You should be aware that the Issuer may also purchase the Notes in open market or privately negotiated purchases.

This Consent Solicitation Memorandum is dated 8 October 2019

Solicitation Agents

| Citigroup | Nordea |

THE DEADLINE FOR RECEIPT BY THE TABULATION AGENT OF VOTING INSTRUCTIONS FOR NOTEHOLDERS TO BE ELIGIBLE TO RECEIVE THE EARLY INSTRUCTION FEE IS 4 P.M. (CENTRAL EUROPEAN TIME) ON 18 OCTOBER 2019.

THE DEADLINE FOR RECEIPT BY THE TABULATION AGENT OF VOTING INSTRUCTIONS FOR NOTEHOLDERS TO BE ELIGIBLE TO RECEIVE THE BASIC INSTRUCTION FEE IS 4 P.M. (CENTRAL EUROPEAN TIME) ON 25 OCTOBER 2019.

NOTEHOLDERS SHOULD BE AWARE OF ANY EARLIER DEADLINES IMPOSED BY ANY INTERMEDIARY AND THE CLEARING SYSTEM THROUGH WHICH THEY HOLD THEIR NOTES.

- ii -

Any Instruction Fee will be paid to Noteholders of each Series of Notes (as defined herein) on the relevant Settlement Date, subject to the relevant Extraordinary Resolution having been duly passed at the Meeting in respect of such Series.

NOTEHOLDERS MUST ENSURE DELIVERY OF THEIR ELECTRONIC VOTING INSTRUCTIONS THROUGH THE RELEVANT CLEARING SYSTEM (AS DEFINED HEREIN) TO THE TABULATION AGENT PRIOR TO THE RELEVANT FEE INSTRUCTION DEADLINE OR, IF EARLIER, BEFORE ANY TIME AND/OR DATE SET BY THE RELEVANT CLEARING SYSTEM.

NOTEHOLDERS SHOULD CONTACT THEIR BROKER, DEALER, COMMERCIAL BANK, CUSTODIAN, TRUST COMPANY OR ACCOUNTHOLDER, AS THE CASE MAY BE, TO CONFIRM THE DEADLINE FOR RECEIPT OF THEIR ELECTRONIC VOTING INSTRUCTIONS SO THAT SUCH ELECTRONIC VOTING INSTRUCTIONS MAY BE PROCESSED AND DELIVERED TO THE TABULATION AGENT IN A TIMELY MANNER AND IN ACCORDANCE WITH THE RELEVANT DEADLINES.

Direct participants in any Clearing System by submission of Electronic Voting Instructions authorise such Clearing System to disclose their identity to the Issuer, the Solicitation Agents, the Paying Agents and the Tabulation Agent.

BEFORE MAKING ANY DECISIONS IN RESPECT OF THE PROPOSAL NOTEHOLDERS SHOULD CAREFULLY CONSIDER ALL OF THE INFORMATION CONTAINED IN THIS MEMORANDUM.

The distribution of this Memorandum may be restricted by law in certain jurisdictions. None of the Issuer, the Solicitation Agents, the Paying Agents, the Tabulation Agent or any other person represents that this Memorandum may be lawfully distributed in compliance with any applicable registration or other requirements in any jurisdiction, or pursuant to an exemption thereunder, or assumes any responsibility for facilitating any such distribution. Persons into whose possession this Memorandum comes are required by the Issuer, the Solicitation Agents, the Paying Agents and the Tabulation Agent to inform themselves about, and to observe, any such restrictions. None of the Issuer, the Solicitation Agents, the Paying Agents or the Tabulation Agent will incur any liability for the failure of any person or persons to comply with the provisions of any such restrictions.

Capitalised terms used herein and not otherwise defined herein are defined in “Definitions”. References in this Memorandum to a specific time are, unless otherwise indicated herein, to Central European time on the relevant day or date and references to Central European time mean Central European time or, prior to 27 October 2019, Central European Summer time. Terms used in this Memorandum that are not otherwise defined herein have the meanings set forth in the Conditions.

Questions relating to the terms of the Consent Solicitation and requests for additional copies of this Memorandum may be directed to the Solicitation Agents or the Tabulation Agent at the addresses and telephone numbers set forth at the end of this Memorandum. Questions or requests for assistance in connection with voting at the meeting and/or the delivery of Electronic Voting Instructions must be directed to the Tabulation Agent at the address and telephone number set forth at the end of this Memorandum.

The Issuer accepts responsibility for the information contained in this Memorandum. To the best of the knowledge and belief of the Issuer (having taken all reasonable care to ensure that such is the case), the information contained in this Memorandum is in accordance with the facts and does not omit anything likely to affect the import of such information. The Issuer has not authorised any person to give any information or to make any representation not contained in, or not consistent with, this Memorandum and, if given or made, such information or representation must not be relied upon as having been authorised by the Issuer or any other person.

The statements made in this Memorandum are made as of the date hereof and delivery of this Memorandum and the accompanying materials at any later time does not imply that the information herein or therein is correct as of any subsequent date.

None of the Solicitation Agents, the Paying Agents or the Tabulation Agent has independently verified the information contained herein. Accordingly, no representation, warranty or undertaking, express or implied,

- iii -

is made and no responsibility or liability is accepted or assumed by the Solicitation Agents, the Paying Agents or the Tabulation Agent as to the accuracy or completeness of the information contained in this Memorandum or any other information provided by the Issuer in connection with the Consent Solicitation and none of the Solicitation Agents, the Paying Agents or the Tabulation Agent accepts any responsibility for any act or omission of the Issuer or any other person in connection with the Consent Solicitation.

This Memorandum is issued and directed only to the Noteholders and no other person shall be, or is entitled to rely or act on, or be able to act on, its content.

All references in this Memorandum to “euro”, “EUR” and “€” are to the currency introduced at the start of the third stage of European Economic and Monetary Union pursuant to the Treaty establishing the European Community, as amended.

Notes in respect of which Electronic Voting Instructions have been delivered will be blocked in an account with the relevant Clearing System and may not be traded during the period beginning at the time at which the Noteholder delivers, or instructs the Accountholder through which it holds such Notes to deliver, such Electronic Voting Instructions to the relevant Clearing System and ending on the earliest to occur of (a) the date of a valid revocation of such Electronic Voting Instructions (in the limited circumstances as permitted herein), (b) the date on which the Consent Solicitation is terminated or withdrawn, (c) the date of the relevant Meeting in the event that the relevant Extraordinary Resolution is rejected and (d) the Settlement Date. See “Voting and Quorum - Blocking of Accounts” below. The delivery of Electronic Voting Instructions will not further restrict the transferability of the Notes.

The Solicitation Agents may, to the extent permitted by applicable law, have or hold a position in the Notes and the Solicitation Agents may, to the extent permitted by applicable law, make or continue to make a market in, or vote in respect of, or act as principal in any transactions in, or relating to, or otherwise act in relation to, the Notes.

The Solicitation Agents are acting exclusively for the Issuer and nobody else in relation to the Proposal and will not be responsible to anyone other than the Issuer for providing the protections afforded to their customers or for giving advice or other investment services in relation to the Proposal.

NOTEHOLDERS MUST MAKE THEIR OWN DECISION WITH REGARD TO GIVING ELECTRONIC VOTING INSTRUCTIONS IN RESPECT OF THE RELEVANT EXTRAORDINARY RESOLUTION. NONE OF THE ISSUER, THE SOLICITATION AGENTS, THE PAYING AGENTS OR THE TABULATION AGENT MAKES ANY RECOMMENDATION IN CONNECTION WITH THE CONSENT SOLICITATION. NONE OF THE ISSUER, THE SOLICITATION AGENTS, THE PAYING AGENTS OR THE TABULATION AGENT EXPRESSES ANY VIEWS AS TO THE MERITS OF THE PROPOSAL OR THE EXTRAORDINARY RESOLUTIONS SET OUT IN THE NOTICES OF MEETINGS.

EACH PERSON RECEIVING THIS MEMORANDUM ACKNOWLEDGES THAT SUCH PERSON HAS NOT RELIED ON THE ISSUER, THE SOLICITATION AGENTS, THE PAYING AGENTS OR THE TABULATION AGENT IN CONNECTION WITH ITS DECISION ON HOW TO VOTE IN RELATION TO THE RELEVANT EXTRAORDINARY RESOLUTION. NOTEHOLDERS SHOULD CONSULT WITH THEIR BROKER, FINANCIAL ADVISER, LEGAL COUNSEL OR OTHER ADVISERS REGARDING THE TAX, LEGAL AND OTHER IMPLICATIONS OF THE CONSENT SOLICITATION.

- iv -

IMPORTANT NOTICE TO NOTEHOLDERS

A Noteholder may communicate Electronic Voting Instructions via the relevant Clearing System to the Tabulation Agent as to how it wishes the votes in respect of the Note(s) beneficially owned by it to be cast at a Meeting.

The Clearing Systems will require Electronic Voting Instructions with respect to the relevant Extraordinary Resolution from Noteholders who are their Accountholders sufficiently in advance of the relevant Fee Instruction Deadline, so that such Electronic Voting Instructions may be communicated to the Tabulation Agent prior to the stated deadline.

Noteholders whose Notes are held on their behalf by a broker, dealer, commercial bank, custodian, trust company or Accountholder must contact and request such broker, dealer, commercial bank, custodian, trust company or Accountholder to effect the relevant Electronic Voting Instructions on their behalf sufficiently in advance of the relevant Fee Instruction Deadline in order for such Electronic Voting Instructions to be delivered to the relevant Clearing System in accordance with any deadlines they may set and in time for transmission to the Tabulation Agent prior to the stated deadline.

Noteholders must provide their Electronic Voting Instructions by transmitting them or procuring their transmission to the relevant Clearing System. A Noteholder may:

| (i) | approve the relevant Extraordinary Resolution by voting or communicating voting instructions by the relevant Fee Instruction Deadline in favour of such Extraordinary Resolution; or |

| (ii) | reject the relevant Extraordinary Resolution by voting, or communicating voting instructions by the relevant Fee Instruction Deadline, against such Extraordinary Resolution, or |

| (iii) | obtain a voting certificate permitting the holder thereof to attend and vote in person at the relevant Meeting; or |

| (iv) | abstain from voting action. |

Voting instructions must be given to the Tabulation Agent by delivery of an Electronic Voting Instruction or otherwise in accordance with the usual procedures of the Clearing Systems. (See “The Solicitation” and “Voting and Quorum” below.) If an Extraordinary Resolution is passed at a Meeting in respect of a Series of Notes, each Noteholder of such Notes will be bound by the Extraordinary Resolution, whether or not such Noteholder was present at such Meeting and whether or not such Noteholder voted in respect of, or in favour of, such Extraordinary Resolution.

The Issuer is submitting the Proposal to the holders of each Series of Notes. The Proposal is submitted separately in respect of each Series of Notes. The passing of an Extraordinary Resolution in respect of one Series of Notes is not conditional upon the passing of an Extraordinary Resolution in respect of the other Series of Notes.

Assuming the passing of an Extraordinary Resolution, the Proposal will be binding on all the holders of that Series of Notes to which the Extraordinary Resolution relates, including those Noteholders who do not accept the Proposal.

- v -

CONTENTS

| Page | ||||

| SUMMARY |

1 | |||

| DOCUMENTS AVAILABLE FOR INSPECTION AND ADDITIONAL INFORMATION |

5 | |||

| DEFINITIONS |

6 | |||

| EXPECTED TIMETABLE OF EVENTS |

12 | |||

| CERTAIN SIGNIFICANT CONSIDERATIONS |

14 | |||

| BACKGROUND TO SOLICITATION |

19 | |||

| TERMS OF THE PROPOSAL |

32 | |||

| OUTSTANDING NOTES |

33 | |||

| THE SOLICITATION |

34 | |||

| VOTING AND QUORUM |

39 | |||

| TAX CONSEQUENCES |

42 | |||

| GENERAL/CONTACT DETAILS |

43 | |||

| APPENDIX 1: DEMERGER PLAN |

45 | |||

| APPENDIX 2: NOTICES OF MEETINGS |

69 | |||

| APPENDIX 3: UNAUDITED PRO FORMA FINANCIAL INFORMATION |

87 | |||

SUMMARY

The following summary is provided solely for the convenience of Noteholders. This summary is not intended to be complete and is qualified in its entirety by the more detailed information contained elsewhere in this Memorandum, including under the heading “The Consent Solicitation”.

The Consent Solicitation

The Issuer is soliciting the consent of the Noteholders of each Series of Notes, by way of separate Extraordinary Resolutions, to the Proposal sanctioning (a) the Substitution, (b) the waiver and authorisation of any breach or any alleged breach of certain of the Conditions as may be caused by, or arise in respect of, the proposed Demerger and (c) certain waivers in respect of certain statutory rights that such Noteholders may have under Finnish law as may be caused by, or arise in respect of, the proposed Demerger, each as further described herein, in exchange for an Instruction Fee as described herein.

In particular, under Finnish law, creditors of a demerging entity have the right to (a) object to the demerger pursuant to Chapter 17, Section 6 of the Finnish Companies Act and (b) to make claims against the Issuer after the Effective Date on the basis of any actual or alleged Secondary Demerger Liability with respect to the Notes.

For each Series of Notes, a Meeting of the Noteholders of such Series is being convened for the purpose of obtaining their consent to the Proposal.

Among other things, the Issuer is requesting that the Noteholders of each Series of Notes sanction:

| 1. |

| (a) | the substitution of the New Issuer in place of the Issuer as the issuer of the Notes on the Effective Date; |

| (b) | the irrevocable and unconditional waiver of any and all of the rights that they may have to make claims against the Issuer (in its capacity as issuer of the Notes) from the Effective Date; |

| (c) | an acknowledgement and agreement that, with effect from the Effective Date, the Issuer shall not have any obligations or liability whatsoever towards the Noteholders under or in relation to such Series of Notes; and |

| (d) | all other modifications to the Conditions, the relevant Deed of Covenant or the relevant Agency Agreement as are necessary for or expedient to effect the substitution set out in paragraph (a) above; |

| 2. |

| (a) | the irrevocable and unconditional waiver and authorisation of any breach or any alleged breach whether caused by the threat of, being in anticipation of, being in connection with, or being as a result of, the proposed Demerger, of the following Conditions of each such Series: |

| (i) | Condition 13(c)(ii) (Cross-default of Issuer or Material Subsidiary) of the 2022 Notes and Condition 12(c)(ii) (Cross-default of Issuer or Material Subsidiary) of the 2024 Notes, as the case may be; and |

| (ii) | Condition 13(f)(iv) (Insolvency etc.) of the 2022 Notes and Condition 12(f)(iv) (Insolvency etc.) of the 2024 Notes, as the case may be (insofar as the Demerger contemplates the cessation of a substantial part of the Issuer’s business); |

| (b) | the irrevocable and unconditional waiver and authorisation of any breach or any alleged breach whatsoever of any other obligation under or in respect of the Notes which may be breached or may be capable of being breached by the threat of, in anticipation of, in connection with, or as a result, of the proposed Demerger; |

- 1 -

| (c) | that the Conditions shall be deemed amended accordingly; and |

| (d) | all other modifications to the Conditions as are necessary for or expedient to effect the waivers and authorisation set out above in paragraphs (a) and (b) above and the consummation of the Demerger; and |

| 3. |

| (a) | the irrevocable and unconditional waiver of their statutory rights to object to the Demerger pursuant to Chapter 17, Section 6 of the Finnish Companies Act; and |

| (b) | the irrevocable and unconditional waiver of any and all of the rights that they may have to make claims against the Issuer from the Effective Date on the basis of any actual or alleged Secondary Demerger Liability with respect to the Notes. |

The Substitution will be implemented by a Deed Poll (as defined below), subject to satisfaction of the Implementation Conditions (as defined below).

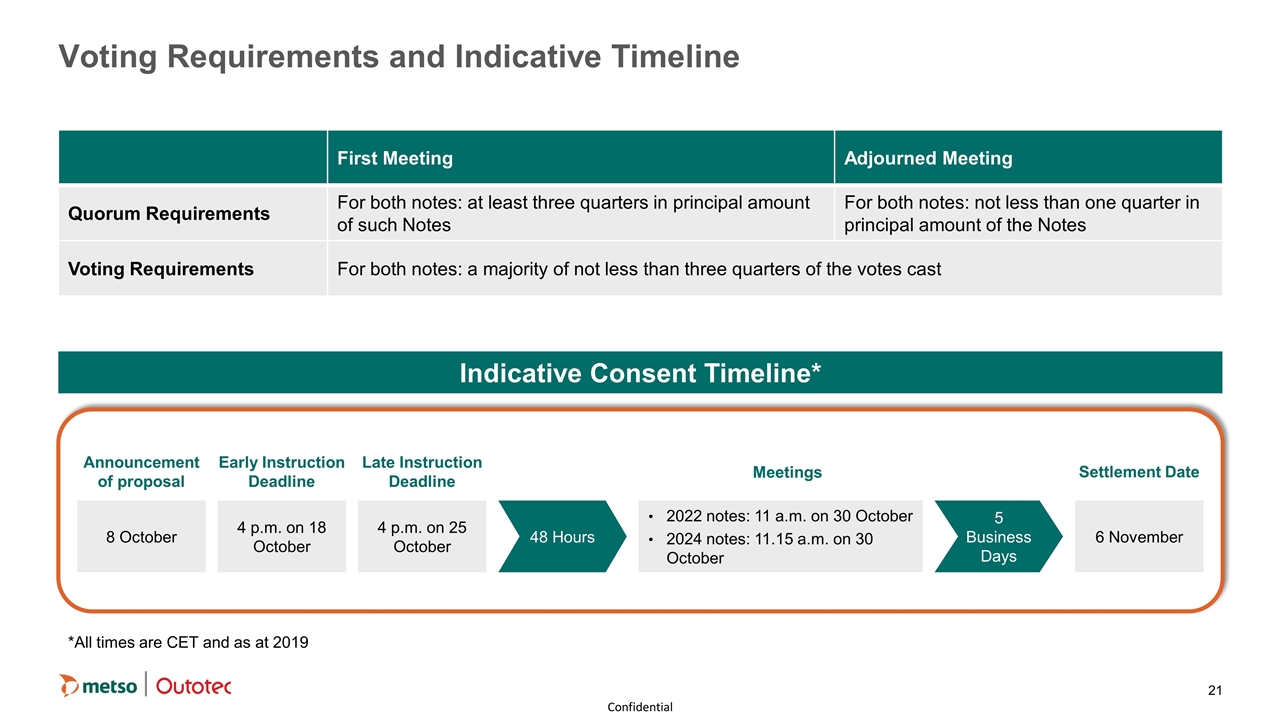

Quorum

The quorum required at a Meeting of either Series of Notes shall be two or more persons present in person holding Notes or voting certificates or being proxies and holding or representing in the aggregate not less than three quarters in principal amount of the Notes of the Series in respect of which the Meeting is convened for the time being outstanding.

Pursuant to paragraph 8 (Quorum) of Schedule 4 (Provisions for Meetings of the Holders of Notes) to the relevant Agency Agreement, so long as at least three quarters in principal amount of such Notes of the relevant Series for the time being outstanding is represented by a Global Note, the holder (or the proxy of the holder) of the Global Note shall be treated as two persons for the purposes of any quorum requirements of the relevant Meeting.

If within 15 minutes after the time fixed for either Meeting a quorum is not present, the relevant Meeting shall stand adjourned to such date, being not less than 14 days nor more than 42 days later, and to such place as the chairman may decide.

At least 10 days’ notice of an adjourned Meeting shall be given, in the same manner as for the original Meeting. Notice of the adjourned meeting shall state the quorum required at the adjourned meeting.

At any adjourned Meeting, two or more persons present in person holding Notes or voting certificates or being proxies and holding or representing in the aggregate not less than one quarter in principal amount of the Notes of the Series in respect of which the Meeting is convened for the time being outstanding shall form a quorum and may pass any resolution and decide upon all matters which could properly have been dealt with at the original Meeting had a quorum been present at such meeting.

If the Meeting is adjourned for lack of quorum, it is the intention of the Issuer to arrange for a notice convening the adjourned Meeting to be given as soon as reasonably practicable (in accordance with the Meeting Provisions (as defined herein)) following such adjournment.

Electronic Voting Instructions given and voting certificates obtained by Noteholders in respect of either Meeting shall remain valid for such adjourned Meeting unless, in the case of Electronic Voting Instructions, revoked or amended in the limited circumstances permitted herein or, in the case of voting certificates, surrendered not less than 48 hours (as defined in the relevant Agency Agreement) before the time appointed for any adjourned meeting.

Required majority

To be passed at a Meeting, an Extraordinary Resolution requires a majority of not less than three quarters of the votes cast. If passed, an Extraordinary Resolution shall be binding on all the Noteholders of the relevant Series, whether or not present at the relevant Meeting, and each of them shall be bound to give effect to it accordingly.

- 2 -

Instruction Fees and Fee Instruction Deadlines

If an Extraordinary Resolution is duly passed, the Issuer shall pay the Early Instruction Fee to those Noteholders of the relevant Series who have delivered Electronic Voting Instructions voting in favour of the relevant Extraordinary Resolution prior to the Early Instruction Deadline (and have not subsequently revoked or amended such instructions in the limited circumstances as permitted herein). The Early Instruction Fee shall be paid to such Noteholders’ cash accounts through the relevant Clearing System on the Settlement Date, subject to the relevant Extraordinary Resolution having duly been passed.

If an Extraordinary Resolution is duly passed, the Issuer shall pay the Basic Instruction Fee to those Noteholders of the relevant Series who have delivered Electronic Voting Instructions voting in favour of the relevant Extraordinary Resolution on or after the Early Instruction Deadline but prior to the Late Instruction Deadline (and have not subsequently revoked or amended such instructions in the limited circumstances as permitted herein). The Basic Instruction Fee shall be paid to such Noteholders’ cash accounts through the relevant Clearing System on the Settlement Date, subject to the relevant Extraordinary Resolution having duly been passed.

Noteholders who deliver voting instructions other than by way of Electronic Voting Instructions or who deliver Electronic Voting Instructions voting against the relevant Extraordinary Resolution and/or deliver Electronic Voting Instructions after the relevant Fee Instruction Deadline will not be eligible to receive the relevant Instruction Fee. Noteholders who attend the relevant Meeting(s) in person or by proxy will not be eligible to receive the relevant Instruction Fee.

Noteholders should note that Electronic Voting Instructions given in respect of any Meeting shall remain valid for any such adjourned Meeting (unless revoked or amended in the limited circumstances as permitted herein prior to the Adjournment Instruction Deadline).

If a Meeting is adjourned, Noteholders who have not already submitted or delivered Electronic Voting Instructions prior to the Late Instruction Deadline may submit or deliver Electronic Voting Instructions during the period commencing at the conclusion of the original Meeting and ending on the Adjournment Instruction Deadline (but will not, for the avoidance of doubt, be entitled to any Instruction Fee). During the period commencing on the Adjournment Instruction Deadline and ending at the conclusion of the adjourned Meeting, Noteholders will not be able to submit or deliver Electronic Voting Instructions.

Noteholders who submit or deliver their Electronic Voting Instructions after the Late Instruction Deadline will not be eligible to receive an Instruction Fee and will not be eligible to vote.

Amendment and termination of the Consent Solicitation and the Proposal

The Issuer reserves the right, at its sole discretion subject to the terms of the Notes, the Agency Agreements and to applicable law, at any time on or prior to the Late Instruction Deadline to terminate, extend, modify, amend, vary or waive the terms of the Proposal or the Consent Solicitation, including the form or amount of any Instruction Fee, as further described herein (see “The Solicitation – Amendment and Termination of the Consent Solicitation and the Proposal”).

Voting procedures

Voting instructions may only be delivered by Accountholders in accordance with the customary procedures of the Clearing Systems. Noteholders who are not Accountholders must arrange through their broker, dealer, bank, custodian, trust company or other nominee to contact the Accountholder through which they hold their Notes in the relevant Clearing System so that Electronic Voting Instructions may be delivered in respect of such Notes.

NOTEHOLDERS SHOULD CONTACT THEIR BROKER, DEALER, COMMERCIAL BANK, CUSTODIAN, TRUST COMPANY OR ACCOUNTHOLDER, AS THE CASE MAY BE, TO CONFIRM THE DEADLINE FOR RECEIPT OF THEIR ELECTRONIC VOTING INSTRUCTIONS SO THAT SUCH ELECTRONIC VOTING INSTRUCTIONS MAY BE PROCESSED AND DELIVERED TO THE TABULATION AGENT IN A TIMELY MANNER AND IN ACCORDANCE WITH THE RELEVANT DEADLINES.

- 3 -

Revocation of Electronic Voting Instructions

Noteholders who submit or deliver Electronic Voting Instructions voting in favour of an Extraordinary Resolution will not be able to revoke or amend such instructions at any time except in the limited circumstances described herein. See “The Solicitation – Revocation Rights”.

An Electronic Voting Instruction previously submitted may only be validly revoked by submitting a valid Revocation Instruction.

Any Noteholder who revokes their Electronic Voting Instruction (and who does not subsequently validly re-submit an Electronic Voting Instruction in accordance with the procedures set out in the Memorandum) or otherwise makes arrangements to abstain from voting in respect of the relevant Extraordinary Resolution will not be entitled to receive an Instruction Fee.

Only the Accountholder is entitled to revoke or amend an Electronic Voting Instruction previously given. A beneficial owner of Notes held through the Clearing Systems must arrange with the Accountholder to submit or deliver on its behalf a valid Revocation Instruction. Following such revocation, the Tabulation Agent will advise the relevant Clearing System that the relevant Notes may be unblocked.

- 4 -

DOCUMENTS AVAILABLE FOR INSPECTION AND ADDITIONAL INFORMATION

This Memorandum contains important information which Noteholders should read carefully before making any decision with respect to giving Electronic Voting Instructions.

The following documents are available for inspection and/or collection, as indicated below, at any time during normal business hours on any weekday (Saturdays, Sundays and bank and other public holidays excepted) prior to and during the Meeting, at the office of the Issuer at Töölönlahdenkatu 2, FI-00100 Helsinki, Finland and at the office of the Tabulation Agent, Lucid Issuer Services Limited at Tankerton Works, 12 Argyle Walk, London WC1H 8HA, United Kingdom:

| • | this Memorandum; |

| • | the Agency Agreements; |

| • | the Notice of Meeting for each Series of Notes; and |

| • | the Deed Poll. |

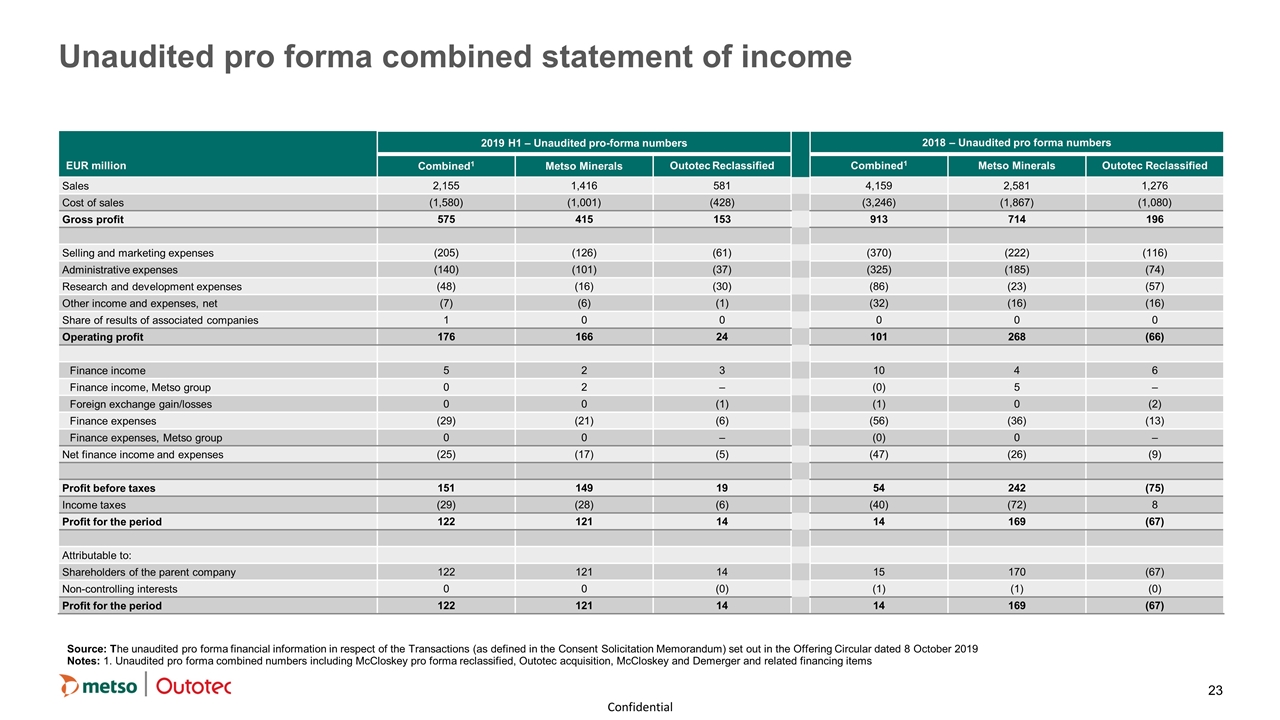

In addition, an offering circular dated 7 October 2019 (the “Offering Circular”) has been prepared in connection with the Demerger and provides financial and business information in respect of the Issuer and the New Issuer, as well as risk factors related to the combined business, demerger and related matters, information regarding the Demerger, governance and management of the New Issuer, and financial statements for the New Issuer. The offering circular is available at www.metso.com/news-metso-outotec-neles/ and may be accessed by Noteholders. Alternatively, copies of the Offering Circular can be requested by Noteholders by contacting the Issuer using the contact details provided on page 43 of this Memorandum. Noteholders are urged to review the relevant portions of the offering circular in connection with this Consent Solicitation but should note it was not prepared for purposes of the Consent Solicitation. The unaudited pro forma financial information included in the Offering Circular (the “Unaudited Pro Forma Financial Information”) is included in this Memorandum as Appendix 3 (Unaudited Pro Forma Financial Information). The Offering Circular includes as Annex B the independent auditor’s assurance report from PricewaterhouseCoopers Oy on the compilation of the Unaudited Pro Forma Financial Information. For the avoidance of doubt, the independent auditor’s assurance report issued by PricewaterhouseCoopers Oy on the compilation of the Unaudited Pro Forma Financial Information was prepared solely for the purpose of including it in the Offering Circular prepared by the New Issuer in accordance with Prospectus Regulation (EU) 2017/1129 and Commission Delegated Regulation (EU) 2019/980. Noteholders should not rely on said report or use it for any decision making purposes. Further, it should be noted that the work by PricewaterhouseCoopers Oy relating to said report has not been carried out in accordance with auditing standards or other standards and practices generally accepted in the United States of America or auditing standards of the Public Company Accounting Oversight Board (United States).

- 5 -

DEFINITIONS

In this Memorandum, the following capitalised terms shall, unless otherwise defined or the context otherwise requires, have the meanings ascribed to them below:

| 2022 Notes | Series 22 EUR 100,000,000 Fixed Rate Notes due 27 June 2022 (ISIN: XS0795500437; Common Code: 079550043). | |

| 2024 Notes | Series 24 EUR 300,000,000 1.125 per cent. Senior Notes due 13 June 2024 (ISIN: XS1626574708; Common Code: 162657470). | |

| Accountholder | Each person who is shown in the records of Euroclear or Clearstream, Luxembourg as a holder of outstanding Notes of the relevant Series. | |

| Adjournment Instruction Deadline | Not less than 48 hours (as defined in the relevant Agency Agreement) prior to the time and date fixed for any adjourned Meeting. | |

| Agency Agreements | The amended and restated fiscal agency agreement dated 4 April 2012 (in respect of the 2022 Notes) and the amended and restated fiscal agency agreement dated 5 April 2017 (in respect of the 2024 Notes), each between the Issuer, the Fiscal Agent and the other Paying Agents. | |

| Backup and Term Loan Facilities Agreement | A EUR 1.55 billion backup and term loan facilities agreement entered into by and between the Issuer and Nordea Bank Abp on 4 July 2019. | |

| Basic Instruction Fee | If Electronic Voting Instructions voting in favour of an Extraordinary Resolution in respect of a Series of Notes are received on or after the Early Instruction Deadline but prior to the Late Instruction Deadline (and not subsequently revoked or amended in the limited circumstances as permitted herein), subject to the passing of the relevant Extraordinary Resolution, a cash payment by the Issuer to each Noteholder of such Series who has submitted or delivered such Electronic Voting Instructions voting in favour of the relevant Extraordinary Resolution of an amount equal to 0.10 per cent. of the principal amount of the Notes which are the subject of the Electronic Voting Instruction. | |

| Beneficial Owner | Has the meaning set out in “Voting and Quorum – Meeting Provisions”. | |

| Business Day | a TARGET Settlement Day. | |

| Clearing Systems | The clearing and settlement systems operated by Euroclear and Clearstream, Luxembourg, respectively. | |

| Clearstream, Luxembourg | Clearstream Banking S.A. | |

| Combination Agreement | The agreement concerning the combination of the business operations of the Companies Participating in the Demerger through a partial demerger of the Issuer with the effect that the Minerals Business shall transfer, without liquidation of the Issuer, to the New Issuer in accordance with the Demerger Plan entered into by the Companies Participating in the Demerger on 4 July 2019. | |

- 6 -

| Companies Participating in the Demerger | The Issuer and the New Issuer. | |

| Conditions | Means, (i) in respect of the 2022 Notes, the terms and conditions set out in the base prospectus dated 4 April 2012 as completed by the final terms dated 27 June 2012 and 21 August 2012 and (ii) in respect of the 2024 Notes, the terms and conditions set out in the base prospectus dated 5 April 2017 as completed by the final terms dated 9 June 2017. | |

| Deed Poll | The deed poll to be dated on or around the Effective Date relating to the Notes to be entered into by the New Issuer to give effect to and implement the Substitution, a draft of which is to be tabled at the Meetings. | |

| Deed of Covenant | Means, (i) in respect of the 2022 Notes, the deed of covenant dated 4 April 2012 and made by the Issuer and (ii) in respect of the 2024 Notes, the deed of covenant dated 5 April 2017 and made by the Issuer. | |

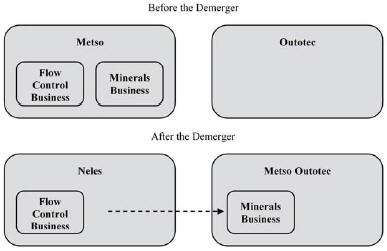

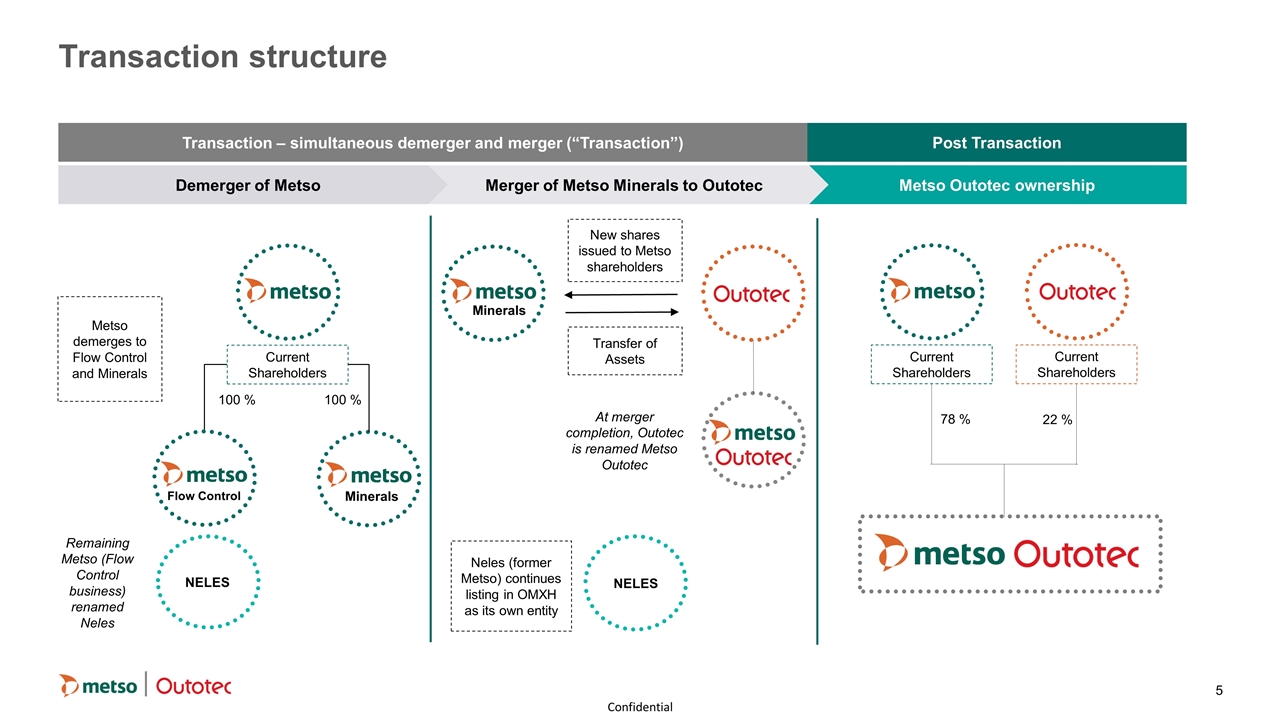

| Demerger | The partial demerger of the Issuer with the effect that the Minerals Business, that is all such assets, rights, debts and liabilities of the Issuer that relate to, or primarily serve, the Minerals Business shall transfer, without liquidation of the Issuer, to the New Issuer in the manner set forth in the Demerger Plan, as more fully described in the “Background to Solicitation” section of this Memorandum. | |

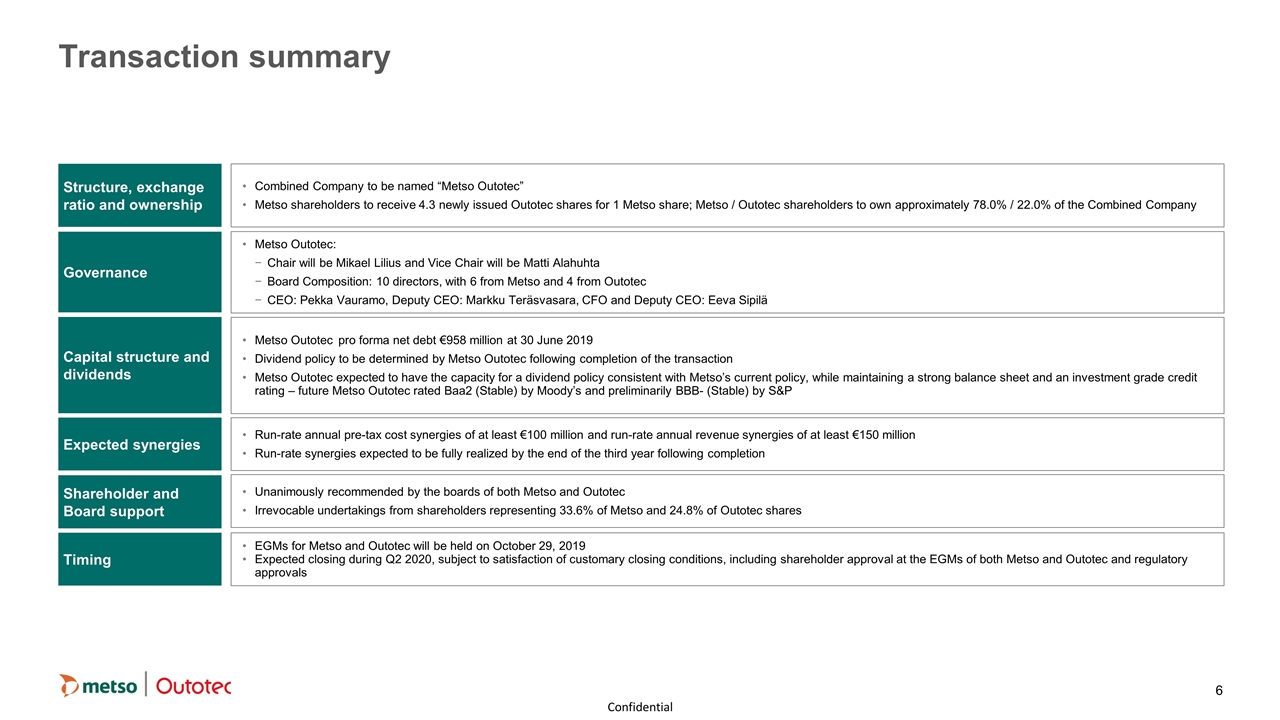

| Demerger Consideration | The 4.3 shares issued by the New Issuer for each share owned in the Issuer that the shareholders of the Issuer shall receive as demerger consideration. No Demerger Consideration shall be issued in respect of any treasury shares held by the Issuer. As at the date of the Demerger Plan, the total number of shares in the New Issuer to be issued as Demerger Consideration would, therefore, be 645,327,522 shares. | |

| Demerger Plan | The demerger plan dated 4 July 2019 relating to the Demerger, a copy of which, including appendices, is set out in Appendix 1 (Demerger Plan) to this Memorandum (as such demerger plan may be amended, restated and/or supplemented from time to time). | |

| Demerging Company | The Issuer. | |

| Early Instruction Deadline | 4 p.m. (Central European time) on 18 October 2019. | |

| Early Instruction Fee | If Electronic Voting Instructions voting in favour of an Extraordinary Resolution in respect of a Series of Notes are received prior to the Early Instruction Deadline (and not subsequently revoked or amended in the limited circumstances as permitted herein), subject to the passing of the relevant Extraordinary Resolution, a cash payment by the Issuer to each Noteholder of such Series who has submitted or delivered such Electronic Voting Instructions voting in favour of the relevant Extraordinary Resolution of an amount equal to 0.50 per cent. of the principal amount of the Notes which are the subject of the Electronic Voting Instruction. | |

| Effective Date | The date of registration of the completion of the Demerger with the Finnish Trade Register, which is expected to take place in the second quarter of 2020, subject to the approval of the | |

- 7 -

| transaction by the extraordinary shareholders’ meetings of both the Issuer and the New Issuer, the statutory creditor hearing process and receipt of all required regulatory and other approvals, including competition clearances, as described in more detail in the ”Background to the Solicitation – Demerger Plan – Conditions for the completion of the Demerger” section of this Memorandum. | ||

| Electronic Voting Instruction | The Electronic Voting Instruction which must be delivered by each Accountholder in Euroclear or Clearstream, Luxembourg through Euroclear or Clearstream, Luxembourg to the Tabulation Agent (on behalf of a Paying Agent), instructing such Paying Agent under the relevant Agency Agreement, that the vote(s) attributable to the Notes the subject of such Electronic Voting Instruction should be cast in a particular way in relation to the relevant Extraordinary Resolution, which instructions shall form part of a block voting instruction to be issued by such Paying Agent, in such capacity, appointing the Tabulation Agent as proxy in relation to the relevant Meeting. | |

| Euroclear | Euroclear Bank SA/NV. | |

| Extraordinary Resolution | An Extraordinary Resolution to be proposed and considered at a Meeting. | |

| Fee Instruction Deadline | The Early Instruction Deadline or the Late Instruction Deadline, as the case may be. | |

| Finnish Accounting Act | Finnish Accounting Act (1336/1997, as amended). | |

| Finnish Companies Act | Finnish Companies Act (624/2006, as amended). | |

| Finnish Trade Register | The Finnish Trade Register maintained by the Finnish Patent and Registration Office. | |

| Fiscal Agent | Citibank, N.A. | |

| Flow Control Business | The flow control businesses of the Issuer as specified in more detail in the Demerger Plan that remains with the Issuer pursuant to the Demerger Plan. | |

| Global Note | Means, in respect of each Series of Notes, the permanent global bearer note executed by the Issuer on the issue date of the relevant Series and authenticated by the Fiscal Agent. | |

| IFRS | International Financial Reporting Standards, as adopted by the European Union. | |

| Instruction Fee | The Early Instruction Fee or the Basic Instruction Fee, as the case may be. | |

| Issuer | Metso Corporation (or Neles Corporation following renaming after the Effective Date, as the case may be). | |

| Implementation Conditions | Has the meaning set out in “The Solicitation – Conditions to Implementation”. | |

| Late Instruction Deadline | 4 p.m. (Central European time) on 25 October 2019. | |

| Meetings | Each Meeting of the Noteholders of a Series of Notes to be held on 30 October 2019 at the office of Clifford Chance LLP, 10 Upper Bank Street, London E14 5JJ, United Kingdom for the purposes of considering and, if thought fit, the passing of the relevant Extraordinary Resolution. | |

- 8 -

| Minerals Business | The minerals business of the Issuer, as specified in more detail in the Demerger Plan, that shall transfer to the New Issuer pursuant to the Demerger Plan. | |

| Nasdaq Helsinki | Nasdaq Helsinki Ltd. | |

| New Issuer | Outotec Oyj (or Metso Outotec Corporation following renaming after the Effective Date, as the case may be). | |

| New Revolving Credit Facility Agreement | A EUR 600 million multicurrency revolving credit facility agreement entered into by and among the Issuer, Nordea Bank Abp, Banco Bilbao Vizcaya Argentaria S.A., London Branch, BNP Paribas S.A., Citigroup Global Markets Limited, Commerzbank Aktiengesellschaft, HSBC France, OP Corporate Bank plc, Scotiabank (Ireland) Designated Activity Company, Skandinaviska Enskilda Banken AB (publ) and Standard Chartered Bank and which will be available to the New Issuer after the Effective Date. | |

| Noteholder | (i) Each Accountholder; and | |

| (ii) each beneficial owner of outstanding Notes of the relevant Series holding such Notes, directly or indirectly, in an account in the name of an Accountholder acting on such beneficial owner’s behalf, | ||

| except that for the purposes of the payment of any Instruction Fee, to the extent the beneficial owner of the relevant Notes is not an Accountholder, such Instruction Fee will only be paid to the relevant Accountholder and the payment of the Instruction Fee to such Accountholder will satisfy the obligations of the Issuer in respect of such Instruction Fee. | ||

| Notes | The 2022 Notes and the 2024 Notes. | |

| Notice of Meeting | Each notice to the Noteholders of a Series of Notes dated 8 October 2019 convening a Meeting of the holders of the Notes of such Series, copies of which are set out in Appendix 2 (Notices of Meetings) to this Memorandum. | |

| Paying Agents | The Fiscal Agent and the other paying agents party to the Agency Agreements. | |

| Programme | The €1,500,000,000 euro medium term note programme of the Issuer. | |

| Proposal | In respect of each Series, the invitation by the Issuer to Noteholders to sanction, by Extraordinary Resolution, (a) the Substitution, (b) the waiver and authorisation of any breach or any alleged breach of certain of the Conditions of each series of the Notes as may be caused by, or arise in respect of, the proposed Demerger and (c) certain waivers in respect of certain statutory rights that such Noteholders may have under Finnish law as may be caused by, or arise in respect of, the proposed Demerger, in exchange for an Instruction Fee, as more fully described in the “Terms of the Proposal” section of this Memorandum. | |

- 9 -

| Receiving Company | The New Issuer. | |

| Revocation Instruction |

An electronic instruction sent by an Accountholder on the instruction of a beneficial owner of a particular principal amount of the Notes in respect of which an Electronic Voting Instruction was previously submitted, withdrawing such Electronic Voting Instruction and sent to the relevant Clearing System. To be valid the instruction must be: in a format customarily used by the relevant Clearing System; be submitted or delivered in accordance with the procedures of, and within the time limits specified by, the relevant Clearing System; specify the Notes to which the original Electronic Voting Instruction related; the securities account in which such Notes are credited; and any other information required by the relevant Clearing System. | |

| Sanctions Restricted Person | An individual or an entity (a “Person”):

(i) that is, or is directly or indirectly, owned or controlled by a Person that is, described or designated in (a) the most current “Specially Designated Nationals and Blocked Persons” list (which as of the date hereof can be found at: https://www.treasury.gov/ofac/downloads/sdnlist.pdf) or (b) the Foreign Sanctions Evaders List (which as of the date hereof can be found at: https://www.treasury.gov/ofac/downloads/fse/fselist.pdf) or (c) the most current “Consolidated list of persons, groups and entities subject to EU financial sanctions” (which as of the date hereof can be found at: https://data.europa.eu /euodp/en/data/dataset/consolidated-list-of-persons-groups-and-entities-subject-to-eu-financial-sanctions); or

(ii) that is otherwise the subject or target of any sanctions administered or enforced by any Sanctions Authority, other than solely by virtue of their inclusion in: (a) the most current “Sectoral Sanctions Identifications” list (which as of the date hereof can be found at: https://www.treasury.gov/resource-center/sanctions/SDN-List/Pages/ssi_list.aspx) (the “SSI List”), (b) Annexes III, IV, V and VI of Council Regulation No.833/2014, as amended by Council Regulation No.960/2014 (the “EU Annexes”), or (c) any other list maintained by a Sanctions Authority, with similar effect to the SSI List or the EU Annexes. | |

| Secondary Demerger Liability | Has the meaning set out in the “Background to Solicitation – Demerger Plan – Secondary Demerger Liability” section of this Memorandum. | |

| Series | The 2022 Notes and/or the 2024 Notes, as the case may be. | |

| Settlement Date | Subject to an Extraordinary Resolution in respect of a Series of Notes having been passed, a date not later than the fifth Business Day following the passing of such Extraordinary Resolution. | |

- 10 -

| Substitution | The substitution of the New Issuer in place of the Issuer as the issuer of the Notes on the Effective Date, as more fully described in the ”Terms of the Proposal” section of this Memorandum. | |

| Solicitation Agents | Citigroup Global Markets Limited and Nordea Bank Abp. | |

| Tabulation Agent | Lucid Issuer Services Limited. | |

| TARGET2 | The Trans-European Automated Real-Time Gross Settlement Express Transfer payment system which utilises a single shared platform and which was launched on 19 November 2007. | |

| TARGET Settlement Day | Any day on which TARGET2 is open for the settlement of payments in euro. | |

- 11 -

EXPECTED TIMETABLE OF EVENTS

The times stated below refer to Central European time on the relevant date. Although it is intended that each Meeting in respect of each Series of Notes will take place pursuant to the same timetable set out below, the following should be noted: (a) this timetable assumes that in respect of each Series of Notes (i) a Meeting is quorate on the date on which it is first convened and, accordingly, no adjourned Meetings are required and (ii) new meetings are not convened in respect of such Series of Notes, (b) the relevant Fee Instruction Deadline for each Meeting, among others, can be amended under the terms of the Proposal and (c) all of the dates set out below are subject to change to comply with any earlier deadlines that may be set by the Clearing Systems or any intermediary.

Noteholders holding Notes in the Clearing Systems should take steps to inform themselves of and to comply with the particular practice and policy of the relevant Clearing System. Noteholders who are not direct accountholders in the Clearing Systems should read carefully the provisions set out under “The Solicitation” and “Voting and Quorum” below.

| Event |

Date and Time | |

| Announcement of the Proposal, Notices of Meetings to be given to Noteholders of each Series of Notes and Consent Solicitation Memorandum to be made available to Noteholders from the Tabulation Agent (copies of which are obtainable, upon request, free of charge) | 8 October 2019 | |

| Early Instruction Deadline – latest time and date for receipt by the Tabulation Agent of Electronic Voting Instructions in order for Noteholders to be eligible to receive the Early Instruction Fee | 4 p.m. (Central European time) on 18 October 2019 | |

| Late Instruction Deadline – latest time and date for receipt by the Tabulation Agent of Electronic Voting Instructions in order for Noteholders to be eligible to receive the Basic Instruction Fee | 4 p.m. (Central European time) on 25 October 2019 | |

| Time and date of the Meetings | The Meeting for the 2022 Notes will start at 11 a.m. (Central European time) on 30 October 2019 and the Meeting for the 2024 Notes, will start at 11.15 a.m. (Central European time) on 30 October 2019 | |

| Notice of the results of the Meetings intended to be given to Noteholders for Series of Notes for which the Meetings were quorate | As soon as reasonably practicable following the relevant Meeting | |

| If an Extraordinary Resolution is passed at any Meeting: | ||

| Settlement Date (in respect of a Meeting that was not adjourned) for payment of Instruction Fees to Noteholders who have submitted or delivered Electronic Voting Instructions by the relevant Fee Instruction Deadline and have not (except in the limited circumstances as permitted herein) subsequently revoked or amended such instructions | 6 November 2019 | |

| If any Meeting is adjourned: | ||

| Notice of adjourned Meeting intended to be given to Noteholders | 30 October 2019 | |

- 12 -

| Event |

Date and Time | |

| Latest time and date for delivery of Electronic Voting Instructions through the Clearing Systems for adjourned Meeting | 4 p.m. (Central European time) on 8 November 2019 | |

| Earliest time and date of adjourned Meeting (if any) | 11 a.m. (Central European time) on 13 November 2019 | |

| If an Extraordinary Resolution is passed at any adjourned Meeting: | ||

| Notice of result of any adjourned Meeting to be given to Noteholders | As soon as reasonably practicable following the relevant Meeting | |

| If an Extraordinary Resolution is passed at any adjourned Meeting: | ||

| Settlement Date (in respect of any adjourned Meeting) for payment of Instruction Fees to Noteholders who have submitted or delivered Electronic Voting Instructions by the relevant Fee Instruction Deadline and have not (except in the limited circumstances as permitted herein) subsequently revoked or amended such instructions | 20 November 2019 | |

| If an Extraordinary Resolution is passed at any Meeting or any adjourned Meeting: | ||

| Effective Date on which the Demerger is effected | In the second quarter of 2020, subject to certain conditions as described in the “Background to the Solicitation – Demerger Plan – Conditions for the completion of the Demerger” section of this Memorandum | |

| If the Effective Date occurs, the date on which the Deed Poll will be executed and the Substitution will be implemented | As soon as reasonably practicable following the Effective Date | |

| Notice of the Effective Date and the execution of the Deed Poll and the implementation of the Substitution | As soon as reasonably practicable following the execution of the Deed Poll and the implementation of the Substitution | |

In respect of each Series of Notes, the above times and dates are indicative only and will depend, among other things, on timely receipt (and non-revocation) of instructions and passing the relevant Extraordinary Resolution at the relevant Meeting. If a Meeting for any Series of Notes is adjourned, the relevant times and dates set out above will be modified accordingly and will be set out in the notice convening such adjourned meeting.

NOTEHOLDERS ARE ADVISED TO CHECK WITH ANY BROKER, DEALER, BANK, CUSTODIAN, TRUST COMPANY OR OTHER TRUSTEE THROUGH WHICH THEY HOLD NOTES WHETHER SUCH BROKER, DEALER, BANK, CUSTODIAN, TRUST COMPANY OR OTHER TRUSTEE WOULD REQUIRE RECEIVING ANY NOTICE OR INSTRUCTIONS PRIOR TO THE DEADLINES SET OUT ABOVE.

- 13 -

CERTAIN SIGNIFICANT CONSIDERATIONS

You should carefully consider the risks and uncertainties described below as well as the other information appearing elsewhere in this Memorandum before making a decision whether to deliver your consent.

Certain significant considerations in respect of the Consent Solicitation

Notes held through the Clearing Systems

In relation to the delivery or revocation of Electronic Voting Instructions or obtaining voting certificates or otherwise making arrangements for the giving of voting instructions, in each case through the Clearing Systems, Noteholders holding Notes in Euroclear or Clearstream, Luxembourg should note the particular practice and policy of the relevant Clearing System, including any earlier deadlines set by such Clearing System.

Early Instruction Fee and Basic Instruction Fee

Noteholders should note that the Early Instruction Fee or the Basic Instruction Fee is payable only to a Noteholder who has delivered a valid Electronic Voting Instruction in accordance with the terms of this Memorandum before the Early Instruction Deadline (in the case of the Early Instruction Fee) or the Late Instruction Deadline (in the case of the Basic Instruction Fee), and provided that an Extraordinary Resolution is passed in respect of the Series of Notes for which the Noteholder has delivered the valid Electronic Voting Instruction. Only Accountholders may deliver valid Electronic Voting Instructions before the Early Instruction Deadline or the Late Instruction Deadline, as the case may be, and receive the Early Instruction Fee or the Basic Instruction Fee, as the case may be. Noteholders who are not Accountholders should arrange for the Accountholder through which they hold their Notes to deliver an Electronic Voting Instruction on their behalf to the relevant Clearing System and to transfer any Instruction Fee to them.

Noteholders who have not delivered or arranged for the delivery of Electronic Voting Instructions as provided above but who wish to attend and vote at the relevant Meeting or otherwise give voting instructions may do so in accordance with the voting and quorum procedures set out in the relevant Notice of Meeting. However, such holders will not be eligible to receive any Early Instruction Fee or Basic Instruction Fee. Only Noteholders who deliver, or arrange to have delivered on their behalf, valid Electronic Voting Instructions in advance of the relevant deadline will be eligible to receive an Early Instruction Fee or a Basic Instruction Fee, as the case may be.

Noteholders who do not vote in favour of the Proposal prior to the Early Instruction Deadline or the Late Instruction Deadline, as the case may be, will not be eligible to receive the Early Instruction Fee or Basic Instruction Fee even though the Proposal will be binding upon them.

Blocking of Notes

When considering whether to participate in the Consent Solicitation or submit an Electronic Voting Instruction, Noteholders should take into account that restrictions on the transfer of the Notes by Noteholders will apply from the time of submission of an Electronic Voting Instruction.

Notes in respect of which Electronic Voting Instructions have been delivered will be blocked in an account by the relevant Clearing System and may not be traded during the period beginning at the time at which the Noteholder delivers, or instructs the Accountholder through which it holds such Notes to deliver, such Electronic Voting Instructions to the relevant Clearing System and ending on the earliest to occur of (a) the date of a valid revocation of such Electronic Voting Instructions (in the limited circumstances as permitted herein), (b) the date on which the Consent Solicitation is terminated or withdrawn, (c) the date of the relevant Meeting in the event that the Extraordinary Resolution is rejected and (d) the Settlement Date; provided, however, in the case of (b) above, that, if a Paying Agent has caused a proxy to be appointed in respect of such Note(s), such Note(s) will not be released to the relevant Accountholder unless and until such Paying Agent has notified Fiscal Agent and the Issuer of the necessary revocation of or amendment to such proxy. The delivery of Electronic Voting Instructions will not further restrict the transferability of the Notes.

- 14 -

Electronic Voting Instructions in favour of the Proposal will be irrevocable

Electronic Voting Instructions in favour of the Proposal will be irrevocable except in the limited circumstances described in “The Solicitation – Revocation Rights”.

Sanctions Restricted Persons may not participate in the Consent Solicitation.

A Noteholder or a beneficial owner of the Notes who is, or who is believed by the Issuer to be, a Sanctions Restricted Person (as defined herein) may not participate in the Consent Solicitation. Such Sanctions Restricted Person will not be eligible to receive the Early Instruction Fee or the Basic Instruction Fee in any circumstances.

No assurance the Proposal will be sanctioned or implemented

Until the Issuer announces an Extraordinary Resolution has been passed in respect of a Series, no assurance can be given that the Proposal will be sanctioned in respect of such Series and until the Implementation Conditions have been satisfied (including successful completion of the Demerger on the Effective Date), no assurance can be given that the Substitution will be implemented in respect of such Series. In the event that the Proposal in respect of any Series is not sanctioned, the relevant Conditions of the Notes of such Series will not be waived as described herein and the current Conditions will continue to apply to such Series which may have an adverse consequence on the proposed Demerger.

Even if the Proposal is passed by the requisite majorities for each Series as described herein, the Substitution will only occur if the other Implementation Conditions are satisfied, in particular the completion of the Demerger. If the Demerger does not complete, the Substitution will not become effective, the Issuer will remain the issuer of the Notes and the New Issuer will have no obligations under or in connection with any of the Notes. The other matters contemplated by the Proposals will become effective immediately upon passing of the Extraordinary Resolutions.

All Noteholders of a Series of Notes are bound by the relevant Extraordinary Resolution

Noteholders should note that if the relevant Extraordinary Resolution in respect of a Series of Notes is passed it will be binding on all Noteholders of such Series, whether or not they chose to respond to the Consent Solicitation or otherwise vote at the relevant Meeting. However, the passing of an Extraordinary Resolution with respect to a particular Series of Notes will not be deemed a passing of an Extraordinary Resolution with respect to another Series of Notes. Non-consenting Noteholders of the relevant Series of Notes, although bound by the Proposal, will not be entitled to an Instruction Fee. Non-consenting Noteholders of the relevant Series of Notes (whether or not they affirmatively objected to the Proposal) will not be entitled to any rights of appraisal or similar rights of dissenters with respect to the Proposal.

The Proposal may have an adverse effect

Noteholders should carefully consider the Proposal proposed to be sanctioned as set out in “Terms of the Proposal” below which is being proposed in respect of the Demerger. Noteholders should be aware that the Proposal may have an adverse effect on the rights of Noteholders in that they may no longer be able to call an Event of Default in the context of the Demerger. Additionally, after the Effective Date, Noteholders will have no recourse against the Issuer in respect of its obligations as issuer of the Notes and they will only have recourse against the New Issuer in respect of such obligations.

Each Noteholder is solely responsible for making its own independent appraisal of all matters as such Noteholder deems appropriate (including those relating to the Consent Solicitation and the relevant Extraordinary Resolution) and each Noteholder must make its own decision whether to participate in the Consent Solicitation or otherwise participate at the relevant Meeting.

Noteholders should consult their own tax, accounting, financial and legal advisers regarding the suitability to themselves of the tax or accounting consequences of participating in the Consent Solicitation and regarding the impact on them of the implementation of the relevant Extraordinary Resolution.

None of the Issuer, the Solicitation Agents, the Paying Agents or the Tabulation Agent nor any of their respective affiliates will be responsible to any Noteholder for providing any protections which would be afforded to its clients or for providing advice in relation to the Consent Solicitation or Extraordinary Resolutions, and accordingly none of the Issuer, the Solicitation Agents, the Paying Agents or the Tabulation Agent nor any of their respective affiliates makes any recommendation as to whether or not or how Noteholders should participate in the Consent Solicitation or otherwise participate at the relevant Meeting.

- 15 -

The Proposal may not be sanctioned in respect of all Series

If the Proposal is not sanctioned in respect of one Series or more, the holders of Notes of such Series may be able to claim a breach of the Conditions of the Notes of such Series in connection with the Demerger, whereas the holders of Notes of any Series in respect of which the Proposal has been sanctioned may not be able to claim such a breach of the Conditions of the Notes of such Series, even in circumstances where the Issuer’s payment obligations in respect of other Series are accelerated.

Waiving Finnish law rights via an Extraordinary Resolution

If passed, an Extraordinary Resolution will include a waiver of the statutory right under the Finnish Companies Act to (a) object to the Demerger and (b) make claims against the Issuer after the Effective Date on the basis of any actual or alleged Secondary Demerger Liability. The Issuer believes that such waiver will be binding upon all Noteholders of a Series of Notes that have properly passed the Extraordinary Resolution although, in the absence of prior court decisions on this point, no assurance can be given that such resolution would be deemed to amount to a valid waiver of such rights under Finnish law, if challenged in a Finnish court.

Ability to terminate, withdraw, extend, modify, amend, vary or waive the Consent Solicitation

The Issuer is entitled to terminate, withdraw, extend, modify, amend, vary or waive the Consent Solicitation at any time on or before the Late Instruction Deadline, whether before or after any Electronic Voting Instruction has been received from any Noteholder.

Effects on ratings of the Notes

There can be no assurance that, as a result of the Consent Solicitation, rating agencies will retain their current ratings on the Notes. On 8 October 2019, Moody’s Investors Service Limited and S&P Global Ratings (“S&P”) published preliminary ratings of the New Issuer (i.e. the combined company following completion of the Demerger) of “Baa2 (stable outlook)” and “BBB- (stable outlook)” respectively. Whilst S&P has indicated that it would assign the same rating to the Notes following the Demerger and the Substitution as to the New Issuer, there can be no assurance that similar ratings will apply to the Notes following the Substitution or whether any such ratings will be maintained.

Certain tax consequences