Form CB Berli Jucker Public Co Filed by: Berli Jucker Public Co Ltd

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form CB

TENDER OFFER/RIGHTS OFFERING NOTIFICATION FORM

Please place an X in the box(es) to designate the appropriate rule provision(s) relied upon to file this Form:

| Securities Act Rule 801 (Rights Offering) | x |

| Securities Act Rule 802 (Exchange Offer) | ¨ |

| Exchange Act Rule 13e-4(h)(8) (Issuer Tender Offer) | ¨ |

| Exchange Act Rule 14d-1(c) (Third Party Tender Offer) | ¨ |

| Exchange Act Rule 14e-2(d) (Subject Company Response) | ¨ |

Filed or submitted in paper if permitted by Regulation S-T Rule 101(b)(8) ¨

Berli Jucker Public Company Limited

(Name of Subject Company)

Not Applicable

(Translation of Subject Company’s Name into English (if applicable))

Kingdom of Thailand

(Jurisdiction of Subject Company’s Incorporation or Organization)

Berli Jucker Public Company Limited

(Name of Person(s) Furnishing Form)

Ordinary Shares with a par value of 1 Thai Baht each

(Title of Class of Subject Securities)

Not Applicable

(CUSIP Number of Class of Securities (if applicable))

Aswin Techajareonvikul

Berli Jucker House

99 Soi Rubia, Sukhumvit 42 Road

Phrakanong, Klongtoey, Bangkok 10110

Thailand

66 0-2367-1111

(Name, Address (including zip code) and Telephone Number (including area code) of

Person(s) Authorized to Receive Notices and Communications on Behalf of Subject Company)

21 July 2016 (date of publication of offering announcement)

(Date Tender Offer/Rights Offering Commenced)

PART I - INFORMATION SENT TO SECURITY HOLDERS

Item 1. Home Jurisdiction Documents

Exhibit No.

99.1 English translation of notification of rights to subscribe for newly issued ordinary shares of Berli Jucker Public Company Limited, dated 21 July 2016.

Item 2. Informational Legends

Berli Jucker Public Company Limited has included the legend required by Rule 801(b) in the English translation of the notification of rights to subscribe for newly issued ordinary shares of Berli Jucker Public Company Limited, dated 21 July 2016.

PART II - INFORMATION NOT REQUIRED TO BE SENT TO SECURITY HOLDERS

(1) Not applicable.

(2) Not applicable.

(3) Not applicable.

PART III - CONSENT TO SERVICE OF PROCESS

Concurrently with the furnishing of this Form CB with the Securities and Exchange Commission (the “SEC”), Berli Jucker

Public Company Limited is filing with the SEC a written irrevocable consent and power of attorney on Form F-X.

PART IV - SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Berli Jucker Public Company Limited | |||

| By: | /s/ Aswin Techajareonvikul | ||

| Name: | Aswin Techajareonvikul | ||

| Title: | Director | ||

| By: | /s/ Thirasakdi Nathikanchanalab | ||

| Name: | Thirasakdi Nathikanchanalab | ||

| Title: | Director | ||

| Date: 22 July 2016 | |||

Exhibit 99.1

Importance Disclaimers

By accepting delivery of this notification (the “Notice of Subscription Rights”) of rights to subscribe for newly issued ordinary shares (the “New Shares”) of Berli Jucker Public Company Limited (the “Company”), shareholders acknowledge and agree to the disclaimers and conditions set forth below.

This offering of New Shares to existing shareholders of the Company in proportion to their respective shareholdings is an offering of securities in Thailand pursuant to Section 33 of the Securities and Exchange Act B.E. 2535 (as amended) and will only take place in Thailand. These New Shares (i) have not been and will not be registered with the U.S. Securities and Exchange Commission or any other securities regulatory authority, or under the U.S. Securities Act of 1993 (the “Securities Act”) or the laws of any other jurisdiction, and (ii) may not be offered, sold or delivered within the United States of America, except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and any applicable state or local securities laws.

The shareholders are prohibited to disclose, publish or distribute the Notice of Subscription Rights, whether in whole or in part. The Company urges shareholders who accept delivery of this Notice of Subscription Rights to rely upon their own examination of the restrictions regarding investments in securities and offerings to sell securities in their countries of domicile or nationality. The Company will not be responsible for any violation of any of these restrictions by any person. The shareholders warrant that they are not restricted under any law of any jurisdiction from subscribing for the New Shares and that subscription by the shareholders for the New Shares will not be a violation of any applicable law of the relevant jurisdiction.

Notice to US shareholders:

This rights offering is made for the securities of a foreign company. The offer is subject to the disclosure requirements of a foreign country that are different from those of the United States. Financial statements included in the document, if any, have been prepared in accordance with foreign accounting standards that may not be comparable to the financial statements of United States companies.

It may be difficult for you to enforce your rights and any claim you may have arising under the federal securities laws, since the issuer is located in a foreign country, and some or all of its officers and directors may be residents of a foreign country. You may not be able to sue the foreign company or its officers or directors in a foreign court for violations of the U.S. securities laws. It may be difficult to compel a foreign company and its affiliates to subject themselves to a U.S. court’s judgment.

|

(Translation) |

|

21 July 2016

| Subject: | Notification of the subscription entitlement for the newly-issued ordinary shares of Berli Jucker Public Company Limited for the rights offering to the existing shareholders proportionate to their respective shareholdings under the Second Rights Offering |

| To: | Shareholders of Berli Jucker Public Company Limited |

| Enclosures: | 1. | Notification of the Allocation and the Subscription Documents of Newly issued ordinary shares of Berli Jucker Public Company Limited |

| 2. | Share Subscription Form of Berli Jucker Public Company Limited |

| 3. | Certificate of Subscription Entitlement issued by Thailand Securities Depository Co., Ltd. |

| 4. | Bill Payment slip |

| 5. | Power of Attorney for the subscription of the newly issued ordinary shares of Berli Jucker Public Company Limited |

| 6. | Additional Documents for Depositary into an Issuer Account for the subscriber who is an individual and juristic person and Entity Status Certification and Information Disclosure Consent Form under FATCA for a juristic person |

Extraordinary General Meeting of Shareholders of Berli Jucker Public Company Limited (the “Company”) No. 2/2016, convened on 29 June 2016, resolved to approve the capital increase of Baht 2,400,000,000 from the existing registered capital to the new registered capital of Baht 4,053,955,000 by means of issuing 2,400,000,000 newly-issued ordinary shares with a par value of Baht 1.00 per share in order to accommodate the allocation of the newly-issued ordinary shares to the existing shareholders proportionate to their respective shareholdings (Rights Offering), as follows:

| (1) | To allocate not exceeding 800,000,000 newly-issued ordinary shares to the specific investors (Private Placement); |

| (2) | To allocate not exceeding 1,600,000,000 newly-issued ordinary shares to the existing shareholders proportionate to their respective shareholdings (First Rights Offering), having the subscription period of 13-15, 20, and 21 July 2016; |

| (3) | In the case of the shares remaining from the Private Placement under (1) and/or the First Rights Offering under (2), the Company may again allocate all or part of the remaining shares to the existing shareholders proportionate to their respective shareholdings (Second Rights Offering). |

Subsequently, Board of Directors’ Meeting No. 9/2016 convened on 7 July 2016 resolved to not allocate 800,000,000 newly-issued shares to the specific investors (Private Placement) as specified

|

(Translation) |

|

under Clause (1) above, due to the resolution passed by Extraordinary General Meeting of Shareholders No. 2/2016 convened on 29 June 2016 which provides additional conditions that, the offering price of the shares under the Private Placement must be the price which is not discounted by more than 10 percent of the closing price of the shares traded on the Stock Exchange of Thailand as at 28 June 2016, which must be no less than Baht 40.5. The Company was informed by the underwriters that, the prospective investors who were desirous to acquire the Company’s shares were of the view that they had an issue with the time constraints and thus were unable to make a decision within the capital increase plan in accordance with the resolution of the shareholders’ meeting. As a result, it is necessary for the Company to cancel the allocation of newly-issued shares to the specific investors (Private Placement) and instead offer the shares which should have been allocated under the Private Placement Scheme, to the existing shareholders under the Second Rights Offering in order to be in accordance with the resolution of the shareholders’ meeting.

The Board of Directors, therefore, resolved to approve the allocation of 807,779,000 remaining shares (comprising 800,000,000 shares from the share allocation to Private Placement, and 7,779,000 shares from the share allocation to the existing shareholders for the First Rights Offering) to the existing shareholders of the Company for the Second Rights Offering. In this regard, the offering ratio is equivalent to 2 existing shares per 1 newly-issued ordinary share (any fraction of shares shall be rounded down), and the offering price is Baht 35 per share. The shareholders are entitled to the oversubscription.

If there are any remaining shares from the first allocation to the existing shareholders, the Company will allocate such remaining shares to the shareholders who wish to subscribe for the newly issued shares in excess of their entitlement, at the same offering price as that of the shares to be allocated. In this regard, the Company will allocate the remaining shares until there are no shares to be allocated or the shares cannot be allocated due to any fraction of shares or until such shares are no longer subscribed for by any shareholders.

In this regard, the details of the allocation of the newly-issued ordinary shares if there are shares remaining from the first Rights Offering are as follows:

| 1) | If the number of shares remaining from the first Rights Offering is more than the total number of oversubscription shares, the Company shall allocate such remaining shares to the shareholders who have expressed their intention for oversubscription and paid for the oversubscription shares. |

| 2) | If the shares remaining from the first allocation are less than the total number of oversubscription shares, |

| (a) | Each shareholder who oversubscribes shall be entitled to the allocation proportionate to his/her respective shareholdings (any fraction of shares shall be rounded down), provided that the number of shares to be allocated shall not exceed the number for which each shareholder has subscribed and paid for; |

|

(Translation) |

|

| (b) | If there are shares remaining from the allocation under (a), the allocation shall be made to each shareholder who oversubscribes but has yet to be allocated his/her oversubscription amount, proportionate to his/her respective shareholdings (any fraction of shares shall be rounded down), provided that the number of shares to be allocated shall not exceed the number for which each shareholder has subscribed and paid for. The allocation under (b) shall be made until there are no shares remaining from the allocation or the allocation cannot be made due to any fraction of shares. |

The Company has scheduled the date to record the names of the shareholders who are entitled to subscribe for the newly-issued shares proportionate to their respective shareholdings for the Second Rights Offering (Record Date) on 13 July 2016 and the date to close the share register to list the names of the shareholders (Closing Date) in compliance with Section 225 of the Securities and Exchange Act B.E. 2535 (1992) (including any amendment thereto) on 14 July 2016 and the Company has determined the subscription and payment period of the Rights Offering to be 29 July 2016 and 1, 2, 3, and 4 August 2016 (a total of 5 business days). The details of which are set out in the Notification of the Allocation and the Subscription Documents of Newly-issued ordinary shares of Berli Jucker Public Company Limited (Enclosure 1).

The Company hereby informs you of your subscription entitlement for the newly-issued shares under the Second Rights Offering in the number of shares specified in the Certificate of the Subscription Entitlement issued by Thailand Securities Depository Co., Ltd. (Enclosure 3). The details of such subscription are set out in the Notification of the Allocation and the Subscription Documents of Newly issued ordinary shares (Enclosure 1).

Please be informed accordingly.

|

Sincerely Yours, Berli Jucker Public Company Limited (Mr. Aswin Techajareonvikul / Mr. Thirasakdi Nathikanchanalab)

|

(Translation) |

|

Enclosure 1

Notice of Allocation and Subscription Document of

Newly-issued Ordinary Shares

Berli Jucker Public Company Limited

|

(Translation) |

|

Part 1

Information on the Allocation of Newly-issued Ordinary Shares

| 1 |

|

(Translation) |

|

| Part 1: Information on the Allocation of Newly-Issued Ordinary Shares |

| 1. | Name and address of listed company |

| Name: | Berli Jucker Public Company Limited (the “Company”) |

| Address: | Berli Jucker House, No. 99 Soi Rubia, Sukhumvit 42 Road, |

Phra Khanong Subdistrict, Khlong Toei District, Bangkok

Telephone: (662) 367-1111, (662) 381-4520-39

Facsimile: (662) 367-1000, (662) 381-4545

| Website: | www.bjc.co.th |

| 2. | Date and number of the Board of Directors’ meeting that approved the allocation of newly-issued ordinary shares |

| (1) | Board of Directors’ Meeting No. 6/2016 convened on 25 May 2016 resolved to propose that the shareholders’ meeting approve the allocation of the newly-issued ordinary shares to the existing shareholders proportionate to their respective shareholdings on the Second Rights Offering in the case that there are shares remaining from the allocation to the specific investors (Private Placement) and/or to the existing shareholders proportionate to their respective shareholdings from the First Rights Offering. |

| (2) | Board of Directors’ Meeting No. 9/2016 convened on 7 July 2016 resolved to not allocate 800,000,000 newly-issued shares to the specific investors (Private Placement) and to allocate such shares which should have been allocated under such Private Placement Scheme, to the existing shareholders under the Second Rights Offering in order to be in accordance with the resolution of Extraordinary General Meeting of Shareholders No. 2/2016 convened on 29 June 2016. |

The Board of Directors, therefore, resolved to approve the allocation of 807,779,000 remaining shares (comprising 800,000,000 shares from the share allocation to Private Placement, and 7,779,000 shares from the share allocation to the existing shareholders for the First Rights Offering) to the existing shareholders of the Company for the Second Rights Offering. In this regard, the offering ratio is equivalent to 2 existing shares per 1 newly-issued ordinary share (any fraction of shares shall be rounded down), and the offering price is Baht 35 per share.

| 3. | Details of the allocation of the newly-issued ordinary shares |

| Type of shares | : | Ordinary shares | |

| Registered capital and paid-up capital | : | After Extraordinary General Meeting of Shareholders No. 2/2016 resolved to approve the capital increase and the Company registered the capital increase with the Ministry of Commerce, the registered capital was Baht 4,053,955,000, divided into 4,053,955,000 ordinary shares, at the par value of Baht 1.00 per share. The paid-up capital was Baht 1,593,282,800, divided into |

| 2 |

|

(Translation) |

|

| 1,593,282,800 issued shares, at the par value of Baht 1.00 per share. | |||

| Capital to be increased for the allocation of the newly-issued ordinary shares to the existing shareholders proportionate to their respective shareholdings | : | Not exceeding Baht 807,779,000. If the Company is able to offer all of the newly-issued shares to the existing shareholders proportionate to their respective shareholdings (Rights Offering) on this occasion, the paid-up capital after the offering of shares to the existing shareholders proportionate to their respective shareholdings on the First and Second Rights Offering will increase to Baht 3,982,145,200, and number of the issued shares will increase to 3,982,145,200 shares, with the par value of Baht 1.0 per share. | |

| Number of shares to be allocated | : | Not exceeding 807,779,000 shares. | |

| (As the total number of issued shares is 1,593,282,800 shares, the number of newly-issued ordinary shares to be allocated to the existing shareholders, at the ratio of 2 existing shares per 1 newly-issued ordinary share is accountable for 796,641,400 shares, from the total number of not exceeding 807,779,000 newly-issued ordinary shares. | |||

| Offering price per share | : | Baht 35.00 | |

| Allocation ratio | : | 2 existing ordinary shares for 1 newly-issued ordinary share. The shareholders are entitled to subscribe for shares in excess of their subscription entitlements. | |

| Allocation methods | : |

The Company shall allocate not exceeding 807,779,000 newly-issued ordinary shares under this Second Rights Offering, at the par value of Baht 1.00 per share, by offering the shares to the existing shareholders proportionate to their respective shareholdings (Rights Offering), at the offering price of Baht 35 per share. Any fraction of shares shall be rounded down.

If there are any remaining shares from the first allocation to the existing shareholders, the Company will allocate such remaining shares to the shareholders who wish to subscribe for the newly issued shares in excess of their entitlement, at the same offering price as that of the shares to be allocated. In this regard, the Company will allocate the remaining shares until there are no shares to be allocated or the shares cannot be allocated due to any fraction of shares or until such shares are no longer subscribed by any shareholders.

In this regard, the details of the allocation of the newly-issued ordinary shares if there are shares remaining from the first Rights Offering are as follows: |

| 1) | If the number of shares remaining from the first Rights Offering is more than the total number of oversubscription shares, the Company shall allocate such remaining shares to |

| 3 |

|

(Translation) |

|

| the shareholders who have expressed their intention for oversubscription and paid for the oversubscription shares. | ||

| 2) | If the shares remaining from the first allocation are less than the total number of oversubscription shares, |

| (a) | each shareholder who oversubscribes shall be entitled to the allocation proportionate to his/her respective shareholdings (any fraction of shares shall be rounded down), provided that the number of shares to be allocated shall not exceed the number for which each shareholder has subscribed and paid for; | |

| (b) | If there are shares remaining from the allocation under (a), the allocation shall be made to each shareholder who oversubscribes but has yet to be allocated his/her oversubscription amount, proportionate to his/her respective shareholdings (any fraction of shares shall be rounded down), provided that the number of shares to be allocated shall not exceed the number for which each shareholder has subscribed and paid for. The allocation under (b) shall be made until there are no shares remaining from the allocation or the allocation cannot be made due to any fraction of shares. |

Example: The allocation of the oversubscribed newly-issued ordinary shares

150 newly-issued ordinary shares remaining from the subscription.

The 1st Round of Oversubscription Allocation

| Subscription Amount | Number of | |||||||||||||||||||||

| Shareholder | Number

of shares held | In accordance with the subscription right | Oversubscription | 1st Round of Oversubscription allocation | 1st

Round of Actual allocation | shares oversubscribed for and not having been allocated | ||||||||||||||||

| Shareholder A | 100 | 100 | 20 | (100/450x150)=33.33 | 20 | 0 | ||||||||||||||||

| Shareholder B | 150 | 150 | 100 | (150/450x150)=50.00 | 50 | 50 | ||||||||||||||||

| Shareholder C | 200 | 200 | 150 | (200/450x150)=66.67 | 66 | 84 | ||||||||||||||||

| Total | 450 | 450 | 136 | 134 | ||||||||||||||||||

| Number of shares remaining from the first oversubscription allocation | 14 | |||||||||||||||||||||

| 4 |

|

(Translation) |

|

According to the first oversubscription allocation, Shareholder A shall be entitled to the allocation of 33.33 shares, whereby the fraction of 0.33 shares shall be rounded down. However, Shareholder A oversubscribes for 20 shares only, so the number of shares allocated to him is 20 shares. Shareholder B shall be entitled to the allocation of 50 shares and receive the actual allocation of 50 shares. Shareholder C shall be entitled to the allocation of 66.67 shares, whereby the fraction of 0.67 shares shall be rounded down, and receive the actual allocation of 66 shares. Consequently, the remaining unallocated shares which are equivalent to 14 shares shall be further allocated in the second oversubscription allocation, because after the first oversubscription allocation, Shareholder B and Shareholder C still have not received the amount for which they oversubscribed of another 50 shares and 84 shares, respectively.

The 2nd Round of Oversubscription Allocation

| Subscription Amount | Number of | |||||||||||||||||||||

| Shareholder | Number of shares held | In accordance with the subscription right | Oversubscription | 2nd Round of Oversubscription allocation | 2nd Round of Actual allocation | shares oversubscribed for and not having been allocated | ||||||||||||||||

| Shareholder B | 150 | 150 | 100 | (150/350x14)=6.00 | 6 | 44 | ||||||||||||||||

| Shareholder C | 200 | 200 | 150 | (200/350x14)=8.00 | 8 | 76 | ||||||||||||||||

| Total | 350 | 350 | 250 | 14 | 120 | |||||||||||||||||

| Number of shares remaining from the second oversubscription allocation | 0 | |||||||||||||||||||||

According to the second oversubscription allocation, Shareholder B shall receive the actual allocation of 6 shares and Shareholder C shall receive the actual allocation of 8 shares. This is an example for the case where there are unallocated shares remaining from the allocation which the Company shall allocate in the oversubscription allocation as shown above until there are no shares remaining from the allocation or the allocation cannot be made due to any fraction of shares.

| 4. | Name and place for subscription of the newly-issued ordinary shares of the Subscription Agent |

SCB Securities Co., Ltd. (the “Subscription Agent”)

No. 19, Tower 3, SCB Park Plaza, 20th Floor,

Ratchadapisek Road, Chatuchak Subdistrict, Chatuchak District, Bangkok

Telephone: 0-2949-1999

| 5. | The date to record the names of shareholders entitled to subscribe for newly-issued ordinary shares |

| 5 |

|

(Translation) |

|

13 July 2016 is scheduled as the date to record the names of the shareholders entitled to the subscription of the newly-issued ordinary shares proportionate to their respective shareholdings for the Second Rights Offering (Record Date); and 14 July 2016 is scheduled as the date to close the share register book to list the names of shareholders (Closing Date) in accordance with Section 225 of the Securities and Exchange Act B.E. 2535 (1992) (including any amendment thereto).

| 6. | Schedule for subscription, subscription methods and payment of subscription for the newly-issued ordinary shares |

| 6.1 | Subscription period |

During 29 July 2016, and 1, 2, 3, and 4 August 2016 (totalling 5 business days), during 9.00 a.m. to 4.00 p.m., at the office of the Subscription Agent, as specified in Clause 4.

| 6.2 | Venue of the subscription for the newly-issued ordinary shares |

A shareholder who is entitled to the subscription and wishes to subscribe for the newly-issued ordinary shares shall submit the subscription documents and Evidence(s) of payment of subscription for the newly-issued ordinary shares (as specified in Clause 6.3) to the Subscription Agent, as specified in Clause 4 only.

With respect to the shareholders under scripless system, please contact the securities companies who are acting as their brokers. The securities companies shall collect the subscription documents and submit it to the Subscription Agent.

In this regard, the Company represented by the Subscription Agent does not accept the subscription documents by mail.

| 6.3 | Subscription methods and payment of subscription for the newly-issued ordinary shares |

A shareholder wishing to subscribe for the newly-issued ordinary shares shall fill out the complete, accurate and clear details of subscription in the subscription form, by specifying the number of shares to be subscribed by each shareholder, whether the subscription of shares in proportionate of or less than their respective shareholding according to the Certificate of the Subscription Entitlement and the number of shares to be oversubscribed (if any) in the subscription form (one subscription form for each subscriber) and affix his/her signature thereon and pay for the newly-issued ordinary shares in full accordance with the subscribed number of shares, both of the subscribed amount in proportionate of or less than their allocated amount and the oversubscription amount (if any), by enclosing the bill payment, or personal cheque, or cashier cheque, or bank draft and delivering all documents to the office of Subscription Agent, as specified in Clause 4.

In case that any shareholders intend to subscribe for the newly-issued ordinary shares exceeding their respective shareholdings, the shareholders are required to express their intention to subscribe for their full entitlement of the newly-issued ordinary shares pursuant to their respective shareholdings first then they are entitled to exercise for the oversubscription.

| 6 |

|

(Translation) |

|

The subscribers or their grantees shall submit the subscription documents required as follows:

| 6.3.1 | Share Subscription Form of the Company (Enclosure 2) which has been complete, accurate and clear and signed by the subscriber. Each subscriber, in any case, are allowed to submit one Share Subscription Form per one Certificate of the Subscription Entitlement only. In this regard, the shareholder can download the subscription form from the Company’s website (www.bjc.co.th); |

| 6.3.2 | Certificate of the Subscription Entitlement (if any) issued by Thailand Securities Depository Co., Ltd. (“TSD”), the share registrar of the Company (Enclosure 3); |

| 6.3.3 | Evidence of payment i.e. the original Bill Payment slip (Enclosure 4), in the case of money transfer, or personal cheque or cashier cheque, or bank draft, the subscribers shall specify their first name, last name and contact number on the back of such evidence of payment. |

| ■ | Payment by personal cheque or cashier cheque, or bank draft: The shareholders who intend to make the payment by personal cheque or cashier cheque, or bank draft, the Company reserves the right to receive the subscription documents and subscription payment from 9.00 a.m. to 4.00 p.m., on 29 July 2016, 1 and 2 August 2016. The personal cheque or cashier cheque, or bank draft must be dated within the subscription period but no later than 2 August 2016 and shall be collectible from the same clearing house within the following business day. |

The payment by personal cheque

or cashier cheque, or bank draft must be crossed and made payable to  or “Subscription

Account for BJC”. In this regard, one personal cheque or cashier cheque, or bank draft is allowed per one

subscription form.

or “Subscription

Account for BJC”. In this regard, one personal cheque or cashier cheque, or bank draft is allowed per one

subscription form.

| ■ | Payment by money transfer to a bank account: The shareholders who intend to make the payment by money transfer, shall subscribe for the newly-issued ordinary shares from 9.00 a.m. to 4.00 p.m., on 29 July 2016, and 1, 2, 3, and 4 August 2016. The shareholders are required to submit Bill Payment Form (Enclosure 4) or requested such form from The Siam Commercial Bank Public Company Limited’s teller counter. The shareholders are required to complete the form by specifying the customer reference number (Ref. 1) with their 10-digit shareholder registration number (as appeared in Certificate of the Subscription Entitlement, Enclosure 3) and reference number (Ref. 2) with 13-digit Thai national identification number. In this regard, the payment must be made through the teller counter of The Siam Commercial Bank Public Company Limited only. |

The payment by money transfer to a

bank account shall made payable to  or “Subscription Account for

or “Subscription Account for

| 7 |

|

(Translation) |

|

BJC”, The Siam Commercial Bank Public Company Limited, Current Account, Ratchayothin Branch, A/C Number 111-3-92514-5

The Subscription Agent reserves the right to not accept any subscription payment for the newly-issued ordinary shares in cash.

In this regard, the subscribers shall make the full payment of the subscription portion including the portion of right to their respective shareholdings or less than the right to their respective shareholdings or the oversubscription (if any) at once. The subscriber shall be responsible for any expenses and bank fees (if any) separately from the payment of subscription.

| 6.3.4 | Identification documents |

| ■ | Thai individual |

A certified copy of a valid identification card or a certified copy of a house registration booklet in which the 13-digit identification number is specified, or a certified copy of any other official document in which the 13-digit identification number is specified.

In the case of a name/surname change resulting in the name/surname not being in accordance with what is recorded in the share register book as at 14 July 2016 or the Certificate of the Subscription Entitlement, the subscriber is required to attach a certified copy of a document showing the change of name/surname issued by a government agency such as a marriage or divorce certificate, or a change of name/surname certificate, etc.

In this regard, the signature on all certified copies must be identical to the signature endorsed on all relevant documents for the subscription.

| ■ | Foreign individual |

A certified copy of a valid foreign identification card or passport, whereby the signature on all certified copies must be identical to the signature endorsed on all relevant documents for the subscription.

| ■ | Juristic person registered in Thailand |

A certified copy of an Affidavit issued by the Ministry of Commerce no later than 12 months before the subscription date, with the signature of the authorized person and the juristic person’s seal affixed (if any), with a certified copy of the identification card, foreign identification card, or passport (as the case may be) of the authorized person attached, whereby the signature on all certified copies must be identical to the signature endorsed on all relevant documents for the subscription.

In the case of government office, government entities, state-own enterprise, or other entities relating to government, it is required to attach the command/resolution letter or appointment letter or power of attorney to enter into the transaction.

| 8 |

|

(Translation) |

|

In the case of cooperative, association, temple, mosque, shrine, and equivalent entities, it is required to attach letter of intent to enter into the transaction or the committee’s resolution, Certificate of Incorporation from relevant authorities, letter of appointment or power of attorney and the evidence of withholding tax exemption (if any).

| ■ | Juristic person registered overseas |

A certified copy of a Certificate of Incorporation, Memorandum of Association, or Affidavit issued no later than 12 months before the subscription date, whereby such Affidavit shall be illustrated name of juristic person, authorized person(s), address of head office, and conditions of the authorized person(s) to sign/bind such juristic person, with the signature of the authorized person and the juristic person’s seal affixed (if any), with a certified copy of the foreign identification card, or passport (as the case may be) of the authorized person attached, whereby the signature on all certified copies must be identical to the signature endorsed on all relevant documents for the subscription.

The copies of the said documents shall be notarized by the Notary Public and certified by the official of the Thai Embassy or Thai Consulate in the country in which the documents are prepared or certified. All of the said documents must be issued within the period of 12 months prior to the subscription date.

| 6.3.5 | For shareholders who oversubscribe and intend to receive the refund from any unallocated portion or uncompleted portion in accordance with the oversubscription amount via Automatic Transfer System or ATS, they are required to attach the certified copy of the first page of their passbook for savings account or certified copy of statement of current account specifying the name of account owner, whereby the account name must be the same as the subscriber and such account must not be a joint account (only with Bangkok Bank Public Company Limited, Kasikorn Bank Public Company Limited, Krung Thai Bank Public Company Limited, TMB Bank Public Company Limited, The Siam Commercial Bank Public Company Limited, United Overseas Bank (Thai) Public Company Limited, Bank of Ayudhya Public Company Limited and Thanachart Bank Public Company Limited). |

| 6.3.6 | A power of attorney (Enclosure 5) for the subscription of the newly-issued ordinary shares of the Company, affixed with Baht 30 stamp duty (in the case of appointment of attorney) together with certified copies of identification cards of the subscriber and his/her attorney. |

| 6.4 | Other conditions for subscription |

| 6.4.1 | A shareholder who subscribed for the newly-issued ordinary shares and made payment for the subscription shall not be entitled to cancel the subscription nor request for a refund. The Company reserves the right to deny the subscription right if the Company does not receive the subscription documents and/or subscription payment within the specified period. |

| 9 |

|

(Translation) |

|

| 6.4.2 | If the subscription payment is made by cheque or cashier cheque, or bank draft, the payment shall be deemed complete once the Company and/or the Subscription Agent are able to collect the subscription payment. |

| 6.4.3 | If a subscriber fails to pay the subscription payment; or fails to comply with the payment method in accordance with the conditions and procedures specified in order for the Company to be able to complete the collection of the subscription payment within the subscription period; or the Company and/or the Subscription Agent are not able to collect all or any part of the subscription payment (due to the fault not attributable to the Company and/or the Subscription Agent) within the subscription period; or subscribes for the shares by any other means not specified under this Notice of Allocation; or fails to submit the complete subscription documents, the Company and/or the Subscription Agent shall deem that the shareholder waives the subscription. In this regard, the Company and/or the Subscription Agent reserve the rights to not allocate the newly-issued ordinary shares to such shareholder. |

| 6.4.4 | If the subscriber fills in incomplete, unclear, or inconsistent details in the documents, the Company and/or the Subscription Agent reserve the right to use the information in the subscription documents for the purpose of the allocation of the newly-issued ordinary shares as it deems appropriate. The Company and/or the Subscription Agent shall deem that the shareholder waives the subscription. In this regard, the Company and/or the Subscription Agent reserve the right to not allocate the newly-issued ordinary shares to such shareholder. |

| 6.4.5 | If the first Right Offering or the oversubscription allocation results in the shareholding of any foreign shareholder being in excess of 49 percent of the total issued shares, the Company reserves the right to not allocate the newly-issued ordinary shares to such foreign shareholder as such allocation violates or may violate the limitation on foreign shareholding proportion as required in the Company’s Articles of Association. Nevertheless, the Company reserves the right to allocate the newly-issued ordinary shares remaining from such allocation. |

| 6.4.6 | The subscribers shall be responsible for expenses and bank fees (if any). |

| 6.4.7 | The Company represented by the Subscription Agent does not accept subscription documents by mail and the subscribers shall be strictly prohibited to place the subscription documents and evidences of subscription payment with the banks, since the banks have only duty to deposit the money into the subscription account. |

| 6.4.8 | If a shareholder receives the Certificate of the Subscription Entitlement for more than one shareholder registration number, the shareholder must prepare the subscription documents for each shareholder registration number for which he/she receives, that is, one set of subscription documents for one shareholder registration number. If the subscriber subscribes for the shares with one shareholder registration number by combining all subscription rights to which he/she is entitled under all of his/her shareholder registration numbers into one transaction or fills out such information in the same set of subscription documents, the subscriber may not be allocated the newly-issued |

| 10 |

|

(Translation) |

|

shares in accordance with all subscription rights to which he/she is entitled under all of his/her combined shareholder registration numbers. In this regard, the Company reserves the right to allocate the newly-issued shares to the subscriber as it deems appropriate or not allocate the newly-issued shares to such subscriber.

| 6.4.9 | If the number of shares specified in the Share Subscription Form are more than the money received by the company, the Company and/or the Subscription Agent reserve the right to allocate the newly-issued ordinary shares to such shareholder pursuant to the money received. |

| 6.4.10 | If the number of shares specified in the Share Subscription Form are less than the money received by the company, the Company and/or the Subscription Agent reserve the right to allocate the newly-issued ordinary shares to such shareholder as it deems appropriate. |

| 6.4.11 | The Company reserves the right to change the details of the subscription methods and payment and other conditions for subscription as it deems appropriate in the case of issues, difficulties, or restriction in relation to the operation, in the interest of the subscription of the newly-issued ordinary shares. |

| 6.5 | Refund of subscription payment if the subscribers have not been allocated the shares in accordance with the subscribed amount |

If a shareholder who subscribes for the newly-issued ordinary shares has not been allocated the shares or a shareholder who oversubscribes has not been allocated the shares in accordance with the oversubscription amount, the Company represented by the Subscription Agent will refund the subscription payment to the shareholder who subscribes for the newly-issued ordinary shares which have not been allocated or the shareholder who oversubscribes and has not been allocated the shares in accordance with the oversubscription amount without interest and/or damages by using any of the methods that the shareholder specifies in the Share Subscription Form as follows:

| 6.5.1 | The refund shall be transferred via the automatic transfer system (ATS) into the subscribers’ bank account (only with Bangkok Bank Public Company Limited, Kasikorn Bank Public Company Limited, Krung Thai Bank Public Company Limited, TMB Bank Public Company Limited, The Siam Commercial Bank Public Company Limited, United Overseas Bank (Thai) Public Company Limited, Bank of Ayudhya Public Company Limited and Thanachart Bank Public Company Limited), as specified in the Share Subscription Form, within 7 business days from the last date of subscription period, whereby the account name must be the same as the subscriber and such account must not be a joint account; or |

| 6.5.2 | The refund shall be made in the form of a crossed cheque made payable to the name of the subscriber, as specified in the Share Subscription Form, and deliver the cheque via registered mail to the address of the shareholder recorded in the Company’s shareholder database in accordance with the share register book as at 14 July 2016, within 10 business days from the last date of subscription period; or |

| 11 |

|

(Translation) |

|

| 6.5.3 | Other methods as the Company and/or the Subscription Agent deem appropriate, whereby the subscriber shall be responsible for the fee for money transfer or the fee charged by the different Clearing House (if any). |

Nevertheless, if the Company and/or the Subscription Agent fail to refund the subscription payment for the shares which have not been allocated or have been allocated in an amount which is less than the oversubscribed amount by means of a bank transfer as specified in the Subscription Form, as set out in Clause 6.5.1 due to the name of the bank account not being the same as the subscriber or due to any other reason which is beyond the control of the Subscription Agent, the Company and/or the Subscription Agent shall refund the subscription payment for the shares which have not been allocated or have been allocated in an amount which is less than the oversubscribed amount in the form of a crossed cheque made payable to the name of the subscriber, and deliver the cheque via registered mail to the address of the shareholder recorded in the Company’s shareholder database in accordance with the share register book as at 14 July 2016, as set out in Clause 6.5.2.

In this regard, if the subscription payment for the shares which have not been allocated is made or the allocated newly issued shares are less than the oversubscribed amount is transferred to the bank account of the subscriber as specified in the Subscription Form or by a cheque delivered via registered mail to the address recorded in the Company’s shareholder database in accordance with the share register book as at 14 July 2016, it shall be deemed that the subscriber duly received the subscription payment for the shares which have not been allocated or have been allocated in an amount which is less than the oversubscribed amount, and the subscriber shall no longer have any right to claim for any interest and/or damages from the Company or the Subscription Agent.

| 6.6 | Delivery of securities |

| 6.6.1 | If the subscriber wishes to deposit the shares in a securities trading account that the subscriber has opened with a securities company, the Company will deposit the allocated shares in the “Thailand Securities Depository Company Limited for Depositors” account maintained by the TSD. The securities company will record the number of shares deposited by the subscriber and issue an evidence of deposit to the subscriber within the period of 7 business days from the last date of the subscription period. In such a case, the subscriber can immediately sell the allotted shares in the Stock Exchange of Thailand (“SET”) after the first trading day of the newly-issued shares of the Company. |

In the case that the subscribers choose to proceed with Clause 6.6.1, the name of the subscriber in the Share Subscription Form must be the same with the name of the assigned trading account for the share deposit in the securities company only. In case that the name of subscriber does not be same with the trading account or the securities companies or the number of member of the depositary is not consistent, the Company reserves the right to deliver such securities in the form of share certificate (scrip). In this regard, TSD will issue the share certificate for the shares amounting of the allotted shares under the name of the subscriber and deliver to the subscriber according to the name and address as per the Company’s Shareholder Database in accordance with the share register book as at 14 July 2016 via registered

| 12 |

|

(Translation) |

|

mail, within 15 business days from the last date of the subscription period. In this regard, the Company shall not be responsible for the shareholders if they cannot sell their allotted shares by the first trading day of such allotted shares.

| 6.6.2 | If the subscriber wishes to deposit the newly-issued ordinary shares in Issuer’s Account No. 600, the Company will deposit the allocated shares with the TSD. The TSD will deposit the shares in account of Berli Jucker Public Company Limited No. 600 and will record the number of shares in such account under the name of the subscriber and issue an evidence of deposit to the subscriber within the period of 7 business days from the last date of the subscription period. In this case, the subscriber shall fill the additional subscription document i.e. “Additional Documents for Depositary into an Issuer Account only” for the subscriber who is individual and juristic person and “Entity Status Certification and Information Disclosure Consent Form under FATCA for juristic person only” (Enclosure 6) to be submitted to TSD. When the subscribers would like to sell the allotted shares, they must withdraw those shares from the account No. 600 by requesting the securities companies, with potential fees applicable as indicated by the TSD and/or such securities company. The subscriber can immediately sell the allotted shares in the SET after the first trading day of the newly-issued shares of the Company. |

| 6.6.3 | If the subscriber wishes to receive the share certificate under his/her name, the TSD, as the Company’s registrar, will deliver the share certificate representing the allocated number of shares to the subscriber via registered mail to the addressee under the name and address recorded in the Company’s shareholder database in accordance with the share register book as at 14 July 2016, within the period of 15 business days from the last date of the subscription period. In this case, the subscriber cannot sell the allotted shares in SET until receiving the share certificate, which may receive after the first trading day of such allotted shares. |

In the case that the subscriber does not indicate any case of delivery of shares as specified in the Share Subscription Form, the Company reserves the right to deliver those shares by issuing the share certificate under the name of the subscriber and TSD will deliver the share certificate representing the allotted shares to the subscriber according to the name and address as per the Company’s Shareholder Database in accordance with the share register book as at 14 July 2016 via registered mail.

| 7. | Objectives of the capital increase and plans for utilizing proceeds derived from the capital increase |

This capital increase will be used for the restructure of the capital and repayment of the loan from financial institution received by the Group of Company, totaling Baht 204,330 million (excluding interest and expenses incurred from the entering into of the transaction) for the acquisition of the group of business of Big C Supercenter Public Company Limited (“BIGC Group”) at the amount of 97.94 percent of its total issued shares.

| 8. | Benefits which the Company will receive from the allocation of the newly-issued ordinary shares |

| 13 |

|

(Translation) |

|

For making repayment of the short term loan from the financial institution used for investment in BigC Group without delay and reduce the interests burden and to help adjust the capital and debt structure of the Company to be suitable.

| 9. | Benefits which the shareholders are to receive from the capital increase/allocation of the newly-issued ordinary shares |

| 9.1 | Dividend policy |

The Company pays dividends at the rate of not less than 50% of net profit after tax and other legal reserves (if any). The Company also takes into consideration cash flows and/or any new investment or expansion of both existing businesses and potential new businesses. However, the purpose of this fund raising by issuing and offering of the newly issued shares is for repayment of the bridge loan granted from the financial institution for the acquisition of the business of BIGC Group, which is only the partial repayment. The Company is still obligated to pay the interest of the remaining bridge loan or the refinancing of debt by mean of the issuance of debenture and/or lending from the financial institution and/or the issuance of the bill of exchange within the amount of Baht 130,000 million. These factors may impact to the consideration of the dividend payment to be paid to the shareholders of the Company.

| 9.2 | The subscriber shall be entitled to receive the dividend payment derived from the business operation of the Company from the date on which the subscriber is registered as a shareholder of the Company, by having his/her name recorded in the shareholders register of the Company and the Company making an announcement on the dividend payment. In this regard, the dividend payment shall be carried out in compliance with the relevant laws and regulations. |

| 10. | Other details necessary for the shareholders in support of their consideration on approval of the capital increase/allocation of the newly-issued ordinary shares |

– None –

| 14 |

|

(Translation) |

|

Part 2

General Information of the Company

| 15 |

|

(Translation) |

|

Part 2: General Information of the Company

| 1. | General Information |

| Name: | Berli Jucker Public Company Limited (the “Company”) |

| Symbol: | BJC |

| Address: | Berli Jucker House, No. 99 Soi Rubia, Sukhumvit 42 Road, Phrakanong Subdistrict, Khlong Toei District, Bangkok, 10100 |

| Types of Business: | The Company’s core businesses involve manufacturing, distribution, and service provision as detailed below: |

| 1. | Modern retail and wholesale of goods including consumer goods, medical products and medicine via actual and online stores (e-Commerce), as well as the leasing of areas for its business operation; | |

| 2. | Manufacture, marketing and distribution of (1) products in the packaging business such as glass containers, aluminum cans, and rigid plastic containers; (2) consumer products such as snacks, beverages, dairy products, personal goods (soap, shampoo, and cosmetics), household goods (tissue paper and cleaning products); | |

| 3. | Import and distribution of (1) healthcare products including medical and pharmaceutical products and medical equipment; (2) technical supplies such as industrial chemicals and photo technology products; (3) books and magazines, stationery and office supplies; | |

| 4. | Design, procurement, and distribution of equipment and tools, automatic control systems and industrial equipment, warehousing tools, goods transport, and galvanized steel structures for high voltage transmission towers; | |

| 5. | Customs formalities, warehousing, transport, and logistics services; and | |

| 6. | Information technology services and other businesses. |

| Registration No.: | 0107536000226 |

| 16 |

|

(Translation) |

|

| Registered and Paid-up Capital: | After Extraordinary General Meeting of Shareholders No. 2/2016 convened on 29 June 2016 has resolved to approve the capital increase and the Company has registered the capital increase with the Ministry of Commerce, the registered capital of the Company shall be equivalent to Baht 4,053,955,000, divided into 4,053,955,000 ordinary shares, at the par value of Baht 1.00 per share, with paid-up capital of Baht 1,593,282,800, divided into 1,593,282,800 issued shares, at the par value of Baht 1.00 per share. |

| Voting Rights: | 1 share is equivalent to 1 vote. |

| Telephone: | 0 2367 1111 (D.I.D. system) and 0 2367 4520-39 |

| Facsimile: | 0 2367 1000 and 0 2381 4545 |

| Website: | http://www.bjc.co.th |

| 17 |

|

(Translation) |

|

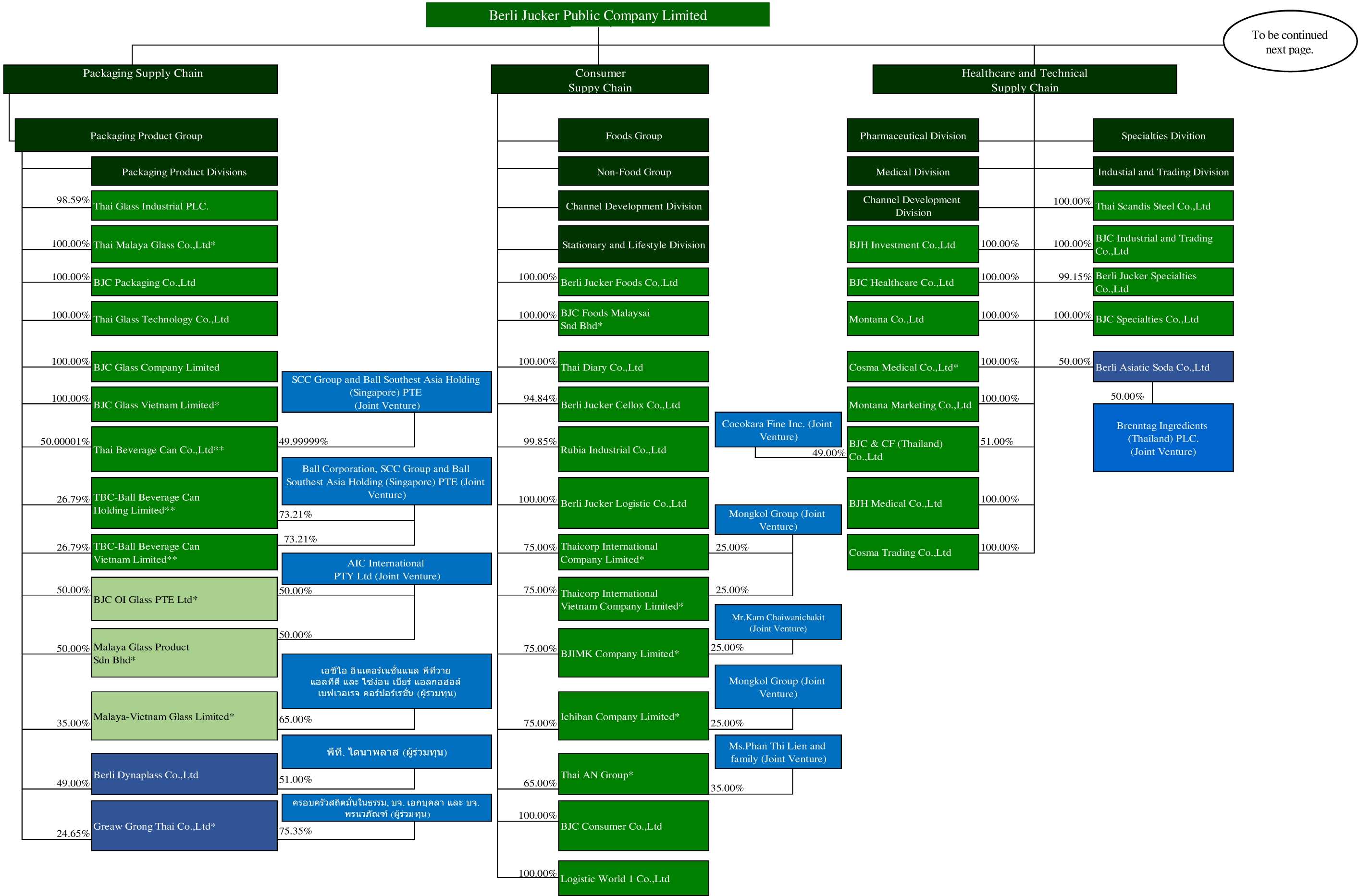

| 2. | Description of Business Operation by Business Group |

The Company has undergone a major significant change in the year 2016 with the acquisition of 58.5549 percent of the total issued shares of Big C Supercenter Public Company Limited (“Big C”) from Casino Group, its major shareholder, and the tender offer for the total amount of shares of Big C in May 2016 resulting in the Company’s becoming the major shareholder of Big C, holding 97.94 percent of the total amount of issued shares. The acquisition marks a giant step in the Company’s history: it not only builds up the Company’s growth, but also enhances its business potential, gearing up for long-term growth. Big C is an operator of the modern trade business for consumer goods with a network of the fully-fledged distribution channels and centers that can penetrate a nationwide customer base. In addition, Big C has enjoyed profitable operational results and dividend payments have been made to its shareholders on a regular basis. Furthermore, the acquisition of Big C is expected to bring about synergies to the existing business. The synergies achieved through the acquisition will take the form of the increase in the distribution channels for the Company’s products through the Big C stores; hence, the Company will have more opportunities available to increase its production volume for consumer goods under private labels. Another form of synergy achieved through the acquisition is the chance to combine transportation activities and share the distribution centers, which will enhance the effectiveness of the distribution activities and reduces operation costs in the long-term (for more details of the business operation of Big C, please refer to Clause 2.4).

In furtherance of the acquisition of Big C, the short-term loans from financial institutions have been substantially increased. Therefore, the Company is obligated to satisfy the loans of approximately Baht 204,330 million due to the capital restructuring. In view of the above, the Company plans to apply the proceeds from the offering of the newly-issued shares to the shareholders in accordance with their respective shareholding proportion (right offering) on this occasion, as well as the funds from the offering of the newly-issued shares in a private placement) for the repayment of the loans. The proceeds from the right offering and the funds from issuing debentures and/or securing loans from financial institutions and/or issuing bills of exchange for repayment of the loans (refinancing) in the maximum credit line of not exceeding Baht 130,000 million, and the Company will acquire sufficient funds for the repayment of the loans from financial institutions used in the acquisition of Big C.

The Company operates its business with the commitment to excellence in the development of product manufacturing process and the improvement of service provisions to ensure that the quality of products and services is maintained, from the upstream to the downstream stages, as well as to be the leading distributor of daily consumer products in order to satisfy the everyday needs of the consumers. The Company has expanded its business continuously with the current business operation classified into five major business groups.

| 2.1 | Packaging Supply Chain |

| (1) | Description of Products or Services |

| (1.1) | Glass Packaging Business |

The production of a broad range of glass packaging including both reusable and lightweight types of narrow-mouth and wide-mouth bottles is operated by Thai Glass Industries Public Company Limited (“TGI”) and Thai Malaya Glass Co., Ltd. (“TMG”). The Glass Product Division was responsible for the marketing and distribution of all glass products in the first quarter of 2014. TMG later took over the marketing and distribution all glass products produced by TGI and

| 18 |

|

(Translation) |

|

TMG. The Group also offers imported glass products including lug cap or twist-off types of narrow-mouth and wide-mouth bottles.

In addition, the Company teamed up with Owens-Illinois Inc., the world’s largest glass container manufacturer from USA., to form a joint venture, namely BJC O-I Glass Pte. Ltd. (“BJC O-I”) to make investments in Malaya Glass Products Sdn Bhd (“MGP”) and Malaya Vietnam Glass Limited (“MVG”), a manufacturer and distributor of the glass bottle containers in various forms, including those for beer, spirits, beverages, and food products, which are marketed to large industry groups domestically and internationally.

| (1.2) | Aluminum Can Business |

The Company conducts its aluminum packaging products for holding beverages including cans and lids with printing customization options for customers through Thai Beverage Can Co., Ltd. (“TBC”).

TBC also teamed up with Ball Corporation Co., Ltd., a leading manufacturer of packaging products from USA, to jointly establish an aluminium can factory in Vietnam under TBC-Ball Beverage Can Vietnam Limited (“TBC-BALL VN”) in order to produce and distribute aluminium beverage cans, as well as to import and distribute aluminium beverage can lids.

| (1.3) | Plastic Packaging Business |

Berli Dynoplast Co., Ltd. (“BDP”) produces, distributes, and develops packaging products using cutting-edge engineering technology while simultaneously lowering costs and increasing the quality of the products and plastic bottles, boxes, and lids. It also prints and applies stickers or plastic labels on products in the following groups:

| 1. | Cosmetics and consumer products, e.g. bottles for talc, shampoo, lotion, cleaning products |

| 2. | Food and dairy products, e.g. milk bottles, ice cream boxes, snacks, fried potato chips |

| 3. | Lubricating oils, e.g. bottles and lids for engine oil |

| 4. | Medicine and medical equipment |

| 5. | Plastic parts |

| (2) | Marketing and Competition |

| (2.1) | Glass Packaging Business Marketing Strategy |

Marketing Strategy

The marketing strategy of the Company for glass packaging is to expand the market both domestically and internationally by distinguishing itself from its competitors by means of producing high-quality products and launching new products to demonstrate its ability to offer a wide variety of products; developing

| 19 |

|

(Translation) |

|

and fine-tuning the characteristics of the products; expanding the quality of the service provision; coming up with new technologies that will allow for production processes that use fewer resources and are more environmentally-friendly; as well as developing a standardized system for its work operations with a view to best meet the market demand.

The Company has a policy to establish strategic alliances with other companies in order to meet the demand of the companies holding the Company’s shares and that of other customers in terms of both quantity and quality. It is prepared for the increase in production capacity for the purpose of accommodating the growth of its customer base and has also expanded the same by means of acquiring new customers both domestically and internationally.

Competition in Industry

Considering that the glass packaging industry is a business that requires a large amount of investment funds and advanced technology, and the fact that a continuous and sufficient influx of purchase orders is required for 24-hr production during the entire year, it is difficult for emerging manufacturers to establish a position in the industry. There are currently four major glass packaging manufacturers in Thailand, each with its own primary customer base.

The Company is able to maintain its competitive advantage over its international competitors due to the fact that the import of glass bottles from overseas incurs high transportation costs and is subject to high import tax rates because of the large size and heavy weight of the glass bottles and disposable packaging materials used for transport. As such, there is little competition from companies overseas.

The production of glass bottles entails high advantages over other types of packaging such as aluminum cans, plastic bottles, and paper boxes. This is because there is no reaction between the glass bottles and their contents, thus making them very safe to use as containers. Glass bottles can also be re-used many times, which then reduces the cost of the ready-made products. Moreover, glass bottles that are no longer used or culled can be used for continually producing new glass bottles with the very same quality as the original bottles. In addition, glass containers also make the products more attractive overall.

The slowdown of the global economy continued throughout 2015. A number of countries were still in the process of economic recovery, thus the purchasing capacity of consumers was still relatively low. This had a negative impact on the Thai economy, which was heavily dependent on its exports, and this, coupled with other domestic factors, resulted in Thailand’s slow economic growth rate. In addition, new manufacturers are becoming more aggressive with their marketing initiatives by employing competitive pricing strategies, thus resulting in a highly competitive environment in the beverage bottle market in terms of pricing. However, due to the Company’s efficient management, it was able to expand its customer base in the food and carbonated beverage group and increase its production efficiency, and consequently performed even better than the expected targets.

| 20 |

|

(Translation) |

|

| (2.2) | Aluminum Can Business |

Marketing Strategy

In 2015, TBC’s sales volume increased from the sales volume in 2014 by approximately 16 percent, with a domestic and international sales proportion of approximately 72 and 28 percent, respectively. TBC’s primary customers in Thailand are, for example, Beer Thai (1991) Public Company Limited, C.T. Pharmaceutical Co., Ltd., Thai Asia Pacific Brewery Co., Ltd., Carabao Tawandang Co., Ltd., Serm Suk Public Company Limited, and Boon Rawd Brewery Co., Ltd. etc. TBC’s primary customers overseas are, for example, F&N Beverages Manufacturing Sdn. Bhd. Malaysia, Cambrew Limited (Cambodia), Lao Brewery Co., Ltd., and Coca-Cola Pinya Beverages Myanmar Ltd. etc.

In 2015, TBC-BALL VN’s sales volume increased from the sales volume in 2014 by approximately 20.7 percent. Vietnam’s population is approximately 90 million, with over 60 per cent of its population between the ages of 15 and 54. There is, therefore, a high demand for aluminum cans. Products are also exported to customers based overseas, with a domestic and international sales portion of approximately 81 percent and 19 percent, respectively. The primary domestic customers are VBL (Heineken), HVB (Carlsberg), Pepsi Vietnam, and Coca-Cola Vietnam. The primary international customers are Coca-Cola Cambodia and Coca-Cola Pinya Beverages Myanmar Ltd.

Competition in Industry

The production process of aluminum cans requires advanced technology in order to maintain low production costs through mass production. As such, there are only a few competitors in the industry. In 2015, there were a total of four aluminum can manufacturers in Thailand, and TBC is one of the largest manufacturers.

| (2.3) | Plastic Packaging Business |

Marketing Strategy

The Company engages in business with customers that are leading manufacturers with the highest standards at the global level. The Company’s major customers in this industry are Johnson & Johnson (Thailand) Ltd., Unilever Thai Trading Ltd., Beiersdorf (Thailand) Co., Ltd., Mead Johnson Nutrition (Thailand) Ltd., FrieslandCampina (Thailand) Public Company Limited, and Pepsi-Cola (Thai) Trading Co., Ltd.

Competition in Industry

BDP is a packaging manufacturer which produces high-quality products for the consumer market. There are approximately five major manufacturers in this industry. The major manufacturers increase their production volumes in order to accommodate market needs at all times. Investments in the manpower, production process and technology requires a high amount of funding, thus making it difficult for new manufacturers to compete in the market.

| 21 |

|

(Translation) |

|

| (3) | Sourcing of Products or Services |

| (3.1) | Glass Packaging Business |

Production Capacity and Volume

TGI has two glass packaging factories as follows:

Factory No.1: Rajburana Factory, located at No. 15 Rajburana Road, Rajburana Subdistrict, Rajburana District, Bangkok 10140, which had a production capacity of 700 tons per day. However, all of the furnaces at the factory were closed down in 2013-2014, thus decreasing the overall production capacity in 2015 in comparison with the preceding year. Currently, this factory has not been operated the glass packaging business.

Factory No. 2: Bangplee Factory, located at No. 78 Moo 3, Soi Watsriwareenoi, Bangna-Trad Km. 18, Nong Prue Subdistrict, Bangplee District, Samut Prakan Province 10540, which has a production capacity of 1,745 tons per day/

The details of the production capacity and volume are as follows:

| Capacity and Volume | 2015 | 2014 | 2013 | |||||||||

| Maximum capacity (unit : ton) | 636,925 | 737,325 | 862,665 | |||||||||

| Actual volume (unit : ton) | 554,603 | 635,819 | 751,424 | |||||||||

| Capacity usage (%) | 87.1 | 86.2 | 97.1 | |||||||||

| Increase in volume (%) | -12.77 | -15.38 | -7.6 | |||||||||

TMG has two glass packaging factories as follows:

Factory No.1: TMG1, located at No. 28 Moo 1, SIL Industrial Land, Bualoy Subdistrict, Nong Khae District, Sara Buri Province. This factory contains two furnaces. The first furnace has a production capacity of 290 tons per day while the second furnace has a production capacity of 300 tons per day (commercial operations at the second furnace began in mid-April 2013).

Factory No.2: TMG1, located at No. 49 Moo 1, SIL Industrial Land, Bualoy Subdistrict, NongKhae district, Sara Buri Province. In October 2014, TMG launched its third furnace which has a production capacity of 400 tons per day. As a result, the combined production capacity of TMG is 990 tons per day. TMG is planning to increase its production capacity in 2016 by launching its fourth furnace.

| 22 |

|

(Translation) |

|

The details on the production capacity and volume are as follows:

| Capacity and Volume | 2015 | 2014 | 2013 | |||||||||

| Maximum capacity (unit : ton) | 361,350 | 248,950 | 187,150 | |||||||||

| Actual volume (unit : ton) | 317,988 | 230,268 | 180,469 | |||||||||

| Capacity usage (%) | 93.5 | 92.5 | 96.4 | |||||||||

| Increase in volume (%) | 38.1 | 27.6 | 70.1 | |||||||||

MGP, located at No. 72A, Jalan Tampoi, 81200 Johor Bharu, Johor, Malaysia, has a production capacity of 510 tons per day (In 2015, the production capacity was 461 tons per day). In 2014, MGP installed equipment for facilitating the melting of water glasses using electrical energy. As a consequence, MGP’s production capacity in the past year was higher than the production capacity in the preceding year. In 2015, MGP installed the narrow neck press & blow technology for producing light weight bottles in the sixth production line in order to reduce the use of resources and to focus on responding to the demand of the customers in the alcoholic beverage group. The details of the production capacity and volume are as follows:

| Capacity and Volume | 2015 | 2014 | 2013 | |||||||||

| Maximum capacity (unit : ton) | 186,150 | 182,500 | 162,425 | |||||||||

| Actual volume (unit : ton) | 168,190 | 171,422 | 164,965 | |||||||||

| Capacity usage (%) | 90.4 | 93.9 | 101.6 | |||||||||

| Increase in volume (%) | -1.9 | 3.9 | 3.2 | |||||||||

MVG has one glass packaging factory comprising land, office buildings, factory buildings, warehouses, machinery, and various equipment. Each factory had the necessary equipment and machinery installed for the production process, i.e. mixers, furnaces, forming machines, and annealing lehrs. The factory is located in an industrial estate in My Xuan A, Tan Thanh District, Ba Ria Vung Tau Province, Vietnam, and has a production capacity of 280 tons per day. The details of the production capacity and volume are as follows:

| 23 |

|

(Translation) |

|

| Capacity and Volume | 2015 | 2014 | 2013 | |||||||||

| Maximum capacity (unit : ton) | 102,200 | 102,200 | 102,200 | |||||||||

| Actual volume (unit : ton) | 92,428 | 79,214 | 72,061 | |||||||||

| Capacity usage (%) | 90.4 | 78 | 71 | |||||||||

| Increase in volume (%) | 16.7 | 9.93 | 3.67 | |||||||||

| (3.2) | Aluminum Can Packaging Business |

Production Capacity and Volume

TBC has an office and production plant in Hemaraj Saraburi Industrial Land, Nong Khae District, Sara Buri Province, located on a parcel of land of 56-2-75 rai. The details of the production lines are as follows:

| 1. | Three production lines of regular cans of 330 ml and 250 ml, and sleek cans of 330 ml and 250 ml |

| 2. | Four production lines of stay-on-tab and large opening end lids |

| 3. | One cutting and one coating line for aluminum lid production |

The details of the production capacity and volume are as follows:

| Capacity and Volume | 2015 | 2014 | 2013 | |||||||||||||||||||||

| Production line | Cans | Lids | Cans | Lids | Cans | Lids | ||||||||||||||||||

| Maximum capacity (Unit : million cans) | 2,200 | 3,450 | 2,200 | 2,700 | 2,200 | 2,700 | ||||||||||||||||||

| Actual volume (Unit: million cans) | 2,061 | 2,802 | 1,872 | 2,563 | 1,741 | 2,343 | ||||||||||||||||||

| Capacity and Volume | 2015 | 2014 | 2013 | |||||||||||||||||||||

| Capacity usage (%) | 94 | 81 | 85 | 95 | 79 | 87 | ||||||||||||||||||

| Increase in volume (%) | 10 | 9 | 8 | 9 | -3 | 33 | ||||||||||||||||||

| 24 |

|

(Translation) |

|

TBC BALL – VN has one aluminum can production line of regular cans of 330 ml and 250 ml. The details of the production capacity and volume are as follows:

| Capacity and Volume | 2015 | 2014 | 2013 | |||||||||

| Production line | ||||||||||||

| Maximum capacity (Unit : million cans) | 850 | 850 | 850 | |||||||||

| Actual volume (Unit: million cans) | 843 | 743 | 731 | |||||||||

| Capacity usage (%) | 99 | 87 | 86 | |||||||||

| Increase in volume (%) | 13 | 1.7 | 145 | |||||||||

| (3.3) | Plastic Packaging Business |

Production Capacity and Volume

BDP is located at Berli Jucker House, 12A floor, 99 Soi Rubia, Sukhumvit 42 Road, Phra Kanong Subdistrict, Khlong Toey District, Bangkok 10110. Its factory buildings, warehouses, machinery and other equipment are located at No. 166 Moo 3, Nikhom Sang Ton Eng Subdistrict, Muang Lop Buri District, Lop Buri Province 15000.

There is one production plant which is operational 24-hrs a day, divided into three shifts of eight hours each. The details of the production capacity and volume for the past three years are as follows:

| Capacity and Volume | 2015 | 2014 | 2013 | |||||||||

| Maximum capacity (unit : ton) | 33,412 | 33,412 | 32,514 | |||||||||

| Actual volume (unit : ton) | 14,210 | 16,412 | 16,332 | |||||||||

| Capacity usage (%) | 42.52 | 49.12 | 50.23 | |||||||||

| Increase in volume (%) | -13.42 | 0.48 | 1.44 | |||||||||

| 25 |

|

(Translation) |

|

| 2.2 | Consumer Supply Chain |

| (1) | Description of Products or Services |

| (1.1) | Food Products Business |

| - | Manufacture of snack food products and chocolate drinks under the brands: (1) “Party” mixed buttered and caramel fried sweet potato chips and buttered and caramel corn chips; (2) “Tasto” fried potato chips; (3) chocolate-coated snacks, (4) “Dozo” seasoned crispy rice crackers and fried seaweed; and (5) “Karamucho” Japanese fried potato chips by Berli Jucker Foods Co., Ltd. (“BJF”). |

| - | Manufacture, manufacture for hire, and distribution of snacks under the brands: “Wise”, “Tasto”, “Calbee”, and “Tesco”, by BJC Foods (Malaysia) Sdn. Bhd. (“BJFM”). |

| - | Manufacture and distribution of yoghurt drink and yoghurt under the brands: “Activia” which was rebranded as “Party Dairy” from February 2016, by Thai Dairy Co., Ltd. (“TDC”). |

| - | Marketing and distribution of food products manufactured within the country and abroad by the Company’s group, and the provision of a full-scale marketing and advertising plan via various channels of media such as television, magazines, radio, printed material, and promotional activities in order to create consumer awareness and acceptance, as well as the distribution to other manufacturers, by the Food Products Unit of the Company. The products are: |

| Company’s Brands | Contracted Brands | |

|

– “Tasto Fit” fried potato chips

– “Campus” fried potato chips

– “Party” mixed buttered fried sweet potato chips

– “Campus” chocolate-coated snacks

– “Dozo” seasoned crispy rice crackers

– “Cocoa Dutch” cocoa flavoured drinks

– “Campus Malt” U.H.T. drinks

– “Party Dairy” yoghurt product and yoghurt drink |

– “Kato” ready-to-drink juices

– “Zummer” ready-to-drink juices

– “Dole” packaged fruits

– “Karamucho” fried potato chips |

| 26 |

|

(Translation) |

|

| (1.2) | Consumer Products Business |

| - | Manufacture of tissue paper under the Company’s brands: “Cellox”, “Zilk”, “Belle”, “Maxmo”, and “BJC Hygienist”, as well as other retail stores’ brands, by Berli Jucker Cellox Co., Ltd. (“CPC”). |

| - | Manufacture and manufacture for hire of personal care products and household goods comprising soap, shampoo, cosmetics, candy, and chocolate, by Rubia Industry Co., Ltd., as follows: |

Product Details |

Soap | Cosmetics | Snacks | |||

| Brands under BJC Group |

- “Parrot Botanical”

- “Parrot Gold”

- “Parrot Natural Guard” for healthy skin

- “Parrot Herbal”

- “Dermapon”

- “Rosette” |

- “Parrot Botanical” shower cream

- “Parrot Gold” shower cream

- “Parrot Natural Guard” shower cream

- “Dermapon” baby shower cream

- Rosette” shower cream

- “Miruku” shower cream

|

- “Thailand Deluxe” chocolate | |||

| Manufacture for hire |

- “Baby Mild”

- “Avon”

- “Dr. Somchai”

- “Acne Aid”

- “Dermist” |

- “Dettol”

- “Avon”

- “Nivea”

- “Natriv”

- “Tabu” shower cream

- “Sparkle” toothpaste

- “Dentrium” toothpaste |

- “Sugus”

- “Coryfin C”

- “Sweet Perfect” chocolate

- “Big B” chocolate |

| 27 |

|

(Translation) |

|

| - | Marketing and distribution, as well as market planning, advertising, and arranging promotional activities at the sales location in order to create consumer awareness and acceptance of the products manufactured in the country and abroad by the Company’s group, and distribution of products to other business partners, by the Personal Care Products and Household Goods Unit. The products are categorized into three groups as follows: |

| 1. | Personal care products: “Parrot” soap, “Himalaya” personal household, “Dermapon” baby products, and “Belle” mosquito repellent. |

| 2. | Household goods: “Cellox”, “Zilk”, “Belle”, “Maxmo”, and “BJC Hygienist” tissue papers and cleaning products. |

| 3. | Contracted products both personal products and household goods: “Victory” toothbrushes, “Drypers” diapers, “Duck”, “Mr. Muscle”, “Spa Clean” and “Penguin” cleaning products, “Sawaday” and “Glade” air fresheners, “Baygon” insecticide, “Off” mosquito repellent, and “Hero” plastic bags. |

| (1.3) | Warehouse and Delivery Business |

Provision of logistics business, warehouse, and delivery business in order to distribute the products throughout the country, as well as customs clearance service for which the Company has been granted a license as an Authorized Economic Operator (AEO) with License No. 45 for the operation of import and export activities, and to render services for customers within and outside the Company’s Group, by Berli Jucker Logistics Co., Ltd. (“BJL”).

| (1.4) | Production and Distribution Business in Vietnam |