Form 8-K WhiteHorse Finance, Inc. For: Mar 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: March 2, 2021

(Date of earliest event reported)

WhiteHorse Finance, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 814-00967 | 45-4247759 | ||

| (State or other jurisdiction | (Commission | (IRS Employer | ||

| of incorporation) | File Number) | Identification Number) |

| 1450 Brickell Avenue, 31st Floor | ||

| Miami, Florida | 33131 | |

| (Address of principal executive offices) | (Zip Code) |

(305) 381-6999

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Stock, par value $0.001 per share | WHF | The Nasdaq Stock Market LLC (Nasdaq Global Select Market) | ||

| 6.50% Notes due 2025 | WHFBZ | The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition

On March 2, 2021, WhiteHorse Finance, Inc. (the “Company”) issued a press release announcing a quarterly distribution and its financial results for the fourth quarter and fiscal year ended December 31, 2020. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 furnished herewith, is being furnished and shall not be deemed “filed” for any purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such Section. The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 furnished herewith, shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure

A copy of an earnings presentation that is intended to be used by representatives of the Company is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 furnished herewith, is being furnished and shall not be deemed “filed” for any purpose of Section 18 of the Exchange Act, or otherwise subject to the liabilities of such Section. The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 furnished herewith, shall not be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2 furnished herewith, may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this Current Report on Form 8-K may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in filings with the Securities and Exchange Commission. The Company undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| 99.1 | Press Release of WhiteHorse Finance, Inc. dated March 2, 2021 |

| 99.2 | Earnings Presentation of WhiteHorse Finance, Inc. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: March 2, 2021 | WHITEHORSE FINANCE, INC. | |

| By: | /s/ Joyson C. Thomas | |

| Joyson C. Thomas | ||

| Chief Financial Officer | ||

Exhibit 99.1

WhiteHorse Finance, Inc. Announces Fourth Quarter and Full Year 2020 Earnings Results and Declares Quarterly Distribution of $0.355 Per Share

NEW YORK, NY, March 2, 2021 – WhiteHorse Finance, Inc. (“WhiteHorse Finance” or the “Company”) (Nasdaq: WHF) today announced its financial results for the year ended December 31, 2020. Additionally, the Company announced that its board of directors has declared a distribution of $0.355 per share with respect to the quarter ending March 31, 2021. The distribution will be payable on April 5, 2021 to stockholders of record as of March 26, 2021.

Fourth Quarter 2020 Summary Highlights

| • | Net Asset Value of $312.9 million, or $15.23 per share, compared to $15.23 per share in 2019 | |

| • | Investment portfolio(1) totaling $690.7 million | |

| • | STRS JV investment portfolio totaling $174.6 million | |

| • | Gross investment deployments(2) of $162.4 million for the fourth quarter, including new originations of $158.9 million and $3.5 million of fundings for add-ons to existing investments | |

| • | Gross investment deployments(2) of $286.9 million for the year, including new originations of $261.3 million and $25.6 million of fundings for add-ons to existing investments | |

| • | Net investment income of $6.9 million, or $0.335 per share, for the fourth quarter | |

| • | Core net investment income of $7.1 million, or $0.348 per share(3), for the fourth quarter | |

| • | Annual net investment income of $24.2 million, or $1.176 per share | |

| • | Annual core net investment income of $25.7 million, or $1.249 per share(3) | |

| • | Annual distributions of $1.545 per share, including special distributions of $0.125 per share |

(1) Includes investments in WHF STRS Ohio Senior Loan Fund LLC (“STRS JV”), an unconsolidated joint venture, totaling $51.2 million, at fair value.

(2) Excludes investments made in STRS JV.

(3) Core net investment income is a non-GAAP financial measure. The Company believes that core net investment income provides useful information to investors and management because it reflects the Company's financial performance excluding (i) the net impact of costs associated with the refinancing of the Company’s indebtedness, (ii) the accrual of the capital gains incentive fee attributable to net realized and unrealized gains and losses, and (iii) excise and other income taxes related to such net realized gains and losses (net of incentive fees). The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. Additional information on core net investment income and a reconciliation of core net investment income to its most directly comparable GAAP financial measure, net investment income, are set forth in Schedule 1 hereto.

Stuart Aronson, WhiteHorse Finance’s Chief Executive Officer commented, “During the fourth quarter, we successfully originated 16 first lien loans financed partially through $60 million unsecured notes newly issued under the current favorable market conditions. Our fourth quarter origination volume set a new company record and enabled us to reach our target leverage of 1.25x. The year 2020 presented unprecedented challenges, but our business remained resilient and we finished the year stronger than ever which emphasizes the strength of our three-tiered sourcing approach and rigorous underwriting standards. We will remain prudent as we continue to enhance value for our shareholders in this environment.”

Portfolio and Investment Activity

As of December 31, 2020, the fair value of WhiteHorse Finance’s investment portfolio was $690.7 million, compared with $589.7 million as of December 31, 2019. The portfolio at December 31, 2020 consisted of 99 positions across 67 companies with a weighted average effective yield of 9.9% on income-producing debt investments. The average debt investment size (excluding investments in STRS JV) was $7.3 million with the overall portfolio comprised of approximately 85.2% first lien secured loans, 4.0% second lien secured loans, 3.4% equity and 7.4% in investments in STRS JV. Almost all loans were substantially variable-rate investments (primarily indexed to the London Interbank Offered Rate) with fixed rate securities representing only 0.2% of loans at fair value. Nearly all performing floating rate investments have interest rate floors.

During the three months ended December 31, 2020, WhiteHorse Finance made investments in 16 new portfolio companies totaling $158.9 million, added a total of $3.5 million to five existing portfolio companies and funded $1.2 million to revolver commitments. Proceeds from sales and repayments totaled approximately $39.1 million for the quarter ended December 31, 2020, driven by a full realization in Vessco Holdings, LLC, partial sales of Vero Parent, Inc. and payments received from Golden Pear Funding Assetco, LLC.

In addition to the transactions above, during the three months ended December 31, 2020, WhiteHorse Finance transferred assets comprised of four new portfolio companies and one existing portfolio company totaling $32.4 million to STRS JV in exchange for cash consideration.

During the year ended December 31, 2020, WhiteHorse Finance invested $261.3 million across 26 new portfolio companies. The Company also invested $26 million in existing portfolio companies. Gross proceeds from sales and repayments (exclusive of asset transfers to STRS JV) totaled approximately $119.0 million for the year.

In addition to the transactions above, during the year ended December 31, 2020, WhiteHorse Finance transferred assets totaling $98.8 million in exchange for a net investment in STRS JV of $18.4 million as well as cash proceeds of $80.4 million. As of December 31, 2020, the Company’s investment in STRS JV was approximately $51.2 million, at fair value.

WHF STRS Ohio Senior Loan Fund LLC

As of December 31, 2020, STRS JV’s portfolio totaled $174.6 million, consisted of 20 portfolio companies and had a weighted average effective yield of 7.9% on its portfolio.

Results of Operations

For the three months and year ended December 31, 2020, the Company’s net investment income was approximately $6.9 million and $24.2 million, respectively, compared with approximately $7.7 million and $31.2 million for the same periods in the prior year, representing a decrease of approximately 10.4% and 22.4%, respectively. The decrease in net investment income for the year-over-year period was primarily attributable to lower non-recurring fee income, partially offset by higher investment income generated from STRS JV for the year ended December 31, 2020. The decrease in fee income during the quarter and year ended December 31, 2020 as compared with the same period in the prior year was primarily a result of fewer nonrecurring, fee-generating events.

For the three months and year ended December 31, 2020, core net investment income, a non-GAAP financial measure that excludes capital gains incentive fee accruals, the net effects of excise or other income taxes related to net realized gains and losses, and the associated costs of refinancing the Company’s indebtedness, was $7.1 million and $25.7 million, respectively, compared with $7.9 million and $31.1 million for the same period in the prior year, representing a decrease of approximately 10.1% and 17.4%, respectively.

For the three months and year ended December 31, 2020, WhiteHorse Finance reported net realized and unrealized gains on investments and foreign currency transactions of $1.3 million and $7.5 million, respectively. This compares with a net realized and unrealized gain on investments and foreign currency transactions of $1.1 million and a net realized and unrealized loss on investments and foreign currency transactions of $0.4 million for the three months and year ended December 31, 2019, respectively. The increase for the year-over-year period was primarily attributable to unrealized gains generated on AG Kings Holdings, Inc., partially offset by unrealized losses recognized on positions in Grupo HIMA San Pablo, Inc., Honors Holdings, LLC as well as Lift Brands, Inc., in addition to realized gains generated from sales and equity realizations in Vessco Holdings, LLC, PMA Holdco, LLC, Fluent, LLC and Vero Parent, Inc.

WhiteHorse Finance reported a net increase in net assets resulting from operations of approximately $8.2 million and $31.7 million for the three months and year ended December 31, 2020, respectively, which compares with a net increase of $8.8 million and $30.8 million for the three months and year ended December 31, 2019, respectively.

WhiteHorse Finance’s net asset value was $312.9 million, or $15.23 per share, as of December 31, 2020, as compared with $314.6 million, or $15.31 per share, as of September 30, 2020. As of December 31, 2019, WhiteHorse Finance’s net asset value was $313.0 million, or $15.23 per share.

Liquidity and Capital Resources

As of December 31, 2020, WhiteHorse Finance had cash and cash equivalents of $15.9 million, as compared with $22.9 million as of September 30, 2020, inclusive of restricted cash. As of December 31, 2020, the Company also had $19.8 million of undrawn capacity under its revolving credit facility.

Distributions

The Company’s board of directors has declared a distribution of $0.355 per share with respect to the quarter ending March 31, 2021. The distribution will be payable on April 5, 2021 to stockholders of record as of March 26, 2021.

On November 9, 2020, the Company declared a distribution of $0.355 per share for the quarter ended December 31, 2020, consistent with distributions declared for the thirty-third consecutive quarter since the Company’s initial public offering. The distribution was paid on January 5, 2021 to stockholders of record as of December 21, 2020. In addition, previously on October 9, 2020, the Company declared a special distribution of $0.125 per share, which was paid on December 10, 2020 to stockholders of record as of October 30, 2020.

Distributions are paid from taxable earnings and may include return of capital and/or capital gains. The specific tax characteristics of the distributions will be reported to stockholders on Form 1099-DIV after the end of the calendar year and in the Company's periodic reports filed with the Securities and Exchange Commission.

Conference Call

WhiteHorse Finance will host a conference call to discuss its fourth quarter and fiscal year-end results at 2:30 p.m. ET on Tuesday, March 2, 2021. To access the teleconference, please dial 706-758-9224 (domestic and international) approximately 10 minutes before the teleconference’s scheduled start time and reference ID #1860839. Investors may also access the call on the investor relations portion of the Company’s website at www.whitehorsefinance.com.

If you are unable to access the live teleconference, a replay will be available beginning approximately two hours after the call’s completion through March 9, 2021. The teleconference replay can be accessed by dialing 404-537-3406 (domestic and international) and entering ID #1860839. A webcast replay will also be available on the investor relations portion of the Company’s website at www.whitehorsefinance.com.

About WhiteHorse Finance, Inc.

WhiteHorse Finance is a business development company that originates and invests in loans to privately held, lower middle market companies across a broad range of industries. The Company's investment activities are managed by H.I.G. WhiteHorse Advisers, LLC, an affiliate of H.I.G. Capital, LLC, (“H.I.G. Capital”). H.I.G. Capital is a leading global alternative asset manager with $43 billion of capital under management(4) across a number of funds focused on the small and mid-cap markets. For more information about H.I.G. Capital, please visit http://www.higcapital.com. For more information about the Company, please visit http://www.whitehorsefinance.com.

Forward-Looking Statements

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Statements other than statements of historical facts included in this press release may constitute forward-looking

statements and are not guarantees of future performance or results and involve a number of risks and uncertainties. Actual results

may differ materially from those in the forward-looking statements as a result of a number of factors, including those described

from time to time in filings with the Securities and Exchange Commission. The Company undertakes no duty to update any forward-looking

statement made herein. All forward-looking statements speak only as of the date of this press release.

(4) Based on total capital commitments managed by H.I.G. Capital and affiliates.

SCHEDULE 1

As a supplement to GAAP financial measures, the Company has provided information relating to core net investment income, which is a non-GAAP measure. This measure is provided in addition to, but not as a substitute for, net investment income determined in accordance with GAAP. The Company’s non-GAAP measures may differ from similar measures by other companies, even if similar terms are used to identify such measures. Core net investment income represents net investment income adjusted to exclude the net impact of costs associated with the refinancing of the Company’s indebtedness, the accrual of the capital gains incentive fee attributable to net realized and unrealized gains and losses, and excise or other income taxes related to such net realized gains and losses (net of incentive fees). There were no excise or other income taxes related to net realized gains and losses nor did the Company incur any costs with refinancing any of its indebtedness for the quarters and years ended December 31, 2020 and December 31, 2019.

The following table provides a reconciliation of net investment

income to core net investment income for the three months ended December 31, 2020 and December 31, 2019 (in thousands, except per

share data):

| December 31, 2020 | December 31, 2019 | |||||||||||||||

| Amount | Per Share Amounts | Amount | Per Share Amounts | |||||||||||||

| Net investment income | $ | 6,883 | $ | 0.335 | $ | 7,702 | $ | 0.375 | ||||||||

| Net impact of costs associated with refinancing of indebtedness | - | - | - | - | ||||||||||||

| Accrual for capital gains incentive fee | 262 | 0.013 | 212 | 0.010 | ||||||||||||

| Net impact of excise tax expense related to net realized gains and losses | - | - | - | - | ||||||||||||

| Core net investment income | $ | 7,145 | $ | 0.348 | $ | 7,914 | $ | 0.385 | ||||||||

The following table provides a reconciliation of net investment

income to core net investment income for the years ended December 31, 2020 and December 31, 2019 (in thousands, except per share

data):

| December 31, 2020 | December 31, 2019 | |||||||||||||||

| Amount | Per Share Amounts | Amount | Per Share Amounts | |||||||||||||

| Net investment income | $ | 24,157 | $ | 1.176 | $ | 31,196 | $ | 1.518 | ||||||||

| Net impact of costs associated with refinancing of indebtedness | - | - | - | - | ||||||||||||

| Accrual for capital gains incentive fee | 1,505 | 0.073 | (71 | ) | (0.003 | ) | ||||||||||

| Net impact of excise tax expense related to net realized gains and losses | - | - | - | - | ||||||||||||

| Core net investment income | $ | 25,662 | $ | 1.249 | $ | 31,125 | $ | 1.515 | ||||||||

WHITEHORSE FINANCE, INC.

CONSOLIDATED STATEMENTS OF ASSETS AND

LIABILITIES

(in thousands, except share and per share data)

| December 31, 2020 | December 31, 2019 | |||||||

| Assets | ||||||||

| Investments, at fair value | ||||||||

| Non-controlled/non-affiliate company investments | $ | 623,777 | $ | 546,744 | ||||

| Non-controlled affiliate company investments | 15,717 | 9,651 | ||||||

| Controlled affiliate company investments | 51,241 | 33,293 | ||||||

| Total investments, at fair value (amortized cost $695,429 and $597,725, respectively) | 690,735 | 589,688 | ||||||

| Cash and cash equivalents | 8,062 | 4,294 | ||||||

| Restricted cash and cash equivalents | 7,549 | 23,252 | ||||||

| Restricted foreign currency (cost of $319) | 333 | — | ||||||

| Interest and dividend receivable | 6,532 | 6,010 | ||||||

| Amounts receivable on unsettled investment transactions | 4,717 | 360 | ||||||

| Prepaid expenses and other receivables | 1,061 | 7,620 | ||||||

| Total assets | $ | 718,989 | $ | 631,224 | ||||

| Liabilities | ||||||||

| Debt | $ | 384,880 | $ | 298,924 | ||||

| Distributions payable | 7,294 | 7,294 | ||||||

| Management fees payable | 3,354 | 3,060 | ||||||

| Incentive fees payable | 6,117 | 5,230 | ||||||

| Amounts payable on unsettled investment transactions | 497 | — | ||||||

| Interest payable | 1,870 | 1,674 | ||||||

| Accounts payable and accrued expenses | 1,708 | 1,944 | ||||||

| Advances received from unfunded credit facilities | 372 | 143 | ||||||

| Total liabilities | 406,092 | 318,269 | ||||||

| Commitments and contingencies | ||||||||

| Net assets | ||||||||

| Common stock, 20,546,032 and 20,546,032 shares issued and outstanding, par value $0.001 per share, respectively, and 100,000,000 shares authorized | 21 | 21 | ||||||

| Paid-in capital in excess of par | 300,002 | 300,744 | ||||||

| Accumulated undistributed (overdistributed) earnings | 12,874 | 12,190 | ||||||

| Total net assets | 312,897 | 312,955 | ||||||

| Total liabilities and total net assets | $ | 718,989 | $ | 631,224 | ||||

| Number of shares outstanding | 20,546,032 | 20,546,032 | ||||||

| Net asset value per share | $ | 15.23 | $ | 15.23 | ||||

WHITEHORSE FINANCE, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

| Years ended December 31, | ||||||||||||

| 2020 | 2019 | 2018 | ||||||||||

| Investment income | ||||||||||||

| From non-controlled/non-affiliate company investments | ||||||||||||

| Interest income | $ | 54,039 | $ | 56,566 | $ | 56,208 | ||||||

| Fee income | 1,988 | 8,398 | 4,906 | |||||||||

| Dividend income | 133 | — | — | |||||||||

| From non-controlled affiliate company investments | ||||||||||||

| Dividend income | 1,183 | 1,173 | 2,132 | |||||||||

| From controlled affiliate company investments | ||||||||||||

| Interest income | 2,595 | 936 | — | |||||||||

| Dividend income | 1,761 | — | — | |||||||||

| Total investment income | 61,699 | 67,073 | 63,246 | |||||||||

| Expenses | ||||||||||||

| Interest expense | 13,125 | 13,468 | 11,599 | |||||||||

| Base management fees | 12,464 | 11,300 | 10,511 | |||||||||

| Performance-based incentive fees | 7,619 | 7,710 | 12,134 | |||||||||

| Administrative service fees | 683 | 646 | 684 | |||||||||

| General and administrative expenses | 2,909 | 2,337 | 2,646 | |||||||||

| Total expenses, before fees waived | 36,800 | 35,461 | 37,574 | |||||||||

| Base management fees waived | — | (397 | ) | (270 | ) | |||||||

| Total expenses, net of fees waived | 36,800 | 35,064 | 37,304 | |||||||||

| Net investment income before excise tax | 24,899 | 32,009 | 25,942 | |||||||||

| Excise tax | 742 | 813 | 942 | |||||||||

| Net investment income after excise tax | 24,157 | 31,196 | 25,000 | |||||||||

| Realized and unrealized gains (losses) on investments and foreign currency transactions | ||||||||||||

| Net realized gains (losses) | ||||||||||||

| Non-controlled/non-affiliate company investments | 4,118 | (409 | ) | (216 | ) | |||||||

| Non-controlled affiliate company investments | — | — | 32,950 | |||||||||

| Foreign currency transactions | 70 | 1 | — | |||||||||

| Foreign currency forward contracts | (25 | ) | — | — | ||||||||

| Net realized gains (losses) | 4,163 | (408 | ) | 32,734 | ||||||||

| Net change in unrealized appreciation (depreciation) | ||||||||||||

| Non-controlled/non-affiliate company investments | 4,685 | 388 | (5,136 | ) | ||||||||

| Non-controlled affiliate company investments | (878 | ) | (514 | ) | 4,703 | |||||||

| Controlled affiliate company investments | (464 | ) | 363 | — | ||||||||

| Translation of assets and liabilities in foreign currencies | 22 | (184 | ) | — | ||||||||

| Net change in unrealized appreciation (depreciation) | 3,365 | 53 | (433 | ) | ||||||||

| Net realized and unrealized gains (losses) on investments and foreign currency transactions | 7,528 | (355 | ) | 32,301 | ||||||||

| Net increase in net assets resulting from operations | $ | 31,685 | $ | 30,841 | $ | 57,301 | ||||||

| Per Common Share Data | ||||||||||||

| Basic and diluted earnings per common share | $ | 1.55 | $ | 1.50 | $ | 2.79 | ||||||

| Dividends and distributions declared per common share | $ | 1.55 | $ | 1.62 | $ | 1.42 | ||||||

| Basic and diluted weighted average common shares outstanding | 20,546,032 | 20,546,032 | 20,538,971 | |||||||||

WHITEHORSE FINANCE, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2020

(in thousands)

| Investment Type(1) | Spread

Above Index(2) | Interest

Rate(3) | Acquisition

Date(10) | Maturity

Date | Principal/ Share Amount | Amortized

Cost | Fair

Value(11) | Fair

Value As A Percentage of Net Assets | ||||||||||||||||||||

| North America | ||||||||||||||||||||||||||||

| Debt Investments | ||||||||||||||||||||||||||||

| Advertising | ||||||||||||||||||||||||||||

| Fluent, LLC | ||||||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.00% (0.50% Floor) | 7.50 | % | 03/26/18 | 03/27/23 | 7,453 | $ | 7,453 | $ | 7,453 | 2.38 | % | ||||||||||||||||

| SmartSign Holdings LLC | ||||||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.50% (1.00% Floor) | 8.50 | % | 08/21/20 | 10/11/24 | 7,744 | 7,603 | 7,706 | 2.46 | |||||||||||||||||||

| 15,197 | 15,056 | 15,159 | 4.84 | |||||||||||||||||||||||||

| Agricultural & Farm Machinery | ||||||||||||||||||||||||||||

| Bad Boy Mowers Acquisition, LLC | ||||||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 5.75% (1.00% Floor) | 6.75 | % | 12/19/19 | 12/06/25 | 9,294 | 9,062 | 9,201 | 2.94 | |||||||||||||||||||

| Air Freight & Logistics | ||||||||||||||||||||||||||||

| Access USA Shipping, LLC | ||||||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 8.00% (1.50% Floor) | 9.50 | % | 02/08/19 | 02/08/24 | 5,359 | 5,309 | 5,359 | 1.71 | |||||||||||||||||||

| Application Software | ||||||||||||||||||||||||||||

| Connexity, Inc. | ||||||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 8.50% (1.50% Floor) | 10.00 | % | 05/21/20 | 05/21/25 | 10,863 | 10,577 | 10,863 | 3.47 | |||||||||||||||||||

| Newscycle Solutions, Inc. | ||||||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.00% (1.00% Floor) | 8.00 | % | 06/14/19 | 12/29/22 | 3,245 | 3,209 | 3,194 | 1.02 | |||||||||||||||||||

| First Lien Secured Revolving Loan(7) | L+ 7.00% (1.00% Floor) | 8.00 | % | 06/14/19 | 12/29/22 | 181 | 179 | 177 | 0.06 | |||||||||||||||||||

| TaxSlayer LLC | ||||||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.50% (1.00% Floor) | 7.50 | % | 12/31/20 | 12/31/26 | 14,452 | 14,163 | 14,163 | 4.53 | |||||||||||||||||||

| First Lien Secured Revolving Loan(7) | L+ 6.50% (1.00% Floor) | 7.50 | % | 12/31/20 | 12/31/26 | — | — | — | — | |||||||||||||||||||

| 28,741 | 28,128 | 28,397 | 9.08 | |||||||||||||||||||||||||

| Automotive Retail | ||||||||||||||||||||||||||||

| Team Car Care Holdings, LLC | ||||||||||||||||||||||||||||

| First Lien Secured Term Loan(12) | Base rate+ 8.00% (1.00% Floor) | 9.00 | % | 02/26/18 | 02/23/23 | 16,168 | 16,011 | 15,820 | 5.06 | |||||||||||||||||||

| BW Gas & Convenience Holdings, LLC | ||||||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.25% (0.00% Floor) | 6.40 | % | 11/15/19 | 11/18/24 | 6,319 | 6,121 | 6,319 | 2.02 | |||||||||||||||||||

| 22,487 | 22,132 | 22,139 | 7.08 | |||||||||||||||||||||||||

| Broadcasting | ||||||||||||||||||||||||||||

| Alpha Media, LLC | ||||||||||||||||||||||||||||

| First Lien Secured Term Loan | P+7.50% (2.00% Floor) | 10.75 | % | 08/14/18 | 02/25/22 | 5,075 | 5,022 | 4,844 | 1.55 | |||||||||||||||||||

| Building Products | ||||||||||||||||||||||||||||

| Drew Foam Companies Inc | ||||||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.50% (1.00% Floor) | 7.50 | % | 12/15/20 | 11/24/25 | 10,078 | 9,878 | 9,879 | 3.16 | |||||||||||||||||||

| First Lien Secured Revolving Loan(7) | L+ 6.50% (1.00% Floor) | 7.50 | % | 12/15/20 | 11/05/25 | 332 | 325 | 325 | 0.10 | |||||||||||||||||||

| LHS Borrower, LLC | ||||||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.75% (1.00% Floor) | 7.75 | % | 09/30/20 | 09/30/25 | 9,689 | 9,483 | 9,543 | 3.05 | |||||||||||||||||||

| First

Lien Secured Revolving Loan (7) | L+ 6.75% (1.00% Floor) | 7.75 | % | 09/30/20 | 09/30/25 | — | — | 4 | — | |||||||||||||||||||

| 20,099 | 19,686 | 19,751 | 6.31 | |||||||||||||||||||||||||

WHITEHORSE FINANCE, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2020

(in thousands)

| Investment Type(1) | Spread

Above Index(2) | Interest

Rate(3) | Acquisition

Date(10) | Maturity

Date | Principal/ Share Amount | Amortized

Cost | Fair

Value(11) | Fair

Value As A Percentage of Net Assets | ||||||||||||||||

| Cable & Satellite | ||||||||||||||||||||||||

| Bulk Midco, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan(15) | L+ 7.19% (1.00% Floor) | 8.19% | 06/08/18 | 06/08/23 | 15,000 | $ | 14,890 | $ | 14,250 | 4.55 | % | |||||||||||||

| Communications Equipment | ||||||||||||||||||||||||

| Ribbon Communications Operating Company, Inc. | ||||||||||||||||||||||||

| First Lien Secured Term Loan(5) | L+ 7.50% (0.00% Floor) | 7.65% | 08/14/20 | 03/03/26 | 12,438 | 12,002 | 12,313 | 3.94 | % | |||||||||||||||

| Sorenson Communications, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.50% (0.00% Floor) | 6.75% | 03/15/19 | 04/29/24 | 3,462 | 3,393 | 3,457 | 1.10 | ||||||||||||||||

| 15,900 | 15,395 | 15,770 | 5.04 | |||||||||||||||||||||

| Construction & Engineering | ||||||||||||||||||||||||

| Atlas Intermediate Holdings LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.25% (1.00% Floor) | 7.25% | 05/26/20 | 02/13/26 | 15,073 | 14,259 | 14,922 | 4.77 | ||||||||||||||||

| Road Safety Services, Inc. | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.00% (1.00% Floor) | 7.00% | 12/31/20 | 09/18/23 | 4,550 | 4,459 | 4,461 | 1.43 | ||||||||||||||||

| First Lien Secured Revolving

Loan(7) | L+ 6.00% (1.00% Floor) | 7.00% | 12/31/20 | 09/18/23 | — | — | 17 | 0.01 | ||||||||||||||||

| Tensar Corp. | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.75% (1.00% Floor) | 7.75% | 11/20/20 | 08/20/25 | 7,000 | 6,829 | 6,829 | 2.18 | ||||||||||||||||

| 26,623 | 25,547 | 26,229 | 8.39 | |||||||||||||||||||||

| Construction Materials | ||||||||||||||||||||||||

| Claridge Products and Equipment, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.50% | 7.50% | 12/30/20 | 12/29/25 | 8,000 | 7,840 | 7,840 | 2.51 | ||||||||||||||||

| (1.00% Floor) | ||||||||||||||||||||||||

| First

Lien Secured Revolving Loan(7) | L+ 6.50% (1.00% Floor) | 7.50% | 12/30/20 | 12/29/25 | — | — | — | — | ||||||||||||||||

| 8,000 | 7,840 | 7,840 | 2.51 | |||||||||||||||||||||

| Consumer Finance | ||||||||||||||||||||||||

| Maxitransfers Blocker Corp | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 9.00% (1.00% Floor) | 10.00% | 10/07/20 | 10/07/25 | 8,869 | 8,668 | 8,668 | 2.77 | ||||||||||||||||

| First Lien Secured Revolving Loan(4) | L+ 9.00% (1.00% Floor) | 10.00% | 10/07/20 | 10/07/25 | 1,038 | 1,014 | 1,014 | 0.32 | ||||||||||||||||

| 9,907 | 9,682 | 9,682 | 3.09 | |||||||||||||||||||||

| Data Processing & Outsourced Services | ||||||||||||||||||||||||

| Escalon Services Inc | ||||||||||||||||||||||||

| First Lien Secured Term Loan | P+12.50% (0.75% Floor) | 15.75% (1.50% PIK) | 12/04/20 | 12/04/25 | 8,000 | 7,295 | 7,763 | 2.48 | ||||||||||||||||

| FPT Operating Company, LLC/ | ||||||||||||||||||||||||

| TLabs Operating Company, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 8.25% (1.00% Floor) | 9.25% (0.50% PIK) | 12/23/16 | 06/07/24 | 24,467 | 24,225 | 23,460 | 7.50 | ||||||||||||||||

| Geo Logic Systems Ltd.(5) | ||||||||||||||||||||||||

| First Lien Secured Term Loan(13) | C +6.25% (1.00% Floor) | 7.25% | 12/19/19 | 12/19/24 | 6,709 | 5,035 | 5,164 | 1.65 | ||||||||||||||||

| First Lien Secured Revolving Loan(7)(13) | C +6.25% (1.00% Floor) | 7.25% | 12/19/19 | 12/19/24 | — | — | (2 | ) | — | |||||||||||||||

| 39,176 | 36,555 | 36,385 | 11.63 | |||||||||||||||||||||

WHITEHORSE FINANCE, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2020

(in thousands)

| Investment Type(1) | Spread Above Index(2) | Interest Rate(3) | Acquisition Date(10) | Maturity Date | Principal/ Share Amount | Amortized Cost | Fair Value(11) | Fair Value As A Percentage of Net Assets | ||||||||||||||||

| Department Stores | ||||||||||||||||||||||||

| Mills Fleet Farm Group, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.00% (1.00% Floor) | 7.00% | 10/24/18 | 10/24/24 | 13,543 | $ | 13,292 | $ | 13,272 | 4.24 | % | |||||||||||||

| Distributors | ||||||||||||||||||||||||

| Crown Brands, LLC | ||||||||||||||||||||||||

| Second Lien Secured Term

Loan(20) | L+ 10.50% (1.50% Floor) | 12.00% | 12/15/20 | 01/08/26 | 4,526 | 4,420 | 3,621 | 1.16 | ||||||||||||||||

| Second Lien Secured Delayed Draw Loan(20) | L+ 10.50% (1.50% Floor) | 12.00% | 12/15/20 | 01/08/26 | 671 | 671 | 537 | 0.17 | ||||||||||||||||

| 5,197 | 5,091 | 4,158 | 1.33 | |||||||||||||||||||||

| Diversified Chemicals | ||||||||||||||||||||||||

| Sklar Holdings, Inc. | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.00% (1.00% Floor) | 7.00% | 11/13/19 | 05/13/23 | 8,882 | 8,718 | 8,834 | 2.82 | ||||||||||||||||

| Diversified Support Services | ||||||||||||||||||||||||

| ImageOne Industries, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 10.00% (1.00% Floor) | 11.00% (4.00% PIK) | 01/11/18 | 01/11/23 | 6,564 | 6,422 | 6,564 | 2.10 | ||||||||||||||||

| First Lien Secured Revolving Loan(4)(7) | L+ 10.00% (1.00% Floor) | 11.00% (4.00% PIK) | 07/22/19 | 12/12/22 | 379 | 379 | 379 | 0.12 | ||||||||||||||||

| NNA Services, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.00% (1.50% Floor) | 8.50% | 10/16/18 | 10/16/23 | 13,353 | 13,178 | 13,284 | 4.25 | ||||||||||||||||

| 20,296 | 19,979 | 20,227 | 6.47 | |||||||||||||||||||||

| Education Services | ||||||||||||||||||||||||

| EducationDynamics, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.75% (1.00% Floor) | 8.75% | 11/26/19 | 11/26/24 | 13,649 | 13,428 | 13,612 | 4.35 | ||||||||||||||||

| Food Retail | ||||||||||||||||||||||||

| AG Kings Holdings, Inc. | ||||||||||||||||||||||||

| First Lien Secured Term Loan(4)(8) | P+ 11.00% (0.75% Floor) | 16.25% (2.00% PIK) | 8/10/16 | 08/10/21 | 21,755 | 8,612 | 7,600 | 2.43 | ||||||||||||||||

| Superpriority Secured Debtor-In-Possession Term Loan(4)(18) | L+ 10.00% (1.00% Floor) | 11.00% | 08/26/20 | 02/08/21 | 14,222 | 5,663 | 14,222 | 4.55 | ||||||||||||||||

| 35,977 | 14,275 | 21,822 | 6.98 | |||||||||||||||||||||

| Health Care Facilities | ||||||||||||||||||||||||

| Epiphany Dermatology | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.50% (1.00% Floor) | 8.50% | 12/04/20 | 12/01/25 | 3,500 | 3,414 | 3,414 | 1.09 | ||||||||||||||||

| First Lien Secured Revolving

Loan(7) | L+ 7.50% (1.00% Floor) | 8.50% | 12/04/20 | 12/01/25 | — | — | — | — | ||||||||||||||||

| First Lien Secured Delayed Draw Loan(7) | L+ 7.50% (1.00% Floor) | 8.50% | 12/04/20 | 12/01/25 | — | — | — | — | ||||||||||||||||

| Grupo HIMA San Pablo, Inc. | ||||||||||||||||||||||||

| First Lien Secured Term Loan A | L+ 9.00% | 9.22% | 05/15/19 | 04/30/19 | 3,855 | 3,855 | 2,613 | 0.84 | ||||||||||||||||

| First Lien Secured Term Loan B | L+ 9.00% (1.50% Floor) | 10.50% | 02/01/13 | 04/30/19 | 13,511 | 13,511 | 9,161 | 2.93 | ||||||||||||||||

| Second Lien Secured Term Loan(8) | N/A | 15.75% (2.00% PIK) | 02/01/13 | 07/31/18 | 1,028 | 1,024 | — | — | ||||||||||||||||

| 21,894 | 21,804 | 15,188 | 4.86 | |||||||||||||||||||||

| Health Care Services | ||||||||||||||||||||||||

| CHS Therapy, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan A | L+ 7.75% (1.50% Floor) | 9.25% | 06/14/19 | 06/14/24 | 7,422 | 7,325 | 7,422 | 2.37 | ||||||||||||||||

| First Lien Secured Term Loan C | L+ 7.75% (1.50% Floor) | 9.25% | 10/07/20 | 06/14/24 | 912 | 895 | 895 | 0.29 | ||||||||||||||||

WHITEHORSE FINANCE, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2020

(in thousands)

| Investment Type(1) | Spread

Above Index(2) | Interest

Rate(3) | Acquisition

Date(10) | Maturity

Date | Principal/ Share Amount | Amortized

Cost | Fair

Value(11) | Fair

Value As A Percentage of Net Assets | ||||||||||||||||

| Ivy Rehab Holdings LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.75% (1.00% Floor) | 7.75% | 12/04/20 | 12/04/24 | 8,855 | $ | 8,682 | $ | 8,682 | 2.77 | % | |||||||||||||

| First Lien Secured Revolving

Loan(7) | L+ 6.75% (1.00% Floor) | 7.75% | 12/04/20 | 12/04/25 | — | — | — | — | ||||||||||||||||

| First Lien Secured Delayed Draw Loan(7) | L+ 6.75% (1.00% Floor) | 7.75% | 12/04/20 | 12/04/25 | — | — | — | — | ||||||||||||||||

| Lab Logistics, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.25% (1.00% Floor) | 8.25% | 10/16/19 | 11/19/25 | 709 | 693 | 694 | 0.22 | ||||||||||||||||

| First Lien Secured Delayed Draw Loan | L+ 7.25% (1.00% Floor) | 8.25% | 10/16/19 | 09/25/23 | 5,236 | 5,209 | 5,236 | 1.67 | ||||||||||||||||

| PG Dental New Jersey Parent, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.75% (1.00% Floor) | 8.75% | 11/25/20 | 11/25/25 | 16,170 | 15,813 | 15,814 | 5.05 | ||||||||||||||||

| First

Lien Secured Revolving Loan (7) | L+ 7.75% (1.00% Floor) | 8.75% | 11/25/20 | 11/25/25 | — | — | — | — | ||||||||||||||||

| 39,304 | 38,617 | 38,743 | 12.37 | |||||||||||||||||||||

| Home Furnishings | ||||||||||||||||||||||||

| Sure Fit Home Products, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan(8) | L+ 9.75% (1.00% Floor) | 10.75% | 10/26/18 | 07/13/22 | 5,229 | 5,111 | 4,019 | 1.28 | ||||||||||||||||

| Interactive Media & Services | ||||||||||||||||||||||||

| What If Media Group, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.50% (1.00% Floor) | 7.50% | 10/02/19 | 10/02/24 | 12,594 | 12,405 | 12,594 | 4.02 | ||||||||||||||||

| Internet & Direct Marketing Retail | ||||||||||||||||||||||||

| BBQ Buyer, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 8.00% (1.50% Floor) | 9.50% | 08/28/20 | 08/28/25 | 10,669 | 10,421 | 10,563 | 3.38 | ||||||||||||||||

| First Lien Secured Revolving

Loan(7) | L+ 8.00% (1.50% Floor) | 9.50% | 08/28/20 | 02/28/21 | — | — | 8 | — | ||||||||||||||||

| Luxury Brand Holdings, Inc. | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.00% (1.00% Floor) | 8.00% | 12/04/20 | 06/04/26 | 6,000 | 5,882 | 5,882 | 1.88 | ||||||||||||||||

| Potpourri Group, Inc. | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 8.25% (1.50% Floor) | 9.75% | 07/03/19 | 07/03/24 | 18,390 | 18,099 | 18,238 | 5.83 | ||||||||||||||||

| 35,059 | 34,402 | 34,691 | 11.09 | |||||||||||||||||||||

| Investment Banking & brokerage | ||||||||||||||||||||||||

| JVMC Holdings Corp. (f/k/a RJO Holdings Corp) | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.25% (1.00% Floor) | 8.25% | 02/28/19 | 02/28/24 | 13,598 | 13,512 | 13,598 | 4.35 | ||||||||||||||||

| IT Consulting & Other Services | ||||||||||||||||||||||||

| AST-Applications Software Technology LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 8.00% (1.00% Floor) | 9.00% (1.00% PIK) | 01/10/17 | 01/10/23 | 4,019 | 3,988 | 4,019 | 1.28 | ||||||||||||||||

| RCKC Acquisitions LLC (dba KSM Consulting LLC) | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.25% (1.00% Floor) | 7.25% | 12/31/20 | 12/31/26 | 11,378 | 11,150 | 11,150 | 3.56 | ||||||||||||||||

| First Lien Secured Revolving

Loan(7) | L+ 6.25% (1.00% Floor) | 7.25% | 12/31/20 | 12/31/26 | — | — | — | — | ||||||||||||||||

| First Lien Secured Delayed Draw Loan(7) | L+ 6.25% (1.00% Floor) | 7.25% | 12/31/20 | 12/31/22 | — | — | — | — | ||||||||||||||||

| 15,397 | 15,138 | 15,169 | 4.84 | |||||||||||||||||||||

WHITEHORSE FINANCE, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2020

(in thousands)

| Investment Type(1) | Spread

Above Index(2) | Interest

Rate(3) | Acquisition

Date(10) | Maturity

Date | Principal/ Share Amount | Amortized

Cost | Fair

Value(11) | Fair

Value As A Percentage of Net Assets | ||||||||||||||||

| Leisure Facilities | ||||||||||||||||||||||||

| Honors Holdings, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan(16) | L+ 7.97% (1.00% Floor) | 8.97% (0.50% PIK) | 09/06/19 | 09/06/24 | 9,427 | $ | 9,278 | $ | 8,296 | 2.65 | % | |||||||||||||

| First Lien Secured Delayed Draw Loan(16) | L+ 7.61% (1.00% Floor) | 8.61% (0.50% PIK) | 09/06/19 | 09/06/24 | 4,643 | 4,597 | 4,086 | 1.31 | ||||||||||||||||

| Lift Brands, Inc. (aka Snap Fitness Holdings, Inc) | ||||||||||||||||||||||||

| First Lien Secured Term Loan A | L+ 3.25% (1.00% Floor) | 4.25% | 06/29/20 | 06/29/25 | 5,659 | 5,580 | 5,569 | 1.78 | ||||||||||||||||

| First Lien Secured Term Loan B | N/A | 9.50% (9.50% PIK) | 06/29/20 | 06/29/25 | 1,164 | 1,138 | 1,133 | 0.36 | ||||||||||||||||

| First Lien Secured Term Loan C(9) | N/A | 9.50% (9.50% PIK) | 06/29/20 | NA | 1,268 | 1,265 | 1,265 | 0.40 | ||||||||||||||||

| 22,161 | 21,858 | 20,349 | 6.50 | |||||||||||||||||||||

| Office Services & Supplies | ||||||||||||||||||||||||

| Empire Office, Inc. | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.75% (1.50% Floor) | 8.25% | 04/12/19 | 04/12/24 | 10,736 | 10,595 | 10,489 | 3.35 | ||||||||||||||||

| Packaged Foods & Meats | ||||||||||||||||||||||||

| Lenny & Larry's, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan(17) | L+ 7.94% (1.00% Floor) | 8.94% (1.17% PIK) | 05/15/18 | 05/15/23 | 11,304 | 11,200 | 10,811 | 3.46 | ||||||||||||||||

| Personal Products | ||||||||||||||||||||||||

| Inspired Beauty Brands, Inc. | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.00% (1.00% Floor) | 8.00% | 12/30/20 | 12/31/25 | 11,500 | 11,270 | 11,270 | 3.60 | ||||||||||||||||

| First

Lien Secured Revolving Loan(7) | L+ 7.00% (1.00% Floor) | 8.00% | 12/30/20 | 12/31/25 | — | — | — | — | ||||||||||||||||

| 11,500 | 11,270 | 11,270 | 3.60 | |||||||||||||||||||||

| Property & Casualty Insurance | ||||||||||||||||||||||||

| Policy Services Company, LLC(5) | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.00% (1.00% Floor) | 7.00% | 03/06/20 | 05/31/24 | 6,240 | 5,987 | 6,115 | 1.95 | ||||||||||||||||

| Research & Consulting Services | ||||||||||||||||||||||||

| Comniscient Technologies LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.50% (1.00% Floor) | 8.50% | 10/13/20 | 10/13/25 | 6,962 | 6,830 | 6,830 | 2.18 | ||||||||||||||||

| First Lien Secured Revolving

Loan(7) | L+ 7.50% (1.00% Floor) | 8.50% | 10/13/20 | 10/13/25 | — | — | — | — | ||||||||||||||||

| Nelson Worldwide, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 9.25% (1.00% Floor) | 10.25% | 01/09/18 | 01/09/23 | 11,593 | 11,477 | 11,362 | 3.63 | ||||||||||||||||

| ALM Media, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.50% (1.00% Floor) | 7.50% | 11/25/19 | 11/25/24 | 14,962 | 14,728 | 14,439 | 4.61 | ||||||||||||||||

| 33,517 | 33,035 | 32,631 | 10.42 | |||||||||||||||||||||

| Restaurants | ||||||||||||||||||||||||

| LS GFG Holdings Inc. | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.00% (1.00% Floor) | 8.00% (1.00% PIK) | 11/30/18 | 11/19/25 | 11,240 | 10,442 | 9,779 | 3.13 | ||||||||||||||||

| Specialized Consumer Services | ||||||||||||||||||||||||

| True Blue Car Wash, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 7.12% (1.00% Floor) | 8.12% | 10/17/19 | 10/17/24 | 4,349 | 4,283 | 4,349 | 1.39 | ||||||||||||||||

| First Lien Secured Delayed Draw Loan | L+ 7.12% (1.00% Floor) | 8.12% | 10/17/19 | 10/17/24 | 2,014 | 1,997 | 2,014 | 0.64 | ||||||||||||||||

| 6,363 | 6,280 | 6,363 | 2.03 | |||||||||||||||||||||

WHITEHORSE FINANCE, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2020

(in thousands)

| Investment Type(1) | Spread

Above Index(2) | Interest

Rate(3) | Acquisition

Date(10) | Maturity

Date | Principal/ Share Amount | Amortized

Cost | Fair

Value(11) | Fair

Value As A Percentage of Net Assets | ||||||||||||||||

| Specialized Finance | ||||||||||||||||||||||||

| Golden Pear Funding Assetco,

LLC(5) | ||||||||||||||||||||||||

| Second Lien Secured Term Loan | L+ 10.50% (1.00% Floor) | 11.50% | 09/20/18 | 03/20/24 | 10,938 | $ | 10,810 | $ | 10,938 | 3.50 | % | |||||||||||||

| Oasis Legal Finance, LLC(5) | ||||||||||||||||||||||||

| Second Lien Secured Term Loan | L+ 10.75% (1.00% Floor) | 11.75% | 09/09/16 | 03/09/22 | 12,500 | 12,446 | 12,500 | 3.99 | ||||||||||||||||

| WHF STRS Ohio Senior Loan Fund LLC | ||||||||||||||||||||||||

| Subordinated Note(4)(5)(7)(9)(14) | L+ 6.50% | 6.65% | 07/19/19 | N/A | 41,073 | 41,073 | 41,073 | 13.13 | ||||||||||||||||

| 64,511 | 64,329 | 64,511 | 20.62 | |||||||||||||||||||||

| Specialty Chemicals | ||||||||||||||||||||||||

| Flexitallic Group SAS | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.50% (1.00% Floor) | 7.50% | 10/28/19 | 10/29/26 | 11,632 | 11,389 | 10,818 | 3.46 | ||||||||||||||||

| Systems Software | ||||||||||||||||||||||||

| Vero Parent, Inc. | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 6.00% (1.00% Floor) | 7.00% | 11/06/19 | 08/16/24 | 7,074 | 6,613 | 7,074 | 2.26 | ||||||||||||||||

| Technology Hardware, Storage & Peripherals | ||||||||||||||||||||||||

| Source Code Midco, LLC | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 8.25% (1.00% Floor) | 9.25% | 05/04/18 | 05/04/23 | 22,322 | 22,022 | 22,322 | 7.13 | ||||||||||||||||

| Telestream Holdings Corporation | ||||||||||||||||||||||||

| First Lien Secured Term Loan | L+ 8.75% (1.00% Floor) | 9.75% | 10/15/20 | 10/15/25 | 14,037 | 13,608 | 13,769 | 4.40 | ||||||||||||||||

| First

Lien Secured Revolving Loan(7) | L+ 8.75% (1.00% Floor) | 9.75% | 10/15/20 | 10/15/25 | — | — | 15 | — | ||||||||||||||||

| 36,359 | 35,630 | 36,106 | 11.54 | |||||||||||||||||||||

| Total Debt Investments | 694,114 | 658,704 | 657,249 | 210.03 | ||||||||||||||||||||

| Equity Investments | ||||||||||||||||||||||||

| Asset Management & Custody Banks | ||||||||||||||||||||||||

| Arcole Holding Corp. Shares(4)(5)(6)(19) | N/A | N/A | 10/01/20 | N/A | — | 6,944 | 6,448 | 2.06 | ||||||||||||||||

| Data Processing & Outsourced Services | ||||||||||||||||||||||||

| Escalon Services Inc Warrants(4) | N/A | N/A | 12/04/20 | N/A | 709 | 476 | 476 | 0.15 | ||||||||||||||||

| Diversified Support Services | ||||||||||||||||||||||||

| Quest Events, LLC Preferred Units(4) | N/A | N/A | 12/28/18 | 12/08/25 | 317 | 317 | — | — | ||||||||||||||||

| ImageOne

Industries, LLC Common A Units(4) | N/A | N/A | 09/20/19 | N/A | 225 | — | 14 | — | ||||||||||||||||

| 542 | 317 | 14 | — | |||||||||||||||||||||

| Health Care Services | ||||||||||||||||||||||||

| Lab Logistics Preferred Units(4) | N/A | N/A | 10/29/19 | N/A | 2 | 857 | 857 | 0.27 | ||||||||||||||||

| Internet & Direct Marketing Retail | ||||||||||||||||||||||||

| BBQ Buyer, LLC Shares(4) | N/A | N/A | 08/28/20 | N/A | 1,100 | 1,100 | 1,265 | 0.40 | ||||||||||||||||

| Ross-Simons Topco, LP Preferred Units(4) | N/A | N/A | 12/04/20 | N/A | 600 | 600 | 600 | 0.19 | ||||||||||||||||

| 1,700 | 1,700 | 1,865 | 0.59 | |||||||||||||||||||||

| IT Consulting & Other Services | ||||||||||||||||||||||||

| Keras Holdings, LLC Shares(dba KSM Consulting LLC)(4) | N/A | N/A | 12/31/20 | N/A | 496 | 496 | 496 | 0.16 | ||||||||||||||||

| Leisure Facilities | ||||||||||||||||||||||||

| Lift Brands, Inc. (aka Snap Fitness Holdings, Inc.) Class A Common Stock(4) | N/A | N/A | 06/29/20 | N/A | 2 | 1,955 | 282 | 0.09 | ||||||||||||||||

| Lift Brands, Inc. (aka Snap Fitness Holdings, Inc.) Warrants(4) | N/A | N/A | 06/29/20 | 06/28/28 | 1 | 793 | 114 | 0.04 | ||||||||||||||||

WHITEHORSE FINANCE, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2020

(in thousands)

| Investment Type(1) | Spread Above Index(2) | Interest Rate(3) | Acquisition Date(10) | Maturity Date | Principal/ Share Amount | Amortized Cost | Fair Value(11) | Fair Value As A Percentage of Net Assets | ||||||||||||||||

| 3 | 2,748 | 396 | 0.13 | |||||||||||||||||||||

| Other Diversified Financial Services | ||||||||||||||||||||||||

| RCS Creditor Trust Class B Units(4)(6) | N/A | N/A | 10/01/17 | N/A | 143 | $ | — | $ | — | —% | ||||||||||||||

| SFS Global Holding Company Warrants(4) | N/A | N/A | 06/28/18 | 12/28/25 | — | — | — | — | ||||||||||||||||

| Sigue Corporation Warrants(4) | N/A | N/A | 06/28/18 | 12/28/25 | 22 | 2,890 | 3,498 | 1.12 | ||||||||||||||||

| 165 | 2,890 | 3,498 | 1.12 | |||||||||||||||||||||

| Specialized Finance | ||||||||||||||||||||||||

| NMFC Senior Loan Program I LLC Units(4)(5)(6) | N/A | N/A | 08/13/14 | 08/31/22 | 10,000 | 10,029 | 9,269 | 2.96 | ||||||||||||||||

| WHF STRS Ohio Senior Loan Fund LLC Interests(4)(5)(7)(14) | N/A | N/A | 07/19/19 | N/A | 10,268 | 10,268 | 10,167 | 3.25 | ||||||||||||||||

| 20,268 | 20,297 | 19,436 | 6.21 | |||||||||||||||||||||

| Total Equity Investments | 23,885 | 36,725 | 33,486 | 10.69 | ||||||||||||||||||||

| Total Investments | 717,999 | $ | 695,429 | $ | 690,735 | 220.72 | % | |||||||||||||||||

WHITEHORSE FINANCE, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2020

(in thousands)

(1) Except as otherwise noted, all investments are non-controlled/non-affiliate investments as defined by the Investment Company Act of 1940, as amended (the “1940 Act”), and provide collateral for the Company’s credit facility.

(2) The investments bear interest at a rate that may be determined by reference to the London Interbank Offered Rate (“LIBOR” or “L”), which resets monthly, quarterly or semiannually, the Canadian Dollar Offered Rate (“CDOR” or “C”) or the U.S. Prime Rate as published by the Wall Street Journal (“Prime” or “P”). The one, three and six-month LIBOR were 0.1%, 0.2% and 0.3%, respectively, as of December 31, 2020. The Prime was 3.25% as of December 31, 2020. The CDOR was 0.5% as of December 31, 2020.

(3) The interest rate is the “all-in-rate” including the current index and spread, the fixed rate, and the payment-in-kind (“PIK”) interest rate, as the case may be.

(4) The investment or a portion of the investment does not provide collateral for the Company’s credit facility.

(5) Not a qualifying asset under Section 55(a) of the 1940 Act. Under the 1940 Act, the Company may not acquire any non-qualifying asset unless, at the time the acquisition is made, qualifying assets represent at least 70% of total assets. Qualifying assets represented 84% of total assets as of the date of the consolidated schedule of investments.

(6) Investment is a non-controlled/affiliate investment as defined by the 1940 Act.

(7) The investment has an unfunded commitment in addition to any amounts presented in the consolidated schedule of investments as of December 31, 2020.

(8) The investment is on non-accrual status.

(9) Security is perpetual with no defined maturity date.

(10) Except as otherwise noted, all of the Company’s portfolio company investments, which as of the date of the consolidated schedule of investments represented 221% of the Company’s net assets or 96% of the Company’s total assets, are subject to legal restrictions on sales.

(11) The fair value of each investment was determined using significant unobservable inputs.

WHITEHORSE FINANCE, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS

December 31, 2020

(in thousands)

(12) The investment was comprised of two contracts, which were indexed to different base rates, L and P, respectively. The Spread Above Index and Interest Rate presented represent the weighted average of both contracts.

(13) Principal amount is denominated in Canadian dollars.

(14) Investment is a controlled affiliate investment as defined by the 1940 Act. On January 14, 2019, the Company entered into an agreement with State Teachers Retirement System of Ohio, a public pension fund established under Ohio law (“STRS Ohio”), to create WHF STRS Ohio Senior Loan Fund, LLC (“STRS JV”), a joint venture, which invests primarily in senior secured first and second lien term loans.

(15) In addition to the interest earned based on the stated interest rate of this security, the Company is entitled to receive an additional interest amount of 2.75% on its “last out” tranche of the portfolio company’s senior term debt, which was previously syndicated into “first out” and “last out” tranches, whereby the “first out” tranche will have priority as to the “last out” tranche with respect to payments of principal, interest and any other amounts due thereunder.

(16) In addition to the interest earned based on the stated interest rate of this security, the Company is entitled to receive an additional interest amount of 3.50% on its “last out” tranche of the portfolio company’s senior term debt, which was previously syndicated into “first out” and “last out” tranches, whereby the “first out” tranche will have priority as to the “last out” tranche with respect to payments of principal, interest and any other amounts due thereunder.

(17) In addition to the interest earned based on the stated interest rate of this security, the Company is entitled to receive an additional interest amount of 3.00% on its “last out” tranche of the portfolio company’s senior term debt, which was previously syndicated into “first out” and “last out” tranches, whereby the “first out” tranche will have priority as to the “last out” tranche with respect to payments of principal, interest and any other amounts due thereunder.

(18) In August 2020, in conjunction with the AG Kings Holdings, Inc. bankruptcy, the Company converted approximately $14.2 million of its existing first lien secured term loan into a new superpriority secured debtor-in-possession term loan.

(19) On October 1, 2020, as part of a restructuring agreement between the Company and Arcole Acquisition Corp, the Company’s investments in first lien secured term loans to Arcole Acquisition Corp were converted into common shares of Arcole Holding Corp.

(20) At the option of the issuer, interest can be paid in cash or cash and PIK. The issuer may elect to pay up to 2.00% PIK.

Contacts

Stuart Aronson

WhiteHorse Finance, Inc.

212-506-0500

or

Joyson Thomas

WhiteHorse Finance, Inc.

305-379-2322

or

Sean Silva

Prosek Partners

646-818-9122

Source: WhiteHorse Finance, Inc.

Exhibit 99.2

Earnings Presentation Quarter Ended December 31, 2020 WhiteHorse Finance, Inc. NASDAQ: WHF (Common Stock) NASDAQ: WHFBZ (6.50% Notes due 2025)

1 References in this presentation to “WHF”, “we”, “us”, “our” and “the Company” refer to WhiteHorse Finance, Inc. This presentation and the information and views included herein do not constitute investment advice, or a recommendation or a n o ffer to enter into any transaction with the Company or any of its affiliates. Investors are advised to consider carefully the Company’s investment objectives, r isk s, charges and expenses before investing in the Company’s securities. Our annual reports on Form 10 - K, quarterly reports on Form 10 - Q and current reports on Fo rm 8 - K, which have been filed with the Securities and Exchange Commission (“SEC”), contain this and other information about the Company and should be read car efully before investing in the Company’s securities. The information in this presentation is not complete and may be changed. This presentation is not an of fer to sell the Company’s securities and is not soliciting an offer to buy the Company’s securities in any jurisdiction where such offer or sale is not permitted. A shelf registration statement relating to the Company’s securities is on file with the SEC. A public offering of the Company ’s securities may be made only by means of a prospectus and a related prospectus supplement, copies of which may be obtained by writing the Company at 1450 Bri cke ll Avenue, 31st Floor, Miami, FL 33131, Attention: Investor Relations, or by calling (305) 381 - 6999; copies may also be obtained by visiting EDGAR on the SEC’ s website at http://www.sec.gov . Forward Looking Statements Some of the statements in this presentation constitute forward - looking statements, which relate to future events or the Company’ s future performance or financial condition. The forward - looking statements contained in this presentation involve risks and uncertainties, including statements as to: the Company’s future operating results; changes in political, economic or industry conditions, the interest rate environment or conditions affecti ng the financial and capital markets, which could result in changes to the value of the Company’s assets; the impact of the COVID - 19 pandemic and its effects on the C ompany’s and its portfolio companies’ results of operations and financial condition; the Company’s business prospects and the prospects of its prospecti ve portfolio companies; the impact of investments that the Company expects to make; the impact of increased competition; the Company’s contractual arrangements and relationships with third parties; the dependence of the Company’s future success on the general economy and its impact on the industries in which the Com pany invests; the ability of the Company’s prospective portfolio companies to achieve their objectives; the relative and absolute performance of the Company’s in vestment adviser; the Company’s expected financings and investments; the adequacy of the Company’s cash resources and working capital; the timing o f c ash flows, if any, from the operations of the Company’s prospective portfolio companies; and the impact of future acquisitions and divestitures. Such forward - looking statements may include statements preceded by, followed by or that otherwise include the words “may,” “migh t,” “will,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” “plan” or similar words. The Company has based the forward - looking statements included in this presentation on information available to us on the date of this presentation, and the Company assumes no obligation to update any such forward - looking statements. Actual results could differ materially from those implied or expressed in the Company’s forward - looking statements for any reason, and future results could differ materially from historical performance. Al though the Company undertakes no obligation to revise or update any forward - looking statements, whether as a result of new information, future events or other wise, you are advised to consult any additional disclosures that are made directly to you or through reports that the Company in the future may file with the SEC , including annual reports on Form 10 - K, quarterly reports on Form 10 - Q and current reports on Form 8 - K. For a further discussion of factors that could cause the Company’s future results to differ materially from any forward - looking statements, see the section entitled “Risk Factors” in the annual reports on Form 10 - K and q uarterly reports on Form 10 - Q we file with the SEC. Important Information and Forward Looking Statements

2 WhiteHorse Finance Snapshot Company: WhiteHorse Finance, Inc. (“WhiteHorse Finance” or the “Company”) : Equity Ticker: NASDAQ: WHF Market Cap: $301.6MM (1) NAV / Share: $15.23 Portfolio Fair Value: $690.7MM Current Dividend Yield: 9.7% (1)(2) ; consistent quarterly dividends of $0.355 per share since 2012 IPO (1) Based on February 26, 2021 share price of $14.68. (2) Based on LTM dividend rate, excluding special dividends, relative to closing share price. External Manager: Affiliate of H.I.G. Capital, LLC (“H.I.G. Capital” or “H.I.G.”)

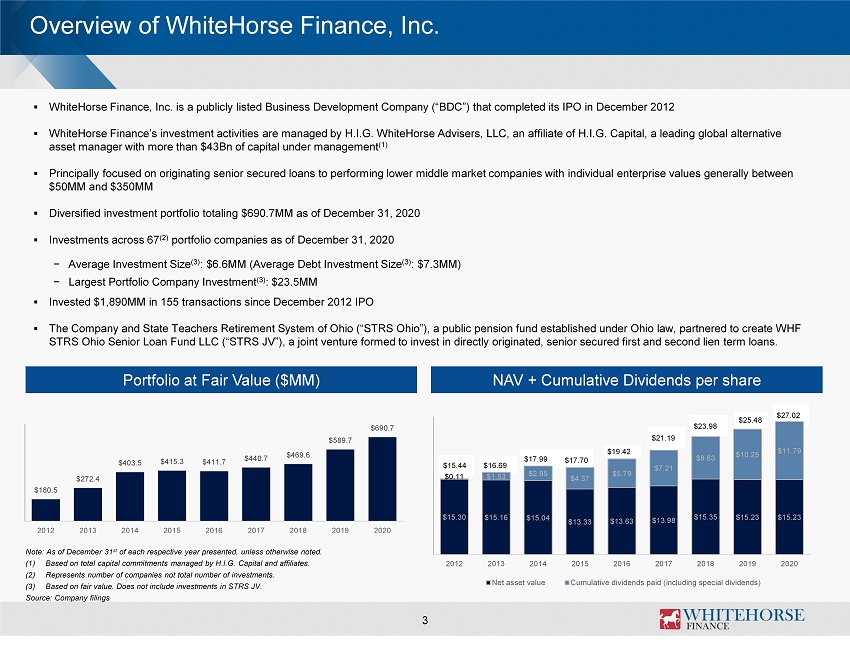

Overview of WhiteHorse Finance, Inc. 3 Portfolio at Fair Value ($MM) NAV + Cumulative Dividends per share Note: As of December 31 st of each respective year presented, unless otherwise noted. (1) Based on total capital commitments managed by H.I.G. Capital and affiliates. (2) Represents number of companies not total number of investments. (3) Based on fair value. Does not include investments in STRS JV. Source: Company filings ▪ WhiteHorse Finance, Inc. is a publicly listed Business Development Company (“BDC”) that completed its IPO in December 2012 ▪ WhiteHorse Finance’s investment activities are managed by H.I.G. WhiteHorse Advisers, LLC, an affiliate of H.I.G. Capital, a lea ding global alternative asset manager with more than $43Bn of capital under management (1) ▪ Principally focused on originating senior secured loans to performing lower middle market companies with individual enterpris e v alues generally between $50MM and $350MM ▪ Diversified investment portfolio totaling $690.7MM as of December 31, 2020 ▪ Investments across 67 (2) portfolio companies as of December 31, 2020 − Average Investment Size (3) : $6.6MM (Average Debt Investment Size (3) : $7.3MM) − Largest Portfolio Company Investment (3) : $23.5MM ▪ Invested $1,890MM in 155 transactions since December 2012 IPO ▪ The Company and State Teachers Retirement System of Ohio (“STRS Ohio”), a public pension fund established under Ohio law, par tne red to create WHF STRS Ohio Senior Loan Fund LLC (“STRS JV”), a joint venture formed to invest in directly originated, senior secured first and se cond lien term loans. $15.44 $16.69 $17.99 $17.70 $19.42 $25.48 $23.98 $21.19 $ 27.02 $180.5 $272.4 $403.5 $415.3 $411.7 $440.7 $469.6 $589.7 $690.7 2012 2013 2014 2015 2016 2017 2018 2019 2020 $15.30 $15.16 $15.04 $13.33 $13.63 $13.98 $15.35 $15.23 $15.23 $0.11 $1.53 $2.95 $4.37 $5.79 $7.21 $8.63 $10.25 $11.79 2012 2013 2014 2015 2016 2017 2018 2019 2020 Net asset value Cumulative dividends paid (including special dividends)

4 Overview of WhiteHorse Finance, Inc. (continued) Note: As of Dec ember 31, 2020 unless otherwise noted. (1) Reflects life - to - date since IPO, and may exclude follow - on transactions and investments in STRS JV made via asset transfers in - k ind. (2) Across 97 investments. Does not include investments in STRS JV. (3) Reflects weighted average effective yield of income - producing debt investments. Weighted average effective yield for entire port folio, including equities and investments in STRS JV, as of December 31, 2020, is 9.4%. Weighted average effective yield is computed by dividing (a) annualized interest income (includin g i nterest income resulting from the amortization of fees and discounts) by (b) the weighted average cost of investments. (4) Measured at origination based on WHF’s underwriting leverage. Does not include investments in STRS JV. (5) Does not include the Company’s investments in STRS JV. ▪ Generate attractive risk - adjusted return in all market conditions by originating and investing in senior secured loans to performing lower middle market companies and leveraging the knowledge of H.I.G. Capital ▪ Differentiated proprietary deal flow from over 45 dedicated deal professionals sourcing through direct coverage of financial sponsors and intermediaries ▪ Rigorous credit process focused on fundamental analysis with emphasis on downside protection and cash flow visibility ▪ 11 - person investment committee with more than 250 years of industry experience ▪ Investment strategy focused on first lien and second lien senior secured investments in lower middle market companies with a target hold size of $4MM to $20MM Summary Stats: Invested Capital since IPO: $1,890MM (1) Number of Investments Made: ~ 155 (1) Average Investment Size: ~$6.6 MM (2) All - in Yield : 9.9% (3) Net Debt / EBITDA of Current Portfolio Companies: ~3.8x (4) Secured Debt as a % of Total Debt : 100% (5) Investment Strategy

5 Summary of Quarterly Results Fiscal Quarter Highlights ▪ Total investments at fair value increased to $690.7 million in Q4 2020 as compared to $595.3 million in Q3 2020. ▪ The Company made investments in sixteen new portfolio companies for gross deployments of $158.9 million as well as funded add - on investments totaling $3.5 million. ▪ The Company transferred five investments to the STRS JV totaling $32.4 million and had additional sales and principal repayme nts of $39.1 million. ▪ The weighted average effective yield on income - producing investments at the end of Q4 2020 was approximately 9.9% as compared to approximately 9.9% at the end of the prior quarter. ▪ Q4 net investment income (“NII”) was $6.9 million, or $0.335 per share, which compares to Q3 NII of $5.9 million, or $0.289 p er share. ▪ Q4 Core NII (1) after adjusting for an approximate $0.3 million capital gains incentive fee accrual, was $7.1 million, or $0.348 per share, compared with the quarterly distribution of $0.355 per share. This compares with Q3 Core NII of $7.8 million, or $0.380 per s har e. ▪ Net unrealized losses on investments for Q4 2020 were $1.5 million and were primarily driven by reversals of unrealized gains up on the Vessco Holdings, LLC realization and Vero Parent, Inc. partial sales as well as fair value decreases on our investments in AG Kings Holdings, Inc. and NMFC Senior Loan Program I LLC, partially offset by unrealized gains in STRS JV, LS GFG Holdings Inc. and Esc alon Services Inc. ▪ NAV per share at the end of Q4 2020 was $15.23 per share compared to $15.31 per share reported at the end of Q3 2020. Excluding the 12.5 cent per share special dividend, NAV per share would have increased to $15.35, an improvement of 4 cents compared with Q 3 2 020. ▪ Gross leverage levels increased during the quarter to 1.25x from 0.94x at the end of Q3 2020. Cash on - hand at the end of Q4 2020 was $15.9 million resulting in net leverage of 1.20x as compared to 0.87x at the end of Q3 2020. ▪ As of December 31, 2020, STRS JV had total assets of $181.4 million. At December 31, 2020, STRS JV had a weighted average unl eve red effective yield on its portfolio of 7.9%. (1) Core net investment income is a non - GAAP financial measure. Refer to next slide for components and discussion of core net invest ment income. Additional information on core net investment income and a reconciliation of core net investment income to its most directly comparable GAAP financial measure, net investment income, can also be found by accessing the earnings releases posted to the Company’s website at http://www.whitehorsefinance.com.

6 Quarterly Operating Highlights Note: N umbers may not foot due to rounding. (1) Total investment income includes investment income (e.g., interest and dividends) from investments in STRS JV. (2) Net of fee waivers, if any. (3) Core net investment income is a non - GAAP financial measure. The Company believes that core net investment income provides useful information to investors and management because it reflects the Company's financial performance excluding (i) the net impact of costs associated with the refinancing of the Company's indebtedness, (ii) the acc rua l of the capital gains incentive fee attributable to realized and unrealized gains and losses, and (iii) certain excise or other income taxes (net of incentive fees). The presentation of this additional information is not me ant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. Additional information on core net investment income and a reconciliation of core net investment income to its most directly com parable GAAP financial measure, net investment income, can be found by accessing the earnings releases posted to the Company’s website at http://www.whitehorsefinance.com . Source: Company filings Unaudited Quarterly Financials Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 (USD in MM, expect per share data) Total Investment Income (1) 17.8$ 17.4$ 14.5$ 13.8$ 16.5$ 16.8$ Expenses Interest Expenses 3.5 3.7 3.7 3.2 2.8 3.5 Base Management Fees (2) 2.8 3.1 3.1 2.9 3.1 3.4 Performance-based Incentive Fees 1.7 2.2 0.4 1.3 3.8 2.0 Other Expenses 1.1 0.7 1.2 1.2 0.9 1.1 Total Expenses 9.1 9.7 8.4 8.6 10.6 10.0 Net Investment Income 8.7$ 7.7$ 6.1$ 5.2$ 5.9$ 6.8$ Net Realized and Unrealized Gain / (Loss) (1.8) 1.1 (27.1) 17.6 15.7 1.3 Net Increase in Net Assets from Operations 6.9$ 8.8$ (21.0)$ 22.8$ 21.6$ 8.1$ Per Share Net Investment Income (NII) 0.42$ 0.37$ 0.30$ 0.26$ 0.29$ 0.34$ Core NII (3) 0.40$ 0.39$ 0.27$ 0.26$ 0.38$ 0.35$ Net Realized and Unrealized Gain / (Loss) (0.08)$ 0.05$ (1.31)$ 0.85$ 0.77$ 0.06$ Earnings 0.34$ 0.42$ (1.01)$ 1.11$ 1.06$ 0.40$ Dividends Declared 0.355$ 0.355$ 0.355$ 0.355$ 0.355$ 0.355$ Core NII Dividend Coverage 114% 108% 75% 72% 107% 98%

7 Quarterly Balance Sheet Highlights Note: Numbers may not foot due to rounding (1) Includes Restricted Cash. (2) Calculated as Total Gross Debt Outstanding divided by Total Net Assets. (3) Net Leverage Ratio is defined as debt outstanding less cash, divided by total net assets. (4) Fundings, exits and repayments may include cash flows on revolver investments as well as non - cash transactions (e.g., PIK, equit y issuances). Unaudited Quarterly Financials Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 (USD in MM, expect per share data) Assets Investments at Fair Value 527.5$ 589.7$ 557.1$ 547.4$ 595.3$ 690.7$ Cash and Equivalents (1) 22.2 27.5 28.1 20.9 22.9 15.9 Other Assets 16.3 14.0 6.7 6.6 7.6 12.3 Total Assets 566.0$ 631.2$ 591.9$ 574.9$ 625.8$ 719.0$ Liabilities Debt (net of issuance costs) 232.0 298.9 291.1 252.7 291.9 384.9 Other Liabilities 18.6 19.3 16.1 22.0 19.3 21.2 Total Liabilities 250.5$ 318.3$ 307.2$ 274.7$ 311.2$ 406.1$ Total Net Assets 315.5$ 313.0$ 284.7$ 300.2$ 314.6$ 312.9$ Total Liabilities and Net Assets 566.0$ 631.2$ 591.9$ 574.9$ 625.8$ 719.0$ Net Asset Value per Share 15.36$ 15.23$ 13.86$ 14.61$ 15.31$ 15.23$ Leverage Ratio (2) 0.75x 0.97x 1.04x 0.86x 0.94x 1.25x Net Leverage Ratio (3) 0.68x 0.88x 0.94x 0.79x 0.87x 1.20x Gross Fundings (4) 81.6 155.4 27.6 39.3 59.3 176.5 Exits and Repayments (4) (89.1) (95.8) (33.6) (67.7) (28.1) (84.4) Net Fundings (7.5)$ 59.6$ (6.0)$ (28.4)$ 31.2$ 92.1$

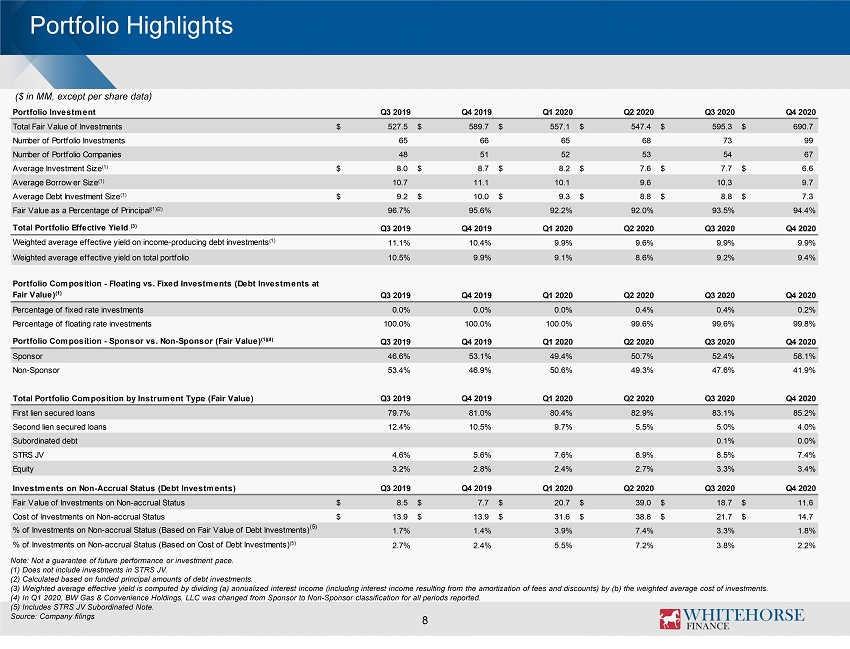

Portfolio Highlights 8 Note: Not a guarantee of future performance or investment pace. (1) Does not include investments in STRS JV. (2) Calculated based on funded principal amounts of debt investments. ( 3) Weighted average effective yield is computed by dividing (a) annualized interest income (including interest income resulting fro m the amortization of fees and discounts) by (b) the weighted average cost of investments. (4) In Q1 2020, BW Gas & Convenience Holdings, LLC was changed from Sponsor to Non - Sponsor classification for all periods report ed. (5) Includes STRS JV Subordinated Note. Source: Company filings ($ in MM, except per share data) Portfolio Investment Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Total Fair Value of Investments 527.5$ 589.7$ 557.1$ 547.4$ 595.3$ 690.7$ Number of Portfolio Investments 65 66 65 68 73 99 Number of Portfolio Companies 48 51 52 53 54 67 Average Investment Size(1) 8.0$ 8.7$ 8.2$ 7.6$ 7.7$ 6.6$ Average Borrower Size(1) 10.7 11.1 10.1 9.6 10.3 9.7 Average Debt Investment Size(1) 9.2$ 10.0$ 9.3$ 8.8$ 8.8$ 7.3$ Fair Value as a Percentage of Principal(1)(2) 96.7% 95.6% 92.2% 92.0% 93.5% 94.4% Total Portfolio Effective Yield (3) Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Weighted average effective yield on income-producing debt investments(1) 11.1% 10.4% 9.9% 9.6% 9.9% 9.9% Weighted average effective yield on total portfolio 10.5% 9.9% 9.1% 8.6% 9.2% 9.4% Portfolio Composition - Floating vs. Fixed Investments (Debt Investments at Fair Value)(1) Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Percentage of fixed rate investments 0.0% 0.0% 0.0% 0.4% 0.4% 0.2% Percentage of floating rate investments 100.0% 100.0% 100.0% 99.6% 99.6% 99.8% Portfolio Composition - Sponsor vs. Non-Sponsor (Fair Value)(1)(4) Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Sponsor 46.6% 53.1% 49.4% 50.7% 52.4% 58.1% Non-Sponsor 53.4% 46.9% 50.6% 49.3% 47.6% 41.9% Total Portfolio Composition by Instrument Type (Fair Value) Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 First lien secured loans 79.7% 81.0% 80.4% 82.9% 83.1% 85.2% Second lien secured loans 12.4% 10.5% 9.7% 5.5% 5.0% 4.0% Subordinated debt 0.1% 0.0% STRS JV 4.6% 5.6% 7.6% 8.9% 8.5% 7.4% Equity 3.2% 2.8% 2.4% 2.7% 3.3% 3.4% Investments on Non-Accrual Status (Debt Investments) Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Fair Value of Investments on Non-accrual Status 8.5$ 7.7$ 20.7$ 39.0$ 18.7$ 11.6$ Cost of Investments on Non-accrual Status 13.9$ 13.9$ 31.6$ 38.8$ 21.7$ 14.7$ % of Investments on Non-accrual Status (Based on Fair Value of Debt Investments) (5) 1.7% 1.4% 3.9% 7.4% 3.3% 1.8% % of Investments on Non-accrual Status (Based on Cost of Debt Investments)(5) 2.7% 2.4% 5.5% 7.2% 3.8% 2.2%

Portfolio Trends Historical Portfolio Trends 9 % Floating and % Fixed (Based on Fair Value) % Instrument Type (Based on Fair Value) % Sponsored / Non - Sponsored (Based on Fair Value) % Non Accruals (Based on Fair Value of Debt Investments) (1) Note: As of end of each year/quarter presented, unless otherwise noted; percentages may not add up to 100% due to rounding. Not a guarantee of future performance or investment pace. (1) Except as otherwise indicated, non - zero values <0.05%. Based on fair value of debt investments, including STRS JV Subordinated N ote. 88.4% 96.1% 97.1% 99.8% 99.9% 100.0% 100.0% 99.8% 11.6% 3.9% 2.9% 0.2% 0.1% 0.2% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 2013 2014 2015 2016 2017 2018 2019 2020 Floating Fixed 52% 55% 52% 60% 52% 77% 81% 85% 48% 40% 43% 33% 39% 21% 11% 4% 5% 5% 7% 9% 3% 3% 3% 6% 7% 2013 2014 2015 2016 2017 2018 2019 2020 % First Lien Loans % Second Lien Loans % Equity STRS JV 60% 33% 28% 32% 32% 44% 53% 58% 40% 67% 72% 68% 68% 56% 47% 42% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 2013 2014 2015 2016 2017 2018 2019 2020 Sponsor Non-Sponsor 4.1% 1.7% 1.4% 3.9% 7.4% 3.3% 1.8% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 % of Investments on NonAccrual