Form 8-K WESCO INTERNATIONAL INC For: May 06

| NEWS RELEASE | ||||

| WESCO International, Inc. / Suite 700, 225 West Station Square Drive / Pittsburgh, PA 15219 | |||||

WESCO International, Inc. Reports First Quarter 2021 Results

First quarter summary:

•Net sales of $4.0 billion, up more than double due to the Anixter merger

–Up 3.2% on a pro forma workday-adjusted basis

•Operating profit of $133.3 million; operating margin of 3.3%

–Gross margin of 20.1%, up 100 basis points year-over-year and 50 bps basis points sequentially

–Adjusted operating profit of $170.6 million; adjusted operating margin of 4.2%, up 90 basis points

–Adjusted EBITDA of $216.5 million; adjusted EBITDA margin of 5.4%, up 100 basis points

•Earnings per diluted share of $0.87

–Adjusted earnings per diluted share of $1.43

•Operating cash flow of $120.5 million

–Free cash flow of $124.8 million, 141% of adjusted net income

•Leverage of 4.9x; improvement of 0.4x sequentially and 0.8x since Anixter merger

–Net debt reduction of $144 million in the first quarter, and $534 million since the Anixter merger

•Raising 2021 outlook for adjusted earnings per diluted share to a range of $6.80 to $7.30

PITTSBURGH, May 6, 2021 /PRNewswire/ -- WESCO International, Inc. (NYSE: WCC), a leading provider of business-to-business distribution, logistics services and supply chain solutions, announces its results for the first quarter of 2021.

“We’re off to a great start to the year and delivered excellent results across the board that exceeded our expectations. I am very proud of our team and the work that they are doing in executing our integration plan, delivering the synergies, and capturing the value of the transformational combination of WESCO and Anixter,” said John Engel, Chairman, President and CEO. “We’re outperforming our markets, delivering significant margin expansion, and generating very strong free cash flow. With over $500 million of debt reduction over the last three quarters, our financial leverage is now below 5.0X, showing the power of our business model. The first quarter is another strong proof point of the substantial value creation potential of WESCO plus Anixter.”

“We are seeing positive sales and margin momentum across each of our three global business units. Backlog has reached a new all-time record level, our margin improvement programs are generating results, and structural cost takeout has increased our operating leverage. As a result of our strong first quarter results and accelerated synergy realization to start the year, we are raising our full-year 2021 outlook for sales, synergies, and profitability. We now expect sales to increase 4.5% to 7.5%, adjusted EBITDA margin to expand to 5.8% to 6.1%, and adjusted EPS to grow to $6.80 to $7.30.”

“The strength of our franchise, power of our industry-leading value proposition, and benefits of our increased scale, is now more evident than ever. As the economic recovery accelerates, we are exceptionally well positioned to capitalize on the secular growth trends of electrification, automation, communications and security.”

The following are results for the three months ended March 31, 2021 compared to the three months ended March 31, 2020:

•Net sales were $4.0 billion for the first quarter of 2021 compared to $2.0 billion for the first quarter of 2020, an increase of 105.3% due to the merger with Anixter that was completed on June 22, 2020. On a pro forma basis, and adjusted for two fewer workdays, net sales for the first quarter of 2021 were up 3.2% compared to the first quarter of the prior year. This increase reflects growth across all segments. At the end of the first quarter of 2021, WESCO's book-to-bill ratio was above 1.0 and backlog has grown double digits since the end of the fourth quarter of 2020.

1

•Cost of goods sold for the first quarter of 2021 was $3.2 billion compared to $1.6 billion for the first quarter of 2020, and gross profit was $811.0 million and $376.4 million, respectively. As a percentage of net sales, gross profit was 20.1% for the first quarter of 2021, an increase of 100 basis points compared to 19.1% for the first quarter of 2020. Gross profit as a percentage of sales for the first quarter of 2021 reflects the favorable impact of margin improvement initiatives, partially offset by a write-down to the carrying value of certain personal protective equipment products, which had a negative impact of 20 basis points. Sequentially, gross profit as a percentage of net sales increased 50 basis points from 19.6% for the fourth quarter of 2020, as adjusted for merger-related fair value adjustments of $15.7 million, as well as an out-of-period adjustment of $23.3 million related to inventory absorption accounting.

•Selling, general and administrative expenses were $636.6 million, or 15.8% of net sales, for the first quarter of 2021, compared to $299.4 million, or 15.2% of net sales, for the first quarter of 2020. SG&A expenses for the first quarter of 2021 include merger-related costs of $46.3 million, as well as a net gain of $8.9 million resulting from the sale of WESCO's legacy utility and data communications businesses in Canada, which were divested in connection with the merger. Adjusted for these amounts, SG&A expenses were $599.2 million, or 14.8% of net sales, for the first quarter of 2021. SG&A expenses for the first quarter of 2020 include $4.6 million of merger-related costs. Adjusted for these costs, SG&A expenses were $294.8 million, or 15.0% of net sales for the first quarter of 2020.

•Operating profit was $133.3 million for the first quarter of 2021, compared to $60.9 million for the first quarter of 2020. Operating profit as a percentage of net sales was 3.3% for the current quarter, compared to 3.1% for the first quarter of the prior year. Operating profit for the first quarter of 2021 includes merger-related costs and the net gain on the Canadian divestitures, as described above. Adjusted for these amounts, operating profit was $170.6 million, or 4.2% of net sales. Adjusted for merger-related costs of $4.6 million, operating profit was $65.5 million for the first quarter of 2020, or 3.3% of net sales. Adjusted operating margin was up 90 basis points compared to the prior year.

•Net interest expense for the first quarter of 2021 was $70.4 million, compared to $16.6 million for the first quarter of 2020. The increase in interest expense was driven by financing activity related to the Anixter merger.

•The effective tax rate for the first quarter of 2021 was 9.9%, compared to 23.1% for the first quarter of 2020. The lower effective tax rate in the current quarter was primarily due to a discrete income tax benefit associated with a change in valuation allowance related to foreign tax credit carryforwards, which impacted the effective tax rate by approximately 12.7 percentage points.

•Net income attributable to common stockholders was $44.8 million for the first quarter of 2021, compared to $34.4 million for the first quarter of 2020. Adjusted for merger-related costs and interest, the net gain on the Canadian divestitures, and the related income tax effects, net income attributable to common stockholders was $74.1 million and $38.3 million for the first quarter of 2021 and 2020, respectively, an increase of 93.2%.

•Earnings per diluted share for the first quarter of 2021 was $0.87, based on 51.7 million diluted shares, compared to $0.82 for the first quarter of 2020, based on 42.1 million diluted shares. Adjusted for merger-related costs and interest, the net gain on the Canadian divestitures, and the related income tax effects, earnings per diluted share for the first quarter of 2021 and 2020 was $1.43 and $0.91, respectively, an increase of 57.1%.

•Operating cash flow for the first quarter of 2021 was $120.5 million, compared to $31.5 million for the first quarter of 2020. Free cash flow for the first quarter of 2021 was $124.8 million, or 141% of adjusted net income, compared to $15.8 million, or 41% of adjusted net income, for the first quarter of 2020.

Segment Results

The Company has operating segments that are organized around three strategic business units consisting of Electrical & Electronic Solutions ("EES"), Communications & Security Solutions ("CSS") and Utility & Broadband Solutions ("UBS").

Corporate expenses are incurred to obtain and coordinate financing, tax, information technology, legal and other related services. Segment results include depreciation expense or other allocations related to various corporate assets. Interest expense and other non-operating items are not allocated to the segments or reviewed on a segment basis. Corporate expenses are not directly identifiable with our reportable segments and are reported in the tables below to reconcile the reportable segments to the consolidated financial statements.

2

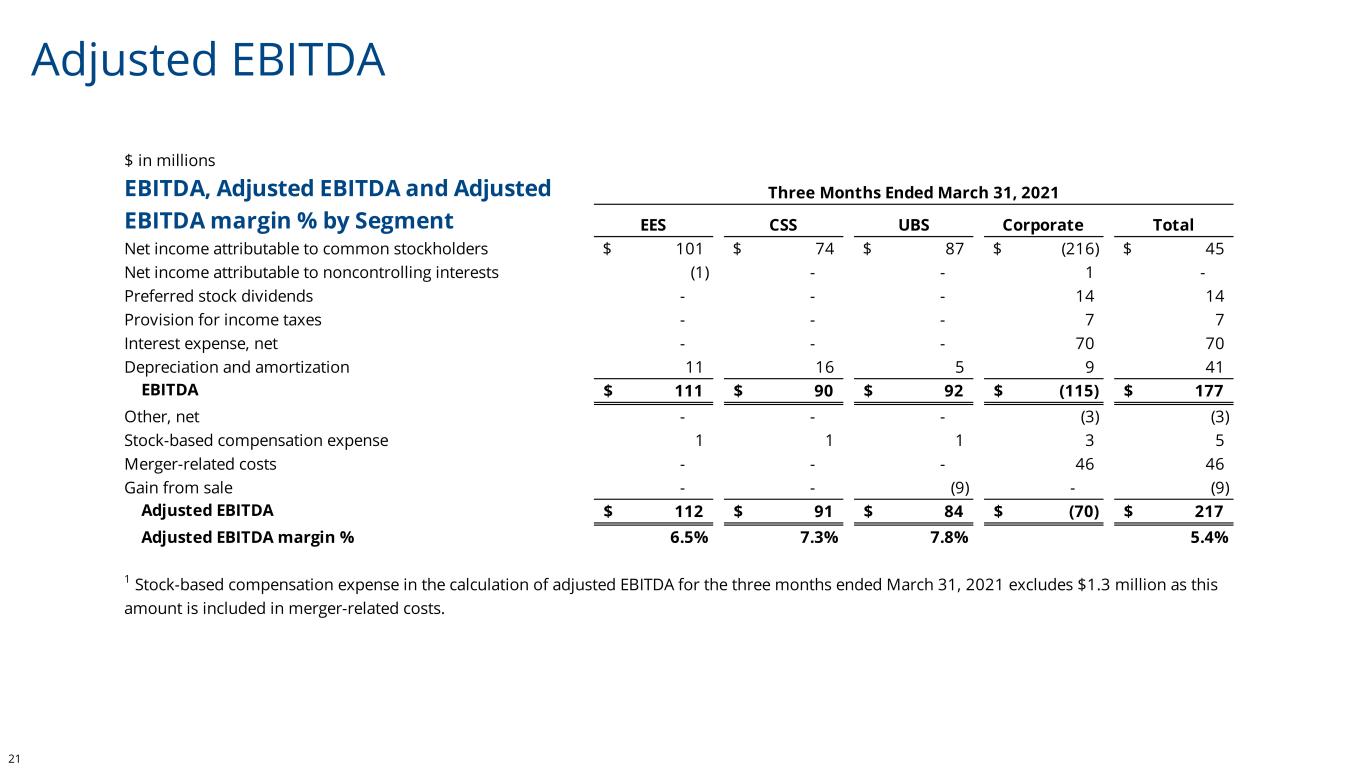

The following are results by segment for the three months ended March 31, 2021 compared to the three months ended March 31, 2020, which primarily reflect the impact of the merger with Anixter. For the first quarter of 2021, adjusted EBITDA margin improved for all segments (EES, CSS and UBS) and reflects the favorable impact of margin improvement initiatives, as well as lower operating expenses due to cost reduction actions, synergy capture and integration initiatives.

•EES reported net sales of $1.7 billion for the first quarter of 2021, compared to $1.1 billion for the first quarter of 2020, an increase of 54.4%. In addition to the impact from the merger, the increase reflects sales growth in our construction and original equipment manufacturer businesses. Operating profit was $100.1 million for the first quarter of 2021, compared to $43.3 million for the first quarter of 2020. Adjusted EBITDA was $112.0 million for the first quarter of 2021, or 6.5% of net sales, compared to $51.0 million for the first quarter of 2020, or 4.6% of net sales.

•CSS reported net sales of $1.3 billion for the first quarter of 2021, compared to $223.7 million for the first quarter of 2020, an increase of 459.0%. The increase reflects the impact of the merger. Operating profit was $74.0 million for the first quarter of 2021, compared to $9.9 million for the first quarter of 2020. The inventory write-down described above negatively impacted the operating profit of the CSS segment for the first quarter of 2021. Adjusted EBITDA was $90.7 million for the first quarter of 2021, or 7.3% of net sales, compared to $11.9 million for the first quarter of 2020, or 5.3% of net sales.

•UBS reported net sales of $1.1 billion for the first quarter of 2021, compared to $630.5 million for the first quarter of 2020, an increase of 69.7%. Along with the impact of the merger, the increase reflects sales growth in our utility and broadband businesses, partially offset by lower sales from integrated supply programs due to the disruption caused by the COVID-19 pandemic. Operating profit was $87.0 million for the first quarter of 2021, compared to $41.8 million for the first quarter of 2020. Operating profit for the first quarter of 2021 includes the benefit from the Canadian divestitures, as described above. Adjusted EBITDA was $83.7 million for the first quarter of 2021, or 7.8% of net sales, compared to $45.6 million for the first quarter of 2020, or 7.2% of net sales.

Webcast and Teleconference Access

WESCO will conduct a webcast and teleconference to discuss the first quarter of 2021 earnings as described in this News Release on Thursday, May 6, 2021, at 10:00 a.m. E.T. The call will be broadcast live over the internet and can be accessed from the Investor Relations page of the Company's website at www.wesco.investorroom.com. The call will be archived on this internet site for seven days.

WESCO International, Inc. (NYSE: WCC), a publicly traded FORTUNE 500® company headquartered in Pittsburgh, Pennsylvania, is a leading provider of business-to-business distribution, logistics services and supply chain solutions. Pro forma 2020 annual sales were over $16 billion, including Anixter International Inc., which it acquired in June 2020. WESCO offers a best-in-class product and services portfolio of Electrical and Electronic Solutions, Communications and Security Solutions, and Utility and Broadband Solutions. The Company employs nearly 18,000 people, maintains relationships with approximately 30,000 suppliers, and serves more than 125,000 customers worldwide. With nearly 1,500,000 products, end-to-end supply chain services, and leading digital capabilities, WESCO provides innovative solutions to meet customer needs across commercial and industrial businesses, contractors, government agencies, institutions, telecommunications providers, and utilities. WESCO operates approximately 800 branches, warehouses and sales offices in more than 50 countries, providing a local presence for customers and a global network to serve multi-location businesses and multi-national corporations.

Forward-Looking Statements

All statements made herein that are not historical facts should be considered as forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. These statements include, but are not limited to, statements regarding the expected benefits and costs of the transaction between WESCO and Anixter International Inc., including anticipated future financial and operating results, synergies, accretion and growth rates, and the combined company's plans, objectives, expectations and intentions, statements that address the combined company's expected future business and financial performance, and other statements identified by words such as "anticipate," "plan," "believe," "estimate," "intend," "expect," "project," "will" and similar words, phrases or expressions. These forward-looking statements are based on current expectations and beliefs of WESCO's management, as well as assumptions made by, and information currently available to, WESCO's management, current market trends and market conditions and involve risks and uncertainties, many of which are outside of WESCO's and WESCO's management's control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements.

3

Those risks, uncertainties and assumptions include the risk of any unexpected costs or expenses resulting from the transaction, the risk of any litigation or post-closing regulatory action relating to the transaction, the risk that the transaction could have an adverse effect on the ability of the combined company to retain customers and retain and hire key personnel and maintain relationships with its suppliers, customers and other business relationships and on its operating results and business generally, or the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve those synergies or benefits, the risk that the leverage of the company may be higher than anticipated, the impact of natural disasters, health epidemics and other outbreaks, especially the outbreak of COVID-19 since December 2019, which may have a material adverse effect on the combined company's business, results of operations and financial conditions, and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond each company's control. Additional factors that could cause results to differ materially from those described above can be found in WESCO's Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and WESCO's other reports filed with the U.S. Securities and Exchange Commission ("SEC").

Contact Information:

Will Ruthrauff

Director, Investor Relations and Corporate Communications

(412) 454-4220

http://www.wesco.com

4

WESCO INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(dollar amounts in thousands, except per share amounts)

(Unaudited)

| Three Months Ended | |||||||||||||||||

| March 31, 2021 | March 31, 2020 | ||||||||||||||||

| Net sales | $ | 4,041,477 | $ | 1,968,647 | |||||||||||||

| Cost of goods sold (excluding depreciation and amortization) | 3,230,441 | 79.9 | % | 1,592,249 | 80.9 | % | |||||||||||

| Selling, general and administrative expenses | 636,576 | 15.8 | % | 299,392 | 15.2 | % | |||||||||||

| Depreciation and amortization | 41,209 | 16,093 | |||||||||||||||

| Income from operations | 133,251 | 3.3 | % | 60,913 | 3.1 | % | |||||||||||

| Interest expense, net | 70,373 | 16,592 | |||||||||||||||

| Other, net | (2,807) | (120) | |||||||||||||||

| Income before income taxes | 65,685 | 1.6 | % | 44,441 | 2.3 | % | |||||||||||

| Provision for income taxes | 6,531 | 10,266 | |||||||||||||||

| Net income | 59,154 | 1.5 | % | 34,175 | 1.7 | % | |||||||||||

| Net loss attributable to noncontrolling interests | (24) | (232) | |||||||||||||||

| Net income attributable to WESCO International, Inc. | 59,178 | 1.5 | % | 34,407 | 1.7 | % | |||||||||||

| Preferred stock dividends | 14,352 | — | |||||||||||||||

| Net income attributable to common stockholders | $ | 44,826 | 1.1 | % | $ | 34,407 | 1.7 | % | |||||||||

| Earnings per diluted share attributable to common stockholders | $ | 0.87 | $ | 0.82 | |||||||||||||

| Weighted-average common shares outstanding and common share equivalents used in computing earnings per diluted common share (in thousands) | 51,708 | 42,075 | |||||||||||||||

| Reportable Segments | |||||||||||||||||

| Net sales: | |||||||||||||||||

| Electrical & Electronic Solutions | $ | 1,720,813 | $ | 1,114,456 | |||||||||||||

| Communications & Security Solutions | 1,250,615 | 223,726 | |||||||||||||||

| Utility & Broadband Solutions | 1,070,049 | 630,465 | |||||||||||||||

| $ | 4,041,477 | $ | 1,968,647 | ||||||||||||||

| Income from operations: | |||||||||||||||||

| Electrical & Electronic Solutions | $ | 100,111 | $ | 43,326 | |||||||||||||

| Communications & Security Solutions | 73,964 | 9,946 | |||||||||||||||

| Utility & Broadband Solutions | 87,030 | 41,785 | |||||||||||||||

| Corporate | (127,854) | (34,144) | |||||||||||||||

| $ | 133,251 | $ | 60,913 | ||||||||||||||

5

WESCO INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(dollar amounts in thousands)

(Unaudited)

| March 31, 2021 | December 31, 2020 | ||||||||||

| Assets | |||||||||||

| Current Assets | |||||||||||

| Cash and cash equivalents | $ | 303,887 | $ | 449,135 | |||||||

| Trade accounts receivable, net | 2,574,803 | 2,466,903 | |||||||||

| Inventories | 2,290,453 | 2,163,831 | |||||||||

| Other current assets | 405,997 | 427,109 | |||||||||

| Total current assets | 5,575,140 | 5,506,978 | |||||||||

| Goodwill and intangible assets | 5,245,486 | 5,252,664 | |||||||||

| Other assets | 1,057,644 | 1,120,572 | |||||||||

| Total assets | $ | 11,878,270 | $ | 11,880,214 | |||||||

| Liabilities and Stockholders' Equity | |||||||||||

| Current Liabilities | |||||||||||

| Accounts payable | $ | 1,955,365 | $ | 1,707,329 | |||||||

Short-term borrowings and current portion of long-term debt(1) | 20,802 | 528,830 | |||||||||

| Other current liabilities | 749,844 | 750,836 | |||||||||

| Total current liabilities | 2,726,011 | 2,986,995 | |||||||||

| Long-term debt, net | 4,592,734 | 4,369,953 | |||||||||

| Other noncurrent liabilities | 1,159,822 | 1,186,877 | |||||||||

| Total liabilities | 8,478,567 | 8,543,825 | |||||||||

| Stockholders' Equity | |||||||||||

| Total stockholders' equity | 3,399,703 | 3,336,389 | |||||||||

| Total liabilities and stockholders' equity | $ | 11,878,270 | $ | 11,880,214 | |||||||

(1) On January 14, 2021, the Company redeemed its $500.0 million aggregate principal amount of 5.375% Senior Notes due 2021 (the "2021 Notes").

6

WESCO INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollar amounts in thousands)

(Unaudited)

| Three Months Ended | |||||||||||

| March 31, 2021 | March 31, 2020 | ||||||||||

| Operating Activities: | |||||||||||

| Net income | $ | 59,154 | $ | 34,175 | |||||||

| Add back (deduct): | |||||||||||

| Depreciation and amortization | 41,209 | 16,093 | |||||||||

| Deferred income taxes | (13,074) | 1,979 | |||||||||

| Change in trade receivables, net | (117,412) | (53,944) | |||||||||

| Change in inventories | (124,772) | 37,807 | |||||||||

| Change in accounts payable | 250,987 | (10,858) | |||||||||

| Other, net | 24,398 | 6,276 | |||||||||

| Net cash provided by operating activities | 120,490 | 31,528 | |||||||||

| Investing Activities: | |||||||||||

| Capital expenditures | (10,211) | (15,762) | |||||||||

Other, net(1) | 54,753 | (94,503) | |||||||||

| Net cash provided by (used in) investing activities | 44,542 | (110,265) | |||||||||

| Financing Activities: | |||||||||||

Debt borrowings, net(2) | (288,499) | 284,617 | |||||||||

| Equity activity, net | (4,342) | (1,566) | |||||||||

Other, net(3) | (19,332) | (4,360) | |||||||||

| Net cash (used in) provided by financing activities | (312,173) | 278,691 | |||||||||

| Effect of exchange rate changes on cash and cash equivalents | 1,893 | (8,296) | |||||||||

| Net change in cash and cash equivalents | (145,248) | 191,658 | |||||||||

| Cash and cash equivalents at the beginning of the period | 449,135 | 150,902 | |||||||||

| Cash and cash equivalents at the end of the period | $ | 303,887 | $ | 342,560 | |||||||

(1) For the three months ended March 31, 2021, other investing activities includes cash consideration totaling approximately $54.1 million from the sale of WESCO's legacy utility and data communications businesses in Canada. The Company used the net proceeds from the divestitures to repay indebtedness. Other investing activities for the three months ended March 31, 2020 includes a $100.0 million termination fee that was required to terminate Anixter's then-existing merger agreement with Clayton, Dubilier & Rice, LLC.

(2) The three months ended March 31, 2021 includes the redemption of the Company's $500.0 million aggregate principal amount of 2021 Notes. The redemption of the 2021 Notes was funded with excess cash, as well as borrowings under the Company's accounts receivable securitization and revolving credit facilities.

(3) Includes $14.4 million of dividends paid to holders of Series A preferred stock.

7

NON-GAAP FINANCIAL MEASURES

In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles ("U.S. GAAP") above, this earnings release includes certain non-GAAP financial measures. These financial measures include pro forma workday-adjusted net sales, gross profit, adjusted gross profit, gross margin, adjusted gross margin, earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted EBITDA, adjusted EBITDA margin, pro forma adjusted EBITDA, financial leverage, pro forma financial leverage, free cash flow, adjusted income from operations, adjusted operating margin, adjusted interest expense, net, adjusted provision for income taxes, adjusted net income, adjusted net income attributable to WESCO International, Inc., adjusted net income attributable to common stockholders, and adjusted earnings per diluted share. The Company believes that these non-GAAP measures are useful to investors as they provide a better understanding of sales performance, and the use of debt and liquidity on a comparable basis. Additionally, certain non-GAAP measures either focus on or exclude items impacting comparability of results such as merger-related costs, and the related income tax effect of such items, allowing investors to more easily compare the Company's financial performance from period to period. Management does not use these non-GAAP financial measures for any purpose other than the reasons stated above.

8

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(dollar amounts in thousands, except per share data)

(Unaudited)

| Pro Forma Workday-Adjusted Net Sales: | |||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||

| March 31, 2021 | March 31, 2020 | Growth | |||||||||||||||||||||||||||||||||||||||

| Reported | Reported | Anixter(1) | Pro Forma | Reported | Pro Forma | Adjusted(2) | |||||||||||||||||||||||||||||||||||

| Net sales | $ | 4,041,477 | $ | 1,968,647 | $ | 2,071,662 | $ | 4,040,309 | 105.3% | —% | 3.2% | ||||||||||||||||||||||||||||||

(1) Represents Anixter’s reported results for the period from January 4, 2020 to April 3, 2020, as previously filed in an exhibit to Form 8-K on November 4, 2020.

(2) Represents the percentage impact of 62 workdays in the three months ended March 31, 2021 compared to 64 workdays in the three months ended March 31, 2020.

Note: Pro forma workday-adjusted net sales is a non-GAAP financial measure of sales performance. Pro forma workday-adjusted net sales gives effect to the combination of WESCO and Anixter as if it had occurred at the beginning of the prior quarterly period, and adjusts for the percentage impact from the number of workdays in the comparable periods.

| Three Months Ended | |||||||||||

| Gross Profit: | March 31, 2021 | March 31, 2020 | |||||||||

| Net sales | $ | 4,041,477 | $ | 1,968,647 | |||||||

| Cost of goods sold (excluding depreciation and amortization) | 3,230,441 | 1,592,249 | |||||||||

| Gross profit | $ | 811,036 | $ | 376,398 | |||||||

| Gross margin | 20.1 | % | 19.1 | % | |||||||

| Three Months Ended | |||||

| Gross Profit: | December 31, 2020 | ||||

| Net sales | $ | 4,128,841 | |||

| Cost of goods sold (excluding depreciation and amortization) | 3,356,890 | ||||

| Gross profit | $ | 771,951 | |||

Adjusted gross profit(1) | $ | 810,909 | |||

| Gross margin | 18.7 | % | |||

Adjusted gross margin(1) | 19.6 | % | |||

Note: Gross profit is a financial measure commonly used within the distribution industry. Gross profit is calculated by deducting cost of goods sold, excluding depreciation and amortization, from net sales. Gross margin is calculated by dividing gross profit by net sales.

(1) Adjusted gross profit and adjusted gross margin exclude the effect of merger-related fair value adjustments to inventory, and an out-of-period adjustment related to inventory absorption accounting totaling $39.0 million for the three months ended December 31, 2020.

9

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(dollar amounts in thousands, except per share data)

(Unaudited)

| Three Months Ended | |||||||||||

| Adjusted Income from Operations: | March 31, 2021 | March 31, 2020 | |||||||||

| Income from operations | $ | 133,251 | $ | 60,913 | |||||||

| Merger-related costs | 46,322 | 4,608 | |||||||||

| Net gain on Canadian divestitures | (8,927) | — | |||||||||

| Adjusted income from operations | $ | 170,646 | $ | 65,521 | |||||||

| Adjusted income from operations margin % | 4.2 | % | 3.3 | % | |||||||

| Three Months Ended | |||||||||||

| Adjusted Interest Expense, Net: | March 31, 2021 | March 31, 2020 | |||||||||

| Interest expense, net | $ | 70,373 | $ | 16,592 | |||||||

Merger-related interest expense(1) | — | (515) | |||||||||

| Adjusted interest expense, net | $ | 70,373 | $ | 16,077 | |||||||

(1) The adjustment for the three months ended March 31, 2020 represents interest for borrowings against our prior accounts receivable securitization facility to fund the $100.0 million termination fee described above.

| Three Months Ended | |||||||||||

| Adjusted Provision for Income Taxes: | March 31, 2021 | March 31, 2020 | |||||||||

| Provision for income taxes | $ | 6,531 | $ | 10,266 | |||||||

Income tax effect of adjustments to income from operations and net interest(1) | 8,145 | 1,183 | |||||||||

| Adjusted provision for income taxes | $ | 14,676 | $ | 11,449 | |||||||

(1) The adjustments to income from operations and net interest expense have been tax effected at rates of 21.8% and 23.1% for the three months ended March 31, 2021 and 2020, respectively.

10

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(dollar amounts in thousands, except per share data)

(Unaudited)

| Three Months Ended | |||||||||||

| Adjusted Earnings per Diluted Share: | March 31, 2021 | March 31, 2020 | |||||||||

| Adjusted income from operations | $ | 170,646 | $ | 65,521 | |||||||

| Adjusted interest expense, net | 70,373 | 16,077 | |||||||||

| Other, net | (2,807) | (120) | |||||||||

| Adjusted income before income taxes | 103,080 | 49,564 | |||||||||

| Adjusted provision for income taxes | 14,676 | 11,449 | |||||||||

| Adjusted net income | 88,404 | 38,115 | |||||||||

| Net loss attributable to noncontrolling interests | (24) | (232) | |||||||||

| Adjusted net income attributable to WESCO International, Inc. | 88,428 | 38,347 | |||||||||

| Preferred stock dividends | 14,352 | — | |||||||||

| Adjusted net income attributable to common stockholders | $ | 74,076 | $ | 38,347 | |||||||

| Diluted shares | 51,708 | 42,075 | |||||||||

| Adjusted earnings per diluted share | $ | 1.43 | $ | 0.91 | |||||||

Note: For the three months ended March 31, 2021, income from operations, the provision for income taxes and earnings per diluted share have been adjusted to exclude merger-related costs, a net gain on the sale of WESCO's legacy utility and data communications businesses in Canada, and the related income tax effects. For the three months ended March 31, 2020, income from operations, net interest expense, the provision for income taxes and earnings per diluted share have been adjusted to exclude merger-related costs and interest, and the related income tax effects. These non-GAAP financial measures provide a better understanding of the Company's financial results on a comparable basis.

11

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(dollar amounts in thousands, except per share data)

(Unaudited)

| Three Months Ended March 31, 2021 | ||||||||||||||||||||||||||||||||

| EBITDA and Adjusted EBITDA by Segment: | EES | CSS | UBS | Corporate | Total | |||||||||||||||||||||||||||

| Net income attributable to common stockholders | $ | 100,629 | $ | 73,594 | $ | 87,013 | $ | (216,410) | $ | 44,826 | ||||||||||||||||||||||

| Net loss attributable to noncontrolling interests | (75) | — | — | 51 | (24) | |||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | 14,352 | 14,352 | |||||||||||||||||||||||||||

| Provision for income taxes | — | — | — | 6,531 | 6,531 | |||||||||||||||||||||||||||

| Interest expense, net | — | — | — | 70,373 | 70,373 | |||||||||||||||||||||||||||

| Depreciation and amortization | 10,563 | 16,293 | 5,210 | 9,143 | 41,209 | |||||||||||||||||||||||||||

| EBITDA | $ | 111,117 | $ | 89,887 | $ | 92,223 | $ | (115,960) | $ | 177,267 | ||||||||||||||||||||||

| Other, net | (443) | 370 | 17 | (2,751) | (2,807) | |||||||||||||||||||||||||||

Stock-based compensation expense(1) | 1,351 | 425 | 340 | 2,577 | 4,693 | |||||||||||||||||||||||||||

| Merger-related costs | — | — | — | 46,322 | 46,322 | |||||||||||||||||||||||||||

| Net gain on Canadian divestitures | — | — | (8,927) | — | (8,927) | |||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 112,025 | $ | 90,682 | $ | 83,653 | $ | (69,812) | $ | 216,548 | ||||||||||||||||||||||

| Adjusted EBITDA margin % | 6.5 | % | 7.3 | % | 7.8 | % | 5.4 | % | ||||||||||||||||||||||||

(1) Stock-based compensation expense in the calculation of adjusted EBITDA for the three months ended March 31, 2021 excludes $1.3 million as such amount is included in merger-related costs. | ||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2020 | ||||||||||||||||||||||||||||||||

| EBITDA and Adjusted EBITDA by Segment: | EES | CSS | UBS | Corporate | Total | |||||||||||||||||||||||||||

| Net income attributable to common stockholders | $ | 43,446 | $ | 9,946 | $ | 41,785 | $ | (60,770) | $ | 34,407 | ||||||||||||||||||||||

| Net loss attributable to noncontrolling interests | (232) | — | — | — | (232) | |||||||||||||||||||||||||||

| Provision for income taxes | — | — | — | 10,266 | 10,266 | |||||||||||||||||||||||||||

| Interest expense, net | — | — | — | 16,592 | 16,592 | |||||||||||||||||||||||||||

| Depreciation and amortization | 6,876 | 1,841 | 3,521 | 3,855 | 16,093 | |||||||||||||||||||||||||||

| EBITDA | $ | 50,090 | $ | 11,787 | $ | 45,306 | $ | (30,057) | $ | 77,126 | ||||||||||||||||||||||

| Other, net | (120) | — | — | — | (120) | |||||||||||||||||||||||||||

| Stock-based compensation expense | 1,079 | 156 | 293 | 3,098 | 4,626 | |||||||||||||||||||||||||||

| Merger-related costs | — | — | — | 4,608 | 4,608 | |||||||||||||||||||||||||||

| Adjusted EBITDA | $ | 51,049 | $ | 11,943 | $ | 45,599 | $ | (22,351) | $ | 86,240 | ||||||||||||||||||||||

| Adjusted EBITDA margin % | 4.6 | % | 5.3 | % | 7.2 | % | 4.4 | % | ||||||||||||||||||||||||

Note: EBITDA, Adjusted EBITDA and Adjusted EBITDA margin % are non-GAAP financial measures that provide indicators of the Company's performance and its ability to meet debt service requirements. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA before other, net, non-cash stock-based compensation, merger-related costs and net gain on the sale of WESCO's legacy utility and data communications businesses in Canada. Adjusted EBITDA margin % is calculated by dividing Adjusted EBITDA by net sales.

12

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(dollar amounts in thousands, except per share data)

(Unaudited)

Pro Forma(1) | |||||||||||

| Twelve Months Ended | |||||||||||

| Financial Leverage: | March 31, 2021 | December 31, 2020 | |||||||||

| Net income attributable to common stockholders | $ | 90,323 | $ | 115,572 | |||||||

| Net loss attributable to noncontrolling interests | (313) | (521) | |||||||||

| Preferred stock dividends | 44,491 | 30,139 | |||||||||

| Provision for income taxes | 39,598 | 55,659 | |||||||||

| Interest expense, net | 292,898 | 255,842 | |||||||||

| Depreciation and amortization | 161,543 | 153,499 | |||||||||

| EBITDA | $ | 628,540 | $ | 610,190 | |||||||

| Other, net | (4,771) | 4,635 | |||||||||

| Stock-based compensation | 30,278 | 34,733 | |||||||||

| Merger-related costs and fair value adjustments | 245,556 | 206,748 | |||||||||

| Out-of-period adjustment | 18,852 | 18,852 | |||||||||

| Net gain on sale of asset and Canadian divestitures | (28,742) | (19,816) | |||||||||

| Adjusted EBITDA | $ | 889,713 | $ | 855,342 | |||||||

| As of | |||||||||||

| March 31, 2021 | December 31, 2020 | ||||||||||

| Short-term borrowings and current portion of long-term debt | $ | 20,802 | $ | 528,830 | |||||||

| Long-term debt | 4,592,734 | 4,369,953 | |||||||||

Debt discount and debt issuance costs(2) | 83,627 | 88,181 | |||||||||

Fair value adjustments to Anixter Notes due 2023 and 2025(2) | (1,479) | (1,650) | |||||||||

| Total debt | 4,695,684 | 4,985,314 | |||||||||

| Less: cash and cash equivalents | 303,887 | 449,135 | |||||||||

| Total debt, net of cash | $ | 4,391,797 | $ | 4,536,179 | |||||||

| Financial leverage ratio | 4.9 | 5.3 | |||||||||

(1)Pro forma adjusted EBITDA includes the financial results of WESCO's legacy utility and data communications businesses in Canada, which were divested in the first quarter of 2021 under a Consent Agreement with the Competition Bureau of Canada.

(2)Long-term debt is presented in the condensed consolidated balance sheets net of debt discount and debt issuance costs, and includes adjustments to record the long-term debt assumed in the merger with Anixter at its acquisition date fair value.

Note: Financial leverage measures the use of debt. Financial leverage ratio is calculated by dividing total debt, excluding debt discount, debt issuance costs and fair value adjustments, net of cash, by adjusted EBITDA. EBITDA is defined as the trailing twelve months earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as the trailing twelve months EBITDA before foreign exchange and other non-operating expenses, non-cash stock-based compensation, costs and fair value adjustments associated with the merger with Anixter, an out-of-period adjustment related to inventory absorption accounting, and net gain on the sale of a U.S. operating branch and WESCO's legacy utility and data communications businesses in Canada. Pro forma financial leverage ratio is calculated by dividing total debt, excluding debt discount and debt issuance costs, net of cash, by pro forma adjusted EBITDA. Pro forma EBITDA and pro forma adjusted EBITDA gives effect to the combination of WESCO and Anixter as if it had occurred at the beginning of the respective trailing twelve month period.

13

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(dollar amounts in thousands, except per share data)

(Unaudited)

| Three Months Ended | |||||||||||

| Free Cash Flow: | March 31, 2021 | March 31, 2020 | |||||||||

| Cash flow provided by operations | $ | 120,490 | $ | 31,528 | |||||||

| Less: Capital expenditures | (10,211) | (15,762) | |||||||||

| Add: Merger-related expenditures | 14,472 | — | |||||||||

| Free cash flow | $ | 124,751 | $ | 15,766 | |||||||

| Percentage of adjusted net income | 141 | % | 41 | % | |||||||

Note: Free cash flow is a measure of liquidity. Capital expenditures are deducted from operating cash flow to determine free cash flow. Free cash flow is available to fund investing and financing activities. For the three months ended March 31, 2021, the Company paid certain fees, expenses and other costs related to the merger with Anixter. Such expenditures have been added back to cash flow provided by operations to determine free cash flow for such period.

14

1 First Quarter 2021 Webcast Presentation May 6, 2021 NYSE: WCC

2 Forward-Looking Statements All statements made herein that are not historical facts should be considered as forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. These statements include, but are not limited to, statements regarding the expected benefits and costs of the transaction between WESCO and Anixter International Inc., including anticipated future financial and operating results, synergies, accretion and growth rates, and the combined company's plans, objectives, expectations and intentions, statements that address the combined company's expected future business and financial performance, and other statements identified by words such as "anticipate," "plan," "believe," "estimate," "intend," "expect," "project," "will" and similar words, phrases or expressions. These forward-looking statements are based on current expectations and beliefs of WESCO's management, as well as assumptions made by, and information currently available to, WESCO's management, current market trends and market conditions and involve risks and uncertainties, many of which are outside of WESCO's and WESCO's management's control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements. Those risks, uncertainties and assumptions include the risk of any unexpected costs or expenses resulting from the transaction, the risk of any litigation or post- closing regulatory action relating to the transaction, the risk that the transaction could have an adverse effect on the ability of the combined company to retain customers and retain and hire key personnel and maintain relationships with its suppliers, customers and other business relationships and on its operating results and business generally, or the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or other anticipated benefits of the proposed transaction or it may take longer than expected to achieve those synergies or benefits, the risk that the leverage of the company may be higher than anticipated, the impact of natural disasters, health epidemics and other outbreaks, especially the outbreak of COVID-19 since December 2019, which may have a material adverse effect on the combined company's business, results of operations and financial conditions, and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond each company's control. Additional factors that could cause results to differ materially from those described above can be found in WESCO's Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and WESCO's other reports filed with the U.S. Securities and Exchange Commission ("SEC"). Non-GAAP Measures In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles ("U.S. GAAP"), this slide presentation includes certain non-GAAP financial measures. These financial measures include workday-adjusted net sales, gross profit, adjusted gross profit, gross margin, adjusted gross margin, earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted EBITDA, adjusted EBITDA margin, pro forma adjusted EBITDA, financial leverage, pro forma financial leverage, free cash flow, adjusted income from operations, adjusted operating margin, adjusted interest expense, net, adjusted provision for income taxes, adjusted net income, adjusted net income attributable to WESCO International, Inc., adjusted net income attributable to common stockholders, and adjusted earnings per diluted share. Additionally, certain results are presented on a pro forma basis giving effect to the combination of WESCO and Anixter as if it had occurred at the beginning of the respective prior period. The Company believes that these non-GAAP measures are useful to investors as they provide a better understanding of sales performance, and the use of debt and liquidity on a comparable basis. Additionally, certain non-GAAP measures either focus on or exclude items impacting comparability of results such as merger-related costs, and the related income tax effect of such items, allowing investors to more easily compare the Company's financial performance from period to period. Management does not use these non-GAAP financial measures for any purpose other than the reasons stated above.

3 Agenda Business Overview Financial Results Overview John Engel Chairman, President & CEO Executive Vice President & CFO Dave Schulz

4 2021 Off to an Excellent Start Strong integration execution and macro recovery support revised guidance • Sales up 3% YOY on a pro forma workday-adjusted basis – Outperforming market – Economic recovery better than expected and supported by secular growth trends • Adjusted gross margin up 50 basis points YOY on a pro forma basis and sequentially – Strong execution of margin improvement program – Ability to more than offset cost inflation • Adjusted EBITDA margin up 90 basis points YOY on a pro forma basis – Gross margin expansion – Accelerated capture of cost synergies • Free cash flow of 141% of adjusted net income – Net debt reduction of $534 million since Anixter merger – Leverage of 4.9x, down 0.8x since Anixter merger

5 WESCO + Anixter a Powerful Combination Strengthening our Value Proposition Building and extending our competitive advantage as we transform • Sales Synergies – Cross Selling opportunities captured from complementary products, services, and technologies that enable us to offer more solutions, to more customers, in more locations around the world • Cost Synergies – Organization Redesign – reducing redundant roles and administrative services – Supply Chain Network Optimization – consolidating for efficiencies, improved service levels, benefits of scale • Margin Improvement Program – Value-based pricing that includes enhanced sales training and refined incentive targets

6 First Quarter Results Overview Dave Schulz Executive Vice President & Chief Financial Officer

7 Q1 2020 Pro Forma1 Q1 2021 YOY Sales $4,040 $4,041 flat Gross Profit 793 811 2% % of sales 19.6% 20.1% +50 bps Adjusted Income from Operations2 140 171 22% % of sales 3.5% 4.2% +70 bps Adjusted EBITDA2 182 217 19% % of sales 4.5% 5.4% +90 bps Adjusted Diluted EPS2 $1.43 First Quarter Results Overview Accelerating sales momentum and substantial margin improvement to start 2021 1 Includes Anixter’s reported results for the period from January 4, 2020 to April 3, 2020, as filed in an exhibit to Form 8-K on November 4, 2020. 2 Adjusted Income from Operations, Adjusted EBITDA and Adjusted earnings per diluted share have been adjusted to exclude merger-related costs, a net gain on the sale of WESCO's legacy utility and data communications businesses in Canada, and the related income tax effects. See appendix for reconciliation. $M Except per share amounts • Sales +3% on workday-adjusted basis • Record backlog in Q1, up over 20% from year-end • Highest gross margin since 2016 • Significant cost synergies in Q1 – $34 million realized

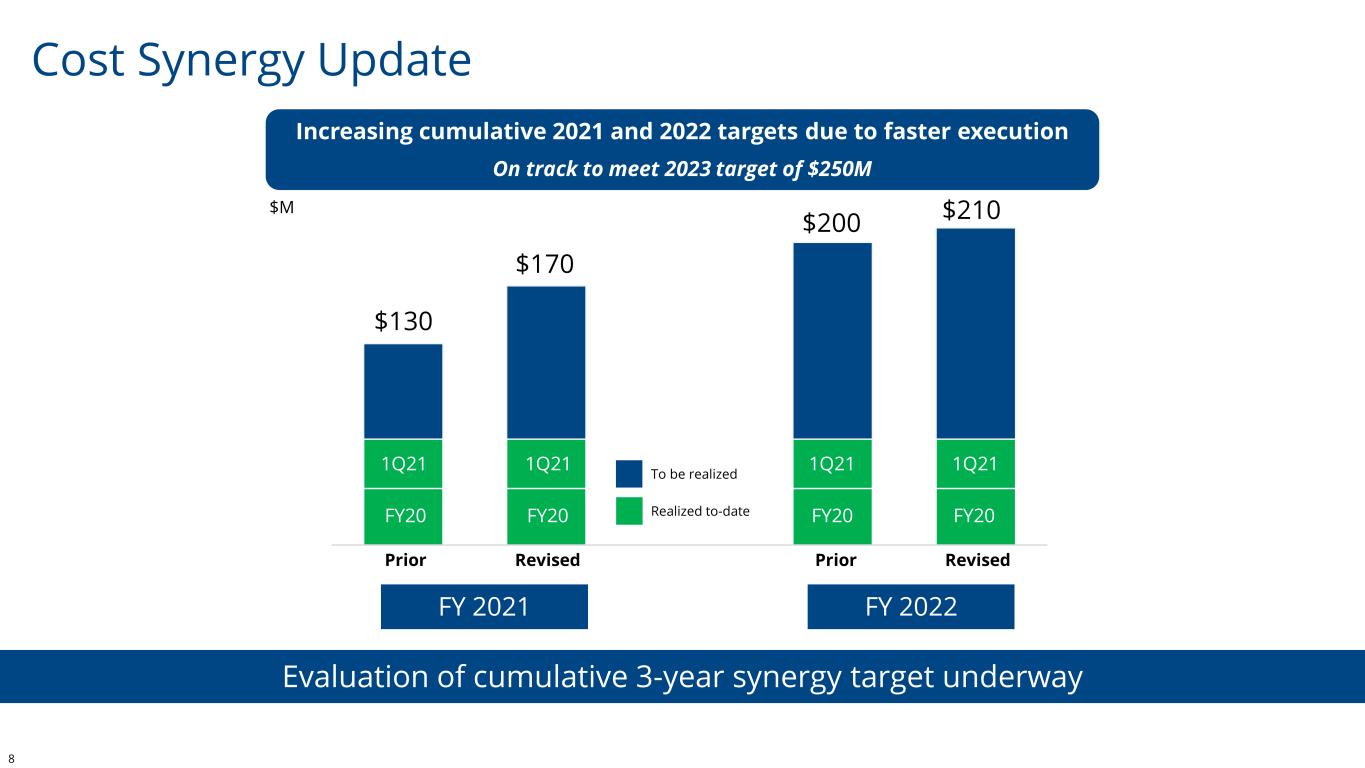

8 Cost Synergy Update Evaluation of cumulative 3-year synergy target underway FY 2021 FY 2022 Prior Revised Prior Revised $130 $170 $200 $210 FY20 FY20 FY20 FY20 1Q21 1Q211Q21 1Q21 Realized to-date To be realized Increasing cumulative 2021 and 2022 targets due to faster execution On track to meet 2023 target of $250M $M

9 Adjusted EBITDA Bridge • Accelerated Synergy Capture + Market Recovery Drives Margin Growth 2020 Q1 Adjusted EBITDA Gross Margin Cost Synergies Variable Compensation & Benefits Other SG&A 2021 Q1 Adjusted EBITDA $182 $M $217 1 Includes Anixter’s reported results for the period from January 4, 2020 to April 3, 2020, as filed in an exhibit to Form 8-K on November 4, 2020. See appendix for non-GAAP reconciliations. 1 4.5% of sales 5.4% of sales

10 $1,657 $1,721 Q1 2020 Pro Forma Q1 2021 $86 $112 Q1 2020 Pro Forma Q1 2021 Construction Industrial / MRO OEM / CIG Electrical & Electronic Solutions (EES) •Record backlog, strong execution and improving end market trends driving momentum See appendix for non-GAAP reconciliations. Sales Adjusted EBITDA $M 6.5% of sales • Sales up 4% YOY and up 7% on a workday-adjusted basis • Construction sales up on faster recovery than anticipated – More projects being released from backlog – Backlog at record high with sequential monthly growth • OEM up on strong and improving demand • Industrial/MRO activity levels improving in-line with industrial recovery • Secular trends of electrification, LED adoption, IoT and automation supporting demand growth • Adjusted EBITDA margin up 130bps due to synergy capture, effective cost controls, and execution of margin improvement initiatives U.S. Canada ROW 1 Includes Anixter’s reported results for the period from January 4, 2020 to April 3, 2020, as filed in an exhibit to Form 8-K on November 4, 2020. 1 1 +7% WD-adjusted 5.2% of sales

11 $1,304 $1,251 Q1 2020 Pro Forma Q1 2021 Communications & Security Solutions (CSS) Industry-leading value propositions in attractive high-growth markets • Sales down 4% YOY and down 1% on a workday-adjusted basis, outperforming market trends; backlog at record level • Strong growth in security solutions driven by retrofit projects and global accounts • Network infrastructure growth in datacenter and hyperscale projects • Growth offset by project timing, a slowdown in safety sales and COVID-19 impact in certain regions • Secular trends of remote connectivity, data center capacity expansion, secure networks, and IoT and automation supporting demand growth • Adjusted EBITDA margin 40 bps higher including inventory write-down with increase driven by integration synergies and execution of margin improvement initiatives Network Infrastructure Security Solutions Other U.S. Canada ROW See appendix for non-GAAP reconciliations. $90 $91 Q1 2020 Pro Forma Q1 2021 Sales Adjusted EBITDA 7.3% of sales 1 1 (1)% WD-adjusted 6.9% of sales 1 Includes Anixter’s reported results for the period from January 4, 2020 to April 3, 2020, as filed in an exhibit to Form 8-K on November 4, 2020. $M

12 • Sales down 1% YOY, up 2% on workday-adjusted basis • Utility’s strong and consistent growth driven by industry-leading value proposition, scope expansion and secular trends around grid hardening and reliability • Broadband growth driven by secular trends of 5G build-out and fiber network expansion for rural development • Integrated Supply sales were down vs. prior year but improved sequentially in-line with industrial recovery • Adjusted EBITDA margin up 100 bps due to synergy capture, effective cost controls, and execution of margin improvement initiatives Utility & Broadband Solutions (UBS) Leading supply chain capabilities enable WESCO to continue to take share UtilityIntegrated Supply Broadband U.S. Canada ROW See appendix for non-GAAP reconciliations. $1,079 $1,070 Q1 2020 Pro Forma Q1 2021 $74 $84 Q1 2020 Pro Forma Q1 2021 Sales Adjusted EBITDA 7.8% of sales 1 1 +2% WD-adjusted 6.8% of sales 1 Includes Anixter’s reported results for the period from January 4, 2020 to April 3, 2020, as filed in an exhibit to Form 8-K on November 4, 2020. $M

13 5.7x 5.3x 5.3x 4.9x 4000 4100 4200 4300 4400 4500 4600 4700 4800 4900 5000 4.4 4.6 4.8 5 5.2 5.4 5.6 5.8 6 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Leverage Net Debt Strong Free Cash Flow Supporting Debt Paydown •On track to return to target leverage range of 2.0-3.5x by mid-2023 • Free Cash Flow of $698 million TTM • Net debt reduced by $144 million in Q1 – $534 million since June 2020 – No near-term debt maturities • Leverage reduced 0.4x in Q1 – 0.8x since June 2020 $M $142 $307 $124 $125 Net Debt: $4.9B Net Debt: $4.4B Free Cash Flow See appendix for non-GAAP reconciliations.

14 2021 Outlook Accelerated synergy capture and market growth drive increased outlook for 2021 FY 2021 Outlook Prior (2/9/21) Revised (5/6/21) Reported Sales1 3% - 6% 4.5% - 7.5% 2021 Adjusted EBITDA margin2 5.4% - 5.7% 5.8% - 6.1% Effective Tax Rate ~23% ~22% Adjusted EPS2 $5.50 - $6.00 $6.80 - $7.30 Free Cash Flow (percent of net income) ~100% ~100% Capital Expenditures $100 - $120M $100 - $120M 1 Reflects one less workday in 2021 compared to 2020. 2 Adjusted EBITDA is defined as EBITDA before other, net, non-cash stock-based compensation, merger-related costs and the net gain on the sale of WESCO's legacy utility and data communications businesses in Canada; Adjusted EPS only excludes the net gain on the sale of WESCO's legacy utility and data communications businesses in Canada, merger-related costs and the related income tax effects.

15 Summary •Our performance and improving macro environment drive stronger 2021 outlook • Excellent start to the year with strong results across the board – Capitalized on market leadership and operating leverage as economic recovery accelerated – Continued to outperform market and realizing cross-sell benefits – Delivered margin expansion on strong execution of integration plan; synergy targets raised • Continue to rapidly delever balance sheet with leverage reduced 0.8x since June 2020 • Increased full year outlook for sales, Adjusted EBITDA, and Adjusted EPS – Continuing to monitor supply chain and pandemic recovery cadence • Well positioned to participate in evolving secular growth opportunities

APPENDIX

17 Glossary 1H: First half of fiscal year 2H: Second half of fiscal year A/V: Audio/visual COGS: Cost of goods sold CIG: Commercial, Institutional, and Government CSS: Communications & Security Solutions (business unit) EES: Electrical & Electronic Solutions (business unit) ETR: Effective tax rate FTTx: Fiber-to-the-x (last mile fiber optic network connections) HSD: High-single digit LSD: Low-single digit Executed synergies: Initiatives fully implemented – actions taken to generate savings Realized synergies: Savings that impact financial results versus pro forma 2019 Leverage: Debt, net of cash, divided by trailing-twelve-month adjusted EBITDA MRO: Maintenance, repair, and operating MTDC: Multi-tenant datacenter MSD: Mid-single digit PF: Pro Forma OEM: Original equipment manufacturer OPEX: Operating expenses ROW: Rest of world Seq: Sequential TTM: Trailing twelve months UBS: Utility & Broadband Solutions (business unit) WD: Workday YoY: Year-over-year Abbreviations Definitions

18 Workdays Q1 Q2 Q3 Q4 FY 2019 63 64 63 62 252 2020 64 64 64 61 253 2021 62 64 64 62 252

19 Pro Forma and Workday-Adjusted Sales $ in millions March 31, 2021 Reported Reported Anixter 1 Pro Forma Reported Pro Forma Adjusted 2 Net sales 4,041$ 1,969$ 2,072$ 4,040$ 105% 0% 3% Growth Pro Forma Workday- Adjusted Net Sales 1 Represents Anixter’s reported results for the period from January 4, 2020 to April 3, 2020, as previously filed in an exhibit to Form 8-K on November 4, 2020. 2 Represents the percentage impact of 62 workdays in the three months ended March 31, 2021 compared to 64 workdays in the three months ended March 31, 2020. March 31, 2020 Three Months Ended

20 Gross Profit and Free Cash Flow $ in millions March 31, 2021 March 31, 2020 Net sales 4,041$ 1,969$ Cost of goods sold (1) 3,230 1,592 Gross profit 811$ 377$ Gross margin 20.1% 19.1% March 31, 2021 March 31, 2020 Cash flow provided by operations 120$ 32$ Less: capital expenditures (10) (16) Add: merger-related expenditures 15 - Free cash flow 125$ 16$ Adjusted net income 88 38 % of adjusted net income 141% 41% (1) Excludes depreciation and amortization. Gross Profit Three Months Ended, Free Cash Flow Three Months Ended,

21 Adjusted EBITDA $ in millions EES CSS UBS Corporate Total Net income attributable to common stockholders 101$ 74$ 87$ (216)$ 45$ Net income attributable to noncontrolling interests (1) - - 1 - Preferred stock dividends - - - 14 14 Provision for income taxes - - - 7 7 Interest expense, net - - - 70 70 Depreciation and amortization 11 16 5 9 41 EBITDA 111$ 90$ 92$ (115)$ 177$ Other, net - - - (3) (3) Stock-based compensation expense 1 1 1 3 5 Merger-related costs - - - 46 46 Gain from sale - - (9) - (9) Adjusted EBITDA 112$ 91$ 84$ (70)$ 217$ Adjusted EBITDA margin % 6.5% 7.3% 7.8% 5.4% EBITDA, Adjusted EBITDA and Adjusted EBITDA margin % by Segment Three Months Ended March 31, 2021 1 Stock-based compensation expense in the calculation of adjusted EBITDA for the three months ended March 31, 2021 excludes $1.3 million as this amount is included in merger-related costs.

22 Adjusted EPS Reported Results Adjusted Results Reported Results Adjusted Results (in millions, except for EPS) Income from operations 133.3$ 37.4$ 170.7$ 60.9$ 4.6$ 65.5$ Interest expense, net 70.4 - 70.4 16.6 (0.5) 16.1 Other, net (2.8) - (2.8) (0.1) - (0.1) Income before income taxes 65.7 37.4 103.1 44.4 5.1 49.6 Income tax 6.5 8.1 2 14.6 10.3 1.2 2 11.4 Effective tax rate 9.9% 14.2% 23.1% 23.1% Net income 59.2 29.3 88.4 34.2 3.9 38.1 Less: Non-controlling interests - - - (0.2) - (0.2) Net income attributable to WESCO 59.2 29.3 88.4 34.4 3.9 38.3 Preferred stock dividends 14.4 - 14.4 - - - Net income attributable to common stockholders 44.8 29.3 74.0 34.4 3.9 38.3 Diluted Shares 51.7 51.7 42.1 42.1 EPS 0.87$ 1.43$ 0.82$ 0.91$ Q1 2021 Q1 2020 Adjustments (1) Adjustments (1) 2 The adjustments to income from operations and net interest expense have been tax effected at rates of 21.8% and 23.1% for the three months ended March 31, 2021 and 2020, respectively. 1 Adjustments include merger-related costs and interest, a net gain on the sale of WESCO's legacy utility and data communications businesses in Canada, and the related income tax effects.

23 Capital Structure and Leverage $ in millions March 31, 2021 December 31, 2020 Net income attributable to common stockholders 90$ 116$ Net loss attributable to noncontrolling interests (0) (1) Preferred stock dividends 44 30 Provision for income taxes 40 56 Interest expense, net 293 256 Depreciation and amortization 162 153 EBITDA 629$ 610$ Other, net (5) 5 Stock-based compensation 30 35 Merger-related costs and fair value adjustments 246 207 Out-of-period adjustment 19 19 Net gain on sale of asset and Canadian divestitures (29) (20) Adjusted EBITDA 890$ 855$ Maturity March 31, 2021 December 31, 2020 Receivables Securitization (variable) 945$ 950$ 2023 Inventory Revolver (variable) 475 250 2025 2021 Senior Notes (fixed) - 500 2021 2023 Senior Notes AXE (fixed) 59 59 2023 2024 Senior Notes (fixed) 350 350 2024 2025 Senior Notes AXE (fixed) 4 4 2025 2025 Senior Notes (fixed) 1,500 1,500 2025 2028 Senior Notes (fixed) 1,325 1,325 2028 Other 38 47 Various Total debt 1 4,696$ 4,985$ Less: cash and cash equivalents 304 449 Total debt, net of cash 4,392$ 4,536$ Leverage 4.9x 5.3x 1 Total debt is presented in the consolidated balance sheets net of debt discount and debt issuance costs, and includes adjustments to record the long-term debt assumed in the merger with Anixter at its acquisition date fair value. Pro Forma Financial Leverage Twelve Months Ended, Debt As of,

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Wesco Supports American Red Cross Humanitarian Mission Through Annual Disaster Giving Program

- Consilience.ai Unveils AlphaIQ Platform for Instant and Verifiable Insights for Financial Analysis

- Pharming Group announces the placement of €100 million convertible bonds due 2029

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share