Form 8-K Vectrus, Inc. For: May 11

Exhibit 99.1 1 PRESS RELEASE CONTACT: Vectrus Mike Smith, CFA 719-637-5773 [email protected] Vectrus Announces Strong First Quarter 2021 Results • Revenue of $434 million up 23% yr/yr • Adjusted EBITDA margin1 of 4.8%, an increase of 60 bps yr/yr • First quarter fully diluted EPS of $1.02; Adjusted diluted EPS1 adding back acquisition related amortization, increased 46% yr/yr to $1.20 • Integration and performance of recent acquisitions on track • Increasing low-end and mid-point of 2021 guidance COLORADO SPRINGS, Colo., May 11, 2021 — Vectrus, Inc. (NYSE: VEC) announced first quarter 2021 financial results. “Vectrus reported strong first quarter results driven by the continued momentum in the execution of our strategy,” said Chuck Prow, Chief Executive Officer of Vectrus. “During the quarter, revenue grew 23% year-over-year, with organic growth of 4%,” said Prow. “Revenue growth was driven by our recent acquisitions, continued phase-in of LOGCAP V, as well as the progress made in executing growth in our core programs. Additionally, adjusted EBITDA margin increased 60 basis points year-over-year.” “Our growth-related activities and efforts to make Vectrus the premier converged infrastructure company continue to experience positive momentum,” said Prow. “During the quarter Vectrus was awarded the CBRN integrated defense prime OTA contract, which was based on our well-known capabilities in sensor integration, Internet of Things, and perimeter security solutions. The award is valued at $19 million over two years and extends Vectrus’ IoT, machine learning and data analytics offerings. This effort is co-sponsored between the DoD and Department of Homeland Security and provides sensor integration as well as data integration and analysis related to threat detection

Exhibit 99.1 2 domestically. This program brings our digitally integrated solutions, that were originally deployed overseas, to the U.S. to support protection of the Homeland. We are pleased to have been selected for such an important mission and look forward to the opportunity to bring our unique and differentiated solutions utilized by the DoD to a new client and market. This work is illustrative of how Vectrus is building capabilities and inserting technology to deliver a more integrated and comprehensive suite of solutions in support of the converged infrastructure market.” Prow continued, “We are also continuing to execute our IDIQ portfolio by leveraging our converged solutions, geographic footprint, and ability to provide complex mission-critical IT services. During the quarter, we won a $22 million five-year task order under the Army’s ITES-3S IDIQ to provide enterprise IT services to the U.S. Army Corp of Engineers across Europe. This is an important win for Vectrus which leverages the more than 30 years of experience we have in providing a full range of operations and maintenance, IT support and supply services with our Army OPMAS-E contract in Europe. This task order provides Vectrus with an opportunity to grow its’ presence in support of the 37,000 U.S. Army Corp of Engineers civilians and soldiers that are delivering vital engineering services in over 130 countries worldwide.” “Last quarter we completed two strategic acquisitions that added key clients, capabilities, and accelerated our converged infrastructure strategy,” said Prow. “The integration of these acquisitions is well underway and on track with our plan. We remain excited about the talent, combined capabilities, and opportunities for accelerated growth.” “Regarding LOGCAP V, we continue to phase-in and anticipate being at full operational capability in Iraq by June,” said Prow. “In terms of INDOPACOM, the phase-in process remains elongated due to base access restrictions associated with COVID-19; but we continue to anticipate phase-in later this year with full operational capability in early 2022.” First Quarter 2021 Results First quarter 2021 revenue of $434.0 million was up $82.3 million dollars year on year or 23.4% as compared to the same period last year. Revenue grew by $68.9 million year on year as a result of the companies’ two acquisitions on December 31, 2020 and grew $13.4 million organically. Operating income was $16.5 million or 3.8% margin in the first quarter of 2021. Adjusted operating income1 was $19.1 million or 4.4% margin. EBITDA1 was $20.5 million or 4.7% margin and Adjusted EBITDA1 was $20.7 million or 4.8% margin for the first quarter of 2021. Margin improved by 60 basis points for both EBITDA and Adjusted EBITDA due to the company’s two acquisitions and improved operating performance.

Exhibit 99.1 3 Fully diluted EPS for the first quarter of 2021 was $1.02 as compared to $0.74 cents in the same period last year. Adjusted diluted EPS1, which adds back amortization of acquired intangible assets, was $1.20 for the quarter, as compared to $0.82 cents in the prior year. The improvement in EPS is due to the company’s two acquisitions, improved operating performance, and lower tax expense. “Our first quarter results demonstrate that our strategic execution is resulting in a more capable and diverse company,” said Susan Lynch, Senior Vice President and Chief Financial Officer. “For example, our revenue with the Navy now comprises 13% of total revenue compared to 4% during the same time last year. Our geographic and contract mix have also diversified.” Lynch continued, “We are very pleased with our first quarter operating performance, the contributions from our recent December 31, 2020 acquisitions, and our overall progress in becoming a higher value, growth-oriented platform. We expect to continue to derive synergies from our acquisitions on both the top and bottom line while achieving greater operational efficiencies from our new ERP systems.” Cash used in operating activities through April 2, 2021 was $21.7 million and was a result of timing and the strong cash performance in the fourth quarter of 2020. Net debt at April 2, 2021 was $138.7 million, up $100.9 million from April 3, 2020 due to the acquisitions of Zenetex and HHB on December 31, 2020. Total debt at April 2, 2021 was $177.0 million, down $7 million from $184.0 million at April 3, 2020. Cash at quarter-end was $38.3 million. Total consolidated indebtedness to consolidated EBITDA1 (total leverage ratio) was 2.0x. Total backlog as of April 2, 2021 was $4.5 billion and funded backlog was $0.9 billion. The trailing twelve-month book-to-bill was 0.8x as of April 2, 2021.

Exhibit 99.1 4 Increasing 2021 Guidance Mid-Point Lynch continued, “In light of our strong first quarter performance we are increasing the low-end of the guidance range.” Guidance for 2021 is as follows: $ millions, except for EBITDA margins and per share amounts Previous 2021 Guidance Updated 2021 Guidance Updated 2021 Mid-Point Revenue $1,645 to $1,715 $1,680 to $1,715 $1,698 Adjusted EBITDA Margin1 4.6% to 5.0% 4.8% to 5.0% 4.9% Adjusted Diluted Earnings Per Share1 $4.25 to $4.85 $4.55 to $4.85 $4.70 Net Cash Provided by Operating Activities $55.0 to $65.0 $58.0 to $65.0 $61.5 Forward-looking statements are based upon current expectations and are subject to factors that could cause actual results to differ materially from those suggested here, including those factors set forth in the Safe Harbor Statement below. First Quarter 2021 Conference Call Management will conduct a conference call with analysts and investors at 4:30 p.m. ET on Tuesday, May 11, 2021. U.S.-based participants may dial in to the conference call at 877-407-0792, while international participants may dial 201-689-8263. For all other listeners, a live webcast of the conference call will be available on the Vectrus Investor Relations website at http://investors.vectrus.com or https://www.webcaster4.com/Webcast/Page/1431/41306. An accompanying slide presentation will also be available on the Vectrus Investor Relations website. A replay of the conference call will be posted on the Vectrus website shortly after completion of the call and will be available for one year. A telephonic replay will also be available through May 25, 2021, at 844-512- 2921 (domestic) or 412-317-6671 (international) with passcode 13719138. Footnotes: 1 See "Key Performance Indicators and Non-GAAP Financial Measures" for reconciliation. About Vectrus Vectrus is a leading provider of global service solutions with a history in the services market that dates back more than 70 years. The company provides facility and base operations; supply chain and logistics services; information technology mission support; and engineering and digital integration services primarily to U.S. government customers around the world. Vectrus is differentiated by operational excellence,

Exhibit 99.1 5 superior program performance, a history of long-term customer relationships and a strong commitment to its clients' mission success. Vectrus is headquartered in Colorado Springs, Colo., and includes about 9,200 employees spanning 206 locations in 27 countries. In 2020, Vectrus generated sales of $1.4 billion. To learn about career opportunities at Vectrus, visit www.vectrus.com/careers. For more information, visit the company's website at www.vectrus.com or connect with Vectrus on Facebook, Twitter, and LinkedIn. Safe Harbor Statement Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 (the "Act"): Certain material presented herein includes forward-looking statements intended to qualify for the safe harbor from liability established by the Act. These forward-looking statements include, but are not limited to, all of the statements and items listed in the table in "2021 Guidance" above and other assumptions contained therein for purposes of such guidance, other statements about our 2021 performance outlook, five-year growth plan, revenue, DSO, contract opportunities, the potential impact of COVID-19, and any discussion of future operating or financial performance. Whenever used, words such as "may," "are considering," "will," "likely," "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "target," "could," "potential," "continue," "goal" or similar terminology are forward-looking statements. These statements are based on the beliefs and assumptions of our management based on information currently available to management. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside our management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. For a discussion of some of the risks and important factors that could cause actual results to differ from such forward-looking statements, see the risks and other factors detailed from time to time our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the U.S. Securities and Exchange Commission. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Exhibit 99.1 6 VECTRUS, INC. CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) Three Months Ended April 2, April 3, (In thousands, except per share data) 2021 2020 Revenue $ 434,004 $ 351,734 Cost of revenue 393,648 319,693 Selling, general, and administrative expenses 23,823 19,558 Operating income 16,533 12,483 Interest expense, net (1,932) (1,703) Income from operations before income taxes 14,601 10,780 Income tax expense 2,553 2,112 Net income $ 12,048 $ 8,668 Earnings per share Basic $ 1.03 $ 0.75 Diluted $ 1.02 $ 0.74 Weighted average common shares outstanding - basic 11,648 11,545 Weighted average common shares outstanding - diluted 11,827 11,745

Exhibit 99.1 7 VECTRUS, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) April 2, December 31, (In thousands, except share information) 2021 2020 Assets Current assets Cash and cash equivalents $ 38,347 $ 66,949 Restricted cash 1,778 1,778 Receivables 359,182 314,959 Other current assets 27,319 24,702 Total current assets 426,626 408,388 Property, plant, and equipment, net 21,410 22,573 Goodwill 315,401 339,702 Intangible assets, net 71,254 48,105 Right-of-use assets 20,802 18,718 Other non-current assets 6,839 6,325 Total non-current assets 435,706 435,423 Total Assets $ 862,332 $ 843,811 Liabilities and Shareholders' Equity Current liabilities Accounts payable $ 197,447 $ 159,586 Compensation and other employee benefits 56,349 79,568 Short-term debt 9,200 8,600 Other accrued liabilities 41,249 40,657 Total current liabilities 304,245 288,411 Long-term debt, net 166,383 168,751 Deferred tax liability 41,999 39,386 Other non-current liabilities 35,239 42,325 Total non-current liabilities 243,621 250,462 Total liabilities 547,866 538,873 Commitments and contingencies (Note 10) Shareholders' Equity Preferred stock; $0.01 par value; 10,000,000 shares authorized; No shares issued and outstanding — — Common stock; $0.01 par value; 100,000,000 shares authorized; 11,700,232 and 11,624,717 shares issued and outstanding as of April 2, 2021 and December 31, 2020, respectively 117 116 Additional paid in capital 82,735 82,823 Retained earnings 234,074 222,026 Accumulated other comprehensive loss (2,460) (27) Total shareholders' equity 314,466 304,938 Total Liabilities and Shareholders' Equity $ 862,332 $ 843,811

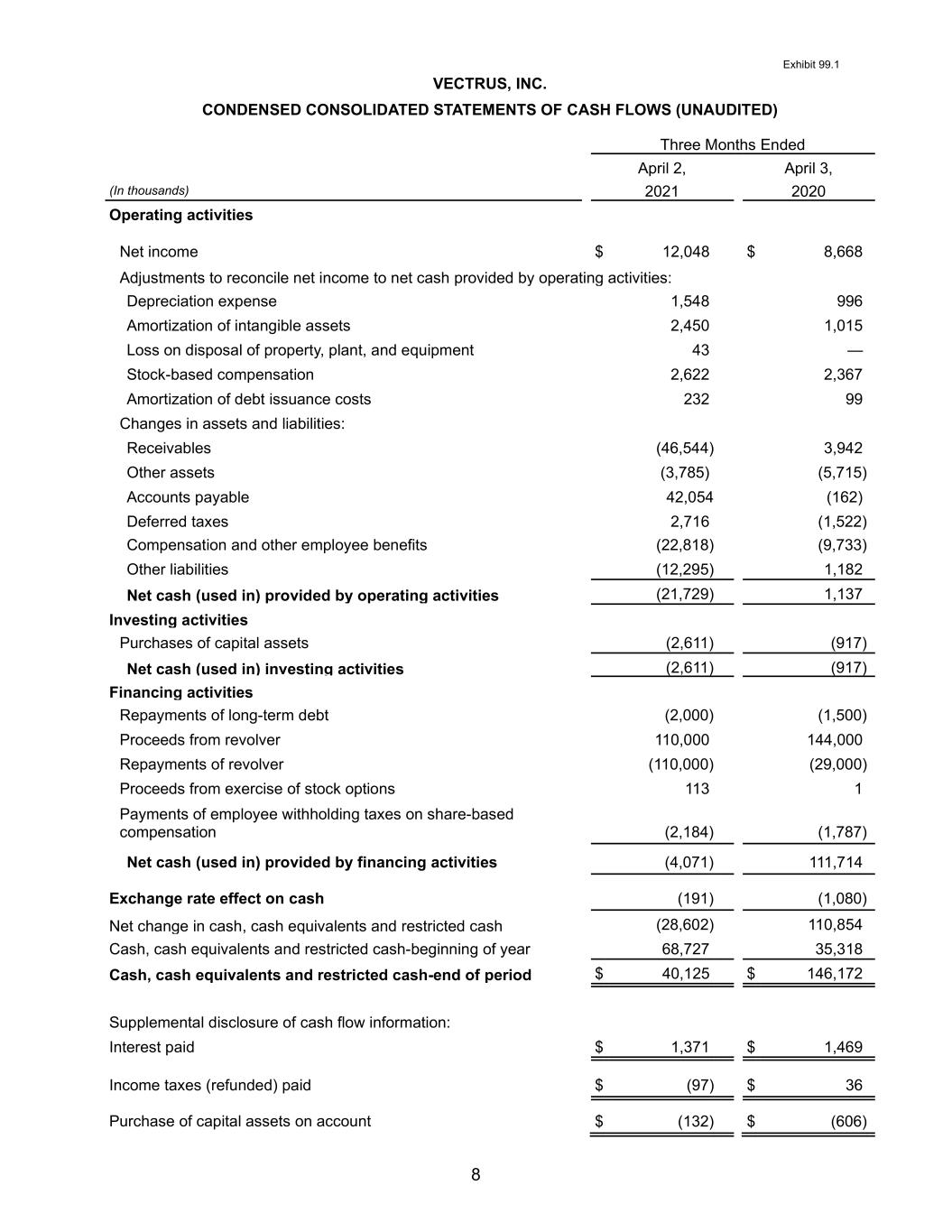

Exhibit 99.1 8 VECTRUS, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) Three Months Ended April 2, April 3, (In thousands) 2021 2020 Operating activities Net income $ 12,048 $ 8,668 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense 1,548 996 Amortization of intangible assets 2,450 1,015 Loss on disposal of property, plant, and equipment 43 — Stock-based compensation 2,622 2,367 Amortization of debt issuance costs 232 99 Changes in assets and liabilities: Receivables (46,544) 3,942 Other assets (3,785) (5,715) Accounts payable 42,054 (162) Deferred taxes 2,716 (1,522) Compensation and other employee benefits (22,818) (9,733) Other liabilities (12,295) 1,182 Net cash (used in) provided by operating activities (21,729) 1,137 Investing activities Purchases of capital assets (2,611) (917) Net cash (used in) investing activities (2,611) (917) Financing activities Repayments of long-term debt (2,000) (1,500) Proceeds from revolver 110,000 144,000 Repayments of revolver (110,000) (29,000) Proceeds from exercise of stock options 113 1 Payments of employee withholding taxes on share-based compensation (2,184) (1,787) Net cash (used in) provided by financing activities (4,071) 111,714 Exchange rate effect on cash (191) (1,080) Net change in cash, cash equivalents and restricted cash (28,602) 110,854 Cash, cash equivalents and restricted cash-beginning of year 68,727 35,318 Cash, cash equivalents and restricted cash-end of period $ 40,125 $ 146,172 Supplemental disclosure of cash flow information: Interest paid $ 1,371 $ 1,469 Income taxes (refunded) paid $ (97) $ 36 Purchase of capital assets on account $ (132) $ (606)

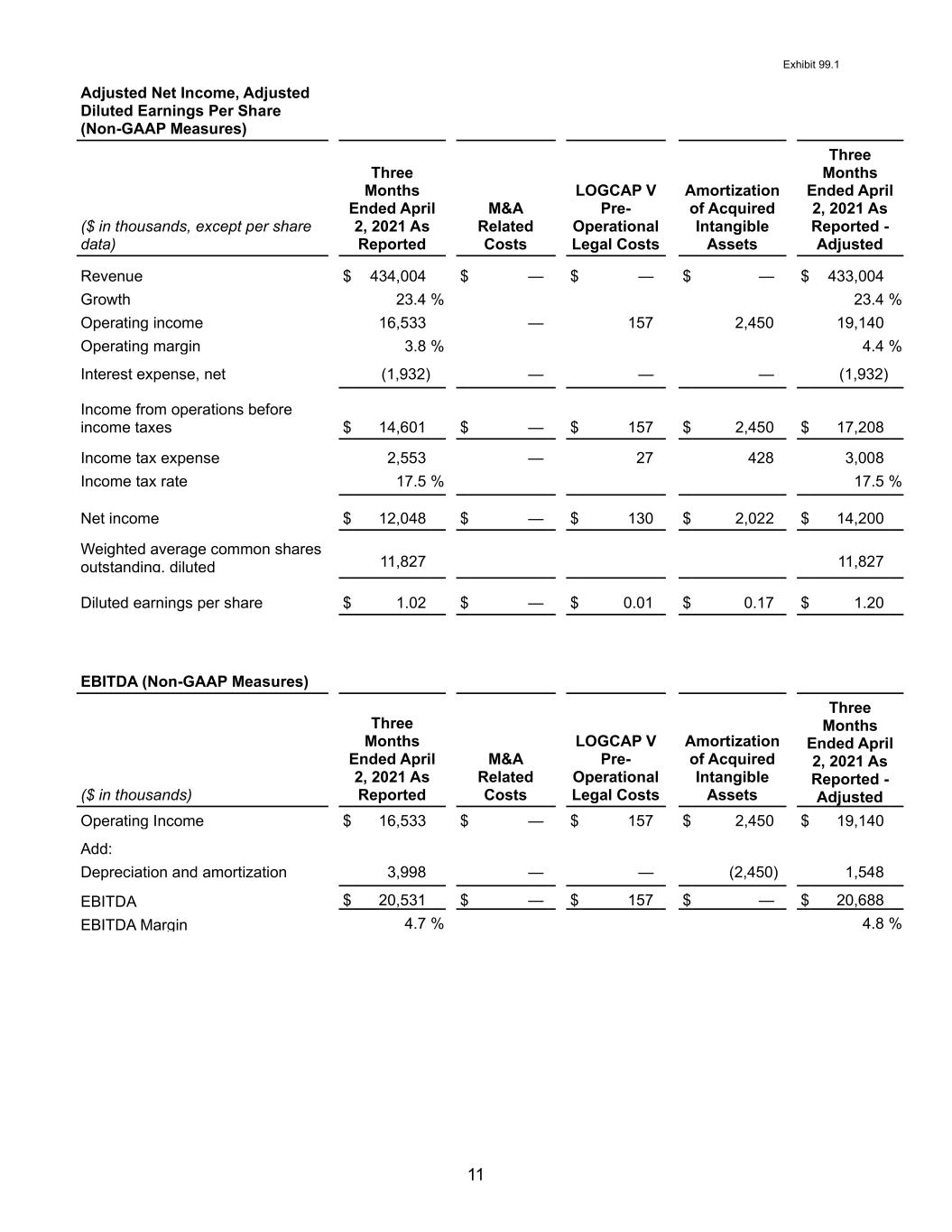

Exhibit 99.1 9 Key Performance Indicators and Non-GAAP Measures The primary financial performance measures we use to manage our business and monitor results of operations are revenue trends and operating income trends. Management believes that these financial performance measures are the primary drivers for our earnings and net cash from operating activities. Management evaluates its contracts and business performance by focusing on revenue, operating income and operating margin. Operating income represents revenue less both cost of revenue and selling, general and administrative (SG&A) expenses. Cost of revenue consists of labor, subcontracting costs, materials, and an allocation of indirect costs, which includes service center transaction costs. SG&A expenses consist of indirect labor costs (including wages and salaries for executives and administrative personnel), bid and proposal expenses and other general and administrative expenses not allocated to cost of revenue. We define operating margin as operating income divided by revenue. We manage the nature and amount of costs at the program level, which forms the basis for estimating our total costs and profitability. This is consistent with our approach for managing our business, which begins with management's assessing the bidding opportunity for each contract and then managing contract profitability throughout the performance period. In addition to the key performance measures discussed above, we consider adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted earnings per share, EBITDA, adjusted EBITDA, EBITDA margin, adjusted EBITDA margin, and organic revenue to be useful to management and investors in evaluating our operating performance, and to provide a tool for evaluating our ongoing operations. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives. We provide this information to our investors in our earnings releases, presentations and other disclosures. Adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted earnings per share, EBITDA, adjusted EBITDA, EBITDA margin, adjusted EBITDA margin, and organic revenue, however, are not measures of financial performance under GAAP and should not be considered a substitute for operating income, operating margin, net income and diluted earnings per share as determined in accordance with GAAP. Definitions and reconciliations of these items are provided below. • Adjusted operating income is defined as operating income, adjusted to exclude items that may include, but are not limited to significant charges or credits, and unusual and infrequent non-operating items, such as M&A transaction and LOGCAP V pre-operational legal costs, and amortization of acquired intangible assets that impact current results but are not related to our ongoing operations. • Adjusted operating margin is defined as adjusted operating income divided by revenue.

Exhibit 99.1 10 • Adjusted net income is defined as net income, adjusted to exclude items that may include, but are not limited to, significant charges or credits, and unusual and infrequent non-operating items, such as M&A transaction and LOGCAP V pre-operational legal costs, and amortization of acquired intangible assets that impact current results but are not related to our ongoing operations. • Adjusted diluted earnings per share is defined as adjusted net income divided by the weighted average diluted common shares outstanding. • EBITDA is defined as operating income, adjusted to exclude depreciation and amortization. • Adjusted EBITDA is defined as EBITDA, adjusted to exclude items that may include, but are not limited to, significant charges or credits and unusual and infrequent non-operating items, such as M&A transaction and LOGCAP V pre-operational legal costs that impact current results but are not related to our ongoing operations. • EBITDA margin is defined as EBITDA divided by revenue. • Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue. • Organic revenue is defined as revenue, adjusted to exclude revenue from acquired companies.

Exhibit 99.1 11 Adjusted Net Income, Adjusted Diluted Earnings Per Share (Non-GAAP Measures) ($ in thousands, except per share data) Three Months Ended April 2, 2021 As Reported M&A Related Costs LOGCAP V Pre- Operational Legal Costs Amortization of Acquired Intangible Assets Three Months Ended April 2, 2021 As Reported - Adjusted Revenue $ 434,004 $ — $ — $ — $ 433,004 Growth 23.4 % 23.4 % Operating income 16,533 — 157 2,450 19,140 Operating margin 3.8 % 4.4 % Interest expense, net (1,932) — — — (1,932) Income from operations before income taxes $ 14,601 $ — $ 157 $ 2,450 $ 17,208 Income tax expense 2,553 — 27 428 3,008 Income tax rate 17.5 % 17.5 % Net income $ 12,048 $ — $ 130 $ 2,022 $ 14,200 Weighted average common shares outstanding, diluted 11,827 11,827 Diluted earnings per share $ 1.02 $ — $ 0.01 $ 0.17 $ 1.20 EBITDA (Non-GAAP Measures) ($ in thousands) Three Months Ended April 2, 2021 As Reported M&A Related Costs LOGCAP V Pre- Operational Legal Costs Amortization of Acquired Intangible Assets Three Months Ended April 2, 2021 As Reported - Adjusted Operating Income $ 16,533 $ — $ 157 $ 2,450 $ 19,140 Add: Depreciation and amortization 3,998 — — (2,450) 1,548 EBITDA $ 20,531 $ — $ 157 $ — $ 20,688 EBITDA Margin 4.7 % 4.8 %

Exhibit 99.1 12 Adjusted Net Income, Adjusted Diluted Earnings Per Share (Non-GAAP Measures) ($ in thousands, except per share data) Three Months Ended April 3, 2020 As Reported M&A Related Costs LOGCAP V Pre- Operational Legal Costs Amortization of Acquired Intangible Assets Three Months Ended April 3, 2020 As Reported - Adjusted Revenue $ 351,734 $ — $ — $ — $ 351,734 Operating income $ 12,483 $ — $ 141 $ 1,015 $ 13,639 Operating margin 3.5 % 3.9 % Interest expense, net $ (1,703) $ — $ — $ — $ (1,703) Income from operations before income taxes $ 10,780 $ — $ 141 $ 1,015 $ 11,936 Income tax expense $ 2,112 $ — $ 28 $ 171 $ 2,311 Income tax rate 19.6 % 19.4 % Net income $ 8,668 $ — $ 113 $ 844 $ 9,625 Weighted average common shares outstanding, diluted 11,745 11,745 Diluted earnings per share $ 0.74 $ — $ 0.01 $ 0.07 $ 0.82 EBITDA (Non-GAAP Measures) ($ in thousands) Three Months Ended April 3, 2020 As Reported M&A Related Costs LOGCAP V Pre- Operational Legal Costs Amortization of Acquired Intangible Assets Three Months Ended April 3, 2020 As Reported - Adjusted Operating Income $ 12,483 $ — $ 141 $ 1,015 $ 13,639 Add: Depreciation and amortization $ 2,011 $ — $ — $ (1,015) $ 996 EBITDA $ 14,494 $ — $ 141 $ — $ 14,635 EBITDA Margin 4.1 % 4.2 %

Exhibit 99.1 13 ($ In thousands) Three Months Ended April 2, 2021 As Reported Three Months Ended April 2, 2021 Zenetex & HHB Three Months Ended April 2, 2021 As Reported - Organic Revenue $ 434,004 $ 68,869 $ 365,135 ($ In thousands) Three Months Ended April 3, 2020 As Reported Three Months Ended April 3, 2020 Zenetex & HHB Three Months Ended April 3, 2020 As Reported - Organic Revenue $ 351,734 $ — $ 351,734 Organic Revenue $ $ 13,401 Organic Revenue % 3.8 %

Exhibit 99.1 14 SUPPLEMENTAL INFORMATION Revenue by client branch, contract type, contract relationship, and geographic region for the periods presented below was as follows: Revenue by Client Three Months Ended April 2. April 3, (In thousands) 2021 % 2020 % Army $ 257,349 59 % $ 247,555 70 % Air Force 78,170 18 % 73,341 21 % Navy 56,427 13 % 15,237 4 % Other 42,058 10 % 15,601 5 % Total revenue $ 434,004 $ 351,734 Revenue by Contract Type Three Months Ended April 2, April 3, (In thousands) 2021 % 2020 % Cost-plus and cost-reimbursable ¹ $ 305,247 70 % $ 256,319 73 % Firm-fixed-price 128,757 30 % 95,415 27 % Total revenue $ 434,004 $ 351,734 ¹ Includes time and material contracts Revenue by Contract Three Months Ended April 2, April 3, (In thousands) 2021 % 2020 % Prime contractor $ 403,262 93 % $ 333,393 95 % Subcontractor 30,742 7 % 18,341 5 % Total revenue $ 434,004 $ 351,734 Revenue by Geographic Region Three Months Ended April 2, April 3, (In thousands) 2021 % 2020 % Middle East $ 241,813 56 % $ 237,937 68 % United States 151,582 35 % 81,469 23 % Europe 40,609 9 % 32,328 9 % Total revenue $ 434,004 $ 351,734

VECTRUS FIRST QUARTER 2021 RESULTS CHUCK PROW – PRESIDENT AND CHIEF EXECUTIVE OFFICER SUSAN LYNCH – SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER MAY 11, 2021

Safe Harbor Statement Page 2 SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 (THE “ACT"): CERTAIN MATERIAL PRESENTED HEREIN INCLUDES FORWARD-LOOKING STATEMENTS INTENDED TO QUALIFY FOR THE SAFE HARBOR FROM LIABILITY ESTABLISHED BY THE ACT. THESE FORWARD- LOOKING STATEMENTS INCLUDE, BUT ARE NOT LIMITED TO, ALL OF THE STATEMENTS AND ITEMS LISTED IN THE TABLES FOR 2021 GUIDANCE AND OTHER ASSUMPTIONS CONTAINED THEREIN FOR PURPOSES OF SUCH GUIDANCE, STATEMENTS ABOUT OUR 2021 PERFORMANCE OUTLOOK, FIVE-YEAR GROWTH PLAN, REVENUE, DSO, CONTRACT OPPORTUNITIES, THE IMPACT OF COVID-19, THE CONTINUED INTEGRATION OF OUR ACQUISITIONS, AND ANY DISCUSSION OF FUTURE OPERATING OR FINANCIAL PERFORMANCE. WHENEVER USED, WORDS SUCH AS "MAY," "ARE CONSIDERING," "WILL," "LIKELY," "ANTICIPATE," "ESTIMATE," "EXPECT," "PROJECT," "INTEND," "PLAN," "BELIEVE," "TARGET," "COULD," "POTENTIAL," "CONTINUE," "GOAL" OR SIMILAR TERMINOLOGY ARE FORWARD-LOOKING STATEMENTS. THESE STATEMENTS ARE BASED ON THE BELIEFS AND ASSUMPTIONS OF OUR MANAGEMENT BASED ON INFORMATION CURRENTLY AVAILABLE TO MANAGEMENT. THESE FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE, CONDITIONS OR RESULTS, AND INVOLVE A NUMBER OF KNOWN AND UNKNOWN RISKS, UNCERTAINTIES, ASSUMPTIONS AND OTHER IMPORTANT FACTORS, MANY OF WHICH ARE OUTSIDE OUR MANAGEMENT’S CONTROL, THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THE RESULTS DISCUSSED IN THE FORWARD-LOOKING STATEMENTS. FOR A DISCUSSION OF SOME OF THE RISKS AND IMPORTANT FACTORS THAT COULD CAUSE ACTUAL RESULTS TO DIFFER FROM SUCH FORWARD-LOOKING STATEMENTS, SEE THE RISKS AND OTHER FACTORS DETAILED FROM TIME TO TIME OUR ANNUAL REPORT ON FORM 10-K, QUARTERLY REPORTS ON FORM 10-Q, AND OTHER FILINGS WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION. WE UNDERTAKE NO OBLIGATION TO UPDATE ANY FORWARD-LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE, EXCEPT AS REQUIRED BY LAW.

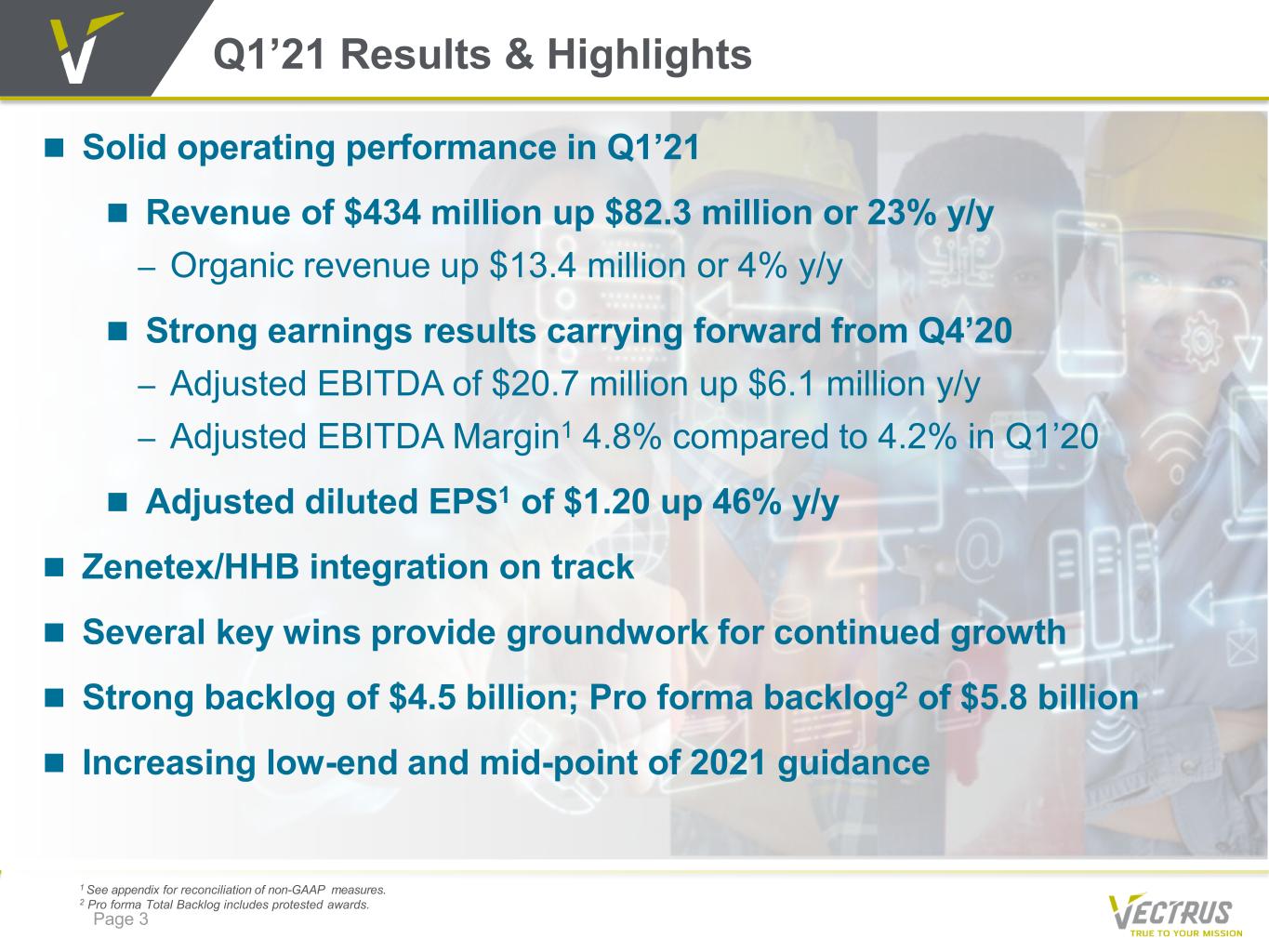

Page 3 1 See appendix for reconciliation of non-GAAP measures. 2 Pro forma Total Backlog includes protested awards. Q1’21 Results & Highlights Solid operating performance in Q1’21 Revenue of $434 million up $82.3 million or 23% y/y – Organic revenue up $13.4 million or 4% y/y Strong earnings results carrying forward from Q4’20 – Adjusted EBITDA of $20.7 million up $6.1 million y/y – Adjusted EBITDA Margin1 4.8% compared to 4.2% in Q1’20 Adjusted diluted EPS1 of $1.20 up 46% y/y Zenetex/HHB integration on track Several key wins provide groundwork for continued growth Strong backlog of $4.5 billion; Pro forma backlog2 of $5.8 billion Increasing low-end and mid-point of 2021 guidance

As we transform the Army, we have to transform installations along with it. Gen. James C. McConville, Chief of Staff, Army Market Trends Support Converged Infrastructure Growth Page 4 The Federal technical services sector is transforming, and the addressable market is expanding. Clients are migrating from traditional ways of operating their infrastructure to a much more instrumented, predictive, and converged approach. Client expectations are evolving to include enhanced mission capabilities, improved performance, lower cost points, and outcome-based contract structures. Recently the U.S. Army released its “Installations Strategy”, which is the first strategy to identify the need for modernized, resilient and sustainable installations. — This strategy outlines how every installation will be a “smart” platform of capabilities, utilizing connected sensors to enhance operational capacity and improve the delivery of services. Client examples and use-cases are rapidly emerging across defense, national security and federal civilian markets (e.g. 5G pilots, “installation of the future”, NASA Sustainability Center at Ames Research Lab, Yokota AFB microgrid, NGA West construction of Green LEED facility). Vectrus is innovating and investing to meet these needs and capture new, high growth opportunities in the emerging market. Army Installations Strategic Outcomes Enhance Readiness and Resilience. “Operationalizes Installations,” and implements solutions for protection, resilience, mission assurance (power projection), education and training Modernize and Innovate. Expands 5G capability, seeks innovation to modernize services, standards, and find efficiencies 1 2

Converged Market Leadership Page 5 We leveraged our experience in how installations are operating today with how clients should prepare for the future by providing thought leadership to the marketplace We are also inserting operational technologies that provide real world, immediately practical capabilities into our core functional services and as point solutions Vectrus Integrated Security Platform Vectrus Installation of the Future Platform Vectrus Zero Trust Logistics Modernization Architecture over 5G Vectrus Energy Solutions: - Vectrus Thermal Coating - Vectrus Water Purification - Vectrus Water Energy Conservation Measures - Vectrus Solar Lighting - Vectrus Power Solutions 1 2 3 4

Vectrus is at the Forefront of 5G and Converged Infrastructure Enablement Page 6 Naval Base Coronado & Marine Corp Logistics Command using 5G to build Smart Warehouses Private 5G Wireless Network Detect In-Bound and Out-Bound Property Verify Receipt against Advance Ship Notice (ASN) Verify Shipment against Request Sensors detect open doors, temperature, humidity Track People, Property, and Equipment In Motion; E-Deliver Put Lists E-Deliver Pick Lists Smart Carts & Distributed Displays AGV Integration Predictive Analytics Warehouse Space Optimization Detect Last Known Location of Property Automate Inventory Detect Open/Tamper of containers Core System: Query, Map, Audit, Historical Replay, Alert/ Event Alert on Unauthorized Movement 5G Camera; Auto-Tagging; Alerting S P Query and Find Property Receive Issue/Ship Voice Lookup & Interact Holographic Warehouse Visability 12 2 2 3 2 10 4 5 6 Base Project Increment 7 4 8 79 5G 5G 5G 5G 5G 5G RF RF RF RF RF RF RF RF Optional R&D Extension Project OP1 OP2 5G 5G OP3 OP4 OP6 OP7 OP5 Faster data to decision, enhanced cyber, security, greater operational efficiency through use of Robotics AR/VR Machine Learning & AI Network Splicing Applications to leverage 5G Digital BOSSS Smart IoT implementations Improved supply chain Effective maintenance operations Secure endpoints

Notable Contract Wins to Date Page 7 IDIQ Awarded GSA Schedule for facilities maintenance, energy management, water conservation & support services, & industrial aerospace coating solutions to all federal clients. GSA 03FAC $33M 4-year contract to support Navy technology modernization including systems migration, reporting and analysis, and operational support. Tech Modernization $22M 5-year firm fixed-price task order under the Air Force AFCAP V contract to provide dining facility support services. AFCAP V $19M 2-year cost plus provide CBRN sensor integration, as well as data management, analytics, and visualization in the cloud. Sensor Integration $22M 5-year firm-fixed-price Army ITES- 3S IDIQ task order to provide enterprise IT services to the U.S. Army Corp of Engineers in Europe. Enterprise IT $76M 5-year firm fixed-price Air Force AFCAP V task order to provide airfield aerial port operations. AFCAP V

Page 8 Pipeline Expansion Driving Positive Momentum Steady proposal activity Solid expansion of opportunities across federal, non-federal, and international client sets Continued portfolio diversification and alignment to higher margin technology enabled solutions $ 6.0 $ 7.0 $ 7.7 $ 8.0 $ 9.1 $ 10.3 $ 1.5 $ 1.0 $ 1.4 $ 2.4 $ 2.0 $ 1.7 $ 7.5 $ 8.0 $ 9.1 $ 10.4 $ 11.1 $12.0 2016 2017 2018 2019 2020 Q1 2021 Bids Planned to Submit Bids Submitted ($B)

Page 9 1 See appendix for reconciliation of non-GAAP measures. 2 Definition of metric updated in Q1 2021 to add-back amortization of acquired intangible assets. Q1’21 Financial Results Revenue increased $82.3M y/y, or 23.4% Organic revenue1 growth of $13.4M y/y, or 3.8% Revenue ($M) Adj. EBITDA Margin1 Adj. Diluted EPS1,2 Adj. EBITDAmargin1 of 4.8% Increased 60 bps y/y Adj. diluted EPS1 of $1.20 Increased $0.38 y/y, or 46.3% $351.7 $434.0 Q1'20 Q1'21 4.2% 4.8% Q1'20 Q1'21 $0.82 $1.20 Q1'20 Q1'21

Page 10 Q1’21 Revenue by Category Customer Geographic Region Contract Type 59%18% 13% 10% Q1'21 Army Air Force Navy Other 70% 21% 4% 5% Q1'20 Army Air Force Navy Other 56%35% 9% Q1'21 Middle East United States Europe 68% 23% 9% Q1'20 Middle East United States Europe 67% 30% 3% Q1'21 Cost-type Fixed Price T&M 73% 27% Q1'20 Cost-type Fixed Price

Solid Backlog and Book-to-Bill Page 11 Total Q1’21 Pro Forma Backlog of $5.8 Billion Pro forma backlog includes contracts under protest $1.3B Backlog is 2.7x the 2021 revenue mid-point, providing insight into future revenue and cash flow generation Backlog1 ($B) Trailing 12-Month Book-to-Bill Ratio TTM Pro Forma Book-to-Bill Ratio is 1.7x OMDAC protest expected to be resolved favorably ~$0.9B contract value 1.5 x 1.4 x 1.5 x 2.1 x 0.8 x 1.7 x 1Q'20 Q2'20 Q3'20 Q4'20 Q1'21 Q1'21PF $ 1.0 $ 0.9 $ 1.0 $ 0.9 $ 0.9 $ 0.9 $ 3.0 $ 2.9 $ 2.7 $ 4.2 $ 3.6 $ 3.6 $ 1.3 1Q'20 Q2'20 Q3'20 Q4'20 Q1 '21 Q1'21PF BacklogProtest Unfunded Funded $5.1 $5.8 $3.7$3.8 $4.1 $4.5 1 Total Backlog represents firm orders and potential options on multi-year contracts, excluding potential orders under IDIQ contracts. 2 Pro forma Total Backlog includes protested awards. 2

($M) 2020 2021 $ y/y change % y/y change YTD Net Cash Provided by (Used in) Operating Activities $1.1 ($21.7) ($22.8) N/A Cash2 $146.2 $38.3 ($107.9) (74%) Receivables $263.6 $359.2 $95.6 36% Debt $184.0 $177.0 ($7.0) (4%) Net Debt1 $37.8 $138.7 $100.9 267% Leverage Ratio (x) 2.62x 2.00x N/A (24%) Page 12 Cash Flow and Liquidity Three months ended Q1 1 Net Debt = Debt – Cash 2 Cash excludes restricted cash YTD Cash Flow from Operations of ($21.7) million Revolver drawn at quarter end to support Zenetex and HHB acquisitions Strong balance sheet and financial position

Increasing 2021 Guidance Mid-Point 2021 guidance assumptions include: Capital expenditures ~ $5 million Depreciation and amortization ~ $17 million Amortization of acquired intangible assets ~$11 million Mandatory debt payments $8.6 million Interest expense ~ $8 million Tax rate of ~ 19.0% Diluted EPS assumes 11.9 million weighted average diluted shares outstanding at December 31, 2021 Operating Cash Flow in 2020 benefitted from the CARES Act by $13.2M Page 13 1 See appendix for reconciliation of non-GAAP measures. 2 Definition of metric updated in Q1 2021 to add-back amortization of acquired intangible assets. ($M, except per share data) 2020 Actual Previous 2021 Guidance Updated 2021 Guidance Updated 2021 Mid-Point Revenue $1,396 $1,645 — $1,715 $1,680 — $1,715 $1,698 Adjusted EBITDA Margin1 (%) 4.0% 4.6% — 5.0% 4.8% — 5.0% 4.9% Adjusted Diluted Earnings Per Share1,2 $3.36 $4.25 — $4.85 $4.55 — $4.85 $4.70 Net Cash Provided by Operating Activities $64.1 $55.0 — $65.0 $58.0 — $65.0 $61.5

APPENDIX

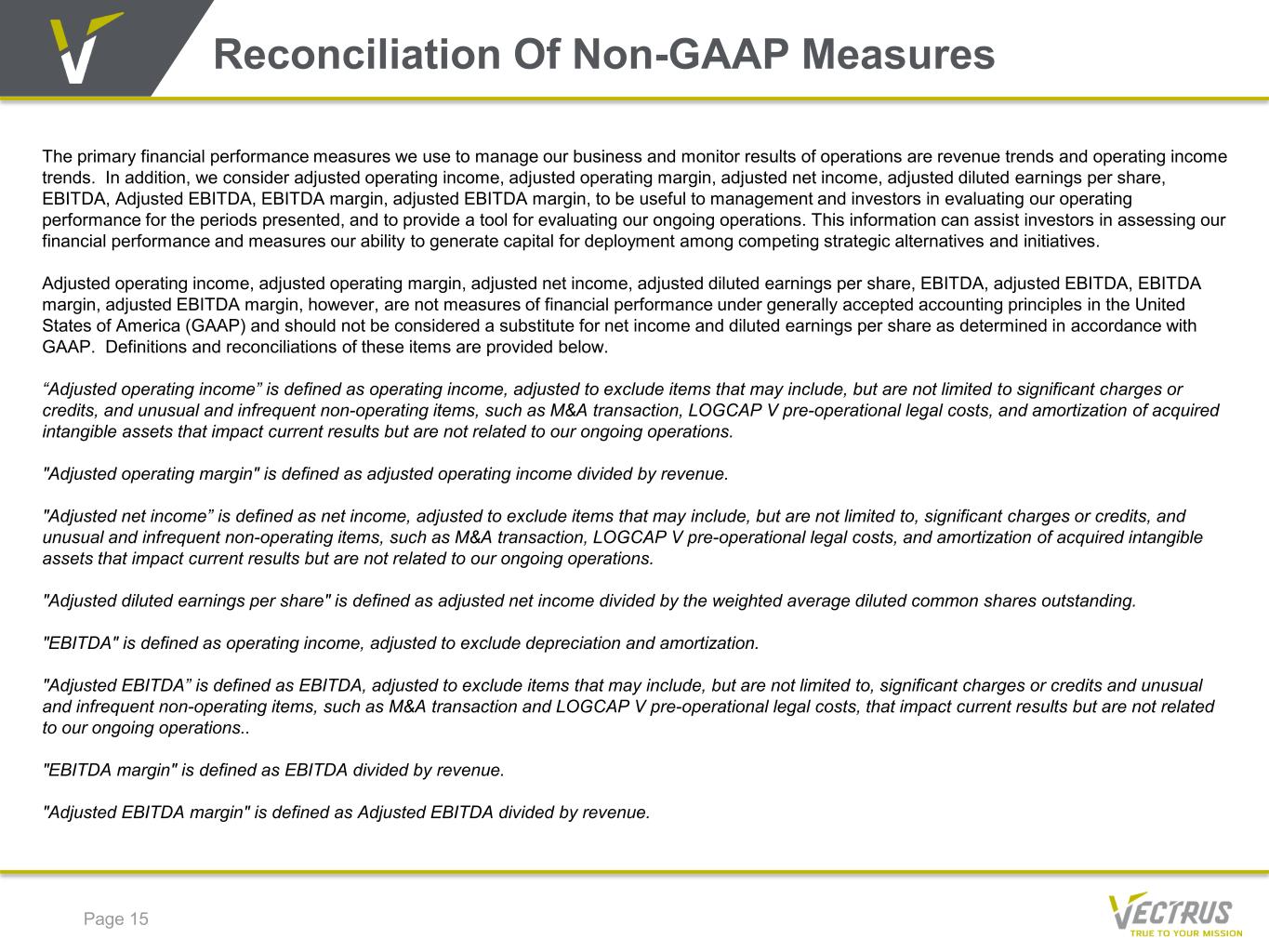

Reconciliation Of Non-GAAP Measures Page 15 The primary financial performance measures we use to manage our business and monitor results of operations are revenue trends and operating income trends. In addition, we consider adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted earnings per share, EBITDA, Adjusted EBITDA, EBITDA margin, adjusted EBITDA margin, to be useful to management and investors in evaluating our operating performance for the periods presented, and to provide a tool for evaluating our ongoing operations. This information can assist investors in assessing our financial performance and measures our ability to generate capital for deployment among competing strategic alternatives and initiatives. Adjusted operating income, adjusted operating margin, adjusted net income, adjusted diluted earnings per share, EBITDA, adjusted EBITDA, EBITDA margin, adjusted EBITDA margin, however, are not measures of financial performance under generally accepted accounting principles in the United States of America (GAAP) and should not be considered a substitute for net income and diluted earnings per share as determined in accordance with GAAP. Definitions and reconciliations of these items are provided below. “Adjusted operating income” is defined as operating income, adjusted to exclude items that may include, but are not limited to significant charges or credits, and unusual and infrequent non-operating items, such as M&A transaction, LOGCAP V pre-operational legal costs, and amortization of acquired intangible assets that impact current results but are not related to our ongoing operations. "Adjusted operating margin" is defined as adjusted operating income divided by revenue. "Adjusted net income” is defined as net income, adjusted to exclude items that may include, but are not limited to, significant charges or credits, and unusual and infrequent non-operating items, such as M&A transaction, LOGCAP V pre-operational legal costs, and amortization of acquired intangible assets that impact current results but are not related to our ongoing operations. "Adjusted diluted earnings per share" is defined as adjusted net income divided by the weighted average diluted common shares outstanding. "EBITDA" is defined as operating income, adjusted to exclude depreciation and amortization. "Adjusted EBITDA” is defined as EBITDA, adjusted to exclude items that may include, but are not limited to, significant charges or credits and unusual and infrequent non-operating items, such as M&A transaction and LOGCAP V pre-operational legal costs, that impact current results but are not related to our ongoing operations.. "EBITDA margin" is defined as EBITDA divided by revenue. "Adjusted EBITDA margin" is defined as Adjusted EBITDA divided by revenue.

Reconciliation Of Non-GAAP Measures Page 16

Reconciliation Of Non-GAAP Measures Page 17

Reconciliation Of Non-GAAP Measures Page 18

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Together Selects nCino to Revolutionise its Lending Business

- Strifor Announces Strategic Move to Marshall Islands, Joins the Financial Commission

- Zscaler Research Finds 60% Increase in AI-Driven Phishing Attacks

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share