Form 8-K VALMONT INDUSTRIES INC For: May 20

© 2021 Valmont® Industries, Inc. Valmont Investor Day May 20, 2021

Disclosure Regarding Forward-Looking Statements 2 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 These slides contain (and the accompanying oral discussion will contain) “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such statements, including general economic and business conditions, conditions affecting the industries served by the Company and its subsidiaries including the continuing and developing effects of COVID-19 including the effects of the outbreak on the general economy and the specific economic effects on the Company’s business and that of its customers and suppliers, competitor responses to the Company’s products and services, the overall market acceptance of such products and services, the integration of acquisitions and other factors disclosed in the Company’s periodic reports filed with the Securities and Exchange Commission. Consequently, such forward-looking statements should be regarded as the Company’s current plans, estimates and beliefs. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Agenda 3 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 8:30 am Welcome and Opening Remarks Renee Campbell VP, Investor Relations & Corporate Communications Infusing Technology to Accelerate Growth Steve Kaniewski President & CEO Advancing Sustainability & Resource Efficiency Lennie Adams Group President, Irrigation Proliferating Smart Infrastructure Aaron Schapper EVP, Infrastructure Innovating for Smart Grid Solutions Chris Colwell Group President, Utility Growing Opportunities with Solar Greg Turi VP, Global Generation 10:00 am Q&A Session 10:30 am BREAK 10:35 am Leveraging Our Digital Gateway Tim Donahue Group President, Lighting & Transportation Accelerating Industry-leading Speed and Reliability Joe Catapano Group President, Telecommunications Delivering Unparalleled Coatings Technology & Customer Service Rick Cornish Group President, Coatings Elevating Our Operational Transformation Diane Larkin EVP, Global Operations Focusing on ROIC to Drive Value Creation Avner Applbaum EVP & CFO Closing Remarks Steve Kaniewski President & CEO 11:55 am Q&A Session

INFUSING TECHNOLOGY TO ACCELERATE GROWTH Steve Kaniewski President & CEO

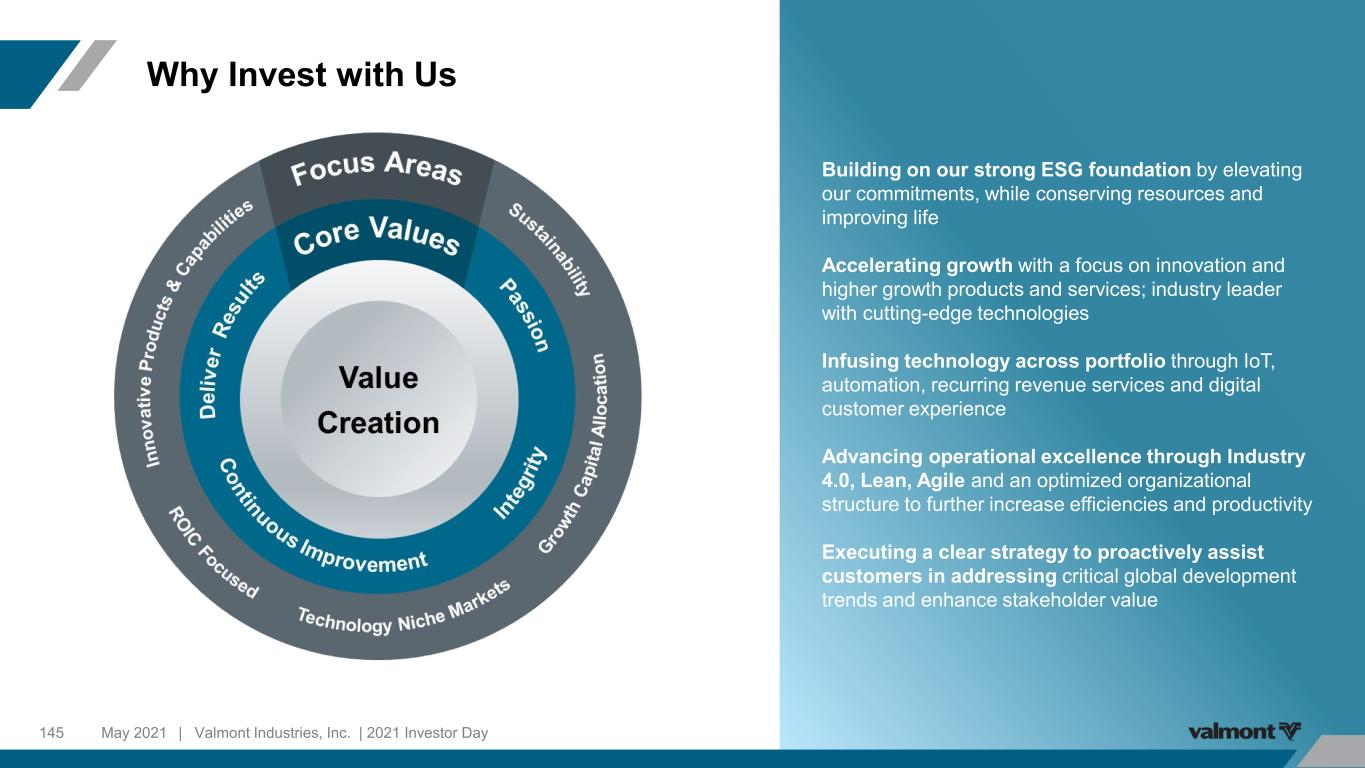

Key Messages 5 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 01 02 03 04 Building on our strong ESG foundation by elevating our commitments, while conserving resources and improving life Accelerating growth with a focus on innovation and higher growth products and services; industry leader with cutting-edge technologies Infusing technology across portfolio through IoT, automation, recurring revenue services and digital customer experience Advancing operational excellence through Industry 4.0, Lean, Agile and an optimized organizational structure to further increase efficiencies and productivity Executing a clear strategy to proactively assist customers in addressing critical global development trends and enhance stakeholder value 05

Valmont Snapshot (NYSE: VMI) 6 Delivering Solutions for Agriculture and Infrastructure Development | Valmont Industries, Inc. | 2021 Investor DayMay 2021 $101 $65 $83 $43 $1,002 $996 $646 $345 $1103 $903 $863 $473 Omaha, NE Headquarters $2.9B 2020 Sales $5.5B Market Cap1 22 Countries of Operation 85 Manufacturing Sites ~10,000 Total Employees 2020 Revenue2 ($M) 2020 Operating Income ($M) 1As of 5/11/21. 2Includes intersegment sales. 3Adjusted Operating Income; Please see Company’s Reg G table at end of presentation. Engineering Supports Structures | ESS Supporting Global Infrastructure and Development Irrigation Improving Optimal Farm Productivity and Efficiency Coatings Extending the Life, Value, and Aesthetic Properties of Metal Products Utility Support Structures | USS Assisting Industry to Generate and Transmit Power Efficiently to Customers

Broad Global Footprint Serving Diverse End Markets 7 #1 or #2 in All Markets We Serve | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Manufacturing Facilities Americas APAC EMEA Americas EMEA APAC 15% 14% 71%

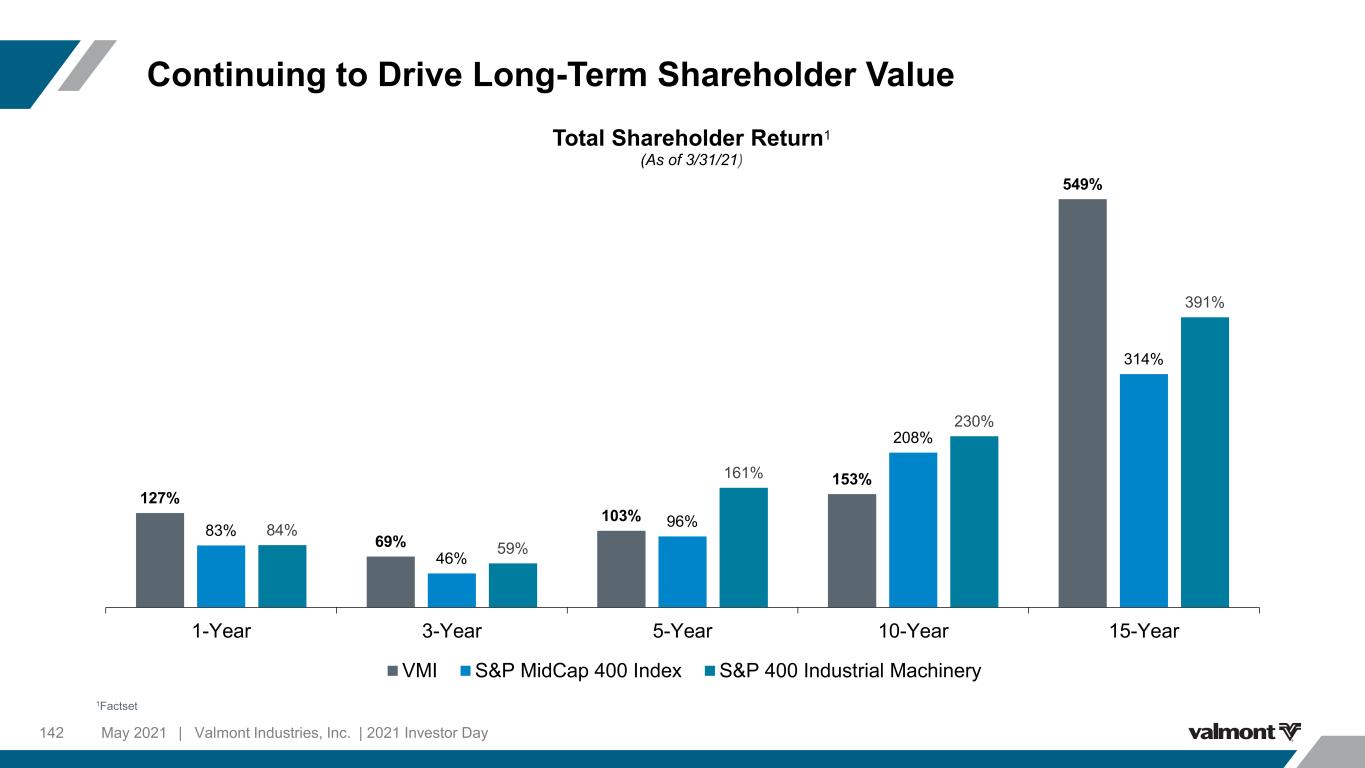

8 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Our Differentiated Business Model Has Driven Strong Results ~12.0% Total Compounded Annualized Return Over Past 15 Years1 1Total Shareholder Return Annual CAGR from 5/11/06 to 5/11/21. Source: FactSet Value Creation

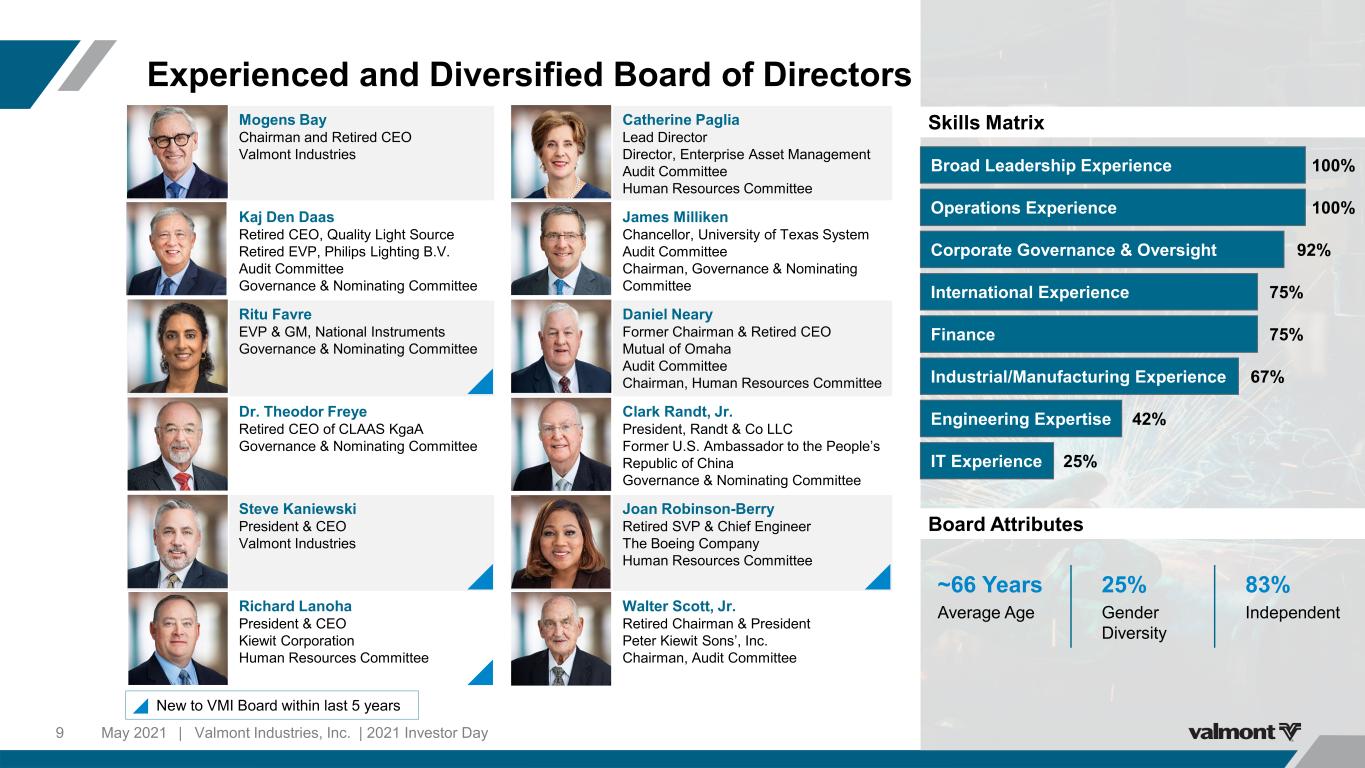

Catherine Paglia Lead Director Director, Enterprise Asset Management Audit Committee Human Resources Committee James Milliken Chancellor, University of Texas System Audit Committee Chairman, Governance & Nominating Committee Daniel Neary Former Chairman & Retired CEO Mutual of Omaha Audit Committee Chairman, Human Resources Committee Clark Randt, Jr. President, Randt & Co LLC Former U.S. Ambassador to the People’s Republic of China Governance & Nominating Committee Joan Robinson-Berry Retired SVP & Chief Engineer The Boeing Company Human Resources Committee Walter Scott, Jr. Retired Chairman & President Peter Kiewit Sons’, Inc. Chairman, Audit Committee Mogens Bay Chairman and Retired CEO Valmont Industries Kaj Den Daas Retired CEO, Quality Light Source Retired EVP, Philips Lighting B.V. Audit Committee Governance & Nominating Committee Ritu Favre EVP & GM, National Instruments Governance & Nominating Committee Dr. Theodor Freye Retired CEO of CLAAS KgaA Governance & Nominating Committee Steve Kaniewski President & CEO Valmont Industries Richard Lanoha President & CEO Kiewit Corporation Human Resources Committee Experienced and Diversified Board of Directors 9 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Broad Leadership Experience Skills Matrix 100% Operations Experience Corporate Governance & Oversight International Experience Industrial/Manufacturing Experience Engineering Expertise Finance IT Experience 100% 92% 75% 67% 42% 25% Board Attributes ~66 Years Average Age 25% Gender Diversity 83% Independent New to VMI Board within last 5 years 75%

Steve Kaniewski President & CEO Joined: 2010 Avner Applbaum EVP & CFO 2020 Diane Larkin EVP, Global Operations 2020 Aaron Schapper EVP, Infrastructure 2011 Tim Francis SVP & Corporate Controller 2014 Tim Donahue Group President, Lighting & Transportation 2018 Joe Catapano Group President, Telecom 2008 Greg Turi VP, Global Generation 2010 Claudio Laterreur SVP, Information Technology & CIO Joined: 2019 Mitchell Parnell SVP, Human Resources 2015 Ellen Dasher VP, Global Taxation 1996 Andrew Massey VP, Chief Legal & Corporate Secretary 2006 Experienced Leadership Team Focused on Execution 10 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Lennie Adams Group President, Irrigation 1978 Chris Colwell Group President, Utility 2011 Rick Cornish Group President, Coatings 1996 New to VMI within last 5 years New to role within last 2 years Business LeadershipExecutive Officers

Significant Accomplishments Since 2018 Investor Day 11 Culture of Execution and Accountability | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Build and Align the Organization Execute Transformation Plan for Operations and Shared Services Implement Processes for New Product Development Build Pathways to Growth Diversified Board of Directors Reshaped organization to drive focus as we grow Onboarded new CFO with deep financial and manufacturing operations expertise Talent development process with strong emphasis on inclusion and diversity Onboarded EVP, Global Operations to execute operational excellence transformation Initiated and implemented agile engineering transformation Shared services transformation (Finance, HR, Marketing and IT) Appointed new SVPs of HR and IT Metrics-based new product development; combining innovation with financial rigor Driven by Voice of Customer Quicker Agile development process Increased new product revenue streams Appointed new VP of Strategic Marketing; created corporate marketing team Expanded markets that we serve through new products and services, geographic expansion and acquisitions Focused strategic technology investments across all businesses Strategic capital allocation to support growth initiatives Active portfolio management across products and markets 2018 Investor Day Strategic Focus Areas

Clear Strategy for Sustainable, Long-Term Profitable Growth 12 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Expanding Markets that We Serve Accelerating Growth Operational Excellence with ESG Focus Elevating ESG Accelerating Innovation Optimizing Talent and Technology

Continuously Elevating Our ESG Commitments 13 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 ~90% of Net Sales Support ESG Efforts Environmental Sustainably building upon a foundation focused on managing risks and improving efficiencies Compliance • Expanded reporting to include carbon intensity, recycling, renewable energy and water source Resource Optimization • Developed new goals for carbon, combustion fuel and electricity • Set global water standard for manufacturing sites Market Differentiation • Conduct carbon life cycle assessment on selected center pivot and solar tracker products Purpose Driven • Published statement and white paper outlining our approach to climate change Social Empowering our workforce, customers and communities • Committed to I&D initiatives: ꟷ Launched first 3 ERGs in 2020: Women’s Leadership Council, Indian American Leadership Council, Hispanic Organization for Leadership and Advancement (HOLA) ꟷ Implemented Equal Pay Initiative ꟷ Administered Annual Employee Engagement Survey • Investing 1.0% of O.P. (annual goal) in communities where we live / work; Valmont Foundation supported 120+ organizations in 2020 • Maintaining global EHS management system to provide complete visibility on safety and incident management for 100% of facilities • Improving site risk engagement and lowering overall OH&S risk to employees Governance Operating ethically and managing oversight through open collaboration • Dedicated, CEO-led ESG Taskforce • Diverse board with majority independent directors • Oversight committees: Audit, Human Resources, Governance and Nominating; Sustainability oversight by Governance and Nominating Committee • Published Statement on Human Rights • Annual Code of Business Conduct Assessment

2020 2021 2022 2023-2025 • $2.4M reduction in absolute electricity spend • Achieved 14% reduction in normalized electricity usage • Published Valmont’s Baseline Scope 1 and 2 Global Carbon emissions • Launched the Valley Electric Vehicle Project (Valley Campus) • Launched construction of a 1MW solar field at Valmont’s Valley Campus • Conduct life-cycle assessment for selected product lines • Launch new suite of conservation goals ꟷ Combustion Fuel Goal ꟷ New Electricity Goal ꟷ Carbon Intensity Goal • Launched Valmont’s Climate White Paper • Implement Valley Solar Field and Electric Vehicle Initiatives • Launch Project 90/90 Global LED Lighting Standard • Initiated Diversity target to increase representation of people of color by 50% by 2025 and double by 2030 • Refine Climate Strategy • Report Water Inventory Results • Launch Global Waste Goal • Develop selected Environmental Product Declarations based on life- cycle assessments • Report progress on conservation goals • Review commitments to Global Climate Initiatives • Implement alternative fuel / energy program for production and fleet vehicles • Prepare for Scope 3 data gathering and reporting • Audit Scope 1 and 2 data Based on UN Global Compact LEAD Sustainability Stages Model Evolving Our Sustainability Journey 14 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Risk Management Productivity Growth1. Compliance 2. Resource Optimization 3. Market Differentiation 4. Purpose Driven

ESG Targets 15 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 2025 Environmental Goals1 10% Reduction in Carbon Emissions / Million $ Revenue Carbon Intensity Goal 12% Additional Reduction in Normalized Electricity Usage Revised Global Electricity Goal 19% Reduction in Normalized Carbon Emissions from Scope 1 Mobile sources Global Combustion Fuel Goal- Mobile Source Carbon Emissions Employee & Community 3 New ERGs2 in 2021 (LGBTQ+, African American Leadership Council, Valmont Young Professionals) Inclusion & Diversity Goal ~1.0% Of annual Operating Profit invested in communities where we live and work Community Giveback Goals Alignment United Nations Sustainable Development Goals SASB Standards GRI3 Sustainability Reporting Standards (from G4) 50% Increase in people of color representation by 2025; double by 2030 Complete 2021 Global Employee Engagement Survey Employee Engagement 1All 2025 goals use 2018 baseline 2Employee Resource Groups 3Global Reporting Initiative

Focused Market Growth Areas Valmont Positioning Utility Support Structures • Grid resiliency • Renewable generation • Services & Technology Transmission, Distribution and Substations products Integrated solar tracking Engineering, data and inspection services Engineering Support Structures • Infrastructure renewal • 5G buildout; supporting connectivity • Smart city: data hub acquisition and transmission Lighting and Transportation structures Wireless communication solutions Smart city solutions Coatings • Protection of critical infrastructure • Targeted geographic expansion • Digital Transformation led by Voice of Customer Galvanizing services Applied Coatings Value-added services Irrigation • Food security and resource conservation • Ag Tech: digital crop management solutions • Larger corporate farms and key accounts Valley Water Valley Technology Global key account management Accelerating Growth through Strategic Focus Areas 16 | Valmont Industries, Inc. | 2021 Investor DayMay 2021

Accelerating Growth through Technology 17 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Internet of Things (IoT) Automation / Industry 4.0 & Internal Processes Digital Customer Experience Recurring Revenue Services

Leadership Leadership aligned and focused with key growth and productivity initiatives Organizational Design Allocation of resources and capital for growth and productivity initiatives Productivity Driving overall productivity with optimized footprint and product portfolio management Process Lean and Agile processes across businesses • Implemented in Utility (30% increase in productivity) • Automation / Industry 4.0 Optimizing Organization for Higher Growth 18 | Valmont Industries, Inc. | 2021 Investor DayMay 2021

Deep Focus on Talent Development and Building an Inclusive Culture 19 Human Capital Strategy Aligned with Our Core Values | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Initiatives Related to • Employee Training & Development, including Inclusion & Diversity • Equal pay and incentives aligned with shareholder interest • Technology skills enhancement Commitment to Values • Participate in JUST1, demonstrating Valmont’s social justice commitment related to ꟷ Inclusion & Diversity ꟷ Employee Health ꟷ Benefits Stewardship ꟷ Purchasing and Supply Chain Organizational Transformation • Aligned talent acquisition / development with core values: Passion, Integrity, Continuous Improvement, Deliver Results • Utilize balance slate methodology to attract the best and brightest talent • Committed to diversity at every level; created ERGs to provide insight into diverse workforce Employee Feedback • 2020 Employee Engagement Survey ꟷ 84% of employees completed survey ꟷ Results indicated strong engagement, commitment and alignment with Valmont values and goals • Employee Engagement Survey to continue annually 1International Living Future Institute (ILFI) Program

Strategic M&A Aligned with Our Strategy 20 Leveraging M&A as a Strategic Accelerator | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Strategic Filters • Technology Acceleration • Portfolio Breadth • High-Growth Businesses • Global Product Line Focus Financial Criteria • Sales and Operational Synergies • ROIC > Cost of Capital by Year 3 • Free Cash Flow Generation

Price $300M Financing Cash + Revolving Credit Facility Closed May 2021 Prospera Expands Our Irrigation Technology Leadership 21 Building on Global Partnership Accomplishments; Grower Adoption Expected to Double in 2021 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Key Stats 2014 Founded Austin, TX Headquarters Transaction Details Combining Technologies to Accelerate Industry Leadership Unique, Disruptive and Differentiated Value Proposition • Solution brings demonstrated advanced agronomy and unprecedented visibility to field • Combination will create first commercially available subscription model, helping growers lower costs, increase yields, use less land and save time Catalyst for Growth • Strengthens and expands total addressable market • Accelerates technology adoption with growers • Provides a less-cyclical sales contribution delivered through subscription-based data analytics and insights Entrepreneurial Spirit and Key Talent Additions • Adds world-class talent across technology, data science and agronomy; senior leadership team and 90 colleagues Tel Aviv, Israel R&D Center

Prospera Value Proposition | Valmont Industries, Inc. | 2021 Investor DayMay 2021

Well-Positioned as Largest, Vertically Integrated AI Company in Ag 23 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Industry First Mover • Building on two-year relationship • History of images and data • Established relationships with farmers Unique, Established Technology & Model • In-season data collection capabilities; established algorithm enables more images • Sensor agnostic and economic • Subscription-based model drives recurring revenue Alignment with ESG Initiatives • Technology enables resource conservation on the farm; requires less land and water Market Expansion Beyond Irrigated Acres • Opportunities beyond traditional, pivot-based irrigated acres Why We Are Excited

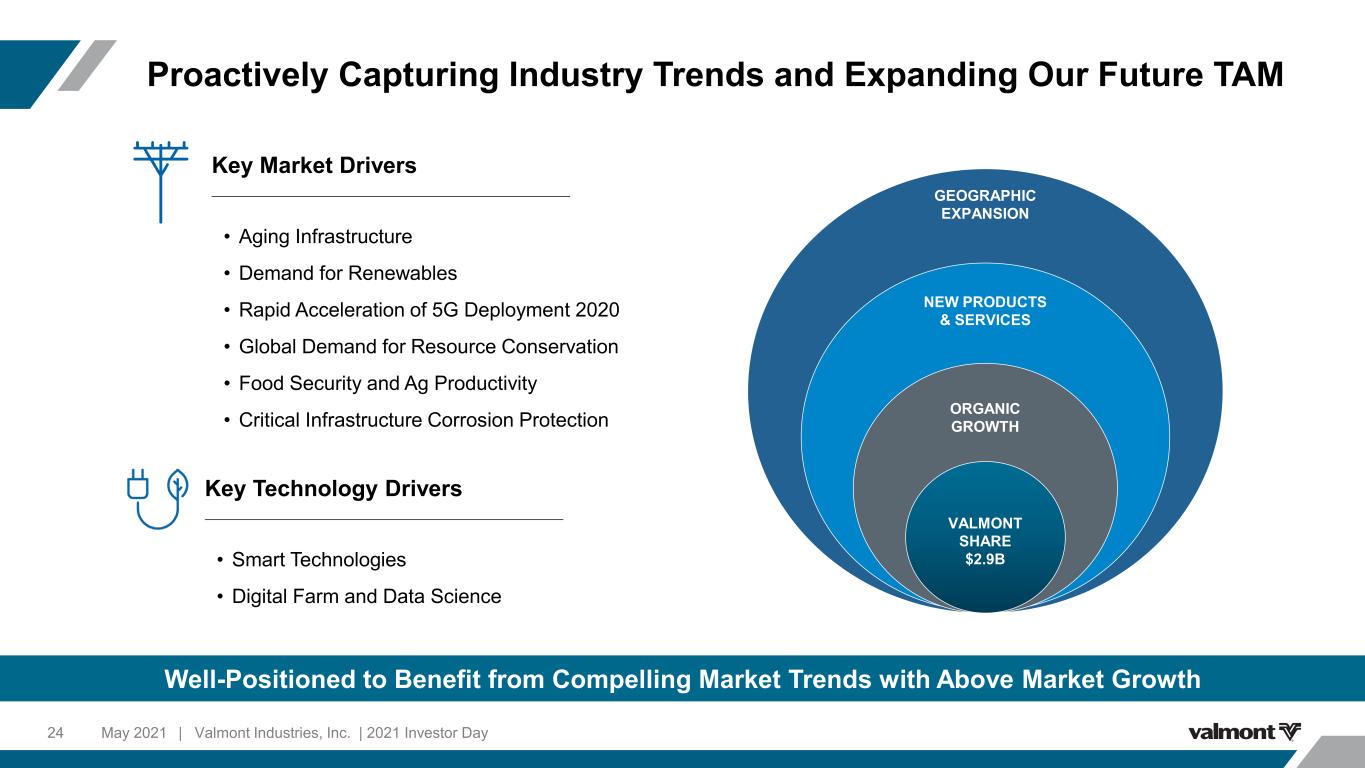

Proactively Capturing Industry Trends and Expanding Our Future TAM 24 Well-Positioned to Benefit from Compelling Market Trends with Above Market Growth | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Key Market Drivers • Aging Infrastructure • Demand for Renewables • Rapid Acceleration of 5G Deployment 2020 • Global Demand for Resource Conservation • Food Security and Ag Productivity • Critical Infrastructure Corrosion Protection Key Technology Drivers • Smart Technologies • Digital Farm and Data Science ORGANIC GROWTH NEW PRODUCTS & SERVICES GEOGRAPHIC EXPANSION VALMONT SHARE $2.9B

Our 3 – 5 Year Financial Targets 25 Continuing to Reinvest Capital in Growth Opportunities across the Organization | Valmont Industries, Inc. | 2021 Investor DayMay 2021 >12% Operating Margin 7% - 12% Revenue Growth1 13 - 15% EPS Growth1 >11% ROIC Net Earnings FCF Conversion >1.0x Key Assumptions • Greater near to medium term focus on funding growth with R&D • FCF conversion long-term over the cycle • Acquisitions over time are necessary to achieve top end of range 1Estimated compound annualized growth rates from base year 2020

ADVANCING SUSTAINABILITY AND RESOURCE EFFICIENCY Lennie Adams Group President, Irrigation

Key Messages 27 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Recognized brand and industry leader earned through reliability, innovation, and our global dealer network Unique position to lead global large-scale water opportunities ESG early adopter Proven leader in autonomous crop management through technology, artificial intelligence, and machine learning via acquisitions and partnerships Strong financial performance enabling further investments in technology services and solutions 01 02 03 04 05

Irrigation Snapshot 28 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Valley Water $646M 2020 Revenue 14 Manufacturing / Distribution Sites 8 Countries ~1,900 Employees 59% 41% North America International 2020 Revenue Mix Products and Solutions Portfolio Valley Technology

Global Irrigation Footprint 29 Global Footprint Enables Us to Maximize Supply Chain to Support Customers and Large Projects | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Highlights • #1 Global Market Share Position • Unique ability to source from all global facilities • Split shipment philosophy allows freight maximization, reduced shipping lead times, and improved product availability • Maximize global supply chain opportunities and cost optimization

Irrigation | Sustainable Competitive Advantages 30 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Valley University Technology Leadership Global Reach, Local Presence Best Global Dealer-Distribution Network Connected Machines Provide Platform for Technology Leverage Premium Brand and Reputation

• Constraints on Freshwater Resources and Demand on Food Production • Food Security: Government’s Desire to Become More Self-Sufficient in Food Production • Large Installed Base of Machines Creates Replacement Opportunity • Elevated ESG Focus across Customer Base • Digital Farm Long-Term Market Drivers Well-Positioned to Capture Future Market Demand 31 Valley Well-Positioned Given Strong Reputation to Provide More Crop for the Drop | Valmont Industries, Inc. | 2021 Investor DayMay 2021 • Commodity Prices • Availability of Farm Labor • Tech and AI Development ~$111B Net Farm Income (2021E) Near-Term Market Drivers

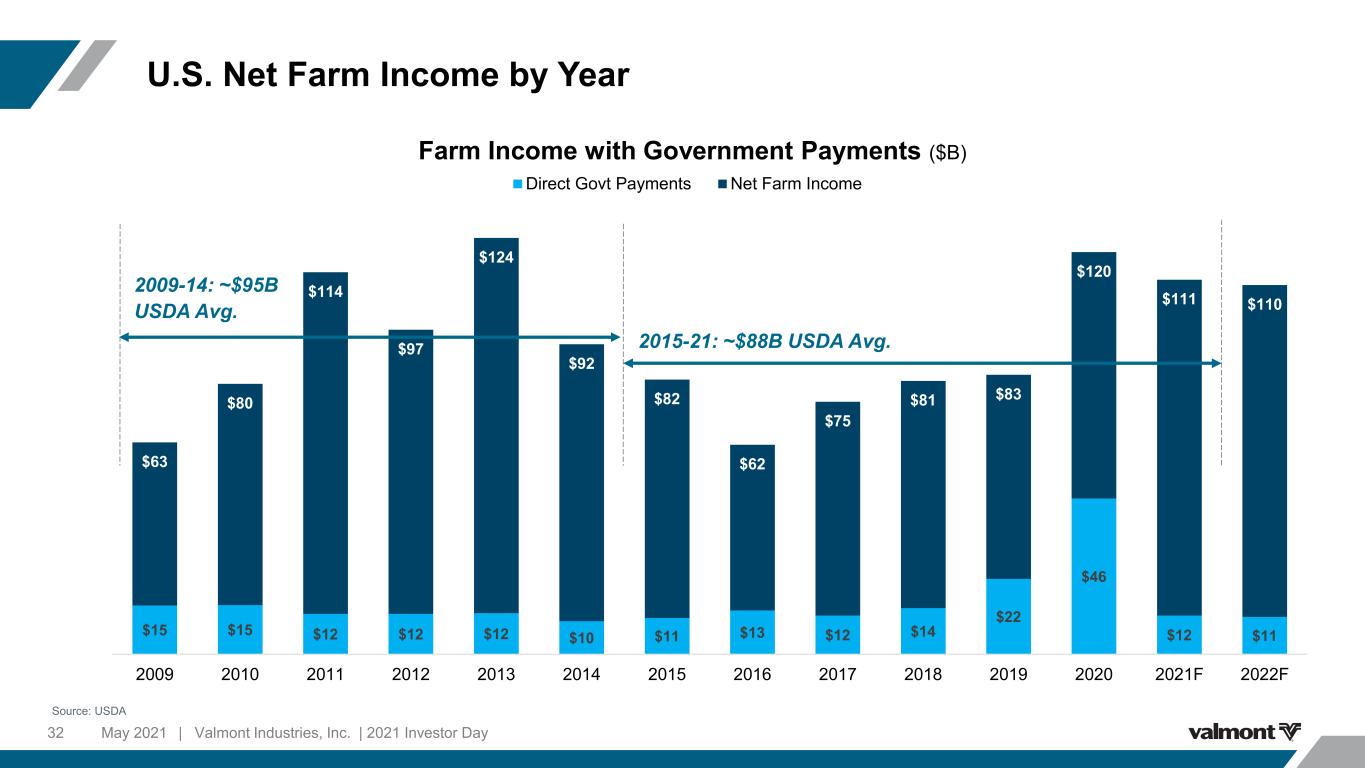

$15 $15 $12 $12 $12 $10 $11 $13 $12 $14 $22 $46 $12 $11 $63 $80 $114 $97 $124 $92 $82 $62 $75 $81 $83 $120 $111 $110 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021F 2022F Direct Govt Payments Net Farm Income U.S. Net Farm Income by Year 2009-14: ~$95B USDA Avg. May 2021 | Valmont Industries, Inc. | 2021 Investor Day32 Farm Income with Government Payments ($B) Source: USDA 2015-21: ~$88B USDA Avg.

Expanding Our Total Addressable Market Strategic Expansion Driving Continued Above-Market Growth 33 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Strategic Market Expansion Opportunities International Growth Full-Service Water Management for Ag; Gain Market Share through M&A/Partnerships Total Crop Management Technology Solutions Higher Value Crops Larger, Corporate Farms and Key Accounts Due to Consolidation ORGANIC GROWTH NEW PRODUCTS & SERVICES GEOGRAPHIC EXPANSION VALMONT SHARE $646M 1Based on Company estimates and MarketsandMarkets™ Strategic Insights; Public Company Data Total Market CAGR1: ~5 – 8% Valmont Irrigation: 8%+ 3 – 5 Year Expected Growth

Expanding Markets that We Serve Elevating Operational Excellence with ESG Focus Accelerating Innovation through Strategic Focus Areas and Technology Our Strategy for Long-Term Profitable Growth 34 | Valmont Industries, Inc. | 2021 Investor DayMay 2021

ESG Focus Technology, water conservation “More crop for the drop”: Our product can double irrigation efficiency Product pipeline that can water and treat each plant differently As freshwater becomes a limiting factor, technology will be even more beneficial Pivots were “green” before sustainability was in vogue Technology driven management and reporting: • Irrigation Scheduling • Power (electricity) Load Control • Wastewater Management Solar / Renewable energy utilization Elevating Operational Excellence on the Farm Focused Operational Excellence Supporting ESG Initiatives 35 | Valmont Industries, Inc. | 2021 Investor DayMay 2021

Renewable Energy Opportunity | Valmont Solar 36 Delivering On-Farm, Low-Cost Energy Leveraging Our Global Footprint and Expertise in Fall 2021 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 • Uniquely positioned to serve farms and agribusinesses with photovoltaic, renewable energy ꟷ Solbras Acquisition May 2020 ꟷ Convert Italia Acquisition August 2018 • Pilot Agribusiness EPC in Brazil ꟷ 503 installed plants totaling 43 MW ꟷ 9 of top 10 Valley Irrigation dealers selling and installing solar with dedicated staff ꟷ 24x7x365 monitoring for uptime and return on investment ꟷ Multinational protein sector opportunity underway • Pilot projects in progress in U.S. and Sudan • Utilizes Valmont Utility (Convert) designs, capabilities and experience 625 kW array, Itiquira, MT Brazil

Expanding Markets that We Serve 37 Remain Committed to Conserving Resources. Improving Life.® | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Global Water Scarcity and Policy Expanding Markets through • Products which promote efficient irrigation (Valley Scheduling, Valley Insights and Variable Rate Irrigation) • Solutions that transcend mechanized irrigation, pump control and monitoring for flood and drip Shaping Government Policy and Increasing Education • Deep relationship with Daugherty Water for Food Institute • Commissioned studies in Kazakhstan and Sudan Well-Positioned to Grow through Industry Disruption Connected Network of Digital Farms will Accelerate Efforts to Address: • Resource conservation • Increasing export demand International Market Expansion (early innings) • Large Northern Africa projects • Kazakhstan agreements International Food Security

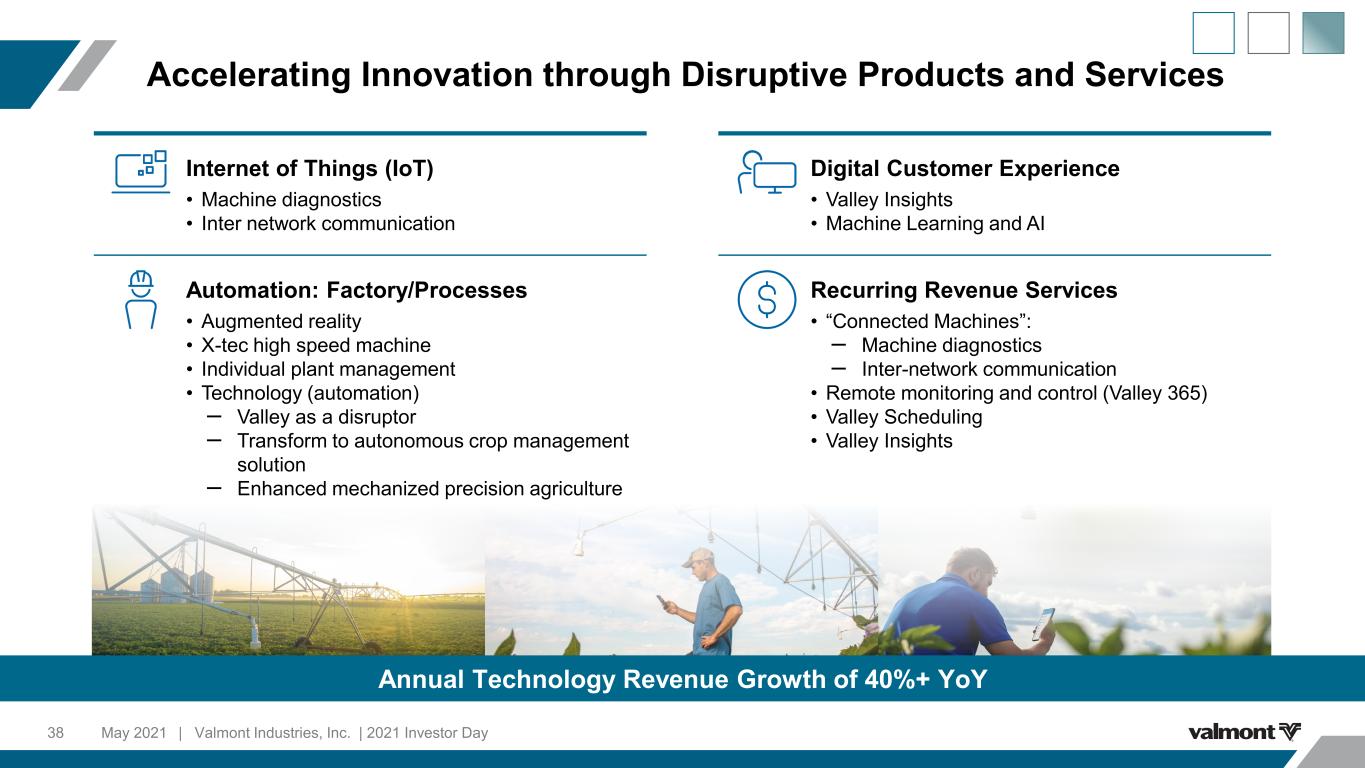

Accelerating Innovation through Disruptive Products and Services 38 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Internet of Things (IoT) • Machine diagnostics • Inter network communication Digital Customer Experience • Valley Insights • Machine Learning and AI Automation: Factory/Processes • Augmented reality • X-tec high speed machine • Individual plant management • Technology (automation) ꟷ Valley as a disruptor ꟷ Transform to autonomous crop management solution ꟷ Enhanced mechanized precision agriculture Recurring Revenue Services • “Connected Machines”: ꟷ Machine diagnostics ꟷ Inter-network communication • Remote monitoring and control (Valley 365) • Valley Scheduling • Valley Insights Annual Technology Revenue Growth of 40%+ YoY

Irrigation | Key Takeaways Recognized brand and industry leader earned through reliability, innovation, and our global dealer network Unique position to lead global large-scale water opportunities ESG early adopter Proven leader in autonomous crop management through technology, artificial intelligence, and machine learning via acquisitions and partnerships Strong financial performance enabling further investments in technology services and solutions 39 | Valmont Industries, Inc. | 2021 Investor DayMay 2021

PROLIFERATING SMART INFRASTRUCTURE Aaron Schapper EVP, Infrastructure

Key Messages 41 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Simplifying the business to manage our portfolio to enable greater focus on higher growth opportunities Leveraging key partnerships with leading global technology providers to enable smart infrastructure Capturing opportunities from continued infrastructure investments enabled by our global footprint and strong market position 01 02 03

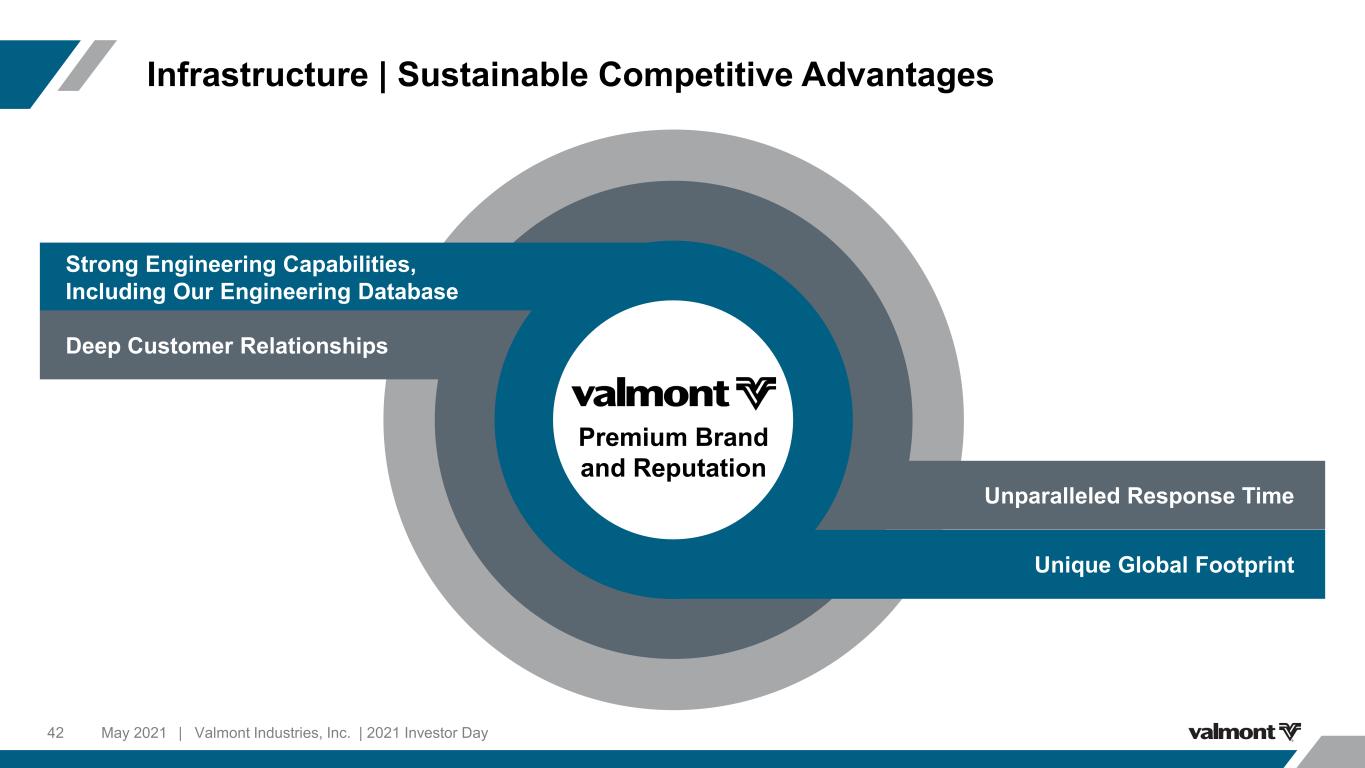

Infrastructure | Sustainable Competitive Advantages 42 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Unique Global Footprint Unparalleled Response Time Strong Engineering Capabilities, Including Our Engineering Database Deep Customer Relationships Premium Brand and Reputation

43 Valmont Provides Critical Infrastructure Recovery at a Scale No One Else Can | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Case Study | Entergy Storm Recovery Customer Need • Hurricane Laura decimates region ꟷ 616,000 customers without power Valmont Solution • 7 manufacturing facilities switched to full emergency manufacturing for Entergy Outcome • 207 structures delivered in 2 weeks • 2,175 steel sections delivered in 7 weeks • 315 concrete structures delivered in 7 weeks • PyraMAX® structures performed exceptionally • Customer now requesting a PyraMAX® “standard” for go-forward mitigation

Case Study – Entergy Storm Recovery 44 | Valmont Industries, Inc. | 2021 Investor DayMay 2021

Well-Positioned to Capture Future Market Demand 45 Strong Markets Helping Drive Future Growth | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Driving increased investment in grid as shift will require upgrades to generation fleet, transmission and distribution Acceleration of grid investment will lead to increased demand for power lines, substations and communication infrastructure Renewable Generation & Vehicle Electrification Telecommunications3 Utility1 Lighting & Transportation2 ~7% Annual growth (3 – 5 Years) ~4% Annual growth (3 – 5 Years) ~8-12% Annual growth (3 – 5 Years) 1Weighted avg. of TD&S & Solar market CAGR; Based on Company estimates and TD&S data: CThree Transmission Study 2020; Solar data: IHS Market 2020 Global PV Tracker 2Company estimates and CMD 3Based on Company estimates and Deutsche Bank Research

Our Strategy for Long-Term Profitable Growth 46 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Elevating Operational Excellence with ESG Focus Accelerating Innovation through Strategic Focus Areas and Technology Expanding Markets through Active Portfolio Management and Price Leadership

Improving platform design Enhancing Digital Customer Experience Elevating Operational Excellence with ESG Focus 47 Conserving Resources. Improving Life.® | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Creating One Valmont Infrastructure business system to enable all of us to operate the same processes and procedures Electrification of vehicles will require more energy grid Growing our Solar business and ensuring that green power gets to the customer Footprint and engineering expertise to provide world with quality, resilient infrastructure Renewables expansion drives infrastructure investment Administrative Lean ESG Focus Driving Enterprise Operational Excellence

Portfolio Management USS ESS • Grow the high ROIC businesses • Divest or fix the low performers • Price leadership • Replacement of existing transmission / substation infrastructure • New product opportunities in distribution poles • Vehicle electrification • Integrated 5G small cell for Telecom • Rural broadband buildout • Smart Pole solutions Strategic Market Expansion 48 Well-Positioned to Capture Expanding Future Market Opportunities in USS and ESS | Valmont Industries, Inc. | 2021 Investor DayMay 2021

Valmont Technology Partnerships Existing Infrastructure Digital Gateway Integrated Projects Project Optimization • ~50% of all North America Transmission monopoles • ~50% of all North America Light Poles • Global Manufacturing Base • Transmission Condition Monitoring • Next Generation Multi-Function Street Pole and Traffic Structures • Integration of Future Power Needs in Factory • Smart City Integration • Multi-Function Street Pole using Internet of Things (IoT) • Smart Grid Integration • Internet of Things (IoT) Communication for Disaster Recovery • Real Time Traffic and City Logistics • Utility Operations Integration Roadmap for Infrastructure Technology Partnerships 49 Unique Positioning to Bring Gateway Power and Connectivity to the Smart City and Smart Grid | Valmont Industries, Inc. | 2021 Investor DayMay 2021

Internet of Things (IoT) Smart Cities | Digital Gateway • Integration of traffic and multi function sensors into existing infrastructure • Sensors provide real-time traffic logistics, public safety and environmental monitoring data Smart Grids | Digital Gateway • Channel enabler for technology to get to the field in an expeditious manner • Condition monitoring (e.g., wildfires, line galloping) Accelerating Innovation through Disruptive Products and Services 50 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Focused on Technology that Improves Life

Key Takeaways 51 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Simplifying the business to enable greater focus on higher growth opportunities; investing in technology and maximizing profitability Leveraging key partnerships with leading global technology providers to enable smart infrastructure Capturing opportunities from continued infrastructure investments enabled by our global footprint and strong market position

INNOVATING FOR SMART GRID SOLUTIONS Chris Colwell Group President, Utility

Key Messages 53 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Significant long-term market opportunity driven by renewable generation, aging infrastructure and reliability requirements Well-positioned with differentiated products, services, engineering expertise and manufacturing capabilities Long-standing customer relationships enable collaboration and innovation Continued investments in technology and strategic acquisitions driving addressable market expansion 01 02 03 04

Utility Snapshot 54 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 79% 21% North America International 2020 Revenue Mix Products and Solutions Portfolio Transmission Distribution Substation Renewables Services Steel Concrete Hybrid Steel Concrete Hybrid Composites Steel Pre-fab Packaged Solar Wind Inspection O&M1 Data Analysis Training $1.0B 2020 Revenue 19 Manufacturing Facilities 6 Countries ~2,500 Employees 1Operations & Maintenance

Global Utility Footprint 55 Global Footprint Enables Us to Support Projects around the World | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Highlights • Leveraging global manufacturing and engineering • Risk mitigation due to multiple global manufacturing facilities • Footprint provides global growth opportunities and cost advantages

Utility | Sustainable Competitive Advantages 56 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Breadth of Product Offerings Product and Services Innovation Engineering Expertise and Leadership Manufacturing Capabilities Customer Relationships Premium Brand and Reputation

Well-Positioned to Capture Future Market Demand 57 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Renewable Generation • Investment in renewables increasing dramatically • Renewables will double as percentage of total generation by 2050 • Solar represents 80% of this growth • Increasingly impacting overall transmission market Reliability • Catastrophic weather events around the world continue to increase in size and frequency Aging Infrastructure • Ongoing upgrades occurring in all regions • Significant amount of infrastructure built in 1960s • Many not engineered for current reliability demands Competitive Advantages and History of Performance Position Valmont for Future Growth Source: U.S. Energy Information Administration (EIA) Annual Energy Outlook 2021 CThree Transmission Study 2020

Expanding Our Total Addressable Market 58 Strategic Expansion Driving Continued Above-Market Growth | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Strategic Market Expansion Opportunities Transmission Distribution Substation Solar Smart Grid Technology Services ORGANIC GROWTH NEW PRODUCTS & SERVICES GEOGRAPHIC EXPANSION VALMONT SHARE $1.0B Total Market CAGR1: ~7% Valmont Utility: 8%+ 1Weighted average of TD&S and Solar market CAGR; Based on Company estimates and TD&S data source: CThree Transmission Study 2020; Solar data source: IHS Market 2020 Global PV Tracker 3 – 5 Year Expected Growth

Our Strategy for Long-Term Profitable Growth Expanding Markets through Disruption 59 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Elevating Operational Excellence with ESG Focus Accelerating Innovation through Technology

Global Utility Product Vision 60 Driving Innovation to Provide Smart Grid Infrastructure Solutions | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Bundled Solutions Regional Distribution Drone Services Solar Tracker Solutions Transmission, Distribution and Substation Structures Management Services Smart Grid Technology Tracker Control Systems Innovative Products Smart Grid Infrastructure Solutions Technology Services

Leveraging Strengths to Build Long-Standing Customer Relationships • Valmont historic performance has enabled close working relationships with industry-leading Utilities, Transmission companies and EPCs • Deep, long-standing connections at multiple levels with our customers – engineering, business development, senior management • Formal Alliance contractual relationships with over 23 major Utilities in North America • Enables collaboration and an open partnership to innovate • Enables us to enter new product segments, allowing us to have an immediate conversation with the right people 61 Relationships Enable Innovative Partnerships and Opportunities | Valmont Industries, Inc. | 2021 Investor DayMay 2021

Innovation Transmission • Design for ease of construction • Innovative design for foundation cost reductions • Multiple patents (i.e., adjustable cross-arms) • Price for added value Substation • Pre-fabricated and packaged • Focused on ease of construction • Significantly reduced construction costs • Innovative and patented manufacturing process • Price for added value Distribution • Spun concrete and composites; multiple patents • Address reliability and need for hardening • Significantly shorter lead-times and less material cost volatility Accelerating Innovation through Disruptive Products 62 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 PyraMAX® H-Frame, Tripod, Monopole StructuresPrefabricated SubstationSpun Conc ete and C mpo ite Distribution

Recurring Revenue Services Drone applications • Drone inspection, maintenance and repair • Proprietary AI predictive solutions • Significantly reduces costs and improves results • Disrupt current industry models Internet of Things (IoT) Smart Grid • Remote condition monitoring • Asset tracking technology • Disrupt traditional structure competitors • Add value through technology and information Accelerating Innovation through Disruptive Services 63 | Valmont Industries, Inc. | 2021 Investor DayMay 2021

Case Study | Drone Services 64 Technology-Driven Innovation to Disrupt, Add Value and Grow | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Customer Need • Inspect line post-storm season • Conduct maintenance as needed Valmont Solution • Use AI to detect potential stress indications • Utilize drone technology to pressure wash components • Utilize drone technology to apply cold-galvanizing Outcomes • Reduced: ꟷ Inspection costs by 65% ꟷ Time to completion by 50% ꟷ Headcount by 75% • Improved job-site safety and environmental impact • Technology avoided system outages and associated loss of revenue to customer

Innovation: Reallocate resources to focus on innovation and disruption Platform Design: Design standardization to improve Engineering and Manufacturing efficiencies One Valmont: Common tools and processes to leverage global advantage Electric Vehicles will be supported by energy grid infrastructure Smart Grid data will improve future designs to further optimize and reduce carbon footprint Grid Resiliency improves lives across the globe Renewables expansion drives infrastructure investment Administrative Lean: Digital Engineering Kanban to optimize flow, reduce cycle times and improve productivity Elevating Operational Excellence with ESG Focus 65 Conserving Resources. Improving Life.® and Helping Power the World | Valmont Industries, Inc. | 2021 Investor DayMay 2021 ESG Focus Driving Enterprise Operational Excellence

Expanding Markets through Strategic Focus Areas 66 Market Leadership for Long-Term Success | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Strategic Focus Areas • Exceed Customer expectations by helping them solve problems • Expand markets through disruptive innovation – change the game and shift value-add towards Valmont Utility • Smart Grid technology - increase value proposition and gain valuable data • Price leadership – set the example and benefit from the value we add • Leverage global engineering and manufacturing scale for our products and solutions portfolio • Divest low growth products to drive higher profitability and growth

GROWING OPPORTUNITIES WITH SOLAR Greg Turi VP, Global Generation

Well-Positioned to Capture Future Market Demand 68 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Long-Term Market Drivers1 ~17% Annual growth (3 – 5 Years) • Dual product portfolio with control software; 14+ years of product track record; • Established in 3 global regional markets; several expansion opportunities following Valmont footprint • Solutions for Utility Scale + Distributed Generation applications Well-Positioned to Capture: ~25%+ Annual growth (3 – 5 Years) Valmont Solar Expected Growth 2023E Global Spend2 Solar Structures Trackers 44% 36% 11% 9% EMEA North America LatAm APAC Strong Diversified Global Growth Platform 1IHS Markit 2020 Global PV Tracker and Company estimates 2Wood Mackenzie – The Global Solar PV Tracker Landscape 2020

Valmont knowledge is a differentiator Leveraging Valmont Global Business Model 69 Uniquely Positioned to Increase Served Market | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Agile engineering expertise within project environment Valmont operational model drives global strategy and regional execution Steel leverage and commodity management drive continued value Utility Scale and Distributed Generation project execution from one business process platform Broad market approach EMEA, LATAM, and NA each contributing between 20% and 50% of revenue Balanced regional portfolio

Case Study | Utility Scale Execution 70 Product Innovation + Global Supply with Regional Execution | Valmont Industries, Inc. | 2021 Investor DayMay 2021 • 382 MW utility scale project in Chile • Bi-Facial module tracker solution • Scale: 2,846 acres, project site perimeter 14.7 miles Designed 2 x 28 panel string, 2 in portrait tracker with automated controls Accelerated delivery of 34,000 trackers using 19,400 tons of steel Contracted 140 vessels to deliver 1,100 containers Utilized Valmont in country resources to support site services when COVID closed international borders PMI1 named top 50 influential project of 2020: #4 in Energy, #1 in Solar • Develop and validate custom tracker solution • Global project management resources support regional execution • Global supply chain to produce and deliver product from 3 continents Local Services Global Supply Chain Project Management Design Engineering Agile Execution Customer Need OutcomesValmont Solution / Competitive Advantage 1Project Management Institute

Accelerating Innovation through Disruptive Products and Services 71 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Focused on Customer and Technology Driven Innovation Internet of Things (IoT) Solar tracker control software – TRJ-AI • Remote monitoring and configuration • Condition monitoring and machine learning • Mitigate severe weather risk • Increase energy production / reduced energy costs • Lower O&M costs through preventative maintenance • Reduces downtime • Reduce commissioning time • Data analytics models

Market Alignment One Valmont • Utility: Customer relationships, product bundling • Irrigation: Technology development Agrivoltaics product development & market • ESS / Coatings: Access to high energy usage customers Vertical Integration “Class of One” –Wood Mackenzie • Steel: Purchasing leverage; commodity management pricing techniques • Global Operational Footprint: Component manufacturing; incremental ROIC • Facilities & Material Management: Global Distribution Centers; Inventory Management Developing Sales and Operational Synergies 72 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Unique Value Creation Opportunities

USS | Key Takeaways 73 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Significant long-term market opportunity driven by renewable generation, aging infrastructure and reliability requirements Well-positioned with differentiated products, services, engineering expertise and manufacturing capabilities Long-standing customer relationships enable collaboration and innovation Continued investments in technology and strategic acquisitions driving addressable market expansion

Q&A 74 | Valmont Industries, Inc. | 2021 Investor DayMay 2021

BREAK 75 | Valmont Industries, Inc. | 2021 Investor DayMay 2021

LEVERAGING OUR DIGITAL GATEWAY Tim Donahue Group President, Lighting & Transportation

Key Messages 77 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Well-positioned as premier provider of global lighting and transportation solutions Strong focus on operational excellence to enhance customer experience and optimize cost structure Innovation and new product development focused on smart infrastructure and integration of new technology into existing structures Strong execution with improved market penetration in existing and new geographies 01 02 03 04

Global Lighting and Transportation Snapshot 78 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 $770M 2020 Revenue 35 Manufacturing Facilities 20 Countries ~3,200 Employees Transportation Products and Solutions Portfolio Lighting Highway SafetyHigh Mass Transit Sign Structures Traffic Structures Area Decorative Sports Street and Roadway

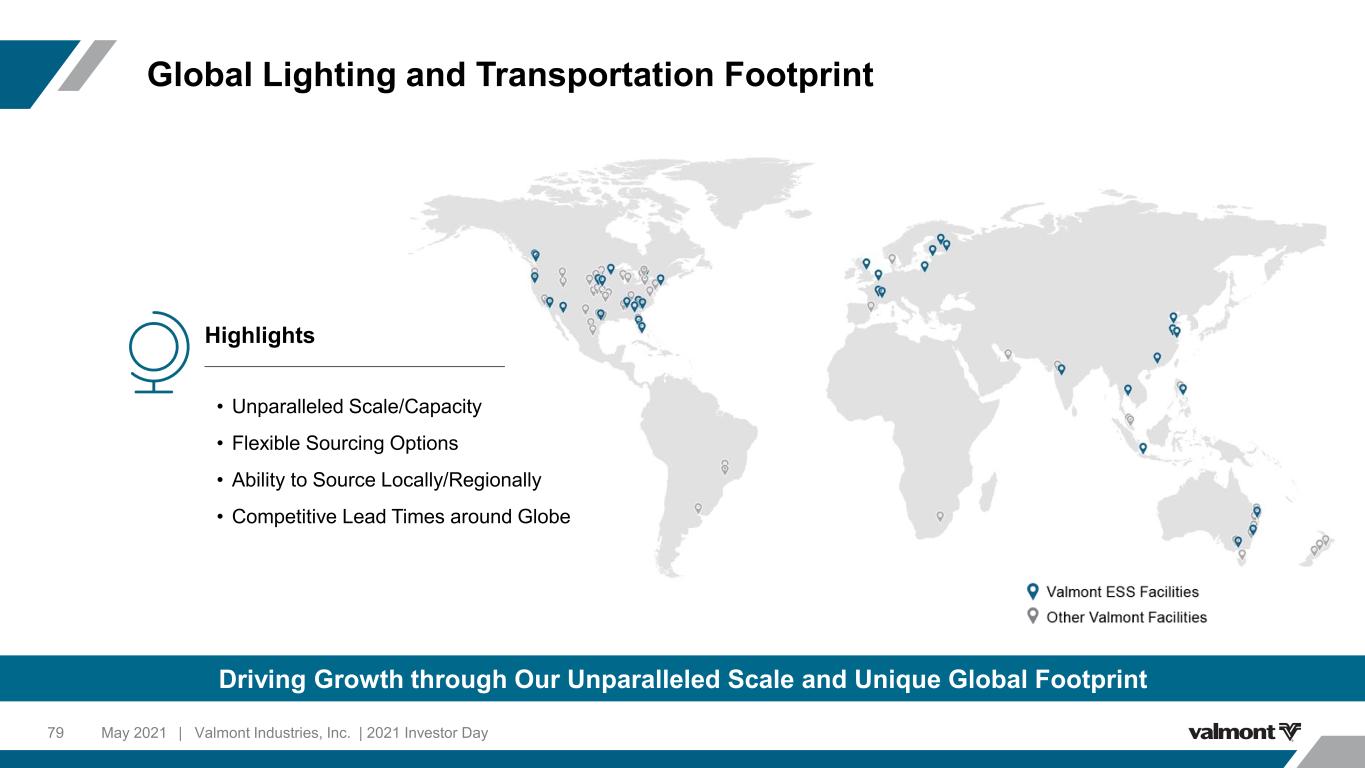

Global Lighting and Transportation Footprint 79 Driving Growth through Our Unparalleled Scale and Unique Global Footprint | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Highlights • Unparalleled Scale/Capacity • Flexible Sourcing Options • Ability to Source Locally/Regionally • Competitive Lead Times around Globe

Portfolio Breadth Lighting & Transportation | Sustainable Competitive Advantages 80 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Engineering Strength & Depth Large Project Management Capability Industry-Leading Quality Industry-Leading Customer Service Global Supply Chain Premium Brand and Reputation

Well-Positioned to Capture Future Market Demand 81 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 1Based on Company estimates and CMD Long-Term U.S. Market Drivers1 ~6% Annual growth (3 – 5 Years) Road and Bridge Construction ~7% Annual growth (3 – 5 Years) Commercial Development: Education & Medical • Road and bridge construction opportunity with traffic lighting, sign structures and bridge girders • Single-family residential construction opportunity with street, traffic lighting • IoT opportunity through vertical infrastructure capabilities Well-Positioned to Capture: ~6% Annual growth (3 – 5 Years) Single-Family Residential Construction ~7% Annual growth (3 – 5 Years) Multi-Family Residential Construction

Expanding Our Total Addressable Market 82 Strategic Expansion Driving Continued Above-Market Growth | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Strategic Market Expansion Opportunities Sign Structures Highway Safety Smart Pole Solutions Bridge Girders Bus Charging Stations ORGANIC GROWTH NEW PRODUCTS & SERVICES GEOGRAPHIC EXPANSION VALMONT SHARE $770M 1Based on Company estimates and Construction Market data report Total Global Market CAGR1: ~4% Valmont Lighting & Transportation: 5 – 6% 3 – 5 Year Expected Growth

Accelerating Innovation through Strategic Focus Areas and Technology Our Strategy for Long-Term Profitable Growth 83 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Elevating Operational Excellence with ESG Focus Expanding Markets through Active Portfolio Management and Price Leadership

Ability to differentiate channel/customer interactions Streamline commercial operations process/systems Elevating Operational Excellence with ESG Focus 84 Enhancing the Customer Experiencing and Optimizing Our Cost Structure | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Driving Operational Excellence through Digital Transformation Real-time monitoring and data aggregation – safety and energy efficiency Improved safety and lower crime in public areas Decrease highway fatalities/injuries Reduce auto emissions ESG Focus

Clear Digital Transformation Strategy for Premium Customer Experience Significant Opportunity to Enhance Scale and Automation through Digitalization 85 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 • Improved SG&A scale • Streamlining legacy engineering systems • Eliminate dual entry • Self-configuration by agent • Global platform • Pooled global resources • Ready access to technical information • Customer portal • Self-configuration and 3D drawings • World-class lead and response times • End-to-end transparency Cost Flexibility/Responsiveness Customer Experience

Internet of Things (IoT) Smart infrastructure • Monitoring: Environmental, Maintenance and Repair, Traffic Management, Public Safety • Commerce Enablement: Parking (real time availability and billing), Digital Signage/Advertising, EV Charging • Video Surveillance: Public safety, traffic management / assessment Accelerating Innovation through Disruptive Products and Services 86 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Unique, Innovative Solutions with Customer-First Focus

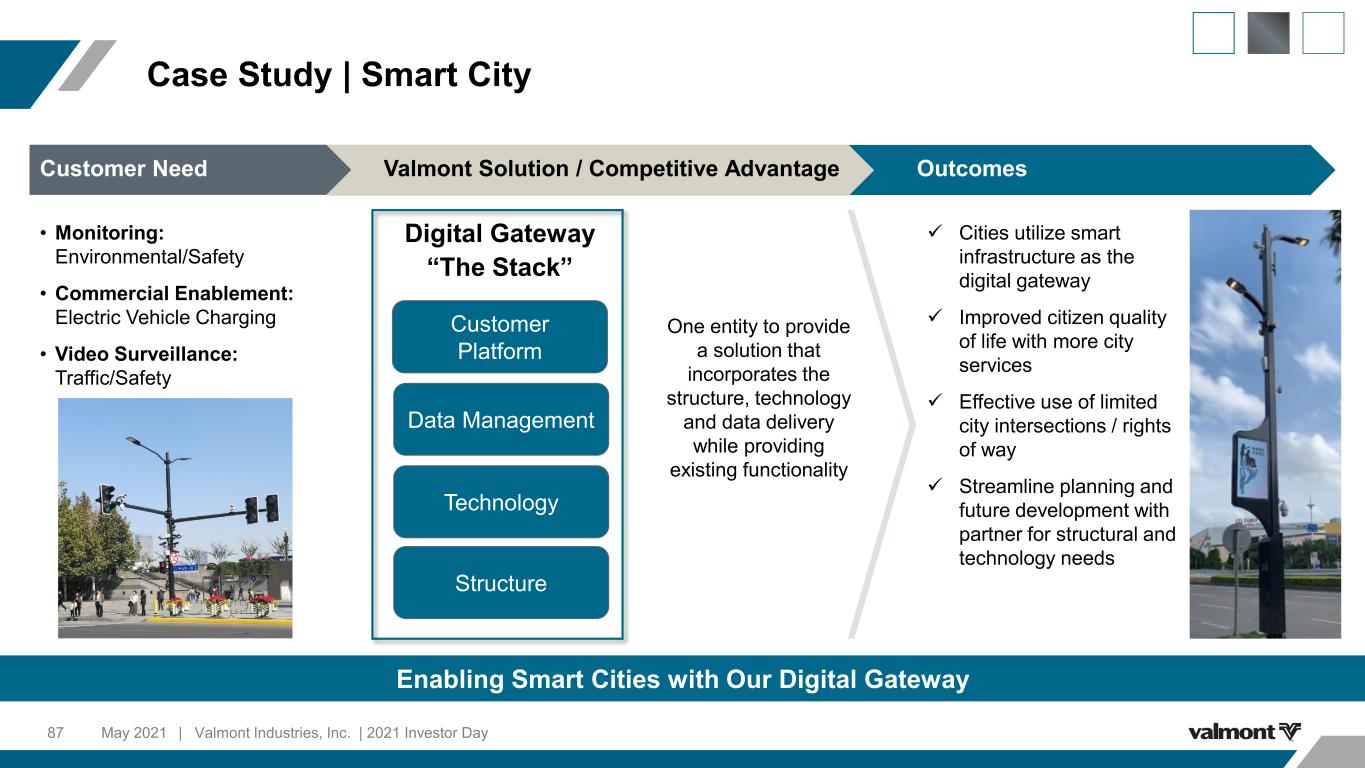

Case Study | Smart City 87 Enabling Smart Cities with Our Digital Gateway | Valmont Industries, Inc. | 2021 Investor DayMay 2021 • Monitoring: Environmental/Safety • Commercial Enablement: Electric Vehicle Charging • Video Surveillance: Traffic/Safety Cities utilize smart infrastructure as the digital gateway Improved citizen quality of life with more city services Effective use of limited city intersections / rights of way Streamline planning and future development with partner for structural and technology needs One entity to provide a solution that incorporates the structure, technology and data delivery while providing existing functionality Digital Gateway “The Stack” Structure Technology Data Management Customer Platform Customer Need OutcomesValmont Solution / Competitive Advantage

Expanding Markets through Strategic Focus Areas Active Portfolio Management to Focus on Higher Growth, Higher ROIC Opportunities 88 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Strategic Focus Areas • Significant ability to expand markets through smart cities – global opportunity to bundle technology solutions with our structures • Stronger focus on profit and ROIC • Consistent market and price leader • Evolving business models – potential for vertical and smart infrastructure with IoT to capture recurring service revenue • Leverage global technology, automation and scale for our products and solutions portfolio • Divest low growth products; driving higher profitability and growth

Key Takeaways 89 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Well-positioned as premier provider of global lighting and transportation solutions Focus on operational excellence to enhance customer experience and optimize cost structure Innovation and new product development focused on smart infrastructure and integration of new technology into existing structures Strong execution with improved market penetration in existing and new geographies

ACCELERATING INDUSTRY- LEADING SPEED & RELIABILITY Joe Catapano Group President, Telecommunications

Key Messages 91 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Best-in-class customer service, driving speed and reliability to Telecom component market with same-day component service and digital tools Shift to 5G presents significant opportunity, due to increased demand for speed, data and related telecom components Focused on closing the Digital Divide, early stages of bringing broadband to rural areas with a long runway ahead International expansion opportunities, due to our existing footprint and standardized playbook 01 02 03 04

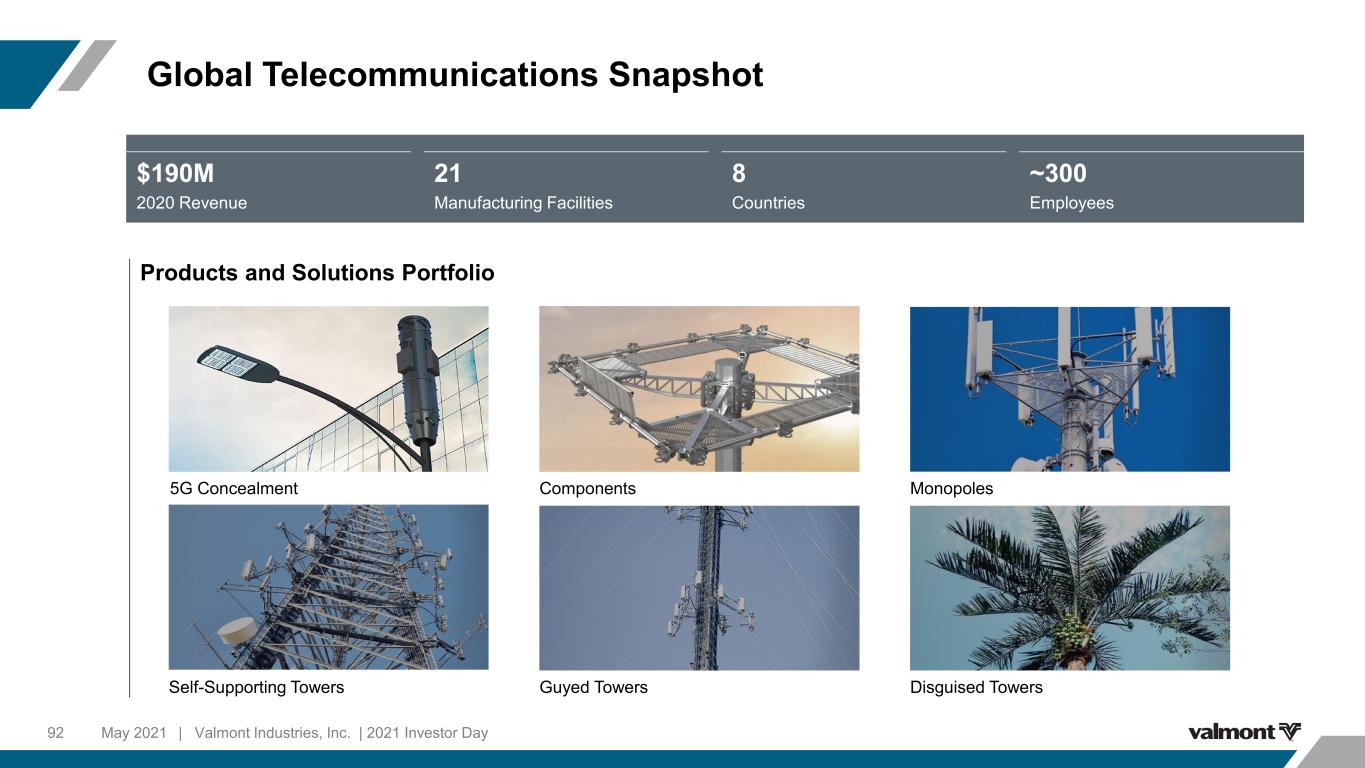

Global Telecommunications Snapshot 92 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Disguised TowersGuyed Towers Monopoles $190M 2020 Revenue 21 Manufacturing Facilities 8 Countries ~300 Employees Self-Supporting Towers 5G Concealment Components Products and Solutions Portfolio

Global Telecommunications Footprint 93 Leveraging Expertise in North America across Our Global Business | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Highlights • Adding 5G concealment capabilities within existing facilities • Focused on global Telecom business expansion • Leverage incremental return on global manufacturing assets • Site Pro 1 Global Playbook

Our Sustainable Competitive Advantages 94 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Agile Engineering Expertise Long-Standing Relationships with Key Customers Industry-Leading Response Time for Components Breadth of Manufacturing Capabilities Premium Brand and Reputation

Well-Positioned to Capture Future Market Demand 95 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Internet of Things – Future 5G Driver • Proliferation of connected devices Closing of the Digital Divide • Federal investments to increase speed and access in rural areas • Strong relationships with Wireless Internet Service Providers (WISPs) Entrance of New Participants • Well established in marketplace to capture opportunity Buildout 5G • Well-positioned with leading carriers • Breadth of product line Strong Breadth of Product Line and Relationships with Leading Carriers

Expanding Our Total Addressable Market 96 Favorable Market Tailwinds Will Support Double Digit Market Growth for the Near Future | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Strategic Market Expansion Opportunities Component Business Going Global Leverage Poles Footprint Small Cell PIM1 MitigationORGANIC GROWTH NEW PRODUCTS & SERVICES GEOGRAPHIC EXPANSION VALMONT SHARE $190M 1Passive Intermodulation 2Based on Company estimates and third-party data Total Market CAGR2: ~8-12% Valmont Telecommunications: ~15%+ 3 – 5 Year Expected Growth

Expanding Markets to Connect the World Our Strategy for Long-Term Profitable Growth 97 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Elevating Operational Excellence with Fast Customer Service Focus Accelerating Innovation through Strategic Focus Areas and Technology

Case Study | Built for Speed and Customer Satisfaction 98 95%+ of All Components Orders Shipped Complete Same Day | Valmont Industries, Inc. | 2021 Investor DayMay 2021 3:00 PM - Order Placed Customer places an order online for a Fortress Monopole Platform (1 ton / 2000+ lbs.) which is needed by tomorrow morning 3:15 PM - Order Processed CSR receives order from customer Best warehouse is chosen Order arrives at warehouse floor 4:05 PM - Order Prepared to Ship Warehouse team packages order for shipment 4:45 PM - Order Ready to Ship BOL filled Order ready for shipment 5:00 PM - Order Shipped Order picked up from warehouse by Trucking Company Evening - Customer Receives Tracking Customer sent an email with packing list and tracking details Next Day AM - Delivered Order received by customer 3:01 PM - Notification Sent Customer immediately receives order acknowledgment

Elevating Customer Experience 99 Customer-Centric Culture of Continuous Improvement | Valmont Industries, Inc. | 2021 Investor DayMay 2021 “You folks are always quick, have most items in stock, delivery is always better than expected. So, I do not shop much anymore, I just go to your web site!” – Mark R. from Oregon (A WISP Customer) “Site Pro 1 is a great asset to us. Products are always in stock and shipped fast! Also, their technical department is prompt to answer any questions that may arise.” – Jason R. from PA (Large GC) “Great variety of products, product availability when you need it and the best customer service!” – Anthony V. from PA (Large Turfing Vendor) Customer Testimonials Ease of Use Focus is to become one Company to increase ease of use for the customer • Pre-approved provider for municipalities increases speed to market for carriers and neutral hosts Versatile Transitioning salespeople to be able to sell all product lines (~75-85% transitioned) Standardization Opportunity for standardization for modular components; focused on speed of engineering Customer Service Initiatives

Expanding Markets to Connect the World 100 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Bringing reliable, high speed broadband access to rural areas is vital to supporting economies, enable remote learning, emergency communications and greater connectivity overall We are committed to closing the “Digital Divide” by providing vital infrastructure products and aligning with organizations focused on spreading inclusive connectivity: Wireless Internet Service Providers Association (WISPA) Represents the interests of Wireless Internet Service Providers (WISPs) across America. WISPs bring affordable Internet access to millions in rural communities American Connection Project (ACP) A coalition of more than 150 companies which advocates for policies to bring high-speed internet access to all Americans

Accelerating Innovation through Strategic Focus Areas Well-Positioned to Benefit from Significant 5G Opportunity 101 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Strategic Focus Areas Focused on 5G Expansion • Leveraging successful Site Pro 1 business model to expand global footprint ꟷ Leading position to capitalize on compelling market dynamics • Adding capabilities in Small Cell and PIM mitigation Components Expansion • Add more locations in the U.S.; currently 9 locations growing to 11 • Expect to add 2 sites in Canada Rural Broadband • Enabling spread and enhancement of wireless connectivity to rural communities • Aligned with non-Valmont entities focused on spreading inclusive connectivity ꟷ Wireless Internet Service Providers Association (WISPA) ꟷ The American Connection Project Broadband Coalition (ACPBC)

Key Takeaways 102 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Best-in-class customer service, driving speed and reliability to Telecom component market with same-day component service and digital tools Focused on closing the Digital Divide; early stages of bringing broadband to rural areas with a long runway ahead International expansion opportunities due to our existing structures footprint and standardized playbook Shift to 5G presents significant opportunity due to increased demand for more speed, data and related telecom components

DELIVERING UNPARALLELED COATINGS TECHNOLOGY & CUSTOMER SERVICE Rick Cornish Group President, Coatings

Key Messages 104 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Uniquely positioned to capture compelling industry trends Focus on operational excellence and continuous improvement across our facilities Commitment to ESG through our products and solutions Deep customer relationships driven by superior understanding of Voice of Customer, custom solutions and extensive visibility into operations Industry-leading technology with a focus on disruptive innovative solutions 01 02 03 04 05

Coatings Snapshot 105 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 71% 29% $345M 2020 Revenue 36 Locations 7 Countries ~1,900 Employees North America International 2020 Revenue Mix Products and Solutions Portfolio Galvanizing Applied Coatings Value-Added Services

Global Coatings Footprint 106 Continually Reevaluating Opportunities to Move into New Geographies | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Highlights • #1 Global Footprint in the Industry • Strong Position in North America • Leading Position in ANZ; Increasing APAC and India Footprint • Strategically Positioned to Serve Major Industrial Areas

Coatings | Sustainable Competitive Advantages 107 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 ESG Innovation & Technology Unparalleled Customer Service Valmont Coatings Operating System Best-in-Class Quality Premium Brand and Reputation

108 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 $2.5T Global Cost of Corrosion Increasing demand for superior corrosion control methods, such as galvanizing 90% Not yet galvanized of total suited steel; substantial market growth opportunity 15,000 Active Accounts Vast experience with a diverse variety of product types across active accounts and 28 market segments Protection of critical infrastructure and essential metal products from corrosion and premature obsolescence Developing economies’ need for new infrastructure, as well as mature economies’ responsible replacement of aging infrastructure Well-Positioned to Capture Future Market Demand

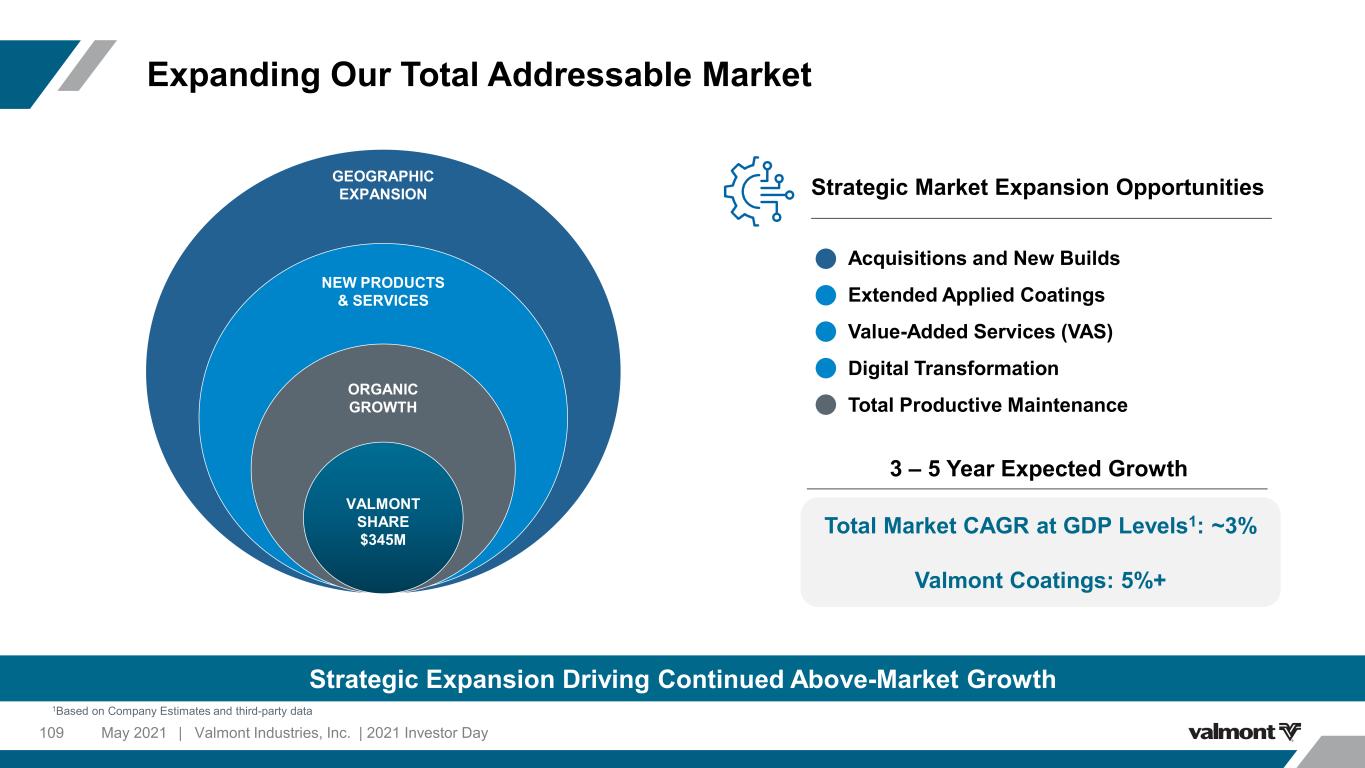

Expanding Our Total Addressable Market 109 Strategic Expansion Driving Continued Above-Market Growth | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Strategic Market Expansion Opportunities Acquisitions and New Builds Extended Applied Coatings Value-Added Services (VAS) Digital Transformation Total Productive Maintenance ORGANIC GROWTH NEW PRODUCTS & SERVICES GEOGRAPHIC EXPANSION VALMONT SHARE $345M 1Based on Company Estimates and third-party data Total Market CAGR at GDP Levels1: ~3% Valmont Coatings: 5%+ 3 – 5 Year Expected Growth

Our Strategy for Long-Term Profitable Growth 110 May 2021 Accelerating Innovation through Strategic Focus Areas and Technology | Valmont Industries, Inc. | 2021 Investor Day Expanding Markets that We Serve through Value-Added Services Elevating Operational Excellence with ESG Focus

Operational Excellence Driven by Valmont Coatings Operating System (VCOS) • Consistent and standardized practices across all global locations • Development of precise, proven & repeatable lean processes supported by strong technical acumen • Manager and supervisor development program key in helping develop and retain talent across the organization • Valmont University – sharing of best practices Elevating Operational Excellence with ESG Focus 111 Focused Operational Excellence Supporting ESG Initiatives | Valmont Industries, Inc. | 2021 Investor DayMay 2021 ESG/Sustainability • Galvanizing delivers a sustainable product with lowest lifecycle cost and carbon footprint • Primary components, zinc and steel, are 100% recyclable making hot-dip galvanized steel an infinitely renewable building material • Durability of galvanized coating eliminates maintenance costs; longevity saves resources by extending lifespan of structural steel • Recover by-products from our processes to reuse on-site or sell for use in down-stream manufacturing products; environmentally friendly, proprietary metal surface treatment system • Grid hardening/resiliency from coating steel used in infrastructure allows for greater longevity/protection against natural disasters

Expanding Markets that We Serve through Value-Added Services 112 Process Improvements and Value-Add Opportunities Derive from Voice of Customer | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Voice of Customer • Deploy customer satisfaction survey annually to collect feedback and track performance by site, country and globally • Benchmark against competition; identify improvement opportunities • Improving NPS Scores: 2018: 16, 2019: 42, 2020: 48 • Drive process improvements and continuously enhance value-added services such as: ꟷ Transportation Expansion ꟷ Expediting Services ꟷ Sourcing/Storage/Kitting/Distribution ꟷ Sandblasting Service Management Drives an Innovative Customer Experience • Customer input drives development of innovative solutions creating an unsurpassed connected experience designed to address market needs • Valmont Coatings Connector was developed and continues to be 100% driven/developed based on customer feedback: ꟷ Order status visibility ꟷ Quicker notification when product is ready for pick-up ꟷ Order documents accessibility • Extensive visibility into our operations strengthens customer loyalty and trust • Internally disrupted how we run operations to better serve customers

Accelerating Innovation through Disruptive Products and Services 113 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Smart Supply/Inventory Management • Internet Connected Vending machines/rooms – MRO, PPE, Supplies (automated inventory & reorder) Internet of Things (IoT) Near Future (Piloting): Galvanizable Product tags • Valmont & customer tracking (barcode, QR) detail Automation: Factory/Processes Connected Systems, Tracking & Monitoring Devices • Valmont Coatings Connector (VCC & VCCMax) ꟷ Customer future orders, automated weight capture, automated email\text per product process\step ꟷ Electronic customer signature capture; wireless mil readers, barcode scanners/trackers • GalvTrac, TankTrac & Kettleboard • AI Vision Systems (KettleVision) • Thermal Imaging Fire Detection Cameras • Remote Monitoring 24/7 – Virtual Camera Tours Digital Customer Experience Valmont Coatings Connector (VCC & VCCMax) • Realtime product tracking & process visibility – any device, anywhere; automated email\text notifications • Electronic order and product action items • Electronic access to order documents • Visibility of product photos • Digitized product pickup & delivery scheduling – Trucking & Logistics Showpad • Sales enablement tool allowing customers & leads to digitally access sales/marketing collateral

Coatings | Key Takeaways 114 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Uniquely positioned to capture compelling industry trends Focus on operational excellence and continuous improvement across our facilities Commitment to ESG through our products and solutions Deep customer relationships driven by superior understanding of Voice of Customer, custom solutions and extensive visibility into operations Industry-leading technology with a focus on disruptive innovative solutions

ELEVATING OUR OPERATIONAL TRANSFORMATION Diane Larkin EVP, Global Operations

Key Messages 116 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 01 02 03 04 ESG is at the core of our operational strategy Strategic focus on disruptive innovation to elevate operational excellence across the business Lean culture focused on continuous improvement Business simplification through supply chain optimization and complexity reduction in our operating models

Continuing to Build on Our Strong Foundation with Key Focus Areas 117 Leveraging a More Strategic Mindset Related to Operations | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Key Focus Areas • ESG Fundamentals • Disruptive Innovation • Lean Fundamentals and Culture • Simplification Strong Operations Foundation • SQDC thought process • Combined S&OP from a demand-planning perspective • Beginning to leverage our footprint in a more centralized manner, specifically related to large poles and infrastructure

Operational Excellence Strategic Priorities 118 Continuously Optimizing Our Manufacturing Platform and Supply Chain Network | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Enablers Enhanced Organizational Structure • Global EHS • Operational Excellence • Global Supply Chain Culture of Lean Excellence • Bring lean thinking and vision to World Class levels • Focus on continuous improvement in systems, process and tools • Drive results via scientific problem-solving & data analytics Strategic Priorities Focus on Disruptive Innovation • Connected/Industry 4.0 • Cutting-edge technology • Technology roadmap informed by need of the business Drive Simplification • Support Platform Design initiatives • Continuously evaluate Global Footprint Strategy • Systems/Supply Chain optimization

Water: Driving Enhanced Structure through ESG Strategic Initiatives 119 Strong Internal Focus on Sustainability and EHS at Our Facilities | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Sustainability Established Manufacturing Goals of: 90/90 LED Electric Vehicles Projects: Solar Array Implemented facility water standards Creation of Valmont Safety Index to measure leading indicators Report Use of data to drive focus Focus Engaged, hands-on leaders and training Education Led as grassroots programs Programs 40% Reduction in Carbon Intensity 20% Reduction in Combustion Fuel Carbon Emissions by 2025 8% Reduction in Electricity kWh/$M Revenue 75% Reduction in Overall Measured Risk since 2015 16% Reduction in LTIR Since 2015 43% Reduction in TRIR Since 2015 Health & Safety 0.57 0.48 2015 2020 3.15 2.00 2015 2020

Relationships Launching a Supplier Relationship Management (SRM) tool to ensure our policies and requirements around human rights and ESG are acknowledged by our supplier partners Process Enhancing ESG section of supplier audits to inform selection process Metrics Adding ESG metrics to our supplier scorecards to ensure we hold strategic partners accountable Production Partner with steel suppliers to pilot Hydrogen technology in steel production Driving Enhanced Structure through ESG Strategic Initiatives 120 Strong External Commitment to Driving ESG Initiatives | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Supply Chain Community Outreach Partnership with Marion County Schools Work Based Learning Welding Program Rosie the Riveter Revisited Career Fair Chattanooga, TN Career Fair for Veterans Fort Campbell, Kentucky Pre-Apprenticeship Welding Program Jasper, TN

Our Lean Transformation Roadmap 121 | Valmont Industries, Inc. May 2021 2023 2021 Critical Mass/Culture Codified • Focus on Making Material Flow through pull systems • Leveraging consistent, best-in-class problem solving tools • Optimizing plant layouts • Commission additional Smart factories • Culture of Continuous Improvement in several locations as proofs of concept 2020 Learning/Planning • Site lean assessments • Identify and prioritize • Lean culture • Talent evaluation Piloting/Assessments • Identify Best Practice Sites for standard work • Identify and develop Focus sites • Develop best practice: ꟷ Leading for Daily Management ꟷ Value stream mapping ꟷ Standard work • Full site-level transformation plans established Deployment/Execution • Focus on creating continuous flow in each site • Execute transformation plans • Establish layered audits • Pilot Smart Factory 2022

Driving Higher ROIC & Supporting ESG via Disruptive Technology 122 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Internet of Things (IoT) • Real-time notification and data for escalation via connected Smart Watches • Predictive Maintenance tools • Real-time product tracking through GPS • Connected information flow (from supplier, through manufacturing, to shipping, from the carrier, to the customer) Industry 4.0: Factory/Processes • Connected equipment for line balancing, throughput, and quality mitigation • E-Controls for leveling/automatic adjustments • Industry-leading longitudinal seaming technology (hybrid laser, automatic sub-arc seaming) • Fully autonomous welding • Precision quality systems with Phased Array Ultrasonics • Robotic hyperfill stations • Next generation electric resistance welding (Poland CoE) Value Proposition Decreases labor requirement to address labor scarcity ESG improvements via less energy/waste/safety Cost savings driven by labor savings, maintenance reduction and decreased footprint Improve ROIC due to real-time pull signals to supplier Superior quality via repeatable processes Decreased lead time for customers Order visibility and tracking for our customers Product line profitability analysis

Disruptive Innovation | Autonomous Welding Video 123 | Valmont Industries, Inc. | 2021 Investor DayMay 2021

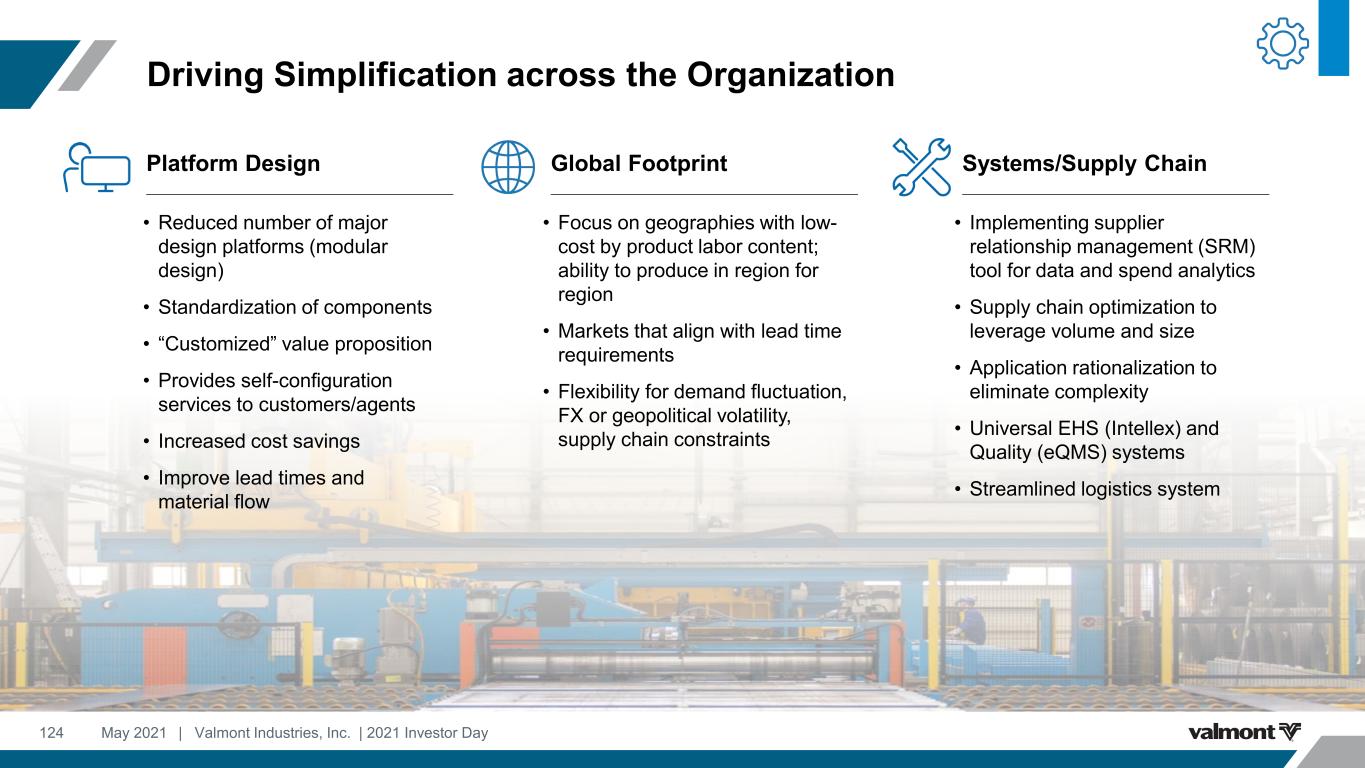

Driving Simplification across the Organization 124 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Platform Design • Reduced number of major design platforms (modular design) • Standardization of components • “Customized” value proposition • Provides self-configuration services to customers/agents • Increased cost savings • Improve lead times and material flow Systems/Supply Chain • Implementing supplier relationship management (SRM) tool for data and spend analytics • Supply chain optimization to leverage volume and size • Application rationalization to eliminate complexity • Universal EHS (Intellex) and Quality (eQMS) systems • Streamlined logistics system Global Footprint • Focus on geographies with low- cost by product labor content; ability to produce in region for region • Markets that align with lead time requirements • Flexibility for demand fluctuation, FX or geopolitical volatility, supply chain constraints

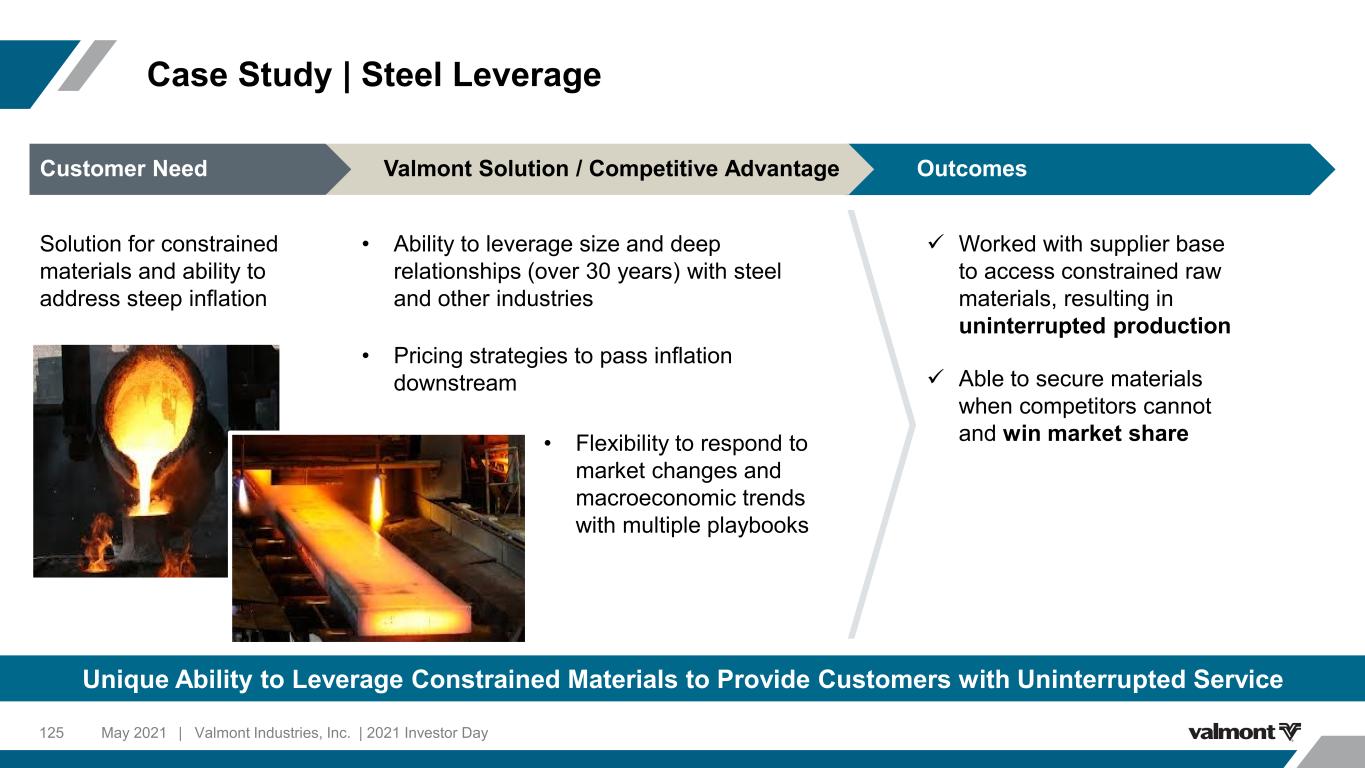

Case Study | Steel Leverage 125 Unique Ability to Leverage Constrained Materials to Provide Customers with Uninterrupted Service | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Solution for constrained materials and ability to address steep inflation Worked with supplier base to access constrained raw materials, resulting in uninterrupted production Able to secure materials when competitors cannot and win market share • Ability to leverage size and deep relationships (over 30 years) with steel and other industries • Pricing strategies to pass inflation downstream Customer Need OutcomesValmont Solution / Competitive Advantage • Flexibility to respond to market changes and macroeconomic trends with multiple playbooks

Transitioning from Reactive to Predictive Measurement 126 Shifting from Internally Focused to Customer Focused | Valmont Industries, Inc. | 2021 Investor DayMay 2021 • Total Incident Rate • Warranty Dollars • On-time Delivery • Total Manufacturing Costs • Inventory Dollars and Turns • Risk Levels by Process • Cost of Poor Quality/FPY • On-time Delivery to Customer Request • Arc-on Time/Productivity • ROIC • Valmont Safety Index (BBS) • Design for Manufacturability ratings/PFMEA scores • Perfect Order Rate/Schedule • Effectiveness Score • Continuous Flow/OEE • Forecasted Inventory by SegmentReactive KPIs Proactive KPIs Predictive KPIs 2017 2020 2023

Key Takeaways 127 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 ESG is at the core of our operational strategy Strategic focus on disruptive innovation to elevate operational excellence across the business Lean culture focused on continuous improvement Business simplification through supply chain optimization and complexity reduction in our operating models

FOCUSING ON ROIC TO DRIVE VALUE CREATION Avner Applbaum EVP & CFO

Key Messages 129 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Continuing finance function transformation to a more business minded, data driven organization, with improved enabling technologies Leveraging clear capital allocation framework with disciplined and strategic approach to M&A Enhancing stakeholder value by executing our strategy with a focus on ROIC 01 02 03

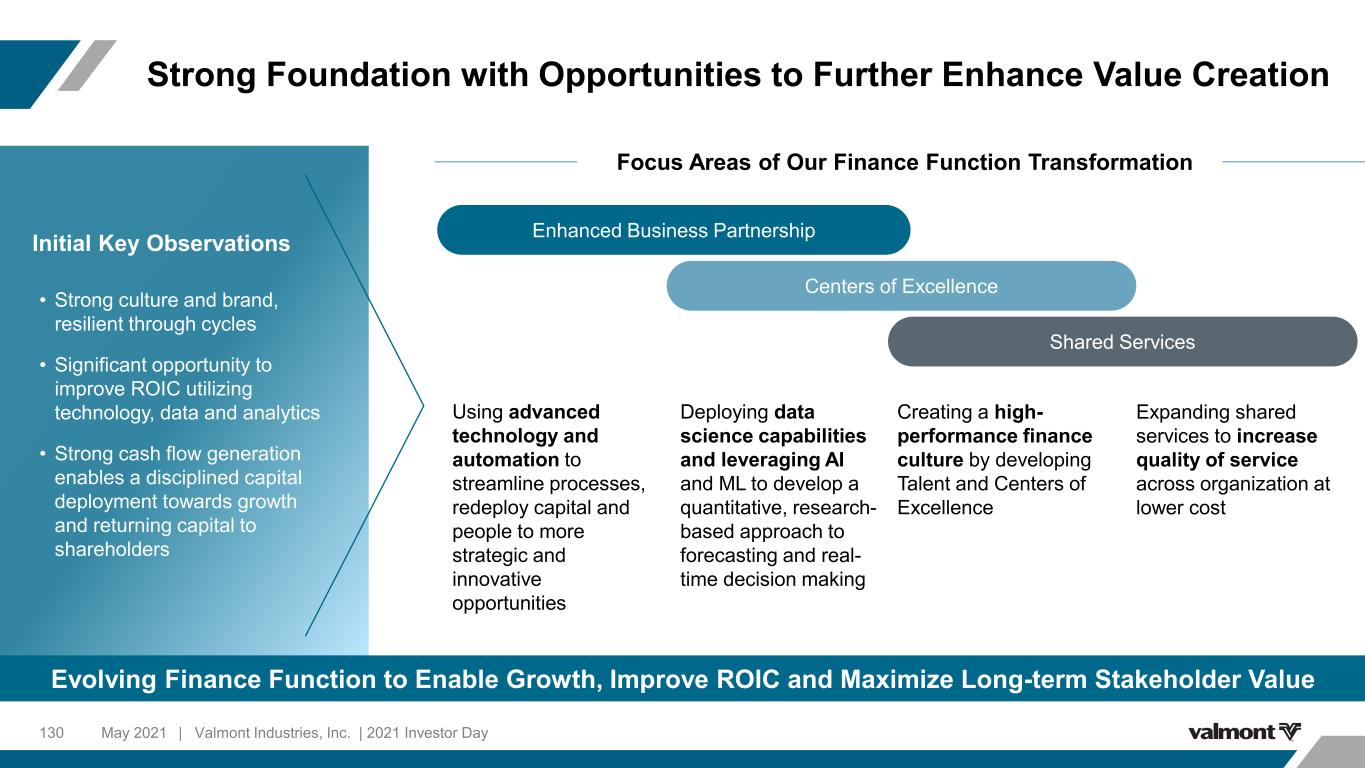

Strong Foundation with Opportunities to Further Enhance Value Creation 130 Evolving Finance Function to Enable Growth, Improve ROIC and Maximize Long-term Stakeholder Value | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Using advanced technology and automation to streamline processes, redeploy capital and people to more strategic and innovative opportunities Deploying data science capabilities and leveraging AI and ML to develop a quantitative, research- based approach to forecasting and real- time decision making Creating a high- performance finance culture by developing Talent and Centers of Excellence Expanding shared services to increase quality of service across organization at lower cost Centers of Excellence Enhanced Business Partnership Shared Services Initial Key Observations • Strong culture and brand, resilient through cycles • Significant opportunity to improve ROIC utilizing technology, data and analytics • Strong cash flow generation enables a disciplined capital deployment towards growth and returning capital to shareholders Focus Areas of Our Finance Function Transformation

Finance Transformation in Action – ROIC Improvement 131 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 Valmont Goal >11% ROIC ExecutionBusiness Partner Strategy Development FP&A COE Data Analysis Predictive Analytics Insight Treasury COE Cash Operations Working Capital Cash Optimization Tax MinimizationTax COE Tax Rate Planning Efficiency & Cost ReductionShared Services Automation and Standardization

Strong Peak to Trough Performance Ability to Execute through the Cycles Trough Trough Peak $2,662 $3,030 $3,304 $3,123 $2,619 $2,522 $2,746 $2,757 $2,767 $2,895 $263 $382 $473 $358 $238 $256 $267 $279 $228 $269 $- $100 $200 $300 $400 $500 $600 $700 $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Sales Adjusted Operating Income Sales and Operating Income ($M) $263 $382 $473 $358 $132 $243 $267 $212 $228 $226 1 GAAP Operating Income 132 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 1Excludes restructuring charges, impairments and significant one-time adjustments. Please see Company’s Reg. G table at end of presentation.

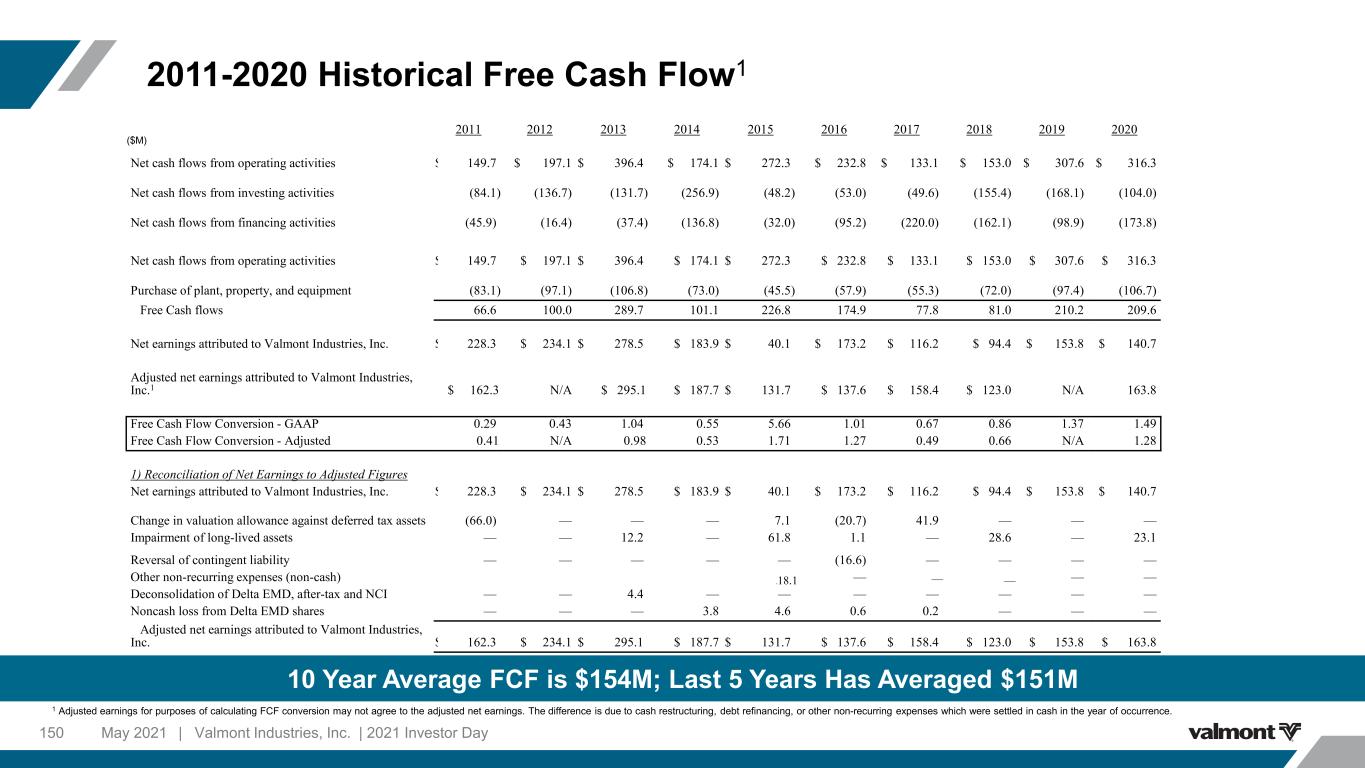

GAAP 101% 67% 86% 137% 149% Adj. 127% 49% 66% 137% 128% Robust Free Cash Flow Generation 133 | Valmont Industries, Inc. | 2021 Investor DayMay 2021 1We use the non-GAAP measure of FCF, which we define as GAAP net cash flows from operating activities reduced by capex. We believe that FCF is a useful performance measure for management and useful to investors as the basis for comparing our performance with other companies. Our measure of FCF may not be directly comparable to similar measure use by other companies. $175 $78 $81 $210 $210 $- $50 $100 $150 $200 $250 2016 2017 2018 2019 2020 Free Cash Flow1 ($M) Historical FCF Conversion by Year1 Highlights • Strategic working capital initiatives including inventory optimization, supply chain finance • Using analytics Robotic Process Automation and BI tools to drive cash optimization • Focused on cash conversion cycle • Disciplined, process-oriented approach to business investments

Cash $391.5M Total Debt (Long-Term) $729.6M Shareholders’ Equity $1,250.1M Total Debt to Adj. EBITDA1 2.1x Net Debt to Adj. EBITDA1 1.0x Available Credit under Revolving Credit Facility2 $585.4M Cash $391.5M Total Available Liquidity $976.9M AS OF MARCH 27, 2021 ► Long-term debt of $729.6M, mostly fixed-rate, with long-dated maturities to 2044 and 2054 ► Maintain liquidity to support operations and investment grade credit rating ꟷ Moody’s reaffirmed Baa3/Stable credit rating during Q1 ꟷ Purchased $11.1M of company stock in Q1, and $137M remains on current authorization 1See slide 150 for calculation of Adjusted EBITDA and Leverage Ratio. 2$600M Total Revolver less borrowings and Standby LC”s of $15M. Continue to Maintain Strong, Flexible Balance Sheet with Ample Liquidity 134 | Valmont Industries, Inc. | 2021 Investor DayMay 2021