Form 8-K VALERO ENERGY CORP/TX For: Aug 22

Investor Presentation August 2019 Exhibit 99.01

Disclaimers This presentation contains forward-looking statements made by Valero Energy Corporation (“VLO” or “Valero”) within the meaning of federal securities laws. These statements discuss future expectations, contain projections of results of operations or of financial condition or state other forward-looking information. You can identify forward-looking statements by words such as “believe,” “estimate,” “expect,” “forecast,” “could,” “may,” “will,” “targeting,” “illustrative” or other similar expressions that convey the uncertainty of future events or outcomes. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the control of Valero and are difficult to predict. These statements are often based upon various assumptions, many of which are based, in turn, upon further assumptions, including examination of historical operating trends made by the management of Valero. Although Valero believes that the assumptions were reasonable when made, because assumptions are inherently subject to significant uncertainties and contingencies, which are difficult or impossible to predict and are beyond its control, Valero can not give assurance that it will achieve or accomplish its expectations, beliefs or intentions. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements contained in Valero’s filings with the Securities and Exchange Commission, including Valero’s annual reports on Form 10-K, quarterly reports on Form 10-Q, and other reports available on Valero’s website at www.valero.com. These risks could cause the actual results of Valero to differ materially from those contained in any forward-looking statement. This presentation includes non-GAAP financial measures. Our reconciliations of GAAP financial measures to non-GAAP financial measures are located at the end of this presentation. These non-GAAP financial measures should not be considered as an alternative to GAAP financial measures.

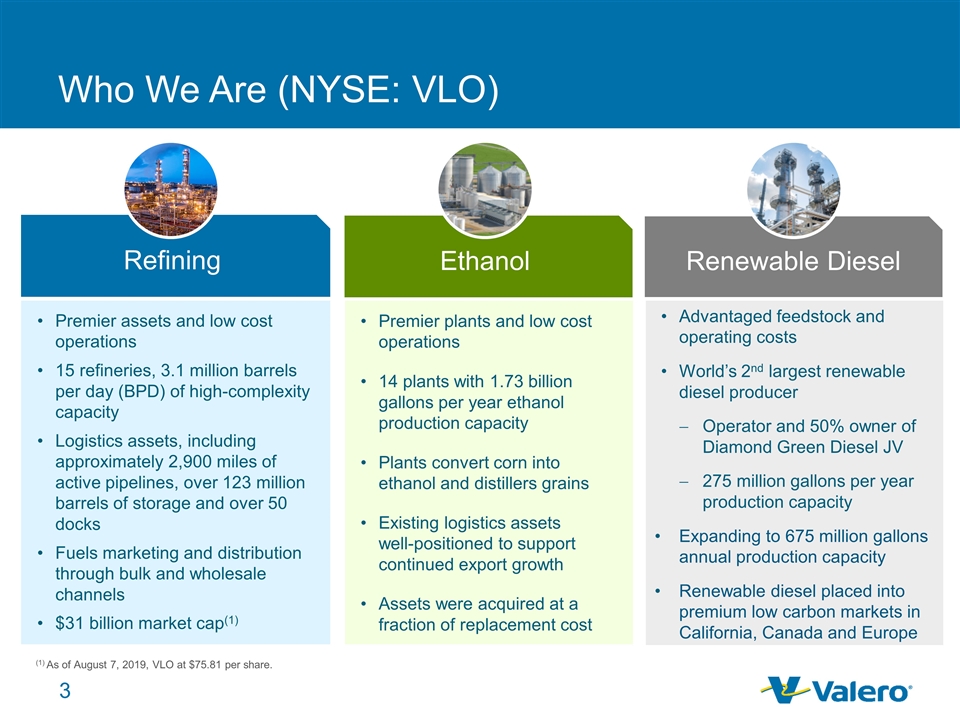

Who We Are (NYSE: VLO) Refining Premier assets and low cost operations 15 refineries, 3.1 million barrels per day (BPD) of high-complexity capacity Logistics assets, including approximately 2,900 miles of active pipelines, over 123 million barrels of storage and over 50 docks Fuels marketing and distribution through bulk and wholesale channels $31 billion market cap(1) (1) As of August 7, 2019, VLO at $75.81 per share. Ethanol Premier plants and low cost operations 14 plants with 1.73 billion gallons per year ethanol production capacity Plants convert corn into ethanol and distillers grains Existing logistics assets well-positioned to support continued export growth Assets were acquired at a fraction of replacement cost Renewable Diesel Advantaged feedstock and operating costs World’s 2nd largest renewable diesel producer Operator and 50% owner of Diamond Green Diesel JV 275 million gallons per year production capacity Expanding to 675 million gallons annual production capacity Renewable diesel placed into premium low carbon markets in California, Canada and Europe

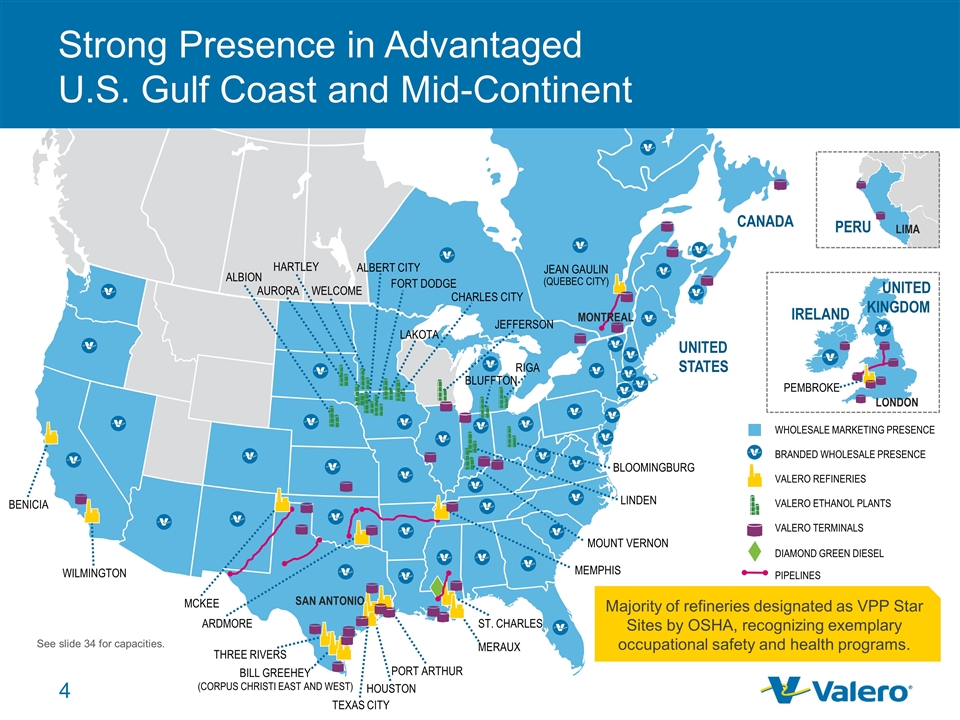

Strong Presence in Advantaged U.S. Gulf Coast and Mid-Continent UNITED STATES WHOLESALE MARKETING PRESENCE VALERO ETHANOL PLANTS VALERO REFINERIES BRANDED WHOLESALE PRESENCE VALERO TERMINALS DIAMOND GREEN DIESEL PIPELINES PERU LIMA LONDON PEMBROKE UNITED KINGDOM IRELAND CANADA BENICIA WILMINGTON MCKEE ARDMORE THREE RIVERS BILL GREEHEY (CORPUS CHRISTI EAST AND WEST) TEXAS CITY HOUSTON PORT ARTHUR MERAUX ST. CHARLES MEMPHIS MOUNT VERNON LINDEN BLOOMINGBURG SAN ANTONIO ALBION AURORA HARTLEY WELCOME ALBERT CITY FORT DODGE CHARLES CITY JEFFERSON JEAN GAULIN (QUEBEC CITY) MONTREAL RIGA BLUFFTON LAKOTA See slide 34 for capacities. Majority of refineries designated as VPP Star Sites by OSHA, recognizing exemplary occupational safety and health programs.

Demonstrated Strategy for Value Creation Proven history of operations excellence: Safe, reliable, environmentally responsible operations have driven higher profitability through multiple commodity cycles One of the lowest cash operating costs among peer group Visibility to earnings growth: Steady pipeline of high return projects focused on operating cost control, market expansion and margin improvement 25% after-tax IRR hurdle rate for projects Demonstrated commitment to stockholders: Disciplined capital allocation with solid free cash flow and returns to stockholders Exceeded our target payout ratio of 40% to 50% every year under current management Texas City Refinery.

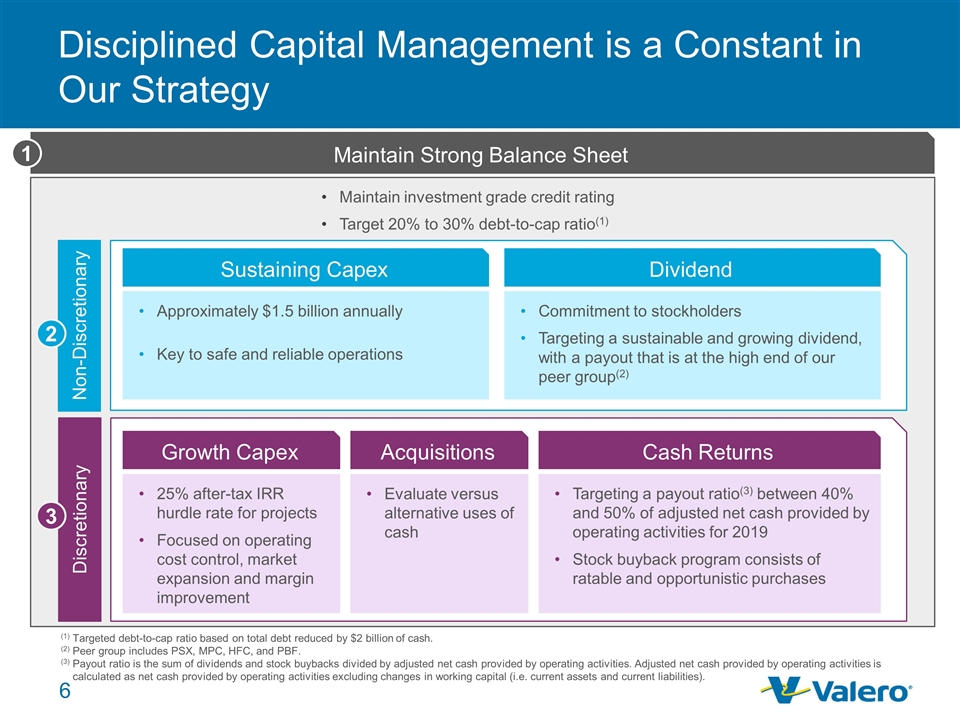

Disciplined Capital Management is a Constant in Our Strategy Maintain Strong Balance Sheet (1)Targeted debt-to-cap ratio based on total debt reduced by $2 billion of cash. (2)Peer group includes PSX, MPC, HFC, and PBF. (3)Payout ratio is the sum of dividends and stock buybacks divided by adjusted net cash provided by operating activities. Adjusted net cash provided by operating activities is calculated as net cash provided by operating activities excluding changes in working capital (i.e. current assets and current liabilities). Sustaining Capex Approximately $1.5 billion annually Key to safe and reliable operations Dividend Commitment to stockholders Targeting a sustainable and growing dividend, with a payout that is at the high end of our peer group(2) Non-Discretionary Growth Capex 25% after-tax IRR hurdle rate for projects Focused on operating cost control, market expansion and margin improvement Cash Returns Targeting a payout ratio(3) between 40% and 50% of adjusted net cash provided by operating activities for 2019 Stock buyback program consists of ratable and opportunistic purchases Acquisitions Evaluate versus alternative uses of cash Discretionary Maintain investment grade credit rating Target 20% to 30% debt-to-cap ratio(1) 1 2 3

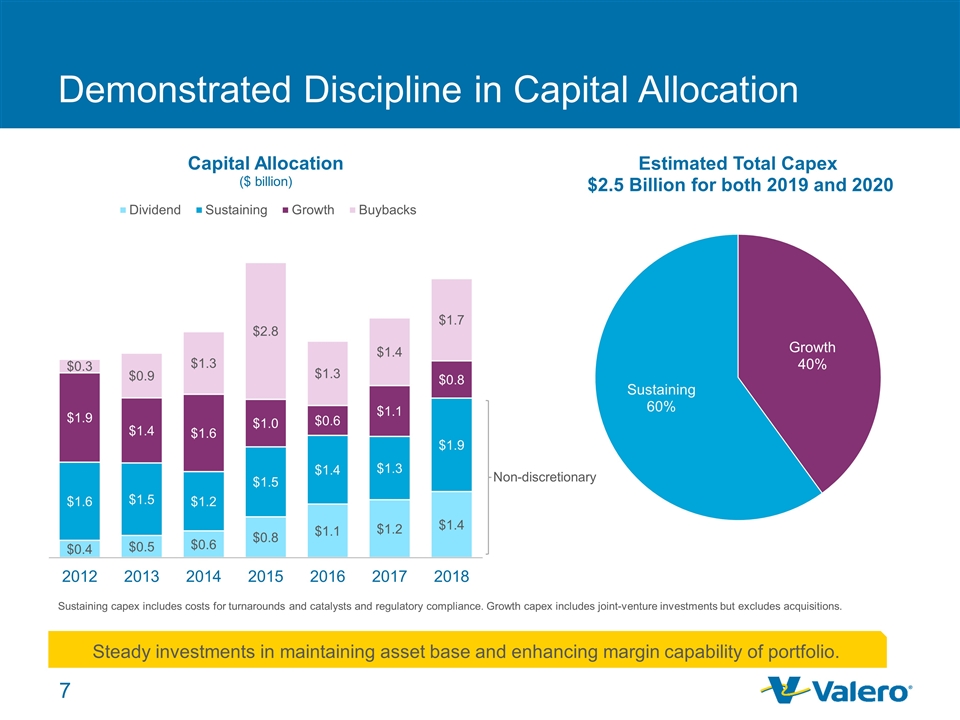

Demonstrated Discipline in Capital Allocation Steady investments in maintaining asset base and enhancing margin capability of portfolio. Non-discretionary Sustaining capex includes costs for turnarounds and catalysts and regulatory compliance. Growth capex includes joint-venture investments but excludes acquisitions.

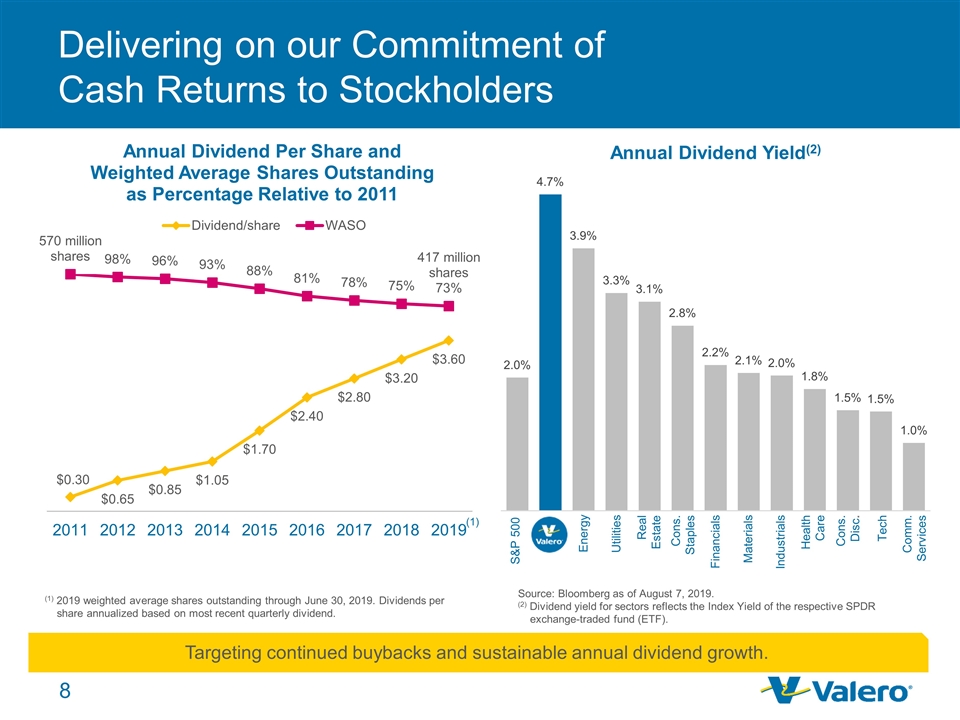

Delivering on our Commitment of Cash Returns to Stockholders Targeting continued buybacks and sustainable annual dividend growth. (1) 2019 weighted average shares outstanding through June 30, 2019. Dividends per share annualized based on most recent quarterly dividend. Energy Real Estate Utilities Cons. Staples Financials Materials Industrials Tech Health Care Comm. Services Cons. Disc. S&P 500 Source: Bloomberg as of August 7, 2019. (2) Dividend yield for sectors reflects the Index Yield of the respective SPDR exchange-traded fund (ETF). (1)

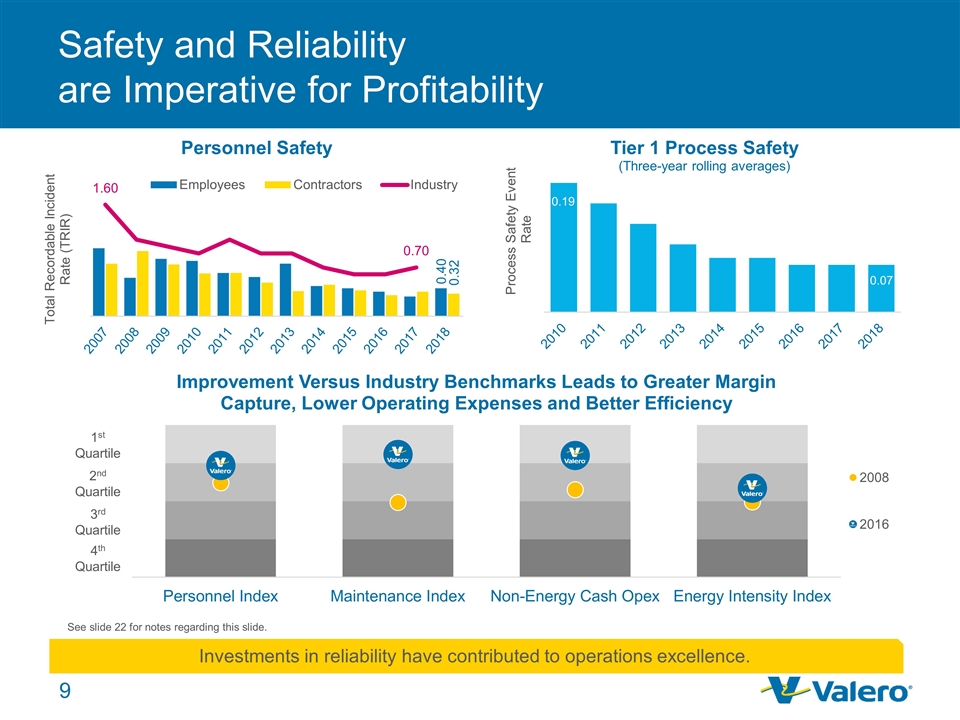

Safety and Reliability are Imperative for Profitability See slide 22 for notes regarding this slide. Investments in reliability have contributed to operations excellence. 1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

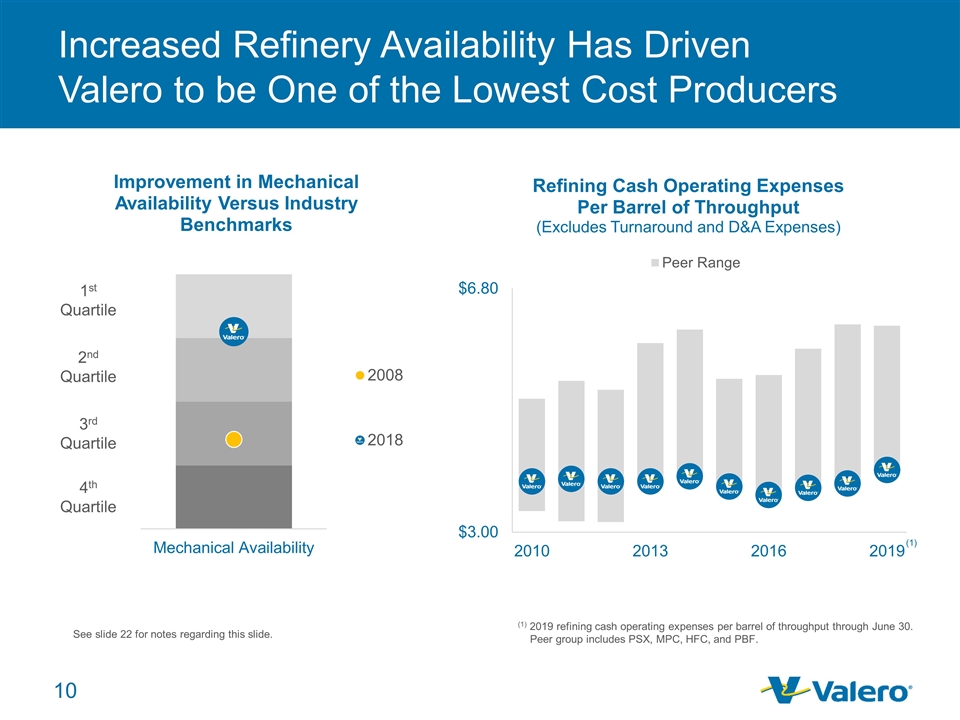

Increased Refinery Availability Has Driven Valero to be One of the Lowest Cost Producers See slide 22 for notes regarding this slide. 1st Quartile 2nd Quartile 3rd Quartile 4th Quartile (1) 2019 refining cash operating expenses per barrel of throughput through June 30. Peer group includes PSX, MPC, HFC, and PBF. (1)

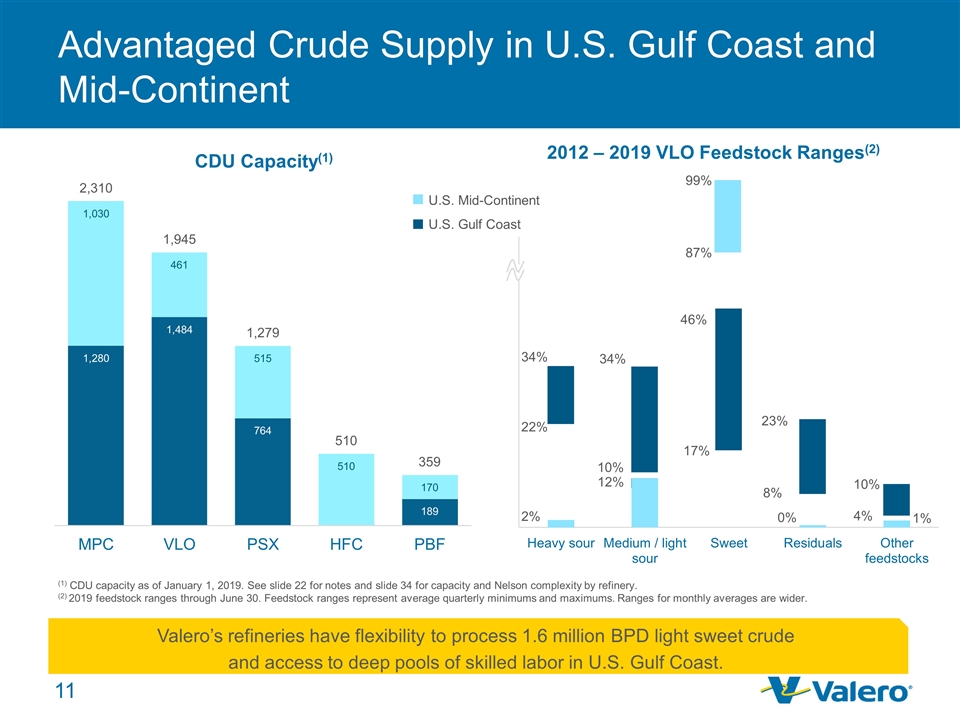

Advantaged Crude Supply in U.S. Gulf Coast and Mid-Continent U.S. Mid-Continent U.S. Gulf Coast (1) CDU capacity as of January 1, 2019. See slide 22 for notes and slide 34 for capacity and Nelson complexity by refinery. (2) 2019 feedstock ranges through June 30. Feedstock ranges represent average quarterly minimums and maximums. Ranges for monthly averages are wider. Valero’s refineries have flexibility to process 1.6 million BPD light sweet crude and access to deep pools of skilled labor in U.S. Gulf Coast.

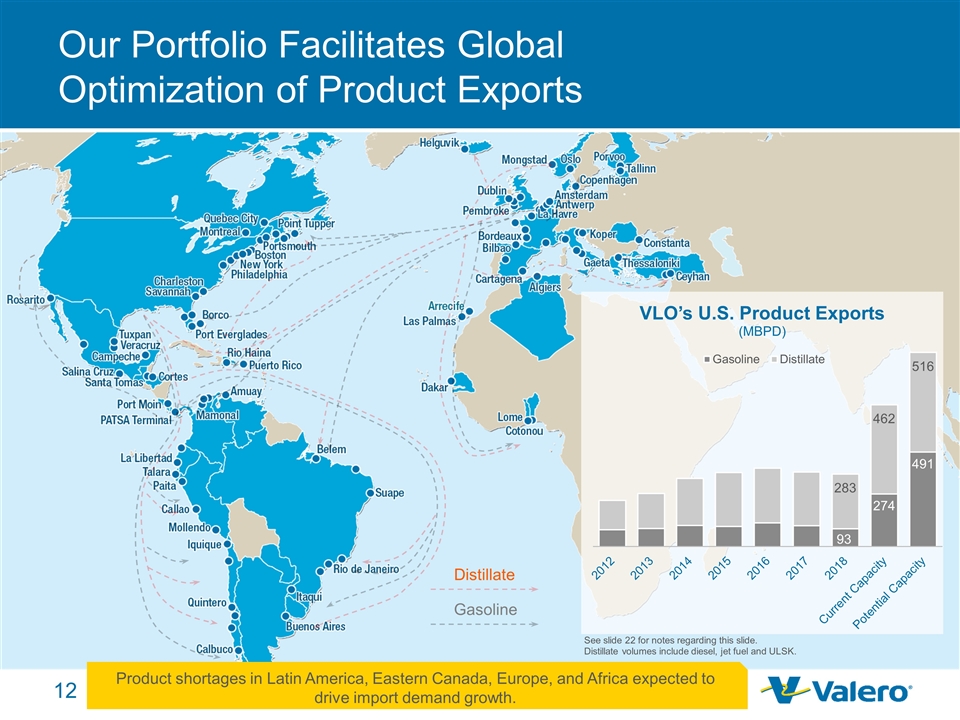

Our Portfolio Facilitates Global Optimization of Product Exports See slide 22 for notes regarding this slide. Distillate volumes include diesel, jet fuel and ULSK. Distillate Gasoline Product shortages in Latin America, Eastern Canada, Europe, and Africa expected to drive import demand growth.

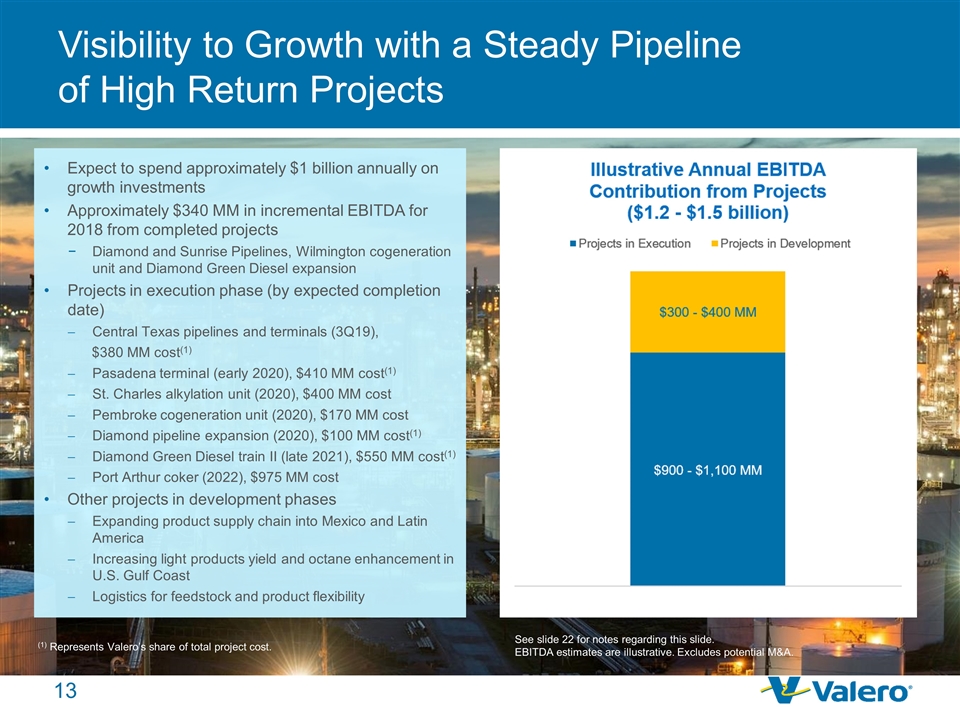

Visibility to Growth with a Steady Pipeline of High Return Projects Expect to spend approximately $1 billion annually on growth investments Approximately $340 MM in incremental EBITDA for 2018 from completed projects Diamond and Sunrise Pipelines, Wilmington cogeneration unit and Diamond Green Diesel expansion Projects in execution phase (by expected completion date) Central Texas pipelines and terminals (3Q19), $380 MM cost(1) Pasadena terminal (early 2020), $410 MM cost(1) St. Charles alkylation unit (2020), $400 MM cost Pembroke cogeneration unit (2020), $170 MM cost Diamond pipeline expansion (2020), $100 MM cost(1) Diamond Green Diesel train II (late 2021), $550 MM cost(1) Port Arthur coker (2022), $975 MM cost Other projects in development phases Expanding product supply chain into Mexico and Latin America Increasing light products yield and octane enhancement in U.S. Gulf Coast Logistics for feedstock and product flexibility See slide 22 for notes regarding this slide. EBITDA estimates are illustrative. Excludes potential M&A. (1) Represents Valero’s share of total project cost.

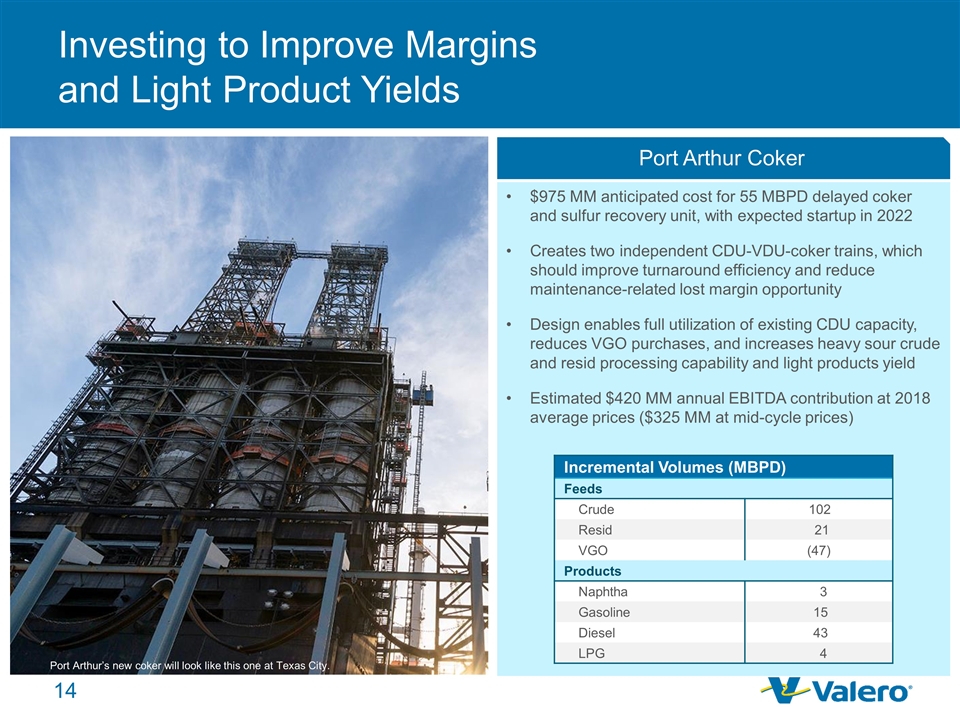

Investing to Improve Margins and Light Product Yields $975 MM anticipated cost for 55 MBPD delayed coker and sulfur recovery unit, with expected startup in 2022 Creates two independent CDU-VDU-coker trains, which should improve turnaround efficiency and reduce maintenance-related lost margin opportunity Design enables full utilization of existing CDU capacity, reduces VGO purchases, and increases heavy sour crude and resid processing capability and light products yield Estimated $420 MM annual EBITDA contribution at 2018 average prices ($325 MM at mid-cycle prices) Port Arthur Coker Port Arthur’s new coker will look like this one at Texas City. Incremental Volumes (MBPD) Feeds Crude 102 Resid 21 VGO (47) Products Naphtha 3 Gasoline 15 Diesel 43 LPG 4

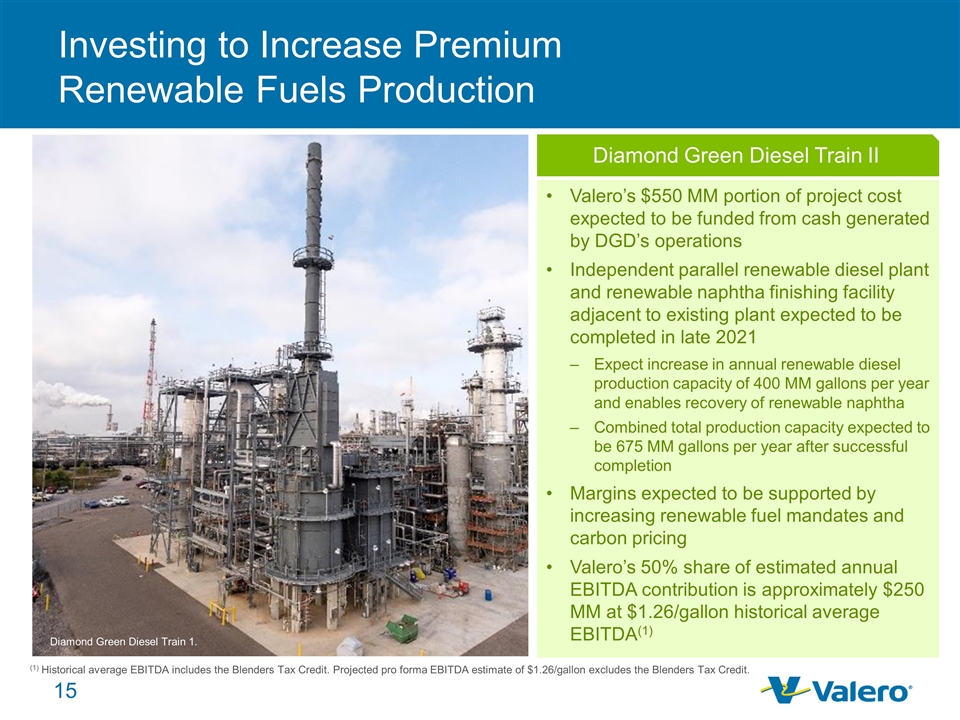

Valero’s $550 MM portion of project cost expected to be funded from cash generated by DGD’s operations Independent parallel renewable diesel plant and renewable naphtha finishing facility adjacent to existing plant expected to be completed in late 2021 Expect increase in annual renewable diesel production capacity of 400 MM gallons per year and enables recovery of renewable naphtha Combined total production capacity expected to be 675 MM gallons per year after successful completion Margins expected to be supported by increasing renewable fuel mandates and carbon pricing Valero’s 50% share of estimated annual EBITDA contribution is approximately $250 MM at $1.26/gallon historical average EBITDA(1) Investing to Increase Premium Renewable Fuels Production Diamond Green Diesel Train 1. Diamond Green Diesel Train II (1) Historical average EBITDA includes the Blenders Tax Credit. Projected pro forma EBITDA estimate of $1.26/gallon excludes the Blenders Tax Credit.

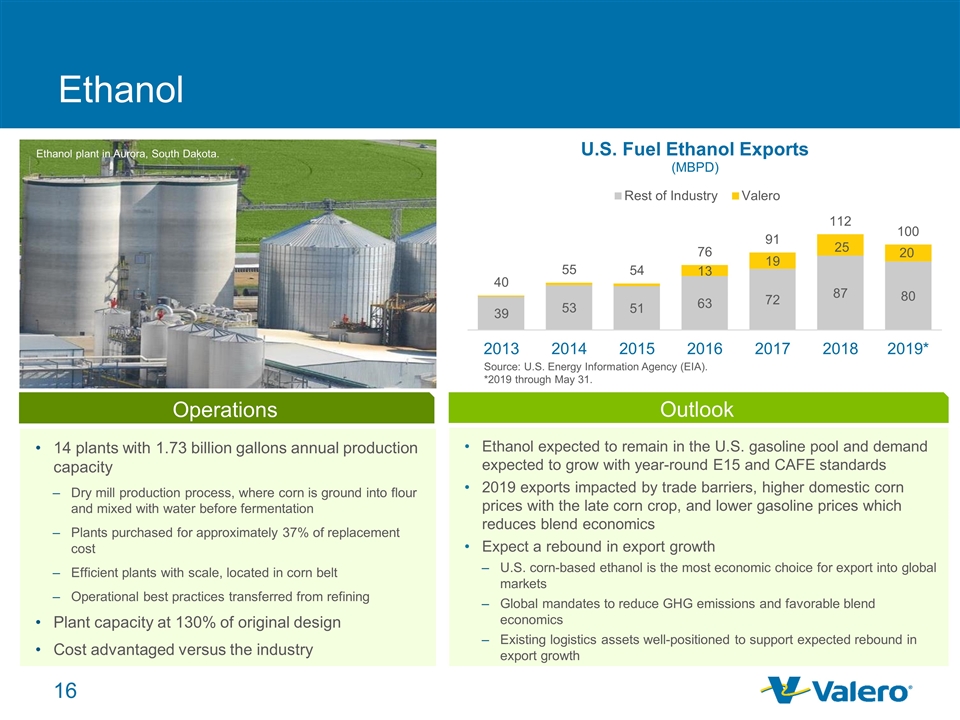

Ethanol Operations 14 plants with 1.73 billion gallons annual production capacity Dry mill production process, where corn is ground into flour and mixed with water before fermentation Plants purchased for approximately 37% of replacement cost Efficient plants with scale, located in corn belt Operational best practices transferred from refining Plant capacity at 130% of original design Cost advantaged versus the industry Outlook Ethanol expected to remain in the U.S. gasoline pool and demand expected to grow with year-round E15 and CAFE standards 2019 exports impacted by trade barriers, higher domestic corn prices with the late corn crop, and lower gasoline prices which reduces blend economics Expect a rebound in export growth U.S. corn-based ethanol is the most economic choice for export into global markets Global mandates to reduce GHG emissions and favorable blend economics Existing logistics assets well-positioned to support expected rebound in export growth Ethanol plant in Aurora, South Dakota. Source: U.S. Energy Information Agency (EIA). *2019 through May 31.

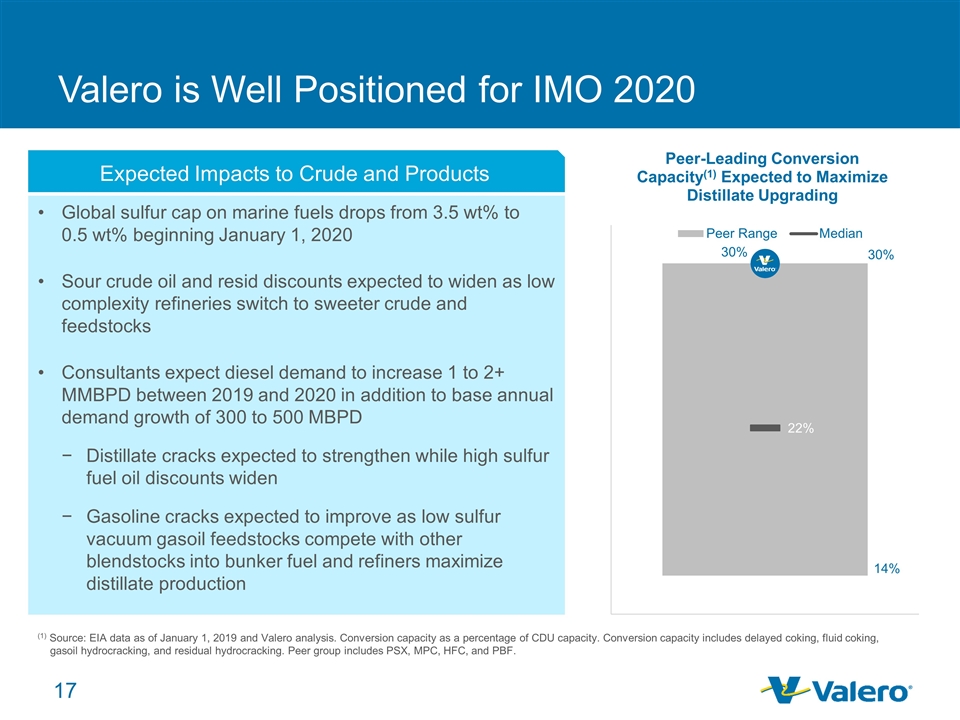

Valero is Well Positioned for IMO 2020 Expected Impacts to Crude and Products Global sulfur cap on marine fuels drops from 3.5 wt% to 0.5 wt% beginning January 1, 2020 Sour crude oil and resid discounts expected to widen as low complexity refineries switch to sweeter crude and feedstocks Consultants expect diesel demand to increase 1 to 2+ MMBPD between 2019 and 2020 in addition to base annual demand growth of 300 to 500 MBPD Distillate cracks expected to strengthen while high sulfur fuel oil discounts widen Gasoline cracks expected to improve as low sulfur vacuum gasoil feedstocks compete with other blendstocks into bunker fuel and refiners maximize distillate production (1) Source: EIA data as of January 1, 2019 and Valero analysis. Conversion capacity as a percentage of CDU capacity. Conversion capacity includes delayed coking, fluid coking, gasoil hydrocracking, and residual hydrocracking. Peer group includes PSX, MPC, HFC, and PBF.

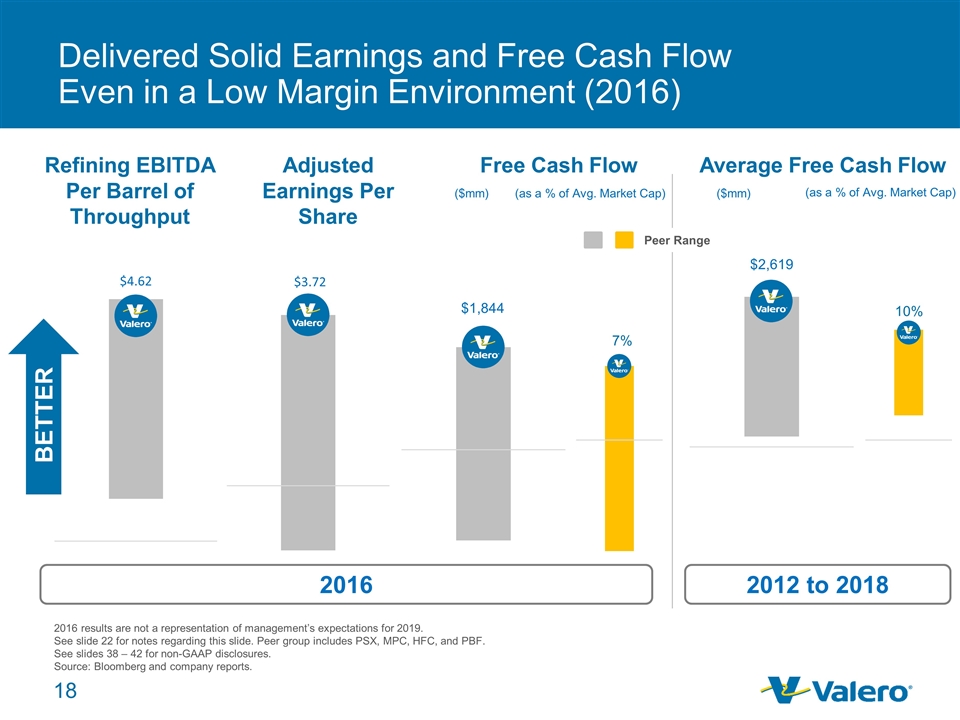

2016 results are not a representation of management’s expectations for 2019. See slide 22 for notes regarding this slide. Peer group includes PSX, MPC, HFC, and PBF. See slides 38 – 42 for non-GAAP disclosures. Source: Bloomberg and company reports. Refining EBITDA Per Barrel of Throughput Free Cash Flow BETTER Delivered Solid Earnings and Free Cash Flow Even in a Low Margin Environment (2016) Adjusted Earnings Per Share Peer Range Average Free Cash Flow ($mm) ($mm) (as a % of Avg. Market Cap) (as a % of Avg. Market Cap) 2016 2012 to 2018

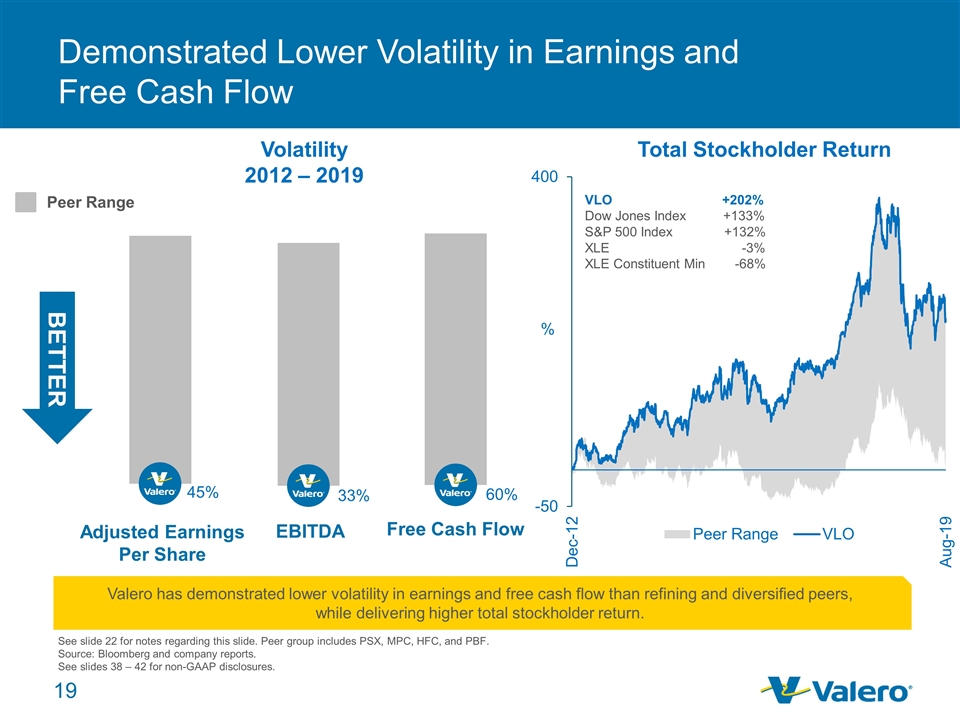

Demonstrated Lower Volatility in Earnings and Free Cash Flow See slide 22 for notes regarding this slide. Peer group includes PSX, MPC, HFC, and PBF. Source: Bloomberg and company reports. See slides 38 – 42 for non-GAAP disclosures. Volatility 2012 – 2019 Adjusted Earnings Per Share Free Cash Flow EBITDA Total Stockholder Return BETTER Peer Range Valero has demonstrated lower volatility in earnings and free cash flow than refining and diversified peers, while delivering higher total stockholder return.

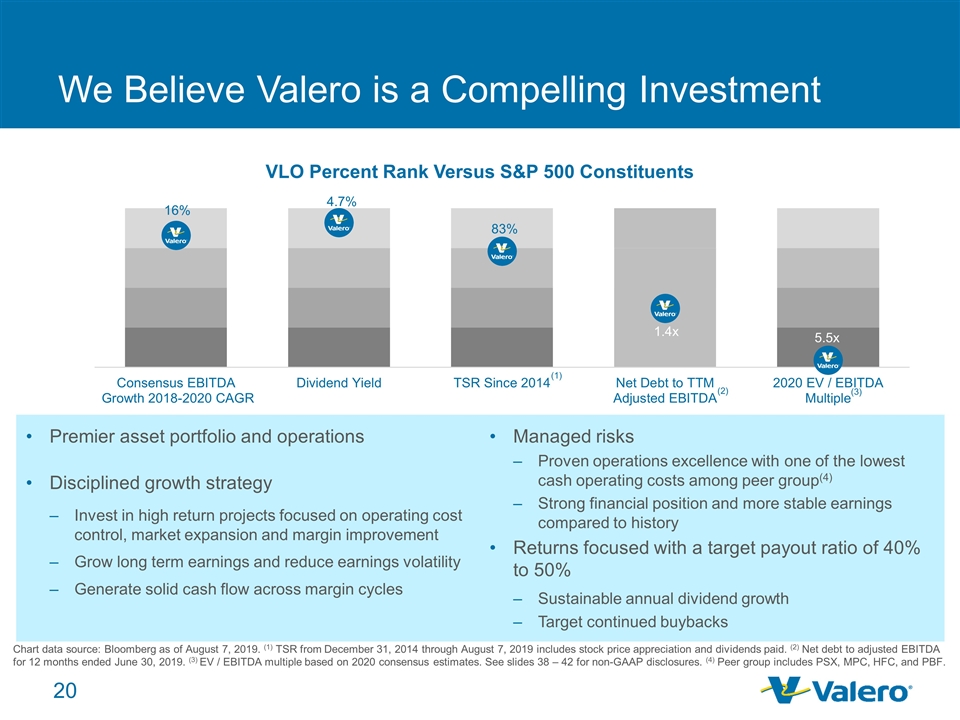

We Believe Valero is a Compelling Investment Premier asset portfolio and operations Disciplined growth strategy Invest in high return projects focused on operating cost control, market expansion and margin improvement Grow long term earnings and reduce earnings volatility Generate solid cash flow across margin cycles Managed risks Proven operations excellence with one of the lowest cash operating costs among peer group(4) Strong financial position and more stable earnings compared to history Returns focused with a target payout ratio of 40% to 50% Sustainable annual dividend growth Target continued buybacks Chart data source: Bloomberg as of August 7, 2019. (1) TSR from December 31, 2014 through August 7, 2019 includes stock price appreciation and dividends paid. (2) Net debt to adjusted EBITDA for 12 months ended June 30, 2019. (3) EV / EBITDA multiple based on 2020 consensus estimates. See slides 38 – 42 for non-GAAP disclosures. (4) Peer group includes PSX, MPC, HFC, and PBF. (1) (2) (3)

Appendix Contents Topic Pages Notes 22 Guidance 23 Environmental, Social and Governance (ESG) 24 Macro Environment Themes 25 Logistics Investments to Improve Feedstock Flexibility, Cost & Crude Quality 26 Valero Logistics Assets 27 Primary Export Markets 28 – 29 Project Price Set Assumptions 30 Projects in Execution Phase or Recently Completed 31 – 33 Refining Capacity and Nelson Complexity 34 Natural Gas Cost Sensitivity 35 Total Stockholder Return 36 A Shift In Refining Valuation 37 Non-GAAP Disclosures 38 – 42 Investor Relations Contacts 43

Notes Slide 9 Contractor total recordable incident rate from U.S. Bureau of Labor Statistics. Tier 1 three-year rolling averages of process safety events per 20,000 work hours. Tier 1 defined within API Recommended Practice 754. Industry benchmarking and Valero’s performance statistics from Solomon Associates and Valero. Slide 10 Industry benchmarking and Valero’s performance statistics from Solomon Associates and Valero. 2018 VLO performance is based on VLO projections. Refining cash operating expenses per barrel of throughput, excluding turnaround and D&A, from company reports. Slide 11 Crude distillation capacities by geographic location from 10-K filings and company reports. U.S. Gulf Coast region is consistent with EIA’s PADD 3; U.S. Mid-Continent region represents PADDs 2 and 4. Slide 12 Valero’s actual U.S. gasoline and distillate export volumes and current and potential future gasoline and distillate export capacities are shown in the chart. Potential future gasoline and distillate export capacities are based upon expansion opportunities identified at the St. Charles (gasoline and distillate), Port Arthur (gasoline and distillate), Corpus Christi (gasoline), and Texas City (distillate) refineries. Potential capacity also includes Pasadena terminal currently under construction. Map shows destinations for products exported from Valero’s refineries in the U.S., Canada and the U.K. Slide 13 Amounts shown represent targeted EBITDA growth. We are unable to provide a reconciliation of such forward-looking targets because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown financing terms, project timing and costs, and other potential variables. Accordingly, a reconciliation is not available without unreasonable effort. Slide 18 Refining EBITDA per barrel of throughput is defined as refining margin less operating expenses (excluding depreciation and amortization expenses) divided by total throughput volumes. VLO defines refining margin as refining operating income excluding operating expenses (excluding depreciation and amortization expense), depreciation and amortization expense, lower cost or market inventory valuation adjustment, and asset impairment loss. Earnings per share adjusted to exclude special or nonrecurring items. Free cash flow is defined as net cash provided by operating activities less capital expenditures, deferred turnaround and catalyst costs, investments in joint ventures, and changes in current assets and liabilities. Average free cash flow for PBF reflects years 2013 to 2018 due to its December 2012 IPO. Slide 19 Volatility expressed as coefficient of variance, or the standard deviation divided by the mean, of the respective metric on a quarterly basis from the first quarter of 2012 to the second quarter of 2019. EBITDA is defined as net income plus income tax, net interest and depreciation and amortization. TSR from December 31, 2012, through August 7, 2019. TSR includes stock price appreciation and dividends paid.

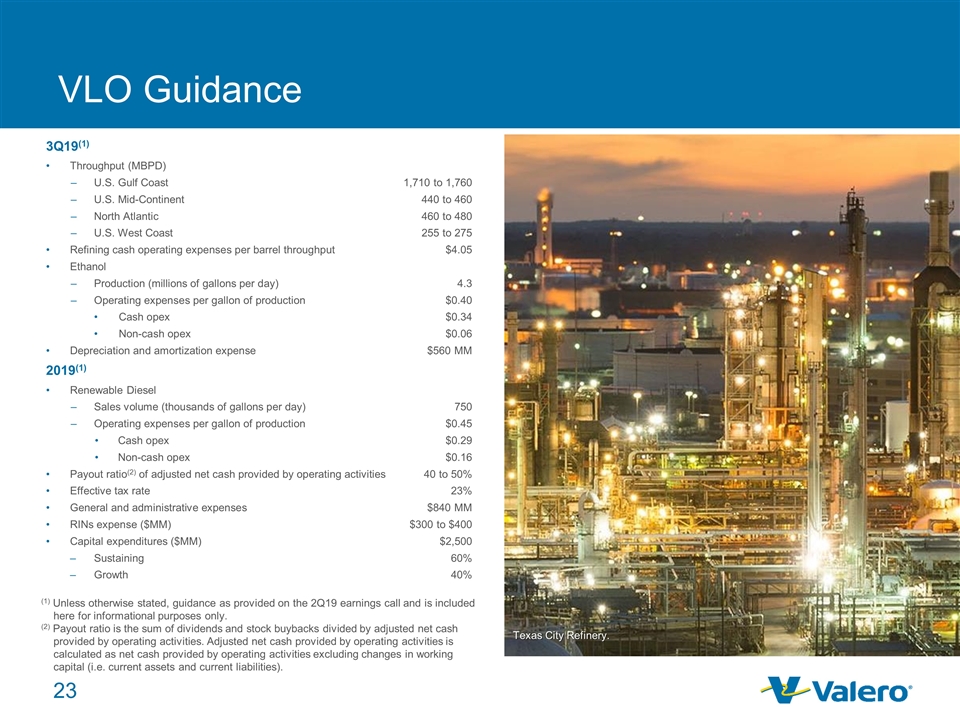

VLO Guidance 3Q19(1) Throughput (MBPD) U.S. Gulf Coast1,710 to 1,760 U.S. Mid-Continent 440 to 460 North Atlantic460 to 480 U.S. West Coast255 to 275 Refining cash operating expenses per barrel throughput$4.05 Ethanol Production (millions of gallons per day)4.3 Operating expenses per gallon of production$0.40 Cash opex$0.34 Non-cash opex$0.06 Depreciation and amortization expense$560 MM 2019(1) Renewable Diesel Sales volume (thousands of gallons per day)750 Operating expenses per gallon of production$0.45 Cash opex$0.29 Non-cash opex$0.16 Payout ratio(2) of adjusted net cash provided by operating activities40 to 50% Effective tax rate23% General and administrative expenses$840 MM RINs expense ($MM)$300 to $400 Capital expenditures ($MM) $2,500 Sustaining 60% Growth40% (1) Unless otherwise stated, guidance as provided on the 2Q19 earnings call and is included here for informational purposes only. (2) Payout ratio is the sum of dividends and stock buybacks divided by adjusted net cash provided by operating activities. Adjusted net cash provided by operating activities is calculated as net cash provided by operating activities excluding changes in working capital (i.e. current assets and current liabilities). Texas City Refinery.

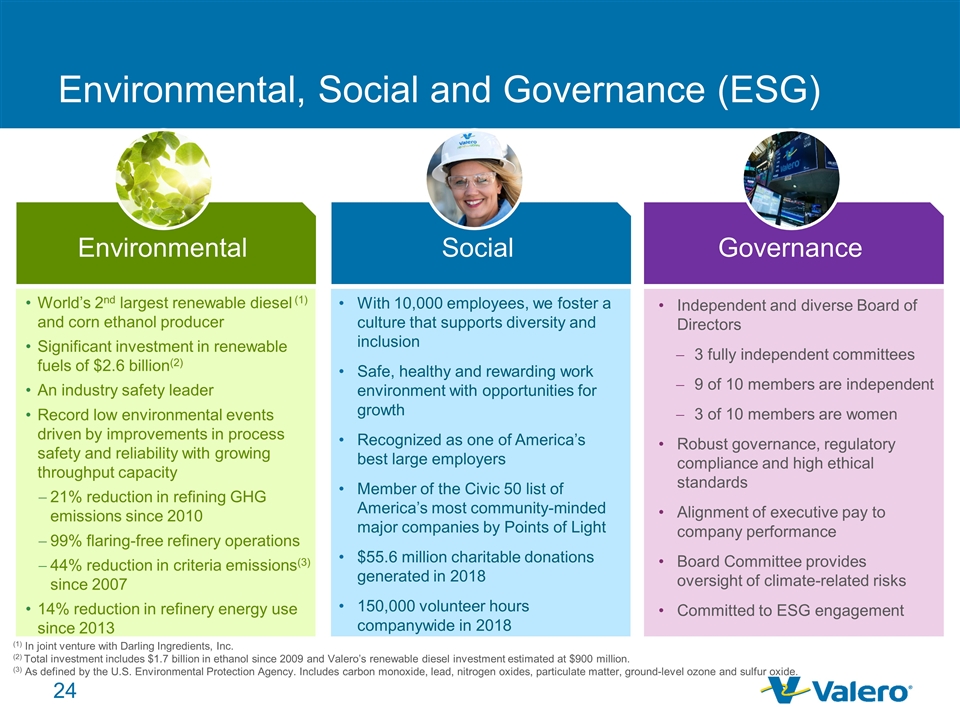

World’s 2nd largest renewable diesel (1) and corn ethanol producer Significant investment in renewable fuels of $2.6 billion(2) An industry safety leader Record low environmental events driven by improvements in process safety and reliability with growing throughput capacity 21% reduction in refining GHG emissions since 2010 99% flaring-free refinery operations 44% reduction in criteria emissions(3) since 2007 14% reduction in refinery energy use since 2013 Environmental, Social and Governance (ESG) Environmental Social Governance With 10,000 employees, we foster a culture that supports diversity and inclusion Safe, healthy and rewarding work environment with opportunities for growth Recognized as one of America’s best large employers Member of the Civic 50 list of America’s most community-minded major companies by Points of Light $55.6 million charitable donations generated in 2018 150,000 volunteer hours companywide in 2018 Independent and diverse Board of Directors 3 fully independent committees 9 of 10 members are independent 3 of 10 members are women Robust governance, regulatory compliance and high ethical standards Alignment of executive pay to company performance Board Committee provides oversight of climate-related risks Committed to ESG engagement (1) In joint venture with Darling Ingredients, Inc. (2) Total investment includes $1.7 billion in ethanol since 2009 and Valero’s renewable diesel investment estimated at $900 million. (3) As defined by the U.S. Environmental Protection Agency. Includes carbon monoxide, lead, nitrogen oxides, particulate matter, ground-level ozone and sulfur oxide. Social Environmental Governance

FEEDSTOCK SUPPLY Abundant and growing supply of crude oil and natural gas Expanding North American logistics capacity continues to add efficiency to crude oil movements, particularly in the U.S. Gulf Coast Supportive Macro Environment Expected PRODUCT DEMAND Macro environment themes represent industry consultant views. See slide 28 for supply and demand details. REGULATORY AND GEOPOLITICAL Evolving U.S. legislative and regulatory landscape Emerging global developments Positive fundamentals continue to drive global transportation fuels growth. Economic growth continues to generate rising product demand Price environment remains favorable for healthy product demand Bunker fuel specification change expected to increase distillate demand Product shortages in Latin America, Eastern Canada, Europe and Africa

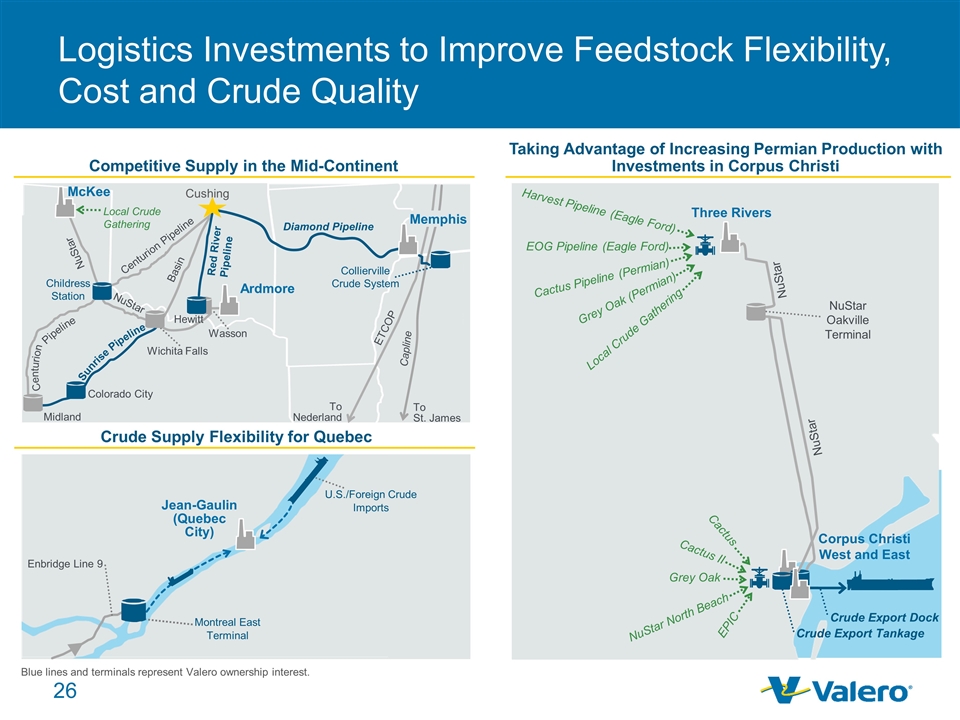

Logistics Investments to Improve Feedstock Flexibility, Cost and Crude Quality Valero Terminals Valero Refineries Pipelines Terminal Projects Pipelines Projects Export Dock Projects Competitive Supply in the Mid-Continent Taking Advantage of Increasing Permian Production with Investments in Corpus Christi Crude Supply Flexibility for Quebec Jean-Gaulin (Quebec City) Montreal East Terminal Enbridge Line 9 Diamond Pipeline Cushing Capline Midland Colorado City Sunrise Pipeline Red River Pipeline Childress Station Wichita Falls Hewitt McKee Ardmore Collierville Crude System Centurion Pipeline ETCOP Basin Cactus Pipeline (Permian) EOG Pipeline (Eagle Ford) Grey Oak (Permian) Harvest Pipeline (Eagle Ford) EPIC NuStar North Beach Cactus Three Rivers Corpus Christi West and East Cactus II Grey Oak Crude Export Tankage Crude Export Dock NuStar NuStar Oakville Terminal U.S./Foreign Crude Imports To Nederland To St. James Centurion Pipeline Memphis Blue lines and terminals represent Valero ownership interest. NuStar Wasson NuStar NuStar Local Crude Gathering Local Crude Gathering

Valero Logistics Assets Racks, Terminals and Storage(1) Over 123 million barrels of active shell capacity for crude oil and products Over 200 truck rack bays Rail Approximately 5,250 purchased railcars Expected to serve long-term needs of ethanol, asphalt, aromatics, and other products Pipelines(1) Approximately 2,900 miles of active pipelines Diamond Pipeline from Cushing to Memphis started up in November 2017 Sunrise Pipeline expansion in Permian started up in November 2018 Marine(1) Over 50 docks Two Panamax class vessels (joint venture) (1) Includes assets that have other joint venture or minority interests. Does not include ethanol assets.

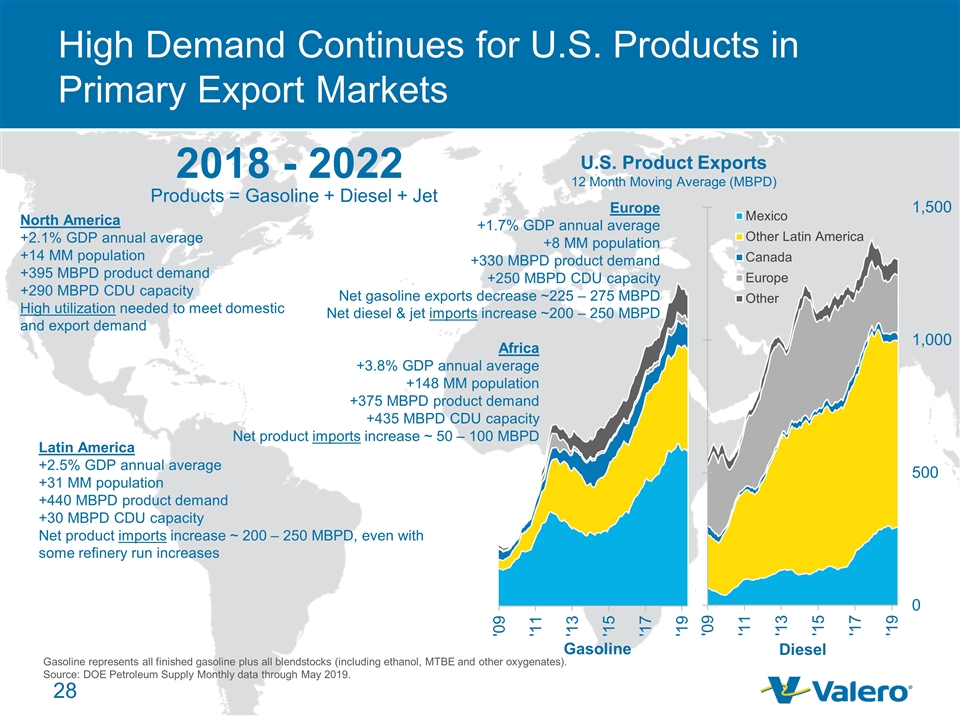

High Demand Continues for U.S. Products in Primary Export Markets North America +2.1% GDP annual average +14 MM population +395 MBPD product demand +290 MBPD CDU capacity High utilization needed to meet domestic and export demand Latin America +2.5% GDP annual average +31 MM population +440 MBPD product demand +30 MBPD CDU capacity Net product imports increase ~ 200 – 250 MBPD, even with some refinery run increases Africa +3.8% GDP annual average +148 MM population +375 MBPD product demand +435 MBPD CDU capacity Net product imports increase ~ 50 – 100 MBPD 2018 - 2022 Products = Gasoline + Diesel + Jet Gasoline represents all finished gasoline plus all blendstocks (including ethanol, MTBE and other oxygenates). Source: DOE Petroleum Supply Monthly data through May 2019. U.S. Product Exports 12 Month Moving Average (MBPD) Europe +1.7% GDP annual average +8 MM population +330 MBPD product demand +250 MBPD CDU capacity Net gasoline exports decrease ~225 – 275 MBPD Net diesel & jet imports increase ~200 – 250 MBPD

Investing to Grow Product Placement into Higher Netback Markets (1) Includes terminals owned or leased by Valero. (1) U.S. Product Exports 12 Month Moving Average (MBPD) 72% Advantaged Refineries and Logistics Expansion of supply chain to high demand growth markets provides ratable product outlet and improves margin capture. Source: DOE Petroleum Supply Monthly data through May 2019. (2) Gasoline represents all finished gasoline plus all blendstocks (including ethanol, MTBE and other oxygenates).

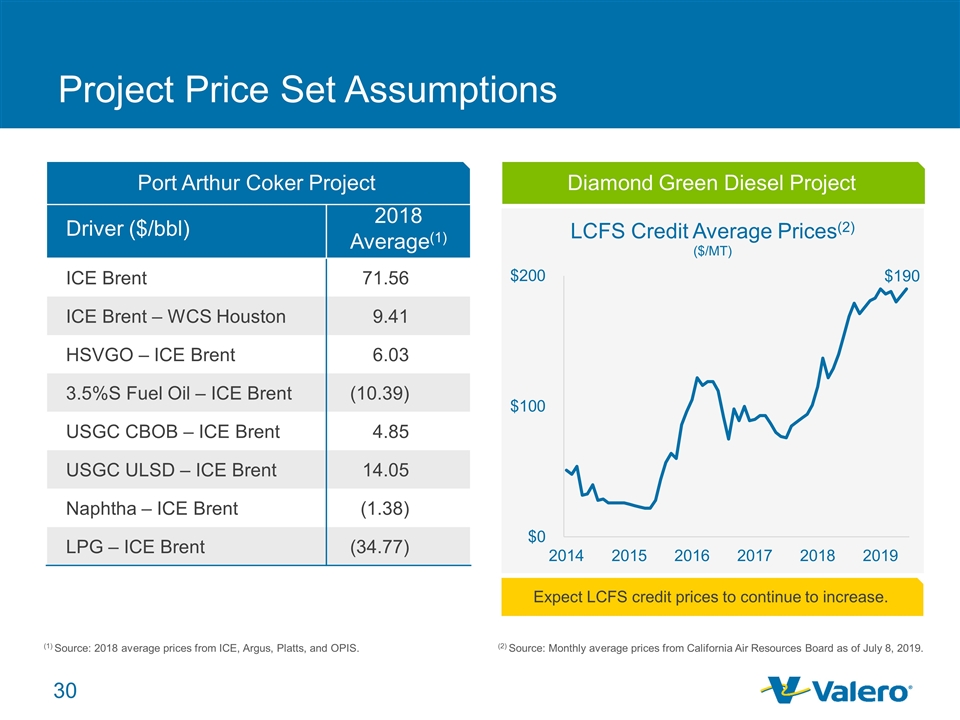

Project Price Set Assumptions Driver ($/bbl) 2018 Average(1) ICE Brent 71.56 ICE Brent – WCS Houston 9.41 HSVGO – ICE Brent 6.03 3.5%S Fuel Oil – ICE Brent (10.39) USGC CBOB – ICE Brent 4.85 USGC ULSD – ICE Brent 14.05 Naphtha – ICE Brent (1.38) LPG – ICE Brent (34.77) Expect LCFS credit prices to continue to increase. (1) Source: 2018 average prices from ICE, Argus, Platts, and OPIS. Port Arthur Coker Project Diamond Green Diesel Project (2) Source: Monthly average prices from California Air Resources Board as of July 8, 2019.

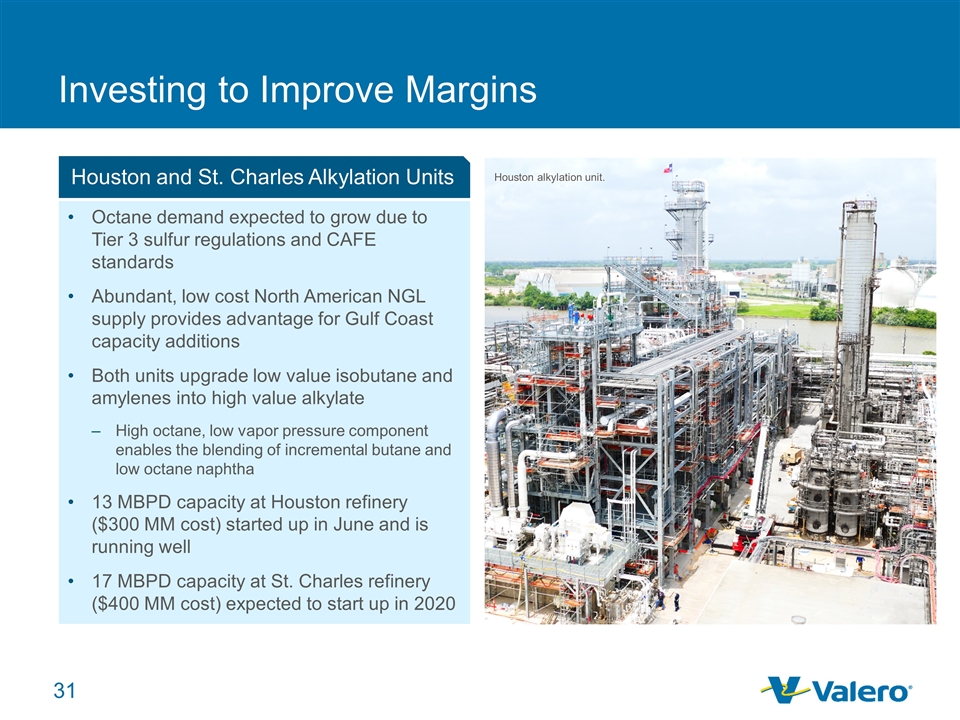

Investing to Improve Margins Octane demand expected to grow due to Tier 3 sulfur regulations and CAFE standards Abundant, low cost North American NGL supply provides advantage for Gulf Coast capacity additions Both units upgrade low value isobutane and amylenes into high value alkylate High octane, low vapor pressure component enables the blending of incremental butane and low octane naphtha 13 MBPD capacity at Houston refinery ($300 MM cost) started up in June and is running well 17 MBPD capacity at St. Charles refinery ($400 MM cost) expected to start up in 2020 Houston and St. Charles Alkylation Units Houston alkylation unit.

Investing to Improve Access to North American Crude and Refinery Operating Cost Structure Diamond 200 MBPD capacity connecting Memphis to Cushing ($460 MM cost(1)), and Sunrise 100 MBPD undivided interest connecting Midland to Wichita Falls ($135 MM cost(1)) 200 MBPD expansion and extension of Diamond ($100 MM cost(1)) expected to be completed in 2020 Provides additional Mid-Continent crude access to our McKee, Ardmore and Memphis refineries Improves crude oil supply flexibility, efficiency and blend quality Wilmington facility ($110 MM cost) started up in November 2017 Pembroke plant (£130 MM or $170 MM cost) scheduled to be completed in 2020 Expect to reduce costs and improve supply reliability for power and steam Cogeneration Plants Diamond and Sunrise Pipelines Diamond pipeline. Wilmington cogeneration plant. (1) Project cost for Valero’s 50% share of Diamond and 20% undivided interest in Sunrise.

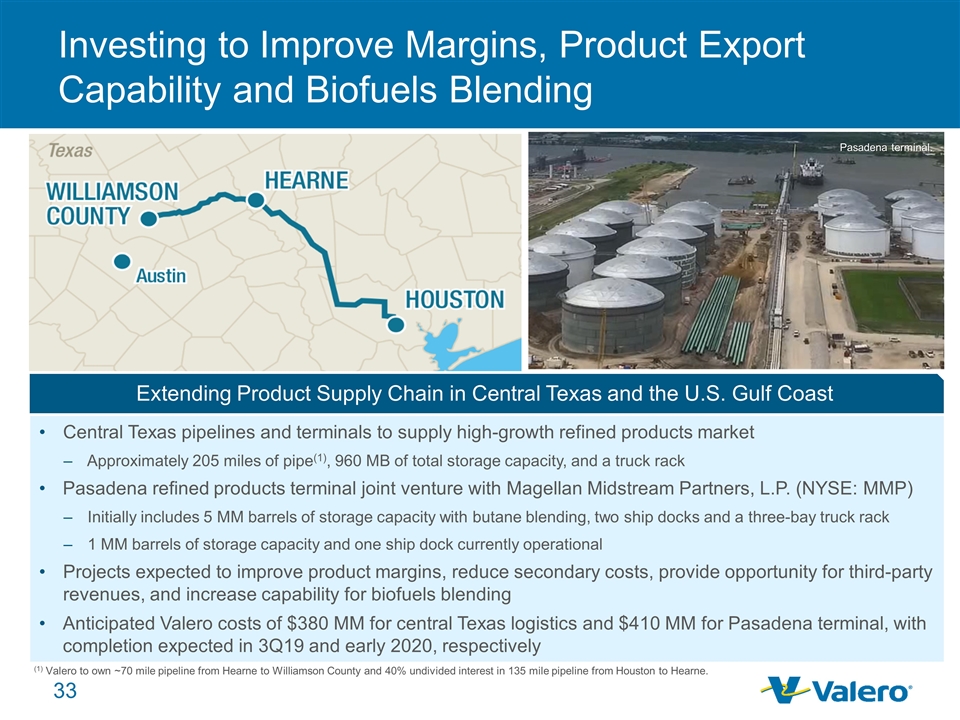

Investing to Improve Margins, Product Export Capability and Biofuels Blending Central Texas pipelines and terminals to supply high-growth refined products market Approximately 205 miles of pipe(1), 960 MB of total storage capacity, and a truck rack Pasadena refined products terminal joint venture with Magellan Midstream Partners, L.P. (NYSE: MMP) Initially includes 5 MM barrels of storage capacity with butane blending, two ship docks and a three-bay truck rack 1 MM barrels of storage capacity and one ship dock currently operational Projects expected to improve product margins, reduce secondary costs, provide opportunity for third-party revenues, and increase capability for biofuels blending Anticipated Valero costs of $380 MM for central Texas logistics and $410 MM for Pasadena terminal, with completion expected in 3Q19 and early 2020, respectively (1) Valero to own ~70 mile pipeline from Hearne to Williamson County and 40% undivided interest in 135 mile pipeline from Houston to Hearne. Extending Product Supply Chain in Central Texas and the U.S. Gulf Coast Pasadena terminal.

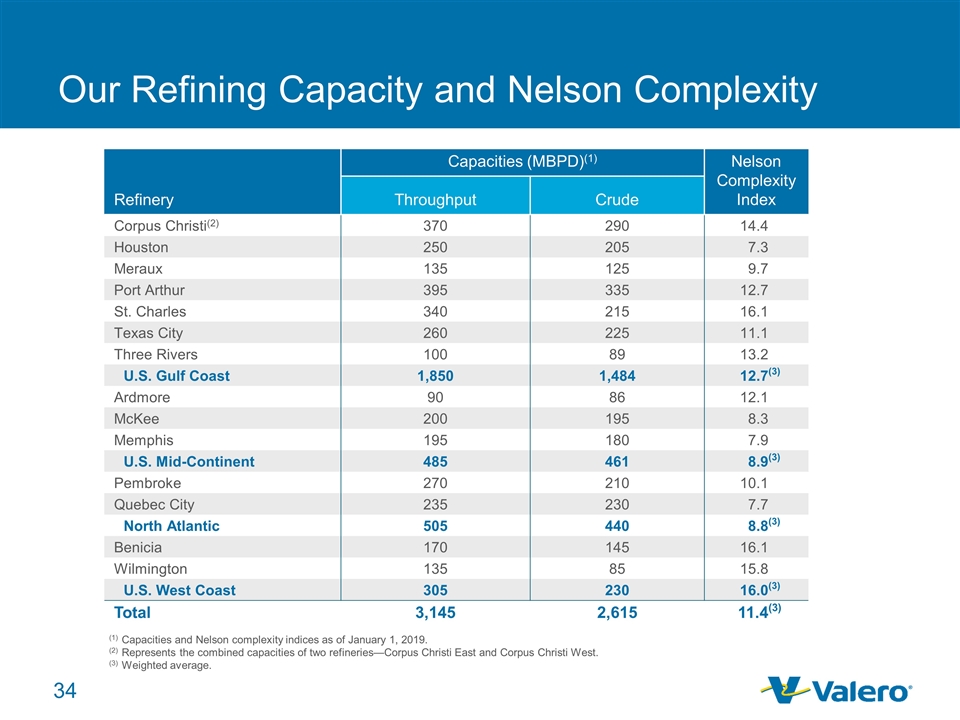

Our Refining Capacity and Nelson Complexity Refinery Capacities (MBPD)(1) Nelson Complexity Index Throughput Crude Corpus Christi(2) 370 290 14.4 Houston 250 205 7.3 Meraux 135 125 9.7 Port Arthur 395 335 12.7 St. Charles 340 215 16.1 Texas City 260 225 11.1 Three Rivers 100 89 13.2 U.S. Gulf Coast 1,850 1,484 12.7 (3) Ardmore 90 86 12.1 McKee 200 195 8.3 Memphis 195 180 7.9 U.S. Mid-Continent 485 461 8.9 (3) Pembroke 270 210 10.1 Quebec City 235 230 7.7 North Atlantic 505 440 8.8 (3) Benicia 170 145 16.1 Wilmington 135 85 15.8 U.S. West Coast 305 230 16.0 (3) Total 3,145 2,615 11.4 (3) (1)Capacities and Nelson complexity indices as of January 1, 2019. (2)Represents the combined capacities of two refineries—Corpus Christi East and Corpus Christi West. (3)Weighted average.

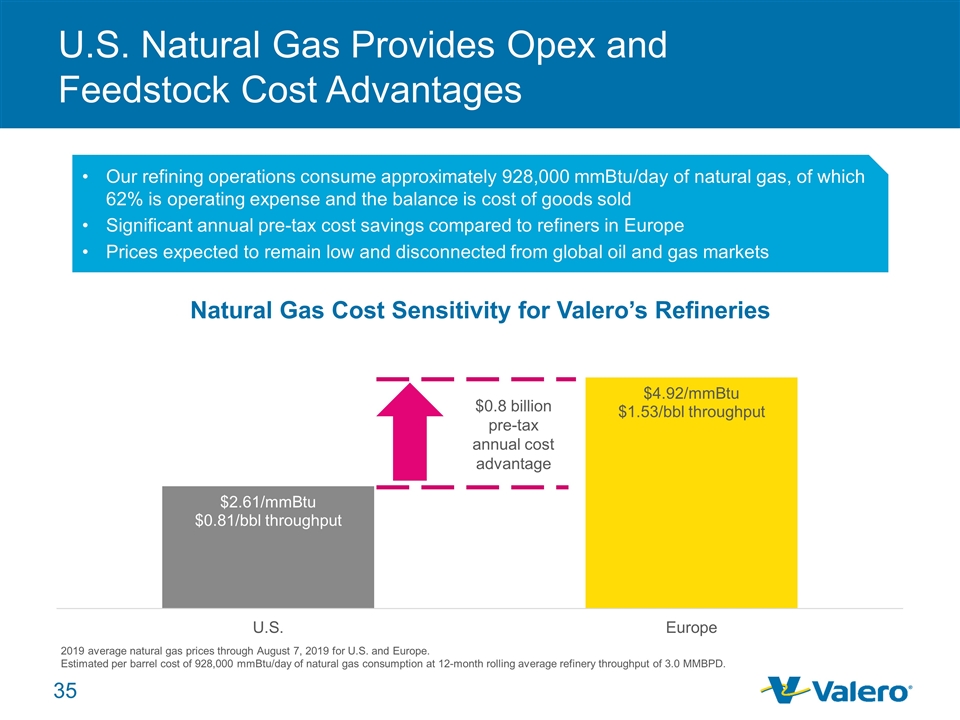

U.S. Natural Gas Provides Opex and Feedstock Cost Advantages 2019 average natural gas prices through August 7, 2019 for U.S. and Europe. Estimated per barrel cost of 928,000 mmBtu/day of natural gas consumption at 12-month rolling average refinery throughput of 3.0 MMBPD. $0.8 billion pre-tax annual cost advantage Our refining operations consume approximately 928,000 mmBtu/day of natural gas, of which 62% is operating expense and the balance is cost of goods sold Significant annual pre-tax cost savings compared to refiners in Europe Prices expected to remain low and disconnected from global oil and gas markets

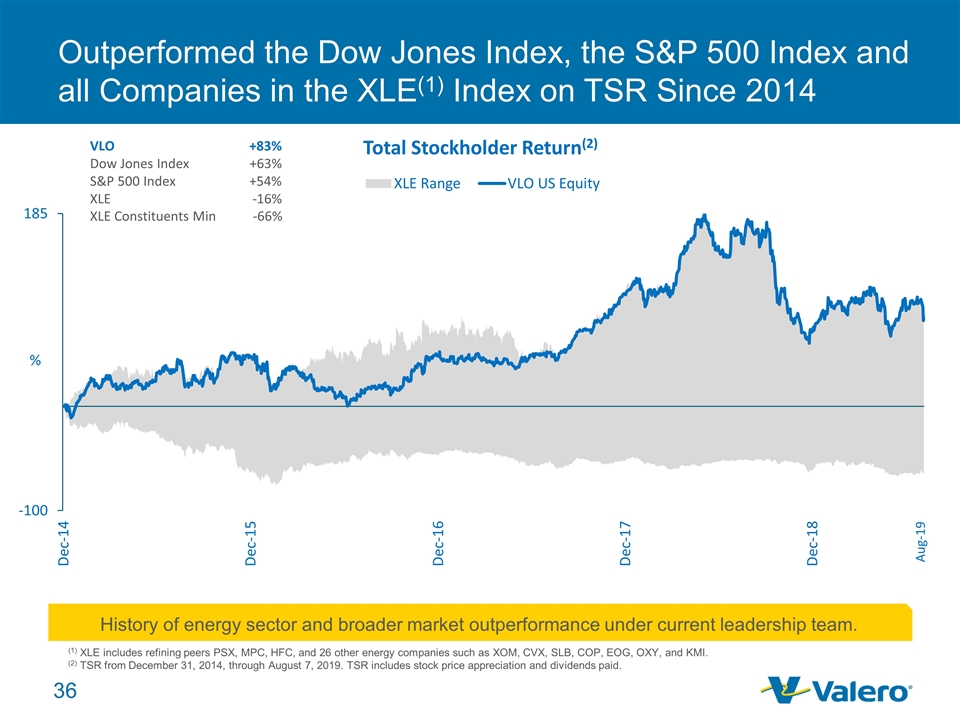

Outperformed the Dow Jones Index, the S&P 500 Index and all Companies in the XLE(1) Index on TSR Since 2014 (1) XLE includes refining peers PSX, MPC, HFC, and 26 other energy companies such as XOM, CVX, SLB, COP, EOG, OXY, and KMI. (2) TSR from December 31, 2014, through August 7, 2019. TSR includes stock price appreciation and dividends paid. History of energy sector and broader market outperformance under current leadership team. May-19

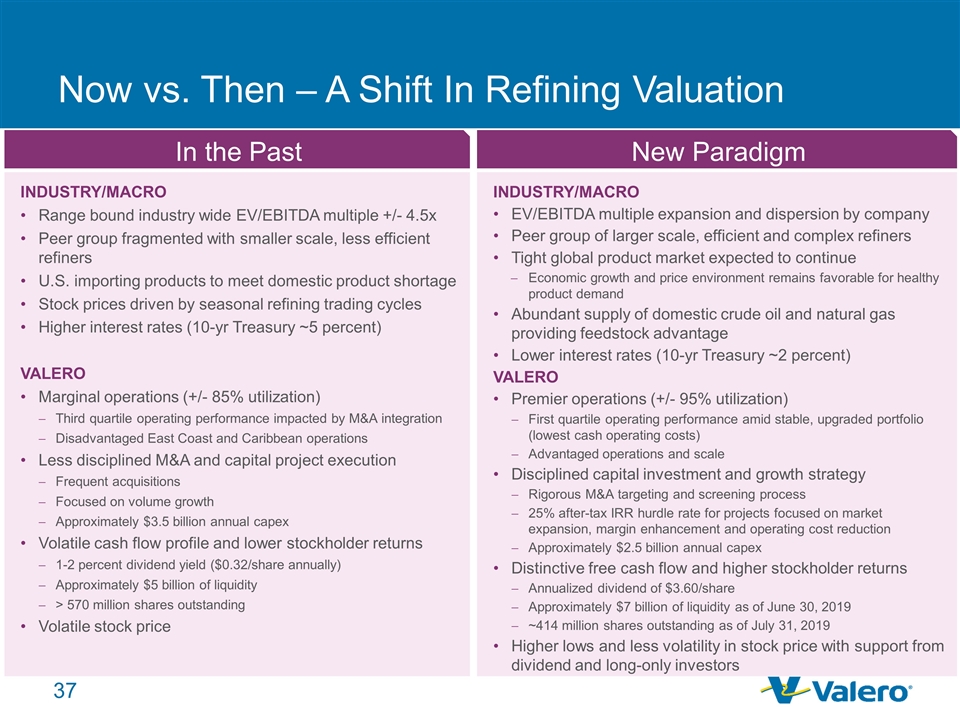

In the Past INDUSTRY/MACRO Range bound industry wide EV/EBITDA multiple +/- 4.5x Peer group fragmented with smaller scale, less efficient refiners U.S. importing products to meet domestic product shortage Stock prices driven by seasonal refining trading cycles Higher interest rates (10-yr Treasury ~5 percent) VALERO Marginal operations (+/- 85% utilization) Third quartile operating performance impacted by M&A integration Disadvantaged East Coast and Caribbean operations Less disciplined M&A and capital project execution Frequent acquisitions Focused on volume growth Approximately $3.5 billion annual capex Volatile cash flow profile and lower stockholder returns 1-2 percent dividend yield ($0.32/share annually) Approximately $5 billion of liquidity > 570 million shares outstanding Volatile stock price Now vs. Then – A Shift In Refining Valuation New Paradigm INDUSTRY/MACRO EV/EBITDA multiple expansion and dispersion by company Peer group of larger scale, efficient and complex refiners Tight global product market expected to continue Economic growth and price environment remains favorable for healthy product demand Abundant supply of domestic crude oil and natural gas providing feedstock advantage Lower interest rates (10-yr Treasury ~2 percent) VALERO Premier operations (+/- 95% utilization) First quartile operating performance amid stable, upgraded portfolio (lowest cash operating costs) Advantaged operations and scale Disciplined capital investment and growth strategy Rigorous M&A targeting and screening process 25% after-tax IRR hurdle rate for projects focused on market expansion, margin enhancement and operating cost reduction Approximately $2.5 billion annual capex Distinctive free cash flow and higher stockholder returns Annualized dividend of $3.60/share Approximately $7 billion of liquidity as of June 30, 2019 ~414 million shares outstanding as of July 31, 2019 Higher lows and less volatility in stock price with support from dividend and long-only investors

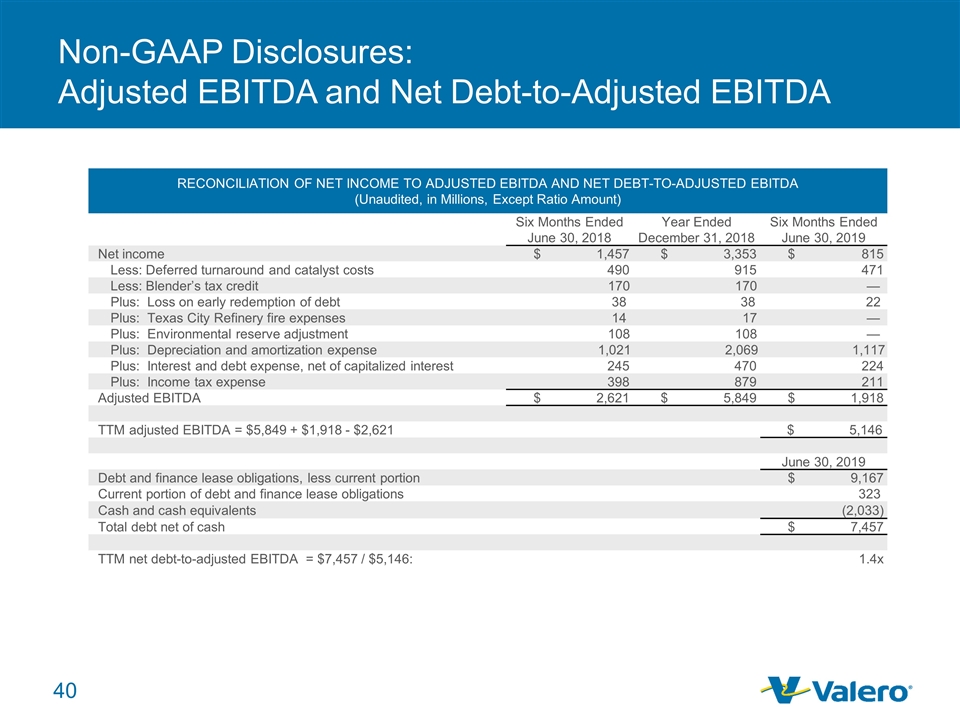

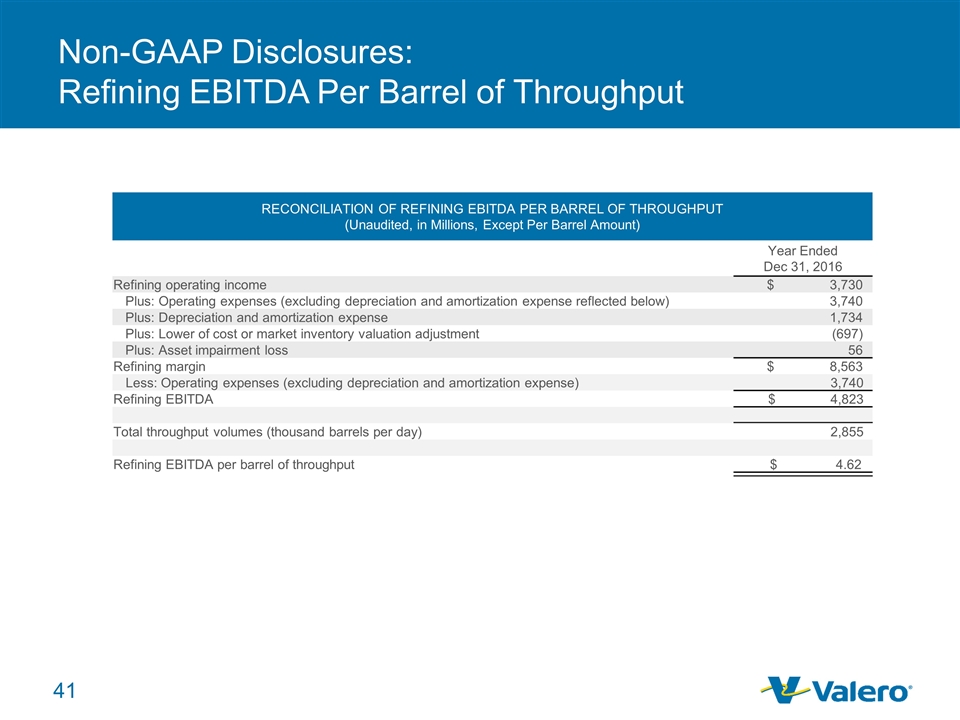

Non-GAAP Disclosures Adjusted EBITDA and Net Debt-to-Adjusted EBITDA VLO defines EBITDA as net income before income tax expense, interest and debt expense, net of capitalized interest, and depreciation and amortization expense. VLO defines net debt-to-adjusted EBITDA as the ratio of total debt, net of cash, divided by adjusted EBITDA, which is defined as EBITDA further adjusted for deferred turnaround and catalyst costs, blender’s tax credit, loss on early redemption of debt, Texas City fire expenses, and environmental reserve adjustment. VLO defines adjusted EBITDA for the trailing 12-month period (TTM) as the sum of adjusted EBITDA for the year ended Dec 31, 2018 and the six months ended June 30, 2019, less that for the six months ended June 30, 2018. VLO believes that the presentation of adjusted EBITDA provides useful information to investors to assess our ongoing financial performance because, when reconciled to net income, it provides improved comparability between periods through the exclusion of certain items that VLO believes are not indicative of our core operating performance and that may obscure our underlying business results and trends. VLO believes that the presentation of net debt-to-adjusted EBITDA provides useful information to investors to assess VLO’s ability to incur and service debt. The GAAP measures most directly comparable to adjusted EBITDA are net income and net cash provided by operating activities. Adjusted EBITDA should not be considered an alternative to net income or net cash provided by operating activities presented in accordance with GAAP. Adjusted EBITDA has important limitations as an analytical tool because it excludes some, but not all, items that affect net income or net cash provided by operating activities. Adjusted EBITDA should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Additionally, because adjusted EBITDA may be defined differently by other companies in our industry, VLO’s definition of adjusted EBITDA may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. Refining EBITDA Per Barrel of Throughput VLO defines refining EBITDA per barrel of throughput as refining margin less operating expenses (excluding depreciation and amortization expenses) divided by total throughput volumes. VLO defines refining margin as refining operating income excluding operating expenses (excluding depreciation and amortization expense), depreciation and amortization expense, lower cost or market inventory valuation adjustment, and asset impairment loss. VLO believes refining EBITDA provides useful information to investors to assess our ongoing financial performance because, when reconciled to refining operating income, it provides improved comparability between periods through the exclusion of certain items that VLO believes are not indicative of our core operating performance and that may obscure our underlying business results and trends. The GAAP measure most directly comparable to refining EBITDA is refining operating income. Refining EBITDA should not be considered an alternative to refining operating income presented in accordance with GAAP. Refining EBITDA has important limitations as an analytical tool because it excludes some, but not all, items that affect refining operating income. Refining EBITDA should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Additionally, because refining EBITDA may be defined differently by other companies in our industry, VLO’s definition of refining EBITDA may not be comparable to similarly titled measures of other companies, thereby diminishing its utility.

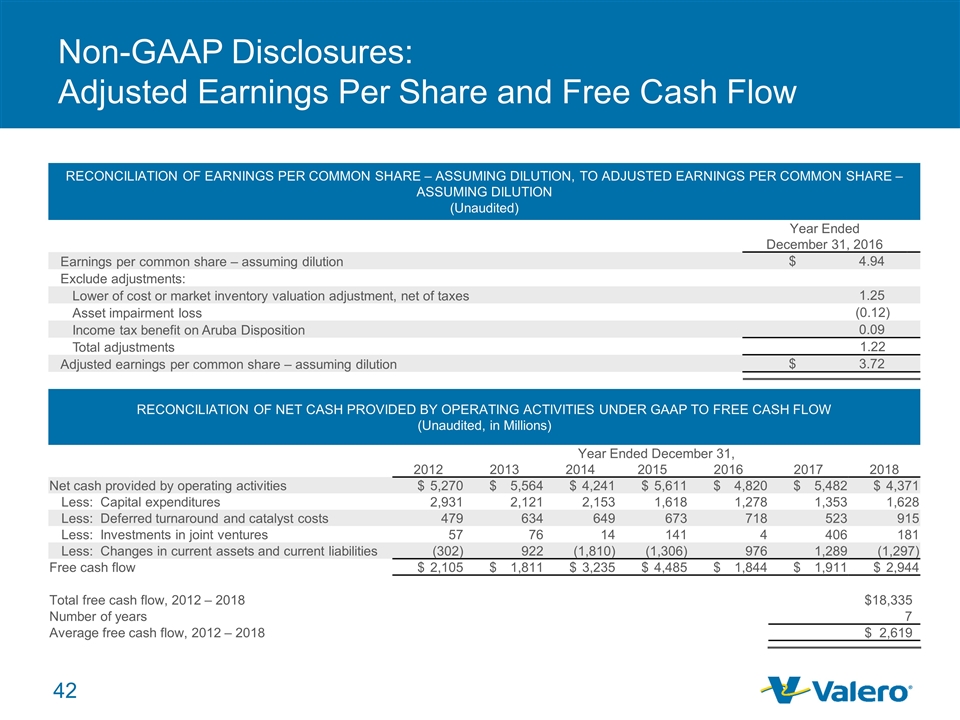

Non-GAAP Disclosures (continued) Adjusted Earnings Per Common Share – assuming dilution VLO defines adjusted earnings per common share – assuming dilution as earnings per common share – assuming dilution excluding the lower of cost or market inventory valuation adjustment and its related income tax effect, asset impairment losses and the income tax benefit from the Aruba disposition. VLO believes this measure is useful to assess our ongoing financial performance because, when reconciled to earnings per common share – assuming dilution, it provides improved comparability between periods through the exclusion of certain items that VLO believes are not indicative of our core operating performance and that their exclusion results in an important measure of our ongoing financial performance to better assess our underlying business results and trends. The GAAP measures most directly comparable to adjusted earnings per common share – assuming dilution are earnings per common share – assuming dilution. Adjusted earnings per common share – assuming dilution should not be considered an alternative to earnings per common share – assuming dilution presented in accordance with GAAP. Adjusted earnings per common share – assuming dilution has important limitations as an analytical tool because it excludes some, but not all, items that affect earnings per common share – assuming dilution. Adjusted earnings per common share – assuming dilution should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Additionally, because adjusted earnings per common share – assuming dilution may be defined differently by other companies in our industry, VLO’s definition of adjusted earnings per common share – assuming dilution may not be comparable to similarly titled measures of other companies, thereby diminishing its utility. Free Cash Flow VLO defines free cash flow as net cash provided by operating activities less capital expenditures, deferred turnaround and catalyst costs, investments in joint ventures, and changes in current assets and liabilities. VLO believes that the presentation of free cash flow provides useful information to investors in assessing our ability to cover ongoing costs and our ability to generate cash returns to stockholders. The GAAP measures most directly comparable to free cash flow are net cash provided by operating activities and net cash used in investing activities. Free cash flow should not be considered an alternative to net cash provided by operating activities or net cash used in investing activities presented in accordance with GAAP. Free cash flow has important limitations as an analytical tool because it excludes some, but not all, items that affect net cash provided by operating activities or net cash used in investing activities. Free cash flow should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Additionally, because free cash flow may be defined differently by other companies in our industry, VLO’s definition of free cash flow may not be comparable to similarly titled measures of other companies, thereby diminishing its utility.

Non-GAAP Disclosures: Adjusted EBITDA and Net Debt-to-Adjusted EBITDA RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA AND NET DEBT-TO-ADJUSTED EBITDA (Unaudited, in Millions, Except Ratio Amount) Six Months Ended June 30, 2018 Year Ended December 31, 2018 Six Months Ended June 30, 2019 Net income $1,457 $3,353 $815 Less: Deferred turnaround and catalyst costs 490 915 471 Less: Blender’s tax credit 170 170 — Plus: Loss on early redemption of debt 38 38 22 Plus: Texas City Refinery fire expenses 14 17 — Plus: Environmental reserve adjustment 108 108 — Plus: Depreciation and amortization expense 1,021 2,069 1,117 Plus: Interest and debt expense, net of capitalized interest 245 470 224 Plus: Income tax expense 398 879 211 Adjusted EBITDA $2,621 $5,849 $1,918 TTM adjusted EBITDA = $5,849 + $1,918 - $2,621 $ 5,146 June 30, 2019 Debt and finance lease obligations, less current portion $9,167 Current portion of debt and finance lease obligations 323 Cash and cash equivalents (2,033) Total debt net of cash $7,457 TTM net debt-to-adjusted EBITDA = $7,457 / $5,146: 1.4x

Non-GAAP Disclosures: Refining EBITDA Per Barrel of Throughput RECONCILIATION OF REFINING EBITDA PER BARREL OF THROUGHPUT (Unaudited, in Millions, Except Per Barrel Amount) Year Ended Dec 31, 2016 Refining operating income $3,730 Plus: Operating expenses (excluding depreciation and amortization expense reflected below) 3,740 Plus: Depreciation and amortization expense 1,734 Plus: Lower of cost or market inventory valuation adjustment (697) Plus: Asset impairment loss 56 Refining margin $8,563 Less: Operating expenses (excluding depreciation and amortization expense) 3,740 Refining EBITDA $ 4,823 Total throughput volumes (thousand barrels per day) 2,855 Refining EBITDA per barrel of throughput $ 4.62

Non-GAAP Disclosures: Adjusted Earnings Per Share and Free Cash Flow RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES UNDER GAAP TO FREE CASH FLOW (Unaudited, in Millions) Year Ended December 31, 2012 2013 2014 2015 2016 2017 2018 Net cash provided by operating activities $5,270 $5,564 $4,241 $5,611 $4,820 $5,482 $4,371 Less: Capital expenditures 2,931 2,121 2,153 1,618 1,278 1,353 1,628 Less: Deferred turnaround and catalyst costs 479 634 649 673 718 523 915 Less: Investments in joint ventures 57 76 14 141 4 406 181 Less: Changes in current assets and current liabilities (302) 922 (1,810) (1,306) 976 1,289 (1,297) Free cash flow $2,105 $1,811 $3,235 $4,485 $1,844 $1,911 $2,944 Total free cash flow, 2012 – 2018 $18,335 Number of years 7 Average free cash flow, 2012 – 2018 $ 2,619 RECONCILIATION OF EARNINGS PER COMMON SHARE – ASSUMING DILUTION, TO ADJUSTED EARNINGS PER COMMON SHARE – ASSUMING DILUTION (Unaudited) Year Ended December 31, 2016 Earnings per common share – assuming dilution $4.94 Exclude adjustments: Lower of cost or market inventory valuation adjustment, net of taxes 1.25 Asset impairment loss (0.12) Income tax benefit on Aruba Disposition 0.09 Total adjustments 1.22 Adjusted earnings per common share – assuming dilution $3.72

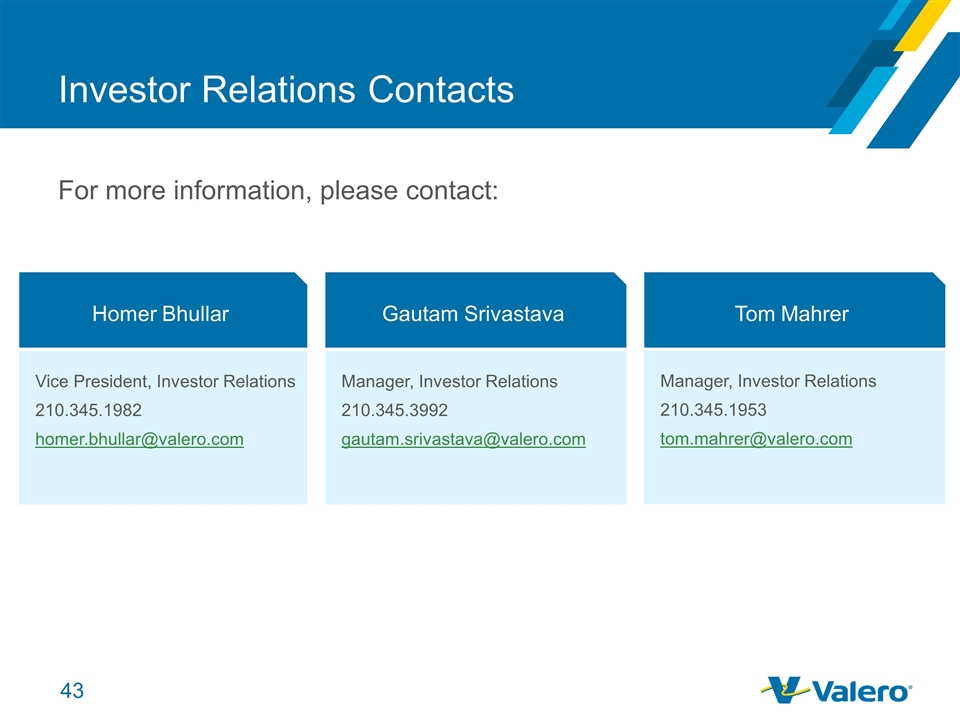

Investor Relations Contacts For more information, please contact: Homer Bhullar Vice President, Investor Relations 210.345.1982 [email protected] Gautam Srivastava Manager, Investor Relations 210.345.3992 [email protected] Tom Mahrer Manager, Investor Relations 210.345.1953 [email protected]

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Valero Energy (VLO) PT Raised to $192 at Citi

- Midday movers: Netflix, Super Micro fall; Paramount Global gains

- Valero Energy (VLO) PT Raised to $187 at Morgan Stanley

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share