Form 8-K UNITED STATES STEEL CORP For: Apr 29

First Quarter 2021 Earnings Presentation www.ussteel.com April 29, 2021

2 Forward-looking statements These slides are being provided to assist readers in understanding the results of operations, financial condition and cash flows of United States Steel Corporation as of and for the first quarter of 2021. They should be read in conjunction with the consolidated financial statements and Notes to the Consolidated Financial Statements contained in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. This presentation contains information that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “will,” "may" and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume changes, share of sales and earnings per share changes, anticipated cost savings, potential capital and operational cash improvements, anticipated disruptions to our operations and industry due to the COVID-19 pandemic, changes in global supply and demand conditions and prices for our products, international trade duties and other aspects of international trade policy, the integration of Big River Steel in our existing business, business strategies related to the combined business and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to, the risks and uncertainties described in this report and in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020, our Quarterly Reports on Form 10-Q and those described from time to time in our future reports filed with the Securities and Exchange Commission. References to (i) "U. S. Steel," "the Company," "we," "us," and "our" refer to United States Steel Corporation and its consolidated subsidiaries unless otherwise indicated by the context and (ii) “Big River Steel” refer to Big River Steel Holdings LLC and its direct and indirect subsidiaries unless otherwise indicated by the context.

3 We present adjusted net earnings (loss), adjusted net earnings (loss) per diluted share, earnings (loss) before interest, income taxes, depreciation and amortization (EBITDA) and adjusted EBITDA, which are non-GAAP measures, as additional measurements to enhance the understanding of our operating performance. We believe that EBITDA, considered along with net earnings (loss), is a relevant indicator of trends relating to our operating performance and provides management and investors with additional information for comparison of our operating results to the operating results of other companies. Adjusted net earnings (loss) and adjusted net earnings (loss) per diluted share are non-GAAP measures that exclude the effects of items that include: debt extinguishment, Big River Steel - inventory step-up amortization, Big River Steel - unrealized losses, Big River Steel - acquisition costs, restructuring and other charges, gain on previously held investment in Big River Steel, asset impairment charge, gain on previously held investment in UPI and Big River Steel options and forward adjustments (Adjustment Items). Adjusted EBITDA is also a non- GAAP measure that excludes the effects of certain Adjustment Items. We present adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA to enhance the understanding of our ongoing operating performance and established trends affecting our core operations, by excluding the effects of events that can obscure underlying trends. U. S. Steel's management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA provides insight into management’s view and assessment of the Company’s ongoing operating performance, because management does not consider the adjusting items when evaluating the Company’s financial performance. Adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA should not be considered a substitute for net earnings (loss), earnings (loss) per diluted share or other financial measures as computed in accordance with U.S. GAAP and is not necessarily comparable to similarly titled measures used by other companies. A condensed consolidated statement of operations (unaudited), condensed consolidated cash flow statement (unaudited), condensed consolidated balance sheet (unaudited) and preliminary supplemental statistics (unaudited) for U. S. Steel are attached. Explanation of use of non-GAAP measures

4 Accomplishments aligned with value creation: Well-timed acquisition of Big River Steel✓ Industry-leading sustainability announcements✓ Strengthened balance sheet and restored financial flexibility ✓ Continued execution in the first quarter

WELL-TIMED ACQUISITION OF BIG RIVER STEEL

6 6 Well-timed acquisition of Big River Steel First quarter highlights 32% EBITDA margin Continued margin expansion from Phase 2 expansion Strong per ton profitability reflects a highly variable cost structure $362 EBITDA per ton Well-timed acquisition of the remaining stake in Big River Steel $967 Average selling price per ton Increased spot market exposure from Phase 2 expansion Note: Big River Steel statistics calculated based off their January 15 – March 31 contribution, as reflected in the Mini Mill segment.

Well-timed acquisition of Big River Steel Outperforming the competition Efficiencies from Phase 2 expansion delivering strong margin performance 32% 19% 22% 1Q 2021 EBITDA margin % 7 Mini mill competitor #1 Mini mill competitor #2 Note: Big River Steel statistics calculated based off their January 15 – March 31 contribution, as reflected in the Mini Mill segment. Mini mill competitor data is based on enterprise-level adjusted EBITDA from company filings.

8 8 Well-timed acquisition of Big River Steel Mini Mill segment Mini Mill segment Mini Mill segment $162M Segment EBITDA January 15 – March 31, 2021 During U. S. Steel’s full ownership Big River Steel 1Q 2021 Performance $192M Adjusted EBITDA January 1 – March 31, 2021 Note: The Mini Mill segment does not include the electric arc furnace at our Fairfield Tubular Operations in Fairfield, Alabama. The Fairfield EAF is included in the Tubular segment.

Well-timed acquisition of Big River Steel 1Q 2021 shipment statistics 9 60% 17% 23% By product: By end-market: By contract / spot mix: 51% 24% 18% 5% 1% 1% 13% 7% 4% 56% 20% Hot rolled coil (60%) Cold rolled coil (17%) Coated (23%) Service centers (51%) Further conversions (24%) Construction (18%) Appliance / Electrical (5%) Transportation / Auto (1%) Containers / Packaging (1%) Firm (13%) Cost based (7%) Market based quarterly (4%) Market based monthly (56%) Spot (20%) Note: Excludes intersegment shipments.

Well-timed acquisition of Big River Steel Steelmaking inputs 10 Note: Pie charts are based on 1Q 2021 production. R a w m a te ri a ls 1.1 Tons of scrap and scrap substitutes / ton of hot rolled coil 65% 35% Scrap Other metallics1 E le c tr ic it y 0.14 Production manhours / ton of hot rolled coil3 90% 10% Steelmaking2 Hot rolling2 651 total headcount L a b o r 0.6 Electricity (MWH) / ton of hot rolled coil 80% 20% Production Management 1 Other metallics primarily include pig iron and hot briquetted iron (HBI). 3 Includes melt shop, caster, and hot mill employees. Based on 3.3 million ton capacity. 2 Steelmaking = electric arc furnace, Hot rolling = compact strip mill.

INDUSTRY-LEADING SUSTAINABILITY ANNOUNCEMENTS Our world-class finishing lines at PRO-TEC are a key component of our recently announced verdeXTM line of sustainable steels

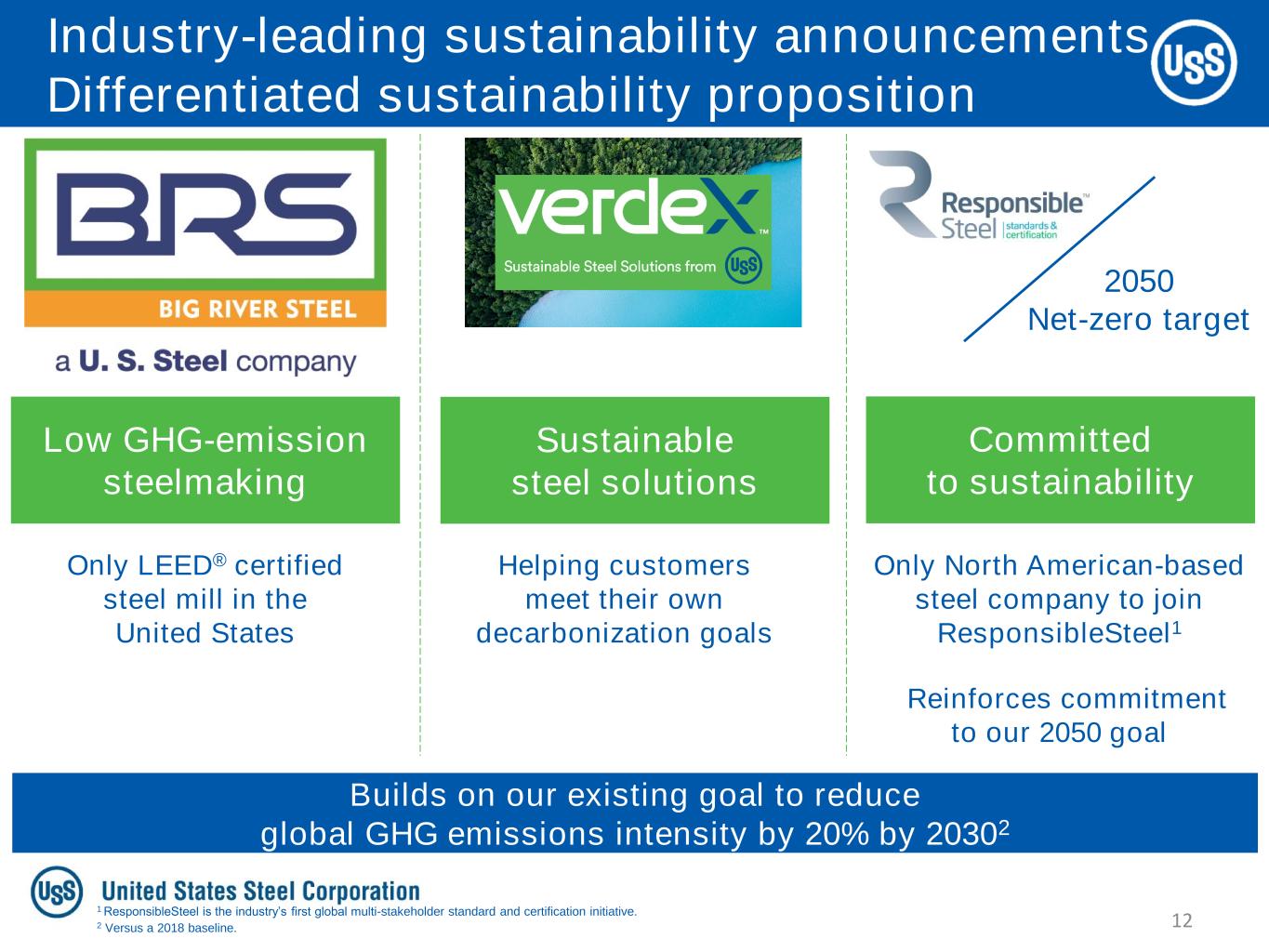

12 12 Industry-leading sustainability announcements Differentiated sustainability proposition Only LEED® certified steel mill in the United States Helping customers meet their own decarbonization goals Only North American-based steel company to join ResponsibleSteel1 Reinforces commitment to our 2050 goal Low GHG-emission steelmaking Sustainable steel solutions Committed to sustainability Builds on our existing goal to reduce global GHG emissions intensity by 20% by 20302 2050 Net-zero target 1 ResponsibleSteel is the industry’s first global multi-stakeholder standard and certification initiative. 2 Versus a 2018 baseline.

13 13 Industry-leading sustainability announcements Differentiated product offering 1 Compared to the traditional, integrated steelmaking process. up to 75% reduction in CO2 emissions1 Our most advanced high-strength steels … MADE SUSTAINABLY WORLD-CLASS finishing assets BEST … for our customers …for the planet

STRENGTHENED BALANCE SHEET

Maintain strong liquidity Proactively manage debt maturity profile Prioritize financial flexibility Strengthened balance sheet Restored financial flexibility Strong liquidity maintained Restored secured debt capacity and removed secured notes limitations2 Extended maturity profile with 2029 senior unsecured notes Reduced annual run- rate interest expense by ~$100M1 ~$1.2B debt reduction in 1Q 20211 ✓ ✓ ✓ ✓ ✓ Capital Structure Priorities: 15 1 Excluding the impact of the Big River Steel debt assumed in connection with the acquisition. Face value of debt excludes accounting impacts of unamortized discounts and issuance costs. 2 Secured debt capacity for U. S. Steel Corp. as issuer.

Combined Maturity Profile, as of March 31, 2021, in millions Strengthened balance sheet Manageable combined maturity profile $750M $68M 2023 20282021 2022 $41M 2026 $662M 2024 2025 2027 2029 2030- 2048 2049+ $40M $356M $83M $740M $1,104M $37M $1,674M $1,039M No significant notes maturities until 2025 U. S. Steel Big River Steel U. S. Steel new unsecured notes 16 Call provisions increase flexibility to proactively manage our debt maturity profile

2021 OUTLOOK

2021 outlook Stronger for longer steel market environment 18 Informing our perspective: Healthy customer order book Supportive Raw Material Prices Low Steel Supply Chain Inventories Continued confidence in strong demand and market fundamentals Elevated steelmaking input costs for blast furnaces and EAFs Restocking period needed to replenish customer inventories

2021 outlook Stronger for longer steel market environment U .S . fl a t- ro ll e d m a rk e t T u b u la r m a rk e t E u ro p e f la t- ro ll e d m a rk e t Automotive Construction Appliance Automotive Construction Appliance Oil & gas March auto sales at 17.75 million SAAR exceeded expectations. This is the second highest March on record. Strong sales have pulled inventory levels to a low 39 days of supply. We expect automakers will need to accelerate their build rate in 2H 2021 / 2022. Put-in-place square footage accelerated in March to 440 million square feet, the highest since the Global Financial Crisis. New and existing home inventories are low likely keeping the construction market well positioned for several quarters. First quarter AHAM6 unit shipments were the highest ever for a first quarter at 13.5 million units, and projected to continue, supporting strong utilization rates at our Mon Valley operations. Oil prices consistently above $60/barrel are encouraging additional rigs to come back on-line. Last week’s rig count of 438 active rigs has moved higher to within 27 rigs of year ago levels. c u s to m e r c u s to m e r c u s to m e r Our 2Q order book suggests strong steel demand from the auto sector due to healthy customer activity and increased household savings. Eurofer expects construction output to increase over 4% in 2021, driven largely by infrastructure spending. EU appliance demand is expected to increase nearly 5% in 2021 as consumer-facing end markets continue to support strong steel demand. 19 Sources: Wards / S&P Global Dodge / National Association of Realtors / National Association of Home Builders / AHAM / IHS / Eurofer / Bloomberg / Baker Hughes.

Operating Idled Indefinitely Idled N o rt h A m e ri c a n F la t- ro ll e d T u b u la r E u ro p e MinntacIron ore pellets Keetac – 22.4 Cokemaking Clairton – 4.3 Gary BF #4 BF #6 BF #8 BF #14 – 7.5 Granite City BF ‘A’ BF ‘B’ 1.4 2.8 Great Lakes BF ‘D4’BF ‘B2’BF ‘A1’ 3.8 3.8 Mon Valley BF #1 BF #3 – 2.9 Kosice BF #3BF #2BF #1 – 5.0 Fairfield EAF steelmaking / seamless pipe – 0.90 Lorain #3 seamless pipe 0.38 0.38 Lone Star #1 ERW #2 ERW 0.79 0.79 Idled Total Capability1 Global operating footprint Current footprint supporting customer demand 1 Raw steel capability, except at Minntac and Keetac (iron ore pellet capability), Clairton (coke capability), Lorain, and Lone Star (pipe capability). 20 M in i M il l Big River Steel EAF #1 EAF #2 – 3.3 Recent Changes

FIRST QUARTER UPDATE

22 1 Occupational Safety and Health Administration (OSHA) Days Away from Work is defined as number of days away cases x 200,000 / hours worked. YTD as of April 21, 2021. 2 BLS – Iron & Steel 2019 data. First quarter 2021 update Safety performance Safety First 0.14 0.10 0.07 0.08 20202018 2019 YTD 2021 BLS - Iron & Steel: 0.60 Benchmark 2 : OSHA Days Away from Work 1 Record-setting performance

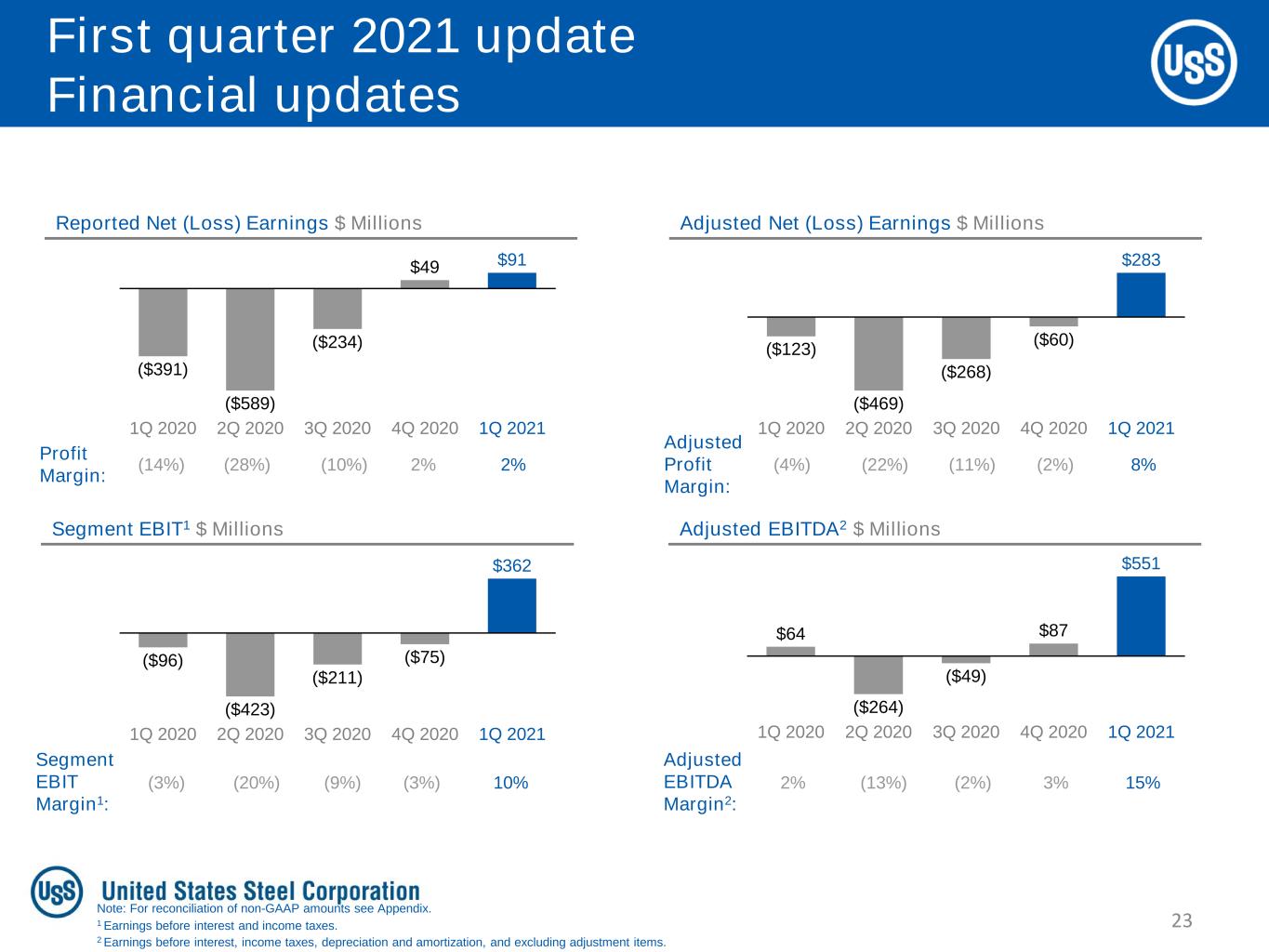

23 Reported Net (Loss) Earnings $ Millions Profit Margin: ($123) ($469) ($268) ($60) $283 1Q 20211Q 2020 2Q 2020 4Q 20203Q 2020 Adjusted Net (Loss) Earnings $ Millions Adjusted Profit Margin: ($96) ($423) ($211) ($75) $362 1Q 20211Q 2020 2Q 2020 3Q 2020 4Q 2020 Segment EBIT1 $ Millions Segment EBIT Margin1: $64 ($264) ($49) $87 $551 1Q 2020 3Q 20202Q 2020 4Q 2020 1Q 2021 Adjusted EBITDA2 $ Millions Adjusted EBITDA Margin2: ($391) ($589) ($234) $49 $91 1Q 2020 4Q 20202Q 2020 3Q 2020 1Q 2021 (14%) (4%) (3%) 2% (28%) (22%) (20%) (13%) (10%) (11%) (9%) (2%) 2% (2%) (3%) 3% 1 Earnings before interest and income taxes. Note: For reconciliation of non-GAAP amounts see Appendix. 2 Earnings before interest, income taxes, depreciation and amortization, and excluding adjustment items. 2% 8% 10% 15% First quarter 2021 update Financial updates

24 Shipments: in 000s, net tons Production: in 000s, net tons EBITDA Bridge 4Q 2020 vs. 1Q 2021 EBITDA Margin: 4% (2%)(13%) $86 ($203) ($33) $50 $266 1Q 20214Q 20201Q 2020 2Q 2020 3Q 2020 3% $266 $362 OtherRaw Materials $1($16) $50 4Q 2020 Commercial Maintenance & Outage ($131) 1Q 2021 Commercial: The favorable impact is primarily the result of higher average realized prices. Raw Materials: The unfavorable impact is primarily the result of higher purchased scrap costs. Maintenance & Outage: The change is not material. Other: The unfavorable impact is primarily the result of increased variable compensation and higher energy costs. Average Selling Price $ / net ton 1Q 2020 3,148 2,509 $711 2Q 2020 1,468 1,790 $721 3Q 2020 2,207 2,155 $712 4Q 2020 2,490 2,257 $731 1Q 2021 2,581 2,332 $888 11% EBITDA Bridge 1Q 2020 vs. 1Q 2021 $86 $266 $298 ($97) ($1) 1Q 2020 Commercial Maintenance & Outage ($20) Raw Materials Other 1Q 2021 Commercial: The favorable impact is primarily the result of higher average realized prices. Raw Materials: The unfavorable impact is primarily the result of higher purchased scrap costs partially offset by lower costs for coking coal. Maintenance & Outage: The change is not material. Other: The unfavorable impact is primarily the result of increased variable compensation and higher energy costs. Flat-rolled segment Key statistics Operating Statistics Note: For reconciliation of non-GAAP amounts see Appendix. Segment EBITDA $ Millions

25 Segment EBITDA $ Millions EBITDA Margin: - -- $162 1Q 2020 2Q 2020 3Q 2020 1Q 20214Q 2020 - 32% Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price $ / net ton 1Q 2020 - - - 2Q 2020 - - - 3Q 2020 - - - 4Q 2020 - - - 1Q 2021 510 447 $967 Operating Statistics EBITDA Bridge 1Q 2020 vs. 1Q 2021 Mini Mill segment Key statistics EBITDA Bridge 4Q 2020 vs. 1Q 2021 Initial Mini Mill reporting quarter; EBITDA bridge not applicable Initial Mini Mill reporting quarter; EBITDA bridge not applicable Note: For reconciliation of non-GAAP amounts see Appendix. 1Q 2021 613 534 $938 Pro forma full 1Q stats1 1 Mini Mill segment includes Big River Steel performance as a fully consolidated entity of U. S. Steel. $192 1Q 2021 32% Pro forma full 1Q stats1

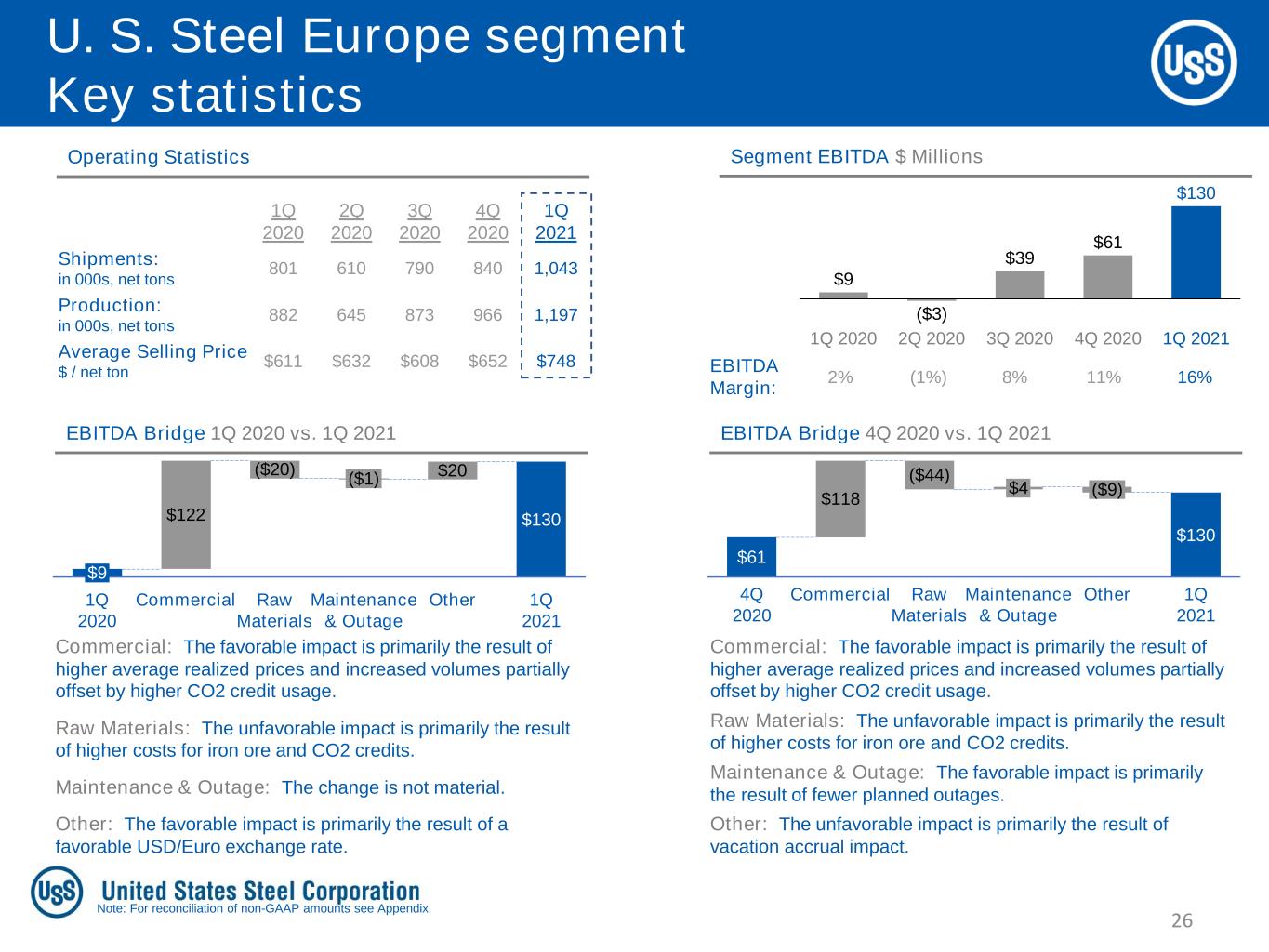

26 Segment EBITDA $ Millions EBITDA Margin: 2% 8%(1%) $9 ($3) $39 $61 $130 2Q 2020 4Q 20203Q 20201Q 2020 1Q 2021 11% 16% Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price $ / net ton 1Q 2020 882 801 $611 2Q 2020 645 610 $632 3Q 2020 873 790 $608 4Q 2020 966 840 $652 1Q 2021 1,197 1,043 $748 Operating Statistics EBITDA Bridge 1Q 2020 vs. 1Q 2021 $130$122 $20 ($1) Maintenance & Outage $9 1Q 2020 1Q 2021 Commercial OtherRaw Materials ($20) Commercial: The favorable impact is primarily the result of higher average realized prices and increased volumes partially offset by higher CO2 credit usage. Raw Materials: The unfavorable impact is primarily the result of higher costs for iron ore and CO2 credits. Maintenance & Outage: The change is not material. Other: The favorable impact is primarily the result of a favorable USD/Euro exchange rate. EBITDA Bridge 4Q 2020 vs. 1Q 2021 $61 $130 $118 Maintenance & Outage ($9) 4Q 2020 Commercial ($44) Raw Materials Other $4 1Q 2021 Commercial: The favorable impact is primarily the result of higher average realized prices and increased volumes partially offset by higher CO2 credit usage. Raw Materials: The unfavorable impact is primarily the result of higher costs for iron ore and CO2 credits. Maintenance & Outage: The favorable impact is primarily the result of fewer planned outages. Other: The unfavorable impact is primarily the result of vacation accrual impact. U. S. Steel Europe segment Key statistics Note: For reconciliation of non-GAAP amounts see Appendix.

27 EBITDA Margin: (14%) (46%)(22%) ($35) ($40) ($44) ($21) ($17) 4Q 20201Q 2020 2Q 2020 3Q 2020 1Q 2021 (20%) (12%) Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price $ / net ton 1Q 2020 - 187 $1,283 2Q 2020 - 132 $1,288 3Q 2020 - 71 $1,230 4Q 2020 16 74 $1,267 1Q 2021 93 89 $1,372 Operating Statistics EBITDA Bridge 1Q 2020 vs. 1Q 2021 ($35) ($17) ($9) ($4) 1Q 2020 OtherCommercial Raw Materials Maintenance & Outage $10 $21 1Q 2021 Commercial: The unfavorable impact is primarily the result of decreased volumes partially offset by higher average realized prices. Raw Materials: The unfavorable impact is primarily the result of higher scrap costs. Maintenance & Outage: The favorable impact is primarily related to cost control measures. Other: The favorable impact is primarily the result of the reduced idled plant carrying costs. EBITDA Bridge 4Q 2020 vs. 1Q 2021 ($21) ($17) ($7) Raw Materials $13 $0 4Q 2020 Commercial ($2) Maintenance & Outage Other 1Q 2021 Commercial: The favorable impact is primarily the result of higher average realized prices and increased volumes. Raw Materials: The unfavorable impact is primarily the result of higher scrap costs partially offset by improved yields at our steelmaking operations. Maintenance & Outage: The unfavorable impact is primarily the result of the EAF start-up. Other: No change. Tubular segment Key statistics Note: For reconciliation of non-GAAP amounts see Appendix. Segment EBITDA $ Millions

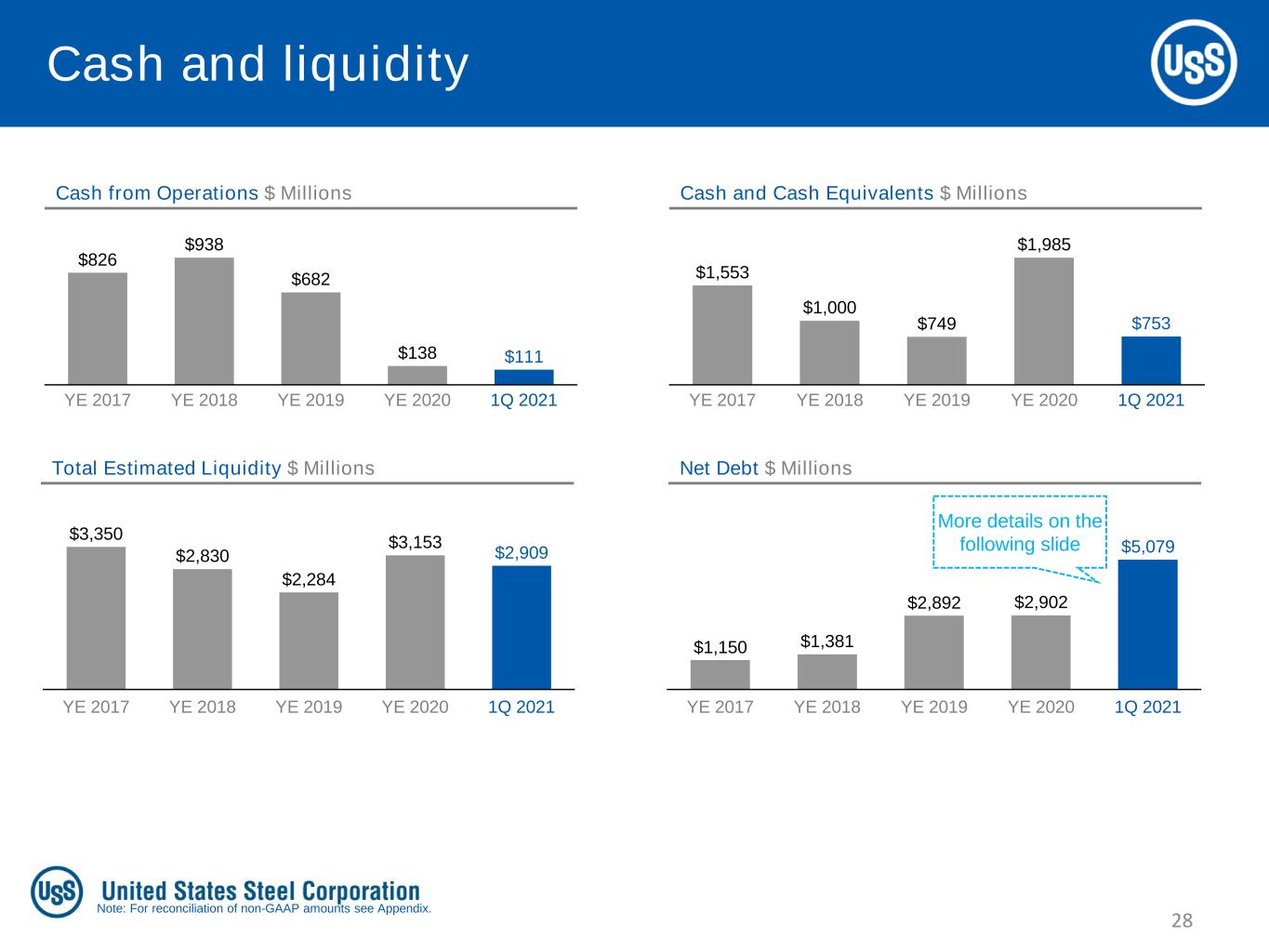

28 Cash and liquidity $826 $938 $682 $138 $111 YE 2019YE 2017 1Q 2021YE 2020YE 2018 Cash from Operations $ Millions Cash and Cash Equivalents $ Millions Total Estimated Liquidity $ Millions Net Debt $ Millions $1,553 $1,000 $749 $1,985 $753 YE 2020YE 2019YE 2017 YE 2018 1Q 2021 $3,350 $2,830 $2,284 $3,153 $2,909 YE 2020YE 2017 YE 2018 1Q 2021YE 2019 $1,150 $1,381 $2,892 $2,902 $5,079 YE 2020YE 2017 YE 2018 1Q 2021YE 2019 Note: For reconciliation of non-GAAP amounts see Appendix. More details on the following slide

29 Net debt 4Q 2020 vs 1Q 2021 $2,902 $5,079 $1,294 $2,055 Big River Steel Debt2 ($1,110) 4Q 2020 ($62) USS Cash Net Reduction in USS / USSK Debt Credit Facility1 BRS Cash 1Q 2021 in millions Net debt bridge U. S. Steel Capital Structure (quarter-over-quarter changes) Big River Steel Capital Structure (added to balance sheet after full acquisition) 1 Includes unamortized discounts and issuance costs. 2 The acquisition included a fair value step-up from the net book value of debt of $194 million. (use) (source)

APPENDIX

31 Additional Big River Steel summary data In c o m e S ta te m e n t B a la n c e S h e e t C a s h F lo w Customer Sales 1Q 2021 Intersegment Sales Net Sales EBIT1 $450M $62M $512M $132M Total Assets $4,073M Depreciation and Amortization Capital Expenditures $30M $36M 1 Earnings before interest and income taxes. 2029 senior secured notes $900M ARTRS – Notes Payable $106M Environmental revenue bonds $752M Financial leases and all other obligations $119M ABL Facility $30M Total Debt $2,055M Fair value step up2 $149M 2 Big River Steel debt amounts are shown at aggregate principal amounts which do not include Big River Steel’s unamortized discounts and fees which were removed with the purchase. The fair value step up shown here represents the fair value step up over the aggregate principal amount.

32 Flat-rolled ($millions) 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Segment (loss) earnings before interest and income taxes ($35) ($329) ($159) ($73) $146 Depreciation 121 126 126 123 120 Flat-rolled Segment EBITDA $86 ($203) ($33) $50 $266 U. S. Steel Europe ($ millions) 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Segment (loss) earnings before interest and income taxes ($14) ($26) $13 $36 $105 Depreciation 23 23 26 25 25 U. S. Steel Europe Segment EBITDA $9 ($3) $39 $61 $130 Tubular ($ millions) 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Segment (loss) earnings before interest and income taxes ($48) ($47) ($52) ($32) ($29) Depreciation 13 7 8 11 12 Tubular Segment EBITDA ($35) ($40) ($44) ($21) ($17) Other ($ millions) 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Segment (loss) earnings before interest and income taxes $1 ($21) ($13) ($6) $8 Depreciation 3 3 2 3 2 Other Segment EBITDA $4 ($18) ($11) ($3) $10 Reconciliation of segment EBITDA Mini Mill ($ millions) 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Segment (loss) earnings before interest and income taxes - - - - $132 Depreciation - - - - 30 Mini Mill Segment EBITDA - - - - $162

33 Net Debt ($ millions) YE 2017 YE 2018 YE 2019 YE 2020 1Q 2021 Short-term debt and current maturities of long-term debt $3 $65 $14 $192 $45 Long-term debt, less unamortized discount and debt issuance costs 2,700 2,316 3,627 4,695 5,787 Total Debt $2,703 $2,381 $3,641 $4,887 $5,832 Less: Cash and cash equivalents 1,553 1,000 749 1,985 753 Net Debt $1,150 $1,381 $2,892 $2,902 $5,079 Reconciliation of net debt

34 Reconciliation of reported and adjusted net earnings ($ millions) 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Reported net (loss) earnings attributable to U. S. Steel ($391) ($589) ($234) $49 $91 Debt extinguishment ─ ─ ─ ─ 255 Asset impairment charges 263 ─ ─ ─ ─ Restructuring and other charges 41 82 ─ 8 6 Gain on previously held investment in Big River Steel ─ ─ ─ ─ (111) Gain on previously held investment in UPI (25) ─ ─ ─ ─ Tubular inventory impairment ─ 24 ─ ─ ─ Big River Steel inventory step-up amortization ─ ─ ─ ─ 24 Big River Steel unrealized losses ─ ─ ─ ─ 9 Big River Steel acquisitions costs ─ ─ ─ 3 9 Big River Steel debt extinguishment charges ─ ─ ─ 18 ─ Big River Steel financing costs ─ ─ ─ 8 ─ Fairless property sale ─ ─ ─ (145) ─ December 24, 2018 Clairton coke making facility fire ─ (4) ─ (2) ─ Big River Steel options and forward adjustments (11) 5 (34) 1 ─ Uncertain tax positions ─ 13 ─ ─ ─ Adjusted net (loss) earnings attributable to U. S. Steel ($123) ($469) ($268) ($60) $283

35 Reconciliation of adjusted EBITDA ($ millions) 1Q 2020 2Q 2020 3Q 2020 4Q 2020 1Q 2021 Reported net (loss) earnings attributable to U. S. Steel ($391) ($589) ($234) $49 $91 Income tax provision (benefit) (19) (5) (24) (94) 1 Net interest and other financial costs 35 62 47 88 333 Reported (loss) earnings before interest and income taxes ($375) ($532) ($211) $43 $425 Depreciation, depletion and amortization expense 160 159 162 162 189 EBITDA ($215) ($373) ($49) $205 $614 Asset impairment charges 263 ─ ─ ─ ─ Restructuring and other charges 41 89 ─ 8 6 Big River Steel inventory step-up amortization ─ ─ ─ ─ 24 Big River Steel unrealized losses ─ ─ ─ ─ 9 Big River Steel acquisitions costs ─ ─ ─ 3 9 Big River Steel debt extinguishment charges ─ ─ ─ 18 ─ Fairless property sale ─ ─ ─ (145) ─ Gain on previously held investment in Big River Steel ─ ─ ─ ─ (111) Gain on previously held investment in UPI (25) ─ ─ ─ ─ Tubular inventory impairment ─ 24 ─ ─ ─ December 24, 2018 Clairton coke making facility fire ─ (4) ─ (2) ─ Adjusted EBITDA $64 ($264) ($49) $87 $551

INVESTOR RELATIONS Kevin Lewis Vice President 412-433-6935 [email protected] Eric Linn Senior Manager 412-433-2385 [email protected] www.ussteel.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- U.S. Steel (X) shareholders approve Nippon Steel's acquisition offer

- Iovance Biotherapeutics Reports Inducement Grants under NASDAQ Listing Rule 5635(c)(4)

- Celularity Inc. Announces Receipt of Nasdaq Notice Regarding Late Form 10-K Filing

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share