Form 8-K TWC Tech Holdings II For: Apr 08

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 8, 2021

TWC

Tech Holdings II Corp.

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-39499 | 85-2061861 | ||

| (State

or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S.

Employer Identification Number) |

Four Embarcadero Center, Suite 2100 San Francisco, CA |

94111 | |

| (Address of principal executive offices) | (Zip code) |

| (415) 780-9975 | ||

| (Registrant’s telephone number, including area code) | ||

| Not Applicable | ||

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Title of each class | Trading Symbol(s) | Name

of each exchange on which registered | ||

| Units, each consisting of one share of Class A Common Stock and one-third of one Redeemable Warrant | TWCTU | The Nasdaq Stock Market LLC | ||

| Class A Common Stock, par value $0.0001 per share | TWCT | The Nasdaq Stock Market LLC | ||

| Warrants, each exercisable for one share of Class A Common Stock for $11.50 per share | TWCTW | The Nasdaq Stock Market LLC |

Item 1.01. Entry into a Material Definitive Agreement

The Business Combination Agreement

On April 8, 2021, TWC Tech Holdings II Corp., a Delaware corporation (“TWC”), Cellebrite DI Ltd., a company organized under the laws of the State of Israel (“Cellebrite”) and Cupcake Merger Sub, Inc., a Delaware corporation and a direct wholly owned subsidiary of Cellebrite (“Merger Sub”), entered into a Business Combination Agreement and Plan of Merger (the “Business Combination Agreement”), providing for, among other things, and subject to the terms and conditions therein, a business combination between TWC and Cellebrite (the “Business Combination”) pursuant to which, among other things, Merger Sub will merge with and into TWC at the Effective Time (as defined in the Business Combination Agreement), with TWC continuing as the surviving entity and as a wholly owned subsidiary of Cellebrite.

The Business Combination

The Business Combination Agreement provides that, among other things and upon the terms and subject to the conditions thereof, the following transactions will occur in order to effect the Business Combination:

(i) (a) immediately prior to the Effective Time, the outstanding preferred shares of Cellebrite will be converted into ordinary shares of Cellebrite (“Cellebrite Ordinary Shares” and each, a “Cellebrite Ordinary Share”), (b) immediately following such conversion, Cellebrite will effect a stock split (the “Stock Split”) pursuant to which each Cellebrite Ordinary Share will be converted into a number of Cellebrite Ordinary Shares equal to (A)(x) the equity value of Cellebrite (which will be based on an enterprise valuation of Cellebrite of $1,707,192,607.00 and certain adjustments thereto as set forth in the Business Combination Agreement), divided by (y) the number of Cellebrite Ordinary Shares (determined on a fully-diluted basis in the manner set forth in the Business Combination Agreement) issued and outstanding following such conversion of preferred shares of Cellebrite, divided by (B) $10.00 (which shall be equitably adjusted for stock splits, reverse stock splits, stock dividends, reorganizations, recapitalizations, reclassifications, combination, exchange of shares or other like change or transaction with respect to shares of Class A common stock of TWC occurring prior to the Effective Time) (the “Reference Price”), in each case as calculated pursuant to terms and methodologies set forth in the Business Combination Agreement (the transactions described in the foregoing clauses (a) and (b), the “Capital Restructuring”), (c) immediately prior to the Effective Time, each share of Class B common stock of TWC will be automatically converted into one (1) share of Class A common stock of TWC (a “TWC Share” and the holders thereof, “TWC Stockholders”), and (d) immediately prior to the Effective Time, the TWC shares and the TWC public warrants comprising each issued and outstanding TWC unit shall be automatically separated and the holder thereof shall be deemed to hold one (1) TWC Share and 1/3 of one TWC public warrant.

1

(ii) at the closing of the transactions contemplated by the Business Combination Agreement (the “Closing”), upon the terms and subject to the conditions thereof, and in accordance with the Delaware General Corporation Law, as amended or restated, Merger Sub will merge with and into TWC at the Effective Time (the “Merger”), the separate corporate existence of Merger Sub will cease and TWC will continue as the surviving corporation in the Merger and as a wholly owned subsidiary of Cellebrite;

(iii) at the Effective Time, as a result of the Merger, (a) each TWC Share will be converted into the right to receive: (x) an amount of cash equal to the greater of $0 and the quotient of (A)(x) $120,000,000 minus (y) the amount of TWC Stockholder redemptions, divided by (B) the number of TWC Shares outstanding as of immediately prior to the Effective Time but after the conversion described in sub-clause(i)(c) above (other than any treasury shares of TWC) (the “Per Share Cash Consideration”) and (y) a number of Cellebrite Ordinary Shares equal to the quotient of (A)(x) the Reference Price minus the (y) Per Share Cash Consideration, divided by the (B) Reference Price (the “Per Share Equity Consideration” and together with the Per Share Cash Consideration, the “Merger Consideration”), (b) each warrant of TWC will be converted into a warrant of Cellebrite (“Cellebrite Warrants” and each, a “Cellebrite Warrant”), exercisable for the amount of Merger Consideration that the holder thereof would have received if such warrant had been exercisable and exercised immediately prior to the Business Combination and (c) each option and restricted stock unit of Cellebrite will remain outstanding, subject to adjusted terms to reflect the effect of the Stock Split on Cellebrite Ordinary Shares; and

(iv) following the Business Combination, holders of Cellebrite Ordinary Shares and vested restricted share units, in each case as of immediately prior to the Effective Time, will be eligible to receive additional Cellebrite Ordinary Shares post-Closing upon the achievement of certain trading price targets, or upon a Change of Control (as defined in the Business Combination Agreement) of Cellebrite, before the five (5) year anniversary of the Closing Date.

On the date of Closing and prior to the conversion of preferred shares of Cellebrite described above, an initial dividend of $21,300,000 will be declared by Cellebrite’s board of directors and paid to the holders of Cellebrite Ordinary Shares and holders of vested restricted stock units of Cellebrite. An additional dividend of $78,700,000 (or such lesser amount as approved by the Israeli district court) would also be payable at such time to the holders of Cellebrite Ordinary Shares and holders of vested restricted stock units if such additional dividend is approved by the Israeli district court.

The board of directors of TWC (the “TWC Board”) has unanimously (i) approved and declared advisable the Business Combination Agreement, the Business Combination and the other transactions contemplated thereby and (ii) resolved to recommend approval of the Business Combination Agreement and related matters by the TWC Stockholders.

Conditions to the Closing

The Business Combination Agreement is subject to the satisfaction or waiver of certain customary closing conditions, including, among others, (i) obtaining required approvals of the Business Combination and related matters by the respective stockholders of TWC and Cellebrite, (ii) the effectiveness of the registration statement on Form F-4 filed by Cellebrite in connection with the Business Combination, (iii) receipt of approval for the listing on Nasdaq of Cellebrite Ordinary Shares and Cellebrite Warrants to be issued in connection with the Business Combination, (iv) that Cellebrite has at least $2,000,001 of net tangible assets upon the Closing (after giving effect to any TWC Stockholder redemptions), (v) that TWC has at least $5,000,001 of net tangible assets (after giving effect to any TWC Stockholder redemptions), (vi) the completion of the Capital Restructuring, (vii) the absence of a continuing Company Material Adverse Effect (as defined in the Business Combination Agreement), (viii) either (a) the issuance of a Transaction Tax Ruling (as defined in the Business Combination Agreement) reasonably satisfactory to TWC or, at Cellebrite’s sole and absolute discretion, the written undertaking of Cellebrite to indemnify TWC Stockholders and holders of TWC warrants from certain Israeli taxes incurred by such parties, (ix) the amount of cash and cash equivalents in TWC’s trust account (after giving effect to redemptions of TWC Shares and payment of TWC expenses), together with the aggregate amount actually received from the PIPE Investors (as defined below) pursuant to the PIPE Investment (as defined below), any backstop financing received by TWC prior to the Effective Time, and the amount of cash and cash equivalents held by TWC without restriction outside of its trust account and interest earned on cash held inside of its trust account (less indebtedness or other accrued payment obligations not constituting TWC expenses), equaling at least $300,000,000, (x) the accuracy of the each party’s representations and warranties, except generally as would not have a Company Material Adverse Effect or SPAC Material Adverse Effect (as applicable, and in each case as defined in the Business Combination Agreement) and in the case of certain fundamental representations, in all material respects, (xi) compliance with pre-closing covenants in all material respects, (xii) the absence of any legal restraints or injunctions enjoining or prohibiting the consummation of the Business Combination and (xiii) the receipt, expiration or termination of applicable government approvals and antitrust waiting periods.

Covenants

The Business Combination Agreement contains customary covenants by TWC, Merger Sub and Cellebrite, including, among others, providing for (i) the parties to conduct, as applicable, their respective businesses in the ordinary course and consistent with past practice through the Closing, (ii) the parties to not initiate any negotiations or enter into any agreements for certain alternative transactions, (iii) Cellebrite to prepare and deliver to TWC certain audited consolidated financial statements of Cellebrite, (iv) Cellebrite to prepare and file a registration statement on Form F-4 and take certain other actions for TWC to obtain the requisite approval of TWC stockholders of certain proposals regarding the Business Combination and (v) the parties to use reasonable best efforts to obtain necessary approvals from governmental agencies.

2

Representations and Warranties

The Business Combination Agreement contains customary representations and warranties by TWC and Cellebrite. The representations and warranties of the respective parties to the Business Combination Agreement generally will not survive the Closing.

Termination

The Business Combination Agreement may be terminated at any time prior to the Closing (i) by mutual written consent of TWC and Cellebrite, (ii) by Cellebrite, if certain approvals of the TWC Stockholders, to the extent required under the Business Combination Agreement, are not obtained as set forth therein or if there is a modification in recommendation by the TWC Board, (iii) by TWC, if certain approvals of the shareholders of Cellebrite, to the extent required under the Business Combination Agreement, are not obtained as set forth therein and (iv) by either TWC or Cellebrite in certain other circumstances set forth in the Business Combination Agreement, including (a) if any governmental authority shall have issued or otherwise entered a final, nonappealable governmental order making consummation of the Business Combination illegal or otherwise preventing or prohibiting consummation of the Business Combination, (b) in the event of certain uncured breaches by the other party that would render applicable closing conditions unable to be satisfied and (c) if the Closing has not occurred on or before the October 8, 2021.

The foregoing description of the Business Combination Agreement is qualified in its entirety by reference to the full text of the Business Combination Agreement, a copy of which is included as Exhibit 2.1 to this Current Report on Form 8-K, and incorporated herein by reference.

Certain Related Agreements

Sponsor Support Agreement

Contemporaneously with the execution of the Business Combination Agreement, TWC, TWC Tech Holdings II, LLC (the “Sponsor”), Cellebrite and the persons set forth on Schedule I thereto (such Persons, together with the Sponsor, the “Sponsor Parties”) entered into a sponsor support agreement (the “Sponsor Support Agreement”), pursuant to which, among other things, (i) each Sponsor Party and each director of TWC agreed to vote in favor of, and to adopt and approve, the Business Combination Agreement and all other documents and transactions contemplated thereby, (ii) each Sponsor Party agreed to deliver a duly executed copy of the Investor Rights Agreement (as defined below) on the date of Closing, (iii) each Sponsor Party acknowledges the Lock-Up Restrictions set forth in the Amended Articles (as defined below) and acknowledges that such Lock-Up Restrictions shall be binding and enforceable against such Sponsor Party upon the Amended Articles coming into effect, (iv) each Sponsor Party agrees to waive and not exercise any rights to adjustment or other anti-dilution protections with respect to the rate at which shares of Class B common stock of TWC convert into TWC Shares under the terms of TWC’s certificate of incorporation, (v) each Sponsor Party agreed to forfeit certain of their TWC Shares immediately prior to the Effective Time, and (vi) each Sponsor Party agreed to subject certain of their shares of Cellebrite Ordinary Shares received in the Business Combination to certain vesting provisions following the Closing, based on the achievement of certain trading price targets or upon a Change of Control (as defined in the Business Combination Agreement) of Cellebrite between the Closing and the seven (7) year anniversary of Closing, in each case subject to the terms and conditions of the Sponsor Support Agreement.

The foregoing description of the Sponsor Support Agreement is qualified in its entirety by reference to the full text of the Sponsor Support Agreement, a copy of which is included as Exhibit 10.1 to this Current Report on Form 8-K, and incorporated herein by reference.

Cellebrite Shareholders Support Agreements

Contemporaneously with the execution of the Business Combination Agreement, TWC, Cellebrite and certain shareholders of Cellebrite entered into shareholder support agreements (the “Cellebrite Shareholders Support Agreements”), pursuant to which, among other things, such shareholders agreed to (i) vote in favor of, and to adopt and approve, the Business Combination Agreement and all other documents and transactions contemplated thereby, (ii) deliver a duly executed copy of the Investor Rights Agreement substantially simultaneously with the Effective Time and (iii) acknowledge the Lock-Up restrictions set forth in the Amended Articles (as defined below) and acknowledge that such Lock-Up restrictions shall be binding and enforceable against such shareholders upon the Amended Articles coming into effect.

The foregoing description of the Cellebrite Shareholders Support Agreements is qualified in its entirety by reference to the full text of the Form of Cellebrite Shareholders Support Agreement, a copy of which is included as Exhibit 10.2 to this Current Report on Form 8-K, and incorporated herein by reference.

3

Share Purchase Agreement

Contemporaneously with the execution of the Business Combination Agreement, certain accredited investors (the “PIPE Investors”), entered into share purchase agreements (each, a “Share Purchase Agreement”) pursuant to which the PIPE Investors have committed to purchase 30,000,000 Cellebrite Ordinary Shares from certain Cellebrite shareholders at a purchase price of $10.00 per share and an aggregate purchase price of $300,000,000 (the “PIPE Investment”). The purchase of the Cellebrite Ordinary Shares is conditioned upon, and will be consummated concurrently with, the Closing.

The foregoing description of the Share Purchase Agreements is qualified in its entirety by reference to the full text of the Form of Share Purchase Agreement, a copy of which is included as Exhibit 10.3 to this Current Report on Form 8-K, and incorporated herein by reference.

Redemption and Voting Agreement

Contemporaneously with the execution of the Business Combination Agreement, TWC and certain institutional investors entered into a redemption and voting agreement with respect to 4,750,000 TWC Shares (the “Redemption and Voting Agreement”), pursuant to which, among other things, such institutional investors have agreed to (i) elect to exercise redemption rights with respect to TWC Shares beneficially owned by them and (ii) vote to adopt and approve the Business Combination Agreement and all other documents and transactions contemplated thereby.

The foregoing description of the Redemption and Voting Agreement is qualified in its entirety by reference to the full text of the Form of Redemption and Voting Agreement, a copy of which is included as Exhibit 10.4 to this Current Report on Form 8-K, and incorporated herein by reference.

Investor Rights Agreement

The Business Combination Agreement contemplates that, at the Closing, certain TWC Stockholders who will receive Cellebrite Ordinary Shares and certain Cellebrite equityholders (collectively “Cellebrite Equityholders”) and Cellebrite will enter into an investor rights agreement (the “Investor Rights Agreement”), pursuant to which, among other things, Cellebrite will agree to file a registration statement within 30 days of the Effective Time to register for resale under the U.S. Securities Act of 1933, as amended (the “Securities Act”) (x) the Cellebrite Ordinary Shares and Cellebrite Warrants issued or issuable pursuant to the Business Combination Agreement (including the Cellebrite Ordinary Shares underlying the Cellebrite Warrants, any and all earned Price Adjustment Shares (as defined in the Business Combination Agreement), and the Cellebrite Ordinary Shares issued pursuant to the Share Purchase Agreement), (y) certain Cellebrite Ordinary Shares held by Cellebrite Equityholders which were subject to registration rights pursuant to other registration rights agreements in existence prior to the date hereof. The Investor Rights Agreement also permits underwritten takedowns and provides for customary “piggyback” registration rights. Cellebrite will agree to indemnify Sponsor and certain of Sponsor’s related persons from certain liabilities arising from the Business Combination Agreement, the transactions agreements relating to the Business Combination, and the transactions and filings contemplated thereby, subject to certain limitations set forth in the Investor Rights Agreement.

The foregoing description of the Investor Rights Agreement is qualified in its entirety by reference to the full text of the Form of Investor Rights Agreement, a copy of which is included as Exhibit 10.5 to this Current Report on Form 8-K, and incorporated herein by reference.

Amended Articles

The Business Combination Agreement contemplates that, at the Closing, Cellebrite will adopt the amended and restated articles of association in connection with the Business Combination (the “Amended Articles”), pursuant to which, among other things, (i) Cellebrite shareholders will be subject to certain restrictions on transfer (“Lock-Up Restrictions”) with respect to Cellebrite Ordinary Shares held by each such holder (subject to certain exceptions) for a period ending on the earlier of (x) the date that is 180 days after the date of Closing, (y) with respect to a specified portion of the shares subject to restriction, the trading price of Cellebrite Ordinary Shares achieving the target set forth in the Amended Articles and (z) the consummation of a bona fide liquidation, merger, stock exchange, reorganization, tender offer, change of control or other similar transaction which results in all of Cellebrite’s shareholders having the right to exchange their Cellebrite Ordinary Shares for cash, securities or other property subsequent, so long as Cellebrite’s shareholders as of immediately prior to such transaction hold less than 50% of the equity interests of the acquiror, successor entity or surviving entity (as applicable) and (ii) Sponsor, IGP Saferworld, Limited Partnership, and SUN CORPORATION will have certain director nomination rights.

4

The foregoing description of the Amended Articles is qualified in its entirety by reference to the full text of the Amended Articles, a copy of which is included as Exhibit 10.6 to this Current Report on Form 8-K, and incorporated herein by reference.

Item 7.01. Regulation FD Disclosure.

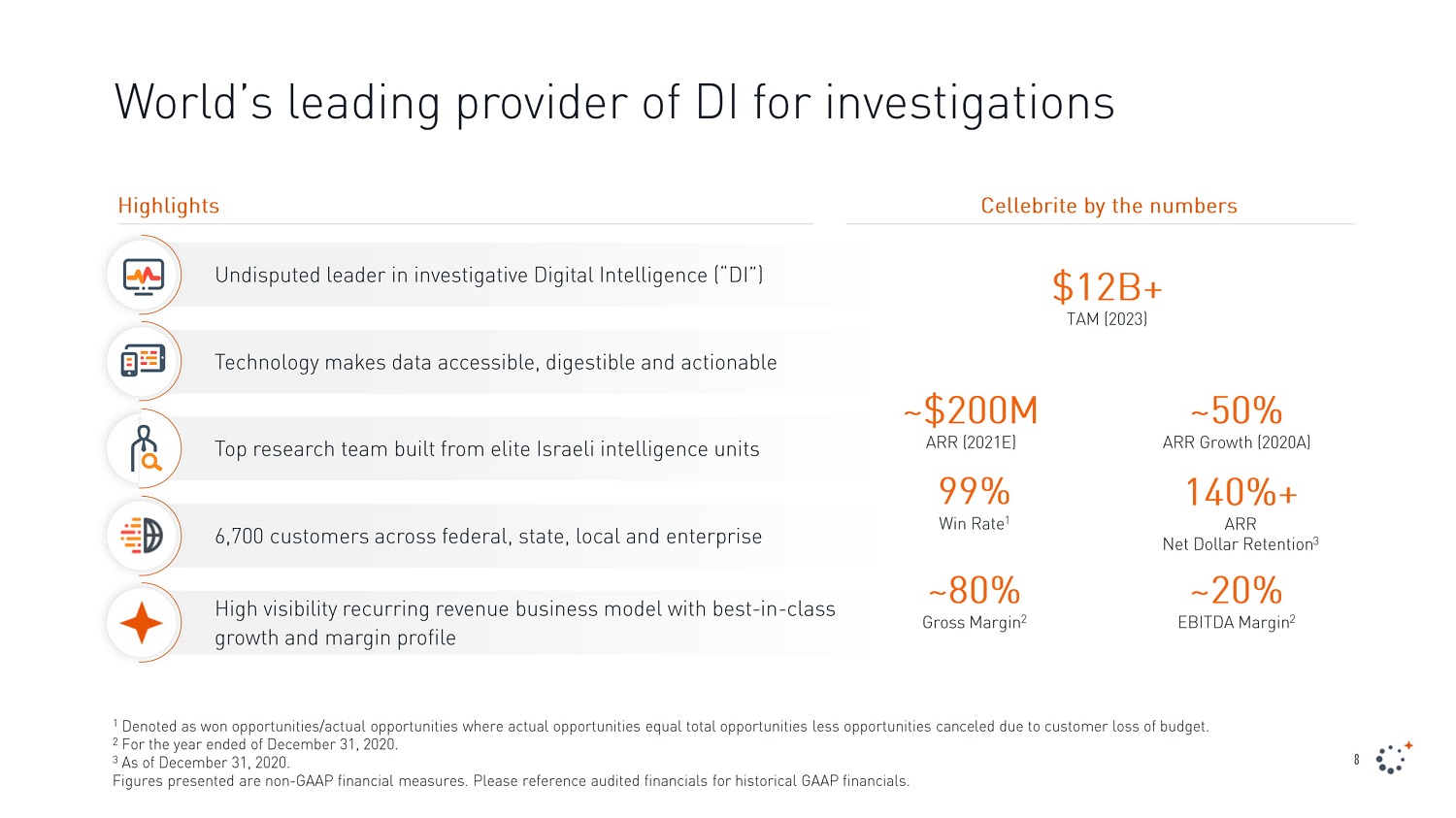

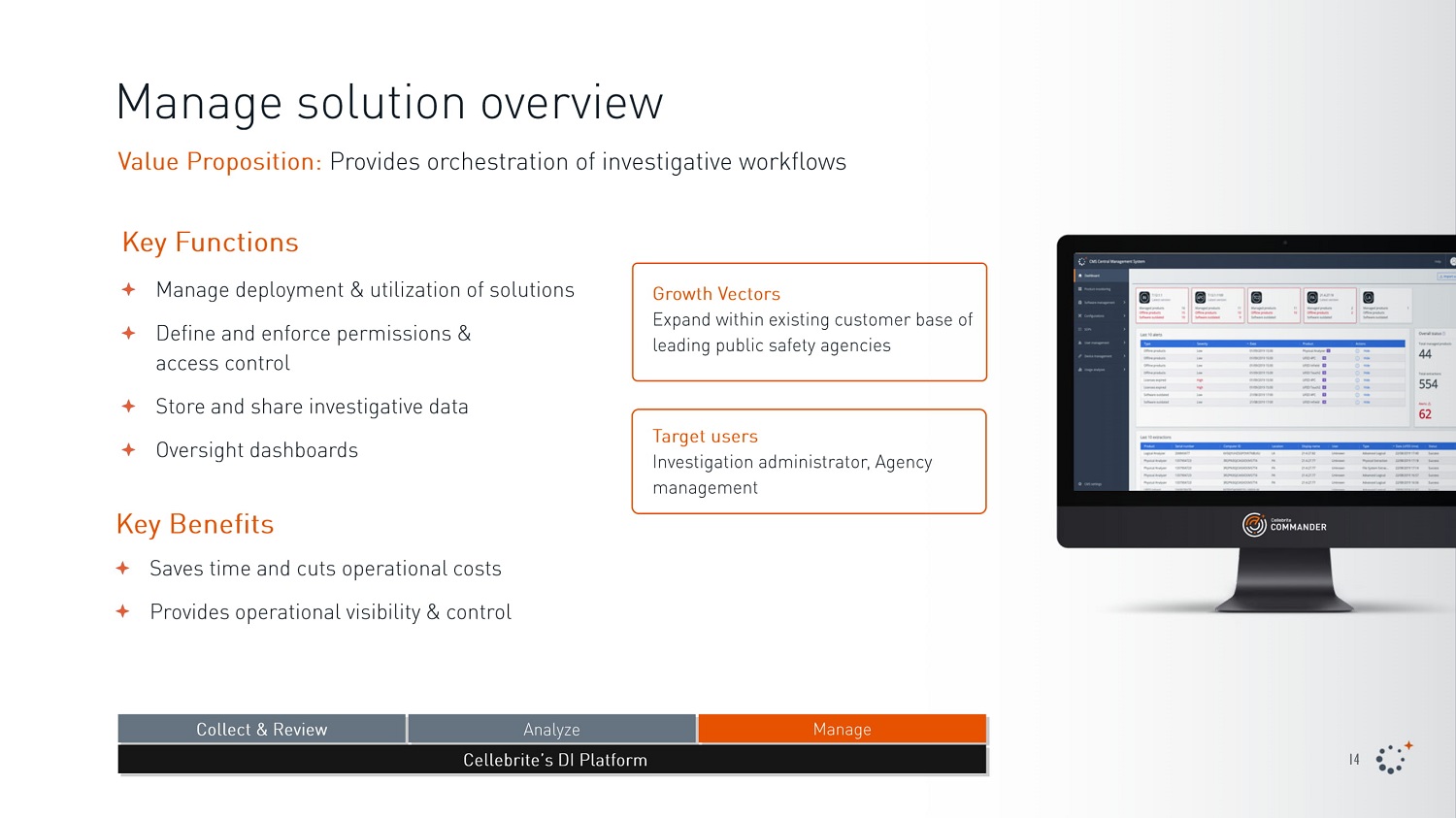

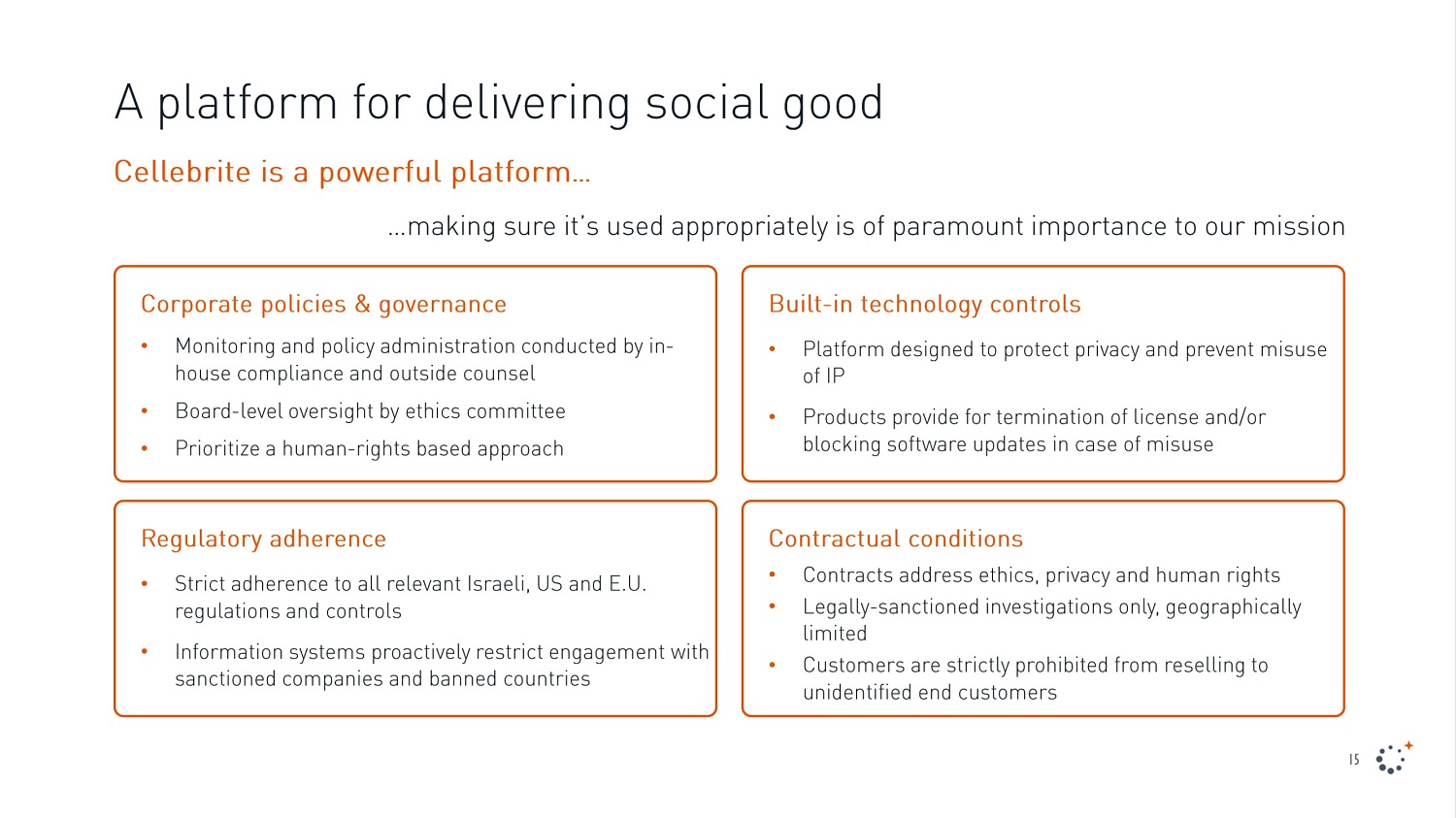

On April 8, 2021, TWC and Cellebrite issued a joint press release announcing the execution of the Business Combination Agreement and announcing that Cellebrite will post a pre-recorded video to its website that discusses the transaction and reviews an investor presentation (the “Investor Presentation”). A copy of the press release, which includes information regarding the Investor Presentation, is attached included as Exhibit 99.1 to this Current Report on Form 8-K, and incorporated herein by reference. Such exhibit and the information set forth therein shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act.

Included as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference is the form of Investor Presentation to be used by TWC in presentations for stockholders of TWC and shareholders of Cellebrite and other persons. Such exhibit and the information set forth therein shall not be deemed to be filed for purposes of Section 18 of the Exchange Act, or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act.

Additional Information

In connection with the proposed Business Combination between Cellebrite and TWC, Cellebrite intends to file a registration statement on Form F-4 that will include a preliminary proxy statement/prospectus to be distributed to stockholders of TWC in connection with TWC’s solicitation of proxies for the vote by its stockholders with respect to the proposed Business Combination. After the registration statement has been filed and declared effective by the SEC, TWC will mail a definitive proxy statement/prospectus to its stockholders as of the record date established for voting on the proposed Business Combination and the other proposals regarding the proposed Business Combination set forth in the proxy statement/prospectus. Cellebrite or TWC may also file other documents with the SEC regarding the proposed Business Combination. Before making any investment or voting decision, stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and any amendments thereto, and the definitive proxy statement/prospectus in connection with TWC’s solicitation of proxies for the special meeting to be held to approve the transactions contemplated by the proposed Business Combination because these materials will contain important information about Cellebrite, TWC and the proposed transaction. Stockholders will also be able to obtain a copy of the preliminary proxy statement/prospectus and the definitive proxy statement/prospectus once they are available, without charge, at the SEC’s website at www.sec.gov, or at Cellebrite’s website at www.cellebrite.com, or by directing a request to: TWC Tech Holdings II Corp., Four Embarcadero Center, Suite 2100, San Francisco, CA 94111.

Participants in the Solicitation

Cellebrite and TWC and their respective directors and officers may be deemed participants in the solicitation of proxies of TWC Stockholders in connection with the proposed Business Combination. TWC Stockholders, Cellebrite’s shareholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of Cellebrite and TWC at Cellebrite’s website at www.cellebrite.com, or in TWC’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, respectively.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to TWC Stockholders in connection with the proposed transaction will be set forth in the proxy statement/prospectus for the transaction when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the proxy statement/prospectus filed with the SEC in connection with the proposed Business Combination.

5

Non-Solicitation

This Current Report on Form 8-K is not a proxy statement/prospectus or solicitation or a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination and shall not constitute an offer to sell or exchange, or a solicitation of an offer to buy or exchange, the securities of Cellebrite, TWC or the combined company, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “could,” “continue,” “expect,” “estimate,” “may,” “plan,” “outlook,” “future” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements may include estimated financial information. Any such forward-looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of TWC, Cellebrite or the combined company after completion of the proposed Business Combination are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Business Combination Agreement and the proposed Business Combination contemplated thereby; (2) the inability to complete the transactions contemplated by the Business Combination Agreement due to the failure to obtain approval of the stockholders of TWC or other conditions to closing in the Business Combination Agreement; (3) the ability to meet Nasdaq’s listing standards following the consummation of the transactions contemplated by the Business Combination Agreement; (4) the risk that the proposed transaction disrupts current plans and operations of Cellebrite as a result of the announcement and consummation of the transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (6) costs related to the proposed Business Combination; (7) changes in applicable laws or regulations; (8) the possibility that Cellebrite may be adversely affected by other economic, business, and/or competitive factors; and (9) other risks and uncertainties indicated from time to time in other documents filed or to be filed with the SEC by TWC. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. TWC and Cellebrite undertake no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

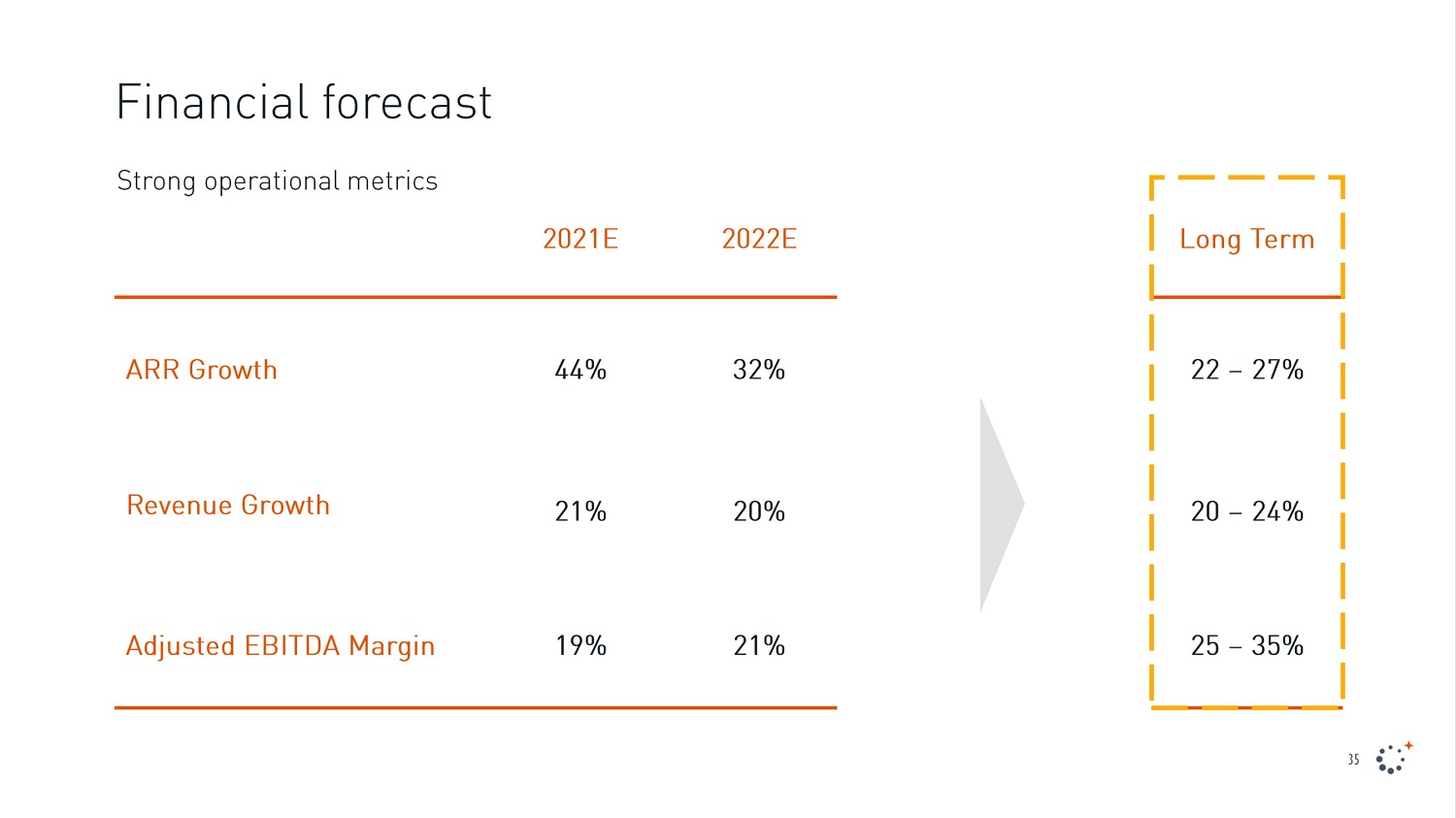

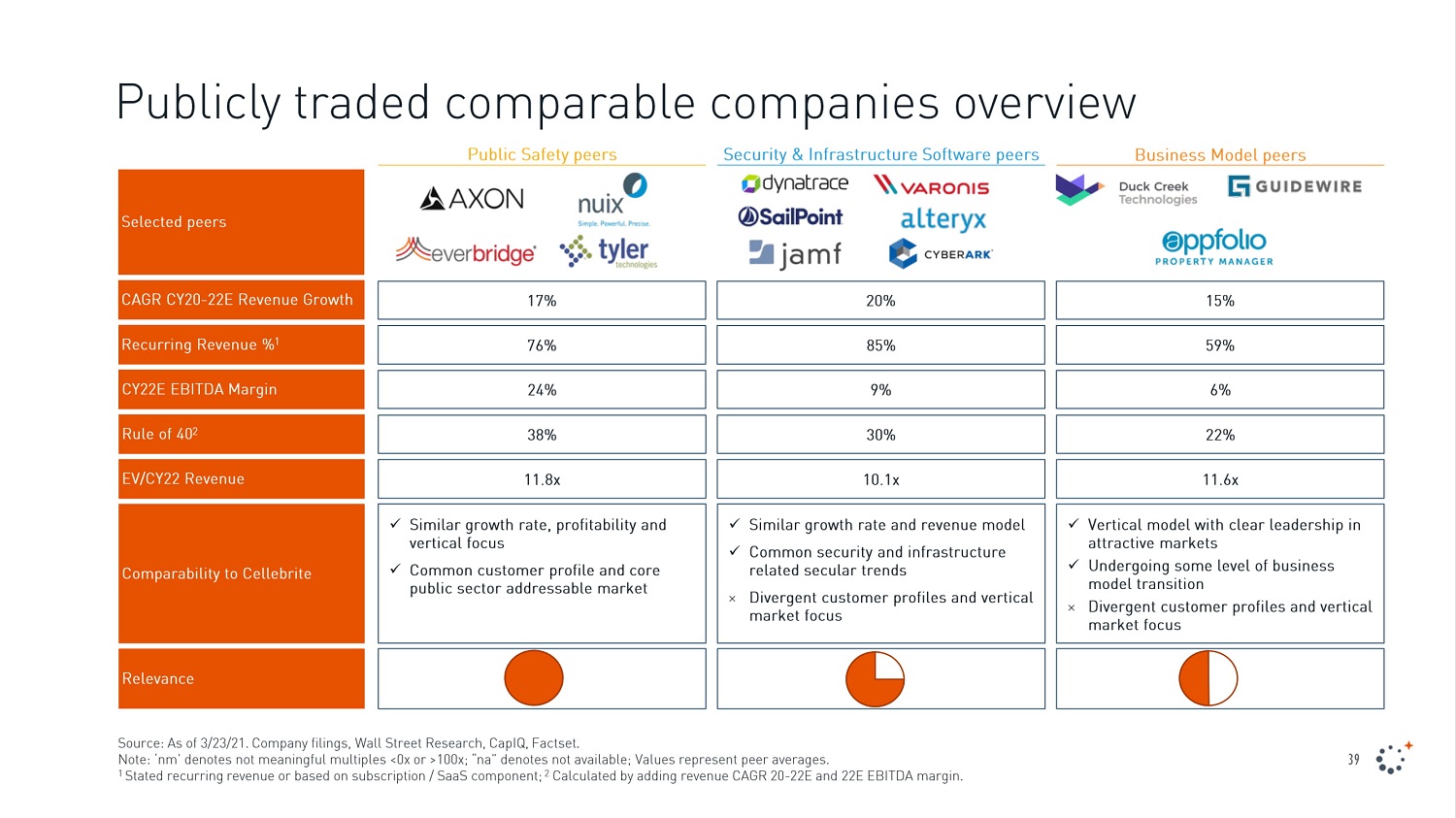

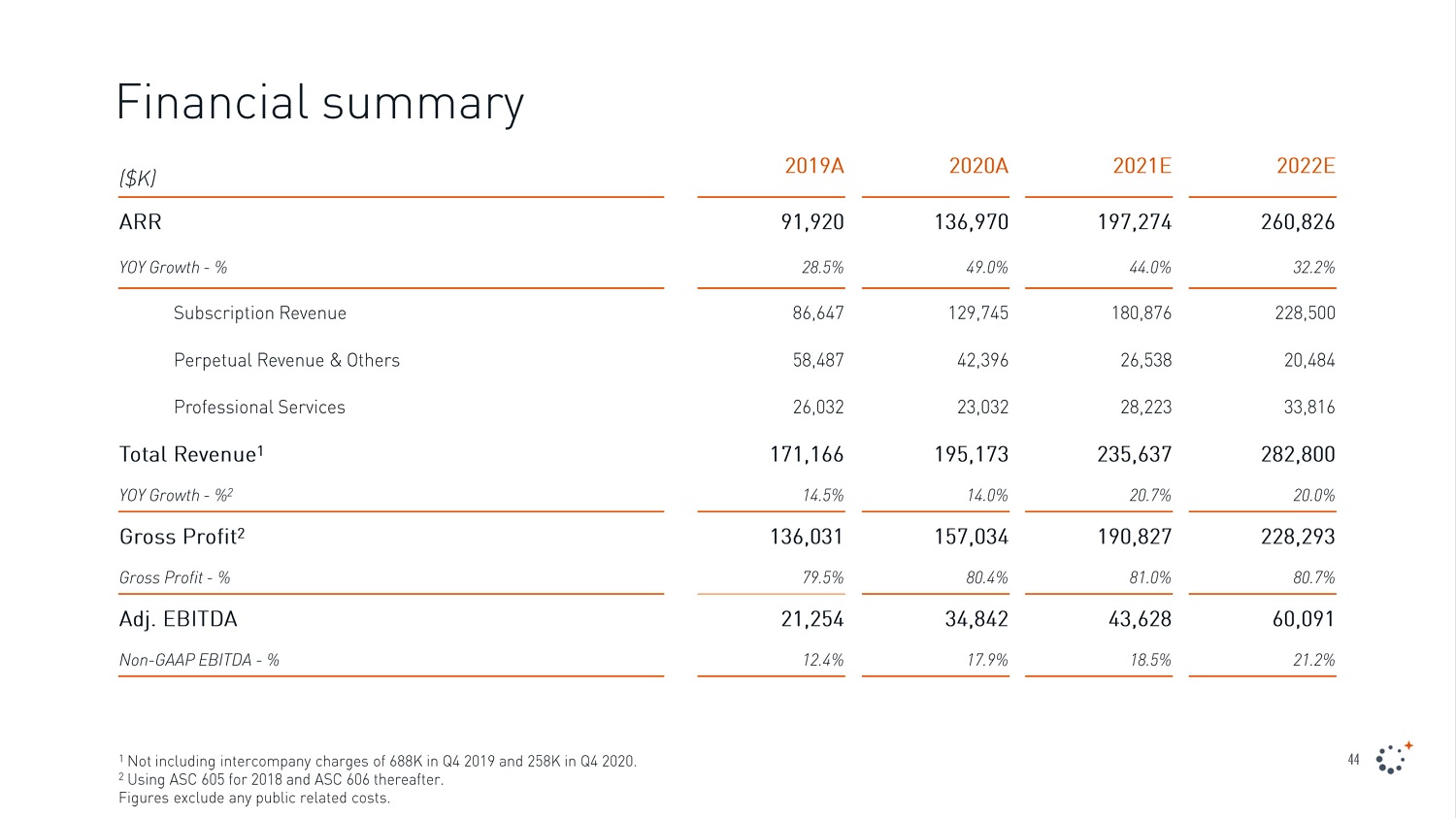

Non-GAAP Financial Measure and Related Information

Certain of the exhibits to this Current Report on Form 8-K may reference EBITDA and EBITDA margin, which are financial measures that are not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures do not have a standardized meaning, and the definition of EBITDA used by Cellebrite may be different from other, similarly named non-GAAP measures used by others. In addition, such financial information is unaudited and does not conform to SEC Regulation S-X and as a result such information may be presented differently in future filings by Cellebrite with the SEC.

6

Item 9.01. Financial Statements and Exhibits.

| (d) | Exhibits. |

7

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: April 8, 2021

| TWC Tech Holdings II Corp. | |||

| By: | /s/ Adam H. Clammer | ||

| Name: | Adam H. Clammer | ||

| Title: | Chief Executive Officer | ||

8

Exhibit 2.1

| STRICTLY CONFIDENTIAL | Execution Version |

BUSINESS COMBINATION AGREEMENT AND PLAN OF MERGER

by and among

TWC TECH HOLDINGS II CORP.,

CELLEBRITE DI LTD.,

and

CUPCAKE MERGER SUB, INC.

dated as of April 8, 2021

TABLE OF CONTENTS

| Page | ||

| Article I CERTAIN DEFINITIONS | 3 | |

| Section 1.01 | Definitions | 3 |

| Section 1.02 | Construction | 25 |

| Section 1.03 | Knowledge | 26 |

| Article II THE MERGER; CLOSING | 26 | |

| Section 2.01 | The Merger | 27 |

| Section 2.02 | Effects of the Merger | 27 |

| Section 2.03 | Closing; Effective Time | 27 |

| Section 2.04 | Closing Deliverables | 27 |

| Section 2.05 | Governing Documents | 29 |

| Section 2.06 | Directors and Officers | 29 |

| Section 2.07 | Tax-Deferred Reorganization Matters | 29 |

| Article III PRE-CLOSING TRANSACTIONS; EFFECTS OF THE MERGER ON THE SPAC COMMON STOCK | 30 | |

| Section 3.01 | Pre-Closing Transactions | 30 |

| Section 3.02 | Conversion of Securities | 31 |

| Section 3.03 | Exchange Procedures | 31 |

| Section 3.04 | Treatment of Warrants | 32 |

| Section 3.05 | Withholding | 33 |

| Section 3.06 | Dissenting Shares | 33 |

| Section 3.07 | Issuance of Price Adjustment Shares to Company Shareholders | 34 |

| Section 3.08 | Additional Dividend | 35 |

| Section 3.09 | Transaction Tax Ruling | 35 |

| Section 3.10 | Taking of Necessary Action; Further Action | 36 |

| Article IV REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 36 | |

| Section 4.01 | Company Organization | 36 |

| Section 4.02 | Subsidiaries | 37 |

| Section 4.03 | Due Authorization | 37 |

| Section 4.04 | No Conflict | 38 |

| Section 4.05 | Governmental Authorities; Approvals | 38 |

| Section 4.06 | Capitalization of the Company | 39 |

| Section 4.07 | Capitalization of Subsidiaries | 40 |

| Section 4.08 | Financial Statements | 40 |

| Section 4.09 | Undisclosed Liabilities | 41 |

| Section 4.10 | Litigation and Proceedings | 41 |

| Section 4.11 | Legal Compliance | 42 |

| Section 4.12 | Contracts; No Defaults | 43 |

| Section 4.13 | Company Benefit Plans | 45 |

| Section 4.14 | Labor Relations; Employees | 47 |

| Section 4.15 | Taxes | 49 |

| Section 4.16 | Brokers’ Fees | 52 |

| Section 4.17 | Insurance | 52 |

| Section 4.18 | Permits | 52 |

-i-

| Section 4.19 | Real Property | 53 |

| Section 4.20 | Intellectual Property | 54 |

| Section 4.21 | Privacy and Cybersecurity | 55 |

| Section 4.22 | Environmental Matters | 56 |

| Section 4.23 | Absence of Changes | 56 |

| Section 4.24 | Information Supplied | 57 |

| Section 4.25 | Top Customers and Top Vendors | 57 |

| Section 4.26 | Government Contracts; Government Grants | 57 |

| Section 4.27 | Financial Assistance | 58 |

| Section 4.28 | PIPE Share Purchase Agreements | 58 |

| Section 4.29 | No Additional Representations or Warranties | 58 |

| Article V REPRESENTATIONS AND WARRANTIES OF SPAC | 59 | |

| Section 5.01 | Company Organization | 59 |

| Section 5.02 | Due Authorization | 59 |

| Section 5.03 | No Conflict | 60 |

| Section 5.04 | Litigation and Proceedings | 60 |

| Section 5.05 | SEC Filings | 60 |

| Section 5.06 | Internal Controls; Listing; Financial Statements | 61 |

| Section 5.07 | Governmental Authorities; Approvals | 62 |

| Section 5.08 | Trust Account | 62 |

| Section 5.09 | Investment Company Act; JOBS Act | 63 |

| Section 5.10 | Absence of Changes | 63 |

| Section 5.11 | No Undisclosed Liabilities | 63 |

| Section 5.12 | Capitalization of SPAC | 63 |

| Section 5.13 | Brokers’ Fees | 64 |

| Section 5.14 | Indebtedness | 64 |

| Section 5.15 | Taxes | 64 |

| Section 5.16 | Business Activities | 66 |

| Section 5.17 | Nasdaq Stock Market Quotation | 67 |

| Section 5.18 | Registration Statement, Proxy Statement and Proxy Statement/Registration Statement | 67 |

| Section 5.19 | Affiliate Transactions | 67 |

| Section 5.20 | Title to Assets | 67 |

| Section 5.21 | No Israeli Shareholders | 67 |

| Section 5.22 | No Additional Representations or Warranties | 68 |

| Article VI COVENANTS | 69 | |

| Section 6.01 | Company Conduct of Business | 69 |

| Section 6.02 | SPAC Conduct of Business | 72 |

| Section 6.03 | Access | 74 |

| Section 6.04 | Preparation and Delivery of Additional Company Financial Statements | 75 |

| Section 6.05 | Acquisition Proposals | 75 |

| Section 6.06 | No Solicitation by SPAC | 76 |

| Section 6.07 | Preparation of Proxy Statement/Registration Statement; Shareholders’ Meeting and Approvals | 76 |

| Section 6.08 | Support of Transaction | 79 |

| Section 6.09 | HSR Act; Other Filings | 79 |

| Section 6.10 | SPAC Reduction | 80 |

-ii-

| Section 6.11 | Employee Matters | 80 |

| Section 6.12 | Post-Closing Directors and Officers of the Company | 81 |

| Section 6.13 | Indemnification and Insurance | 82 |

| Section 6.14 | Affiliate Agreements | 83 |

| Section 6.15 | Section 16 Matters | 83 |

| Section 6.16 | Trust Account Proceeds and Related Available Equity | 83 |

| Section 6.17 | Nasdaq Listing | 84 |

| Section 6.18 | SPAC Public Filings | 84 |

| Section 6.19 | PIPE Share Purchases | 84 |

| Section 6.20 | Israeli 102 Tax Rulings | 84 |

| Section 6.21 | Warrant Agreement | 85 |

| Section 6.22 | Transaction Litigation | 85 |

| Section 6.23 | SPAC Backstop Financing | 85 |

| Section 6.24 | Termination of Certain Agreements | 85 |

| Article VII CONDITIONS TO OBLIGATIONS | 85 | |

| Section 7.01 | Conditions to Obligations of SPAC, Merger Sub, and the Company | 85 |

| Section 7.02 | Conditions to Obligations of SPAC | 86 |

| Section 7.03 | Conditions to the Obligations of the Company and Merger Sub | 87 |

| Article VIII TERMINATION/EFFECTIVENESS | 87 | |

| Section 8.01 | Termination | 87 |

| Section 8.02 | Effect of Termination | 88 |

| Article IX MISCELLANEOUS | 88 | |

| Section 9.01 | Trust Account Waiver | 88 |

| Section 9.02 | Waiver | 88 |

| Section 9.03 | Notices | 89 |

| Section 9.04 | Assignment | 90 |

| Section 9.05 | Rights of Third Parties | 90 |

| Section 9.06 | Expenses | 90 |

| Section 9.07 | Governing Law; Jurisdiction | 90 |

| Section 9.08 | Waiver of Jury Trial | 91 |

| Section 9.09 | Company and SPAC Disclosure Letters | 91 |

| Section 9.10 | Entire Agreement | 92 |

| Section 9.11 | Amendments | 92 |

| Section 9.12 | Publicity | 92 |

| Section 9.13 | Severability | 93 |

| Section 9.14 | Headings; Counterparts | 93 |

| Section 9.15 | Enforcement | 93 |

| Section 9.16 | Non-Recourse | 93 |

| Section 9.17 | Non-Survival of Representations, Warranties and Covenants | 94 |

| Section 9.18 | Legal Representation | 94 |

-iii-

EXHIBITS

| Exhibit A | Form of Company Holders Support Agreement |

| Exhibit B | Form of Sponsor Support Agreement |

| Exhibit C | Form of Investor Rights Agreement |

| Exhibit D | Form of Amended Articles of Association |

| Exhibit E | Form of Declaration of Non-Israeli Residence |

-iv-

BUSINESS COMBINATION AGREEMENT AND PLAN OF MERGER

This Business Combination Agreement and Plan of Merger, dated as of April 8, 2021 (as amended, restated, modified or supplemented in accordance with its terms, this “Agreement”), is made and entered into by and among TWC Tech Holdings II Corp., a Delaware corporation (“SPAC”), Cellebrite DI Ltd., a company organized under the laws of the State of Israel (the “Company”) and Cupcake Merger Sub, Inc., a Delaware corporation and a direct wholly-owned Subsidiary of the Company (“Merger Sub”).

RECITALS

WHEREAS, SPAC is a blank check company incorporated as a Delaware corporation for the purpose of effecting a merger, share exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses;

WHEREAS, immediately prior to the Effective Time, (i) each Company Preferred Share will be converted into one (1) Company Ordinary Share and (ii) immediately following such conversion, the Company shall effect the Stock Split (as defined below) (the foregoing transactions, the “Capital Restructuring”);

WHEREAS, upon the terms and subject to the conditions of this Agreement, and in accordance with the DGCL, immediately following the Capital Restructuring, and at the Effective Time, Merger Sub will merge with and into SPAC, the separate corporate existence of Merger Sub will cease and SPAC will be the surviving corporation and a wholly-owned Subsidiary of the Company (the “Merger”);

WHEREAS, (i) immediately prior to the Effective Time, each share of SPAC Class B Common Stock shall be automatically converted into one (1) share of SPAC Class A Common Stock (the “SPAC Class B Conversion”) and, after giving effect to such automatic conversion at the Effective Time, as a result of the Merger, each issued and outstanding share of SPAC Class A Common Stock shall no longer be outstanding and shall automatically be converted into the right of the holder thereof to receive one Company Ordinary Share and (ii) at the Effective Time, each outstanding SPAC Warrant will automatically become one Company Warrant and all rights with respect to shares of SPAC Class A Common Stock underlying the SPAC Warrants will be automatically converted into a warrant to purchase the Warrant Consideration and thereupon assumed by the Company;

WHEREAS, for U.S. federal income Tax purposes, the parties intend that (a) the Merger qualifies as a “reorganization” within the meaning of Section 368(a) of the Code, and the Treasury Regulations promulgated thereunder, (b) this Agreement is and is hereby adopted as a “plan of reorganization” within the meaning of Sections 354, 361 and 368 of the Code and Treasury Regulations Sections 1.368-2(g) and 1.368-3(a), and (c) the transfer of SPAC Common Stock by SPAC Stockholders pursuant to the Merger, other than by any SPAC Stockholders who are U.S. persons and who are or will be “five-percent transferee shareholders” within the meaning of Treasury Regulations Section 1.367(a)-3(c)(5)(ii) but who do not enter into gain recognition agreements within the meaning of Treasury Regulations Sections 1.367(a)-3(c)(1)(iii)(B) and 1.367(a)-8, qualifies for an exception to Section 367(a)(1) of the Code (the “Intended Tax Treatment”);

WHEREAS, the Board of Directors of each of the Company and Merger Sub has (i) determined that it is advisable for the Company and Merger Sub to enter into this Agreement and the documents contemplated hereby to which the Company and Merger Sub is a party, respectively, (ii) approved the execution and delivery of this Agreement and the documents contemplated hereby and the transactions contemplated hereby and thereby, and (iii) recommended the adoption and approval of this Agreement and the other documents contemplated hereby and the transactions contemplated hereby and thereby by the Company Shareholders and sole stockholder of Merger Sub, as applicable;

WHEREAS, the Company, as sole stockholder of Merger Sub has approved and adopted this Agreement and the documents contemplated hereby and the transactions contemplated hereby and thereby;

WHEREAS, as a condition and inducement to SPAC’s willingness to enter into this Agreement, simultaneously with the execution and delivery of this Agreement, the Requisite Company Shareholders have each executed and delivered to SPAC a Company Holders Support Agreement (as defined below) in the form attached hereto as Exhibit A, pursuant to which the Requisite Company Shareholders have agreed, among other things, to vote at the Company Special Meeting in favor of the adoption and approval, of this Agreement and the other documents contemplated hereby and the transactions contemplated hereby and thereby and to grant certain waivers and consents in connection herewith and therewith;

WHEREAS, the Board of Directors of SPAC has unanimously (i) determined that it is advisable for SPAC to enter into this Agreement and the documents contemplated hereby to which SPAC is a party, (ii) approved the execution and delivery of this Agreement and the documents contemplated hereby and the transactions contemplated hereby and thereby, and (iii) recommended the adoption and approval of this Agreement and the other documents contemplated hereby and the transactions contemplated hereby and thereby by the SPAC Stockholders;

WHEREAS, in furtherance of the Merger and in accordance with the terms hereof, SPAC shall provide an opportunity to its stockholders to have their outstanding shares of SPAC Common Stock redeemed on the terms and subject to the conditions set forth in this Agreement and SPAC’s Governing Documents (as defined below) in connection with obtaining the SPAC Stockholder Approval (as defined below);

WHEREAS, as a condition and inducement to the Company’s willingness to enter into this Agreement, simultaneously with the execution and delivery of this Agreement, the Sponsor has executed and delivered to the Company the Sponsor Support Agreement (as defined below) in the form attached hereto as Exhibit B, pursuant to which the Sponsor has agreed to, among other things, (i) vote to adopt and approve this Agreement and the other documents contemplated hereby and the transactions contemplated hereby and thereby, (ii) waive the anti-dilution conversion formula set forth in the SPAC’s certificate of incorporation as in effect on the date hereof, (iii) subject certain Company Ordinary Shares to be issued to the Sponsor pursuant to the Merger to vesting criteria, (iv) forfeit for no consideration a certain number of shares of SPAC Common Stock, and (v) terminate certain existing agreements in favor of Sponsor with respect to registration rights and other matters, in each case, subject to the terms and conditions set forth therein;

WHEREAS, prior to the date hereof or concurrently with the execution of this Agreement, the PIPE Investors (as defined below) have entered into the Share Purchase Agreements (as defined below) pursuant to which the PIPE Investors have committed to purchase Company Ordinary Shares from certain Company Shareholders immediately prior to or concurrently with the Effective Time;

WHEREAS, at the Closing, the Company shall enter into an Investor Rights Agreement (the “Investor Rights Agreement”) with the Sponsor and certain holders of Company Ordinary Shares, substantially in the form attached hereto as Exhibit C (with such changes as may be mutually agreed in writing by SPAC and the Company), which shall be effective as of the Closing; and

-2-

WHEREAS, at the Closing, the Company shall amend and restate, effective as of prior to the Effective Time, its articles of association substantially in the form attached hereto as Exhibit D (the “Amended Articles”), which Amended Articles will include the lock-up provisions set forth in the form of the Amended Articles attached hereto as Exhibit D (with such changes as may be mutually agreed in writing by SPAC and the Company).

NOW, THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants and agreements set forth in this Agreement and intending to be legally bound hereby, SPAC, Merger Sub and the Company agree as follows:

Article

I

CERTAIN DEFINITIONS

Section 1.01 Definitions. As used herein, the following terms shall have the following meanings:

“102 Plan” has the meaning specified in Section 4.15(q).

“102 Trustee” means the trustee appointed by the Company from time to time in accordance with the provisions of the ITO, and approved by the ITA, with respect to the Options, RSUs and the Company Ordinary Shares that are subject to Section 102(b)(2) and Section 102(b)(3) of the ITO.

“5% Shareholder” has the meaning specified in Section 3.05.

“Acquisition Proposal” means, as to any Person, other than the transactions contemplated hereby and other than the acquisition or disposition of equipment or other tangible personal property in the ordinary course of business, any offer or proposal relating to: (a) any acquisition or purchase, direct or indirect, of (i) 10% or more of the consolidated assets of such Person and its Subsidiaries or (ii) 10% or more of any class of equity or voting securities of (x) such Person or (y) one or more Subsidiaries of such Person holding assets constituting, individually or in the aggregate, 10% or more of the consolidated assets of such Person and its Subsidiaries; (b) any tender offer (including a self-tender offer) or exchange offer that, if consummated, would result in any Person beneficially owning 10% or more of any class of equity or voting securities of (i) such Person or (ii) one or more Subsidiaries of such Person holding assets constituting, individually or in the aggregate, 10% or more of the consolidated assets of such Person and its Subsidiaries; or (c) a merger, consolidation, share exchange, business combination, sale of substantially all the assets, reorganization, recapitalization, liquidation, dissolution or other similar transaction involving (i) such Person or (ii) one or more Subsidiaries of such Person holding assets constituting, individually or in the aggregate, 10% or more of the consolidated assets of such Person and its Subsidiaries, in each case of sub-clause (c), pursuant to which any Person acquires 10% or more of any class of equity or voting securities of such Person or of such Subsidiaries.

“Action” means any claim, action, suit, audit, examination, assessment, arbitration, mediation, proceeding, or investigation, by or before any Governmental Authority.

“Actual Additional Dividend Payment Amount” has the meaning specified in Section 3.08.

“Affiliate” means, with respect to any specified Person, any Person that, directly or indirectly, controls, is controlled by, or is under common control with, such specified Person, whether through one or more intermediaries or otherwise. The term “control” (including the terms “controlling”, “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by Contract or otherwise; provided, that, notwithstanding anything to the contrary herein, except for purposes of Section 9.05 and Section 9.16, in no event shall True Wind Capital or any investment funds or investment vehicles affiliated with, or managed or advised by, True Wind Capital or any portfolio company (as such term is customarily used in the private equity industry) or investment of True Wind Capital or of any such investment fund or investment vehicle) or any interest therein (including the Sponsor) be deemed, treated or considered to be an “Affiliate” of SPAC or its Subsidiaries (or, in each case, vice versa).

-3-

“Affiliate Agreements” has the meaning specified in Section 4.12(a)(vi).

“Aggregate Exercise Price Amount” means the sum of (i) the aggregate amount of the exercise (or conversion or exchange, as applicable) prices of all vested options, warrants, rights or other securities convertible into or exchangeable or exercisable for Company Ordinary Shares that are issued and outstanding following the Company Preferred Share Conversion and immediately prior to the Stock Split but after giving effect to any reduction of exercise price due to the payment of dividends (including the Initial Dividend and Actual Additional Dividend Payment Amount) (excluding, for the avoidance of doubt, any Unvested Options), plus (ii) the Included Unvested Option Exercise Price Amount.

“Aggregate Merger Consideration” has the meaning specified in Section 3.02(c).

“Agreement” has the meaning specified in the Preamble hereto.

“Agreement End Date” has the meaning specified in Section 8.01(b).

“Amended and Restated Warrant Agreement” has the meaning specified in Section 6.21.

“Amended Articles” has the meaning specified in the Recitals hereto.

“Ancillary Agreements” has the meaning specified in Section 9.10.

“Anti-Bribery Laws” means the anti-bribery provisions of the Foreign Corrupt Practices Act of 1977, as amended, the Israeli Penal Law-1977, as amended, and all other applicable anti-corruption and bribery Laws (including the U.K. Bribery Act 2010, and any rules or regulations promulgated thereunder or other Laws of other countries implementing the OECD Convention on Combating Bribery of Foreign Officials).

“Anti-Money Laundering Laws” means all applicable laws, regulations, administrative orders, and decrees concerning or relating to the prevention of money laundering or countering the financing of terrorism, including, without limitation, the Currency and Financial Transactions Reporting Act of 1970, as amended by the USA PATRIOT Act, which legislative framework is commonly referred to as the “Bank Secrecy Act”, the Israeli Prohibition on Money Laundering Law-2000, the Israeli Combatting Terror Law-2016 and the Israeli Restriction on Use of Cash Law-2018, and, in each case, the rules and regulations thereunder.

“Antitrust Authorities” means the Antitrust Division of the United States Department of Justice, the United States Federal Trade Commission or the antitrust or competition Law authorities of any other jurisdiction (whether United States, foreign or multinational).

“Antitrust Information or Document Request” means any request or demand for the production, delivery or disclosure of documents or other evidence, or any request or demand for the production of witnesses for interviews or depositions or other oral or written testimony, by any Antitrust Authorities relating to the transactions contemplated hereby or by any third party challenging the transactions contemplated hereby, including any so called “second request” for additional information or documentary material or any civil investigative demand made or issued by any Antitrust Authority or any subpoena, interrogatory or deposition.

-4-

“Bid” has the meaning specified in Section 4.26(a).

“Business Combination” has the meaning specified in Article II of SPAC’s amended and restated certificate of incorporation as in effect on the date hereof.

“Business Combination Proposal” means other than the transactions contemplated hereby any offer, inquiry, proposal or indication of interest (whether written or oral, binding or non-binding, and other than an offer, inquiry, proposal or indication of interest with respect to the transactions contemplated hereby), relating to a Business Combination or other Acquisition Proposal with respect to SPAC.

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks in New York, New York or Tel-Aviv, Israel are authorized or required by Law to close.

“CAA” means the Consolidated Appropriations Act, 2021.

“Capital Restructuring” has the meaning specified in the Recitals hereto.

“CARES Act” means the Coronavirus Aid, Relief, and Economic Security Act and any similar or successor legislation, including any presidential memoranda or executive orders, relating to the COVID-19 pandemic, as well as any applicable guidance issued thereunder or relating thereto.

“Cash” means, with respect to any Person (without duplication of any of the following amounts): (i) all cash and cash equivalents held by such Person, determined in accordance with GAAP, plus (ii) all certificates of deposit with maturity of twelve (12) months or less from the date of purchase, plus (iii) uncleared checks and deposits in transit, in each case, received or deposited or available for the account of such Person, plus (iv) any cash held by such Person subject to contractual restriction on the ability of such Person to use such cash for any lawful purpose where such contractual restriction will be eliminated concurrently with or promptly after the Closing. For the avoidance of doubt, Cash shall not include (x) any security deposits (which, for the avoidance of doubt is separate and distinct from certificates of deposit except to the extent any such certificate of deposit is used as a security deposit), (y) any cash held by such Person subject to contractual restriction on the ability of such Person to use such cash for any lawful purpose (other than any such contractual restriction that will be eliminated concurrently with or promptly after the Closing) and (z) uncleared checks and wires in transit, in each case, issued by such Person that are not yet credited to the account of the recipient thereof.

“Change of Control” shall mean the occurrence of any of the following events: (i) any transaction or series of transactions the result of which is: (x) the acquisition by any Person or “group” (as defined in the Exchange Act) of Persons (in each case, excluding the Sponsor, the Company Shareholders or any Person that is an Affiliate of the Sponsor or any of the Company Shareholders immediately prior to the entry into such transaction or series of related transactions) of direct or indirect beneficial ownership of securities representing 50% or more of the combined voting power of the then outstanding securities of the Company; (y) a merger, consolidation, reorganization or other business combination, however effected, resulting in any Person or “group” (as defined in the Exchange Act) of Persons (in each case, excluding the Sponsor, the Company Shareholders or any Person that is an Affiliate of the Sponsor or any of the Company Shareholders immediately prior to the entry into such transaction or series of related transactions) acquiring at least 50% of the combined voting power of the then outstanding securities of the Company or the surviving Person outstanding immediately after such combination; or (z) a sale of all or substantially all of the assets of the Company other than to (1) the Sponsor, the Company Shareholders or any Person that is an Affiliate of the Sponsor or any of the Company Shareholders immediately prior to the entry into such sale transaction or (2) a Subsidiary of the Company; or (ii) the following individuals cease for any reason to constitute a majority of the number of directors of the Company then serving: individuals who, on immediately after the Closing, constitute the Board of Directors of the Company and any new director whose appointment or election by the Board of Directors of the Company or nomination for election by the Company’s stockholders was approved or recommended by a vote of at least a majority of the directors then still in office who either were members of the Board of Directors of the Company immediately after the Closing or whose appointment, election or nomination for election was previously so approved or recommended by the directors referred to in this clause (ii).

-5-

“Closing” has the meaning specified in Section 2.03(a).

“Closing Adjustment Amount” means an amount, which may be positive or negative, equal to (i) subject to the next sentence, the Cash of the Company and its Subsidiaries as of the Reference Time (for the avoidance of doubt, calculated as of after the payment of the Initial Dividend and the Actual Additional Dividend Payment Amount pursuant to Section 3.01(a)(i)), plus (ii) the amount of Cash actually used by the Company or its Subsidiaries to fund the purchase of any Permitted Acquisitions prior to the Effective Time, solely to the extent that such Cash would have been included in the foregoing clause (i) but for such funding, minus (iii) the Indebtedness of the Company and its Subsidiaries as of the Reference Time, minus (iv) the excess (if any) of the Tax Liability Amount over $5,500,000.00, minus (v) the amount of Unpaid Company Expenses as of the Reference Time, minus (vi) the Vested Promote Amount, plus (vii) the Aggregate Exercise Price Amount, minus (viii) the Excluded Unvested Option Shortfall. Notwithstanding the foregoing, for purposes of the definition of “Closing Adjustment Amount”, the Cash of the Company and its Subsidiaries as of the Reference Time shall not include any Cash (x) directly or indirectly acquired or assumed by the Company or its Subsidiaries pursuant to any Permitted Acquisition or (y) of any Person acquired by the Company or its Subsidiaries pursuant to any Permitted Acquisition.

“Closing Company Audited Financial Statements” has the meaning specified in Section 6.04.

“Closing Date” has the meaning specified in Section 2.03(a).

“Closing Equity Value” means an amount equal to (i) the Enterprise Value, plus (ii) the Closing Adjustment Amount.

“Closing Share Consideration” has the meaning specified in Section 3.02(c).

“Closing Statements” has the meaning specified in Section 2.04(d).

“Code” means the Internal Revenue Code of 1986, as amended.

“Company” has the meaning specified in the Preamble hereto.

“Company Articles” means the Amended and Restated Articles of Association of the Company, dated August 31, 2021.

“Company Benefit Plan” has the meaning specified in Section 4.13(a).

“Company Closing Statement” has the meaning specified in Section 2.04(c).

“Company Disclosure Letter” has the meaning specified in the introduction to Article IV.

“Company Fundamental Representations” means the representations and warranties made pursuant to the first and second sentences of Section 4.01 (Company Organization), the first and second sentences of Section 4.02 (Subsidiaries), Section 4.03 (Due Authorization), Section 4.06(a), the first sentence of Section 4.06(b), Section 4.06(c), Section 4.06(d) (Capitalization of the Company), Section 4.07(b) (Capitalization of Subsidiaries) and Section 4.16 (Brokers’ Fees).

“Company Holders Support Agreement” means that certain Support Agreement, dated as of the date hereof, by and among each of the Requisite Company Shareholders, SPAC and the Company, as amended or modified from time to time.

“Company Incentive Plan” means, collectively, the Cellebrite Mobile Synchronization Ltd. 2019 Share Option Plan, the Cellebrite Mobile Synchronization Ltd. 2019 Sub Option Plan, the Cellebrite Mobile Synchronization Ltd. 2008 Share Option Plan and the Cellebrite Mobile Synchronization Ltd. 2020 Sub Option Plan.

“Company Intellectual Property” has the meaning specified in Section 4.20(a).

-6-

“Company Material Adverse Effect” means any event, state of facts, development, circumstance, occurrence or effect (collectively, “Events”) that (i) has had, or would reasonably be expected to have, individually or in the aggregate, a material adverse effect on the business, assets, results of operations or financial condition of the Company and its Subsidiaries, taken as a whole or (ii) does or would reasonably be expected to, individually or in the aggregate, prevent or materially delay the ability of the Company to consummate the transactions contemplated by this Agreement and the other transactions contemplated by the other Transaction Agreements; provided, however, that solely in the case of the foregoing clause (i), in no event would any of the following, alone or in combination, be deemed to constitute, or be taken into account in determining whether there has been or will be, a “Company Material Adverse Effect”: (a) any change or proposed change in applicable Laws or GAAP or any interpretation thereof following the date of this Agreement, (b) any change in interest rates or economic, political, business or financial market conditions generally in the United States, Israel, or anywhere else in the world, (c) any natural disaster (including hurricanes, storms, tornados, flooding, earthquakes, volcanic eruptions or similar occurrences), pandemic (including COVID-19 and any COVID-19 Measures), epidemics, or change in climate or man-made disasters, (d) any acts of terrorism, war, civil unrest or sabotage, the outbreak or escalation of hostilities, geopolitical conditions, local, regional, state, national or international political or social conditions, (e) any Events generally applicable to the industries or markets in which the Company and/or any of its Subsidiaries operate (including increases in the cost of products, supplies, materials or other goods purchased from third party suppliers), (f) any failure of the Company to meet any projections, forecasts, or other forward-looking predictions of revenue, earnings, cash flow or cash position (provided that this clause (f) shall not prevent a determination that any Event not otherwise excluded from this definition of Company Material Adverse Effect underlying such failure has resulted in a Company Material Adverse Effect), (g) the announcement or pendency of this Agreement and consummation of the transactions contemplated hereby, including any termination of, reduction in or similar adverse impact (but in each case only to the extent attributable to such announcement, pendency or consummation) on relationships, contractual or otherwise, with any landlords, customers, suppliers, or employees of the Company and/or any of its Subsidiaries (it being understood that this clause (g) shall be disregarded for purposes of the representations and warranties set forth in Section 4.04, Section 4.12(a)(viii) and Section 4.13(f) and, in each case, the condition to Closing with respect thereto), (h) any action or omission by the Company to the extent such action or omission is expressly required or expressly permitted by this Agreement, (i) any action taken or not taken by, or at the written request of, SPAC or Merger Sub, or (j) any matter set forth in the Company Disclosure Letter, including on Section 1.01-B of the Company Disclosure Letter; provided, further, that any Event referred to in clauses (a), (b), (c), (d) or (e) above may be taken into account (but only the extent of the disproportionate and adverse effect as described in this proviso) in determining if a Company Material Adverse Effect has occurred to the extent it has a disproportionate and adverse effect on the business, assets, results of operations or financial condition of the Company and its Subsidiaries, taken as a whole, relative to similarly situated companies in the industry in which the Company and its Subsidiaries conduct their respective operations.

“Company Ordinary Shares” means the ordinary shares, with par value of NIS 0.00001 per share, of the Company.

-7-

“Company Preferred Share Conversion” has the meaning specified in Section 3.01(a).

“Company Preferred Shares” means the Series A Preferred Shares, with par value of NIS 0.00001 per share, of the Company.

“Company Registered Intellectual Property” has the meaning specified in Section 4.20(a).

“Company Shareholder” means a holder of a Company Ordinary Share issued and outstanding immediately after the Capital Restructuring and immediately prior to the consummation of the PIPE Investment and the Effective Time (for the avoidance of doubt, excluding the PIPE Investors); provided, that, (i) solely with respect to the definition of “Pro Rata Share”, Section 3.07 and any other Section or Article of this Agreement referenced in Section 3.07 which give appropriate effect to Section 3.07, “Company Shareholder” shall (x) not include any holders of Company Ordinary Shares that are issued after the date hereof in connection with the Permitted Acquisitions or any Company Ordinary Shares that are issued pursuant to options, warrants, rights or other convertible securities issued in connection with the Permitted Acquisitions entered into after the date hereof, and (y) include holders of vested RSUs and (ii) solely with respect to (A) the definition of “Initial Dividend” and (B) Section 3.08 and any other Section or Article of this Agreement referenced in Section 3.08 which give appropriate effect to Section 3.08, “Company Shareholder” shall include holders of vested RSUs.

“Company Shareholder Approval” means the vote of holders of Company Shares required to approve the Company Transaction Proposals, as determined in accordance with applicable Law and the Company’s Governing Documents.

“Company Shares” means the Company Ordinary Shares and the Company Preferred Shares, collectively.

“Company Special Meeting” has the meaning specified in Section 6.07(c).

“Company Special Meeting Notice Date” has the meaning specified in Section 6.07(c).

“Company Transaction Proposals” means (i) the adoption of this Agreement and approval of the transactions contemplated hereby, including the authorization of the Merger, (ii) the approval of the conversion of the Company Preferred Shares into Company Ordinary Shares and the effectiveness of the Stock Split in connection with the Capital Restructuring, (iii) the approval of the transfer of Company Ordinary Shares to the PIPE Investors pursuant to the PIPE Investment, (iv) the election of directors to the board of directors of the Company and entry into customary indemnification agreements with the directors of the Company, (v) approval of the Amended Articles, (vi) New Equity Incentive Plan and the ESPP, (vii) the increase of the number of Company Ordinary Shares reserved for issuance pursuant to the New Equity Incentive Plan or the ESPP or in connection with the Stock Split, (viii) the execution and delivery by the Company of the Employment Agreements (to the extent the approval of the Company’s shareholders is required), (ix) the purchase by the Company of a D&O Insurance Policy, effective as of immediately following the Closing Date, covering the Company’s directors and officers as of immediately following the Closing Date, (x) the appointment of the Company’s auditors, and (xi) the adoption and approval of each other proposal reasonably agreed to by SPAC and the Company as necessary or appropriate in connection with the consummation of the transactions contemplated by this Agreement.

-8-

“Company Warrant” means warrants to purchase the Warrant Consideration, which shall be in form identical to the SPAC Warrants (including with respect to terms applicable to the SPAC Private Placement Warrants, as applicable), but in the name of the Company and as amended pursuant to the Amended and Restated Warrant Agreement.

“Constituent Corporations” has the meaning specified in Section 2.01(a).

“Continuing Option” has the meaning specified in Section 3.01(b).

“Continuing RSU” has the meaning specified in Section 3.01(b).

“Contracting Parties” has the meaning specified in Section 9.16.

“Contracts” means any contract, agreement, instrument, option, lease, license, sales and purchase order, warranty, note, bond, mortgage, indenture, obligation, commitment, binding application, arrangement or understanding, whether written or oral, express or implied, in each case as amended and supplemented from time to time.

“Copyleft License” means any license that requires, as a condition of use, modification and/or distribution, conveyance or availability of software subject to such license, that such software subject to such license, and any other software incorporated into, derived from, or used, embedded, combined or distributed with such software subject to such license (i) be made available or distributed in source code form, (ii) be licensed for the purpose of preparing derivative works, (iii) be licensed under terms that allow the Company’s or any Subsidiary of the Company’s products, services or portions thereof or interfaces therefor to be reverse engineered, reverse assembled or disassembled (other than by operation of Law), or (iv) be licensed in a redistributable manner at no license fee. By way of example and not limitation, Copyleft Licenses include the GNU General Public License, the GNU Lesser General Public License, the GNU Affero General Public License, the Mozilla Public License, the Common Development and Distribution License, the Eclipse Public License and all Creative Commons “sharealike” licenses.

“COVID-19” means SARS CoV-2 or COVID-19, and any evolutions thereof.

“COVID-19 Action” means an inaction or action by the Company, including the establishment of any policy, procedure or protocol, in response to COVID-19 or any COVID-19 Measures that (i) is commercially reasonable, (ii) is intended to protect the health and safety of employees, independent contractors or customers of the Company or its Subsidiaries, (iii) is consistent with prevalent practices of similarly situated businesses in the industries or the locations in which the Company and its Subsidiaries operate and (iv) (x) is approved in advance in writing by SPAC, (y) is consistent with the past practice of the Company in response to COVID-19 prior to the date of this Agreement (but only to the extent in compliance with applicable Law) (except for (1) any employee layoff or furlough, reduction-in-force or facility closure or shutdown, (2) any inaction or action that would reasonably be expected to have an adverse financial impact on the Company and its Subsidiaries in excess of $1,000,000 or (3) any inaction or action that would reasonably be expected to materially and adversely impact the business of the Company and its Subsidiaries) or (z) would, given the totality of the circumstances under which the Company acted or did not act, be unreasonable for SPAC to withhold, condition or delay consent with respect to such action or inaction (whether or not SPAC has a consent right with respect thereto).

-9-

“COVID-19 Measures” means any quarantine, “shelter in place”, “stay at home”, workforce reduction, social distancing, shut down, closure, sequester, safety or similar Law, Governmental Order, Action, directive, guidelines or recommendations promulgated by any Governmental Authority that has jurisdiction over the Company or its Subsidiaries, including the Centers for Disease Control and Prevention and the World Health Organization, in each case, in connection with or response to COVID-19, including the CARES Act.

“D&O Indemnified Party” has the meaning specified in Section 6.13(a).

“D&O Tail” has the meaning specified in Section 6.13(b).

“DGCL” means the Delaware General Corporation Law, as amended or restated from time to time.

“Disclosure Letter” means, as applicable, either the Company Disclosure Letter or the SPAC Disclosure Letter or, if the context so requires, both the Company Disclosure Letter and the SPAC Disclosure Letter.

“Dissenting Shares” has the meaning specified in Section 3.06.

“Dividend Participation Plan” means all obligations of the Company to pay cash bonuses in lieu of dividend distributions, as evidenced by Dividend Participation Plan letters signed between the Company and various employees and service providers of the Company and its Affiliates.

“Dollars” or “$” means lawful money of the United States.

“Effective Time” has the meaning specified in Section 2.03(b).

“Employment Agreements” shall mean any employment agreements entered into by and between the Company and the employees of the Company to be identified by the Company in forms and substance to be agreed to by SPAC, the Company and the relevant employee between the date of execution of this Agreement and Closing and to become effective upon the Closing.

“Encouragement Law” means the Law for Encouragement of Capital Investments, 1959.

“Encouragement Law Incentives” has the meaning specified in Section 4.15(u).

“Encryption Laws” has the meaning specified in Section 4.11(d).

“Encryption Licenses” has the meaning specified in Section 4.11(d).

“Enterprise Value” means $1,707,192,607.00.

“Environmental Laws” means any and all applicable Laws (including common law) or other legally enforceable requirement regulating, relating to or imposing liability or standards of conduct concerning protection of the environment (including flora, fauna and their habitat), natural resources or, as such matters relate to human health, including employee health and safety, from the use, handling, presence, transportation, treatment, storage, disposal, release or discharge of, or exposure to, Hazardous Materials.

-10-

“ERISA” has the meaning specified in Section 4.13(a).

“ERISA Affiliate” means any Affiliate or business, whether or not incorporated, that together with the Company would be deemed to be a “single employer” within the meaning of Section 414(b), (c), (m) or (o) of the Code.

“ESPP” has the meaning specified in Section 6.11(b).

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Exchange Agent” has the meaning specified in Section 3.03(a).

“Excluded Unvested Options” means, as of following the Company Preferred Share Conversion and immediately prior to the Stock Split, outstanding Unvested Options and unvested RSUs convertible into or exchangeable or exercisable for an aggregate number of Company Ordinary Shares equal to 14,650,000.

“Excluded Unvested Option Shortfall” means an amount (which if less than $0.00, will be deemed equal to $0.00) equal to the product of (i) (x) $3.26 minus (y) the weighted average exercise price of the Unvested Options, as of following the Company Preferred Share Conversion and immediately prior to the Stock Split, but before giving effect to any reduction of exercise price due to the payment of dividends (including the Initial Dividend and Actual Additional Dividend Payment Amount), multiplied by (ii) the number of Company Ordinary Shares into or for which the Excluded Unvested Options are convertible, exchangeable or exercisable, as of following the Company Preferred Share Conversion and immediately prior to the Stock Split.

“Export Approvals” has the meaning specified in Section 4.11(c).

“Financial Assistance” has the meaning specified in Section 4.27.

“Financial Statements” has the meaning specified in Section 4.08(a).

“GAAP” means generally accepted accounting principles in the United States as in effect from time to time, consistently applied.

“Governing Documents” means the legal document(s) by which any Person (other than an individual) establishes its legal existence or which govern its internal affairs. For example, the “Governing Documents” of a corporation are its certificate of incorporation and by-laws, the “Governing Documents” of a limited partnership are its limited partnership agreement and certificate of limited partnership, the “Governing Documents” of a limited liability company are its operating agreement and certificate of formation and the “Governing Documents” of a company organized under the laws of the State of Israel are its memorandum and articles of association (including, with respect to the Company, the Company Articles).

“Government Contract” has the meaning specified in Section 4.26(a).

“Governmental Approval” has the meaning specified in Section 4.05.