Form 8-K TRICO BANCSHARES / For: Jul 27

Exhibit 99.1

| PRESS RELEASE | Contact: Peter G. Wiese | ||||

| For Immediate Release | EVP & Chief Financial Officer (530) 898-0300 | ||||

TRICO BANCSHARES ANNOUNCES QUARTERLY RESULTS

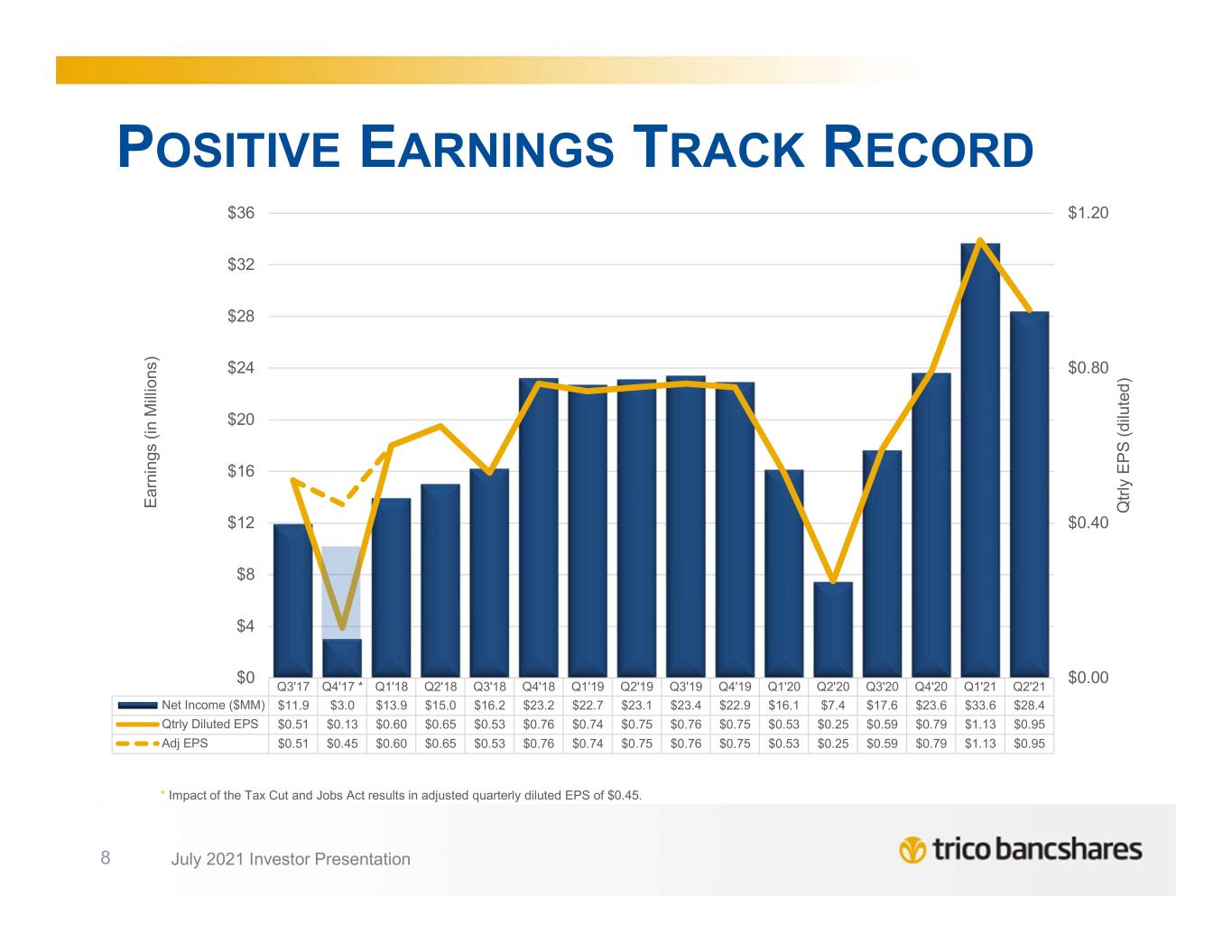

CHICO, CA – (July 27, 2021) – TriCo Bancshares (NASDAQ: TCBK) (the “Company”), parent company of Tri Counties Bank, today announced net income of $28,362,000 for the quarter ended June 30, 2021, compared to $33,649,000 during the trailing quarter ended March 31, 2021 and $7,430,000 during the quarter ended June 30, 2020. Diluted earnings per share were $0.95 for the second quarter of 2021, compared to $1.13 for the first quarter of 2021 and $0.25 for the second quarter of 2020.

Financial Highlights

Performance highlights and other developments for the Company as of or for the three and six months ended June 30, 2021 included the following:

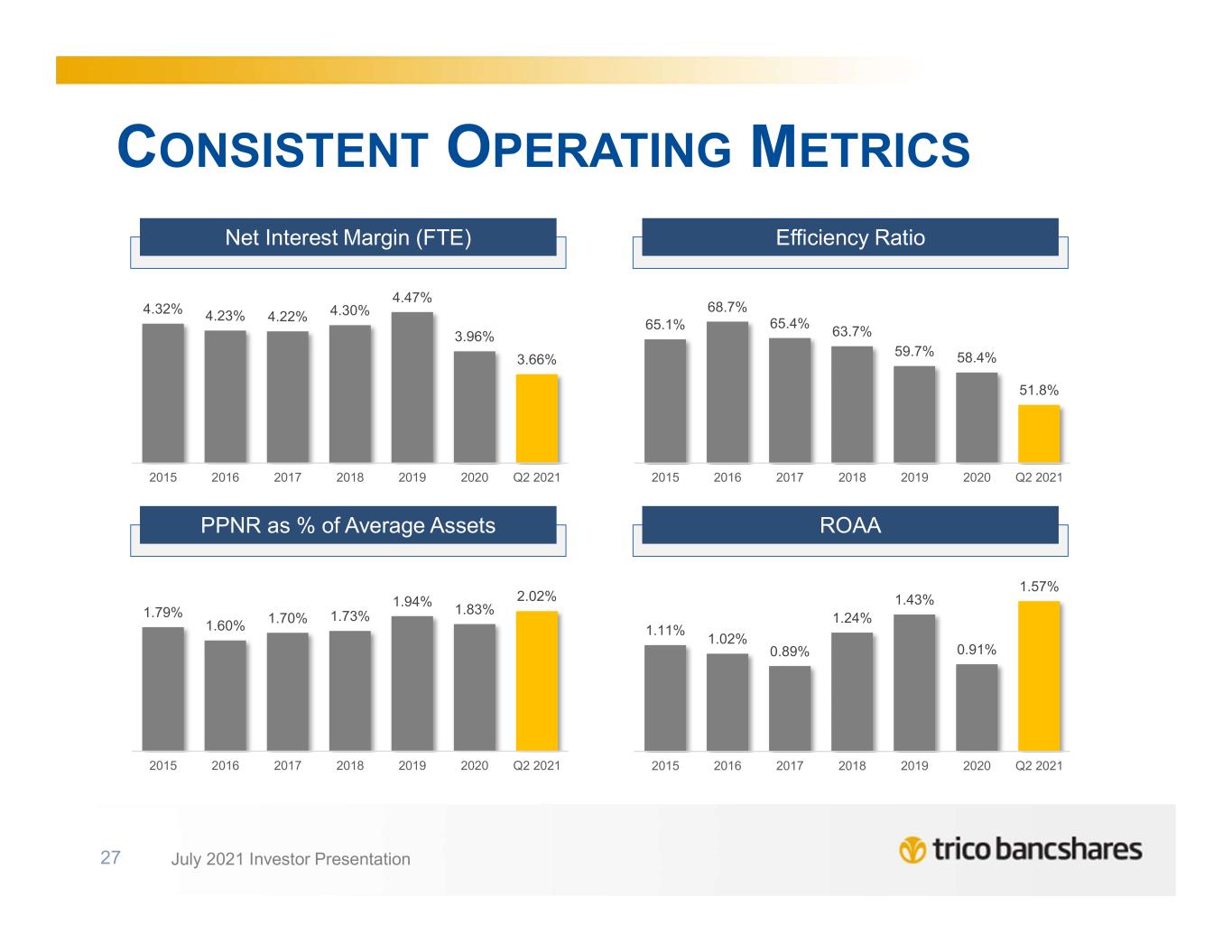

•For the three and six months ended June 30, 2021, the Company’s return on average assets was 1.40% and 1.57%, respectively, and the return on average equity was 11.85% and 13.16%, respectively.

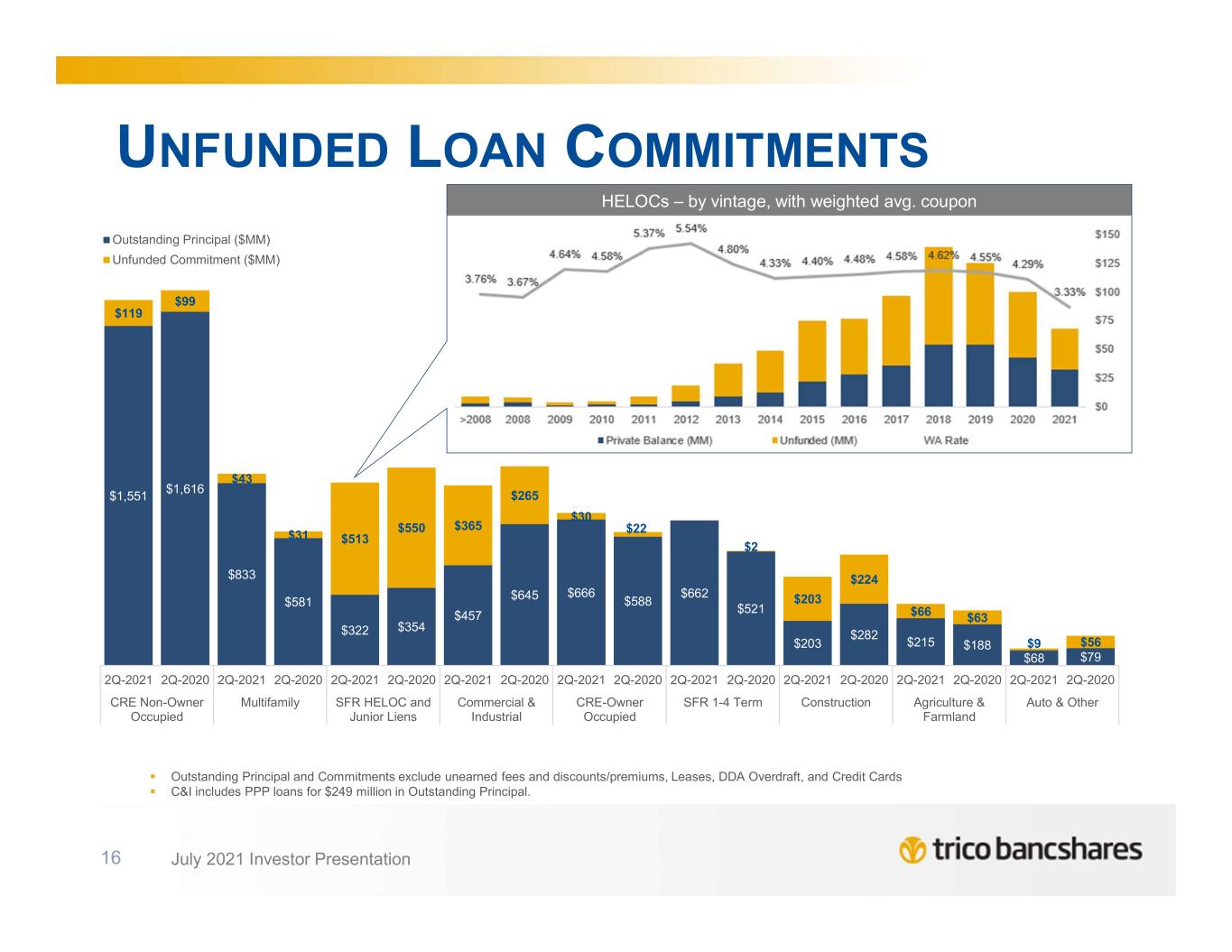

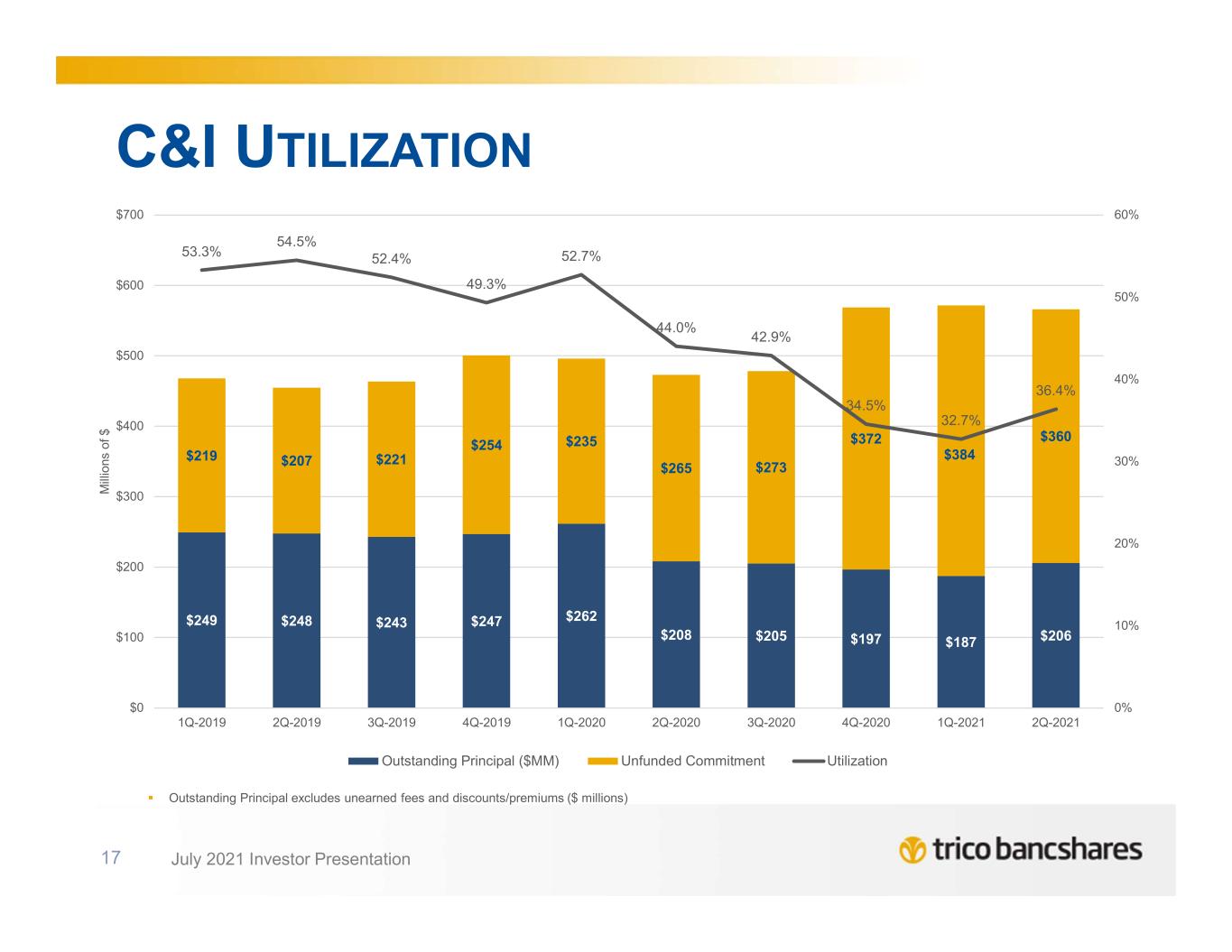

•Organic loan growth, excluding PPP, totaled $99.2 million (8.6% annualized) for the current quarter and $327.3 million (7.5%) for the trailing twelve-month period.

•For the current quarter, net interest margin was 3.58% on a tax equivalent basis as compared to 4.10% in the quarter ended June 30, 2020, and a decrease of 16 basis points from 3.74% in the trailing quarter.

•The efficiency ratio was 53.19% as of June 30, 2021, as compared to 50.42% in the trailing quarter and 59.69% in the same quarter of the prior year.

•As of June 30, 2021, the Company reported total loans, total assets and total deposits of $4.94 billion, $8.17 billion and $6.99 billion, respectively. As a direct result of the considerable deposit growth in the last 6 quarters, the loan to deposit ratio was 70.72% as of June 30, 2021, as compared to 73.21% at December 31, 2020 and 76.84% at June 30, 2020.

•Non-interest bearing deposits as a percentage of total deposits were 40.67% at June 30, 2021, as compared to 39.68% at December 31, 2020 and 39.81% at June 30, 2020.

•The average rate of interest paid on deposits, including non-interest-bearing deposits, decreased to 0.05% for the second quarter of 2021 as compared with 0.06% for the trailing quarter, and decreased by 7 basis points from the average rate paid of 0.12% during the same quarter of the prior year.

•The balance of PPP loans outstanding at June 30, 2021 totaled $248.6 million and the balance of SBA fees remaining to be accreted totaled $9.0 million. In addition, nearly 90% of all round one PPP loans have been forgiven and repaid.

•Noninterest income related to service charges and fees was $10.9 million and $21.4 million for the three and six month periods ended June 30, 2021, representing an increase of 33.8% and 23.8% when compared to the same periods in 2020.

•The reversal of provision for credit losses for loans and debt securities was $0.3 million during the quarter ended June 30, 2021, as compared to a reversal of provision expense of $6.1 million during the trailing quarter ended March 31, 2021, and a provision expense totaling $22.2 million for the three month period ended June 30, 2020.

•The allowance for credit losses to total loans was 1.74% as of June 30, 2021, compared to 1.93% as of December 31, 2020, and 1.15% as January 1, 2020, following the Company's adoption of CECL. Non-performing assets to total assets were 0.43% at June 30, 2021, as compared to 0.39% as of March 31, 2021, and 0.31% at June 30, 2020.

“The low rate and high liquidity environment in which we currently operate necessitates our continued focus on high quality earning asset growth. Our team's ability to execute our growth strategies while maintaining or improving the efficiency of our operations, as we scale towards $10 billion in total assets, will be critical to our long-term success. We believe that our year-to-date results for 2021 are a reflection of our accomplishments," commented Peter Wiese, EVP and Chief Financial Officer. Rick Smith, President and Chief Executive Officer added; "We are very pleased with the level of non-PPP organic loan growth that has been generated to date, and we remain optimistic regarding expected production and growth the latter half of the year. Additionally, our new loan production offices, located in San Diego, Irvine, and Pasadena, will officially open in late Q3. We are pleased with the level of talent we have been able to add to the organization in the southern California geography as well as our legacy footprint, both of which should augment our performance in the latter part of 2021 and beyond."

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Financial results reported in this document are preliminary. Final financial results and other disclosures will be reported in our Quarterly Report on Form 10-Q for the period ended June 30, 2021, and may differ materially from the results and disclosures in this document due to, among other things, the completion of final review procedures, the occurrence of subsequent events, or the discovery of additional information.

1

Summary Results

For the three and six months ended June 30, 2021, the Company’s return on average assets was 1.40% and 1.57%, respectively, while the return on average equity was 11.85% and 13.16%, respectively. For the three and six months ended June 30, 2020, the Company’s return on average assets was 0.43% and 0.70%, respectively, while the return on average equity was 3.39% and 5.06%, respectively.

The following is a summary of the components of the Company’s operating results and performance ratios for the periods indicated:

| Three months ended | |||||||||||||||||||||||

| June 30, | March 31, | ||||||||||||||||||||||

| (dollars and shares in thousands) | 2021 | 2021 | $ Change | % Change | |||||||||||||||||||

| Net interest income | $ | 67,083 | $ | 66,440 | $ | 643 | 1.0 | % | |||||||||||||||

| Reversal of credit losses | 260 | 6,060 | (5,800) | (95.7) | % | ||||||||||||||||||

| Noninterest income | 15,957 | 16,110 | (153) | (0.9) | % | ||||||||||||||||||

| Noninterest expense | (44,171) | (41,618) | (2,553) | 6.1 | % | ||||||||||||||||||

| Provision for income taxes | (10,767) | (13,343) | 2,576 | (19.3) | % | ||||||||||||||||||

| Net income | $ | 28,362 | $ | 33,649 | $ | (5,287) | (15.7) | % | |||||||||||||||

| Diluted earnings per share | $ | 0.95 | $ | 1.13 | $ | (0.18) | (15.9) | % | |||||||||||||||

| Dividends per share | $ | 0.25 | $ | 0.25 | $ | — | — | % | |||||||||||||||

| Average common shares | 29,719 | 29,727 | (8) | (0.03) | % | ||||||||||||||||||

| Average diluted common shares | 29,904 | 29,905 | (1) | 0.00 | % | ||||||||||||||||||

| Return on average total assets | 1.40 | % | 1.75 | % | |||||||||||||||||||

| Return on average equity | 11.85 | % | 14.51 | % | |||||||||||||||||||

| Efficiency ratio | 53.19 | % | 50.42 | % | |||||||||||||||||||

| Three months ended June 30, | |||||||||||||||||||||||

| (dollars and shares in thousands) | 2021 | 2020 | $ Change | % Change | |||||||||||||||||||

| Net interest income | $ | 67,083 | $ | 64,659 | $ | 2,424 | 3.7 | % | |||||||||||||||

| Reversal of (provision for) credit losses | 260 | (22,244) | 22,504 | (101.2) | % | ||||||||||||||||||

| Noninterest income | 15,957 | 11,657 | 4,300 | 36.9 | % | ||||||||||||||||||

| Noninterest expense | (44,171) | (45,550) | 1,379 | (3.0) | % | ||||||||||||||||||

| Provision for income taxes | (10,767) | (1,092) | (9,675) | 886.0 | % | ||||||||||||||||||

| Net income | $ | 28,362 | $ | 7,430 | $ | 20,932 | 281.7 | % | |||||||||||||||

| Diluted earnings per share | $ | 0.95 | $ | 0.25 | $ | 0.70 | 280.0 | % | |||||||||||||||

| Dividends per share | $ | 0.25 | $ | 0.22 | $ | 0.03 | 13.6 | % | |||||||||||||||

| Average common shares | 29,719 | 29,754 | (35) | (0.1) | % | ||||||||||||||||||

| Average diluted common shares | 29,904 | 29,883 | 21 | 0.1 | % | ||||||||||||||||||

| Return on average total assets | 1.40 | % | 0.43 | % | |||||||||||||||||||

| Return on average equity | 11.85 | % | 3.39 | % | |||||||||||||||||||

| Efficiency ratio | 53.19 | % | 59.89 | % | |||||||||||||||||||

| Six months ended June 30, | |||||||||||||||||||||||

| (dollars and shares in thousands) | 2021 | 2020 | $ Change | % Change | |||||||||||||||||||

| Net interest income | $ | 133,523 | $ | 127,851 | $ | 5,672 | 4.4 | % | |||||||||||||||

| Reversal of (provision for) credit losses | 6,320 | (30,313) | 36,633 | (120.8) | % | ||||||||||||||||||

| Noninterest income | 32,067 | 23,477 | 8,590 | 36.6 | % | ||||||||||||||||||

| Noninterest expense | (85,789) | (90,300) | 4,511 | (5.0) | % | ||||||||||||||||||

| Provision for income taxes | (24,110) | (7,164) | (16,946) | 236.5 | % | ||||||||||||||||||

| Net income | $ | 62,011 | $ | 23,551 | $ | 38,460 | 163.3 | % | |||||||||||||||

| Diluted earnings per share | $ | 2.07 | $ | 0.78 | $ | 1.29 | 165.4 | % | |||||||||||||||

| Dividends per share | $ | 0.50 | $ | 0.44 | $ | 0.06 | 13.6 | % | |||||||||||||||

| Average common shares | 29,723 | 30,074 | (351) | (1.2) | % | ||||||||||||||||||

| Average diluted common shares | 29,904 | 30,203 | (299) | (1.0) | % | ||||||||||||||||||

| Return on average total assets | 1.57 | % | 0.70 | % | |||||||||||||||||||

| Return on average equity | 13.16 | % | 5.06 | % | |||||||||||||||||||

| Efficiency ratio | 51.81 | % | 59.82 | % | |||||||||||||||||||

2

SBA Paycheck Protection Program

In March 2020 (Round 1) and subsequently in December 2020 (Round 2), the Small Business Administration ("SBA") Paycheck Protection Program ("PPP") was created to help small businesses keep workers employed during the COVID-19 crisis. Tri Counties Bank, through its online portal, facilitated the ability for borrowers to open a new account and submit PPP applications during the entirety of the Programs. The SBA ended PPP and did not accept new borrowing applications, effective May 31, 2021.

The following is a summary of PPP loan related information as of the periods indicated:

| (dollars in thousands) | June 30, 2021 | March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | ||||||||||||||||||||||||

| Total number of PPP loans outstanding | 2,209 | 2,484 | 2,310 | 2,924 | 2,900 | ||||||||||||||||||||||||

| PPP loan balance (Round 1 origination), gross | $ | 51,547 | $ | 193,958 | $ | 333,982 | $ | 437,793 | $ | 436,731 | |||||||||||||||||||

| PPP loan balance (Round 2 origination), gross | 197,035 | 176,316 | n/a | n/a | n/a | ||||||||||||||||||||||||

| Total PPP loans, gross outstanding | $ | 248,582 | $ | 370,274 | $ | 333,982 | $ | 437,793 | $ | 436,731 | |||||||||||||||||||

| PPP deferred loan fees (Round 1 origination) | $ | 477 | $ | 2,358 | $ | 7,212 | $ | 11,846 | $ | 13,300 | |||||||||||||||||||

| PPP deferred loan fees (Round 2 origination) | 8,513 | 7,072 | n/a | n/a | n/a | ||||||||||||||||||||||||

| Total PPP deferred loan fees outstanding | $ | 8,990 | $ | 9,430 | $ | 7,212 | $ | 11,846 | $ | 13,300 | |||||||||||||||||||

As of June 30, 2021, the total gross balance outstanding of PPP loans was $248,582,000 as compared to total PPP originations of $640,410,000. In connection with the origination of these loans, the Company earned approximately $25,299,000 in loan fees, offset by deferred loan costs of approximately $1,245,000, the net of which will be recognized over the earlier of loan maturity (between 24-60 months), repayment or receipt of forgiveness confirmation. As of June 30, 2021, there was approximately $8,990,000 in net deferred fee income remaining to be recognized. During the three and six months ended June 30, 2021, the Company recognized $2,344,000 and $7,304,000, respectively in fees on PPP loans.

COVID Deferrals

Following the passage of the CARES Act legislation, the "Interagency Statement on Loan Modifications and Reporting for Financial Institutions Working with Customers Affected by the Coronavirus" was issued by federal bank regulators, which offers temporary relief from troubled debt restructuring accounting for loan payment deferrals for certain customers whose businesses are experiencing economic hardship due to Coronavirus. The applicable period for this relief, originally expected to expire on December 31, 2020, was extended through 2021 by way of the Consolidated Appropriations Act.

The following is a summary of COVID related loan customer modifications with outstanding balances as of June 30, 2021:

| Modification Type | Deferral Term | ||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Modified Loan Balances Outstanding | % of Total Category of Loans | Interest Only Deferral | Principal and Interest Deferral | 90 Days | 180 Days | Other | ||||||||||||||||||||||||||||||||||

| Commercial real estate: | |||||||||||||||||||||||||||||||||||||||||

| CRE non-owner occupied | $ | 23,811 | 1.6 | % | 94.4 | % | 5.6 | % | — | % | 81.5 | % | 18.5 | % | |||||||||||||||||||||||||||

| CRE owner occupied | 2,943 | 0.5 | 100.0 | — | — | 57.1 | 42.9 | ||||||||||||||||||||||||||||||||||

| Multifamily | 26,311 | 3.2 | 100.0 | — | — | 100.0 | — | ||||||||||||||||||||||||||||||||||

| Farmland | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total commercial real estate loans | 53,065 | 1.7 | 97.5 | 2.5 | 23.7 | 89.3 | 10.7 | ||||||||||||||||||||||||||||||||||

| Consumer loans | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Commercial and industrial | 557 | 0.1 | 100.0 | — | — | — | 100.0 | ||||||||||||||||||||||||||||||||||

| Construction | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Agriculture production | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Leases | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Total modifications | $ | 53,622 | 1.1 | % | 95.7 | % | 2.5 | % | — | % | 88.4 | % | 11.6 | % | |||||||||||||||||||||||||||

Of the remaining balance outstanding as of June 30, 2021, $33,350,000 is related to second deferrals which are expected to conclude their modification period by November 2021, and $2,525,595 is related to third deferrals expected to conclude in October, 2021. The remaining balance of loans with modified terms are scheduled to conclude their modification period during fiscal 2021. However, as long as the current pandemic and recessionary economic conditions continue, it is possible that additional borrowers may request an initial or subsequent modification to their loan terms.

3

Balance Sheet

Total loans outstanding, excluding PPP, grew to $4.71 billion as of June 30, 2021, an increase of 7.5% over the same quarter of the prior year, and an annualized increase of 8.6% over the trailing quarter. Investments outstanding increased to $2.10 billion as of June 30, 2021, an increase of 28.7% annualized over the trailing quarter. Average earning assets to total average assets continued to increase to 92.8% at June 30, 2021, as compared to 92.7% and 90.6% at March 31, 2021, and June 30, 2020, respectively. The loan to deposit ratio was 70.7% at June 30, 2021, as compared to 72.4% and 76.8% at March 31, 2021, and June 30, 2020, respectively.

Total shareholders' equity increased by $24,241,000 during the quarter ended June 30, 2021, primarily as a result of net income of $28,362,000, plus an increase in accumulated other comprehensive income of $5,206,000, offset by $7,431,000 in cash dividends paid on common stock. As a result, the Company’s book value increased to $32.53 per share at June 30, 2021 as compared to $31.71 and $29.76 at March 31, 2021, and June 30, 2020, respectively. The Company’s tangible book value per share, a non-GAAP measure, calculated by subtracting goodwill and other intangible assets from total shareholders’ equity and dividing that sum by total shares outstanding, was $24.60 per share at June 30, 2021, as compared to $23.72 and $21.64 at March 31, 2021, and June 30, 2020, respectively.

Trailing Quarter Balance Sheet Change

| Ending balances | As of June 30, | March 31, | $ Change | Annualized % Change | |||||||||||||||||||

| (dollars in thousands) | 2021 | 2021 | |||||||||||||||||||||

| Total assets | $ | 8,170,365 | $ | 8,031,612 | $ | 138,753 | 6.9 | % | |||||||||||||||

| Total loans | 4,944,894 | 4,966,977 | (22,083) | (1.8) | % | ||||||||||||||||||

| Total loans, excluding PPP | 4,705,302 | 4,606,133 | 99,169 | 8.6 | % | ||||||||||||||||||

| Total investments | 2,103,575 | 1,962,780 | 140,795 | 28.7 | % | ||||||||||||||||||

| Total deposits | $ | 6,992,053 | $ | 6,863,400 | $ | 128,653 | 7.5 | % | |||||||||||||||

Organic loan growth, excluding PPP, of $99,169,000 or 8.6% on an annualized basis was realized during the quarter ended June 30, 2021, primarily within commercial real estate. In addition, investment security growth was $140,795,000 or 28.7% on an annualized basis as excess liquidity, driven by continued strong deposit growth, was put to use in higher yielding earning assets. Earning asset growth was funded by the continued growth of deposit balances which increased during the second quarter of 2021 by $128,653,000 or 7.5% annualized. SBA forgiveness outpaced net new loan origination activity, resulting in a $22,083,000 or 1.8% annualized decrease in total loans during the second quarter as compared to the trailing quarter.

Average Trailing Quarter Balance Sheet Change

| Qtrly avg balances | As of June 30, | As of March 31, | $ Change | Annualized % Change | |||||||||||||||||||

| (dollars in thousands) | 2021 | 2021 | |||||||||||||||||||||

| Total assets | $ | 8,128,674 | $ | 7,808,912 | $ | 319,762 | 16.4 | % | |||||||||||||||

| Total loans | 4,978,465 | 4,763,025 | 215,440 | 18.1 | % | ||||||||||||||||||

| Total loans, excluding PPP | 4,646,188 | 4,407,150 | 239,038 | 21.7 | % | ||||||||||||||||||

| Total investments | 2,007,090 | 1,775,035 | 232,055 | 52.3 | % | ||||||||||||||||||

| Total deposits | $ | 6,943,081 | $ | 6,653,754 | $ | 289,327 | 17.4 | % | |||||||||||||||

The increase in average total loans of $215,440,000, or 18.1% on an annualized basis, during the second quarter of 2021 was benefited by both the timing of organic loan origination activity early in the quarter as well as the Company's purchase of a pool of single family residential mortgages totaling approximately $101,466,000 which occurred on the final day of the first quarter, and thus minimally impacted the March 31, 2021 average balances while fully benefiting the average balances in the second quarter. The significant growth in both ending and average balances of investment securities was a direct result of management's focus on the deployment of excess cash balances which remained elevated due to continued deposit growth during the quarter.

Year Over Year Balance Sheet Change

| Ending balances | As of June 30, | |||||||||||||||||||||||||

| (dollars in thousands) | 2021 | 2020 | $ Change | % Change | ||||||||||||||||||||||

| Total assets | $ | 8,170,365 | $ | 7,360,071 | $ | 810,294 | 11.0 | % | ||||||||||||||||||

| Total loans | 4,944,894 | 4,801,405 | 143,489 | 3.0 | % | |||||||||||||||||||||

| Total loans, excluding PPP | 4,705,302 | 4,377,974 | 327,328 | 7.5 | % | |||||||||||||||||||||

| Total investments | 2,103,575 | 1,353,728 | 749,847 | 55.4 | % | |||||||||||||||||||||

| Total deposits | $ | 6,992,053 | $ | 6,248,258 | $ | 743,795 | 11.9 | % | ||||||||||||||||||

As discussed in previous quarters, the PPP program generated significant increases in volume during the twelve months ended June 30, 2021, for both loan and deposit balances. Other forms of stimulus payments have further elevated deposit levels during the same period. While excess deposit proceeds are ratably being allocated to the purchase of investment securities with medium term durations to improve overall margin, we expect to maintain above average levels of liquidity through 2021, as the economic impacts of COVID-19 and amount of future stimulus both remain uncertain. Investment securities increased to $2,103,575,000 at June 30, 2021, a change of $749,847,000 or 55.4% from $1,353,728,000 at June 30, 2020.

4

Net Interest Income and Net Interest Margin

The following is a summary of the components of net interest income for the periods indicated:

| Three months ended | |||||||||||||||||||||||

| June 30, | March 31, | ||||||||||||||||||||||

| (dollars in thousands) | 2021 | 2021 | $ Change | % Change | |||||||||||||||||||

| Interest income | $ | 68,479 | $ | 67,916 | $ | 563 | 0.8 | % | |||||||||||||||

| Interest expense | (1,396) | (1,476) | 80 | (5.4) | % | ||||||||||||||||||

Fully tax-equivalent adjustment (FTE) (1) | 255 | 277 | (22) | (7.9) | % | ||||||||||||||||||

| Net interest income (FTE) | $ | 67,338 | $ | 66,717 | $ | 621 | 0.9 | % | |||||||||||||||

| Net interest margin (FTE) | 3.58 | % | 3.74 | % | |||||||||||||||||||

| Acquired loans discount accretion, net: | |||||||||||||||||||||||

| Amount (included in interest income) | $ | 2,566 | $ | 1,712 | $ | 854 | |||||||||||||||||

Net interest margin less effect of acquired loan discount accretion(1) | 3.44 | % | 3.64 | % | (0.20) | % | |||||||||||||||||

| PPP loans yield, net: | |||||||||||||||||||||||

| Amount (included in interest income) | $ | 3,179 | $ | 5,863 | $ | (2,684) | |||||||||||||||||

Net interest margin less effect of PPP loan yield (1) | 3.61 | % | 3.59 | % | 0.02 | % | |||||||||||||||||

Acquired loans discount accretion and PPP loan yield, net: | |||||||||||||||||||||||

| Amount (included in interest income) | $ | 5,745 | $ | 7,575 | $ | (1,830) | |||||||||||||||||

Net interest margin less effect of acquired loan discount accretion and PPP loan yield (1) | 3.47 | % | 3.49 | % | (0.02) | % | |||||||||||||||||

| Three months ended June 30, | |||||||||||||||||||||||

| (dollars in thousands) | 2021 | 2020 | $ Change | % Change | |||||||||||||||||||

| Interest income | $ | 68,479 | $ | 67,148 | $ | 1,331 | 2.0 | % | |||||||||||||||

| Interest expense | (1,396) | (2,489) | 1,093 | (43.9) | % | ||||||||||||||||||

Fully tax-equivalent adjustment (FTE) (1) | 255 | 286 | (31) | (10.8) | % | ||||||||||||||||||

| Net interest income (FTE) | $ | 67,338 | $ | 64,945 | $ | 2,393 | 3.7 | % | |||||||||||||||

| Net interest margin (FTE) | 3.58 | % | 4.10 | % | |||||||||||||||||||

| Acquired loans discount accretion, net: | |||||||||||||||||||||||

| Amount (included in interest income) | $ | 2,566 | $ | 2,587 | $ | (21) | |||||||||||||||||

Net interest margin less effect of acquired loan discount accretion(1) | 3.44 | % | 3.94 | % | (0.50) | % | |||||||||||||||||

| PPP loans yield, net: | |||||||||||||||||||||||

| Amount (included in interest income) | $ | 3,179 | $ | 2,356 | $ | 823 | |||||||||||||||||

Net interest margin less effect of PPP loan yield (1) | 3.61 | % | 4.14 | % | (0.53) | % | |||||||||||||||||

Acquired loans discount accretion and PPP loan yield, net: | |||||||||||||||||||||||

| Amount (included in interest income) | $ | 5,745 | $ | 4,943 | $ | 802 | |||||||||||||||||

Net interest margin less effect of acquired loan discount accretion and PPP loan yield (1) | 3.47 | % | 3.98 | % | (0.51) | % | |||||||||||||||||

| Six months ended June 30, | |||||||||||||||||||||||

| (dollars in thousands) | 2021 | 2020 | $ Change | % Change | |||||||||||||||||||

| Interest income | $ | 136,395 | $ | 133,665 | $ | 2,730 | 2.0 | % | |||||||||||||||

| Interest expense | (2,872) | (5,814) | 2,942 | (50.6) | % | ||||||||||||||||||

Fully tax-equivalent adjustment (FTE) (1) | 532 | 557 | (25) | (4.5) | % | ||||||||||||||||||

| Net interest income (FTE) | $ | 134,055 | $ | 128,408 | $ | 5,647 | 4.4 | % | |||||||||||||||

| Net interest margin (FTE) | 3.66 | % | 4.22 | % | |||||||||||||||||||

| Acquired loans discount accretion, net: | |||||||||||||||||||||||

| Amount (included in interest income) | $ | 4,278 | $ | 4,335 | $ | (57) | |||||||||||||||||

Net interest margin less effect of acquired loan discount accretion(1) | 3.54 | % | 4.08 | % | (0.54) | % | |||||||||||||||||

| PPP loans yield, net: | |||||||||||||||||||||||

| Amount (included in interest income) | $ | 9,042 | $ | 2,356 | $ | 6,686 | |||||||||||||||||

Net interest margin less effect of PPP loan yield (1) | 3.59 | % | 4.25 | % | (0.66) | % | |||||||||||||||||

Acquired loans discount accretion and PPP loan yield, net: | |||||||||||||||||||||||

| Amount (included in interest income) | $ | 13,320 | $ | 6,691 | $ | 6,629 | |||||||||||||||||

Net interest margin less effect of acquired loans discount and PPP loan yield (1) | 3.46 | % | 4.11 | % | (0.65) | % | |||||||||||||||||

5

(1)Certain information included herein is presented on a fully tax-equivalent (FTE) basis and / or to present additional financial details which may be desired by users of this financial information. The Company believes the use of these non-generally accepted accounting principles (non-GAAP) measures provide additional clarity in assessing its results, and the presentation of these measures are common practice within the banking industry. See additional information related to non-GAAP measures at the back of this document.

Loans may be acquired at a premium or discount to par value, in which case, the premium is amortized (subtracted from) or accreted (added to) interest income over the remaining life of the loan. Generally, as time goes on, the dollar impact of loan discount accretion and loan premium amortization decrease as the purchased loans mature or pay off early. Upon the early pay off of a loan, any remaining unaccreted discount or unamortized premium is immediately taken into interest income; and as loan payoffs may vary significantly from quarter to quarter, so may the impact of discount accretion and premium amortization on interest income. As a result of the decrease in interest rates, the prepayment rate of portfolio loans, inclusive of those acquired at a premium or discount, increased during the second quarter of 2021. During the three months ended June 30, 2021, March 31, 2021, and June 30, 2020, purchased loan discount accretion was $2,566,000, $1,712,000, and $2,587,000, respectively.

The following table shows the components of net interest income and net interest margin on a fully tax-equivalent (FTE) basis for the quarterly periods indicated:

ANALYSIS OF CHANGE IN NET INTEREST MARGIN ON EARNING ASSETS

(unaudited, dollars in thousands)

| Three months ended | Three months ended | Three months ended | |||||||||||||||||||||||||||||||||||||||||||||||||||

| June 30, 2021 | March 31, 2021 | June 30, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance | Income/ Expense | Yield/ Rate | Average Balance | Income/ Expense | Yield/ Rate | Average Balance | Income/ Expense | Yield/ Rate | |||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans, excluding PPP | $ | 4,646,188 | $ | 57,125 | 4.93 | % | $ | 4,407,150 | $ | 54,573 | 5.02 | % | $ | 4,363,481 | $ | 56,053 | 5.23 | % | |||||||||||||||||||||||||||||||||||

| PPP loans | 332,277 | 3,179 | 3.84 | % | 355,875 | 5,863 | 6.68 | % | 292,569 | 2,356 | 3.24 | % | |||||||||||||||||||||||||||||||||||||||||

| Investments-taxable | 1,875,056 | 7,189 | 1.54 | % | 1,649,980 | 6,394 | 1.57 | % | 1,251,873 | 7,689 | 2.47 | % | |||||||||||||||||||||||||||||||||||||||||

Investments-nontaxable (1) | 132,034 | 1,106 | 3.36 | % | 125,055 | 1,200 | 3.89 | % | 119,860 | 1,238 | 4.15 | % | |||||||||||||||||||||||||||||||||||||||||

| Total investments | 2,007,090 | 8,295 | 1.66 | % | 1,775,035 | 7,594 | 1.74 | % | 1,371,733 | 8,927 | 2.62 | % | |||||||||||||||||||||||||||||||||||||||||

| Cash at Federal Reserve and other banks | 559,026 | 135 | 0.10 | % | 701,666 | 163 | 0.09 | % | 338,082 | 98 | 0.12 | % | |||||||||||||||||||||||||||||||||||||||||

| Total earning assets | 7,544,581 | 68,734 | 3.65 | % | 7,239,726 | 68,193 | 3.82 | % | 6,365,865 | 67,434 | 4.26 | % | |||||||||||||||||||||||||||||||||||||||||

| Other assets, net | 584,093 | 569,186 | 661,870 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 8,128,674 | $ | 7,808,912 | $ | 7,027,735 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and shareholders’ equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing demand deposits | $ | 1,490,247 | $ | 77 | 0.02 | % | $ | 1,430,943 | $ | 76 | 0.02 | % | $ | 1,293,007 | $ | 64 | 0.02 | % | |||||||||||||||||||||||||||||||||||

| Savings deposits | 2,316,889 | 308 | 0.05 | % | 2,228,281 | 329 | 0.06 | % | 1,968,374 | 644 | 0.13 | % | |||||||||||||||||||||||||||||||||||||||||

| Time deposits | 324,867 | 443 | 0.55 | % | 336,605 | 532 | 0.64 | % | 409,242 | 1,105 | 1.09 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 4,132,003 | 828 | 0.08 | % | 3,995,829 | 937 | 0.10 | % | 3,670,623 | 1,813 | 0.20 | % | |||||||||||||||||||||||||||||||||||||||||

| Other borrowings | 40,986 | 5 | 0.05 | % | 32,709 | 4 | 0.05 | % | 26,313 | 4 | 0.06 | % | |||||||||||||||||||||||||||||||||||||||||

| Junior subordinated debt | 57,788 | 563 | 3.91 | % | 57,688 | 535 | 3.76 | % | 57,372 | 672 | 4.71 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 4,230,777 | 1,396 | 0.13 | % | 4,086,226 | 1,476 | 0.15 | % | 3,754,308 | 2,489 | 0.27 | % | |||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 2,811,078 | 2,657,925 | 2,266,671 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 126,674 | 123,986 | 126,351 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 960,145 | 940,775 | 880,405 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 8,128,674 | $ | 7,808,912 | $ | 7,027,735 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest rate spread (1) (2) | 3.52 | % | 3.67 | % | 3.99 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest income and margin (1) (3) | $ | 67,338 | 3.58 | % | $ | 66,717 | 3.74 | % | $ | 64,945 | 4.10 | % | |||||||||||||||||||||||||||||||||||||||||

(1)Fully taxable equivalent (FTE). All yields and rates are calculated using specific day counts for the period and year as applicable.

(2)Net interest spread is the average yield earned on interest-earning assets minus the average rate paid on interest-bearing liabilities.

(3)Net interest margin is computed by calculating the difference between interest income and interest expense, divided by the average balance of interest-earning assets.

Net interest income (FTE) during the three months ended June 30, 2021 increased $621,000 or 0.9% to $67,338,000 compared to $66,717,000 during the three months ended March 31, 2021. Over the same period, net interest margin decreased 16 basis points to 3.58% as compared to 3.74% in the trailing quarter. The 16 basis point decrease is primarily attributed to a 9 basis point decrease in non-PPP loan yields, as well as a 284 basis point decline in PPP loans, which yielded 3.84% as of June 30, 2021 as compared to 6.68% for the trailing quarter ended March 31, 2021. The quarterly decrease in yield on PPP loans was due to a deceleration of

6

deferred loan fee accretion stemming from nearly 90% of the Round 1 PPP loans being forgiven by the SBA and repaid. The aforementioned yield decline was partially offset by a 2 basis point improvement in the rate paid on interest-bearing liabilities.

As compared to the same quarter in the prior year, average loan yields, excluding PPP, decreased 30 basis points from 5.23% during the three months ended June 30, 2020, to 4.93% during the three months ended June 30, 2021. The 30 basis point decrease in yields on loans during the comparable three month periods ended June 30, 2021 and 2020 was entirely attributable to decreases in market rates. Loan fees as the accretion of discounts from acquired loans added 17 basis points to loan yields during the quarter ended June 30, 2021 and 24 basis points during the quarter ended June 30, 2020. The index utilized in a significant portion of the Company’s variable rate loans, Wall Street Journal Prime, has remained unchanged at 3.25% since March 15, 2020, when it was reduced from 4.25%.

The decline in interest expense when compared to both the trailing quarter and the same quarter from the prior year was primarily attributed to reductions in the rates offered on deposit products. As a result, the cost of interest-bearing deposits decreased by 2 basis points as of June 30, 2021, to 0.08% from 0.10% at March 31, 2021. In addition, the growth of noninterest-bearing deposits continues to benefit the average cost of total deposits as compared to historical periods. Specifically, the ratio of average total noninterest-bearing deposits to total average deposits was 40.5% and 39.9% as of June 30, 2021 and March 31, 2021, respectively, as compared to 38.2% in the quarter ended June 30, 2020. As a result, the average cost of total deposits decreased to 0.05% at June 30, 2021, compared to 0.12% in the same period of 2020.

ANALYSIS OF CHANGE IN NET INTEREST MARGIN ON EARNING ASSETS

(unaudited, dollars in thousands)

| Six months ended June 30, 2021 | Six months ended June 30, 2020 | ||||||||||||||||||||||||||||||||||

| Average Balance | Income/ Expense | Yield/ Rate | Average Balance | Income/ Expense | Yield/ Rate | ||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Loans, excluding PPP | $ | 4,527,329 | $ | 111,698 | 4.98 | % | $ | 4,346,419 | $ | 112,311 | 5.20 | % | |||||||||||||||||||||||

| PPP loans | 344,011 | 9,042 | 5.30 | % | 146,285 | 2,356 | 3.24 | % | |||||||||||||||||||||||||||

| Investments-taxable | 1,763,140 | 13,583 | 1.55 | % | 1,235,672 | 16,261 | 2.65 | % | |||||||||||||||||||||||||||

Investments-nontaxable (1) | 128,564 | 2,306 | 3.62 | % | 118,992 | 2,413 | 4.08 | % | |||||||||||||||||||||||||||

| Total investments | 1,891,704 | 15,889 | 1.69 | % | 1,354,664 | 18,674 | 2.77 | % | |||||||||||||||||||||||||||

| Cash at Federal Reserve and other banks | 629,952 | 298 | 0.10 | % | 266,752 | 881 | 0.66 | % | |||||||||||||||||||||||||||

| Total earning assets | 7,392,996 | 136,927 | 3.73 | % | 6,114,120 | 134,222 | 4.41 | % | |||||||||||||||||||||||||||

| Other assets, net | 575,138 | 653,006 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 7,968,134 | $ | 6,767,126 | |||||||||||||||||||||||||||||||

| Liabilities and shareholders’ equity | |||||||||||||||||||||||||||||||||||

| Interest-bearing demand deposits | $ | 1,461,377 | $ | 153 | 0.02 | % | $ | 1,269,452 | $ | 233 | 0.04 | % | |||||||||||||||||||||||

| Savings deposits | 2,272,830 | 637 | 0.06 | % | 1,918,918 | 1,706 | 0.18 | % | |||||||||||||||||||||||||||

| Time deposits | 330,703 | 975 | 0.59 | % | 419,638 | 2,425 | 1.16 | % | |||||||||||||||||||||||||||

| Total interest-bearing deposits | 4,064,910 | 1,765 | 0.09 | % | 3,608,008 | 4,364 | 0.24 | % | |||||||||||||||||||||||||||

| Other borrowings | 36,870 | 9 | 0.05 | % | 24,552 | 9 | 0.07 | % | |||||||||||||||||||||||||||

| Junior subordinated debt | 57,739 | 1,098 | 3.83 | % | 57,324 | 1,441 | 5.06 | % | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 4,159,519 | 2,872 | 0.14 | % | 3,689,884 | 5,814 | 0.32 | % | |||||||||||||||||||||||||||

| Noninterest-bearing deposits | 2,734,922 | 2,059,242 | |||||||||||||||||||||||||||||||||

| Other liabilities | 123,233 | 123,481 | |||||||||||||||||||||||||||||||||

| Shareholders’ equity | 950,460 | 894,519 | |||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 7,968,134 | $ | 6,767,126 | |||||||||||||||||||||||||||||||

Net interest rate spread (1) (2) | 3.59 | % | 4.09 | % | |||||||||||||||||||||||||||||||

Net interest income and margin (1) (3) | $ | 134,055 | 3.66 | % | $ | 128,408 | 4.22 | % | |||||||||||||||||||||||||||

(1)Fully taxable equivalent (FTE). All yields and rates are calculated using specific day counts for the period and year as applicable.

(2)Net interest spread is the average yield earned on interest-earning assets minus the average rate paid on interest-bearing liabilities.

(3)Net interest margin is computed by calculating the difference between interest income and interest expense, divided by the average balance of interest-earning assets.

7

Interest Rates and Loan Portfolio Composition

During the quarter ended June 30, 2021, market interest rates, including many rates that serve as reference indices for variable rate loans, showed signs of upward improvement during April and May before ultimately retreating in June of 2021. This prolonged retraction in rates continues to apply downward pressure on the portfolio. As of June 30, 2021, the Company's loan portfolio consisted of approximately $4.9 billion in outstanding principal with a weighted average coupon rate of 4.25%, inclusive of the PPP program loans. Excluding PPP loans, the Company's loan portfolio has approximately $4.7 billion outstanding with a weighted average coupon rate of 4.42% as of June 30, 2021. Included in the June 30, 2021 loan total, exclusive of PPP loans, are variable rate loans totaling $3.0 billion of which 88.9% or $2.7 billion were at their floor rate. The remaining variable rate loans totaling $340.0 million, which carried a weighted average coupon rate of 4.89% as of June 30, 2021, are subject to further rate adjustment. If those remaining variable rate loans were to collectively, through future rate adjustments, be reduced to their respective floors, they would have a weighted average coupon rate of approximately 4.29% which would result in the reduction of the weighted average coupon rate of the total loan portfolio, exclusive of PPP loans, from 4.42% to approximately 4.38%.

As of December 31, 2020, the Company's loan portfolio consisted of approximately $4.80 billion in outstanding principal with a weighted average coupon rate of 4.35%, inclusive of the PPP program loans. Excluding PPP loans, the Company's loan portfolio has approximately $4.47 billion outstanding with a weighted average coupon rate of 4.60% as of December 31, 2020. Included in the December 31, 2020 loan total, exclusive of PPP loans, are variable rate loans totaling $3.02 billion of which 88.2% or $2.66 billion were at their floor rate. The remaining variable rate loans totaling $357.0 million, which carried a weighted average coupon rate of 5.03% as of December 31, 2020, are subject to further rate adjustment. If those remaining variable rate loans were to collectively, through future rate adjustments, be reduced to their respective floors, they would have a weighted average coupon rate of approximately 4.36% which would result in the reduction of the weighted average coupon rate of the total loan portfolio, exclusive of PPP loans, from 4.60% to approximately 4.55%.

Asset Quality and Credit Loss Provisioning

During the three months ended June 30, 2021, the Company recorded a reversal of provision for credit losses of $260,000, as compared to a reversal of provision for credit losses of $6,060,000 during the trailing quarter, and a provision expense of $22,244,000 during the second quarter of 2020.

The following table presents details of the provision for credit losses for the periods indicated:

| Three months ended | |||||||||||||||||||||||||||||

| (dollars in thousands) | June 30, 2021 | March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | ||||||||||||||||||||||||

| Addition to (reversal of) allowance for credit losses | $ | (145) | $ | (6,240) | $ | 4,450 | $ | 7,649 | $ | 22,089 | |||||||||||||||||||

Addition to (reversal of) reserve for unfunded loan commitments | (115) | 180 | 400 | — | 155 | ||||||||||||||||||||||||

| Total provision for credit losses | $ | (260) | $ | (6,060) | $ | 4,850 | $ | 7,649 | $ | 22,244 | |||||||||||||||||||

The following table presents the activity in the allowance for credit losses on loans for the periods indicated:

| Three months ended | Six months ended | ||||||||||||||||||||||

| (dollars in thousands) | June 30, 2021 | June 30, 2020 | June 30, 2021 | June 30, 2020 | |||||||||||||||||||

| Balance, beginning of period | $ | 85,941 | $ | 57,911 | $ | 91,847 | $ | 30,616 | |||||||||||||||

| Impact from adoption of ASU 2016-13 | — | — | — | 18,913 | |||||||||||||||||||

| Provision for (reversal of) credit losses | (145) | 22,089 | (6,385) | 30,089 | |||||||||||||||||||

| Loans charged-off | (387) | (491) | (613) | (1,001) | |||||||||||||||||||

| Recoveries of previously charged-off loans | 653 | 230 | 1,213 | 1,122 | |||||||||||||||||||

| Balance, end of period | $ | 86,062 | $ | 79,739 | $ | 86,062 | $ | 79,739 | |||||||||||||||

The allowance for credit losses (ACL) was $86,062,000 as of June 30, 2021, a net increase of $121,000 over the immediately preceding quarter. The reversal of allowance for credit losses of $145,000 was necessary as the net recoveries totaling $266,000 during the quarter were in excess of the required changes in quantitative and qualitative reserve components. More specifically, the portfolio-wide qualitative indicator associated with the forecast levels of US unemployment reduced the required credit reserves by $2,294,000, while the qualitative factors associated with portfolio concentration risks, stemming from second quarter loan growth, added approximately $1,708,000 to the credit expense on loans as of June 30, 2021.

8

The Company utilizes a forecast period of approximately eight quarters and obtains the forecast data from publicly available sources as of the balance sheet date. This forecast data continues to evolve and included significant shifts in the magnitude of changes for both the unemployment and GDP factors leading up to the balance sheet date. Management noted that the majority of economic forecasts utilized in the ACL calculation seem to have rebounded slightly in the current quarter, coinciding with the widespread availability of vaccines, continued easing of occupancy and social distancing restrictions, and continued government stimulus efforts.

Loans past due 30 days or more decreased by $1,258,000 during the quarter ended June 30, 2021 to $9,292,000, as compared to $10,550,000 at March 31, 2021. Non-performing loans were $32,705,000 at June 30, 2021, an increase of $3,764,000 and $11,975,000, respectively, from $28,941,000 and $20,730,000 as of March 31, 2021, and June 30, 2020, respectively.

The following table illustrates the total loans by risk rating and their respective percentage of total loans for the periods presented.

| June 30, | % of Total Loans | March 31, | % of Total Loans | June 30, | % of Total Loans | |||||||||||||||||||||

| (dollars in thousands) | 2021 | 2021 | 2020 | |||||||||||||||||||||||

| Risk Rating: | ||||||||||||||||||||||||||

| Pass | $ | 4,756,381 | 96.2 | % | $ | 4,765,180 | 95.9 | % | $ | 4,698,393 | 97.9 | % | ||||||||||||||

| Special Mention | 130,232 | 2.6 | % | 143,677 | 2.9 | % | 61,883 | 1.3 | % | |||||||||||||||||

| Substandard | 58,281 | 1.2 | % | 58,120 | 1.2 | % | 41,129 | 0.9 | % | |||||||||||||||||

| Total | $ | 4,944,894 | $ | 4,966,977 | $ | 4,801,405 | ||||||||||||||||||||

| Classified loans to total loans | 1.18 | % | 1.17 | % | 0.86 | % | ||||||||||||||||||||

| Loans past due 30+ days to total loans | 0.19 | % | 0.19 | % | 0.35 | % | ||||||||||||||||||||

The Company's loan portfolio for non-classified loans (loans graded special mention or better) remains consistent for the quarter ended June 30, 2021, as compared to the trailing quarter March 31, 2021, representing 98.8% of total loans outstanding, respectively. Loans risk graded special mention decreased by approximately $13,445,000 during the quarter ended June 30, 2021 as compared to the trailing quarter, while loans risk graded substandard increased modestly by $161,000 over the same period of the prior year. The reduction in special mention risk graded credits was largely the result of two relationships being upgraded, totaling $9,747,000. The total balance of substandard risk graded credits remained consistent as of the current and trailing quarters; although, the Company did benefit from the payoff of one credit, which was subsequently offset by a separate credit that was downgraded to substandard.

There was one addition to other real estate owned totaling approximately $101,000 during the quarter ended June 30, 2021 and there was one sale for proceeds of approximately $184,000, which generated a net gain of $15,000 for the quarter. As of June 30, 2021, other real estate owned consisted of six properties with a carrying value of approximately $2,248,000.

Allocation of Credit Loss Reserves by Loan Type

| As of June 30, 2021 | As of December 31, 2020 | As of June 30, 2020 | |||||||||||||||||||||||||||||||||

| (dollars in thousands) | Amount | % of Loans Outstanding | Amount | % of Loans Outstanding | Amount | % of Loans Outstanding | |||||||||||||||||||||||||||||

| Commercial real estate: | |||||||||||||||||||||||||||||||||||

| CRE - Non Owner Occupied | $ | 26,028 | 1.70 | % | $ | 29,380 | 1.91 | % | $ | 26,091 | 1.63 | % | |||||||||||||||||||||||

| CRE - Owner Occupied | 10,463 | 1.59 | % | 10,861 | 1.74 | % | 8,710 | 1.50 | % | ||||||||||||||||||||||||||

| Multifamily | 13,196 | 1.59 | % | 11,472 | 1.79 | % | 8,581 | 1.49 | % | ||||||||||||||||||||||||||

| Farmland | 1,950 | 1.13 | % | 1,980 | 1.30 | % | 1,468 | 0.97 | % | ||||||||||||||||||||||||||

| Total commercial real estate loans | 51,637 | 1.62 | % | 53,693 | 1.82 | % | 44,850 | 1.54 | % | ||||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||||||||

| SFR 1-4 1st Liens | 10,629 | 1.61 | % | 10,117 | 1.83 | % | 8,015 | 1.58 | % | ||||||||||||||||||||||||||

| SFR HELOCs and Junior Liens | 10,701 | 3.29 | % | 11,771 | 3.59 | % | 12,108 | 3.38 | % | ||||||||||||||||||||||||||

| Other | 2,620 | 3.73 | % | 3,260 | 4.20 | % | 3,042 | 3.73 | % | ||||||||||||||||||||||||||

| Total consumer loans | 23,950 | 2.27 | % | 25,148 | 2.62 | % | 23,165 | 2.45 | % | ||||||||||||||||||||||||||

| Commercial and Industrial | 4,511 | 1.00 | % | 4,252 | 0.81 | % | 4,018 | 0.63 | % | ||||||||||||||||||||||||||

| Construction | 4,951 | 2.47 | % | 7,540 | 2.65 | % | 6,775 | 2.43 | % | ||||||||||||||||||||||||||

| Agricultural Production | 1,007 | 2.40 | % | 1,209 | 2.74 | % | 919 | 2.59 | % | ||||||||||||||||||||||||||

| Leases | 6 | 0.12 | % | 5 | 0.13 | % | 12 | 0.68 | % | ||||||||||||||||||||||||||

| Allowance for credit losses | 86,062 | 1.74 | % | 91,847 | 1.93 | % | 79,739 | 1.66 | % | ||||||||||||||||||||||||||

| Reserve for unfunded loan commitments | 3,465 | 3,400 | 3,000 | ||||||||||||||||||||||||||||||||

| Total allowance for credit losses | $ | 89,527 | 1.81 | % | $ | 95,247 | 2.00 | % | $ | 82,739 | 1.72 | % | |||||||||||||||||||||||

For the periods presented in the table above and for purposes of calculating the "% of Loans Outstanding", PPP loans are included in the segment "Commercial and Industrial." PPP loans are fully guaranteed and therefore would not require any loss reserve allocation. Excluding the net outstanding balances of PPP loans from the ratio of the ACL to total loans results in a reserve ratio of approximately 1.83% as of June 30, 2021. In addition to the allowance for credit losses above, the Company has acquired various performing loans

9

whose fair value as of the acquisition date was determined to be less than the principal balance owed on those loans. This difference represents the collective discount of credit, interest rate and liquidity measurements which is expected to be amortized over the life of the loans. As of June 30, 2021, the unamortized discount associated with acquired loans totaled $20,087,000 and, if aggregated with the ACL, would collectively represent 2.14% of total gross loans and 2.26% of total loans less PPP loans.

Non-interest Income

The following table presents the key components of non-interest income for the current and trailing quarterly periods indicated:

| Three months ended | |||||||||||||||||||||||

| (dollars in thousands) | June 30, 2021 | March 31, 2021 | $ Change | % Change | |||||||||||||||||||

| ATM and interchange fees | $ | 6,558 | $ | 5,861 | $ | 697 | 11.9 | % | |||||||||||||||

| Service charges on deposit accounts | 3,462 | 3,269 | 193 | 5.9 | % | ||||||||||||||||||

| Other service fees | 914 | 871 | 43 | 4.9 | % | ||||||||||||||||||

| Mortgage banking service fees | 467 | 463 | 4 | 0.9 | % | ||||||||||||||||||

| Change in value of mortgage servicing rights | (471) | 12 | (483) | (4025.0) | % | ||||||||||||||||||

| Total service charges and fees | 10,930 | 10,476 | 454 | 4.3 | % | ||||||||||||||||||

| Increase in cash value of life insurance | 745 | 673 | 72 | 10.7 | % | ||||||||||||||||||

| Asset management and commission income | 947 | 834 | 113 | 13.5 | % | ||||||||||||||||||

| Gain on sale of loans | 2,847 | 3,247 | (400) | (12.3) | % | ||||||||||||||||||

| Lease brokerage income | 249 | 110 | 139 | 126.4 | % | ||||||||||||||||||

| Sale of customer checks | 116 | 119 | (3) | (2.5) | % | ||||||||||||||||||

| Gain on sale of investment securities | — | — | — | n/m | |||||||||||||||||||

| Gain (loss) on marketable equity securities | 8 | (53) | 61 | (115.1) | % | ||||||||||||||||||

| Other | 115 | 704 | (589) | (83.7) | % | ||||||||||||||||||

| Total other non-interest income | 5,027 | 5,634 | (607) | (10.8) | % | ||||||||||||||||||

| Total non-interest income | $ | 15,957 | $ | 16,110 | $ | (153) | (0.9) | % | |||||||||||||||

Non-interest income decreased $153,000 or 0.9% to $15,957,000 during the three months ended June 30, 2021, compared to $16,110,000 during the trailing quarter March 31, 2021. Changes in the value of mortgage servicing rights and gain on sale of mortgage loans declined by $483,000 and $400,000, respectively, during the recent quarter ended. Interest rates trended higher during April and May of 2021, before reversing in June of 2021 and ending the second quarter near flat, which contributed to the decline in total mortgage origination and refinance activity during the three months ended June 30, 2021. Other income decreased by $589,000 during the period, primarily due to changes in the valuation of certain fully funded deferred compensation plans. Following the relaxed social distancing guidelines, increased debit card usage benefited ATM and interchange fees during the three months ended June 30, 2021, increasing by $697,000.

The following table presents the key components of non-interest income for the current and prior year periods indicated:

| Three months ended June 30, | |||||||||||||||||||||||

| (dollars in thousands) | 2021 | 2020 | $ Change | % Change | |||||||||||||||||||

| ATM and interchange fees | $ | 6,558 | $ | 5,165 | $ | 1,393 | 27.0 | % | |||||||||||||||

| Service charges on deposit accounts | 3,462 | 3,046 | 416 | 13.7 | % | ||||||||||||||||||

| Other service fees | 914 | 734 | 180 | 24.5 | % | ||||||||||||||||||

| Mortgage banking service fees | 467 | 459 | 8 | 1.7 | % | ||||||||||||||||||

| Change in value of mortgage servicing rights | (471) | (1,236) | 765 | (61.9) | % | ||||||||||||||||||

| Total service charges and fees | 10,930 | 8,168 | 2,762 | 33.8 | % | ||||||||||||||||||

| Increase in cash value of life insurance | 745 | 710 | 35 | 4.9 | % | ||||||||||||||||||

| Asset management and commission income | 947 | 661 | 286 | 43.3 | % | ||||||||||||||||||

| Gain on sale of loans | 2,847 | 1,736 | 1,111 | 64.0 | % | ||||||||||||||||||

| Lease brokerage income | 249 | 127 | 122 | 96.1 | % | ||||||||||||||||||

| Sale of customer checks | 116 | 88 | 28 | 31.8 | % | ||||||||||||||||||

| Gain on sale of investment securities | — | — | — | n/m | |||||||||||||||||||

| Gain on marketable equity securities | 8 | 25 | (17) | (68.0) | % | ||||||||||||||||||

| Other | 115 | 142 | (27) | (19.0) | % | ||||||||||||||||||

| Total other non-interest income | 5,027 | 3,489 | 1,538 | 44.1 | % | ||||||||||||||||||

| Total non-interest income | $ | 15,957 | $ | 11,657 | $ | 4,300 | 36.9 | % | |||||||||||||||

In addition to the discussion above within the non-interest income for the three months ended June 30, 2021, deposit account related fee revenue increased $416,000 or 13.7% during the three months ended June 30, 2021 when compared to the same period in the prior year as a result of the level of economic and monetary transaction activity increasing as the COVID related restrictions throughout our footprint have been relaxed.

10

The following table presents the key components of non-interest income for the current and prior year periods indicated:

| Six months ended June 30, | |||||||||||||||||||||||

| (dollars in thousands) | 2021 | 2020 | $ Change | % Change | |||||||||||||||||||

| ATM and interchange fees | $ | 12,419 | $ | 10,276 | $ | 2,143 | 20.9 | % | |||||||||||||||

| Service charges on deposit accounts | 6,731 | 7,092 | (361) | (5.1) | % | ||||||||||||||||||

| Other service fees | 1,785 | 1,492 | 293 | 19.6 | % | ||||||||||||||||||

| Mortgage banking service fees | 930 | 928 | 2 | 0.2 | % | ||||||||||||||||||

| Change in value of mortgage servicing rights | (459) | (2,494) | 2,035 | (81.6) | % | ||||||||||||||||||

| Total service charges and fees | 21,406 | 17,294 | 4,112 | 23.8 | % | ||||||||||||||||||

| Increase in cash value of life insurance | 1,418 | 1,430 | (12) | (0.8) | % | ||||||||||||||||||

| Asset management and commission income | 1,781 | 1,577 | 204 | 12.9 | % | ||||||||||||||||||

| Gain on sale of loans | 6,094 | 2,627 | 3,467 | 132.0 | % | ||||||||||||||||||

| Lease brokerage income | 359 | 320 | 39 | 12.2 | % | ||||||||||||||||||

| Sale of customer checks | 235 | 212 | 23 | 10.8 | % | ||||||||||||||||||

| Gain on sale of investment securities | — | — | — | n/m | |||||||||||||||||||

| Gain (loss) on marketable equity securities | (45) | 72 | (117) | (162.5) | % | ||||||||||||||||||

| Other | 819 | (55) | 874 | (1,589.1) | % | ||||||||||||||||||

| Total other non-interest income | 10,661 | 6,183 | 4,478 | 72.4 | % | ||||||||||||||||||

| Total non-interest income | $ | 32,067 | $ | 23,477 | $ | 8,590 | 36.6 | % | |||||||||||||||

The changes in non-interest income for the six months ended June 30, 2021 and 2020 are generally consistent with the changes in the comparable three month periods discussed above.

Non-interest Expense

The following table presents the key components of non-interest expense for the current and trailing quarterly periods indicated:

| Three months ended | |||||||||||||||||||||||

| (dollars in thousands) | June 30, 2021 | March 31, 2021 | $ Change | % Change | |||||||||||||||||||

| Base salaries, net of deferred loan origination costs | $ | 17,537 | $ | 15,511 | $ | 2,026 | 13.1 | % | |||||||||||||||

| Incentive compensation | 4,322 | 3,580 | 742 | 20.7 | % | ||||||||||||||||||

| Benefits and other compensation costs | 5,222 | 6,239 | (1,017) | (16.3) | % | ||||||||||||||||||

| Total salaries and benefits expense | 27,081 | 25,330 | 1,751 | 6.9 | % | ||||||||||||||||||

| Occupancy | 3,700 | 3,726 | (26) | (0.7) | % | ||||||||||||||||||

| Data processing and software | 3,201 | 3,202 | (1) | — | % | ||||||||||||||||||

| Equipment | 1,207 | 1,517 | (310) | (20.4) | % | ||||||||||||||||||

| Intangible amortization | 1,431 | 1,431 | — | — | % | ||||||||||||||||||

| Advertising | 734 | 380 | 354 | 93.2 | % | ||||||||||||||||||

| ATM and POS network charges | 1,551 | 1,246 | 305 | 24.5 | % | ||||||||||||||||||

| Professional fees | 1,046 | 594 | 452 | 76.1 | % | ||||||||||||||||||

| Telecommunications | 564 | 581 | (17) | (2.9) | % | ||||||||||||||||||

| Regulatory assessments and insurance | 618 | 612 | 6 | 1.0 | % | ||||||||||||||||||

| Postage | 124 | 198 | (74) | (37.4) | % | ||||||||||||||||||

| Operational losses | 212 | 209 | 3 | 1.4 | % | ||||||||||||||||||

| Courier service | 288 | 294 | (6) | (2.0) | % | ||||||||||||||||||

| Gain on sale or acquisition of foreclosed assets | (15) | (51) | 36 | (70.6) | % | ||||||||||||||||||

| Gain on disposal of fixed assets | (426) | — | (426) | n/a | |||||||||||||||||||

| Other miscellaneous expense | 2,855 | 2,349 | 506 | 21.5 | % | ||||||||||||||||||

| Total other non-interest expense | 17,090 | 16,288 | 802 | 4.9 | % | ||||||||||||||||||

| Total non-interest expense | $ | 44,171 | $ | 41,618 | $ | 2,553 | 6.1 | % | |||||||||||||||

| Average full-time equivalent staff | 1,020 | 1,025 | (5) | (0.5) | % | ||||||||||||||||||

Non-interest expense for the quarter ended June 30, 2021 increased $2,553,000 or 6.1% to $44,171,000 as compared to $41,618,000 during the trailing quarter ended March 31, 2021. Salaries, net of deferred loan origination costs, increased by $2,026,000 to $17,537,000 for the three months ended June 30, 2021 due to an increase in the number of work days in the current versus trailing quarter, annual merit adjustments which averaged slightly more than 3.0% and were effective April 1st, as well as growth in vacation accruals which approximated $675,000. Incentive compensation increased by $742,000 or 20.7% to $4,322,000 during the quarter ended June 30, 2021 as compared to the trailing period due to the organic loan growth and strong overall Company performance during the quarter. Benefits and other compensation costs decreased by $1,017,000 to $5,222,000 during the quarter, primarily as a result of decreases in expenses associated with retirement obligations and group insurance costs. A gain on disposal of fixed assets was recorded during the quarter totaling $426,000 related to the sale of a former retail branch building.

11

The following table presents the key components of non-interest expense for the current and prior year quarterly periods indicated:

| Three months ended June 30, | |||||||||||||||||||||||

| (dollars in thousands) | 2021 | 2020 | $ Change | % Change | |||||||||||||||||||

| Base salaries, net of deferred loan origination costs | $ | 17,537 | $ | 17,277 | $ | 260 | 1.5 | % | |||||||||||||||

| Incentive compensation | 4,322 | 2,395 | 1,927 | 80.5 | % | ||||||||||||||||||

| Benefits and other compensation costs | 5,222 | 7,383 | (2,161) | (29.3) | % | ||||||||||||||||||

| Total salaries and benefits expense | 27,081 | 27,055 | 26 | 0.1 | % | ||||||||||||||||||

| Occupancy | 3,700 | 3,398 | 302 | 8.9 | % | ||||||||||||||||||

| Data processing and software | 3,201 | 3,657 | (456) | (12.5) | % | ||||||||||||||||||

| Equipment | 1,207 | 1,350 | (143) | (10.6) | % | ||||||||||||||||||

| Intangible amortization | 1,431 | 1,431 | — | — | % | ||||||||||||||||||

| Advertising | 734 | 531 | 203 | 38.2 | % | ||||||||||||||||||

| ATM and POS network charges | 1,551 | 1,210 | 341 | 28.2 | % | ||||||||||||||||||

| Professional fees | 1,046 | 741 | 305 | 41.2 | % | ||||||||||||||||||

| Telecommunications | 564 | 639 | (75) | (11.7) | % | ||||||||||||||||||

| Regulatory assessments and insurance | 618 | 360 | 258 | 71.7 | % | ||||||||||||||||||

| Postage | 124 | 283 | (159) | (56.2) | % | ||||||||||||||||||

| Operational losses | 212 | 184 | 28 | 15.2 | % | ||||||||||||||||||

| Courier service | 288 | 337 | (49) | (14.5) | % | ||||||||||||||||||

| Gain on sale or acquisition of foreclosed assets | (15) | (16) | 1 | (6.3) | % | ||||||||||||||||||

| (Gain) loss on disposal of fixed assets | (426) | 15 | (441) | (2940.0) | % | ||||||||||||||||||

| Other miscellaneous expense | 2,855 | 4,375 | (1,520) | (34.7) | % | ||||||||||||||||||

| Total other non-interest expense | 17,090 | 18,495 | (1,405) | (7.6) | % | ||||||||||||||||||

| Total non-interest expense | $ | 44,171 | $ | 45,550 | $ | (1,379) | (3.0) | % | |||||||||||||||

| Average full-time equivalent staff | 1,020 | 1,140 | (120) | (10.5) | % | ||||||||||||||||||

Non-interest expense decreased by $1,379,000 or 3.0% to $44,171,000 during the three months ended June 30, 2021 as compared to $45,550,000 for the three months ended June 30, 2020. For reasons similar to those discussed above, benefits and other compensation expense decreased by $2,161,000 during the three months ended June 30, 2021. Other miscellaneous expenses decreased by $1,520,000 during the three months ended June 30, 2021, due specifically to the absence of indirect loan documentation and administrative costs incurred in conjunction with the PPP loan program incurred during the three months ended June 30, 2020. Incentive compensation costs increased during the three months ended June 30, 2021, as compared to the same period in 2020, as a result of strong Company performance.

The following table presents the key components of non-interest income for the current and prior year periods indicated:

| Six months ended June 30, | |||||||||||||||||||||||

| (dollars in thousands) | 2021 | 2020 | $ Change | % Change | |||||||||||||||||||

| Base salaries, net of deferred loan origination costs | $ | 33,048 | $ | 34,900 | $ | (1,852) | (5.3) | % | |||||||||||||||

| Incentive compensation | 7,902 | 5,496 | 2,406 | 43.8 | % | ||||||||||||||||||

| Benefits and other compensation costs | 11,461 | 13,931 | (2,470) | (17.7) | % | ||||||||||||||||||

| Total salaries and benefits expense | 52,411 | 54,327 | (1,916) | (3.5) | % | ||||||||||||||||||

| Occupancy | 7,426 | 7,273 | 153 | 2.1 | % | ||||||||||||||||||

| Data processing and software | 6,403 | 7,024 | (621) | (8.8) | % | ||||||||||||||||||

| Equipment | 2,724 | 2,862 | (138) | (4.8) | % | ||||||||||||||||||

| Intangible amortization | 2,862 | 2,862 | — | — | % | ||||||||||||||||||

| Advertising | 1,114 | 1,196 | (82) | (6.9) | % | ||||||||||||||||||

| ATM and POS network charges | 2,797 | 2,583 | 214 | 8.3 | % | ||||||||||||||||||

| Professional fees | 1,640 | 1,444 | 196 | 13.6 | % | ||||||||||||||||||

| Telecommunications | 1,145 | 1,364 | (219) | (16.1) | % | ||||||||||||||||||

| Regulatory assessments and insurance | 1,230 | 455 | 775 | 170.3 | % | ||||||||||||||||||

| Postage | 322 | 573 | (251) | (43.8) | % | ||||||||||||||||||

| Operational losses | 421 | 405 | 16 | 4.0 | % | ||||||||||||||||||

| Courier service | 582 | 668 | (86) | (12.9) | % | ||||||||||||||||||

| Gain on sale or acquisition of foreclosed assets | (66) | (57) | (9) | 15.8 | % | ||||||||||||||||||

| (Gain) loss on disposal of fixed assets | (426) | 15 | (441) | (2940.0) | % | ||||||||||||||||||

| Other miscellaneous expense | 5,204 | 7,306 | (2,102) | (28.8) | % | ||||||||||||||||||

| Total other non-interest expense | 33,378 | 35,973 | (2,595) | (7.2) | % | ||||||||||||||||||

| Total non-interest expense | $ | 85,789 | $ | 90,300 | $ | (4,511) | (5.0) | % | |||||||||||||||

| Average full-time equivalent staff | 1,022 | 1,141 | (119) | (10.4) | % | ||||||||||||||||||

12

Provision for Income Taxes

The Company’s effective tax rate was 28.0% for the six months ended June 30, 2021, as compared to 25.8% for the year ended December 31, 2020. The reduced effective tax rate in the prior year was made possible through the provisions of the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) which provided the Company with an opportunity to file amended tax returns and generate proposed refunds of approximately $805,000. Other differences between the Company's effective tax rate and applicable federal and state statutory rates are due to the proportion of non-taxable revenue and low income housing tax credits as compared to the levels of pre-tax earnings.

About TriCo Bancshares

Established in 1975, Tri Counties Bank is a wholly-owned subsidiary of TriCo Bancshares (NASDAQ: TCBK) headquartered in Chico, California, providing a unique brand of customer Service with Solutions available in traditional stand-alone and in-store bank branches in communities throughout Northern and Central California. Tri Counties Bank provides an extensive and competitive breadth of consumer, small business and commercial banking financial services, along with convenient around-the-clock ATMs, online and mobile banking access. Brokerage services are provided by Tri Counties Advisors through affiliation with Raymond James Financial Services, Inc. Visit www.TriCountiesBank.com to learn more.

Forward-Looking Statement

The statements contained herein that are not historical facts are forward-looking statements based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond our control. There can be no assurance that future developments affecting us will be the same as those anticipated by management. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: the strength of the United States economy in general and the strength of the local economies in which we conduct operations; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; inflation, interest rate, market and monetary fluctuations; the impact of changes in financial services policies, laws and regulations; technological changes; weather, natural disasters and other catastrophic events that may or may not be caused by climate change and their effects on economic and business environments in which the Company operates; the continuing adverse impact on the U.S. economy, including the markets in which we operate due to the COVID-19 global pandemic, and the impact of a slowing U.S. economy and increased unemployment on the performance of our loan portfolio, the market value of our investment securities, the availability of sources of funding and the demand for our products; the costs or effects of mergers, acquisitions or dispositions we may make; the ability to execute our business plan in new lending markets, the future operating or financial performance of the Company, including our outlook for future growth and changes in the level of our nonperforming assets and charge-offs; the appropriateness of the allowance for credit losses, including the timing and effects of the implementation of the current expected credit losses model; any deterioration in values of California real estate, both residential and commercial; the effect of changes in accounting standards and practices; possible other-than-temporary impairment of securities held by us; changes in consumer spending, borrowing and savings habits; our ability to attract and maintain deposits and other sources of liquidity; changes in the financial performance and/or condition of our borrowers; our noninterest expense and the efficiency ratio; competition and innovation with respect to financial products and services by banks, financial institutions and non-traditional providers including retail businesses and technology companies; the challenges of integrating and retaining key employees; the costs and effects of litigation and of unexpected or adverse outcomes in such litigation; a failure in or breach of our operational or security systems or infrastructure, or those of our third-party vendors or other service providers, including as a result of cyber-attacks and the cost to defend against such attacks; change to U.S. tax policies, including our effective income tax rate; the effect of a fall in stock market prices on our brokerage and wealth management businesses; the discontinuation of the London Interbank Offered Rate and other reference rates; and our ability to manage the risks involved in the foregoing. Additional factors that could cause results to differ materially from those described above can be found in our Annual Report on Form 10-K for the year ended December 31, 2020, which has been filed with the Securities and Exchange Commission (the “SEC”) and are available in the “Investor Relations” section of our website, https://www.tcbk.com/investor-relations and in other documents we file with the SEC. Annualized, pro forma, projections and estimates are not forecasts and may not reflect actual results. We are under no obligation (and expressly disclaim any such obligation) to update or alter our forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

13

TRICO BANCSHARES—CONDENSED CONSOLIDATED FINANCIAL DATA

(Unaudited. Dollars in thousands, except share data)

| Three months ended | |||||||||||||||||||||||||||||

| June 30, 2021 | March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | |||||||||||||||||||||||||

| Revenue and Expense Data | |||||||||||||||||||||||||||||

| Interest income | $ | 68,479 | $ | 67,916 | $ | 68,081 | $ | 65,438 | $ | 67,148 | |||||||||||||||||||

| Interest expense | 1,396 | 1,476 | 1,659 | 1,984 | 2,489 | ||||||||||||||||||||||||

| Net interest income | 67,083 | 66,440 | 66,422 | 63,454 | 64,659 | ||||||||||||||||||||||||

| Provision for (benefit from) credit losses | (260) | (6,060) | 4,850 | 7,649 | 22,244 | ||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||

| Service charges and fees | 10,930 | 10,476 | 10,218 | 10,469 | 8,168 | ||||||||||||||||||||||||

| Gain on sale of investment securities | — | — | — | 7 | — | ||||||||||||||||||||||||

| Other income | 5,027 | 5,634 | 6,362 | 4,661 | 3,489 | ||||||||||||||||||||||||

| Total noninterest income | 15,957 | 16,110 | 16,580 | 15,137 | 11,657 | ||||||||||||||||||||||||

| Noninterest expense: | |||||||||||||||||||||||||||||

| Salaries and benefits | 27,081 | 25,330 | 28,473 | 29,321 | 27,055 | ||||||||||||||||||||||||

| Occupancy and equipment | 4,907 | 5,243 | 5,108 | 4,989 | 4,748 | ||||||||||||||||||||||||

| Data processing and network | 4,752 | 4,448 | 4,455 | 4,875 | 4,867 | ||||||||||||||||||||||||

| Other noninterest expense | 7,431 | 6,597 | 7,709 | 7,529 | 8,880 | ||||||||||||||||||||||||

| Total noninterest expense | 44,171 | 41,618 | 45,745 | 46,714 | 45,550 | ||||||||||||||||||||||||

| Total income before taxes | 39,129 | 46,992 | 32,407 | 24,228 | 8,522 | ||||||||||||||||||||||||

| Provision for income taxes | 10,767 | 13,343 | 8,750 | 6,622 | 1,092 | ||||||||||||||||||||||||

| Net income | $ | 28,362 | $ | 33,649 | $ | 23,657 | $ | 17,606 | $ | 7,430 | |||||||||||||||||||

| Share Data | |||||||||||||||||||||||||||||

| Basic earnings per share | $ | 0.95 | $ | 1.13 | $ | 0.80 | $ | 0.59 | $ | 0.25 | |||||||||||||||||||

| Diluted earnings per share | $ | 0.95 | $ | 1.13 | $ | 0.79 | $ | 0.59 | $ | 0.25 | |||||||||||||||||||

| Dividends per share | $ | 0.25 | $ | 0.25 | $ | 0.22 | $ | 0.22 | $ | 0.22 | |||||||||||||||||||

| Book value per common share | $ | 32.53 | $ | 31.71 | $ | 31.12 | $ | 30.31 | $ | 29.76 | |||||||||||||||||||

| Tangible book value per common share (1) | $ | 24.60 | $ | 23.72 | $ | 23.09 | $ | 22.24 | $ | 21.64 | |||||||||||||||||||

| Shares outstanding | 29,716,294 | 29,727,122 | 29,727,214 | 29,769,389 | 29,759,209 | ||||||||||||||||||||||||

| Weighted average shares | 29,718,603 | 29,727,182 | 29,756,831 | 29,763,898 | 29,753,699 | ||||||||||||||||||||||||

| Weighted average diluted shares | 29,903,560 | 29,904,974 | 29,863,478 | 29,844,396 | 29,883,193 | ||||||||||||||||||||||||

| Credit Quality | |||||||||||||||||||||||||||||

| Allowance for credit losses to gross loans | 1.74 | % | 1.73 | % | 1.93 | % | 1.81 | % | 1.66 | % | |||||||||||||||||||

| Loans past due 30 days or more | $ | 9,292 | $ | 10,550 | $ | 6,767 | $ | 10,522 | $ | 16,622 | |||||||||||||||||||

| Total nonperforming loans | $ | 32,705 | $ | 28,941 | $ | 26,864 | $ | 22,963 | $ | 20,730 | |||||||||||||||||||

| Total nonperforming assets | $ | 34,952 | $ | 31,250 | $ | 29,708 | $ | 25,020 | $ | 22,652 | |||||||||||||||||||

| Loans charged-off | $ | 387 | $ | 226 | $ | 560 | $ | 194 | $ | 491 | |||||||||||||||||||

| Loans recovered | $ | 653 | $ | 560 | $ | 382 | $ | 381 | $ | 230 | |||||||||||||||||||

| Selected Financial Ratios | |||||||||||||||||||||||||||||

| Return on average total assets | 1.40 | % | 1.75 | % | 1.24 | % | 0.95 | % | 0.43 | % | |||||||||||||||||||

| Return on average equity | 11.85 | % | 14.51 | % | 10.37 | % | 7.79 | % | 3.39 | % | |||||||||||||||||||

| Average yield on loans, excluding PPP | 4.93 | % | 5.02 | % | 5.04 | % | 5.02 | % | 5.17 | % | |||||||||||||||||||

| Average yield on interest-earning assets | 3.65 | % | 3.82 | % | 3.88 | % | 3.83 | % | 4.26 | % | |||||||||||||||||||

| Average rate on interest-bearing deposits | 0.08 | % | 0.10 | % | 0.12 | % | 0.15 | % | 0.20 | % | |||||||||||||||||||

| Average cost of total deposits | 0.05 | % | 0.06 | % | 0.07 | % | 0.09 | % | 0.12 | % | |||||||||||||||||||

| Average rate on borrowings & subordinated debt | 2.31 | % | 2.42 | % | 2.43 | % | 2.49 | % | 3.25 | % | |||||||||||||||||||

| Average rate on interest-bearing liabilities | 0.13 | % | 0.15 | % | 0.17 | % | 0.20 | % | 0.27 | % | |||||||||||||||||||

| Net interest margin (fully tax-equivalent) (1) | 3.58 | % | 3.74 | % | 3.79 | % | 3.72 | % | 4.10 | % | |||||||||||||||||||

| Loans to deposits | 70.72 | % | 72.37 | % | 73.21 | % | 76.12 | % | 76.84 | % | |||||||||||||||||||

| Efficiency ratio | 53.19 | % | 50.42 | % | 55.11 | % | 59.44 | % | 59.69 | % | |||||||||||||||||||

| Supplemental Loan Interest Income Data | |||||||||||||||||||||||||||||

| Discount accretion on acquired loans | $ | 2,566 | $ | 1,712 | $ | 1,960 | $ | 1,876 | $ | 2,587 | |||||||||||||||||||

| All other loan interest income (excluding PPP) (1) | $ | 54,559 | $ | 52,861 | $ | 53,379 | $ | 53,560 | $ | 53,466 | |||||||||||||||||||

| Total loan interest income (excluding PPP) (1) | $ | 57,125 | $ | 54,573 | $ | 55,339 | $ | 55,436 | $ | 56,053 | |||||||||||||||||||

(1) Non-GAAP measure

14

TRICO BANCSHARES—CONDENSED CONSOLIDATED FINANCIAL DATA

(Unaudited. Dollars in thousands)

| Balance Sheet Data | June 30, 2021 | March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | ||||||||||||||||||||||||

| Cash and due from banks | $ | 639,740 | $ | 609,522 | $ | 669,551 | $ | 652,582 | $ | 705,852 | |||||||||||||||||||

| Securities, available for sale, net | 1,850,547 | 1,685,076 | 1,417,289 | 1,145,989 | 999,313 | ||||||||||||||||||||||||

| Securities, held to maturity, net | 235,778 | 260,454 | 284,563 | 310,696 | 337,165 | ||||||||||||||||||||||||

| Restricted equity securities | 17,250 | 17,250 | 17,250 | 17,250 | 17,250 | ||||||||||||||||||||||||

| Loans held for sale | 5,723 | 3,995 | 6,268 | 6,570 | 8,352 | ||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||

| Commercial real estate | 3,194,336 | 3,108,624 | 2,951,902 | 2,936,422 | 2,905,485 | ||||||||||||||||||||||||

| Consumer | 1,050,609 | 1,041,213 | 952,108 | 926,835 | 945,669 | ||||||||||||||||||||||||

| Commercial and industrial | 452,069 | 551,077 | 526,327 | 633,897 | 634,481 | ||||||||||||||||||||||||

| Construction | 200,714 | 221,613 | 284,842 | 284,933 | 278,566 | ||||||||||||||||||||||||

| Agriculture production | 41,967 | 39,753 | 44,164 | 40,613 | 35,441 | ||||||||||||||||||||||||

| Leases | 5,199 | 4,697 | 3,784 | 3,638 | 1,763 | ||||||||||||||||||||||||

| Total loans, gross | 4,944,894 | 4,966,977 | 4,763,127 | 4,826,338 | 4,801,405 | ||||||||||||||||||||||||

| Allowance for credit losses | (86,062) | (85,941) | (91,847) | (87,575) | (79,739) | ||||||||||||||||||||||||

| Total loans, net | 4,858,832 | 4,881,036 | 4,671,280 | 4,738,763 | 4,721,666 | ||||||||||||||||||||||||

| Premises and equipment | 79,178 | 82,338 | 83,731 | 84,856 | 85,292 | ||||||||||||||||||||||||

| Cash value of life insurance | 120,287 | 119,543 | 118,870 | 120,026 | 119,254 | ||||||||||||||||||||||||

| Accrued interest receivable | 18,923 | 19,442 | 20,004 | 19,557 | 20,337 | ||||||||||||||||||||||||

| Goodwill | 220,872 | 220,872 | 220,872 | 220,872 | 220,872 | ||||||||||||||||||||||||

| Other intangible assets | 14,971 | 16,402 | 17,833 | 19,264 | 20,694 | ||||||||||||||||||||||||

| Operating leases, right-of-use | 26,365 | 27,540 | 27,846 | 28,879 | 29,842 | ||||||||||||||||||||||||

| Other assets | 81,899 | 88,142 | 84,172 | 84,495 | 74,182 | ||||||||||||||||||||||||

| Total assets | $ | 8,170,365 | $ | 8,031,612 | $ | 7,639,529 | $ | 7,449,799 | $ | 7,360,071 | |||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||