Form 8-K Stabilis Solutions, Inc. For: Feb 17

1©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Stabilis Solutions Investor Presentation February 2021 Providing Enlightened Energy™ for the Energy Transition

2©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Forward Looking Statements IN GENERAL: This cautionary note applies to this document and the verbal or written comments of any person presenting it. This document, taken together with any such verbal or written comments, is referred to herein as the “Presentation.” “FORWARD-LOOKING STATEMENTS”: This Presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995 and within the meaning of Section 27a of the Securities Act of 1933, as amended, and Section 21e of the Securities Exchange Act of 1934, as amended. Actual results may differ from expectations, estimates and projections presented or implied and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “can”, “believes”, “anticipates”, “expects”, “could”, “will”, “plan”, “may”, “should”, “predicts”, “potential”, “outlook”, “approaches”, “continues”, “nearly”, “approximately”, “estimates”, “seeks”, “intends”, “plans”, “contemplates”, “indicative”, “illustrative”, “target”, “goal”, “projects”, “future” or the negative version of those words or other comparable words and similar expressions are intended to identify such forward-looking statements. Any forward-looking statements contained in this presentation, including statements regarding the Company’s potential future project development candidates and the development of such candidates, the projection of future operating and financial results which may be achieved in connection such future project development candidates, the timing of specific milestones for completion of our future development projects and facilities, including first gas flows and other milestones, the expected volumes that we will sell based on our expected volumes or other illustrative models, our expectations about new projects and facilities with respect to project cost and timeline, our ability to convert from future project development candidates to binding commitments, the expected capabilities of our development projects and facilities once completed, our illustrations of our goals for revenue, cash flow, EBITDA and earnings at particular points and on a run rate and annualized basis, the timing of our facilities coming online and the timing of related volumes reaching expected run rate, our plans and business strategy for specific industries, types of fuel and power users and geographies, expected business and developments in the future (including but not limited to, our liquidity and financing plans and expected borrowing capacity), our market assumptions including those regarding the cost of our shipping, logistics and regasification activities, and the pricing of LNG, natural gas and other alternative fuels, our financing plans, our Company’s equity value and equity value per share, are based upon our limited historical performance and on our current plans, estimates and expectations in light of information (including industry data) currently available to us. The inclusion of this forward-looking information should not be regarded as a representation by the Company or any other person that the future development plans, estimates or expectations contemplated by us will be achieved. These statements are subject to a number of factors that could cause actual results to differ materially from those described in the forward-looking statements, many of which are beyond our control. Stabilis can give no assurance that its expectations regarding any forward-looking statements will be attained. Accordingly, you should not place undue reliance on any forward-looking statements made in this Presentation. Factors that could cause or contribute to such differences include, but are not limited to, the future performance of Stabilis, future demand for LNG and remote power solutions, our future project development candidates not being approved or not resulting in binding commitments, the risk that our construction or commissioning schedules will take longer than we expect, that our expectations about the price at which we sell LNG and power, the cost at which we produce, ship and deliver LNG and the margin that we receive for the LNG that we sell are not in line with our expectations, that our operating or other costs will increase, or our expected remaining costs for development projects increases, such that our expected of funding of projects may not be possible, that our expected financing based on cash flows of existing or future projects may not be achievable by us on commercially favorable terms or at all, that we may be unable to agree on terms for projects on favorable terms or at all, that we may not have access to credit at an acceptable price, that the novel coronavirus and its impact on the economy and travel will negatively impact our ability to do business, develop projects or finance projects, that we may be unwilling or unable to make commitments to new projects for internal, external, financing, or any other reason, that we may be unable to implement our plans and business strategy in the way that we expect. The foregoing list of factors is not exclusive. Additional information concerning these and other risk factors is contained in the Risk Factors in Item 1A of our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 16, 2020 which is available on the SEC’s website at www.sec.gov or on the Investors section of our website at www.stabilis-solutions.com. All subsequent written and oral forward-looking statements concerning Stabilis, or other matters attributable to Stabilis, or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any forward- looking statements, which speak only as of the date made. Stabilis does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement or illustrative economics to reflect any change in their expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law. PAST PERFORMANCE: Our operating history is limited and our past performance is not a reliable indicator of future results and should not be relied upon for any reason. ILLUSTRATIVE ECONOMICS: Illustrative economics (including of revenue, EBITDA, earnings and cash flow) are based on management’s judgement of future courses of action and market conditions as of a future date. Actual results could differ materially and management’s assumptions on which this illustrative data is based are subject to numerous risks and uncertainties, including particular risks and uncertainties introduced due to the novel coronavirus and its broad and ongoing impact on the worldwide economy.

3©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Stabilis Solutions Provides Enlightened Energy™ for the Energy Transition OTC: SLNG We provide turnkey clean energy production, storage, transportation and fueling system solutions for Liquid Natural Gas (LNG) and Hydrogen across North America Business Overview

4©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Bu si ne ss O ve rv ie w • Stable, predictable supply • Affordable for all Security & Access • Reduce harmful emissions • Focus on renewables Environmental Sustainability • Cost effective solutions that support growth • Solutions that do not require subsidies Economic Development The cleanest, most viable energy today balances the demands of the energy transition ™

5©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Enlightened Energy™ Is A Bridge To Renewables Natural gas and hydrogen can partner with renewable energy sources to meet market needs Environmental Sustainability Security & Access Economic Development & Growth Renewable Energy Hydrogen Natural Gas Oil Coal Bu si ne ss O ve rv ie w ™

6©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Enlightened Energy™ Reduces Emissions with Low Cost, Reliable Fuels Significant emissions reductions from traditional diesel, coal, and other fossil fuelsBu si ne ss O ve rv ie w Natural Gas Hydrogen CO2 Particulate Matter NOx Reduction of 20-30% Reduction 90%+ Reduction 75% Reduction 100% Reduction 100% Reduction 100% Reduction Source: U.S. Energy Information Administration, industry research

7©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Stabilis Brings Enlightened Energy™ to Customers Where They Need It Bu si ne ss O ve rv ie w Pipeline Gas / Renewable Gas LNG/H2 Production LNG / H2 Transportation Power Generation Proven experience delivering distributed energy to customers for 15+ years • LNG plant in Texas has produced 80+ million gallons since 2016 • H2 production similar in design and operations • Can also access LNG and H2 from 25+ sources • Growth strategy is to replicate plant success in new markets • Complete North American distribution capabilities • 150+ piece fleet of mobile cryogenic equipment for rapid deployment • 24/7 field service and remote monitoring • LNG and Hydrogen capable • Can provide remote, clean power generation solutions throughout North America • Temporary and permanent power solutions available • Provides fully integrated relationship with customer Stabilis Capabilities

8©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes 250M+ LNG Gallons Delivered 200+ Projects Served 25,000+ Deliveries Made

9©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Stabilis Serves Customers Across Diverse End Markets Bu si ne ss O ve rv ie w Agriculture & Food Asphalt Mining Oil & Gas Electric Utility Pipeline General Industrial 6% 11% 17% 8% 15% 19% 19% Other 4% End markets as a percentage of 2020 revenue

10©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Energy Customers Are Seeking Cheaper, Cleaner Fuels Attractive, stable LNG pricing and positive emissions profile is driving growth across North America Sources: U.S. Energy Information Administration. *Data through December 2020 LNG / Diesel / Propane Historical Pricing ($ per MMBTU)* Bu si ne ss O ve rv ie w LNG Propane Diesel LNG pricing is cheaper and more stable than the alternatives Adoption of LNG and H2 is rapidly accelerating 499 557 621 693 772 862 961 1,072 1,196 1,334 1,488 1,659 1,851 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Projected North American Small-Scale LNG Demand (millions of LNG gallons per year) $0 $5 $10 $15 $20 $25 $30 $35 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 11.5 % C AGR Source: ADI Analytics

11©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Marine Users Are Driving Enlightened Energy™ Adoption Hydrogen Powered Passenger Ferry Bunkering • First of its kind pilot project in H2 marine fuel • Stabilis leading technical and operational solutions • Anticipated launch 1H21 • 100% reduction of emissions LNG Powered Container Ship Bunkering • Commercial project for full fleet installation • Stabilis leading technical and operational solutions • Ensures compliance with IMO 2020 marine emissions regulations by reducing sulfur oxide (-100%), particulate matter (-100%), nitrogen oxide (-95%), and carbon dioxide (-20-30%) emissions Bu si ne ss O ve rv ie w Marine regulations and social responsibility goals are driving rapid adoption of cleaner fueling solutions Source: https://sea-lng.org/why-lng/

12©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes 2.3 1.5 1.4 2.1 3.7 5.3 7.5 9.2 0 1 2 3 4 5 6 7 8 9 1 0 2016 2030 Electricity Industrial Petroleum Residential & Commercial The Mexican Market is Our Largest Growth Opportunity Bu si ne ss O ve rv ie w Mexico’s Natural Gas Shortfall is Increasing (Mexican demand by sector vs. production, billion cubic feet per day, bcfd) (36%) +46% +46% 22 .7% To ta l G ro wt h Mexico’s Domestic Production Lack of natural gas pipeline infrastructure Higher cost of alternative fuels Lower transportation costs Fewer existing experienced LNG operators Large and increasing market for natural gas Source SENER Prospectiva de Gas Natural, FTI Analysis. Residential and Commercial in 2016 is 0.1 Bcfd and 2030 is 0.2 Bcfd.

13©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Stabilis Executed the Largest Distributed LNG Project in Mexican History[1] 2.3 Million LNG gallons delivered 75k Peak daily burn of LNG gallons 250 LNG truck deliveries 35 Megawatts of Power generation fueled (Enough to support ~29,000 homes) 15 Dedicated pieces of cryogenic equipment Bu si ne ss O ve rv ie w

14©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Stabilis Solutions is at the Heart of the Energy Transition Our future is bright OTC: SLNGFuture Potential

15©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Positioned for Significant Value Accretion Fu tu re P ot en ti al Current Market Value[2] Book Value Equity[3] Book Value Assets[4] Illustrative Growth Multiple[5] Recent Comparable Acquisition[6] Share Price $2.80 $3.64 $4.68 $6.84 $9.68 Delta from current - +25% +61% +136% +234% Implied EV / EBITDA Multiple[7&8]* 6.5x 8.2x 10.4x 15.0x 21.0x Comparable acquisition recently announced at 21x EV/EBITDA Stabilis is currently trading at a discount to book equity / asset and is receiving no growth premium *Based on $8M annualized EBITDA

16©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Our Project Pipeline Creates the Opportunity for Step Change Growth Fu tu re P ot en ti al (000’s) Project Country Phase[9] Timing[9] Revenue[9] Cash Flow[9] $26M+ Potential incremental revenue from 2021 Dev-stage projects CNG Production Facility MX Dev 2021 $10,000 $7,000 3rd Party LNG + Power Gen MX Dev 2021 $20,000 $5,000 Illustrative Project 2 Marine Bunkering - Hydrogen A US Dev 2021 $1,250 $625 Marine Bunkering - LNG A US Dev 2021 $5,000 $2,500 $60M+ Potential Incremental revenue from 2022 + 2023 dev-stage projects LNG Production + Power Gen MX Dev 2023 $40,000 $26,000 Illustrative Project 1 LNG Supply Facility MX Dev 2022 $20,000 $10,000 $145M+ Potential incremental revenue from 2022 prospect pipeline Marine Bunkering - LNG B US Prospect 2022 $2,500 $1,250 Marine Bunkering - LNG C US Prospect 2022 $2,500 $1,250 LNG Production Facility B MX Prospect 2022 $35,000 $15,000 LNG Production Facility C MX Prospect 2022 $35,000 $15,000 LNG Production Facility D MX Prospect 2022 $35,000 $15,000 LNG Production Facility E MX Prospect 2022 $35,000 $15,000

17©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Illustrative Project Economics 1 – LNG Plant / Transport / Power Gen Fu tu re P ot en ti al Project Overview § LNG Production, transport, logistics and power generation for remote industrial power § Construction and operation of a 120,000 LNG-gpd plant and 25MW of power generation equipment § 10-year take-or-pay contract Illustrative Project Economics[10] Annual Revenue [1] : $45 million Annual EBITDA: $29 million Annual Net Income: $12 million

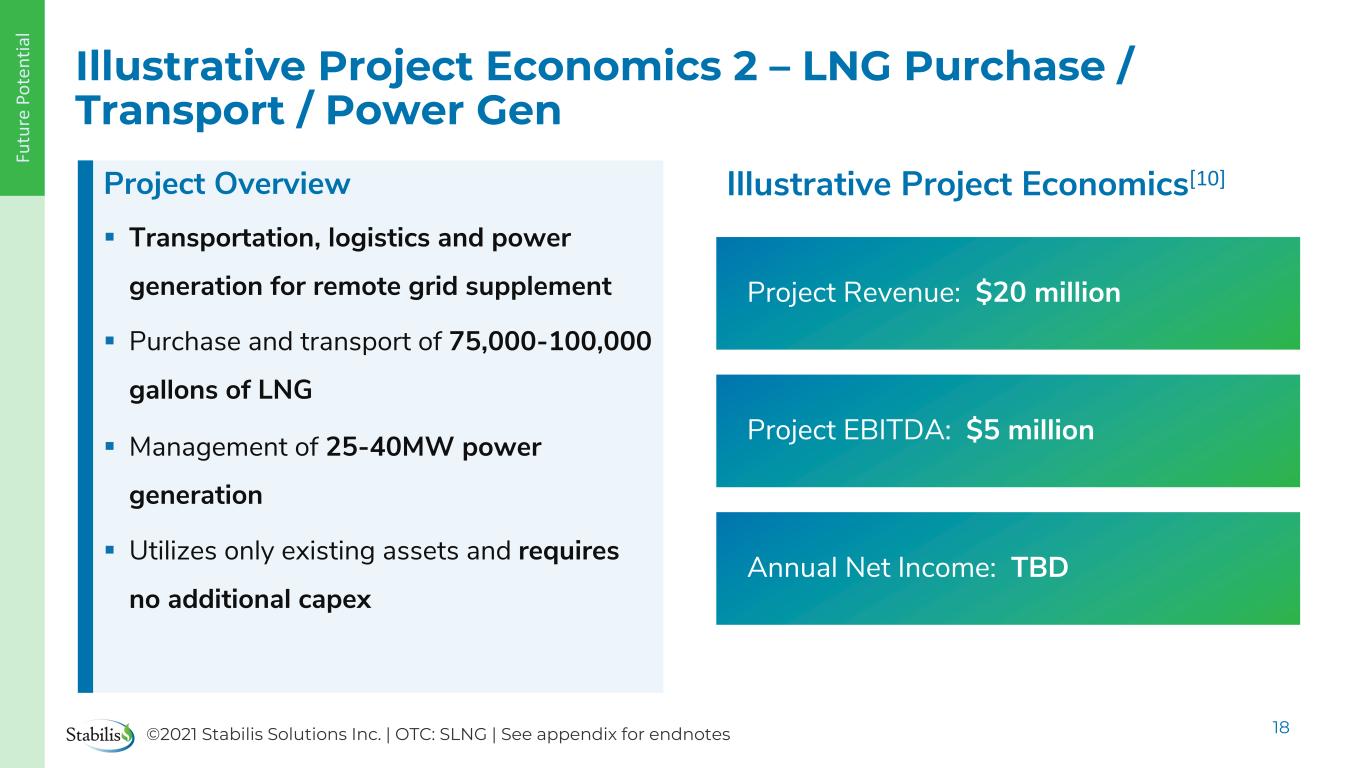

18©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Illustrative Project Economics 2 – LNG Purchase / Transport / Power Gen Fu tu re P ot en ti al Project Overview § Transportation, logistics and power generation for remote grid supplement § Purchase and transport of 75,000-100,000 gallons of LNG § Management of 25-40MW power generation § Utilizes only existing assets and requires no additional capex Illustrative Project Economics[10] Project Revenue: $20 million Project EBITDA: $5 million Annual Net Income: TBD

19©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes A Profitable, Growing Business • 4Q20 revenue of $13.5M-$13.8M [11] is second best quarterly revenue in company history • Existing business produces positive operating cash flows sufficient to fund growth initiatives • Anticipate 20%+ organic growth from existing business • Significant revenue growth (>100%)[12] potential from future projects Fu tu re P ot en ti al $20.4M $37.3M $47.1M $41.4M To $41.7M $56.5M $67.8M $26.3M $50.5M 2017 2018 2019 2020E 2021E 2022E Existing Business Revenue Illustrative Future Project Revenue Illustrative Future Periods [12] $82.8M $118.3M +130% Growth COVID Impact +76% Growth

20©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes New Project Wins Could Create Material Share Price Appreciation [12] Fu tu re P ot en ti al +1 Project +2 Projects +3 Projects Illustrative EBITDA $29.8M $51.5M $73.3M Equity Value per Share EB IT D A M ul tip le [1 3] Current 6.5x $11.18 $19.55 $27.91 10.0x $17.34 $30.21 $43.09 15.0x $26.14 $45.45 $64.76 Peer 21.0x $34.95 $60.69 $87.44 Even at the current valuation, the scale of upcoming projects can radically expand existing equity value

21©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Building On Our Successful Foundation in 2021 2020 Achievements ✓ Expanded new project pipeline by $200M ✓ Executed largest distributed natural gas project in Mexican history ✓ Commenced work on the company’s first LNG marine bunkering project ✓ Commenced work on the first North American hydrogen marine bunkering project ✓ Fully recovered from negative COVID-impact and have resumed growth trajectory Fu tu re P ot en ti al 2021 Expectations o Materially grow revenue and earnings by executing at least one development-stage project o Drive growth and profitability in core business o Increase footprint in Mexico with additional sales, development, and execution capabilities o Develop and execute at least one additional hydrogen energy project o Continue to review acquisition opportunities

22©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Stabilis Solutions Today OTC: SLNG World class provider of Enlightened EnergyTM solutions including Liquid Natural Gas (LNG) and Hydrogen Robust project pipeline of $200M+ in new opportunities over the next two years Experienced operator poised to apply proven development and operating capabilities to rapidly grow into energy transition opportunities

23©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Appendix Endnotes OTC: SLNG

24©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Endnotes Certain of the below Endnotes include forward-looking statements. Please see our note” on the slide titled “Cautionary Note Concerning Forward-Looking Statements” in this Investor Update (the “Presentation”). Please evaluate this Presentation in connection with the risk factors in our public reports, including our annual report on Form 10-K for the period ended December 31, 2019. 1) Management’s estimate. 2) Current Market Value as of February 3, 2021. 3) “Book Value Equity” is calculated as Total Stockholders’ Equity divided by Shares Outstanding at September 30, 2020. This information is for illustrative purposes only and is not intended to be a projection of our equity value per share. 4) “Book Value of Assets” is calculated as book value of Total Assets divided by Shares Outstanding at September 30, 2020. This information is for illustrative purposes only and is not intended to be a projection of our equity value per share. 5) “Illustrative Growth Multiple” is calculated by multiplying $8 million of EBITDA by the Multiple of 15 times. This information is for illustrative purposes only and is not intended to be a projection of our future EBITDA or equity value. In addition, there can be no assurance that a multiple of 15 times is the correct or only multiple that could be used in calculating an equity value for the Company. 6) “Recent Comparable Acquisition” is based on a third- party acquisition announced in January 2021. This information is for illustrative purposes only and is not intended to be a projection of our equity value or that a similar transaction would be available to Stabilis or that 21 times is the correct or only multiple that could be used in a similar transaction. En dn ot es

25©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Endnotes 7) “Implied EV / EBITDA Multiple” is calculated by dividing the illustrative market capitalization plus book value of debt divided by $8 million of EBITDA. This multiple is illustrative in nature and is not intended to be a projection of our equity value per share or EBITDA. 8) “EBITDA” is Earnings before Interest (includes interest income and interest expense), Taxes, Depreciation & Amortization and is a non-GAAP measure. Accordingly, it should not be used as an indicator of, or an alternative to, net income as a measure of operating performance. In addition, EBITDA is not intended to be measures of free cash flow available for management’s discretionary use. Because the definition of EBITDA may vary among companies and industries, it may not be comparable to other similarly titled measures used by other companies. 9) “Dev” or “Prospect” phase refers to the Company’s potential future project development candidates for which (i) we are in active negotiations, (ii) there is a request for proposals or competitive bid process, or (iii) for whom we anticipate a request for proposals or competitive bid process in the future. We cannot assure you (i) if or when the projects will be approved to move forward, (ii) if or when the Company will enter into contracts for any of these projects, (iii) whether we will be able to obtain the necessary financing to participate in the projects (iv) the timing of the projects or (v) the financial results to Stabilis resulting from participation in the projects. These future development candidates are illustrative in nature. The Revenue and Cash Flow numbers should not be viewed as guidance or management’s view of the Company’s projected financial results from the projects, if any, that the Company would participate in and does not purport to be an actual representation of our future economics. 10) The project is illustrative in nature and the Company currently has no contract or letter of intent to participate in this project. There can be no assurance that the Company will be awarded this or similar projects. The Annual Revenue, EBITDA, and Net Income amounts are illustrative in nature and should not be viewed as guidance or management’s view of the Company’s projected financial results from participating in this project and does not purport to be an actual representation of our future economics. En dn ot es

26©2021 Stabilis Solutions Inc. | OTC: SLNG | See appendix for endnotes Endnotes 11) Preliminary results subject to the completion of the customary quarterly and year-end closing and review process and may be subject to change after completion of the year-end audit. 12) These tables are illustrative in nature. There can be no assurance that the Company will be awarded these or similar future projects or achieve these financial results from future projects and should not be viewed as guidance or management’s view of the Company’s projected Financial Results. 13) This information is for illustrative purposes only and is not intended to be a projection of our future EBITDA or equity value. In addition, there can be no assurance that these EBITDA multiples are the correct or only multiples that could be used in calculating an equity value for the Company. En dn ot es

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- LaPhair Capital Partners Acquires Kinexx Modular Construction to Accelerate Homeownership in Urban Communities

- New Adobe Photoshop with Advanced Generative Fill and Generate Image Brings New Superpowers to All

- Biceps Coin Introduces Bitcoin Earning Potential for $BICS Token Holders

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share