Form 8-K Solis Tek, Inc./NV For: May 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

May 10, 2018

Date of Report

Solis Tek Inc

(Exact name of registrant as specified in its charter)

| Nevada | 000-52446 | 20-8609439 | ||

| (State or other jurisdiction | (Commission | (IRS Employer | ||

| of incorporation) | File Number) | Identification No.) |

| 853 Sandhill Avenue | ||

| Carson, CA | 90746 | |

| (Address of principal executive offices) | (Zip Code) |

(888) 998-8881

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 1.01- Entry into a Material Definitive Agreement

A. Option Agreement for Arizona Property

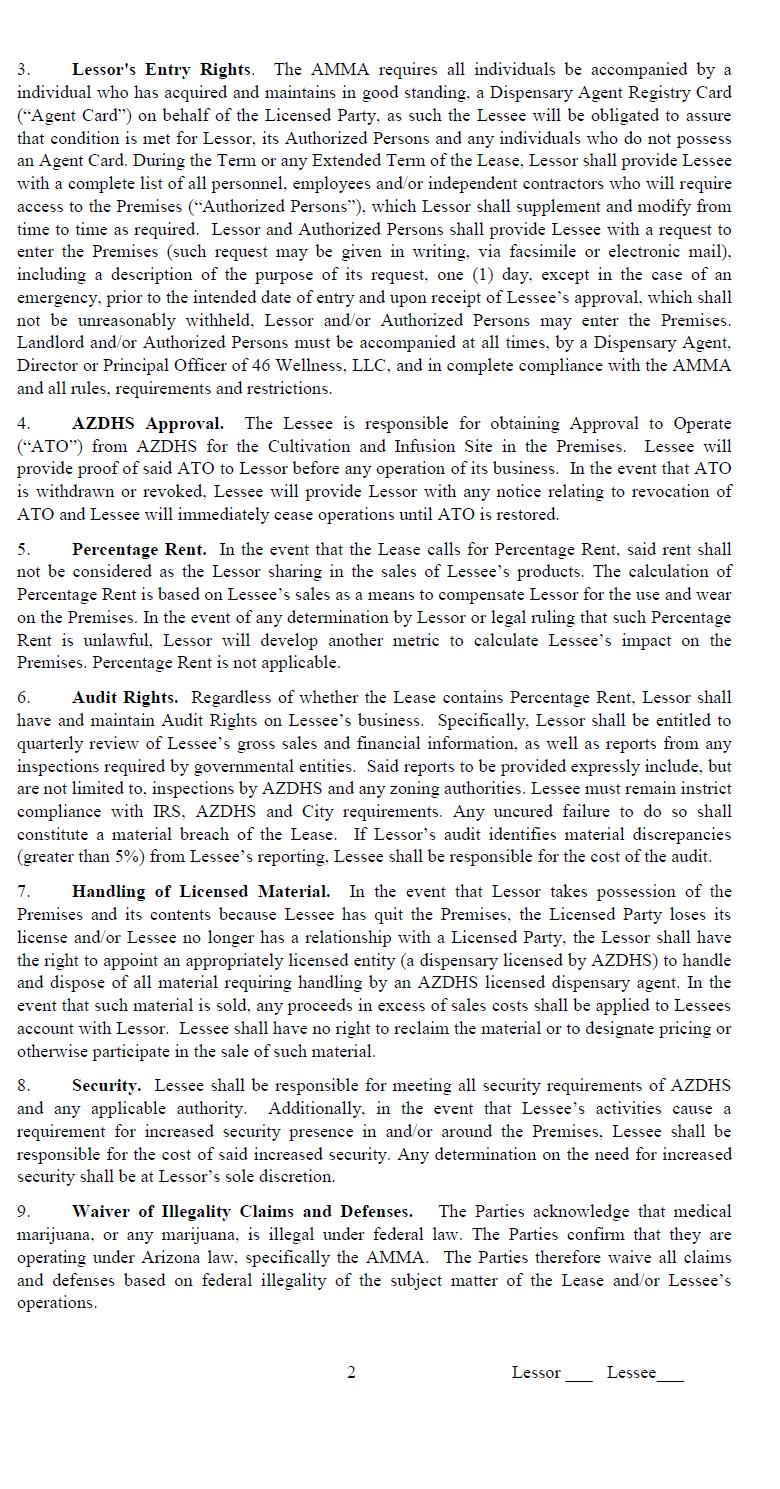

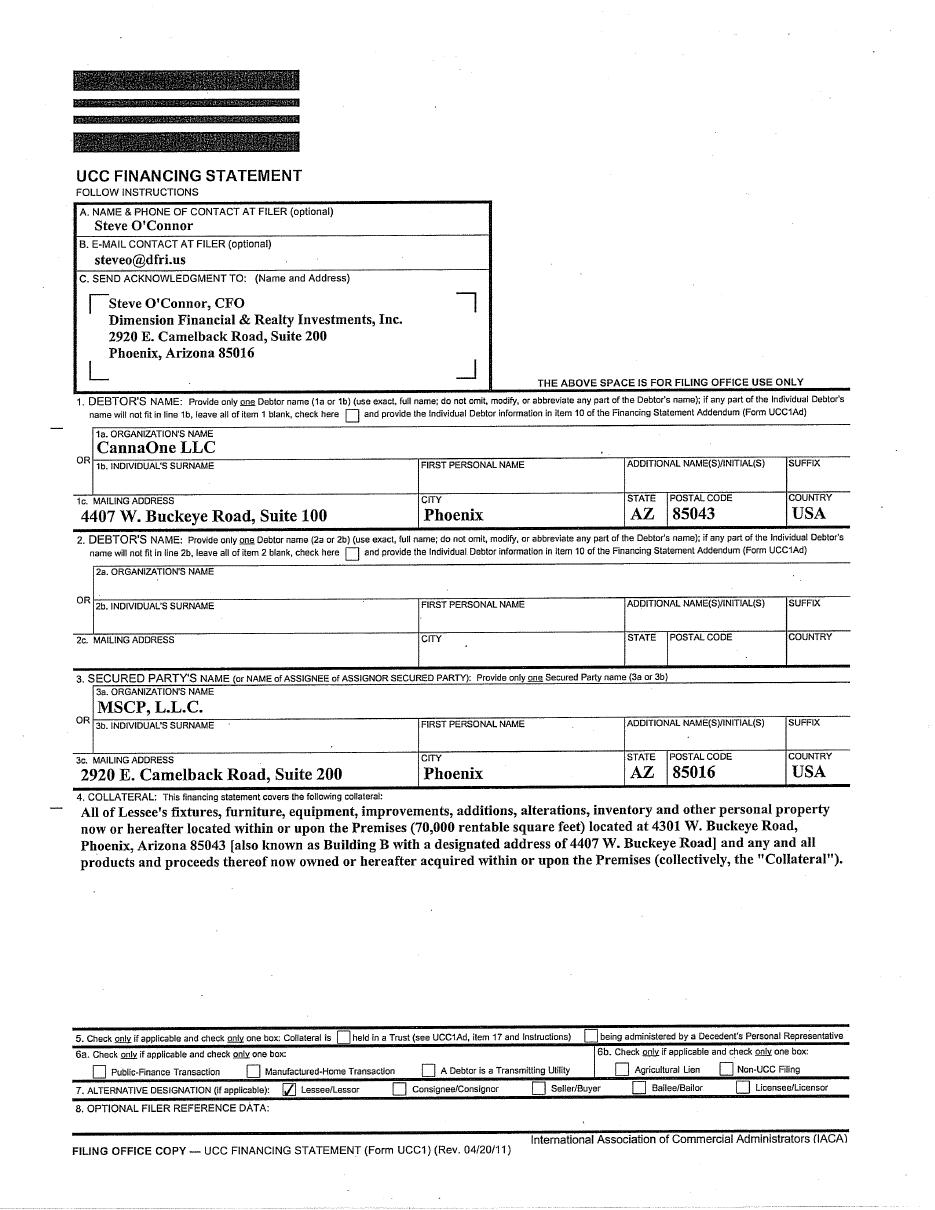

On April 19, 2018, Solis Tek Inc., (the “Company”) entered into an Option Agreement (the “Option”) with MSCP, LLC, a non-affiliated Arizona limited liability company (the “Lessor”), pursuant to which, a wholly owned subsidiary of the Company, (the “Company Subsidiary”), was granted an option to enter into a certain Lease Agreement (the “Lease”) for the real property, including the structure and all improvements, identified in the Option (the “Premises”). The Premises consists of 70,000 square feet of space and is to be used for the sole purpose of providing services related to the management, administration and operation of a cultivation and processing facility (“Facility”) on behalf of an Arizona limited liability company operating as a nonprofit organization (“Arizona Licensee”) which has been allocated a Medical Marijuana Dispensary Registration Certificate by the Arizona Department of Health Services (“AZDHS”). The activities within the Facility shall be limited to the cultivation, processing, production and packaging of medical marijuana (“MMJ”) and manufactured and derivative products which contain medical marijuana (collectively “MMJ Products”), with no right to sell or dispense any such plants or products. The Lease is for a 5-year initial term (the “Term”) with an option to renew for an additional 5 year term. The base rent for the initial year of the Term is $101,500. per month with additional pro-rata net-lease charges.

As consideration for the Option, the Company paid to Lessor, $160,000.00 (the “Deposit”). If the Company’s Subsidiary executes the Lease by May 19, 2018, the Deposit shall be treated as a security deposit and rent advance and governed in accordance with the terms and conditions of the Lease, and the Company will become a guarantor of the Company Subsidiary’s obligations under the Lease, on behalf of Arizona Licensee. If the Lease is not executed by the Company Subsidiary, the Deposit shall be deemed non-refundable.

B. Purchase of YLK Partners NV, LLC

On May 10, 2018, the Company entered into an Acquisition Agreement with the members, which in the aggregate, own 100% of the membership interests (the “Sellers”) in YLK Partners NV, LLC, a Nevada limited liability company (“YLK”). Pursuant to the Acquisition Agreement, in consideration of the Company acquiring all of the outstanding membership interests of YLK, the Company issued to the Sellers, a total of 5,000,000 warrants (the “Warrants”) to purchase 5,000,000 common shares, at an exercise price of $0.01 per share. The Warrants are exercisable until May 9, 2023.

The Sellers were

(a) LK Ventures, LLC a Nevada limited liability company. One half of the membership interests of LK Ventures, LLC is owned by Alan Lien, Chief Executive Officer, President and a director of the Company, and the remaining one half is owned by a non-affiliated party. LK Ventures LLC received 2,250,000 Warrants under the Acquisition Agreement for the 45% membership interests held in YLK.

| 2 |

(b) MDM Cultivation LLC, a Delaware limited liability company. The members of MDM Cultivation are affiliates of YA II PN, Ltd. and, D-Beta One EQ, Ltd., which presently hold (i) 2,258,382 shares of Solis Tek’s common stock, (ii) warrants to purchase 11,200,000 shares of the Company’s common stock and (iii) a Secured Promissory Note issued by Solis Tek in the original principal amount of $1.5 million. In addition, YA II PN, Ltd. and the Company are parties to that Standby Equity Distribution Agreement pursuant to which YA II PN, Ltd. has agreed to purchase up to $25.0 million of the Company’s common stock, subject to the terms and conditions thereof. MDM Cultivation owned 45% of the outstanding membership interests of YLK. MDM Cultivation was issued 2,250,000 Warrants under the Acquisition Agreement. As affiliates of MDM Cultivation, YA II PN, Ltd. and D-Beta One EQ, Ltd. will be deemed to be the beneficial owners of the 2,250,000 Warrants in addition to the other shares and warrants presently held by them.

(c) Future Farm Technologies Inc of Vancouver British Columbia, Canada. Future Farm Technologies, Inc. was issued 500,000 Warrants under the Acquisition Agreement for the 10% membership interests held in YLK.

C. Cultivation Management Services Agreement

On January 5, 2018, a wholly owned subsidiary of YLK (the “YLK Subsidiary”) entered into a Cultivation Management Services Agreement (the “Management Agreement”) with an Arizona Licensee. The Arizona Licensee is authorized to operate a medical marijuana dispensary, one (1) onsite Facility and one (1) offsite Facility, to produce, sell and dispense medical marijuana and manufactured and derivative products which contain marijuana pursuant to Title 9; Chapter 17 of the Arizona Department of Health Services Medical Marijuana Program, (the “AZDHS Rules”) and A.R.S. § 36-2801 et seq., as amended from time to time (the “Act”) (collectively referred to herein as the “AMMA”). Pursuant to the Management Agreement, YLK Subsidiary will provide the management services for the offsite Facility, on behalf of the Arizona Licensee.

As consideration for the exclusive right of YLK Subsidiary to manage Arizona Licensee’s Facility, pursuant to the Management Agreement; (i) YLK Subsidiary paid $750,000 to the Arizona Licensee; (ii) agreed to pay an additional $250,000 within 10 days after receipt of the AZDHS Approval to Operate (“ATO”) the Facility; and (iii) agreed to pay a total of $600,000, payable in 44 equal monthly installments commencing on April 1, 2019.

The term of the Management Agreement is 5 years. The YLK Subsidiary has the option to extend the term for an additional 5 years with the payment of $1,000,000.00 at the commencement of the additional term and a total of $1,000,000.00 payable in equal monthly installments over the extended term of the Management Agreement.

The Management Agreement provides, among other things, that:

YLK Subsidiary as an independent contractor, act as the manager (“Manager”) of the Facility, on behalf of and in conjunction with Arizona Licensee, and shall be responsible for the acquisition, design, planning, zoning, entitlement, development and construction of a Facility, and for the preparation, submission and acquisition of the ATO for the Facility from AZDHS as its authorized offsite Facility, including payment of all costs, fees, and expenses incurred in the acquisition of all authorizations, permits, certificates and approvals, including acquiring the ATO from AZDHS.

Manager shall be responsible for implementation of the Facility’s Business Plan, Security Policies and Procedures, Inventory and Quality Control Policies and Procedures, and any other policies and procedures or any amendments thereto, subject to approval and as adopted by Arizona Licensee for the Facility, in accordance with the AMMA and applicable rules and regulations. As compensation for rendering the services and the ongoing successful operation of the Facility, Arizona Licensee shall pay to Manager, certain management fees agreed to by the Parties.

| 3 |

Manager shall be responsible for taking any action necessary to comply with any change whatsoever in the AMMA and any applicable law, rule, statute, or regulation related to the development, operation, or management of the Facility that comes into being, occurs, accrues, becomes effective, or otherwise becomes applicable after the Effective Date.

Manager shall implement all actions necessary to ensure the quality, safety and security of the Facility and the MMJ and MMJ Products at the Facility, including providing product testing at industry standards for all products grown or developed for Arizona Licensee at the Facility. Manager shall also be responsible for all costs and expenses related to the testing of MMJ and MMJ Products cultivated and produced at the Facility to ensure effectiveness, quality and safety in compliance with the AMMA and all other state and local rules, regulations, requirements and laws. In the event Arizona Licensee reasonably requires the additional testing of MMJ and MMJ Products at the Facility, beyond what is required therein, Arizona Licensee agrees to bear the responsibility of any costs, fees and expenses incurred as a result of such additional testing.

Item 2.01 Completion of Acquisition or Disposition of Assets.

See Item 1.01 above.

Item 3.02 Unregistered Sales of Equity Securities.

On May 10, 2018, the Company entered in to a Securities Purchase Agreement with YA PN II, LLC, pursuant to which the Company sold and issued the following:

| (a) | 500,000 shares of the Company’s common shares for a consideration of $500,000. |

| (b) | A warrant (“Warrant #1”) to purchase 1,000,000 shares of the company’s common stock at an exercise price of $1.50 per share for a term expiring on May 10, 2023. |

| (c) | A warrant (“Warrant #2”) to purchase 2,250,000 shares of the company’s common stock at an exercise price of $1.50 per share for a term expiring on May 10, 2023. At any time, the Company has the right and option to purchase any unexercised Warrant Shares underlying Warrant #2 for a purchase price of $0.03 per Warrant Share so purchased if and only if the average volume weighted average price (“VWAP”) (as reported by Bloomberg, LP) of the Company’s Common Stock is greater than $1.75 per Share for the five (5) consecutive trading days immediately preceding the Company’s delivery of a Notice of exercise. | |

| The Company has the right and option to compel the Holder to exercise any unexercised Warrant Shares underlying Warrant #2 on the terms set forth in Warrant #2 if and only if the average VWAP of the Company’s Common Stock is greater than $1.75 per Share for the five (5) consecutive trading days immediately preceding the Company’s delivery of a Notice of exercise. |

| 4 |

| (d) | A warrant (“Warrant #3”) to purchase 2,250,000 shares of the company’s common stock at an exercise price of $1.50 per share for a term expiring on May 10, 2023. At any time, the Company has the right and option to purchase any unexercised Warrant Shares underlying Warrant #3 for a purchase price of $0.03 per Warrant Share so purchased if and only if the average volume weighted average price (“VWAP”) (as reported by Bloomberg, LP) of the Company’s Common Stock is greater than $2.00 per Share for the five (5) consecutive trading days immediately preceding the Company’s delivery of a Notice of Exercise | |

| The Company has the right and option to compel the Holder to exercise any unexercised Warrant Shares underlying Warrant #3 on the terms set forth in Warrant #3 if and only if the average VWAP of the Company’s Common Stock is greater than $2.00 per Share for the five (5) consecutive trading days immediately preceding the Company’s delivery of a Notice of exercise. | ||

| (e) | A warrant (“Warrant #4”) to purchase 2,250,000 shares of the company’s common stock at an exercise price of $1.50 per share for a term expiring on May 10, 2023. At any time, the Company has the right and option to purchase any unexercised Warrant Shares underlying Warrant #4 for a purchase price of $0.03 per Warrant Share so purchased if and only if the average volume weighted average price (“VWAP”) (as reported by Bloomberg, LP) of the Company’s Common Stock is greater than $2.50 per Share for the five (5) consecutive trading days immediately preceding the Company’s delivery of a Notice of exercise. | |

| The Company has the right and option to compel the Holder to exercise any unexercised Warrant Shares underlying Warrant #4 on the terms set forth in Warrant #4 if and only if the average VWAP of the Company’s Common Stock is greater than $2.50 per Share for the five (5) consecutive trading days immediately preceding the Company’s delivery of a Notice of exercise. | ||

| (f) | A Secured Promissory Note (the “Note”) in the amount of $1,500,000. The Note bears interest at the rate of 8% per annum and has a maturity date of February 9, 2019. The Note is secured by all of the assets of the Company. |

In connection with the Securities Purchase Agreement, the Company executed: (i) a Registration Rights Agreement pursuant to which we are required to file a registration statement (the “Registration Statement”) with the SEC for the resale of certain of the Shares and Warrant Shares; (ii) A Global Guaranty Agreement pursuant to which the Company and all of the Company’s subsidiaries, guaranteed the repayment of the Note; and a Security Agreement pursuant to which the Company and all of its subsidiaries pledged all of their assets as collateral for the repayment of the Note.

Item 9.01 Financial Statements and Exhibits.

Exhibits.

| 5 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: | May 10, 2018 | |

| Solis Tek Inc. | ||

| By: | /s/ Alvin Hao | |

| Alvin Hao, Executive Vice President | ||

| 6 |

SECURITIES PURCHASE AGREEMENT

THIS SECURIRTIES PURCHASE AGREEMENT (this “Agreement”) is entered into as of May 10, 2018 by and among YA II PN, LTD., a Cayman Islands exempted company (the “Investor”), SOLIS TEK INC. (the “Borrower”), a Nevada corporation, SOLIS TEK INC. (“S-Tek”), a California corporation, SOLIS TEK EAST CORPORATION (“S-East”), a New Jersey corporation, and ZELDA HORTICULTURE, INC. (“Zelda”), a California corporation (S-Tek, S-East and Zelda are collectively referred to as the “Guarantors”). The Borrower and the Guarantors are sometimes individually referred to as a “Credit Party” and collectively referred to as the “Credit Parties.”

WITNESSETH

WHEREAS, the Borrower and the Investor are entering into two transactions as more particularly described in this Agreement, consisting of the Investor purchasing (i) 500,000 shares (the “Shares”) of the Borrower’s common stock, warrants (the “Warrants”) to purchase up to 7.5 million Shares, and (iii) a Secured Promissory Note (a “Note”);

WHEREAS, the Guarantors are wholly-owned subsidiaries of the Borrower and will receive direct economic benefits by the Borrower entering into this Agreement and from the extension of credit by the Investor to the Borrower to be evidenced by the Note;

WHEREAS, each Guarantor will jointly and severally guaranty the payment and performance of all of the Borrower’s obligations (collectively, the “Obligations”) under this Agreement, the Note and all other Transaction Documents (as defined below) pursuant to the terms of an Amended and Restated Global Guaranty Agreement (the “Global Guaranty Agreement”) of even date herewith;

WHEREAS, each Credit Party will jointly and severally secure all of the Obligations under this Agreement, the Note, the Global Guaranty Agreement, and all other Transaction Documents by granting to the Investor an unconditional and continuing first priority security interest in all of the assets and properties of each Credit Party, whether now existing or hereafter acquired, pursuant to an Amended and Restated Global Security Agreement (the “Global Security Agreement”) of even date herewith;

WHEREAS, as used herein the term “Transaction Documents” shall mean this Agreement, the Note, the Global Guaranty Agreement, the Global Security Agreement, and any other agreement or item entered into, or delivered to the Investor, in connection with any of the forgoing, all as amended or extended from time to time.

NOW, THEREFORE, in consideration of the mutual covenants and other agreements contained in this Agreement, each Credit Party and the Investor hereby agree as follows:

1. PURCHASE AND SALE OF UNIT AND NOTE.

(a) Purchase of Unit. The Investor shall purchase from the Borrower, and the Borrower shall sell to the Investor, the Unit consisting of (i) 500,000 Shares and (ii) the Warrants to purchase 7.5 million Shares. The terms of the Warrants will be set forth in four (4) separate warrants. The purchase price of the Unit shall be $500,000, payable by the Investor to the Borrower by wire transfer. On the date hereof, the Borrower shall issue to the Investor (i) a stock certificate evidencing the Shares and (ii) the Warrants.

(b) Purchase of the Note. The Investor shall purchase from the Borrower, and the Borrower shall sell to the Investor, the Note in the original principal amount of $1.5 million. The purchase price of the Note shall be $1.5 million, payable by the Investor to the Borrower by wire transfer.

(c) The purchase and sale of the Unit and the Note shall occur concurrently on the date hereof (the “Closing Date”), subject to the satisfaction of all the conditions precedent set forth below.

(d) Form of Payment. Subject to the satisfaction of the terms and conditions of this Agreement, on the Closing Date (i) the Investor shall deliver to the Borrower purchase price for the Unit and the Note, and (ii) the Borrower shall deliver to the Investor, the stock certificate evidencing the 500,000 Shares, the Warrants and a Note, all duly executed on behalf of the Borrower. Each Guarantor hereby acknowledges and consents to the issuance of the Note by the Borrower to the Investor, and further acknowledges and agrees that the payment and performance of any and all Obligations owed by the Borrower to the Investor under such Note shall be subject to the Global Guaranty Agreement and such Guarantor’s obligations shall be secured by a first priority continuing security interest as evidenced by the Global Security Agreement.

(e) Conditions Precedent to the Closing. The obligation of the Investor hereunder to consummate the transactions set forth herein on the Closing Date is subject to the satisfaction, at or before the Closing Date, of each of the following conditions, provided that these conditions are for the Investor’s sole benefit and may be waived by the Investor at any time in its sole discretion:

(f) No Credit Party shall be in material breach or default of, and no Event of Default (an “Event of Default”) shall have occurred on, this Agreement, the Note or any other Transaction Document, and no Event of Default would exist after giving effect to the closing of the transactions. An Event of Default on this Agreement, the Note or any other Transaction Document shall constitute an Event of Default of each other Transaction Document;

(g) There shall not have been any “Material Adverse Effect,” where “Material Adverse Effect” shall mean any condition, circumstance, or situation that may result in, or reasonably be expected to result in (1) a material adverse effect on the legality, validity or enforceability of this Agreement or the transactions contemplated herein, (2) a material adverse effect on the results of operations, assets, business or condition (financial or otherwise) of any Credit Party, or (3) a material adverse effect on any Credit Party’s ability to perform in any material respect on a timely basis its obligations under the Transaction Documents.

(h) The representations and warranties contained in Section 3 shall be true and correct in all material respects on and as of the Closing Date;

(i) The Borrower’s common stock (“Common Stock”) shall be authorized for quotation or trading on the OTC Markets (the “Principal Market”) and trading in the Common Stock shall not have been suspended for any reason. The Borrower shall have timely made all of its filings with the SEC, including, without limitation, any filings on Form 10-K and 10-Q; and

| 2 |

(j) The Credit Parties shall execute and deliver to the Investor the Transaction Documents.

2. INVESTOR’S REPRESENTATIONS AND WARRANTIES.

Investor hereby represents and warrants to the Borrower that the following are true and correct as of the date hereof:

(a) Organization and Authorization. The Investor is duly organized, validly existing and in good standing under the laws of the Cayman Islands and has all requisite power and authority to execute, deliver and perform this Agreement, including all transactions contemplated hereby. The decision to invest, the execution and delivery by the Investor of this Agreement and the other Transaction Documents to which the Investor is a party, the performance by the Investor of its obligations hereunder and thereunder, and the consummation by the Investor of the transactions contemplated hereby and thereby have been duly authorized and require no other proceedings on the part of the Investor. The undersigned has the right, power and authority to execute and deliver this Agreement and the other Transaction Documents to which the Investor is a party, on behalf of the Investor or its shareholders. This Agreement and such other Transaction Documents have been (or, when executed and delivered, will be) duly executed and delivered by the Investor and, assuming the execution and delivery hereof and acceptance thereof by the Company, will constitute the legal, valid and binding obligations of the Investor, enforceable against the Investor in accordance with their respective terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or other laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies and except as rights to indemnification and to contribution may be limited by federal or state securities law.

(b) Evaluation of Risks. The Investor has such knowledge and experience in financial, tax and business matters as to be capable of evaluating the merits and risks of, and bearing the economic risks entailed by, an investment in the Borrower and of protecting its interests in connection with this transaction.

(c) Investment Purpose. The Unit and the Note are being purchased by the Investor for its own account, and for investment purposes. The Investor agrees not to assign or in any way transfer the Investor’s rights to the Unit or the Note or any interest therein and acknowledges that the Borrower will not recognize any purported assignment or transfer of the Note except in accordance with applicable Federal and state securities laws.

(d) Accredited Investor. The Investor is an “Accredited Investor” as that term is defined in Rule 501(a)(3) of Regulation D of the Securities Act of 1933 (the “Securities Act”).

(e) Information. The Investor and its advisors (and its counsel), if any, have been furnished with all materials relating to the business, finances and operations of the Borrower and information it deemed material to making an informed investment decision. The Investor and its advisors, if any, have been afforded the opportunity to ask questions of the Borrower and its management. Neither such inquiries nor any other due diligence investigations conducted by such Investor or its advisors, if any, or its representatives shall modify, amend or affect the Investor’s right to rely on the Borrower’s representations and warranties contained in this Agreement. The Investor understands that its investment involves a high degree of risk. The Investor has sought such accounting, legal and tax advice, as it has considered necessary to make an informed investment decision with respect to this transaction.

| 3 |

(f) No General Solicitation. Neither the Borrower, nor any of its affiliates, nor any person acting on its or their behalf, has engaged in any form of general solicitation or general advertising (within the meaning of Regulation D under the Securities Act) in connection with the offer or sale of the Unit and the Note offered hereby.

(g) Not an Affiliate. The Investor is not an officer, director or a person that directly, or indirectly through one or more intermediaries, controls or is controlled by, or is under common control with the Borrower or any “Affiliate” of the Borrower (as that term is defined in Rule 405 of the Securities Act).

3. REPRESENTATIONS AND WARRANTIES OF THE CREDIT PARTIES.

Each Credit Party hereby jointly and severally represents and warrants to the Investor that each of the representations and warranties set forth in Article IV of the Standby Equity Distribution Agreement dated as of April 16, 2018 are true and correct as of the date hereof, as if each representation and warranty set forth in Article IV of the SEDA were set forth herein in its entirety. For the purposes of this Agreement, references to the Company and the Subsidiaries in the SEDA shall mean the Credit Parties.

4. INDEMNIFICATION. In consideration of the Investor’s execution and delivery of this Agreement and acquiring the Unit and the Note hereunder, and in addition to all of the Credit Party’s other obligations under this Agreement, each Credit Party hereby jointly and severally agrees to defend and indemnify Investor and its Affiliates and subsidiaries and their respective directors, officers, employees, agents and representatives, and the successors and assigns of each of them (collectively, the “Investor Indemnified Parties”) and each Credit Party does hereby agree to hold the Investor Indemnified Parties forever harmless, from and against any and all Claims made, brought or asserted against the Investor Indemnified Parties, or any one of them, and each Credit Party hereby jointly and severally agrees to pay or reimburse the Investor Indemnified Parties for any and all Claims payable by any of the Investor Indemnified Parties to any Person, including reasonable attorneys’ and paralegals’ fees and expenses, court costs, settlement amounts, costs of investigation and interest thereon from the time such amounts are due at the highest non-usurious rate of interest permitted by applicable Law, through all negotiations, mediations, arbitrations, trial and appellate levels, as a result of, or arising out of, or relating to: (i) any misrepresentation or breach of any representation or warranty made by any Credit Party in this Agreement, the Transaction Documents or any other certificate, instrument or document contemplated hereby or thereby; (ii) any breach of any covenant, agreement or Obligation of each Credit Party contained in this Agreement, the Transaction Documents or any other certificate, instrument or document contemplated hereby or thereby; or (iii) any Claims brought or made against the Investor Indemnified Parties, or any one of them, by a third party and arising out of or resulting from the execution, delivery, performance or enforcement of this Agreement, the Transaction Documents or any other instrument, document or agreement executed pursuant hereto or thereto, any transaction financed or to be financed in whole or in part, directly or indirectly, with the proceeds of the issuance of the Unit or the Note, or the status of the Investor or holder of any of the Unit and/or the Note, as a buyer and holder of such Unit and Note of the Borrower. To the extent that the foregoing undertakings by a Credit Party may be unenforceable for any reason, each Credit Party shall make the maximum contribution to the payment and satisfaction of each of the Claims covered hereby, which is permissible under applicable law.

| 4 |

5. COVENANTS OF THE CREDIT PARTIES.

(a) Indebtedness. No Credit Party shall, either directly or indirectly, create, assume, incur or have outstanding any indebtedness for borrowed money of any nature or kind (but excluding purchase money indebtedness), or become liable, whether as endorser, guarantor, surety or otherwise, for any obligation of any other person or entity, except for: (i) the Note and (iii) obligations for accounts payable, other than for money borrowed, incurred in the ordinary course of business of the Credit Parties.

(b) Encumbrances. No Credit Party shall, either directly or indirectly, create, assume, incur or suffer or permit to exist any encumbrance, lien or security interest upon any asset or properties of the Credit Parties, whether owned at the date hereof or hereafter acquired.

(c) Compliance with Laws. Each Credit Party shall comply with all applicable laws, statutes, rules, regulations, orders, executive orders, directives, policies, guidelines and codes having the force of law, whether local, national, or international, as amended from time to time, including without limitation (i) all applicable laws that relate to money laundering, terrorist financing, financial record keeping and reporting, (ii) all applicable laws that relate to anti-bribery, anti-corruption, books and records and internal controls, including the United States Foreign Corrupt Practices Act of 1977, and (iii) any Sanctions laws, and will not take any action which will cause the Investor to be in violation of any such laws.

(d) Use of Proceeds. The Credit Parties shall use the proceeds from the issuance of the Unit and the Note for working capital purposes. So long as any amounts are outstanding on the Note, no Credit Party shall pay any related party obligations, all of which related party obligations shall be subordinated to the obligations owed to the Investor. No Credit Party shall, directly or indirectly, use any portion of the proceeds of the transactions contemplated herein, or lend, contribute, facilitate or otherwise make available such proceeds to any Person (i) to make any payment towards any indebtedness or other obligations of the Credit Parties; (ii) to pay any obligations of any nature or kind due or owing to any officers, directors, employees, or shareholders of the Credit Parties, other than salaries payable in the ordinary course of business of the Credit Parties; (iii) to fund, either directly or indirectly, any activities or business of or with any Person that is identified on the list of Specially Designated Nationals and Blocker Persons maintained by OFAC, or in any country or territory, that, at the time of such funding, is, or whose government is, the subject of Sanctions or Sanctions Programs, or (iv) in any other manner that will result in a violation of Sanctions.

(e) Business Activities; Change of Legal Status and Organizational Documents. No Credit Party shall: (i) engage in any line of business other than the businesses engaged in as of the Effective Date and business reasonably related thereto; (ii) change its name, organizational identification number (if applicable), its type of organization, its jurisdiction of organization or other legal structure; or (iii) permit its Certificate of Incorporation, Bylaws or other organizational documents to be amended or modified in any way which could reasonably be expected to have a Material Adverse Effect; provided that the proposed amendment to the Borrower’s Certificate of Incorporation and/or other organizational documents to (y) increase its authorized shares of Common Stock and (ii) change the Borrower’s name shall not be deemed to be a violation of this Section.

| 5 |

(f) Transactions with Affiliates. No Credit Party shall enter into any transaction with any of its Affiliates, officers, directors, employees, shareholders or other insiders, except in the ordinary Course of business of the Credit Parties and upon fair and reasonable terms that are no less favorable to the Credit Parties than it would obtain in a comparable arm’s length transaction with a Person not an Affiliate of the Credit Parties; provided that the Borrower’s proposed acquisition of YLK Partners NV, LLC shall not be deemed to be a violation of this Section.

(g) No Material Non-Public Information. Except with respect to the material terms and conditions of the transactions contemplated by this Agreement, all of which shall be publicly disclosed by the Borrower as soon as possible after the date hereof, each Credit Party covenants and agrees that none of them, nor any other person acting on its behalf, will provide the Investor or its agents or counsel with any information that such Credit Party believes constitutes material non-public information, unless prior thereto the Investor shall have entered into a written agreement with such Credit Party regarding the confidentiality and use of such information. Each Credit Party understands and confirms that the Investor shall be relying on the foregoing covenant in agreeing to enter into this Agreement and the other Transaction Documents.

6. GOVERNING LAW; MANDATORY JURIDICTION. TO INDUCE INVESTOR TO PURCHASE THE UNIT AND THE NOTE, THE CREDIT PARTIES IRREVOCABLY AGREE THAT ANY DISPUTE ARISING UNDER, RELATING TO, OR IN CONNECTION WITH, DIRECTLY OR INDIRECTLY, THIS AGREEMENT OR RELATED TO ANY MATTER WHICH IS THE SUBJECT OF OR INCIDENTAL TO THIS AGREEMENT ANY OTHER TRANSACTION DOCUMENT (WHETHER OR NOT SUCH CLAIM IS BASED UPON BREACH OF CONTRACT OR TORT) SHALL BE SUBJECT TO THE EXCLUSIVE JURISDICTION AND VENUE OF THE STATE AND/OR FEDERAL COURTS LOCATED IN UNION COUNTY, NEW JERSEY; PROVIDED, HOWEVER, INVESTOR MAY, AT ITS SOLE OPTION, ELECT TO BRING ANY ACTION IN ANY OTHER JURISDICTION. THIS PROVISION IS INTENDED TO BE A “MANDATORY” FORUM SELECTION CLAUSE AND GOVERNED BY AND INTERPRETED CONSISTENT WITH NEW JERSEY LAW. EACH CREDIT PARTY HEREBY CONSENTS TO THE EXCLUSIVE JURISDICTION AND VENUE OF ANY STATE OR FEDERAL COURT HAVING ITS SITUS IN SAID COUNTY, AND WAIVES ANY OBJECTION BASED ON FORUM NON CONVENIENS. EACH CREDIT PARTY HEREBY WAIVES PERSONAL SERVICE OF ANY AND ALL PROCESS AND CONSENT THAT ALL SUCH SERVICE OF PROCESS MAY BE MADE BY CERTIFIED MAIL, RETURN RECEIPT REQUESTED, DIRECTED TO EACH CREDIT PARTY AS SET FORTH HEREIN IN THE MANNER PROVIDED BY APPLICABLE STATUTE, LAW, RULE OF COURT OR OTHERWISE.

7. NOTICES. Any notices, consents, waivers or other communications required or permitted to be given under the terms hereof must be in writing and will be deemed to have been delivered: (i) upon receipt, when delivered personally; (ii) upon receipt, when sent by facsimile (provided confirmation of transmission is mechanically or electronically generated and kept on file by the sending party); or (iii) one (1) Business Day after deposit with a nationally recognized overnight delivery service, in each case properly addressed to the party to receive the same. The addresses and facsimile numbers for such communications shall be:

| 6 |

| If to a Credit Party, to: | Solis Tek Inc. |

| 16926 S. Keegan Ave, Suite A | |

| Carson, CA 90746 | |

Attention: Alan Lien Telephone: (888)998-8881 | |

| Email: [email protected] | |

With a copy to: |

Bingham & Associates Law Group, APC |

1106 Second Street, Suite 195 Encinitas, CA 92024 Attention: Stanley Moskowitz, Esq. Telephone: (858)523-0100 Email: [email protected] |

| If to the Investor: | YA II PN, Ltd. |

| 1012 Springfield Avenue | |

| Mountainside, NJ 07092 | |

| Attention: Mark Angelo | |

Telephone: (201) 985-8300 Email: [email protected] | |

| With a copy to: | David Gonzalez, Esq. |

| 1012 Springfield Avenue | |

| Mountainside, NJ 07092 | |

| Telephone: (201) 985-8300 | |

| Email: [email protected] |

or at such other address and/or facsimile number and/or to the attention of such other person as the recipient party has specified by written notice given to each other party three Business Days prior to the effectiveness of such change. Written confirmation of receipt (i) given by the recipient of such notice, consent, waiver or other communication, (ii) mechanically or electronically generated by the sender’s facsimile machine containing the time, date, recipient facsimile number and an image of the first page of such transmission or (iii) provided by a nationally recognized overnight delivery service, shall be rebuttable evidence of personal service, receipt by facsimile or receipt from a nationally recognized overnight delivery service in accordance with clause (i), (ii) or (iii) above, respectively.

8. MISCELLANEOUS.

(a) Counterparts. This Agreement may be executed in two or more identical counterparts, all of which shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to the other party.

(b) This Agreement shall be binding upon and inure to the benefit of the parties and their successors and permitted assigns. The Borrower may not assign this Agreement or any rights or obligations hereunder without the prior written consent of the Investor (other than by merger). The Investor may assign any or all of its rights under this Agreement to any person to whom the Investor assigns or transfers the Unit or the Note, or a portion thereof, provided that such transferee agrees in writing to be bound, with respect to the Unit and the Note, by the provisions of this Agreement that apply to the Investor.

| 7 |

(c) Usury. To the extent it may lawfully do so, each Credit Party hereby agrees not to insist upon or plead or in any manner whatsoever claim, and will resist any and all efforts to be compelled to take the benefit or advantage of, usury laws wherever enacted, now or at any time hereafter in force, in connection with any claim, action or proceeding that may be brought by the Investor in order to enforce any right or remedy under any Transaction Document. Notwithstanding any provision to the contrary contained in any Transaction Document, it is expressly agreed and provided that the total liability of the Borrower under the Transaction Documents for payments in the nature of interest shall not exceed the maximum lawful rate authorized under applicable law (the “Maximum Rate”), and, without limiting the foregoing, in no event shall any rate of interest or default interest, or both of them, when aggregated with any other sums in the nature of interest that the Borrower may be obligated to pay under the Transaction Documents exceed such Maximum Rate. It is agreed that if the maximum contract rate of interest allowed by law and applicable to the Transaction Documents is increased or decreased by statute or any official governmental action subsequent to the date hereof, the new maximum contract rate of interest allowed by law will be the Maximum Rate applicable to the Transaction Documents from the effective date thereof forward, unless such application is precluded by applicable law. If under any circumstances whatsoever, interest in excess of the Maximum Rate is paid by the Borrower to the Investor with respect to indebtedness evidenced by the Transaction Documents, such excess shall be applied by the Investor to the unpaid principal balance of any such indebtedness or be refunded to the Borrower, the manner of handling such excess to be at the Investor’s election.

(d) Entire Agreement; Amendments. This Agreement supersedes all other prior oral or written agreements between the Investor and the Borrower with respect to the matters discussed herein, and this Agreement, and the instruments referenced herein, contain the entire understanding of the parties with respect to the matters covered herein and therein and, except as specifically set forth herein or therein, neither the Borrower nor the Investor makes any representation, warranty, covenant or undertaking with respect to such matters. No provision of this Agreement may be waived or amended other than by an instrument in writing signed by the party to be charged with enforcement.

9. BORROWER AND GUARANTORS.

(a) Each Credit Party is jointly and severally liable for all debt, principal, interest, and other amounts owed to the Investor by Borrower pursuant to this Agreement, the Transaction Documents, or any other agreement, whether absolute or contingent, due or to become due, now existing or hereafter arising (the “Obligations”) and the Investor may proceed against any Credit Party (or all of them) to enforce the Obligations without waiving its right to proceed against any other party. This Agreement and the Notes are a primary and original obligation of the Credit Parties and shall remain in effect notwithstanding future changes in conditions, including any change of law or any invalidity or irregularity in the creation or acquisition of any Obligations or in the execution or delivery of any agreement between the Investor and any Credit Party. Each Credit Party shall be liable for existing and future Obligations as fully as if all of the funds advanced by the Investor hereunder were advanced to such Credit Party. The Investor may rely on any certificate or representation made by any Credit Party as made on behalf of, and binding on, the other parties hereto. Each Credit Party appoints each other Credit Party as its agent with all necessary power and authority to give and receive notices, certificates or demands for and on behalf of each Credit Party, to act as disbursing agent for receipt of any funds advanced by the Investor hereunder on behalf of each Credit Party. This authorization cannot be revoked, and the Investor need not inquire as to any Credit Party’s authority to act for or on behalf of another Credit Party.

(b) Notwithstanding any other provision of this Agreement or any other Transition Documents, each Credit Party irrevocably waives, until all obligations are paid in full, all rights that it may have at law or in equity (including, without limitation, any law subrogating a Credit Party to the rights of Investor under the Transaction Documents) to seek contribution, indemnification, or any other form of reimbursement from any other Credit Party, or any other person now or hereafter primarily or secondarily liable for any of the Obligations, for any payment made by a Credit Party with respect to the Obligations in connection with the Transaction Documents or otherwise and all rights that it might have to benefit from, or to participate in, any security for the Obligations as a result of any payment made by a Credit Party with respect to the Obligations in connection with the Transaction Documents or otherwise. Any agreement providing for indemnification, reimbursement or any other arrangement prohibited under this Section shall be null and void. If any payment is made to a Credit Party in contravention of this Section, such Credit Party shall hold such payment in trust for the Investor and such payment shall be promptly delivered to the Investor for application to the Obligations, whether matured or unmatured.

[signature page follows]

| 8 |

IN WITNESS WHEREOF, each of the Investor, each Credit Party has affixed their respective signatures to this Securities Purchase Agreement as of the date first written above.

| BORROWER: | ||

| SOLIS TEK INC., a Nevada corporation | ||

| By: | ||

| Name: | ||

| Title: | ||

| GUARANTORS: | ||

| SOLIS TEK INC., a California corporation | ||

| By: | ||

| Name: | ||

| Title: | ||

| SOLIS TEK EAST CORPORATION, a New Jersey corporation | ||

| By: | ||

| Name: | ||

| Title: | ||

| ZELDA HORTICULTURE, INC., a California corporation | ||

| By: | ||

| Name: | ||

| Title: | ||

| INVESTOR: | ||

| YA II PN, LTD. | ||

| By: | Yorkville Advisors Global LP | |

| Its: | Investment Manager | |

| By: | Yorkville Advisors Global LLC | |

| Its: | General Partner | |

| By: | ||

| Name: | ||

| Title: | ||

| 9 |

THIS NOTE HAS NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE. THIS NOTE HAS BEEN SOLD IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS.

SOLIS TEK INC.

(a Nevada Corporation)

Secured Promissory Note

| No. SLTK-1 | Original Principal Amount: $1,500,000 |

| Issuance Date: May 10, 2018 |

FOR VALUE RECEIVED, SOLIS TEK INC. (the “Borrower”), a Nevada corporation, hereby promise to pay to the order of YA II PN, Ltd. or its registered assigns (the “Holder”) (i) the outstanding portion of the amount set out above as the Original Principal Amount (as reduced pursuant to the terms hereof pursuant to scheduled payment, redemption, conversion, or otherwise, the “Principal”) when due, whether upon the Maturity Date (as defined below), acceleration, redemption or otherwise (in each case in accordance with the terms hereof); and (ii) to pay interest (“Interest”) on any outstanding Principal at the applicable Interest Rate (as defined below) from the Issuance Date until the same is paid, whether upon the Maturity Date or acceleration, redemption or otherwise (in each case in accordance with the terms hereof) pursuant to the terms of this Secured Promissory Note (the “Note”). All amounts to be paid by the Borrower to the Holder shall be made by wire transfer of immediately available funds to the account listed on Schedule I hereto (or to any other account specified by the Holder to the Borrower in writing) to be received on or before Maturity Date.

This Note is being issued pursuant to that certain Securities Purchase Agreement of even date herewith, as amended and supplemented from time to time (the “Securities Purchase Agreement”) among the Holder, the Borrower and the Guarantors. Certain capitalized terms used herein but otherwise not defined herein are defined in Section 16 or in the Securities Purchase Agreement. The payment and performance of the Borrower’s obligations under this Note and the other Transaction Documents are being jointly and severally guaranteed by Solis Tek Inc. (“S-Tek”), a California corporation, Solis Tek East Corporation (“S-East”), a New Jersey corporation, and Zelda Horticulture, Inc. (“Zelda”), a California corporation, pursuant to that certain Global Guaranty Agreement (the “Global Guaranty Agreement”) of even date herewith. S-Tek, S-East and Zelda are collectively referred to as the “Guarantors.”

The obligations under this Note and the other Transaction Documents are secured by that certain Amended and Restated Global Security Agreement (the “Security Agreement”) of even date herewith among the Borrower, the Guarantors and the Holder.

| 1. | GENERAL TERMS |

(a) Maturity Date. All amounts owed under this Note shall be due and payable on February 9, 2019 (the “Maturity Date”). On the Maturity Date, the Borrower shall pay to the Holder an amount in cash representing all then outstanding Principal and accrued and unpaid Interest.

(b) Interest. Interest shall accrue on the outstanding Principal balance hereof at a rate equal to 8% per annum (“Interest Rate”); provided that upon an Event of Default hereunder the Interest Rate shall be 18% per annum until all amounts outstanding hereunder received by the Holder. Interest shall be calculated on the basis of a 365-day year and the actual number of days elapsed, to the extent permitted by applicable law.

2. NO PREPAYMENT PENALTY. The Borrower may prepay all or any part of the balance outstanding hereunder at any time without penalty.

3. REPRESENTATIONS AND WARRANTIES. The Borrower hereby represents and warrants to the Holder that the following are true and correct as of the date hereof:

(a)(i) The Borrower has the requisite corporate power and authority to enter into and perform its obligations under this Note and any related agreements, in accordance with the terms hereof and thereof, (ii) the execution and delivery of this Note and any related agreements by the Borrower and the consummation by it of the transactions contemplated hereby and thereby, have been duly authorized by the each Borrower’s Board of Directors and no further consent or authorization is required by any Borrower, Board of Directors, or stockholders, (iii) this Note and any related agreements have been duly executed and delivered by the Borrower, (iv) this Note and any related agreements, constitute the valid and binding obligations of the Borrower enforceable against each Borrower in accordance with their terms, except as such enforceability may be limited by general principles of equity or applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or similar laws relating to, or affecting generally, the enforcement of creditors’ rights and remedies.

(b) The execution, delivery and performance by the Borrower of its obligations under this Note will not (i) result in a violation of any Borrower’s incorporation documents or any certificate of designation of any outstanding series of preferred stock or (ii) conflict with or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which the Borrower or any of its subsidiaries is a party, or result in a violation of any law, rule, regulation, order, judgment or decree (including federal and state securities laws and regulations and the rules and regulations of the Principal Market on which the Common Stock is quoted) applicable to the Borrower or any of its subsidiaries or by which any material property or asset of the Borrower is bound or affected and which would cause a Material Adverse Effect.

| 2 |

4. EVENTS OF DEFAULT.

(a) An “Event of Default”, wherever used herein, means any one of the following events (whatever the reason and whether it shall be voluntary or involuntary or effected by operation of law or pursuant to any judgment, decree or order of any court, or any order, rule or regulation of any administrative or governmental body):

(i) any representation, warranty or covenant made in this Note, any other Transaction Document shall be or shall be untrue or inaccurate in any material respect as of the date when made or on any Closing Date (as defined in the Securities Purchase Agreement);

(ii) the Borrower’s or any Guarantor’s failure to observe or perform, or comply with, in any material respect, any covenant, agreement, warranty or obligation contained in, or otherwise commit any material breach or default of any provision of this Note, any other Transaction Document, or any Event of Default shall have occurred on this Note, the Securities Purchase Agreement or any other Transaction Document;

(iii) the Borrower’s failure to pay to the Holder any amount of Principal, Interest or other amounts when and as due and payable under this Note or any other Transaction Document;

(iv) the Borrower or any Guarantor shall default in any of its obligations under any other note or any mortgage, credit agreement or other facility, indenture agreement, factoring agreement or other instrument under which there may be issued, or by which there may be secured or evidenced any indebtedness for borrowed money or money due under any long term leasing or factoring arrangement of the Borrower or any Guarantor in an amount exceeding $100,000, whether such indebtedness now exists or shall hereafter be created and such default shall result in such indebtedness becoming or being declared due and payable and such default is not cured within five (5) Business Days

(v) any Borrower or any subsidiary of any Borrower shall commence, or there shall be commenced against any Borrower or any subsidiary of any Borrower under any applicable bankruptcy or insolvency laws as now or hereafter in effect or any successor thereto, or any Borrower or any subsidiary of any Borrower commences, or there shall be commenced against any Borrower or any subsidiary of any Borrower, any other proceeding under any reorganization, arrangement, adjustment of debt, relief of debtors, dissolution, insolvency or liquidation or similar law of any jurisdiction whether now or hereafter in effect relating to any Borrower or any subsidiary of any Borrower, in each case which remains un-dismissed for a period of 61 days; or any Borrower or any subsidiary of any Borrower is adjudicated insolvent or bankrupt pursuant to a final, non-appealable order; or any order of relief or other order approving any such case or proceeding is entered; or any Borrower or any subsidiary of any Borrower suffers any appointment of any custodian, private or court appointed receiver or the like for it or any substantial part of its property which continues un-discharged or un-stayed for a period of 61 days; or any Borrower or any subsidiary of any Borrower makes a general assignment for the benefit of creditors; or any Borrower or any subsidiary of any Borrower shall admit in writing that it is unable to pay its debts generally as they become due; or any Borrower or any subsidiary of any Borrower shall call a meeting of its creditors with a view to arranging a composition, adjustment or restructuring of its debts; or any corporate or other action is taken by any Borrower or any subsidiary of any Borrower for the purpose of effecting any of the foregoing;

(vi) the common stock of the Borrower shall cease to be authorized for quotation or trading on the OTC Markets, or trading in the common stock of the Borrower has been suspended for any reason, for a period of more than ten Trading Days or the Borrower shall not have timely made any filing with the SEC that it is required to file in accordance with applicable securities laws or the rules promulgated thereunder; or

| 3 |

(vii) the Borrower is a party to any agreement memorializing (1) the consummation of any transaction or event (whether by means of a share exchange or tender offer applicable to the Common Stock, a liquidation, consolidation, recapitalization, reclassification, combination or merger of the Borrower or a sale, lease or other transfer of all or substantially all of the consolidated assets of the Borrower) or a series of related transactions or events pursuant to which all of the outstanding shares of Common Stock are exchanged for, converted into or constitute solely the right to receive, cash, securities or other property, (2) a consolidation or merger in which the Borrower is not the surviving corporation, or (3) a sale, assignment, transfer, conveyance or other disposal of all or substantially all of the properties or assets of the Borrower to another person or entity (each of (1), (2) and (3) a “Change in Control”) unless in connection with such Change in Control, all Principal and accrued and unpaid Interest due under this Note will be paid in full or the Holder consents to such Change in Control.

5. REMEDIES UPON DEFAULT.

(a) During the time that any portion of this Note is outstanding, if (i) any Event of Default has occurred, the Holder, by notice in writing to any Borrower, may at any time and from time to time declare the full unpaid Principal of this Note or any portion thereof, plus Interest accrued thereon (the “Accelerated Amount”) to be due and payable immediately or (ii) any Event of Default specified in Section 4(a)(v) has occurred the unpaid Principal of the Note and the Interest accrued thereon shall be immediately and automatically due and payable without necessity of further action.

(b) The Holder need not provide and the Borrower hereby waives any presentment, demand, protest or other notice of any kind, (other than required notice of conversion) and the Holder may immediately enforce any and all of its rights and remedies hereunder and all other remedies available to it under applicable law. Such declaration may be rescinded and annulled by Holder at any time prior to payment hereunder. No such rescission or annulment shall affect any subsequent Event of Default or impair any right consequent thereon

6. REISSUANCE OF THIS NOTE. Upon receipt by any Borrower of evidence reasonably satisfactory to such Borrower of the loss, theft, destruction or mutilation of this Note, and, in the case of loss, theft or destruction, of an indemnification undertaking by the Holder to such Borrower in customary form and, in the case of mutilation, upon surrender and cancellation of this Note, the Borrower shall execute and deliver to the Holder a new Note representing the outstanding Principal which Note (i) shall be of like tenor with this Note, (ii) shall represent, as indicated on the face of such new Note, the Principal remaining outstanding (iii) shall have an issuance date, as indicated on the face of such new Note, which is the same as the Issuance Date of this Note, (iv) shall have the same rights and conditions as this Note, and (v) shall represent accrued and unpaid Interest from the Issuance Date.

| 4 |

7. NOTICES. Any notices, consents, waivers or other communications required or permitted to be given under the terms hereof must be in writing and will be deemed to have been delivered: (i) upon receipt, when delivered personally; (ii) upon receipt, when sent by facsimile (provided confirmation of transmission is mechanically or electronically generated and kept on file by the sending party); or (iii) one (1) Business Day after deposit with a nationally recognized overnight delivery service, in each case properly addressed to the party to receive the same. The addresses and facsimile numbers for such communications shall be:

| If to the Borrower, to: | Solis Tek Inc. |

| 16926 S. Keegan Ave, Suite A | |

| Carson, CA 90746 | |

Attention: Alan Lien Telephone: (888)998-8881 | |

| Email: [email protected] | |

With a copy to: |

Bingham & Associates Law Group, APC |

1106 Second Street, Suite 195 Encinitas, CA 92024 Attention: Stanley Moskowitz, Esq. Telephone: (858)523-0100 Email: [email protected] |

| If to the Holder: | YA II PN, Ltd. |

| 1012 Springfield Avenue | |

| Mountainside, NJ 07092 | |

| Attention: Mark Angelo | |

Telephone: (201) 985-8300 Email: [email protected] | |

| With a copy to: | David Gonzalez, Esq. |

| 1012 Springfield Avenue | |

| Mountainside, NJ 07092 | |

| Telephone: (201) 985-8300 | |

| Email: [email protected] |

or at such other address and/or facsimile number and/or to the attention of such other person as the recipient party has specified by written notice given to each other party three Business Days prior to the effectiveness of such change. Written confirmation of receipt (i) given by the recipient of such notice, consent, waiver or other communication, (ii) mechanically or electronically generated by the sender’s facsimile machine containing the time, date, recipient facsimile number and an image of the first page of such transmission or (iii) provided by a nationally recognized overnight delivery service, shall be rebuttable evidence of personal service, receipt by facsimile or receipt from a nationally recognized overnight delivery service in accordance with clause (i), (ii) or (iii) above, respectively.

| 5 |

8. No provision of this Note shall alter or impair the obligations of the Borrower, which are absolute and unconditional, to pay the Principal of or Interest (if any) on, this Note at the time, place, and rate, and in the currency, herein prescribed. This Note is a direct obligation of each Borrower. As long as this Note is outstanding, the Borrower shall not and shall cause its subsidiaries not to, without the consent of the Holder, (i) amend its articles of incorporation, bylaws or other charter documents so as to adversely affect any rights of the Holder under this Note; or (ii) enter into any agreement with respect to any of the foregoing.

9. GOVERNING LAW; MANDATORY JURIDICTION. TO INDUCE HOLDER TO PURCHASE THE NOTES, THE BORROWER IRREVOCABLY AGREE THAT ANY DISPUTE ARISING UNDER, RELATING TO, OR IN CONNECTION WITH, DIRECTLY OR INDIRECTLY, THIS AGREEMENT OR RELATED TO ANY MATTER WHICH IS THE SUBJECT OF OR INCIDENTAL TO THIS AGREEMENT ANY OTHER TRANSACTION DOCUMENT (WHETHER OR NOT SUCH CLAIM IS BASED UPON BREACH OF CONTRACT OR TORT) SHALL BE SUBJECT TO THE EXCLUSIVE JURISDICTION AND VENUE OF THE STATE AND/OR FEDERAL COURTS LOCATED IN UNION COUNTY, NEW JERSEY; PROVIDED, HOWEVER, HOLDER MAY, AT ITS SOLE OPTION, ELECT TO BRING ANY ACTION IN ANY OTHER JURISDICTION. THIS PROVISION IS INTENDED TO BE A “MANDATORY” FORUM SELECTION CLAUSE AND GOVERNED BY AND INTERPRETED CONSISTENT WITH NEW JERSEY LAW. BORROWER HEREBY CONSENTS TO THE EXCLUSIVE JURISDICTION AND VENUE OF ANY STATE OR FEDERAL COURT HAVING ITS SITUS IN SAID COUNTY, AND WAIVES ANY OBJECTION BASED ON FORUM NON CONVENIENS. BORROWER HEREBY WAIVES PERSONAL SERVICE OF ANY AND ALL PROCESS AND CONSENT THAT ALL SUCH SERVICE OF PROCESS MAY BE MADE BY CERTIFIED MAIL, RETURN RECEIPT REQUESTED, DIRECTED TO THE BORROWER AS SET FORTH HEREIN IN THE MANNER PROVIDED BY APPLICABLE STATUTE, LAW, RULE OF COURT OR OTHERWISE.

10. If an Event of Default has occurred, then the Borrower shall reimburse the Holder promptly for all reasonable out-of-pocket fees, costs and expenses, including, without limitation, reasonable attorneys’ fees and expenses incurred by the Holder in any action in connection with this Note, including, without limitation, those incurred: (i) during any workout, attempted workout, and/or in connection with the rendering of legal advice as to the Holder’s rights, remedies and obligations, (ii) collecting any sums which become due to the Holder in accordance with the terms of this Note, (iii) defending or prosecuting any proceeding or any counterclaim to any proceeding or appeal; or (iv) the protection, preservation or enforcement of any rights or remedies of the Holder.

11. Any waiver by the Holder of a breach of any provision of this Note shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any other provision of this Note. The failure of the Holder to insist upon strict adherence to any term of this Note on one or more occasions shall not be considered a waiver or deprive that party of the right thereafter to insist upon strict adherence to that term or any other term of this Note. Any waiver must be in writing.

12. If any provision of this Note is invalid, illegal or unenforceable, the balance of this Note shall remain in effect, and if any provision is inapplicable to any person or circumstance, it shall nevertheless remain applicable to all other persons and circumstances. If it shall be found that any Interest or other amount deemed Interest due hereunder shall violate applicable laws governing usury, the applicable rate of Interest due hereunder shall automatically be lowered to equal the maximum permitted rate of interest. The Borrower covenant (to the extent that it may lawfully do so) that each Borrower shall not at any time insist upon, plead, or in any manner whatsoever claim or take the benefit or advantage of, any stay, extension or usury law or other law which would prohibit or forgive the Borrower from paying all or any portion of the Principal of or Interest on this Note as contemplated herein, wherever enacted, now or at any time hereafter in force, or which may affect the covenants or the performance of this Note, and the Borrower (to the extent they may lawfully do so) hereby expressly waive all benefits or advantage of any such law, and covenants that it will not, by resort to any such law, hinder, delay or impede the execution of any power herein granted to the Holder, but will suffer and permit the execution of every such as though no such law had been enacted.

| 6 |

13. Whenever any payment or other obligation hereunder shall be due on a day other than a Business Day, such payment shall be made on the next succeeding Business Day.

14. Assignment of this Note by the Borrower shall be prohibited without the prior written consent of the Holder. Holder shall be entitled to assign this Note in whole or in part to any person or entity without the consent of the Borrower.

15. THE PARTIES HEREBY KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVE THE RIGHT ANY OF THEM MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION BASED HEREON OR ARISING OUT OF, UNDER OR IN CONNECTION WITH THIS NOTE OR ANY COURSE OF CONDUCT, COURSE OF DEALING, STATEMENTS (WHETHER VERBAL OR WRITTEN) OR ACTIONS OF ANY PARTY. THIS PROVISION IS A MATERIAL INDUCEMENT FOR THE PARTIES’ ACCEPTANCE OF THE SECURITIES PURCHASE AGREEMENT AND THIS NOTE.

16. CERTAIN DEFINITIONS For purposes of this Note, the following terms shall have the following meanings:

(a) “Business Day” means any day except Saturday, Sunday and any day which shall be a federal legal holiday in the United States or a day on which banking institutions in the United States are authorized or required by law or other government action to close.

(b) “Issuance Date” means the date this Note is executed and delivered by the Borrower to the Holder as set forth on the first page of this Note.

(c) “Trading Day” means a day on which the principal Trading Market is open for trading.

(d) “Trading Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the NYSE American, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange, or the OTC Markets (or any successors to any of the foregoing).

(e) “Transaction Documents” shall have the meaning set forth in the Securities Purchase Agreement.

| 7 |

IN WITNESS WHEREOF, each Borrower has caused this Note to be duly executed by a duly authorized officer as of the date first set forth above.

| BORROWER: | ||

| SOLIS TEK INC. | ||

| By: | ||

| Name: | ||

| Title: | ||

| 8 |

Schedule I

(Holder Account Information)

YA II PN, LTD.

| -Wiring Instructions- | |

| *Account Currency: | USD |

| Intermediary Bank: | The Bank of New York Mellon |

| One Wall Street | |

| New York, NY10286 |

Routing # 021 000 018

Swift Code: IRVTUS3N

Account # 890 1050 210

| Beneficiary Bank: | DMS Bank and Trust Ltd. |

| 20 Genesis Close | |

| Grand Cayman KY1-1104 |

Swift Code: CAYIKYKY

| Beneficiary Account Name: | YA II PN, Ltd |

| 1012 Springfield Avenue | |

| Mountainside, NJ 07092 |

Beneficiary Account # 01680100

FBO: YA II PN, LTD (Please instruct your bank to include the FBO details in the wire payment- Bank to Bank reference)

| 9 |

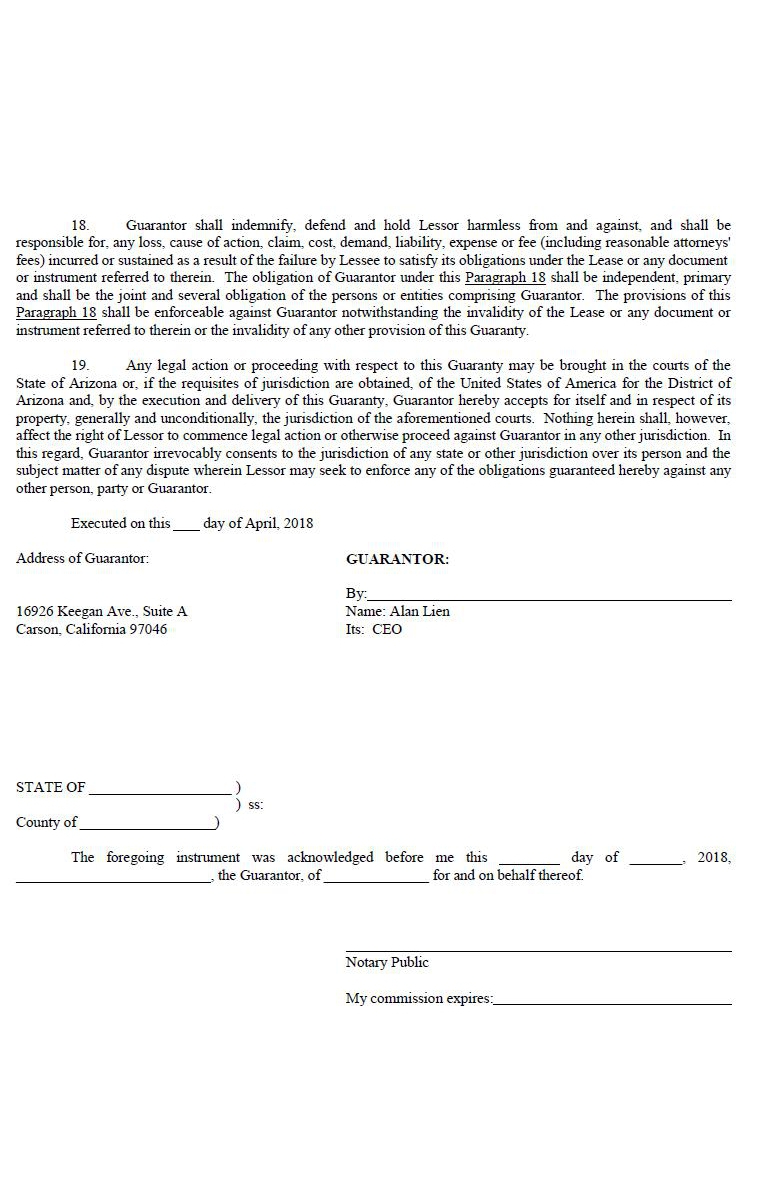

AMENDED AND RESTATED GLOBAL GUARANTY AGREEMENT

This AMENDED AND RESTATED GLOBAL GUARANTY AGREEMENT (the “Guaranty”) is made as of May 10, 2018, by and among SOLIS TEK INC. (“S-Tek”), a California corporation, SOLIS TEK EAST CORPORATION (“S-East”), a New Jersey corporation, and ZELDA HORTICULTURE, INC. (“Zelda”), a California corporation (S-Tek, S-East and Zelda are collectively referred to as the “Guarantors”), in favor of YA II PN, LTD. (the “Investor”) with respect to all obligations of SOLIS TEK INC. (the “Company”), a Nevada corporation, owes to the Investor. Capitalized terms not otherwise defined herein shall have the meanings ascribed to them in the Securities Purchase Agreement (as defined below). This Guaranty amends and restates that certain Global Guaranty Agreement dated as of November 8, 2017 among the Guarantors and the Investor.

RECITALS

WHEREAS, the Company and the Investor are entering into a Securities Purchase Agreement (the “Securities Purchase Agreement”) of even date herewith pursuant to which the Company has agreed, upon the terms and subject to the conditions of the Securities Purchase Agreement, to issue and sell to the Investor (i) 500,000 shares of the Company’s Common Stock, (ii) warrants (the “Warrants”) to purchase 7.5 million shares of the Company’s Common Stock (as exercised, the “Warrant Shares”), and (iii) a Secured Promissory Note (the “Note”) in the original principal amount of $1.5 million. Capitalized terms not defined herein shall have the meaning ascribed to them in the Securities Purchase Agreement;

WHEREAS, each Guarantor is a wholly-owned subsidiary of the Company. Each Guarantor will benefit, directly or indirectly, from the Company entering into the Securities Purchase Agreement and other Transaction Documents; and

WHEREAS, it is a condition of the Securities Purchase Agreement and the Investor’s obligation to enter into the transactions set forth in the Securities Purchase Agreement that the Guarantors jointly and severally guaranty the payment and performance of all of the Company’s obligations under the Securities Purchase Agreement, the Note and all other Transaction Documents. The Investor is only willing to enter into the Securities Purchase Agreement and consummate the transactions set forth therein if each Guarantor jointly and severally agrees to execute and deliver to the Investor this Guaranty.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each Guarantor covenants and agrees as follows:

1. Guaranty of Payment and Performance. Each Guarantor, jointly and severally, hereby guarantees to the Investor the full, prompt and unconditional payment when due (whether at maturity, by acceleration or otherwise), and the performance, of all liabilities, agreements and other obligations of the Company to the Investor, whether direct or indirect, absolute or contingent, due or to become due, secured or unsecured, now existing or hereafter arising or acquired (whether by way of discount, letter of credit, lease, loan, or otherwise), together with all interest and costs of collection, compromise or enforcement, including without limitation reasonable attorneys’ fees, incurred with respect to any such obligations or this Guaranty, or with respect to a proceeding under the federal bankruptcy laws or any insolvency, receivership, arrangement or reorganization law or an assignment for the benefit of the Investor concerning Company or any Guarantor, together with interest on all such costs of collection, compromise or enforcement from the date arising (including without limitation all amounts due and owing under the Note) (all the foregoing, collectively, the “Obligations”). This Guaranty is an absolute, unconditional and continuing guaranty of the full and punctual payment and performance of the Obligations and not of their collectability only and is in no way conditioned upon any requirement that the Investor first attempt to collect any of the Obligations from the Company or resort to any security or other means of obtaining their payment. Should the Company default in the payment or performance of any of the Obligations, the obligations of any Guarantor hereunder shall become immediately due and payable to the Investor, without demand or notice of any nature, all of which are expressly waived by each Guarantor.

2. Unlimited Guaranty. The liability of each Guarantor hereunder shall be unlimited.

3. Waivers by each Guarantor; the Investor’s Freedom to Act. Each Guarantor hereby agrees that the Obligations will be paid and performed strictly in accordance with their terms regardless of any law, regulation or order now or hereafter in effect in any jurisdiction affecting any of such terms or the rights of the Investor with respect thereto. Each Guarantor waives presentment, demand, protest, notice of acceptance, notice of Obligations incurred and all other notices of any kind, all defenses that may be available by virtue of any valuation, stay, moratorium law or other similar law now or hereafter in effect, any right to require the marshalling of assets of the Company, and all suretyship defenses generally. Without limiting the generality of the foregoing, each Guarantor agrees to the provisions of any instrument evidencing, securing or otherwise executed in connection with any Obligation and agrees that the obligations of each Guarantor hereunder shall not be released or discharged, in whole or in part, or otherwise affected by (i) the failure of the Investor to assert any claim or demand or to enforce any right or remedy against the Company; (ii) any extensions or renewals of, or alteration of the terms of, any Obligation or any portion thereof; (iii) any rescissions, waivers, amendments or modifications of any of the terms or provisions of any agreement evidencing, securing or otherwise executed in connection with any Obligation; (iv) the substitution or release of any entity primarily or secondarily liable for any Obligation; (v) the adequacy of any rights the the Investor may have against any collateral or other means of obtaining repayment of the Obligations; (vi) the impairment of any collateral securing the Obligations, including without limitation the failure to perfect or preserve any rights the Investor might have in such collateral or the substitution, exchange, surrender, release, loss or destruction of any such collateral; (vii) failure to obtain or maintain a right of contribution for the benefit of each Guarantor; (viii) errors or omissions in connection with the Investor’s administration of the Obligations (except behavior constituting bad faith); or (ix) any other act or omission that might in any manner or to any extent vary the risk of any Guarantor or otherwise operate as a release or discharge of any Guarantor, all of which may be done without notice to any Guarantor.

4. Unenforceability of Obligations Against Company. If for any reason the Company is under no legal obligation to discharge any of the Obligations, or if any of the Obligations have become irrecoverable from the Company by operation of law or for any other reason, this Guaranty shall nevertheless be binding on each Guarantor to the same extent as if each Guarantor at all times had been the principal obligor on all such Obligations. In the event that acceleration of the time for payment of the Obligations is stayed upon the insolvency, bankruptcy or reorganization of the Company, or for any other reason, all such amounts otherwise subject to acceleration under the terms of any agreement evidencing, securing or otherwise executed in connection with any Obligation shall be immediately due and payable by each Guarantor.

| 2 |

5. Subrogation; Subordination. Until the payment and performance in full of all Obligations and any and all obligations of the Company to the Investor, no Guarantor shall exercise any rights against the Company arising as a result of payment by each Guarantor hereunder, by way of subrogation or otherwise, and will not prove any claim in competition with the Investor in respect of any payment hereunder in bankruptcy or insolvency proceedings of any nature; each Guarantor will not claim any set-off or counterclaim against the Company in respect of any liability of each Guarantor to the Company; and each Guarantor waives any benefit of and any right to participate in any collateral that may be held by the Investor. The payment of any amounts due with respect to any indebtedness of the Company now or hereafter held by each Guarantor is hereby subordinated to the prior payment in full of the Obligations. Each Guarantor agrees that after the occurrence of any default in the payment or performance of the Obligations, each Guarantor will not demand, sue for or otherwise attempt to collect any such indebtedness of the Company to any Guarantor until the Obligations shall have been paid in full. If, notwithstanding the foregoing sentence, any Guarantor shall collect, enforce or receive any amounts in respect of such indebtedness, such amounts shall be collected, enforced and received by any Guarantor as trustee for the Investor and be paid over to the Investor on account of the Obligations without affecting in any manner the liability of any Guarantor under the other provisions of this Guaranty.

6. Termination; Reinstatement. This Guaranty is irrevocable and shall continue without limit of time. This Guaranty shall be reinstated if at any time any payment made or value received with respect to an Obligation is rescinded or must otherwise be returned by the Investor upon the insolvency, bankruptcy or reorganization of the Company, or otherwise, all as though such payment had not been made or value received.

7. Successors and Assigns. This Guaranty shall be binding upon each Guarantor, its successors and assigns, and shall inure to the benefit of and be enforceable by the Investor and the Investor’s shareholders, officers, directors, agents, successors and assigns.

8. Amendments and Waivers. No amendment or waiver of any provision of this Guaranty nor consent to any departure by each Guarantor therefrom shall be effective unless the same shall be in writing and signed by the Investor. No failure on the part of the Investor to exercise, and no delay in exercising, any right hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right hereunder preclude any other or further exercise thereof or the exercise of any other right.

| 3 |