Form 8-K Sabra Health Care REIT, For: Jul 13

Virtual Non-Deal Roadshow Hosted by JMP 1July 13, 2021 Strong. Resilient. Growing. Virtual Non-Deal Roadshow Hosted by JMP July 13, 2021

Our vast industry knowledge, experienced executive team and entrepreneurial spirit make Sabra uniquely positioned to succeed in our dynamic industry. We have the size, know-how, balance sheet and passion to deliver long-term value to shareholders. DELIVERING VALUE Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 2

“WE’VE BUILT A STRONG AND RESILIENT FOUNDATION.” – Rick Matros (he/him), Chief Executive Officer STRATEGY Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 3

4 33% 73 $6.6B1 SABRA TODAY STRATEGY Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 DEBT/ASSET VALUE OPERATOR RELATIONSHIPS ENTERPRISE VALUE $1B+ LIQUIDITY 9% MAX RELATIONSHIP CONCENTRATION 19.8% NOI CAGR SINCE 2011 (1) Includes Sabra’s 49% pro rata share of the debt of its unconsolidated joint venture. Share price as of 7/9/2021. AS OF MARCH 31, 2021

A RESILIENT AND AGILE REIT Investment ▪ Invest in high-quality, strong-performing senior housing and SNF portfolios ▪ Relationship diversification ▪ Geographic diversification (investments in 43 states and Canada) ▪ Grow private-pay through investments in high-quality managed senior housing ▪ Develop purpose-built senior housing Finance ▪ Maintain a fortress balance sheet ▪ Maintain sustainable dividend policy Operations ▪ Encourage the sharing of best practices among tenants ▪ Provide industry-leading business intelligence tools STRATEGY Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 5

“BY OPPORTUNISTICALLY EXECUTING OUR STRATEGY, WE CONTINUE TO DELIVER LONG-TERM VALUE FOR OUR SHAREHOLDERS.” STRATEGY IN ACTION Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 6 – Talya Nevo-Hacohen, Chief Investment Officer

7 34 vs 72 STRENGTHENED BALANCE SHEET BY REDUCING LEVERAGE STRATEGY IN ACTION Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 Lowered cost of PERMANENT DEBT by 65 basis points to 3.63% Reduced NET DEBT TO ADJUSTED EBITDA1 ratio from 5.69x to 4.84x DECEMBER 31, 2018 vs MARCH 31, 2021 (1) Net Debt to Adjusted EBITDA excludes the unconsolidated joint venture. For additional detail and information regarding Net Debt to Adjusted EBITDA, refer to the Credit Metrics and Ratings section of our corresponding Supplemental Report and the Reconciliation of Non-GAAP Financial Measures, both available in the Investor Relations section of our website at http://www.sabrahealth.com/investors/financials/reports-presentations.

8 INTEREST COVERAGE + 1.09x to 5.23x FIXED CHARGE COVERAGE + 1.35x to 5.05x TOTAL DEBT/ASSET VALUE IMPROVED 1600 bps SIGNIFICANTLY IMPROVED CREDIT METRICS STRATEGY IN ACTION Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 DECEMBER 31, 2018 vs MARCH 31, 2021

COMMITTED TO STRONG CORPORATE GOVERNANCE & ETHICAL BUSINESS PRACTICES Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 9 Our inaugural ESG report is now available on our website at sabrahealth.com. We believe that a diverse workforce is essential to our continued success. Our workforce reflects diverse gender, ethnicity, age and cultural backgrounds. • As of December 31, 2020, women comprised 55% of our workforce and 65% of our management level/leadership roles. • As of December 31, 2020, 21% of our team members self-identified as being members of one or more ethnic minorities. We believe our ethnic diversity is higher than this reported percentage as another 21% of our team members chose not to self-identify. ENVIRONMENTAL, SOCIAL AND GOVERNANCE

DIVERSE AND EXPERIENCED LEADERSHIP ENVIRONMENTAL, SOCIAL AND GOVERNANCE Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 10 We added two new board members, Ann Kono and Clifton Porter, during the fourth quarter of 2020 and a third new board member, Katie Cusack, in January of 2021. These members add fresh skillsets to our already strong, independent board including policy, finance and ESG expertise. ANN KONO CLIFTON PORTER KATIE CUSACK

“WE CUSTOMIZE OUR FINANCIAL SOLUTIONS TO PROVIDE OPERATORS WITH CAPITAL TO INVEST IN THEIR BUSINESS AND SUPPORT THE DELIVERY OF QUALITY CARE.” – Talya Nevo-Hacohen, Chief Investment Officer INVESTMENT THESIS Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 11

OPPORTUNISTICALLY SOURCED, CREATIVELY STRUCTURED AND PRUDENTLY FINANCED Unique, Accretive Investments Utilize our operational and asset management expertise to identify and capitalize on new opportunities where off-market price dislocation exists. Support Operator Expansion Be the capital partner of choice for the expansion and growth aspirations of our leading operators with regional expertise and favorable demographics. Creatively Financed Development Pursue strategic development opportunities. Minimize risk by making smaller initial investments in purpose-built facility development projects. Opportunistically utilize preferred equity and mezzanine debt investment structures. Optimize Portfolio Continue to curate our portfolio to optimize diversification and maintain a mix of assets well positioned for the future of health care delivery. INVESTMENT THESIS Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 12

“OUR PORTFOLIO AND TENANTS ARE POSITIONED TO DELIVER QUALITY CARE NOW AND IN THE FUTURE.” PORTFOLIO – Peter Nyland, Executive Vice President Asset Management Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 13

▪ From the beginning of the COVID-19 pandemic through June 2021, we have collected 99.8% of our forecasted rents. While we have agreed to temporary pandemic-related rent deferrals for four tenants of one to six months of rent, we have not granted any permanent pandemic-related rent concessions. Total pandemic-related rent deferrals equal $1.7 million (0.3% of Annualized Cash NOI). ▪ Despite the challenges of the pandemic, we have remained vigilant in maintaining a strong balance sheet. On February 1, 2021, Fitch Ratings (“Fitch”) revised its rating outlook for Sabra to Stable from Negative and both Fitch and S&P Global Ratings affirmed the ratings for Sabra’s debt as 'BBB-’. ▪ As of March 31, 2021, we had over $1.0 billion of liquidity, consisting of unrestricted cash and cash equivalents of $24.9 million and available borrowings of $1.0 billion under our revolving credit facility. As of March 31, 2021, we also had $139.8 million available under our ATM Program. COVID-19 IMPACT ON OUR BUSINESS PORTFOLIO Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 14

The COVID-19 pandemic continues to have a significant impact on the operations of our facilities, although partially mitigated by government relief packages providing assistance to our Skilled Nursing/Transitional Care and Specialty Hospital and Other portfolios, and our Senior Housing - Leased and Senior Housing - Managed portfolios. OCCUPANCY ▪ Average occupancy for our Skilled Nursing/Transitional Care portfolio hit a trough in the final weeks of December 2020 and has shown signs of recovery through June 15, 2021. ▪ Our top seven Skilled Nursing operators, which comprise 63% of our Skilled Nursing rent, saw increased average occupancy of 484 basis points from the late-December 2020 low point through the third week of June 2021. ▪ Skilled Mix census in our Skilled Nursing/Transitional Care portfolio stands 127 basis points higher as of June 15, 2021 compared to February 2020 pre-pandemic levels. ▪ Similarly, average occupancy for our Senior Housing - Leased portfolio bottomed out during the first half of February 2021 and has increased 389 basis points through June 15, 2021. ▪ Occupancy from February 2020 through June 15, 2021 for our Specialty Hospitals and Other portfolio increased 464 basis points. COVID-19 IMPACT ON OUR PORTFOLIO PORTFOLIO Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 15

SENIOR HOUSING – MANAGED OPERATIONS ▪ Average occupancy for our Senior Housing - Managed portfolio bottomed out during the first half of March 2021 and has increased 177 basis points through June 15, 2021. ▪ During the second quarter of 2021, the Enlivant JV continued to see positive trends in both gross move-ins and gross move-outs. Second quarter move-ins were 23% higher than during the first quarter of 2021 and 15% higher than the same period in 2019, averaging 2 move-ins per community per month. At the same time, second quarter move-outs were 12% lower than during the first quarter of 2021 and 11% lower than the same period in 2019, averaging 1.5 move-outs per community per month. As a result of these favorable trends, occupancy on the portfolio grew 300 bps from 67.4% in March 2021 to 70.4% average in June 2021. Since its pandemic low-point in March 2021, the JV has grown 450 bps to its spot occupancy of 71.6% on June 30, 2021. ▪ Occupancy loss is the key driver of lower Cash NOI and Cash NOI margin because of the high operating leverage. Expenses associated with the pandemic spiked with the post-holiday surge, but with the success of the vaccination uptake expenses started decreasing during the quarter, and over time should stabilize at levels not materially higher than pre-COVID levels. ▪ In the second quarter of 2021, our Holiday portfolio saw strong move-in volume (4.5 average move- ins per community), offset by high move-outs (4.4 average move-outs per community), for an occupancy gain of 5 units in the quarter. COVID-19 IMPACT ON OUR PORTFOLIO (CONT.) PORTFOLIO Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 16

▪ In response to the COVID-19 pandemic, the federal government approved several relief packages that initially extended to just our Skilled Nursing/Transitional Care facility operators. However, since September 1, 2020, eligible assisted living and memory care facility operators were also permitted to apply for funding through the CARES Act, with the assistance received or expected to be received partially mitigating the negative impact of COVID-19. ▪ The following summarizes the aggregate amounts reported as being received by or made available to our operators from funding sources provided under the CARES Act. Please refer to the Top 10 Relationships and COVID-19 Mitigation Summary section of our Supplemental Report, available in the Investor Relations section of our website at http://www.sabrahealth.com/investors/financials/reports-presentations, for more details. COVID-19: MITIGATION PORTFOLIO Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 17

Mitigation Source Mitigates EBITDARM Reductions Description Estimated Available (All Sabra Relationships) PRF 2: Yes The CARES Act has, to date, appropriated $178 billion to the Provider Relief Fund (“PRF”) for hospitals and other health care providers nationwide to prevent, prepare for and respond to COVID-19, with such amount to be distributed through grants and other payment mechanisms. Thus far, approximately $145 billion of such appropriated amount has been, or is in the process of being funded through three phases of general distributions, various targeted distributions and certain performance-based incentive payments. $260 million 3 Suspension of Medicare sequestration: Yes The CARES Act initially suspending the Medicare sequester (2% of all Medicare fee-for-service payments) from May 1– December 31, 2020 has since been extended to December 31, 2021. $10 million FMAP: Yes The Families First Coronavirus Response Act provides a temporary 6.2% increase in Federal Medical Assistance Percentages (“FMAP”) retroactive to January 1, 2020 with continuation through September 30, 2021. States have discretion regarding the distribution of these funds to various healthcare providers. $80 million AAMP: The CARES Act expanded the existing program to allow acute, cancer and children’s hospitals to request accelerated and advance Medicare payment (“AAMP”) of up to 100% of their Medicare payments for a six-month period, while critical access hospitals may request up to 125%. Other Medicare providers and suppliers (including physicians) may request up to three months advance payment. Repayment will not begin for one year from when the first loan disbursement was made and will be interest-free for up to 29 months. $140 million 4,5 Employer payroll tax delay: Under the CARES Act, employers can defer payment of the 6.2% FICA tax on wages paid from March 27–December 31, 2020. 50% of the deferred payment is due by December 31, 2021, and the remaining 50% is due by December 31, 2022. All employers are eligible unless they have had a loan forgiven through the Paycheck Protection Program (see PPP below). $40 million 4 PPP: Potentially The Paycheck Protection Program (“PPP”) established by the CARES Act has thus far been authorized to provide a total of up to $943 billion to fund special new loans to small businesses with fewer than 500 employees that have been affected by COVID-19. Through the PPP, the Small Business Association can provide businesses a maximum loan equal to 2.5x times its average monthly payroll costs, capped at $10 million with an aggregate corporate cap of $20 million. Loan amounts spent on payroll and certain other costs for eight weeks following loan origination would be forgiven. $80 million COVID-19: MITIGATION (CONT.) 1 PORTFOLIO Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 18 (1) The following summarizes the aggregate amounts reported as being received by or made available to our operators from funding sources provided under the CARES Act. (2) For information as to specific eligibility requirements and methodology / timing of distributions, please refer to https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/index.html (3) Amount includes estimated distribution to eligible senior housing operators equal to 2% of annual patient care revenue. (4) Provides additional near-term liquidity for our operators. (5) Benefit may be limited depending on reserve requirements under any working capital or other loans utilized by our operators. Total: $610M

▪ Approximately $160 million received from the CARES Act Provider Relief Fund have been recognized in the operating results reported by our operators. We estimate that our operators have received approximately $260 million from the Provider Relief Fund but have only recognized $160 million in their operating results to date. Recognition of the remaining $100 million is dependent on demonstration of need and any unused amounts may be required to be returned to the federal government. ▪ Currently, there is $33 billion remaining to be disbursed from the Provider Relief Fund and that amount may increase as a result of acute hospital providers returning funds to the government. The Department of Health and Human Services (“HHS”) most recently extended the COVID-19 Public Health Emergency for another 90 days, effective April 21, 2021, which allows HHS to continue providing temporary regulatory waivers, including the waiver of the three-day hospital stay requirement, and new rules to equip skilled nursing facilities and some assisted living operators with flexibility to respond to the COVID-19 pandemic. Lastly, the FMAP funding increase was extended through September 30, 2021 (which is anticipated to be further extended through the end of 2021) and suspension of the Medicare sequestration was extended through December 31, 2021. COVID-19: MITIGATION (CONT.) PORTFOLIO Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 19

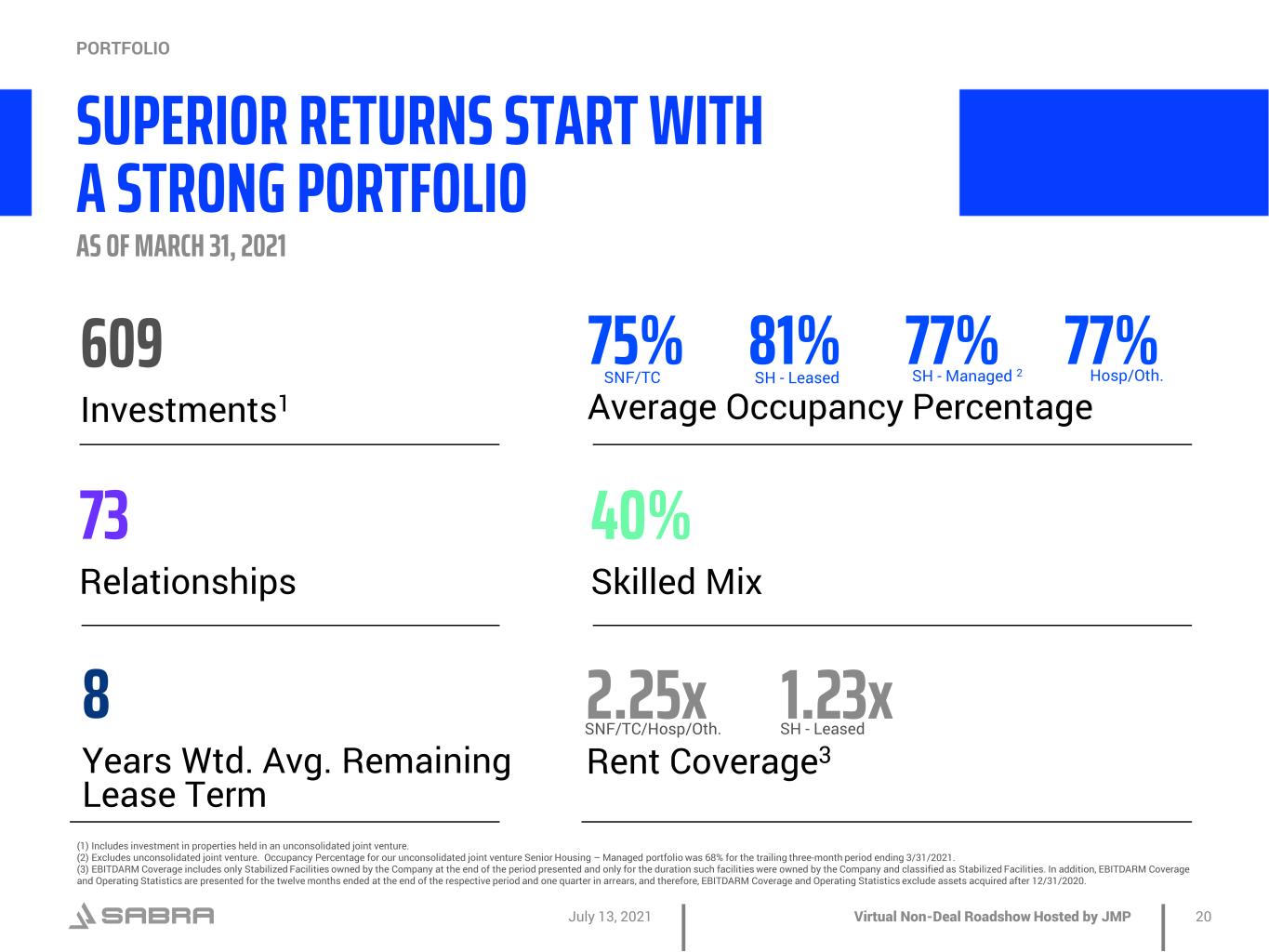

8 Years Wtd. Avg. Remaining Lease Term SUPERIOR RETURNS START WITH A STRONG PORTFOLIO 609 Investments1 PORTFOLIO 75% 81% 77% 77% Average Occupancy Percentage 2.25x 1.23x Rent Coverage3 73 Relationships 40% Skilled Mix SH - Leased SH - Managed 2 SNF/TC/Hosp/Oth. SH - Leased (1) Includes investment in properties held in an unconsolidated joint venture. (2) Excludes unconsolidated joint venture. Occupancy Percentage for our unconsolidated joint venture Senior Housing – Managed portfolio was 68% for the trailing three-month period ending 3/31/2021. (3) EBITDARM Coverage includes only Stabilized Facilities owned by the Company at the end of the period presented and only for the duration such facilities were owned by the Company and classified as Stabilized Facilities. In addition, EBITDARM Coverage and Operating Statistics are presented for the twelve months ended at the end of the respective period and one quarter in arrears, and therefore, EBITDARM Coverage and Operating Statistics exclude assets acquired after 12/31/2020. Hosp/Oth. Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 20 AS OF MARCH 31, 2021 SNF/TC

PROJECTS 25 CURRENT TOTAL INVESTMENT $390M EXPECTED REAL ESTATE VALUE 1 $490M COMPLETED AND PLANNED PROJECTS PROPRIETARY PIPELINE OF PURPOSE-BUILT ASSETS ENHANCES THE QUALITY OF OUR PORTFOLIO PORTFOLIO (1) Represents the value of completed projects at Sabra’s purchase price and the projected purchase price for those projects still in development but for which Sabra has option rights as of 3/31/2021. Virtual Non-Deal Roadshow Hosted by JMP EXPECTED INITIAL CASH YIELD ON RENTS 7.6% July 13, 2021 21

Specialty Hospitals and Other 11.2% Senior Housing - Managed 10.8% Senior Housing - Leased 10.4% Interest and Other Income 2.1% Skilled Nursing / Transitional Care 65.5% EFFECTIVE ASSET MANAGEMENT AND STRONG OPERATOR RELATIONSHIPS Crafted portfolio of high- quality and diverse facilities passionate about care. PORTFOLIO Asset Mix 1 Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 (1) Based on Annualized Cash NOI as of 3/31/2021. See the appendix to this presentation for the definition of Annualized Cash NOI. 22

HIGH QUALITY OF CARE STRONG PERFORMANCE Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 23

OUR OPERATORS ARE DRIVEN BY AN UNWAVERING PASSION: ADVANCING THE QUALITY OF CARE We Work With Operators Who Are: ▪ Highly engaged ▪ Nimble ▪ Regional experts ▪ In markets with favorable demographics ▪ Well positioned for the future of health care delivery OPERATORS Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 24

WE SUPPORT OUR OPERATORS We Invest in Our Tenants’ Success: ▪ Redevelopment ▪ Expansion ▪ Strategic development ▪ Flexible equity and debt capital solutions OPERATORS Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 25

“WHEN IT COMES TO EXECUTING OUR STRATEGY, WE DO WHAT WE SAY WE ARE GOING TO DO.” – Talya Nevo-Hacohen, Chief Investment Officer STRATEGY IN ACTION – Rick Matros, Chief Executive Officer “WE’VE CONSISTENTLY DELIVERED VALUE TO OUR SHAREHOLDERS WHILE MAINTAINING A STRONG BALANCE SHEET.” Virtual Non-Deal Roadshow Hosted by JMP OPERATORS “ONE OF THE MANY ADVANTAGES OF WORKING WITH SABRA IS THAT THEY GET WHAT IT’S LIKE TO BE AN OPERATOR .” - Brent Weil, President and CEO EmpRes Healthcare July 13, 2021 26

PROPRIETARY INFORMATION TECHNOLOGY SYSTEM ▪ Supports the efficient and accurate collection of tenant, financial, asset management and acquisitions information. ▪ Furthers our ability to drive value to shareholders by enabling our team to remain lean, yet effective. CREATING OPERATING EFFICIENCIES OPERATORS Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 27

DRIVING PERFORMANCE WITH FREE ACCESS TO INDUSTRY-LEADING BUSINESS INTELLIGENCE TOOLS Virtual Non-Deal Roadshow Hosted by JMP OPERATORS July 13, 2021 28

Data Integrity Audit Real-time MDS verification analyzes the accuracy of the Minimum Data Set (MDS) assessment prior to CMS submission. Each MDS is checked for logical and clinical coding accuracy, with recommended actions when inaccurate, incomplete, or inconsistent information is identified. Helpful alerts identify quality measure triggers and reimbursement items for compliance monitoring. PointRight® Pro 30® Rehospitalization PointRight® Pro 30® is the only all-cause, risk adjusted rehospitalization measure validated by Brown University, adopted by the American Health Care Association, and endorsed by the National Quality Forum (NQF #2375). Includes All-Payer and Medicare as well as clinical cohort-specific rates, with trending and drill-down capability to evaluate resident-level rehospitalization information. Five-Star FastTrack® Interactive monitoring and management of CMS Five-Star Quality Rating performance in each of the domains: Health Inspection, Quality Measures, and Staffing. A “What if” feature facilitates setting of targets and future planning. POINTRIGHT PROGRAM FOR SNF TENANTS OPERATORS July 13, 2021 Virtual Non-Deal Roadshow Hosted by JMP 29

Avamere 8.9% North American 7.8% Signature Healthcare 7.8% Cadia 7.4% Signature Behavioral 6.8% Enlivant 4.4%Holiday 4.1% Other 2.3% Other 50.5% Relationship Concentration 1 DIVERSE OPERATOR BASE, PASSIONATE ABOUT CARE By diversifying our tenant concentration, we’ve curated a portfolio equipped to perform in today’s dynamic health care market. OPERATORS (1) Based on Annualized Cash NOI as of 3/31/2021. See the appendix to this presentation for the definition of Annualized Cash NOI. Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 30 Managed (No Operator Credit Exposure) 10.8%

“WE’VE DELIVERED ON OUR PROMISE TO STRENGTHEN OUR BALANCE SHEET AND ARE POISED TO CAPITALIZE ON FUTURE GROWTH OPPORTUNITIES.” – Harold Andrews, Jr., Chief Financial Officer PERFORMANCE Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 31

Common Equity Value 60% Secured Debt 7% Unsecured Debt 33% Capital Structure 1 ENTERPRISE VALUE $6.6B BALANCED CAPITAL STRUCTURE Our diverse menu of capital options ensures that we have ready access to low- cost capital to fund our growth. PERFORMANCE (1) As of 3/31/2021. Includes Sabra’s 49% pro rata share of the debt of its unconsolidated joint venture. Common equity value estimated using outstanding common stock of 215.9 million shares and Sabra’s closing price of $18.54 as of 7/9/2021. Our Credit Facility, which includes a $1.0 billion Revolving Credit Facility (with full availability as of 3/31/2021), contains an accordion feature that can increase the total available borrowings to $2.75 billion (up from $2.0 billion plus CAD $125.0 million today). Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 32

(1) Credit metrics (except net debt to adjusted EBITDA) are calculated in accordance with the credit agreement relating to our revolving credit facility and the indentures relating to our unsecured senior notes. (2) Investment Grade Peers consists of WELL, VTR, OHI and NHI, except with respect to the LTM Net Debt to Adjusted EBITDA – Incl. Unconsolidated Joint Venture metric, for which the available data is with respect to WELL and VTR. The metrics used to calculate Investment Grade Peers Median are sourced from most recent public filings with the SEC and may not be calculated in a manner identical to Sabra’s metrics. (3) Net Debt to Adjusted EBITDA is calculated based on Pro Forma Annualized Adjusted EBITDA, which is Adjusted EBITDA, as adjusted for annualizing adjustments that give effect to the acquisitions and dispositions completed during the respective period as though such acquisitions and dispositions were completed as of the beginning of the period presented. Net Debt to Adjusted EBITDA - Including Unconsolidated Joint Venture is calculated based on Annualized Adjusted EBITDA, as adjusted, which includes Annualized Adjusted EBITDA and is further adjusted to include the Company's share of the unconsolidated joint venture interest expense. See “Reconciliations of Non-GAAP Financial Measures” on our website at http://www.sabrahealth.com/investors/financials/reports-presentations/non-gaap for additional information. STRONG INVESTMENT GRADE CREDIT METRICS 1 SABRA 1Q21 INVESTMENT GRADE PEERS MEDIAN 2 LTM Net Debt to Adjusted EBITDA 4.84x 3 5.86x LTM Net Debt to Adjusted EBITDA - Incl. Unconsolidated Joint Venture 5.48x 3 6.96x Interest Coverage Ratio 5.23x 4.49x Debt as a % of Asset Value 33% 42% Secured Debt as a % of Asset Value 1% 5% PERFORMANCE Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 33

300 500 100 350 350 599 189 82 71 1,000 $22 $27 $359 $909 $192 $584 $173 $3 $353 $46 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030+ Unsecured Bonds Term Loans Sabra's Share of Uncons. JV Debt Mortgage Debt / Secured Debt Line of Credit Available Line of Credit FAVORABLE PROFILE WITH STAGGERED MATURITIES DEBT MATURITY PROFILE AT MARCH 31, 2021 PERFORMANCE (1) Term loans are pre-payable at par. (2) Revolving Credit Facility is subject to two six-month extension options. (dollars in millions) Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 34 21

11.2x 11.2x 12.8x 14.4x 15.5x 23.5x 0.0x 4.0x 8.0x 12.0x 16.0x 20.0x 24.0x SBRA OHI NHI LTC CTRE Big 2 Average 6.5% 2.9% 4.2% 5.9% 6.5% 7.2% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% SBRA Big 2 Average CTRE LTC NHI OHI 17.0% 17.1% 24.8% 31.8% 36.4% 37.3% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% SBRA NHI LTC OHI CTRE Big 2 Average 21% 14% 16% 52% 41% 69% 66% 86% 79% 4% 58% 27% 13% 5% 44% 1% 4% 0% 20% 40% 60% 80% 100% SBRA CTRE OHI Big 2 Average LTC NHI Senior Housing Skilled Nursing Other 3% Forward FFO Multiples 1 Dividend Yield Premium / Discount to Consensus NAV Portfolio Composition (% Annualized Cash NOI) 3 Sources: SNL Financial as of 7/9/2021, unless otherwise noted. (1) Forward FFO multiple is calculated as stock price as of 7/9/2021 divided by the forward four quarter consensus FFO from SNL Financial. (2) Big 2 average consists of WELL and VTR. (3) Represents latest available concentration for peers from company filings as of 7/9/2021. (4) Based on Annualized Cash NOI for the quarter ended 3/31/2021. See the appendix to this presentation for the definition of Annualized Cash NOI. ATTRACTIVE RELATIVE VALUATION PERFORMANCE 2 2 22 4 Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 35

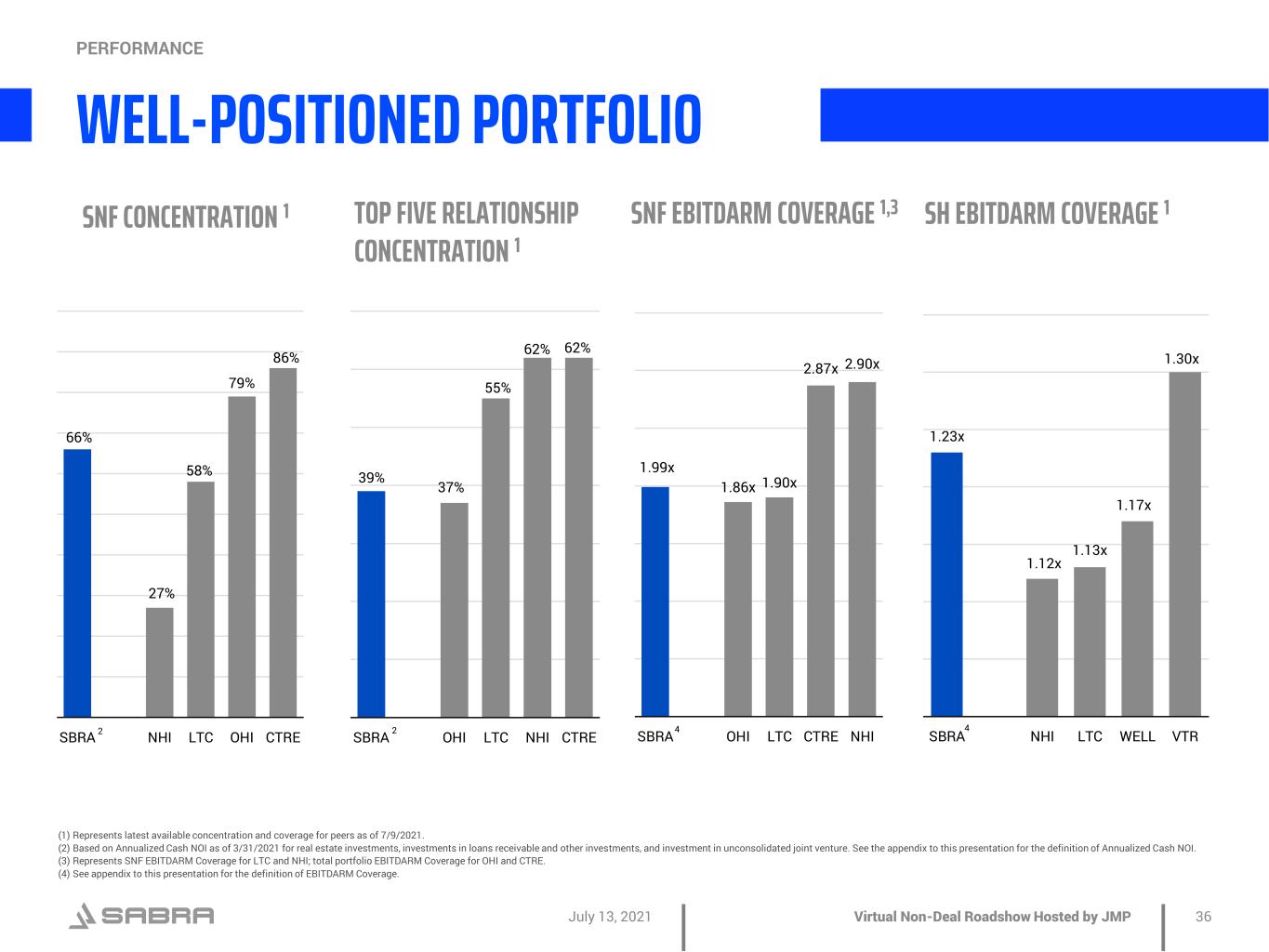

SNF CONCENTRATION 1 SNF EBITDARM COVERAGE 1,3TOP FIVE RELATIONSHIP CONCENTRATION 1 (1) Represents latest available concentration and coverage for peers as of 7/9/2021. (2) Based on Annualized Cash NOI as of 3/31/2021 for real estate investments, investments in loans receivable and other investments, and investment in unconsolidated joint venture. See the appendix to this presentation for the definition of Annualized Cash NOI. (3) Represents SNF EBITDARM Coverage for LTC and NHI; total portfolio EBITDARM Coverage for OHI and CTRE. (4) See appendix to this presentation for the definition of EBITDARM Coverage. WELL-POSITIONED PORTFOLIO PERFORMANCE 66% 27% 58% 79% 86% SBRA NHI LTC OHI CTRE 39% 37% 55% 62% 62% SBRA OHI LTC NHI CTRE2 2 4 Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 36 SH EBITDARM COVERAGE 1 1.23x 1.12x 1.13x 1.17x 1.30x SBRA NHI LTC WELL VTR 4 1.99x 1.86x 1.90x 2.87x 2.90x SBRA OHI LTC CTRE NHI

APPENDIX Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 37

Adjusted EBITDA.* Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation and amortization (“EBITDA”) excluding the impact of merger-related costs, stock-based compensation expense under the Company’s long-term equity award program, and loan loss reserves. Adjusted EBITDA is an important non-GAAP supplemental measure of operating performance. Annualized Cash Net Operating Income (“Annualized Cash NOI”).* The Company believes that net income as defined by GAAP is the most appropriate earnings measure. The Company considers Annualized Cash NOI an important supplemental measure because it allows investors, analysts and its management to evaluate the operating performance of its investments. The Company defines Annualized Cash NOI as Annualized Revenues less operating expenses, excluding expenses related to the COVID-19 pandemic, and non-cash revenues and expenses. Annualized Cash NOI excludes all other financial statement amounts included in net income. Annualized Revenues. The annual contractual rental revenues under leases and interest and other income generated by the Company’s loans receivable and other investments based on amounts invested and applicable terms as of the end of the period presented. Annualized Revenues do not include tenant recoveries, additional rents or government grant income and are net of repositioning reserves, if applicable. Cash Net Operating Income (“Cash NOI”).* The Company believes that net income as defined by GAAP is the most appropriate earnings measure. The Company considers Cash NOI an important supplemental measure because it allows investors, analysts and its management to evaluate the operating performance of its investments. The Company defines Cash NOI as total revenues less operating expenses and non-cash revenues and expenses. Cash NOI excludes all other financial statement amounts included in net income. EBITDARM. Earnings before interest, taxes, depreciation, amortization, rent and management fees (“EBITDARM”) for a particular facility accruing to the operator/tenant of the property (not the Company), for the period presented. The Company uses EBITDARM in determining EBITDARM Coverage. EBITDARM has limitations as an analytical tool. EBITDARM does not reflect historical cash expenditures or future cash requirements for facility capital expenditures or contractual commitments. In addition, EBITDARM does not represent a property’s net income or cash flows from operations and should not be considered an alternative to those indicators. The Company utilizes EBITDARM to evaluate the core operations of the properties by eliminating management fees, which may vary by operator/tenant and operating structure, and as a supplemental measure of the ability of the Company’s operators/tenants and relevant guarantors to generate sufficient liquidity to meet related obligations to the Company. EBITDARM Coverage. Represents the ratio of EBITDARM to cash rent for owned facilities (excluding Senior Housing - Managed communities) for the period presented. EBITDARM Coverage is a supplemental measure of a property’s ability to generate cash flows for the operator/tenant (not the Company) to meet the operator’s/tenant’s related cash rent and other obligations to the Company. However, its usefulness is limited by, among other things, the same factors that limit the usefulness of EBITDARM. EBITDARM Coverage includes only Stabilized Facilities and excludes facilities for which data is not available or meaningful. Funds From Operations (“FFO”) and Adjusted FFO (“AFFO”).* See the definitions included in the accompanying Reconciliations of Non-GAAP Financial Measures for information regarding FFO and AFFO. Occupancy Percentage. Occupancy Percentage represents the facilities’ average operating occupancy for the period indicated. The percentages are calculated by dividing the actual census from the period presented by the available beds/units for the same period. Occupancy includes only Stabilized Facilities and excludes facilities for which data is not available or meaningful. Occupancy Percentage for the Company's unconsolidated joint venture is weighted to reflect the Company's pro rata share. Senior Housing. Senior Housing communities include independent living, assisted living, continuing care retirement and memory care communities. Senior Housing - Managed. Senior Housing communities operated by third-party property managers pursuant to property management agreements. Skilled Mix. Skilled Mix is defined as the total Medicare and non-Medicaid managed care patient revenue at Skilled Nursing/Transitional Care facilities divided by the total revenues at Skilled Nursing/Transitional Care facilities for the period indicated. Skilled Mix includes only Stabilized Facilities and excludes facilities for which data is not available or meaningful. Skilled Nursing/Transitional Care. Skilled Nursing/Transitional Care facilities include skilled nursing, transitional care, multi-license designation and mental health facilities. Specialty Hospitals and Other. Includes acute care, long-term acute care, rehabilitation and behavioral hospitals, facilities that provide residential services, which may include assistance with activities of daily living, and other facilities not classified as Skilled Nursing/Transitional Care or Senior Housing. Stabilized Facility. At the time of acquisition, the Company classifies each facility as either stabilized or non-stabilized. In addition, the Company may classify a facility as nonstabilized after acquisition. Circumstances that could result in a facility being classified as non-stabilized include newly completed developments, facilities undergoing major renovations or additions, facilities being repositioned or transitioned to new operators, and significant transitions within the tenants’ business model. Such facilities are typically reclassified to stabilized upon the earlier of maintaining consistent occupancy (85% for Skilled Nursing/Transitional Care facilities and 90% for Senior Housing communities) or 24 months after the date of classification as non-stabilized. Stabilized Facilities exclude (i) facilities held for sale, (ii) strategic disposition candidates, (iii) facilities being transitioned to a new operator, (iv) facilities being transitioned from being leased by the Company to being operated by the Company and (v) facilities acquired during the three months preceding the period presented. * Non-GAAP Financial Measures: Reconciliations, definitions and important discussions regarding the usefulness and limitations of the Non-GAAP Financial Measures used in this report can be found at http://www.sabrahealth.com/investors/financials/reports-presentations/non-gaap. DEFINITIONS APPENDIX Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 38

This presentation contains “forward-looking” statements that may be identified, without limitation, by the use of “expects,” “believes,” “intends,” “should” or comparable terms or the negative thereof. Forward-looking statements in this presentation include, but are not limited to, all statements regarding the impact of the COVID-19 pandemic on our tenants, operators and Senior Housing - Managed communities, our expectations regarding the potential mitigating effects of the state and federal assistance programs available to our tenants, operators and Senior Housing - Managed communities, and our strategic and operational plans, as well as all statements regarding expected future financial position, results of operations, cash flows, liquidity, financing plans, business strategy, the expected amounts and timing of dividends, projected expenses and capital expenditures, competitive position, growth opportunities and potential investments, plans and objectives for future operations and compliance with and changes in governmental regulations. These statements are made as of the date hereof and are subject to known and unknown risks, uncertainties, assumptions and other factors—many of which are out of the Company’s control and difficult to forecast—that could cause actual results to differ materially from those set forth in or implied by our forward-looking statements. These risks and uncertainties include but are not limited to: the ongoing COVID-19 pandemic and measures intended to prevent its spread, including the impact on our tenants, operators and Senior Housing - Managed communities; our dependence on the operating success of our tenants; the potential variability of our reported rental and related revenues following the adoption of Accounting Standards Update (“ASU”) 2016-02, Leases, as amended by subsequent ASUs, on January 1, 2019; operational risks with respect to our Senior Housing - Managed communities; the effect of our tenants declaring bankruptcy or becoming insolvent; our ability to find replacement tenants and the impact of unforeseen costs in acquiring new properties; the impact of litigation and rising insurance costs on the business of our tenants; the possibility that Sabra may not acquire the remaining majority interest in the Enlivant joint venture; risks associated with our investments in joint ventures; changes in healthcare regulation and political or economic conditions; the impact of required regulatory approvals of transfers of healthcare properties; competitive conditions in our industry; our concentration in the healthcare property sector, particularly in skilled nursing/transitional care facilities and senior housing communities, which makes our profitability more vulnerable to a downturn in a specific sector than if we were investing in multiple industries; the significant amount of and our ability to service our indebtedness; covenants in our debt agreements that may restrict our ability to pay dividends, make investments, incur additional indebtedness and refinance indebtedness on favorable terms; increases in market interest rates; the phasing out of the London Interbank Offered Rate (“LIBOR”) benchmark beginning after 2021; our ability to raise capital through equity and debt financings; changes in foreign currency exchange rates; the relatively illiquid nature of real estate investments; the loss of key management personnel; uninsured or underinsured losses affecting our properties and the possibility of environmental compliance costs and liabilities; the impact of a failure or security breach of information technology in our operations; our ability to maintain our status as a real estate investment trust (“REIT”) under the federal tax laws; changes in tax laws and regulations affecting REITs (including the potential effects of the Tax Cuts and Jobs Act); compliance with REIT requirements and certain tax and tax regulatory matters related to our status as a REIT; and the ownership limits and takeover defenses in our governing documents and under Maryland law, which may restrict change of control or business combination opportunities. Additional information concerning risks and uncertainties that could affect our business can be found in our filings with the Securities and Exchange Commission (the “SEC”), including Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2020. Forward-looking statements made in this presentation are not guarantees of future performance, events or results, and you should not place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company assumes no, and hereby disclaims any, obligation to update any of the foregoing or any other forward-looking statements as a result of new information or new or future developments, except as otherwise required by law. TENANT AND BORROWER INFORMATION This presentation includes information (e.g., EBITDARM Coverage and occupancy percentage) regarding certain of our tenants that lease properties from us and our borrowers, most of which are not subject to SEC reporting requirements. The information related to our tenants and borrowers that is provided in this presentation has been provided by, or derived from information provided by, such tenants and borrowers. We have not independently verified this information. We have no reason to believe that such information is inaccurate in any material respect. We are providing this data for informational purposes only. FORWARD-LOOKING STATEMENTS APPENDIX Virtual Non-Deal Roadshow Hosted by JMPJuly 13, 2021 39

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Groupe Casino: BUT, Conforama, MDA Company, Casino Group and Intermarché end their technical goods purchasing partnership, Sirius Achats

- Tri Ri Asset Management Corp Announces Strategic Leadership Transition

- MONAT Global Announces The Growth Alliance with Eric Worre

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share