Form 8-K STATE STREET CORP For: Jun 13

June 13, 2022 Morgan Stanley U.S. Financials Conference Brian Franz Global Chief Information Officer Eric Aboaf Vice Chairman and Chief Financial Officer Exhibit 99.1

2 Preface and forward-looking statements This presentation contains forward-looking statements as defined by United States securities laws. These statements are not guarantees of future performance, are inherently uncertain, are based on assumptions that are difficult to predict and have a number of risks and uncertainties. The forward-looking statements in this presentation speak only as of the time this presentation is first furnished to the SEC on a Current Report on Form 8-K, and State Street does not undertake efforts to revise forward-looking statements. See “Forward-looking statements” in the Appendix for more information, including a description of certain factors that could affect future results and outcomes.

3 State Street’s technology strategy to support business objectives and financial targets Simplifying and delivering efficiency & productivity Enabling profitable business growth Driving a high- performing organization Simplify, modernize and automate our platform and business operating model Leverage technology to promote growth by building beyond core service infrastructure Develop a technology-forward and innovation-led organization • Simplify application landscape and consolidate data center footprint • Modernize technology infrastructure leveraging cloud capabilities • Drive efficiency through use of AI and automation • Enhance the client experience; Focus on delivery of expanded Alpha functionality • Advance cyber security capabilities to further protect our clients’ and our data • Enable growth through digital technologies • Drive a highly engaged and diverse global workforce • Foster software engineering and technical mastery as core competencies • Innovation lab and sandbox environments supporting ideation Driving efficiency and growth through technology innovation 1 2 3 A Financial targets to be met by the end of 2023 or on a run-rate basis for FY2024 unless noted otherwise. Total revenue growth is market dependent, including, but not limited to, the impacts from interest rate cycles, as well as equity and fixed income markets. Financial targets do not reflect items outside of the normal course of business. Revenue and EPS growth targets stated on a YoY basis. Timing to achieve all medium-term financial targets may become subject to uncertainties associated with the COVID-19 pandemic, the war in Ukraine and other global, macroeconomic and industry factors. Pre-tax margin target was adjusted from 30% to 31% to include the pending BBH Investor Services transaction, which closing is subject to regulatory approvals and other closing conditions. Refer to the Appendix included with this presentation for endnotes 1 to 4. State Street medium-term financial targetsA Revenue growth 4-5%, Pre-tax margin 31%, EPS growth 10-15%, ROE 12-15%, Total payout ratio ≥ 80%1

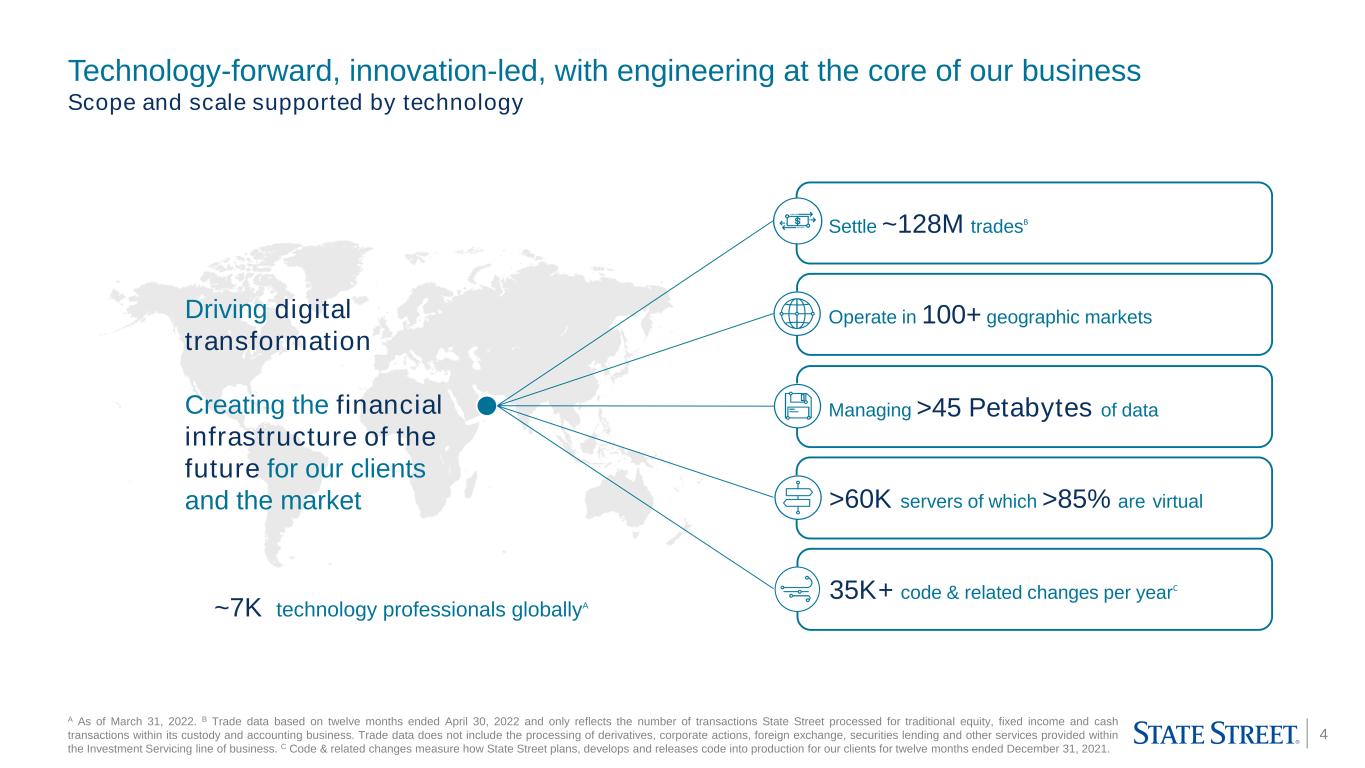

4 Driving digital transformation Creating the financial infrastructure of the future for our clients and the market Technology-forward, innovation-led, with engineering at the core of our business Scope and scale supported by technology A As of March 31, 2022. B Trade data based on twelve months ended April 30, 2022 and only reflects the number of transactions State Street processed for traditional equity, fixed income and cash transactions within its custody and accounting business. Trade data does not include the processing of derivatives, corporate actions, foreign exchange, securities lending and other services provided within the Investment Servicing line of business. C Code & related changes measure how State Street plans, develops and releases code into production for our clients for twelve months ended December 31, 2021. Settle ~128M tradesB Operate in 100+ geographic markets Managing >45 Petabytes of data 35K+ code & related changes per yearC >60K servers of which >85% are virtual ~7K technology professionals globallyA

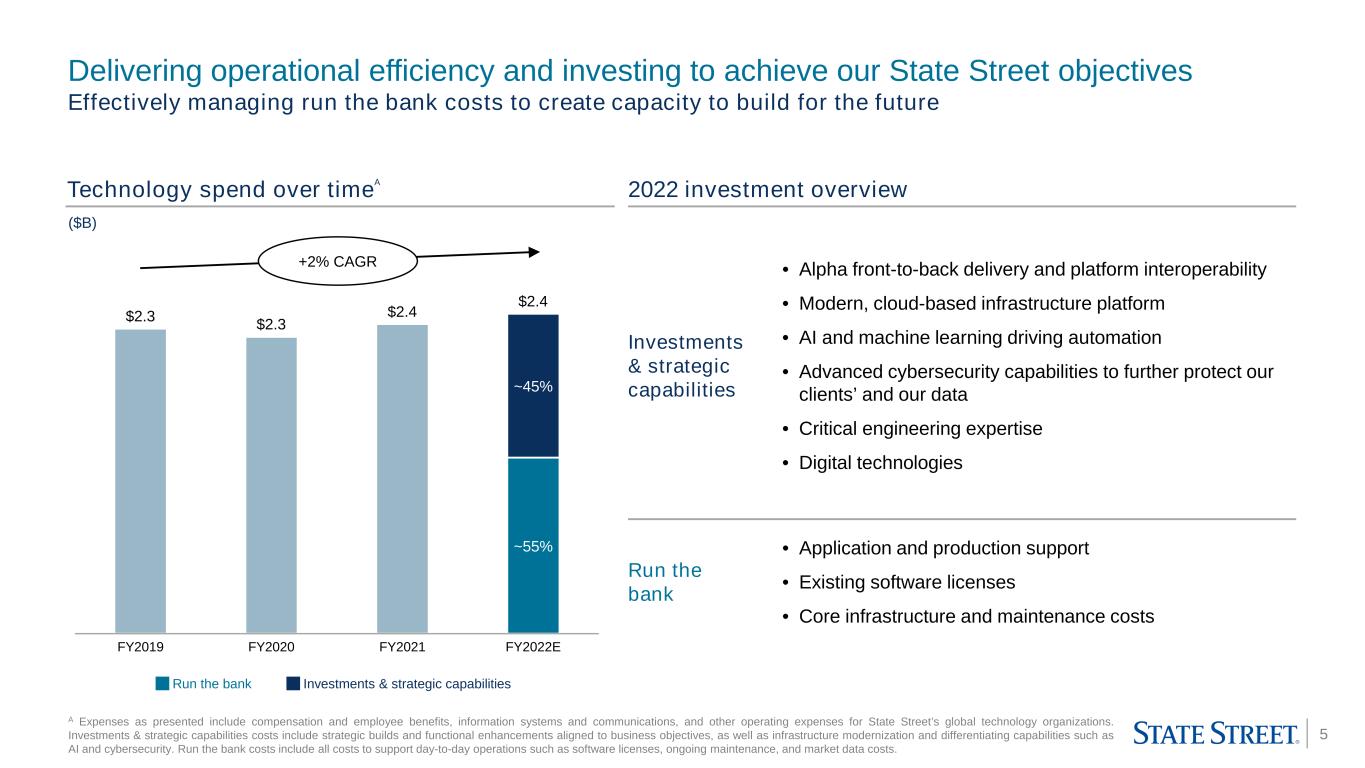

5 Technology spend over timeA ($B) +2% CAGR 2022 investment overview Delivering operational efficiency and investing to achieve our State Street objectives Effectively managing run the bank costs to create capacity to build for the future A Expenses as presented include compensation and employee benefits, information systems and communications, and other operating expenses for State Street’s global technology organizations. Investments & strategic capabilities costs include strategic builds and functional enhancements aligned to business objectives, as well as infrastructure modernization and differentiating capabilities such as AI and cybersecurity. Run the bank costs include all costs to support day-to-day operations such as software licenses, ongoing maintenance, and market data costs. Investments & strategic capabilities • Alpha front-to-back delivery and platform interoperability • Modern, cloud-based infrastructure platform • AI and machine learning driving automation • Advanced cybersecurity capabilities to further protect our clients’ and our data • Critical engineering expertise • Digital technologies Run the bank • Application and production support • Existing software licenses • Core infrastructure and maintenance costs $2.3 FY2019 $2.4 FY2020 $2.3 FY2021 ~55% ~45% FY2022E $2.4 Run the bank Investments & strategic capabilities

6 Key outcomes projected through 2024 Rationalized 30% of legacy applicationsA Reduced mainframe usage by 17%B Consolidate our physical data center footprint Achievements to date and focus areas Digital experience platform consolidated, delivering enhanced data delivery and user experience Modernize infrastructure through multi-cloud strategy Modernize applications to take advantage of cloud-native services AI technology eliminated up to 80% of manual work required to verify NAV accuracy against benchmarks3 Simplify our operations at scale through AI and automation Simplifying and delivering efficiency & productivity Simplifying, modernizing and automating our technology platform and business operating model Generating average productivity savings of 6% while increasing our investments, on average, by 8% between 2019 to 20224 10% additional legacy applications to be retiredA 10-15% 90% reduction in time to deploy infrastructureC,D 1 reduction in number of data centersC25% Simplify our footprint Modernize our platform Automate our processes infrastructure cost reduction driven by cloud migration2 50+ processes leveraging AI to drive efficiency, accuracy and operational excellence A As compared to 2019’s baseline of ~2,000 applications. B Measured by a reduction in MIPs (millions of instructions per second) consumption on the mainframe from 2020 to 2021. C As compared to 2022 estimated baseline. D 90% reduction refers to deployment times in public cloud infrastructure as compared to current data center environments. Refer to the Appendix included with this presentation for endnotes 1 to 4.

7 Improved client experience through proactive management, processes and tools, enhancing client stability Accelerate Alpha client onboarding through automation and standardization State Street Digital: Providing fund administration across 23 funds that invest in cryptocurrency assets while continuing to develop capabilities to complete a digital asset ecosystemC Blockchain, tokenization and smart contract capabilities to further innovate and improve our processes 99.9% Alpha Data Platform: Deployed frictionless access to real-time data, enhancing client ability to explore data and create insights Digital Experience: Improve my.statestreet.com user experience and provide integrated solutions through APIs 10+ 40+ Alpha clients to implement the Alpha Data Platform new API endpoints published across business services (custody, fund accounting and middle office) 2 Create digital wallet, blockchain and tokenization capabilities to offer a differentiated experience; deploy new digital functionalities on liquidity management, securities settlement and fund distribution success rate for 35K+ code & related changes for production environments and applicationsA Enabling profitable business growth Building beyond core service infrastructure – technology promotes growth Enhance the client experience Innovate for the future Features and functionalities 30% reduction of Alpha client onboarding time for standard IT component deploymentB Achievements to date and focus areas Key outcomes projected through 2024 A Code & related changes measure how State Street plans, develops and releases code into production for our clients for twelve months ended December 31, 2021. B Baseline compared to average client onboarding time from 2020-2021. C As of May 31, 2022.

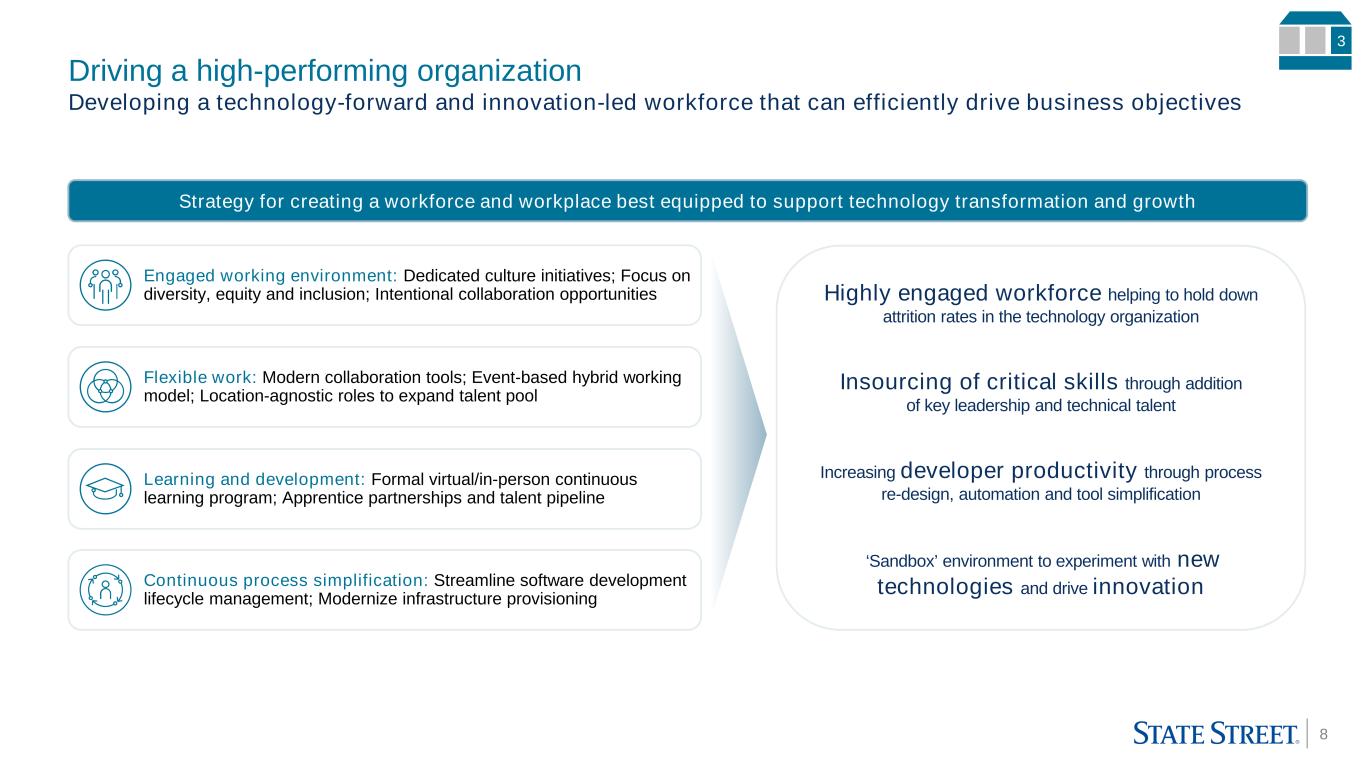

8 Driving a high-performing organization Developing a technology-forward and innovation-led workforce that can efficiently drive business objectives Strategy for creating a workforce and workplace best equipped to support technology transformation and growth 3 Engaged working environment: Dedicated culture initiatives; Focus on diversity, equity and inclusion; Intentional collaboration opportunities Flexible work: Modern collaboration tools; Event-based hybrid working model; Location-agnostic roles to expand talent pool Learning and development: Formal virtual/in-person continuous learning program; Apprentice partnerships and talent pipeline Continuous process simplification: Streamline software development lifecycle management; Modernize infrastructure provisioning Highly engaged workforce helping to hold down attrition rates in the technology organization Insourcing of critical skills through addition of key leadership and technical talent Increasing developer productivity through process re-design, automation and tool simplification ‘Sandbox’ environment to experiment with new technologies and drive innovation

9 Brian Franz Eric Aboaf Betsy Graseck Fireside Chat

10 Appendix Endnotes and definitions 11 Forward-looking statements 12

11 Endnotes and definitions Endnotes 1. State Street’s $3B common stock repurchase authorization, which is suspended through 3Q22, covers through year end 2022. Subsequent authorization are subject to the discretion of the Board of Directors. Stock purchases may be made using various types of transactions, including open-market purchases, accelerated share repurchases or other transactions off the market, and may be made under Rule 10b5-1 trading programs. The timing and amount of any stock purchases and the type of transaction will depend on several factors, including investment opportunities, State Street’s capital position, its financial performance, market conditions and the amount of common stock issued as part of employee compensation programs. The common stock purchase program does not have specific price targets and may be suspended at any time. Payout is also subject to the annual CCAR process conducted by the Board of Governors of the Federal Reserve System. CCAR cycles run from mid-year to mid-year. 2. Infrastructure cost reduction of 10-15% as compared to 2022 estimated baseline. Infrastructure costs include, but not limited to, costs for networks, end user computing, and storage. 3. 80% manual work elimination is measured by the difference in number of alerts (to be addressed manually) before and after using the machine learning based AI NAV benchmark. 4. Productivity savings and investment spend for FY2022 are estimates. Productivity savings reflect the impact of initiatives designed to result in operating expense reductions. These initiatives include, but are not limited to, activities such as resource discipline, infrastructure optimization, location strategy, and application rationalization. Definitions 1. AI: Artificial intelligence 2. API: Application programming interface 3. AUC: Assets under custody 4. AUC/A: Assets under custody and/or administration 5. AUM: Assets under management 6. BBH: Brown Brothers Harriman 7. CAGR: Compound annual growth rate 8. EPS: Earnings per share 9. ETF: Exchange-traded fund 10. FY: Full year 11. IT: Information technology 12. LIBOR: London Inter-Bank Offered Rate 13. NAV: Net asset value 14. Return on equity (ROE): Net income less dividends on preferred stock divided by average common equity 15. RWA: Risk weighted assets 16. SEC: Securities and Exchange Commission

12 Forward-looking statements This presentation (and the conference call referenced herein) contains forward-looking statements within the meaning of United States securities laws, including statements about our goals and expectations regarding our business, financial and capital condition, results of operations, strategies, the financial and market outlook, proposed acquisition of Brown Brothers Harriman’s Investor Services business, dividend and stock purchase programs, governmental and regulatory initiatives and developments, expense reduction programs, new client business, and the business environment. Forward-looking statements are often, but not always, identified by such forward-looking terminology as “target,” “strategy,” “focus,” “vision,” “plan,” “expect,” “intend,” “objective,” “forecast,” “outlook,” “believe,” “priority,” “anticipate,” “estimate,” “seek,” “may,” “will,” “trend,” “target,” “strategy” and “goal,” or similar statements or variations of such terms. These statements are not guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any time subsequent to the time this presentation is first issued. Important factors that may affect future results and outcomes include, but are not limited to: The consummation of our proposed acquisition of the BBH Investor Services business is subject to the receipt of regulatory approvals and the satisfaction of other closing conditions, the failure or delay of which may prevent or delay the consummation of the acquisition; while we are evaluating potential modifications to the transaction that are intended to facilitate resolution of the bank regulatory review, there can be no assurance as to the timing or outcome of that review; Even if we successfully consummate our proposed acquisition of the BBH Investor Services business, we may fail to realize some or all of the anticipated benefits of the transaction or the benefits may take longer to realize than expected; We are subject to intense competition, which could negatively affect our profitability; We are subject to significant pricing pressure and variability in our financial results and our AUC/A and AUM; Our development and completion of new products and services, including State Street Digital or State Street Alpha, and the enhancement of our infrastructure required to meet increased regulatory and client expectations for resiliency and the systems and process re-engineering necessary to achieve improved productivity and reduced operating risk, may involve costs and dependencies and expose us to increased risk; Our business may be negatively affected by our failure to update and maintain our technology infrastructure; The COVID-19 pandemic continues to exacerbate certain risks and uncertainties for our business; Acquisitions, strategic alliances, joint ventures and divestitures, and the integration, retention and development of the benefits of our acquisitions, pose risks for our business; Competition for qualified members of our workforce is intense, and we may not be able to attract and retain the highly skilled people we need to support our business; We could be adversely affected by geopolitical, economic and market conditions; including, for example, as a result of the present war in Ukraine; We have significant International operations, and disruptions in European and Asian economies could have an adverse effect on our consolidated results of operations or financial condition; Our investment securities portfolio, consolidated financial condition and consolidated results of operations could be adversely affected by changes in the financial markets; Our business activities expose us to interest rate risk; We assume significant credit risk to counterparties, who may also have substantial financial dependencies with other financial institutions, and these credit exposures and concentrations could expose us to financial loss; Our fee revenue represents a significant portion of our consolidated revenue and is subject to decline based on, among other factors, market and currency declines, investment activities of our clients and their business mix; If we are unable to effectively manage our capital and liquidity, our consolidated financial condition, capital ratios, results of operations and business prospects could be adversely affected; We may need to raise additional capital or debt in the future, which may not be available to us or may only be available on unfavorable terms; If we experience a downgrade in our credit ratings, or an actual or perceived reduction in our financial strength, our borrowing and capital costs, liquidity and reputation could be adversely affected; Our business and capital-related activities, including common share repurchases, may be adversely affected by capital and liquidity standards required as a result of capital stress testing; We face extensive and changing government regulation in the jurisdictions in which we operate, which may increase our costs and compliance risks; We are subject to enhanced external oversight as a result of the resolution of prior regulatory or governmental matters; Our businesses may be adversely affected by government enforcement and litigation; Any misappropriation of the confidential information we possess could have an adverse impact on our business and could subject us to regulatory actions, litigation and other adverse effects; Our calculations of risk exposures, total RWA and capital ratios depend on data inputs, formulae, models, correlations and assumptions that are subject to change, which could materially impact our risk exposures, our total RWA and our capital ratios from period to period; Changes in accounting standards may adversely affect our consolidated financial statements; Changes in tax laws, rules or regulations, challenges to our tax positions and changes in the composition of our pre-tax earnings may increase our effective tax rate; The transition away from LIBOR may result in additional costs and increased risk exposure; Our control environment may be inadequate, fail or be circumvented, and operational risks could adversely affect our consolidated results of operations; Cost shifting to non-U.S. jurisdictions and outsourcing may expose us to increased operational risk, geopolitical risk and reputational harm and may not result in expected cost savings; Attacks or unauthorized access to our information technology systems or facilities, or those of the third parties with which we do business, or disruptions to our or their continuous operations, could result in significant costs, reputational damage and impacts on our business activities; Long-term contracts expose us to pricing and performance risk; Our businesses may be negatively affected by adverse publicity or other reputational harm; We may not be able to protect our intellectual property; The quantitative models we use to manage our business may contain errors that could result in material harm; Our reputation and business prospects may be damaged if our clients incur substantial losses or are restricted in redeeming their interests in investment pools that we sponsor or manage; The impacts of climate change, and regulatory responses to such risks, could adversely affect us; We may incur losses as a result of unforeseen events including terrorist attacks, natural disasters, the emergence of a new pandemic or acts of embezzlement. Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in our 2021 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this Presentation (and the conference call referenced herein) should not by relied on as representing our expectations or beliefs as of any time subsequent to the time this Presentation is first issued, and we do not undertake efforts to revise those forward-looking statements to reflect events after that time.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- State Street (STT) Said To Explore Acquisition Of Socgen Custody Arm - Bloomberg

- US Copper Corp. Announces Director Resignation

- Enable Drives Millions in Rebate ROI, 100% Growth of Rebate Programs According to Canalys Ecosystem Multiplier Study

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share