Form 8-K SEACOAST BANKING CORP For: Jul 22

SEACOAST REPORTS SECOND QUARTER 2021 RESULTS

Pipelines Expand Sequentially, in Line with a Flourishing Florida Economy

Record Quarter for Wealth Management, Interchange Income, and Growth in Transaction Account Balances

STUART, Fla., July 22, 2021 /GLOBE NEWSWIRE/ -- Seacoast Banking Corporation of Florida ("Seacoast" or the "Company") (NASDAQ: SBCF) today reported net income in the second quarter of 2021 of $31.4 million, or $0.56 per diluted share, a decrease of 7% compared to the first quarter of 2021, and an increase of 25% compared to the second quarter of 2020. Adjusted net income1 for the second quarter of 2021 was $33.3 million, or $0.59 per diluted share, a decrease of 6% compared to the first quarter of 2021, and an increase of 31% compared to the second quarter of 2020. The ratio of tangible common equity to tangible assets was 10.43%, tangible book value per share increased to $17.08 and Tier 1 capital increased to 18.3%.

For the second quarter of 2021, return on average tangible assets was 1.48%, return on average tangible shareholders' equity was 13.88%, and the efficiency ratio was 54.93%, compared to 1.70%, 15.62%, and 53.21%, respectively, in the prior quarter, and 1.37%, 13.47%, and 50.11%, respectively, in the prior year quarter. Adjusted return on average tangible assets1 in the second quarter of 2021 was 1.52%, adjusted return on average tangible shareholders' equity1 was 14.27%, and the adjusted efficiency ratio1 was 53.49%, compared to 1.75%, 16.01%, and 51.99%, respectively, in the prior quarter, and 1.33%, 13.09%, and 49.60%, respectively, in the prior year quarter.

Charles M. Shaffer, Seacoast's President and CEO, said, “Our investments over the last six months in commercial banking talent and technology are evident in the pipeline growth this quarter, and we continue to see strong economic expansion in our markets. Our transaction account balances have grown $860 million from the start of the year, a reflection of the strength of our customer franchise. While this significant growth in deposits is impacting our net interest margin, our low-cost funding base positions us for success as rates increase and as demand for credit continues to expand in the coming periods.”

Mr. Shaffer further commented, “We continue to steadily build shareholder value through consistent growth in our tangible book value per share, which has increased 13% year-over-year to $17.08, overcoming the challenge of the pandemic. The Company is committed to maintaining our fortress balance sheet, supported by a robust capital position and a strictly underwritten credit portfolio. Our prudent capital levels, low cost of funds, and ample liquidity support further disciplined organic growth and opportunistic acquisitions as we move forward.”

Financial Results

Income Statement

•Net income was $31.4 million, or $0.56 per diluted share for the second quarter of 2021, compared to $33.7 million, or $0.60, for the prior quarter, and $25.1 million, or $0.47, for the prior year quarter. For the six months ended June 30, 2021, net income was $65.1 million, or $1.17 per diluted share, compared to $25.8 million, or $0.49, for the six months ended June 30, 2020. Adjusted net income1 was $33.3 million, or $0.59 per diluted share for the second quarter of 2021, compared to $35.5 million, or $0.63, for the prior quarter, and $25.5 million, or $0.48, for the prior year quarter. For the six months ended June 30, 2021, adjusted net income1 was $68.7 million, or $1.23 per diluted share, compared to $30.9 million, or $0.59, for the six months ended June 30, 2020.

•Net revenues were $81.1 million in the second quarter of 2021, a decrease of $3.2 million, or 4%, compared to the prior quarter, and a decrease of $1.2 million, or 1%, compared to the prior year quarter. For the six months ended June 30, 2021, net revenues were $165.4 million, an increase of $5.3 million, or 3%, compared to the six months ended June 30, 2020. Adjusted revenues1 were $81.2 million in the second quarter of 2021, a decrease of $3.2 million, or 4%, from the prior quarter, and an increase of $0.1 million, or 0.2%, compared to the prior year quarter. For the six months ended June 30, 2021 net revenues were $165.6 million, an increase of $6.7 million, or 4%, compared to the six months ended June 30, 2020.

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

•Net interest income totaled $65.8 million in the second quarter of 2021, a decrease of $0.8 million, or 1%, from the prior quarter reflecting lower income from Paycheck Protection Program (“PPP”) loans, partially offset by lower interest expense on deposits. During the second quarter of 2021, net interest income included $5.1 million in interest and fees earned on PPP loans compared to $6.9 million in the first quarter of 2021. For the six months ended June 30, 2021, net interest income was $132.4 million, an increase of $2.0 million, or 2%, compared to the six months ended June 30, 2020. As of June 30, 2021, remaining deferred fees on PPP loans total $10.6 million, which will be recognized over the loans' remaining contractual maturity or earlier, as loans are forgiven.

•Net interest margin declined from 3.51% in the first quarter of 2021 to 3.23% in the second quarter of 2021, largely as the result of significant growth in transaction account deposit balances during the second quarter. This increase in funding occurred across our customer base at near-zero rates, as new clients were onboarded and existing clients continue to see expansion in cash balances. The resulting increase in liquidity negatively impacted net interest margin by 23 basis points. Excluding this increase in liquidity, the remaining decline in net interest margin is attributed to lower PPP interest and fees as a result of declining balances as PPP loans are forgiven. Excess liquidity has been partially invested through securities purchases; however, cash deployment remains disciplined and prudent, with careful reinvestment of liquidity over time. Securities yields declined by only two basis points to 1.63% in the second quarter of 2021. Non-PPP loan yields declined by only one basis point to 4.36% during the second quarter of 2021. Offsetting and favorable was the decline in the cost of deposits from 13 basis points in the first quarter of 2021 to eight basis points in the second quarter of 2021. The effect on net interest margin of accretion of purchase discounts on acquired loans was an increase of 14 basis points in the second quarter compared to an increase of 15 basis points in the prior quarter. The effect on net interest margin of interest and fees on PPP loans was an increase of six basis points in the second quarter and an increase of 11 basis points in the prior quarter.

•Noninterest income totaled $15.3 million in the second quarter of 2021, a decrease of $2.3 million, or 13%, compared to the prior quarter, and an increase of $0.3 million, or 2%, compared to the prior year quarter. For the six months ended June 30, 2021, noninterest income was $33.0 million, an increase of $3.3 million, or 11%, compared to the six months ended June 30, 2020. Results for the second quarter of 2021 included the following:

▪Interchange revenue reached a new record of $4.1 million, compared to $3.8 million in the prior quarter, reflecting higher transactional volume and higher per-card spending, both indicative of the strength and confidence in our consumer and small business franchise.

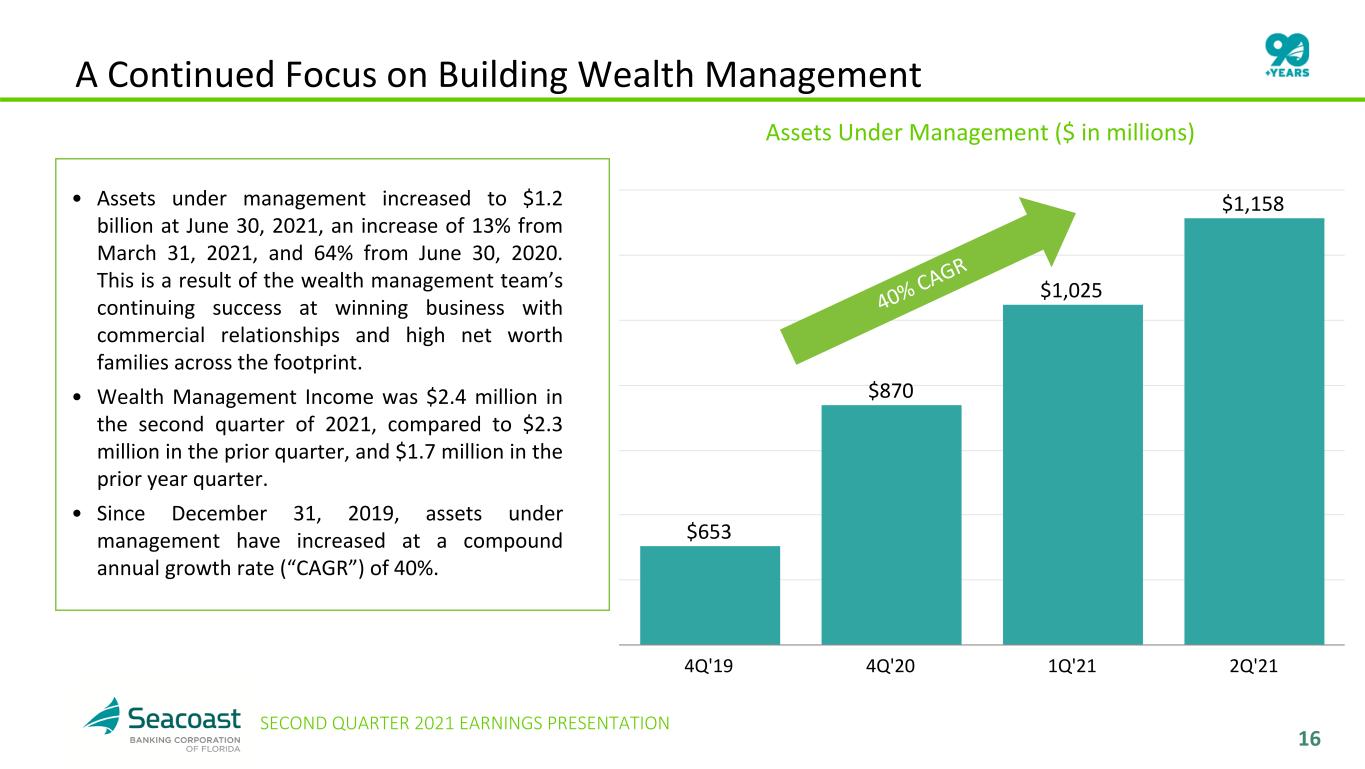

▪Wealth management income increased to a record $2.4 million in the current quarter, compared to $2.3 million in the first quarter of 2021. The team continues to deliver strong growth in assets under management, which increased $133 million quarter-over-quarter, bringing total assets under management to $1.2 billion. The team is successfully winning business with commercial relationships and high net worth families across the Company’s footprint.

▪Mortgage banking fees were $3.0 million, compared to $4.2 million in the prior quarter, due to slowing refinance activity and low housing inventory levels.

▪Other income declined by $1.5 million in the second quarter of 2021, reflecting the impact in the first quarter of 2021 of $1.7 million in income associated with the resolution of contingencies on two loans acquired in 2017.

•The provision for credit losses was a net benefit of $4.9 million in the second quarter of 2021, compared to a net benefit of $5.7 million in the prior quarter, and provision expense of $7.6 million in the prior year quarter. The ratio of allowance for credit losses to total loans declined to 1.49% at June 30, 2021, compared to 1.53% at March 31, 2021 and 1.58% at June 30, 2020. Excluding PPP loans, the ratio declined to 1.60% at June 30, 2021, compared to 1.71% at March 31, 2021 and 1.76% at June 30, 2020, reflecting a continued improvement in the economic outlook.

•Noninterest expense was $45.8 million in the second quarter of 2021, a decrease of $0.3 million, or 1%, compared to the prior quarter, and an increase of $3.4 million, or 8%, compared to the prior year quarter. For the six months ended June 30, 2021, noninterest expense was $91.9 million, an increase of $1.7 million, or 2%,

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

compared to the six months ended June 30, 2020. Changes from the first quarter of 2021 consisted of the following:

▪Salaries and wages increased $1.6 million, or 7%, to $23.0 million. In the first quarter of 2021, PPP loan production resulted in higher deferrals of related salary costs, impacting the first quarter by $1.9 million. This deferral slowed in the second quarter, as the PPP program ended.

▪Employee benefits decreased $1.0 million, or 21%, with the prior quarter reflecting the seasonal impact of higher payroll taxes and 401(k) plan contributions.

▪Occupancy expenses decreased $0.5 million, or 13%. Three branch consolidations were completed in the first quarter of 2021, resulting in associated charges in the first quarter of $0.3 million.

▪Legal and professional fees decreased by $0.4 million, or 15%, compared to the first quarter, reflecting lower legal fees, including a $0.1 million decrease in merger-related costs.

•Seacoast recorded $8.8 million of income tax expense in the second quarter of 2021, compared to $10.2 million in the prior quarter and $7.2 million in the second quarter of 2020. A tax benefit related to stock-based compensation totaled $0.6 million in the second quarter of 2021, compared to a tax benefit of $0.1 million in the first quarter of 2021, and tax expense of $0.2 million in the second quarter of 2020.

•The ratio of net adjusted noninterest expense1 to average tangible assets was 1.98% in the second quarter of 2021, compared to 2.16% in the prior quarter and 2.11% in the second quarter of 2020.

•The efficiency ratio was 54.93% compared to 53.21% in the prior quarter and 50.11% in the prior year quarter. The adjusted efficiency ratio1 was 53.49% compared to 51.99% in the prior quarter and 49.60% in the prior year quarter. The Company remains committed to efficiency through disciplined, proactive management of its cost structure.

Balance Sheet

•At June 30, 2021, the Company had total assets of $9.3 billion and total shareholders' equity of $1.2 billion. Book value per share increased to $21.33 from $20.89 on March 31, 2021, and $19.45 on June 30, 2020. Tangible book value per share of $17.08 on June 30, 2021 has increased 11% on an annualized basis compared to March 31, 2021, and 13% compared to June 30, 2020.

•Debt securities totaled $1.8 billion on June 30, 2021, an increase of $252.5 million, or 16%, compared to March 31, 2021. Purchases during the quarter were primarily in agency-issued collateralized mortgage obligations and had an average yield of 1.39% and a duration of 3.1 years. The Company continues to take a prudent and disciplined approach to reinvesting liquidity.

•Loans totaled $5.4 billion on June 30, 2021, a decrease of $224.4 million, or 4%, compared to March 31, 2021. The decrease includes $243.0 million in PPP loan forgiveness during the second quarter of 2021. Removing the impact of declines in PPP loans outstanding, loans declined only $6.9 million from the prior quarter.

•Loan originations, excluding PPP, were $456.5 million in the second quarter of 2021, compared to $436.0 million in the first quarter of 2021, an increase of 5%.

▪Commercial originations during the second quarter of 2021 were $193.0 million, compared to $204.3 million in the first quarter of 2021 and $106.9 million in the second quarter of 2020.

▪Consumer originations in the second quarter of 2021 increased to $63.7 million from $46.7 million in the first quarter of 2021, and $58.0 million in the second quarter of 2020.

▪Residential loans originated for sale in the secondary market totaled $120.1 million in the second quarter of 2021, compared to $138.3 million in the first quarter of 2021, and $122.5 million in the second quarter of 2020. While we expect to continue to see the benefit of the inflow of new residents and businesses into Florida, refinance activity has slowed from the peaks seen in the last several quarters, and housing inventory is low.

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

▪Closed residential loans retained in the portfolio totaled $79.7 million in the second quarter of 2021, compared to $46.6 million in the first quarter of 2021, and $23.5 million in the second quarter of 2020.

•Pipelines (loans in underwriting and approval or approved and not yet closed) totaled $468.5 million on June 30, 2021, an increase of 8% from March 31, 2021 and an increase of 83% from June 30, 2020.

▪Commercial pipelines were $322.0 million as of June 30, 2021, an increase of 34% from $240.9 million at March 31, 2021 and an increase of 175% from $117.0 million at June 30, 2020. With significant economic growth in the State of Florida and the addition of top talent across our footprint, we expect production to increase in the second half of 2021.

▪Consumer pipelines were $31.7 million as of June 30, 2021, compared to $28.1 million at March 31, 2021 and $30.6 million at June 30, 2020.

▪Residential saleable pipelines were $60.6 million as of June 30, 2021, compared to $92.1 million at March 31, 2021 and $94.7 million at June 30, 2020. Retained residential pipelines were $54.1 million as of June 30, 2021, compared to $72.4 million at March 31, 2021 and $13.2 million at June 30, 2020.

•Total deposits were $7.8 billion as of June 30, 2021, an increase of $450.7 million, or 6%, compared to March 31, 2021.

▪The overall cost of deposits declined to 8 basis points in the second quarter of 2021 from 13 basis points in the prior quarter.

▪Total transaction account balances increased $382.9 million, or 9%, quarter-over-quarter, and at June 30, 2021 represent 60% of overall deposit funding. The increase in funding occurred across our customer base at near-zero rates, as new clients were onboarded and existing clients continue to see expansion in cash balances.

▪Interest-bearing deposits (interest-bearing demand, savings, and money market deposits) increased $295.1 million, or 7%, quarter-over-quarter to $4.4 billion, noninterest-bearing demand deposits increased $266.9 million, or 10%, to $3.0 billion, and CDs (excluding brokered) declined $37.8 million, or 7%, to $481.7 million.

▪As of June 30, 2021, deposits per banking center were $163 million, compared to $154 million at March 31, 2021 and $133 million on June 30, 2020.

Asset Quality

•Nonperforming loans decreased by $2.4 million to $32.9 million at June 30, 2021. Nonperforming loans to total loans outstanding were 0.61% at June 30, 2021, 0.62% at March 31, 2021, and 0.52% at June 30, 2020.

•Nonperforming assets to total assets were 0.49% at June 30, 2021, 0.58% at March 31, 2021, and 0.57% at June 30, 2020.

•The ratio of allowance for credit losses to total loans was 1.49% at June 30, 2021, 1.53% at March 31, 2021, and 1.58% at June 30, 2020. Excluding PPP loans, the ratio of allowance for credit losses to total loans at June 30, 2021, was 1.60%, compared to 1.71% at March 31, 2021 and 1.76% at June 30, 2020. The decline in coverage reflects continued improvement in the economic outlook.

•Net charge-offs were $0.7 million, or 0.05%, of average loans for the second quarter of 2021 compared to $0.4 million, or 0.03%, of average loans in the first quarter of 2021 and $1.8 million, or 0.12%, of average loans in the second quarter of 2020. Net charge-offs for the four most recent quarters averaged 0.10%.

•Portfolio diversification, in terms of asset mix, industry, and loan type, has been a critical element of the Company's lending strategy. Exposure across industries and collateral types is broadly distributed. Excluding PPP loans, Seacoast's average commercial loan size is $420 thousand, reflecting an ability to maintain granularity within the overall loan portfolio.

•Construction and land development and commercial real estate loans remain well below regulatory guidance at 24% and 164% of total bank-level risk-based capital, respectively, compared to 23% and 168%

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

respectively, in the first quarter of 2021. On a consolidated basis, construction and land development and commercial real estate loans represent 22% and 150%, respectively, of total consolidated risk-based capital.

Capital and Liquidity

•The tier 1 capital ratio increased to 18.3% from 18.1% at March 31, 2021, and 16.4% at June 30, 2020. The total capital ratio was 19.2% and the tier 1 leverage ratio was 11.7% at June 30, 2021.

•Cash and cash equivalents at June 30, 2021 totaled $1.4 billion, an increase of $469.5 million, or 48%, from March 31, 2021, largely the result of increased deposit balances during the quarter.

•Tangible common equity to tangible assets was 10.43% at June 30, 2021, compared to 10.71% at March 31, 2021 and 10.19% at June 30, 2020. The ratio declined quarter-over-quarter largely as a result of a continued increase in liquidity on the balance sheet. The Company will deploy this liquidity in a disciplined and prudent manner.

•At June 30, 2021, the Company had available unsecured lines of credit of $135.0 million and lines of credit under lendable collateral value of $1.7 billion. Additionally, $1.5 billion of debt securities and $688.4 million of residential and commercial real estate loans are available as collateral for potential borrowings.

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

| FINANCIAL HIGHLIGHTS | ||||||||||||||||||||||||||||||||

| (Amounts in thousands except per share data) | (Unaudited) | |||||||||||||||||||||||||||||||

| Quarterly Trends | ||||||||||||||||||||||||||||||||

| 2Q'21 | 1Q'21 | 4Q'20 | 3Q'20 | 2Q'20 | ||||||||||||||||||||||||||||

| Selected Balance Sheet Data: | ||||||||||||||||||||||||||||||||

| Total Assets | $ | 9,316,833 | $ | 8,811,820 | $ | 8,342,392 | $ | 8,287,840 | $ | 8,084,013 | ||||||||||||||||||||||

| Gross Loans | 5,437,049 | 5,661,492 | 5,735,349 | 5,858,029 | 5,772,052 | |||||||||||||||||||||||||||

| Total Deposits | 7,836,436 | 7,385,749 | 6,932,561 | 6,914,843 | 6,666,783 | |||||||||||||||||||||||||||

| Performance Measures: | ||||||||||||||||||||||||||||||||

| Net Income | $ | 31,410 | $ | 33,719 | $ | 29,347 | $ | 22,628 | $ | 25,080 | ||||||||||||||||||||||

| Net Interest Margin | 3.23 | % | 3.51 | % | 3.59 | % | 3.40 | % | 3.70 | % | ||||||||||||||||||||||

| Average Diluted Shares Outstanding | 55,901 | 55,992 | 55,739 | 54,301 | 53,308 | |||||||||||||||||||||||||||

| Diluted Earnings Per Share (EPS) | $ | 0.56 | $ | 0.60 | $ | 0.53 | $ | 0.42 | $ | 0.47 | ||||||||||||||||||||||

| Return on (annualized): | ||||||||||||||||||||||||||||||||

| Average Assets (ROA) | 1.40 | % | 1.61 | % | 1.39 | % | 1.11 | % | 1.27 | % | ||||||||||||||||||||||

Average Tangible Assets (ROTA)2 | 1.48 | 1.70 | 1.49 | 1.20 | 1.37 | |||||||||||||||||||||||||||

Average Tangible Common Equity (ROTCE)2 | 13.88 | 15.62 | 13.87 | 11.35 | 13.47 | |||||||||||||||||||||||||||

Tangible Common Equity to Tangible Assets2 | 10.43 | 10.71 | 11.01 | 10.67 | 10.19 | |||||||||||||||||||||||||||

Tangible Book Value Per Share2 | $ | 17.08 | $ | 16.62 | $ | 16.16 | $ | 15.57 | $ | 15.11 | ||||||||||||||||||||||

| Efficiency Ratio | 54.93 | % | 53.21 | % | 48.23 | % | 61.65 | % | 50.11 | % | ||||||||||||||||||||||

Adjusted Operating Measures1: | ||||||||||||||||||||||||||||||||

| Adjusted Net Income | $ | 33,251 | $ | 35,497 | $ | 30,700 | $ | 27,336 | $ | 25,452 | ||||||||||||||||||||||

| Adjusted Diluted EPS | 0.59 | 0.63 | 0.55 | 0.50 | 0.48 | |||||||||||||||||||||||||||

Adjusted ROTA2 | 1.52 | % | 1.75 | % | 1.50 | % | 1.38 | % | 1.33 | % | ||||||||||||||||||||||

Adjusted ROTCE2 | 14.27 | 16.01 | 14.00 | 13.06 | 13.09 | |||||||||||||||||||||||||||

| Adjusted Efficiency Ratio | 53.49 | 51.99 | 48.75 | 54.82 | 49.60 | |||||||||||||||||||||||||||

Net Adjusted Noninterest Expense as a Percent of Average Tangible Assets2 | 1.98 | 2.16 | 2.00 | 2.24 | 2.11 | |||||||||||||||||||||||||||

| Other Data: | ||||||||||||||||||||||||||||||||

Market capitalization3 | $ | 1,893,141 | $ | 2,003,866 | $ | 1,626,913 | $ | 994,690 | $ | 1,081,009 | ||||||||||||||||||||||

| Full-time equivalent employees | 946 | 953 | 965 | 968 | 924 | |||||||||||||||||||||||||||

| Number of ATMs | 75 | 75 | 77 | 77 | 76 | |||||||||||||||||||||||||||

| Full-service banking offices | 48 | 48 | 51 | 51 | 50 | |||||||||||||||||||||||||||

| Registered online users | 129,568 | 126,352 | 123,615 | 121,620 | 117,273 | |||||||||||||||||||||||||||

| Registered mobile devices | 122,815 | 117,959 | 115,129 | 110,241 | 108,062 | |||||||||||||||||||||||||||

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. | ||||||||||||||||||||||||||||||||

2The Company defines tangible assets as total assets less intangible assets, and tangible common equity as total shareholders' equity less intangible assets. | ||||||||||||||||||||||||||||||||

3Common shares outstanding multiplied by closing bid price on last day of each period. | ||||||||||||||||||||||||||||||||

Second Quarter Strategic Highlights

Legacy Bank of Florida Acquisition

Seacoast’s balanced growth strategy, combining organic growth with value-creating acquisitions, continues to benefit shareholders and expand the franchise across Florida. The upcoming acquisition of Legacy Bank of Florida, which is expected to close in the third quarter of 2021, will add experienced bankers in the rapidly growing South Florida market, and should further support disciplined, profitable growth for the Company.

Capitalizing on Seacoast’s Early Commitment to Digital Transformation

•Seacoast and its customers are benefiting from the Company’s automated online PPP forgiveness solution, which streamlines the process for clients while integrating with Seacoast’s existing technology infrastructure. In the second quarter of 2021, Seacoast processed $243 million in PPP loan forgiveness.

•The Company completed a significant investment in its nCino digital commercial loan origination platform. This investment will accelerate speed to market, provide a quicker renewal process, and provide a streamlined workflow for bankers and underwriters.

Scaling and Evolving Our Culture

•Seacoast recently announced the continued expansion of its commercial banking leadership team with three new additions, each bringing significant market expertise and has been successful in developing high performing commercial banking teams.

•James Norton joined Seacoast as executive vice president and commercial real estate executive. James brings 20 years of experience in commercial real estate to Seacoast Bank. Most recently, James served as a real estate banking director covering the Mid-Atlantic market at JPMorgan Chase. He previously served in executive positions with the BB&T Corporation, IronStone Bank, and SunTrust Bank in the Southeast region. Based out of Tampa, James led the expansion of BB&T’s commercial real estate business in Florida prior to relocating to the Mid-Atlantic region.

•Chris Rolle joined Seacoast as president of the West Florida region, covering the west coast from the Tampa Bay area to Naples-Ft. Myers. Rolle is a former executive at Synovus Bank, Florida Community Bank, and the BB&T Corporation covering both the Tampa-St. Petersburg and Orlando MSAs.

•Robert Hursh joined Seacoast as market president for Pinellas County (St. Petersburg/Clearwater). Robert, a Pinellas County native, has more than 20 years of experience in leading commercial banking teams in the Tampa-St. Petersburg MSA, most recently as senior vice president with Synovus Bank.

•The Company also added two new operational leaders to support growth.

•Anthony Cavallaro joined Seacoast as senior vice president and operations executive and brings more than 25 years of experience, having led operations and risk management teams at Civista Bank and KeyBank.

•Robert Walla joined Seacoast as senior vice president and director of loan operations. Bob brings 30 years of operations leadership, most recently at First Midwest Bank in Chicago, Illinois.

•During the second quarter, Seacoast Bank was named among the Orlando Business Journal's 2021 Best Places to Work. This recognition acknowledges Seacoast’s commitment to employees’ well-being, especially throughout the pandemic, as well as the Company’s numerous diversity and inclusion initiatives.

•Seacoast was also recently recognized as part of the Human Rights Campaign Foundation’s 2021 Corporate Equality Index as a Best Place to Work for LGBTQ Equality, earning a top score of 100%.

OTHER INFORMATION

Conference Call Information

Seacoast will host a conference call on July 23, 2021 at 10:00 a.m. (Eastern Time) to discuss the second quarter 2021 earnings results and business trends. Investors may call in (toll-free) by dialing (800) 774-6070 (passcode: 7461 099#; host: Charles Shaffer). Charts will be used during the conference call and may be accessed at Seacoast's website at www.SeacoastBanking.com by selecting "Presentations" under the heading "News/Events." A replay of the call will be available for one month, beginning late afternoon on July 23, 2021, and can be accessed via a link at www.SeacoastBanking.com under the heading “Corporate Information,” using the passcode 50182591.

Alternatively, individuals may listen to the live webcast of the presentation by visiting Seacoast's website at www.SeacoastBanking.com. The link is located in the subsection "Presentations" under the heading “Corporate Information.” Beginning late afternoon on July 23, 2021, an archived version of the webcast can be accessed from this same subsection of the website. The archived webcast will be available for one year.

About Seacoast Banking Corporation of Florida (NASDAQ: SBCF)

Seacoast Banking Corporation of Florida is one of the largest community banks headquartered in Florida with approximately $9.3 billion in assets and $7.8 billion in deposits as of June 30, 2021. The Company provides integrated financial services including commercial and retail banking, wealth management, and mortgage services to customers through advanced banking solutions, and 48 traditional branches of its locally-branded, wholly-owned subsidiary bank, Seacoast National Bank. Offices stretch from Fort Lauderdale, Boca Raton and West Palm Beach north through the Daytona Beach area, into Orlando and Central Florida and the adjacent Tampa market, and west to Okeechobee and surrounding counties. More information about the Company is available at www.SeacoastBanking.com.

Additional Information

Seacoast has filed a registration statement on Form S-4, as amended, with the United States Securities and Exchange Commission (the "SEC") in connection with the proposed merger of Legacy Bank of Florida ("Legacy Bank") with and into Seacoast Bank. The registration statement in connection with the Legacy Bank merger includes a proxy statement of Legacy Bank and a prospectus of Seacoast. A definitive proxy statement/prospectus has been mailed to shareholders of Legacy Bank. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. WE URGE INVESTORS TO READ THE PROXY STATEMENTS/PROSPECTUSES AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENTS/PROSPECTUSES BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Investors may obtain (when available) these documents free of charge at the SEC’s website (www.sec.gov). In addition, documents filed with the SEC by Seacoast will be available free of charge by contacting Investor Relations at (772) 288-6085.

Legacy Bank, its directors, and executive officers and other members of management and employees may be considered participants in the solicitation of proxies in connection with the proposed merger of Legacy Bank with and into Seacoast Bank. Information regarding the participants in the proxy solicitation of Legacy Bank and a description of its direct and indirect interests, by security holdings or otherwise, is contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC.

Cautionary Notice Regarding Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning, and protections, of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including, without limitation, statements about future financial and operating results, loan growth, cost savings, enhanced revenues, economic and seasonal conditions in our markets, and improvements to reported earnings that may be realized from cost controls, tax law changes, new initiatives and for integration of banks that we have acquired, or expect to acquire, including Legacy Bank of Florida, as well as statements with respect to Seacoast's objectives, strategic plans,

expectations and intentions and other statements that are not historical facts, any of which may be impacted by the COVID-19 pandemic and any variants thereof and related effects on the U.S. economy. Actual results may differ from those set forth in the forward-looking statements.

Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the actual results, performance or achievements of Seacoast to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. You should not expect us to update any forward-looking statements.

All statements other than statements of historical fact could be forward-looking statements. You can identify these forward-looking statements through our use of words such as "may", "will", "anticipate", "assume", "should", "support", "indicate", "would", "believe", "contemplate", "expect", "estimate", "continue", "further", "plan", "point to", "project", "could", "intend", "target" or other similar words and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, without limitation: the effects of future economic and market conditions, including seasonality and the adverse impact of COVID-19 (economic and otherwise); governmental monetary and fiscal policies, including interest rate policies of the Board of Governors of the Federal Reserve, as well as legislative, tax and regulatory changes, including those that impact the money supply and inflation; changes in accounting policies, rules and practices, including the impact of the adoption of CECL; our participation in the Paycheck Protection Program ("PPP"); the risks of changes in interest rates on the level and composition of deposits, loan demand, liquidity and the values of loan collateral, securities, and interest sensitive assets and liabilities; interest rate risks, sensitivities and the shape of the yield curve; uncertainty related to the impact of LIBOR calculations on securities and loans; changes in borrower credit risks and payment behaviors; changing retail distribution strategies, customer preferences and behavior; changes in the availability and cost of credit and capital in the financial markets; changes in the prices, values and sales volumes of residential and commercial real estate; our ability to comply with any regulatory requirements; the effects of problems encountered by other financial institutions that adversely affect us or the banking industry; our concentration in commercial real estate loans; inaccuracies or other failures from the use of models, including the failure of assumptions and estimates, as well as differences in, and changes to, economic, market and credit conditions; the impact on the valuation of our investments due to market volatility or counterparty payment risk; statutory and regulatory dividend restrictions; increases in regulatory capital requirements for banking organizations generally; the risks of mergers, acquisitions and divestitures, including our ability to continue to identify acquisition targets and successfully acquire desirable financial institutions; changes in technology or products that may be more difficult, costly, or less effective than anticipated; our ability to identify and address increased cybersecurity risks; inability of our risk management framework to manage risks associated with our business; dependence on key suppliers or vendors to obtain equipment or services for our business on acceptable terms; reduction in or the termination of our ability to use the mobile-based platform that is critical to our business growth strategy; the effects of war or other conflicts, acts of terrorism, natural disasters, health emergencies, epidemics or pandemics, or other catastrophic events that may affect general economic conditions; unexpected outcomes of and the costs associated with, existing or new litigation involving us; our ability to maintain adequate internal controls over financial reporting; potential claims, damages, penalties, fines and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the risks that our deferred tax assets could be reduced if estimates of future taxable income from our operations and tax planning strategies are less than currently estimated and sales of our capital stock could trigger a reduction in the amount of net operating loss carryforwards that we may be able to utilize for income tax purposes; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions operating in our market areas and elsewhere, including institutions operating regionally, nationally and internationally, together with such competitors offering banking products and services by mail, telephone, computer and the Internet; and the failure of assumptions underlying the establishment of reserves for possible loan losses.

The risks relating to the Legacy Bank of Florida proposed merger include, without limitation: the timing to consummate the proposed merger; the risk that a condition to closing of the proposed merger may not be satisfied; the risk that the merger is not completed at all; the diversion of management time on issues related to the proposed merger; unexpected transaction costs, including the costs of integrating operations; the risks that the businesses will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; the potential failure to fully or timely realize expected revenues and revenue synergies, including as the result of revenues following the merger being lower than expected; the risk of deposit and customer attrition; any changes in deposit mix; unexpected operating and other costs, which may differ or change from expectation; the risk of customer and employee loss and business disruptions, including, without limitation, as the result of difficulties in maintaining relationships with employees; increased competitive pressures on solicitations of customers by competitors; as well as difficulties and risks inherent with entering new markets.

Actual results and capital and other financial conditions may differ materially from those included in these statements due to a variety of factors. These factors include, among others described above, macroeconomic and other challenges and uncertainties related to the COVID-19 pandemic, such as the duration and severity of the impact on public health, the U.S. and global economies, financial markets and consumer and corporate customers and clients, including economic activity and employment, as well as the various actions taken in response by governments, central banks and others, including Seacoast, and the precautionary statements included in this release.

All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in our annual report on Form 10-K for the year ended December 31, 2020 and quarterly report on Form 10-Q for the quarter ended March 31, 2021 under "Special Cautionary Notice Regarding Forward-looking Statements" and "Risk Factors", and otherwise in our SEC reports and filings. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC's Internet website at www.sec.gov.

| FINANCIAL HIGHLIGHTS | (Unaudited) | |||||||||||||||||||||||||||||||||||||||||||

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||||||||||||||

| Quarterly Trends | Six Months Ended | |||||||||||||||||||||||||||||||||||||||||||

| (Amounts in thousands, except ratios and per share data) | 2Q'21 | 1Q'21 | 4Q'20 | 3Q'20 | 2Q'20 | 2Q'21 | 2Q'20 | |||||||||||||||||||||||||||||||||||||

| Summary of Earnings | ||||||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 31,410 | $ | 33,719 | $ | 29,347 | $ | 22,628 | $ | 25,080 | $ | 65,129 | $ | 25,789 | ||||||||||||||||||||||||||||||

Adjusted net income1 | 33,251 | 35,497 | 30,700 | 27,336 | 25,452 | 68,748 | 30,914 | |||||||||||||||||||||||||||||||||||||

Net interest income2 | 65,933 | 66,741 | 68,903 | 63,621 | 67,388 | 132,674 | 130,679 | |||||||||||||||||||||||||||||||||||||

Net interest margin2,3 | 3.23 | % | 3.51 | % | 3.59 | % | 3.40 | % | 3.70 | % | 3.37 | % | 3.81 | % | ||||||||||||||||||||||||||||||

| Performance Ratios | ||||||||||||||||||||||||||||||||||||||||||||

Return on average assets-GAAP basis3 | 1.40 | % | 1.61 | % | 1.39 | % | 1.11 | % | 1.27 | % | 1.50 | % | 0.69 | % | ||||||||||||||||||||||||||||||

Return on average tangible assets-GAAP basis3,4 | 1.48 | 1.70 | 1.49 | 1.20 | 1.37 | 1.58 | 0.78 | |||||||||||||||||||||||||||||||||||||

Adjusted return on average tangible assets1,3,4 | 1.52 | 1.75 | 1.50 | 1.38 | 1.33 | 1.63 | 0.86 | |||||||||||||||||||||||||||||||||||||

Net adjusted noninterest expense to average tangible assets1,3,4 | 1.98 | 2.16 | 2.00 | 2.24 | 2.11 | 2.07 | 2.28 | |||||||||||||||||||||||||||||||||||||

Return on average shareholders' equity-GAAP basis3 | 10.76 | 12.03 | 10.51 | 8.48 | 9.96 | 11.39 | 5.17 | |||||||||||||||||||||||||||||||||||||

Return on average tangible common equity-GAAP basis3,4 | 13.88 | 15.62 | 13.87 | 11.35 | 13.47 | 14.73 | 7.27 | |||||||||||||||||||||||||||||||||||||

Adjusted return on average tangible common equity1,3,4 | 14.27 | 16.01 | 14.00 | 13.06 | 13.09 | 15.12 | 8.02 | |||||||||||||||||||||||||||||||||||||

Efficiency ratio5 | 54.93 | 53.21 | 48.23 | 61.65 | 50.11 | 54.05 | 54.88 | |||||||||||||||||||||||||||||||||||||

Adjusted efficiency ratio1 | 53.49 | 51.99 | 48.75 | 54.82 | 49.60 | 52.72 | 51.53 | |||||||||||||||||||||||||||||||||||||

| Noninterest income to total revenue (excluding securities gains/losses) | 18.94 | 21.07 | 17.85 | 21.06 | 17.00 | 20.03 | 17.90 | |||||||||||||||||||||||||||||||||||||

Tangible common equity to tangible assets4 | 10.43 | 10.71 | 11.01 | 10.67 | 10.19 | 10.43 | 10.19 | |||||||||||||||||||||||||||||||||||||

| Average loan-to-deposit ratio | 74.13 | 81.39 | 84.48 | 87.83 | 88.48 | 77.62 | 90.59 | |||||||||||||||||||||||||||||||||||||

| End of period loan-to-deposit ratio | 69.93 | 77.48 | 83.72 | 85.77 | 87.40 | 69.93 | 87.40 | |||||||||||||||||||||||||||||||||||||

| Per Share Data | ||||||||||||||||||||||||||||||||||||||||||||

| Net income diluted-GAAP basis | $ | 0.56 | $ | 0.60 | $ | 0.53 | $ | 0.42 | $ | 0.47 | $ | 1.17 | $ | 0.49 | ||||||||||||||||||||||||||||||

| Net income basic-GAAP basis | 0.57 | 0.61 | 0.53 | 0.42 | 0.47 | 1.18 | 0.49 | |||||||||||||||||||||||||||||||||||||

Adjusted earnings1 | 0.59 | 0.63 | 0.55 | 0.50 | 0.48 | 1.23 | 0.59 | |||||||||||||||||||||||||||||||||||||

| Book value per share common | 21.33 | 20.89 | 20.46 | 19.91 | 19.45 | 21.33 | 19.45 | |||||||||||||||||||||||||||||||||||||

| Tangible book value per share | 17.08 | 16.62 | 16.16 | 15.57 | 15.11 | 17.08 | 15.11 | |||||||||||||||||||||||||||||||||||||

| Cash dividends declared | 0.13 | — | — | — | — | 0.13 | — | |||||||||||||||||||||||||||||||||||||

1Non-GAAP measure - see "Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. | ||||||||||||||||||||||||||||||||||||||||||||

2Calculated on a fully taxable equivalent basis using amortized cost. | ||||||||||||||||||||||||||||||||||||||||||||

3These ratios are stated on an annualized basis and are not necessarily indicative of future periods. | ||||||||||||||||||||||||||||||||||||||||||||

4The Company defines tangible assets as total assets less intangible assets, and tangible common equity as total shareholders' equity less intangible assets. | ||||||||||||||||||||||||||||||||||||||||||||

5Defined as noninterest expense less amortization of intangibles and gains, losses, and expenses on foreclosed properties divided by net operating revenue (net interest income on a fully taxable equivalent basis plus noninterest income excluding securities gains and losses). | ||||||||||||||||||||||||||||||||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME | (Unaudited) | |||||||||||||||||||||||||||||||||||||||||||

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||||||||||||||

| Quarterly Trends | Six Months Ended | |||||||||||||||||||||||||||||||||||||||||||

| (Amounts in thousands, except per share data) | 2Q'21 | 1Q'21 | 4Q'20 | 3Q'20 | 2Q'20 | 2Q'21 | 2Q'20 | |||||||||||||||||||||||||||||||||||||

| Interest on securities: | ||||||||||||||||||||||||||||||||||||||||||||

| Taxable | $ | 6,559 | $ | 6,298 | $ | 6,477 | $ | 6,972 | $ | 7,573 | $ | 12,857 | $ | 16,269 | ||||||||||||||||||||||||||||||

| Nontaxable | 147 | 148 | 86 | 125 | 121 | 295 | 243 | |||||||||||||||||||||||||||||||||||||

| Fees on PPP loans | 3,877 | 5,390 | 3,603 | 161 | 4,010 | 9,267 | 4,010 | |||||||||||||||||||||||||||||||||||||

| Interest on PPP loans | 1,251 | 1,496 | 1,585 | 1,558 | 1,058 | 2,747 | 1,058 | |||||||||||||||||||||||||||||||||||||

| Interest and fees on loans - excluding PPP loans | 55,220 | 55,412 | 60,407 | 58,768 | 59,776 | 110,632 | 123,216 | |||||||||||||||||||||||||||||||||||||

| Interest on federal funds sold and other investments | 709 | 586 | 523 | 556 | 684 | 1,295 | 1,418 | |||||||||||||||||||||||||||||||||||||

| Total Interest Income | 67,763 | 69,330 | 72,681 | 68,140 | 73,222 | 137,093 | 146,214 | |||||||||||||||||||||||||||||||||||||

| Interest on deposits | 980 | 1,065 | 1,228 | 1,299 | 1,203 | 2,045 | 4,393 | |||||||||||||||||||||||||||||||||||||

| Interest on time certificates | 524 | 1,187 | 2,104 | 2,673 | 3,820 | 1,711 | 8,588 | |||||||||||||||||||||||||||||||||||||

| Interest on borrowed money | 457 | 468 | 558 | 665 | 927 | 925 | 2,784 | |||||||||||||||||||||||||||||||||||||

| Total Interest Expense | 1,961 | 2,720 | 3,890 | 4,637 | 5,950 | 4,681 | 15,765 | |||||||||||||||||||||||||||||||||||||

| Net Interest Income | 65,802 | 66,610 | 68,791 | 63,503 | 67,272 | 132,412 | 130,449 | |||||||||||||||||||||||||||||||||||||

| Provision for credit losses | (4,855) | (5,715) | 1,900 | (845) | 7,611 | (10,570) | 37,124 | |||||||||||||||||||||||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 70,657 | 72,325 | 66,891 | 64,348 | 59,661 | 142,982 | 93,325 | |||||||||||||||||||||||||||||||||||||

| Noninterest income: | ||||||||||||||||||||||||||||||||||||||||||||

| Service charges on deposit accounts | 2,338 | 2,338 | 2,423 | 2,242 | 1,939 | 4,676 | 4,764 | |||||||||||||||||||||||||||||||||||||

| Interchange income | 4,145 | 3,820 | 3,596 | 3,682 | 3,187 | 7,965 | 6,433 | |||||||||||||||||||||||||||||||||||||

| Wealth management income | 2,387 | 2,323 | 1,949 | 1,972 | 1,719 | 4,710 | 3,586 | |||||||||||||||||||||||||||||||||||||

| Mortgage banking fees | 2,977 | 4,225 | 3,646 | 5,283 | 3,559 | 7,202 | 5,767 | |||||||||||||||||||||||||||||||||||||

| Marine finance fees | 177 | 189 | 145 | 242 | 157 | 366 | 303 | |||||||||||||||||||||||||||||||||||||

| SBA gains | 232 | 287 | 113 | 252 | 181 | 519 | 320 | |||||||||||||||||||||||||||||||||||||

| BOLI income | 872 | 859 | 889 | 899 | 887 | 1,731 | 1,773 | |||||||||||||||||||||||||||||||||||||

| Other | 2,249 | 3,744 | 2,187 | 2,370 | 2,147 | 5,993 | 5,499 | |||||||||||||||||||||||||||||||||||||

| 15,377 | 17,785 | 14,948 | 16,942 | 13,776 | 33,162 | 28,445 | ||||||||||||||||||||||||||||||||||||||

| Securities (losses) gains, net | (55) | (114) | (18) | 4 | 1,230 | (169) | 1,249 | |||||||||||||||||||||||||||||||||||||

| Total Noninterest Income | 15,322 | 17,671 | 14,930 | 16,946 | 15,006 | 32,993 | 29,694 | |||||||||||||||||||||||||||||||||||||

| Noninterest expenses: | ||||||||||||||||||||||||||||||||||||||||||||

| Salaries and wages | 22,966 | 21,393 | 21,490 | 23,125 | 20,226 | 44,359 | 43,924 | |||||||||||||||||||||||||||||||||||||

| Employee benefits | 3,953 | 4,980 | 3,915 | 3,995 | 3,379 | 8,933 | 7,634 | |||||||||||||||||||||||||||||||||||||

| Outsourced data processing costs | 4,676 | 4,468 | 4,233 | 6,128 | 4,059 | 9,144 | 8,692 | |||||||||||||||||||||||||||||||||||||

| Telephone / data lines | 838 | 785 | 774 | 705 | 791 | 1,623 | 1,505 | |||||||||||||||||||||||||||||||||||||

| Occupancy | 3,310 | 3,789 | 3,554 | 3,858 | 3,385 | 7,099 | 6,738 | |||||||||||||||||||||||||||||||||||||

| Furniture and equipment | 1,166 | 1,254 | 1,317 | 1,576 | 1,358 | 2,420 | 2,981 | |||||||||||||||||||||||||||||||||||||

| Marketing | 1,002 | 1,168 | 1,045 | 1,513 | 997 | 2,170 | 2,275 | |||||||||||||||||||||||||||||||||||||

| Legal and professional fees | 2,182 | 2,582 | 509 | 3,018 | 2,277 | 4,764 | 5,640 | |||||||||||||||||||||||||||||||||||||

| FDIC assessments | 515 | 526 | 528 | 474 | 266 | 1,041 | 266 | |||||||||||||||||||||||||||||||||||||

| Amortization of intangibles | 1,212 | 1,211 | 1,421 | 1,497 | 1,483 | 2,423 | 2,939 | |||||||||||||||||||||||||||||||||||||

| Foreclosed property expense and net (gain) loss on sale | (90) | (65) | 1,821 | 512 | 245 | (155) | (70) | |||||||||||||||||||||||||||||||||||||

| Provision for credit losses on unfunded commitments | — | — | (795) | 756 | 178 | — | 224 | |||||||||||||||||||||||||||||||||||||

| Other | 4,054 | 4,029 | 3,869 | 4,517 | 3,755 | 8,083 | 7,449 | |||||||||||||||||||||||||||||||||||||

| Total Noninterest Expense | 45,784 | 46,120 | 43,681 | 51,674 | 42,399 | 91,904 | 90,197 | |||||||||||||||||||||||||||||||||||||

| Income Before Income Taxes | 40,195 | 43,876 | 38,140 | 29,620 | 32,268 | 84,071 | 32,822 | |||||||||||||||||||||||||||||||||||||

| Income taxes | 8,785 | 10,157 | 8,793 | 6,992 | 7,188 | 18,942 | 7,033 | |||||||||||||||||||||||||||||||||||||

| Net Income | $ | 31,410 | $ | 33,719 | $ | 29,347 | $ | 22,628 | $ | 25,080 | $ | 65,129 | $ | 25,789 | ||||||||||||||||||||||||||||||

| Per share of common stock: | ||||||||||||||||||||||||||||||||||||||||||||

| Net income diluted | $ | 0.56 | $ | 0.60 | $ | 0.53 | $ | 0.42 | $ | 0.47 | $ | 1.17 | $ | 0.49 | ||||||||||||||||||||||||||||||

| Net income basic | 0.57 | 0.61 | 0.53 | 0.42 | 0.47 | 1.18 | 0.49 | |||||||||||||||||||||||||||||||||||||

| Cash dividends declared | 0.13 | — | — | — | — | 0.13 | — | |||||||||||||||||||||||||||||||||||||

| Average diluted shares outstanding | 55,901 | 55,992 | 55,739 | 54,301 | 53,308 | 55,827 | 52,807 | |||||||||||||||||||||||||||||||||||||

| Average basic shares outstanding | 55,421 | 55,271 | 55,219 | 53,978 | 52,985 | 55,347 | 52,394 | |||||||||||||||||||||||||||||||||||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | (Unaudited) | ||||||||||||||||||||||||||||||||||

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||

| June 30, | March 31, | December 31, | September 30, | June 30, | |||||||||||||||||||||||||||||||

| (Amounts in thousands) | 2021 | 2021 | 2020 | 2020 | 2020 | ||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Cash and due from banks | $ | 97,468 | $ | 89,123 | $ | 86,630 | $ | 81,692 | $ | 84,178 | |||||||||||||||||||||||||

| Interest bearing deposits with other banks | 1,351,377 | 890,202 | 317,458 | 227,876 | 440,142 | ||||||||||||||||||||||||||||||

| Total Cash and Cash Equivalents | 1,448,845 | 979,325 | 404,088 | 309,568 | 524,320 | ||||||||||||||||||||||||||||||

| Time deposits with other banks | 750 | 750 | 750 | 2,247 | 2,496 | ||||||||||||||||||||||||||||||

| Debt Securities: | |||||||||||||||||||||||||||||||||||

| Available for sale (at fair value) | 1,322,776 | 1,051,396 | 1,398,157 | 1,286,858 | 976,025 | ||||||||||||||||||||||||||||||

| Held to maturity (at amortized cost) | 493,467 | 512,307 | 184,484 | 207,376 | 227,092 | ||||||||||||||||||||||||||||||

| Total Debt Securities | 1,816,243 | 1,563,703 | 1,582,641 | 1,494,234 | 1,203,117 | ||||||||||||||||||||||||||||||

| Loans held for sale | 42,793 | 60,924 | 68,890 | 73,046 | 54,943 | ||||||||||||||||||||||||||||||

| Loans | 5,437,049 | 5,661,492 | 5,735,349 | 5,858,029 | 5,772,052 | ||||||||||||||||||||||||||||||

| Less: Allowance for credit losses | (81,127) | (86,643) | (92,733) | (94,013) | (91,250) | ||||||||||||||||||||||||||||||

| Net Loans | 5,355,922 | 5,574,849 | 5,642,616 | 5,764,016 | 5,680,802 | ||||||||||||||||||||||||||||||

| Bank premises and equipment, net | 69,392 | 70,385 | 75,117 | 76,393 | 69,041 | ||||||||||||||||||||||||||||||

| Other real estate owned | 12,804 | 15,549 | 12,750 | 15,890 | 15,847 | ||||||||||||||||||||||||||||||

| Goodwill | 221,176 | 221,176 | 221,176 | 221,176 | 212,146 | ||||||||||||||||||||||||||||||

| Other intangible assets, net | 14,106 | 15,382 | 16,745 | 18,163 | 17,950 | ||||||||||||||||||||||||||||||

| Bank owned life insurance | 158,506 | 132,634 | 131,776 | 130,887 | 127,954 | ||||||||||||||||||||||||||||||

| Net deferred tax assets | 21,839 | 24,497 | 23,629 | 25,503 | 21,404 | ||||||||||||||||||||||||||||||

| Other assets | 154,457 | 152,646 | 162,214 | 156,717 | 153,993 | ||||||||||||||||||||||||||||||

| Total Assets | $ | 9,316,833 | $ | 8,811,820 | $ | 8,342,392 | $ | 8,287,840 | $ | 8,084,013 | |||||||||||||||||||||||||

| Liabilities and Shareholders' Equity | |||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||

| Deposits | |||||||||||||||||||||||||||||||||||

| Noninterest demand | $ | 2,952,160 | $ | 2,685,247 | $ | 2,289,787 | $ | 2,400,744 | $ | 2,267,435 | |||||||||||||||||||||||||

| Interest-bearing demand | 1,763,884 | 1,647,935 | 1,566,069 | 1,385,445 | 1,368,146 | ||||||||||||||||||||||||||||||

| Savings | 811,516 | 768,362 | 689,179 | 655,072 | 619,251 | ||||||||||||||||||||||||||||||

| Money market | 1,807,190 | 1,671,179 | 1,556,370 | 1,457,078 | 1,232,892 | ||||||||||||||||||||||||||||||

| Other time certificates | 335,370 | 373,297 | 425,878 | 457,964 | 445,176 | ||||||||||||||||||||||||||||||

| Brokered time certificates | 20,000 | 93,500 | 233,815 | 381,028 | 572,465 | ||||||||||||||||||||||||||||||

| Time certificates of more than $250,000 | 146,316 | 146,229 | 171,463 | 177,512 | 161,418 | ||||||||||||||||||||||||||||||

| Total Deposits | 7,836,436 | 7,385,749 | 6,932,561 | 6,914,843 | 6,666,783 | ||||||||||||||||||||||||||||||

| Securities sold under agreements to repurchase | 119,973 | 109,171 | 119,609 | 89,508 | 92,125 | ||||||||||||||||||||||||||||||

| Federal Home Loan Bank borrowings | — | — | — | 35,000 | 135,000 | ||||||||||||||||||||||||||||||

| Subordinated debt | 71,506 | 71,436 | 71,365 | 71,295 | 71,225 | ||||||||||||||||||||||||||||||

| Other liabilities | 106,571 | 90,115 | 88,455 | 78,853 | 88,277 | ||||||||||||||||||||||||||||||

| Total Liabilities | 8,134,486 | 7,656,471 | 7,211,990 | 7,189,499 | 7,053,410 | ||||||||||||||||||||||||||||||

| Shareholders' Equity | |||||||||||||||||||||||||||||||||||

| Common stock | 5,544 | 5,529 | 5,524 | 5,517 | 5,299 | ||||||||||||||||||||||||||||||

| Additional paid in capital | 862,598 | 858,688 | 856,092 | 854,188 | 811,328 | ||||||||||||||||||||||||||||||

| Retained earnings | 314,584 | 290,420 | 256,701 | 227,354 | 204,719 | ||||||||||||||||||||||||||||||

| Treasury stock | (10,180) | (8,693) | (8,285) | (7,941) | (8,037) | ||||||||||||||||||||||||||||||

| 1,172,546 | 1,145,944 | 1,110,032 | 1,079,118 | 1,013,309 | |||||||||||||||||||||||||||||||

| Accumulated other comprehensive income, net | 9,801 | 9,405 | 20,370 | 19,223 | 17,294 | ||||||||||||||||||||||||||||||

| Total Shareholders' Equity | 1,182,347 | 1,155,349 | 1,130,402 | 1,098,341 | 1,030,603 | ||||||||||||||||||||||||||||||

| Total Liabilities & Shareholders' Equity | $ | 9,316,833 | $ | 8,811,820 | $ | 8,342,392 | $ | 8,287,840 | $ | 8,084,013 | |||||||||||||||||||||||||

| Common shares outstanding | 55,436 | 55,294 | 55,243 | 55,169 | 52,991 | ||||||||||||||||||||||||||||||

| CONSOLIDATED QUARTERLY FINANCIAL DATA | (Unaudited) | |||||||||||||||||||||||||||||||

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||

| (Amounts in thousands) | 2Q'21 | 1Q'21 | 4Q'20 | 3Q'20 | 2Q'20 | |||||||||||||||||||||||||||

| Credit Analysis | ||||||||||||||||||||||||||||||||

| Net charge-offs - non-acquired loans | $ | 214 | $ | 292 | $ | 3,028 | $ | 1,112 | $ | 1,714 | ||||||||||||||||||||||

| Net charge-offs - acquired loans | 441 | 78 | 99 | 624 | 37 | |||||||||||||||||||||||||||

| Total Net Charge-offs | 655 | 370 | 3,127 | 1,736 | 1,751 | |||||||||||||||||||||||||||

| Net charge-offs to average loans - non-acquired loans | 0.02 | % | 0.02 | % | 0.20 | % | 0.08 | % | 0.12 | % | ||||||||||||||||||||||

| Net charge-offs to average loans - acquired loans | 0.03 | 0.01 | 0.01 | 0.04 | — | |||||||||||||||||||||||||||

| Total Net Charge-offs to Average Loans | 0.05 | 0.03 | 0.21 | 0.12 | 0.12 | |||||||||||||||||||||||||||

| Allowance for credit losses - non-acquired loans | $ | 64,525 | $ | 66,523 | $ | 69,786 | $ | 70,388 | $ | 73,587 | ||||||||||||||||||||||

| Allowance for credit losses - acquired loans | 16,602 | 20,120 | 22,947 | 23,625 | 17,663 | |||||||||||||||||||||||||||

| Total Allowance for Credit Losses | $ | 81,127 | $ | 86,643 | $ | 92,733 | $ | 94,013 | $ | 91,250 | ||||||||||||||||||||||

| Non-acquired loans at end of period | $ | 4,290,622 | $ | 4,208,911 | $ | 4,196,205 | $ | 4,157,376 | $ | 4,315,892 | ||||||||||||||||||||||

| Acquired loans at end of period | 782,315 | 870,928 | 972,183 | 1,061,853 | 879,710 | |||||||||||||||||||||||||||

Paycheck Protection Program loans at end of period1 | 364,112 | 581,653 | 566,961 | 638,800 | 576,450 | |||||||||||||||||||||||||||

| Total Loans | $ | 5,437,049 | $ | 5,661,492 | $ | 5,735,349 | $ | 5,858,029 | $ | 5,772,052 | ||||||||||||||||||||||

| Non-acquired loans allowance for credit losses to non-acquired loans at end of period | 1.50 | % | 1.58 | % | 1.66 | % | 1.69 | % | 1.71 | % | ||||||||||||||||||||||

| Total allowance for credit losses to total loans at end of period | 1.49 | 1.53 | 1.62 | 1.60 | 1.58 | |||||||||||||||||||||||||||

| Total allowance for credit losses to total loans, excluding PPP loans | 1.60 | 1.71 | 1.79 | 1.80 | 1.76 | |||||||||||||||||||||||||||

| Purchase discount on acquired loans at end of period | 2.98 | 2.93 | 2.86 | 3.01 | 3.29 | |||||||||||||||||||||||||||

| End of Period | ||||||||||||||||||||||||||||||||

| Nonperforming loans | $ | 32,920 | $ | 35,328 | $ | 36,110 | $ | 36,897 | $ | 30,051 | ||||||||||||||||||||||

| Other real estate owned | 11,019 | 10,836 | 10,182 | 12,299 | 10,967 | |||||||||||||||||||||||||||

| Properties previously used in bank operations included in other real estate owned | 1,785 | 4,713 | 2,569 | 3,592 | 4,880 | |||||||||||||||||||||||||||

| Total Nonperforming Assets | $ | 45,724 | $ | 50,877 | $ | 48,861 | $ | 52,788 | $ | 45,898 | ||||||||||||||||||||||

| Accruing troubled debt restructures (TDRs) | $ | 4,037 | $ | 4,067 | $ | 4,182 | $ | 10,190 | $ | 10,338 | ||||||||||||||||||||||

| Nonperforming Loans to Loans at End of Period | 0.61 | % | 0.62 | % | 0.63 | % | 0.63 | % | 0.52 | % | ||||||||||||||||||||||

| Nonperforming Assets to Total Assets at End of Period | 0.49 | 0.58 | 0.59 | 0.64 | 0.57 | |||||||||||||||||||||||||||

| June 30, | March 31, | December 31, | September 30, | June 30, | ||||||||||||||||||||||||||||

| Loans | 2021 | 2021 | 2020 | 2020 | 2020 | |||||||||||||||||||||||||||

| Construction and land development | $ | 234,347 | $ | 227,117 | $ | 245,108 | $ | 280,610 | $ | 298,835 | ||||||||||||||||||||||

| Commercial real estate - owner occupied | 1,127,640 | 1,133,085 | 1,141,310 | 1,125,460 | 1,076,650 | |||||||||||||||||||||||||||

| Commercial real estate - non-owner occupied | 1,412,439 | 1,438,365 | 1,395,854 | 1,394,464 | 1,392,787 | |||||||||||||||||||||||||||

| Residential real estate | 1,226,536 | 1,246,549 | 1,342,628 | 1,393,396 | 1,468,171 | |||||||||||||||||||||||||||

| Commercial and financial | 900,206 | 860,813 | 854,753 | 833,083 | 757,232 | |||||||||||||||||||||||||||

| Consumer | 171,769 | 173,910 | 188,735 | 192,216 | 201,927 | |||||||||||||||||||||||||||

| Paycheck Protection Program | 364,112 | 581,653 | 566,961 | 638,800 | 576,450 | |||||||||||||||||||||||||||

| Total Loans | $ | 5,437,049 | $ | 5,661,492 | $ | 5,735,349 | $ | 5,858,029 | $ | 5,772,052 | ||||||||||||||||||||||

13Q'20 includes $54 million in Paycheck Protection Program loans acquired from Freedom Bank. | ||||||||||||||||||||||||||||||||

AVERAGE BALANCES, INTEREST INCOME AND EXPENSES, YIELDS AND RATES 1 | (Unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2Q'21 | 1Q'21 | 2Q'20 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average | Yield/ | Average | Yield/ | Average | Yield/ | |||||||||||||||||||||||||||||||||||||||||||||||||||

| (Amounts in thousands) | Balance | Interest | Rate | Balance | Interest | Rate | Balance | Interest | Rate | |||||||||||||||||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Earning assets: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxable | $ | 1,629,410 | $ | 6,559 | 1.61 | % | $ | 1,550,457 | $ | 6,298 | 1.62 | % | $ | 1,135,698 | $ | 7,573 | 2.67 | % | ||||||||||||||||||||||||||||||||||||||

| Nontaxable | 25,581 | 186 | 2.90 | 25,932 | 187 | 2.89 | 19,347 | 152 | 3.14 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total Securities | 1,654,991 | 6,745 | 1.63 | 1,576,389 | 6,485 | 1.65 | 1,155,045 | 7,725 | 2.68 | |||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and other investments | 925,323 | 709 | 0.31 | 377,344 | 586 | 0.63 | 433,626 | 684 | 0.63 | |||||||||||||||||||||||||||||||||||||||||||||||

| Loans excluding PPP loans | 5,092,897 | 55,313 | 4.36 | 5,149,642 | 55,504 | 4.37 | 5,304,381 | 59,861 | 4.54 | |||||||||||||||||||||||||||||||||||||||||||||||

| PPP loans | 505,339 | 5,127 | 4.07 | 609,733 | 6,886 | 4.58 | 424,171 | 5,068 | 4.81 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total Loans | 5,598,236 | 60,440 | 4.33 | 5,759,375 | 62,390 | 4.39 | 5,728,552 | 64,929 | 4.56 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total Earning Assets | 8,178,550 | 67,894 | 3.33 | 7,713,108 | 69,461 | 3.65 | 7,317,223 | 73,338 | 4.03 | |||||||||||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (86,042) | (91,735) | (84,965) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 327,171 | 255,685 | 103,919 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Premises and equipment | 70,033 | 74,272 | 71,173 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Intangible assets | 235,964 | 237,323 | 230,871 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank owned life insurance | 133,484 | 132,079 | 127,386 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 166,686 | 164,622 | 147,395 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $ | 9,025,846 | $ | 8,485,354 | $ | 7,913,002 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Shareholders' Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing demand | $ | 1,692,178 | $ | 235 | 0.06 | % | $ | 1,600,490 | $ | 258 | 0.07 | % | $ | 1,298,639 | $ | 297 | 0.09 | % | ||||||||||||||||||||||||||||||||||||||

| Savings | 790,734 | 118 | 0.06 | 722,274 | 137 | 0.08 | 591,040 | 165 | 0.11 | |||||||||||||||||||||||||||||||||||||||||||||||

| Money market | 1,736,481 | 627 | 0.14 | 1,609,938 | 670 | 0.17 | 1,193,969 | 741 | 0.25 | |||||||||||||||||||||||||||||||||||||||||||||||

| Time deposits | 533,350 | 524 | 0.39 | 711,320 | 1,187 | 0.68 | 1,293,766 | 3,820 | 1.19 | |||||||||||||||||||||||||||||||||||||||||||||||

| Securities sold under agreements to repurchase | 115,512 | 35 | 0.12 | 112,834 | 41 | 0.15 | 74,717 | 34 | 0.18 | |||||||||||||||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank borrowings | — | — | — | — | — | — | 199,698 | 312 | 0.63 | |||||||||||||||||||||||||||||||||||||||||||||||

| Other borrowings | 71,460 | 422 | 2.37 | 71,390 | 427 | 2.43 | 71,185 | 581 | 3.28 | |||||||||||||||||||||||||||||||||||||||||||||||

| Total Interest-Bearing Liabilities | 4,939,715 | 1,961 | 0.16 | 4,828,246 | 2,720 | 0.23 | 4,723,014 | 5,950 | 0.51 | |||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest demand | 2,799,643 | 2,432,038 | 2,097,038 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 116,093 | 88,654 | 79,855 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities | 7,855,451 | 7,348,938 | 6,899,907 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' equity | 1,170,395 | 1,136,416 | 1,013,095 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities & Equity | $ | 9,025,846 | $ | 8,485,354 | $ | 7,913,002 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Cost of deposits | 0.08 | % | 0.13 | % | 0.31 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense as a % of earning assets | 0.10 | % | 0.14 | % | 0.33 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income as a % of earning assets | $ | 65,933 | 3.23 | % | $ | 66,741 | 3.51 | % | $ | 67,388 | 3.70 | % | ||||||||||||||||||||||||||||||||||||||||||||

1On a fully taxable equivalent basis. All yields and rates have been computed using amortized cost. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees on loans have been included in interest on loans. Nonaccrual loans are included in loan balances. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Six Months Ended June 30, 2021 | Six Months Ended June 30, 2020 | |||||||||||||||||||||||||||||||||||||

| Average | Yield/ | Average | Yield/ | |||||||||||||||||||||||||||||||||||

| (Amounts in thousands, except ratios) | Balance | Interest | Rate | Balance | Interest | Rate | ||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||

| Earning assets: | ||||||||||||||||||||||||||||||||||||||

| Securities: | ||||||||||||||||||||||||||||||||||||||

| Taxable | $ | 1,590,152 | $ | 12,857 | 1.62 | % | $ | 1,144,086 | $ | 16,269 | 2.84 | % | ||||||||||||||||||||||||||

| Nontaxable | 25,756 | 373 | 2.90 | 19,544 | 304 | 3.11 | ||||||||||||||||||||||||||||||||

| Total Securities | 1,615,908 | 13,230 | 1.64 | 1,163,630 | 16,573 | 2.85 | ||||||||||||||||||||||||||||||||

| Federal funds sold and other investments | 652,847 | 1,295 | 0.40 | 260,775 | 1,418 | 1.09 | ||||||||||||||||||||||||||||||||

| Loans excluding PPP loans | 5,121,114 | 110,817 | 4.36 | 5,259,808 | 123,385 | 4.72 | ||||||||||||||||||||||||||||||||

| PPP loans | 557,247 | 12,013 | 4.35 | 212,085 | 5,068 | 4.81 | ||||||||||||||||||||||||||||||||

| Total Loans | 5,678,361 | 122,830 | 4.36 | 5,471,893 | 128,453 | 4.72 | ||||||||||||||||||||||||||||||||

| Total Earning Assets | 7,947,116 | 137,355 | 3.49 | 6,896,298 | 146,444 | 4.27 | ||||||||||||||||||||||||||||||||

| Allowance for credit losses | (88,873) | (70,948) | ||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 291,626 | 97,002 | ||||||||||||||||||||||||||||||||||||

| Premises and equipment | 72,141 | 69,379 | ||||||||||||||||||||||||||||||||||||

| Intangible assets | 236,640 | 228,791 | ||||||||||||||||||||||||||||||||||||

| Bank owned life insurance | 132,785 | 126,939 | ||||||||||||||||||||||||||||||||||||

| Other assets | 165,658 | 136,811 | ||||||||||||||||||||||||||||||||||||

| Total Assets | $ | 8,757,093 | $ | 7,484,272 | ||||||||||||||||||||||||||||||||||

| Liabilities and Shareholders' Equity | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing demand | $ | 1,646,587 | $ | 493 | 0.06 | % | $ | 1,236,285 | $ | 1,131 | 0.18 | % | ||||||||||||||||||||||||||

| Savings | 756,693 | 255 | 0.07 | 558,883 | 513 | 0.18 | ||||||||||||||||||||||||||||||||

| Money market | 1,673,559 | 1,297 | 0.16 | 1,161,363 | 2,749 | 0.48 | ||||||||||||||||||||||||||||||||

| Time deposits | 621,844 | 1,711 | 0.55 | 1,222,758 | 8,588 | 1.41 | ||||||||||||||||||||||||||||||||

| Securities sold under agreements to repurchase | 114,181 | 76 | 0.13 | 72,891 | 201 | 0.55 | ||||||||||||||||||||||||||||||||

| Federal Home Loan Bank borrowings | — | — | — | 224,860 | 1,279 | 1.14 | ||||||||||||||||||||||||||||||||

| Other borrowings | 71,425 | 849 | 2.40 | 71,149 | 1,304 | 3.69 | ||||||||||||||||||||||||||||||||

| Total Interest-Bearing Liabilities | 4,884,289 | 4,681 | 0.19 | 4,548,189 | 15,765 | 0.70 | ||||||||||||||||||||||||||||||||

| Noninterest demand | 2,616,856 | 1,861,126 | ||||||||||||||||||||||||||||||||||||

| Other liabilities | 102,450 | 71,413 | ||||||||||||||||||||||||||||||||||||

| Total Liabilities | 7,603,595 | 6,480,728 | ||||||||||||||||||||||||||||||||||||

| Shareholders' equity | 1,153,499 | 1,003,544 | ||||||||||||||||||||||||||||||||||||

| Total Liabilities & Equity | $ | 8,757,093 | $ | 7,484,272 | ||||||||||||||||||||||||||||||||||

| Cost of deposits | 0.10 | % | 0.43 | % | ||||||||||||||||||||||||||||||||||

| Interest expense as a % of earning assets | 0.12 | % | 0.46 | % | ||||||||||||||||||||||||||||||||||

| Net interest income as a % of earning assets | $ | 132,674 | 3.37 | % | $ | 130,679 | 3.81 | % | ||||||||||||||||||||||||||||||

1On a fully taxable equivalent basis. All yields and rates have been computed using amortized cost. | ||||||||||||||||||||||||||||||||||||||

| Fees on loans have been included in interest on loans. Nonaccrual loans are included in loan balances. | ||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED QUARTERLY FINANCIAL DATA | (Unaudited) | |||||||||||||||||||||||||||||||||||||

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES | ||||||||||||||||||||||||||||||||||||||

| June 30, | March 31, | December 31, | September 30, | June 30, | ||||||||||||||||||||||||||||||||||

| (Amounts in thousands) | 2021 | 2021 | 2020 | 2020 | 2020 | |||||||||||||||||||||||||||||||||

| Customer Relationship Funding | ||||||||||||||||||||||||||||||||||||||

| Noninterest demand | ||||||||||||||||||||||||||||||||||||||

| Commercial | $ | 2,431,928 | $ | 2,189,564 | $ | 1,821,361 | $ | 1,973,494 | $ | 1,844,288 | ||||||||||||||||||||||||||||

| Retail | 401,988 | 379,257 | 350,783 | 322,559 | 314,723 | |||||||||||||||||||||||||||||||||

| Public funds | 88,057 | 83,315 | 90,973 | 70,371 | 74,674 | |||||||||||||||||||||||||||||||||

| Other | 30,187 | 33,111 | 26,670 | 34,320 | 33,750 | |||||||||||||||||||||||||||||||||

| Total Noninterest Demand | 2,952,160 | 2,685,247 | 2,289,787 | 2,400,744 | 2,267,435 | |||||||||||||||||||||||||||||||||

| Interest-bearing demand | ||||||||||||||||||||||||||||||||||||||

| Commercial | 545,797 | 497,047 | 454,909 | 413,513 | 412,846 | |||||||||||||||||||||||||||||||||

| Retail | 958,619 | 895,853 | 839,958 | 777,078 | 733,772 | |||||||||||||||||||||||||||||||||

| Public funds | 259,468 | 255,035 | 271,202 | 194,854 | 221,528 | |||||||||||||||||||||||||||||||||

| Total Interest-Bearing Demand | 1,763,884 | 1,647,935 | 1,566,069 | 1,385,445 | 1,368,146 | |||||||||||||||||||||||||||||||||

| Total transaction accounts | ||||||||||||||||||||||||||||||||||||||

| Commercial | 2,977,725 | 2,686,611 | 2,276,270 | 2,387,007 | 2,257,134 | |||||||||||||||||||||||||||||||||

| Retail | 1,360,607 | 1,275,110 | 1,190,741 | 1,099,637 | 1,048,495 | |||||||||||||||||||||||||||||||||

| Public funds | 347,525 | 338,350 | 362,175 | 265,225 | 296,202 | |||||||||||||||||||||||||||||||||

| Other | 30,187 | 33,111 | 26,670 | 34,320 | 33,750 | |||||||||||||||||||||||||||||||||

| Total Transaction Accounts | 4,716,044 | 4,333,182 | 3,855,856 | 3,786,189 | 3,635,581 | |||||||||||||||||||||||||||||||||

| Savings | 811,516 | 768,362 | 689,179 | 655,072 | 619,251 | |||||||||||||||||||||||||||||||||

| Money market | ||||||||||||||||||||||||||||||||||||||

| Commercial | 787,894 | 692,537 | 611,623 | 634,697 | 586,416 | |||||||||||||||||||||||||||||||||

| Retail | 737,554 | 701,453 | 661,311 | 613,532 | 579,126 | |||||||||||||||||||||||||||||||||

| Brokered | 187,023 | 197,389 | 196,616 | 141,808 | — | |||||||||||||||||||||||||||||||||

| Public funds | 94,719 | 79,800 | 86,820 | 67,041 | 67,350 | |||||||||||||||||||||||||||||||||

| Total Money Market | 1,807,190 | 1,671,179 | 1,556,370 | 1,457,078 | 1,232,892 | |||||||||||||||||||||||||||||||||

| Brokered time certificates | 20,000 | 93,500 | 233,815 | 381,028 | 572,465 | |||||||||||||||||||||||||||||||||

| Other time certificates | 481,686 | 519,526 | 597,341 | 635,476 | 606,594 | |||||||||||||||||||||||||||||||||

| 501,686 | 613,026 | 831,156 | 1,016,504 | 1,179,059 | ||||||||||||||||||||||||||||||||||

| Total Deposits | $ | 7,836,436 | $ | 7,385,749 | $ | 6,932,561 | $ | 6,914,843 | $ | 6,666,783 | ||||||||||||||||||||||||||||

| Customer sweep accounts | $ | 119,973 | $ | 109,171 | $ | 119,609 | $ | 89,508 | $ | 92,125 | ||||||||||||||||||||||||||||

Explanation of Certain Unaudited Non-GAAP Financial Measures

This presentation contains financial information determined by methods other than Generally Accepted Accounting Principles (“GAAP”). Management uses these non-GAAP financial measures in its analysis of the Company’s performance and believes these presentations provide useful supplemental information, and a clearer understanding of the Company’s performance. The Company believes the non-GAAP measures enhance investors’ understanding of the Company’s business and performance and if not provided would be requested by the investor community. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. The limitations associated with operating measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might define or calculate these measures differently. The Company provides reconciliations between GAAP and these non-GAAP measures. These disclosures should not be considered an alternative to GAAP.

| GAAP TO NON-GAAP RECONCILIATION | (Unaudited) | ||||||||||||||||||||||||||||||||||||||||

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||

| Quarterly Trends | Six Months Ended | ||||||||||||||||||||||||||||||||||||||||

| (Amounts in thousands, except per share data) | 2Q'21 | 1Q'21 | 4Q'20 | 3Q'20 | 2Q'20 | 2Q'21 | 2Q'20 | ||||||||||||||||||||||||||||||||||

| Net Income | $ | 31,410 | $ | 33,719 | $ | 29,347 | $ | 22,628 | $ | 25,080 | $ | 65,129 | $ | 25,789 | |||||||||||||||||||||||||||

| Total noninterest income | 15,322 | 17,671 | 14,930 | 16,946 | 15,006 | 32,993 | 29,694 | ||||||||||||||||||||||||||||||||||

| Securities losses (gains), net | 55 | 114 | 18 | (4) | (1,230) | 169 | (1,249) | ||||||||||||||||||||||||||||||||||

| Total Adjustments to Noninterest Income | 55 | 114 | 18 | (4) | (1,230) | 169 | (1,249) | ||||||||||||||||||||||||||||||||||

| Total Adjusted Noninterest Income | 15,377 | 17,785 | 14,948 | 16,942 | 13,776 | 33,162 | 28,445 | ||||||||||||||||||||||||||||||||||

| Total noninterest expense | 45,784 | 46,120 | 43,681 | 51,674 | 42,399 | 91,904 | 90,197 | ||||||||||||||||||||||||||||||||||

| Merger related charges | (509) | (581) | — | (4,281) | (240) | (1,090) | (4,793) | ||||||||||||||||||||||||||||||||||

| Amortization of intangibles | (1,212) | (1,211) | (1,421) | (1,497) | (1,483) | (2,423) | (2,939) | ||||||||||||||||||||||||||||||||||

| Business continuity expenses | — | — | — | — | — | — | (307) | ||||||||||||||||||||||||||||||||||

| Branch reductions and other expense initiatives | (663) | (449) | (354) | (464) | — | (1,112) | — | ||||||||||||||||||||||||||||||||||

| Total Adjustments to Noninterest Expense | (2,384) | (2,241) | (1,775) | (6,242) | (1,723) | (4,625) | (8,039) | ||||||||||||||||||||||||||||||||||

| Total Adjusted Noninterest Expense | 43,400 | 43,879 | 41,906 | 45,432 | 40,676 | 87,279 | 82,158 | ||||||||||||||||||||||||||||||||||

| Income Taxes | 8,785 | 10,157 | 8,793 | 6,992 | 7,188 | 18,942 | 7,033 | ||||||||||||||||||||||||||||||||||

| Tax effect of adjustments | 598 | 577 | 440 | 1,530 | 121 | 1,175 | 1,665 | ||||||||||||||||||||||||||||||||||

| Total Adjustments to Income Taxes | 598 | 577 | 440 | 1,530 | 121 | 1,175 | 1,665 | ||||||||||||||||||||||||||||||||||

| Adjusted Income Taxes | 9,383 | 10,734 | 9,233 | 8,522 | 7,309 | 20,117 | 8,698 | ||||||||||||||||||||||||||||||||||

| Adjusted Net Income | $ | 33,251 | $ | 35,497 | $ | 30,700 | $ | 27,336 | $ | 25,452 | $ | 68,748 | $ | 30,914 | |||||||||||||||||||||||||||

| Earnings per diluted share, as reported | $ | 0.56 | $ | 0.60 | $ | 0.53 | $ | 0.42 | $ | 0.47 | $ | 1.17 | $ | 0.49 | |||||||||||||||||||||||||||

| Adjusted Earnings per Diluted Share | 0.59 | 0.63 | 0.55 | 0.50 | 0.48 | 1.23 | 0.59 | ||||||||||||||||||||||||||||||||||

| Average diluted shares outstanding | 55,901 | 55,992 | 55,739 | 54,301 | 53,308 | 55,827 | 52,807 | ||||||||||||||||||||||||||||||||||

| Adjusted Noninterest Expense | $ | 43,400 | $ | 43,879 | $ | 41,906 | $ | 45,432 | $ | 40,676 | $ | 87,279 | $ | 82,158 | |||||||||||||||||||||||||||

| Provision for credit losses on unfunded commitments | — | — | 795 | (756) | (178) | — | (224) | ||||||||||||||||||||||||||||||||||

| Foreclosed property expense and net gain / (loss) on sale | 90 | 65 | (1,821) | (512) | (245) | 155 | 70 | ||||||||||||||||||||||||||||||||||

| Net Adjusted Noninterest Expense | $ | 43,490 | $ | 43,944 | $ | 40,880 | $ | 44,164 | $ | 40,253 | $ | 87,434 | $ | 82,004 | |||||||||||||||||||||||||||

| Revenue | $ | 81,124 | $ | 84,281 | $ | 83,721 | $ | 80,449 | $ | 82,278 | $ | 165,405 | $ | 160,143 | |||||||||||||||||||||||||||