Form 8-K RENT A CENTER INC DE For: May 06

Rent-A-Center: First Quarter 2021 Earnings Review

IMPORTANT NOTICES 2 Forward-Looking Statements This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, among others, statements regarding our goals, plans and projections with respect to our operations, financial position and business strategy. Such forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "will," "expect," "intend," "could," "estimate," "predict," "continue," “maintain,” "should," "anticipate," "believe," or “confident,” or the negative thereof or variations thereon or similar terminology. Such forward-looking statements are based on particular assumptions that our management has made in light of its experience and its perception of expected future developments and other factors that it believes are appropriate under the circumstances, and are subject to various risks and uncertainties. Factors that could cause or contribute to material and adverse differences between actual and anticipated results include, but are not limited to, (1) the impact on our business of the COVID-19 pandemic and related federal, state, and local government restrictions, including adverse changes in such restrictions or the potential re-imposition of such restrictions limiting our ability to operate or that of our retail partners or franchisees, and the continuing economic uncertainty and volatility that has resulted from such matters, and (2) the other risks detailed from time to time in the reports filed by us with the SEC, including our most recently filed Annual Report on Form 10-K, as may be updated by reports on Form 10-Q or Form 8-K filed thereafter. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this communication. Except as required by law, we are not obligated to, and do not undertake to, publicly release any revisions to these forward-looking statements to reflect any events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Use of Non-GAAP Financial Measures This communication contains certain financial information determined by methods other than in accordance with U.S. Generally Accepted Accounting Principles (GAAP), including (1) Non-GAAP diluted earnings per share (net earnings, as adjusted for special items (as defined below), net of taxes, divided by the number of shares of our common stock on a fully diluted basis), (2) Adjusted EBITDA (net earnings before interest, taxes, depreciation and amortization, as adjusted for special items) on a consolidated and segment basis and (3) Free Cash Flow (net cash provided by operating activities less capital expenditures). This communication also contains Adjusted EBITDA information with respect to Acima Holdings, LLC (adjusted earnings before interest, taxes, depreciation and amortization, including all general and administrative expenses and stock based compensation, and excluding items not deemed by management to reflect core business activities). “Special items” refers to certain gains and charges we view as extraordinary, unusual or non-recurring in nature and which we believe do not reflect our core business activities. For the periods presented herein, these special items are described in the quantitative reconciliation tables included in the appendix of this communication. Because of the inherent uncertainty related to the special items, management does not believe it is able to provide a meaningful forecast of the comparable GAAP measures or reconciliation to any forecasted GAAP measure without unreasonable effort. These non-GAAP measures are additional tools intended to assist our management in comparing our performance on a more consistent basis for purposes of business decision-making by removing the impact of certain items management believes do not directly reflect our core operations. These measures are intended to assist management in evaluating operating performance and liquidity, comparing performance and liquidity across periods, planning and forecasting future business operations, helping determine levels of operating and capital investments and identifying and assessing additional trends potentially impacting our company that may not be shown solely by comparisons of GAAP measures. Consolidated Adjusted EBITDA is also used as part of our incentive compensation program for our executive officers and others. We believe these non-GAAP financial measures also provide supplemental information that is useful to investors, analysts and other external users of our consolidated financial statements in understanding our financial results and evaluating our performance and liquidity from period to period. However, non-GAAP financial measures have inherent limitations and are not substitutes for or superior to, and they should be read together with, our consolidated financial statements prepared in accordance with GAAP. Further, because non-GAAP financial measures are not standardized, it may not be possible to compare such measures to the non-GAAP financial measures presented by other companies, even if they have the same or similar names. Note that all sources in this presentation are from Company reports and Company estimates unless otherwise noted.

3 2021 FIRST QUARTER REVIEW Completed acquisition of Acima Holdings, LLC, a leading virtual lease to own provider Q1 2021 Consolidated revenues of $1,037 million, up 47.7%; Consolidated pro forma revenues up 24.8% Q1 2021 Adjusted EBITDA1 of $135 million increased 105.5% and Non-GAAP Diluted EPS1 of $1.32 increased 96.8% versus last year Q1 2021 Adjusted EBITDA margin 13.0%, +370 basis points versus last year Acima invoice volume rose approximately 28% on a pro forma basis, which drove 30.2% pro forma revenue growth Thirteen consecutive quarters of positive same store sales in the Rent-A-Center Business (+25.1% on a 2-year basis), with a significant year over year increase in profitability Rent-A-Center e-commerce increased over 50% 1 Non-GAAP financial measure. Refer to explanations and reconciliations elsewhere in this presentation. 25.1% 0% 5% 10% 15% 20% 25% 30% Q1 '20 Q2 '20 Q3 '20 Q4 '20 Q1 '21 Rent-A-Center Business 2-Year Same Store Sales 27.8% 0% 5% 10% 15% 20% 25% 30% Q1 '20 Q2 '20 Q3 '20 Q4 '20 Q1 '21 Acima Consolidated Invoice Volume Year-over-Year Growth Note: Same store sale methodology - Same store sales generally represents revenue earned in stores that were operated by us for 13 months or more and are reported on a constant currency basis as a percentage of total revenue earned in stores of the segment during the indicated period. The Company excludes from the same store sales base any store that receives a certain level of customer accounts from closed stores or acquisitions. The receiving store will be eligible for inclusion in the same store sales base in the 30th full month following account transfer. Due to the COVID-19 pandemic and related temporary store closures, all 32 stores in Puerto Rico were excluded starting in March 2020 and will remain excluded for 18 months. Note: Pro forma figures assume a full quarter of impact from Acima in Q1 2021 and corresponding prior year period

4 TWO INDUSTRY LEADING PLATFORMS, ONE LTO VISION Foundational LTO Program Seamless LTO across mobile, web & store Proprietary platform to facilitate e-commerce Nationwide store model e-commerce LTO platform Scale allows us to serve customers at multiple touchpoints Digital allows for a broader range of product verticals Enhancements to the online customer experience enables customers more control and tools to manage their lease transactions while providing a more seamless checkout and faster approval process Digital payments save the customers time and reduces default risk Proprietary low friction origination and utilization technologies including mobile app Pursuing e-commerce opportunities at Acima including targeting financing portals, browser extension and MarketPlace Targeting national retail and e-commerce partners MasterCard agreement provides first LTO payments card in the industry that unlocks new level of shopping power for cash and credit constrained customers

5 ACIMA FINANCIAL HIGHLIGHTS Q1 2021 Highlights Invoice Volume Growth: Approximately 28% versus last year on a pro-forma basis Revenue Growth: +111.7% to $457M Pro forma Revenue Growth: +30.2% Skip / Stolen Losses: 8.6% of revenue, lower by 360 basis points versus last year Acima stand-alone Adjusted EBITDA margin of 17.5% Invoice Volume Trend 27.8% 0% 5% 10% 15% 20% 25% 30% Q1 '20 Q2 '20 Q3 '20 Q4 '20 Q1 '21 Acima Invoice Volume Year-over-Year Growth First quarter results driven by continued strong invoice volume demand

6 ACIMA: POSITIONED FOR GROWTH Integration status Financial targets Integration of Preferred Lease and Acima on track Restructured regional leadership of staffed and virtual businesses improving span of control Restructured sales organizations, collections and servicing activities gaining overhead efficiency Formalized a National Accounts team; developed pipeline targets Complementary technology, channels, retail partners and product verticals driving meaningful potential synergies 20-25% Long term annual revenue growth $2.37bn 2021E Revenue1,2 $335mm 2021E Adj. EBITDA1,2,3 Mid-teens Long term annual Adj. EBITDA margin Integration of Acima driving increased revenue growth and expense savings, leading to higher long term margins 1 Acima 2021E financials include approximately 10.5 months post-close of acquisition and approximately $20M of Acima corporate G&A expenses are included in the Corporate segment 2 Based on the midpoint of 2021E guidance 3 Adjusted EBITDA is a non-GAAP measure. Because of the inherent uncertainty related to items excluded from this non-GAAP measure (as described in the Appendix), management does not believe it is able to provide a meaningful forecast of the comparable GAAP measure or reconciliation to any forecasted GAAP measure without unreasonable effort. $40 - $70mm in potential run-rate synergies $25mm to be realized in 2021E 2021E Assumptions Government stimulus impact not assumed to continue in remaining quarters Merchandise sales and margin normalized in back half of year Expense moderation driven by synergies Adjusted EBITDA margins are expected to grow sequentially each quarter as we implement the synergies and are expected to be 13.8% to 14.5% for 2021

Introducing the new Acima LeasePay card First open-loop LeasePay card enabling consumers to shop at a broad array of physical and digital retail locations First LTO payments card in the industry that provides retailers access to a significantly larger segment of consumers Virtual lease pay card will enable a more seamless e-commerce experience including proprietary Acima browser extension and MarketPlace Actions to capture market share of the $40-50B total addressable market opportunity as LTO and buy now, pay later concepts become more widely adopted Focused on leveraging our proprietary low friction origination and utilization technologies (mobile app, browser extension, LeasePay MasterCard) Newly acquired machine learning based decision engine Quantitative marketing group successfully tested customer originations via a variety of technologies (digital, e-commerce, browser extension, website) Supports digital and physical National Accounts strategy 7 EVOLVING THE ACIMA MODEL New Acima LeasePayTM card

8 RENT-A-CENTER BUSINESS FINANCIAL HIGHLIGHTS Rent-A-Center Business Same Store Sales Digital acceleration in the RAC business has generated over 50% growth in e-commerce revenues in the first quarter 2021 25.1% 0% 5% 10% 15% 20% 25% 30% Q1 '20 Q2 '20 Q3 '20 Q4 '20 Q1 '21 Rent-A-Center Business 2-Year Same Store Sales Q1 2021 Highlights Same Store Sales: +23.4% versus last year 13th consecutive quarter of positive same store sales Q1 Ending Lease Portfolio: +17.1% versus last year Skip / Stolen Losses: 2.7% of revenue, lower by 120 basis points versus last year Adjusted EBITDA1: approximately 70% higher versus last year, EBITDA margin of 24.0% E-commerce: represents almost 25% of revenues, over 50% growth versus last year 1 Non-GAAP financial measure. Refer to explanations and reconciliations elsewhere in this presentation.

9 RENT-A-CENTER BUSINESS LONG TERM STRATEGY Long-Term Growth Strategies Invest in digital initiatives to enhance the customer experience Accelerate e-commerce growth via enhancements to platform Leverage Acima decision engine; expand digital payment and communication Continue expansion into emerging product categories (Tires, Tools, Handbags) Store modernization via technology; pipeline to open new locations in 2021

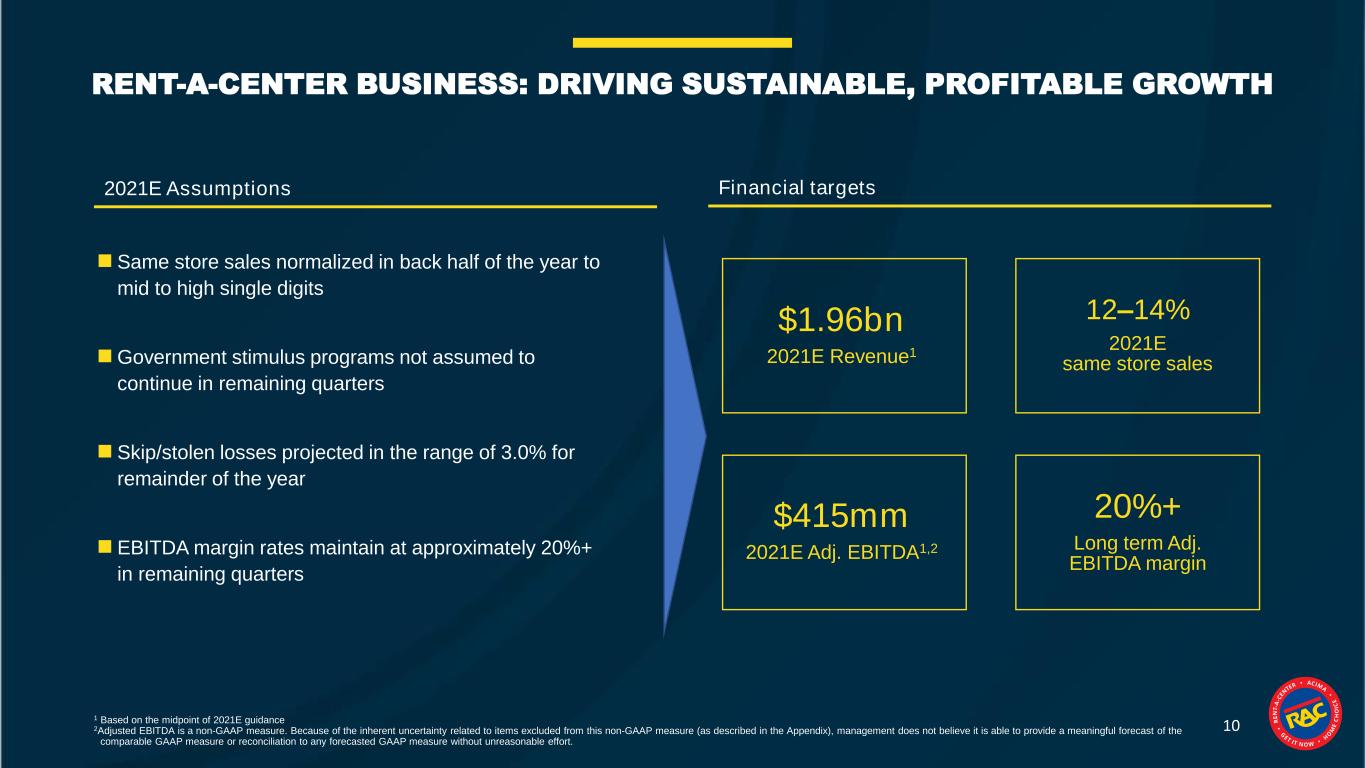

10 RENT-A-CENTER BUSINESS: DRIVING SUSTAINABLE, PROFITABLE GROWTH 2021E Assumptions Financial targets Same store sales normalized in back half of the year to mid to high single digits Government stimulus programs not assumed to continue in remaining quarters Skip/stolen losses projected in the range of 3.0% for remainder of the year EBITDA margin rates maintain at approximately 20%+ in remaining quarters 12–14% 2021E same store sales $1.96bn 2021E Revenue1 $415mm 2021E Adj. EBITDA1,2 20%+ Long term Adj. EBITDA margin 1 Based on the midpoint of 2021E guidance 2Adjusted EBITDA is a non-GAAP measure. Because of the inherent uncertainty related to items excluded from this non-GAAP measure (as described in the Appendix), management does not believe it is able to provide a meaningful forecast of the comparable GAAP measure or reconciliation to any forecasted GAAP measure without unreasonable effort.

11 Q1 2021 FINANCIAL HIGHLIGHTS Consolidated Revenue Growth: +47.7% versus last year Pro Forma Revenue Growth: +24.8% versus last year Adjusted EBITDA1: $135M, higher by 105.5 percent versus last year and 49.3% versus last year on a Pro-Forma basis Adjusted EBITDA Margin: 13.0% of revenue, +370 basis points versus last year Non-GAAP Diluted EPS1: $1.32, higher by 96.8 percent versus last year Free cash flow1: $124M, higher by $86 million versus last year Cash dividend of $0.31 per share for the second quarter of 2021 represents an increase of 6.9% over the prior year Balance Sheet 2 Cash: Ended Q1 2021 with $123M cash balance Debt: $1.38B, paid down $110M on revolver during quarter; additional $25M pay down in April Liquidity: Ended Q1 2021 with $528M in available liquidity Pro Forma Leverage Ratio: Ended Q1 2021 at 2.0x 1 Non-GAAP financial measure. Refer to explanations and reconciliations elsewhere in this presentation 2 In connection with the acquisition of Acima in February 2021, the Company refinanced its prior indebtedness and incurred substantial new indebtedness, as discussed in the Company’s Current Report on Form 8-K filed with the SEC on February 17, 2021.

12 2021 UPDATED GUIDANCE Annual Guidance Consolidated 1,2 Low High Revenues ($bn) $4.450 $4.600 Adjusted EBITDA ($mm) 4 $600 $650 % revenues 13.5% 14.1% Diluted Non-GAAP EPS 4 $5.30 $5.85 Free Cash Flow ($mm) 3,4 $250 $300 Acima Segment (includes Preferred Lease) 1 Revenues ($bn) $2.320 $2.420 Adjusted EBITDA ($mm) 4, 5 $320 $350 % revenues 13.8% 14.5% Rent-A-Center Business Segment Revenues ($bn) $1.940 $1.990 Adjusted EBITDA ($mm) 4 $405 $425 % revenues 20.9% 21.4% 1 Acima 2021E financials based on ~10.5 months post-close of acquisition 2 Includes Rent-A-Center Business, Acima, Mexico, Franchise and Corporate segments 3 Free Cash Flow defined as net cash provided by operating activities less capital expenditures 4 Adjusted EBITDA, non-GAAP diluted earnings per share and free cash flow are non-GAAP measures. Because of the inherent uncertainty related to items excluded from these non-GAAP financial measures, management does not believe it is able to provide a meaningful forecast of the comparable GAAP measure or reconciliation to any forecasted GAAP measure without unreasonable effort 5 Corporate expenses related to Acima of approximately $20M will be reflected in the Corporate segment

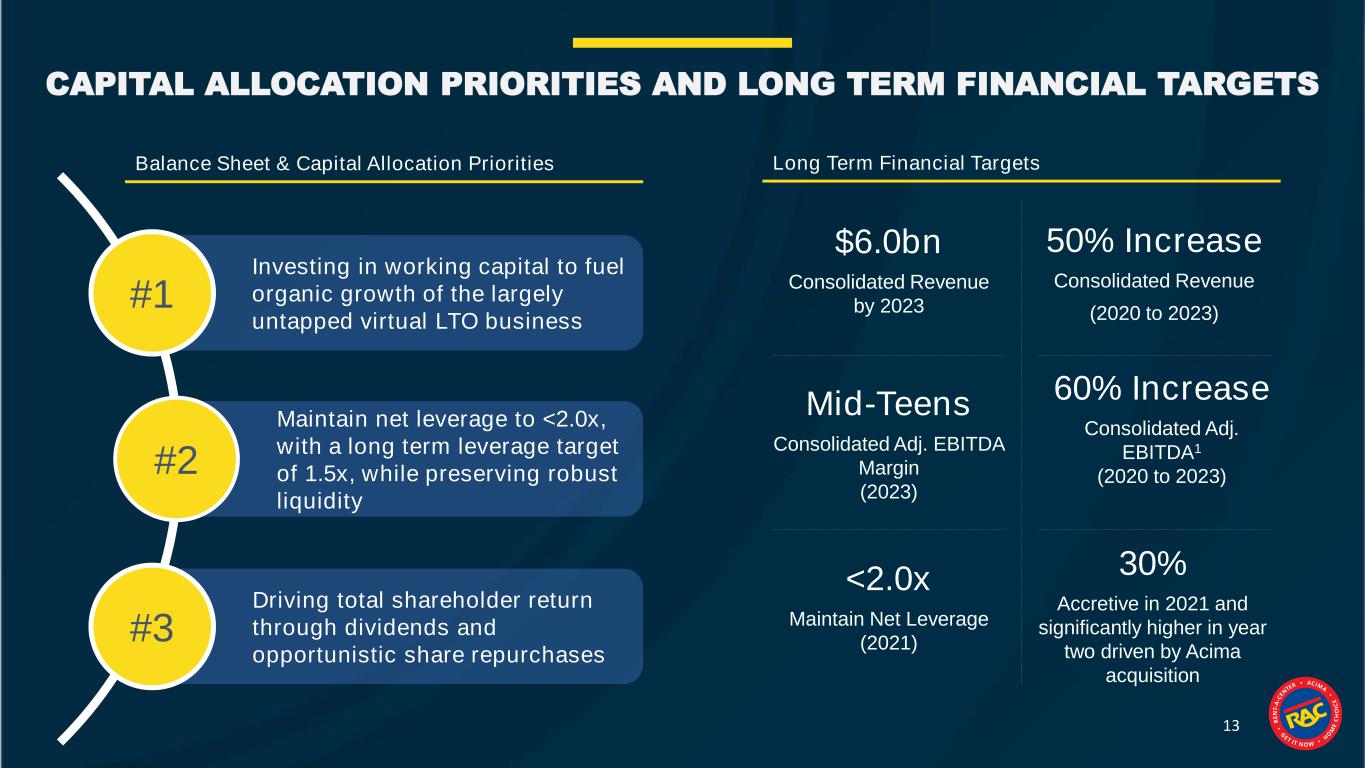

13 Investing in working capital to fuel organic growth of the largely untapped virtual LTO business #1 Maintain net leverage to <2.0x, with a long term leverage target of 1.5x, while preserving robust liquidity #2 Driving total shareholder return through dividends and opportunistic share repurchases #3 CAPITAL ALLOCATION PRIORITIES AND LONG TERM FINANCIAL TARGETS Mid-Teens Consolidated Adj. EBITDA Margin (2023) $6.0bn Consolidated Revenue by 2023 50% Increase Consolidated Revenue (2020 to 2023) 30% Accretive in 2021 and significantly higher in year two driven by Acima acquisition 60% Increase Consolidated Adj. EBITDA1 (2020 to 2023) Long Term Financial Targets <2.0x Maintain Net Leverage (2021) Balance Sheet & Capital Allocation Priorities

Appendix

15 Q1 2021 FINANCIAL HIGHLIGHTS 1 Non-GAAP financial measure. Refer to explanations and reconciliations elsewhere in this presentation. Q1 2021 In millions, except percentages and EPS Actual % of Total Revenue Rent-A-Center Business $525 50.6% Acima $457 44.1% Franchising $40 1.4% Mexico $14 3.9% Total Revenue $1,037 100.0% % of Segment Revenue Rent-A-Center Business $126 24.0% Acima $41 8.9% Franchising $5 12.5% Mexico $2 14.3% Corporate ($39) (3.8%) Adjusted EBITDA1 $135 13.0% Non-GAAP Diluted EPS1 $1.32 Selected Metrics Q1 2021 Cash $123 Debt (excluding financing fees) $1,380 Pro forma Net Debt to Adjusted EBITDA 2.0x

16 RECONCILIATION OF NET EARNINGS PER SHARE TO NON-GAAP DILUTED EARNINGS PER SHARE 1 Refer to slide 17 for additional details (in thousands, except per share data) Amount Per Share Amount Per Share Net Earnings 42,552$ 0.64$ 49,292$ 0.88$ Special items, net of taxes Other (gains) charges 1 43,328 0.65 1,464 0.03 Debt refinancing charges 6,545 0.10 - - Discrete income tax items (4,710) (0.07) (13,012) (0.24) Net earnings excluding special items 87,715$ 1.32$ 37,744$ 0.67$ 2021 2020 Three Months Ended March 31,

17 RECONCILIATION OF OPERATING PROFIT TO ADJUSTED EBITDA (CONSOLIDATED AND BY SEGMENT) (in thousands) Rent-A- Center Business Acima Mexico Franchising Corporate Consolidated GAAP Operating Profit (Loss) 121,277$ 24,814$ 1,954$ 4,985$ (82,984)$ 70,046$ Plus: Amortization, Depreciation 4,577 474 120 16 8,206 13,393 Plus: Special Items (Extraordinary, Unusual or Non-Recurring Gains or Charges) Acima transaction costs - - - - 16,406 16,406 Acima equity consideration vesting - - - - 15,882 15,882 Acima acquired intangibles amortization - 13,934 - - - 13,934 Acima integration costs 18 1,519 - - 1,707 3,244 Acima acquired software depreciation - - - - 1,324 1,324 Store closure costs 327 - 2 - - 329 Adjusted EBITDA 126,199$ 40,741$ 2,076$ 5,001$ (39,459)$ 134,558$ Three Months Ended March 31, 2021 (in thousands) Rent-A- Center Business Acima Mexico Franchising Corporate Consolidated GAAP Operating Profit (Loss) 67,943$ 18,222$ 967$ 2,519$ (40,776)$ 48,875$ Plus: Amortization, Depreciation 4,957 527 93 3 9,333 14,913 Plus: Special Items (Extraordinary, Unusual or Non-Recurring Gains or Charges) Store closure costs 826 - 4 - - 830 Cost savings initiatives 451 77 - - - 528 COVID-19 impacts 317 - - - - 317 Asset disposals 211 - - - - 211 Insurance reimbursement proceeds (183) - - - - (183) Adjusted EBITDA 74,522$ 18,826$ 1,064$ 2,522$ (31,443)$ 65,491$ Three Months Ended March 31, 2020

18 RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITES TO FREE CASH FLOW 2020 (in thousands) Amount Amount Net cash provided by operating activities 135,793$ 47,400$ Purchase of property assets (11,388) (9,151) Free cash flow 124,405$ 38,249$ Proceeds from sale of stores -$ 187$ Acquisitions of businesses (1,267,903) - Free cash flow including acquisitions and divesitures (1,143,498)$ 38,436$ 2021 Three Months Ended March 31,

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Epsilon Energy Ltd. Schedules First Quarter 2024 Earnings Release and Conference Call

- Galway Metals Announces Closing of Private Placement of Flow-Through Units

- First Savings Financial Group, Inc. Reports Financial Results for The Second Fiscal Quarter Ended March 31, 2024

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share