Form 8-K Phillips 66 For: Aug 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report:

(Date of earliest event reported)

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices and zip code)

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading symbol |

Name of each exchange on which registered | ||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

On August 17, 2022, Phillips 66 (the “Company”) posted to its website a presentation summarizing two transactions it announced with respect to the realignment of economic interests in DCP Midstream, LP (“DCP Midstream”) and the offer to purchase for cash all publicly held common units of DCP Midstream pursuant to a merger with an indirect subsidiary of the Company with DCP Midstream being the surviving entity, in each case as further described in Item 8.01 below. A copy of this presentation is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing.

| Item 8.01 | Other Events. |

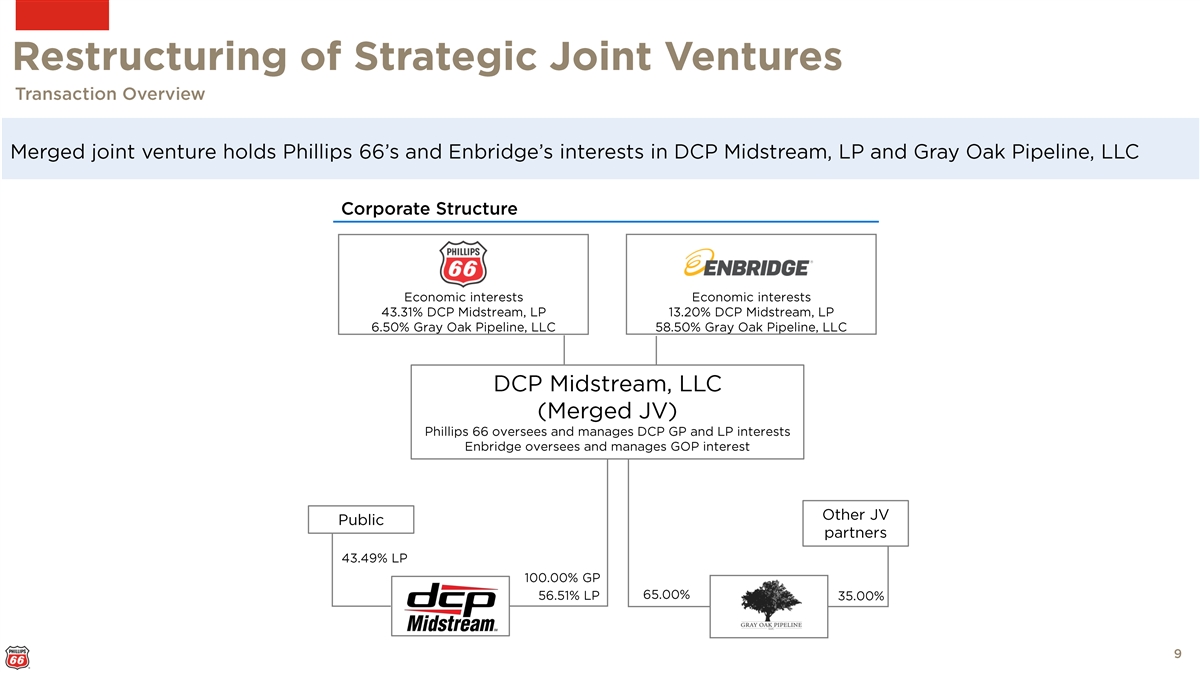

Joint Venture Merger

On August 17, 2022, the Company announced a realignment of its economic and governance interests in DCP Midstream and Gray Oak Pipeline, LLC (“Gray Oak Pipeline”) through the merger of existing joint ventures (the “Merger”) owned with Enbridge (U.S.) Inc. (“Enbridge”). A copy of the news release issued by the Company in connection with the realignment of its interests in DCP Midstream is attached hereto as Exhibit 99.2 and incorporated herein by reference.

The Merger was accomplished pursuant to an Agreement and Plan of Merger entered into as of August 17, 2022 (the “Merger Agreement”), by and among Enbridge, Enbridge Holdings (Gray Oak) LLC, a Delaware limited liability company (“Enbridge GOH Holdings”), Spectra Energy DEFS Holding, LLC, a Delaware limited liability company (“Spectra DEFS Holding”), Phillips 66 Company, a Delaware corporation (“P66”), Phillips Gas Company LLC, a Delaware limited liability company (“PGC”), DCP Midstream, LLC, a Delaware limited liability company (“DCP LLC”), and Gray Oak Holdings LLC, a Delaware limited liability company (“GOH”). A copy of the Merger Agreement is attached hereto as Exhibit 99.3.

Immediately after the effective time of the Merger, PGC and Spectra DEFS Holding, as the members of DCP Midstream, LLC entered into a Third Amended and Restated Limited Liability Company Agreement of DCP Midstream, LLC effective on August 17, 2022 (the “LLC Agreement”). A copy of the LLC Agreement is attached hereto as Exhibit 99.4.

DCP Midstream Proposal

On August 17, 2022, the Company announced it submitted a non-binding proposal to the board of directors of the general partner of DCP Midstream offering to acquire all publicly held common units of DCP Midstream for cash. Subject to negotiation and execution of a definitive agreement, the Company is proposing consideration of $34.75 for each outstanding publicly held common unit of DCP Midstream as part of a transaction that would be structured as a merger of DCP Midstream with an indirect subsidiary of the Company with DCP Midstream as the surviving entity. A copy of the news release issued by the Company in connection with its offer to purchase all publicly held common units of DCP Midstream is attached hereto as Exhibit 99.4 and incorporated herein by reference.

2

Additional Information and Where You Can Find It

This report does not constitute a solicitation of any vote or approval with respect to the proposed transaction. This report relates to a proposed business combination between Phillips 66 and DCP Midstream, LP (“DCP Midstream”). In connection with the proposed transaction, subject to further developments and if a transaction is agreed, Phillips 66 and DCP Midstream expect to file an information statement and other documents with the U.S. Securities and Exchange Commission (“SEC”). INVESTORS AND SECURITYHOLDERS OF PHILLIPS 66 AND DCP MIDSTREAM ARE ADVISED TO CAREFULLY READ ANY INFORMATION STATEMENT AND ANY OTHER DOCUMENTS THAT HAVE BEEN FILED OR MAY BE FILED WITH THE SEC (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION, THE PARTIES TO THE TRANSACTION AND THE RISKS ASSOCIATED WITH THE TRANSACTION. Any definitive information statement, if and when available, will be sent to securityholders of DCP Midstream relating to the proposed transaction. Investors and securityholders may obtain a free copy of such documents and other relevant documents (if and when available) filed by Phillips 66 or DCP Midstream with the SEC from the SEC’s website at www.sec.gov. Securityholders and other interested parties will also be able to obtain, without charge, a copy of such documents and other relevant documents (if and when available) from Phillips 66’s website at www.phillips66.com under the “Investors” tab under the heading “SEC Filings” under the “Financial Information” sub-tab or from DCP Midstream’s website at www.dcpmidstream.com under the “Investors” tab and the “SEC Filings” sub-tab.

Participants in the Solicitation

Phillips 66, DCP Midstream and their respective directors, executive officers and certain other members of management may be deemed to be participants in the solicitation of consents in respect of the transaction. Information about these persons is set forth in Phillips 66’s proxy statement relating to its 2022 Annual Meeting of Stockholders, which was filed with the SEC on March 31, 2022; Phillips 66’s Annual Report on Form 10-K, which was filed with the SEC on February 18, 2022; certain of Phillips 66’s Current Reports on Form 8-K; DCP Midstream’s Annual Report on Form 10-K for the year ended December 31, 2021, which was filed with the SEC on February 18, 2022, and subsequent statements of changes in beneficial ownership on file with the SEC. Securityholders and investors may obtain additional information regarding the interests of such persons, which may be different than those of the respective companies’ securityholders generally, by reading the information statement and other relevant documents regarding the transaction (if and when available), which may be filed with the SEC.

CAUTIONARY STATEMENT FOR FORWARD-LOOKING STATEMENTS

This report certain forward-looking statements. Words and phrases such as “anticipated,” “estimated,” “expected,” “planned,” “scheduled,” “targeted,” “believes,” “continues,” “intends,” “will,” “would,” “objectives,” “goals,” “projects,” “efforts,” “strategies” and similar expressions are used to identify such forward-looking statements. However, the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements included in this report are based on management’s expectations, estimates and projections as of the date they are made.

3

These statements are not guarantees of future performance and you should not unduly rely on them as they involve certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. Forward-looking statements contained in this report include, but are not limited to, statements regarding the expected benefits of the potential transaction to Phillips 66 and its shareholders and DCP Midstream and its unitholders, and the anticipated consummation of the proposed transaction and the timing thereof. Factors that could cause actual results or events to differ materially from those described in the forward-looking statements include: uncertainties as to the timing to consummate the potential transaction; the effects of disruption to Phillips 66’s or DCP Midstream’s respective businesses; the effect of this communication on the price of Phillips 66’s shares or DCP Midstream’s common units; transaction costs; Phillips 66’s ability to achieve benefits from the proposed transaction; and the diversion of management’s time on transaction-related issues. Other factors that could cause actual results to differ from those in forward-looking statements include: the effects of any widespread public health crisis and its negative impact on commercial activity and demand for refined petroleum products; the inability to timely obtain or maintain permits necessary for capital projects; changes to worldwide government policies relating to renewable fuels and greenhouse gas emissions that adversely affect programs like the renewable fuel standards program, low carbon fuel standards and tax credits for biofuels; fluctuations in NGL, crude oil, and natural gas prices, and petrochemical and refining margins; unexpected changes in costs for constructing, modifying or operating our facilities; unexpected difficulties in manufacturing, refining or transporting our products; the level and success of drilling and production volumes around our Midstream assets; risks and uncertainties with respect to the actions of actual or potential competitive suppliers and transporters of refined petroleum products, renewable fuels or specialty products; lack of, or disruptions in, adequate and reliable transportation for our NGL, crude oil, natural gas, and refined products; potential liability from litigation or for remedial actions, including removal and reclamation obligations under environmental regulations; failure to complete construction of capital projects on time and within budget; the inability to comply with governmental regulations or make capital expenditures to maintain compliance; limited access to capital or significantly higher cost of capital related to illiquidity or uncertainty in the domestic or international financial markets; potential disruption of our operations due to accidents, weather events, including as a result of climate change, terrorism or cyberattacks; general domestic and international economic and political developments including armed hostilities, expropriation of assets, and other political, economic or diplomatic developments, including those caused by public health issues and international monetary conditions and exchange controls; changes in governmental policies relating to NGL, crude oil, natural gas, refined petroleum products, or renewable fuels pricing, regulation or taxation, including exports; changes in estimates or projections used to assess fair value of intangible assets, goodwill and property and equipment and/or strategic decisions with respect to our asset portfolio that cause impairment charges; investments required, or reduced demand for products, as a result of environmental rules and regulations; changes in tax, environmental and other laws and regulations (including alternative energy mandates); political and societal concerns about climate change that could result in changes to our business or increase expenditures, including litigation-related expenses; the operation, financing and distribution decisions of equity affiliates we do not control; and other economic, business, competitive and/or regulatory factors affecting Phillips 66’s businesses generally as set forth in our filings with the Securities and Exchange Commission. Phillips 66 is under no obligation (and expressly disclaims any such obligation) to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

4

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Phillips 66 | ||||||

| Dated: August 18, 2022 | By: | /s/ Vanessa Allen Sutherland | ||||

| Vanessa Allen Sutherland Executive Vice President | ||||||

6

Exhibit 99.1

Exhibit 99.2

NEWS RELEASE

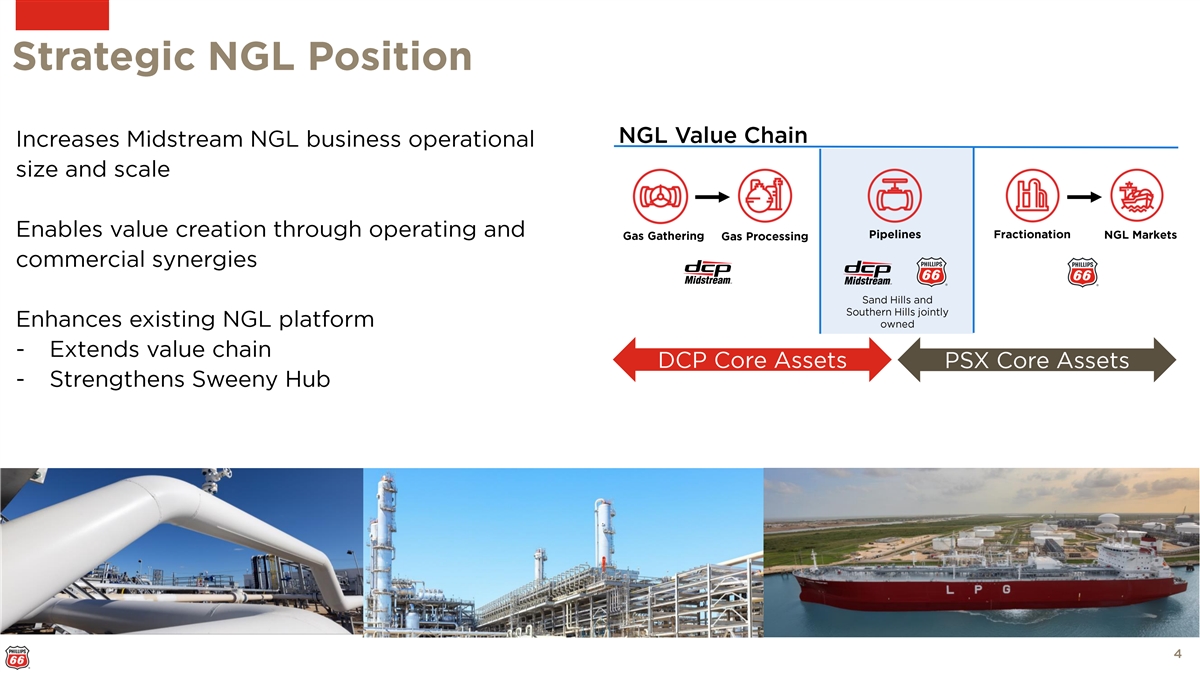

Phillips 66 Enhances NGL Platform with Wellhead to Market

Integration Through Increased Economic Interest in DCP Midstream

| • | Aligns strategic interests through restructuring of joint ventures |

| • | Increases economic interest in DCP Midstream, LP |

| • | Enhances existing NGL platform through value chain integration |

| • | Transaction entered into and closed August 17, 2022 |

HOUSTON, August 17, 2022 – Phillips 66 (NYSE: PSX) announced today a realignment of its economic and governance interests in DCP Midstream, LP (DCP Midstream) (NYSE: DCP) and Gray Oak Pipeline, LLC (Gray Oak Pipeline) through the merger of existing joint ventures owned with Enbridge Inc. (Enbridge).

Phillips 66 increased its economic interest in DCP Midstream from 28.26% to 43.31% and will oversee and manage the joint venture’s interest in DCP Midstream, including the General Partner. Phillips 66’s economic interest in Gray Oak Pipeline decreased from 42.25% to 6.50%. Enbridge will oversee and manage the joint venture’s interest in Gray Oak Pipeline. As part of the transaction, Phillips 66 contributed approximately $400 million of cash. The transaction is expected to be accretive to earnings.

“We are growing our integrated NGL business to further strengthen our competitive position, while driving operational and commercial synergies,” said Mark Lashier, President and CEO of Phillips 66. “DCP is a valued business in our portfolio and enhances our existing value chain from wellhead to market, creating a platform for future NGL growth. Our focus remains on operating excellence and disciplined capital allocation to create sustainable value for our shareholders.”

DCP Midstream is a master limited partnership with a diversified portfolio of assets, engaged in the business of gathering, processing, transporting, storing and marketing natural gas, as well as transporting, fractionating and marketing natural gas liquids. Phillips 66 and Enbridge hold their DCP Midstream general and limited partner interests through DCP Midstream, LLC.

Gray Oak Holdings, LLC, a joint venture between Phillips 66 and Enbridge, has been merged with and into DCP Midstream, LLC. The joint venture continues to own 65% of the Gray Oak Pipeline crude oil system with capacity of 900,000 barrels per day of crude oil from the Permian and Eagle Ford basins in West Texas to the U.S. Gulf Coast.

The transaction was entered into and closed on August 17, 2022. BofA Securities, Inc. acted as exclusive financial advisor to Phillips 66. Bracewell LLP acted as legal counsel, and Gibson Dunn & Crutcher LLP acted as special tax counsel to Phillips 66. For further information on this transaction, refer to the Strategic Joint Venture Update available on the Phillips 66 Investors site, phillips66.com/investors.

CAUTIONARY STATEMENT FOR FORWARD-LOOKING STATEMENTS

This release contains certain forward-looking statements. Words and phrases such as “anticipated,” “estimated,” “expected,” “planned,” “scheduled,” “targeted,” “believes,” “continues,” “intends,” “will,” “would,” “objectives,” “goals,” “projects,” “efforts,” “strategies” and similar expressions are used to identify such forward-looking statements. However, the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements included in this release are based on management’s expectations, estimates and projections as of the date they are made. These statements are not guarantees of future performance and you should not unduly rely on them as they involve certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. Forward-looking statements contained in this release include, but are not limited to, statements regarding the expected benefits of the potential transaction to Phillips 66 and its shareholders and DCP Midstream and its unitholders, and the anticipated consummation of the proposed transaction and the timing thereof. Factors that could cause actual results or events to differ materially from those described in the forward-looking statements include: uncertainties as to the timing to consummate the potential transaction; the effects of disruption to Phillips 66’s or DCP Midstream’s respective businesses; the effect of this communication on the price of Phillips 66’s shares or DCP Midstream’s common units; transaction costs; Phillips 66’s ability to achieve benefits from the proposed transaction; and the diversion of management’s time on transaction-related issues. Other factors that could cause actual results to differ from those in forward-looking statements include: the effects of any widespread public health crisis and its negative impact on commercial activity and demand for refined petroleum products; the inability to timely obtain or maintain permits necessary for capital projects; changes to worldwide government policies relating to renewable fuels and greenhouse gas emissions that adversely affect programs like the renewable fuel standards program, low carbon fuel standards and tax credits for biofuels; fluctuations in NGL, crude oil, and natural gas prices, and petrochemical and refining margins; unexpected changes in costs for constructing, modifying or operating our facilities; unexpected difficulties in manufacturing, refining or transporting our products; the level and success of drilling and production volumes around our Midstream assets; risks and uncertainties with respect to the actions of actual or potential competitive suppliers and transporters of refined petroleum products, renewable fuels or specialty products; lack of, or disruptions in, adequate and reliable transportation for our NGL, crude oil, natural gas, and refined products; potential liability from litigation or for remedial actions, including removal and reclamation obligations under environmental regulations; failure to complete construction of capital projects on time and within budget; the inability to comply with governmental regulations or make capital expenditures to maintain compliance; limited access to capital or significantly higher cost of capital related to illiquidity or uncertainty in the domestic or international financial markets; potential disruption of our operations due to accidents, weather events, including as a result of climate change, terrorism or cyberattacks; general domestic and international economic and political developments including armed hostilities, expropriation of assets, and other political, economic or diplomatic developments, including those caused by public health issues and international monetary conditions and exchange controls; changes in governmental policies relating to NGL, crude oil, natural gas, refined petroleum products, or renewable fuels pricing, regulation or taxation, including exports; changes in estimates or projections used to assess fair value of intangible assets, goodwill and property and equipment and/or strategic decisions with respect to our asset portfolio that cause impairment charges; investments required, or reduced demand for products, as a result of environmental rules and regulations; changes in tax, environmental and other laws and regulations (including alternative energy mandates); political and societal concerns about climate change that could result in changes to our business or increase expenditures, including litigation-related expenses; the operation, financing and distribution decisions of equity affiliates we do not control; and other economic, business, competitive and/or regulatory factors affecting Phillips 66’s businesses generally as set forth in our filings with the Securities and Exchange Commission. Phillips 66 is under no obligation (and expressly disclaims any such obligation) to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

About Phillips 66

Phillips 66 (NYSE: PSX) manufactures, transports and markets products that drive the global economy. The diversified energy company’s portfolio includes Midstream, Chemicals, Refining, and Marketing and Specialties businesses. Headquartered in Houston, Phillips 66 has employees around the globe who are committed to safely and reliably providing energy and improving lives while pursuing a lower-carbon future. For more information, visit phillips66.com or follow @Phillips66Co on LinkedIn or Twitter.

CONTACTS

Jeff Dietert (investors)

832-765-2297

Shannon Holy (investors)

832-765-2297

Thaddeus Herrick (media)

855-841-2368

Exhibit 99.3

AGREEMENT AND PLAN OF MERGER

by and among

ENBRIDGE (U.S.) INC.,

a Delaware corporation,

ENBRIDGE HOLDINGS (GRAY OAK) LLC,

a Delaware limited liability company,

SPECTRA ENERGY DEFS HOLDING, LLC,

a Delaware limited liability company,

PHILLIPS 66 COMPANY,

a Delaware corporation,

PHILLIPS GAS COMPANY LLC,

a Delaware limited liability company,

DCP MIDSTREAM, LLC,

a Delaware limited liability company,

and

GRAY OAK HOLDINGS LLC,

a Delaware limited liability company

Dated as of August 17, 2022

TABLE OF CONTENTS

| ARTICLE 1 DEFINITIONS |

2 | |||||

| 1.1 |

Defined Terms |

2 | ||||

| 1.2 |

Calculation of Time Periods |

10 | ||||

| 1.3 |

Interpretation and Construction |

10 | ||||

| ARTICLE 2 PRE-MERGER TRANSACTIONS |

11 | |||||

| 2.1 |

Contribution of Cash and Purchase and Sale of the Enbridge GOH Interests |

11 | ||||

| ARTICLE 3 MERGER |

11 | |||||

| 3.1 |

The Merger |

11 | ||||

| 3.2 |

Effective Time and Effects of the Merger |

11 | ||||

| 3.3 |

Effect of the Merger on Equity Interests |

12 | ||||

| 3.4 |

Organizational Documents |

12 | ||||

| 3.5 |

Taking of Necessary Action; Further Action |

12 | ||||

| ARTICLE 4 CLOSING |

12 | |||||

| 4.1 |

Closing |

12 | ||||

| 4.2 |

Closing Deliveries by the Enbridge Parties |

13 | ||||

| 4.3 |

Closing Deliveries by the P66 Parties |

13 | ||||

| 4.4 |

Closing Deliveries by DCP LLC |

13 | ||||

| ARTICLE 5 REPRESENTATIONS AND WARRANTIES OF ENBRIDGE |

14 | |||||

| 5.1 |

Organization and Good Standing |

14 | ||||

| 5.2 |

Authorization |

14 | ||||

| 5.3 |

Ownership of Interests |

14 | ||||

| 5.4 |

Non-Contravention |

14 | ||||

| 5.5 |

Consents and Approvals |

15 | ||||

| 5.6 |

Brokerage Fees |

15 | ||||

| 5.7 |

Legal Proceedings |

15 | ||||

| 5.8 |

Independent Investigation; No Other Representations or Warranties |

15 | ||||

| ARTICLE 6 REPRESENTATIONS AND WARRANTIES OF P66 REGARDING THE P66 PARTIES |

16 | |||||

| 6.1 |

Organization and Good Standing |

16 | ||||

| 6.2 |

Authorization |

16 | ||||

| 6.3 |

Ownership of Interests |

16 | ||||

| 6.4 |

Non-Contravention |

17 | ||||

| 6.5 |

Consents and Approvals |

17 | ||||

| 6.6 |

Brokerage Fees |

17 | ||||

| 6.7 |

Legal Proceedings |

17 | ||||

| 6.8 |

Independent Investigation; No Other Representations or Warranties |

17 | ||||

-i-

TABLE OF CONTENTS

| ARTICLE 7 REPRESENTATIONS AND WARRANTIES OF P66 REGARDING GOP |

18 | |||||

| 7.1 |

Organization and Good Standing |

18 | ||||

| 7.2 |

Capitalization |

19 | ||||

| 7.3 |

GOP Financial Statements |

19 | ||||

| 7.4 |

GOP Information |

19 | ||||

| 7.5 |

GOP Governance Agreements |

20 | ||||

| ARTICLE 8 COVENANTS AND AGREEMENTS | 20 | |||||

| 8.1 |

Access and Information |

20 | ||||

| 8.2 |

Change of Operator of GOP |

21 | ||||

| 8.3 |

Public Disclosure and Confidentiality Agreement |

21 | ||||

| 8.4 |

Tax Treatment |

22 | ||||

| 8.5 |

Deliveries of Data Room Content to Enbridge |

23 | ||||

| ARTICLE 9 SURVIVAL; REMEDIES | 23 | |||||

| 9.1 |

Survival |

23 | ||||

| 9.2 |

Remedies; Exclusive Remedy |

24 | ||||

| ARTICLE 10 MISCELLANEOUS |

24 | |||||

| 10.1 |

Notices |

24 | ||||

| 10.2 |

Entire Agreement |

25 | ||||

| 10.3 |

Amendment and Waiver |

26 | ||||

| 10.4 |

Binding Effect; Assignment; No Third Party Benefit |

26 | ||||

| 10.5 |

Severability |

26 | ||||

| 10.6 |

Governing Law; Consent To Jurisdiction; Waiver of Jury Trial |

26 | ||||

| 10.7 |

Expenses |

27 | ||||

| 10.8 |

Transfer Taxes |

27 | ||||

| 10.9 |

Further Assurances |

28 | ||||

| 10.10 |

Specific Performance |

28 | ||||

| 10.11 |

Waiver of Punitive and Other Damages |

28 | ||||

| 10.12 |

Counterparts |

28 | ||||

EXHIBIT A - Form of EGOH Interests Assignment Agreement

EXHIBIT B - Form of Merged LLC JV Agreement

EXHIBIT C - Form of TSA

-ii-

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER is entered into as of 2:00 p.m. Eastern Time on August 17, 2022, by and among Enbridge (U.S.) Inc., a Delaware corporation (“Enbridge”), Enbridge Holdings (Gray Oak) LLC, a Delaware limited liability company (“Enbridge GOH Holdings”), Spectra Energy DEFS Holding, LLC, a Delaware limited liability company (“Spectra DEFS Holding”), Phillips 66 Company, a Delaware corporation (“P66”), Phillips Gas Company LLC, a Delaware limited liability company (“PGC”), DCP Midstream, LLC, a Delaware limited liability company (“DCP LLC”), and Gray Oak Holdings LLC, a Delaware limited liability company (“GOH”).

Recitals:

WHEREAS, each of Spectra DEFS Holding and Enbridge GOH Holdings is an indirect, wholly-owned Subsidiary of Enbridge;

WHEREAS, PGC is an indirect, wholly-owned Subsidiary of P66;

WHEREAS, Spectra DEFS Holding owns 50.00% of the issued and outstanding limited liability company interests in DCP LLC (such interests, the “Enbridge DCP LLC Interests”);

WHEREAS, PGC owns 50% of the issued and outstanding limited liability company interests in DCP LLC (such interests, the “P66 DCP LLC Interests”);

WHEREAS, Enbridge GOH Holdings owns 35% of the issued and outstanding limited liability company interests in GOH (such interests, the “Enbridge GOH Interests”), and PGC owns 65% of the issued and outstanding limited liability company interests in GOH (such interests, the “P66 GOH Interests”);

WHEREAS, the Parties desire that, upon the terms, and subject to the conditions, set forth in this Agreement, on the Closing Date, prior to the Effective Time, (i) in exchange for an agreed upon amount of limited liability company interests in DCP LLC, PGC shall contribute to DCP LLC the amount of cash set forth in Section 2.1(a) of this Agreement, and (ii) upon DCP LLC’s receipt of such cash, Enbridge GOH Holdings shall sell to DCP LLC, and DCP LLC shall purchase from Enbridge GOH Holdings, all of the Enbridge GOH Interests in exchange for such cash (the “GOH Interests Sale”);

WHEREAS, the Parties desire that, upon the terms, and subject to the conditions, set forth in this Agreement, on the Closing Date, at the Effective Time, and after the GOH Interests Sale, GOH shall merge with and into DCP LLC, with DCP LLC surviving such merger as a legal entity jointly owned by (i) Spectra DEFS Holding, holding Class A Membership Interests representing a 23.36% Class A Percentage Interest and Class B Membership Interests representing a 90% Class B Percentage Interest, and (ii) PGC, holding Class A Membership Interests representing a 76.64% Class A Percentage Interest and Class B Membership Interests representing a 10% Class B Percentage Interest, with each owner having rights and obligations with respect to Merged LLC and its Subsidiaries as set forth in the Merged LLC JV Agreement;

-1-

WHEREAS, the Parties desire that, upon the terms, and subject to the conditions, set forth in this Agreement, at the Effective Time, Spectra DEFS Holding and PGC would, as the sole parties to, and owners of, Merged LLC, have the rights and obligations with respect to Merged LLC and its Subsidiaries as set forth in the Merged LLC JV Agreement; and

WHEREAS, the Parties desire to make certain representations, warranties, covenants and agreements in connection with this Agreement, all as set forth in this Agreement.

NOW, THEREFORE, in consideration of the premises and the representations, warranties, covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties hereto agree as follows:

ARTICLE 1

DEFINITIONS

1.1 Defined Terms. As used in this Agreement, each of the following capitalized terms shall have the meaning given to it below:

“Affiliate” means, with respect to any Person, any other Person that directly or indirectly, through one or more intermediaries, Controls, is Controlled by, or is under common Control with, such Person as of the date on which, or at any time during the period for which, the determination of affiliation is being made; provided, however, solely for purposes of this Agreement (and not for purposes of any analysis under GAAP with respect to the consolidation of related entities for accounting purposes), (a) the Enbridge Parties, the P66 Parties and their respective Affiliates (other than the DCP Companies and the GOH Companies) shall be deemed not to be “Affiliates” of the DCP Companies and the GOH Companies, and (b) the DCP Companies and the GOH Companies shall be deemed not to be “Affiliates” of the Enbridge Parties, the P66 Parties and their respective Affiliates (other than the DCP Companies and the GOH Companies).

“Agreement” means this Agreement and Plan of Merger, as the same may be amended or supplemented from time to time in accordance with its terms.

“Announcement Press Releases” has the meaning set forth in Section 8.3(a).

“Audited Financial Statements” has the meaning set forth in Section 7.3.

“Bankruptcy and Equity Exception” has the meaning set forth in Section 5.2.

“Business Day” means a day (other than a Saturday or Sunday) on which commercial banks in Texas are generally open for business.

“Cash Contribution” has the meaning set forth in Section 2.1(a).

“Cash Payment Amount” has the meaning set forth in Section 2.1(b).

“Certificate of Merger” has the meaning set forth in Section 3.2.

“Chosen Courts” has the meaning set forth in Section 10.6(b).

-2-

“Class A Membership Interests” has the meaning set forth in the Merged LLC JV Agreement.

“Class A Percentage Interest” has the meaning set forth in the Merged LLC JV Agreement.

“Class B Membership Interests” has the meaning set forth in the Merged LLC JV Agreement.

“Class B Percentage Interest” has the meaning set forth in the Merged LLC JV Agreement.

“Closing” means the consummation of the Transactions.

“Closing Date” has the meaning set forth in Section 4.1.

“Code” means the Internal Revenue Code of 1986, as amended.

“Confidentiality Agreement” has the meaning set forth in Section 8.3(b).

“Confidential Information” has the meaning set forth in the Confidentiality Agreement.

“Contract” means any written or oral agreement, contract, commitment, undertaking, lease, note, mortgage, indenture, settlement or license.

“Control” and its derivatives mean, with respect to any Person, the possession, directly or indirectly, of (a) the power or authority to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities, by Contract or otherwise, (b) without limiting any other clause of this definition, if applicable to such Person (even if such Person is a corporation), where such Person is a corporation, the power to exercise or determine the voting of more than fifty percent (50%) of the voting rights in such corporation, (c) without limiting any other clause of this definition, if applicable to such Person (even if such Person is a limited partnership), where such Person is a limited partnership, the power to exercise or determine the voting of more than fifty percent (50%) of the Equity Interests of the sole general partner of such limited partnership or (d) without limiting any other clause of this definition, if applicable to such Person, in the case of a Person that is any other type of entity, the right to exercise or determine the voting of more than fifty percent (50%) of the Equity Interests in such Person having voting rights, whether by contract or otherwise.

“COVID-19” means SARS-CoV-2 or COVID-19, and any evolutions of COVID-19 or related or associated epidemics, pandemic or disease outbreaks.

“COVID-19 Measures” means any action or inactions taken (or not taken), or plans, procedures or practices adopted (and compliance with such plans, procedures or practices), in each case, that are (a) taken or adopted in good faith acting as a reasonably prudent operator and (b) in connection with or in respect to any quarantine, “shelter in place,” “stay at home,” social distancing, shut down, closure, sequester or any other Law, order, directive, guidelines or recommendations by any Government Entity (including the Centers for Disease Control and

-3-

Prevention and the World Health Organization) in connection with or in response to COVID-19, including the Coronavirus Aid, Relief, and Economic Security Act (CARES) or the Coronavirus Response and Relief Supplemental Appropriations Act of 2021.

“Data Room” means the electronic, online virtual data room accessed at Intralinks (an SS&C company) maintained by or on behalf of P66.

“DCP Business” means the business of the DCP Companies.

“DCP Companies” means DCP LLC and its Subsidiaries.

“DCP LLC” has the meaning set forth in the Preamble.

“Deemed Contribution” has the meaning set forth in Section 8.4(a).

“DLLCA” has the meaning set forth in Section 3.1.

“Easements” means easements, rights of way, licenses, land use permits and other similar agreements granting rights in the owned real property of another Person and used in the conduct of the GOH Business.

“Effective Time” has the meaning set forth in Section 3.2.

“EGOH Interests Assignment Agreement” means the Enbridge GOH Interests Assignment Agreement to be entered into by Enbridge GOH Holdings and DCP LLC at the Closing, pursuant to which the Enbridge GOH Interests are transferred and assigned by Enbridge GOH Holdings to DCP LLC on the Closing Date, in substantially the form attached hereto as Exhibit A.

“Enbridge” has the meaning set forth in the Preamble.

“Enbridge DCP LLC Interests” has the meaning set forth in the Recitals.

“Enbridge GOH Holdings” has the meaning set forth in the Preamble.

“Enbridge GOH Interests” has the meaning set forth in the Recitals.

“Enbridge Material Adverse Effect” means any change, circumstance, development, state of facts, effect or condition that, individually or in the aggregate, has had or would be reasonably likely to have a material adverse effect on (a) the assets, liabilities, capitalization, business, financial condition or results of operations of the DCP Companies, taken as a whole; provided, however, that in no event shall any of the following, either alone or in combination, be deemed to constitute or contribute to an Enbridge Material Adverse Effect under this clause (a), or otherwise be taken into account in determining whether an Enbridge Material Adverse Effect under this clause (a) has occurred: (i) any change or prospective change in Law or accounting standards (including GAAP) or interpretations or the enforcement thereof, (ii) any change in U.S. economic, political or business conditions or financial, credit, debt or securities market conditions generally, including changes in interest rates, exchange rates, commodity prices, electricity prices and fuel

-4-

costs, (iii) any legal, regulatory or other change generally affecting the industries, industry sectors or geographic sectors in which the DCP Companies or their assets operate, including any change in the prices of oil, natural gas, natural gas liquids or other hydrocarbon products or the demand for related transportation and storage services, (iv) any change resulting or arising from acts of war (whether or not declared), hostilities, sabotage, terrorism, military actions or the escalation of any of the foregoing, any hurricane, flood, tornado, earthquake or other natural disaster, or any other force majeure event, whether or not caused by any Person, or any national or international calamity or crisis, (v) any change in the credit rating of any of the DCP Companies or any of their securities, (vi) the outbreak or continuation of or any escalation or worsening of any epidemic, pandemic or disease (including the COVID-19 pandemic), or any Law, directive, pronouncement or guideline issued by a Government Entity, the Centers for Disease Control and Prevention or the World Health Organization providing for business closures, “sheltering-in-place” or other restrictions that relate to, or arise out of, an epidemic, pandemic or disease outbreak (including COVID-19 Measures) or (vii) any failure by the Enbridge Parties, any of the DCP Companies or the assets of the DCP Companies to achieve any published or internally prepared budgets, projections, predictions, estimates, plans or forecasts of revenues, earnings or other financial performance measures or operating statistics (it being understood that the facts and circumstances giving rise to such failure may be deemed to constitute, and may be taken into account in determining whether there has been or would reasonably be expected to be an Enbridge Material Adverse Effect if such facts and circumstances are not otherwise described in clauses (a)(i) through (a)(vi) of this definition); provided, further, that with respect to clauses (i) through (iv) of this definition, such change, circumstance, development, state of facts, effect or condition may be taken into account to the extent it disproportionately impacts the DCP Companies as compared to other companies in the industries in which the DCP Companies operate; or (b) the ability of the Enbridge Parties to consummate the Transactions. Notwithstanding anything to the contrary in this Agreement, in determining whether an Enbridge Material Adverse Effect exists, any indemnification by Enbridge or P66 under this Agreement or any insurance, claim right of contribution, other indemnity or other rights, shall not be taken into consideration or account.

“Enbridge Parties” means Enbridge, Enbridge GOH Holdings and Spectra DEFS Holding.

“Encumbrance” means any lien, pledge, charge, encumbrance, security interest, option, mortgage, Easement or other restriction on transfers.

“Equity Interests” means, with respect to any Person, (a) capital stock, membership interests, partnership interests, other equity interests, rights to profits or revenue and any other similar interest in such Person, (b) any security or other interest convertible into or exchangeable or exercisable for any of the foregoing, whether at the time of issuance or upon the passage of time or the occurrence of some future event and (c) any warrant, option or other right (contingent or otherwise) to acquire any of the foregoing.

“Financial Statements” has the meaning set forth in Section 7.3.

“Fraud” means, with respect to a Party, actual and intentional common law fraud with an intent to deceive with respect to any material statement in any representation or warranty set forth herein. Without limiting the foregoing, neither imputed nor constructive fraud shall constitute “Fraud” as used in this Agreement.

-5-

“Fundamental Representations” has the meaning set forth in Section 9.1.

“GAAP” means United States generally accepted accounting principles, consistently applied.

“GOH” has the meaning set forth in the Preamble.

“GOH Business” means the business of the GOH Companies.

“GOH Companies” means GOH and its Subsidiaries.

“GOH Interests Sale” has the meaning set forth in the Recitals.

“GOP” means Gray Oak Pipeline, LLC, a Delaware limited liability company.

“GOP Business” means the business of GOP.

“GOP Governance Agreements” means the GOP LLC Agreement and the GOP Operating Agreement.

“GOP LLC Agreement” means that certain Amended and Restated Limited Liability Company Agreement of Gray Oak Pipeline, LLC, dated as of April 23, 2018, by and among GOH, Gray Oak Gateway Holdings LLC and Rattler Midstream Operating LLC, as amended by that certain Addendum Agreement, dated as of February 15, 2019, between Rattler Midstream Operating LLC and GOP.

“GOP Operating Agreement” means that certain Operating Agreement, dated as of April 23, 2018, by and between GOP and P66 Operator.

“Government Entity” means any federal, state, provincial, local or foreign court, tribunal, administrative body or other governmental or quasi-governmental entity, including any head of a government department, body or agency, with competent jurisdiction.

“Governmental Order” means any order, writ, judgment, temporary, preliminary or permanent injunction, decree, ruling, stipulation, determination or award entered by or with any Government Entity.

“Indebtedness” means, with respect to any Person, as of any specified time, (a) all obligations of such Person for borrowed money to the extent required to be reflected as a liability on a balance sheet prepared in accordance with GAAP, (b) all obligations of such Person evidenced by bonds, debentures, notes or similar instruments to the extent required to be reflected as a liability on a balance sheet prepared in accordance with GAAP, (c) all obligations of such Person as an account party in respect of letters of credit and bankers’ acceptances or similar credit transactions and (d) all obligations of such Person guaranteeing any obligations of any other Person of the type described in the foregoing clauses (b) and (c).

“Knowledge” means, with respect to Enbridge, the actual knowledge (as opposed to any constructive or imputed knowledge) of the individuals listed in Schedule 1.1(b) or, with respect to P66, the actual knowledge (as opposed to any constructive or imputed knowledge) of the individuals listed in Schedule 1.1(a).

-6-

“Law” means any law, statute, ordinance, rule, regulation, code, order, judgment, injunction or decree enacted, issued, promulgated, enforced or entered by any Government Entity.

“Liabilities” of any Person means, as of any given time, any and all Indebtedness, liabilities, commitments and obligations of any kind of such Person, whether fixed, contingent or absolute, matured or unmatured, liquidated or unliquidated, accrued or not accrued, asserted or not asserted, known or unknown, determined, determinable or otherwise, whenever or however arising (including whether arising out of any Contract or tort based on negligence or strict liability).

“Marathon Consent” has the meaning set forth in Section 8.2.

“Merged LLC” has the meaning set forth in Section 3.1.

“Merged LLC JV Agreement” means the Third Amended and Restated Limited Liability Company Agreement of DCP Midstream, LLC to be entered into by Spectra DEFS Holding and PGC at the Closing, in the form attached hereto as Exhibit B.

“Merger” has the meaning set forth in Section 3.1.

“Organizational Documents” means (a) with respect to any Person that is a corporation, its articles or certificate of incorporation or memorandum and articles of association, as the case may be, and bylaws, (b) with respect to any Person that is a partnership, its certificate of partnership and partnership agreement, (c) with respect to any Person that is a limited liability company, its certificate of formation and limited liability company or operating agreement, (d) with respect to any Person that is a trust or other entity, its declaration or agreement of trust or other constituent document and (e) with respect to any other Person, its comparable organizational documents.

“P66” has the meaning set forth in the Preamble.

“P66 DCP LLC Interests” has the meaning set forth in the Recitals.

“P66 GOH Interests” has the meaning set forth in the Recitals.

“P66 Material Adverse Effect” means any change, circumstance, development, state of facts, effect or condition that, individually or in the aggregate, has had or would be reasonably likely to have a material adverse effect on (a) the assets, liabilities, capitalization, business, financial condition or results of operations of the GOH Companies, taken as a whole; provided, however, that in no event shall any of the following, either alone or in combination, be deemed to constitute or contribute to a P66 Material Adverse Effect under this clause (a), or otherwise be taken into account in determining whether a P66 Material Adverse Effect under this clause (a) has occurred: (i) any change or prospective change in Law or accounting standards (including GAAP) or interpretations or the enforcement thereof, (ii) any change in U.S. economic, political or business conditions or financial, credit, debt or securities market conditions generally, including changes in interest rates, exchange rates, commodity prices, electricity prices and fuel costs,

-7-

(iii) any legal, regulatory or other change generally affecting the industries, industry sectors or geographic sectors in which the GOH Companies or their assets operate, including any change in the prices of oil, natural gas, natural gas liquids or other hydrocarbon products or the demand for related transportation and storage services, (iv) any change resulting or arising from acts of war (whether or not declared), hostilities, sabotage, terrorism, military actions or the escalation of any of the foregoing, any hurricane, flood, tornado, earthquake or other natural disaster, or any other force majeure event, whether or not caused by any Person, or any national or international calamity or crisis, (v) any change in the credit rating of any of the GOH Companies or any of their securities, (vi) the outbreak or continuation of or any escalation or worsening of any epidemic, pandemic or disease (including the COVID-19 pandemic), or any Law, directive, pronouncement or guideline issued by a Government Entity, the Centers for Disease Control and Prevention or the World Health Organization providing for business closures, “sheltering-in-place” or other restrictions that relate to, or arise out of, an epidemic, pandemic or disease outbreak (including COVID-19 Measures) or (vii) any failure by the P66 Parties, any of the GOH Companies or the assets of the GOH Companies to achieve any published or internally prepared budgets, projections, predictions, estimates, plans or forecasts of revenues, earnings or other financial performance measures or operating statistics (it being understood that the facts and circumstances giving rise to such failure may be deemed to constitute, and may be taken into account in determining whether there has been or would reasonably be expected to be a P66 Material Adverse Effect if such facts and circumstances are not otherwise described in clauses (a)(i) through (a)(vi) of this definition); provided, further, that with respect to clauses (i) through (iv) of this definition, such change, circumstance, development, state of facts, effect or condition may be taken into account to the extent it disproportionately impacts the GOH Companies as compared to other companies in the industries in which the GOH Companies operate; or (b) the ability of the P66 Parties to consummate the Transactions. Notwithstanding anything to the contrary in this Agreement, in determining whether a P66 Material Adverse Effect exists, any indemnification by Enbridge or P66 under this Agreement or any insurance, claim right of contribution, other indemnity or other rights, shall not be taken into consideration or account.

“P66 Operator” means Phillips 66 Pipeline LLC, a Delaware limited liability company.

“P66 Parties” means P66 and PGC.

“Party” means a party to this Agreement.

“Person” means an individual, a corporation, a general or limited partnership, an association, a limited liability company, a Government Entity, a trust or other entity or organization.

“PGC” has the meaning set forth in the Preamble.

“Proceeding” means any action, cause of action, claim, demand, litigation, suit, investigation, grievance, citation, summons, subpoena, inquiry, audit, hearing, originating application to a tribunal, arbitration or other similar proceeding of any nature, civil, criminal, regulatory, administrative or otherwise, whether in equity or at law, in contract, in tort or otherwise.

“Rattler Consent” has the meaning set forth in Section 8.2.

-8-

“Representatives” means, with respect to any Person, any and all partners, managers, members (if such Person is a member-managed limited liability company), directors, officers, employees, consultants, financial advisors, counsels, accountants and other agents of such Person.

“SEC” has the meaning set forth Section 8.3(c)(ii).

“Spectra DEFS Holding” has the meaning set forth in the Preamble.

“Subsidiary” means, with respect to any Person, any other Person of which (a) more than 50% of (i) the total combined voting power of all classes of voting securities of such entity, (ii) the total combined equity interests or (iii) the capital or profit interests, in each case, is beneficially owned, directly or indirectly, by such Person or (b) the power to vote or to direct the voting of sufficient securities to elect a majority of the board of directors or similar governing body is held by such Person; provided, however, that when used with respect to any Enbridge Party or P66 Party, the term “Subsidiary” shall not include GOH, DCP LLC or their respective Subsidiaries.

“Survival Period” has the meaning set forth in Section 9.1.

“Tax Returns” means all reports, returns, declarations, elections, notices, filings, forms, statements and other documents (whether intangible, electronic or other form) and including any amendments, schedules, attachments, supplements, appendices and exhibits thereto, filed or required to be filed by Law with respect to Taxes.

“Taxes” means all federal, state, provincial, territorial, local or foreign taxes, including income, capital, capital gains, gross receipts, windfall profits, value added, severance, property, production, sales, goods and services, harmonized sales, use, duty, license, excise, franchise, employment, withholding or similar taxes, fees, duties, levies, customs, tariffs or imposts, assessments, obligations or charges, together with any interest, additions or penalties with respect thereto and any interest in respect of such additions or penalties.

“Transaction Documents” means this Agreement, the EGOH Interests Assignment Agreement, the TSA, the Merged LLC JV Agreement and any other agreements entered into in connection with the Closing.

“Transactions” means the Merger and the other transactions contemplated by this Agreement, including the execution and delivery of the items described in Section 4.2, Section 4.3 and Section 4.4.

“Transfer Taxes” has the meaning set forth in Section 10.8.

“TSA” means the Transition Services Agreement to be entered into by P66 Operator and Enbridge GOH Holdings at the Closing, pursuant to which P66 Operator will provide certain transition services to Enbridge GOH Holdings after the Closing, in substantially the form attached hereto as Exhibit C.

“Unaudited Financial Statements” has the meaning set forth in Section 7.3.

-9-

1.2 Calculation of Time Periods. When calculating the period of time within which, or following which, any act is to be done or step taken pursuant to this Agreement, the date that is the reference day in calculating such period shall be excluded. If the last day of the period is a non-Business Day, the period in question shall end on the next Business Day.

1.3 Interpretation and Construction. Unless the express context otherwise requires:

(a) The word “day” means calendar day;

(b) the words “hereof”, “herein”, and “hereunder” and words of similar import, when used in this Agreement, shall refer to this Agreement as a whole and not to any particular provision of this Agreement;

(c) the terms defined in the singular have a comparable meaning when used in the plural and vice versa;

(d) the terms “Dollars” and “$” mean United States Dollars;

(e) references to a specific time shall refer to prevailing Central Time, unless otherwise indicated;

(f) the Preamble, and all Recital, Article, Section, Subsection, schedule and exhibit references used in this Agreement are to the preamble, recitals, articles, sections, subsections, schedules and exhibits to this Agreement unless otherwise specified herein;

(g) wherever the word “include”, “includes”, or “including” is used in this Agreement, it shall be deemed to be followed by the words “without limitation”;

(h) references herein to any gender include the other gender;

(i) references in this Agreement to the “United States” mean the United States of America and its territories and possessions;

(j) the word “extent” in the phrase “to the extent” shall mean the degree to which a subject or other thing extends and such phrase shall not mean simply “if”;

(k) except as otherwise specifically provided in this Agreement, any agreement, instrument or statute defined or referred to herein means such agreement, instrument or statute as from time to time amended, supplemented or modified, including (i) (in the case of agreements or instruments) by waiver or consent and (in the case of statutes) by succession of comparable successor statutes and (ii) all attachments thereto and instruments incorporated therein;

(l) the heading references herein and the table of contents hereof are for convenience purposes only, and shall not be deemed to limit or affect any of the provisions hereof;

(m) all accounting terms not otherwise defined herein have the meanings assigned to them in accordance with GAAP; and

-10-

(n) the term “made available to Enbridge,” “provided to Enbridge” or other similar phrases shall mean made and remaining available to Enbridge in the Data Room at least two (2) days prior to the Closing Date and not removed or altered on or prior to the Closing Date.

ARTICLE 2

PRE-MERGER TRANSACTIONS

2.1 Contribution of Cash and Purchase and Sale of the Enbridge GOH Interests. Upon the terms, and subject to the conditions, of this Agreement, the following matters shall take place on the Closing Date, prior to the Effective Time, in the order set forth below:

(a) PGC shall contribute to DCP LLC cash in an amount equal to $403,846,153 (the “Cash Contribution”) that Spectra DEFS Holding and PGC agree will result in an increase in the amount of PGC’s limited liability company interests in DCP LLC and a decrease in the amount of Spectra DEFS Holdings’ limited liability company interests in DCP LLC, effective as of the time the Cash Contribution is made pursuant to this Section 2.1(a).

(b) After DCP LLC’s receipt of the Cash Contribution, Enbridge GOH Holding shall sell, convey, assign and transfer to DCP LLC, free and clear of all Encumbrances (other than those arising pursuant to the Organizational Documents of GOH, this Agreement or applicable federal or state securities Laws), and DCP LLC shall purchase, acquire and accept from Enbridge GOH Holding, all right, title and interest of Enbridge GOH Holding in and to the Enbridge GOH Interests, in exchange for DCP LLC paying Enbridge GOH Holding a cash purchase price in an amount equal to the Cash Contribution (the “Cash Payment Amount”).

ARTICLE 3

MERGER

3.1 The Merger. Upon the terms, and subject to the conditions, of this Agreement, at the Effective Time, which shall be after the GOH Interests Sale, GOH shall be merged with and into DCP LLC (the “Merger”) in accordance with the applicable provisions of the Delaware Limited Liability Company Act (the “DLLCA”), with DCP LLC surviving the Merger (sometimes hereinafter referred to as “Merged LLC”) as a legal entity jointly owned by (i) Spectra DEFS Holding, holding Class A Membership Interests representing a 23.36% Class A Percentage Interest and Class B Membership Interests representing a 90% Class B Percentage Interest, and (ii) PGC, holding Class A Membership Interests representing a 76.64% Class A Percentage Interest and Class B Membership Interests representing a 10% Class B Percentage Interest, with each owner having the rights and obligations with respect to Merged LLC and its Subsidiaries as set out in the Merged LLC JV Agreement. As a result of the Merger, the separate existence of GOH shall cease, and DCP LLC shall continue its existence as Merged LLC under the laws of the State of Delaware as the surviving entity.

3.2 Effective Time and Effects of the Merger. Upon the terms, and subject to the conditions, set forth in this Agreement, on the Closing Date and in connection with the Closing, the Parties shall cause the Merger to be consummated under the DLLCA by filing a certificate of merger in such form as is required by, and executed in accordance with, the DLLCA (the “Certificate of Merger”) with the Office of the Secretary of State of the State of Delaware and

-11-

shall take such further actions as may be required to make the Merger effective. The Merger shall become effective upon the filing of the Certificate of Merger with the Office of the Secretary of State of the State of Delaware, or at such later time as shall be agreed upon by the Parties and specified in the Certificate of Merger (the time at which the Merger becomes effective is herein referred to as the “Effective Time”). At the Effective Time, the Merger shall have the effects set forth in this Agreement and the applicable provisions of the DLLCA. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, all the property, rights, privileges, powers and franchises of GOH shall vest in Merged LLC, and all debts, liabilities, obligations, restrictions and duties of GOH shall become the debts, liabilities, obligations, restrictions and duties of Merged LLC.

3.3 Effect of the Merger on Equity Interests. By virtue of the Merger and without any action on the part of any Person, all of the limited liability company interests of DCP LLC and all of the limited liability company interests of GOH issued and outstanding immediately prior to the Effective Time shall, at the Effective Time, collectively be converted into Class A Membership Interests and Class B Membership Interests of Merged LLC in the respective amounts and types specified in Section 3.1, in each case as evidenced by references in Appendix II to the Merged LLC JV Agreement.

3.4 Organizational Documents. At the Effective Time, (i) the certificate of formation of DCP LLC, as in effect immediately prior to the Effective Time, shall become the certificate of formation of Merged LLC, (ii) the Merged LLC JV Agreement shall become the limited liability company agreement of Merged LLC, and (iii) Spectra DEFS Holding and PGC shall each continue as members of Merged LLC in accordance with, and subject to the rights and obligations of, the Merged LLC JV Agreement.

3.5 Taking of Necessary Action; Further Action. If, at any time after the Effective Time, any further action is necessary or desirable to carry out the purposes of this Article 3 and to vest Merged LLC with full right, title and possession to all assets, property, rights, privileges, powers, franchises, debts, liabilities, obligations, restrictions and duties of GOH, the officers and directors of such constituent parties to the Merger are fully authorized in the name of such constituent parties or otherwise to take, and shall take, all such lawful and necessary action, so long as such action is not inconsistent with this Article 3.

ARTICLE 4

CLOSING

4.1 Closing. The transactions contemplated to occur at the Closing shall commence concurrently with the execution and delivery of this Agreement, or such other time as the Parties may mutually agree, on the date of execution and delivery of this Agreement by each of the Parties (the “Closing Date”). The Closing will take place by electronic delivery of documents (by facsimile, “portable document format,” email or other form of electronic communication) all of which will be deemed to be originals.

-12-

4.2 Closing Deliveries by the Enbridge Parties. At the Closing, Enbridge shall (i) deliver, or cause the other Enbridge Parties to deliver, as applicable, the following to P66 and DCP LLC as specified below, or (ii) take the following actions, as applicable (and which shall be done in the order specified in Section 2.1, Section 3.1 and Section 3.2, as applicable):

(a) a counterpart of the EGOH Interests Assignment Agreement duly executed by Enbridge GOH Holdings;

(b) a counterpart of the Merged LLC JV Agreement duly executed by Spectra DEFS Holding;

(c) a counterpart of the TSA duly executed by Enbridge GOH Holdings;

(d) a resignation, effective as of the Closing, from each Class B Director of the Board of Directors of DCP Midstream GP, LLC; and

(e) a valid IRS Form W-9 properly completed and duly executed by Enbridge.

4.3 Closing Deliveries by the P66 Parties. At the Closing, P66 shall (i) deliver, or cause the other P66 Parties to deliver, as applicable, the following to Enbridge and DCP LLC as specified below, or (ii) take the following actions, as applicable (and which shall be done in the order specified in Section 2.1, Section 3.1 and Section 3.2, as applicable):

(a) contribution by PGC of the Cash Contribution to DCP LLC, by electronic funds transfer of immediately available funds to the account (for the benefit of DCP LLC) designated by DCP LLC to PGC in writing prior to the Closing;

(b) a counterpart of the Merged LLC JV Agreement duly executed by PGC;

(c) a counterpart of the TSA duly executed by P66 Operator; and

(d) resignations, effective as of the Closing, from the Director of the Board of Directors of GOP designated by GOH as its “alternate Director” and the Director of the Board of Directors of GOP designated by GOH as its “designated Director”, in each case, in accordance with Section 5.2 of the GOP LLC Agreement.

4.4 Closing Deliveries by DCP LLC. At the Closing, DCP LLC shall (i) deliver the following to Enbridge as specified below, or (ii) take the following actions, as applicable (and which shall be done in the order specified in Section 2.1, Section 3.1 and Section 3.2, as applicable):

(a) payment by DCP LLC of the Cash Payment Amount to Enbridge GOH Holdings, by electronic funds transfer of immediately available funds to the account (for the benefit of Enbridge GOH Holdings) designated by Enbridge to DCP LLC in writing prior to the Closing; and

(b) a counterpart of the EGOH Interests Assignment Agreement duly executed by DCP LLC.

-13-

ARTICLE 5

REPRESENTATIONS AND WARRANTIES OF ENBRIDGE

Enbridge represents and warrants to the P66 Parties that:

5.1 Organization and Good Standing. Each of the Enbridge Parties has been duly organized, is validly existing and is in good standing (with respect to jurisdictions that recognize the concept of good standing) under the Laws of its jurisdiction of formation.

5.2 Authorization. Each of the Enbridge Parties has all requisite corporate or similar power and authority to execute and deliver this Agreement and the other Transaction Documents to which it is or will be a party, to perform its obligations hereunder and thereunder and to consummate the Transactions. The execution and delivery of this Agreement and the other Transaction Documents, the performance of such Person’s obligations hereunder and thereunder and the consummation of the Transactions have been duly authorized by all necessary action of such Person. This Agreement and the other Transaction Documents to which such Person is or will be a party have been or will be duly executed and delivered by such Person and assuming the due authorization, execution and delivery of the Transaction Documents by each other party that is or will be a party thereto, constitute legal, valid and binding obligations of such Person, enforceable against such Person in accordance with their terms, subject to applicable bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar Laws affecting the enforcement of creditors’ rights generally or, as to enforceability, by general equitable principles (the “Bankruptcy and Equity Exception”).

5.3 Ownership of Interests. Spectra DEFS Holding is the record and beneficial owner of, and has good and valid title to, the Enbridge DCP LLC Interests, and Enbridge GOH Holdings is the record and beneficial owner of, and has good and valid title to, the Enbridge GOH Interests, in each case, free and clear of all Encumbrances (other than those arising pursuant to this Agreement, applicable federal or state securities Laws or the Organizational Documents of DCP LLC or GOH, as applicable). The Enbridge DCP LLC Interests and the Enbridge GOH Interests are not subject to any voting trust agreement or similar arrangement relating to the voting of such capital stock or other equity interests.

5.4 Non-Contravention. The execution and delivery by each of the Enbridge Parties of this Agreement and the other Transaction Documents to which each is or will be a party, the performance of their respective obligations pursuant to the Transaction Documents and the consummation of the Transactions will not constitute or result in (a) a violation of the Organizational Documents of any of the Enbridge Parties, (b) a breach or violation of, a termination of, a right of termination or default under, the creation or acceleration of any obligations under, or the creation of an Encumbrance on any of the assets of any Enbridge Party pursuant to, any Contract to which such Person is a party (with or without notice, lapse of time or both) or (c) a breach or violation of, or a default under, any Law to which an Enbridge Party is subject, except, in the case of clause (b) or (c), as would not, individually or in the aggregate, have an Enbridge Material Adverse Effect.

-14-

5.5 Consents and Approvals. No consent, approval, waiver, authorization, notice or filing is required to be obtained by any Enbridge Party from, or to be given by any such Person to, or to be made by any such Person with, any Government Entity or other Person, in connection with the execution, delivery and performance by the Enbridge Parties of this Agreement and the other Transaction Documents to which each is or will be a party and the consummation of the Transactions, except (x) as would not, individually or in the aggregate, have an Enbridge Material Adverse Effect or (y) as may be required as a result of any facts or circumstances relating solely to the P66 Parties or any of their respective Affiliates.

5.6 Brokerage Fees. None of the Enbridge Parties or any of their respective Affiliates has retained any financial advisor, broker, agent or finder on account of this Agreement or the transactions contemplated hereby for which any P66 Party, DCP Company, GOH Company or any of their respective Affiliates will be liable.

5.7 Legal Proceedings. There is no civil, criminal or administrative action, suit, demand, claim, hearing, proceeding or investigation, to the Knowledge of Enbridge, pending or threatened in writing against any Enbridge Party or any of their respective properties or assets before any Government Entity, except as would not, individually or in the aggregate, have an Enbridge Material Adverse Effect.

5.8 Independent Investigation; No Other Representations or Warranties. THE ENBRIDGE PARTIES ACKNOWLEDGE THAT IN MAKING THE DECISION TO ENTER INTO THIS AGREEMENT AND TO CONSUMMATE THE TRANSACTIONS, THE ENBRIDGE PARTIES HAVE RELIED SOLELY ON (I) THE BASIS OF THEIR OWN INDEPENDENT INVESTIGATION OF DCP LLC, THE DCP BUSINESS, GOH AND THE GOH BUSINESS, THEIR COMPONENTS AND THE RISKS RELATED THERETO AND (II) UPON THE EXPRESS WRITTEN REPRESENTATIONS, WARRANTIES AND COVENANTS IN THIS AGREEMENT. WITHOUT LIMITING THE FOREGOING, THE ENBRIDGE PARTIES EXPRESSLY ACKNOWLEDGE THAT, EXCEPT FOR THE REPRESENTATIONS AND WARRANTIES CONTAINED IN ARTICLE 6 AND ARTICLE 7, NEITHER THE P66 PARTIES, ANY OF THEIR RESPECTIVE AFFILIATES NOR ANY OF THEIR RESPECTIVE STOCKHOLDERS, TRUSTEES, MEMBERS, FIDUCIARIES OR REPRESENTATIVES, NOR ANY OTHER PERSON HAS MADE OR IS MAKING ANY OTHER REPRESENTATION OR WARRANTY OF ANY KIND OR NATURE WHATSOEVER, ORAL OR WRITTEN, EXPRESS OR IMPLIED, WITH RESPECT TO THE P66 PARTIES, THEIR RESPECTIVE AFFILIATES, THEIR RESPECTIVE BUSINESSES, THE GOH COMPANIES, THE GOH BUSINESS, THE DCP COMPANIES, THE DCP BUSINESS, THIS AGREEMENT, THE OTHER TRANSACTION DOCUMENTS OR THE TRANSACTIONS. EXCEPT FOR THE REPRESENTATIONS AND WARRANTIES CONTAINED IN THIS ARTICLE 5, EACH OF THE ENBRIDGE PARTIES DISCLAIMS, ON BEHALF OF ITSELF AND ITS RESPECTIVE AFFILIATES, (A) ANY OTHER REPRESENTATIONS OR WARRANTIES, WHETHER MADE BY THE ENBRIDGE PARTIES, ANY OF THEIR RESPECTIVE AFFILIATES, ANY OF THEIR RESPECTIVE STOCKHOLDERS, TRUSTEES, MEMBERS, FIDUCIARIES OR REPRESENTATIVES OR ANY OTHER PERSON AND (B) ALL LIABILITIES AND RESPONSIBILITY FOR ANY OTHER REPRESENTATION, WARRANTY, OPINION, PROJECTION, FORECAST, ADVICE, STATEMENT OR INFORMATION MADE, COMMUNICATED OR FURNISHED (ORALLY OR IN WRITING) TO THE P66 PARTIES OR THEIR RESPECTIVE AFFILIATES OR REPRESENTATIVES. NONE OF THE P66 PARTIES, ANY OF THEIR RESPECTIVE

-15-

AFFILIATES, ANY OF THEIR RESPECTIVE STOCKHOLDERS, TRUSTEES, MEMBERS, FIDUCIARIES OR REPRESENTATIVES NOR ANY OTHER PERSON HAS MADE OR IS MAKING ANY REPRESENTATIONS OR WARRANTIES TO THE ENBRIDGE PARTIES OR ANY OTHER PERSON REGARDING THE PROBABLE SUCCESS OR PROFITABILITY OF THE GOH COMPANIES, THE GOH BUSINESS, THE DCP COMPANIES, THE DCP BUSINESS OR THE MERGED LLC (WHETHER BEFORE OR AFTER THE CLOSING), INCLUDING REGARDING THE POSSIBILITY OR LIKELIHOOD OF ANY ACTION, APPLICATION, CHALLENGE, CLAIM, PROCEEDING OR REVIEW, REGULATORY OR OTHERWISE, INCLUDING, IN EACH CASE, IN RESPECT OF RATES, OR ANY PARTICULAR RESULT OR OUTCOME THEREFROM, OR THE POSSIBILITY OR LIKELIHOOD OF THE OCCURRENCE OF ANY ENVIRONMENTAL CONDITION, RELEASE OR HAZARD, OR ANY MECHANICAL OR TECHNICAL ISSUE, PROBLEM, OR FAILURE, OR OF ANY INTERRUPTION IN SERVICE, OR OF ANY INCREASE, DECREASE OR PLATEAU IN THE VOLUME OF PRODUCT OR SERVICE, OR REVENUE DERIVED THEREFROM, OR OF THE POSSIBILITY, LIKELIHOOD OR POTENTIAL OUTCOME OF ANY COMPLAINTS, CONTROVERSIES OR DISPUTES WITH RESPECT TO EXISTING OR FUTURE CUSTOMERS OR SUPPLIERS, IN EACH CASE, RELATED TO ANY OF THE GOH COMPANIES, THE GOH BUSINESS, THE DCP COMPANIES, THE DCP BUSINESS OR THE MERGED LLC.

ARTICLE 6

REPRESENTATIONS AND WARRANTIES OF P66 REGARDING THE P66 PARTIES

P66 represents and warrants to the Enbridge Parties that:

6.1 Organization and Good Standing. Each of the P66 Parties has been duly organized, is validly existing and is in good standing (with respect to jurisdictions that recognize the concept of good standing) under the Laws of its jurisdiction of formation.

6.2 Authorization. Each of the P66 Parties has all requisite corporate or similar power and authority to execute and deliver this Agreement and the other Transaction Documents to which it is or will be a party, to perform its obligations hereunder and thereunder and to consummate the Transactions. The execution and delivery of this Agreement and the other Transaction Documents, the performance of such Person’s obligations hereunder and thereunder and the consummation of the Transactions have been duly authorized by all necessary action of such Person. This Agreement and the other Transaction Documents to which such Person is or will be a party have been or will be duly executed and delivered by such Person and assuming the due authorization, execution and delivery of the Transaction Documents by each other party that is or will be a party thereto, constitute legal, valid and binding obligations of such Person, enforceable against such Person in accordance with their terms, subject to the Bankruptcy and Equity Exception.

6.3 Ownership of Interests. PGC is the record and beneficial owner of, and has good and valid title to, the P66 DCP LLC Interests and the P66 GOH Interests, in each case, free and clear of all Encumbrances (other than those arising pursuant to this Agreement, applicable federal or state securities Laws or the Organizational Documents of the DCP LLC or GOH, as applicable). The P66 DCP LLC Interests and the P66 GOH Interests are not subject to any voting trust agreement or similar arrangement relating to the voting of such capital stock or other equity interests.

-16-

6.4 Non-Contravention. The execution and delivery by each of the P66 Parties of this Agreement and the other Transaction Documents to which each is or will be a party, the performance of their respective obligations pursuant to the Transaction Documents and the consummation of the Transactions will not constitute or result in (a) a violation of the Organizational Documents of any of the P66 Parties, (b) a breach or violation of, a termination of, a right of termination or default under, the creation or acceleration of any obligations under, or the creation of an Encumbrance on any of the assets of any P66 Party pursuant to, any Contract to which such Person is a party (with or without notice, lapse of time or both) or (c) a breach or violation of, or a default under, any Law to which a P66 Party is subject, except, in the case of clause (b) or (c), as would not, individually or in the aggregate, have a P66 Material Adverse Effect.

6.5 Consents and Approvals. No consent, approval, waiver, authorization, notice or filing is required to be obtained by any P66 Party from, or to be given by any such Person to, or to be made by any such Person with, any Government Entity or other Person, in connection with the execution, delivery and performance by the P66 Parties of this Agreement and the other Transaction Documents to which each is or will be a party and the consummation of the Transactions, except (x) as would not, individually or in the aggregate, have a P66 Material Adverse Effect or (y) as may be required as a result of any facts or circumstances relating solely to the Enbridge Parties or any of their respective Affiliates.

6.6 Brokerage Fees. None of the P66 Parties or any of their respective Affiliates has retained any financial advisor, broker, agent or finder on account of this Agreement or the transactions contemplated hereby for which any Enbridge Party, DCP Company, GOH Company or any of their respective Affiliates will be liable.

6.7 Legal Proceedings. There is no civil, criminal or administrative action, suit, demand, claim, hearing, proceeding or investigation, to the Knowledge of P66, pending or threatened in writing against any P66 Party or any of their respective properties or assets before any Government Entity, except as would not, individually or in the aggregate, have a P66 Material Adverse Effect.

6.8 Independent Investigation; No Other Representations or Warranties. THE P66 PARTIES ACKNOWLEDGE THAT IN MAKING THE DECISION TO ENTER INTO THIS AGREEMENT AND TO CONSUMMATE THE TRANSACTIONS, THE P66 PARTIES HAVE RELIED SOLELY ON (I) THE BASIS OF THEIR OWN INDEPENDENT INVESTIGATION OF DCP LLC, THE DCP BUSINESS, GOH AND THE GOH BUSINESS, THEIR COMPONENTS AND THE RISKS RELATED THERETO AND (II) UPON THE EXPRESS WRITTEN REPRESENTATIONS, WARRANTIES AND COVENANTS IN THIS AGREEMENT. WITHOUT LIMITING THE FOREGOING, THE P66 PARTIES EXPRESSLY ACKNOWLEDGE THAT, EXCEPT FOR THE REPRESENTATIONS AND WARRANTIES CONTAINED IN ARTICLE 5, NEITHER THE ENBRIDGE PARTIES, ANY OF THEIR RESPECTIVE AFFILIATES NOR ANY OF THEIR RESPECTIVE STOCKHOLDERS, TRUSTEES, MEMBERS, FIDUCIARIES OR REPRESENTATIVES, NOR ANY OTHER

-17-